What Are Market Cycles?

Market cycles are repeated shifts in price behaviour that mirror crowd psychology. Liquidity drives the longer swings from bull to bear markets. Fear and greed cause shorter rallies and pullbacks. By defining clear rules that read those shifts, you can decide whether to press harder or pull back.

This approach helps avoid letting emotion drive your decisions.

Why Recognizing Cycles Matters

When the broader market is rising, even average setups can work. However, when liquidity dries up, it’s like sailing into a headwind—hard work for little progress. A reliable cycle system keeps you focused on:

- Adding exposure when odds favour you

- Scaling down when conditions erode

- Cutting frustration and drawdowns

Building Your Personal Market Cycle System

Pick Clear Technical Signals

Choose indicators you already respect—moving averages, price relative to recent highs, or breadth measures. For swing trading, many use a short-term average such as the 21-day exponential moving average (EMA) on a major index.

Never miss a post.

Sign up to get instant notifications when we publish a new post.

Add Psychological Indicators

Breadth thrusts, volume spikes, or capitulation days confirm that fear or greed has reached an extreme. Those clues often precede a market turn.

Choose Market Gauges

Select a handful of institutional favourites that often lead the market. Tesla, Alphabet, and Nvidia have played that role in recent years. If these stocks firm up while the index still looks weak, odds are a new uptrend is brewing.

Combine the Pieces

Create a checklist. A simple example might be:

- Index closes above its 21-EMA

- Two out of three gauge stocks also close above their 21-EMA

Your rules need to fire together before you label the environment as ‘favourable.’ This ensures you are making informed trading decisions.

Trading Each Phase of the Cycle

From Cash to Exposure

When your checklist turns positive, start small. Initiate one or two positions or buy an index ETF. If they move in your favor, add to them. If they fail, step aside, as that signal may be a head-fake.

Stress Tests

Most fresh rallies suffer a sharp down day around day four to six. This stress test shakes out weak hands. You should maintain partial profits or tight risk to absorb a dip without damage. A quick recovery shows strength; a slide through support warns that the uptrend was premature.

Late-Cycle Caution

After several weeks of higher highs, profits look easy and new breakout attempts often lag. At that point:

- Tighten stops

- Trim laggards quickly

- Avoid brand-new names that just now break to highs—they are late and risky

The goal is to protect the cushion you built early in the move while staying alert to market shifts.

