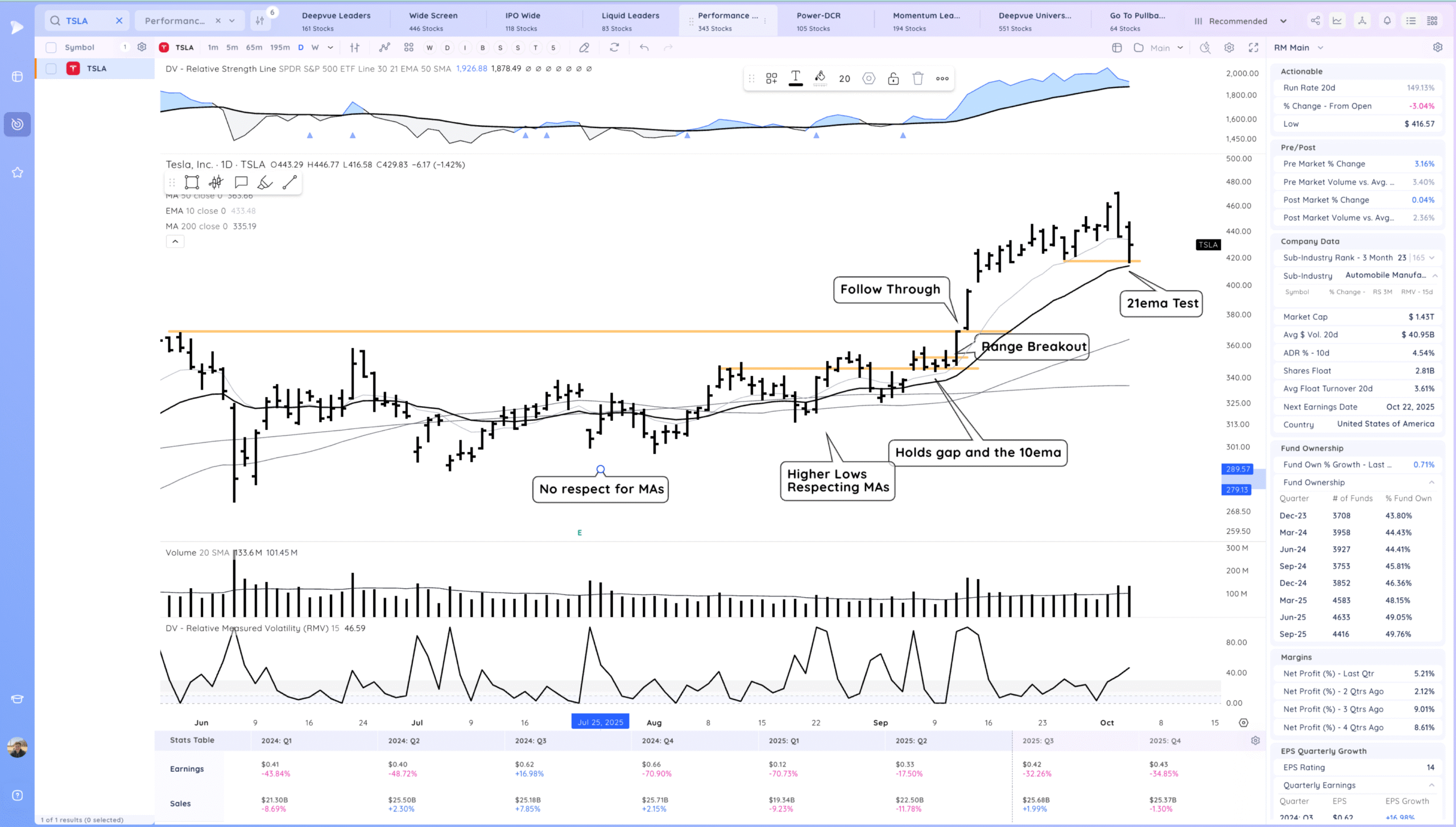

TSLA Pullback into the 21ema

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

October 4, 2025

Market Action

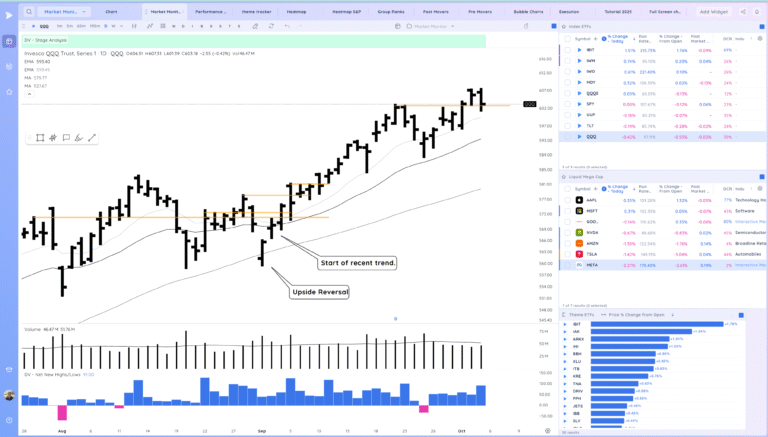

QQQ – This past week we progressed off the 10ema and brok out of the short consolidation. However on Friday we pulled in and tested the pivot. Overall we continue to trend above the moving averages. We are about 5 weeks weeks into the current uptrend.

Bulls want to see a continued trend higher/constructive range sideways

Bears want to see a sharp drop lower testing the 10ema

Daily Chart of the QQQ.

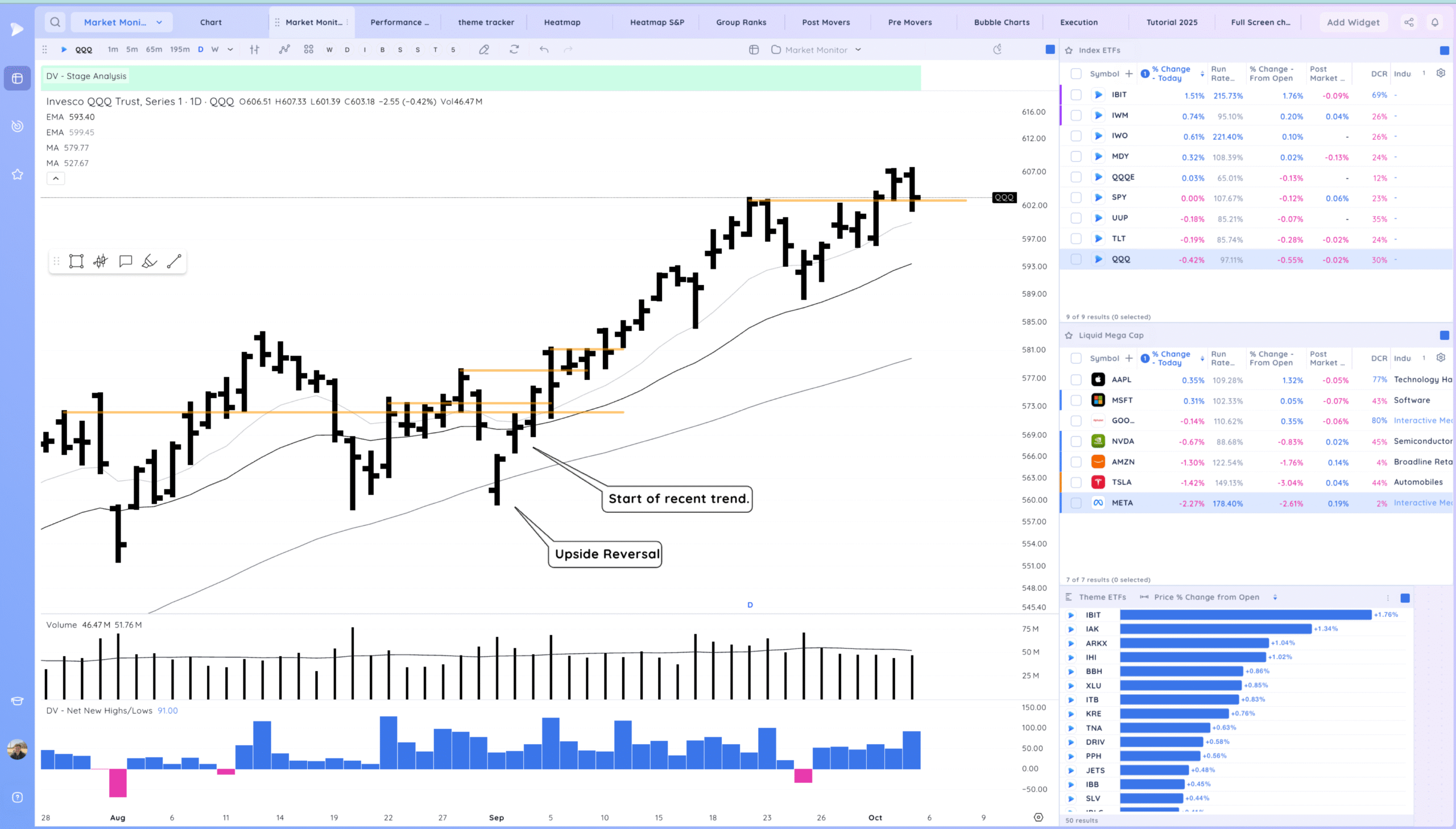

IWM – Fade to end a good week which pushed off the 10ema

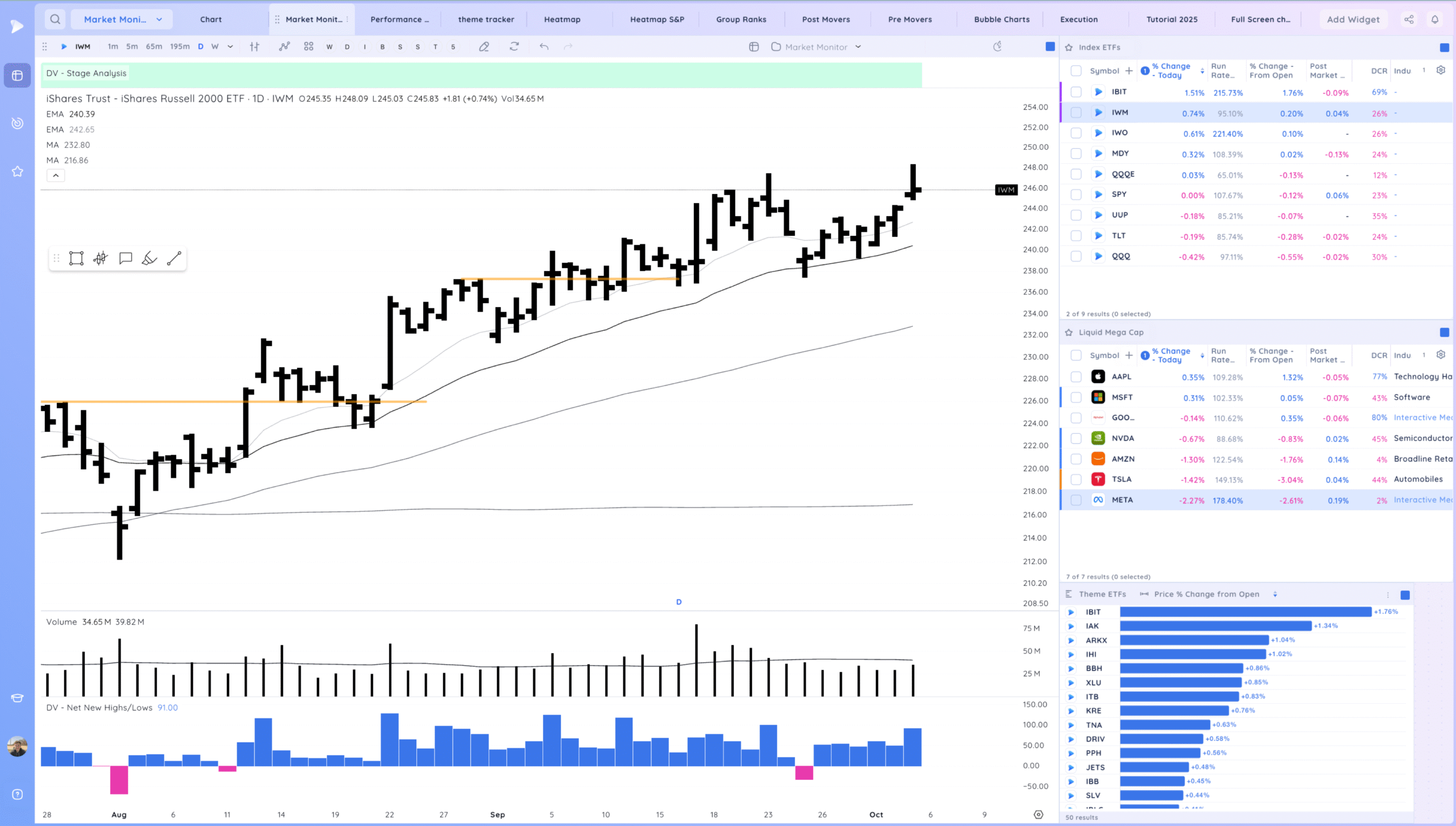

IBIT – Continued expansion. This has been a very strong move. Expecting it to continue to trend although it may need to consolidate a bit first.

