4 Key Types of Stock Gaps Every Trader Should Know

Published: November 4, 2025

What are Stock Gaps and Why Do they Matter?

Stock gaps occur when a stock opens much higher or lower than where it closed the day before. This creates a visible gap on the price chart—like a blank space where no trading happened. Gaps usually form because of news or events that break outside normal trading hours, like earnings reports, mergers, or major economic updates.

Think of it like this: you go to sleep with a stock priced at $100. The next morning, it opens at $110. That $10 “jump” creates a gap—like the market skipped a beat while you were asleep.

Why Do Stock Gaps Form?

Stock gaps are all about unexpected news or sudden changes in sentiment. Here’s how they usually play out:

Gap up: bullish signals

A gap up happens when a stock opens higher than its previous close. It usually signals strong buying interest—investors are excited. You’ll often see this after:

- Better-than-expected earnings

- FDA approvals or positive trial results

- Mergers and acquisitions

- Positive economic news or global tailwinds

In short, something happened that made investors want in and fast.

Gap down: bearish warnings

A gap down is the opposite. The stock opens lower than it closed. It can be triggered by:

- Missed earnings or weak forecasts

- Lawsuits or regulatory issues

- Bad economic data or geopolitical shocks

These are red flags, and investors react by hitting the sell button before the market even opens.

Why Volume is Key When Trading Stock Gaps

Not all gaps are created equal. What really matters is volume.

- Low volume gap? It’s often just noise and might fade quickly.

- High volume gap? That’s real. It shows strong interest, often from institutions like hedge funds or mutual funds.

This ties into the CANSLIM method, where the “S” stands for supply and demand. Heavy demand (high volume) during a gap can signal a powerful trend starting.

