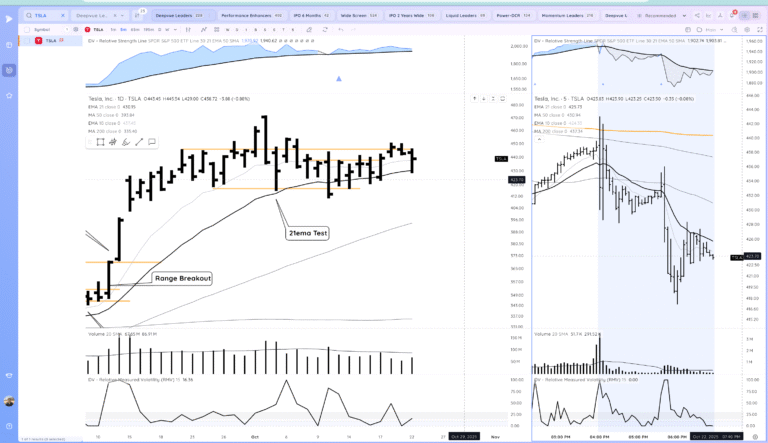

TSLA Down After Earnings

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

October 22, 2025

Market Action

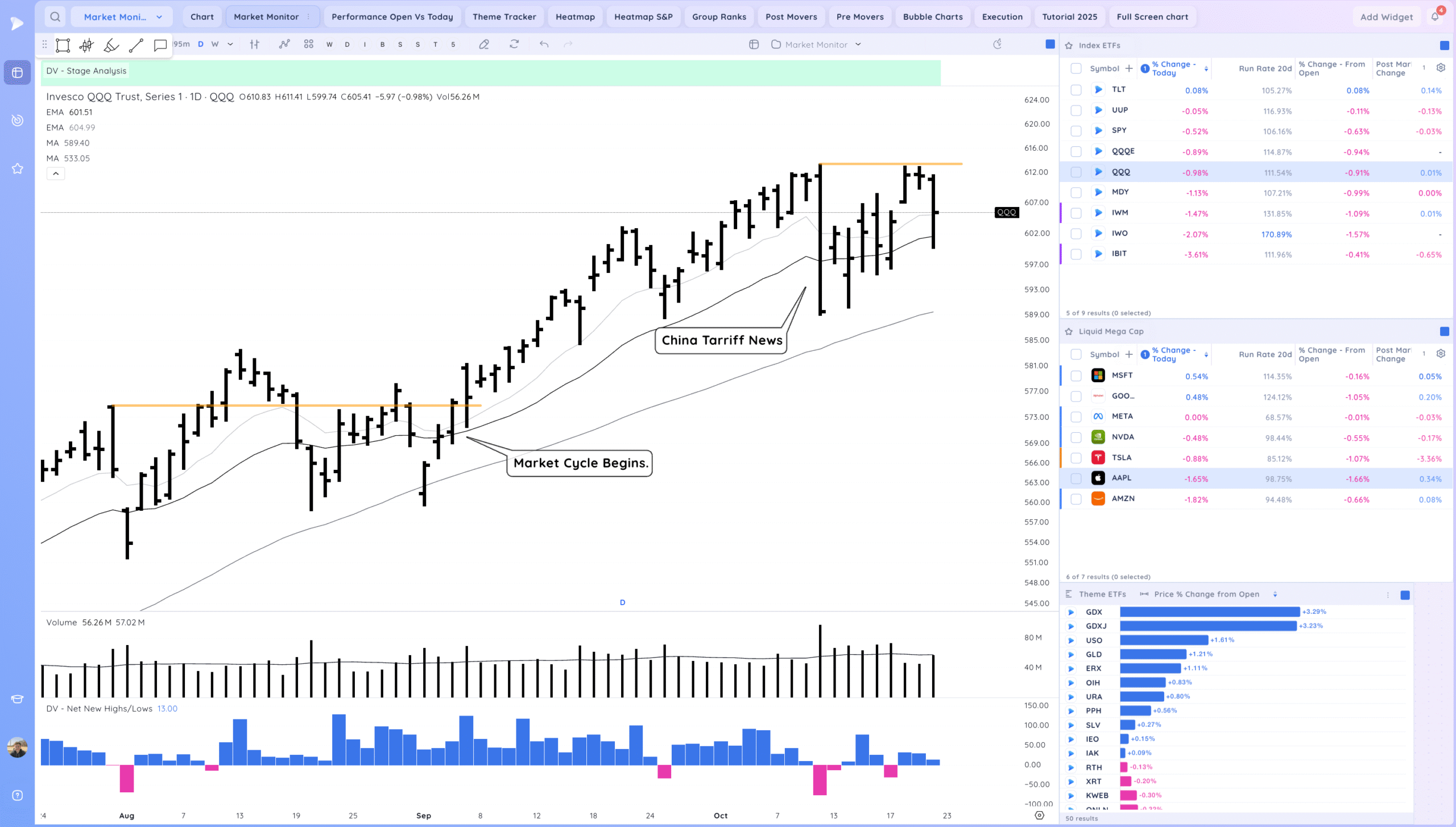

QQQ – Volatile day as we broke lower from the inside day and tested the 21ema before bouncing into the close. We continue to consolidate under the reversal high. The overall environment is still choppy.

Bulls want to see us hold and tighten, before taking out the reversal high.

Bears want to see us reverse down, and see more earnings gap downs than gap ups from key growth names.

Daily Chart of the QQQ.

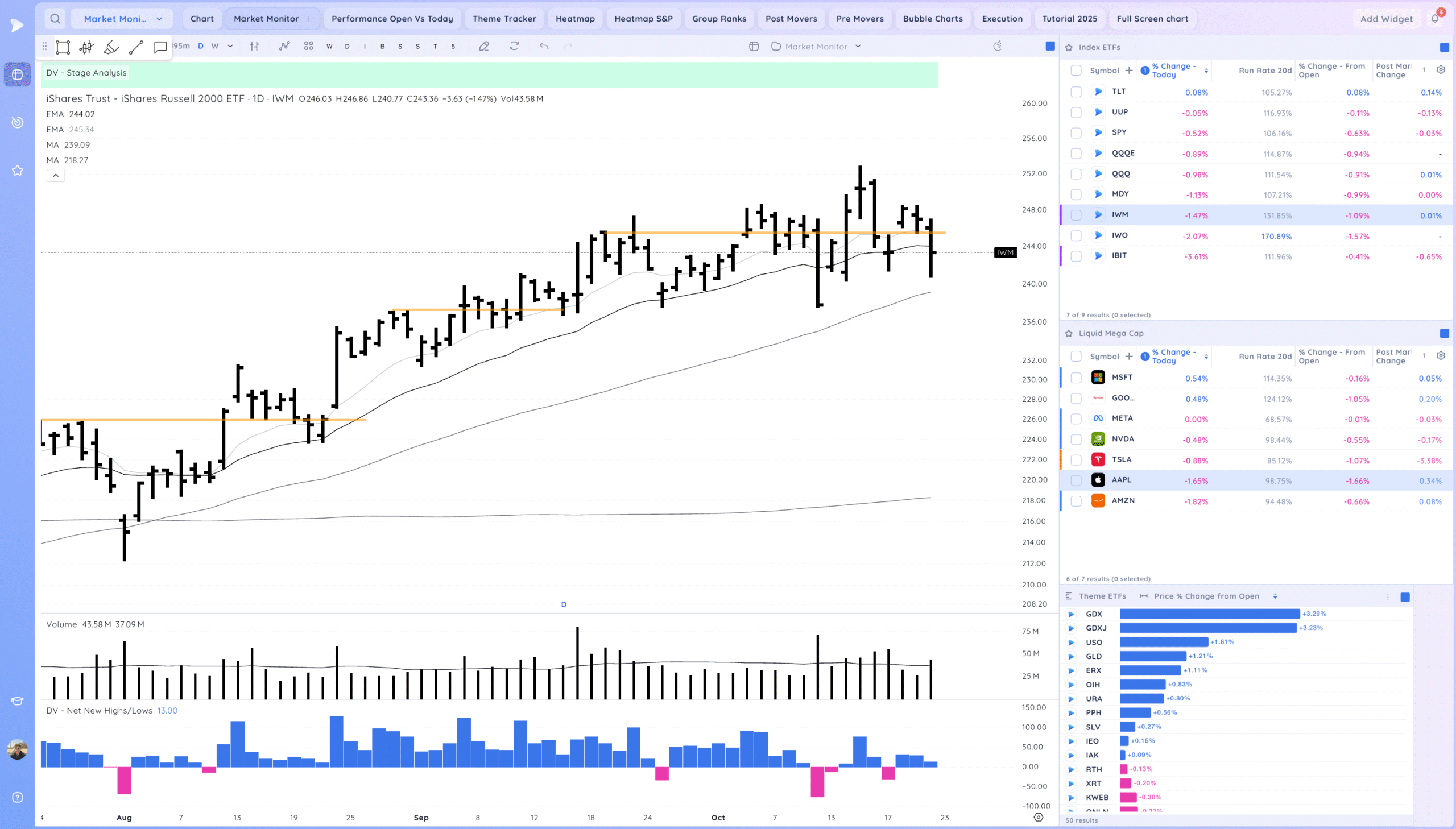

IWM – Break below the pivot and close below the 21ema. Continues to chop in this area