Trends (4/4 Up) – Based on the QQQ

Shortest – 10 Day EMA – Above

Short-term – 21 ema – Above

Intermediate term – 50 sma – Above Rising

Longterm – 200 sma – Up – Above Rising

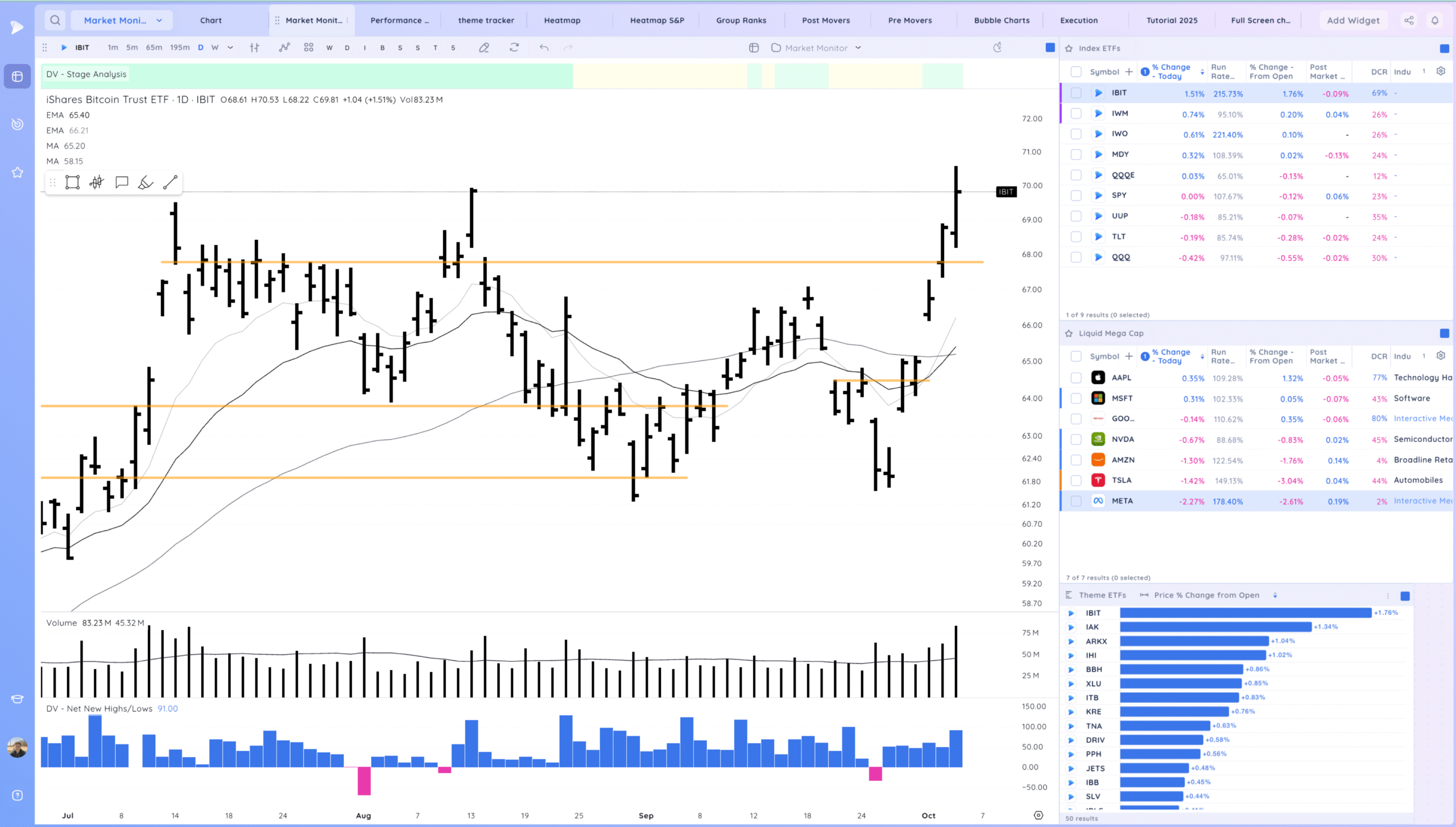

Groups/Sectors

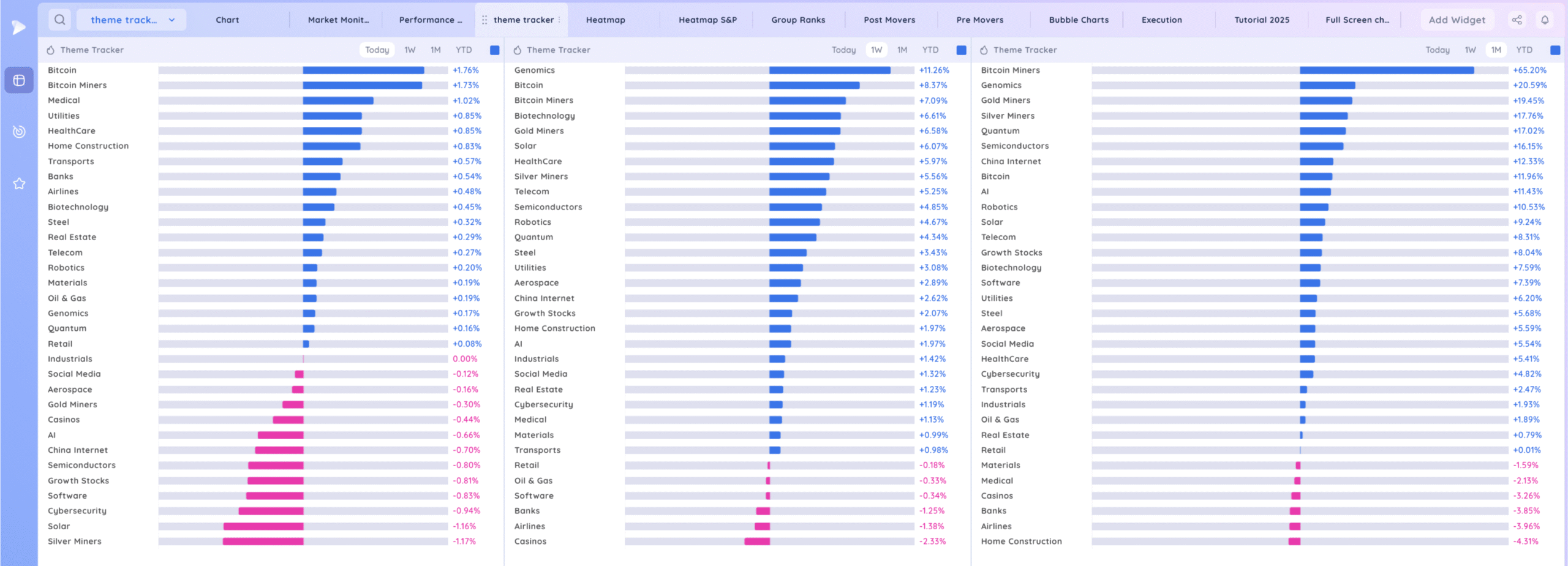

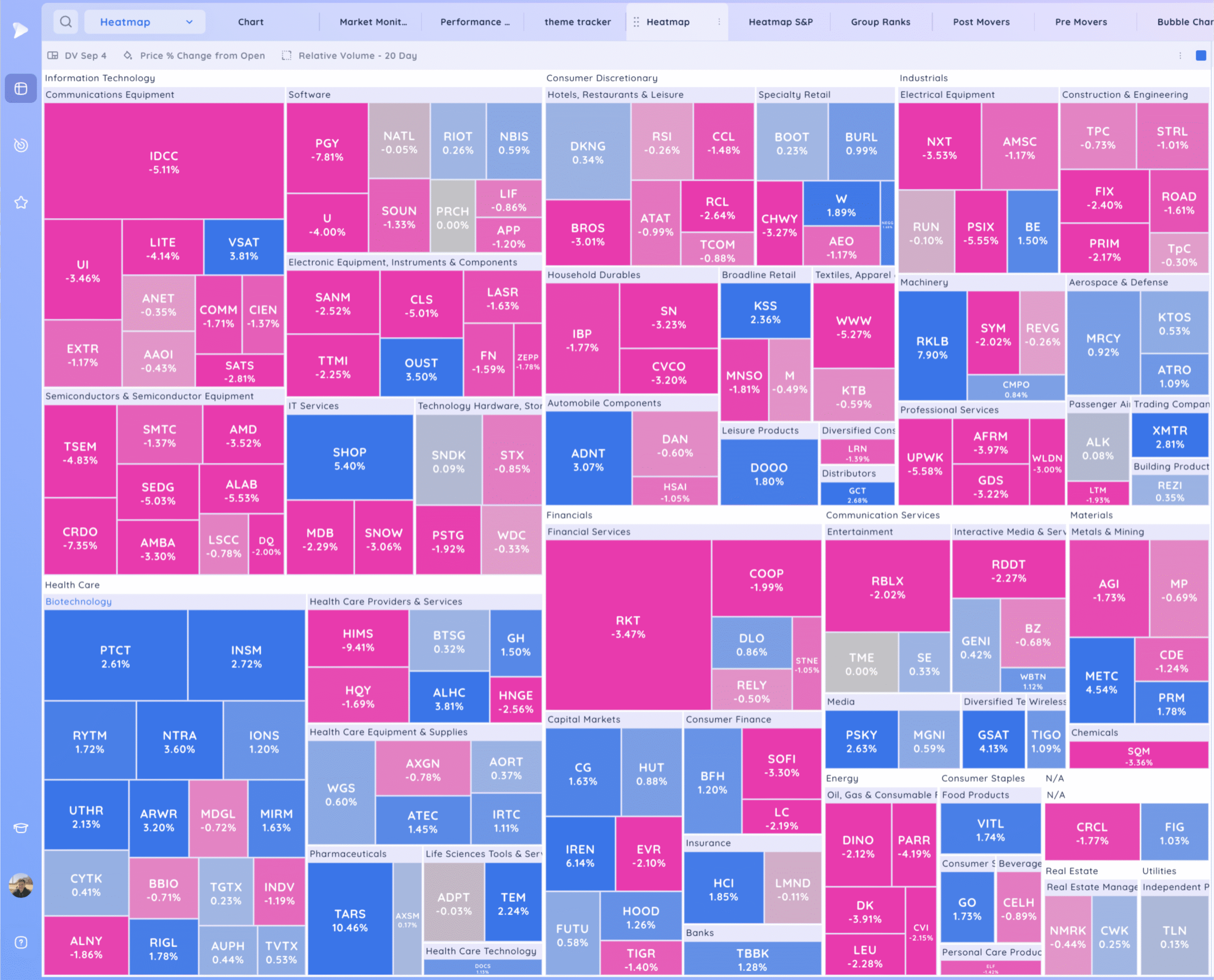

Deepvue Theme Tracker

Deepvue Leaders

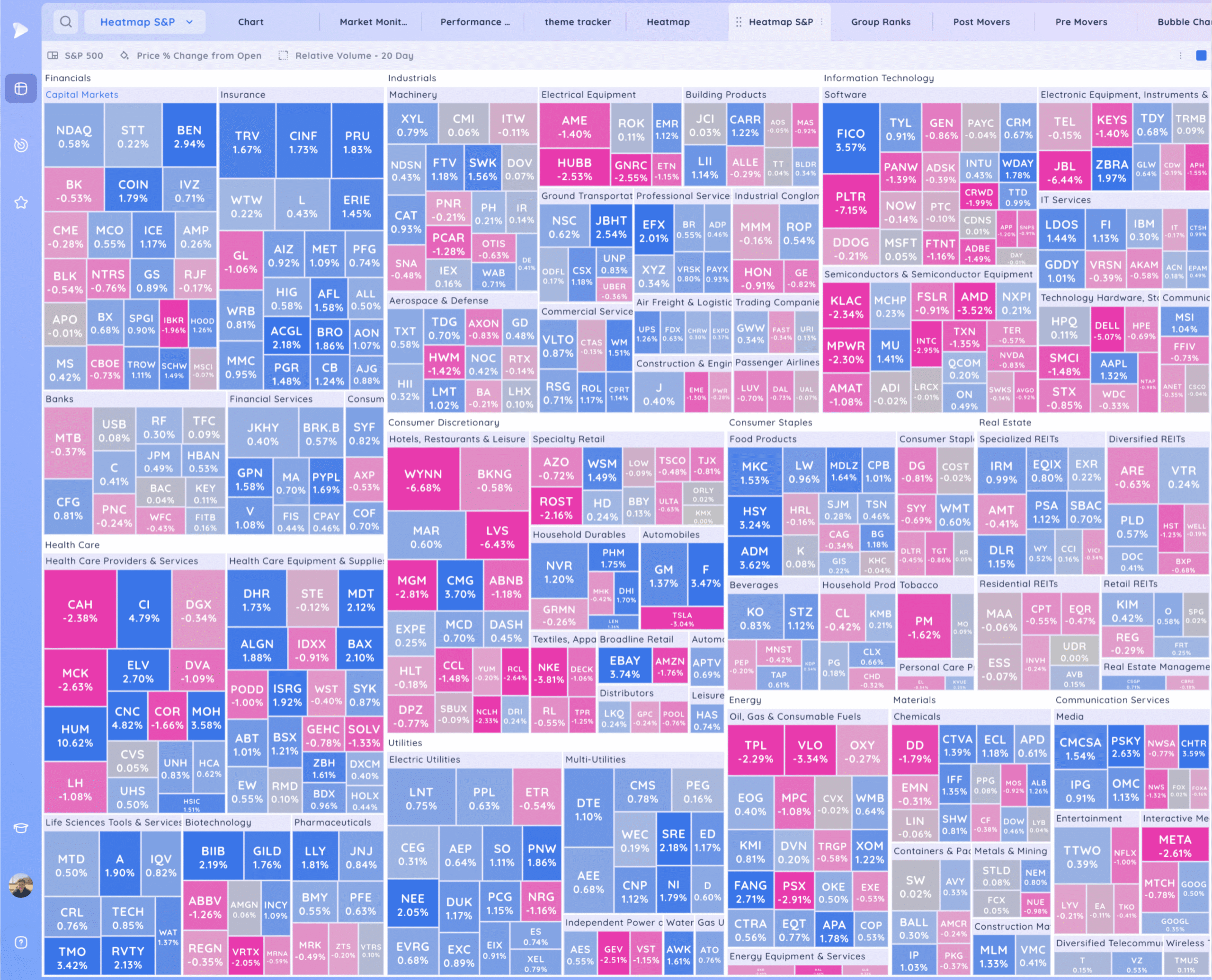

S&P 500.

Leadership

TSLA Sharp pullback to the 21ema to end the week. Decent bounce friday. Ideally sets up a price shelf here and tightens again above the 21ema

