TML Report November 4, 2025

Ross

Ross is a co-founder of TraderLion and Deepvue. He was mentored by William O’Neil, and co-authored The Model Book of Greatest Stock Market Winners at WON + Co.

November 4, 2025

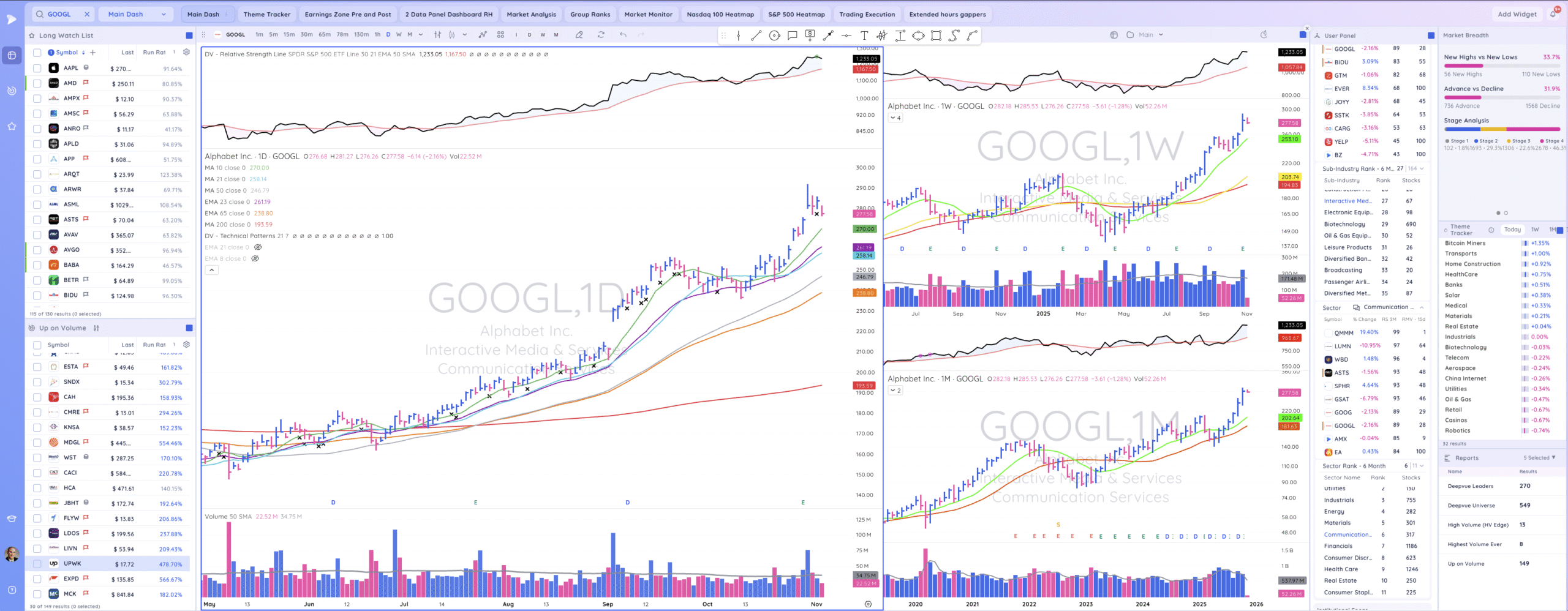

Market Overview

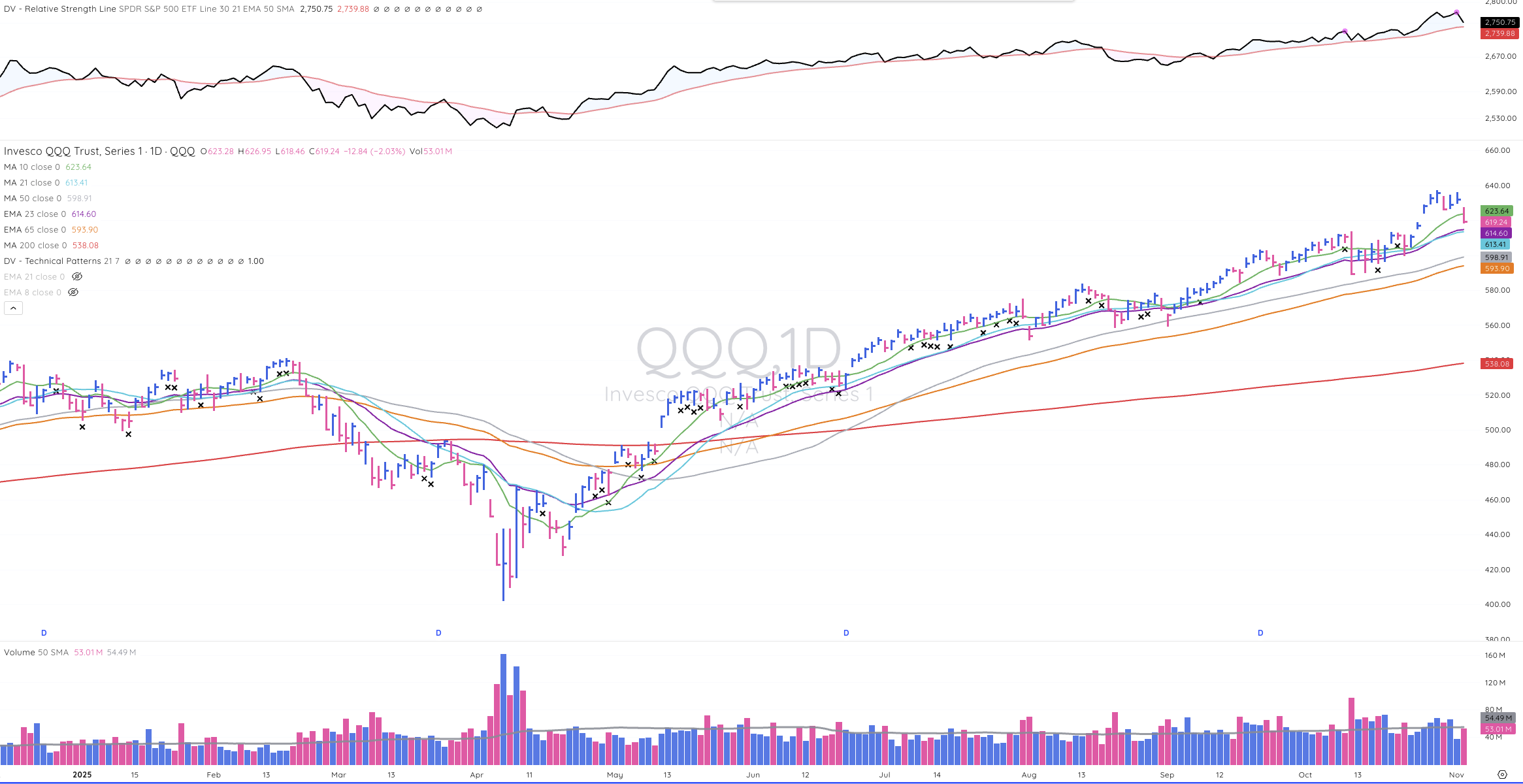

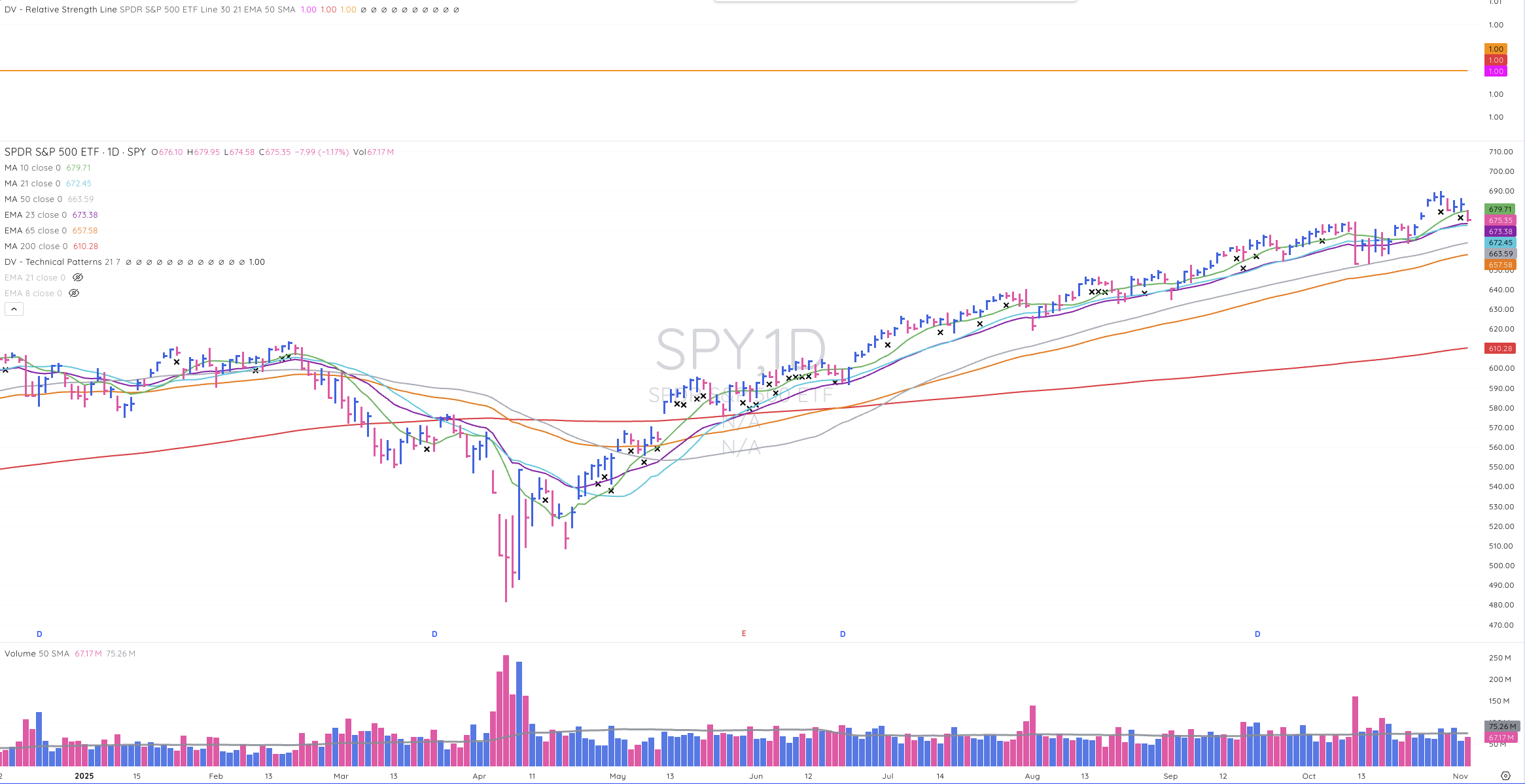

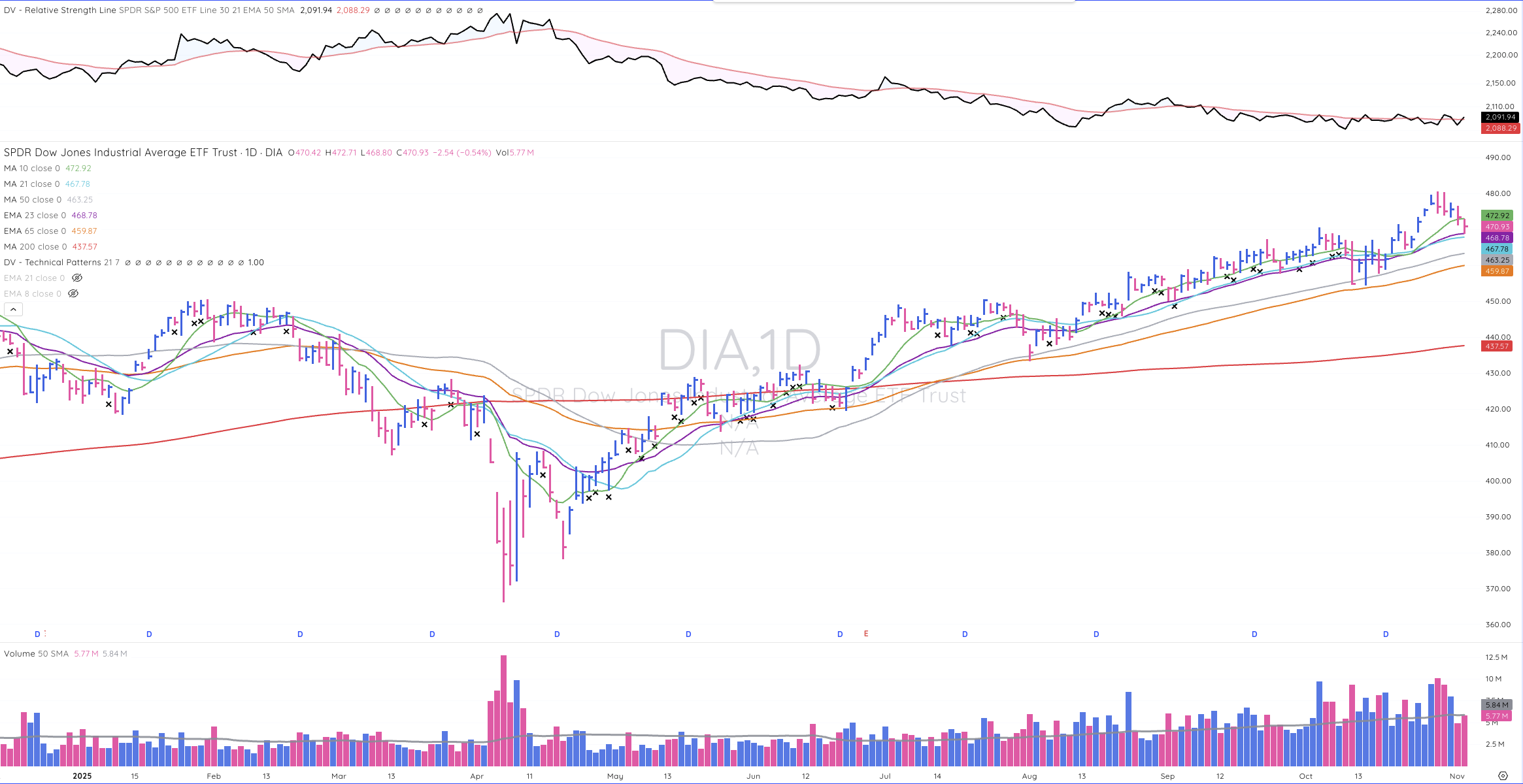

