Market Overview

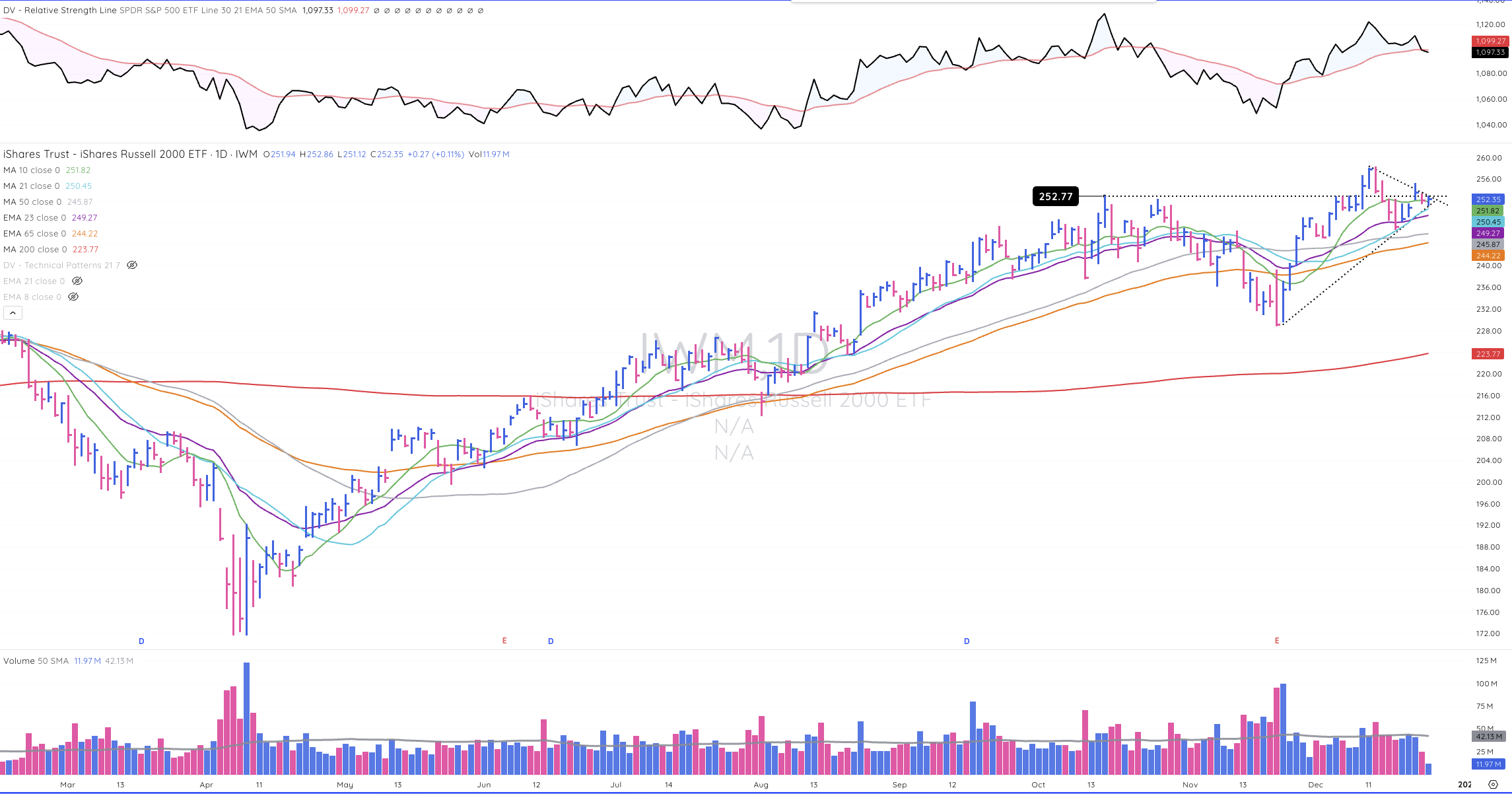

The volatility never ceases to amaze me. However, the market’s traditional growth leadership has continued to improve since last Friday. Furthermore, the S&P 500 closed at a new all-time high, confirming the Russell 2000’s breakout to new all-time highs on December 10th and the Dow’s breakout to new all-time highs on December 11th.

The Dow has held new high ground since then, while the small-cap index is now trading just a tad below. This leaves the NASDAQ as the only major index we are waiting for to confirm new all-time highs on the other major indexes.

I will preface this by saying that at the moment, the health and breadth of leadership is encouraging and would lead me to believe that higher prices are to come and that the NASDAQ will ultimately confirm.

Nevertheless, today was the fifth day up in a row on the NASDAQ on declining volume, which is expected moving into the Christmas holiday. However, this action still looks a little bit wedgy, and some backing and filling here would be expected and, quite frankly, ideal. In conjunction with the recent volatility, this is worth keeping in mind as we move forward.

This means doing your homework, knowing your stops, and having a plan. Then, it becomes a game of patience, discipline, and executing your plan without emotion.

