Trading IPO Stocks: Capitalize on The 3 IPO Phases

Published: June 11, 2025

What is an IPO stock, and why does it matter?

An Initial Public Offering (IPO) is when a private company offers its shares to the public for the first time. It’s a major milestone that turns the business into a publicly traded company listed on a stock exchange.

This move opens the door to a wider range of investors and more money to fuel growth, and boosts brand visibility and credibility in the market. Plus, early investors and employees may get the chance to cash in on their shares.

By going public, companies can raise significant capital. That money can help fund expansion plans, invest in new projects, or pay down existing debt.

For investors, IPO stocks can be exciting. They offer a chance to get in early on a company’s public journey, sometimes before it becomes a household name.

The potential for big gains is real, especially if the company performs well after going public, but it’s important to remember that not all IPO stocks continue to grow. Some may struggle, especially if the market conditions aren’t great or the company wasn’t ready for prime time.

If you want to navigate the stock market with confidence, understanding how IPOs work is key.

Why trade IPO stocks?

Some of the best growth stocks make their biggest moves within the first 10 years after going public. That’s why trading an IPO base can be such a powerful strategy.

An IPO base can show up early in a stock’s life and often mark the start of a big uptrend.

IPO bases form when a stock starts to settle after its initial surge or dip post-IPO. They show up as price consolidations on a chart, and a breakout from that base can signal a strong move ahead.

So what drives an IPO stock to continue on a strong run? A mix of solid fundamentals, buzz in the market, and growing interest from big institutions.

