The Oops Reversal Entry Setup/Tactic – Trader’s Handbook Educational Article

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

Published: April 5, 2025

The Oops Reversal

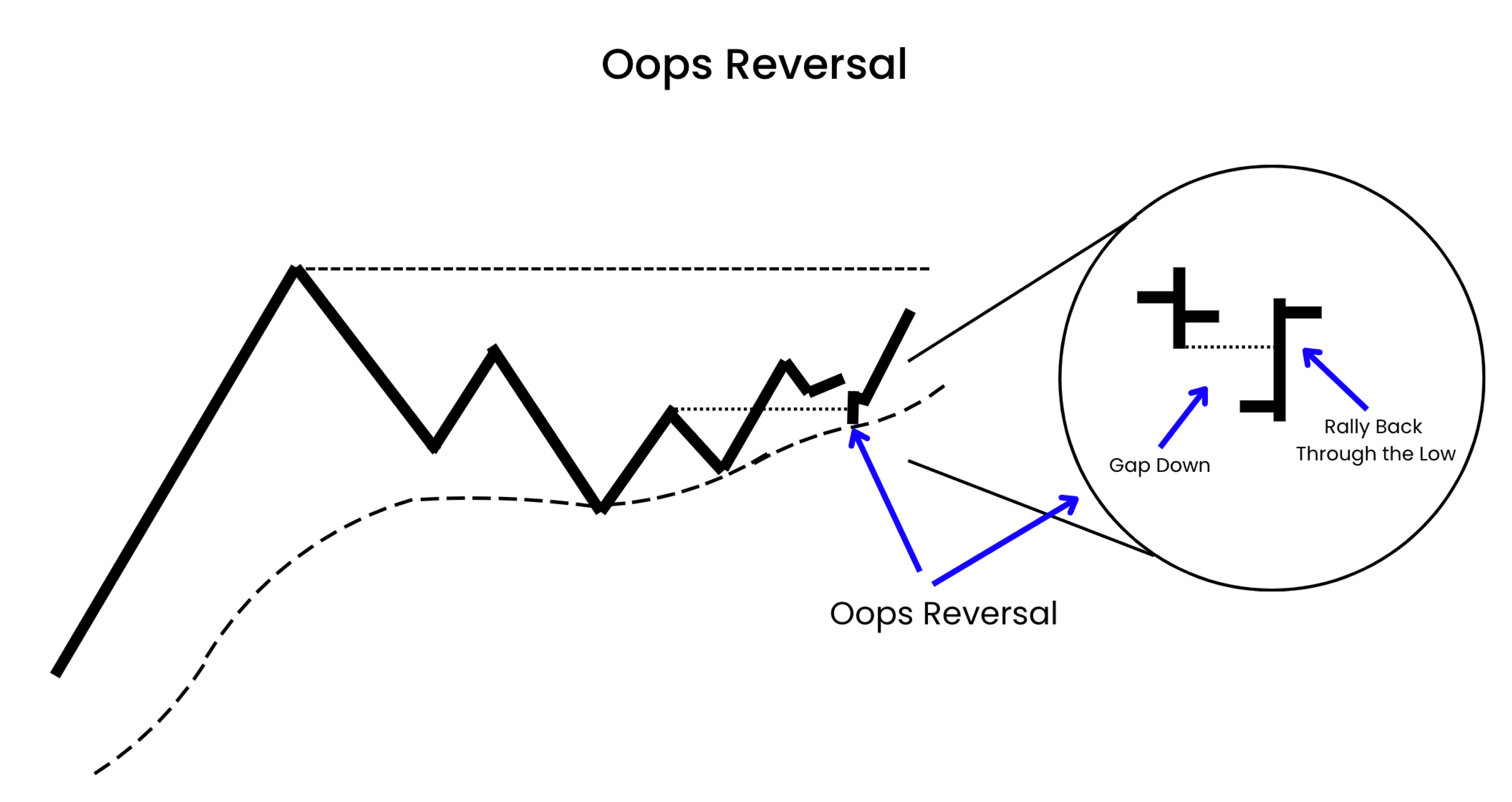

The Oops Reversal is a short term pattern and pullback setup that occurs when a stock/ market gaps lower than the prior day’s low and then rallies back through that level.

