Weekly Digest – Edition 10

Nick Schmidt

Nick Schmidt is a co-founder of TraderLion and Deepvue with over 10 years of market experience. Adopting a “less is more” philosophy, he focuses on weekly charts with an emphasis on price and volume.

Published: September 14, 2025

7 min read

Weekly Subscriber Digest

“My biggest observation still about the current environment and all of these names is that buying weakness is being

rewarded because you can sit patiently, and buying strength is really difficult still.”

Key Trading Insights

Position Sizing is Everything

“After reviewing my trades I realized position sizing is everything and I need to focus more on the total size of my account it is.”

Found that biggest winning years came from 40% position sizes built systematically over time. 30% now considered where it moves the needle.

Found that biggest winning years came from 40% position sizes built systematically over time. 30% now considered where it moves the needle.

Systematic Risk Management

“I was able to get to this size systematically.”

TSLA position built through multiple separate buys over 1.5 months, each with tight risk. Worst case scenario is getting stopped out even, not catastrophic loss.

TSLA position built through multiple separate buys over 1.5 months, each with tight risk. Worst case scenario is getting stopped out even, not catastrophic loss.

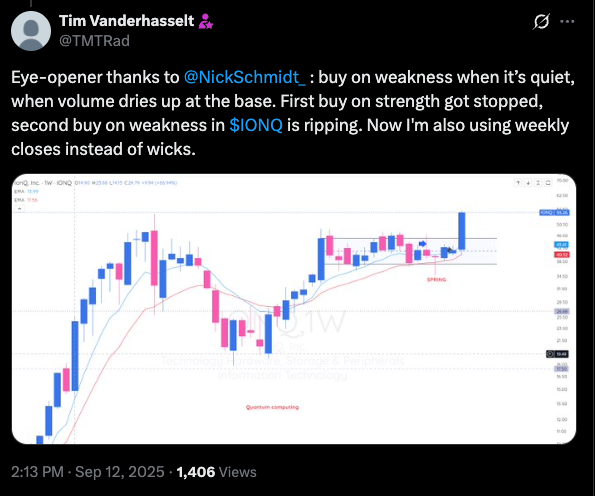

Buy Weakness, Not Strength

“Bases frustrate people because they are buying strength when they should be buying weakness. Buying weakness = you can avoid being stopped until breakout day shows up.”

Market continues to reward buying weakness over strength in current choppy environment.

Market continues to reward buying weakness over strength in current choppy environment.

The N in CANSLIM is Most Important

“A company that changes how we work, play, live is the absolute #1 driver of an absolute monster stock. Fundamentals in that case will catch up eventually.”

Between two identical charts, chooses the one that changes lives over traditional fundamentals.

Between two identical charts, chooses the one that changes lives over traditional fundamentals.

Multi-Month Base Accumulation

After reviewing best trades, they all followed the same script: Multi-month base, get familiar

with structure, accumulate over time on weakness within the base.

“There is a lot of sitting around waiting but by the time it moves I have huge size with very little risk.”

“There is a lot of sitting around waiting but by the time it moves I have huge size with very little risk.”

Exit Rules: Sell Weakness, Not Strength

“I focus on just increasing my worst case scenario as the trade develops.”

Personal rule: don’t sell into strength, only weakness. Tried timing tops and missed significant moves.

Personal rule: don’t sell into strength, only weakness. Tried timing tops and missed significant moves.

Trade Activity

2 new entries this week

| Ticker | Trade Notes |

|---|---|

| HOOD | Bought Started pilot position. S&P 500 addition caused gap to top of base. Made it a full position by end of week on the retest of the breakout level. “Ideal situation is we open in this week’s range and move higher.” |

| PLTR | Bought Small pilot position (7% of account). Still basing, waiting for close above $160 weekly level from hammer candle for confirmation before building to full position. |

