Market Overview

The major indexes held up constructively in a tight range throughout today’s holiday-shortened session. The same cannot be said for all of the market’s leading growth stocks. However, the majority continue to look healthy and constructive.

With just three days left until the end of the year, light volume chop is to be expected. However, given that the market often does what you least expect, I wouldn’t be surprised to see it float up into year-end, nor would I be surprised to see it finish 2025 on its 21-day moving average or lower.

So, keep your lists and your alerts updated, and let’s see what 2026 brings.

Indexes

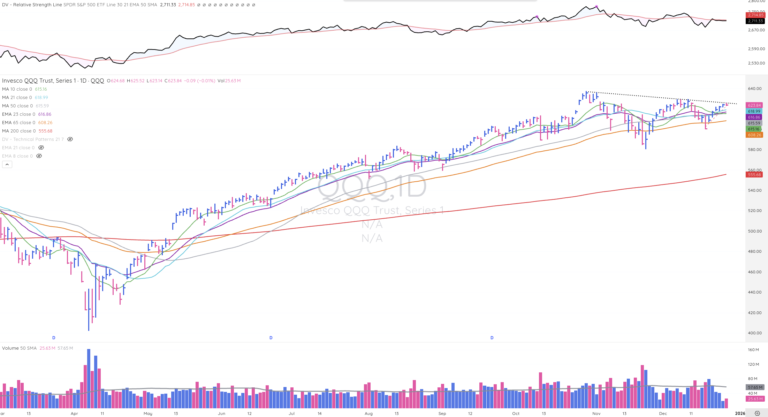

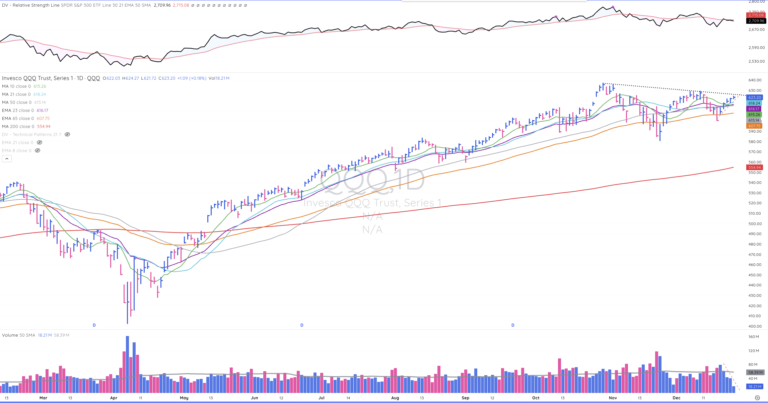

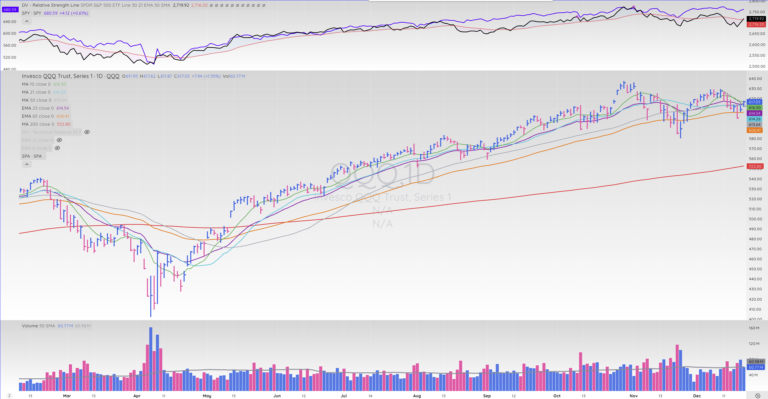

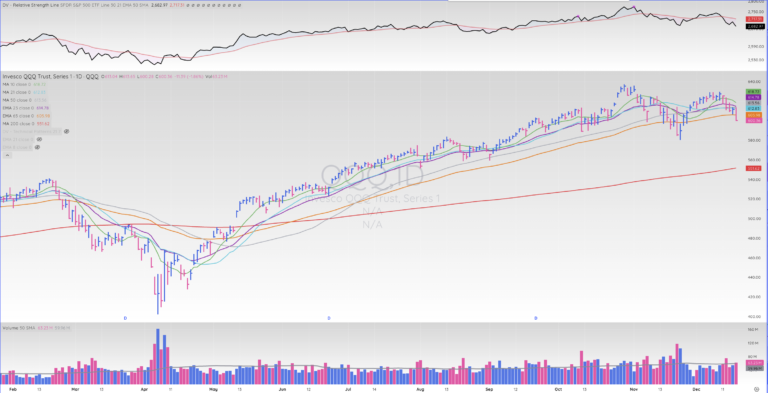

QQQ

And as that continued to hold up in a tight range just below its declining tops trend line and above all of its rising key moving averages, which should now serve as a major area of support from here.

