Weekly Digest – Edition 13

Nick Schmidt

Nick Schmidt is a co-founder of TraderLion and Deepvue with over 10 years of market experience. Adopting a “less is more” philosophy, he focuses on weekly charts with an emphasis on price and volume.

Published: October 4, 2025

7 min read

Weekly Subscriber Digest

Sub Tip: If you click on my X profile there is a search icon at the top. If you use this you can search any symbol to see all of my subscriber only posts on it.

Key Trading Insights

HOOD Breakout Signals April Leaders

“Insane strength in $HOOD. This is what I believe other april leaders like $PLTR will do”

HOOD became the first April leader to break out of its base and follow through. This bodes well for other April leaders like PLTR to break out of their bases and follow through as well.

HOOD became the first April leader to break out of its base and follow through. This bodes well for other April leaders like PLTR to break out of their bases and follow through as well.

Tight Action + Low Volume = Opportunity

“I really like the tightness/quiet action in $PLTR… I’m adding here because of low relative volume and tight action.”

Added to PLTR on quiet, tight action with low relative volume using LIFO stops. This allows sizing up while managing risk with separate tight stops.

Added to PLTR on quiet, tight action with low relative volume using LIFO stops. This allows sizing up while managing risk with separate tight stops.

Higher Lows Make Setups Actionable

“The higher lows make it more actionable because its easier to buy on weakness and manage risk + the higher lows act as a signal that there is underlying strength despite the choppiness.”

Looking for higher lows in base names like SPOT and DAVE – signals underlying strength and provides clear risk management.

Looking for higher lows in base names like SPOT and DAVE – signals underlying strength and provides clear risk management.

Timing vs Direction

“95% of the time being stopped out doesn’t mean the stock is broken it just means your initial entry didnt work.”

Being wrong on timing doesn’t mean being wrong on direction. Most stops don’t invalidate the thesis – just the entry point.

Being wrong on timing doesn’t mean being wrong on direction. Most stops don’t invalidate the thesis – just the entry point.

Trade Activity

2 trades this week • 1 exit, 1 major add

| Ticker | Trade Notes |

|---|---|

| PLTR | Added Monday: Sized up position on tight action with low relative volume. |

| SPOT | Sold Friday: Exited entire position to reduce margin exposure. Not due to invalidation – still showing higher low at rising 30-week support. Personal decision related to having 3 heavy positions down the same day on margin and wanting to lighten up after rough day in TSLA/PLTR. |

| RKLB | AddedTrimmed Thursday: Sold tiny 1/8 of position up 6% only because I hate this stock and I’m heavy on margin. Sitting with bulk of it still. Needed to take a small win in this name its been beating me up. |

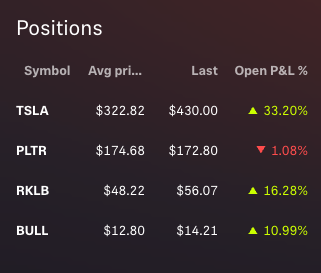

Current Holdings

4 core positions • Total exposure 150%

| Ticker | Status & Notes |

|---|---|

| TSLA | 93% of portfolio Now at the 21-day/4-week MA after Friday’s weakness. “Despite the weakness today theres nothing wrong with it at all.” Structurally intact – the key support level held on a closing basis so far. Has moved quickly, so consolidation acceptable. |

| PLTR | 23% of portfolio. Full position after sizing up Monday. Experienced Friday weakness but never broke out yet, so weakness was to be expected. |

| RKLB | 19% of portfolio. Closed the week at its highest weekly close ever. Now ideally do not want to see it return back into it’s base. |

| BULL | 15% of portfolio. Still intact and acting how it needs to. Will continue to inch up stops using weekly lows and the 4-week moving average. |

← Swipe to see more →

Weekly Market Observations

| Day | Key Observations |

|---|---|

| Monday, Sep 29 | HOOD showing insane strength – first April leader to break out and follow through. PLTR sitting extremely tight with no volume forming “handle”. MSTR potential higher low with crypto breaking out. Strong combo for risk-on/growth to return. |

| Tuesday, Sep 30 | Mixed open with momentum in gold/silver and healthcare while growth lagged. SPOT weakness from Goldman Sachs downgrade but acting fine – sometimes downgrades act as shakeouts. Despite slight pressure, NVDA & HOOD showing strength while key leaders PLTR & TSLA holding well. “Hard to be too pessimistic with these acting so well.” Looking for higher lows in base names like SPOT & DAVE – signals underlying strength and makes them more actionable. |

| Wednesday, Oct 1 | First day of Q4! RKLB showing early strength inside last week’s wick. PLTR volume picking up but below average. “For PLTR to really stick I’d want to see big volume through highs”. SPOT and DAVE both showing higher lows. MSTR higher low looking good. Attempted another position in RKLB using low of week to manage risk. |

| Thursday, Oct 2 | Typical gap up reaction with most names moving lower first 10 minutes – want to see lows put in early. Early strength in small caps. RKLB pushing on volume (still expecting potential flop until closes above prior highs). RGTI never broke 4-week MA – constructive. Trimmed tiny 1/8 of RKLB up 6% for small win. ALAB constructive bounce on 10-week – low risk opportunity and good market sign. SNOW & MDB perking up together. OKLO shaping up well – tight near highs holding 4-week. GEV getting good looking with low volume inside week. |

| Friday, Oct 3 | TSLA gapping up slightly (never loves gaps up). Key level is 21-day/4-week MA for TSLA – will be fine if it can defend that level. RKLB headed for highest weekly close ever. DAVE looking A+ with lower wick and higher low. Most weakness continues to respect structure.. Beautiful day except for TSLA and PLTR (both rough but fine). Exited SPOT to lighten margin exposure – not invalidated, personal decision due to heavy on margin. Everything structurally intact. |

← Swipe to see more →