Weekly Digest – Edition 17

Nick Schmidt

Nick Schmidt is a co-founder of TraderLion and Deepvue with over 10 years of market experience. Adopting a “less is more” philosophy, he focuses on weekly charts with an emphasis on price and volume.

Published: November 22, 2025

Weekly Subscriber Digest

Two-Week Summary & Outlook

Summary: The past two weeks have been a lot of chop and really gappy and volatile action, just not a strong environment. Nvidia, the biggest stock in the market leading this AI revolution, reported really good earnings and initially had a really good reaction. The reaction that we’ve seen on good earnings and across the market good news is it’s been sold and so Nvidia being the big important leader having positive action the market earlier Thursday right after almost looked like a strong follow-through type day action from NVDA renewing confidence in the market but then it completely failed and confirmed that the market has not changed the environment is no good and need to focus on preserving here. Went 100% cash Thursday afternoon. Friday reinforced it—$NFLX leading lower at dead lows, $TSLA closed inside monthly pivot. We’re in correction territory now. NASDAQ, S&P, QQQ all below 50-day. Old leadership has rolled over.

Outlook: Intermediate term very optimistic this AI market has years ahead, but right now environment is extremely low probability. Since October 10th we’ve had wide and loose price action with gaps almost every night. Compare that to April through September when ranges were tight and gaps were rare. What I’m watching for is big liquid leaders, stocks that have real earnings growth, are holding up, showing relative strength, and tracking that until the environment becomes more favorable and higher probability. We’ve constantly, the past four weeks, been seeing negative reactions to good news and good earnings. When we see that change and bad news start to be shrugged off and bought and the stocks that we’re tracking actually start to act constructively and change their character and follow through, it will be a sign that things are shaping up. I gave back more than I should have the past 3 weeks. Now waiting for a more favorable environment to participate in.

Key Trading Insights

A perfect chart setup in a terrible environment is still a low-probability trade. The context, market conditions, internals, how stocks are reacting to news matters more than the individual setup. You can find beautiful patterns all day long, but if the environment is working against you, those setups will fail.

When you see a big ugly down week in real time, you naturally think the stock is toast and going to zero. Sometimes that’s true. But statistically, these kinds of candles usually just mean the stock needs time to re-base. It might not collapse, but it’ll chop around for weeks before the range tightens back up. Look to the left at similar candles in the chart’s history—they almost always require time before becoming actionable again.

If you chop yourself up trying to trade through difficult periods, you’ll waste the next good period just trying to get back to breakeven instead of actually compounding. The key is recognizing when the window to be aggressive isn’t present and pulling back accordingly. Stay flat or very small during the chop so that when conditions improve, you can press from a position of strength rather than from a deficit.

Trade Activity

3 exits, 1 brief entry over two weeks • Moved to 100% cash

| Ticker | Trade Notes |

|---|---|

| $TSLA | Sold 70% (Nov 13) First exit Thursday of week one. Sold most of the position, keeping just 30%. The exit wasn’t ideal—it was lower than my planned 10-week stop and at a spot where I could have been a buyer. But the environment shifted since October 10th with more volatility, wider ranges, more gaps. Good news and earnings weren’t getting rewarded. When you’re getting crushed you have to step back. |

| $GEV | Bought (Nov 20) Sold (Nov 20) Wednesday night $NVDA reported strong. Thursday morning gap up felt like a follow-through day—most stocks continuing higher from the open, feeling like a change in character. Started a very small pilot position to track closely, then added weakness to build to 15% position. But then everything gave up gains and sold off to lows on good earnings and news. That confirmed environment hasn’t changed. Exited same day for a loss that should never have happened if I was waiting for the close like usual. |

| $TSLA | Sold 30% (Nov 20) Final exit Thursday afternoon of week two. Went 100% cash. The early action Thursday really convinced me the character was changing but everything gave up and sold off at lows on good earnings and news, confirming nothing has changed. Real bad action happening on good news is what makes it more concerning. We’ve been seeing this in most stocks and $NVDA confirmed the environment hasn’t changed. Will aggressively monitor for re-entry. |

Current Holdings

0 positions, 3 focus names • 100% cash

| Ticker | Status & Notes |

|---|---|

| CASH | 100% cash – Full preservation mode. Went fully to cash Thursday

afternoon November 20th. Not making a prediction about where the market goes from here.