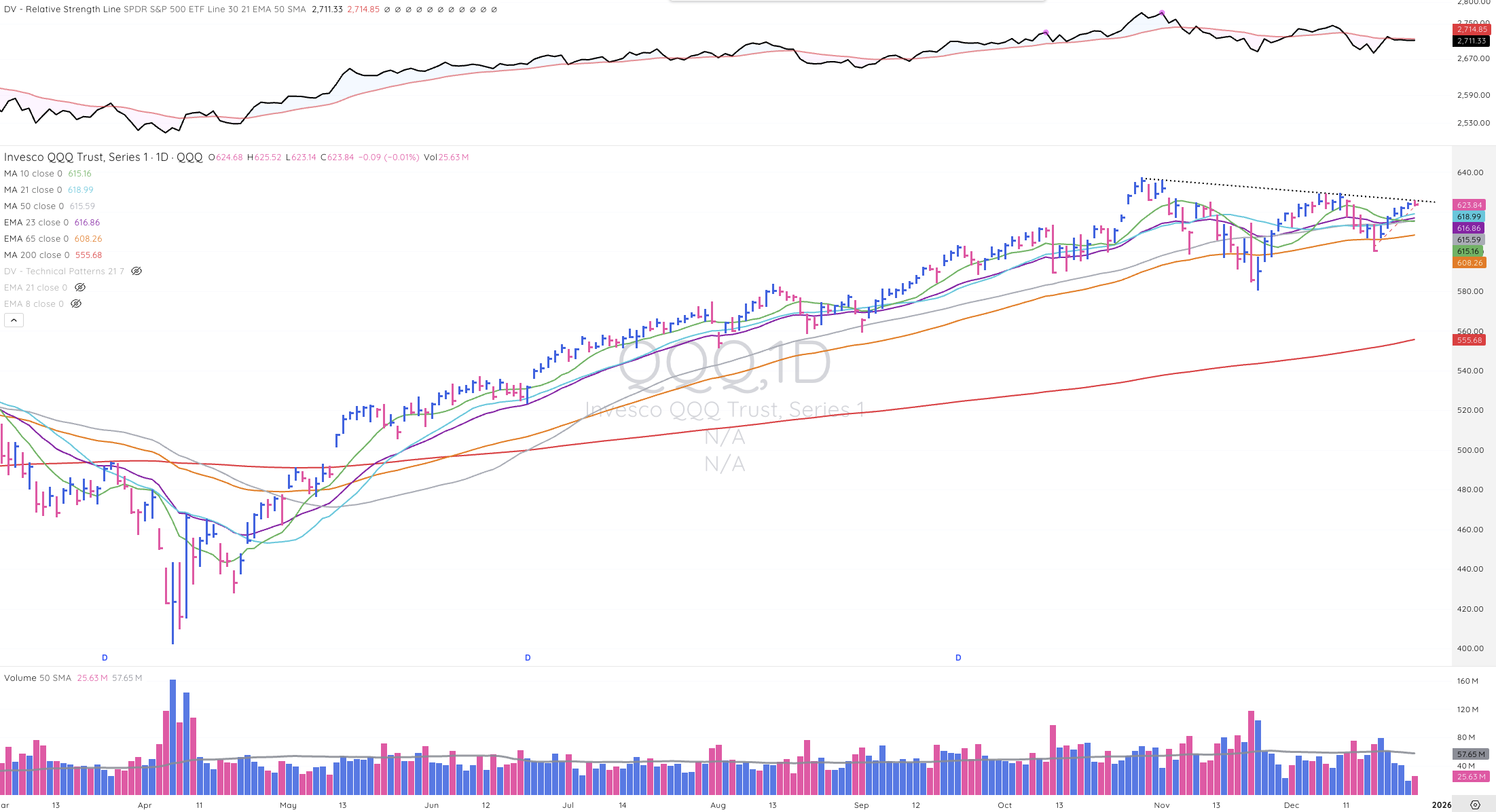

SPY

The S&P 500 held up constructively in a tight range and although it closed slightly negative on the day, it remained above its prior all-time high.

