Undercut and Rallies. Watching for Follow Through

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

November 9, 2025

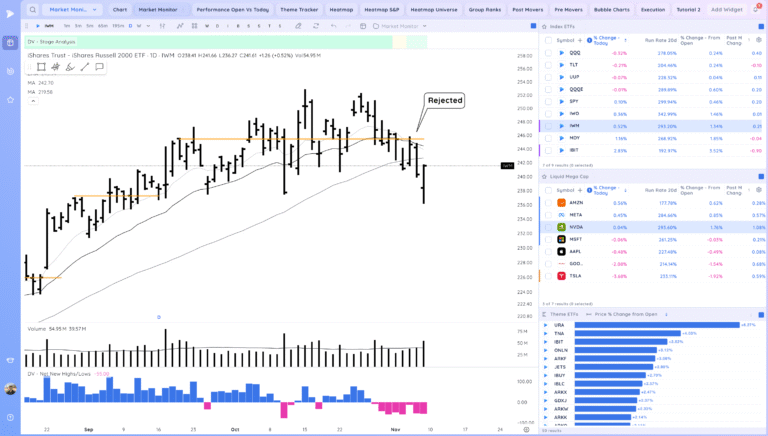

Market Action

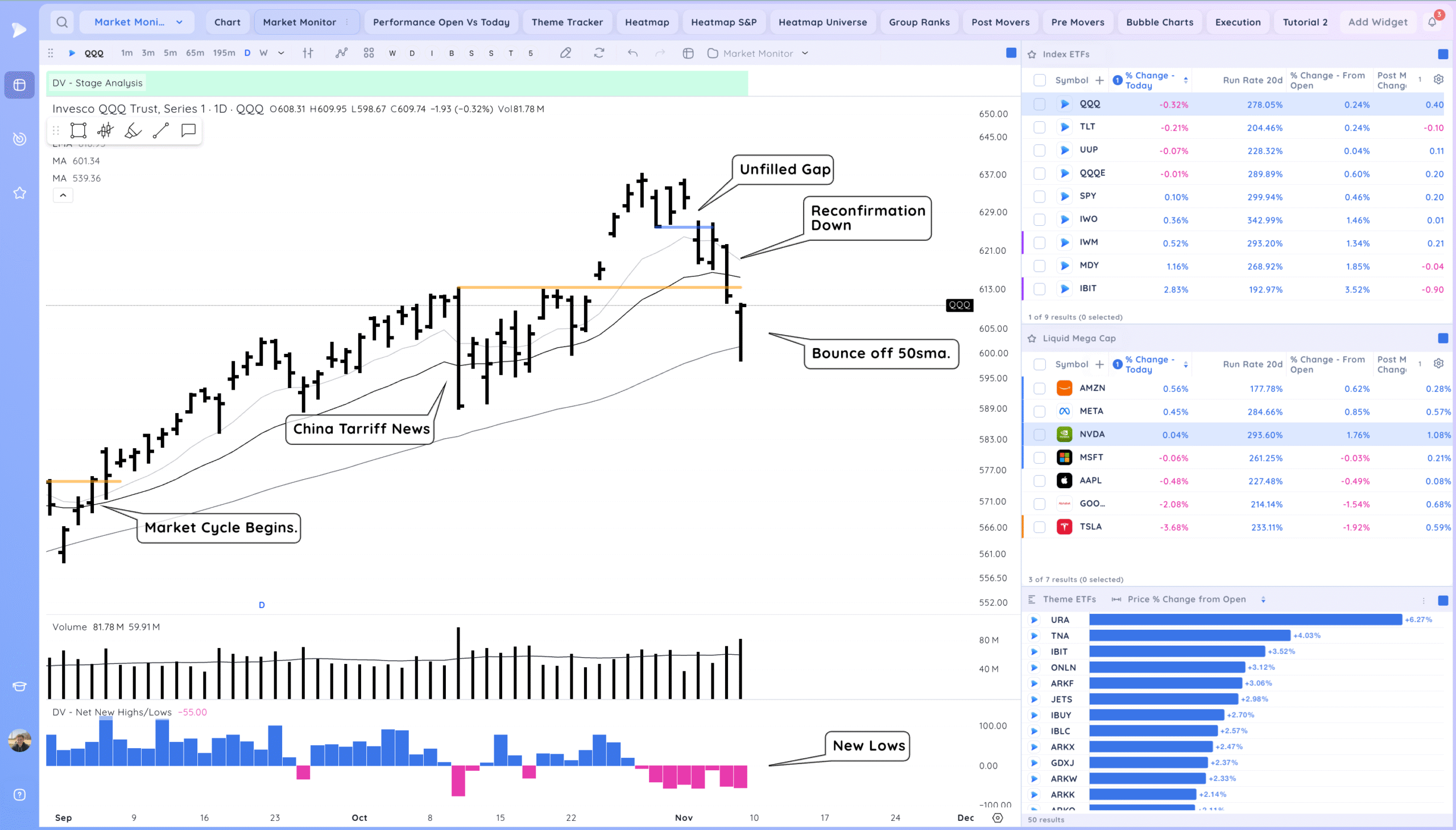

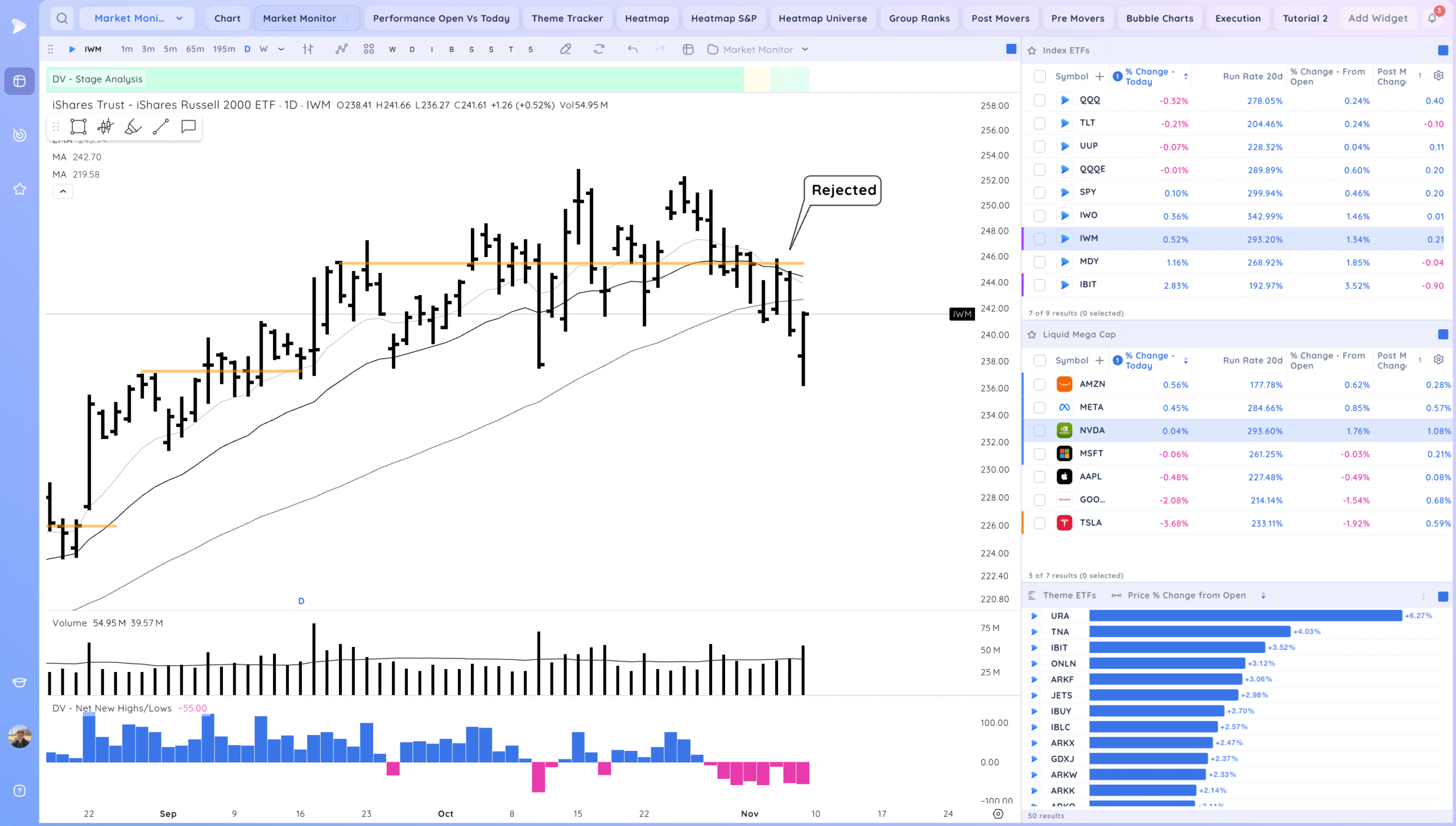

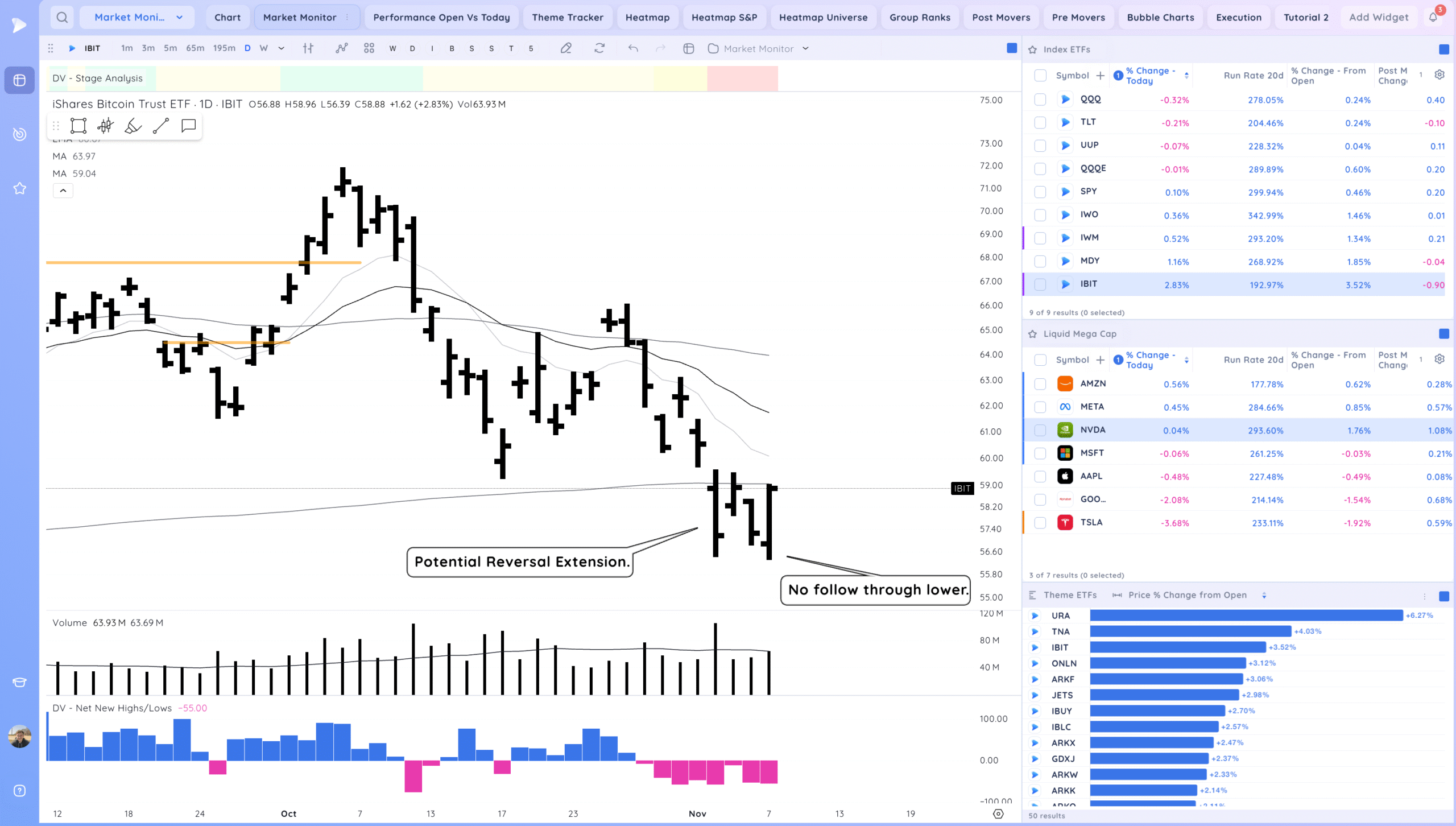

Last week we pulled in sharply down to the 50sma. On Friday we had another weak open but reversed around 12pm ET and closed strongly with the indexes and many names closing near highs. From recent highs we were down close to 6% to Friday’s low. We are below the 10 and 21 ema what what will be key is if we get follow through higher this week or reverse lower. Net new highs/lows have been negative for the first time consistently since the start of the April correction.

