Market Overview

The major indexes weakened into the end of the year. This was the fourth consecutive down day for all the indexes except the Dow, which is on its third.

The health and breadth of leading growth stocks as of Friday’s close were still robust. While this is often a good sign, many of these stocks have already come a long way, leaving them vulnerable to a market that continues to weaken.

Nobody knows whether we will see a snapback recovery at the start of the new year, as we’ve seen so many times in recent years, or if the weakness ultimately continues.

Healthy rotation is the key here. Ideally, we want to see the money coming out of stocks in need of a rest find its way into new sound setups, so the uptrend ultimately remains intact. So, stay patient, do your homework, and have a plan for either scenario.

Indexes

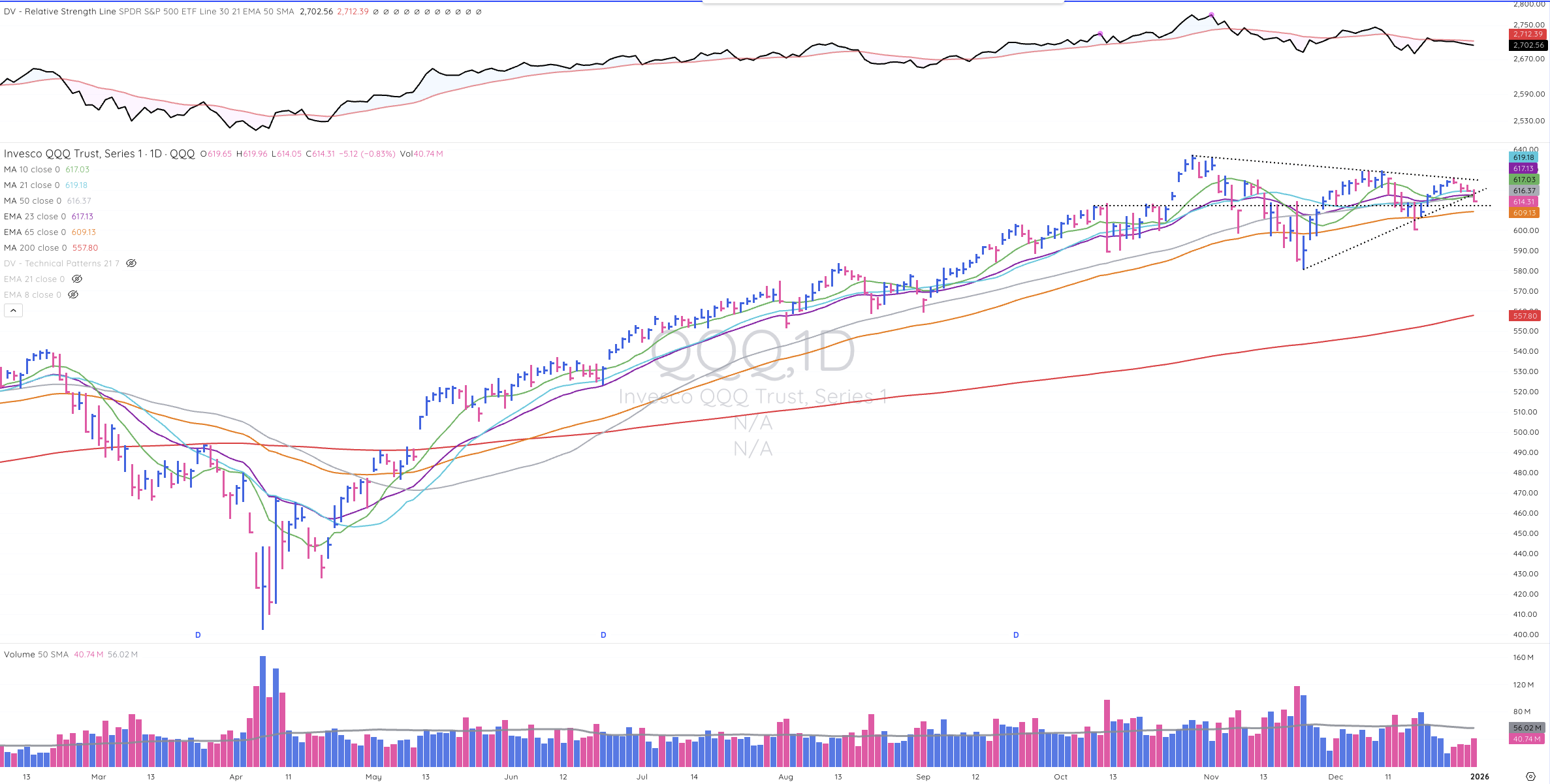

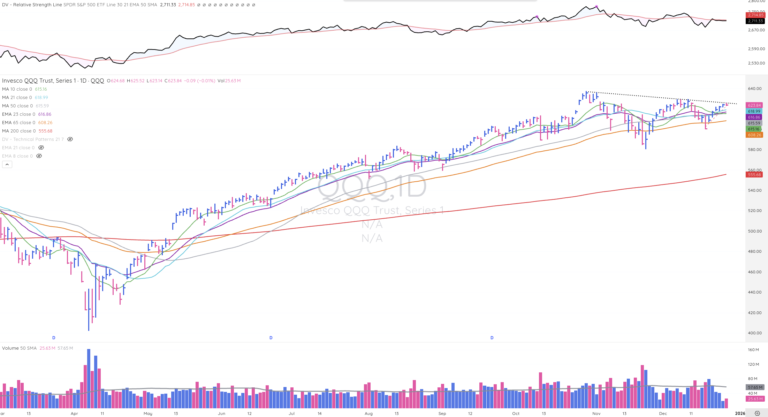

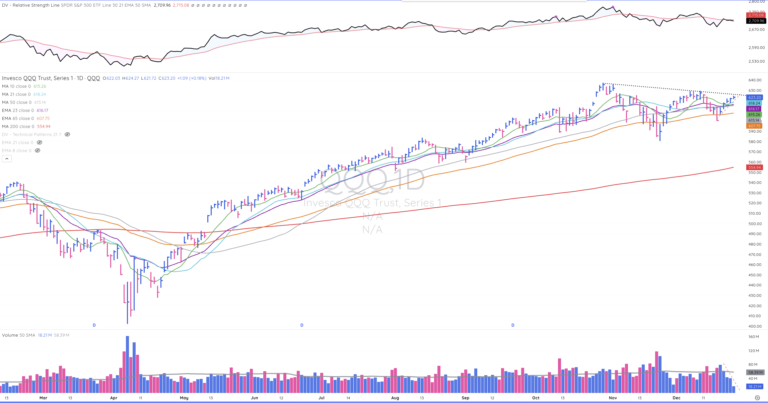

QQQ

The NASDAQ picked up volume as it sold off Wednesday's session, closing below its key 50-day moving average, and looking a bit vulnerable.

