Stop Loss Placement for Tighter Risk Management: Your Key to Trading Success

Published: September 23, 2025

Why is Stop Loss Placement Important?

In the fast-paced world of trading, where markets can shift in an instant, mastering risk management is the difference between thriving and merely surviving.

While many traders focus on finding the perfect entry or chasing big wins, the real edge lies in controlling losses and protecting capital. Stop-loss placement is at the heart of this discipline. It acts as your safety net, helping limit downside and keeping you in the game for the long haul.

In this blog, we’ll explore why risk management is critical, how to set tight and logical stops, and where to place stops for specific trading strategies. We’ll also dive into advanced techniques like adjusting stops as trades progress and using time stops to exit stagnant positions.

Whether you’re just starting out or have years of experience, these strategies will help you trade smarter and stay profitable.

Why Risk Management Matters in Trading

Risk management is the backbone of successful trading because it keeps you in the game. Trading’s not a sprint – it’s a marathon and without a solid risk plan, a single bad trade can wipe out your capital.

By controlling how much you risk on each trade through position sizing and a tight and logical stop loss, you protect yourself from big losses. This lets you stay confident, survive market downturns, and capitalize on new opportunities.

As legendary trader William O’Neil once said, “Buying a stock without knowing when or why you should sell it is like buying a car with no brakes.” Risk management is those brakes. It’s what gives you staying power.

What is a Tight and Logical Stop Loss?

A tight and logical stop is one that limits your loss while respecting the stock’s natural movement.

- Tight means the stop is close to your entry, usually within 1–5% for swing trades, so you don’t lose more than necessary.

- Logical means it’s placed at a meaningful technical level, like below support, a moving average, or a recent low.

Let’s say a stock breaks out from a $50 consolidation. A smart stop might be just below $49—the bottom of that range. That way, if the stock dips under $49, it signals the setup’s failed, and you’re out before things get worse.

Logical stops aren’t random – they’re based on the chart, not emotion.

