Finding Your Trading Edge: Proven Setups That Work

Published: July 22, 2025

Why Edges and Setups Matter

If you’re serious about trading, you’ve probably spent time looking for the perfect setup. One that hits every signal and delivers a big win. But here’s the truth: perfect doesn’t exist. What you need is an edge.

An edge isn’t magic. It’s simply a repeatable advantage that gives you favorable odds over time. Combine that with a defined setup—something you can execute consistently and you’ve got a system that works. Not every trade will win, but the process will put you ahead.

In this post, you’ll learn how to:

- Recognize true edges in the market

- Apply effective setups

- Manage risk with tight, logical stop losses

- Use a system to find and trade high-potential stocks

Let’s break it down.

What’s an Edge?

An edge gives you a statistical advantage. It’s not about guessing right every time. Instead, it’s about spotting repeatable signals that, when followed with discipline, lead to profit over time.

Examples of real edges:

- Massive volume surges after a catalyst

- Relative strength during a market pullback

- Tight consolidations on low volume

- Clear respect for key moving averages

If a stock shows multiple edges at once, that’s a signal worth acting on.

What’s a Setup?

A setup combines edges into a pattern. It includes:

- Entry point

- Logical stop-loss level

- Context for why the trade makes sense

Good setups give you favorable risk/reward and clear decision points. They’re not about prediction—they’re about probabilities and planning.

The S.N.I.P.E. System for Trade Execution

Use this 5-step approach to go from scanning stocks to managing trades:

1. Search and Scan

Find stocks that meet broad criteria—liquidity, dollar volume, basic fundamentals.

2. Narrow

Filter to stocks that match your specific style. For example, only those trending above the 21-day EMA with strong earnings growth.

3. Identify

Spot edges and confirm setups. Focus on the best 1–3 names.

4. Plan

Define your entry tactic, stop-loss, and size based on the setup’s strength.

5. Execute

Take the trade. Stick to your plan and manage the position according to your rules.

