Position Sizing Strategies Every Trader Should Know + Free Calculator

Published: July 2, 2025

Why Position Sizing Matters

Position sizing sits at the center of every winning trading plan. It tells you how many shares to buy, how much cash to commit, and exactly what you stand to lose if the trade turns south. Handle it well and your winning setups build equity fast. Ignore it and even the best ideas can sink your account.

Many traders obsess over entries, exits, and news yet treat size as an afterthought. You are different. By the end, you will know how to size each trade with intent, keep losses small, and press harder when a genuine edge appears.

Linking Position Size to Your Edge

A Trading edge is any repeatable pattern that tilts the odds in your favor. Maybe a stock is holding its 21-day moving average while volume expands. Maybe the group is in strong relative strength. The more edges you stack, the higher the probability that price will continue in your direction.

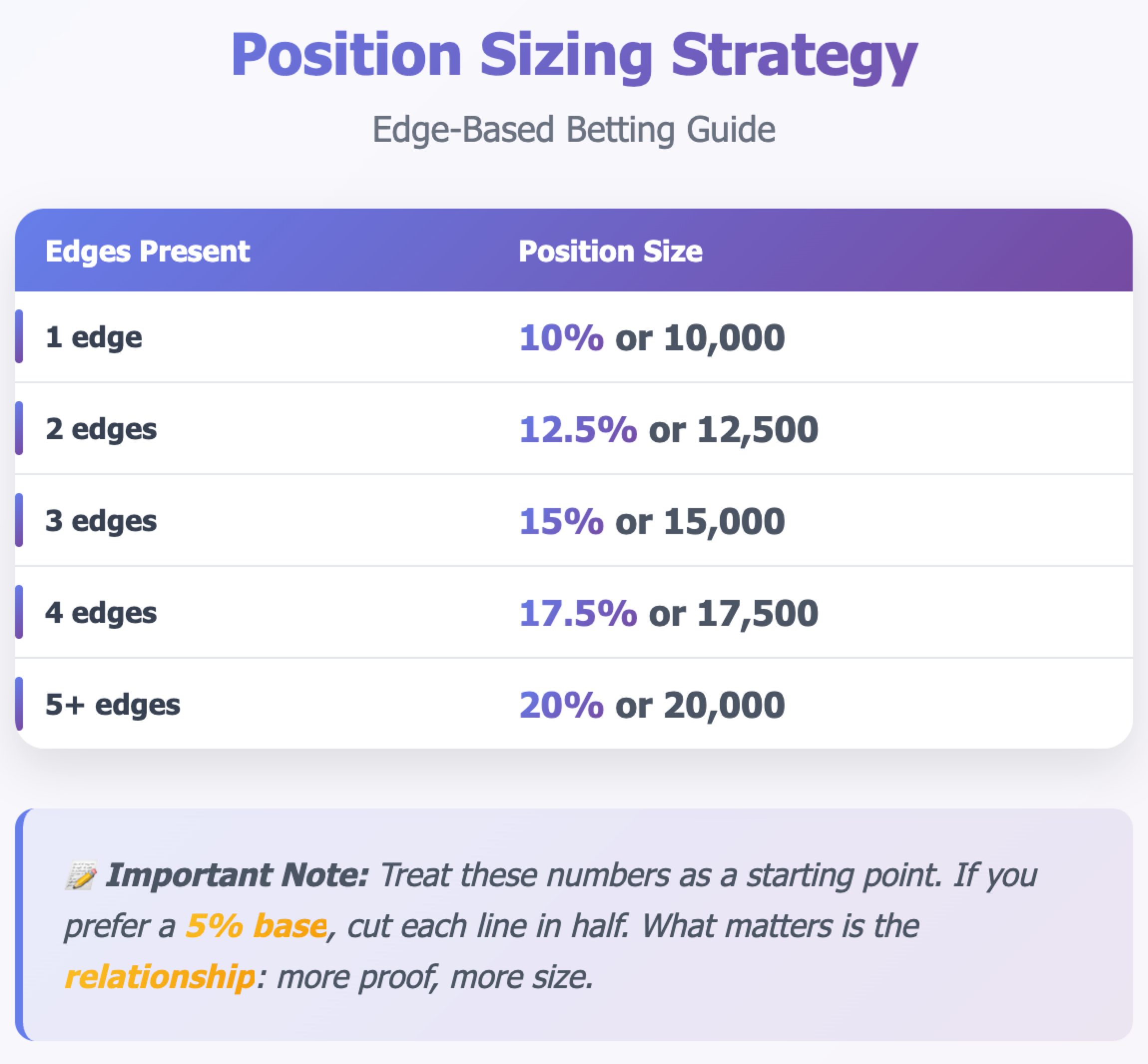

Because probability rises with each edge, your capital commitment should rise too. A simple system can work like this in a $100,000 portfolio:

Never miss a post.

Sign up to get instant notifications when we publish a new post.

Edge-Based Position Size Calculator

Edge‑Driven Position Size Calculator

A Quick Loss Calculator

Loss control is position sizing’s twin. Before you even click buy, decide where your stop sits and how big the total hit could be. Use this shortcut:

- Portfolio loss = Position size × Stop-loss percentage

Examples:

- 3 % stop on a 10 % position → 0.3 % hit to the account

- 3 % stop on a 20 % position → 0.6 % hit

- 3 % stop on a 40 % position → 1.2 % hit

Keep these numbers small and consistent. The goal is to survive strings of losses without emotional damage.

Graduated Sizing for Different Skill Levels

Trading skill grows like strength in a gym. You do not walk in on day one and bench 250 pounds. You start light, master form, then add plates. Position sizing follows the same rule.

Stage 1: Learning the Craft

- Stick to a 10 % starter position.

- Do not use margin.

- Track every trade to spot weaknesses.

Stage 2: Building Consistency

- Base remains 10 %.

- Increase up to 20 % when several edges align.

- Limit the portfolio to eight-ten names to stay focused.

Stage 3: Proven Performer

- Adjust rules to match your style.

- Expand size only after showing you can protect capital through different market cycles.

- Cut size sharply if you feel out of sync.