Where to Place Your Initial Stop Loss When Building a Position

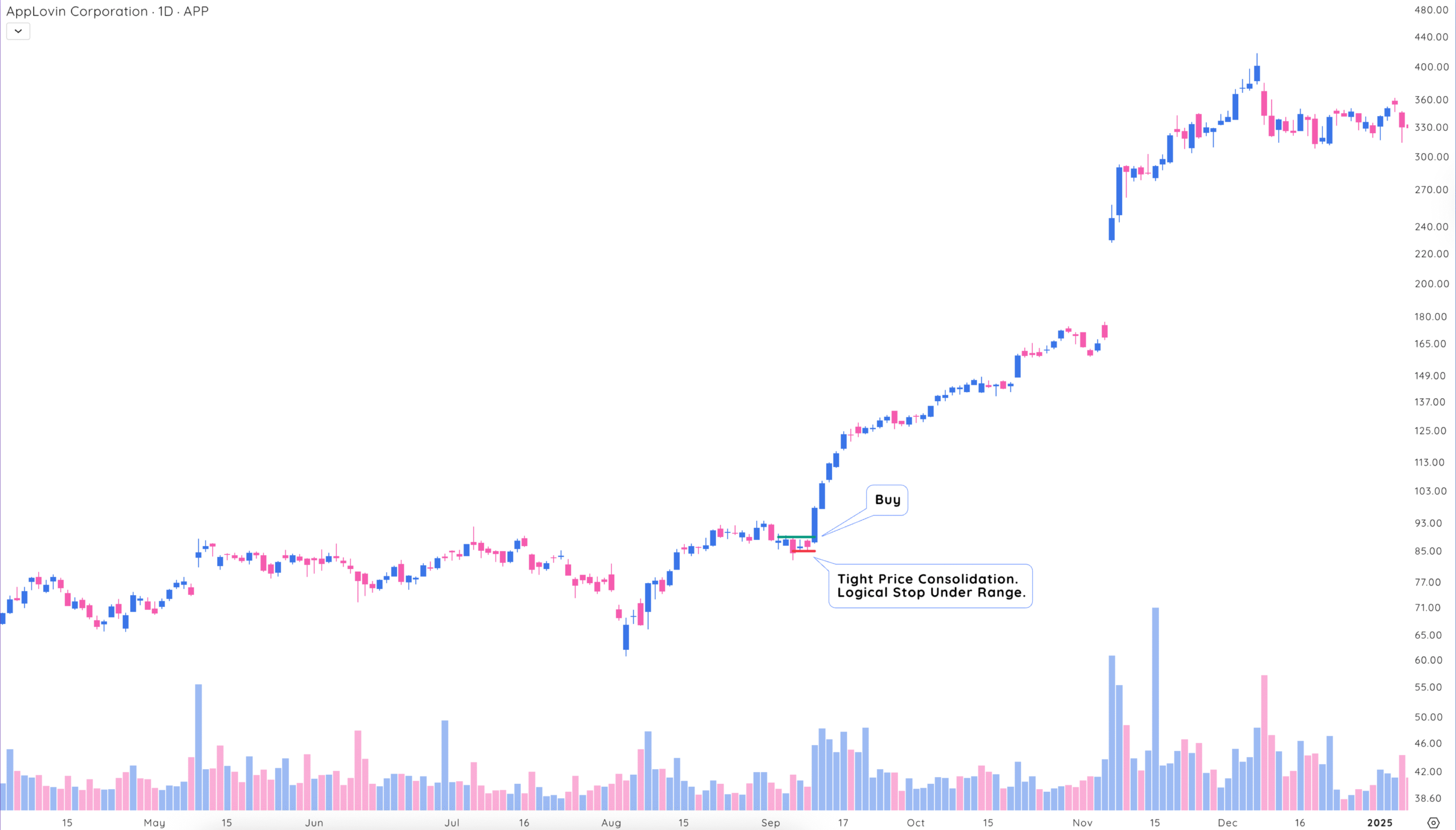

When you’re building a position, your first stop-loss should go under the base or consolidation area – basically, the spot where the stock’s been trading sideways or forming a setup like a cup-with-handle.

If that level breaks, the setup’s no longer valid.

Example: If a stock consolidates between $48 and $50 before breaking out, place your stop just under $48. That protects you if the breakout fails, while giving the trade room to breathe.

Always tie your stop to the chart’s structure – not a fixed percentage.

