Understanding Beta: A Key Metric for Investors

Nick Schmidt

Nick Schmidt is a co-founder of TraderLion and Deepvue with over 10 years of market experience. Adopting a “less is more” philosophy, he focuses on weekly charts with an emphasis on price and volume.

Published: December 2, 2023

What Is Beta?

Beta is a key financial metric that shows how much a stock’s price tends to move compared to the overall market. Think of it as a measure of market risk—it helps investors understand how volatile or stable a stock might be in different market conditions.

Here’s how it works:

Beta is also a core part of the Capital Asset Pricing Model (CAPM), which investors use to estimate a stock’s expected return based on its Beta and other factors. By understanding Beta, investors can better assess the risk and reward of a stock and choose stocks that match their risk tolerance and market outlook.

Why Is Beta Important for Investors?

Beta is a powerful tool for investors to understand and control risk. It shows how much a stock or ETF moves in relation to the overall market, typically measured against benchmarks like the S&P 500. By understanding Beta, you can make smarter decisions about risk, diversification, and portfolio management.

Here’s how Beta helps:

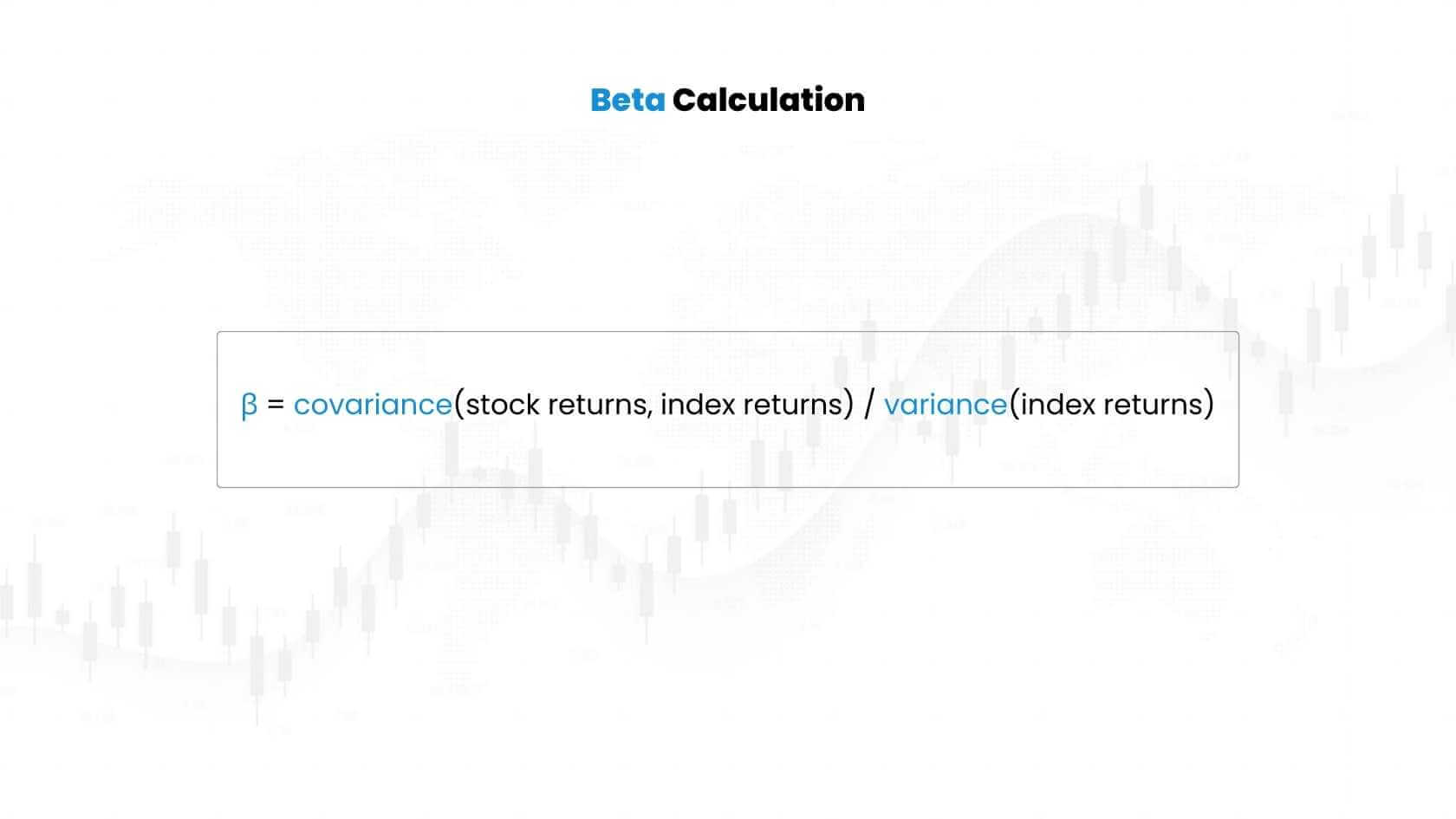

How Is Beta Calculated?

Beta is a key risk metric for investors. It shows how much a security’s price moves in relation to the market. You can calculate Beta in two main ways: with historical data or through regression analysis. Both methods help assess the security’s risk and gives investors valuable insights to make smarter choices.

Most platforms such as Deepvue automatically calculate and display beta for every stock.