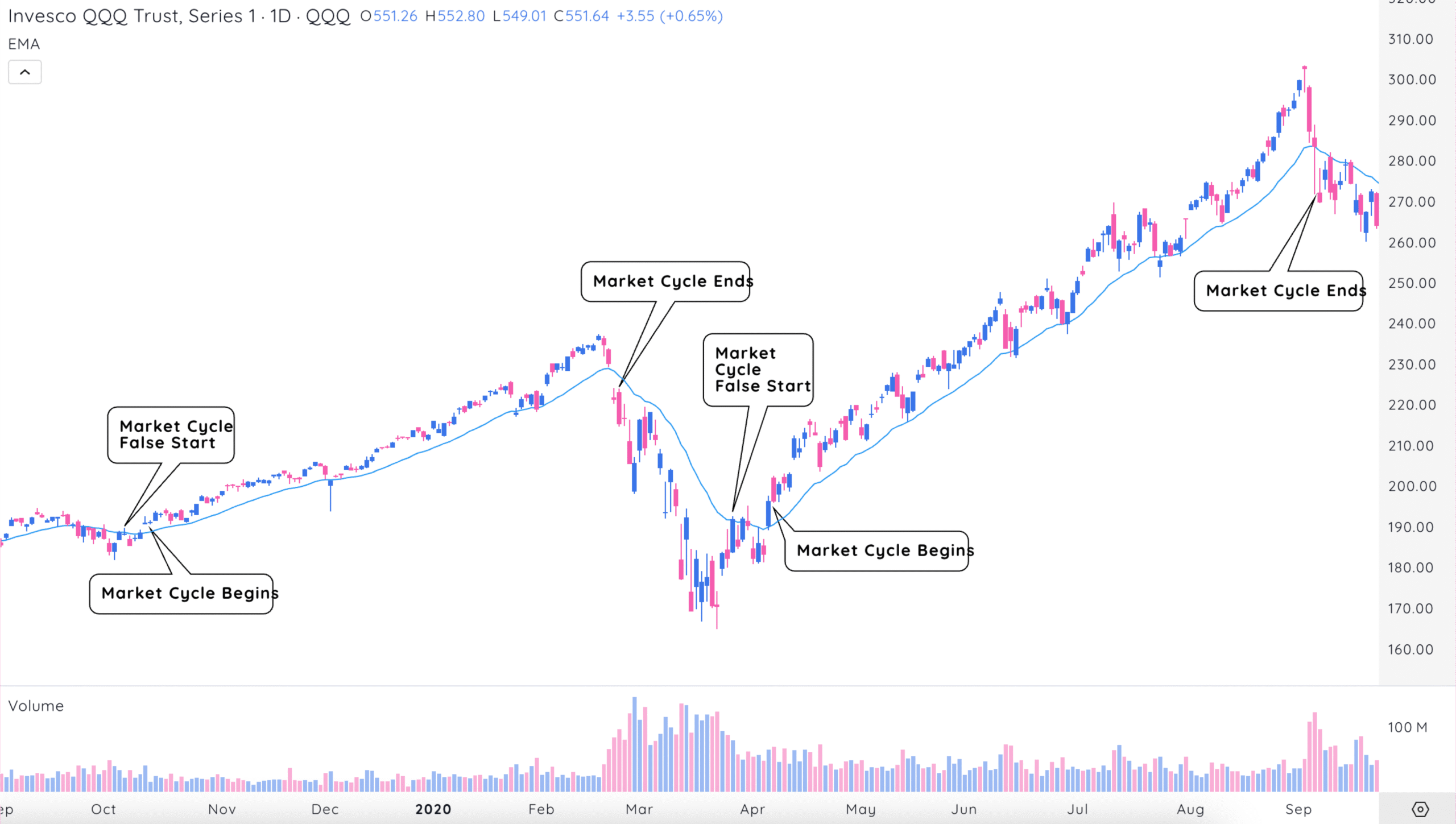

Example: The 21-EMA Swing Trading Template

A straightforward swing framework uses the Nasdaq 100 ETF (QQQ) and its 21-EMA.

- Cycle start: QQQ closes above the 21-EMA

- Cycle end: Two consecutive closes below the average, with the second close under the prior day’s low

During 2019 – 2024, this simple rule caught most multi-week rallies while urging caution during sharp pullbacks. False starts occurred, yet losses stayed small because size was modest until trades proved themselves.

How to act

- Day 1-3 after the trigger:

- Enter a mix of QQQ and one or two leading stocks.

- Keep the risk per trade low.

- Stress test day:

- Hold winners through a brief dip if they remain above the entry.

- Drop positions that slice through support on heavy volume.

- Middle of the run:

- Add to leaders at secondary setups, such as pullbacks to the 10-day line.

- Let early winners breathe; raise stops only under obvious support.

- Late stage:

- Reduce the size on extended names.

- Avoid adding full new positions.

Following this rhythm you participate when odds are stacked in your favour and sit out when they are not.

Key Takeaways

- A market cycle system replaces guesswork with objective signals.

- Use indicators you already check each day so the rules feel natural.

- Start small on new signals, expand only if trades confirm strength.

- Expect stress tests; they separate durable rallies from noise.

- Tighten risk late in the cycle—new trades then have the worst odds.

If you want a step-by-step blueprint that covers cycle detection, entry tactics, and risk management in one place, grab a copy of The Trader’s Handbook. This resource expands on the checklist you learned here, provides annotated charts for multiple years, and includes challenges that walk you through building your own market cycle system.