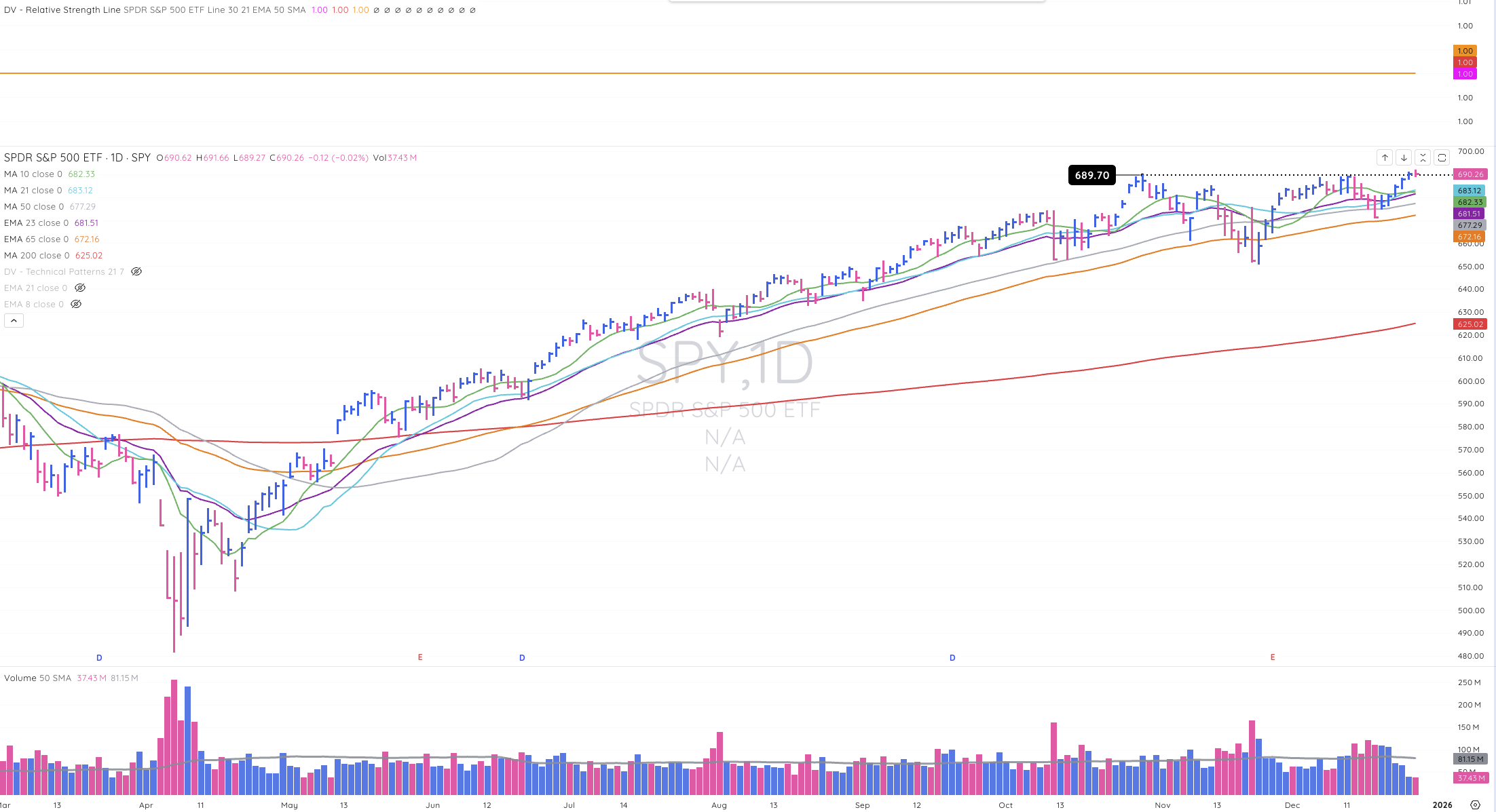

IWM

Russell 2000 also held up in a tight range and managed to close above all of its key moving averages. However, it is still slightly below its prior all-time high.

