What Fueled Every Major Bull Market In The Past 100 Years?

Published: May 29, 2025

How technological breakthroughs lead every major bull market

Major technological shifts have historically fueled bull markets. Innovations like electricity, personal computers, the internet, and AI haven’t just changed how we live, they’ve also reshaped economies and driven massive gains in stock markets.

In this post, we’ll take a look at the tech-driven bull markets of the last 100 years, with a special focus on the past 15 years. We’ll break down key bull runs, highlight the tech trends behind them, and spotlight the top-performing stocks that gained over 100% in each phase.

Studying the past stock market cycles will help train your eye to be ready for the next bull market run.

What drove past bull runs: from electricity to the internet

Before we dive into the last 15 years, let’s take a quick look at how breakthrough technologies have powered major bull markets over the past century. Each era had its own innovation wave, and a few standout stocks that left the rest behind.

1920s: How electrification and cars sparked the roaring twenties

The 1923-1929 bull market was fueled by the widespread adoption of electricity, automobiles, and radio. The Dow jumped nearly 200% as industrial and consumer tech transformed daily life.

- Top performers:

- General Electric (electric power)

- Ford (automobiles)

- RCA (radio)

Each of these leaders saw gains of over 100%. But the boom ended in disaster. The market crashed in 1929, and by 1932, the Dow Jones Industrial Average had dropped by nearly 90%.

1950s–60s: how computing and consumer goods reshaped post-war America

Post-WWII America saw a wave of innovation – TVs, jet aircraft, and the first mainframe computers. Economic growth surged, and so did markets:

- S&P 500 performance:

- 308% from 1947 to 1957

- 76% from 1957 to 1961

- Top performers:

- IBM (computing)

- General Motors (cars)

- Sears (retail)

This was the age of mass consumption and suburban sprawl, fueled by technology and optimism.

1982–2000: the rise of PCs, the internet, and the dot-com boom

Two back-to-back bull markets defined this digital revolution.

1982–1987: The S&P 500 soared 282% thanks to the PC boom. Microsoft and Intel were at the forefront:

- Top performers:

- Microsoft: 1000% post-1986 IPO

- Intel: 500%

1990–2000 (dot-com boom): The internet changed everything. The S&P 500 rose 355%, and the Nasdaq gained around 400%.

- Top performers:

- Cisco: 2000%

- Microsoft, Intel, Oracle, AOL: all gained well over 100%

In 1999, tech drove 70% of the S&P 500’s gains, but the huge bull market advance ended with one of the worst markets in history. The Nasdaq dropped 78% during the dot-com crash (2000–2002).

Breaking down the bull markets of the last 15 years

Let’s dive into the tech trends and stock leaders that defined each bull market since 2010.