Indexes

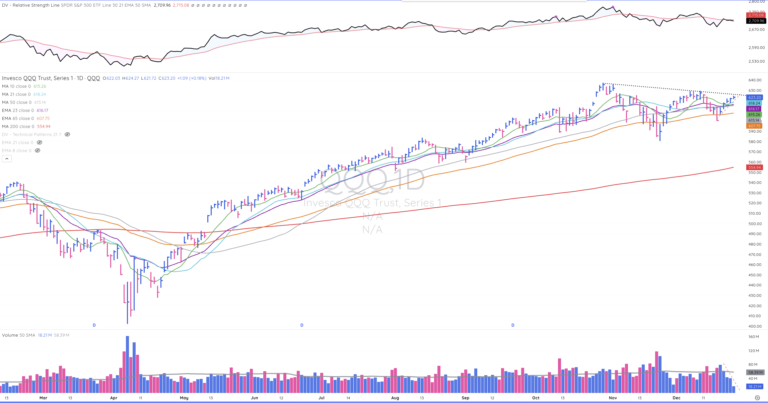

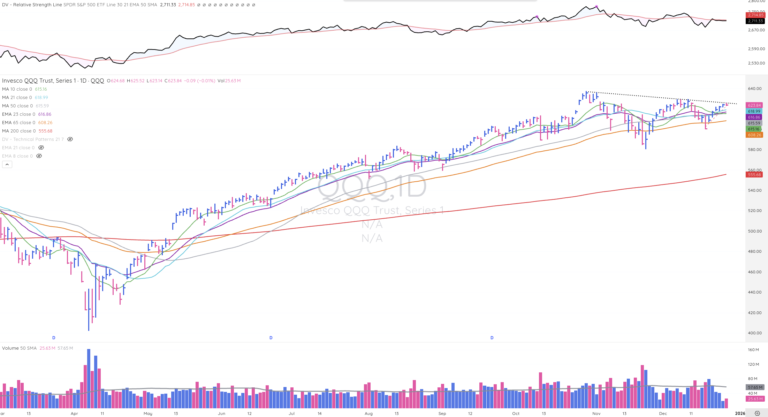

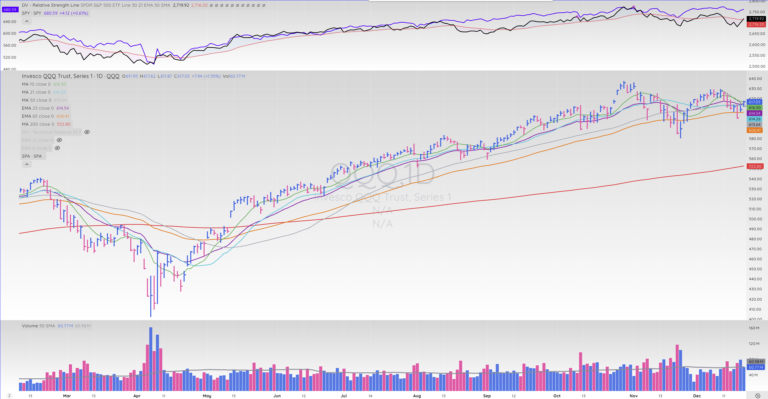

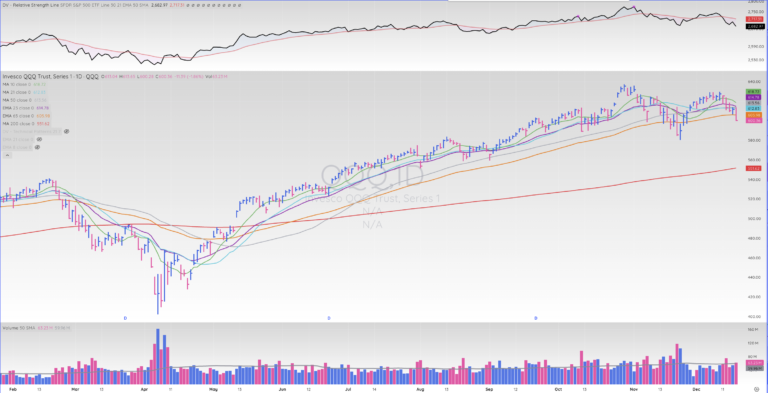

QQQ

The NASDAQ is currently the only index left to make new all-time highs, confirming the other three.