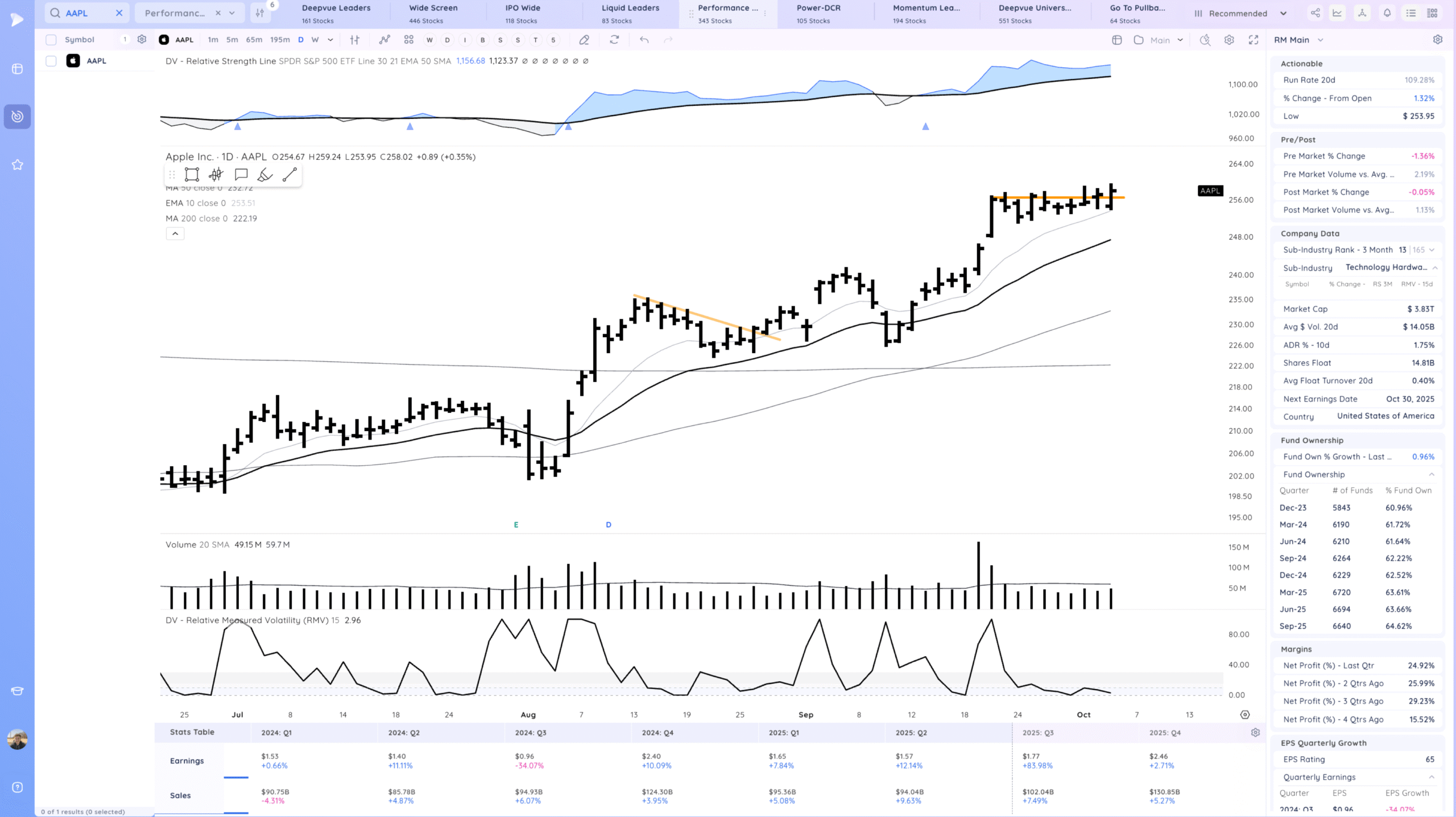

AAPL Trying to push out of this price shelf to end the week

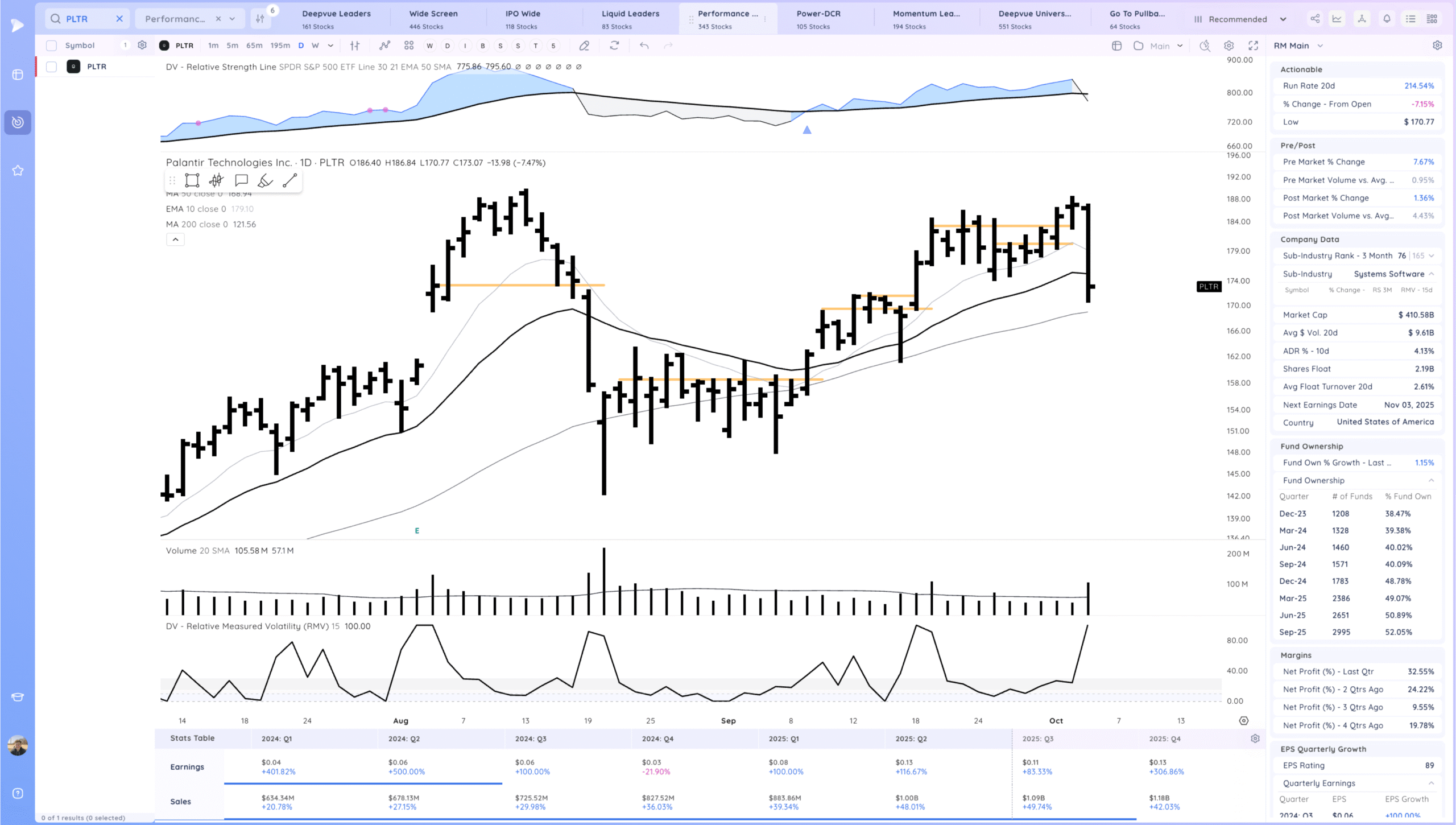

PLTR Sharp pullback on some news to end the week. Certainly something to take note of as this later in this stocks longer term trend.

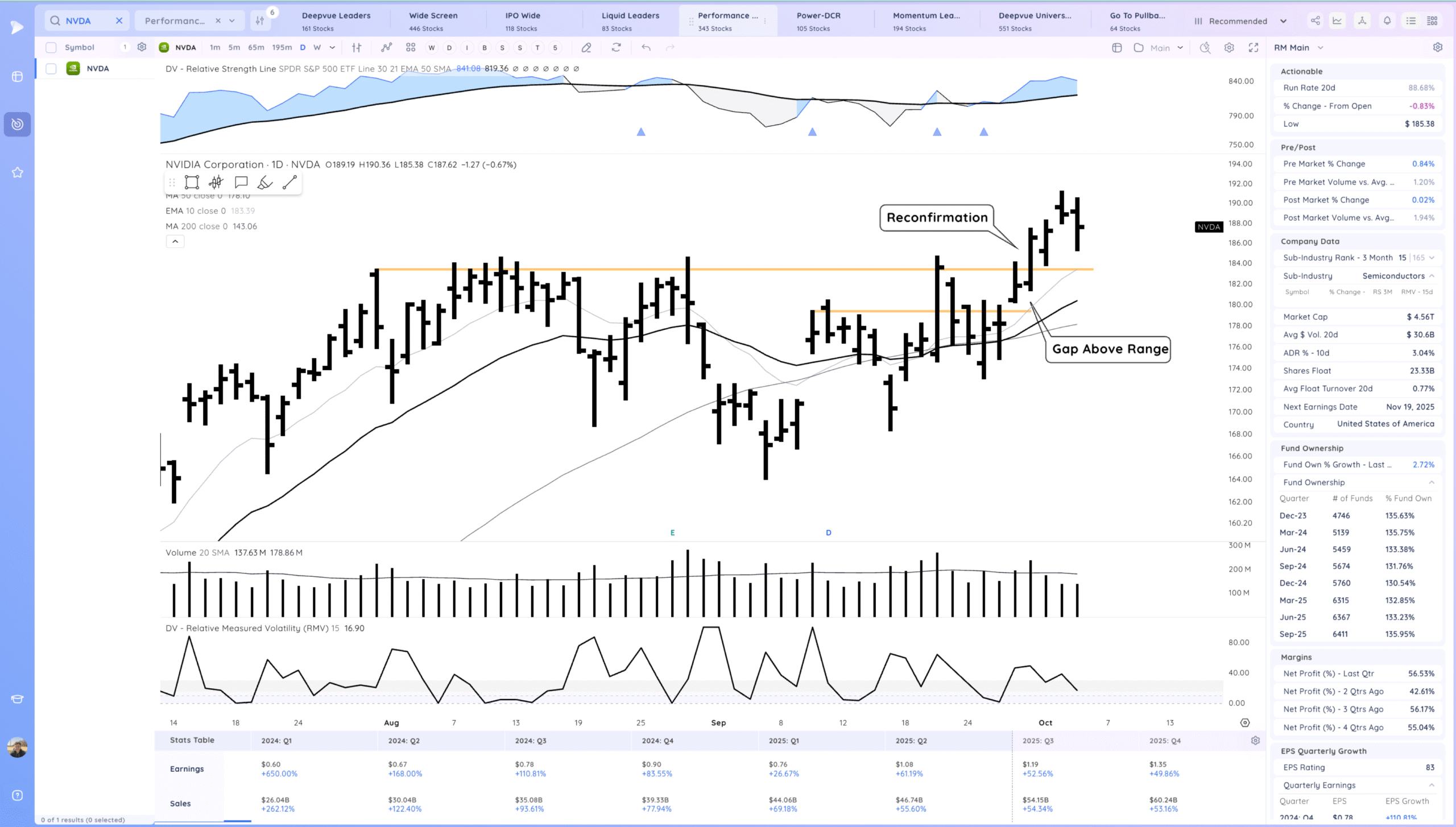

NVDA Base breakout on tuesday. Not too much follow through but holding above the pivot and 10ema. Ideally reconfirms higher and begins a trend. A base breakout failure would be a negative sign for the AI theme

