When To Sell Stocks: 4 Easy Tips On Taking Profits

Published: June 6, 2025

How to master when to sell stocks

You can sell into strength or you can sell into weakness. Either way, knowing when and when to sell stocks is just as important as knowing where to buy.

Most traders love to talk about entry setups – what chart looks good, where the breakout is, or which indicator is flashing green. But here’s the truth: very few focus on the exit, and that’s where a lot of money is made.

Why learning to sell stocks can protect and grow your profits

Buying and holding sounds great in theory. But unless you’re investing long-term and dollar-cost averaging into index funds for retirement, that strategy often falls short for active traders.

Selling is what actually locks in your profits. Without a sale, you haven’t made anything yet.

Once you sell stocks and secure a gain, you can redeploy that capital into stronger setups and new opportunities, allowing you to compound your account over time.

The real challenge? Knowing when to sell stocks:

- Sell too early, and you miss out on bigger gains.

- Sell too late, and you might give back most of your profits.

That classic line, “You can’t go broke taking a profit,” isn’t always helpful. While it’s true that securing gains is smart, it can also lead to choking off your best trades too soon.

You’ve got to let your winners breathe and run, especially if you want to outperform over time.

Once you’ve defined your initial risk and stop loss, it’s time to create a plan for when to exit. Without a clear sell strategy, you’re more likely to make emotional decisions in the heat of the moment.

When you combine a strong entry with a smart exit strategy, you give yourself a much better chance at consistent, long-term success.

Sell stocks based on personal averages

The best traders don’t just wing it. They treat their trading account like a business and have a deep understanding of their personal numbers.

Tracking your trading stats gives you the data you need to make smarter, more confident sell decisions. Instead of reacting to the market or chasing someone else’s strategy, you can build a system based on your own performance.

Here are the key stats you should track:

- Average gain on winners

- Average loss on losers

- Overall win rate

- Average hold time on winning trades

These numbers reveal your performance. And once you understand your numbers, you can sell stocks based on logic, not emotion.

How to use your stats to decide when to sell stocks

Let’s say your average winner brings in a 6% gain.

- Sell part of your position at your average: If you hit 6% on a trade, consider selling a portion. You’ve already reached your baseline – why risk giving it back?

- Sell more at 2x your average: If the trade keeps going and hits 12%, that’s double your average gain. Take more off the table and reward the outperformance.

- Sell the rest on weakness: Keep a small piece and let it run. But once momentum fades or the stock shows signs of breaking down, exit the rest. That way, you’ve locked in strength and managed risk.

Once you know these numbers, selling stocks gets a lot simpler. You’re trading with logic, not emotions.

How to use risk (R) multiples to sell stocks

An R multiple (or risk multiple) helps you measure how much you can make on a trade compared to your initial risk. If your initial risk was $100 and you made $300 on the trade, that’s a 3R profit.

By using R instead of dollar amounts, you shift your mindset away from money and toward process. That makes it easier to stay emotionally grounded, especially when you need to sell stocks during tough market swings.

Let’s break it down with a quick example:

- You buy a stock at $50.

- Your stop loss is $48, so your risk (R) is $2.

- You sell at $60, so your profit is $10.

Therefore: Your R multiple = $10 profit ÷ $2 risk = 5R. In this case, you’re initial risk is 1R and you make 5R.

Using R multiples instead of dollars makes you less emotionally tied to the outcome. Instead of panicking over being down $500, you can calmly say you’re down -0.5R. That’s a big psychological win.

Sell stocks at R multiples: a practical strategy

Once the trade moves in your favor and hits 1R, you might sell a portion of your position to lock in gains. This reduces risk and takes some pressure off the rest of the trade.

After hitting your first profit target, tighten your stop to breakeven or just above. That way, if the trade reverses, you’ve still protected your capital.

As the trade continues to work, take more profits at 2R or 3R. You’ve earned it, and it’s smart to sell stocks to lock in gains.