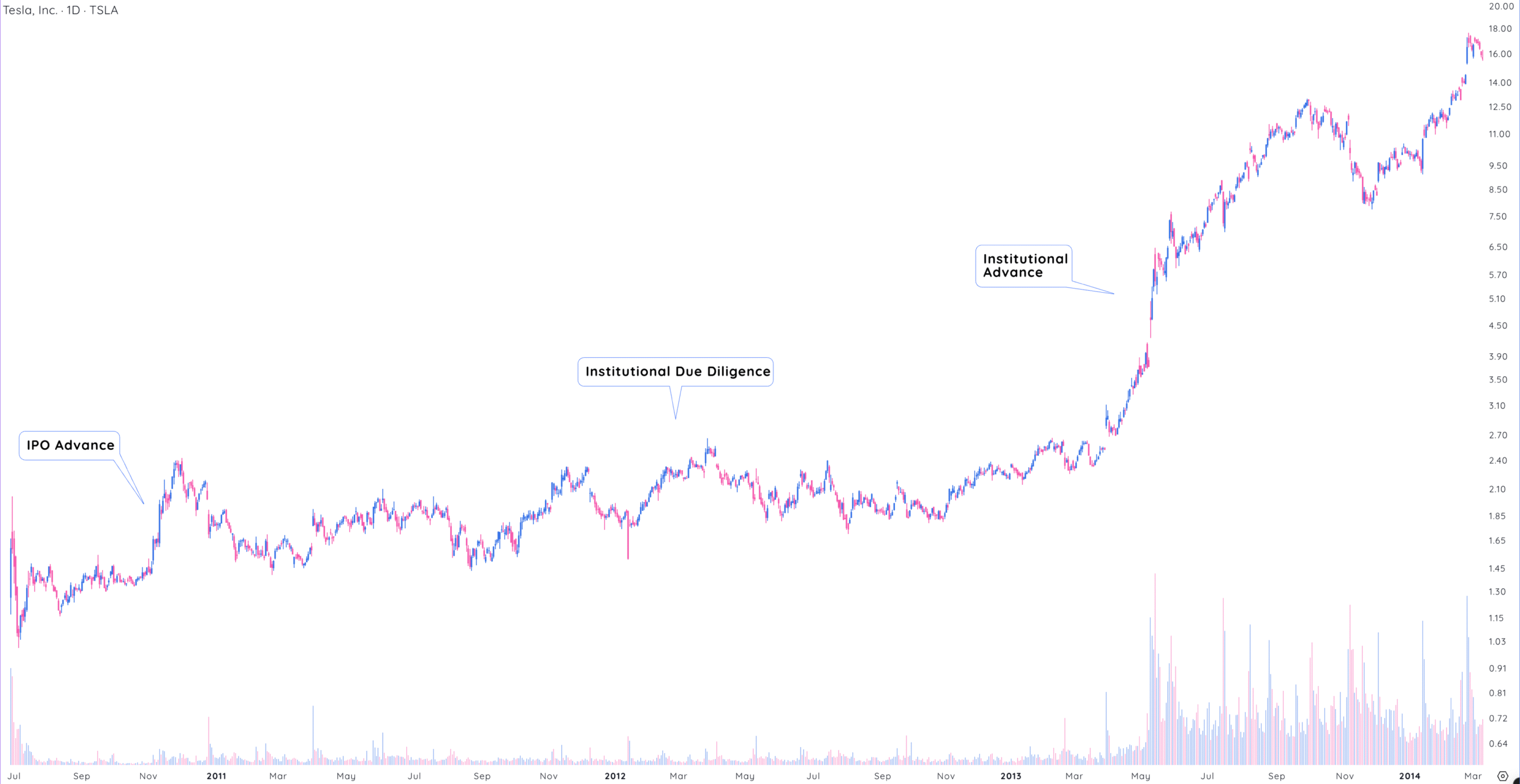

Think about Amazon or Tesla. Both companies had incredible runs in their early public years. Investors who recognized their IPO base setups and acted on them were rewarded in a big way.

Yes, as an IPO base can lead to big gains, but it also comes with risk. New stocks are often volatile, and not every breakout sticks.

Learning the stages of an IPO will help guide your trading decisions.

