Market Overview

The whipsaw volatility has been mind-boggling. Usually, when the major indexes start whipping violently around their key moving averages, looking at qualitative factors, such as the overall health of the market’s leadership, helps clarify things. Recently, this has not been the case.

On Wednesday last week, not only did the market look weak and vulnerable, but the leadership seemed to confirm its position. It was hard to populate my Wednesday evening focus list with anything worth talking about. However, by Friday’s close, I had to keep this list to a minimum, given the significant improvement in just two days.

Patience and discipline have been the key. For example, in the current environment, one of my most costly mistakes has been jumping my stops early based on the action of the indexes, rather than letting my rules take me out. I have let my fear of giving back profits (my emotions) get in the way of my rules, which are there specifically to prevent this.

Keeping this in mind, I plan to add exposure back next week, and at all costs, follow my rules, not my emotions.

Indexes

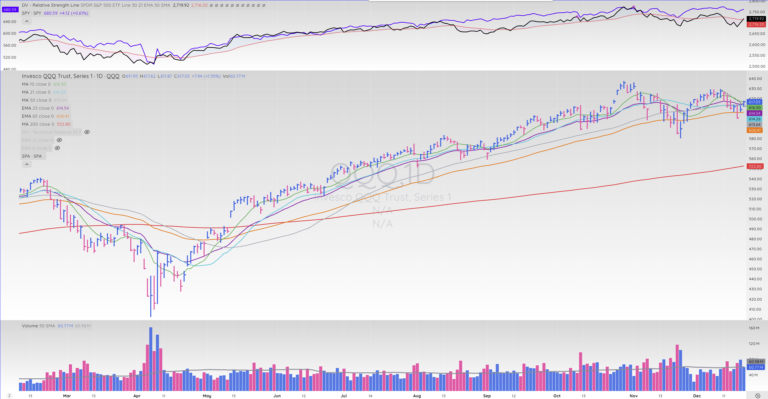

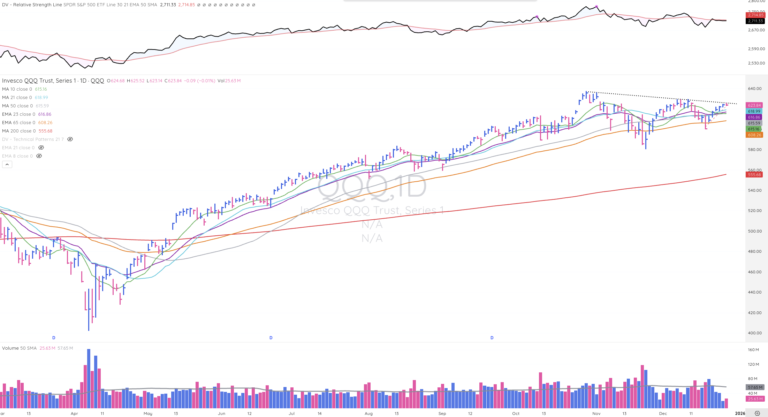

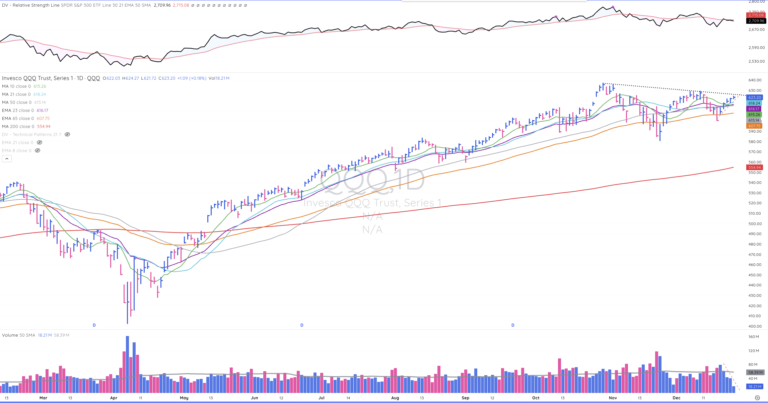

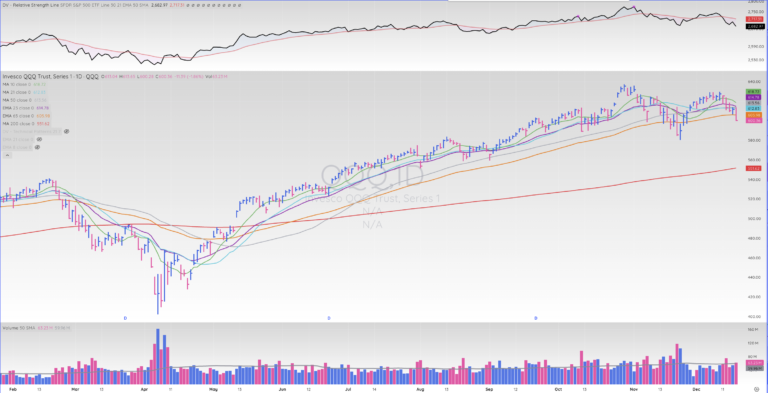

QQQ

Despite last Wednesday's significant distributive action and extremely weak close, the tech-heavy index has casually reclaimed all of its moving averages on Thursday and Friday, as if Wednesday never happened.