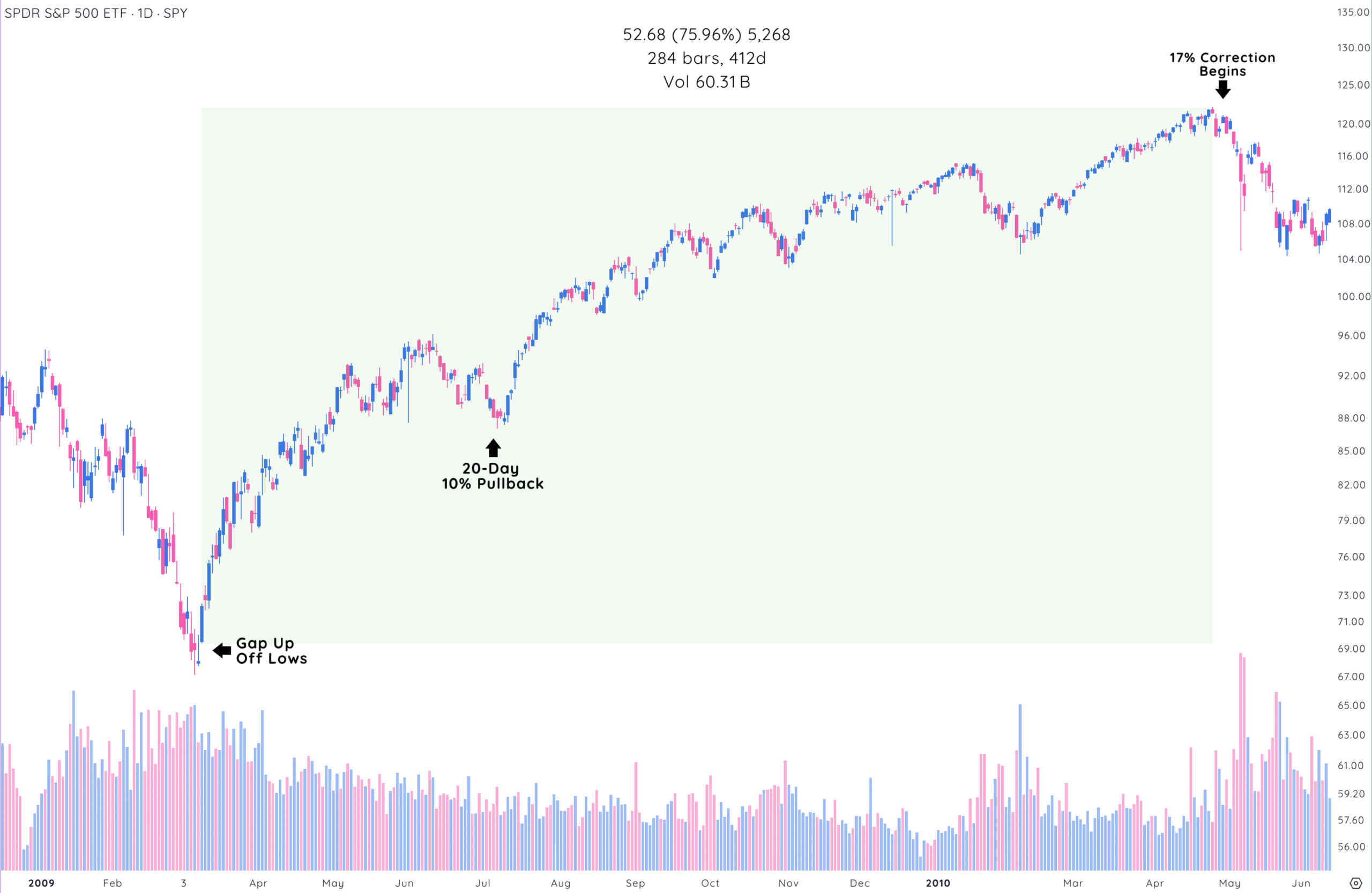

Bull Market 1: March 2009–February 2020 (Longest on Record)

Market Performance:

- S&P 500: Gained 330% from March 9, 2009, to February 19, 2020.

- Nasdaq: Surged 500% from March 9, 2009, to February 19, 2020.

Technological Advancements:

- Smartphones and Mobile Internet: Apple’s iPhone and Google’s Android ecosystem made mobile computing mainstream, unlocking the app economy and 4G growth.

- Cloud Computing: Amazon Web Services (AWS), Microsoft Azure, and Google Cloud transformed enterprise IT, with scalable, cost-efficient, on-demand services.

- Social Media and Digital Advertising: Platforms like Facebook (Meta) and Google reshaped marketing with targeted data-driven platforms, capturing massive market share.

- Streaming and Content Delivery: Netflix and YouTube (Google) disrupted traditional media by leveraging high-speed internet.

- E-commerce: Amazon’s logistics and marketplace innovations reshaped how the world shops online.