It is a sign of support of the stock and a potential low risk entry point that can give you a cushion right away in a strong stock.

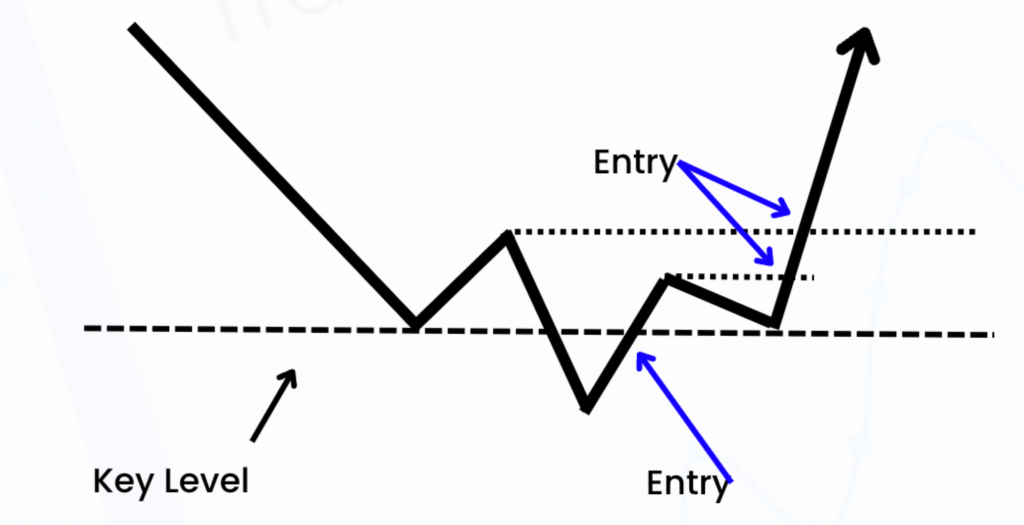

Here is a representation of an oops reversal up the right side of a base:

The Oops Reversal was developed by Market Wizard Larry Williams. You can watch him explain it in our interview here:

The Oops Reversal is a sign of short term momentum change and can lead to follow through buying and a resumption of the intermediate term trend.

The psychology around the setup is that the stock is gapping down below the prior day’s low and session, triggering fear and the stops of weak holders. Then institutions or longer term holders use that liquidity to purchase shares, absorbing the supply with new demand. This stabilizes the stock and causes the short term trend change.

Seeing this trend change, traders who were stopped out may buy back in (the Oops) and intraday trend-followers will join in. At the same time any short sellers who entered on the gap down would likely be stopped out and forced to cover, as their stops were likely set at the prior day’s low.

This confluence of market participants creates an opportunity for a large directional move back upward, at a point where risk can be managed tightly and logically with a stop at the low of the day

Here is a real life example with TEM:

Oops Reversals – The Larger Context Matters

Like all short term patterns, the larger context in which they occur is incredibly important.

First of all the cause of the gap down is important to take into account. I prefer when it is market specific not stock specific and the whole market is experiencing weakness. This is likely when institutions would look to add to their highest conviction names. Stock specific gap downs can potentially be considered based on the catalyst, but must be considered on a case by case basis.

Oops reversals are best used for entries in a strong stock either up the right side of a base or shortly after the breakout.

This is because during these periods institutions are likely still building their positions more aggressively, leading to a greater likelihood of the Oops reversal closing well and following through in successive days.

It’s also important to consider how extended the stock is when it is putting in an Oops reversals. I have found that the best ones occur when the stock’s gap down comes close to a key level like a base pivot, 10ema, 21ema, or prior resistance. I also like when the oops occurs when the stock is forming a short pullback/higher low range.