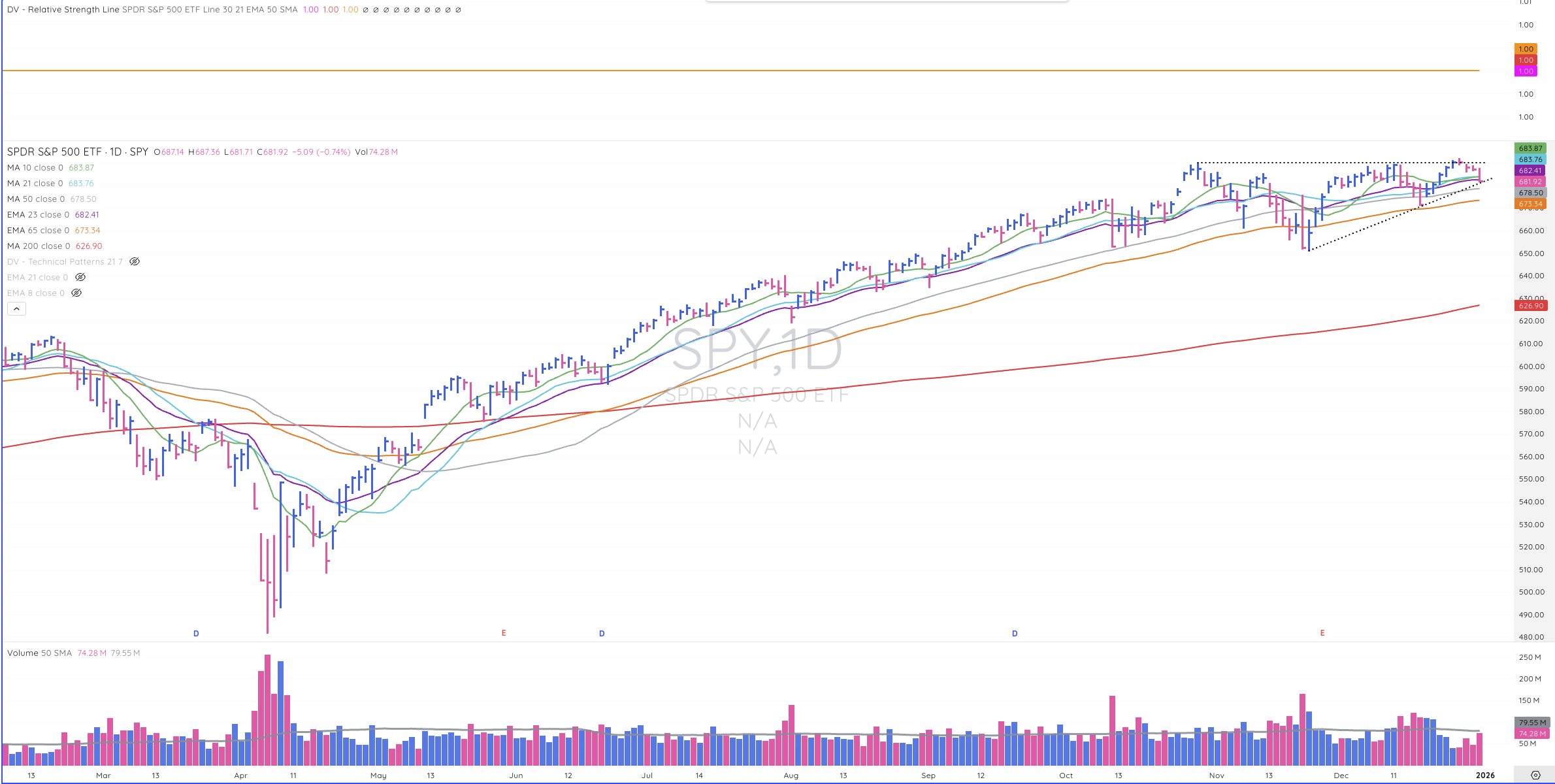

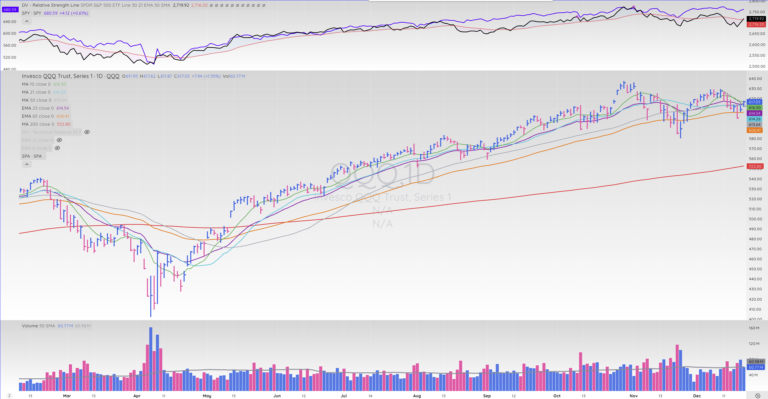

SPY

The S&P 500 held up a bit better than the NASDAQ, which is no surprise, given its recent relative strength.

IWM

At one point, not too long ago, the Russell 2000 was clearly exhibiting the most strength of the four major indexes . This is no longer the case, although, the small-cap Index continues to trade above its 50-day moving average, unlike the NASDAQ.

