Inside Days: How To Catch True Market Leaders After the Breakout

Ameet Rai

Electrical Engineer and Swing Trader focused on achieving super-performance. Through extensive studies of previous super-performance stocks and proprietary data-based research I provide guidance for new traders with an emphasis on building processes and teaching traders how to think and trade for themselves.

Published: July 14, 2024

Have you ever been tracking a name, meticulously stalking it as it builds out a major base, runs up the right side, and preps to break to all-time highs—only to completely miss the breakout move?

This is easily one of the worst feelings in the market and is one of the main reasons so many traders/investors lose money by FOMO in the stock market.

Well, after today’s post, this feeling is one you can learn to avoid!

What Is A Continuation Pattern?

A Continuation Pattern is a secondary setup that allows you to enter stocks that have already broken out/made impressive moves. These types of patterns usually form within the first 1-2 weeks post breakout in an uptrending market.

There are a couple of different types of Continuation Patterns, and the main one we’ll cover today is known as the Inside Day Setup. Here are other common upside Continuation Patterns we see:

- Bull Flags

- Pullbacks To Rising 10/20-Day Moving Averages

- High Tight Flag

- Inside Day Setup*

- 3EMA Shakeout Pattern

- Upside Kicker Pattern

These types of patterns help traders:

- Catch moves in big names with less than traditional entry and exit techniques

- Sometimes allow you to manage risk better than you would have been able to on breakout day

Again, these patterns work best in names that have already broken out or have shown some sort of strong upside institutional accumulation. They can either be areas in which you start new positions (if you missed the traditional breakout point) or where you can add shares to an existing position.

Let’s now take a closer look at how you can do just that with the Inside Day Setup:

The Inside Day Setup

The Inside Day Setup is a specific type of Continuation Pattern that traders use to identify potential entry points in a stock that has shown recent strength or has just broken out. This pattern is observed on the daily chart and is characterized by:

- An Inside Bar

When today’s bar is fully within the high and low of the previous day’s bar, indicating a consolidation or pause in the stock’s movement. - Volume Consideration

It is preferably accompanied by lower than average volume, and less than the previous day’s volume, suggesting a decrease in selling pressure and setting the stage for a potential upward continuation.

For executing trades based on the Inside Day Setup, the approach to entries and exits varies depending on the your strategy and risk appetite:

- Potential Entry Points

- The high of the previous day; or

- The high of the inside day.

This allows traders to engage with the stock as it resumes its upward trajectory, with entry points chosen based on their risk tolerance and trading style.

- Exit Strategies

- The low of the inside day; or

- The low of the previous day.

These points serve as stop-loss markers to protect against unforeseen reversals in the stock’s direction.

In essence, the Inside Day Setup offers a strategic method for traders to leverage potential upward movements in stocks that are already exhibiting strength, providing a secondary approach to positioning yourself in the market’s strongest stocks.

Let’s now take a deep dive into 3 separate examples from the 2024 market:

Inside Days | Examples

NVDA 4 Days Post-2024 Breakout Shows Inside Day

NVDA broke out of a multi-month base on January 8th, 2024 at the $500 level and currently trades near $900. You could have caught the majority of this move (with better risk!) implementing the Inside Day Setup.

- Inside Day Setup occurs on January 12, 2024 (4 days after breakout)

- Following Day Entry: Through $550

- Stop Loss: Under $543

- Total Risk: ~1.4%

Note how volume traded on January 12th was the lowest since breakout, as accumulation from institutions was on pause for a session. The $550 entry would then go on to be tested and defended one more time before price ran 300 points.

