Handling a Gap Down: 3 Ways to Protect Your Account

Published: July 11, 2025

What is a gap down in stock trading?

A gap down happens when a stock opens significantly lower than its previous closing price. This creates a visible “gap” on the price chart.

Gap downs usually occur after the market has been closed and are often triggered by negative news, disappointing earnings reports, or a shift in overall market sentiment.

Let’s say a stock closes on Friday at $50 and over the weekend, bad news comes out – maybe the company missed earnings or announced a major setback. On Monday morning, the stock opens at $45. That $5 difference is the “gap,” and since the price moved lower, it’s called a gap down.

Gap downs can be an early sign of strong bearish momentum, suggesting that traders are rushing to sell the stock.

In some cases, prices may continue falling after the gap. But in other cases, the stock might recover and “fill the gap” by rising back to the previous closing price.

How a gap down can impact your account and mindset

Getting caught in a gap down has two major impacts, both financially and psychologically. Obviously, your account will fall, but your mindset can negatively shift, as well.

Depending on the size of the gap down and position size, your account can take a really big hit. If you are trading with a 20% position and the stock gaps down 5% you will lose 1% of your total portfolio overnight with no real chance to manage it.

If you’re a typical swing trader focused on growth stocks, a gap down can be especially rough because these stocks tend to move in tandem. When one starts falling hard, others in the same sector or theme often follow.

Watching your account drop overnight can feel like a punch to the gut. It’s frustrating, and sometimes even scary, to lose money before you’ve had a chance to react.

If you don’t have a clear trading system with proper risk management strategies in place, you’re more likely to make emotional decisions. That could mean revenge trading, holding losers too long, or trying to “win it back” by taking on more risk – all of which usually lead to more losses.