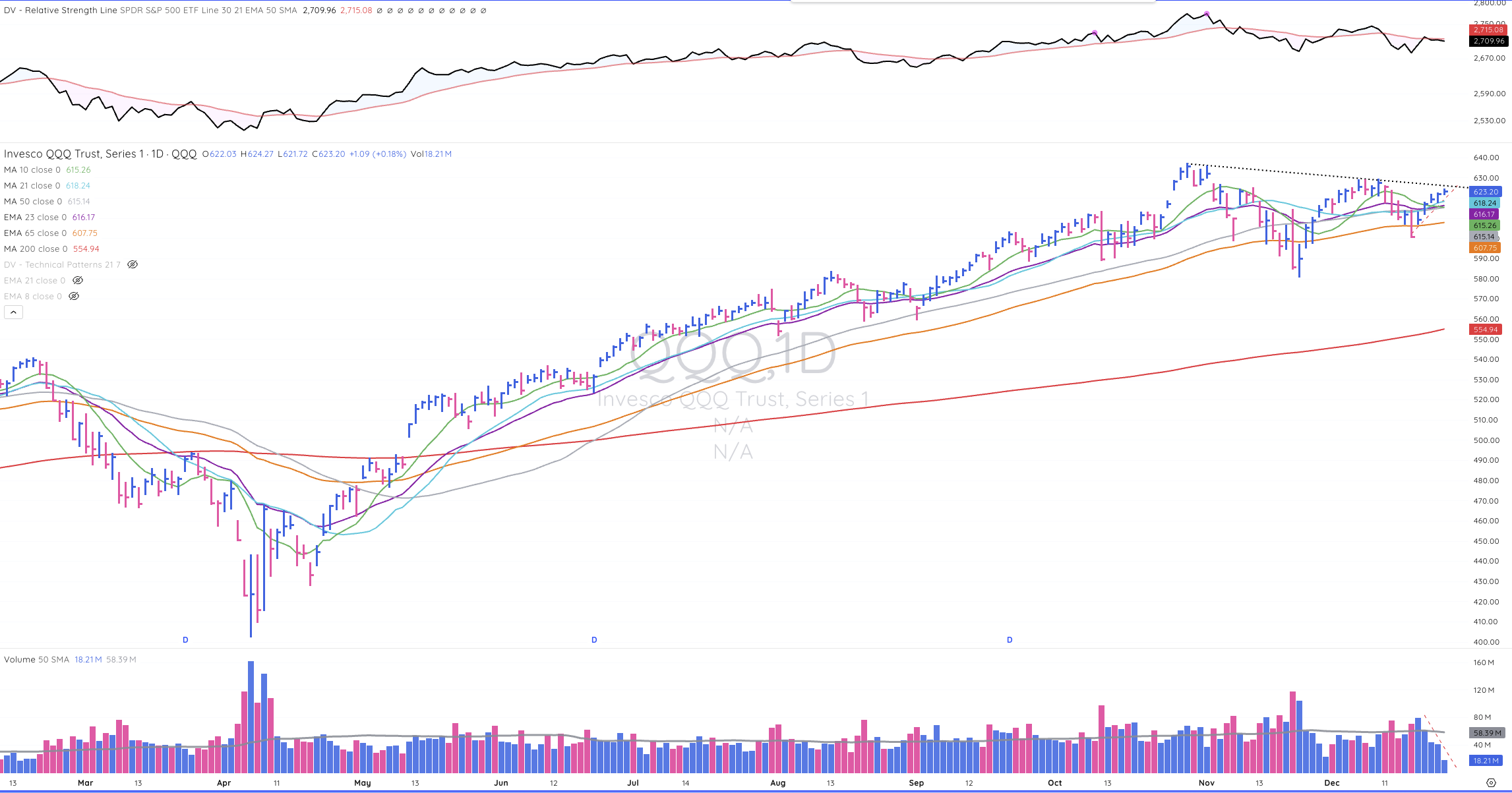

SPY

The S&P 500 broke out to new all-time highs today, albeit on light volume, which is typical on Christmas Eve.

