Upside Reversals – Start of the Bottom? NOW Breaks Out

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

July 25, 2024

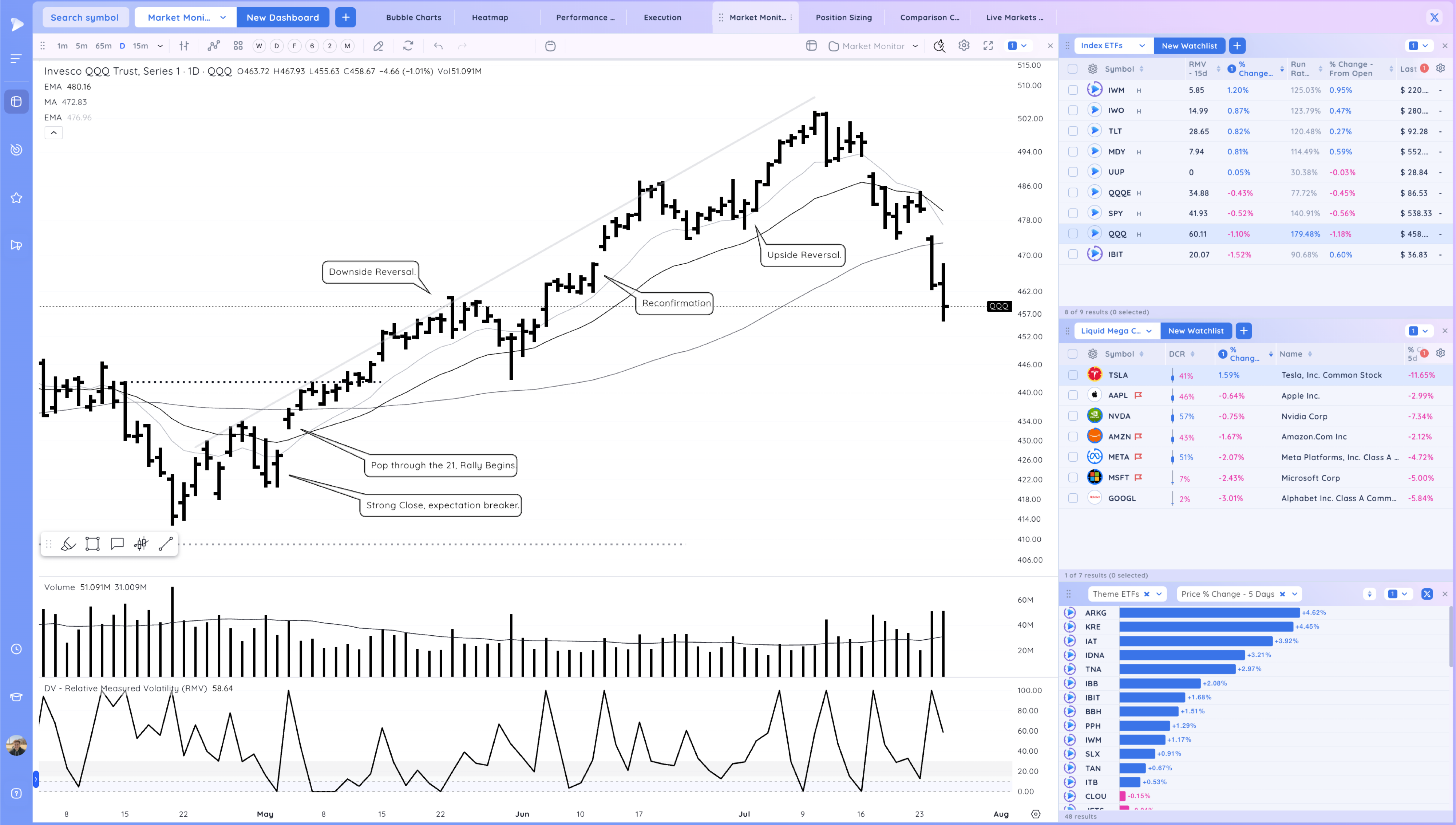

Market Action

QQQ – The Qs put in a strong upside reversal but then sold off later in the day. High volatility. Remember to define your market cycle and where you trade best. For me it’s when we pop above and trend above a rising 21ema

IWM – stronger action but not the best closing range

Trends (1/4 Up)

Shortest – 10 Day EMA – Down – Below Declining

Short-term – 21 ema – Down – Below Declining

Intermediate term – 50 sma – Down – Below Declining

Longterm – 200 sma – Up – Above Rising

Never miss a post from Richard Moglen!