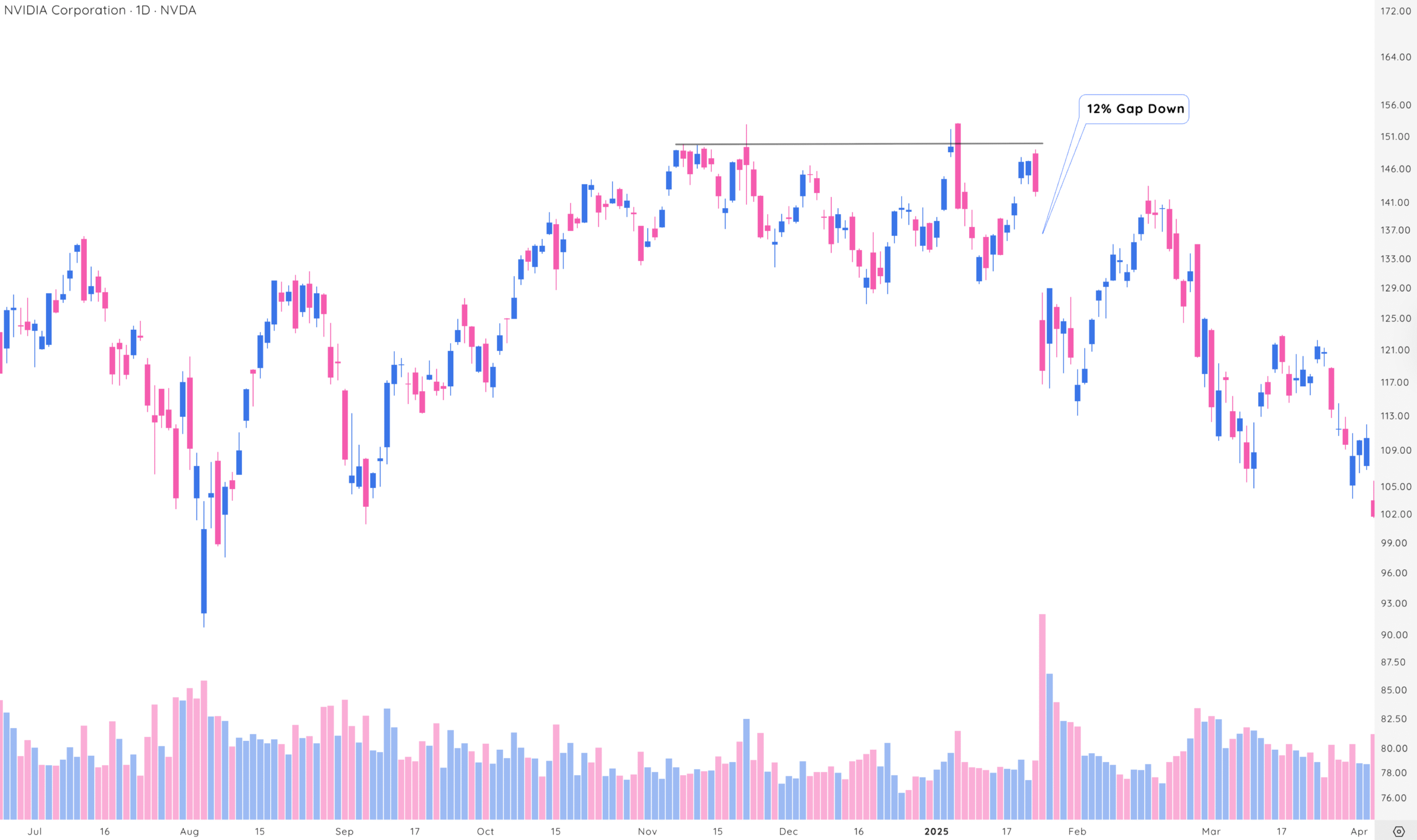

Over the weekend, news of a cheaper alternative to Artificial Intelligence surfaced, and investors were led to believe the demand for NVDA chips would fall. The following day, NVDA opened 12% lower than the previous close.

You can’t plan for events like this, but having strategies with how to deal with them will help you withstand any drawdowns.

How to handle a gap down in trading

Handling gaps down isn’t easy for anyone – it’s just a matter of being prepared. No strategy makes them easy, but being prepared gives you a much better shot at handling them well.

Sometimes it’s best to just cut the position and ask questions later. Maybe you can wait for a logical level of support, or slowly scale out partial positions to reduce the impact while waiting for more clarity.

1. Cut the loss completely and don’t look back

When you are stuck in a gap down, sometimes the best action is to just cut the whole position immediately. When there is an extreme selloff, sell all your shares.

This will help free your mind so your emotions don’t creep in, making you think, “Maybe I should just hold a little longer.” If your position was showing a gain, and all of a sudden shows a loss overnight, get rid of it

Being caught off a gap down hurts for seasoned traders, too. No amount of preparation can help avoid a gap down.

Having a plan just in case it does happen will help you act on a process, not emotions.

