Weekly Digest – Edition 20

Nick Schmidt

Nick Schmidt is a co-founder of TraderLion and Deepvue with over 10 years of market experience. Adopting a “less is more” philosophy, he focuses on weekly charts with an emphasis on price and volume.

Published: December 13, 2025

Weekly Subscriber Digest

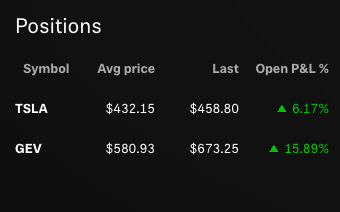

Sitting at 50% exposure going into next week. 30% $TSLA, 20% $GEV. Friday was ugly but I still believe we’re lining up to go higher.

Two trades this week.

Bought $GOOGL on Wednesday against its multi-week low—tight range, good r/r. Got

stopped out Friday morning. Nothing wrong with the setup, just hit stops. I’ll probably buy it back.

Added to $GEV on Wednesday at $681 when it pulled back hard after breaking out. Trimmed most of that add

Friday but kept the core. Breakout still intact above ~$660.

Also sold $ASML Friday even though it looks fine—closed below pivot so I’d rather step aside and buy it back. None of these sells were because something broke structurally. I’d rather reduce and be ready.

$TSLA showed insane relative strength Friday while everything else tanked. Five-year base, multiple themes converging. It’s the #1 opportunity in the market. I never feel like I own enough of it.

Current holdings

2 positions • 50% exposure

| Ticker | Notes |

|---|---|

| $TSLA | 30% — #1 focus. Five-year base. Showed insane RS Friday. |

| $GEV | 20% — Breakout intact above ~$660 pivot. New weekly closing high. Trimmed add Friday but kept core and watching to add back. |

Day by day

| Day | What Happened |

|---|---|

| Mon | Red day but everything acted fine. Nice push into close. $PLTR and $HOOD showing RS. $GOOGL on 2nd tight sideways week, buyable. View post |

| Tue | Strong. 70% of stocks up first 40 min. $TSLA back above key $450 level. $GEV up after hours above $660 breakout level. Need to find opportunity to add tomorrow. |

| Wed | Fed day. $GEV breakout after 8 weeks of stalking. Added $GEV at $681 on pullback. View post Bought $GOOGL vs multi-week low. View post All 4 positions closing strong. |

| Thu | Pressure early but recovered. Weak open, strong close. $TSLA shook below yesterday’s lows then closed upper range feels like its getting ready. View post |

| Fri | Stress test. 75% of stocks down. Stopped $GOOGL View post Sold $ASML below pivot. Trimmed $GEV add. $TSLA insane RS all day. View end of day summary |

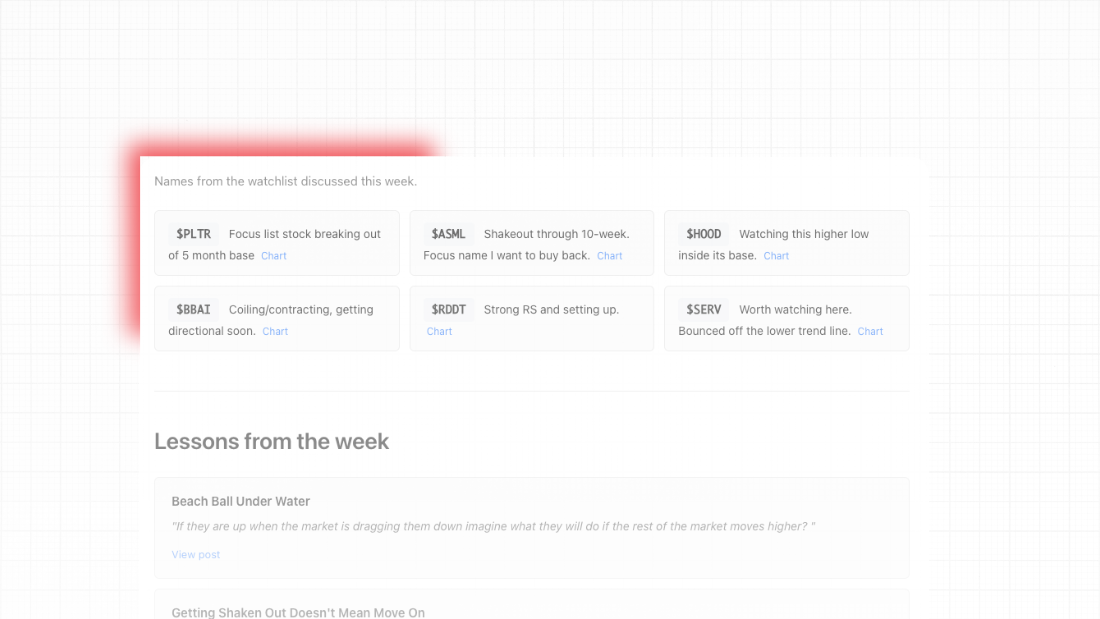

Watchlist mentions

Names I discussed this week from our watchlist.