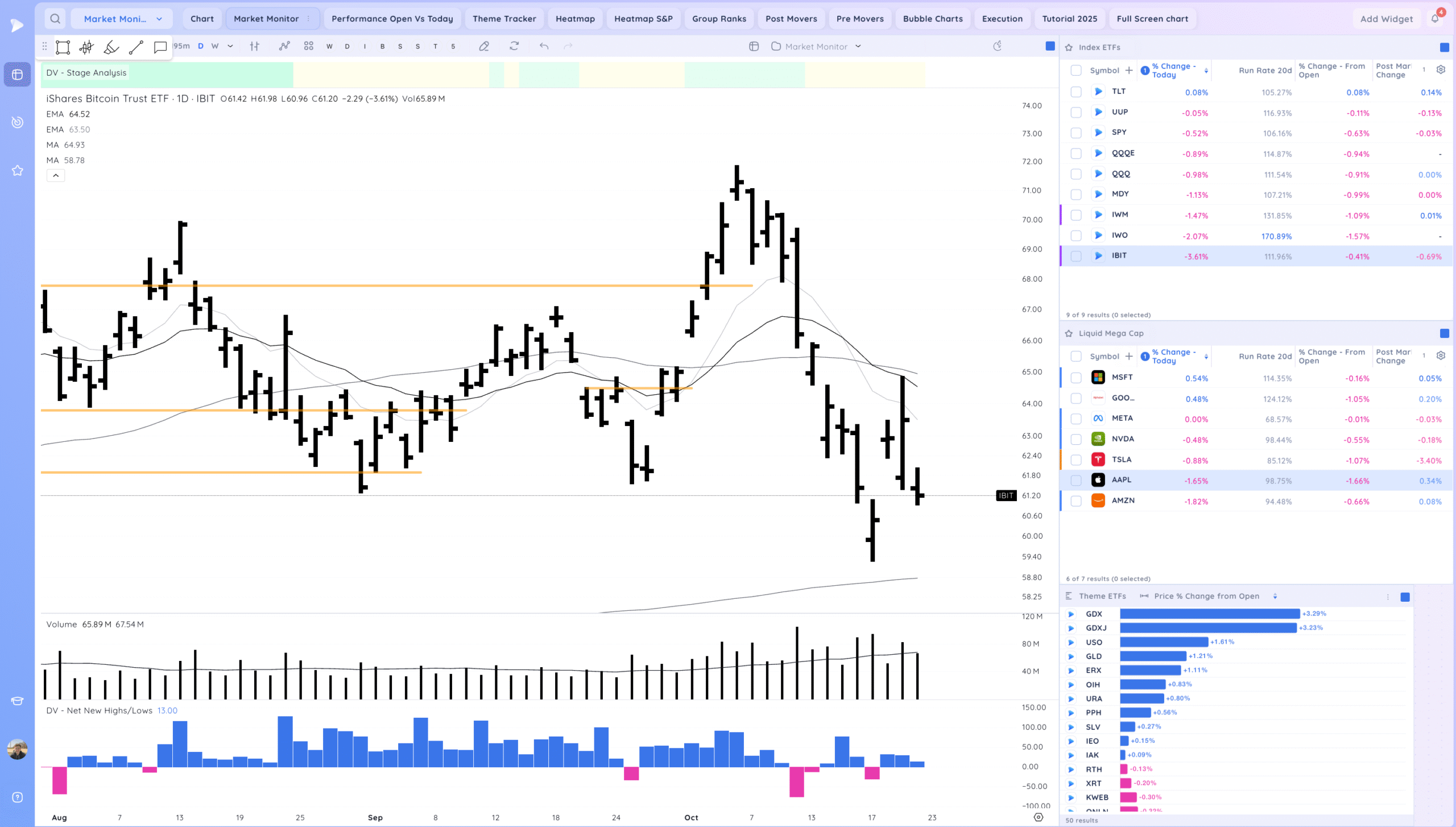

IBIT – Gap down then tight. Remains volatile and below the MAs

Trends (4/4 Up) – Based on the QQQ

Shortest – 10 Day EMA – Above

Short-term – 21 ema – Above

Intermediate term – 50 sma – Above Rising

Longterm – 200 sma – Up – Above Rising

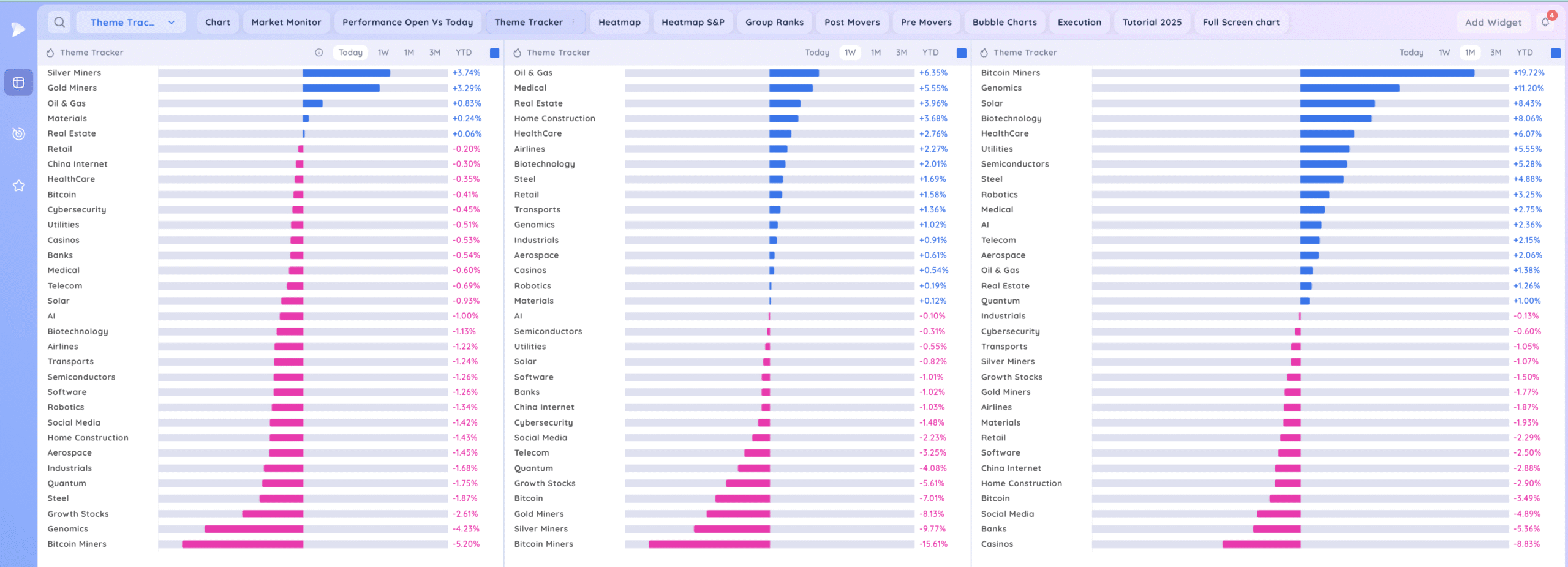

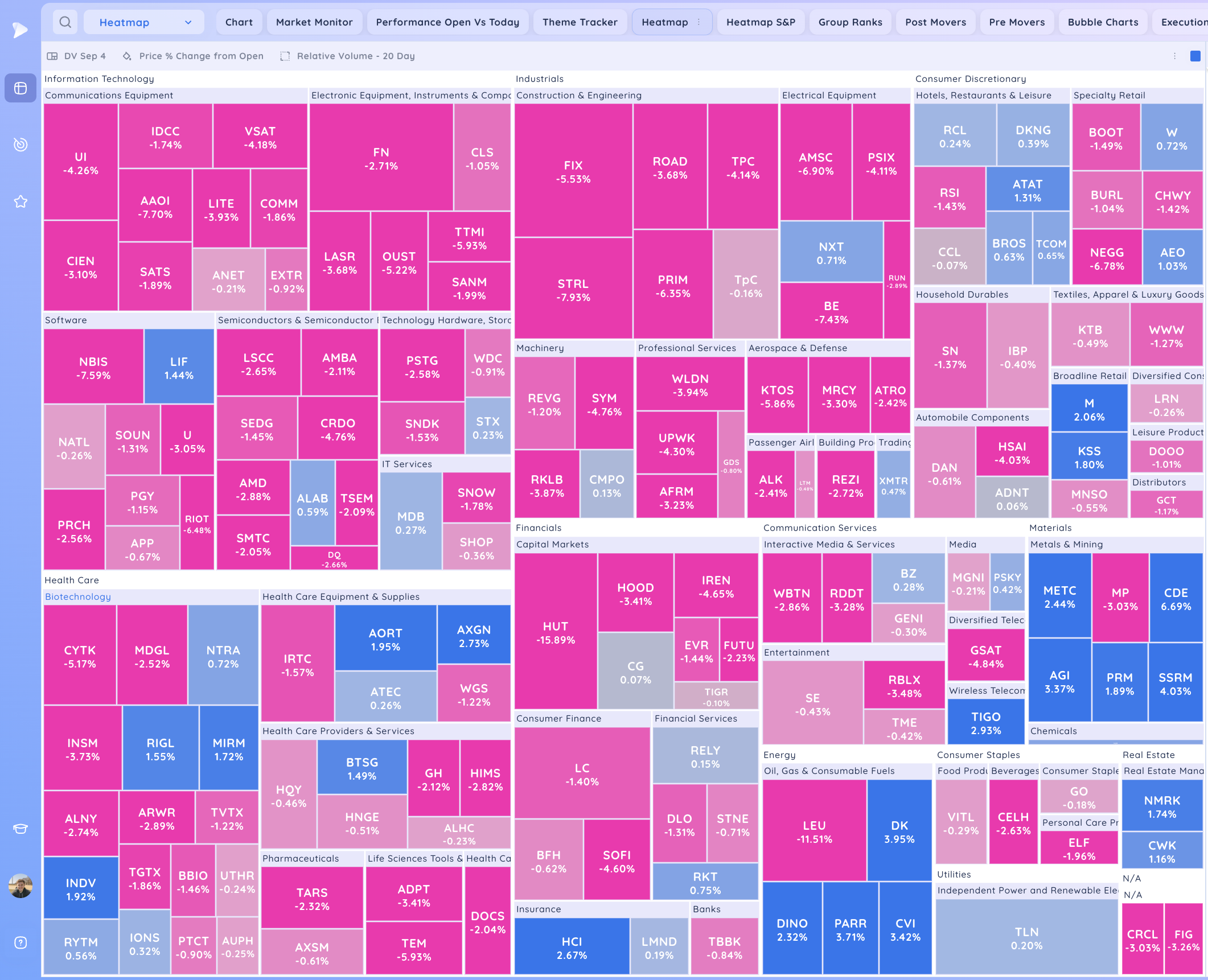

Groups/Sectors

Deepvue Theme Tracker. Home construction leading today

Deepvue Leaders. Gold miners pulling in

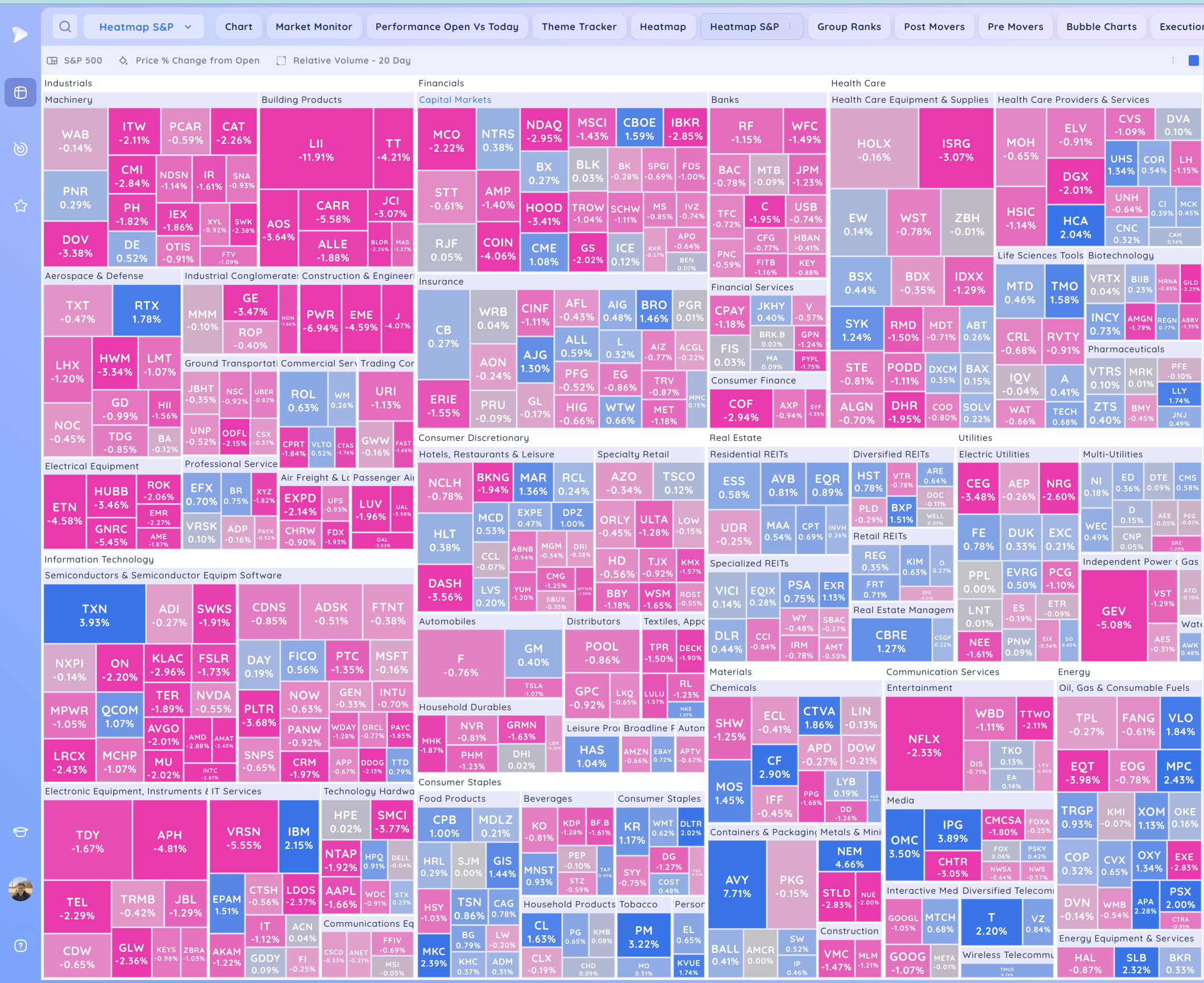

S&P 500.