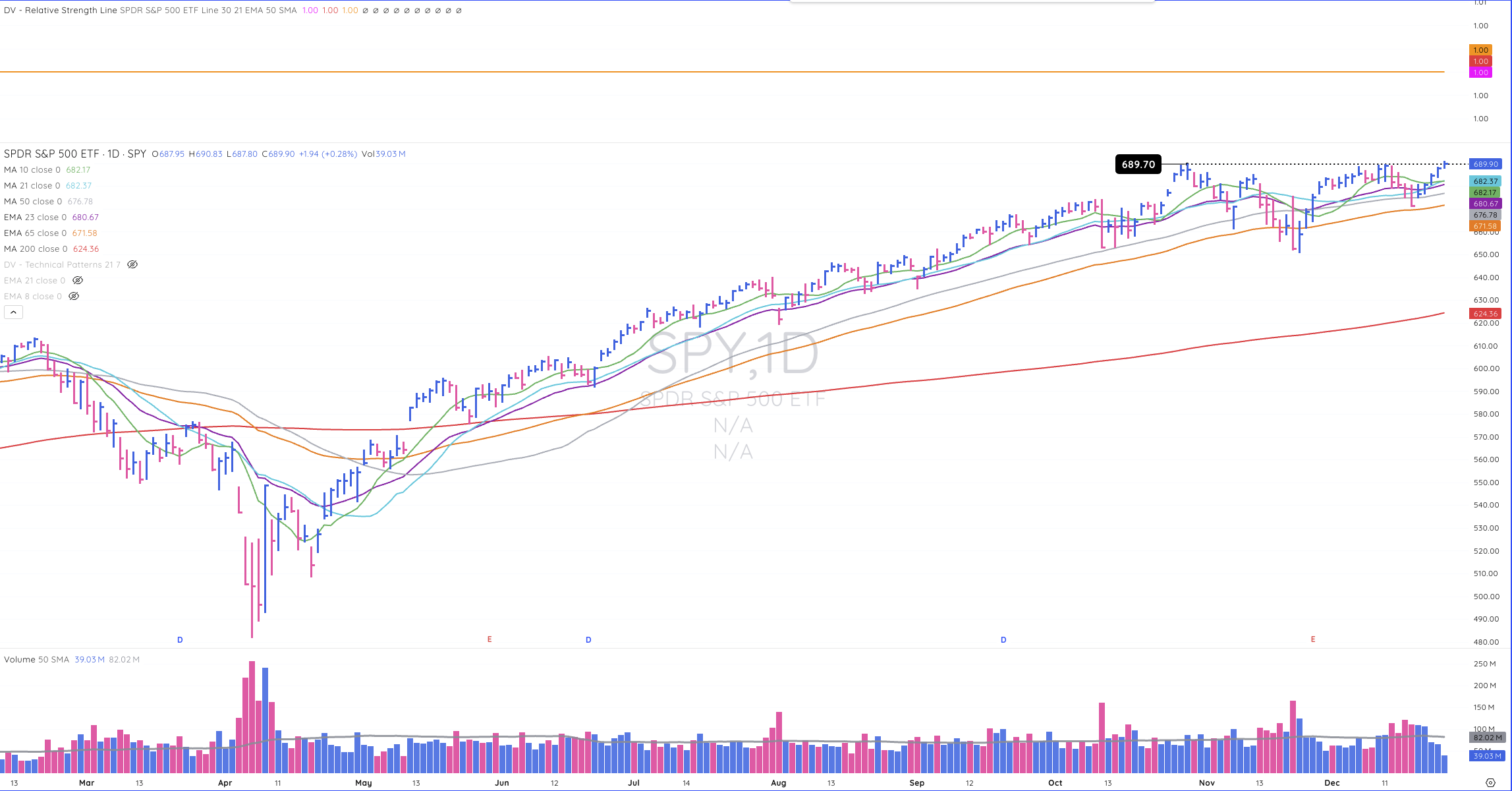

IWM

The Russell 2000 continues to exhibit clear relative strength, not so much as trading below its 21-day SMA over the last couple of weeks. However, it closed ever so slightly below its prior all-time high this afternoon.

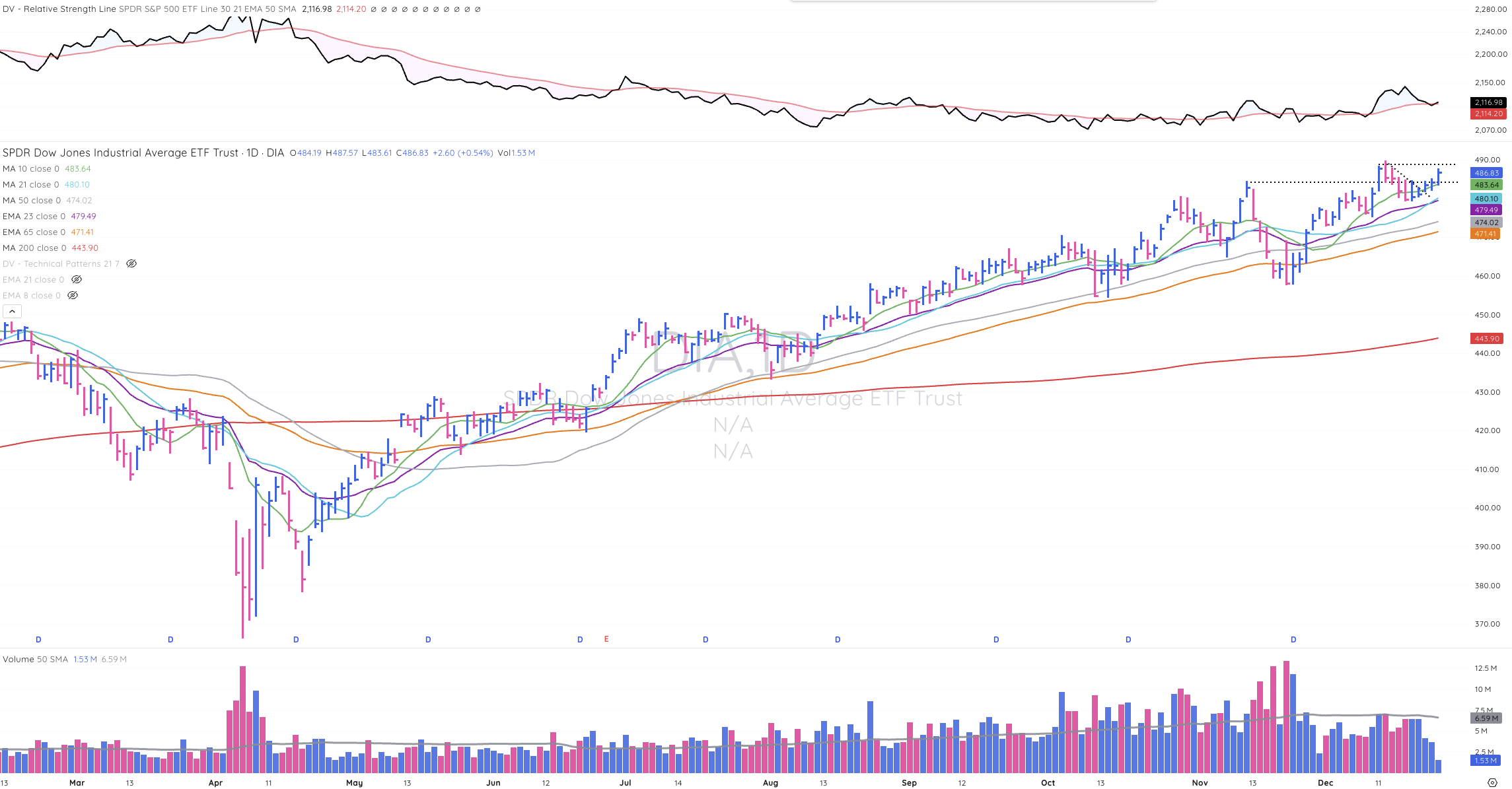

DIA

The Dow continued to exhibit strength, reclaiming its prior all-time high today as it approaches new all-time highs.

