Modern CANSLIM Strategy: How to Trade Growth Stocks in Today’s Volatile Market

Ross

Ross is a co-founder of TraderLion and Deepvue. He was mentored by William O’Neil, and co-authored The Model Book of Greatest Stock Market Winners at WON + Co.

Published: September 17, 2025

After two decades of implementing William O’Neil’s CANSLIM methodology—from managing institutional money to running a hedge fund that grew from $15 million to $850 million—Ross Haber shares how he’s adapted this time-tested growth strategy for today’s volatile markets. His approach combines the foundational principles that still work with modern risk management techniques that address the unique challenges facing growth traders today.

Ross Haber’s journey began in 1998 when he joined William O’Neil’s institutional sales team, eventually becoming a portfolio manager and traveling the country teaching workshops alongside the legendary investor. His track record speaks volumes—helping grow a fund from $15 million to $850 million in just over two years during the late 1990s boom.

Today, as co-founder of TraderLion, Ross continues to apply CANSLIM principles but with crucial modifications that address modern market realities. This isn’t about abandoning what works—it’s about evolving with the times while maintaining the core DNA of successful growth investing.

Never miss a new post from Ross Haber!

Stay in the loop by subscribing to the email list.

CANSLIM Foundations That Still Work

The Unchanging Elements

According to Ross, certain aspects of CANSLIM work as well today as they did in 1890. Relative strength, new highs ahead of price action, and understanding true market leadership remain cornerstones of successful growth trading.

The CANSLIM Breakdown

C – Current Quarterly Earnings: Ross requires triple-digit year-over-year quarterly growth, preferably accelerating. The minimum 25% growth from O’Neil’s book is just the starting point.

A – Annual Earnings: Three years of strong annual earnings growth, typically 20% or higher. Remember, O’Neil emphasized this is 70% fundamentals, 30% technicals.

N – New Product/Service/Management: Something that changes “the way we work, live, play, or communicate.” This could be Apple’s iPhone evolution or a biotech breakthrough like Regeneron’s eye treatment.

S – Supply and Demand: While traditionally focused on shares outstanding, Ross notes this matters less in today’s market where even large-cap stocks can move like smaller ones.

L – Leader or Laggard: Always focus on the strongest stocks in the strongest groups. This requires both quantitative analysis and qualitative judgment about sector rotation.

I – Institutional Sponsorship: High-quality institutions must be accumulating shares. This is where 70%+ of market volume comes from.

M – Market Direction: As O’Neil said, “Getting the market direction right is at least half the ballgame.” Three out of four stocks follow the general market trend.

What’s Changed Since the 1990s

The late 1990s were a different era for growth trading. Distribution day counting worked “like a magical genie,” and buying breakouts with simple stop-losses was highly effective. Today’s market requires more nuanced approaches.

The New Market Structure

The old market makers—Goldman Sachs, Merrill Lynch, Morgan Stanley—have been replaced by algorithmic trading and high-frequency systems. Instead of humans on phones, we now have computers operating at nanosecond speed with the same basic rules but different execution.

What No Longer Works

- Simple breakout buying with immediate success

- Traditional distribution day counting as a short-term sell signal

- Progressive scaling into positions (buying breakouts, then adding 2.5% higher)

- Single sentiment indicator timing (VIX, put/call ratio alone)

What Still Works

- Relative strength analysis and new highs ahead of price

- Fibonacci levels (even built into algorithmic programs)

- Leadership rotation analysis

- Volume and price interpretation

- Follow-through day methodology for market timing

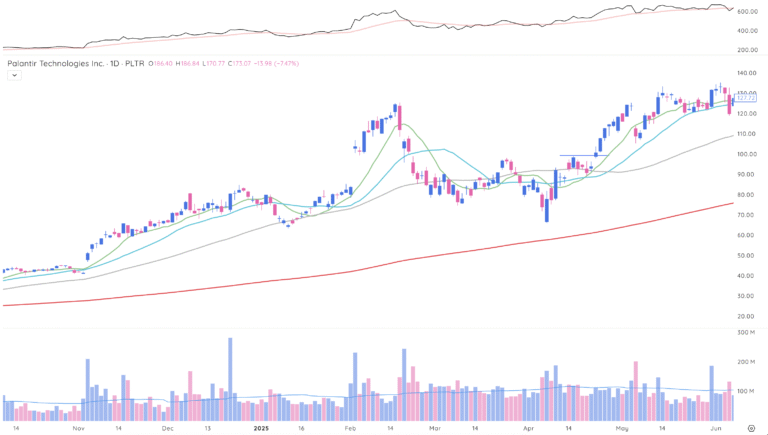

Modern Reality: Today’s market is significantly more volatile. Ross notes that being 130% long now feels like being 200% long in the 1990s, requiring more conservative position sizing and risk management.