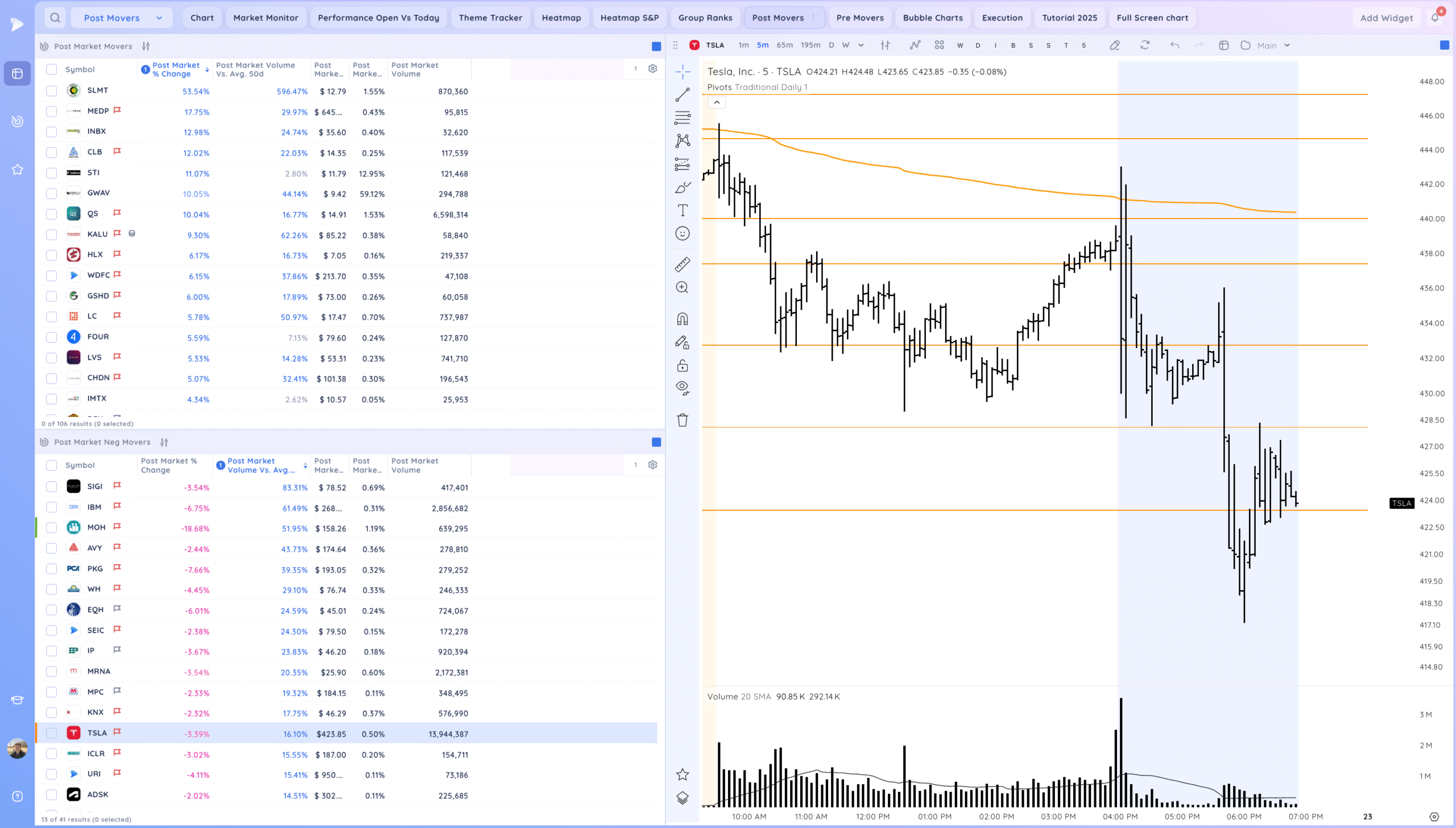

Post Market Movers. TSLA down about 3.5% currently

Leadership Stocks & Analysis

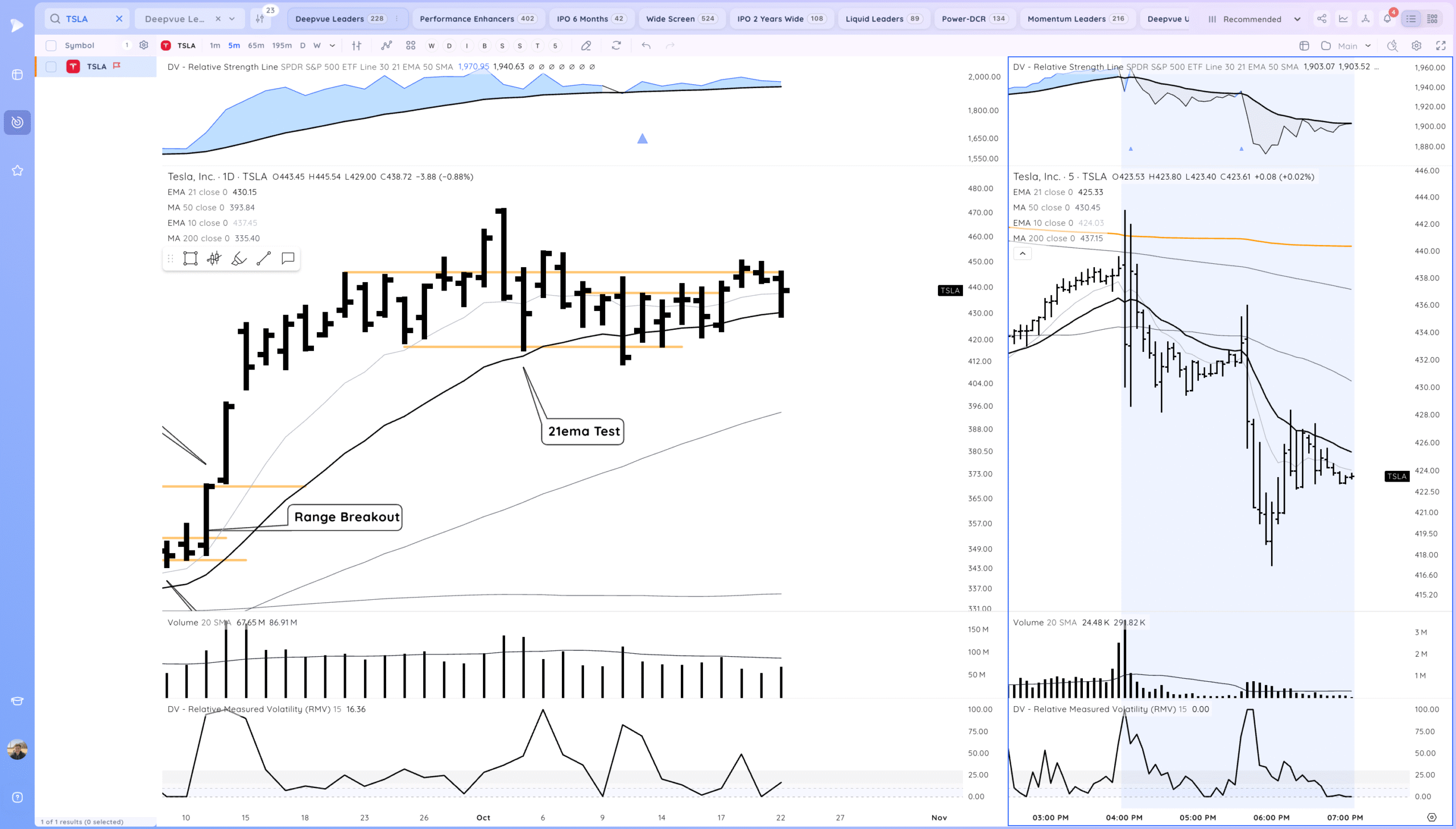

TSLA – Down below the 21ema after hours. Expecting a large move tomorrow.