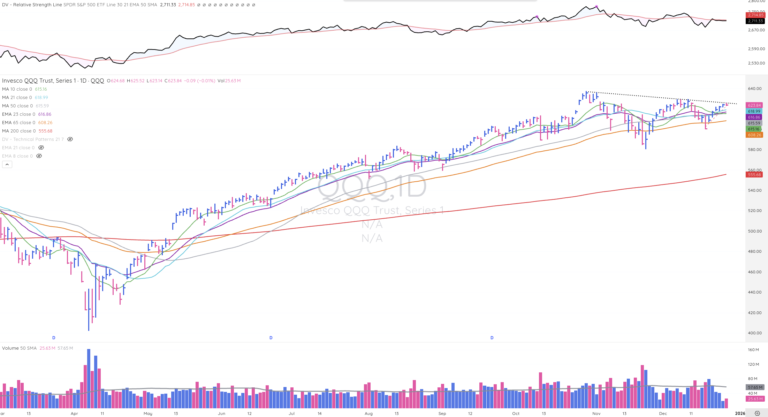

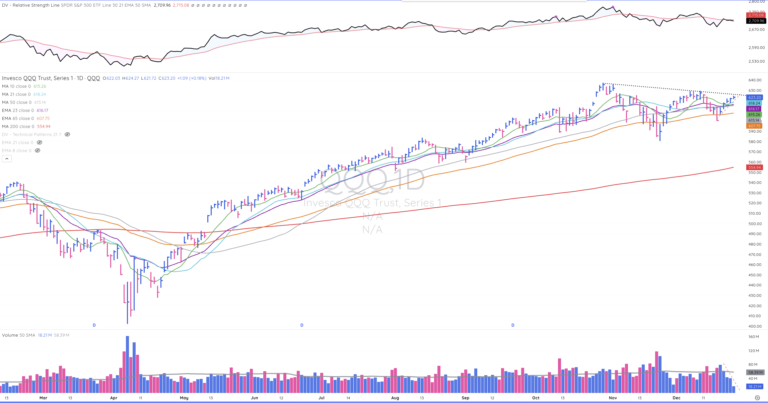

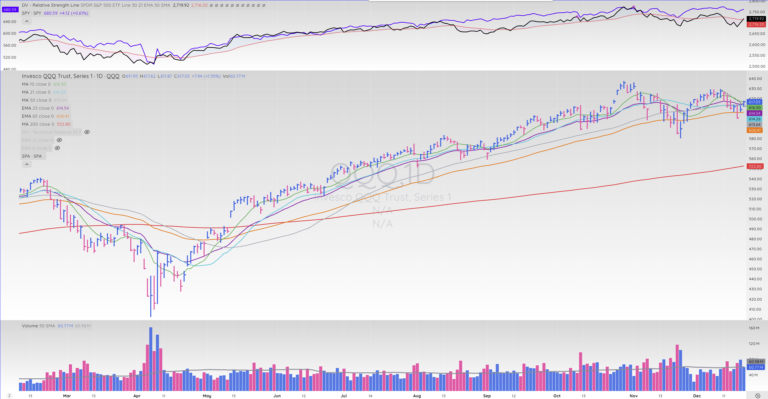

The major indexes all closed lower this afternoon. The NASDAQ, S&P 500, and DOW all held up above their short-term moving averages. However, the Russell 2000 exhibited notable weakness. The small-cap index was the only one of the four major indexes to break below its key 50-DMA and close there.