Stay in the loop by subscribing.

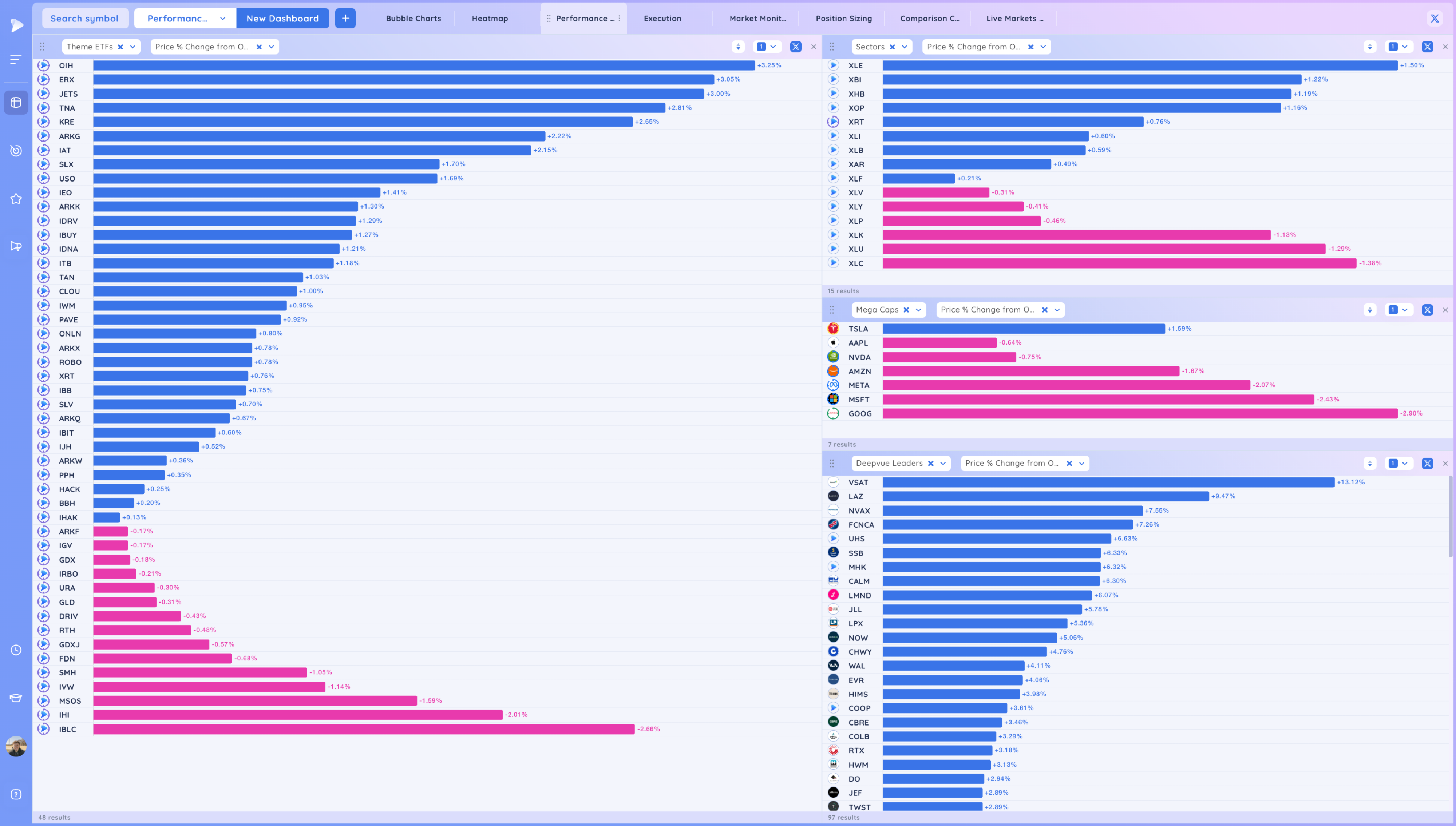

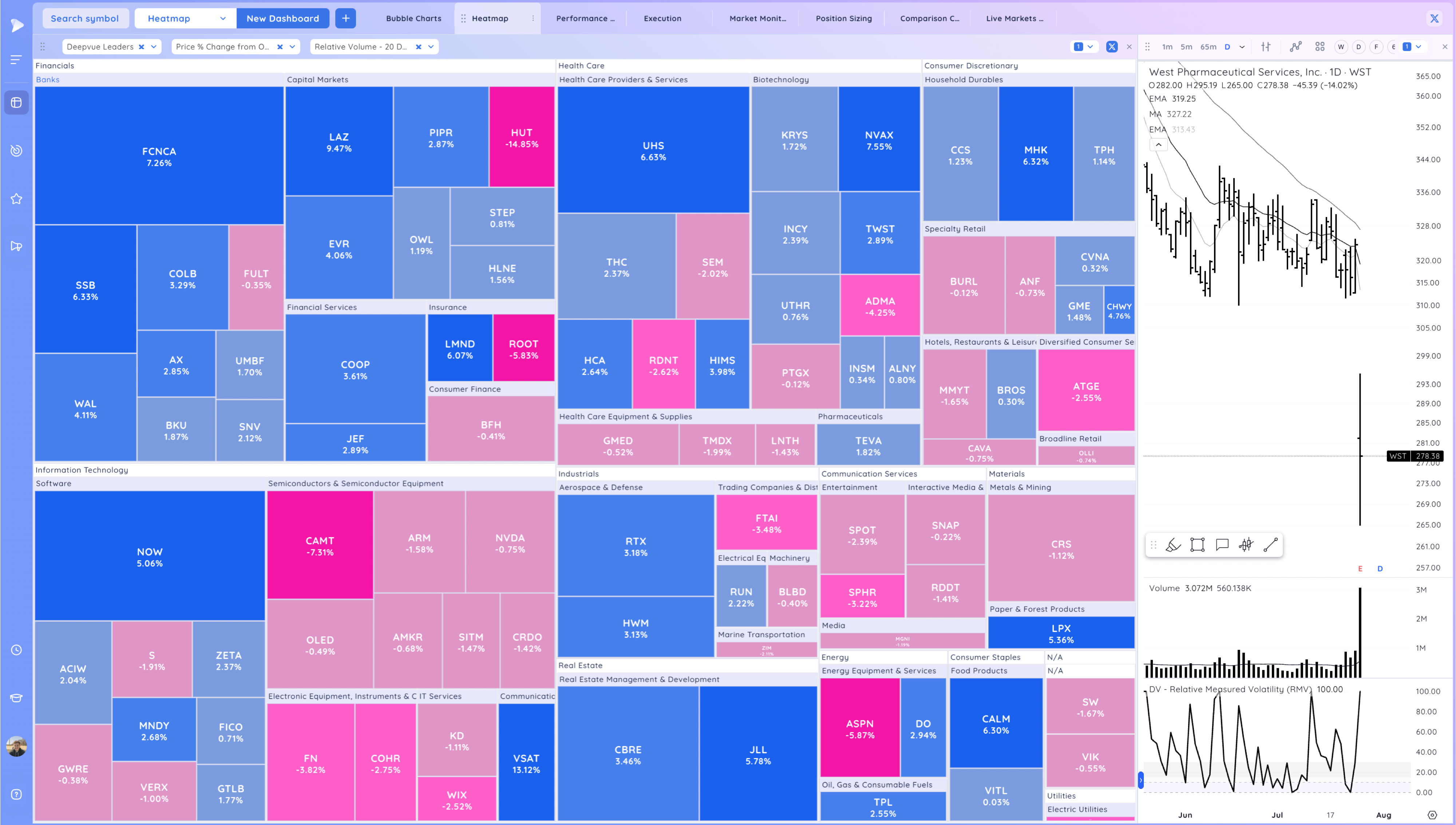

Groups/Sectors % Change from Open

Performance Charts from Deepvue

healthcare, banks, some software with NOW

Key Stocks in Deepvue

NVDA this could be the reversal extension, see if it can build and tighten

LNTH still tightening against the 10ema

HIMS still showing RS

TSLA gap down low holding for now, see which way it pushes the range

COIN more downwards, retesting the prior pivot

NOW Breakout to new highs after EPS

UHS breakout. Health care is a theme right now

FCNCA Banks have been acting well

Market Thoughts

Some strong upside reversals today that faded a bit. Could be the low but also could just be working off extension to reconfirm down. How price builds now will be a tell. Do we see follow on buying and tightening in price, reclaim of MAs?

Know your style, do you perform well in highly volatility and putting on potential trades against levels or do you do better waiting for formations of right sides? Know thyself

Keep monitoring for RS, Day by Day. Homework now will pay during the next uptrend