4 Tips to Keep a Trading Journal That Actually Improves Your Results

Published: October 10, 2025

Why Every Trader Needs a Trading Journal

Every serious trader eventually realizes that tracking performance isn’t optional – it’s essential. A trading journal gives you real, honest feedback.

Without one, you’re basically trading blind, hoping your strategy holds up. With one, you’re tracking your performance, spotting patterns, and sharpening your edge over time.

Think of it like training for a sport. Athletes don’t just play and move on – they watch game footage, study their moves, and figure out what needs to change.

Traders should do the same. Your trading journal is that game footage. It shows you what worked, what didn’t, and most importantly, why.

Never miss a post.

Sign up to get instant notifications when we publish a new post.

Most traders don’t lose because they don’t know enough. They lose because they keep making the same mistakes and don’t even realize it.

A trading journal helps you spot those blind spots early, before they drain your account.

What to Include in a Daily Trading Journal

To get the most out of your trading journal, you need the right balance – enough structure to track useful data, but simple enough to stick with it every day.

Too much detail can overwhelm you. Too little, and you’re left guessing why trades worked or failed.

Here’s what your daily journal should include (and why it matters):

1. Trade Details: Symbol, Date, Shares, and Price

Start with the core numbers that describe each trade:

- Stock symbol: The ticker (e.g., AAPL, NVDA)

- Date and time: When you entered the trade

- Entry price: Your buy price (or short entry)

- Number of shares: Position size matters

- Stop-loss price: Where you planned to exit if wrong

These basics are the foundation for all your analytics later on. With them, you can track metrics like:

- Win/loss percentage

- Average risk vs. reward

- Total profit or loss per trade

- Position sizing efficiency

Over time, these numbers reveal how consistent and disciplined your strategy really is.

2. The Setup: What’s the Trading Edge?

Every trade needs a reason. You shouldn’t enter just because a stock looks “interesting.” Write down what made you pull the trigger.

Ask yourself: What was the setup, and why did it qualify?

Here’s what to include:

- Setup name: Is it a breakout, gap-up, pullback, reversal, etc.?

- Key qualifiers: High volume, pattern structure, Wede Pop, etc.

- Multiple confirmations: Did multiple signals align? (This is called stacking your edges.)

By logging this consistently, you’ll discover which setups truly work for you. Maybe your breakout trades excel in trending markets, but fail during choppy phases. Or maybe you crush gap-up plays only on large-cap tech stocks.

Over time, you’ll learn which setups produce the best results in different market conditions. That kind of insight can completely change your strategy for the better.

3. Market Conditions: Always Track the Bigger Picture

Even the best setups can fail if the broader market is against you. So, always document what the market was doing when you took a trade:

- Was the overall market trending up, down, or sideways?

- What was the stock compared to the market doing (relative strength)?

- Was breadth strong (more stocks advancing than declining)?

- Any news catalysts? (Fed meeting, CPI data, earnings season, etc.)

Context is everything. It helps you understand if your setup failed because of your execution or because the environment wasn’t favorable.

Tracking how your trades perform in different market phases lets you adjust your risk exposure accordingly. You’ll know when to push harder and when to sit tight.

4. Emotions and Execution: How Did You Feel?

This part is often ignored, but it’s where the biggest breakthroughs happen.

Every trade has two sides: the technical setup and the emotional experience.

Ask yourself:

- How confident were you (on a scale from 1 to 10)?

- Did you follow your trading rules?

- Did you hesitate, get scared, or overtrade?

- Were you acting from a clear plan, or reacting emotionally?

Here’s a real-life contrast:

“I followed my plan and entered on confirmation. Felt calm and focused.”

vs.

“I was frustrated from a previous loss and jumped in early, hoping to make it back.”

When you log your emotions, you’ll start to notice patterns like overtrading after losses, or hesitating on valid setups when you’re afraid. These patterns are often the real reason for inconsistent results.

Fixing your mindset and execution can dramatically improve your trading, even if your strategy stays the same.

How to Turn Your Trading Data Into Real Insights

Collecting data isn’t enough. The real power of a trading journal comes from reviewing it regularly.

Set aside time at the end of each week or month to look back and ask:

- Which setups had the highest win rate? Are there strategies that consistently outperform?

- Are your average gains larger than your average losses? If not, your risk management may need work.

- Are you cutting losers quickly or letting them drag down your account?

- Do certain market conditions hurt or help your performance? For example, do you struggle in sideways markets but do well in strong uptrends?

This kind of reflection turns raw trade data into actionable improvements.

To get the full picture, keep an eye on these core stats:

- Win rate: What percentage of your trades are profitable?

- Average gain vs. average loss: Are your winners making up for your losers?

- Risk/reward ratio: Are you taking trades with enough upside to justify the risk?

- Equity curve: This charts your account growth over time. Is it steadily rising or bouncing all over the place?

- Time in trade: Are you exiting too early? Or holding too long and giving back profits?

- Best and worst trades: Identify what made your best trades work and what went wrong on the worst.

Once you start tracking these, you’ll stop guessing and start knowing what needs to change.

You can chart your equity curve to visualize your progress or build histograms to spot patterns in trade duration or size. Group trades by setup and compare their performance side by side.

How to Make Journaling Fast and Effortless

You don’t need a fancy system – just a consistent one. The key is to reflect, adjust, and keep moving forward with clarity.

If journaling feels like a chore, you won’t stick with it. The key to building a sustainable habit is to keep the process simple, quick, and repeatable.

You don’t need a fancy app to start journaling. But using the right tools can make it a whole lot easier.