Modern Risk Management Techniques

The biggest evolution in Ross’s approach centers on risk management. While the stock selection criteria remain largely intact, how he manages positions has changed dramatically to account for increased volatility.

The 7-8% Rule Still Applies

The mathematical reason for the 7-8% maximum loss remains valid: once you lose more than 10%, the recovery becomes significantly harder. Lose 50% and you need a 100% gain just to break even.

Modern Position Management

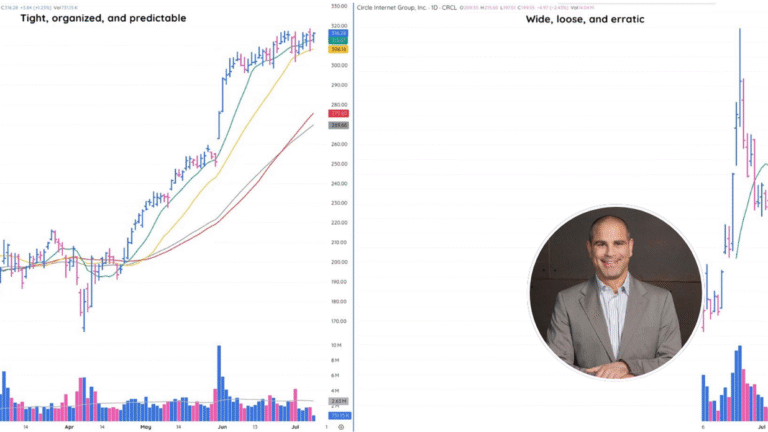

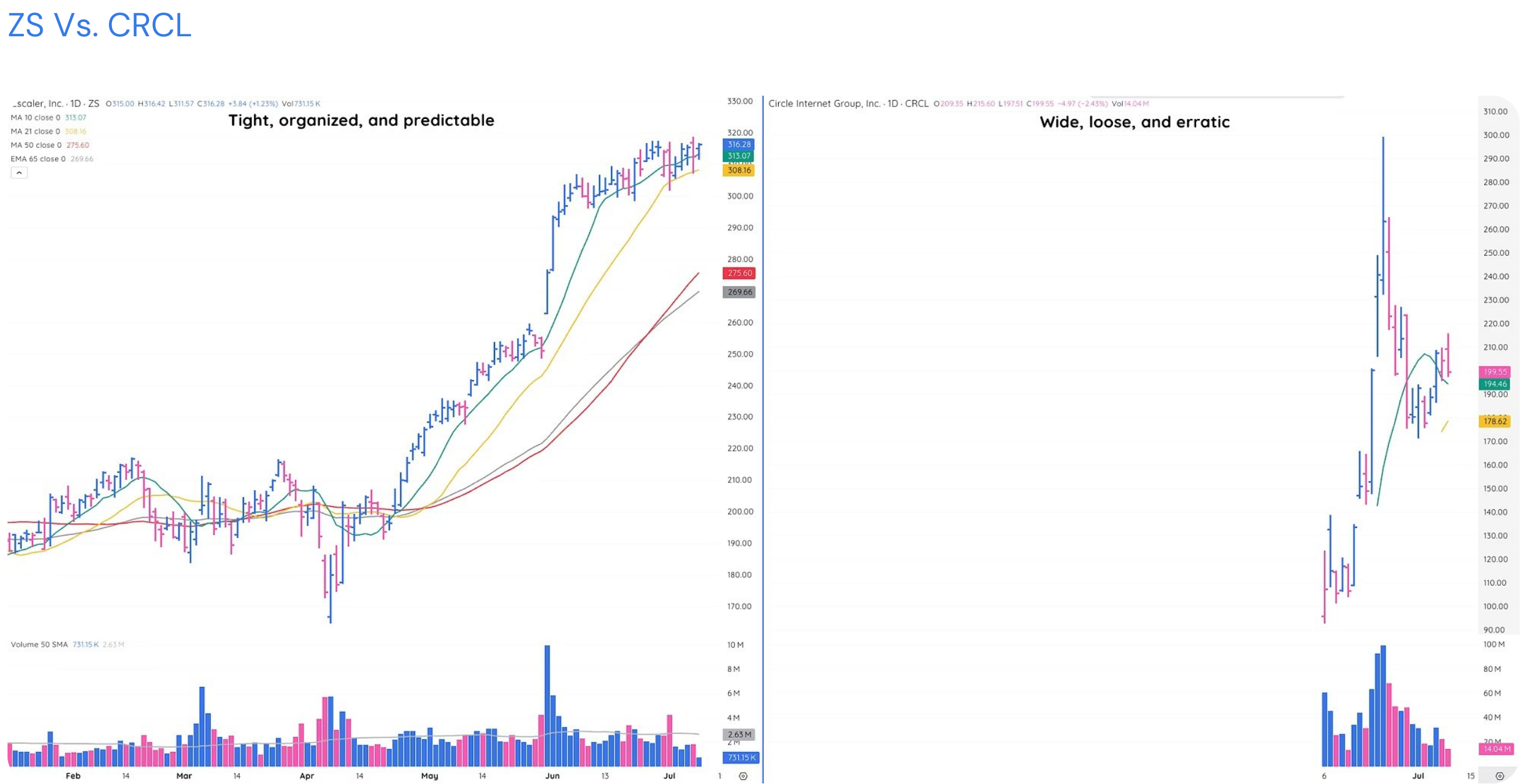

Rather than the old approach of buying breakouts and adding higher, Ross now uses a more sophisticated scaling strategy based on moving averages and stock personality.

Moving Average Strategy: Ross primarily uses the 21-day simple moving average as his line in the sand, but adapts this based on each stock’s personality. Some stocks respect the 23-day exponential, while others work better with different timeframes.

Scaling Out Process: When a stock breaks its 10-day moving average on volume, he typically sells one-third to half the position. If it breaks the 21-day, he considers selling more based on the stock’s recent performance and extension above key averages.

Two-Day Rule: When a stock breaks a key moving average, Ross waits to see if it undercuts the previous day’s low. If it doesn’t recover by the second day, he exits the remaining position intraday rather than waiting for the close.

For more detailed guidance on position management and when to sell stocks, understanding these exit strategies becomes crucial for long-term success.

Understanding Stock Personality

Ross Haber’s modernized CANSLIM approach adapts classic principles for today’s volatile market conditions

One of Ross’s most important insights is that individual stock personality matters enormously. Even with perfect CANSLIM fundamentals, you can lose money if you don’t understand how a particular stock behaves.

Identifying Stock Personality Traits

- How the stock respects moving averages

- Average True Range (ATR) and volatility patterns

- Volume characteristics during different market conditions

- Historical patterns of breakout success vs. failure

- Response to sector rotation and market stress

The Human Element

Ross emphasizes that even if Bill O’Neil gave 100 traders the same 100 winning trades, 90% would lose money. The human element—psychology, execution, and personal style—remains crucial to success.

Market Timing and Leadership Rotation