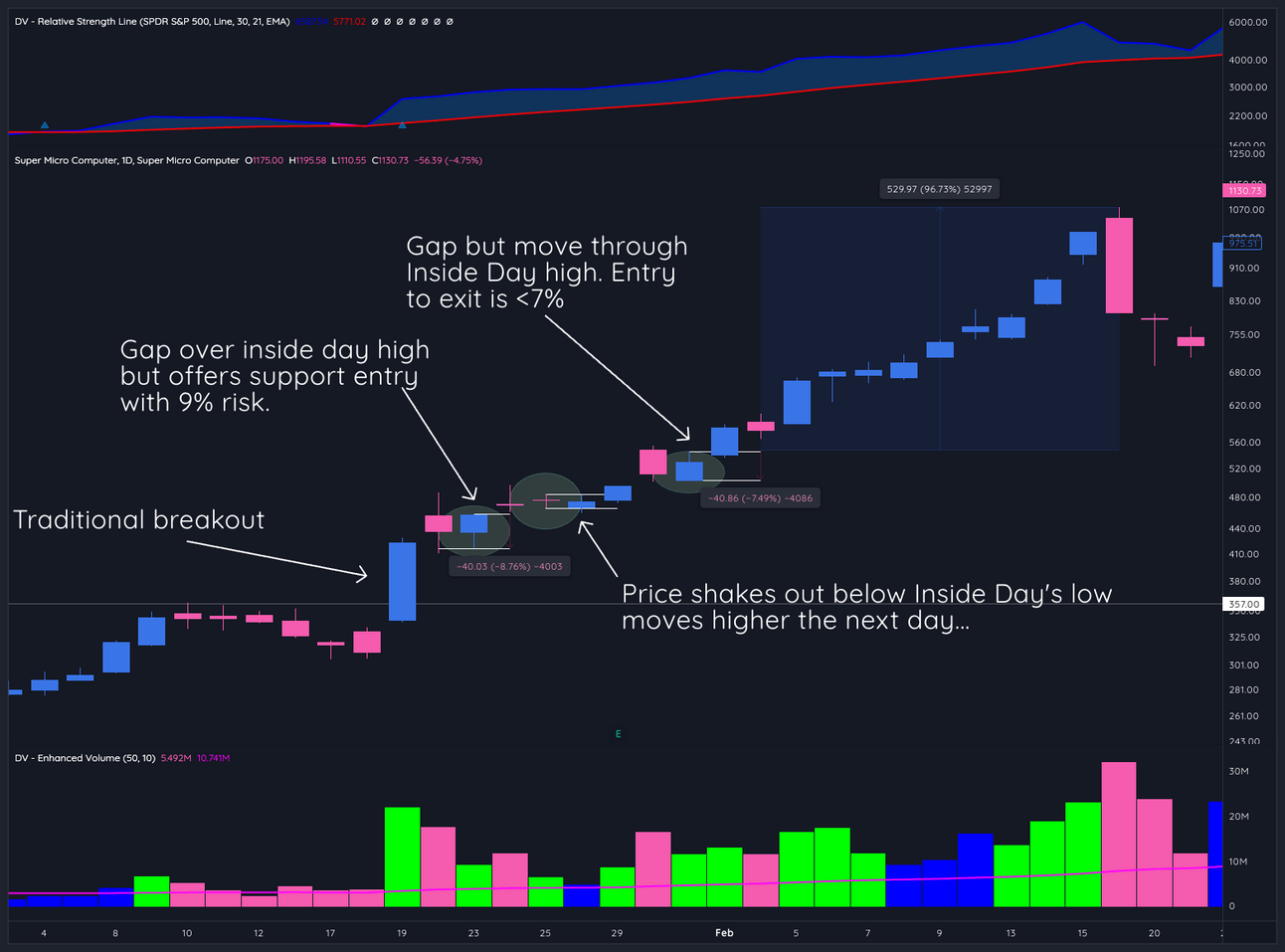

SMCI, Multiple Instances of Inside Day Post-2024 Breakout

SMCI broke out of a major base on February 16th, 2024 and is now 200% higher from a proper buy point. If you missed the initial entry but were attentive in tracking the name, you would have realized 3 different opportunities to execute on the Inside Day Setup within the first 10 days post breakout.

- The first: An Inside Day Setup occurred 2 sessions after breakout, and triggered the following day. This entry offered you a 9% stop loss from inside day low to inside day high.