An Oops reversal in an extended stock shows demand and could be good for a day trade, but may not be the best time to start a swing or position trade. This is because institutions are likely to be less aggressive in bidding it up and follow through may be limited.

Here is an example with RDDT recently. It had a few oops reversals signified with a blue triangle using the Deepvue Technical Patterns Indicator. You can also screen for Oops reversals as a data point.

Notice how the very first oops reversal in the base did not follow through but was the first of multiple reversal action days that put in the last higher low of the base. This low of that oops reversal ended up being undercut but it was still a sign of a bid.

The second oops reversal worked and occurred at the 21ema and the 3rd worked off the 10ema.

In the second one we also saw the entire recent range being undercut, adding fuel to the fire as more traders would have gotten stopped out on the gap and more shorts would have tried to enter close to the open as shorts. However the institutions jumped in strongly right at the open as we can see as the open is very close to being the low of the day.

Trade Execution for Oops Reversals

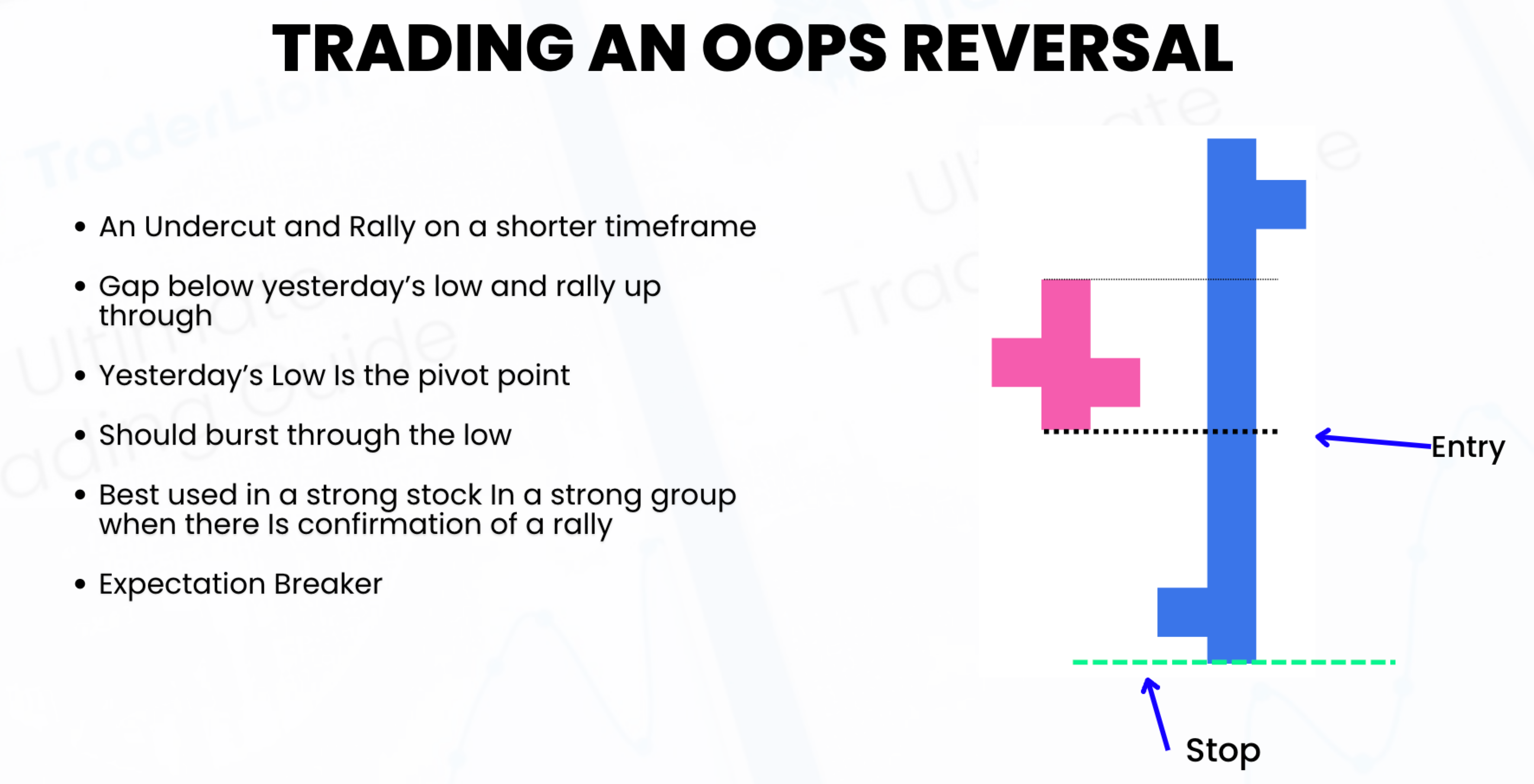

The textbook entry point for the Oops Reversal is as it pushes through the prior day’s low.

On an intraday chart ideally it triggers that pivot and shows sustained demand, trending throughout the day above the AVWAP and closing well into or above the prior day’s range.

As the stock approaches the prior day’s low this is a point of potential volatility. The strongest ones will push through with little resistance while weak ones that may end up failing will stutter at this level and reverse down.

The prior day’s low also may end up transitioning to support later on for intraday bases. You can view it almost like the base breakout pivot from a daily timeframe.

To execute an oops reversal on a gap down I like to set alerts just below the low of the prior day so if we do rally I will be notified on my key names that they are approaching an oops reversal. For a leader/focus list name if it is a potential oops I will have my order ready to go when this early alert triggers.

Before I enter I will check that my risk on the position is ideally less than 3% to the low of the day. Intraday if the oops reversal is working I will adjust my stop up to below the oops reversal pivot when it pushes about 3% above it.