How Gaps Affect Stocks vs. Indices

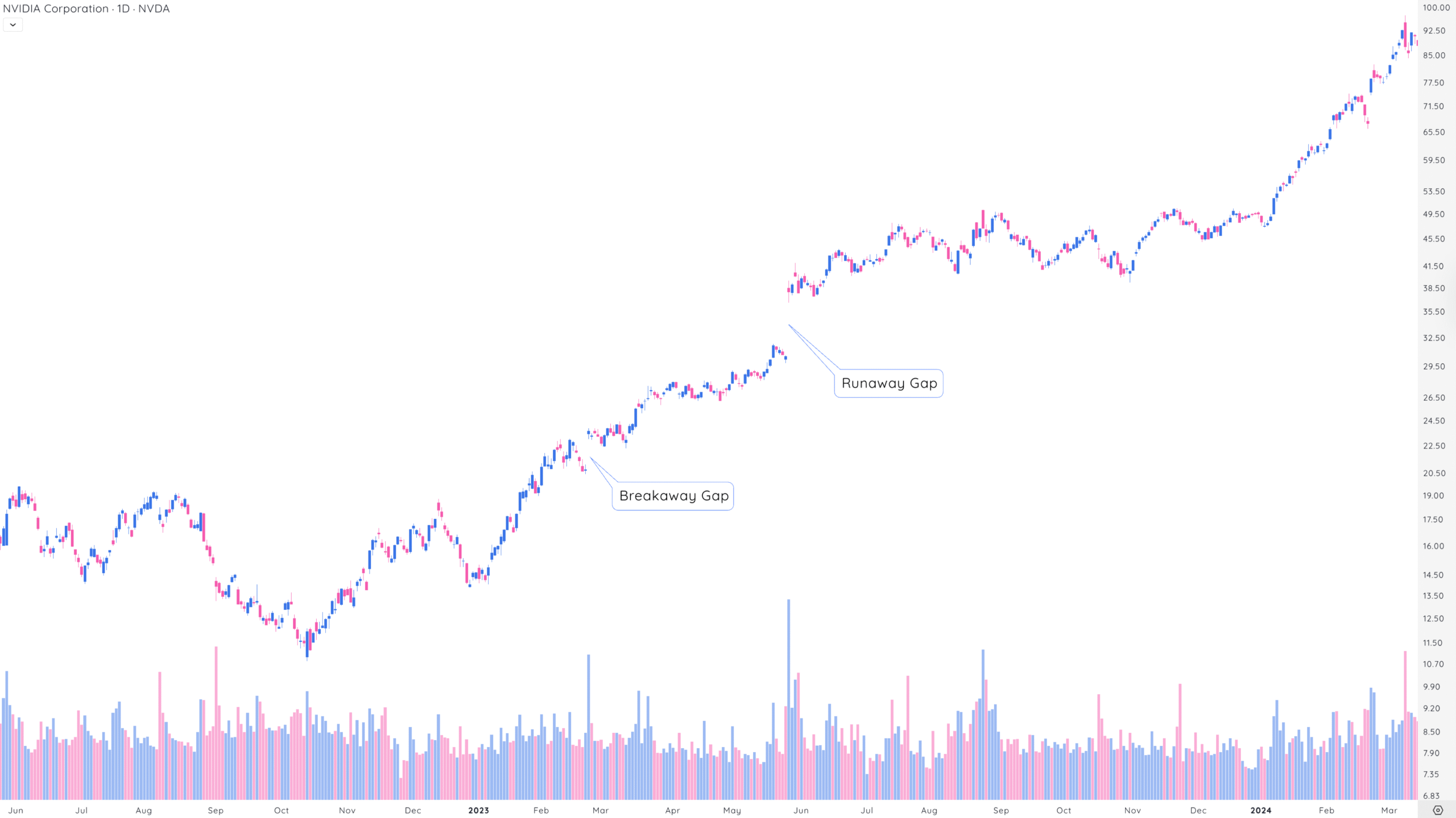

Gaps hit individual growth stocks like NVDA or TSLA more dramatically. These companies can jump or drop double digits overnight. But you’ll also see gaps on major indexes like the S&P 500 or Nasdaq, especially around:

- Federal Reserve announcements

- Big tech rallies

- Major macroeconomic shifts

These broader gaps often point to bigger market trends.

4 Types of Stock Gaps and How to Trade Them

Not all gaps mean the same thing. Understanding the type of gap can help you decide whether to trade it or stay away.

Gaps are important because they signal strong investor sentiment and can mark the start, continuation, or end of a trend. They often show up during earnings season, after big product announcements, or when major macroeconomic data is released.

Here’s why gaps matter to traders and investors:

- They reveal market emotion: A gap up shows optimism; a gap down signals fear or disappointment.

- They can offer trading setups: Gaps are often used in technical trading strategies for entries and exits.

- They help confirm trends: Some gaps suggest a trend is starting or gaining steam, while others warn that a move is running out of fuel.

But not all gaps are worth trading. The key is knowing what type of gap you’re looking at and what it means.

Common Gaps: Noise Inside the Trading Range

Common gaps are the most frequent type. They occur during normal price fluctuations within a stock’s recent trading range.

There’s usually no major news driving them, and they rarely have a lasting impact. Think of them as background noise on the chart.

Key traits:

- When they occur: During quiet markets or low-volume periods

- Volume: Typically low

- Catalyst: None or very minor (like a small analyst note or sector movement)

- Do they fill? Almost always, unless related to major market turns

How to trade common gaps:

Traders usually pause here, meaning they wait for more clues. Since there’s no strong reason behind the gap, it tends to lose momentum as traders wait to see what may happen next.

Traders who are already long may begin selling their position into strength to lock in gains. Other traders discover strong price action on relative strength screeners, but wait to begin buying on future weakness when the price pulls back into support.

Example:

A stock trading between $45–$48 for weeks suddenly opens at $48 on no real news. It drifts back down during the day, closing to close the gap. A stronger stock will close near the highs above the previous close, while a weaker stock will close near the lows inside the previous days range.

Bottom line: Common gaps are rarely worth chasing. They offer quick, short-term setups for experienced traders but don’t signal much for long-term investors.