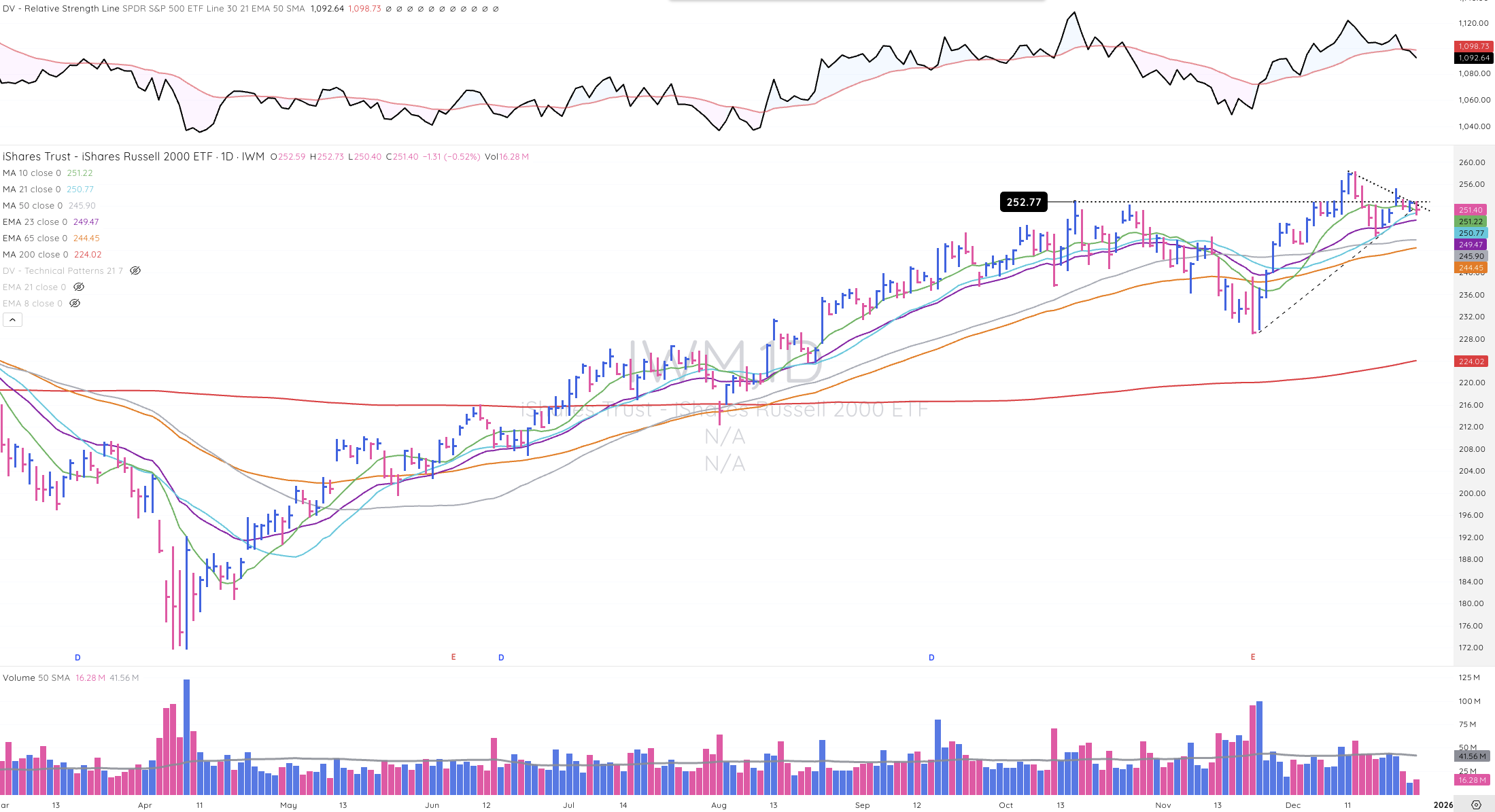

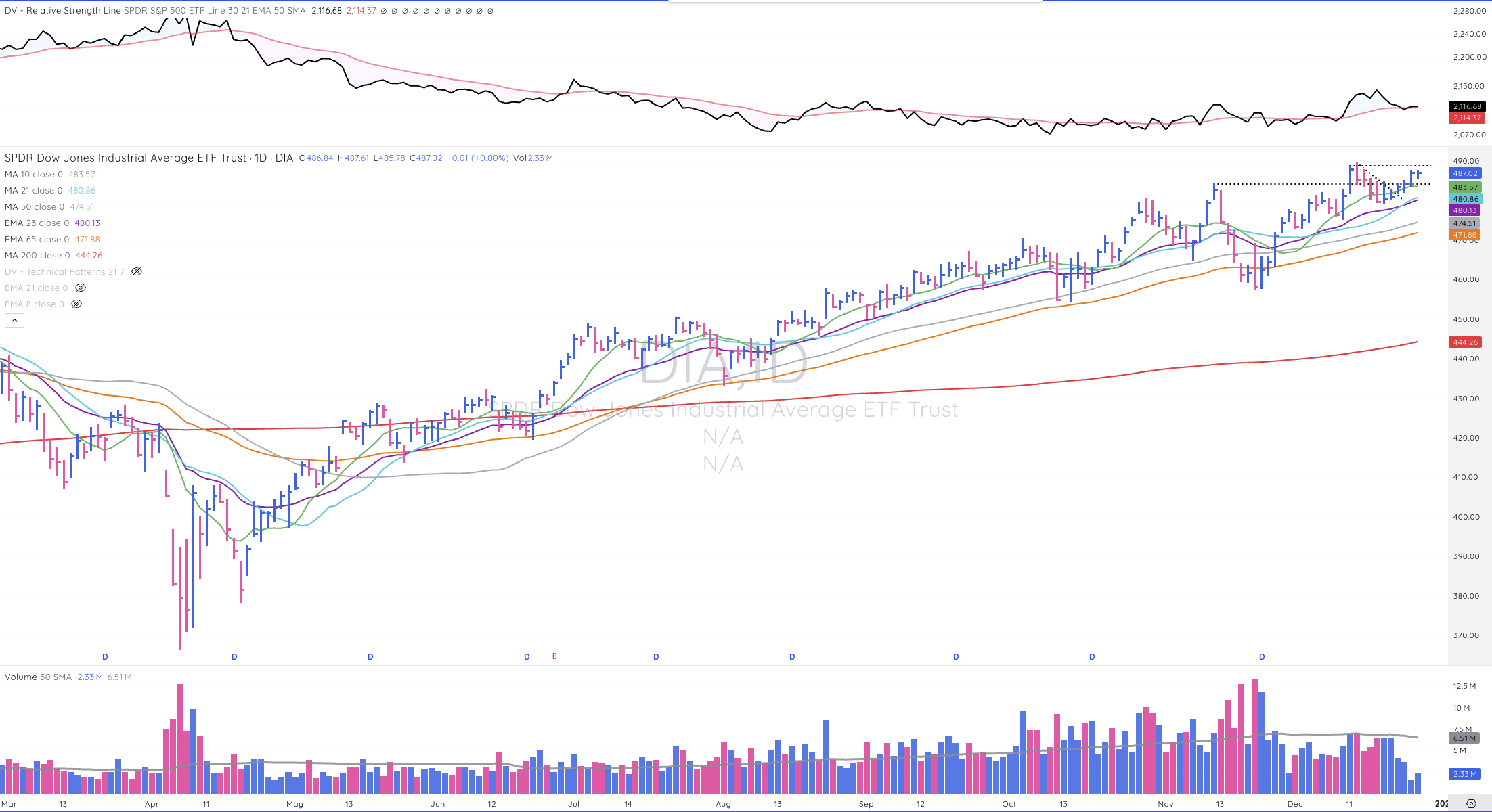

DIA

The Dow held up in a tight range with the other major indexes on Friday, finished above all of its moving averages and prior all-time high, yet just slightly below new all-time highs.

Focus List

GOOGL

Google's tight sideways action on light volume above its 21-day SMA over the last few days is the sort of action that often precedes breakouts to new highs.