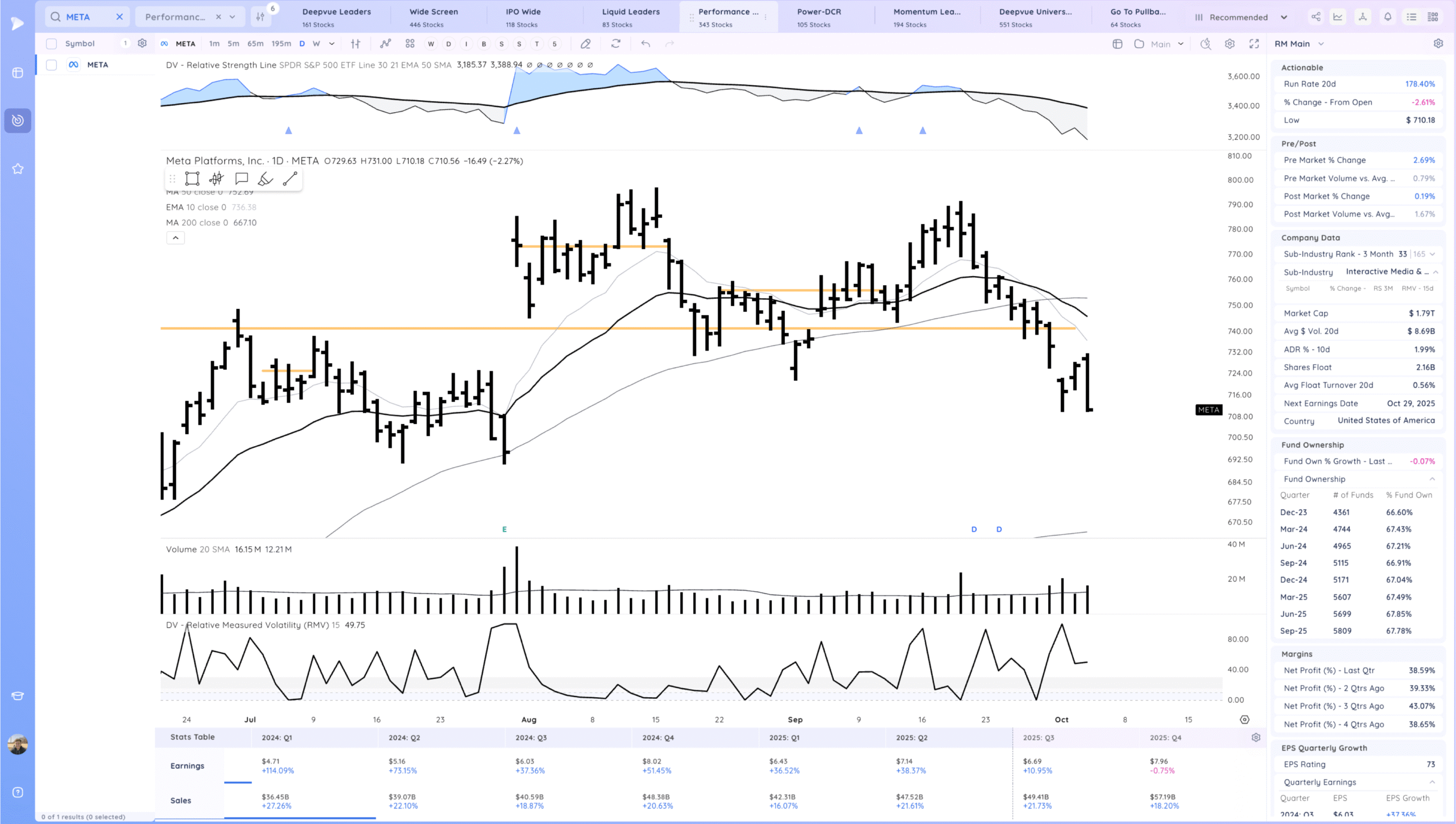

META Weak, trending below the moving averages.

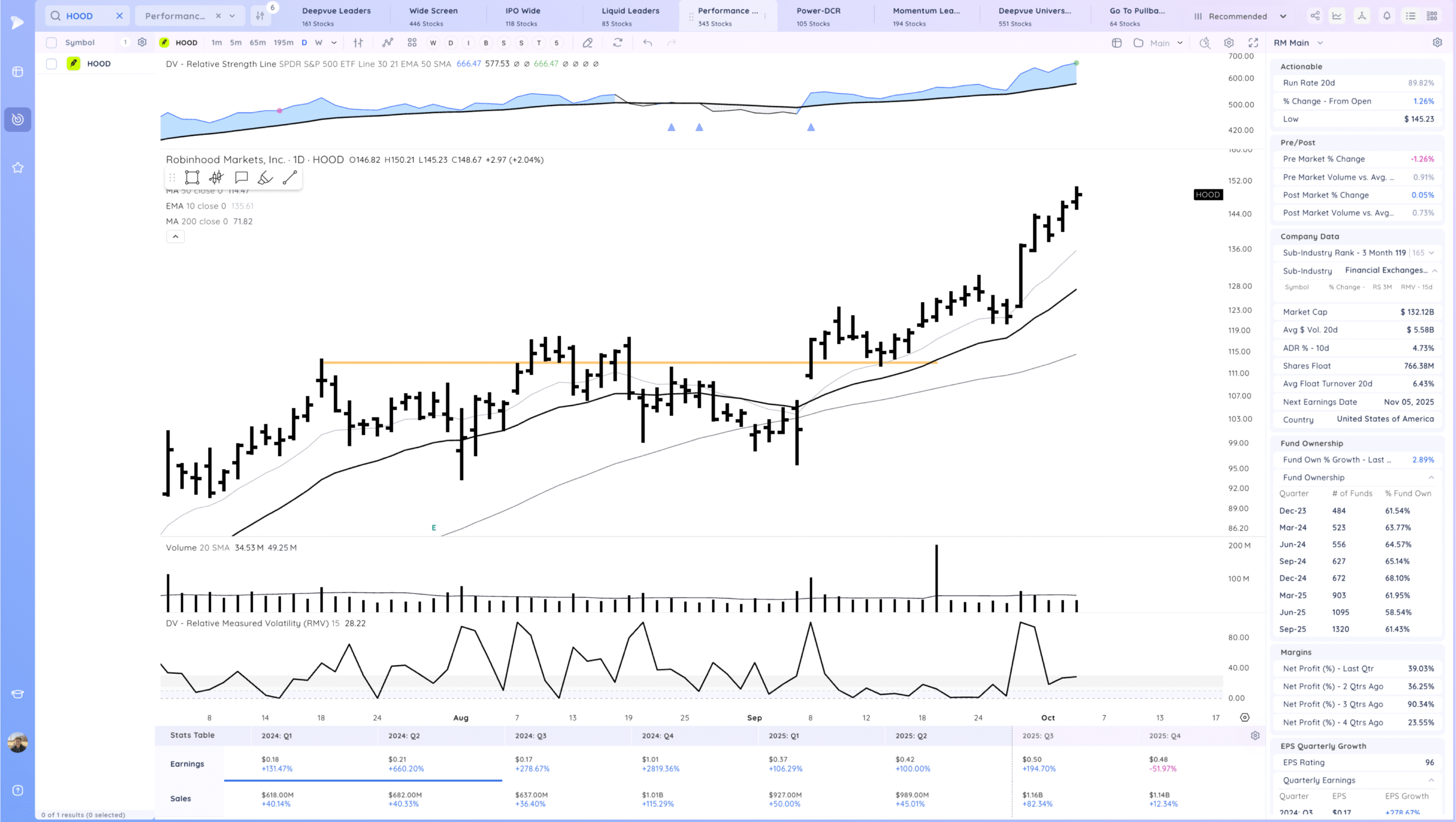

HOOD Strong action monday and continuing to trend above the MAs

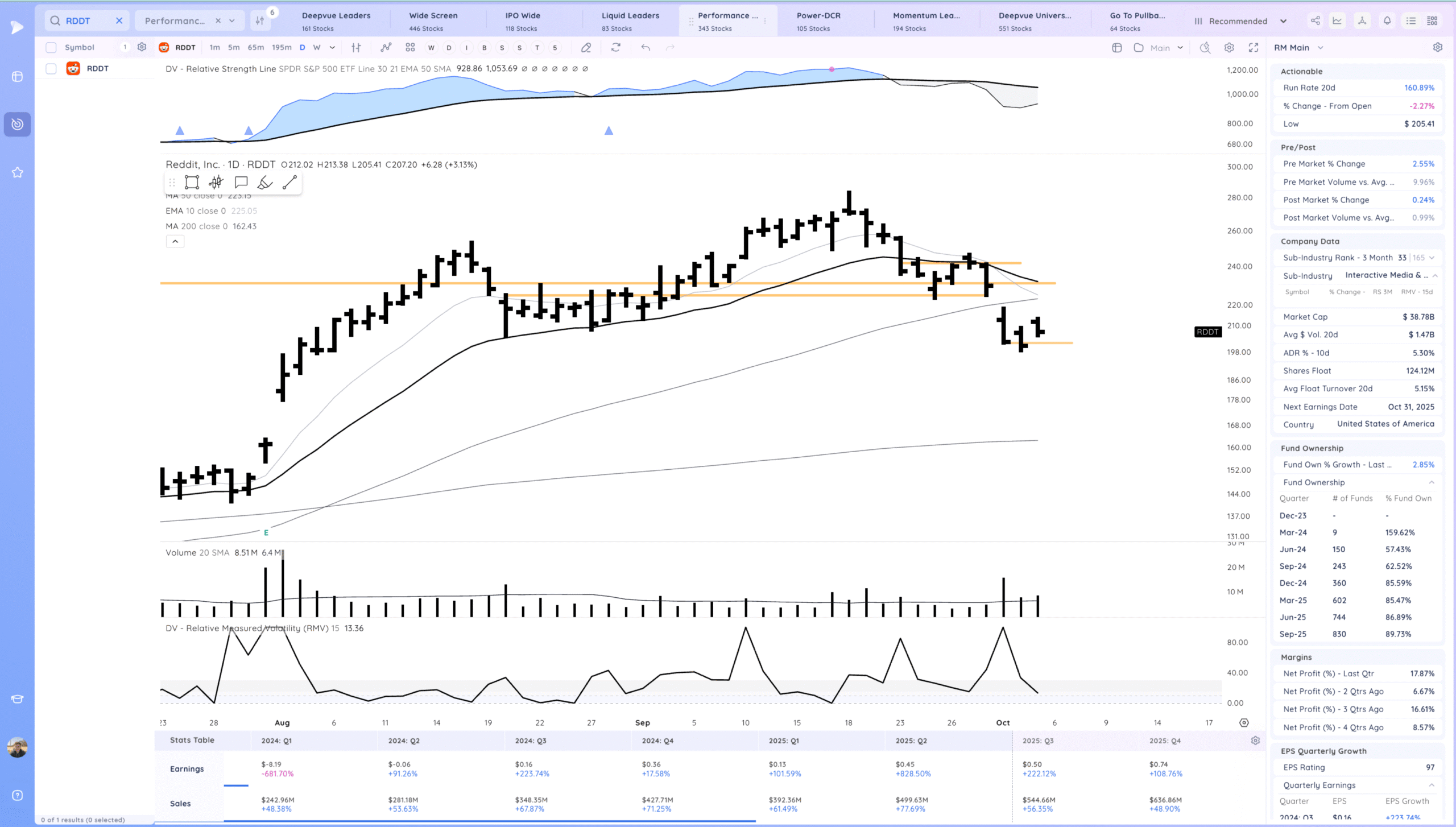

RDDT Some news impacts on it’s influence within the AI theme last week. Unfilled gap down, below the moving average. In a short term downtrend currently