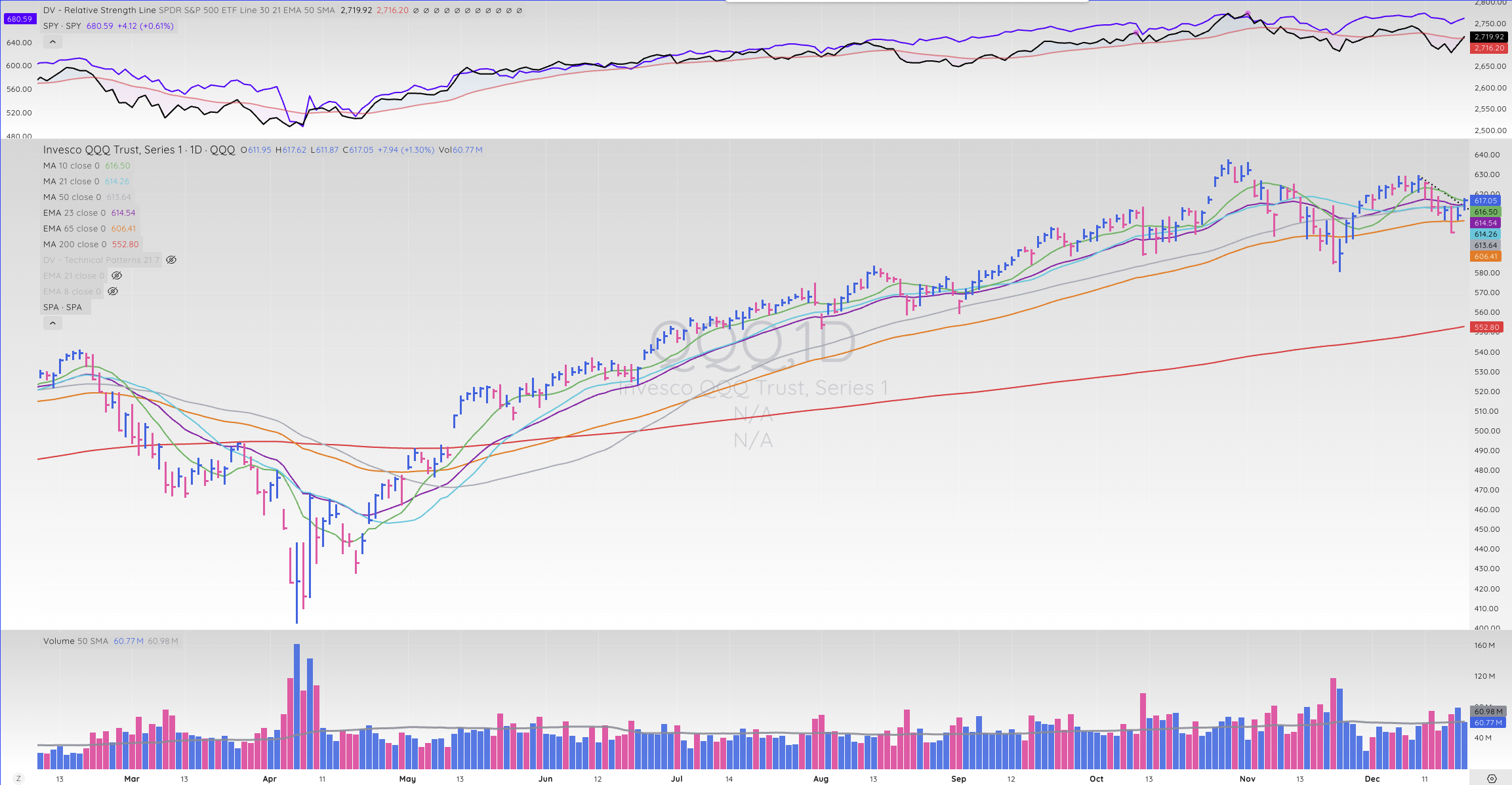

SPY

The S&P 500 held up better than the NASDAQ last Wednesday, however, it's recover wasn't quite as powerful either. The S&P is still trading below its 10-day SMA, which is minor and of no concern.