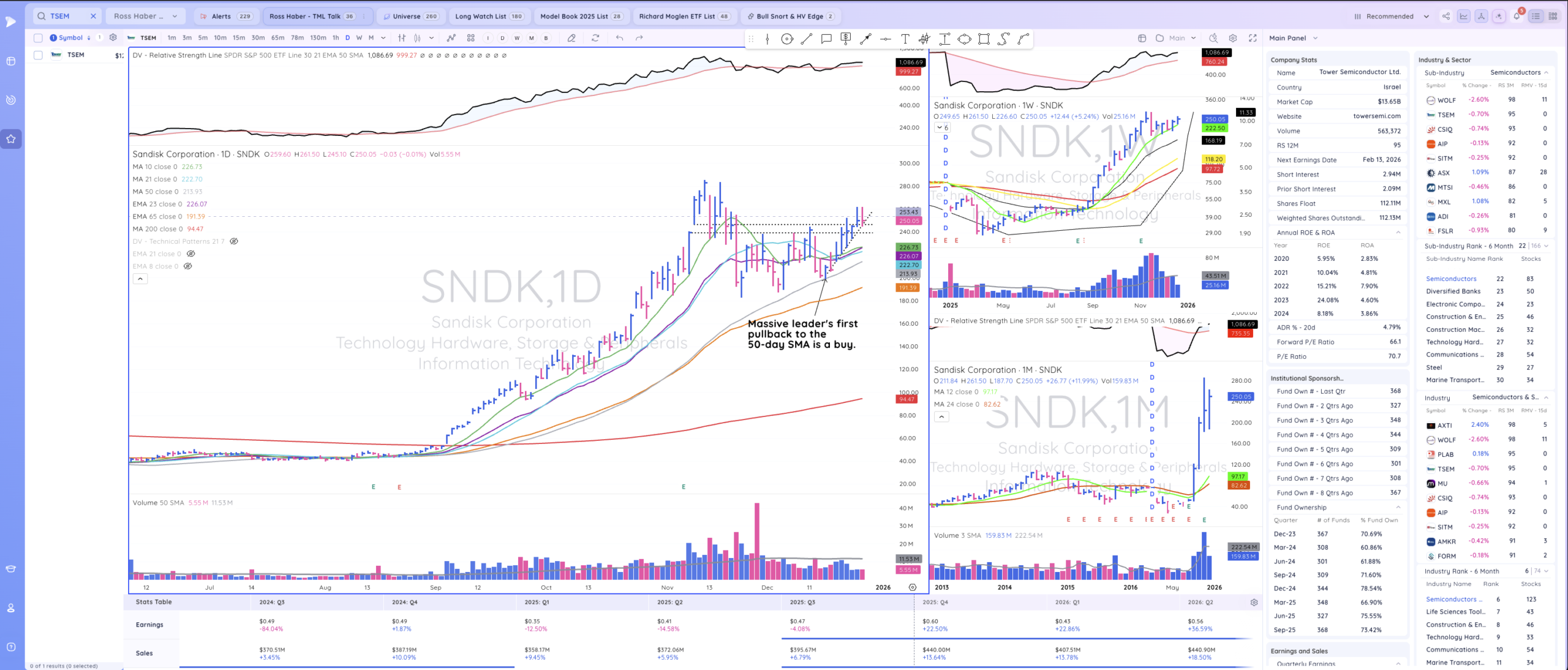

SNDK

SNDK looks like it could use a constructive Shake out below its rising bottoms line to clean up its recent wedging action before moving higher.

ALAB

ALAB's tight sideways action above major support is exactly what you want to see before it attempts to move higher.

