Weekly Digest – Edition 15

Nick Schmidt

Nick Schmidt is a co-founder of TraderLion and Deepvue with over 10 years of market experience. Adopting a “less is more” philosophy, he focuses on weekly charts with an emphasis on price and volume.

Published: October 25, 2025

Weekly Subscriber Digest

Week’s Summary & Outlook

The Week’s Story: Started Monday very constructive with no charts breaking down on weekly timeframes. Tuesday remained calm ahead of key earnings. Wednesday brought the first real test—violent breakdown across the board that made correction feel inevitable. But by Thursday and Friday, names were reclaiming levels and the breakdown failed to follow through, creating what may have been a giant shakeout.

What We Know: The past 2 weeks showed extreme volatility, very wide ranges, unpredictable price action, and headline-driven moves. Need to account for this and keep risk in focus. In real-time we don’t know if this was a shakeout before a rip or first signs of serious breakdown coming.

What’s Broken: Structural damage currently isolated to only $SPOT and $NFLX. Both can still chop around and bottom or develop into double bottoms—can be fixed quickly. But right now they’re red flags. Ideally they fix up next week and follow the rest of leaders instead of leaders following them lower.

What’s Working: From original April leaders, everything besides $SPOT and $NFLX looks good. Focus remains on slowly adding exposure in names showing crazy RS like $GEV, $PLTR, $MDB, $TSLA, $DAVE in their multi-month bases. If we fail you’re not chopped up because you’re adding gradually. If we go higher you’re positioned in stocks coming out of multi-month bases which will have strong new trends.

Approach Going Forward: Until we see a breakdown confirmed, focus remains on weekly structure and avoiding overtrading. Stuff hit hardest (besides Wednesday) has all been extended outside bases. Buying in multi-month bases keeps you safest—bases will really only break if market corrects, and normal weakness or pullbacks will be minimal. Keep activity minimal, focus on bigger trends, and maintain narrow focus list.

Key Trading Insights

Purely from an odds standpoint, if you just focus on structure and managing risk during each period of weakness and treat it like it’s just a pullback, you will be right much more often than wrong.

Can’t operate long-term under that urgency feeling and you don’t need to either.

My activity revolves around: do I need exposure? If so then try to get positioned until it works then hopefully just don’t do anything else. When I review my periods of good and bad the biggest difference is activity. Doing stuff when there’s nothing to do.

Buying stuff in multi-month bases here keeps you safest because the bases will really only break if the market corrects, and normal weakness or pullbacks will be minimal.

Trade Activity

3 trades this week • 1 intraday round-trip, 1 trim

| Ticker | Trade Notes |

|---|---|

| NFLX | Bought Sold Wednesday: Took a small position in the first 10 minutes as it moved higher off the open. Sold later same day for small loss. |

| TSLA | Trimmed Wednesday: Sold a bit to lighten up here before EPS. Reduced from 91% to 79%. Held remaining shares through earnings using 10-week MA as my line. |

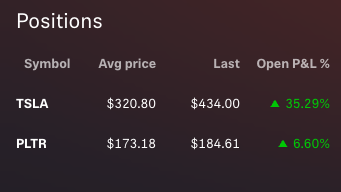

| PLTR | Hold Held since still green and off lows. Never broke the tight area it’s been in. Kept it at 19%. |

Current Holdings

2 positions • 98% total exposure

| Ticker | Status & Notes |

|---|---|

| TSLA | 79% of portfolio – #1 Focus. Despite down on EPS, still in this

consolidation right above its major multi-year base pivot. As long as it stays together

and above the 10-week (which also lines up with the pivot) then structure is intact.

Can’t ask for better reaction on weakness with how the gap down got bought up Thursday.

|

| PLTR | 19% of portfolio. Still in the tight area near all time highs while

other stocks are well off highs and cracking with wide ranges. The weekly chart has a

very clear level under this tight range the past 4 weeks. That level is all I care about

and it has been acting very controlled.

Near highs, multi-month base, tight organized action, weakness so far being bought up — number one candidate for RS whenever the market follows through. |

Weekly Market Observations

| Day | Key Observations |

|---|---|

| Monday | Very nice constructive Monday. Good internals mid-day for a gap up. All of the most

important names as well are all higher from the open — $TSLA $UBER $SPOT $PLTR $CRWD

$NFLX $DASH $HOOD $MSTR $DAVE $NVDA $META $RKLB.

“Still yet to see a single chart breakdown from a weekly perspective. Everything is holding key levels or basing.” Eyes on $NFLX earnings aftermarket Tuesday to see how the first big original leader reacts. Think it sets the tone. |

| Tuesday | Mild open so far no major direction which is fine.

We don’t need direction everyday honestly sometimes the best days are nothing days.

$TSLA trading extremely tight range ahead of earnings Wednesday. I do love the extremely tight range this week ahead of EPS. Several Focus List names ($DAVE, $SPOT, $MDB) perking up and coming up the right side of their bases. |

| Wednesday | First 10 minutes $NFLX moved higher since the open so I took a small position. Sold later for small loss. Sold a bit

of $TSLA to lighten up before EPS.

“The first time that things really looked truly broken where a correction felt like the likeliest thing coming.” A lot of names hit hard but well off their lows of the day and closing with large lower wicks. Doesn’t fix everything but buyers definitely stepped in. $TSLA very volatile after hours. Based on $NFLX and $GEV action I will assume more weakness is a high probability. |

| Thursday | A very nice surprise to see today with the $TSLA gap down being bought up aggressively.

As of now with today’s action all of the original leaders besides $NFLX are structurally intact still. They have recovered key levels so far. $PLTR and $MDB right now look absolute best of the best from a RS standpoint. Just because you see stuff moving up and acting well today doesn’t mean start chasing and buying. We really need to be patient and focus on overall structure. |

| Friday | Fairly slow day no major direction which is good to see after a morning gap.

After a wild week both $HOOD & $NVDA weekly charts look solid if they close here after they each looked pretty rough mid-week. Overall everything (besides $NFLX $SPOT) ended up closing the week looking pretty good. Wednesday was the first time that things really looked truly broken where a correction felt like the likeliest thing coming. But by end of week everything that broke major levels had reclaimed it in a constructive way. Everything violently was breaking down and failed to follow through into the end of the week essentially making a *potential* giant shakeout. |