Trending, Slight Downside Reversal

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

September 16, 2025

Market Action

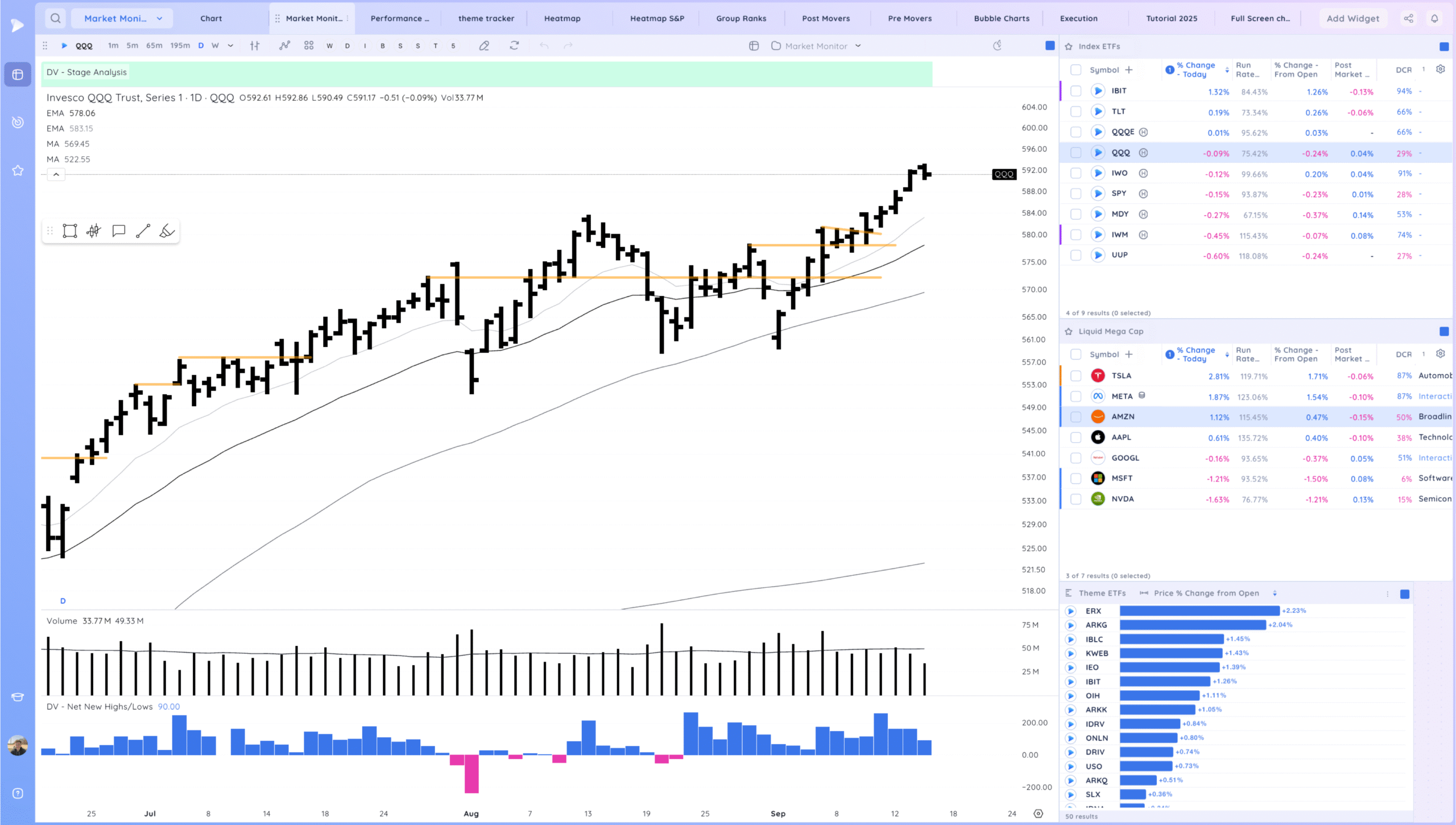

QQQ – New high as we continue to trend above the MAs. Slight downside reversal off highs. Ideally we consolidate for a few days to let the MAs catch up. Be ready for a sharp stress test day.