My decision is based on the fact that this environment is extremely low probability. I will aggressively

monitor my focus list for re-entry when conditions improve. Patience is needed here.

|

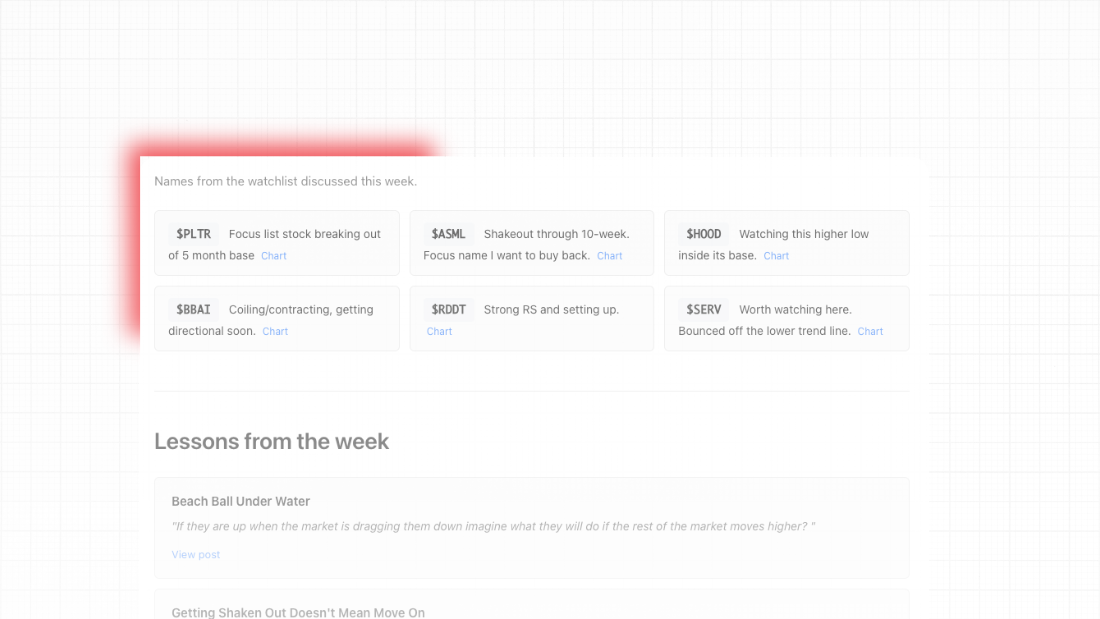

Focus List (In Order)

| Ticker | Why It Remains On Focus |

|---|---|

| $TSLA | Number 1 focus – Will aggressively monitor for re-entry. The multi-year base breakout above the 400 level remains the main play. Longer the base, bigger the space. Thematically, Tesla is positioned perfectly for robotics and autonomy. The bottleneck is scalability and manufacturing at scale—Tesla already has millions of vehicles with technology that can be turned on over the air. When looking at the intersection of a great technical setup and a company positioned for a massive secular trend, this is it. |

| $GEV | Energy is the bottleneck for AI right now, not compute. This is where demand is and where the conversation is. GEV is positioned incredibly well—full stack operation selling equipment for generating electricity and manufacturing everything for the grid. They’re the top supplier for gas turbines that data centers are using for quick energy boosts. I was focused on it as it built a perfect base near highs, then after earnings had that giant shakeout candle I became laser-focused because those shakeouts usually happen before big moves. It’s held the low of that shakeout candle for 4 weeks now in a very organized basing structure. The chart is A+ and technically plus thematically it feels like it’s lining up the same as $TSLA did. |

| $ASML | ASML is essentially a monopoly. They make the machines that allow all semiconductors to advance their chips for AI. To make more powerful chips you need to fit more transistors into less space on the silicon—ASML is the only company with the technology to do this at the level needed for cutting-edge AI chips. Regardless of what happens with NVDA, AMD, or any other semiconductor company, if there’s going to be advancement in AI hardware, ASML’s technology is required. After doubling it’s been contained near highs instead of collapsing—that’s the kind of strength that tells you bigger funds are accumulating for longer-term. Keeping this on watch for when the opportunity presents itself properly. |