Weekly Sub Digest – July Week 3

Nick Schmidt

Nick Schmidt is a co-founder of TraderLion and Deepvue with over 10 years of market experience. Adopting a “less is more” philosophy, he focuses on weekly charts with an emphasis on price and volume.

Published: July 19, 2025

4 min read

Weekly Subscriber Digest

Key Trading Insights

| Key Theme | Key Insight | Reference |

|---|---|---|

| Awareness & Alignment | “The edge is in awareness & alignment.” When aware the wind is at our backs and environment is favorable, just stay aligned until that changes. Then be aware when it changes. | Jul 17 – Trading philosophy View post → |

| The environment won’t last forever | Two key mistakes: 1) Not listening when environment changes and giving up progress made. 2) Being too protective in anticipation of correction – can miss opportunities that last longer than you think. | Jul 18 – Weekly reflection View post → |

| Earnings Strategy | Only hold through earnings if you have a cushion. Use optionslam.com for expected moves. “If earnings are any day I may still take a position but if there is no cushion built before they report I sell and will revisit.” | Jul 16 View post → |

| Focus to stay in-sync | “Having over 5 positions hurts me.” Cleared NFLX, UBER, META after hours to maintain focus. Rule of mine is to stay 5 positions or less to concentrate and feel in sync. | Jul 16-17 View post → |

| Data Points | Uses 20 day RV (relative volume) and DCR (Daily Closing Range). DCR makes it easy to see stocks that closed near highs or lows. | Jul 17 View post → |

| Position Sizing Realization | SOUN re-buy revelation: “I may be leaving opportunity on the table.” Original buy was 1% of account risked at -6%. Re-buy was only 0.5% risked at -2%. Despite smaller %, actual position size was bigger due to tighter stop. | Jul 14 View post → |

| Accumulation Patterns | LUNR showed large accumulation inching up lows each week. RUM showing same skyscraper accumulation with fund ownership jumping from 207 to 242 funds. RGTI same look. All 3 ended up same accumulation look and moving. | Jul 15 LUNR post → RUM post → RGTI post → |

Trade Activity

| Ticker | Note |

|---|---|

| SOUN | Stopped Monday at even, then re-entered same day at half size using lows as stop ($10.82). Re-entry → |

| ALAB | Entered Tuesday (Jul 16). Using weekly lows $87.70 to manage risk after

discussion on positioning.

Despite volatility,

if NVDA & semis lead, this could get going. Entry → Video on why I chose $87.70 stops → |

| RUM | Entered Jul 17 at weekly lows. Big volume up, low volume down, volume

drying up sideways. Same sky scraper accumulation as LUNR & quantum names. Big fund

ownership increase from 207 to 242 funds. “Instant traction.”

Entry → Explanation on Entry → |

| NFLX/UBER/META | Sold Jul 16 after hours. “Nothing wrong with them I just need to focus and having over 5 positions hurts me.” |

| GRRR | Stopped out Jul 18. Quick entry and stop. Still keeping it on radar. |

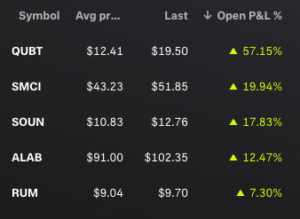

Current Holdings

| Ticker | Status |

|---|---|

| QUBT | Part of quantum names theme that has been showing strength. |

| SMCI | 10-week MA now at $45.25 (~5% above entry). Pushed out of mini-base on 2x relative volume. “Allowing a stock to shakeout intraday and wait for the close has been a big improvement to my trading.” |

| SOUN | Following through with good momentum. Happy with re-entry. |

| ALAB | Highest weekly close and above Livermore $100 level. |

| RUM | Newest position showing “instant traction.” Same accumulation pattern as LUNR and quantum names with increasing fund ownership. |

Looking Ahead

Watchlist Focus: NVDA, SEDG, TOST, IONQ, ARM, QUBT, LUNR, RUM, ALAB, TSLA, GRRR. IONQ

Portfolio Discipline: “Rule of mine is to stay 5 positions or less.” Cleared profitable

positions (NFLX, UBER, META) just to keep focusing on thematic movers.

SEDG Setup: Displaying double inside week. Volume light again – 10 & 30 week MAs are

below price but quiet pause could be good way to manage risk. “Monitoring for now” as energy theme &

character change develops.