FOMC news tomorrow could be a catalyst (or just an excuse) for a volatile day. Be ready.

Bulls want to see continued progress above the MAs

Bears want to see a sharp break lower with a negative close.

Daily Chart of the QQQ.

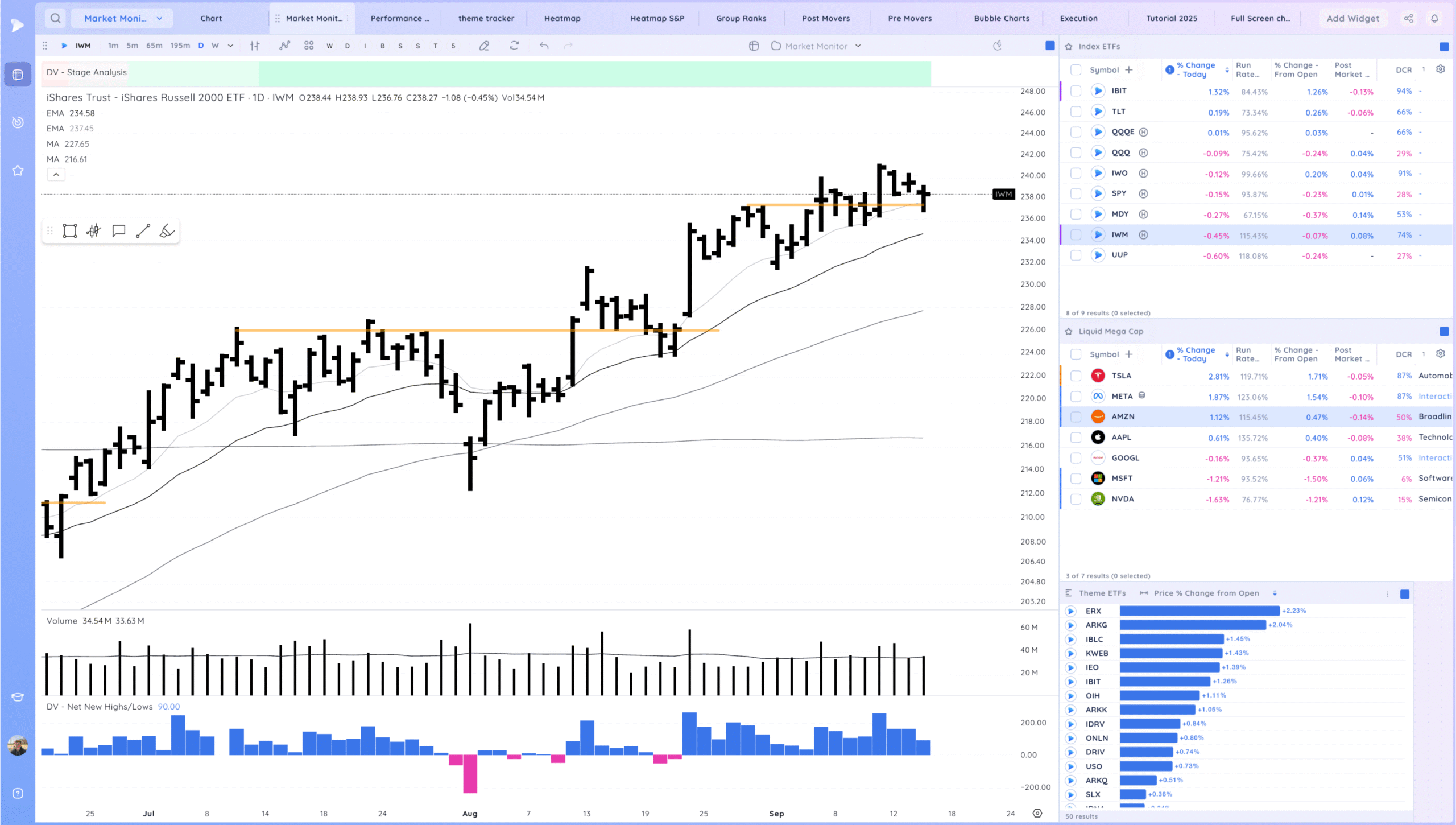

IWM – Upside reversal off the pivot and 10ema area

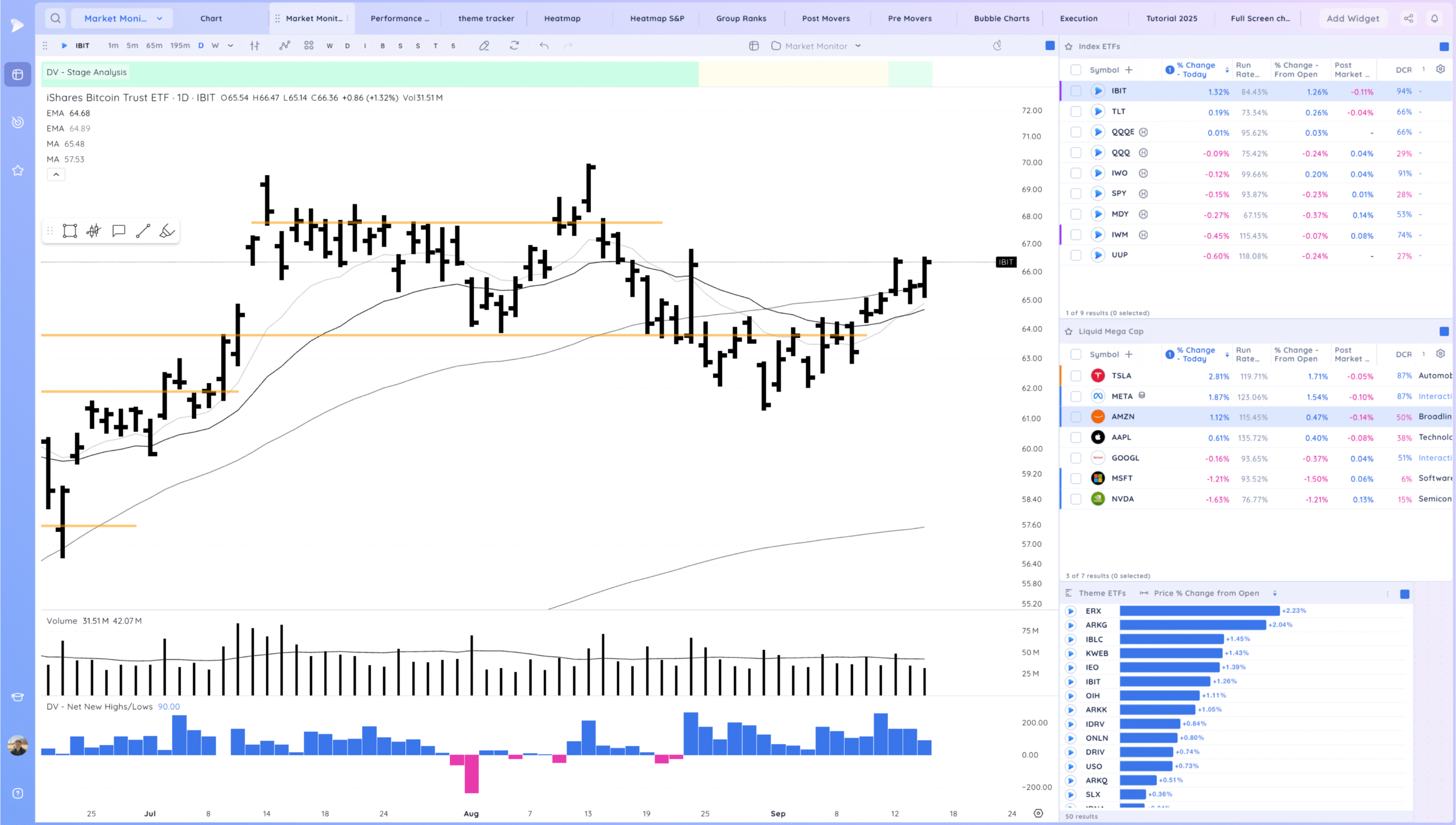

IBIT – Push higher from the upside reversal day. Continues to push up the right side

Trends (4/4 Up) – Based on the QQQ