Trends 2/4 Up – based on the QQQ

Shortest – 10 Day EMA – Below

Short-term – 21 ema – Below

Intermediate term – 50 sma – Above Rising

Longterm – 200 sma – Up – Above Rising

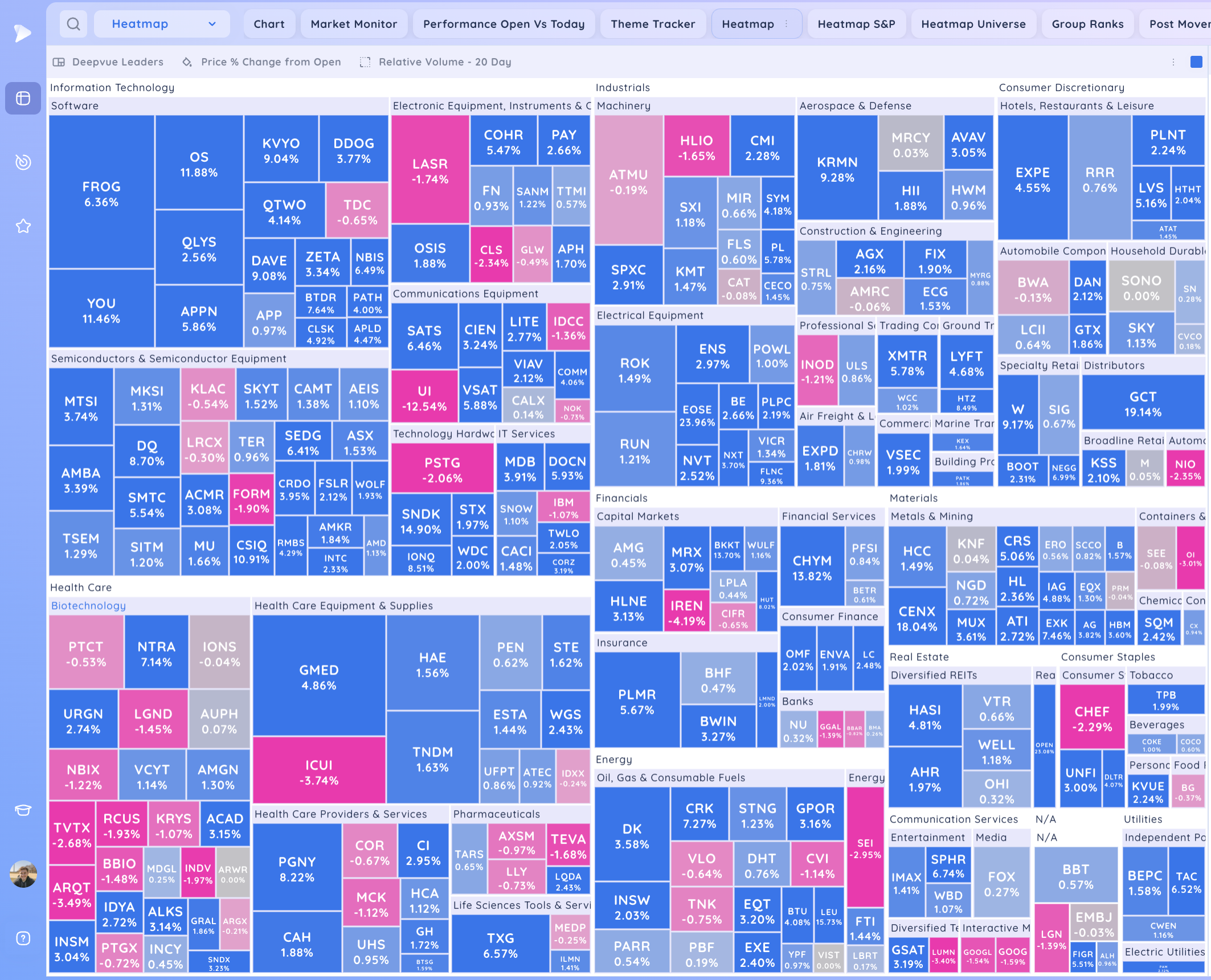