Even veterans scale in rather than buy their full stake at once. They might add 20 %, then 10 %, then another 20 % as fresh pivots trigger. Entries are staged; risk stays capped.

Step by Step: Choosing Size for One Trade

Use this five-question checklist before every order:

- How much open risk sits in my book and how much can I still add?

- Where is the stop and what percentage loss does it represent?

- How many edges does this setup show and what is my conviction?

- Is the overall market weak, normal, or strongly trending?

- Have my recent trades delivered positive feedback?

Walk-through Example

- Current open risk: 7 %. Personal cap: 10 %. You can add up to 3 %.

- Stop sits 4.1 % below the pivot.

- Position size allowed by risk math: 3 % ÷ 0.041 ≈ 73 % of equity. Your own max, though, is 20 %.

- Market is normal. The stock is a potential leader with several edges.

- Recent trade stats are average.

Decision: Start with a 15 % stake. This fits the 20 % ceiling and keeps total risk under 10 %.

Common Mistakes and How to Avoid Them

- Going too big, too soon

New traders copy experts using 50 % positions. That is like sprinting before you can walk. Earn the right to trade larger. - Sizing without a stop

A stop converts risk from fuzzy to fixed. Without it you are blind. - Ignoring market context

Even the best pattern fails more often in a correction. Cut size when conditions deteriorate. - Refusing to cut back after a slump

When your edge goes cold, shrink. Great traders do this automatically.

Putting It All Together

Position sizing blends math and judgment. The math sets maximum exposure so a single decision never ruins you. Judgment tells you when an edge is strong enough to merit extra size. Combine the two and your equity curve starts to look smooth, not jagged.

Start with a base size that feels safe. Tie increases to edges you can define and track. Use stop-loss math to protect the downside. Review results every month and adjust only after solid data says you are ready.

The market rewards those who play defense first. Master position sizing and you give yourself the freedom to swing hard when the odds finally tilt in your favor.

If you want a fuller treatment of position sizing along with entries, exits, and trade psychology, you’ll find detailed worksheets, annotated charts, and real trade diaries in The Trader’s Handbook. It expands on the principles here and shows exactly how to adapt the numbers to different account sizes, making it a practical reference while you refine your plan.