Focus List

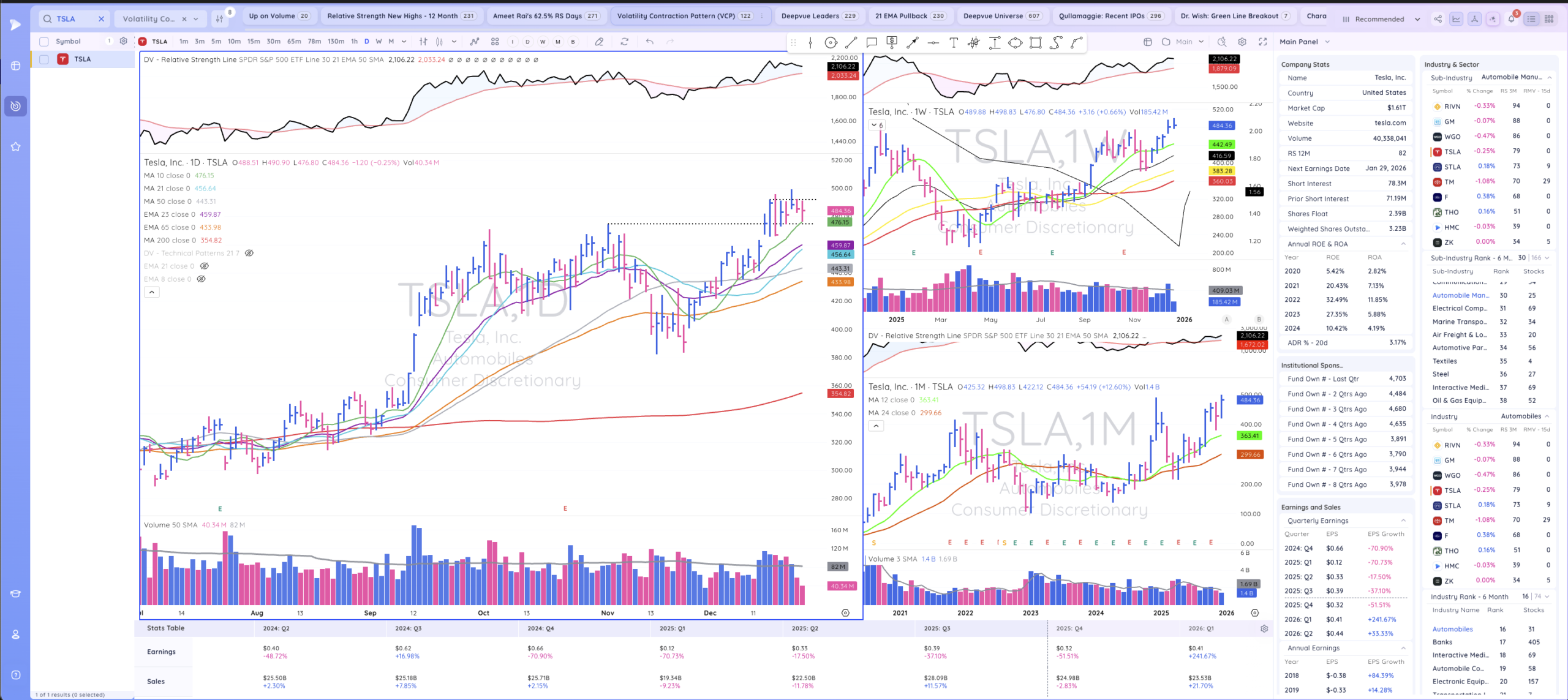

TSLA

TSLA continues to consolidate just a hair below $488.54, its prior all-time high and last hurdle to clear for a clean breakout.

GOOGL

GOOGL has tightened up just below its declining tops trend line and looks ready to continue higher from here.