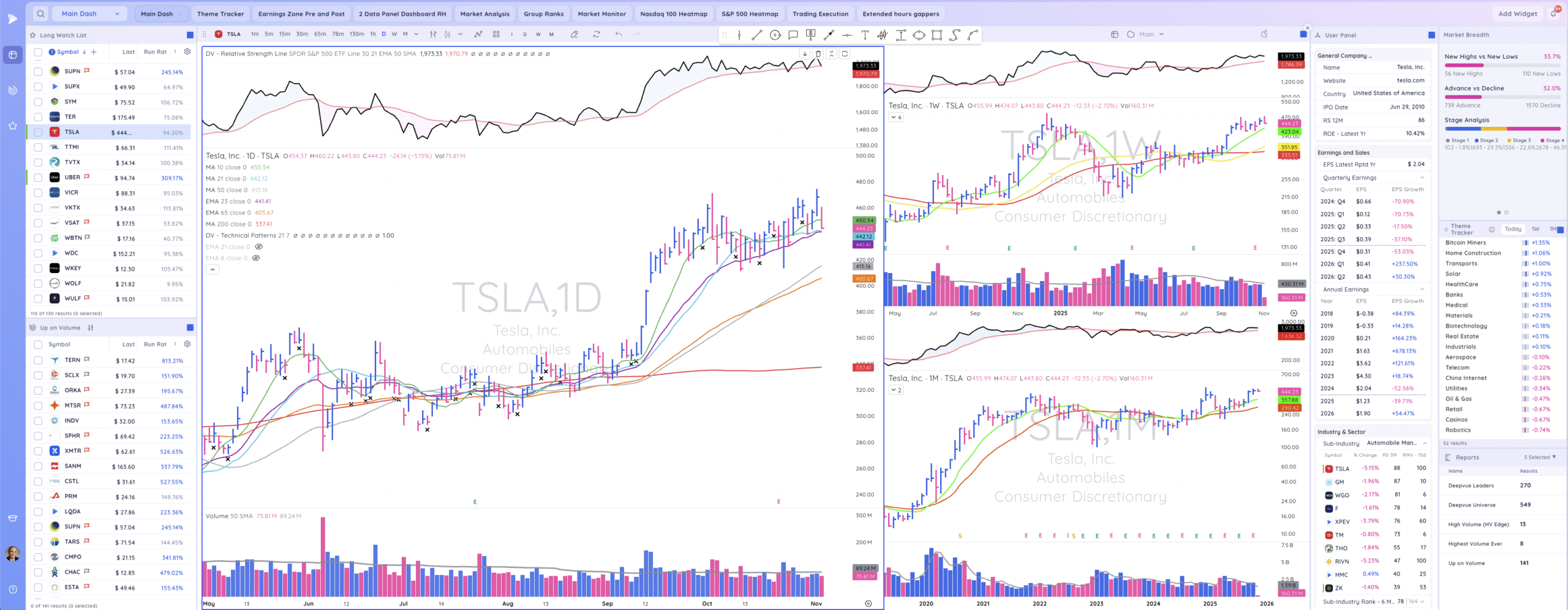

The health and breadth of the market’s leadership deteriorated today. While the major indexes held up relatively well this afternoon, many leading stocks were not so lucky. Quite a few of the names on my long watch list broke down noticeably today. Many are breaking below key short-term support levels, despite the indexes’ overall relative strength.

It will be interesting to see if today’s weakness was just another quick, sharp 1-day “shakeout,” or if things continue lower again tomorrow. While we will point to a handful of names that held up relatively well yesterday, they could be the next ones to break down over the next day or two. I don’t notice any standout groups at this point. It seems more like a handful of stocks across the many leading groups are exhibiting relative strength right now, so it is not evident to me where rotation may be headed.

Since it’s not our job to predict but to interpret and react, it’s not a bad time to play a little defense while we see how things shape up over the next few days.

IWM

The Russell 2000 was the weakest of the bunch this afternoon. It was already trading below its 10-day and 21-day SMAs, so it gapped down with the other major indexes today, but closed below its key 50-DMA, in much worse shape. It seems that it was unable to confirm the all-time highs in the other three major indexes. So, now it will be interesting to see if it can ultimately drag the other indexes lower, assuming weakness in the small-cap index continues from here.

Continue Reading This Week’s TML Report

Get expert CANSLIM analysis from Ross Haber, former William O’Neil portfolio manager, plus live Friday sessions and curated watchlists