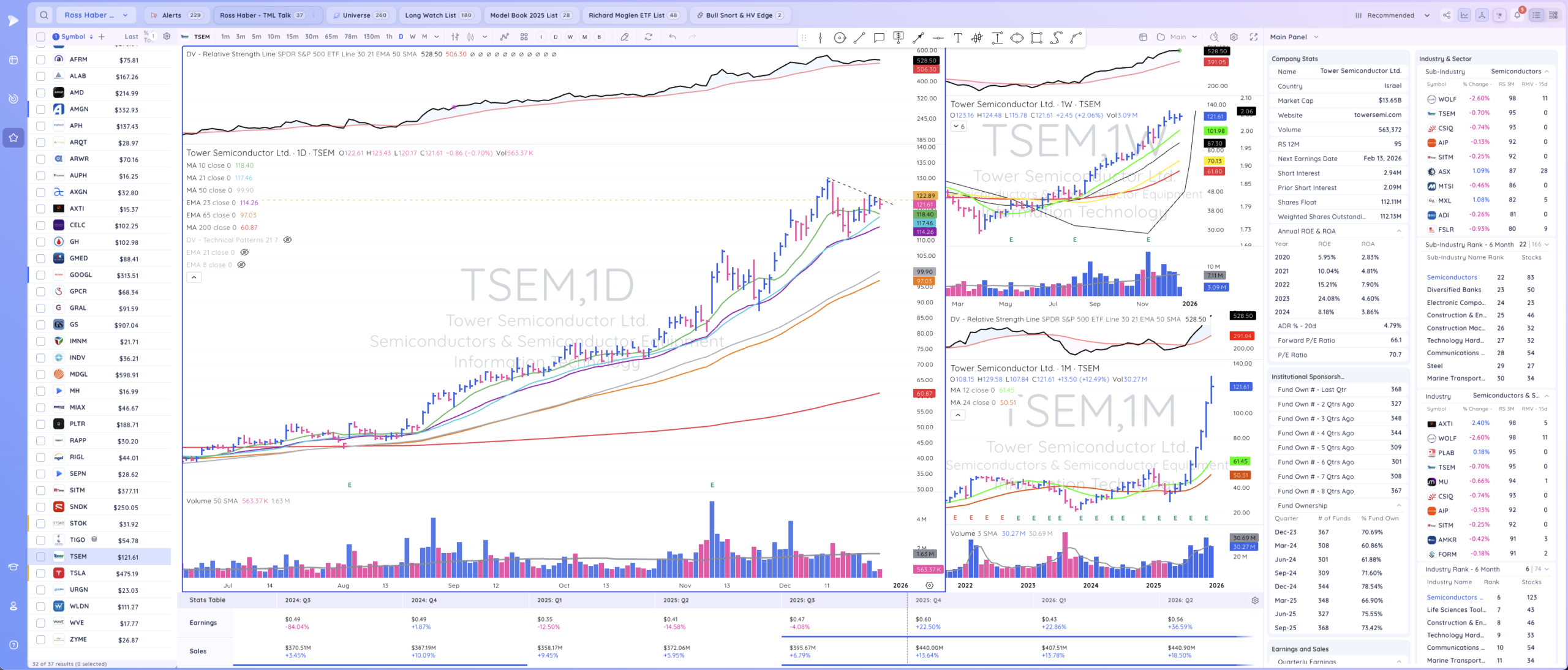

TSEM

TSEM appears to be setting up a constructive continuation pattern above its 10-day SMA.

SITM

SITM has formed a constructive looking continuation pattern just slightly below prior all-time highs and looks ready to move higher again.

AXTI

On one hand, AXTI looks like it's setting up a short-term continuation pattern above its 10-day moving average and getting ready to move higher from here. On the other hand, A pullback to its 21-day SMA would be not only healthy and constructive, but well within its personality.

TIGO

With enough volume, it appears as if TIGO could be off to the races through $55 here.

GH

GH has continued to hold up constructively in a tight range above major support and appears ready to continue higher from here.