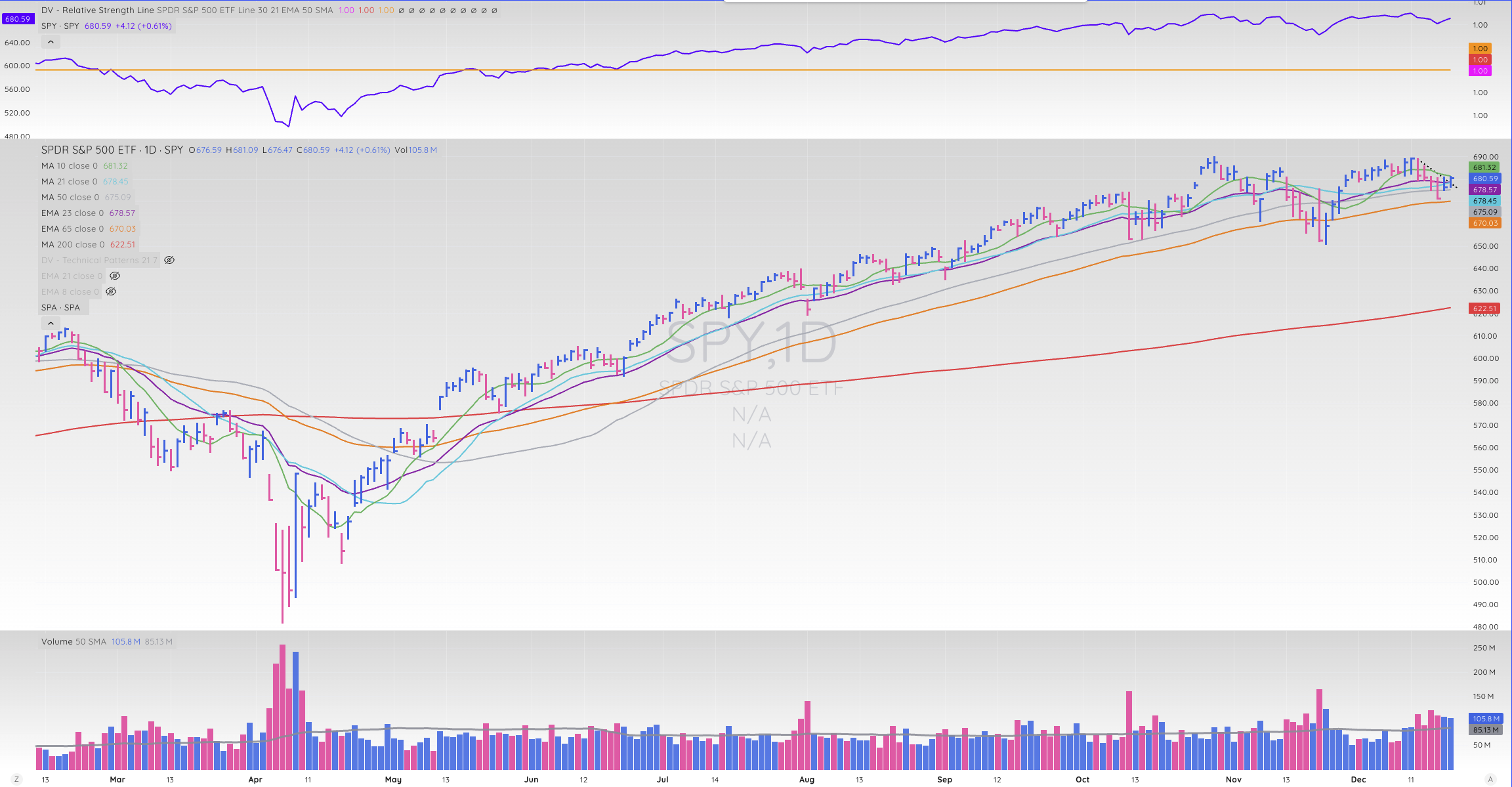

IWM

The Russell 2000 continued to hold up much better than the NASAQ and S&P 500. The small-cap index found support at its 23-day EMA, well above the 50-day SMA and 65-day EMA.