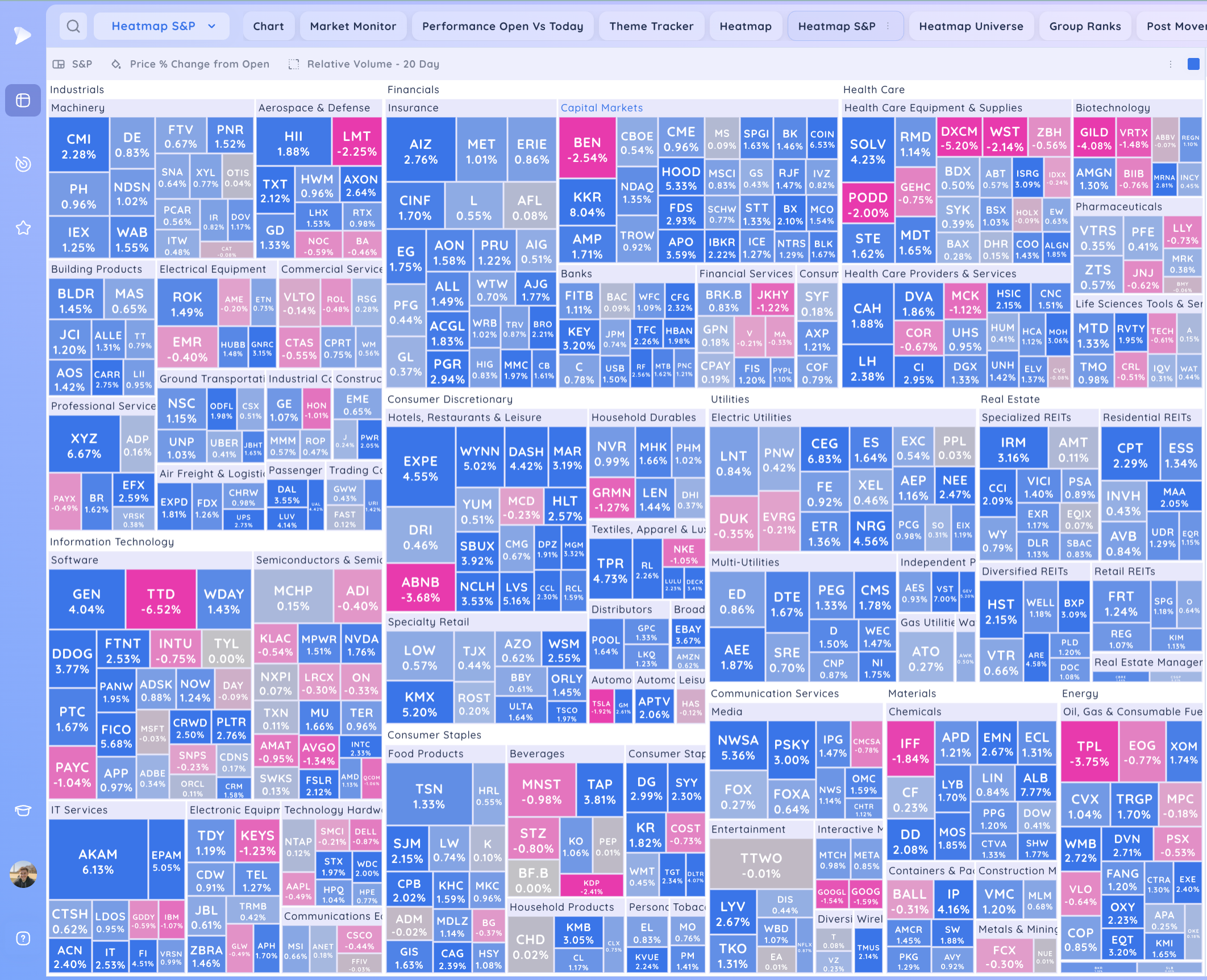

Groups/Sectors

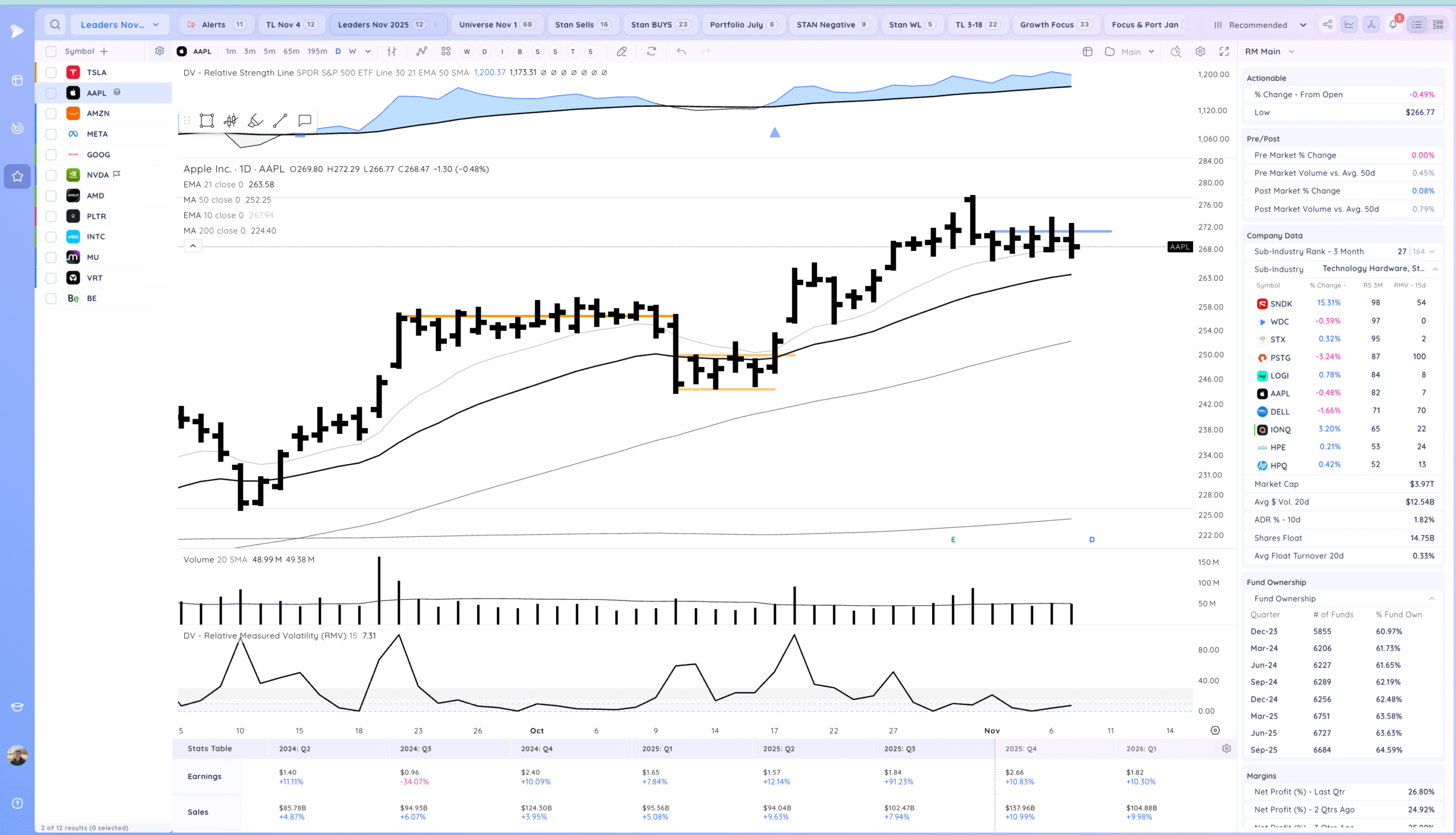

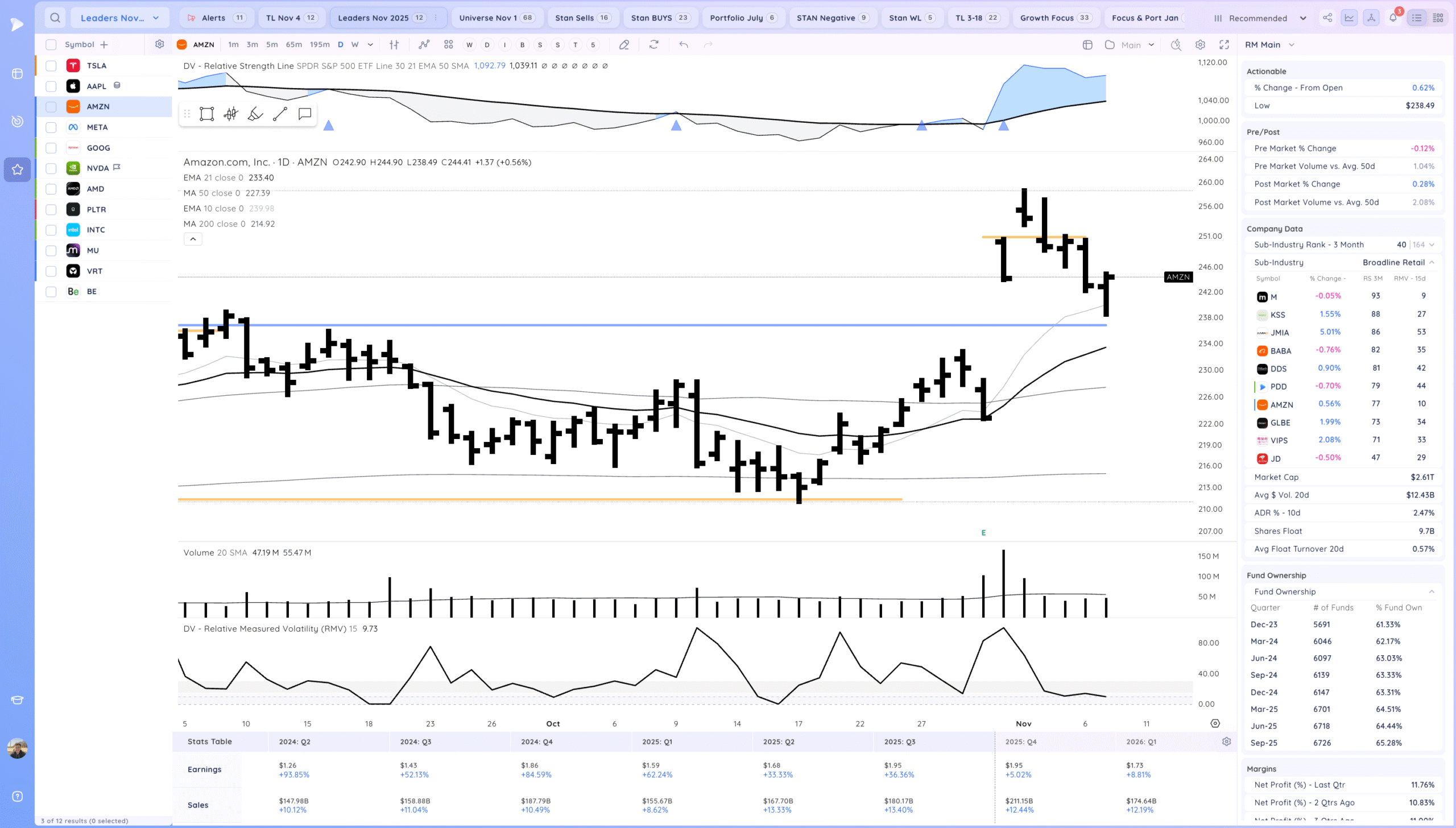

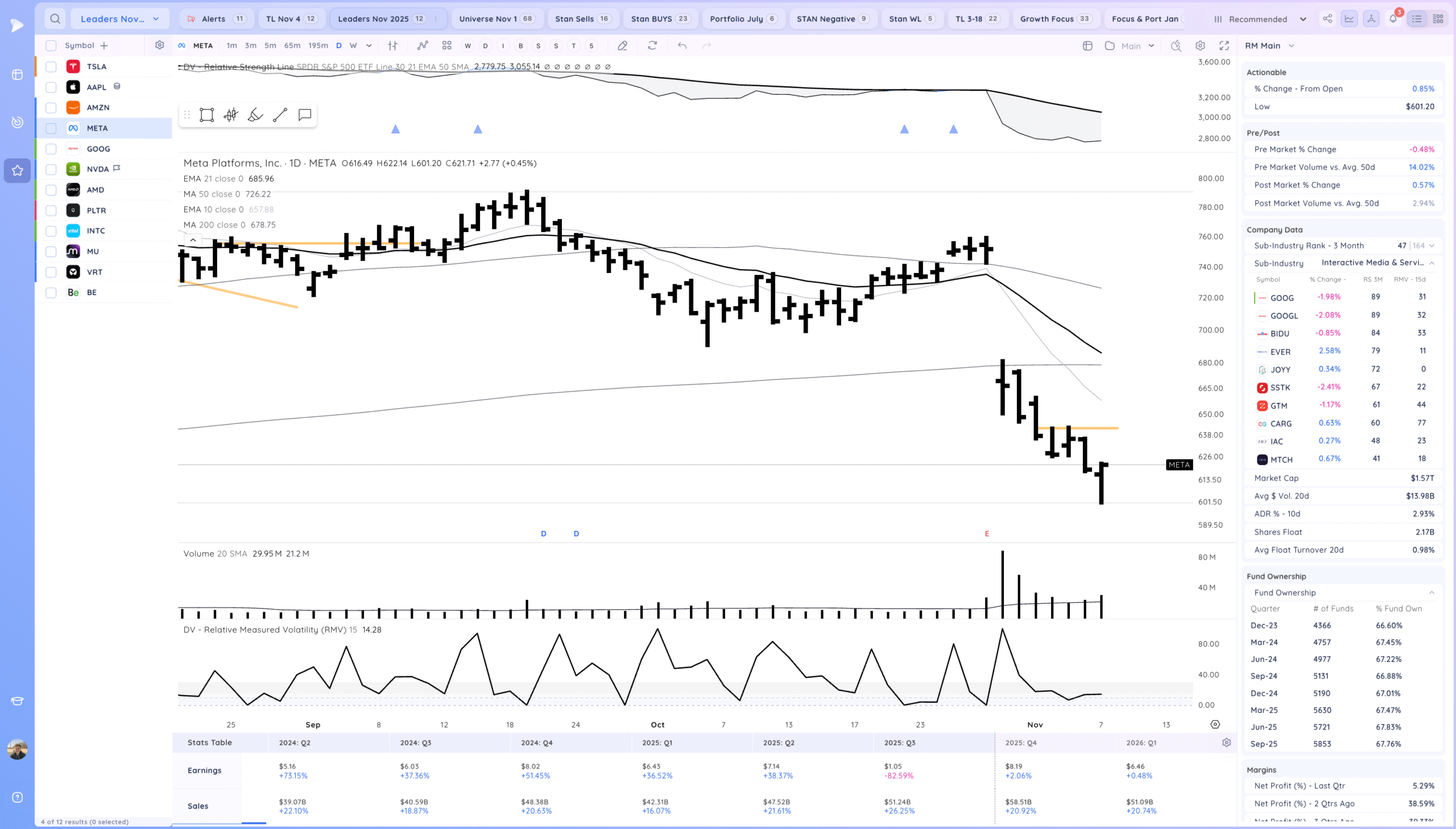

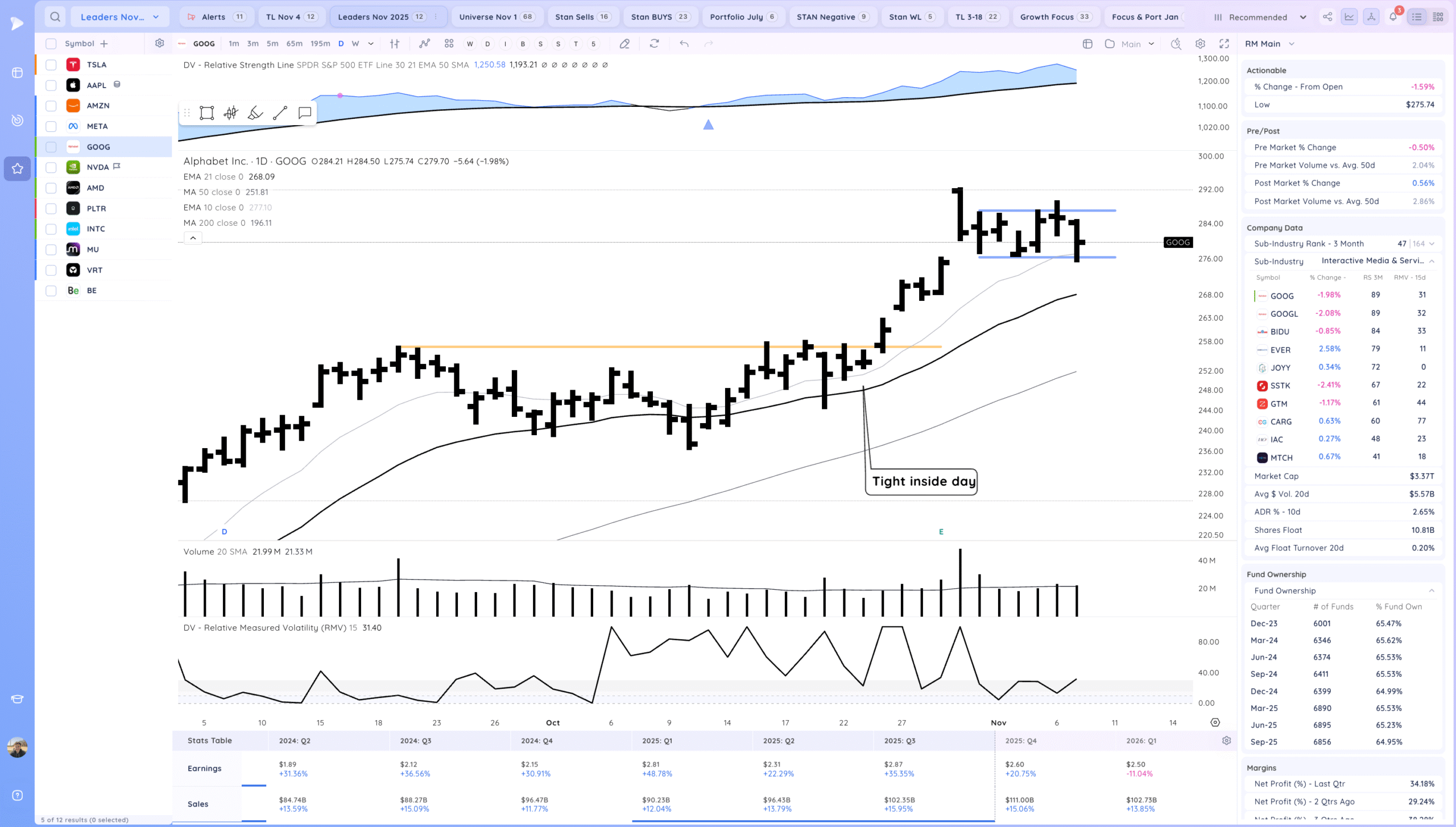