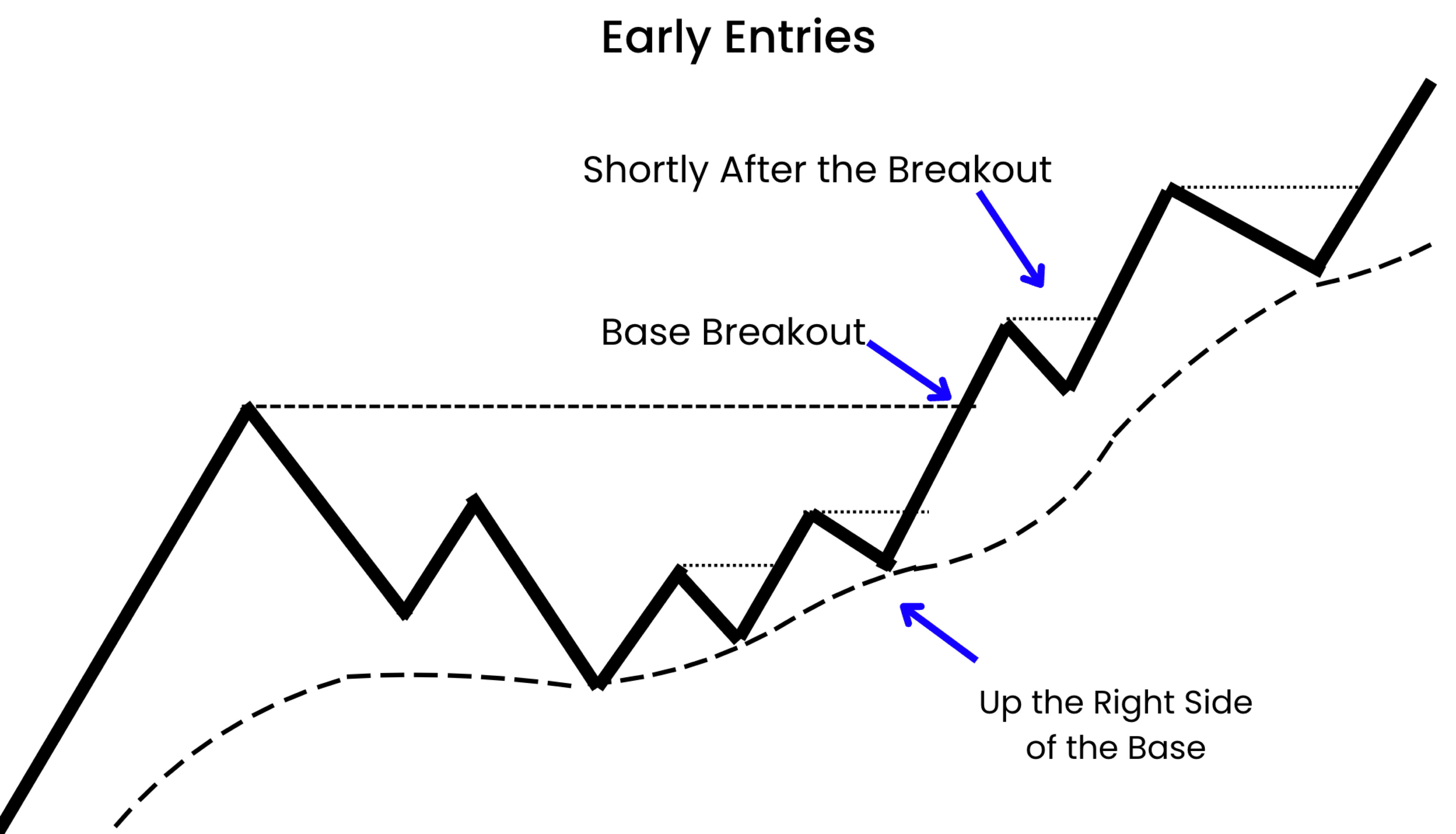

Entering before the Oops Reversal

On a significantly large gap down, the oops reversal may occur 4% or more from the opening price.

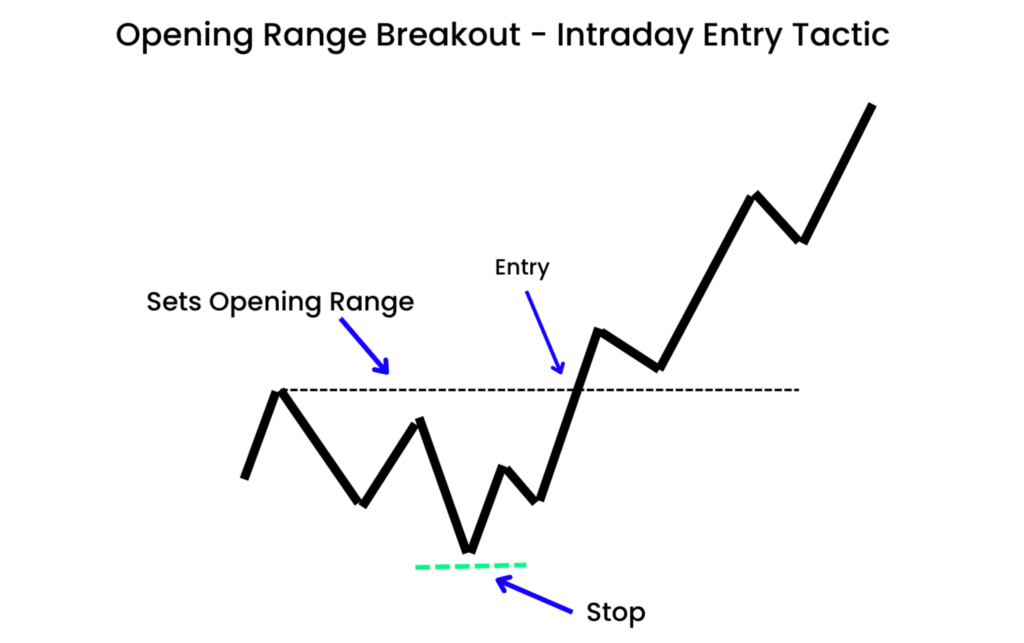

If the larger context is right and the gap down open is close to a daily key moving like the 21ema, 10ema, or prior base pivot, I may look to enter early using an opening range breakout or key level reclaim.