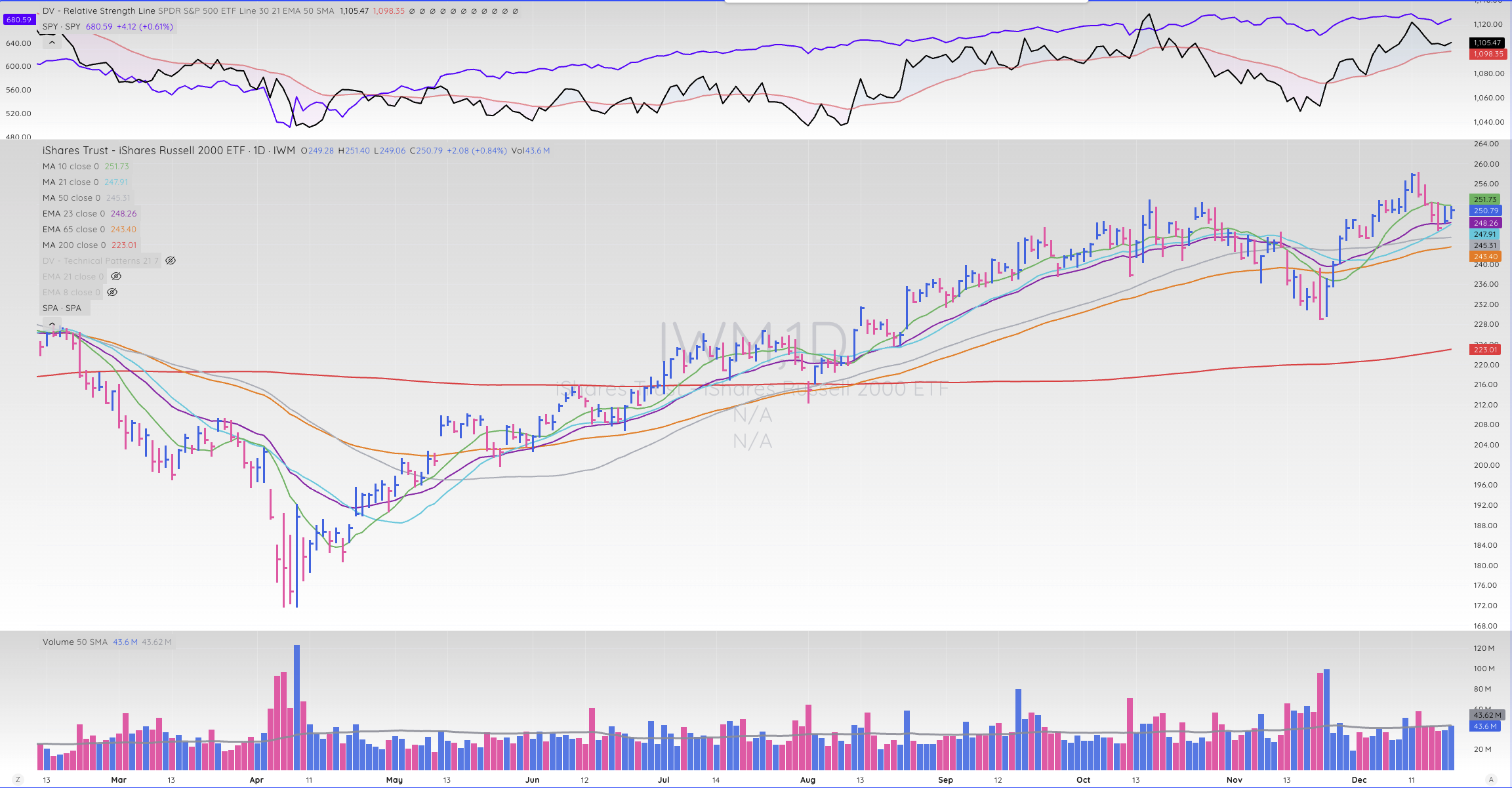

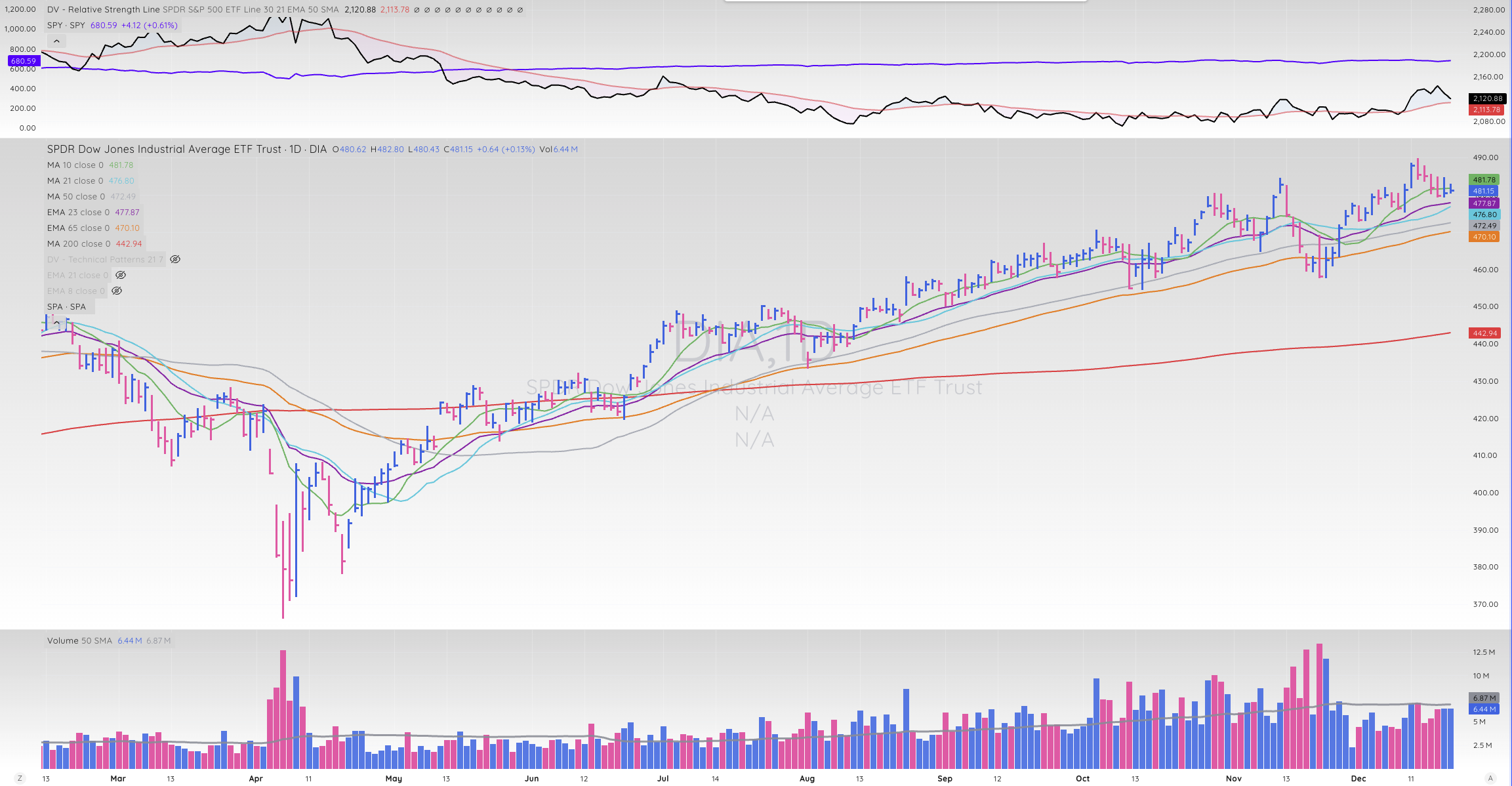

DIA

The 30 stocks of the DOW have managed to hold up the best of the four major indexes recently. It's alway good to see the DOW at least confirm the highs on the other major indexes, and currently it is under the least selling pressure of the bunch. The Dow has managed to stay in and around its short-term 10-day SMA, in stark contrast to the NASDAQ which melted below the 65-day EMA.