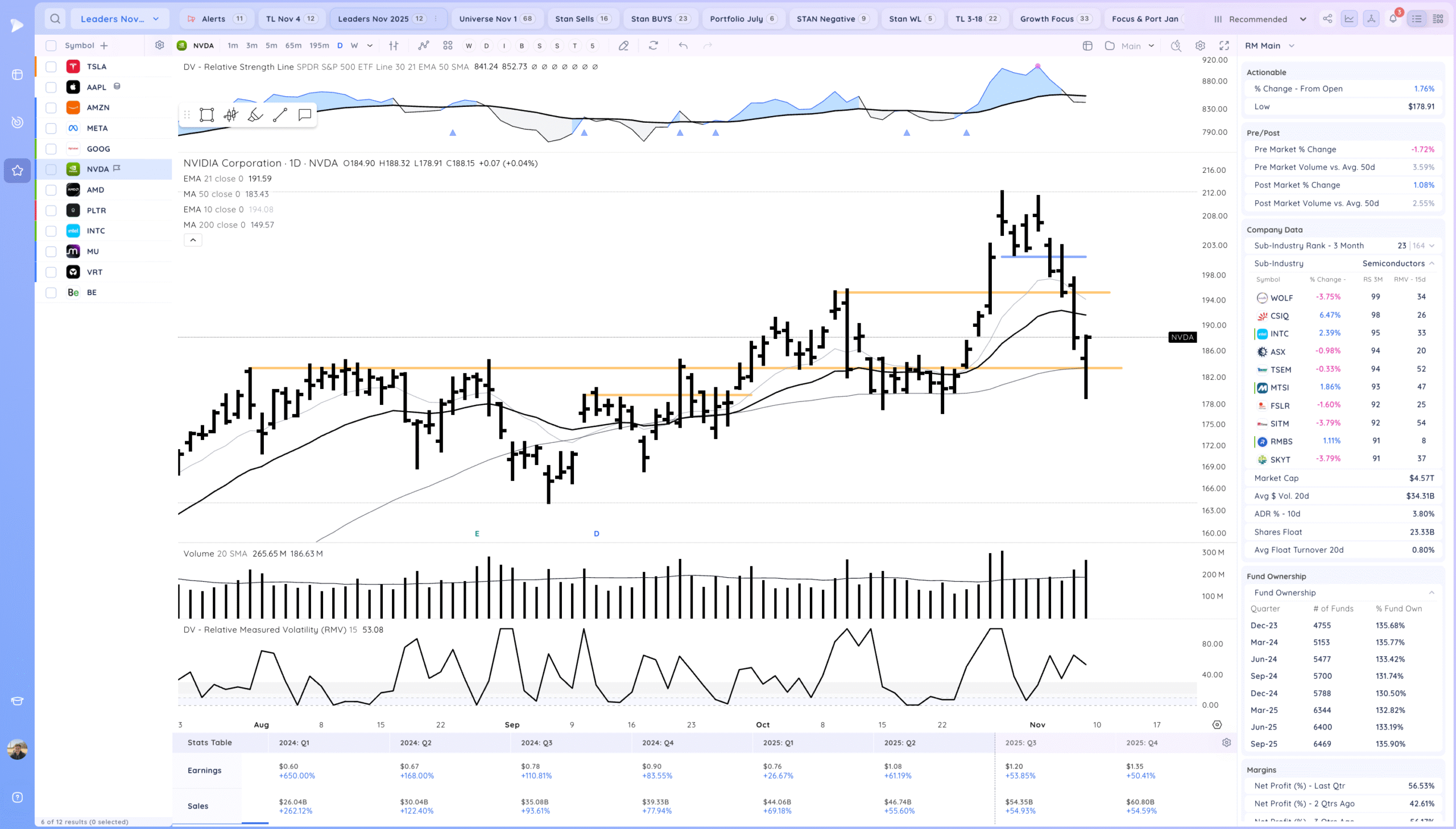

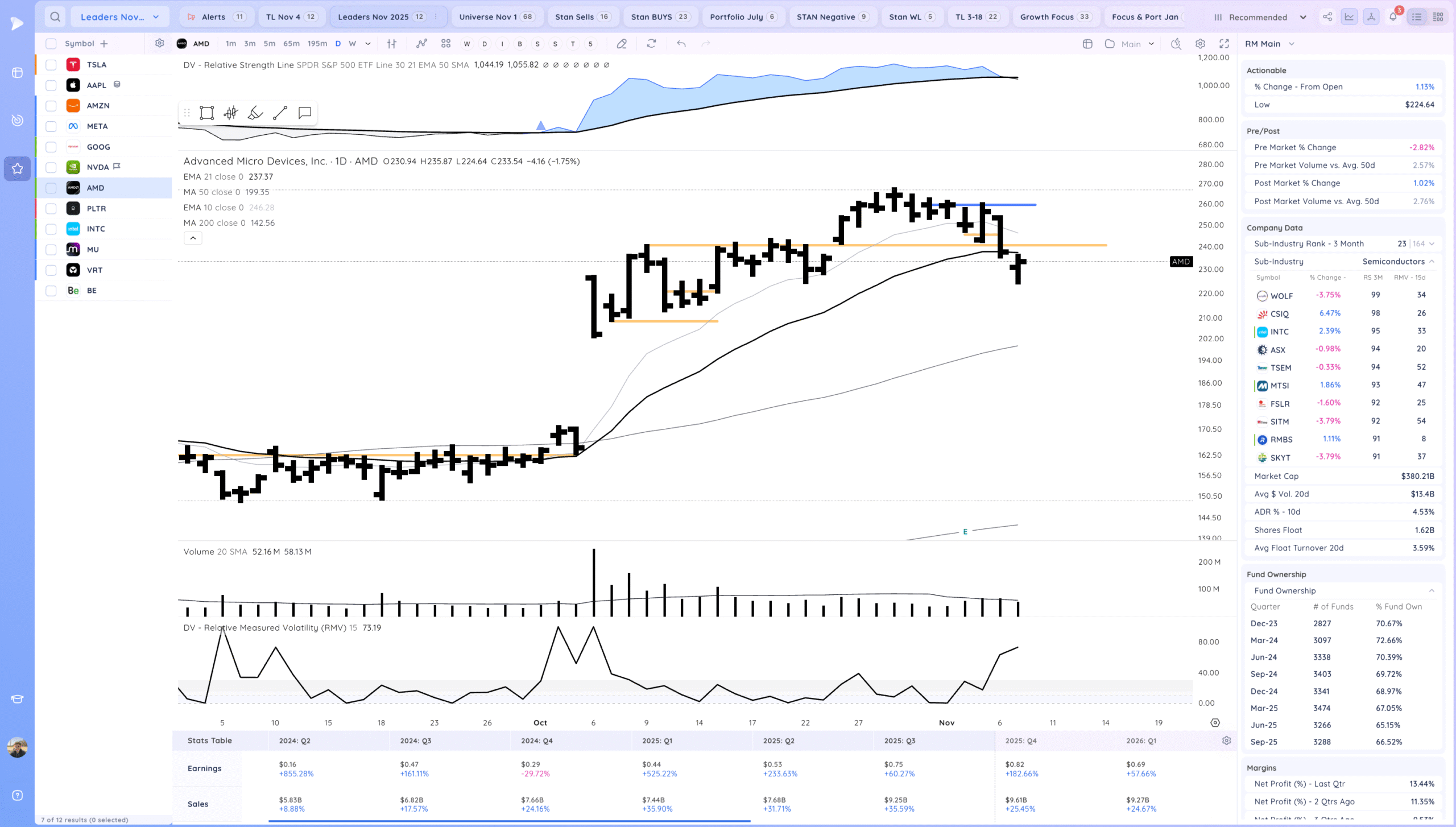

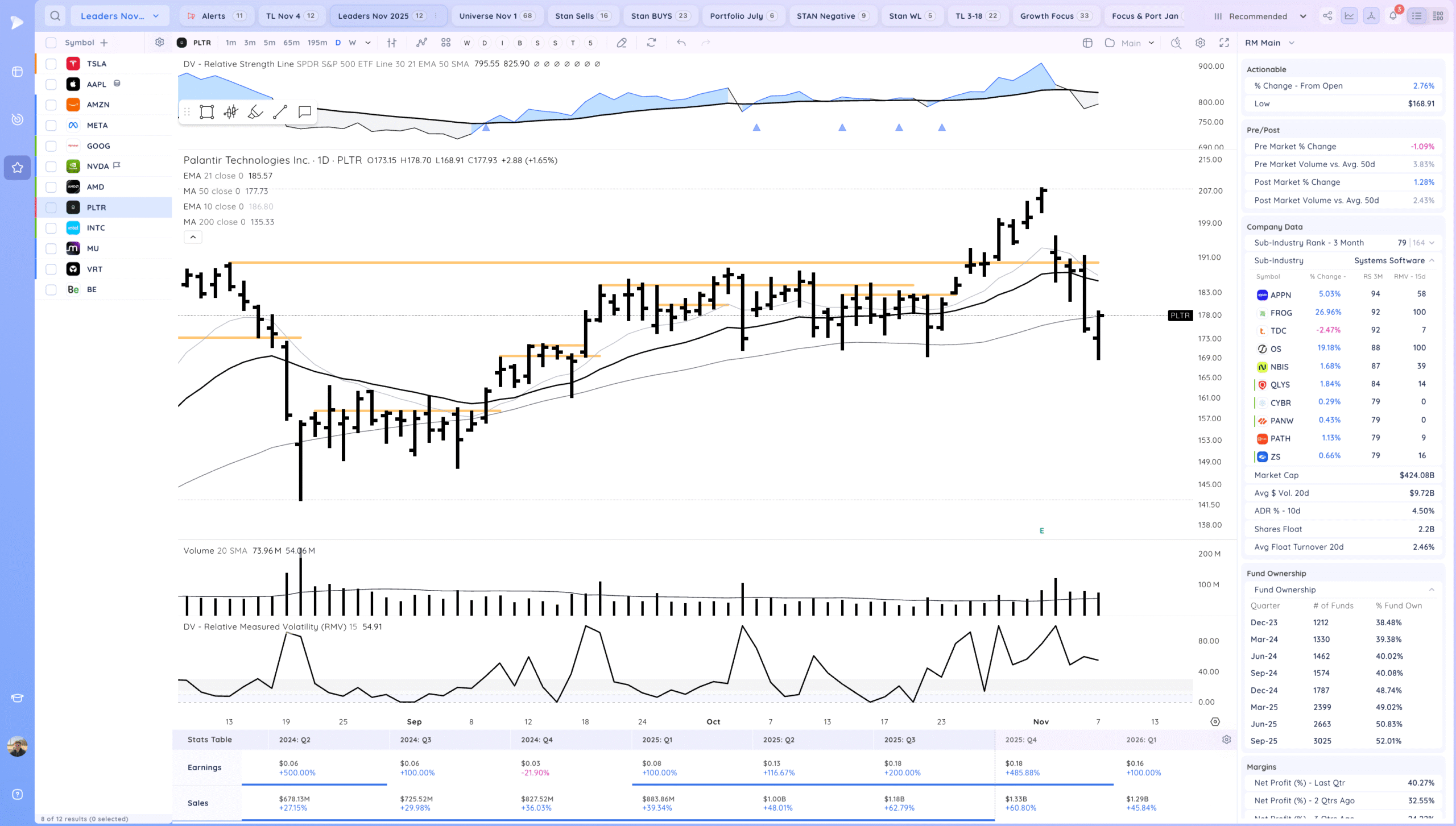

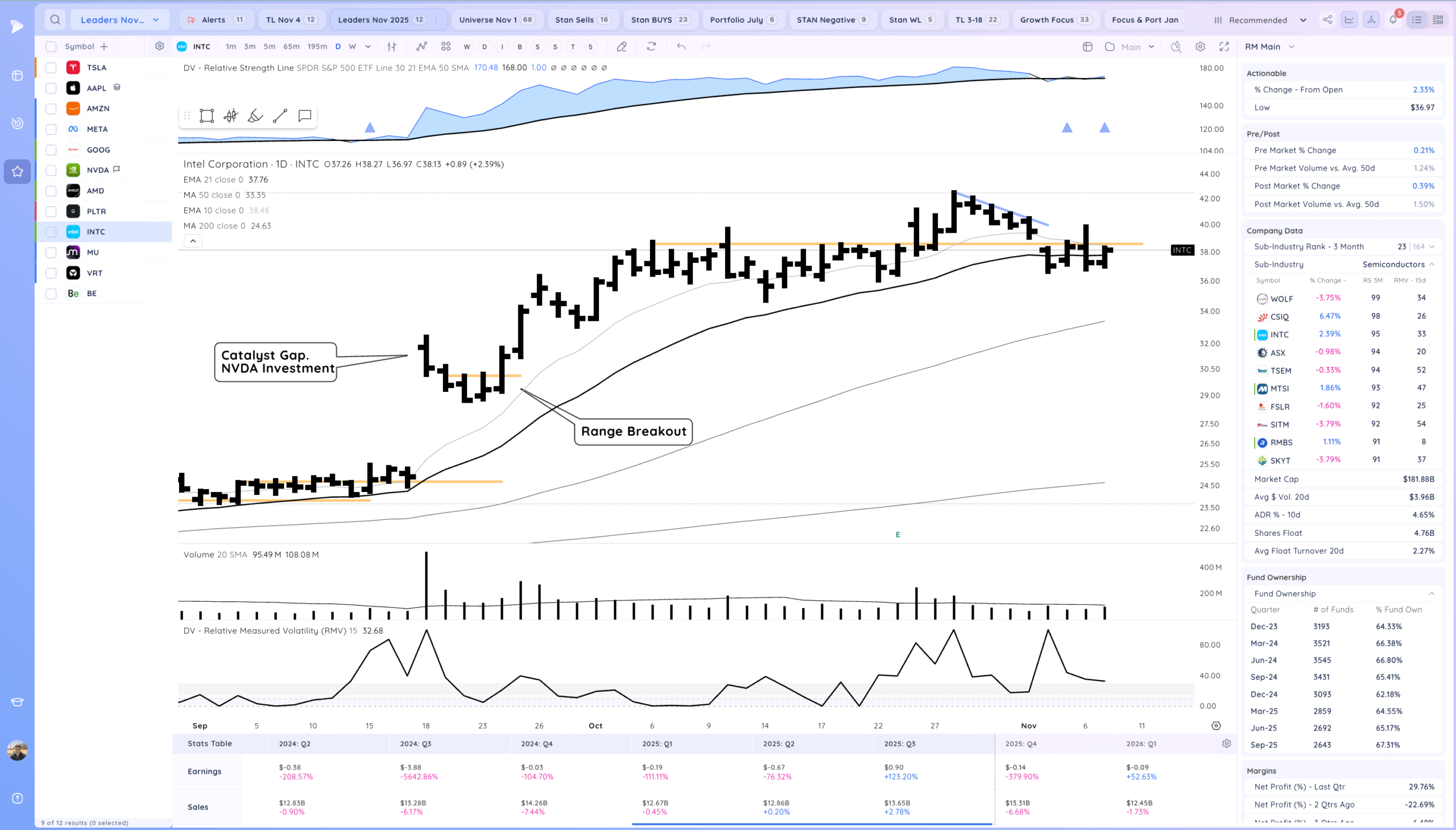

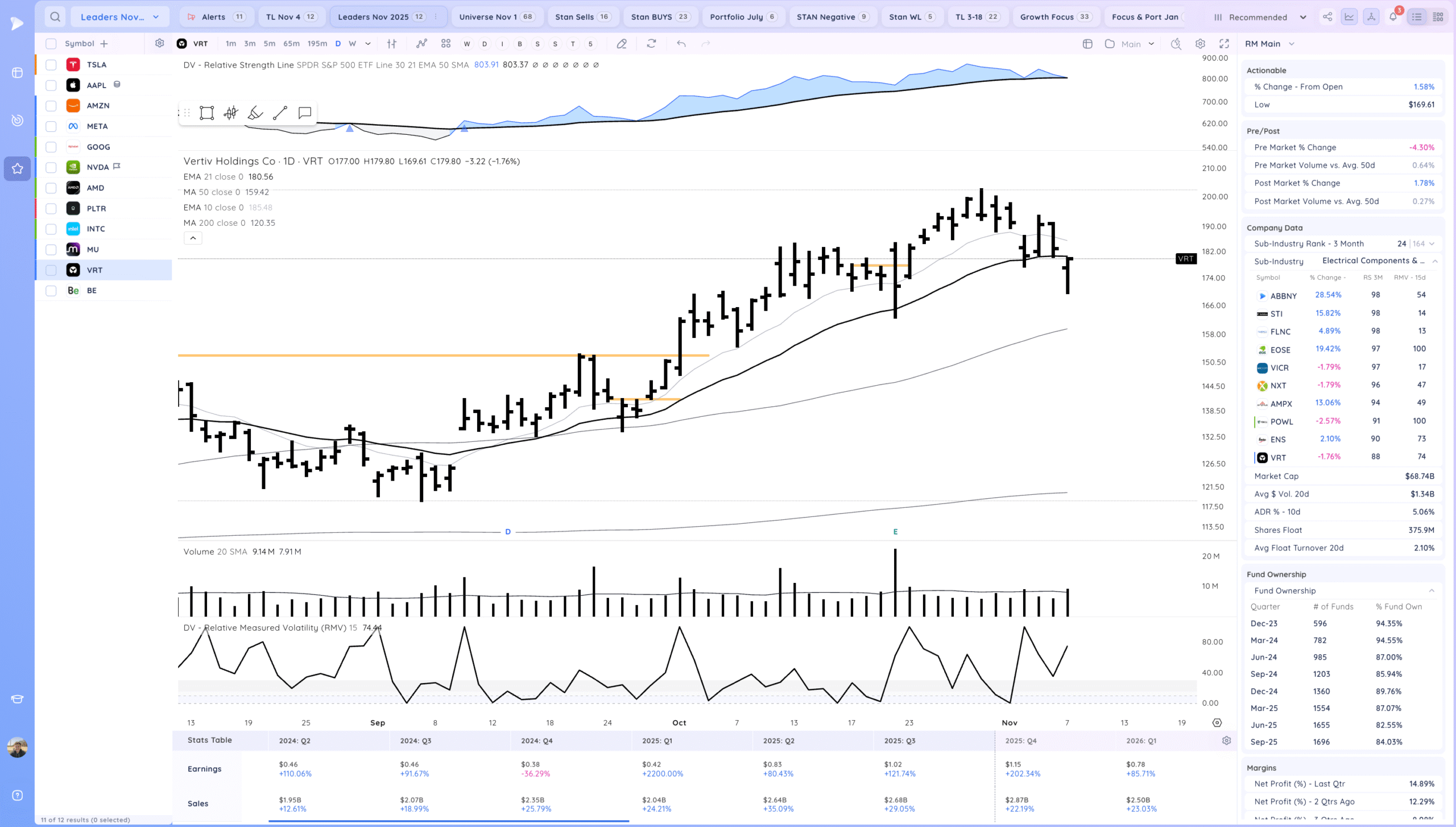

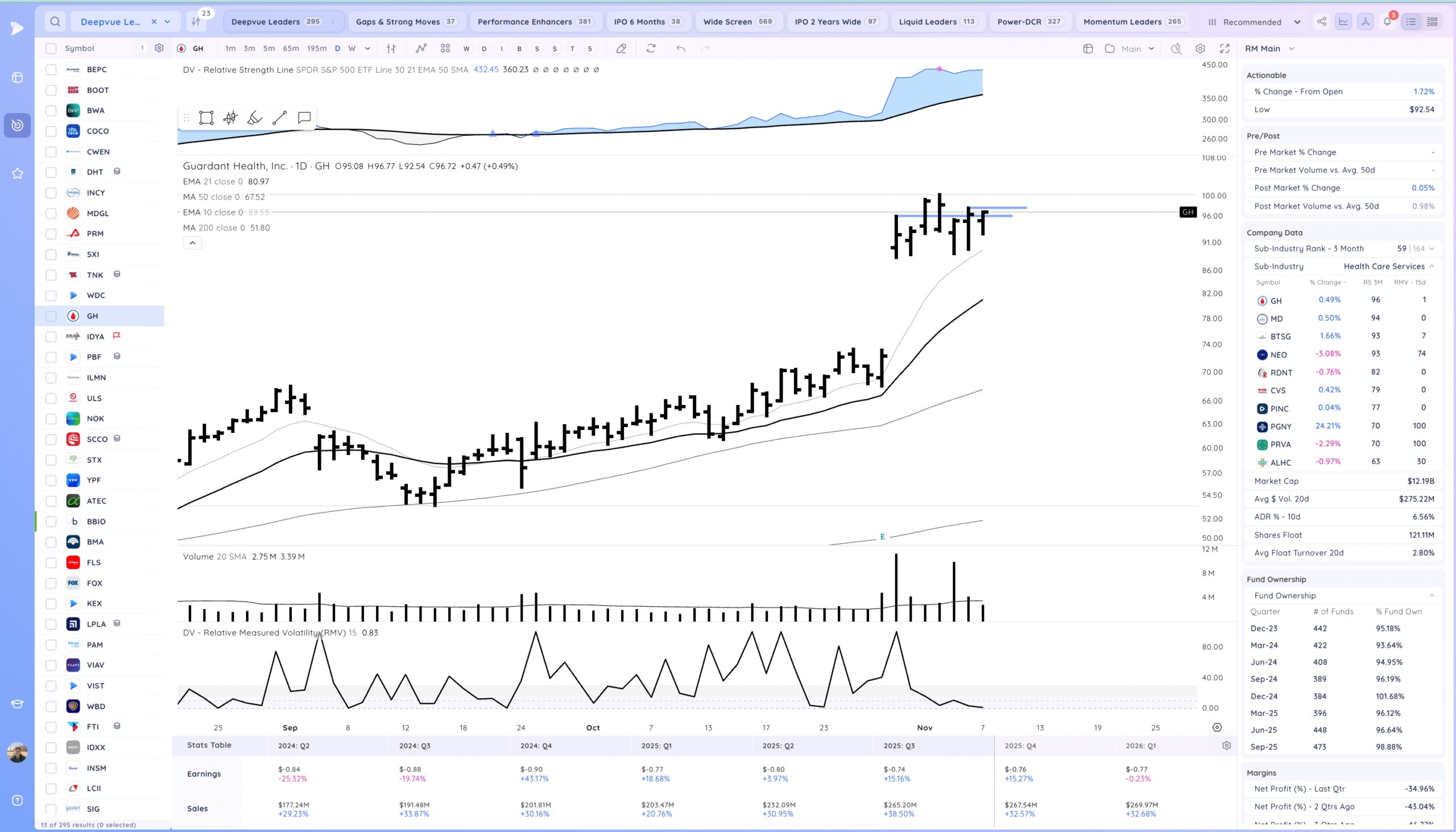