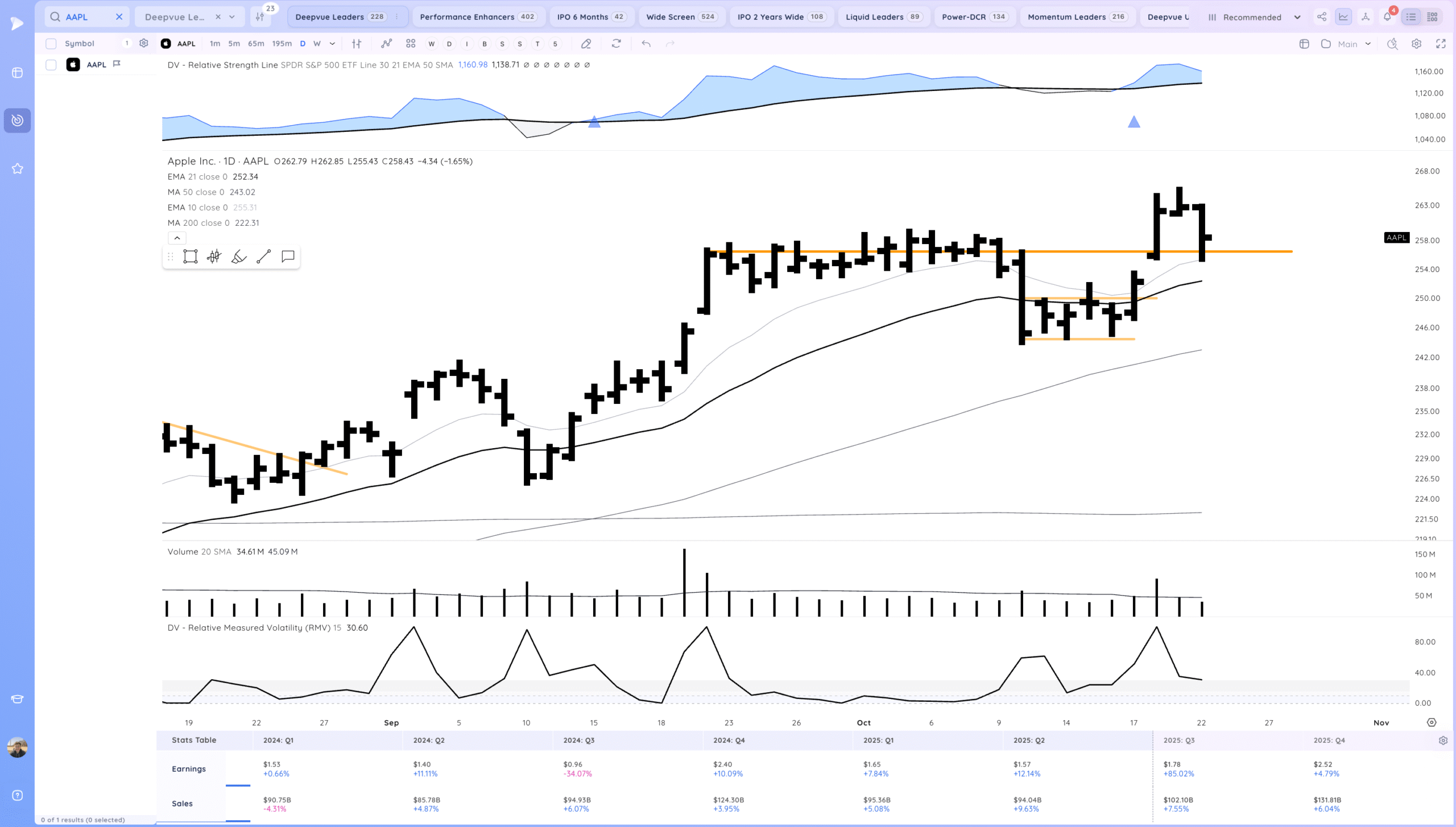

AAPL break lower and then a bounce off the pivot

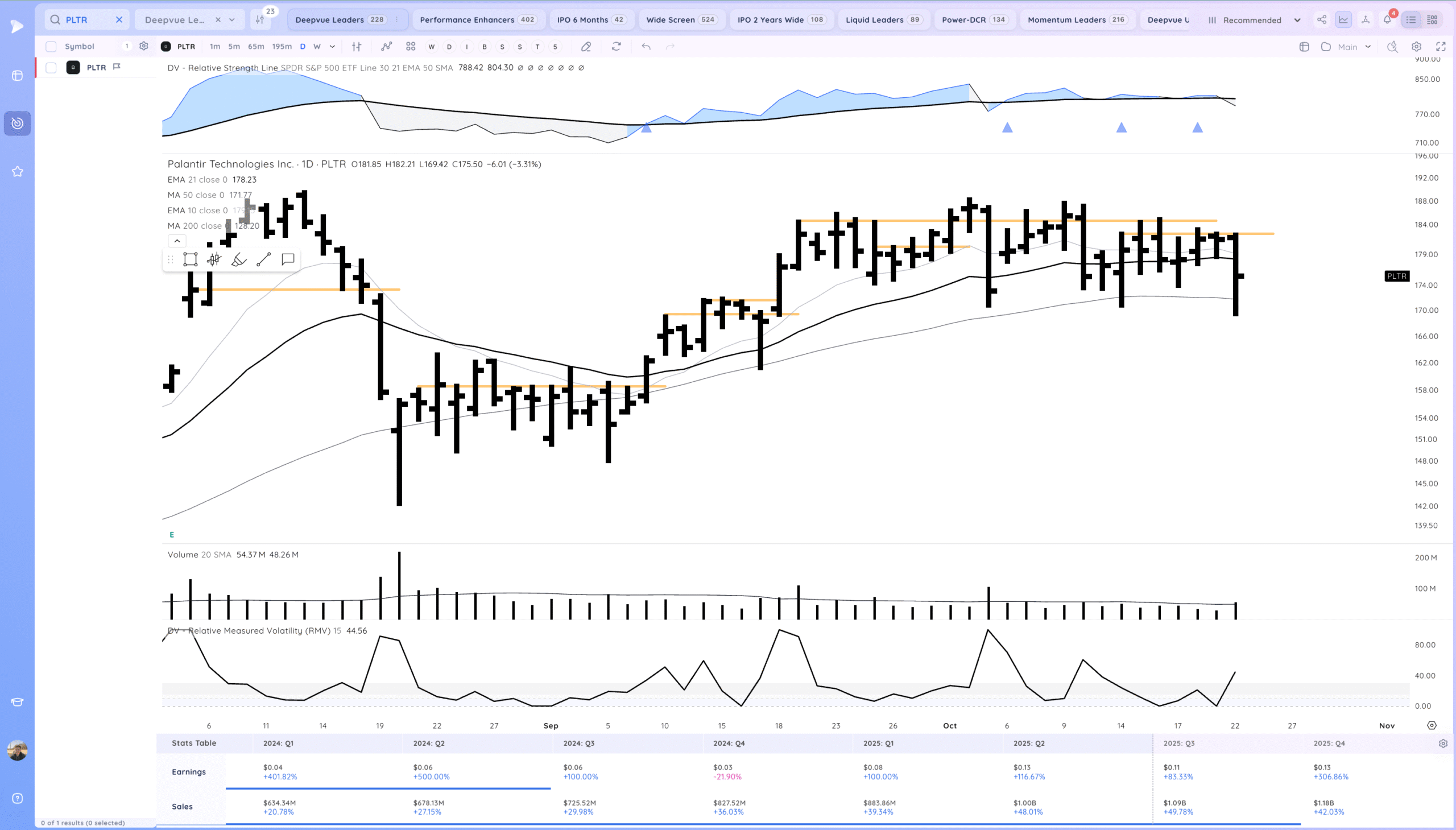

PLTR Good push off lows but this feels like churning action.

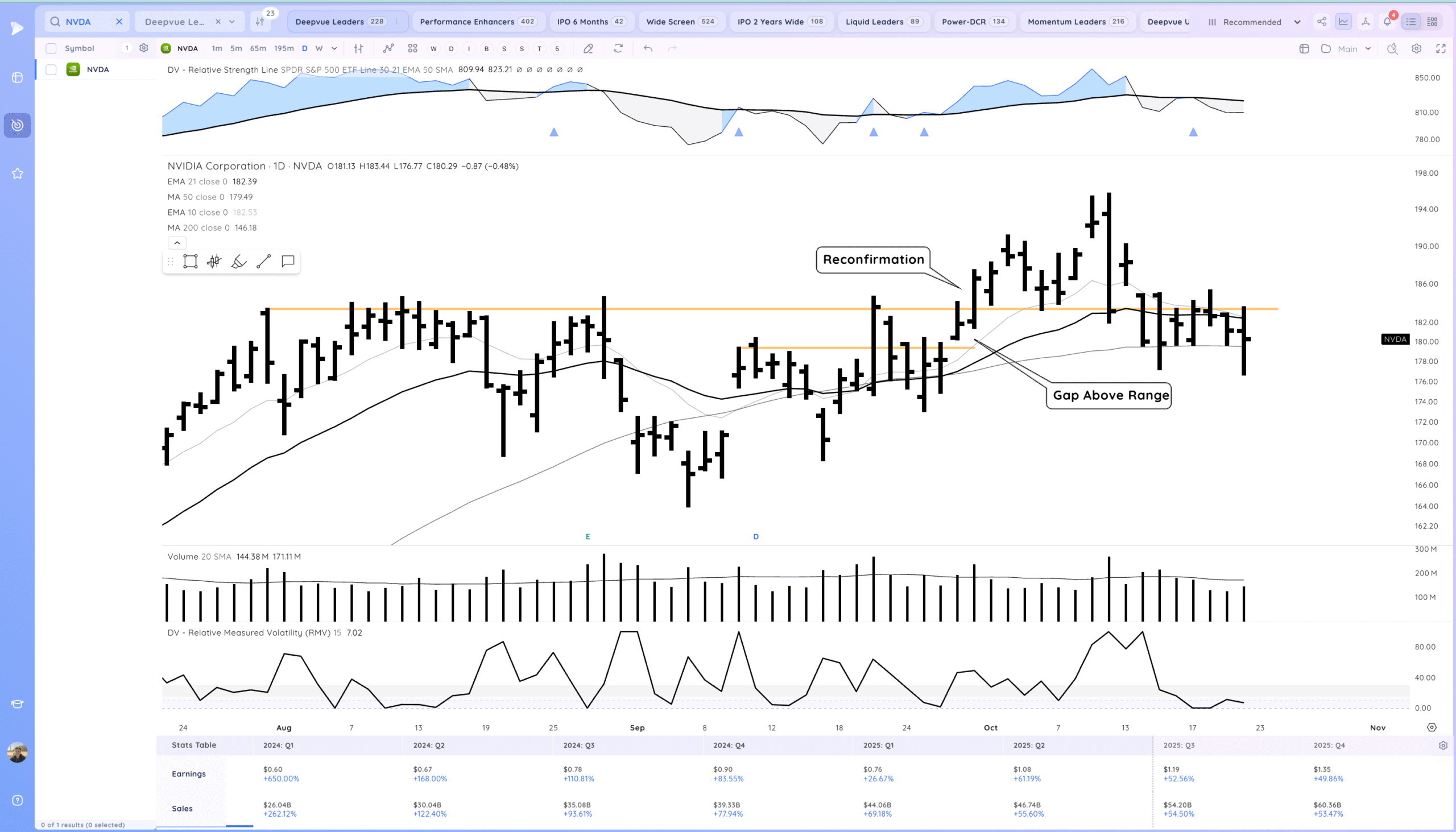

NVDA still chopping between the base pivot and 50sma. Will be tough for semis to make a meaningful move unless this begins trending