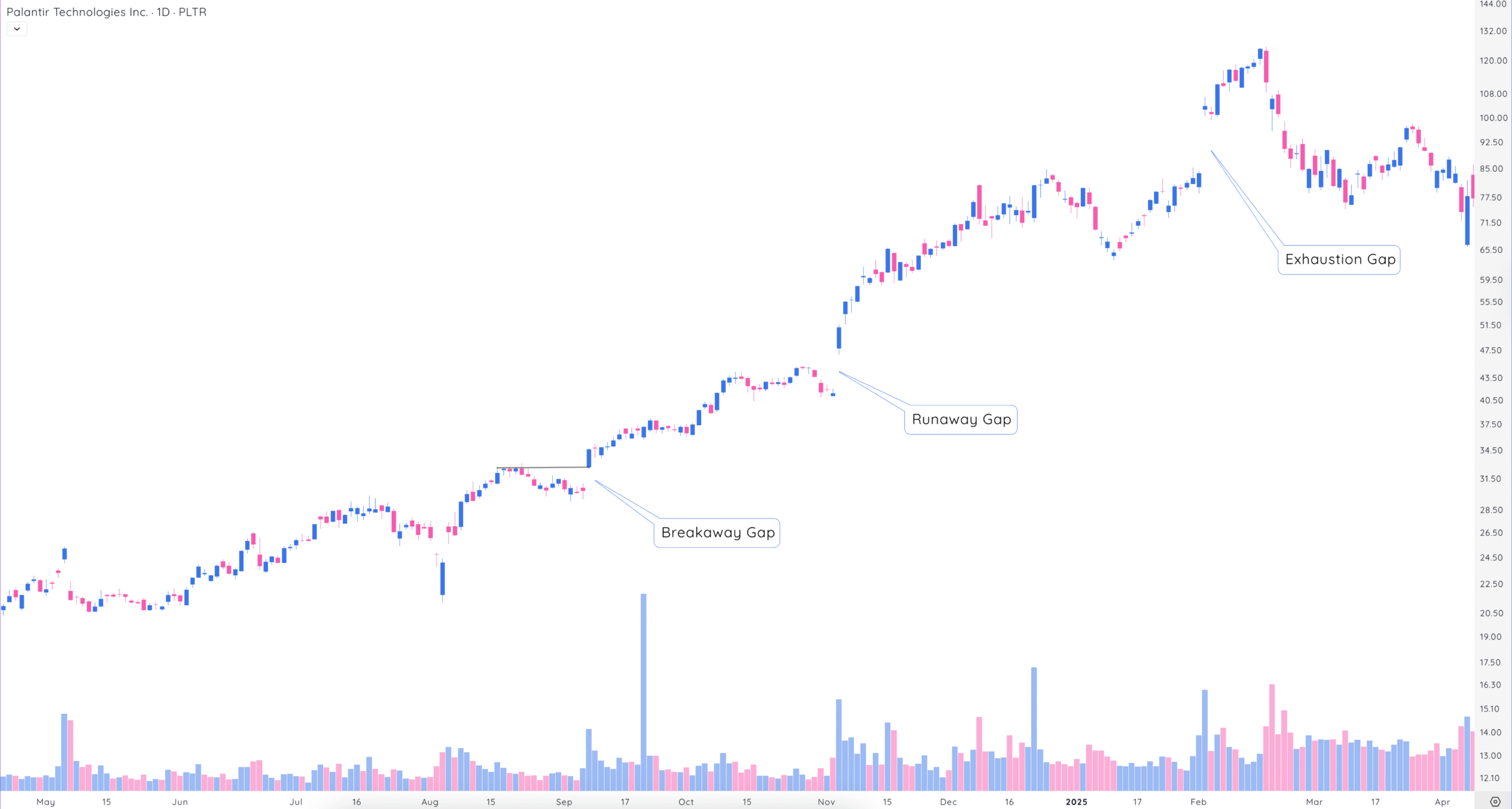

Breakaway Gaps: The Start of Something Big

Breakaway gaps are the exciting kind. They form when a stock breaks out of a key support or resistance level—often after a long consolidation period or technical setup. These gaps are driven by major catalysts and show strong conviction from institutional investors.

Key traits:

- When they occur: At the beginning of a new trend, often after earnings, product launches, or breaking news

- Volume: High to explosive (this is critical for confirmation)

- Catalyst: Big news—earnings beat, FDA approval, buyout rumors, etc.

- Do they fill? Rarely—these gaps usually hold and become support/resistance zones

How to trade breakaway gaps:

These are buy signals, especially if the volume confirms strong demand. Many traders enter positions right after the gap and place stop-losses near the bottom of the gap (or prior resistance).