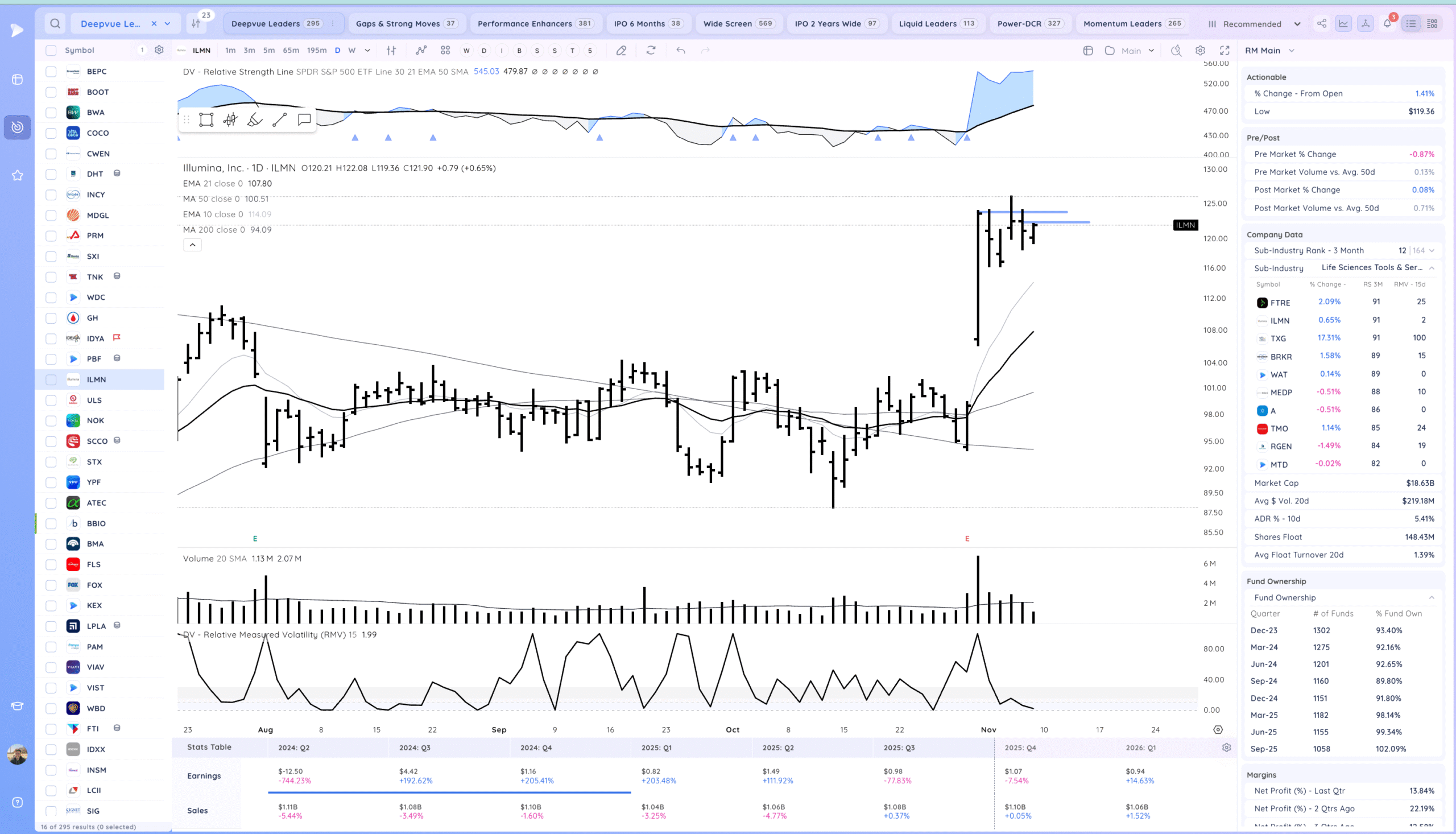

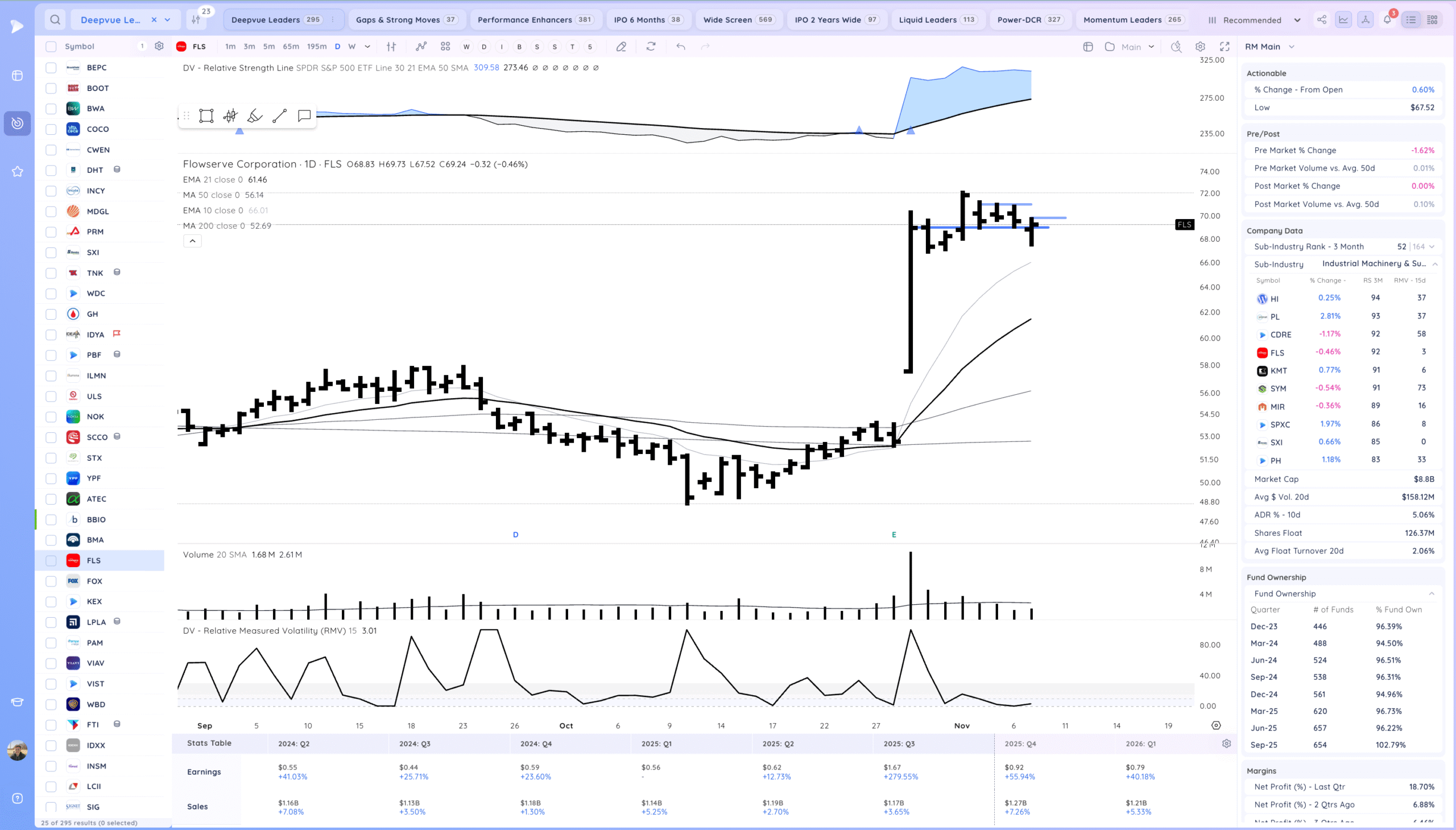

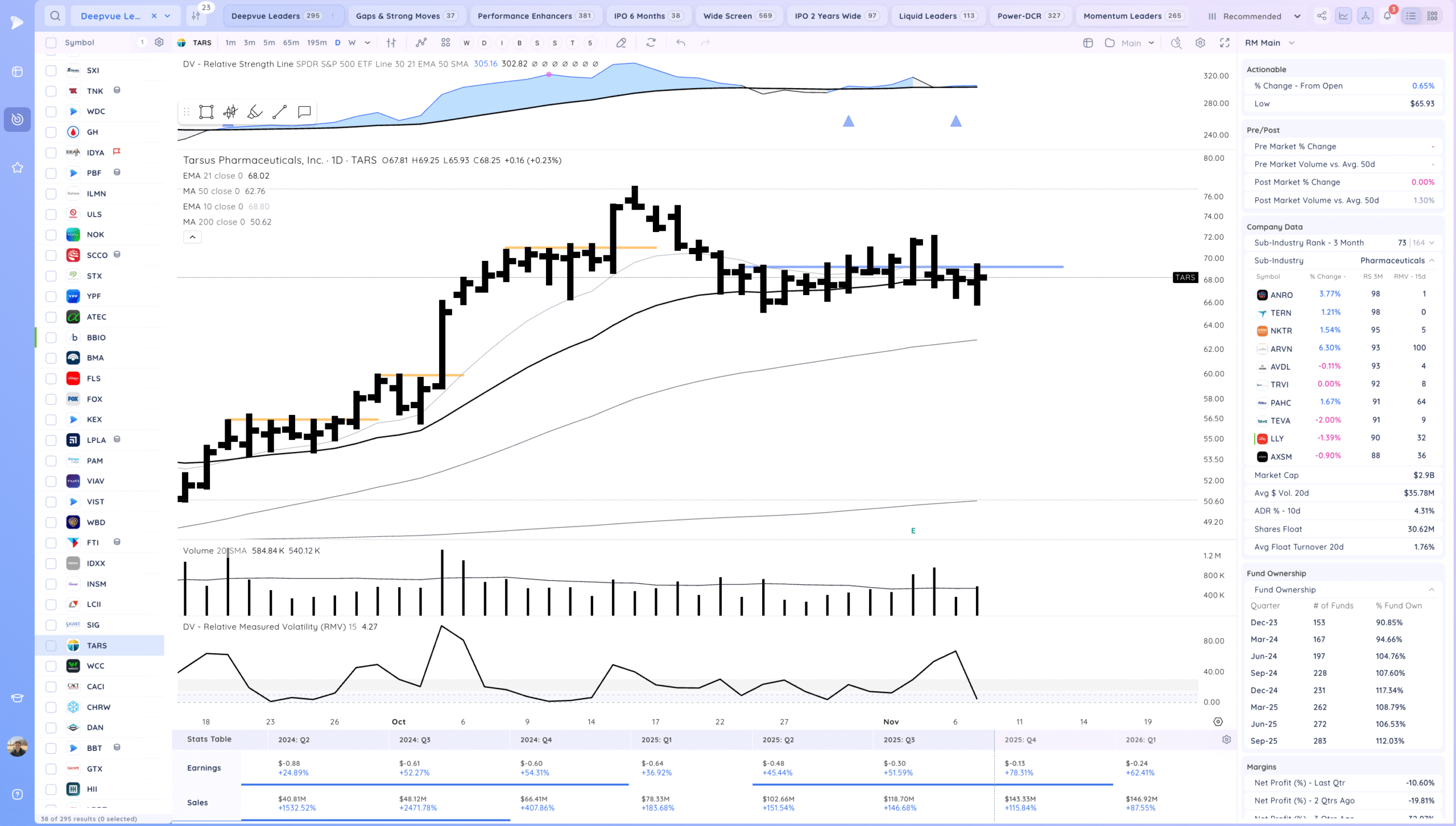

Leadership Stocks & Analysis

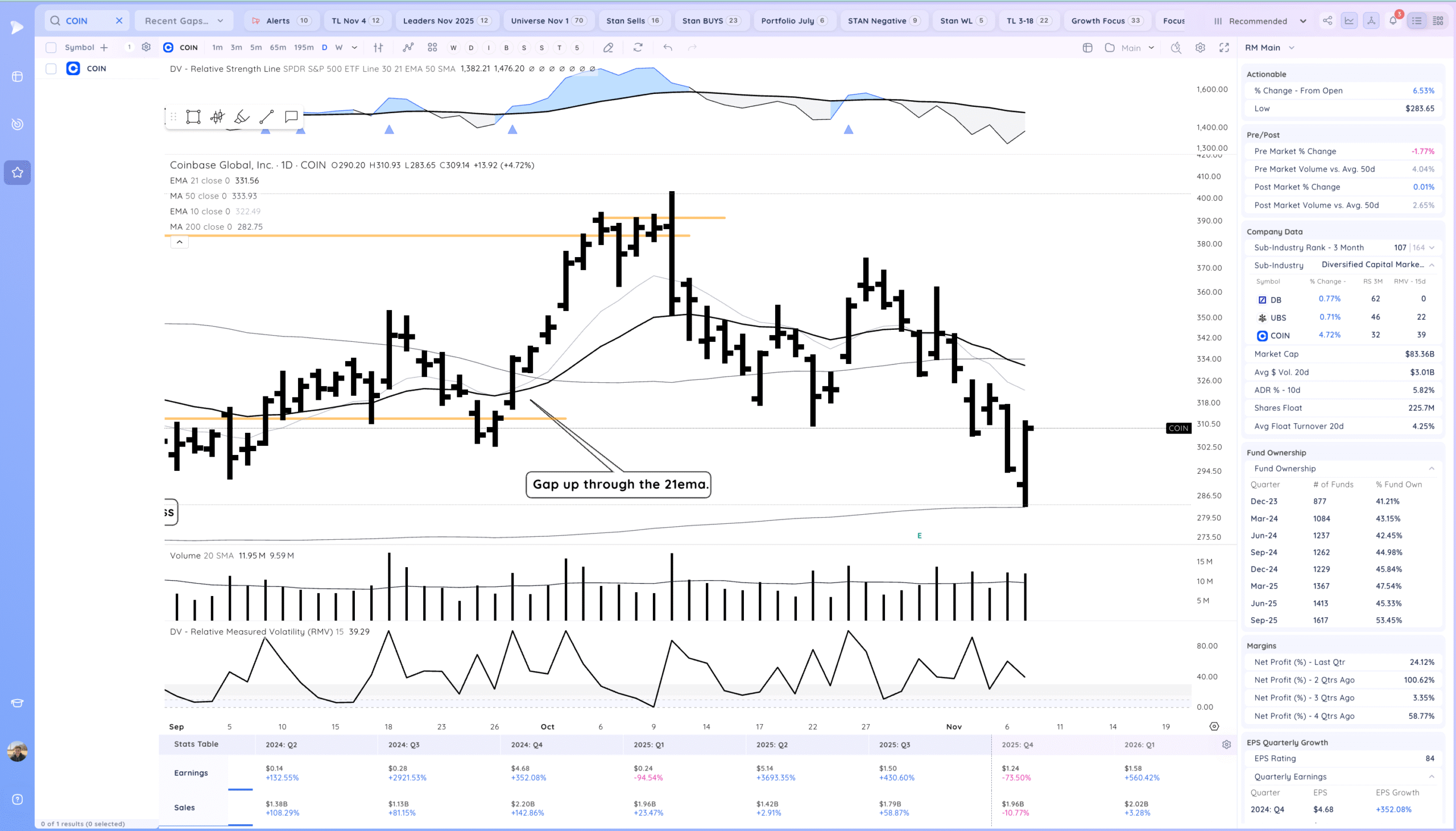

Key Moves