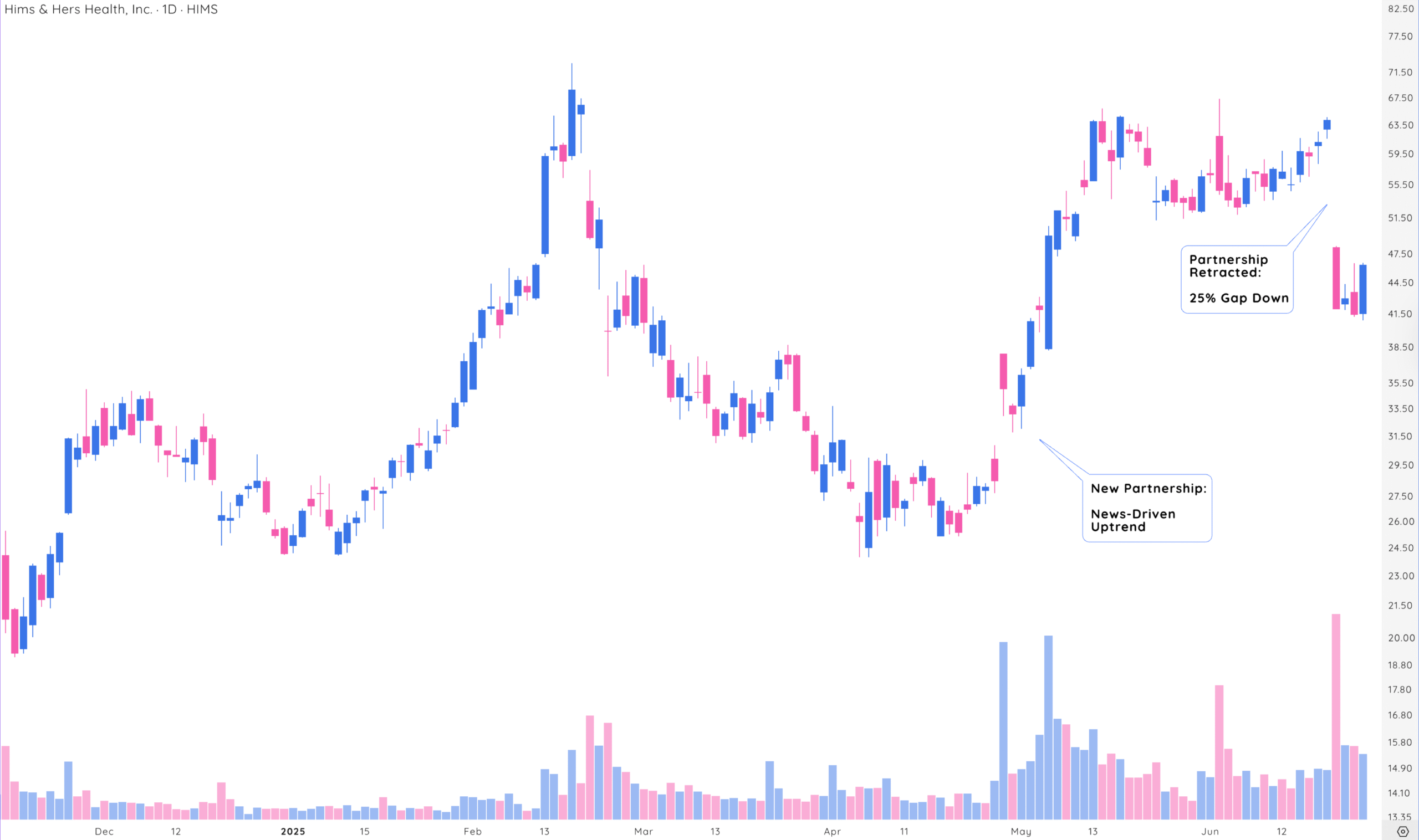

A new partnership with HIMS started a rally as a new base was forming near highs. Traders who invested earlier in the week were caught off guard when the partnership was retracted. When the reason you are trading disappears, sell your stock immediately.

2. Look for intraday support before making a decision

If you entered the stock on a longer timeframe and have a significant cushion (a large gain you have been holding), consider looking at a shorter timeframe for a logical area of support. In that case, watch the intradayfor potential support.

This will allow you to take your time to methodically exit the position. Remember, you are trying to avoid further loss by selling all, or most of, your position when you get stuck in a gap down.

If the opening range is supported at a logical support area, try and hold on a little longer – you might get a better exit. Then you can begin to reduce your position at a higher price later throughout the day.