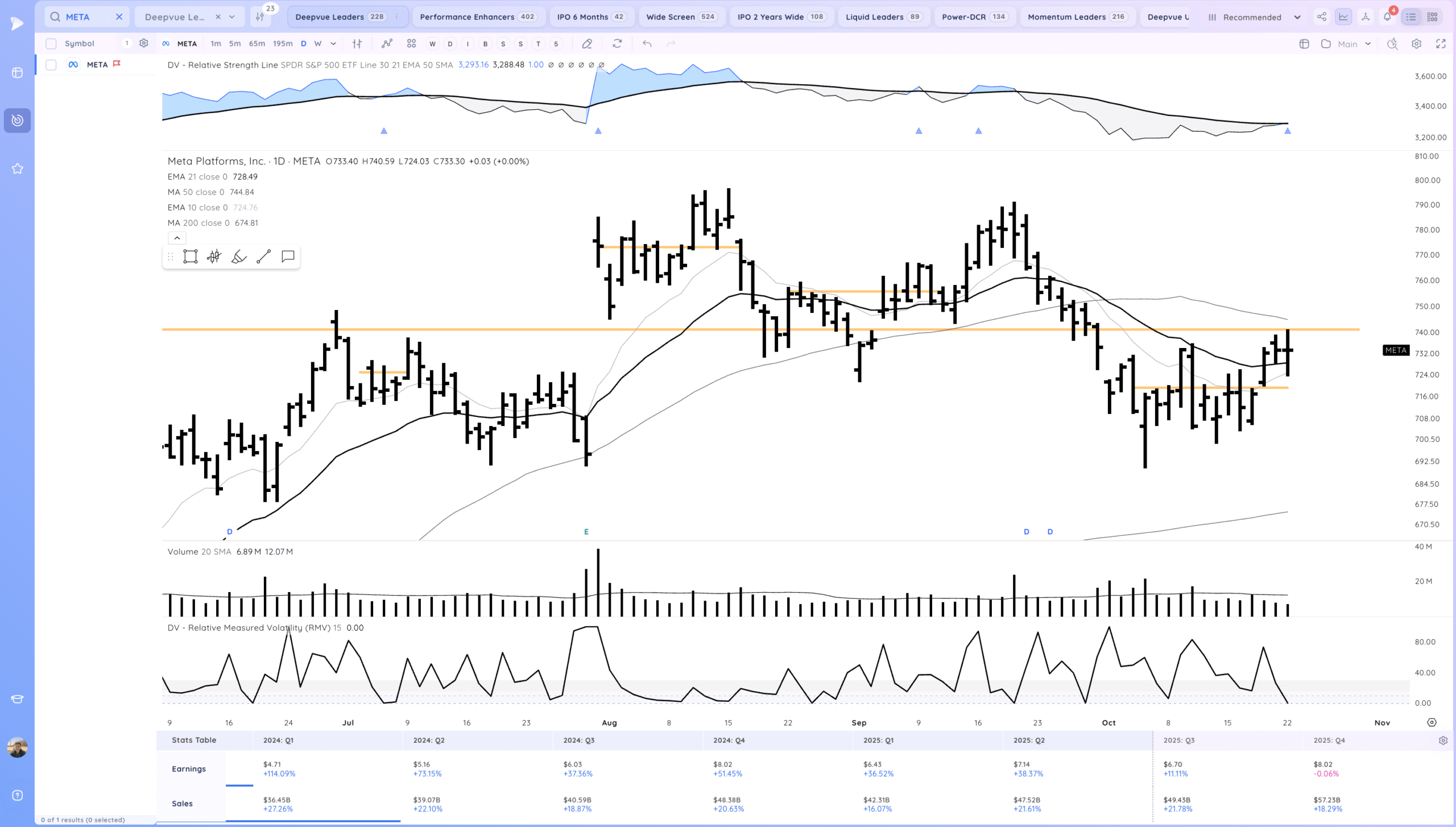

META Holding the 21ema but can’t overcome the key level yet. Tight

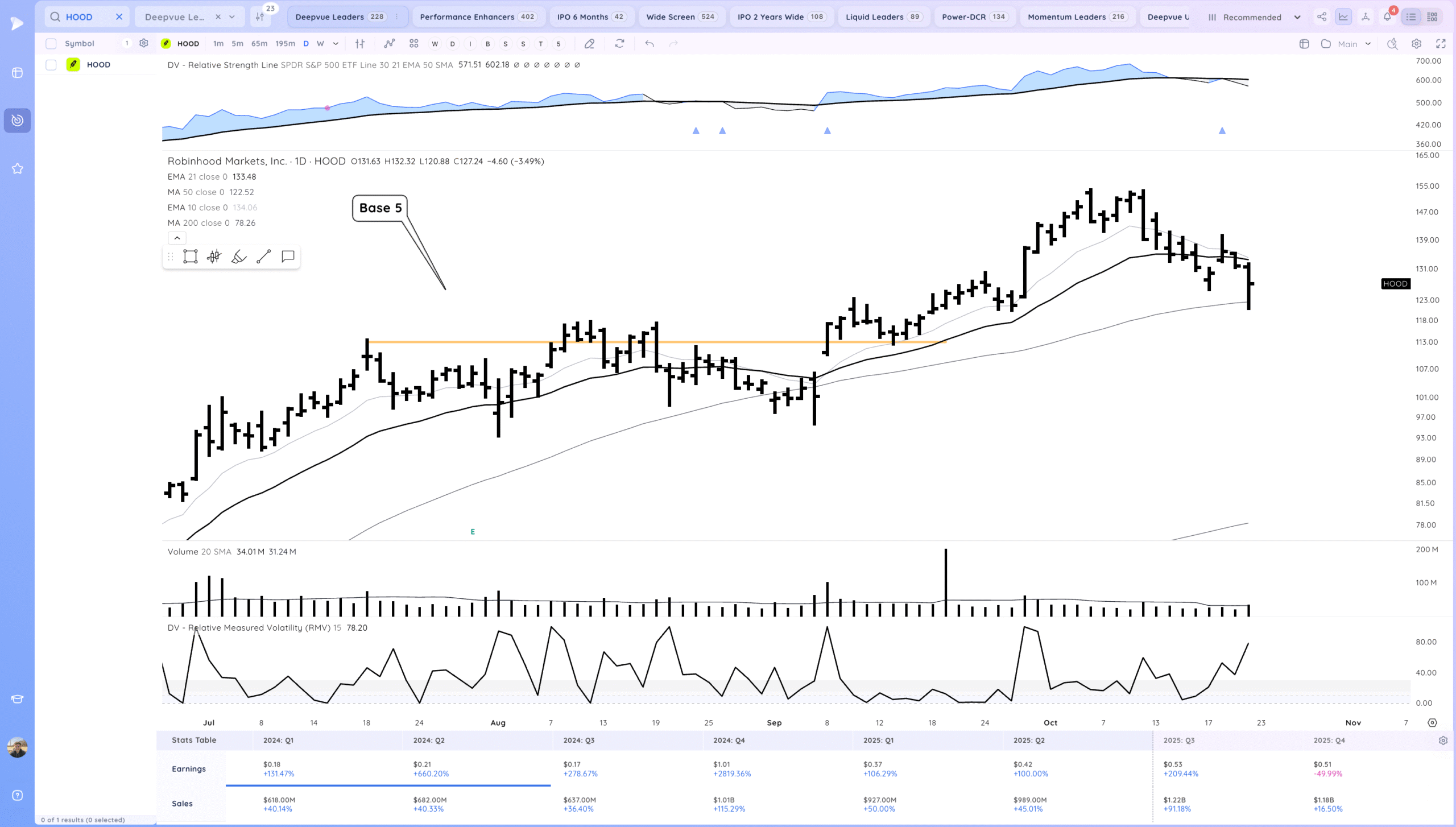

HOOD Bounce off the 50sma. I view this as starting a new base

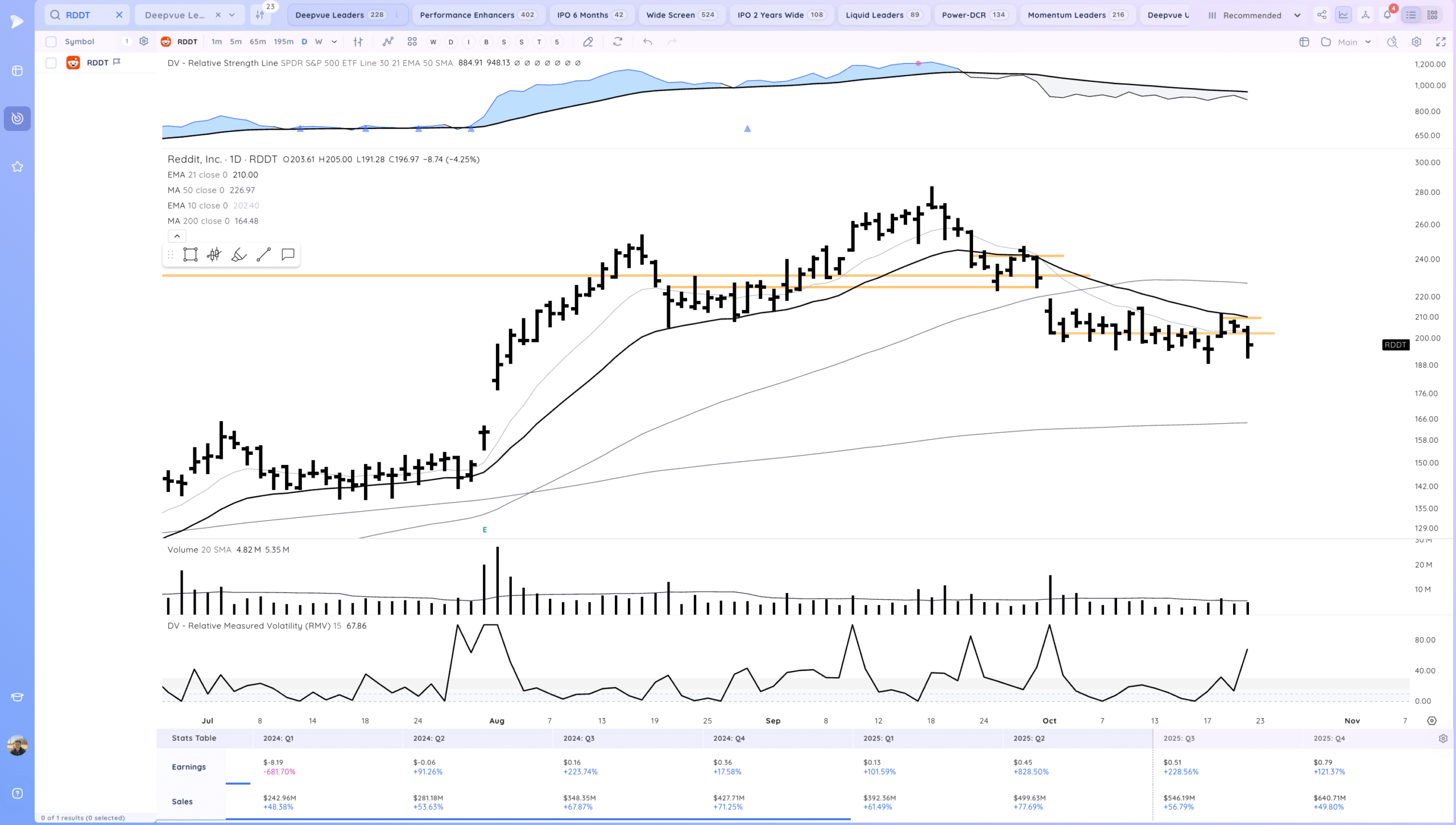