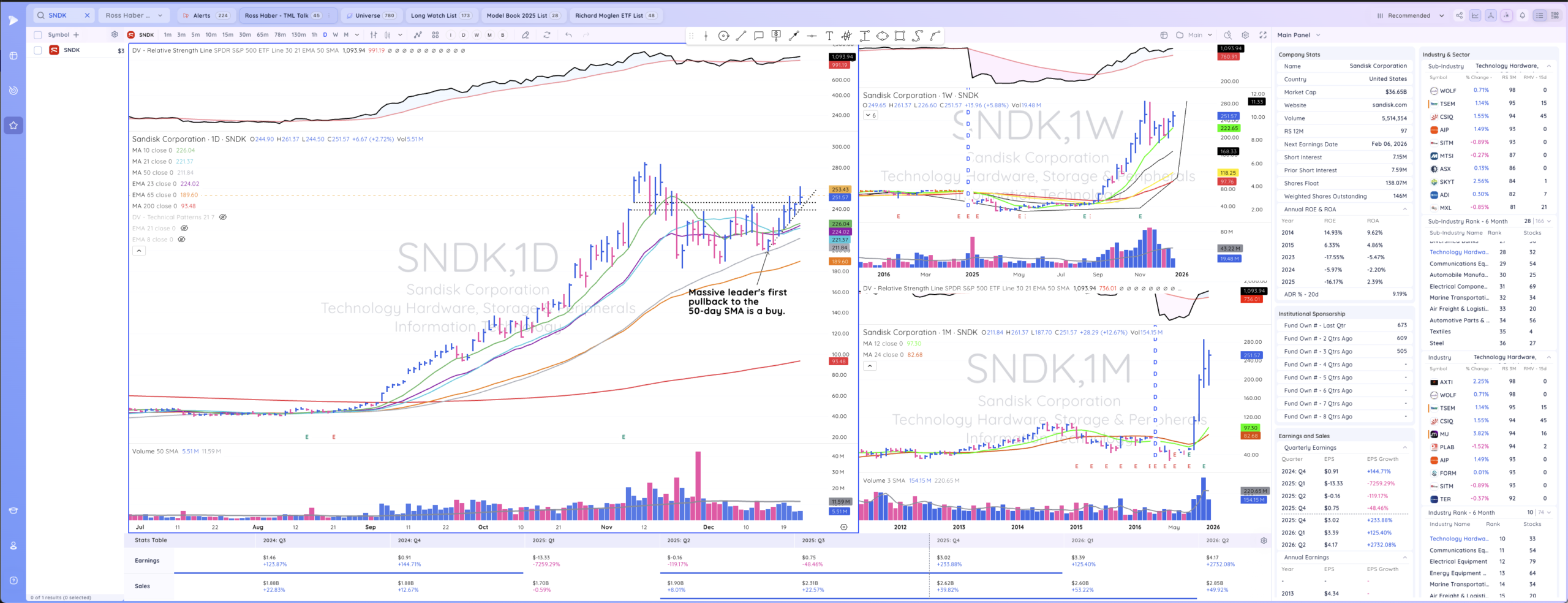

SNDK

SNDK has moved straight up the right side of its base after finding support at the 50-day moving average. It appears to be setting up to go higher. A little backing and filling here would be ideal.

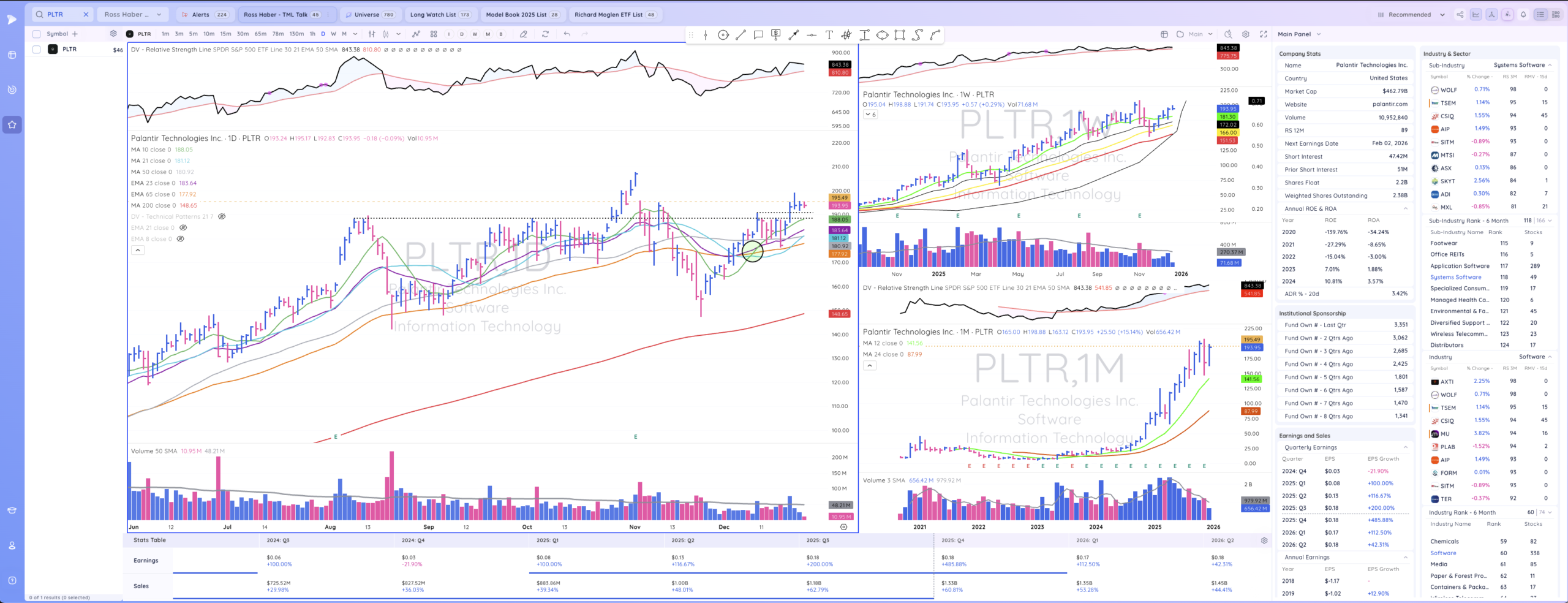

PLTR

PLTR's tight sideways action on light volume after last Friday's breakout is extremely healthy and constructive and it looks like it's setting up to move higher from here.