Focus List

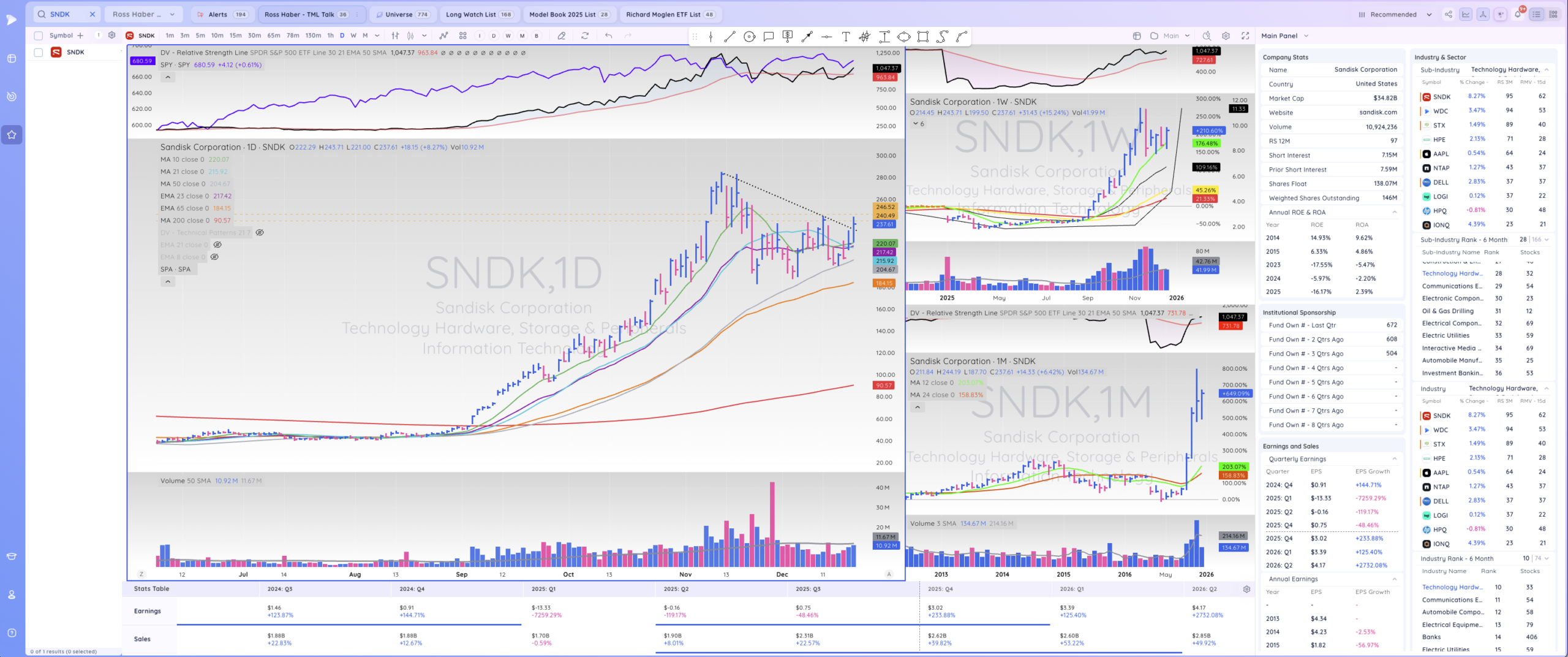

SNDK

Leading memory stock SNDK closed back up and through its declining tops trend line, and appears ready to start forming the right side of a new base.