RDDT Can’t overcome the 21ema just yet

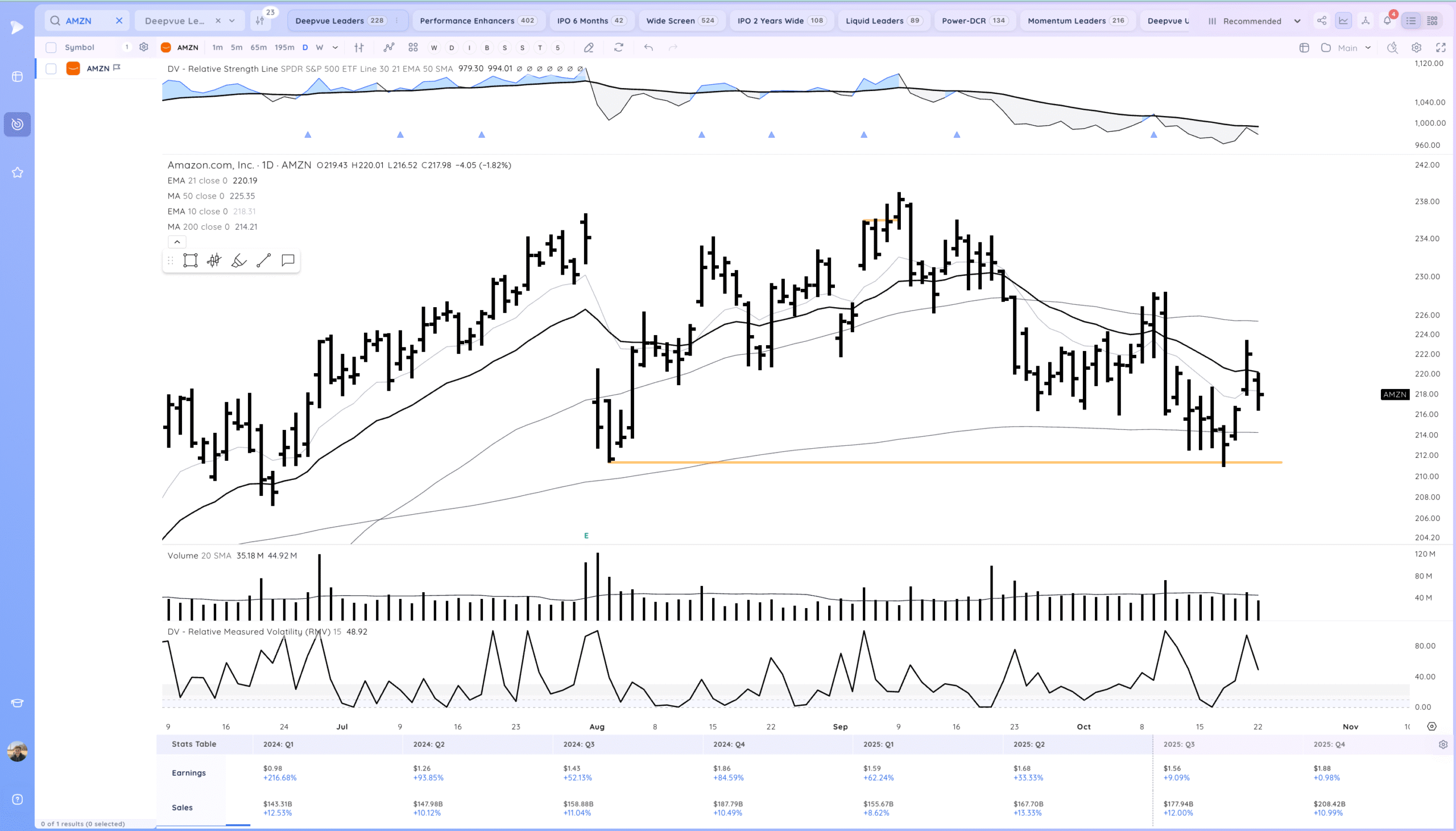

AMZN gap down and filled the gap. Overall choppy

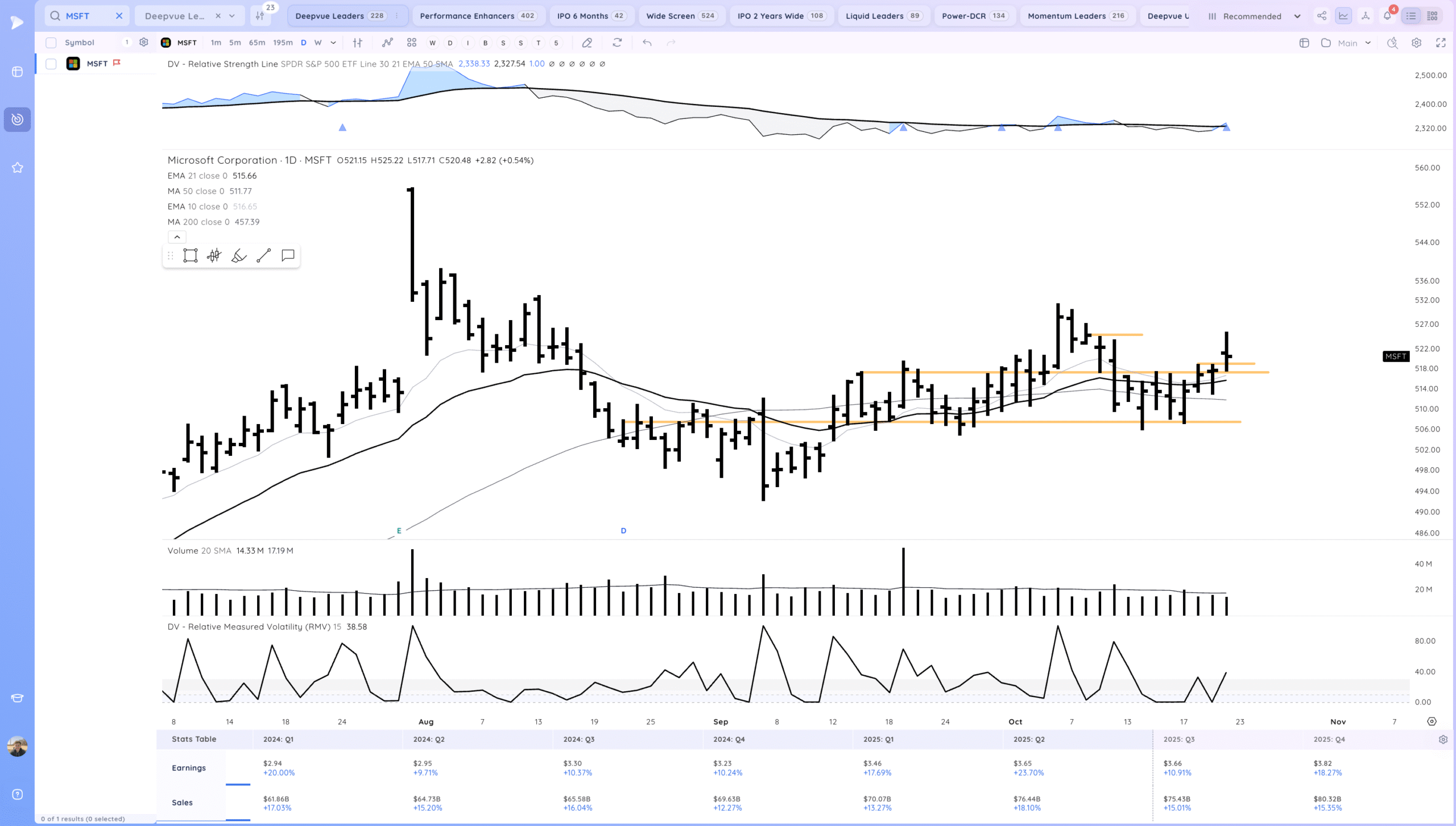

MSFT Tried to push higher but faded off highs.