- The second: The second Inside Day Setup shakes out below the prior day’s low only 5 sessions post breakout. This setup doesn’t work 100% of the time (nothing does in the market!) but if you stayed engaged, you would have been ready for the third setup only two days later.

- The third: The final inside day setup occurred only 8 days post breakout. You would’ve been able to capture nearly a 100% move with less than 7% risk, as highlighted by the third bubble in the example above.

Again, the Inside Day Setup doesn’t work 100% of the time, but by staying engaged and looking to position in names that have already broken out and exhibited leadership status, you give yourself the opportunity to capture big moves with limited downside risk.

CLSK, Multiple Instances of Inside Day Post-2024 Breakout

We wanted to highlight this $CLSK setup for two main reasons:

1. You can implement the Inside Day Setup on less than traditional chart patterns.

With the CLSK example above, you can see price hadn’t necessarily broken out of a beautiful, multi-month base as it did with NVDA or SMCI.

2. Sometimes these moves don’t turn into multi-month swing trades.

With the CLSK example above, price ran up 30% in two sessions following the Inside Day Setup. Unfortunately for those long the stock, all gains were erased 5 sessions after the Setup triggered. It goes to show that entry/stop loss tactics aren’t enough, you need to have clear ‘sell into strength’ rules to really squeeze this pattern for what it’s worth.

Finding Inside Day Setup Candidates

Now that we’ve covered what a Continuation Pattern is and one of our favorite setups to execute on, it’s time to teach you how to fish for yourself. Let’s take a quick look at how you can find these Inside Day Setups consistently:

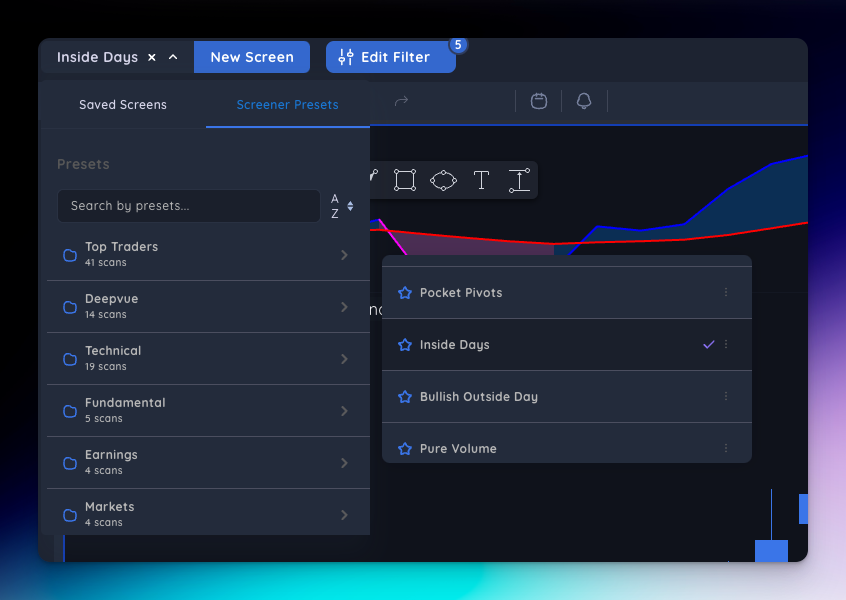

We’ve built an easily accessible preset scan within Deepvue for you to easily track & find tradable Inside Day Setups. Here are the steps you need to follow:

- Hover Over Screener Presets

- Scroll Down To ‘Technical’ Folder

- Click On ‘Inside Days’

It’s that simple!

Or if you’re looking to build this screen yourself, here’s the criteria:

We highly recommend tracking this screen on a daily basis, as the market’s strongest stocks will often populate while they take a breather and prepare for their next upside move.

Putting It All Together

If there’s one thing we want you to come away with today’s lesson with, it’s that there are two ways to respond to missing a major breakout. You can either:

1. Feel bad for yourself, succumb to FOMO, and lose/miss out on making money either way, OR…

2. Prepare to catch an Inside Day Setup or Continuation Pattern, giving yourself the opportunity to profit from a major market move.