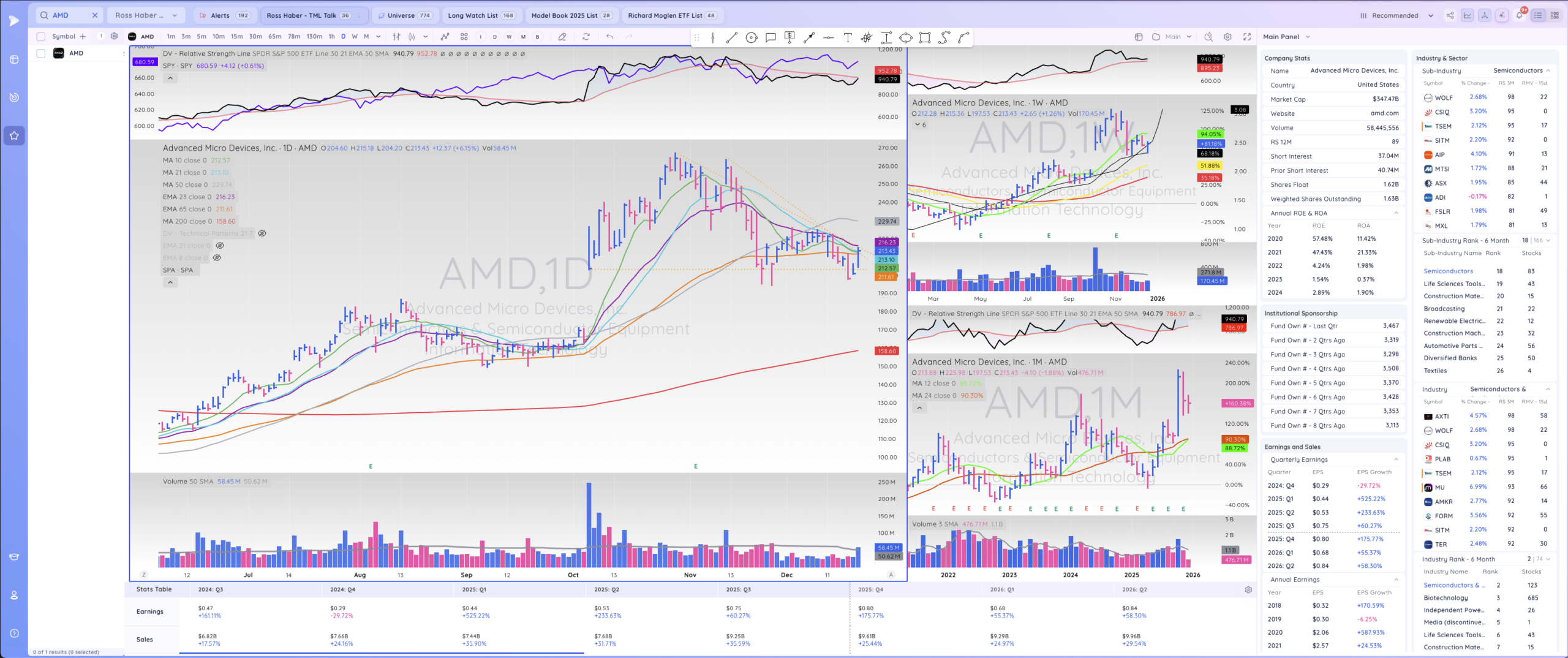

AMD

AMD looks like it's getting ready to break above its declining tops trendline and begin the right side of a new base.

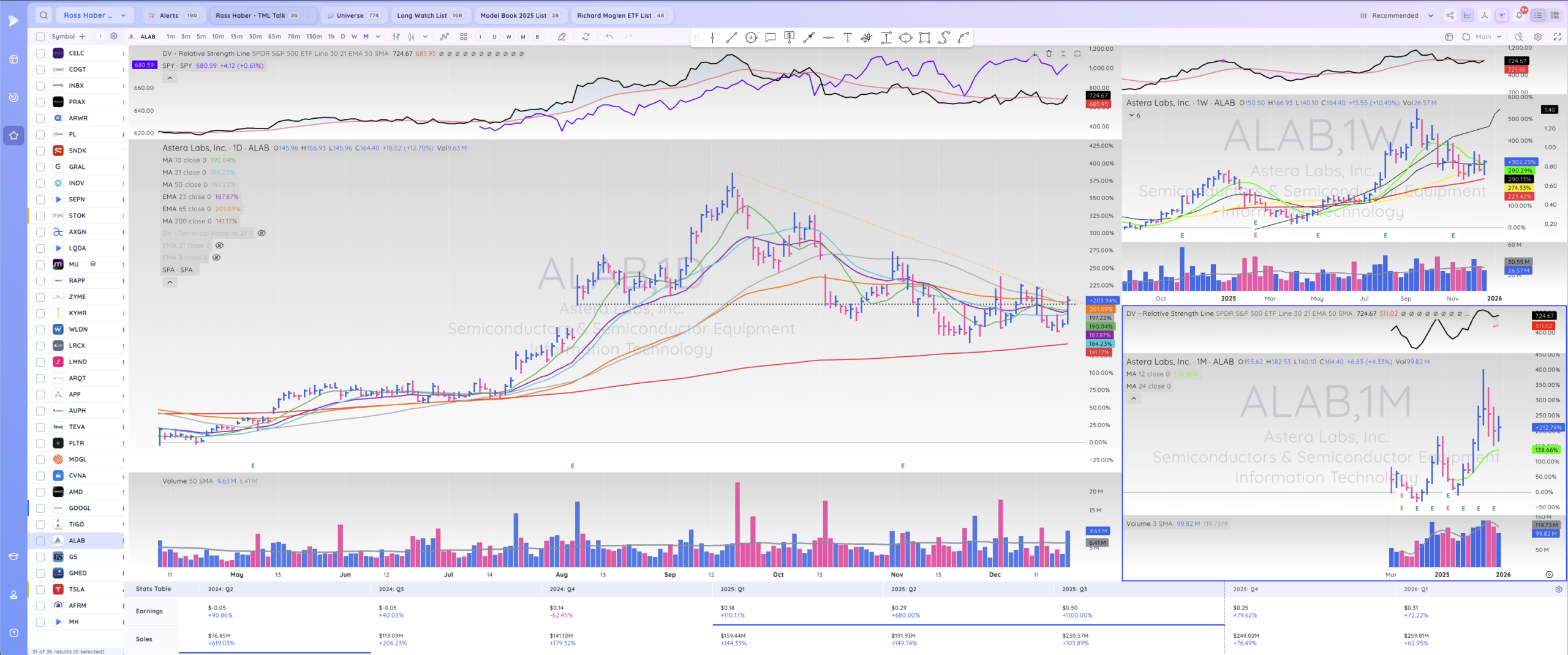

ALAB

Prior big semiconductor leader ALAB, looks like it's setting up to break above its declining tops trend line, after reclaiming its 50-day SMA Friday, on heavy volume.