If the stock is weak first thing off the open and undercuts the key level, I may look to enter as it reclaims it. This is best used when the whole market looks to be turning back up.

If the stock is strong off the open I may look to enter as it sets up an opening range breakout below the traditional oops reversal pivot.

Acting early often allows you to manage risk tighter, but with it comes the added risk that the stock will reconfirm down after a fakeout move higher, stopping you out.

With the opening range breakout or daily key level reclaim, I keep my stops even tighter usually less than 2% position risk. This on a 15% equity position would yield only a 0.3% loss on the portfolio.

Routines and Systems to catch Oops Reversals

Oops reversals can be excellent entry points when the general market gaps down on news such as CPI or something that happened the night before.

However, to trade a potential oops reversal you need to be active in the morning close to the open and make quick decisions on which to choose.

This requires planning in pre-market about which stocks to focus on and setting early alerts so you are notified when a chosen stock gets close to one.

In pre market I set the alerts for potential oops reversals about 0.5% below the prior day’s low.

Then I also set an alert about 0.5% above where the stock is set to open. I only set these alerts on stocks that I view have the potential to make at least a multi-day move after a successful oops reversal meaning that they are setup on a daily and weekly timeframe up the right side of a base or shortly in their trends after a breakout from one.

Other traders may decide to simply focus on the fastest moving stocks, those can work very well for a day trade

These early alerts ensure I’m aware of a stock on my daily focus list starting to push from the open, or approaching the oops reversal pivot. This gives me enough time to analyze the situation properly and get my order ready.