Despite academic claims that market timing is impossible, Ross maintains it’s entirely achievable when treated as a profession rather than a hobby. The key lies in understanding leadership rotation and follow-through day analysis.

The Follow-Through Day Methodology

The Process: After a market begins falling, watch for the first up day (Day 1). Count forward—ideally between days 4-7, you want to see the market up at least 1.75% on higher volume than the previous day.

Critical Point: Every new bull market in history has been preceded by a follow-through day, but not every follow-through day leads to a new bull market. The difference? The action of the leaders.

Leadership Analysis

Ross constantly tracks sector rotation using ETF performance, sorting by percentage change to identify where money is flowing. This daily process involves:

- Screening for the strongest stocks in leading sectors

- Identifying accumulation patterns in potential leaders

- Understanding which groups are forming bases vs. extended

- Differentiating between growth leadership and defensive rotation

Constant Market Monitoring

Ross runs screens and reviews charts daily, including weekends. He constantly updates watchlists, sets alerts, and removes underperforming stocks. This process makes it “impossible not to know where the money’s flowing.” Learning to build your own focus list is essential for tracking the strongest opportunities.

See Ross’s Analysis in Action

Ross Haber’s modernized CANSLIM approach demonstrates that successful growth trading requires both

timeless principles and adaptive techniques. While the core fundamentals of finding great companies

remain unchanged, today’s volatile markets demand more sophisticated risk management and deeper

understanding of individual stock behavior.

The challenge? Developing this expertise takes years of market cycles and constant observation. Ross has spent countless

hours including weekends—running screens, analyzing charts, and tracking leadership rotation. This daily

commitment to identifying accumulation patterns and sector strength is what sets him apart and has shaped his approach

over decades in the market.

That’s where TML Talk comes in. Each week, Ross breaks down exactly what he’s seeing in the market—the same leadership rotation analysis and stock selection process that Ross has refined over two decades. You’ll get the benefit of their daily market monitoring and pattern recognition, seeing the methodology in real-time application rather than just reading about it in theory.