Key Moves

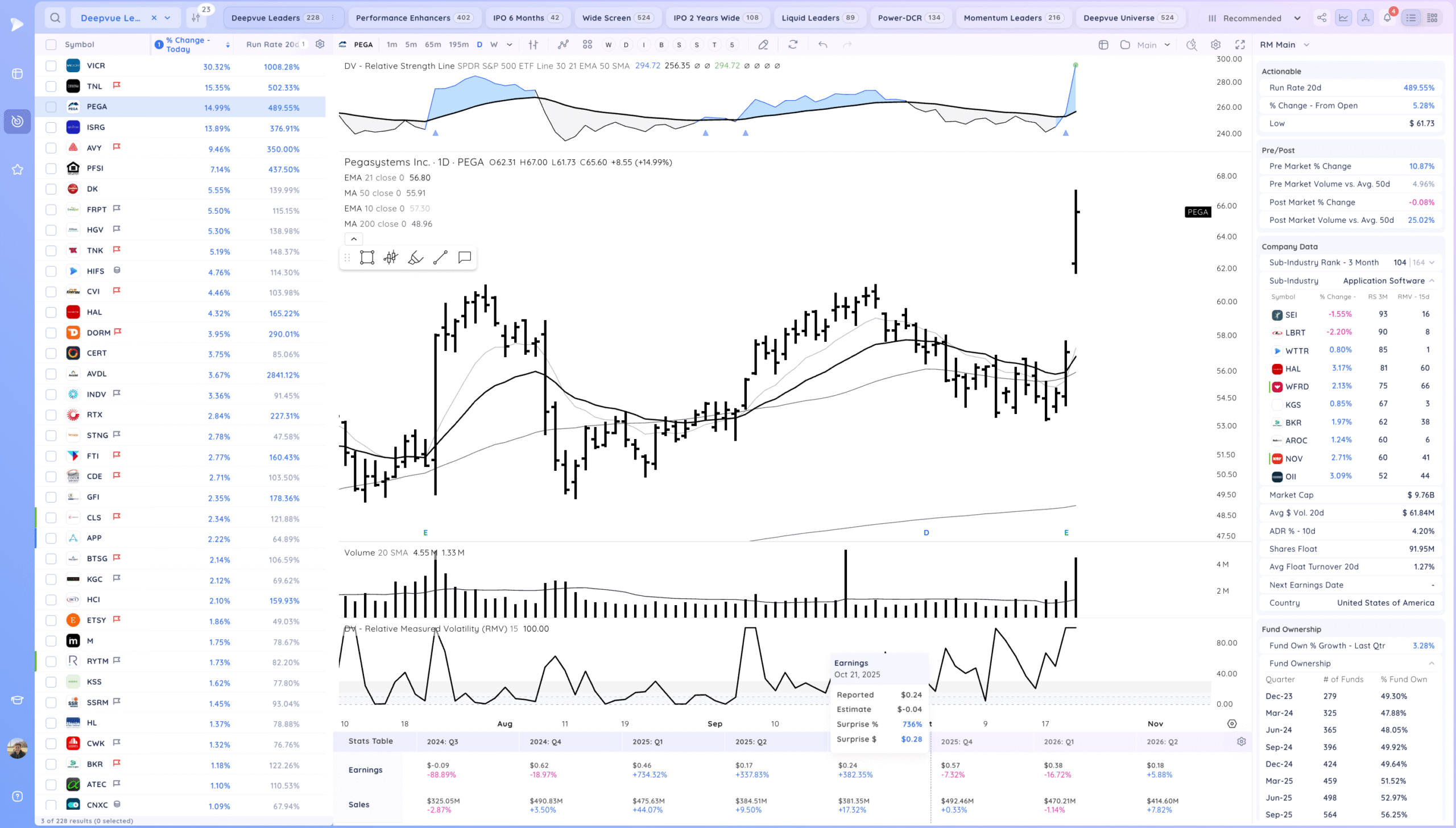

PEGA strong move on earnings beat

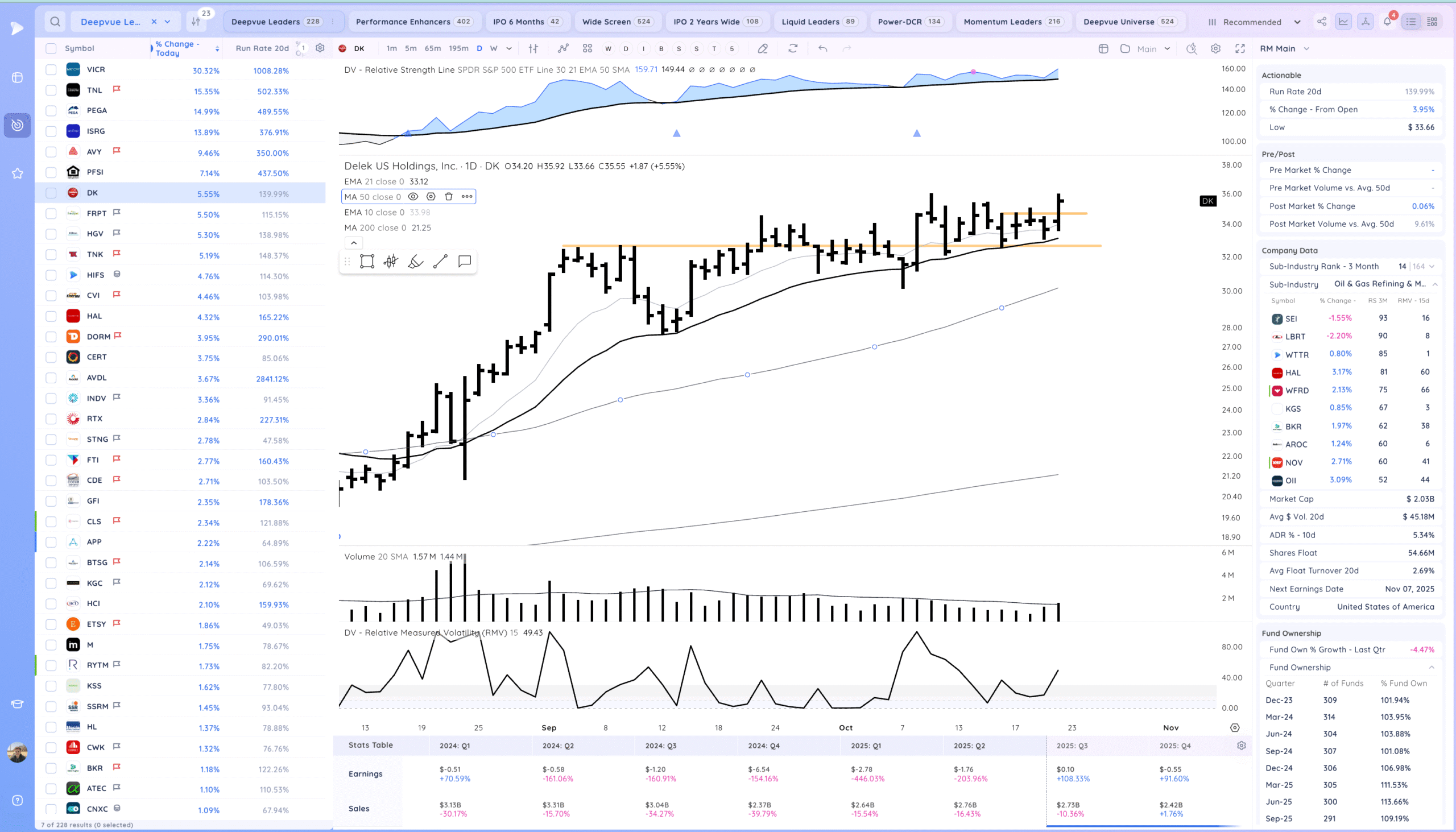

DK range breakout

Setups and Watchlist

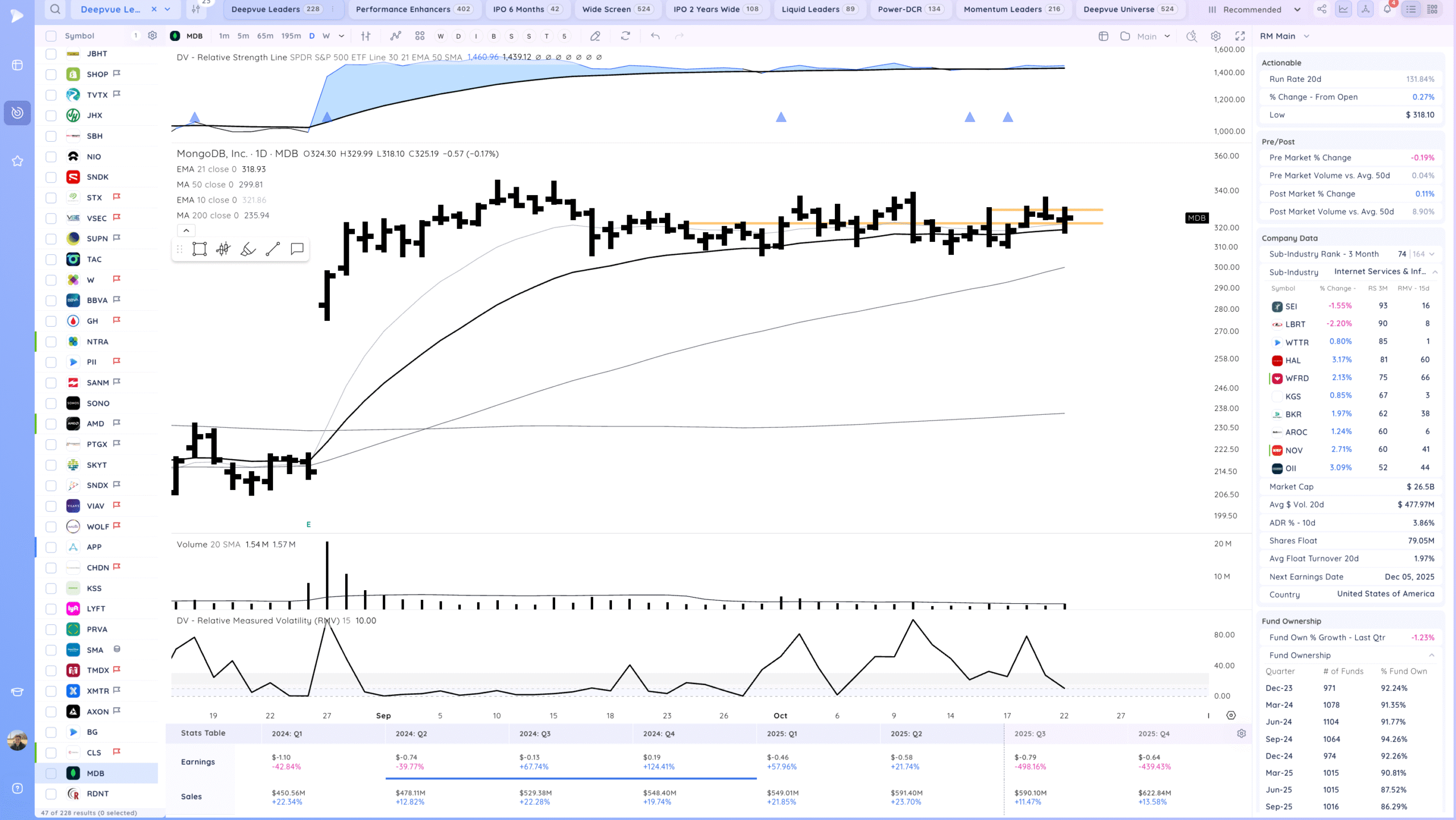

MDB watching for a range breakout.

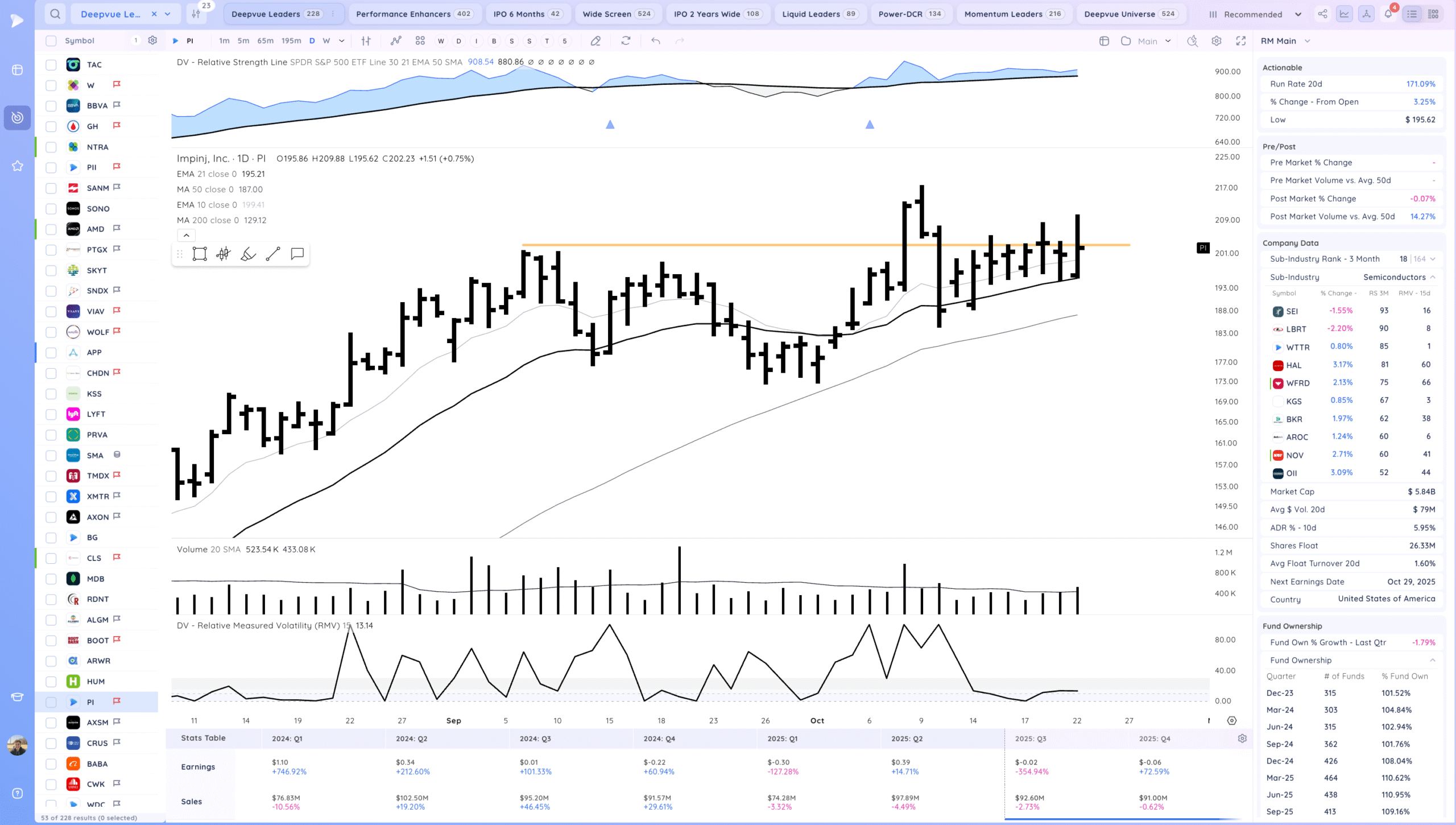

PI watching for a range breakout.