Understanding the three lifecycle phases of an IPO stock

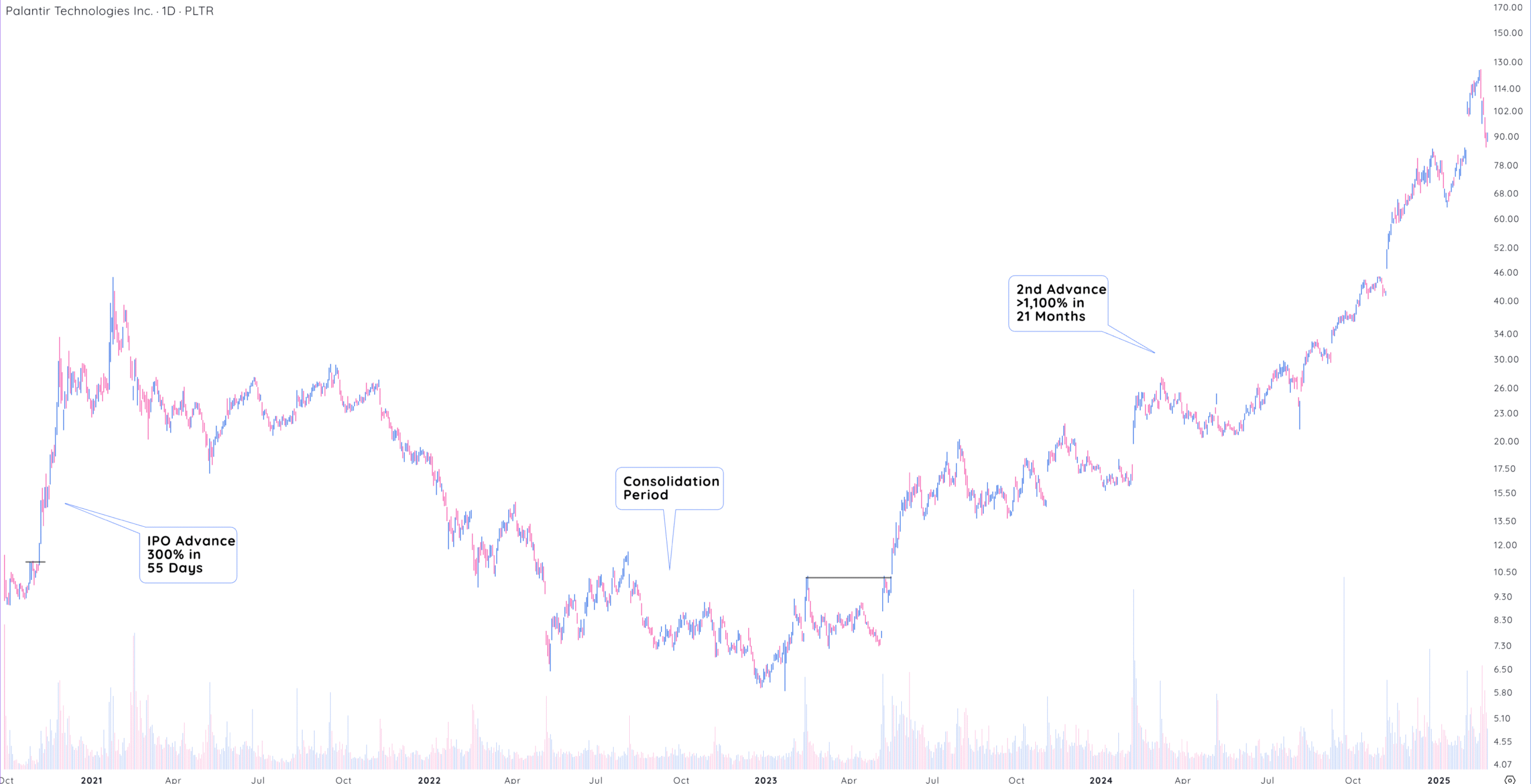

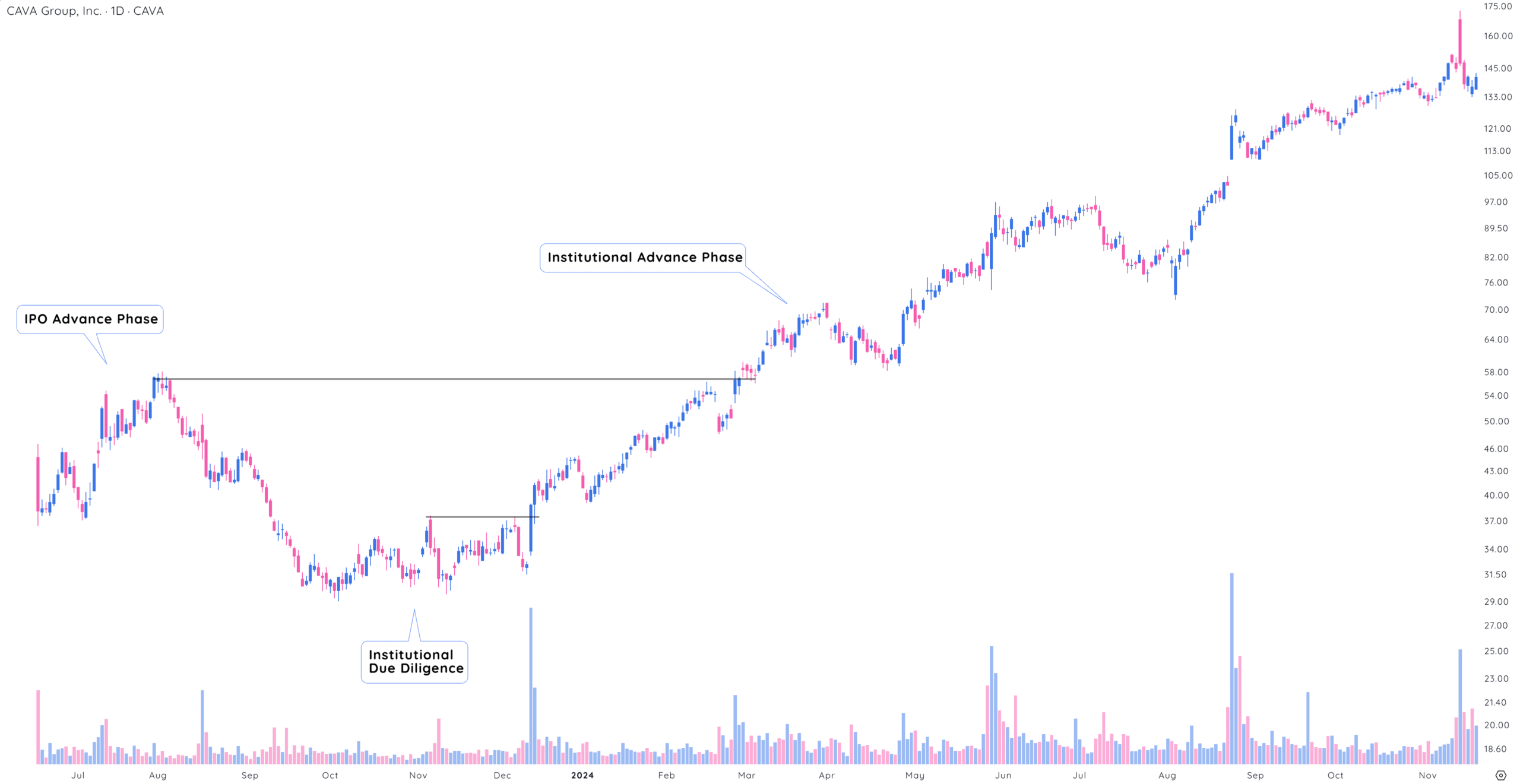

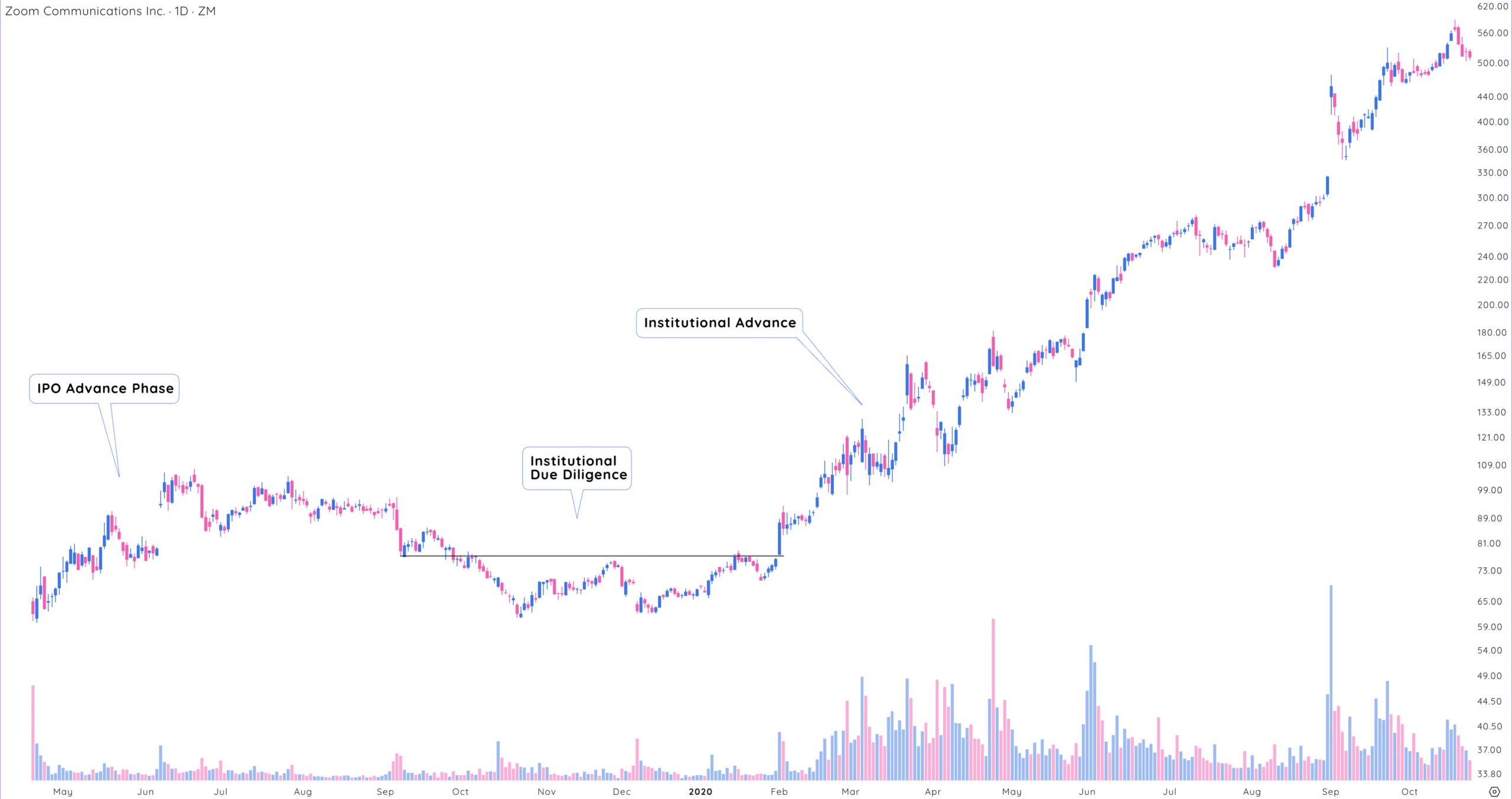

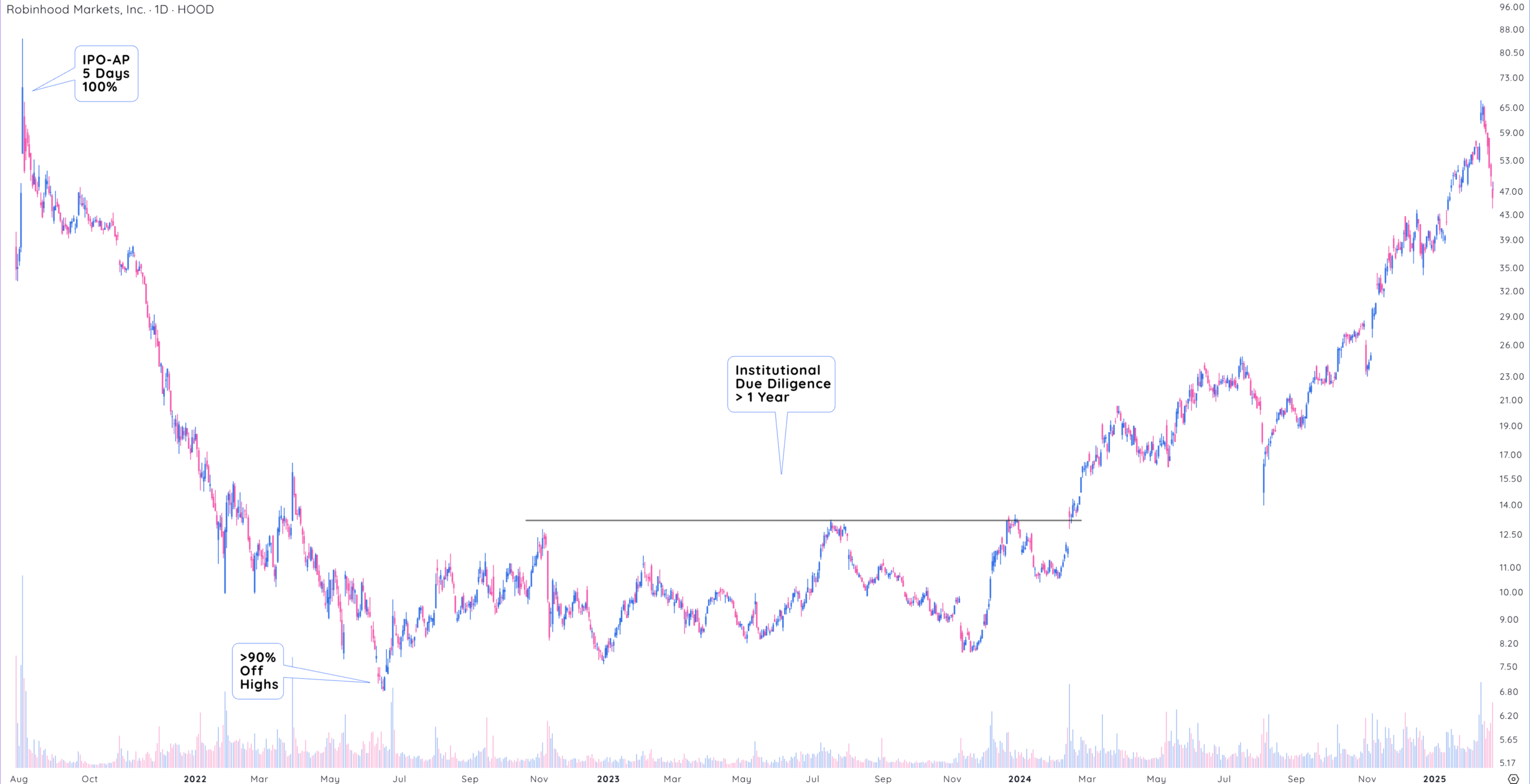

In their book The Lifecycle Trade, Kathy Donnelly, Eric Krull, Kurt Daill, and Eve Boboch analyzed hundreds of IPOs to uncover a pattern that the best-performing IPO stocks tend to follow. They found that successful IPOs typically go through three distinct lifecycle phases.

By learning to recognize these phases, you can better time your trades and avoid common traps many investors fall into when chasing newly public companies.

Whether you’re a swing trader or a long-term investor, understanding these stages helps you decide when to act and when to wait.

IPO Advance Phase

This is the first stage immediately after a company goes public. This is when momentum is high, headlines are fresh, and early demand can send the stock soaring.