PLTR

PLTR broke out of a cup and handle base on Friday. Unsurprisingly, it ran into resistance at the prior gap down from all-time highs.

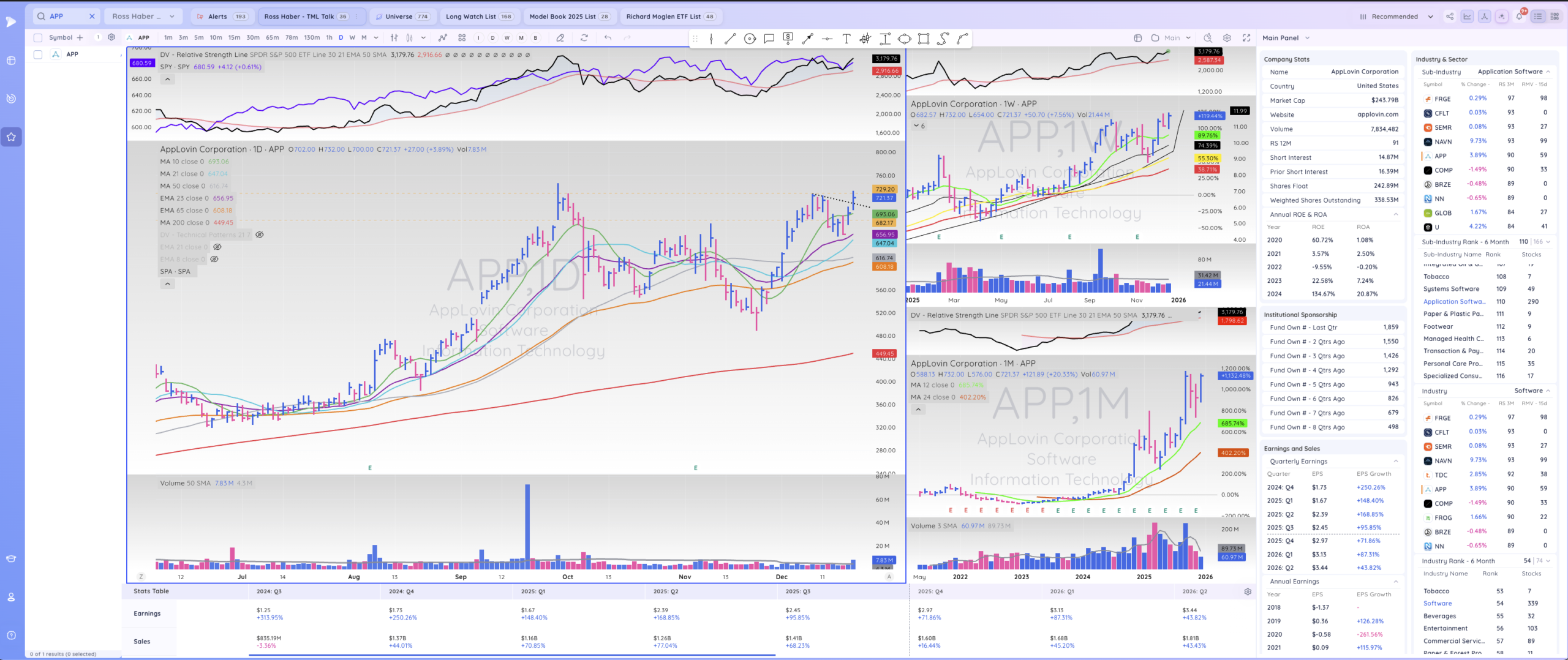

APP

APP broke out of a double bottom with handle base, and looks like it's setting up to ultimately head higher from here.

GOOGL

GOOGL exhibited significantly more strength than the NASADQ last week, and looks like it could be back in play on a reclaim of its 21-day SMA.

