Weekly Sub Digest – Edition 6

Nick Schmidt

Nick Schmidt is a co-founder of TraderLion and Deepvue with over 10 years of market experience. Adopting a “less is more” philosophy, he focuses on weekly charts with an emphasis on price and volume.

Published: August 16, 2025

7 min read

Weekly Subscriber Digest

“After reviewing my decisions the first half of this year, the rest of this year is really going to be

focused on LESS is more.”

Key Trading Insights

Megacap Focus Strategy

“I believe right now for the first time in a month I am positioned well and am looking to focus on a few names and be concentrated.”

Focusing on $100B+ mega caps until smaller caps move and become less volatile.

Focusing on $100B+ mega caps until smaller caps move and become less volatile.

TSLA as Primary Focus

TSLA currently 45% of portfolio.

“I truly believe $TSLA is the number 1 focus for right now” due to contraction

pattern offering low-risk entry and potential early entry to multi-year base breakout.

Gap down opens > Gap up opens

“As always we do prefer gap downs vs gap ups. Don’t chase anything the first 30 minutes from FOMO unless it was planned.”

Gap ups typically fade into close.

Risk-First Always

“Don’t make any decisions out of FOMO… everything needs to be calculated and risk first.”

Took TSLA loss from reckless adding during Elon/Trump drama.

Inside Week Strength Signal

META holding within prior week’s wick and trading as inside week shows strength.

“Last week held within the prior weeks wick – this is a sign of strength.”

Character Change Setups

SEDG is a perfect character change setup, up 25% Friday after mention its sitting on the

10-week. Character Changes especially with group strength behind it are powerful.

Sector Group Confirmation

“When multiple stocks in the same group looks the same its a good sign.” Noted with

GS & JPM both looking good in tight ranges near highs.

Selling Rules

Uses 2 closes below 10-week MA as sell signal, compared to some who use 2 closes below

21-day EMA. Provides clear exit criteria.

| Theme | Insight | Reference |

|---|---|---|

| Megacap Focus Strategy | “I believe right now for the first time in a month I am positioned well and am looking to focus on a few names and be concentrated.” Focusing on $100B+ mega caps until smaller caps move and become less volatile. | Aug 10 – Strategy shift View post → |

| TSLA as Primary Focus | TSLA currently 45% of portfolio. “I truly believe $TSLA is the number 1 focus for right now” due to contraction pattern offering low-risk entry and potential early entry to multi-year base breakout. | Aug 10 – Position sizing View post → |

| Gap down opens > Gap up opens | “As always we do prefer gap downs vs gap ups. Don’t chase anything the first 30 minutes from FOMO unless it was planned.” Gap ups typically fade into close. | Aug 11 – Market open dynamics View post → |

| Risk-First Always | “Don’t make any decisions out of FOMO… everything needs to be calculated and risk first.” Took TSLA loss from reckless adding during Elon/Trump drama. | Aug 11 – Risk management reminder View post → |

| Inside Week Strength Signal | META holding within prior week’s wick and trading as inside week shows strength. “Last week held within the prior weeks wick – this is a sign of strength.” | Aug 11 View post → |

| Character Change Setups | SEDG is a perfect character change setup, up 25% Friday after mention its sitting on the 10-week. Character Changes especially with group strength behind it are powerful. | Aug 14 – SEDG setup mention View post → |

| Sector Group Confirmation | “When multiple stocks in the same group looks the same its a good sign.” Noted with GS & JPM both looking good in tight ranges near highs. | Aug 11 – Sector analysis View post → |

| Selling Rules | Uses 2 closes below 10-week MA as sell signal, compared to some who use 2 closes below 21-day EMA. Provides clear exit criteria. | Aug 13 – Exit strategy View post → |

← Swipe to see more →

Trade Activity

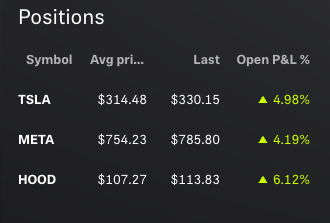

1 trade executed this week • 3 core holdings maintained

| Ticker | Trade Notes |

|---|---|

| SMCI | Sold Monday morning: Officially exited position that he assumed had hit breakeven stops the prior week but hadn’t actually triggered. |

Current Holdings

Nearly 100% invested in 3 concentrated positions

| Ticker | Status & Notes |

|---|---|

| TSLA | 55% of portfolio. Defended $330 support level well during week’s pressure. Showing good shakeout action with higher closes. May add with tight stops if momentum continues. “Based on this weeks close it’s likely it may head back to $310-$320 area before it sticks higher.” |

| META | Finally following through after patient wait. Showed most resilience during Wednesday’s pressure, first to go red-to-green and hit new closing high by Friday. |

| HOOD | Smallest position. Closed above $110 pivot by end of week after tiny shakeout. Showing lots of strength still and a top leader. |

← Swipe to see more →

Weekly Market Observations

| Day | Key Observations |

|---|---|

| Monday | Gap up that faded but close wasn’t as concerning as previous Monday gaps. TSLA was biggest mover from leader list. Overall tight ranges despite fade from highs. |

| Tuesday | Another gap up. META finally followed through, TSLA showed good shakeout action with higher close. |

| Wednesday | Gap down after PPI report – preferred setup. Early strength held, most names bought off the open. Several watchlist names sitting perfectly on 10-week support. $SEDG $AVAV |

| Thursday | Strong close across positions. TSLA defended 330, HOOD above 110 pivot, META new closing high. “Good reason to go down that was shrugged off pretty well.” |

| Friday | Strong day for solar group. Momentum started declining but core positions held strong. Overall characterized as “slow chop” environment. |

← Swipe to see more →