If the trade looks strong, leave a small piece to ride higher. Use a trailing stop to protect profits but stay in the trade as long as it’s working.

Whether you’re in a trending market or a choppy one, the R multiple framework stays solid. It forces discipline, gives you clear targets, and takes emotion out of the picture.

You don’t need to guess what the market will do next. You just need to manage your risk and let the math work in your favor.

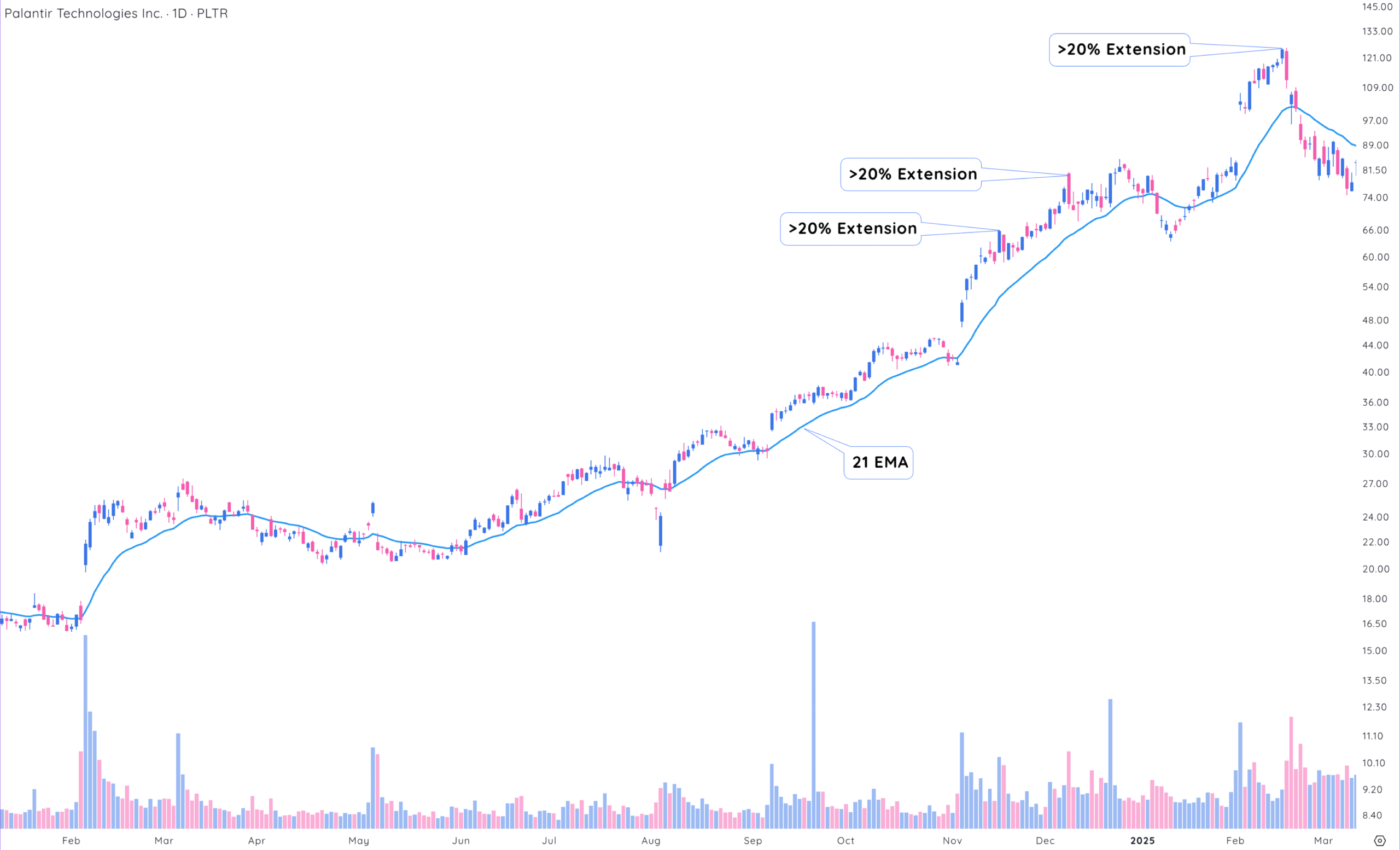

Sell stocks when extended from moving averages

Stocks have a personality. Some move fast and are volatile, others are more controlled and steady. That’s why you’ll often hear the phrase, “Look left to plan right.”

By studying past price behavior, you can spot patterns that tend to repeat. One of the most useful clues? How far a stock extends above its moving averages.

Use moving averages to spot short-term tops

Price moving far above key moving averages isn’t random, and it’s often unsustainable. When stocks stretch well above their moving averages, it’s only a matter of time until they fall back down to retest them during an uptrend.

When a stock starts to run, watch how far it stretches from the average. These extensions often mark short-term exhaustion points.

When the stock eventually pulls back, note how far above the moving average it had climbed. If that same kind of extension shows up again, it might be a good time to take profits.

As part of Oliver Kell’s Cycle of Price Action, Oliver notes that many stocks will see two (and sometimes three) major extensions from key moving averages before needing to rebase completely.

Sell stocks into these price extensions to help lock in profits when the stock is up before the inevitable pullback.

Use defensive selling to limit losses

While offensive selling focuses on locking in gains when a stock is extended, defensive selling is all about protecting your downside when the trend starts to weaken.

By using moving averages (MAs) as guideposts, you can stay in trades when they’re working and exit when the momentum breaks down without panic.

How to sell stocks using moving averages

Moving averages help define a stock’s short, medium, and long-term trend. If the price breaks below those levels, it may be a sign to reduce or exit your position.

Here’s a common approach for traders:

- Sell a portion on a break below the 10MA – If the stock has consistently bounced off the 10-day simple moving average (SMA), a breakdown below it is your first warning. Trim your position to reduce exposure.

- Sell more below the 21MA – This signals a breakdown of the medium-term trend. If the price slices through the 21-day exponential moving average (EMA) and stays below it, consider selling another chunk.

- Sell the rest on a breakdown below the 50SMA – A cut through the 50-day SMA often means the longer-term trend is breaking down. If the stock doesn’t recover quickly, it may be time to fully exit.

💡 Pro Tip: Wait for two consecutive closes below the moving average before selling. This gives the stock a chance to bounce back after a one-day dip and helps you avoid false signals.

Defensive selling:

- Protects your gains if the trend fades

- Keeps you in the game if the price stabilizes

- Helps avoid emotional, all-or-nothing decisions

Instead of trying to guess the top, you’re reacting to real-time price action with a plan. That’s how smart traders stay consistent.

Final thoughts: selling strength allows you to hold

One of the most effective ways to manage a winning trade is by scaling out into strength when the stock is still going up.

Instead of making an all-or-nothing decision, you sell a portion when your trade hits a target, then let the rest ride. This approach helps you lock in profits while keeping upside potential alive.

You’re reducing risk and giving your trade room to breathe. It’s truly the best of both worlds.

Why selling partials gives you the freedom to hold

Trying to sell at the exact top sounds great, but it’s rarely realistic. When you scale out on the way up, you:

- Free yourself to manage the rest of the position more objectively

- Secure profits early

- Take the pressure off your decision-making

Know your numbers. Scaling out based on R multiples and your average gain gives you a clear roadmap that removes guesswork and keeps your trading grounded.

Once you’ve trimmed some gains, you can raise your stop to breakeven on the rest. That eliminates downside risk and turns the remaining shares into a “free trade.”

From there, use moving averages and key price levels to guide your next move. If the trend continues, you stay in. If the stock weakens, you have already locked in strength.