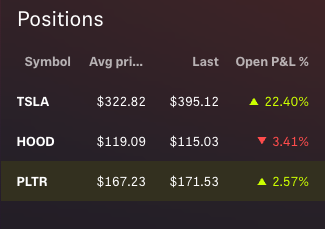

Current Holdings

3 positions • 27% on margin

| Ticker | Status & Notes |

|---|---|

| TSLA | 94% of portfolio. Finally moved out of consolidation with great action – closed at high of week. “This first push out of the consolidation is nice but remember the real play is the breakout of the multi-year base.” Position built systematically over 1.5 months. |

| HOOD | 25% of portfolio. Pilot position started after S&P 500 addition gap. Added to a full position on the retest of the breakout level. Will take loss if returns to base, but looking for continuation above breakout level. |

| PLTR | 8% of portfolio. Small pilot position while stock continues basing. Good action this week but waiting for confirmation above $160 weekly close level. “Will slowly build to a full position as long as we hold above the weekly close of the shakeout candle.” |

← Swipe to see more →

Weekly Market Observations

| Day | Key Observations |

|---|---|

| Monday | HOOD gapped up to top of base on S&P 500 addition news, disrupting original base-buying plan. Most stocks moving lower but watchlist names moving higher – “good sign we are focusing on right groups.” |

| Tuesday | Market continues to reward buying weakness over strength. All watchlist names acting extremely constructively with A+ basing action. RGTI showing double inside week with drying volume. LMND and WULF sitting constructively again at key levels. |

| Wednesday | TSLA making higher lows within tight base around $330 level – any pullbacks forming higher lows are opportunities to buy or add. “These basing periods are the best for slowly accumulating when it’s quiet.” Mixed action, HOOD struggling at base top. |

| Thursday | TSLA pushing through $358-360 levels. Now in new territory from consolidation with increasing volume. Nice momentum across market. PLTR and HOOD not doing much which is fine – patience being rewarded. |

| Friday | Excellent week for TSLA holders. Strong weekly candle formed. “It’s not going to continue straight up, there will be ups and downs, and more opportunity to get involved.” HOOD held breakout level into close – weekly candle crucial for determining next move. Ideally want to open in the wick next week and continue higher. Otherwise if it returns into the base, it will need more time. |

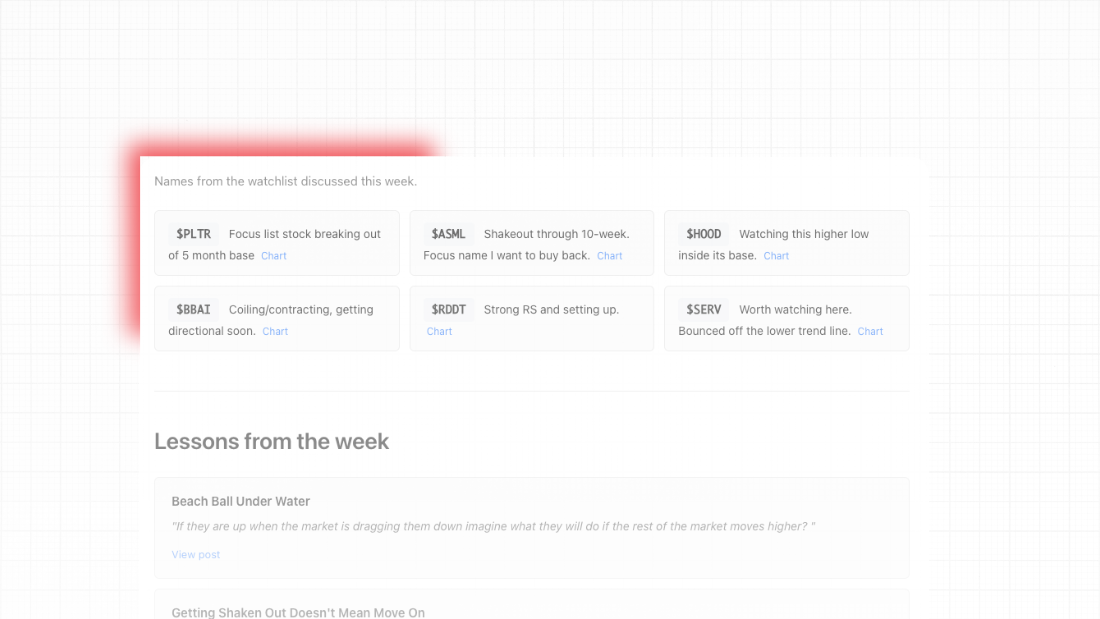

Community Highlight