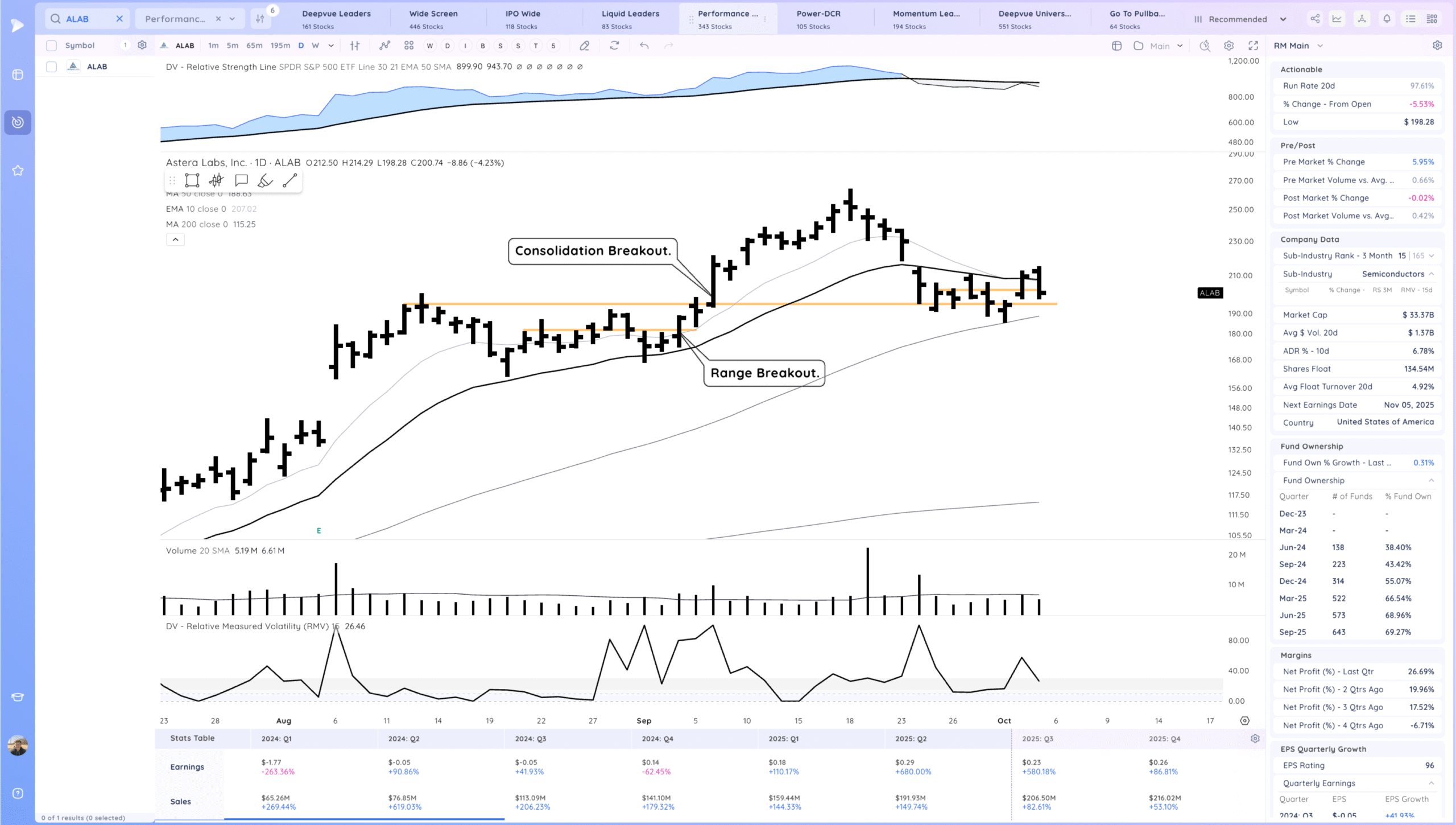

ALAB Good action off the 50sma. Downside reversal friday to end the week at the 21ema

