Trading Routines: Achieve Consistent Profits

Ameet Rai

Electrical Engineer and Swing Trader focused on achieving super-performance. Through extensive studies of previous super-performance stocks and proprietary data-based research I provide guidance for new traders with an emphasis on building processes and teaching traders how to think and trade for themselves.

Published: July 9, 2024

Trading Routines are essential for reaching your goals in the stock market. Without proper processes, success is unattainable. One of the easiest processes you can build now is effective daily and weekend trading routines.

Today’s deep dive will be centered on routines and how you should…

- Structure your daily routine, optimizing for time

- Structure your weekend routine, optimizing for feel

…so that you can start the week with a good idea of what the market should do based on your homework and then make subtle changes day to day as you gather more information.

With that being said, let’s start by looking at a couple of structures for your weekend routine:

Never miss a post.

Sign up to get instant notifications when we publish a new post.

Weekend Trading Routine

Your success during the trading week is directly correlated to the work you put in on the weekends.

If you want to be a successful trader, first look at what you’re doing when the market’s not open.

By the end of this section, you’ll have a great grasp for what a successful weekend routine looks and feels like, built from decades of profitable trading from the TraderLion Team.

What’s The Goal Of A Weekend Trading Routine?

There are a couple of different goals you want to optimize your weekend routine for.

- Ensure you have a good feel for the prior week’s action

- Allow you to develop accurate expectations for what’s to come

- Check in with journals, trade reviews to consistently improve

- Build proper universe & focus lists for the upcoming week

We’ll show you how to do all of this now ↓

Developing A Feel For The Prior Week’s Action

If you’re going to find any consistency from week to week, you need to have a great feel for what just happened over the previous 5 sessions. The best way to do this is to simply get your hands dirty.

- Scan through the entire S&P 500

- Scan through the Nasdaq 100

This will allow you to build an idea for what’s performing well (sectors, individual names) in the eyes of the major institutions, as you’ll then be able to gear your watchlists to include some of the bigger capitalization names & themes that look the best / are performing well.

You can then take these insights and apply them to construct your expectation of what’s to come.

The Weekend Is The Perfect Time To Run A Performance Check-In

We all know the importance of post trade analysis, but one reason so few people do it is because they haven’t blocked out a consistent time to do it. If you know that every weekend you have to run a post trade analysis / performance check in before you’re allowed to trade the upcoming week, your routine gets that much more concrete.

Here’s what you should be analyzing:

- Your journals from throughout the week (how did you perform emotionally, session to session? Were there any notable experiences that you can build on for the upcoming week?)

- Your trades from throughout the week (how did you execute based on your plan session to session? What mistakes did you make that you can correct in the upcoming week?)

You can then look at generic markers, like your Hit Rate / Risk:Reward based on closed trades, and your Most + Least Successful Setups over the past 10-20 trades.

With these insights, you’re well equipped to dive deep into your watchlists and build out a proper focus list.

Using Your Weekend Trading Routine To Build Effective Universe & Focus Lists

This topic could be an entire edition of the TL Trading Academy in and of itself, but we’ll consolidate today’s lesson into its most actionable and applicable takeaways. Here are the scans you should be running every weekend:

- Short-stroke Scan (Momentum Movers)

- Identify stocks that have shown strong recent performance and are likely to continue their momentum.

- Identify stocks that have shown strong recent performance and are likely to continue their momentum.

- IPOs

- Track newly listed companies for potential breakout opportunities.

- Track newly listed companies for potential breakout opportunities.

- YTD Winners

- Focus on stocks that have performed exceptionally well year-to-date.

- These stocks often continue to perform due to their strong fundamentals and institutional demand.

- Upcoming or Recent Earnings Reports

- Pay attention to companies with upcoming earnings reports as a good report can lead to major upside moves.

- Review recent earnings reports to see if any names that responded well are consolidating and prepping for a move higher.

- High-Tight-Flag

- Look for stocks forming high-tight-flag patterns, which can indicate strong continuation potential.

- These names may be more speculative (volatile) in nature depending on where we are in the market cycle.

If you’re looking for a screening & watchlist platform that has all of these scans premade for you already, check out Deepvue.

From Scanning To Watchlist Curation

Once you’ve gone through all of your scans and noted which names look the best (fit the theme at the time, are set up and ready to trade in the coming days/weeks), you can add these names to your respective watchlists.

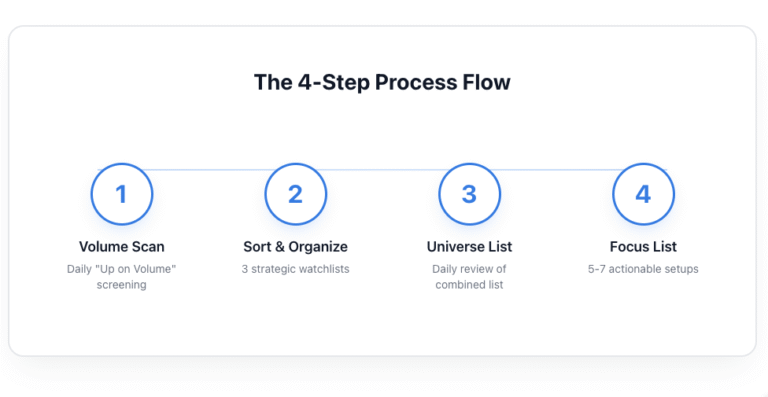

At TraderLion, we teach a 3 Watchlist Approach:

- IPOs

- Momentum Movers

- Earnings Gap Ups

You can see how all of the scans above funnel into our watchlists. From there, you go through each watchlist and highlight names that look actionable for the upcoming sessions. These names will go on your focus list!