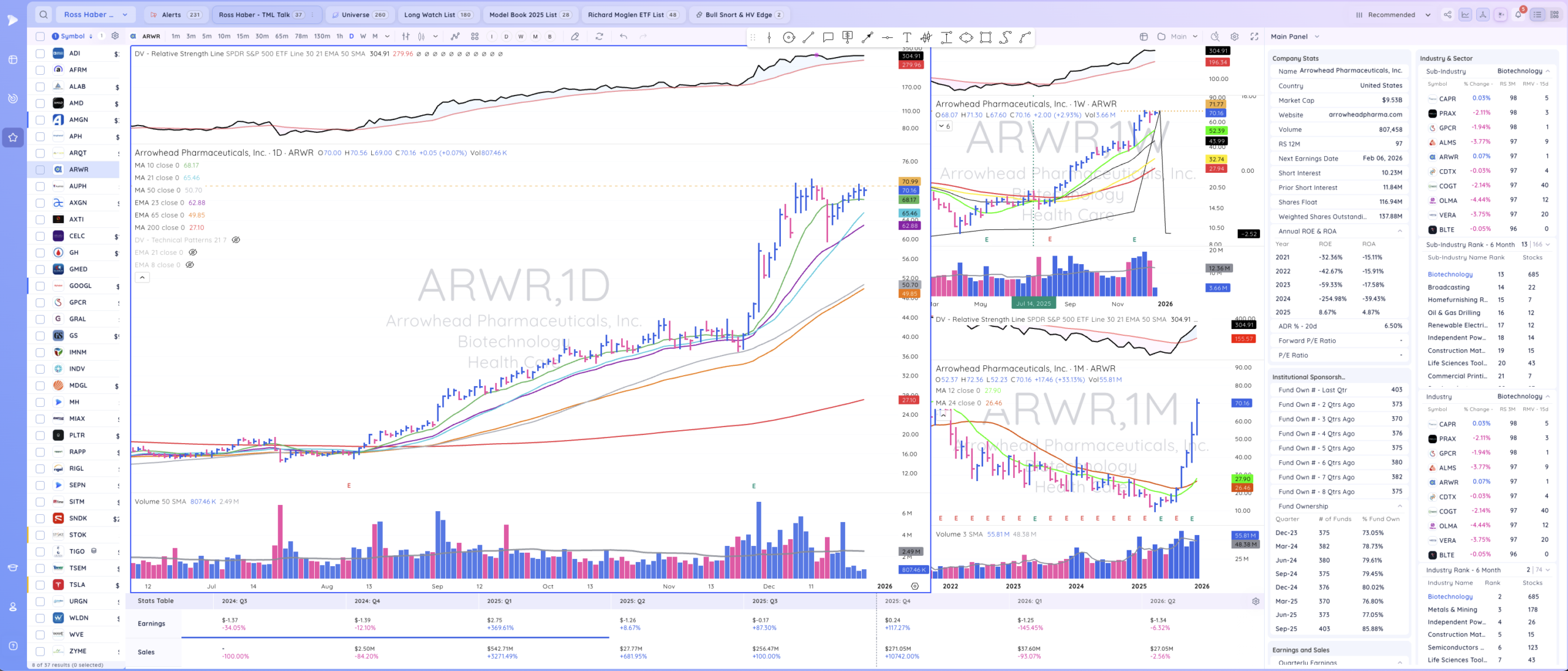

ARWR

ARWR looks ready to continue higher from here. However, it's important to keep in mind that if it pulled back to its 21-day moving average, it would be painful, yet healthy and constructive overall for the stock.

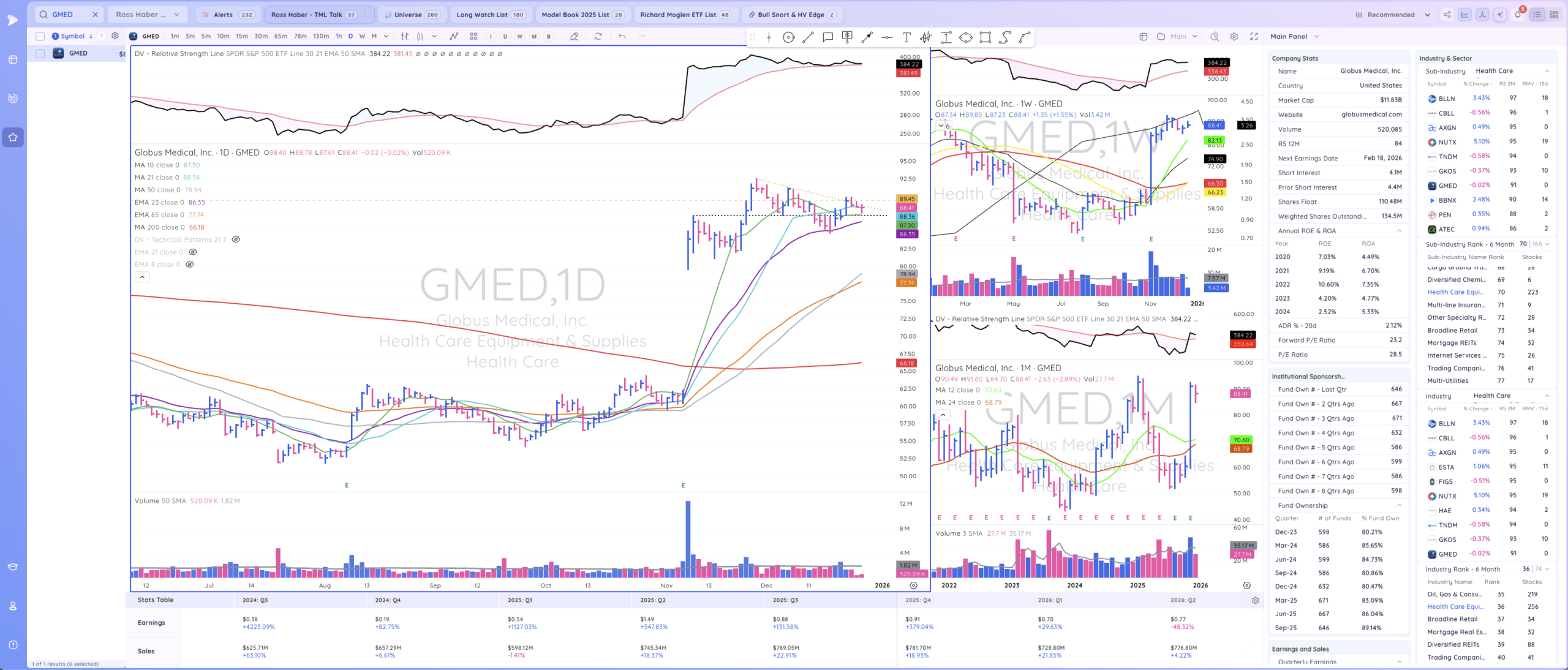

GMED

GMED is setting up constructively below its $94.93 prior all-time high with a potential green line breakout in its near future.