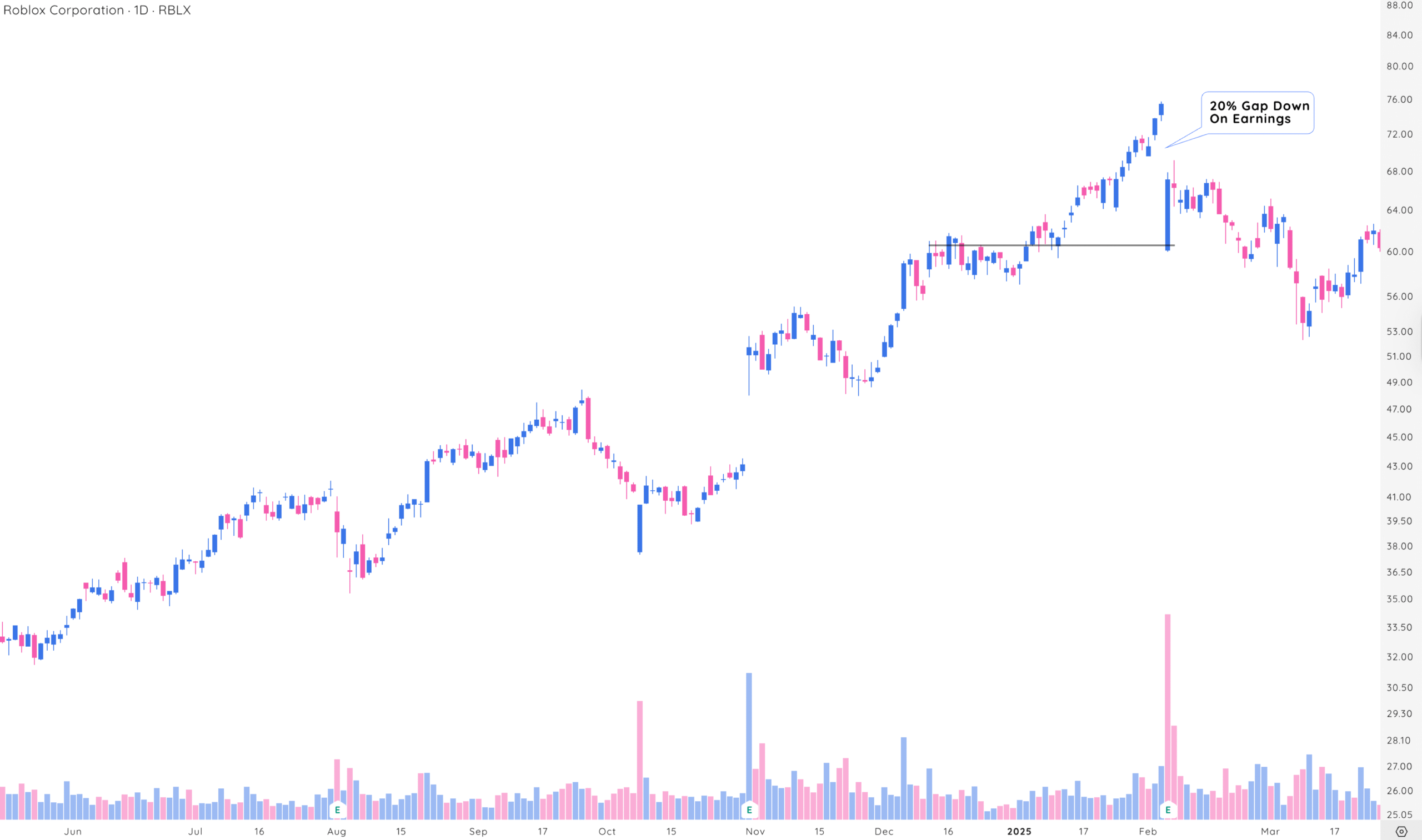

RBLX had a negative reaction to earnings and gapped down 20% into a previous support/resistance area. Waiting for the open, and looking at an intraday chart, would see accumulation right at the open. This provided the opportunity to wait throughout the day to find a better time to sell the stock.

3. Sell partials to reduce stress and exposure

Selling your entire position all at once when a stock gaps down can be difficult, especially if you have been holding on to the stock for a while. Instead, selling your position in pieces can help reduce the stress of selling all at once.

If a stock gaps down, don’t hesitate and sell some of your stock. Start by selling at least 1/3 of the position when you see a huge decline overnight.

Then you can wait and see what happens. If there is no support to be found, continue to reduce the position and take another 1/3 off.

If the price continues to decline, sell the rest.