Example:

A stock in a flat base suddenly gaps up 12% on record volume after smashing earnings expectations. It clears a key resistance level and continues higher for weeks. That’s a textbook breakaway gap.

💡 Pro Tip: Look for gaps breaking out of clear chart patterns (like cup-with-handle or consolidation zones) on heavy volume. That’s where the highest probability setups live.

Bottom line: Breakaway gaps often mark the beginning of big moves. These are high-conviction moments—don’t ignore them.

Runaway Gaps: Momentum Mid-move

Runaway gaps (also called measuring gaps) happen in the middle of an existing trend. They confirm that the trend is strong and gaining steam. These gaps are often caused by continued good news or growing investor interest, not necessarily a single catalyst.

Key traits:

- When they occur: Midway through a powerful trend (up or down)

- Volume: High (but not necessarily as big as at breakout levels)

- Catalyst: Often a continuation of an earlier theme (e.g., new partnerships, follow-up analyst upgrades, macro tailwinds)

- Do they fill? Sometimes, but usually not right away

How to trade runaway gaps:

If you’re already in the trade, these gaps say: “Stay in.” They’re a sign the trend isn’t over. If you’re looking to enter, they can offer a second-chance entry with a proper stop-loss just below the gap.

Example:

A stock that’s been climbing for a month suddenly gaps up 6% after a bullish analyst upgrade. It keeps running for another few weeks before topping out. That gap was a measuring point for the trend’s strength.

💡 Pro Tip: Measuring gaps often appear halfway through a trend. Some traders use the size of the first move to estimate the potential length of the second leg.

Bottom line: Runaway gaps say, “The trend is healthy.” Use them to manage your position—not as late-entry FOMO triggers.

Exhaustion Gaps: Last Gasp Before Reversal

Exhaustion gaps are dramatic—and potentially dangerous. They occur at the tail end of a strong trend, usually when late buyers or sellers rush in, only to get trapped. These gaps feel like breakouts at first, but they quickly reverse, leading to sharp pullbacks or even full trend reversals.

Key traits:

- When they occur: After a big, extended move, right before a reversal

- Volume: Very high—often climactic

- Catalyst: May be news-driven, but often emotional (herd behavior, media hype)

- Do they fill? Yes—and fast

How to trade exhaustion gaps:

These are sell or short signals. If you’re holding a stock that gaps up after a huge run, it may be time to lock in profits. If you’re a short-term trader, look for signs of weakness to fade the gap.

Example:

A stock rallies 40% in two weeks and then gaps up another 10% at the open—only to close flat or negative by the end of the day. Volume is huge, and the move reverses the next session. That’s a textbook exhaustion gap.

Bottom line: Exhaustion gaps are the end of the run. Don’t chase them. Learn to spot them and trade the reversal.

Final Thoughts: How to Use Stock Gaps to Your Advantage

Stock gaps are more than just empty spaces on a chart—they’re real-time signals of market psychology, emotion, and conviction. Whether it’s excitement over blowout earnings or panic after a regulatory blow, gaps tell a story. The key is learning how to read that story—and knowing what kind of gap you’re dealing with.

Here’s what to remember:

- Common gaps are usually meaningless noise inside a trading range. Don’t overreact.

- Breakaway gaps are powerful signals that a new trend is beginning. These are where smart traders strike early.

- Runaway gaps confirm that a trend is healthy and gaining momentum. Use them to hold winners longer or find reentry points.

- Exhaustion gaps warn that a move is likely over. If you’re late to the party, you could get burned—fast.

Volume is the truth-teller in every gap. Light volume? It might be a fakeout. Heavy volume? That’s likely real institutional buying or selling.

If you’re going to trade gaps, always read them in the context of volume and the broader chart pattern.

Gaps offer a rare glimpse into crowd behavior. They expose the extremes—greed, fear, and overconfidence. Understanding this can give you a real edge, especially when combined with technical setups and sound risk management.

Whether you’re a short-term trader, a swing trader, or even a long-term investor trying to fine-tune your entries, gaps can help you:

- Spot high-conviction buying opportunities

- Avoid buying tops or selling bottoms

- Time exits with more precision

- Stay in trends longer—or get out before the crash

You don’t need to trade every gap. The best traders are selective. They know when to lean in and when to step aside.

Master the context. Respect the volume. Let the chart do the talking.