Recapping Your Weekend Trading Routine & Moving On To Your Daily Routine

A solid weekend trading routine sets the stage for a productive week, but it’s your daily trading routine that ensures you stay on track and adapt to new information as it comes. Let’s dive into how you can optimize your daily routine for maximum efficiency and effectiveness.

Daily Trading Routine

Your daily trading routine should be concise yet comprehensive, ensuring you’re well-prepared for each trading session without spending excessive time on preparation. The key is consistency and focus.

What’s The Goal Of A Daily Trading Routine?

You want to be ready for the upcoming session with minimal time input so you’re able to live your life outside of the market. Your other goal is to make sure you’re staying up to date on your watchlists and focus list, updating each list with the best acting names.

Action Items To Structure Your Daily Trading Routine Around

Let’s now get into a potential structure for your daily trading routine:

1. Run Key Scans

- Daily % Gainers (sorted by highest % gain to least, all > +1% on session)

This scan allows you to identify names that have significant price increases during the session, keeping track of names that institutions are accumulating. These names have potential to continue much higher if the market is strong. - Up On Volume

Focus on stocks that have risen with substantial trading volume, indicating strong institutional interest. A stock becomes more attractive if it populates this list multiple times over a multi-week period. - High Volume Scans

Here we’re looking for names that have gapped up after an earnings or news report and have traded major volume, preferably the most volume in a quarter, in a year, since IPO Day/Week, or ever. Fundamental shifts reported through EPS or News reports have the potential to continue much higher in a short amount of time. - Breakouts / 52-Week Highs

Find stocks breaking out to new highs, indicating strong bullish sentiment. If you’re a breakout trader, this scan is a must-run daily. - Any Other Go-To Screen You May Have

Use any additional screens that align with your specific trading strategy or preferences.

2. Journal the Day’s Action

You always want to make sure you’re keeping a good log of what happened during the session to allow yourself to connect historical states to current states.

For example, you could be taking note of how the market usually interacts with VWAP on days where CPI comes out before the market opens. That note-taking can turn into an edge later on in your career!

Here are some other things to make note of in your journal:

- Market Overview

- Summarize the overall market performance, including major indices and sectors.

- Summarize the overall market performance, including major indices and sectors.

- Notable Events

- Note any significant news, economic reports, or events that impacted the market.

- Note any significant news, economic reports, or events that impacted the market.

- Emotional Check

- Record your emotions throughout the trading session to identify any psychological patterns that may affect your decisions.

3. Run Through Your Watchlists After Scans

Now that you’ve run scans and reviewed your journal, you should take a quick glance at your watchlists again to spot any notable action.

- Watchlists

- Maintain a comprehensive universe list of potential trade candidates.

- Break down the universe list into more focused watchlists such as:

- Earnings / Gappers List

- Stocks with upcoming or recent earnings reports, as they can be highly volatile.

- IPOs

- Newly listed companies that might present unique opportunities.

- HTF / Speculative Names

- Stocks with high volatility and speculative interest (e.g., GME, CVNA, etc.).

- Stocks with high volatility and speculative interest (e.g., GME, CVNA, etc.).

- Earnings / Gappers List

- Turn Watchlists into Your Focus List

- Narrow down your broad watchlists to a focus list of the 3-5 most actionable names.

- These should be the stocks you are most confident about and are ready to act on.

Again, we want to make sure your daily trading routine is short and to the point. Most of your work should be done on the weekend so by the time you’re actually trading throughout the week, you don’t have much work to do to stay on top of the market’s action.

This allows you to show up to every session with a fresh mindset, always ready to react and predict the market’s movements at the most effective and efficient levels.

Putting it all together

By implementing these structured trading routines, you’ll cultivate a disciplined approach to trading that will enable you to achieve consistency and improve your trading performance over time.

Here are the key takeaways ↓

- Weekend Trading Routine

- Spend 3-5 hours reviewing the past week’s performance, conducting post-trade analysis, and running comprehensive scans to build your watchlists and focus lists for the upcoming week.

- Ensure you develop a feel for the market by scanning the S&P 500 and Nasdaq 100 and running specialized scans like Short stroke, IPOs, YTD Winners, and High-Tight Flag.

- Daily Trading Routine

- Spend no more than 1.5 hours preparing for the next trading session by running targeted scans, journaling the day’s action, and refining your focus list.

- Keep your trading routine consistent and focused to avoid burnout and maintain a fresh perspective session to session.

By following these trading routines, you’ll be well-prepared to navigate the markets effectively, making informed decisions that lead to better trade ideas and more profitable outcomes. Remember, consistency in your process is key to achieving your trading goals.