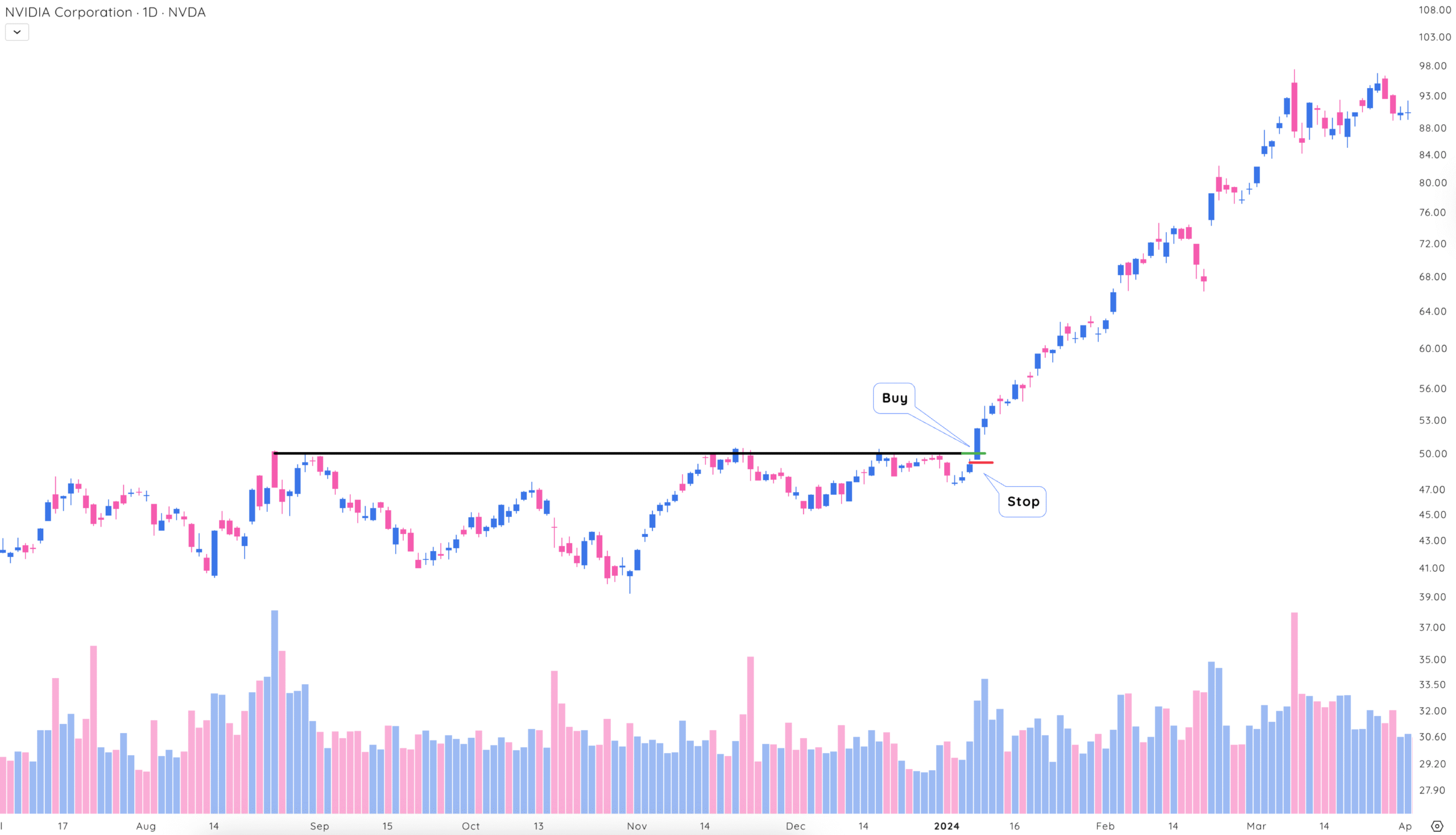

How to Set a Stop Loss When Swing Trading Breakouts

If you’re swing trading a breakout, place your stop loss just below the low of the breakout day.

Why? That day’s low shows where buyers stepped in and proved the breakout. If the stock falls below that point, the breakout likely failed.

Example: If a stock gaps up and breaks out from $50 resistance level and hits a low of $51 on the breakout day, set your stop slightly under $51. This keeps your risk tight and gives you an early exit if the breakout loses momentum.

Breakout failed? You’re out. Breakout continues? You ride the trend.