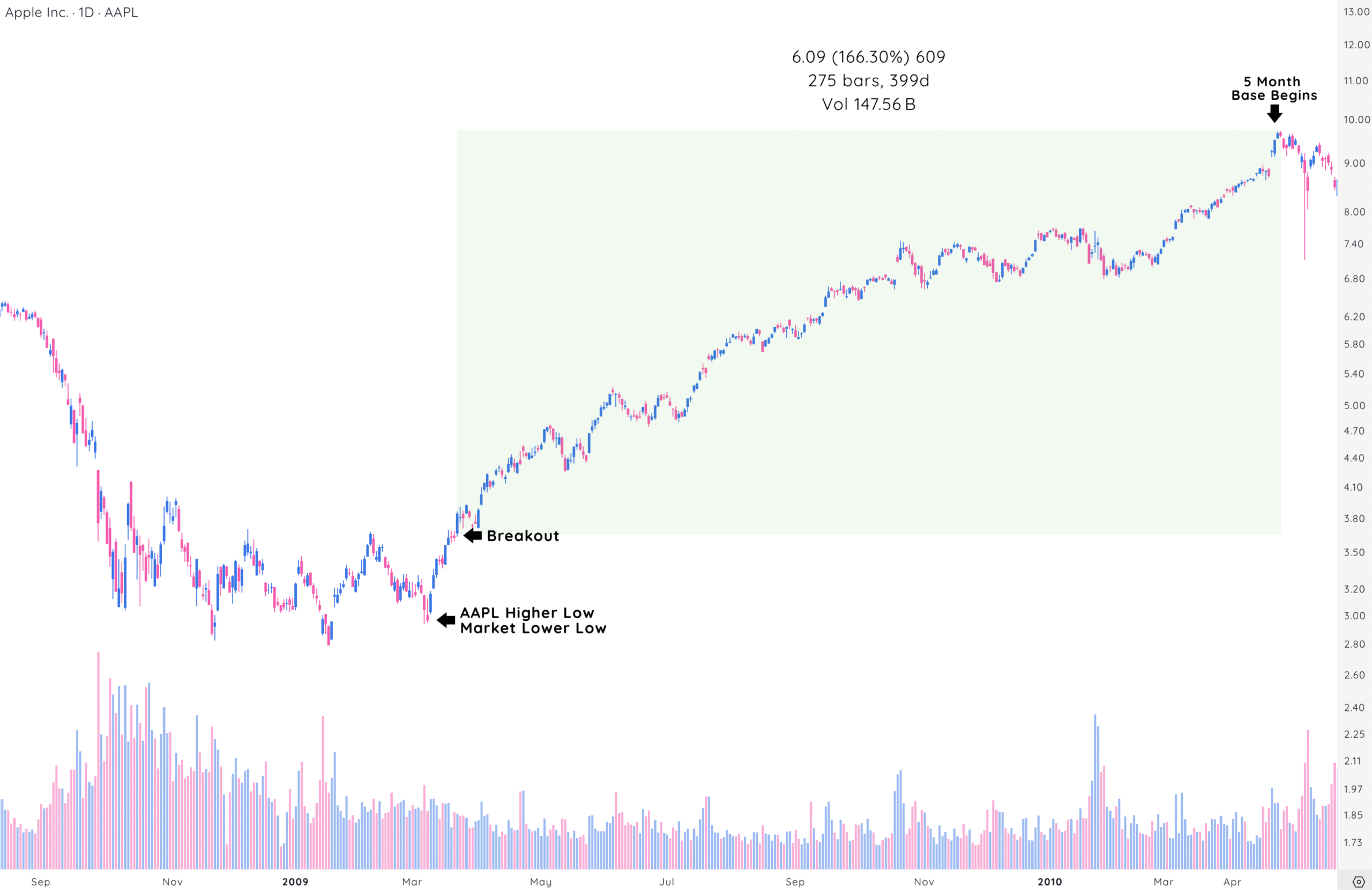

Leading Stocks (Gains >100%):

- Apple (AAPL): 1200% gain, driven by iPhone, iPad, and services (App Store, iCloud).

- Amazon (AMZN): 2000% gain, fueled by e-commerce and AWS (reaching $110B revenue run rate by 2024).

- Netflix (NFLX): 4000% gain, leading streaming media.

- Microsoft (MSFT): 500% gain, pivoting to cloud with Azure and Office 365.

- Google/Alphabet (GOOGL): 600% gain, dominating search, YouTube, and cloud.

- NVIDIA (NVDA): 2000% gain, driven by GPUs for gaming and large compute models in early AI innovation

- Tesla (TSLA): 1500% gain, leading EVs and renewable energy.

- Meta (META): 800% gain (post-2012 IPO), driven by social media and advertising.

This 11-year bull market was supported by low interest rates, quantitative easing post-2008, and global economic recovery. Tech giants, later dubbed the “Magnificent Seven” (AAPL, AMZN, MSFT, GOOGL, META, NVDA, TSLA), drove disproportionate gains, with tech-heavy Nasdaq outperforming the S&P 500.