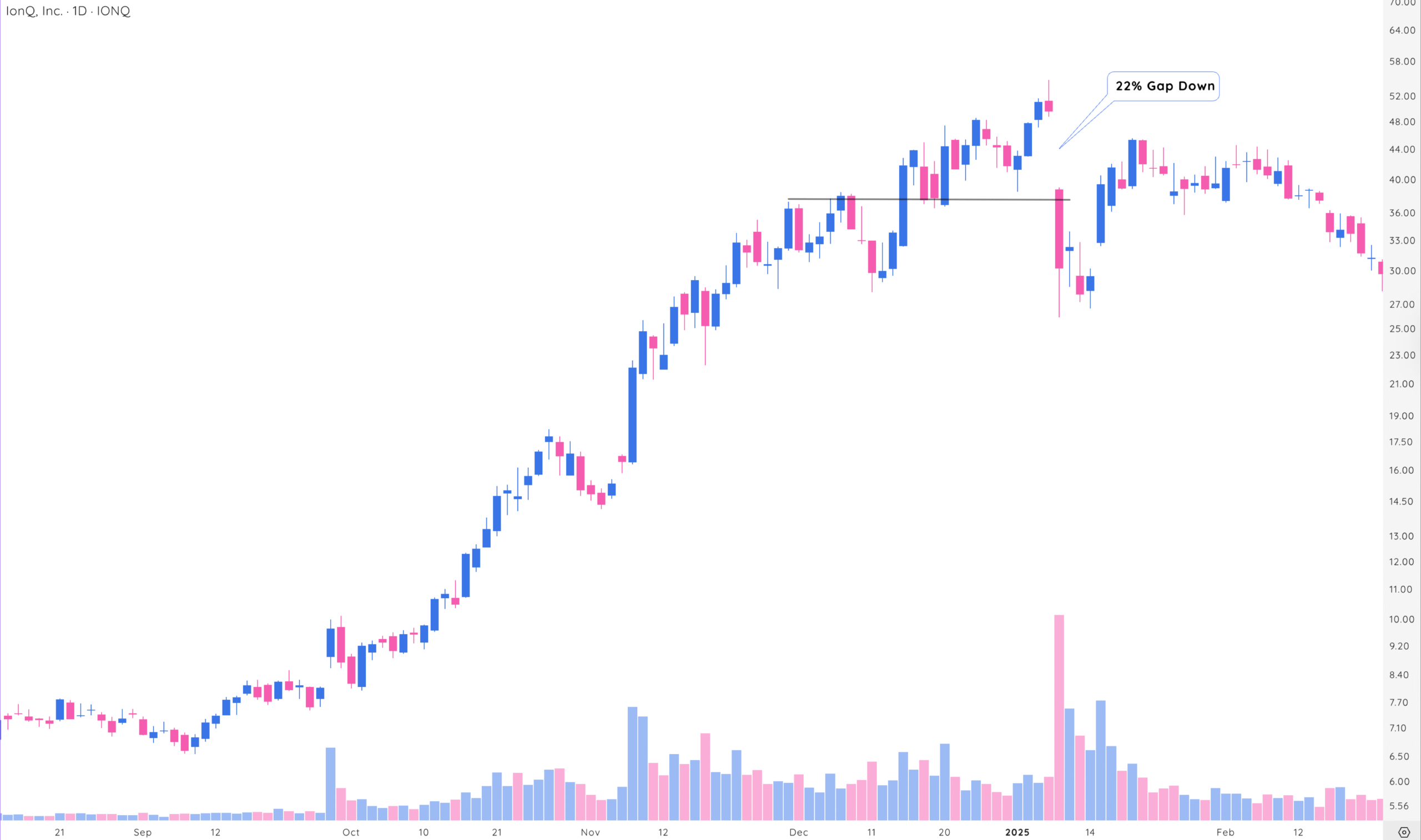

Even though there was no news, IONQ dropped 22% overnight. If you were hesitant because there was no new information, you could have sold part of your position at the open. When support failed, you should sell more. As selling pressure continued throughout the day, you would continue reducing your position.

Why losses are part of the game

If you’ve been trading for any amount of time, you’ve likely faced a big loss or a tough drawdown. And if you haven’t yet, it’s just a matter of time. These moments are emotionally brutal, especially when you’re new and haven’t developed the mental tools to handle them.

But here’s the truth: every successful trader goes through this. Whether it’s from a sudden overnight drop, a concentrated position going south, or a slow grind of small losses adding up over time, it happens to everyone.

Gaps are just another part of the game. Sometimes you will be on the positive side of gaps up, but being able to handle the inevitable gap down will help withstand the pressures of elite stock trading.

The key isn’t to avoid losses altogether. It’s to manage them when they come.

What to do after a gap down loss

One of the first things to do when facing a big loss is cut exposure fast. That means reducing position size dramatically, or even going to cash.

Going to cash might feel like giving up, but it’s the opposite. You’re giving yourself space to think again. That alone can bring clarity, calm your nerves, and stop the emotional decision-making that usually makes things worse.

Once you’ve stepped back, take time to evaluate what actually happened. Ask yourself:

- How much damage did this do to my account?

- How much did it impact my confidence and mindset?

Some losses hit harder mentally than financially, and vice versa. Be honest about where you’re struggling so you know how to move forward.

Once you’ve stepped back, take time to evaluate what actually happened. Ask yourself:

- How much damage did this do to my account?

- How much did it impact my confidence and mindset?

Some losses hit harder mentally than financially, and vice versa. Be honest about where you’re struggling so you know how to move forward.

When you’re ready to come back, do it slowly. Start with small positions – ones that won’t rattle you if they go wrong. The goal here is to make progress.

As you begin to win again, even just a little, your confidence grows. From there, you can slowly increase size and exposure when you’re in the right headspace and seeing consistent success.

Key Points on how to handle a gap down

The real difference between a pro and an amateur isn’t about having better picks or timing. It’s about what they do when things go wrong.

Your financial capital keeps you in the game, but your mental capital, your ability to think clearly, stay confident, and make rational decisions, determines whether you’ll bounce back or spiral.

Gap downs are unpredictable, but your reaction doesn’t have to be. Have a plan before it happens – don’t wait until panic sets in.

Sometimes the best move is to cut everything quickly. Other times, selling in pieces can help ease emotional stress.

Losses happen – focus on managing them, not avoiding them. After a big loss, take time to reset mentally and emotionally.

In trading, your account balance keeps you in the game, but your mental capital decides if you’ll win it.