During the IPO Advance Phase (IPO-AP):

- The stock typically experiences a sharp rally due to investor enthusiasm, media attention, and early institutional interest.

- This phase can last a few days to several weeks, depending on market conditions and company news.

- Technical traders often look for tight consolidations, early base formations, or strong breakouts on high volume to enter trades.

Sometimes the hype fades quickly, or the company disappoints on earnings or guidance. That’s what’s known as an IPO Advance Failure (IPO-AF)—a sharp reversal that can trap late buyers.

Be nimble – Trade setups that show strong price action, but don’t overstay your welcome. Use tight stops and be ready to exit quickly if momentum fades.

Institutional Due Diligence Phase

After the initial rally cools off, the stock often enters a consolidation phase called the Institutional Due Diligence Phase (I-DDP). Think of it as a wait and research stage.

What’s happening here?

- Institutions are taking a step back to dig into the company’s fundamentals like revenue growth, profit margins, scalability, and market opportunity.

- The stock typically trades sideways or pulls back, forming a traditional basing pattern or wide-range chop.

- Volume often dries up, and price action becomes choppy or trendless.

This phase may last months or even years. It’s a test of patience for traders, and a trap for those who chase every bounce. This is also the phase where many weak hands get shaken out.’

Sit on your hands and observe. Focus on watching for accumulation signs, such as higher lows or volume spikes, that might suggest institutions are quietly buying shares.

Institutional Advance Phase

Eventually, the company proves itself with strong earnings, product adoption, or market expansion, and institutions begin to accumulate with serious buying power. This starts the Institutional Advance Phase (I-AP).

Here’s what defines this stage:

- The stock breaks out of a mature base, often with powerful volume behind it.

- You’ll see clear uptrends, often with constructive pullbacks, as institutions continue accumulating shares.

- This phase can last multiple quarters or even years, especially for top-performing growth stocks.

This is when a stock transforms from an interesting idea to a market leader. Classic examples include companies like Amazon, Tesla, Nvidia, and Salesforce, all of which went through long bases before launching into powerful multi-year uptrends.

Be ready to strike. These are the highest-probability trades – breakouts from proper bases, confirmed by volume, fundamentals, and institutional support.

Each lifecycle phase offers different opportunities and different risks. If you try to trade aggressively in the I-DDP phase, you may get chopped up. If you ignore early IPO setups, you might miss the entire move.