The bull run ended with a sharp correction due to the COVID-19 pandemic.

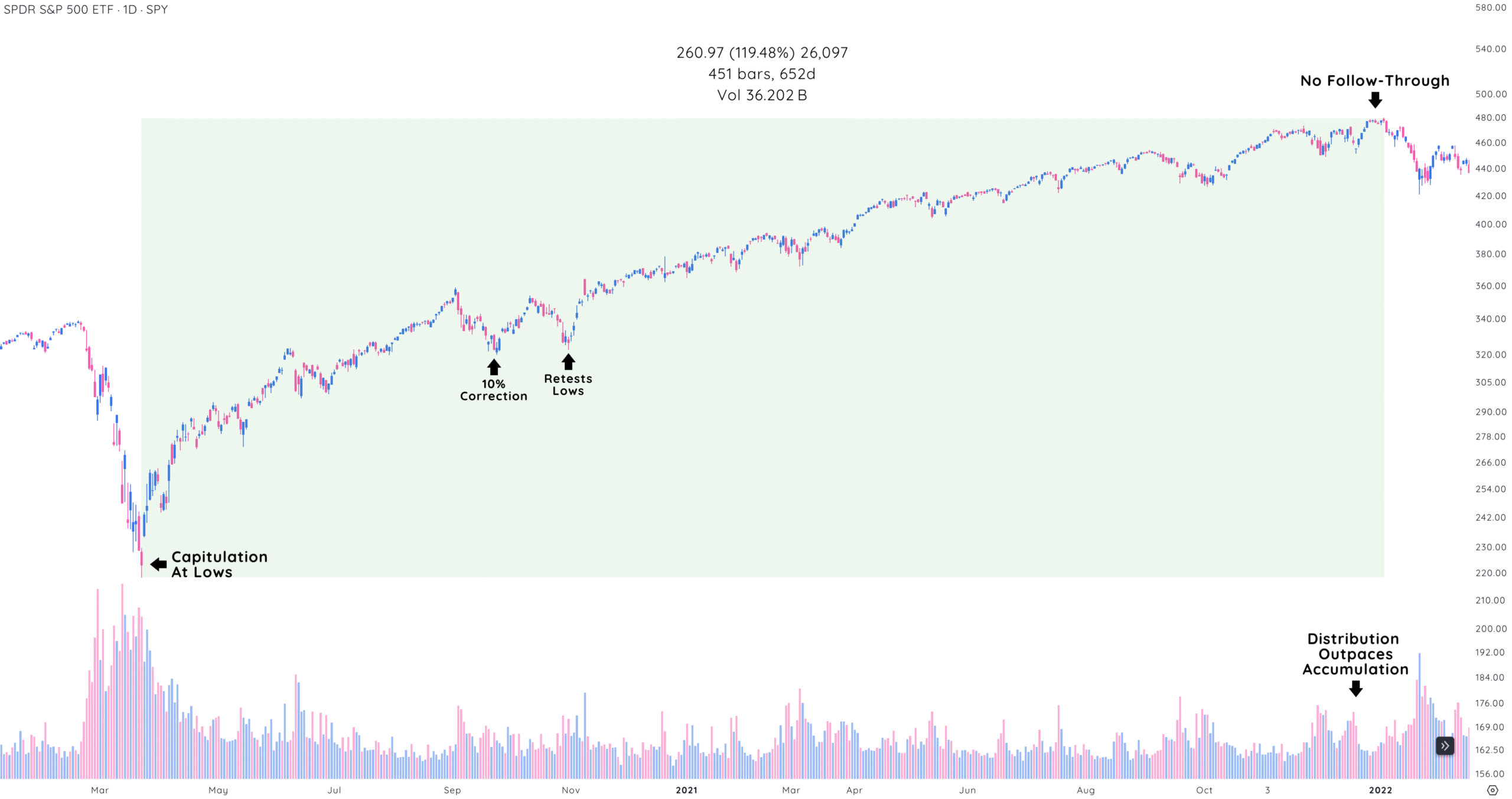

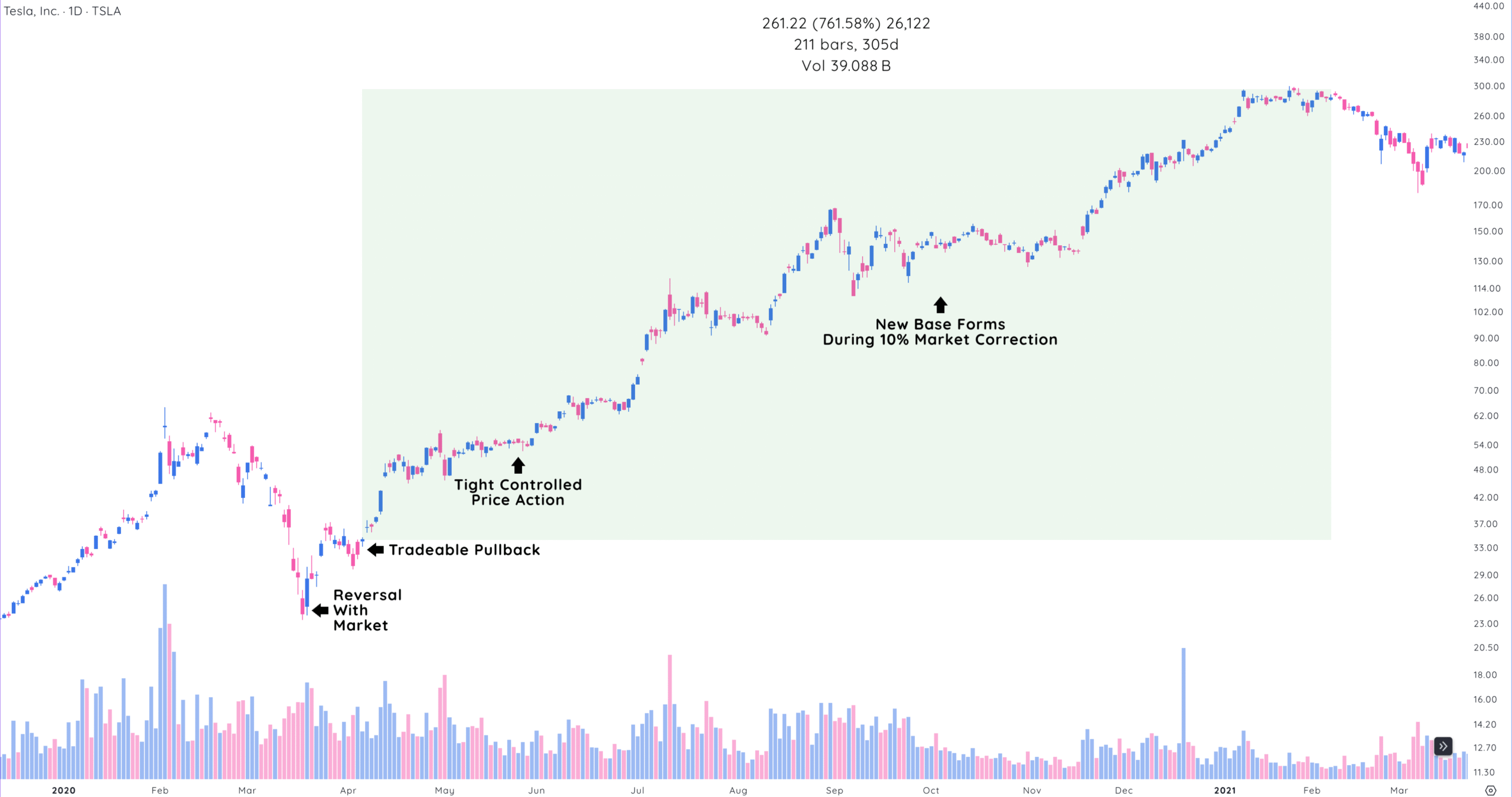

Bull Market 2: March 2020–January 2022 (Post-COVID Recovery)

Market Performance:

- Nasdaq: Surged 130% from March 23, 2020, to January 3, 2022.

- S&P 500: Gained 100% from March 23, 2020, to January 3, 2022.

What powered the rally?

- Remote work tools: Zoom, Microsoft Teams, and cloud platforms boomed as offices went virtual.