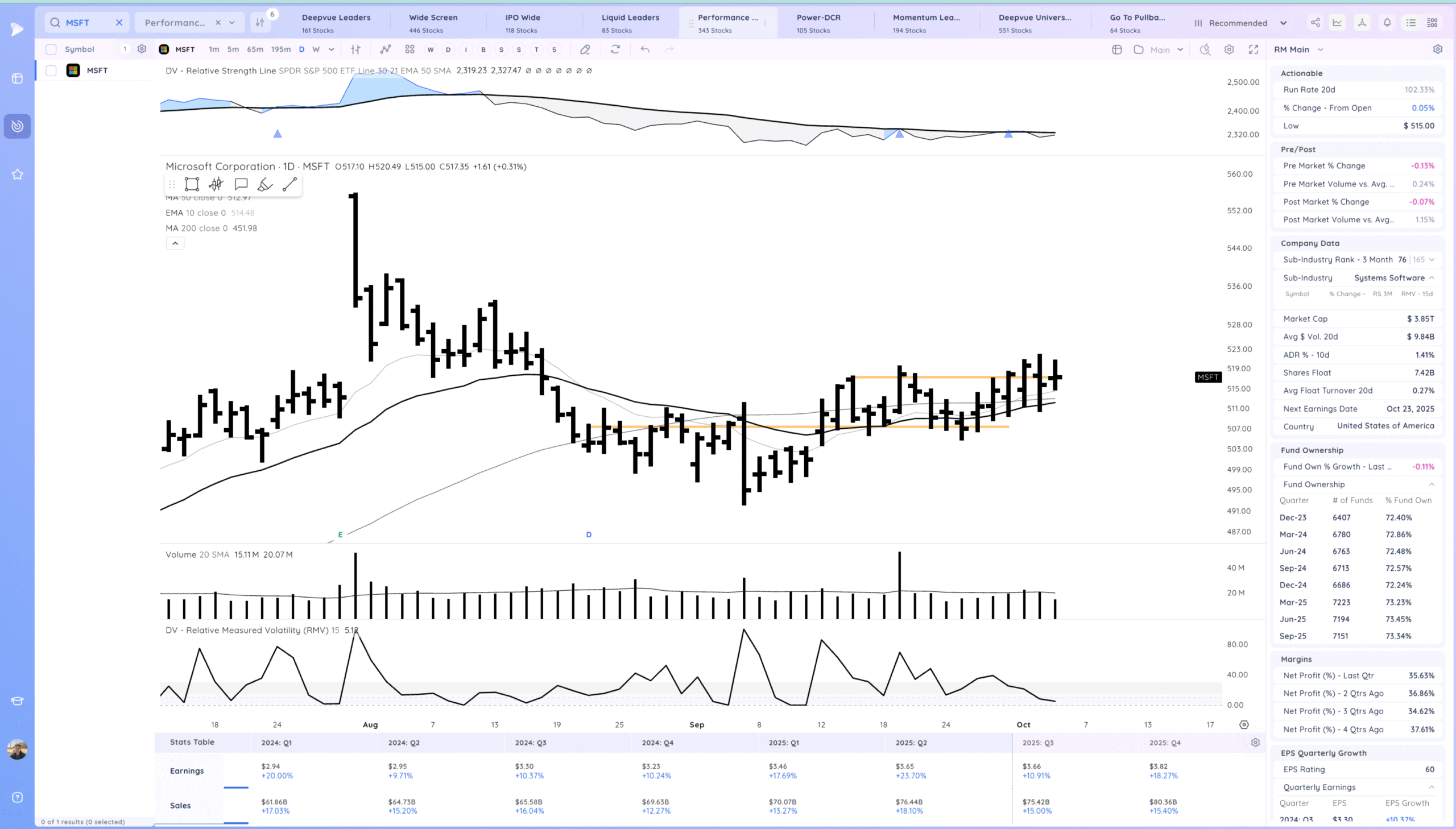

MSFT Tight day friday at the pivot. Expecting expansion this week

Key Moves

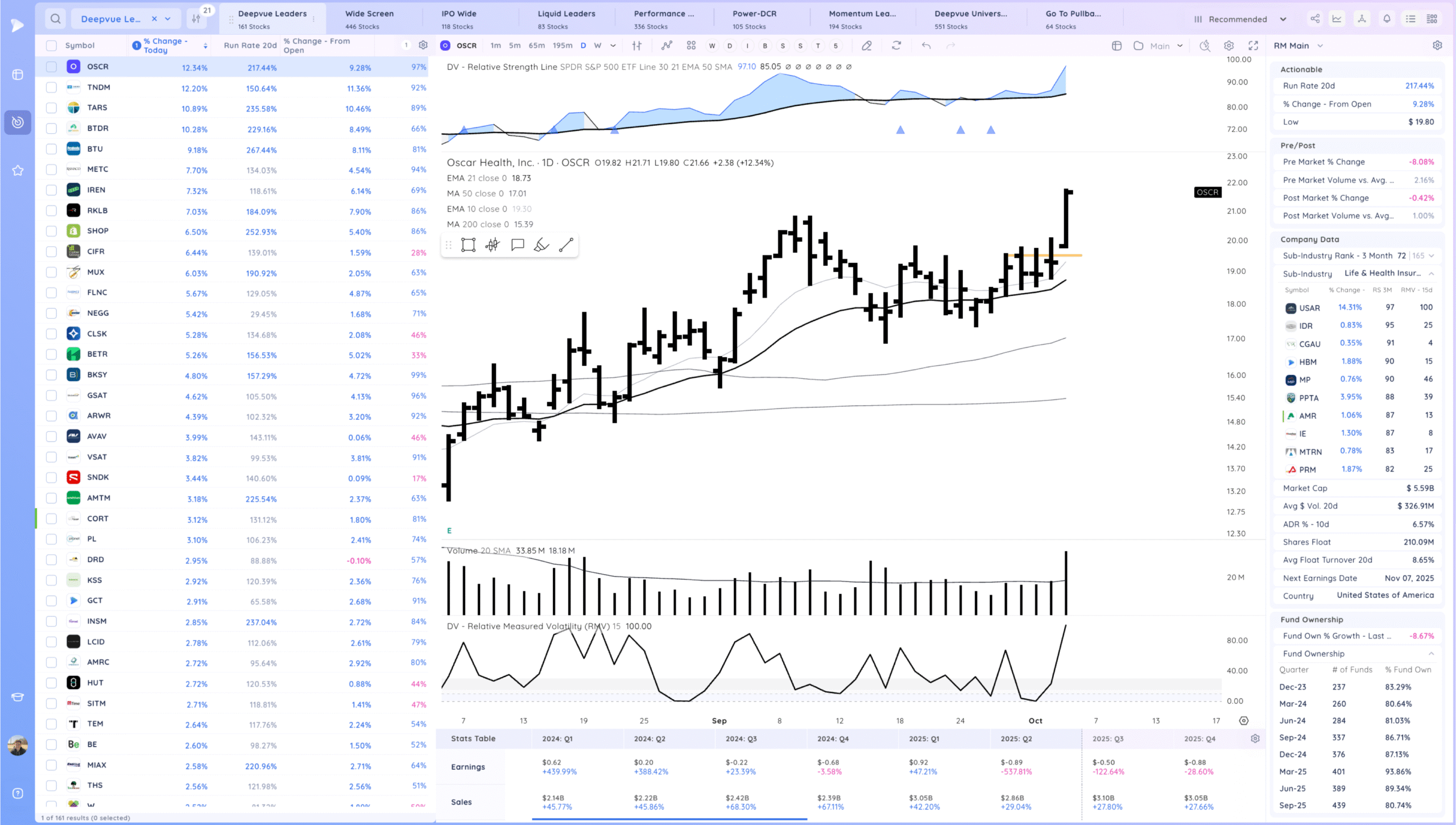

OSCR range breakout friday. In a larger base going back to May 2024

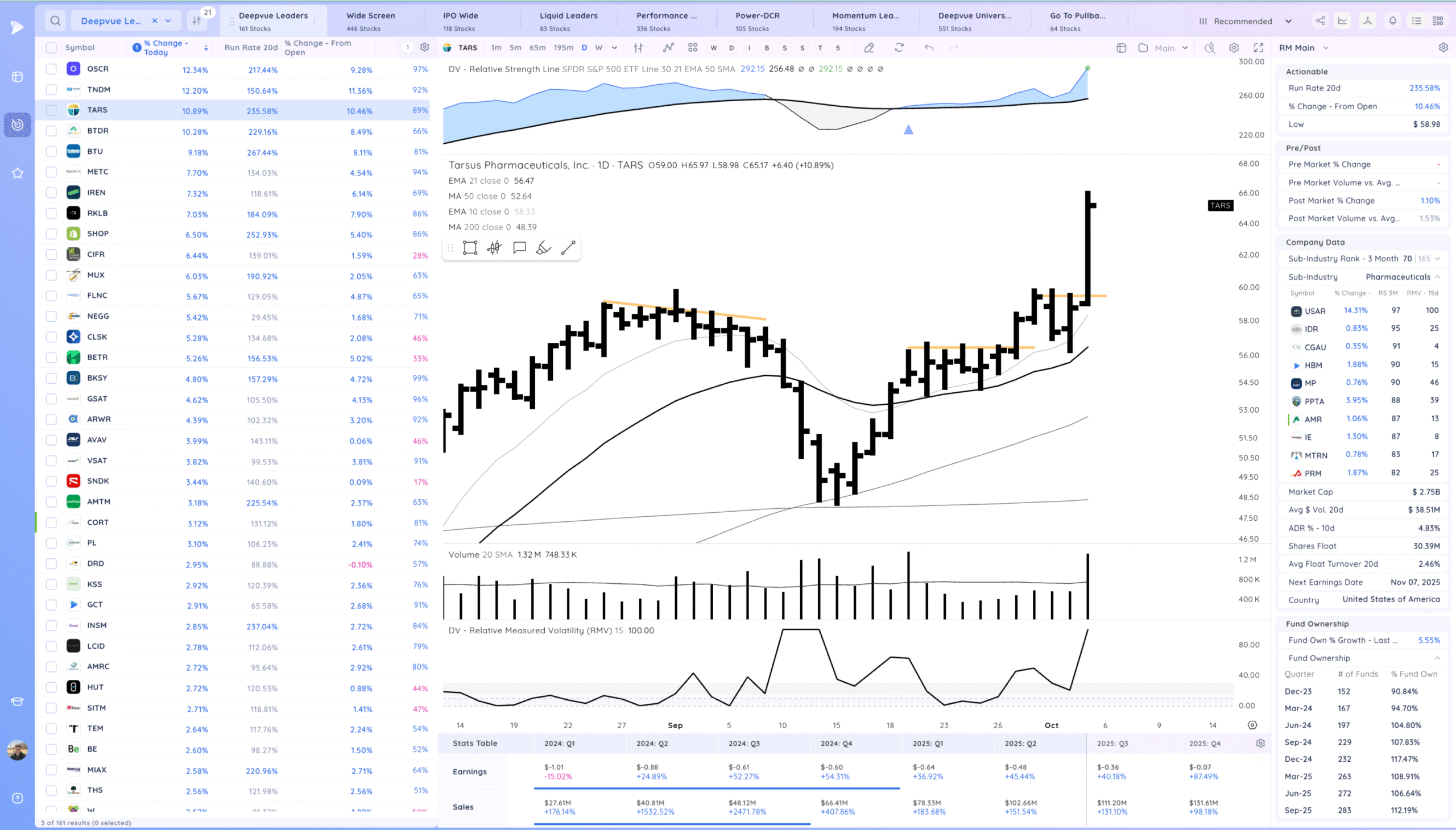

TARS reconfirmation

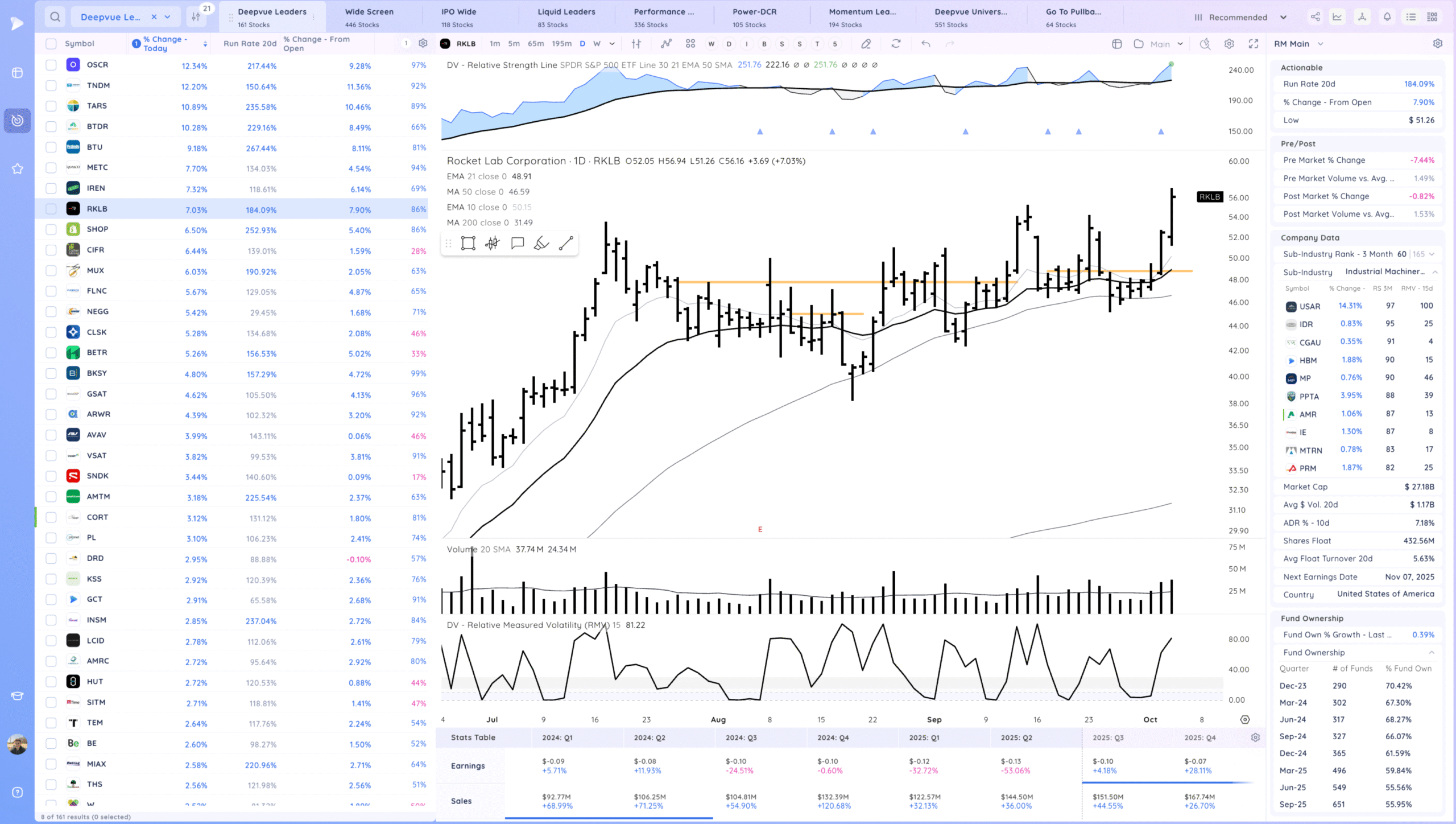

RKLB following through

Setups and Watchlist

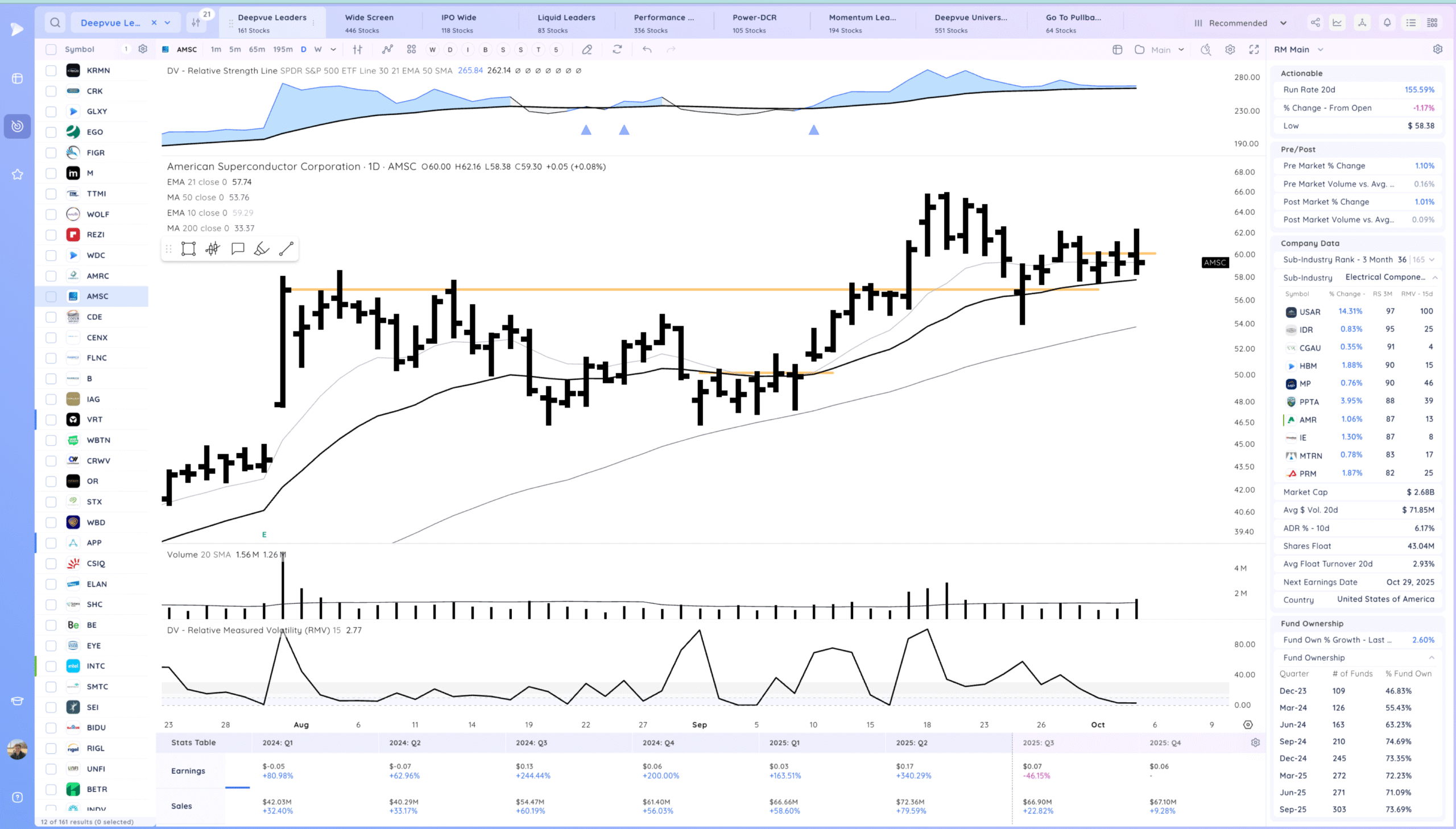