By learning to identify these three phases, you can:

- Avoid entering too early when the stock hasn’t proven itself.

- Know when to be patient during the base-building period.

- Recognize when a stock is gaining real traction and ready for a sustained run.

Most importantly, it gives you a framework, so you’re not just reacting to every price move. Instead, you’re making informed decisions based on where the stock is in its journey.

Why Market Context Matters for IPO Stocks

The broader market environment plays a huge role in how a newly public stock performs for both short-term traders and longer-term investors. Understanding the market cycle can help you avoid costly mistakes and spot hidden opportunities.

Traditionally, more stocks go public during bull markets. When the market’s trending higher, investors are more optimistic, there’s more capital flowing around, and the appetite for risk is much higher.

Demand for new offerings is strong, and even weaker companies can see early price pops. Momentum traders are active, boosting volume and liquidity.

Near the end of a prolonged uptrend, however, be wary when too many companies rush in to go public at once. This kind of IPO surge can signal market exuberance where valuations get stretched and investor judgment gets complacent.

💡 Pro Tip: Dial in on IPO stocks that begin trading during bear markets or severe market declines. Stocks that go public in bear markets are confident they will see continued growth in uncertain market environments.

Younger IPO stocks can see a surge of continued accumulation after they withstand selling pressure in weaker bear markets. When the market turns after a prolonged decline, look for stocks that have been trading under 10 years to emerge as the next market leader.

Trading the IPO base

Knowing when and how to trade an IPO base can make all the difference. Each phase in a stock’s early life requires a different mindset and approach.

Whether you’re reacting to fast-moving price action or waiting for long-term setups, timing is everything.

How to trade the IPO-AP

The IPO-AP is fast, exciting, and full of potential, but also full of traps. This is where early momentum can offer quick gains if you act decisively.

Key strategies for the IPO-AP:

- Be nimble: Focus on quick setups showing strong price action. These are usually short-term trades.

- Use tight stops: Protect your capital. IPOs can reverse fast if the hype cools down.

- Watch intraday or daily charts: Momentum plays often develop within hours or a few days.

- Take profits quickly: Don’t get greedy—move fast when the trade goes in your favor.

- Be cautious of the IPO lock-up period: When the lock-up expires, early investors and insiders may start selling, adding downward pressure.

How to trade the I-DDP

After the initial excitement wears off, many IPOs enter the I-DDP. This is when institutions step back, evaluate the fundamentals, and decide if the company is worth a long-term investment.

Key strategies for the I-DDP:

- Sit on your hands: This is mostly a no-trade zone. Let the stock base and settle.

- Watch for accumulation: Look for subtle signs like higher lows, tightening ranges, or volume spikes on up days.

- Track fundamentals: Earnings, margins, and sales trends matter. Institutions want growth and stability.

- Keep it on your watchlist: This phase can last weeks to months. Be patient and ready for a proper setup.

How to trade the I-AP

This is the phase most traders wait for. By now, the stock has matured, institutions are buying heavily, and fundamentals have improved. It’s no longer a stock story. It’s a legitimate growth candidate.

Key strategies for the I-AP:

- Be ready to strike: This is where real opportunities show up – classic breakouts with strong volume and structure.

- Look for traditional base patterns: Cup-with-handle, flat base, or double bottom backed by volume and earnings strength.

- Focus on fundamentals: The company should have improved quarterly earnings, revenue growth, and positive guidance.

- Confirm institutional interest: Look for accumulation weeks, increasing fund ownership, or analyst upgrades.

- Make sure it’s a known name: Stocks gaining traction in the media and among analysts often attract more buyers.

Final thoughts on trading IPO stocks

Trading IPOs is about more than just chasing hype. It’s about understanding where the stock is in its journey, and how the market context supports or challenges its growth.

If you learn to spot the lifecycle phases, time your entries, and align your trades with the broader market, you’ll be ahead of most investors chasing the next big thing.

In the world of IPOs, timing, patience, and preparation aren’t just helpful – they’re everything.