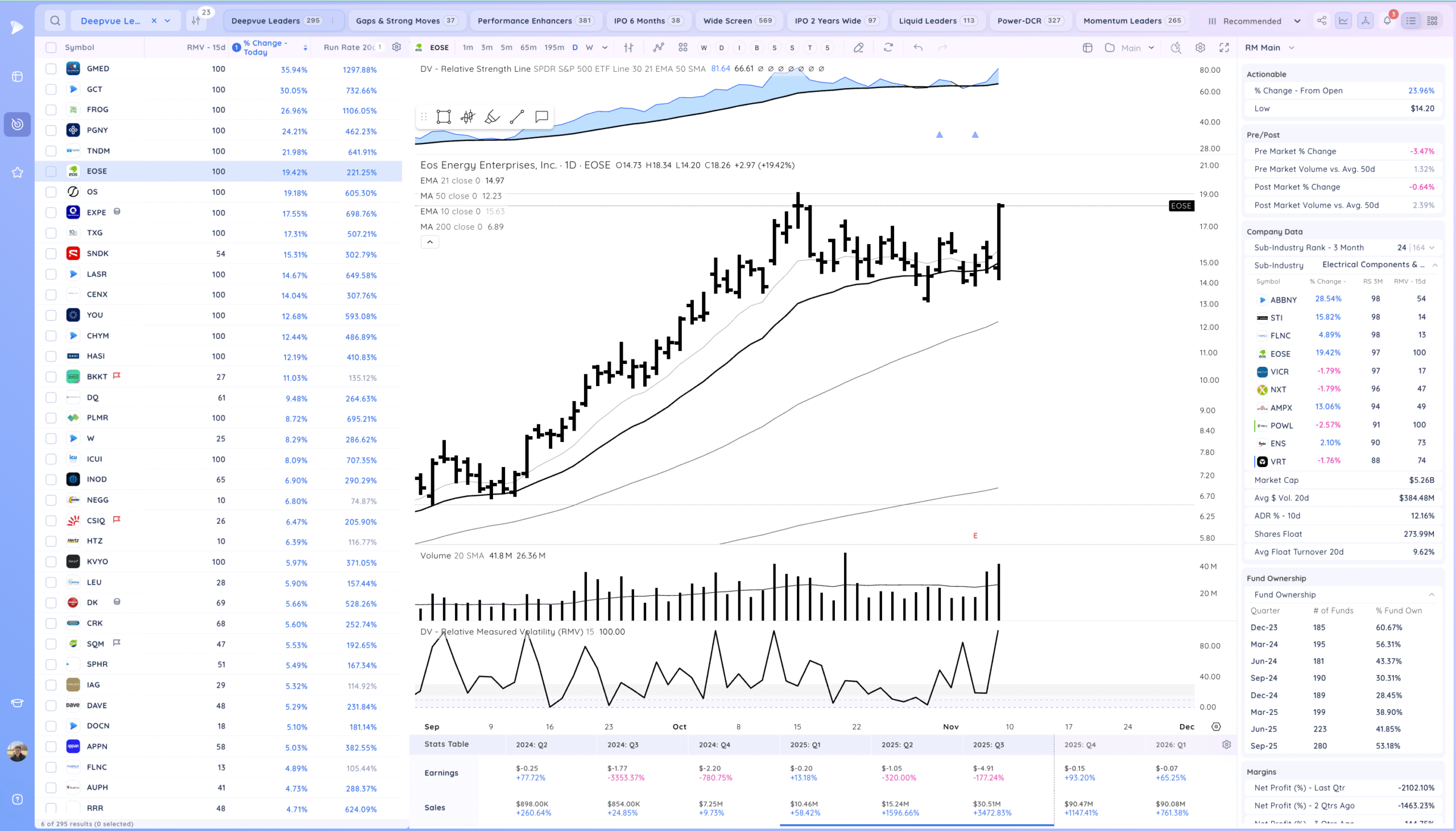

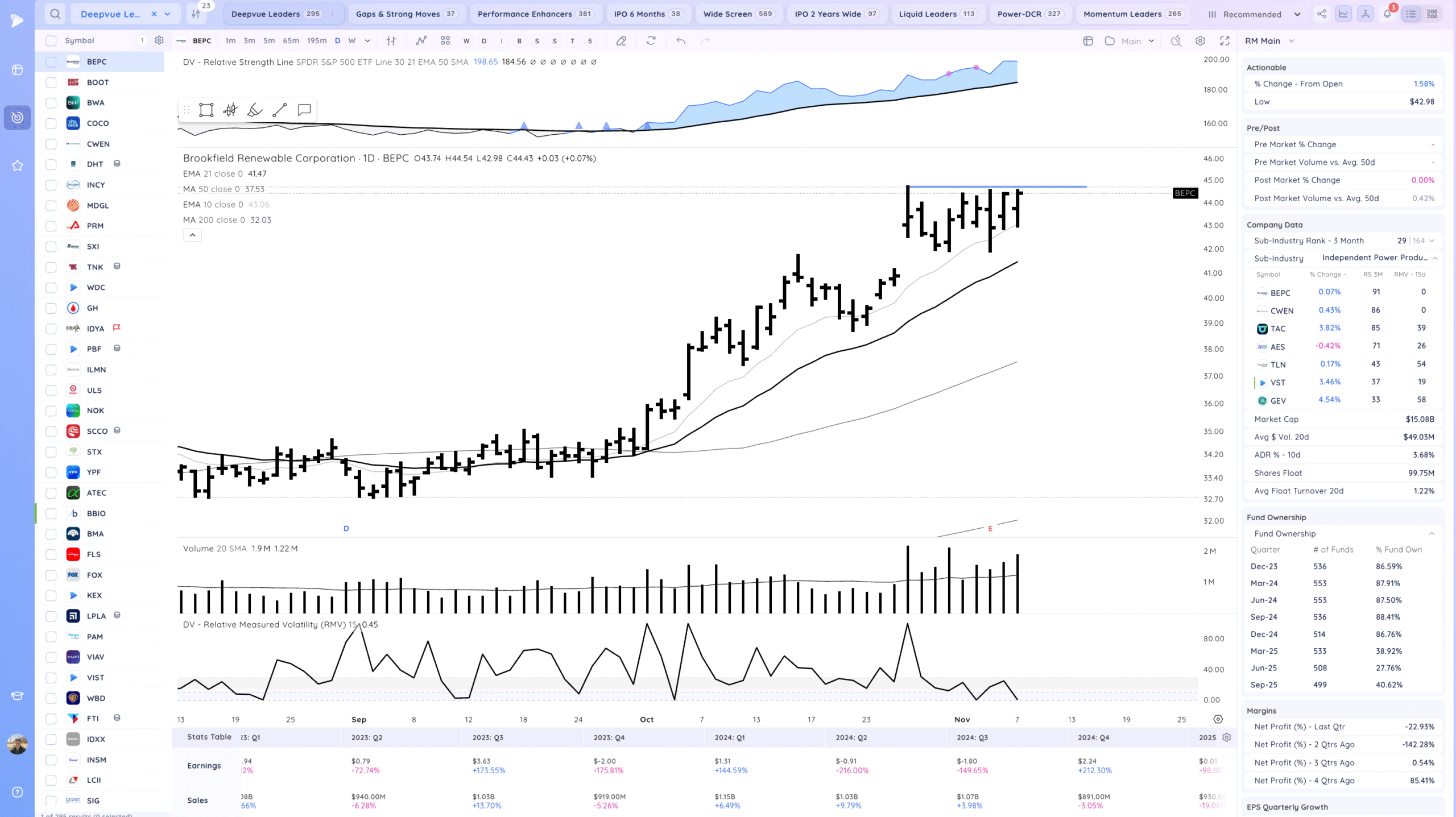

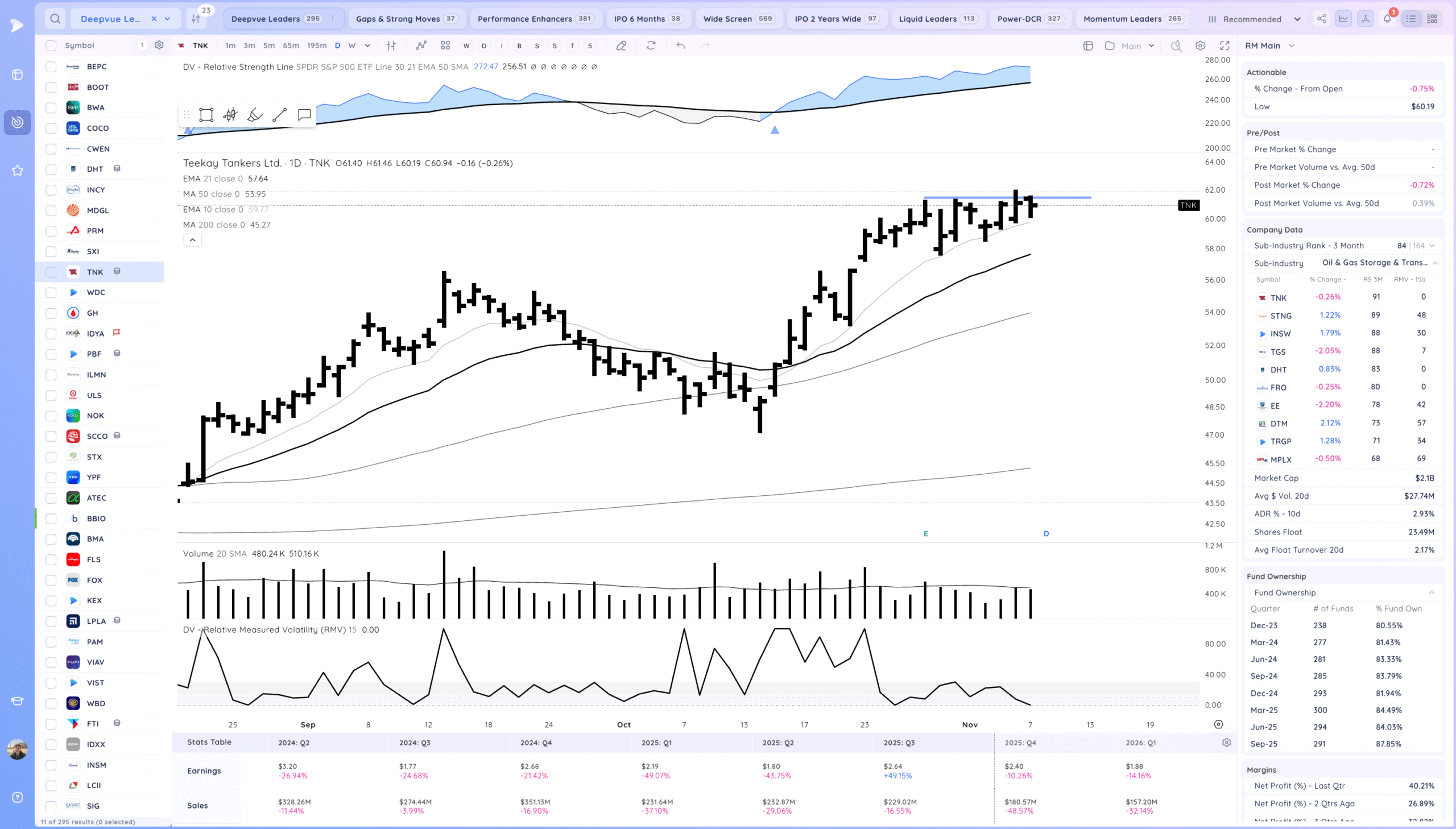

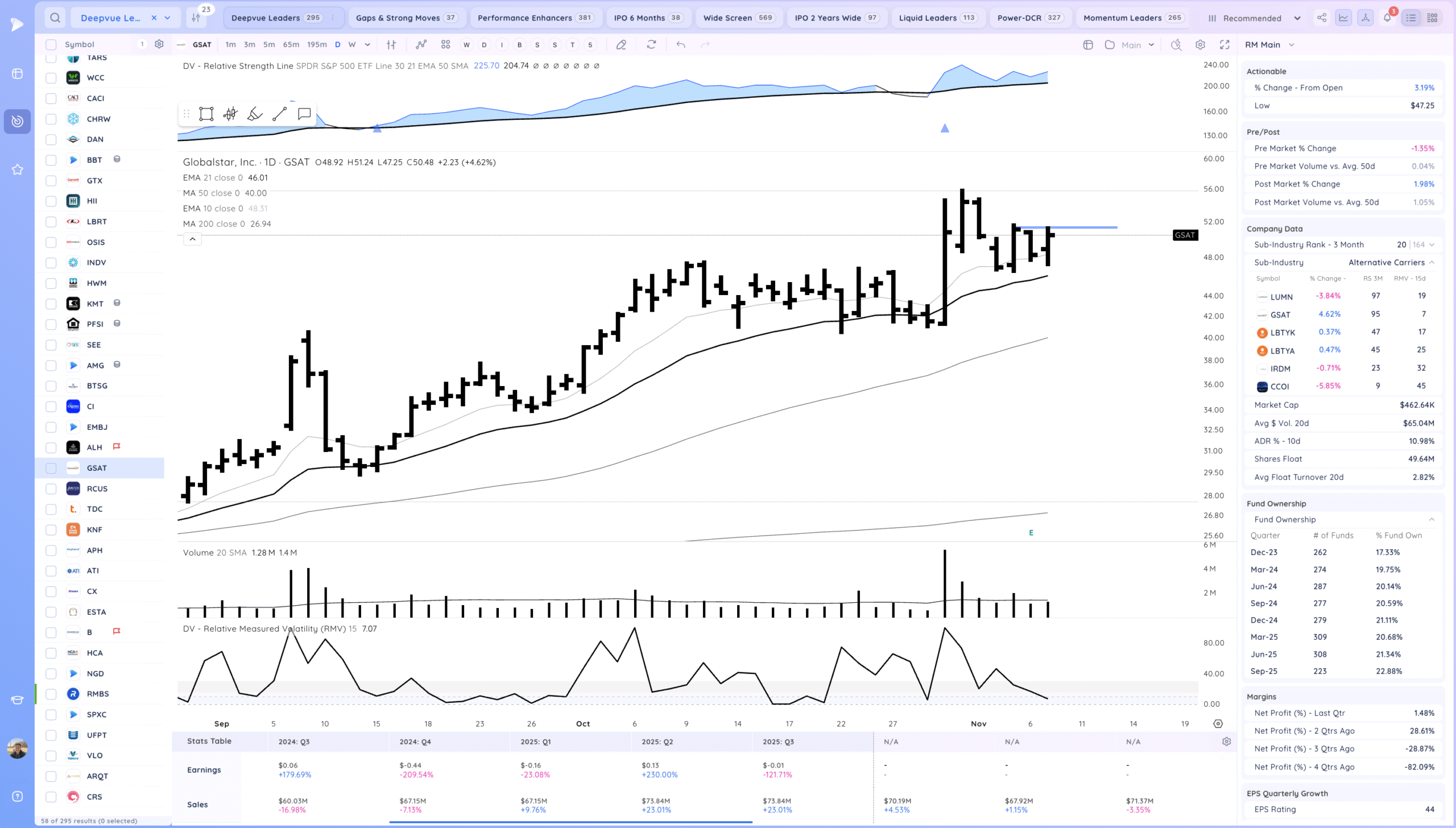

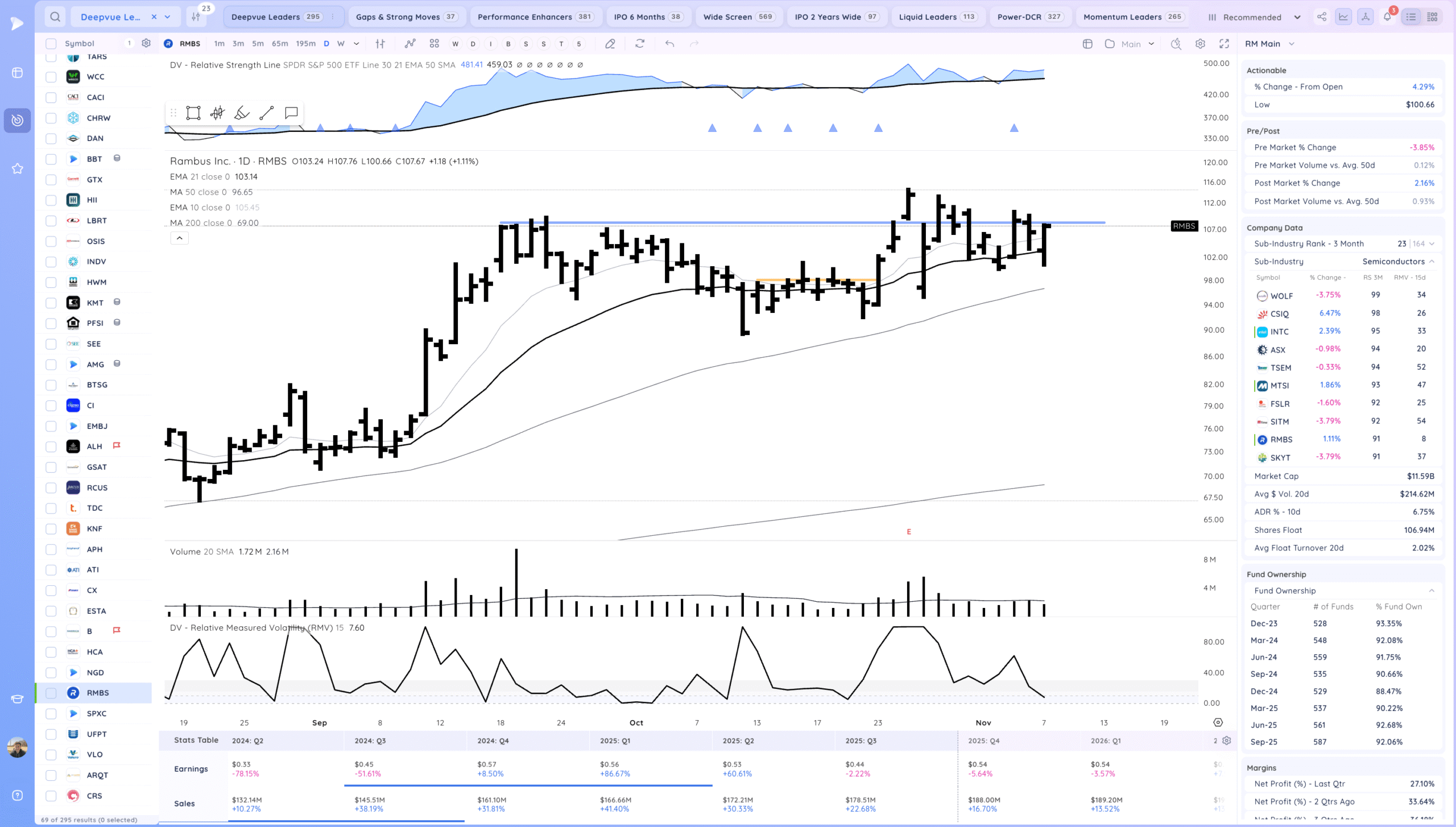

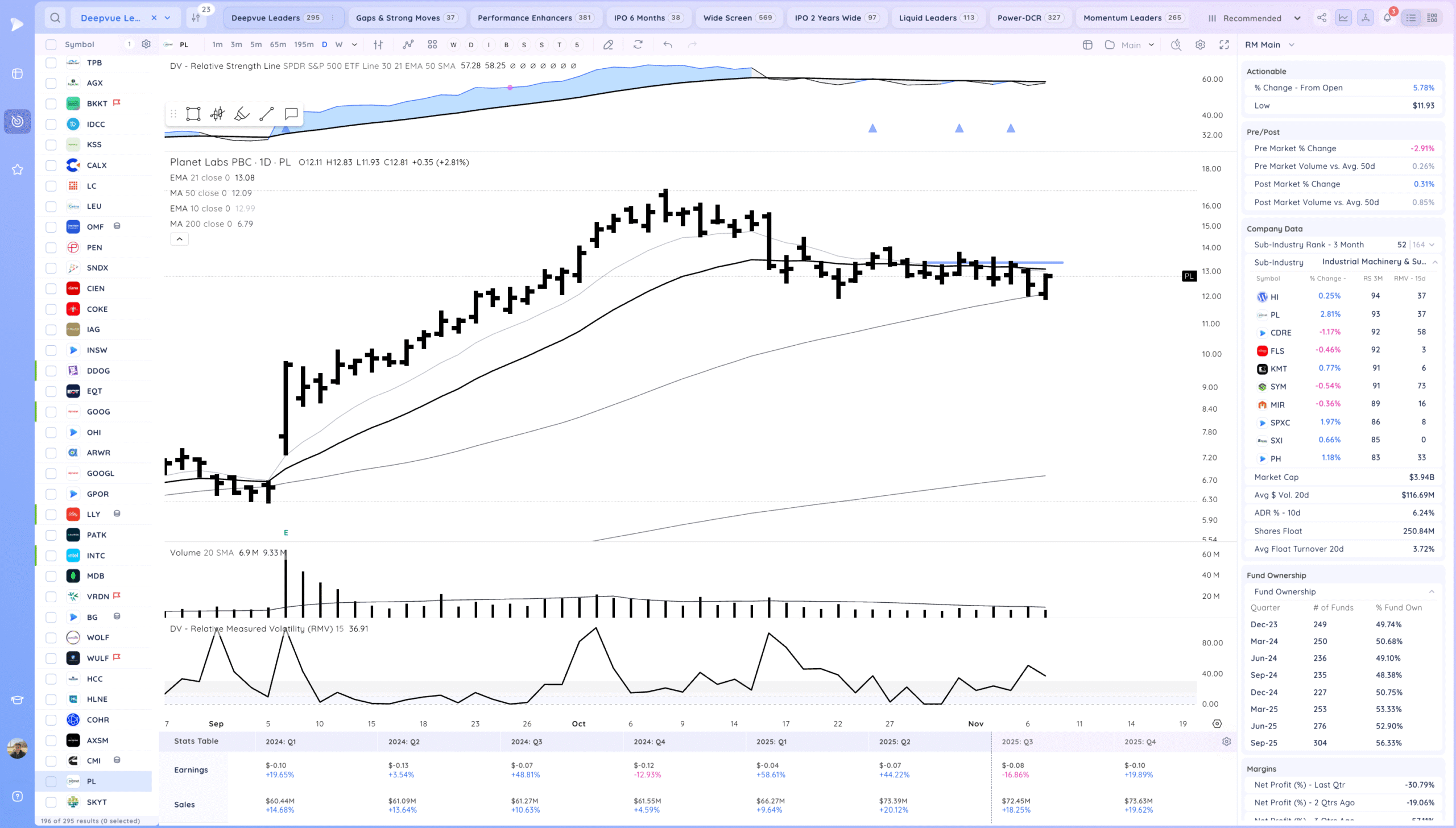