- Online shopping surge: Amazon and Shopify thrived during lockdowns with boosted online retail.

- Digital payments: PayPal and Square gained from the shift towards cashless transaction trends.

- Early AI use cases: AI began making waves in healthcare and automation, lifting NVIDIA and cloud providers.

- Electric vehicle momentum: Tesla expanded production and innovation, solidifying its lead.

Leading Stocks (Gains >100%):

- Tesla (TSLA): 800% gain, driven by EV production and market leadership.

- NVIDIA (NVDA): 300% gain, fueled by GPU demand for AI, gaming, and data centers.

- Shopify (SHOP): 400% gain, powering e-commerce platforms for small businesses.

- Zoom Video (ZM): 500% gain, driven by remote work demand.

- PayPal (PYPL): 200% gain, benefiting from digital payment growth.

- Moderna (MRNA): 600% gain, leading COVID-19 vaccine development.

Massive fiscal stimulus, low interest rates, and vaccine optimism fueled this rapid recovery. Tech’s role in remote work, e-commerce, and digital health led to outperformance, with the Nasdaq doubling the S&P 500’s gains. Inflationary pressures and Federal Reserve tightening loomed by late 2021.

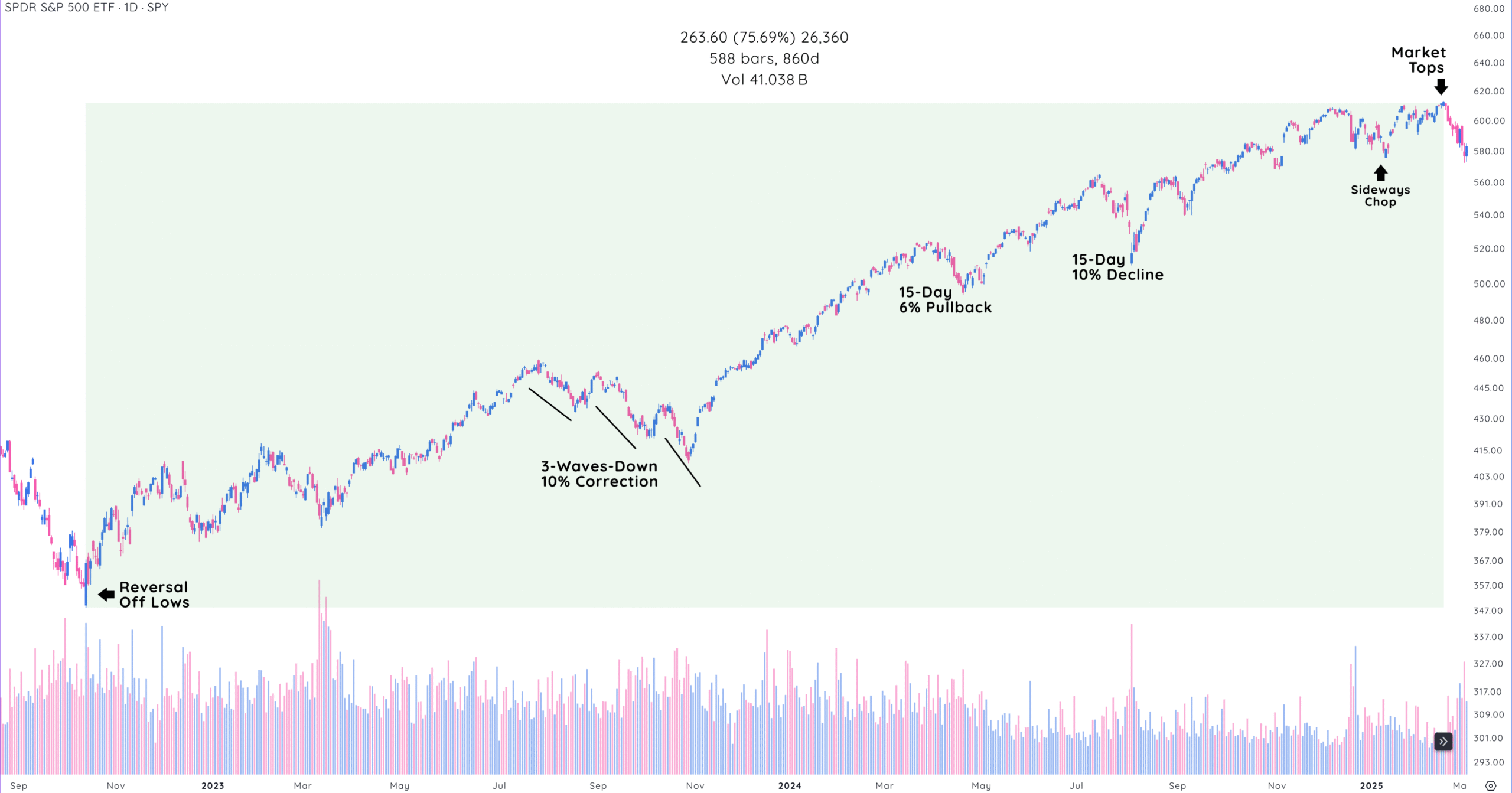

Bull Market 3: October 2022–February 2025 (AI-Driven Rally)

Market Performance:

- S&P 500: Gained 75% from October 12, 2022, to February 14, 2025.

- Nasdaq: Surged 85% from October 12, 2022, to February 14, 2025.

What powered the rally?

- AI infrastructure buildout: Hyperscalers poured $400B annually into GPUs and cloud capacity.

- Generative AI explosion: Tools like ChatGPT sparked a wave of AI investments across industries.

- Cloud expansion: Microsoft, Amazon, and Google scaled rapidly to meet AI workloads.

- Alternative Energy Sources: Increased energy demand soars as AI infrastructure demands more power.

- 5G & edge computing: Faster networks enabled smarter, more connected systems.