Here are a few tools to streamline your workflow:

- Google Sheets + Google Forms: Create a simple form you can access from your phone or computer. Just enter a few fields after each completed trade. You can customize it to track key metrics like entry/exit price, setup type, and emotions.

- Notion or Evernote: Great if you like a more visual trading journal. These platforms let you combine notes, charts, screenshots, and even voice memos in one place. Perfect for traders who want to break down their setups visually.

- Broker integrations: Some platforms automatically import your trades from your brokerage account. You can then add notes and tags without manual data entry.

Focus only on what matters – you don’t need to log every tick or over-analyze every trade. That’s how journaling turns into a burden.

Instead, focus on the core elements that give you actionable feedback:

- Trade setup

- Entry and exit

- Market context

- Execution quality

- Emotional state

That’s it. Just the essentials.

💡 Pro Tip: Set a 5-minute journaling timer after each trade. That’s usually enough to jot down the essentials and keep the habit alive.

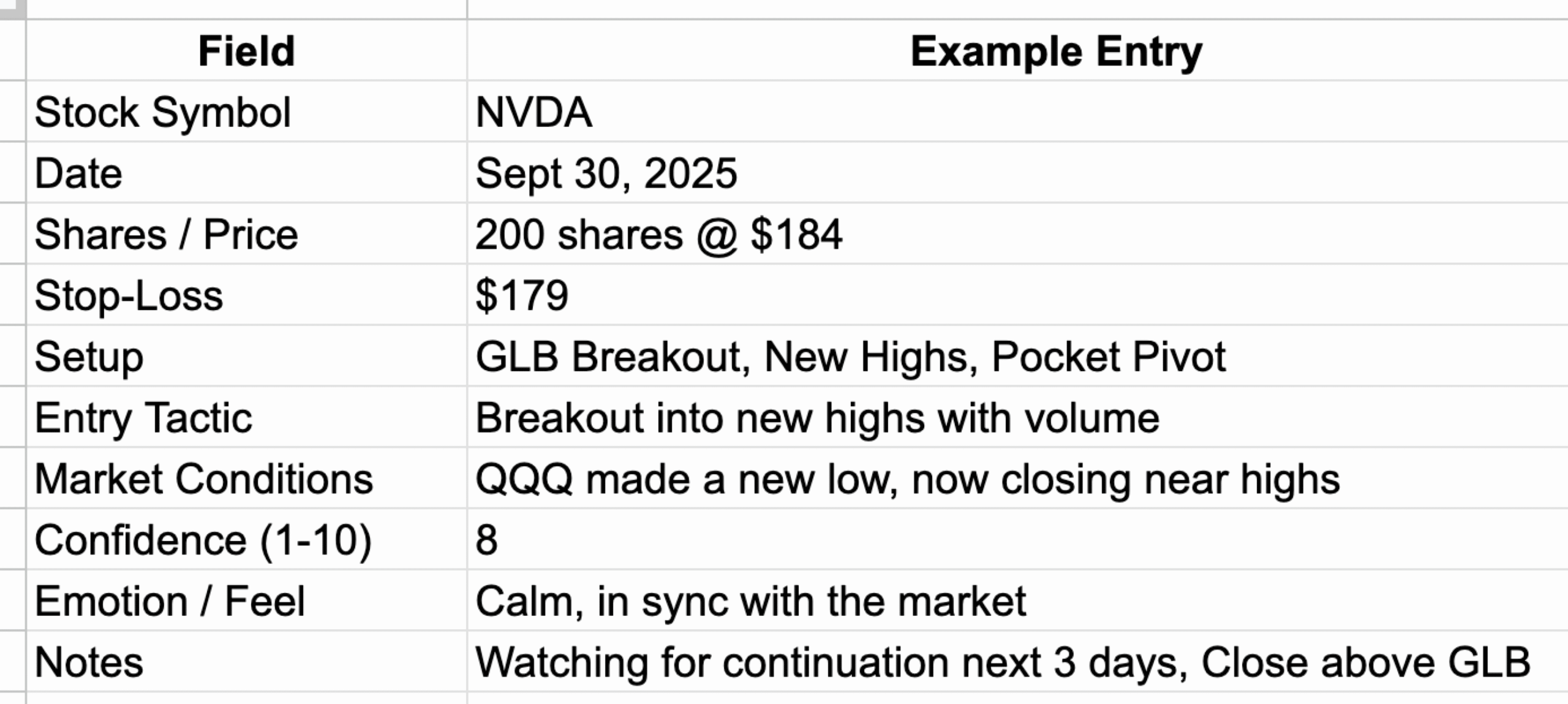

Example Trading Journal Entry (Template)

Here’s a simple, real-world example you can model:

You can customize this to fit your style. Add screenshots, draw trendlines, or use color coding – whatever helps you better analyze and retain lessons.

Why Journaling is the Secret to Long-Term Trading Success

At the end of the day, trading success isn’t about making one great trade. It’s about consistently learning, adapting, and improving. That’s what a trading journal enables.

Without it, you’re reacting. With it, you’re engineering your edge.

A trading journal gives you:

- Clear feedback on your strategy

- Insight into your behavior and habits

- Data to help you make smarter adjustments

- Confidence from knowing what works (and why)

This is what separates amateurs from pros. Amateurs hope while pros track and tweak.

You don’t need fancy tools. You just need to start.

Keep it simple: One trade at a time – One lesson at a time

The more you track, the more you’ll learn and the faster you’ll improve.

Your trading journal isn’t just a log. It’s your roadmap to becoming a consistently profitable trader.