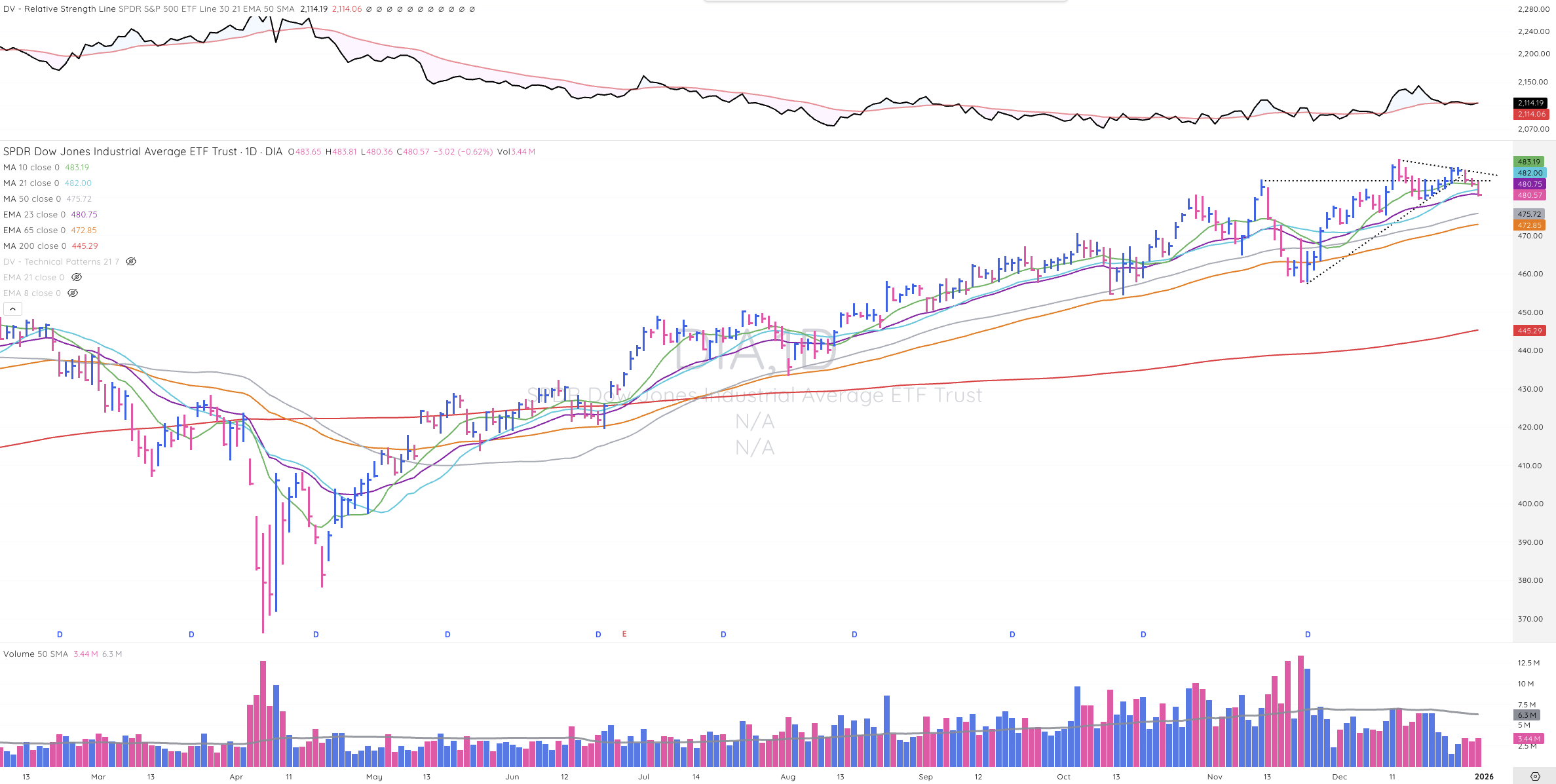

DIA

The Dow ended the year in a similar position to the S&P 500. Both closed slightly below their 21-day SMAs, but above their 50-day SMAs.

Focus List

GOOGL

GOOGL's tight sideways price action along the 21-day SMA on light volume is constructive and often leads to higher prices.

NVDA

Benchmark semiconductor NVDA is at a make-or-break point above its 50-day moving average and below its decline in tops line. It is the NASDAQ Composite's largest component at a bit over 12%. So, It's worth keeping an eye on NVDA and the rest of the leading semiconductors.

ALAB

ALAB is a recent IPO and leading semiconductor name. Like NVIDIA, it's at a make-or-break area in its pattern, yet to pick a direction.

SNDK

It will be interesting to see if SNDK can continue to defy gravity, hold up above its 10-day, and ultimately move higher from this area, or if it needs a another trip to the 50-day.

RDDT

On one hand, RDDT has formed a constructive base-on-base and appears about ready for higher prices. On the other hand, a pullback to its rising 50-day moving average first wouldn't break the chart.

TIGO

TIGO looks like it may be set up for a breakout over the next few days. However, a retest of its 21-day SMA first would ultimately be healthy and constructive.

LLY

LLY looks like it's ultimately setting up for higher prices. However, it looks a little wedgy. So a shakeout first would be ideal.

GH

Leading healthcare name, GH, is also at a make-or-break spot in its pattern. I amwatching for a breakout above its declining top line. However, a pullback to its 50-day first would ultimately be healthy and constructive.

RIGL

IGL's tight sideways action at key support is healthy and constructive and looks about ready to break above its declining tops line from here.

SEPN

Recent IPO, SEPN, is a profitable, leading pharmaceutical name that looks ready to break out to new all-time highs.