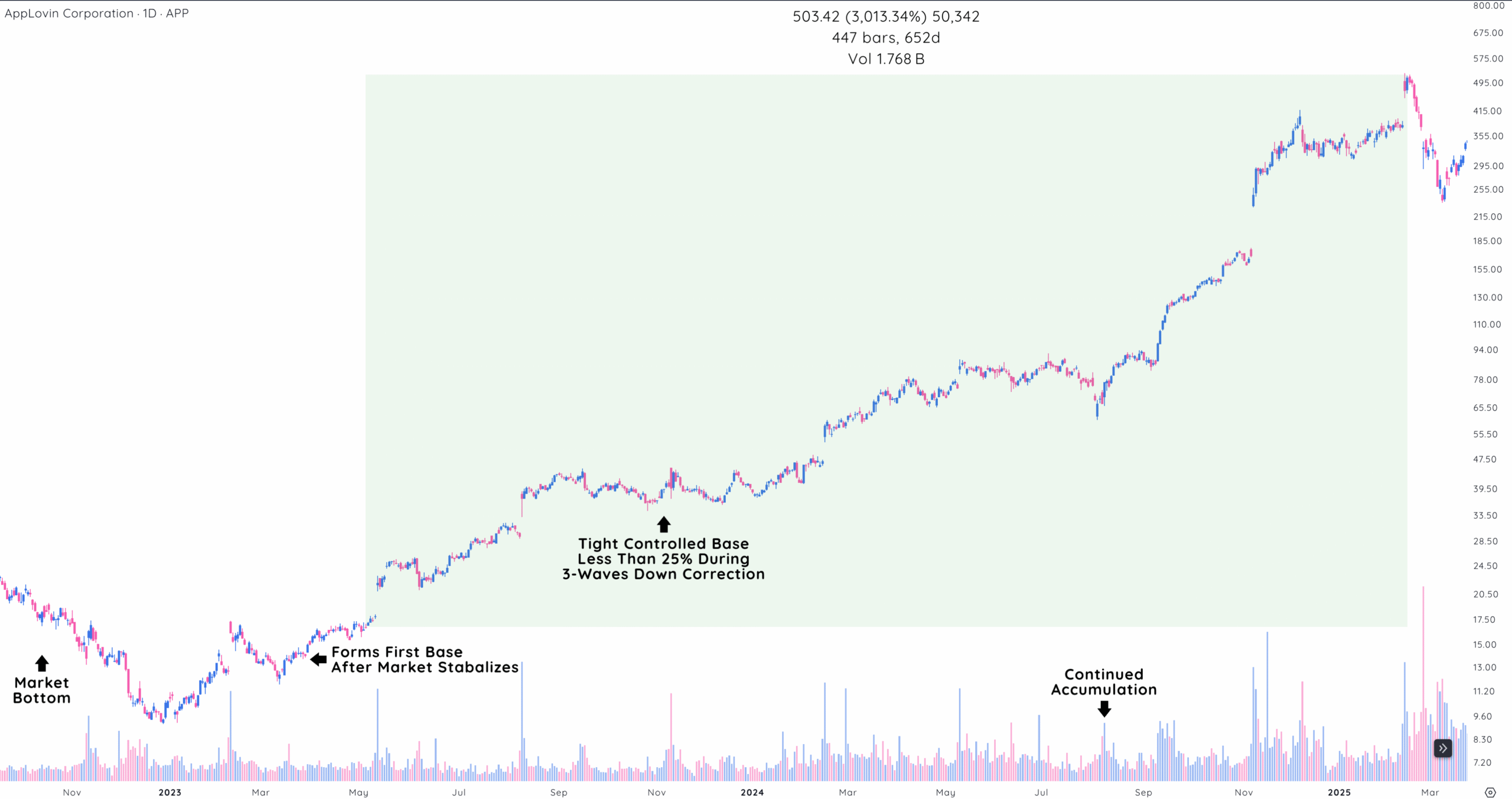

Leading Stocks (Gains >100%):

- NVIDIA (NVDA): 450% gain with 171% in 2024 alone, driven by AI chip demand.

- Palantir (PLTR): 340% gain in 2024, driven by AI analytics for enterprise and defense.

- AppLovin (APP): Over 900% gain in 2024, leveraging AI in mobile advertising.

- Tesla (TSLA): 200% gain, now leading in full-self-driving autonomy.

- Broadcom (AVGO): 150% gain, driven by AI infrastructure and semiconductors.

This AI-led bull market took off after inflation cooled and the Fed began cutting rates in late 2024. While gains were big, they were also concentrated. NVIDIA and Palantir alone drove over half of the S&P 500’s rise in 2024, raising concerns about over-reliance on a few mega-cap names.

Bull Market 4: April 2025–Present (Emerging Recovery)

Market Performance:

- S&P 500 and Nasdaq have gained 30% from the April 2nd low.

What powered the rally?

- Continued AI spending: Despite earlier concerns, Megacap companies like Amazon, Microsoft, and Google ramped up AI-related investments.

- Robotics & autonomy: NVIDIA and Tesla pushed forward with autonomous systems and robotics.

- Cryptocurrency: Robinhood has exerted dominance as the primary large broker during Bitcoin’s social acceptance.

- Cybersecurity growth: With advancements in AI, the demand for reliable cybersecurity is at the forefront of software services.

Leading Stocks (Gains >100%):

- Palantir (PLTR): 100% move after rebounding from correction lows with defense and AI contracts.