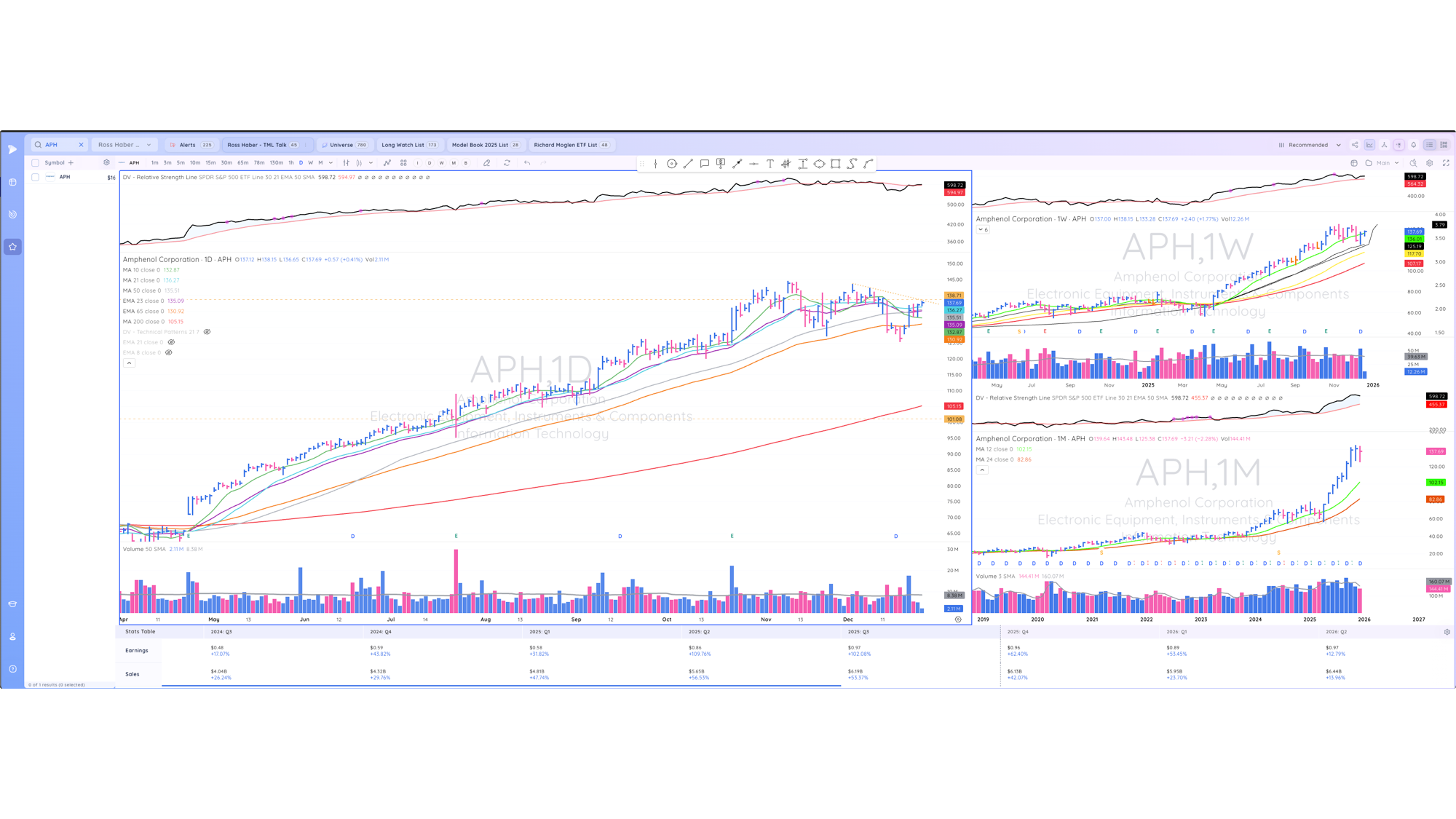

APH

APH has held above its 50-day SMA over the last four sessions and appears to be setting up for a move higher.

alab

APH has turned major key resistance into new key support and looks like it's setting up to move up the right side of its base from here.

SITM

CITM is tightening up constructively above its 10-day moving average and just a tad below its prior all-time high from the last earnings report. And looks like it's setting up to make new all-time highs from here.

fslr

FSLR is no stranger to wild volatility, still well within its personality and hence not doing anything wrong per se. So if it can continue to work its way higher for a breakout through its June 2024 prior all-time high, there may be a lot of gas left in the tank if the whole group can manage to get going.

GH

GH looks like it could get going on a big volume break through its declining tops line in 21 day SMA.