Setups and Watchlist

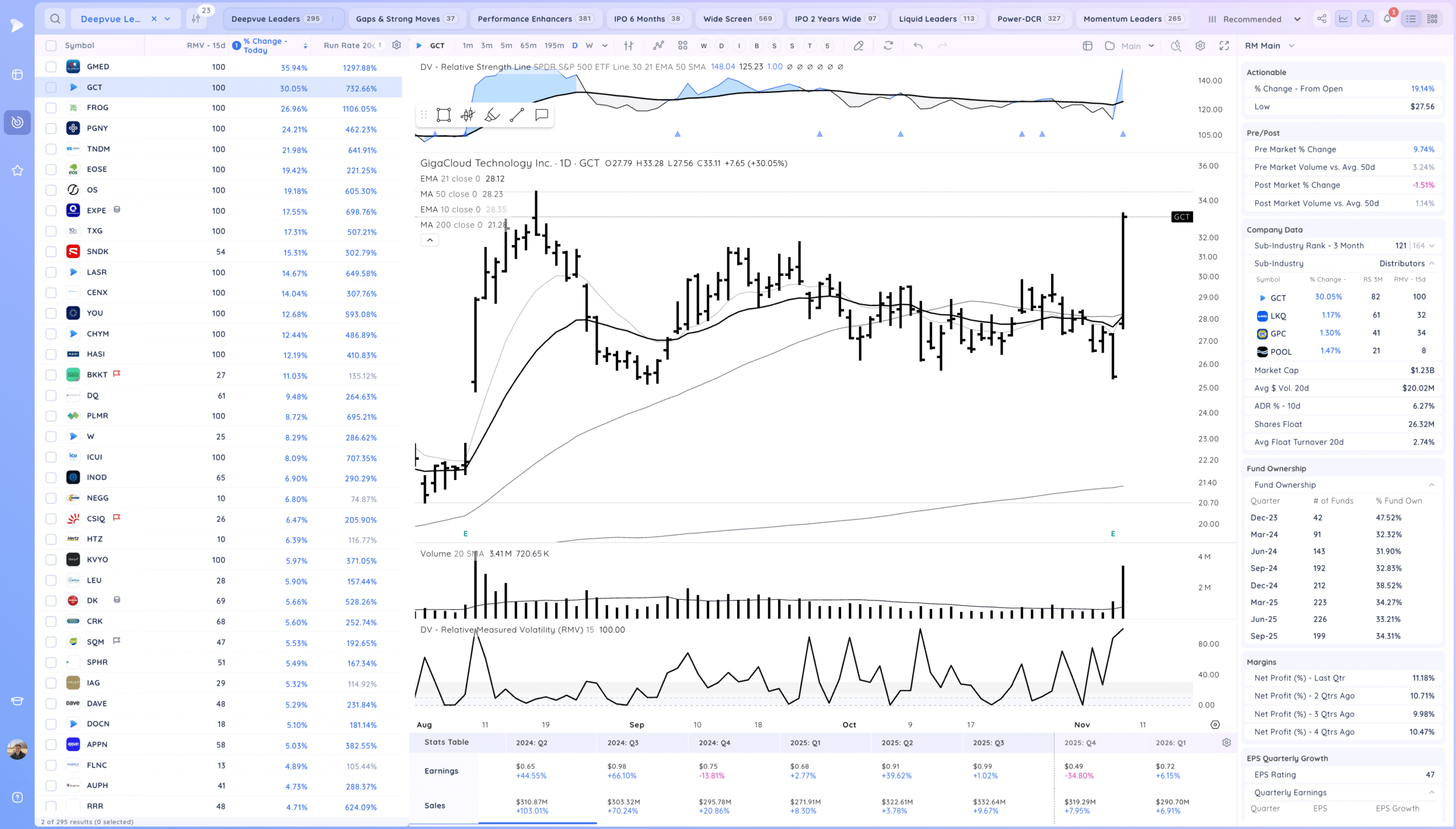

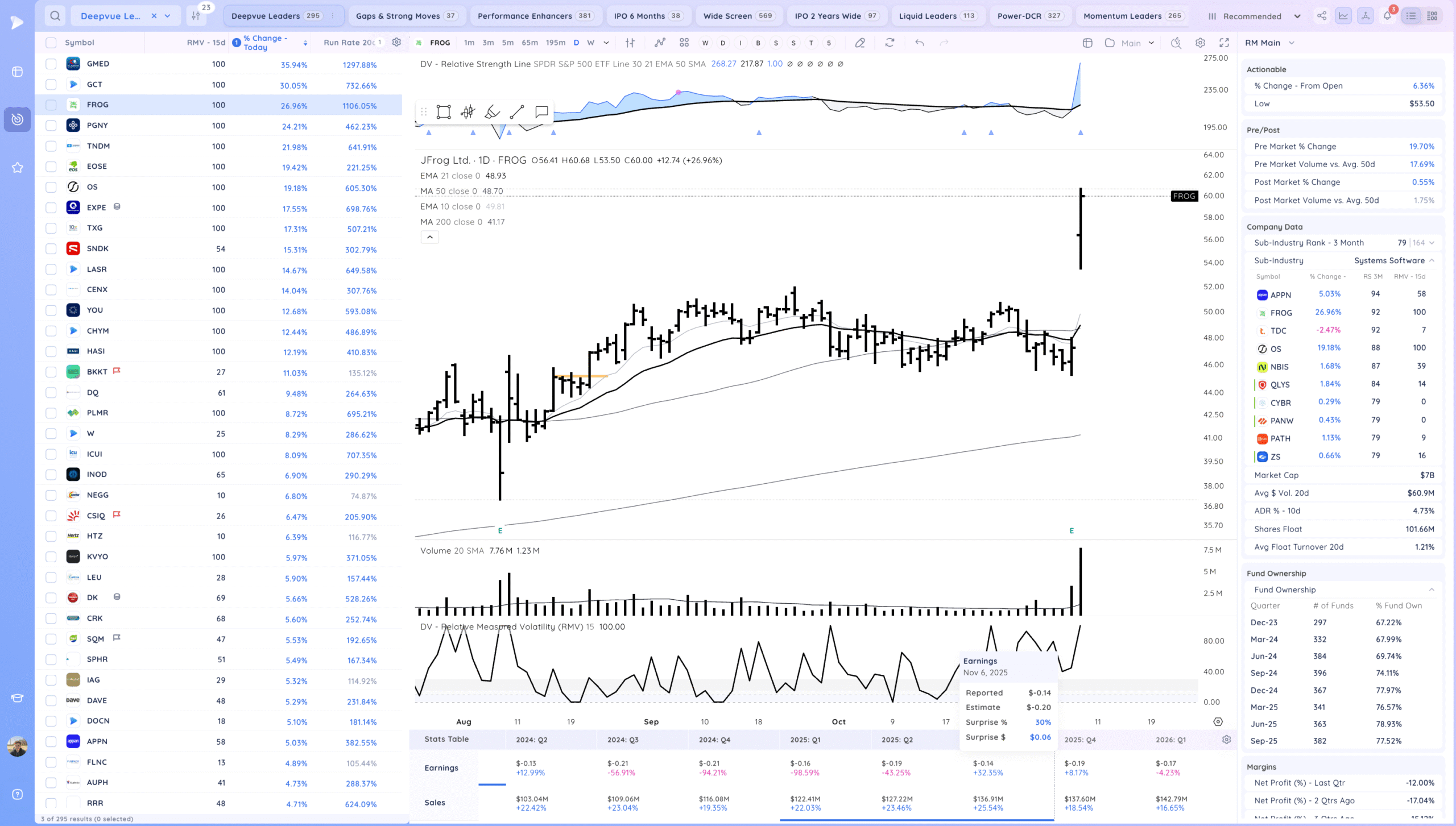

Watchlist & Themes

Today's Watchlist

Daily Focus List

Universe List

Recent Gaps To Watch

Themes to Watch

Additional Thoughts

The expectation is follow through higher early next week. Friday’s lows are key levels to trade against. Seeing lots of recent earnings gappers setting up, how those act next week will be a great tell for the risk appetite.