AMSC watching for a range re-breakout

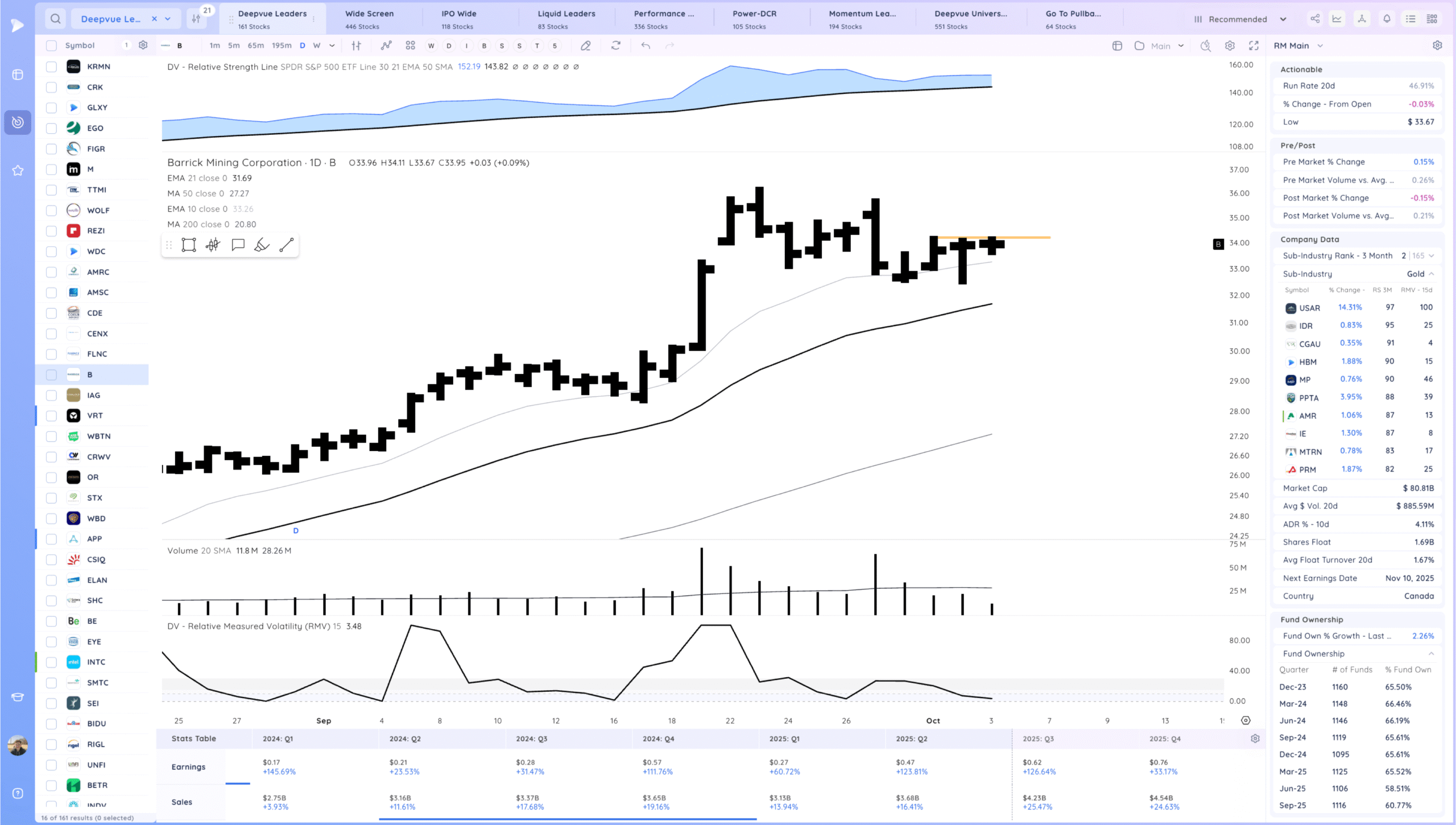

B mining theme. Watching for a range breakout. Swing trade setup

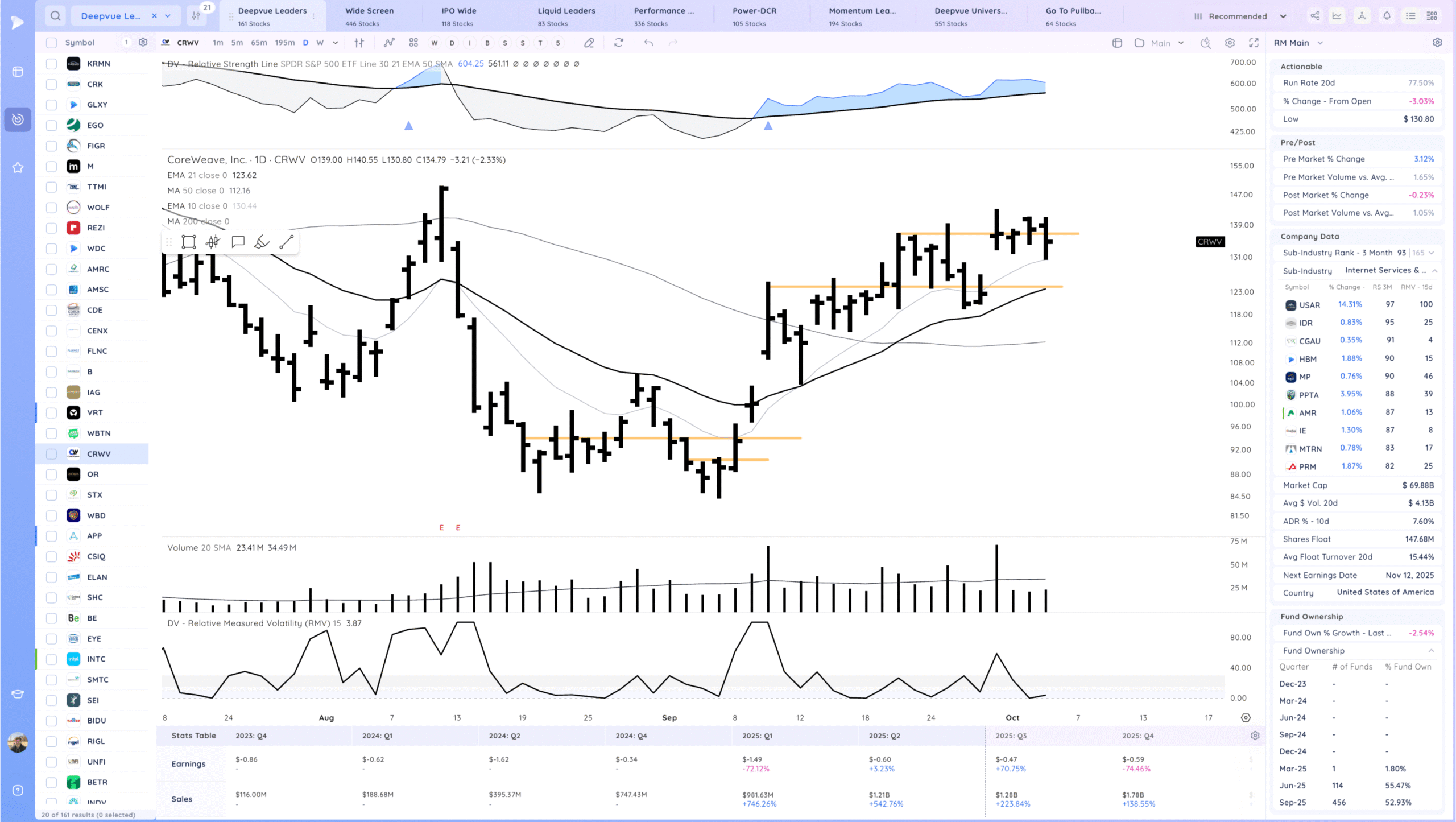

CRWV watching for a range re-breakout through the pivot

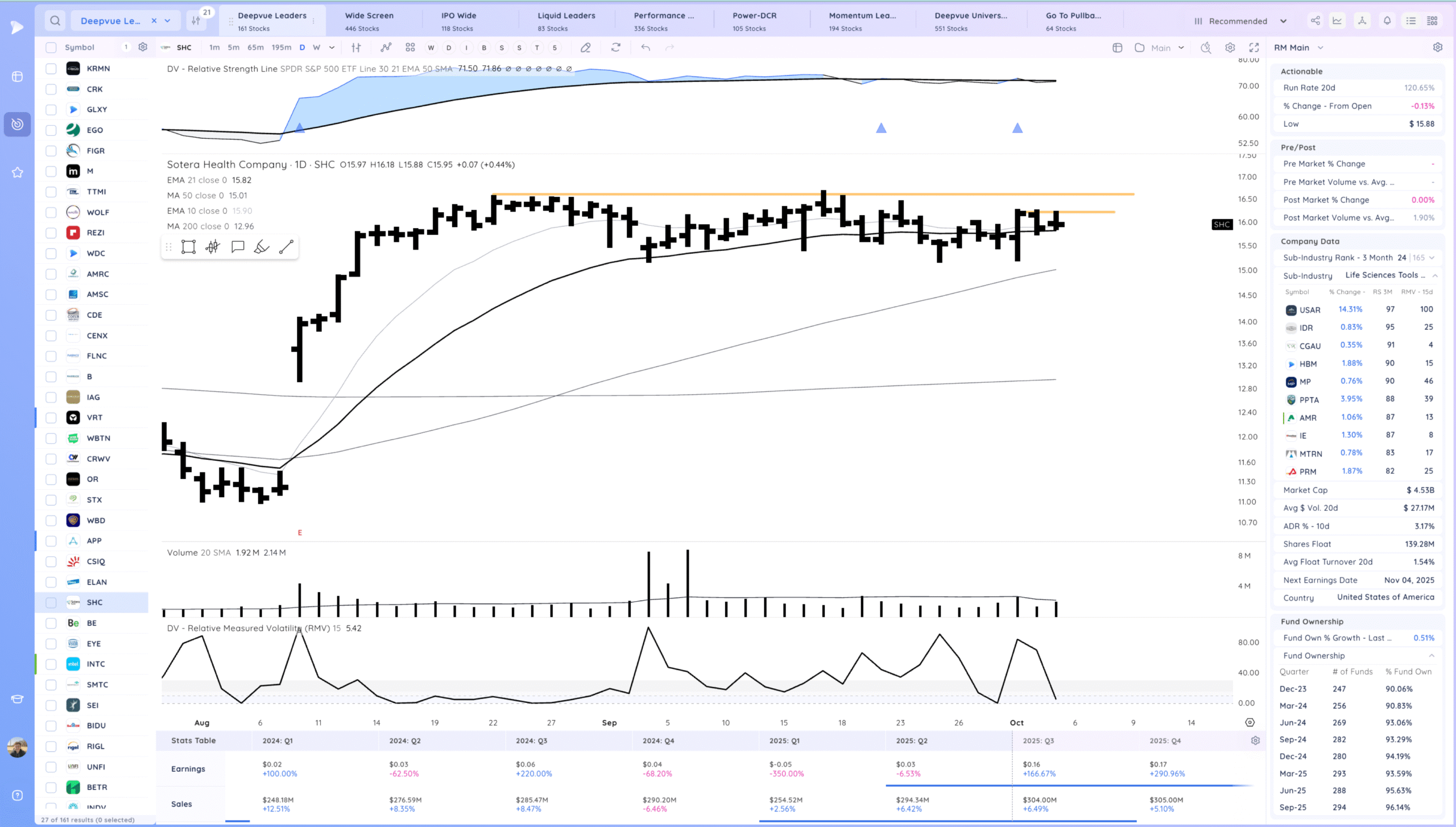

SHC watching for a range breakout

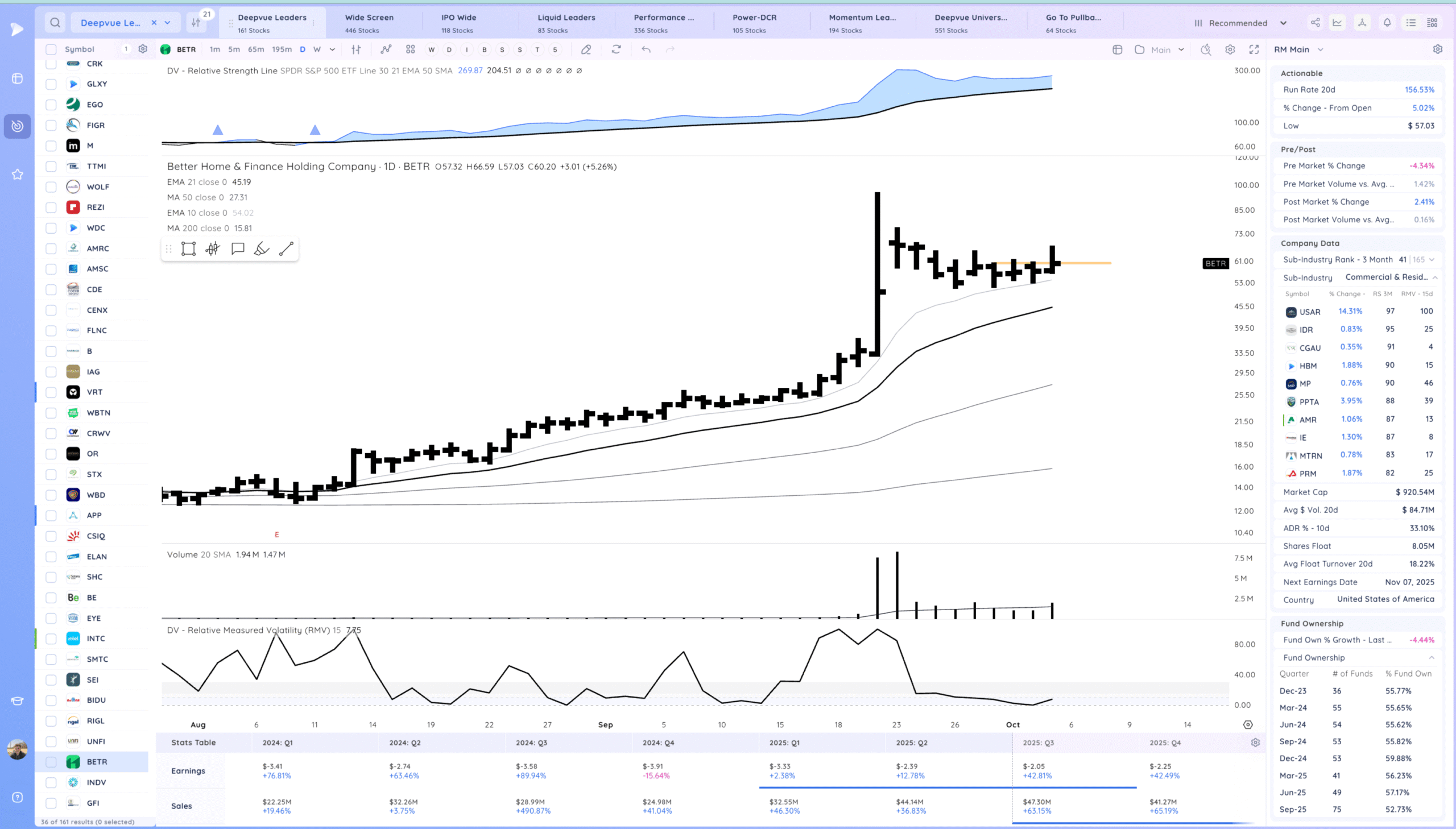

BETR fade friday back to the pivot, watching for follow through up. Extremely fast mover