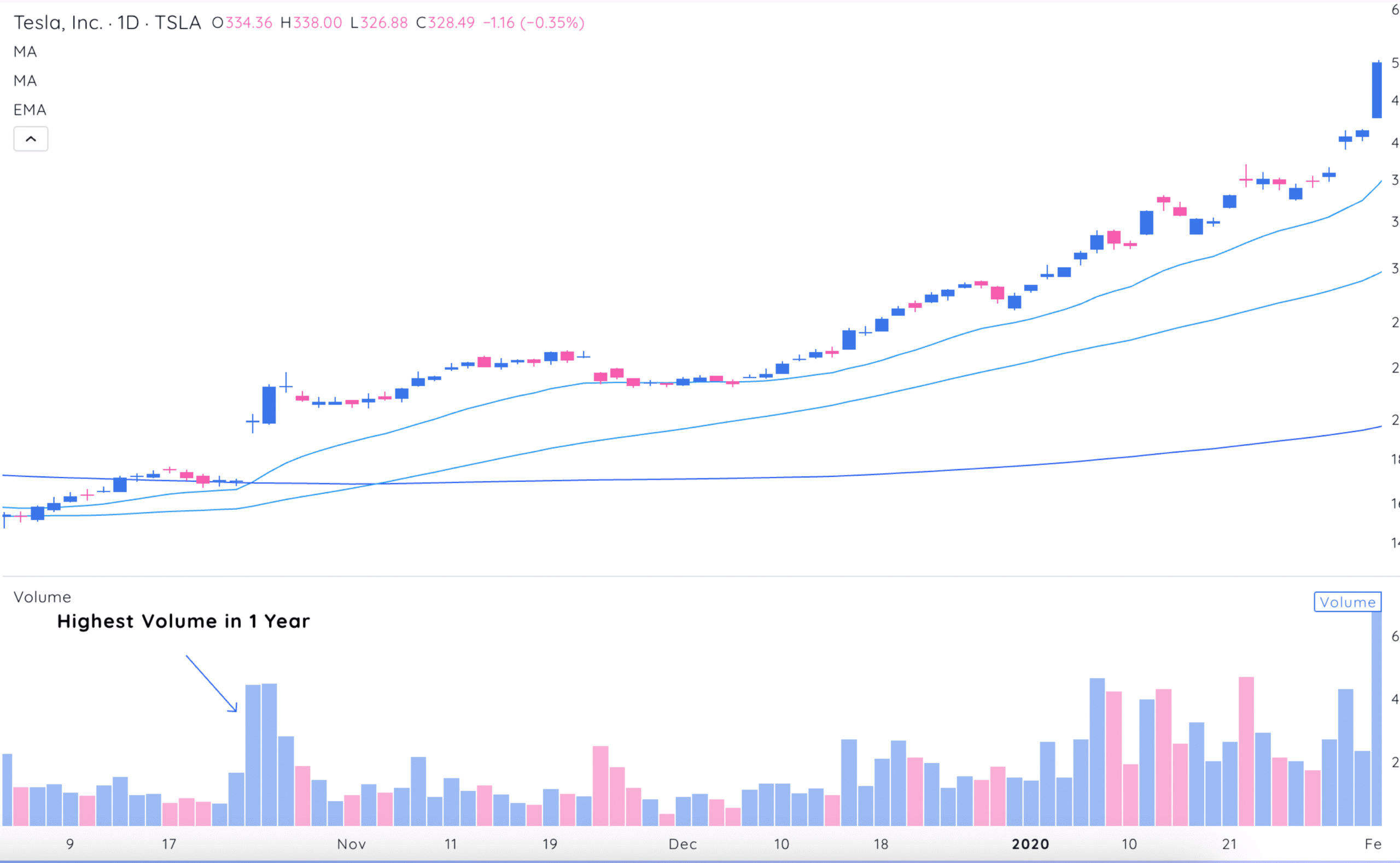

The High-Volume Edge (HV1, HVE, HVIPO)

A surge in volume can mark the beginning of a major trend. The book outlines three variations:

- HV1: Highest volume in a year

- HVE: Highest volume ever

- HVIPO: Highest since the IPO

When volume spikes come with strong closes and a fundamental catalyst (e.g., earnings beat, product launch), it often signals institutional accumulation.

Example:

Tesla on April 24, 2019, gapped up after a surprise profit report and surged over 200% in the following months.

Screen for it:

- Volume today > max volume in last 250 days

- Closing range > 40%

- Dollar volume > $3M

The Relative Strength Edge

During corrections, leaders don’t collapse—they hold up or even rise.

Look for:

- RS lines making new highs

- Strong closes while the market falls

- Tight ranges near highs

Why it matters:

Institutions use these periods to build positions. Once pressure lifts, these stocks tend to move first and fastest.

Check out this guide on how to use the Relative Strength Line to identify these leaders early.

The Launch Pad Setup

This setup combines:

- Tight price action

- Low volume

- Support from key moving averages

It’s like a spring coiling before it pops. You enter as the breakout starts, with a stop just below the consolidation zone.

What to watch for:

- Inside days or weeks

- Confluence of support

- Early signs of momentum

Learn more about Launch Pad: the early entry technique that can help you spot these moves before the breakout.

The Gapper Setup

Gap ups are strong signals—when they hold.

Key traits:

- Big volume

- Strong closing range (>50%)

- Follow-through after the open

Not all gaps are created equal. Focus on the early gaps in a trend, especially those backed by earnings or industry shifts. Biotech gaps based on drug news? Less reliable.

The Base Breakout Setup

Classic but still effective. A stock builds a base (flat, cup, VCP or consolidation), then breaks out with volume.

Checklist:

- Tight price action

- Decreasing volume in the base

- Surge in volume at breakout

- Close near high of day

Set your stop just under the base. If it fails fast, you’re out small. If it works, you ride the trend.

Position Sizing by Edge Count

You don’t have to size every trade the same. Scale your position based on how many edges are present:

| Number of Edges | Position Size (% of portfolio) |

|---|---|

| 1 | 10% |

| 2 | 12.5% |

| 3 | 15% |

| 4 | 17.5–20% |

Final Thoughts

Finding an edge isn’t about being smarter—it’s about being consistent. Focus on setups that let you manage risk, size logically, and stay in control when it counts. You don’t need complexity. You need a plan you can stick to. The rest comes with experience.

Stay focused. Trade small. Keep showing up.

Use this as a guide, then adapt to your risk tolerance. You can always start smaller and scale in.

If this blog helped you understand how to spot and trade high-probability setups, you’ll love The Trader’s Handbook. It walks you through our complete system—entries, risk management, sell strategies, market cycles, and what to do after the trade—all backed by over 60 years of trading experience.

Whether you’re just getting started or fine-tuning your edge, this book gives you the tools, routines, and real-life examples to build a trading process that actually works.