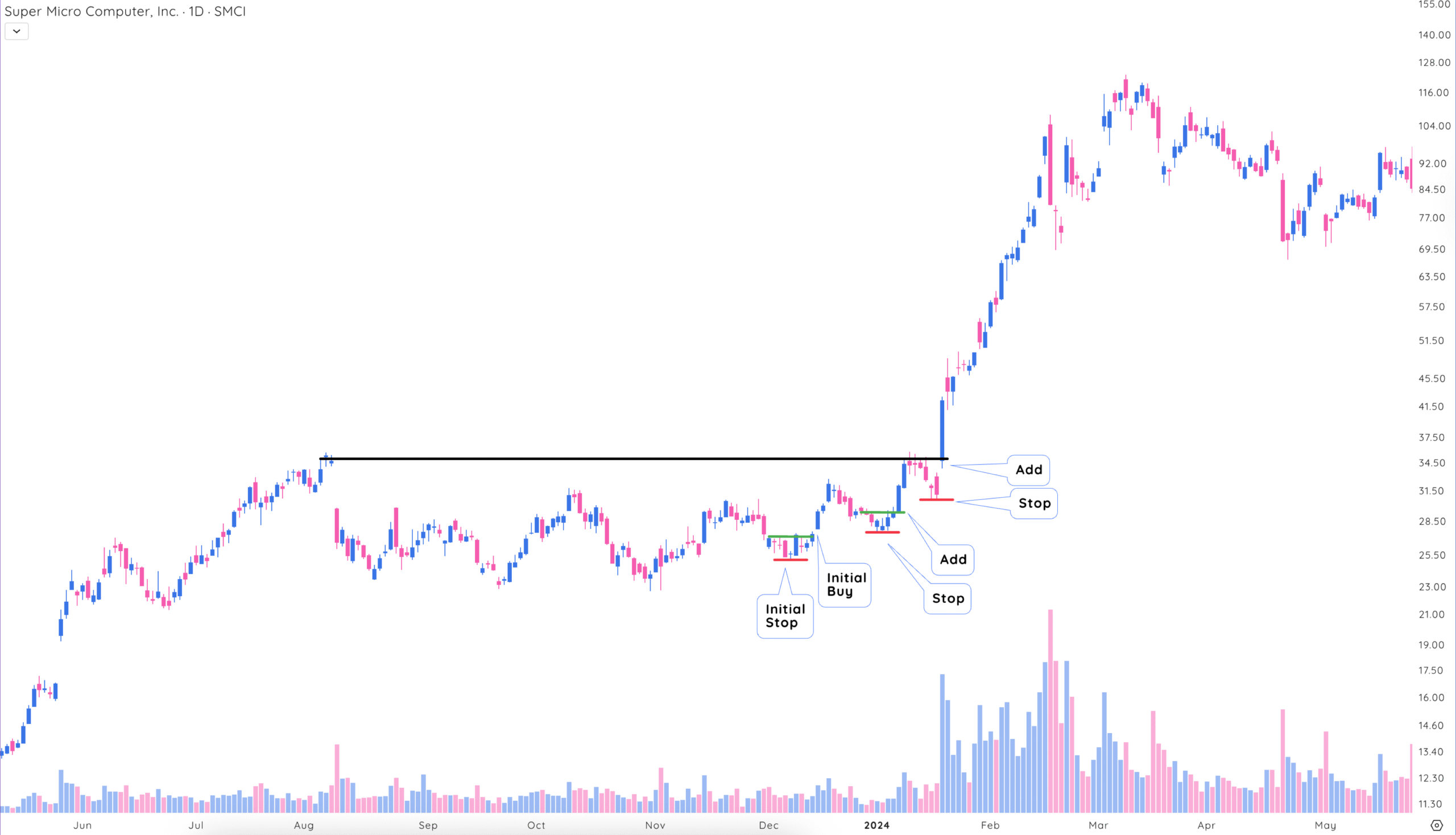

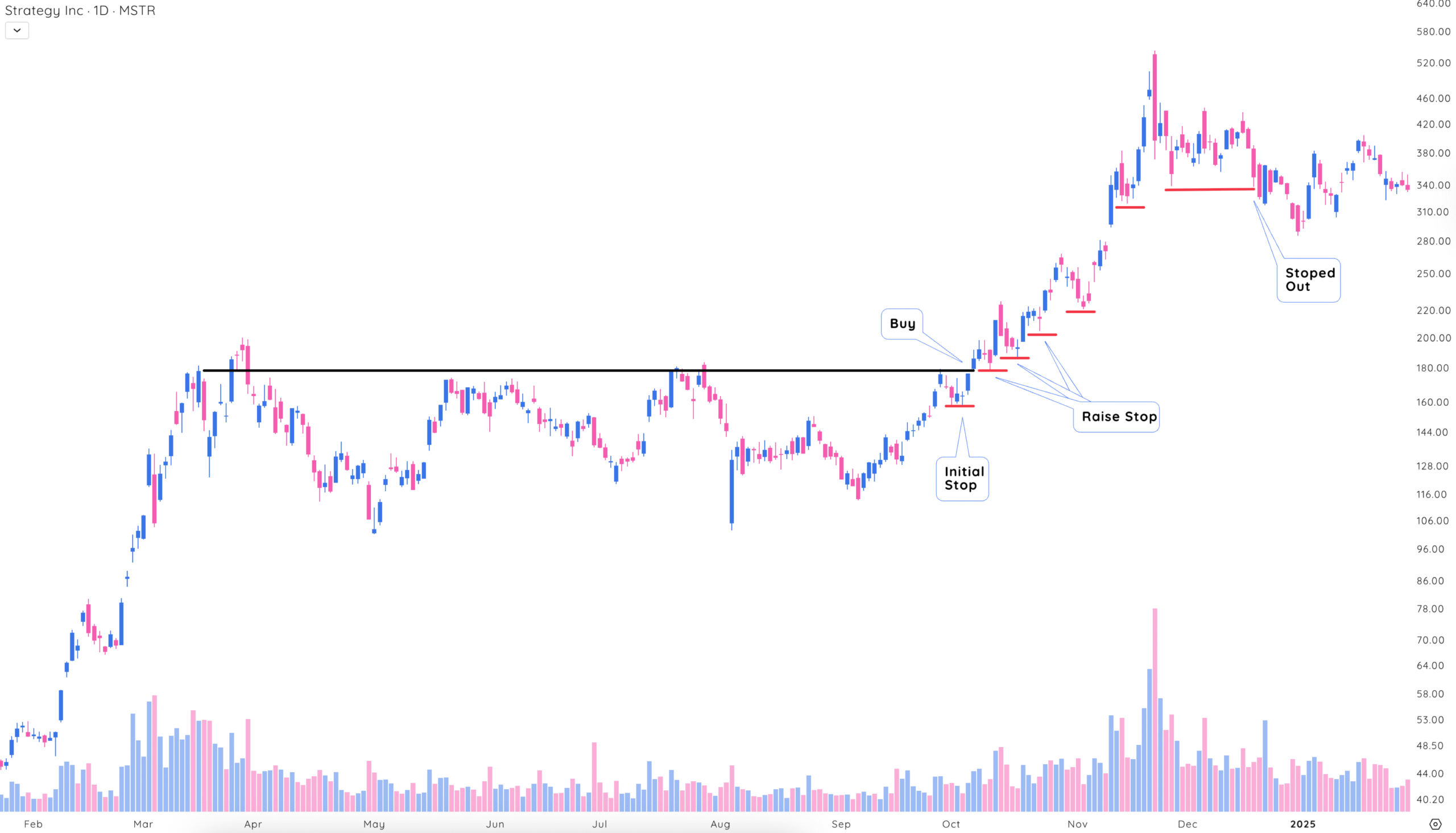

When and How to Adjust Your Stop Loss as Trades Move

Once your trade starts working, don’t just sit back. Adjust your stop-loss to protect profits.

You can:

- Trail your stop using recent swing lows or moving averages like the 10-day or 20-day.

- Move your stop to break-even once you’re up 5–10%, so your worst-case is no loss.

- Raise your stops as the stock makes a series of higher lows.

- Sell part of your position at a reward multiple (like 1.5x your risk), and tighten the stop on the rest.

This way, you reduce your downside while still giving your winners room to run.

How to Use Time Stops to Exit Stagnant Trades

Not every trade takes off, and some just sit there, tying up your capital. That’s where time stops come in.

A time stop is simple: if the stock doesn’t move within a set period, like two weeks, and shows no real momentum, consider exiting.

Let’s say you’re in a swing trade and after 10–14 days, the price hasn’t moved. That might be a sign to cut it and move your money to a better setup.

Time stops help you avoid the “hold and hope” trap, so you stay focused on trades with actual potential.

Final Thoughts on Stop Losses and Risk Management

Effective stop-loss placement and risk management are what separate pros from amateurs in trading.

By:

- Setting tight, logical stops

- Placing them in the right spots based on strategy

- Adjusting as trades move

- Using time stops for dead trades

…you build a system that’s focused not just on making money, but on keeping money too.

This approach keeps your capital safe, your confidence high, and your edge strong. Start applying these strategies now, and you’ll not only protect your downside – you’ll give yourself more chances to win big over time.