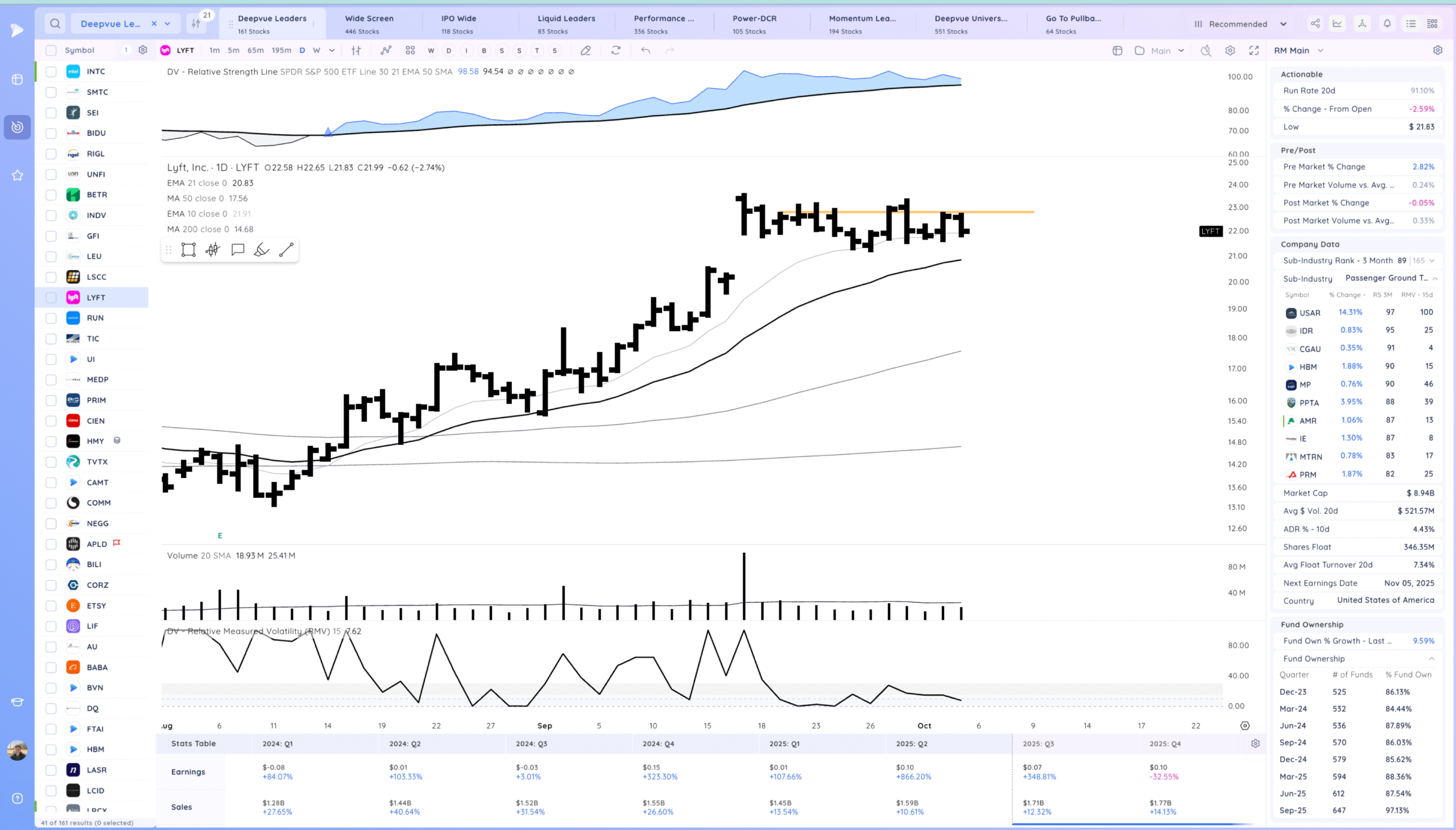

LYFT watching for a range breakout

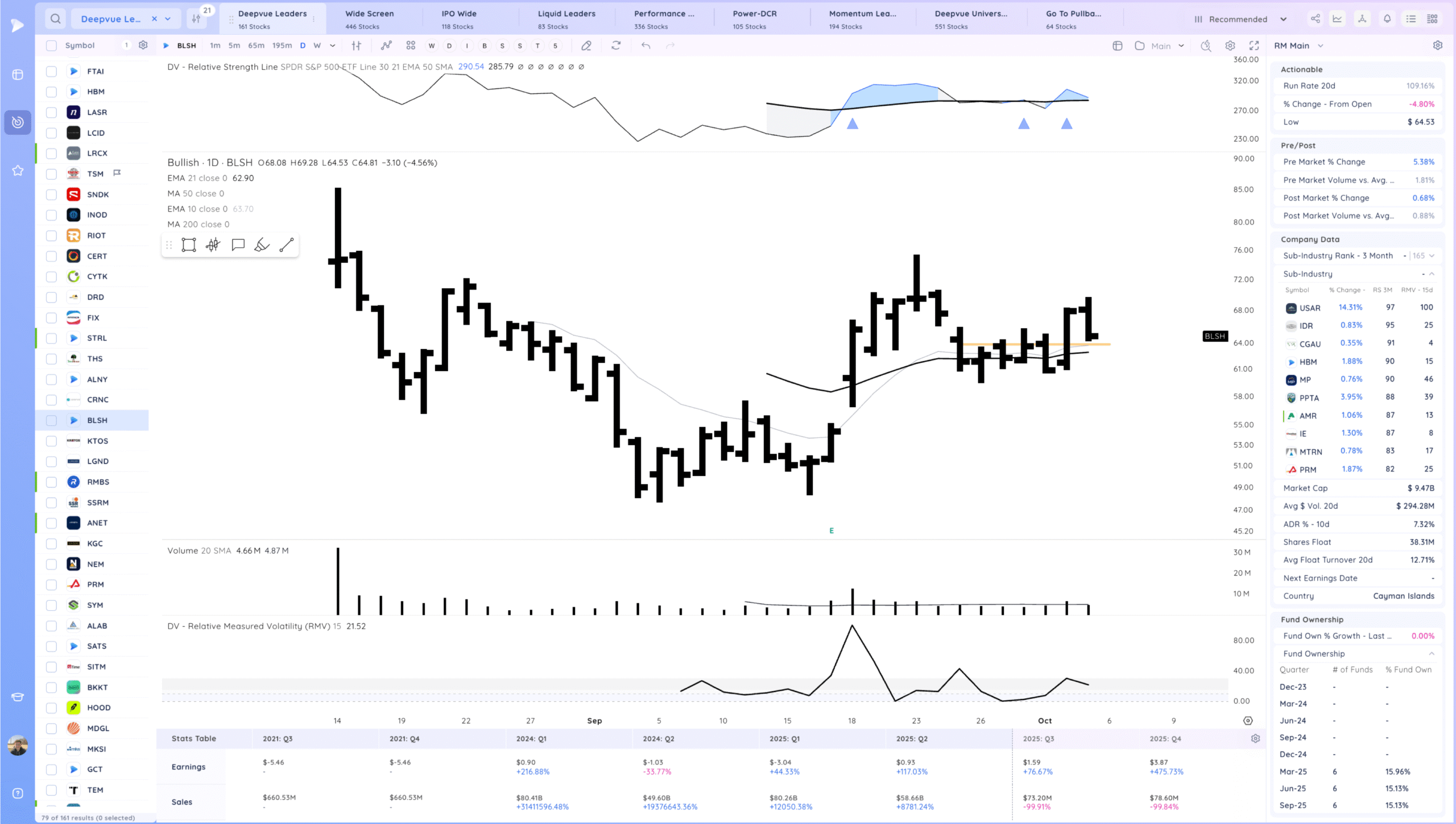

BLSH watching for follow through higher/push off the prior pivot.

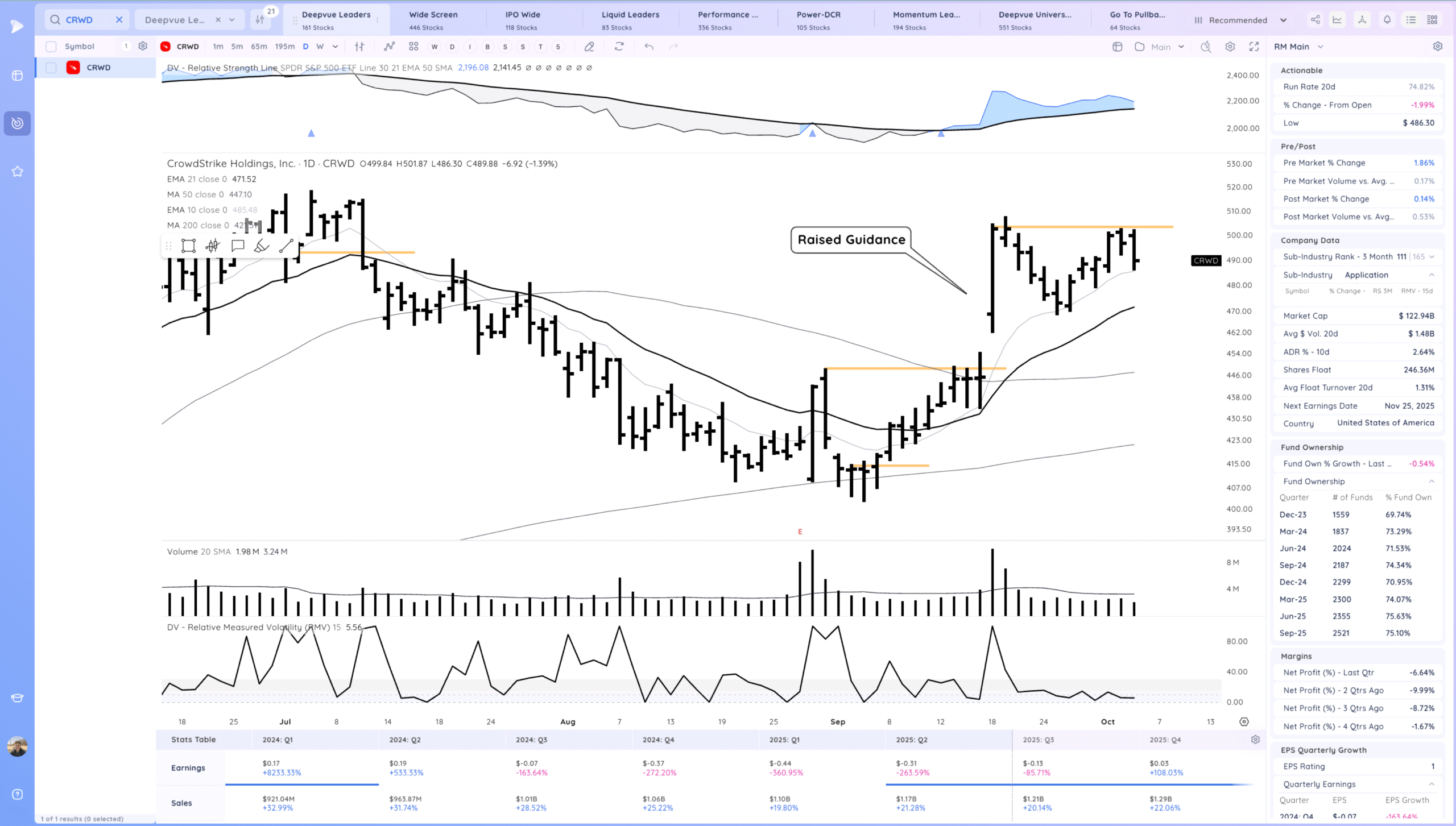

CRWD watching for a range breakout. Pull into the 10ema friday

Today’s Watchlist in List form

Focus List Names

AMSC B CRWV SHC BETR LYFT BLSH CRWD ALAB TSLA

Focus:

B ALAB TSLA

Themes

Strongest Themes: AI, Crypto, Nuclear, Semis, Miners, Rare Earth

Market Thoughts & Focus

Not very impressed going through my screens. Not too many tight pivots or stocks that look ready. Many trending but have moved far the past 2 weeks. Planning to be more patient early next week.

Anything can happen, Day by Day – Managing risk along the way