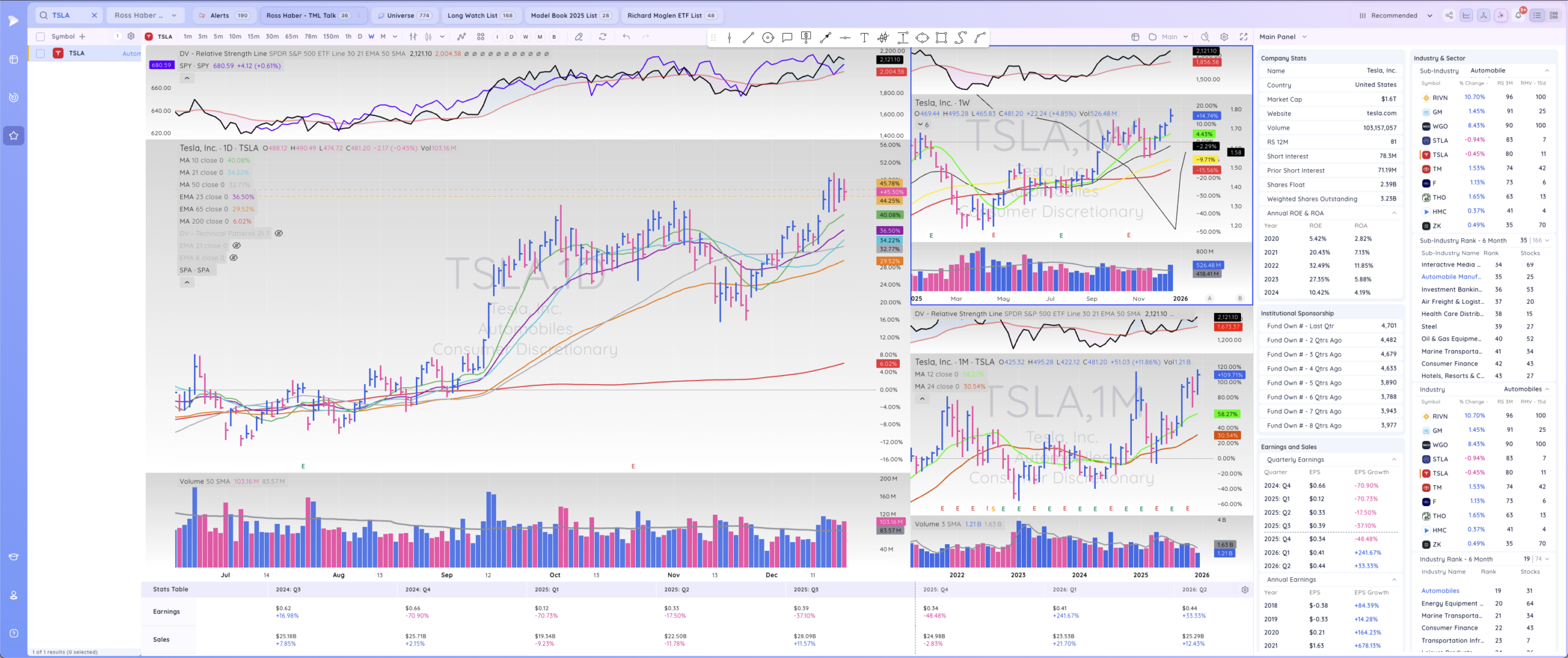

TSLA

TSLA has been consolidating constructively right below its prior all-time high, and looks like it's setting up for a Green Line breakout.

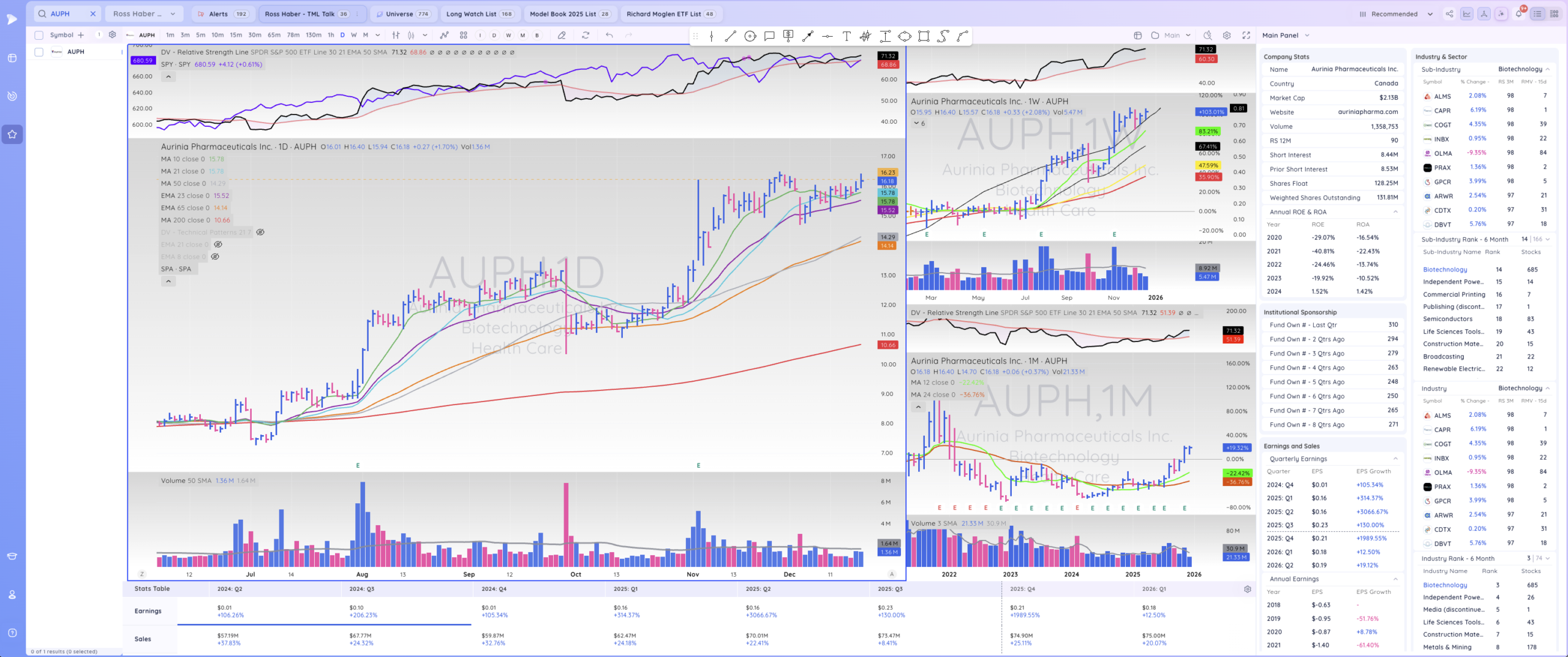

AUPH

AUPH has been tightening up along its 10 and 21-day SMAs, looks like its getting ready to break out.