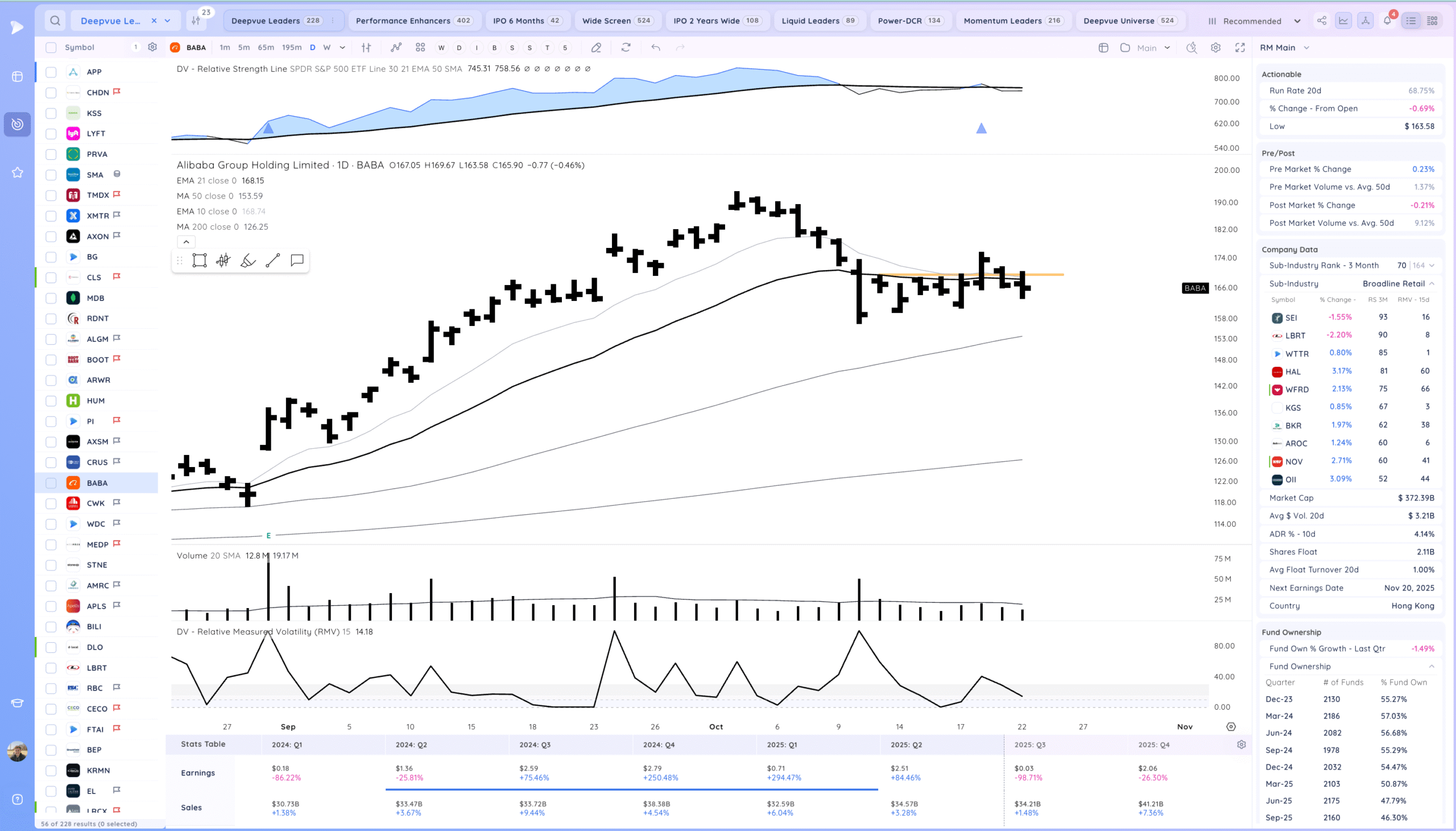

BABA watching for a range breakout

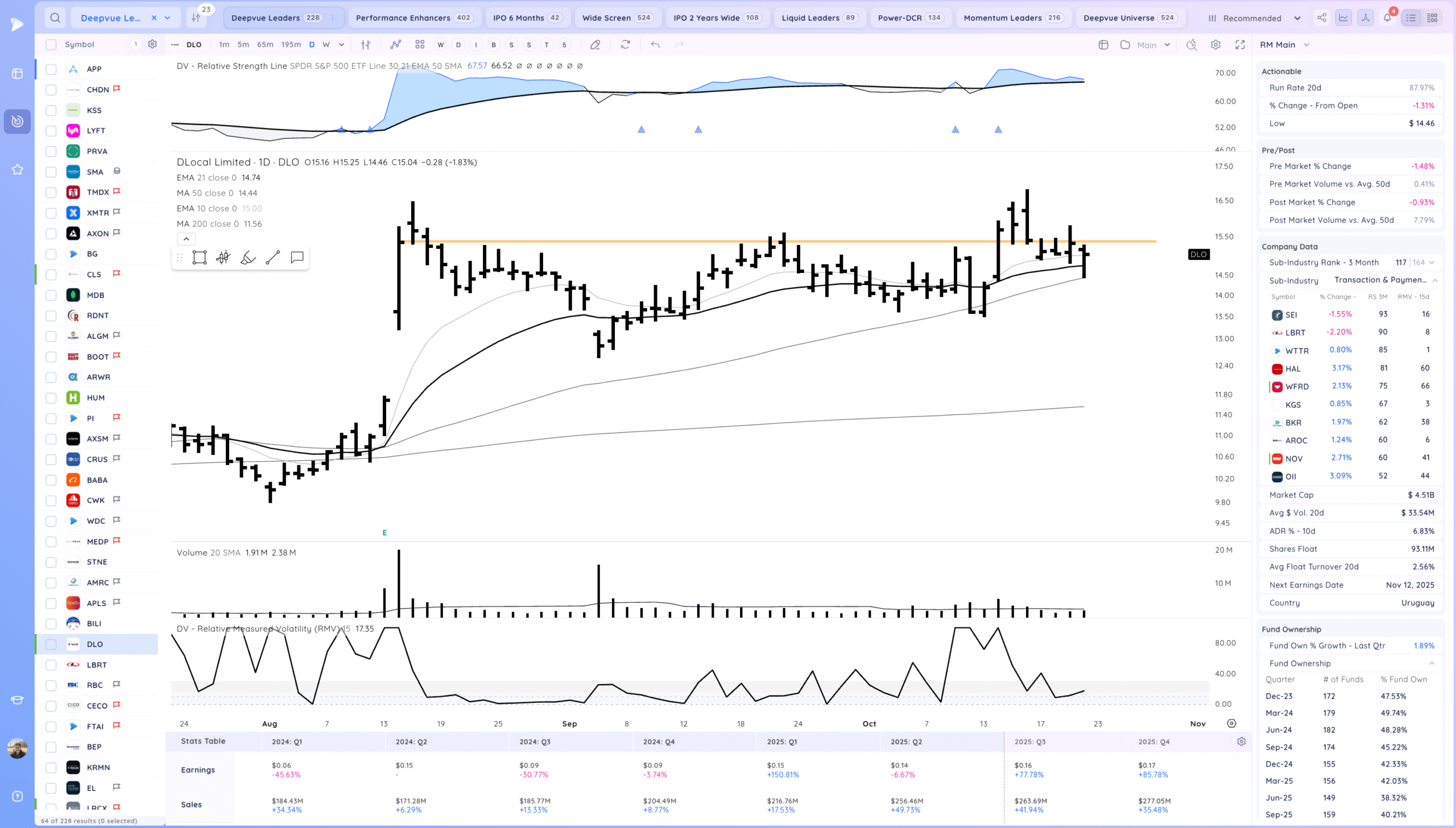

DLO watching for a range breakout.

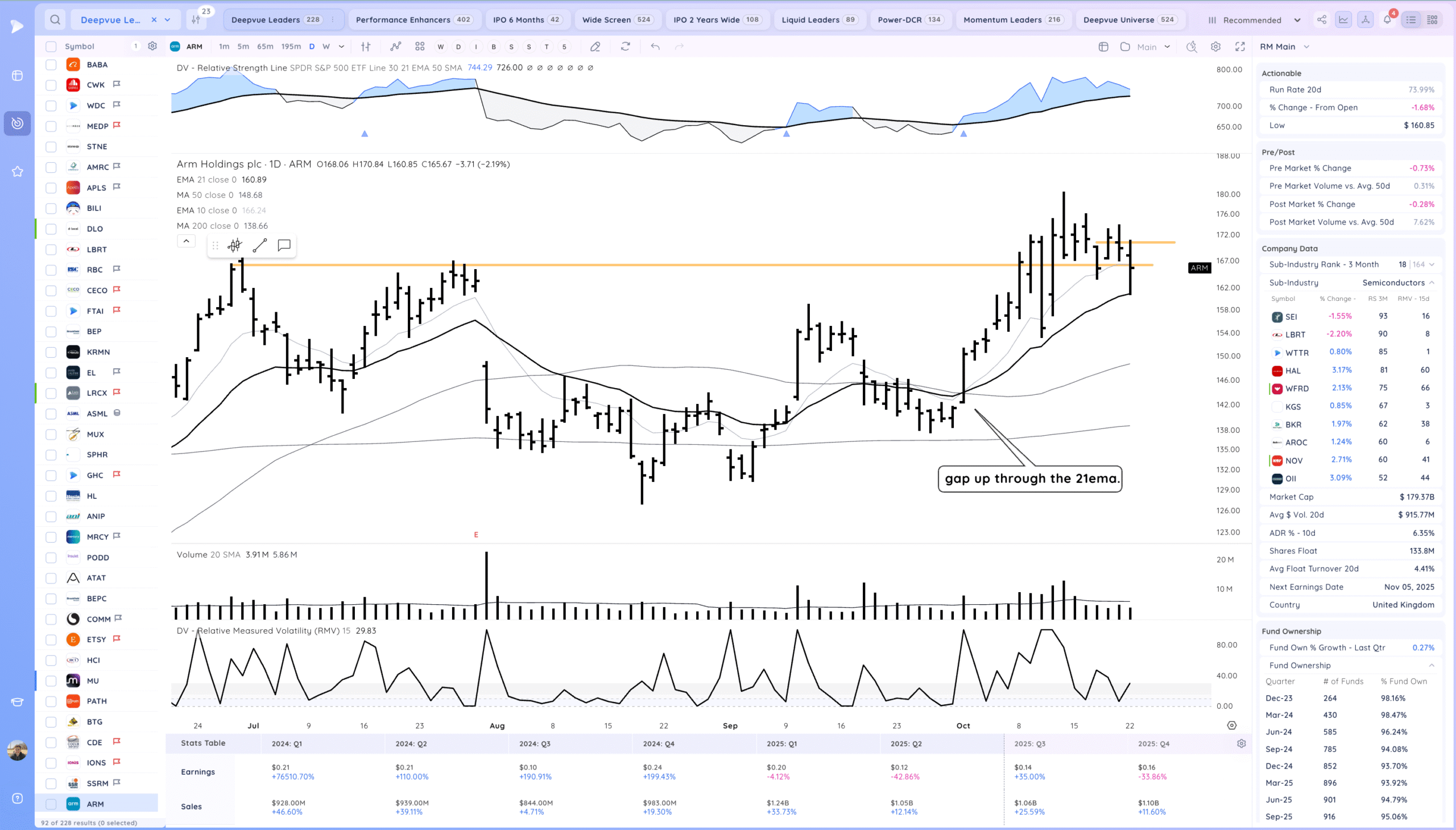

ARM watching for a range breakout

Today’s Watchlist in List form

Focus List Names

MDB PI BABA DLO ARM PLTR TSLA NVDA RDDT MEDP

Focus:

MEDP TSLA ARM DLO

Themes

AI, AI Energy, rare metals, biotech.

Additional Thoughts

Choppy day and not much going right now. How the market reacts to TSLA tomorrow will be telling.

Anything can happen, Day by Day – Managing risk along the way