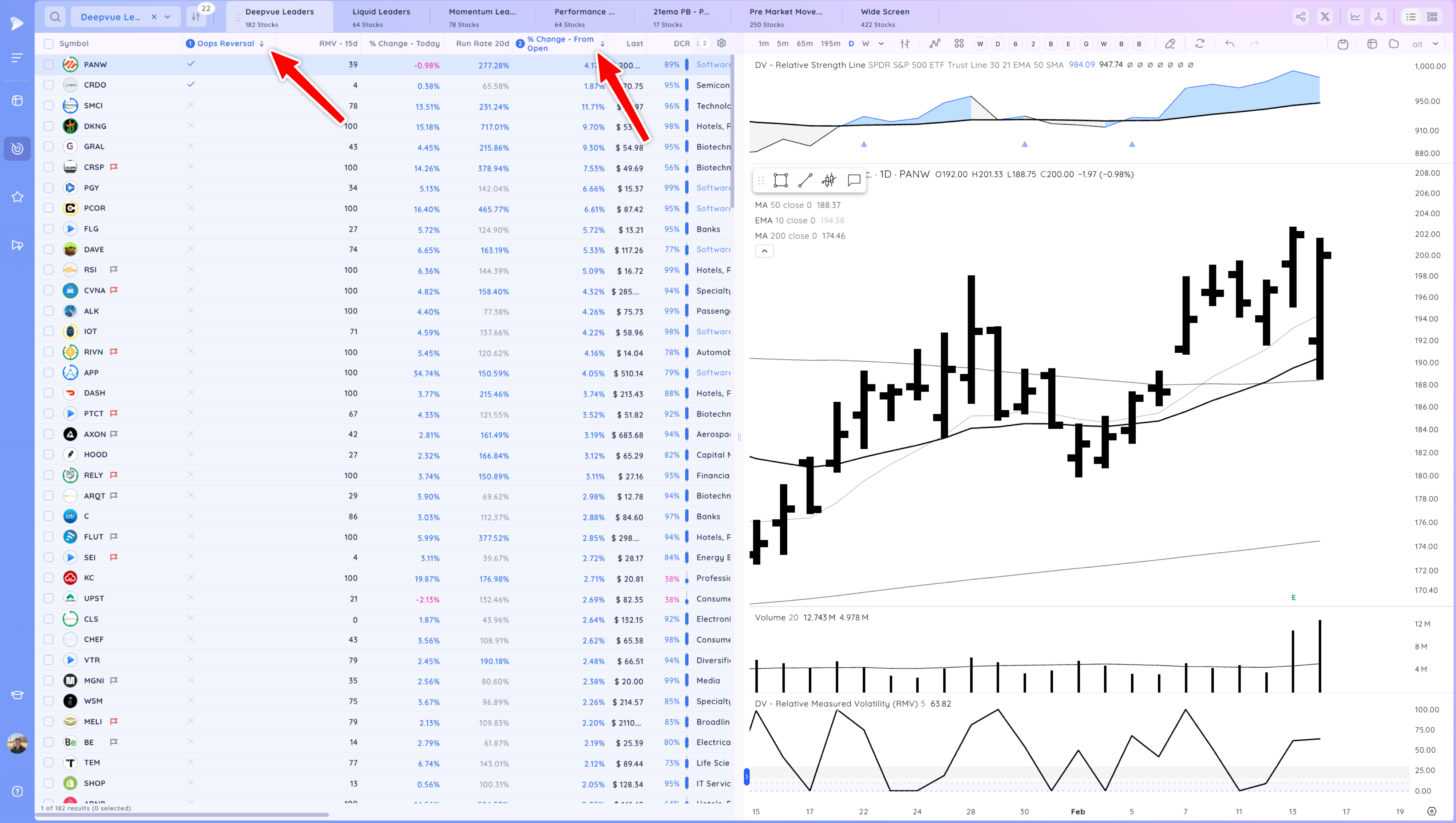

In the morning on gap downs I also like to sort my watchlists by % change from the open. This helps me identify which stocks are pushing fastest after potentially putting in the day’s low. I use Deepvue to track this metric. You can also scan for oops reversals or sort by that data point as a column to see them in real time during the day

Why Follow Through is Key

After entering an oops reversal, there is one essential ingredient to turn it into a successful trade: follow through

Follow means that the stock pushes strongly up from the oops reversal pivot on day 1 and closes with enough cushion, say at least 1 risk multiple ~3% from my entry. This gives me the ability to hold the stock overnight.

It also means that the next day the stock continues the short term momentum and follows through higher. This gives me the cushion needed to hold for a swing/start of a position trade

The best oops reversals turn into significant higher swing lows and start a momentum move upwards. Often they get you in before a range/base breakout that then provides excellent cushion.

Follow through on day 1 and thereafter is a sign of an institutional bid and that the stock is riding a nice wave of additional buying. Ideally I want to see it close near highs for the day and close to the prior day’s high as well. The best oops reversals turn into positive outside days.

Key Points about Oops Reversals

- Oops Reversals are an entry tactic to be used in the context of a strong stock and strong overall pattern that could lead to a multi day/week move if the oops reversal is successful

- Why the stock is gapping down is important, ideally it is market dependent news.

- The best ones tend to occur when the open is near the 10ema or 21ema or other significant area.

- The pivot is the prior day’s low, on large market gap downs there is the potential to anticipate the oops reversal and manage risk with an opening range breakout or key daily level reclaim

- Follow through is key, ideally the stock closes strong and continues the next few days

Homework Assignment

Study the runs of a few recent market leaders and label oops reversals on the chart. See if the started any good swing trade opportunities. Note ones that gapped down near the KMAs and what the % risk to the low of the day would be.