- Robinhood (HOOD): 125% advance to recent highs after the bottom formed.

- GE Vernova (GEV): Reasserts itself as a newer spinoff from GE as a dominant player in alternative energy for AI infrastructure.

- CrowdStrike (CRWD): Reaches new all-time-highs before other leading growth stocks signaling demand for cybersecurity.

- CoreWeave (CRWV): Newly listed IPO during the downtrend explodes almost 250% off its lows as a pure AI play.

This recovery follows the early 2025 tariff news-fueled AI correction. Tech is leading again, but uncertainty remains. The market hasn’t yet reclaimed its February highs, and sustainability hinges on continued AI momentum, global stability, and economic growth.

Final thoughts: What history tells us about bull markets

Every major bull market has been powered by a breakthrough technology, from electricity and automobiles to the internet and AI. These innovations drive growth, transform industries, and create outsized winners.

Volatility is part of the growth stock story. The last 15 years included three major declines, including the COVID crash, the inflation-driven bear market, and more recently, a news-driven reaction to the response to political shifts and the AI transformation.

Tech has always led market growth, and AI may be the most powerful wave yet. But concentration comes with risk.

The key for investors? Ride innovation, but stay vigilant.

Technology stocks are consistently innovating. Continue searching for market leaders that are changing the way people work, live, and play. That’s where tomorrow’s leaders are born.