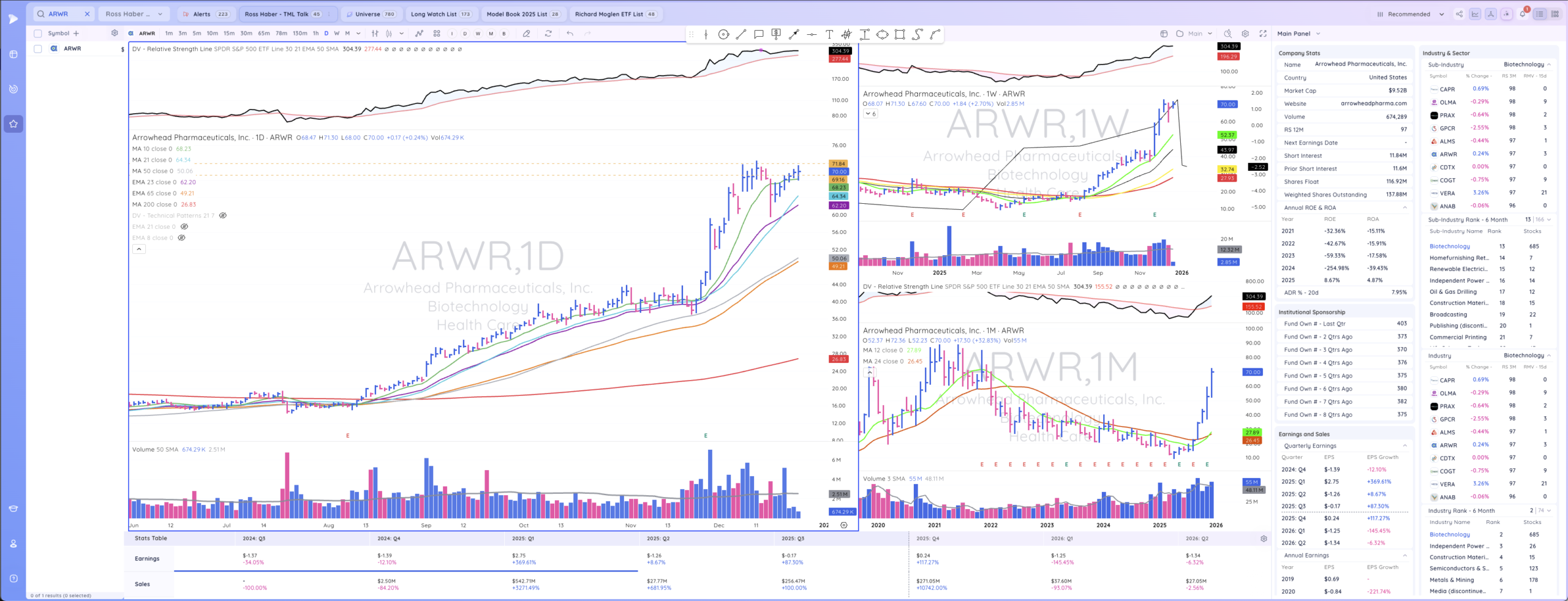

ARWR

ARWR is a powerful biotech leader that has held up extremely well and looks like it's ready to continue to new highs from here.

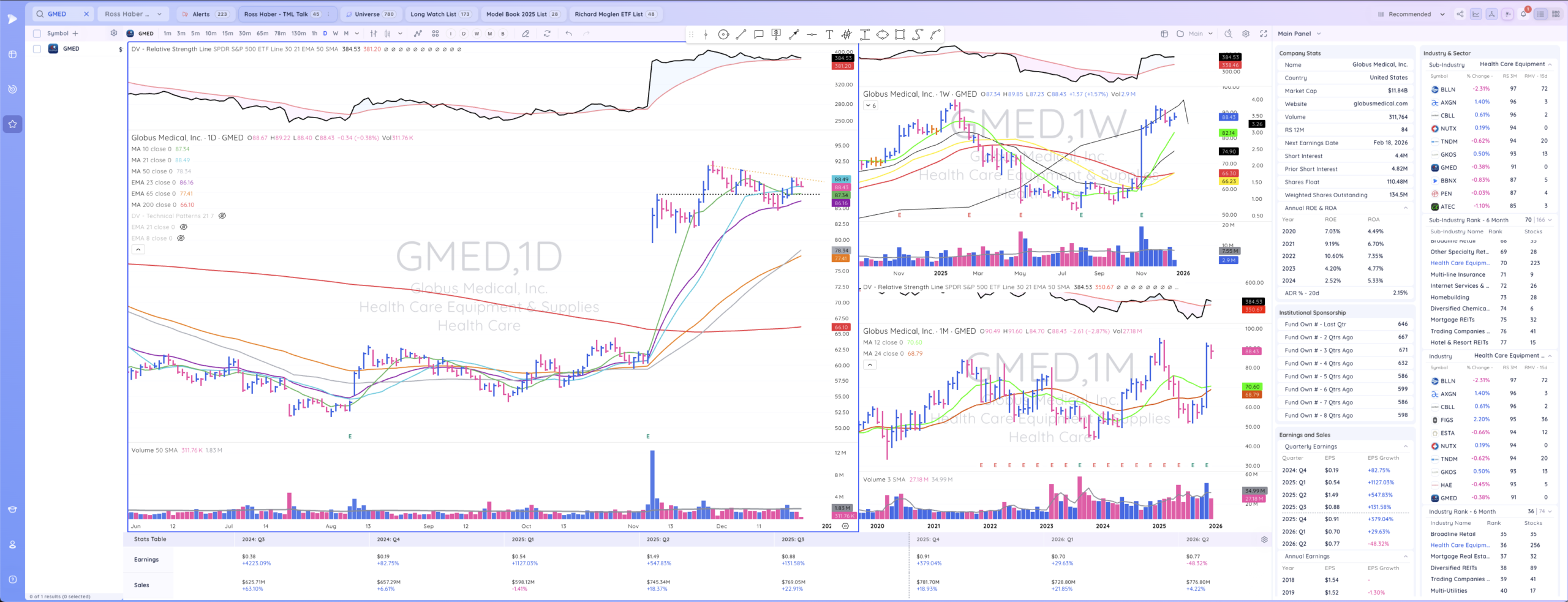

GMED

GMED is tightening up in a constructive manner just a bit below its declining tops line and looks like it's setting up to move higher from here.