Shortest – 10 Day EMA – Above

Short-term – 21 ema – Above

Intermediate term – 50 sma – Above Rising

Longterm – 200 sma – Up – Above Rising

Groups/Sectors

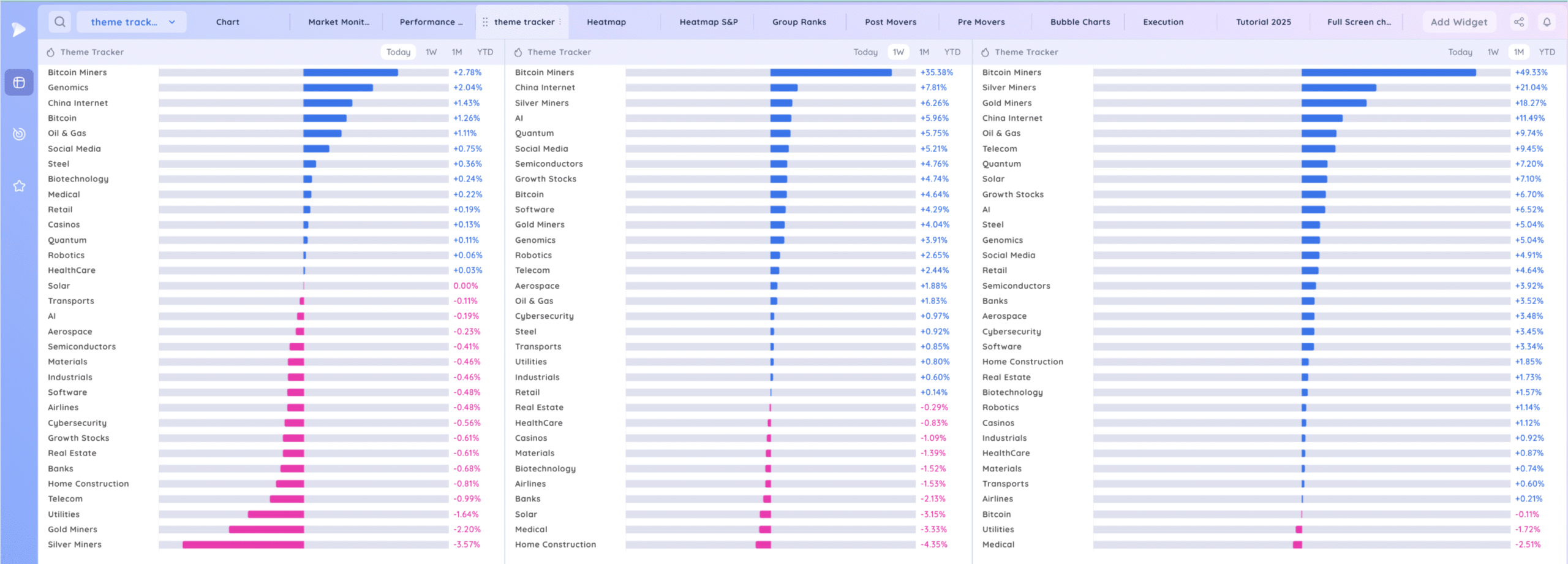

Deepvue Theme Tracker

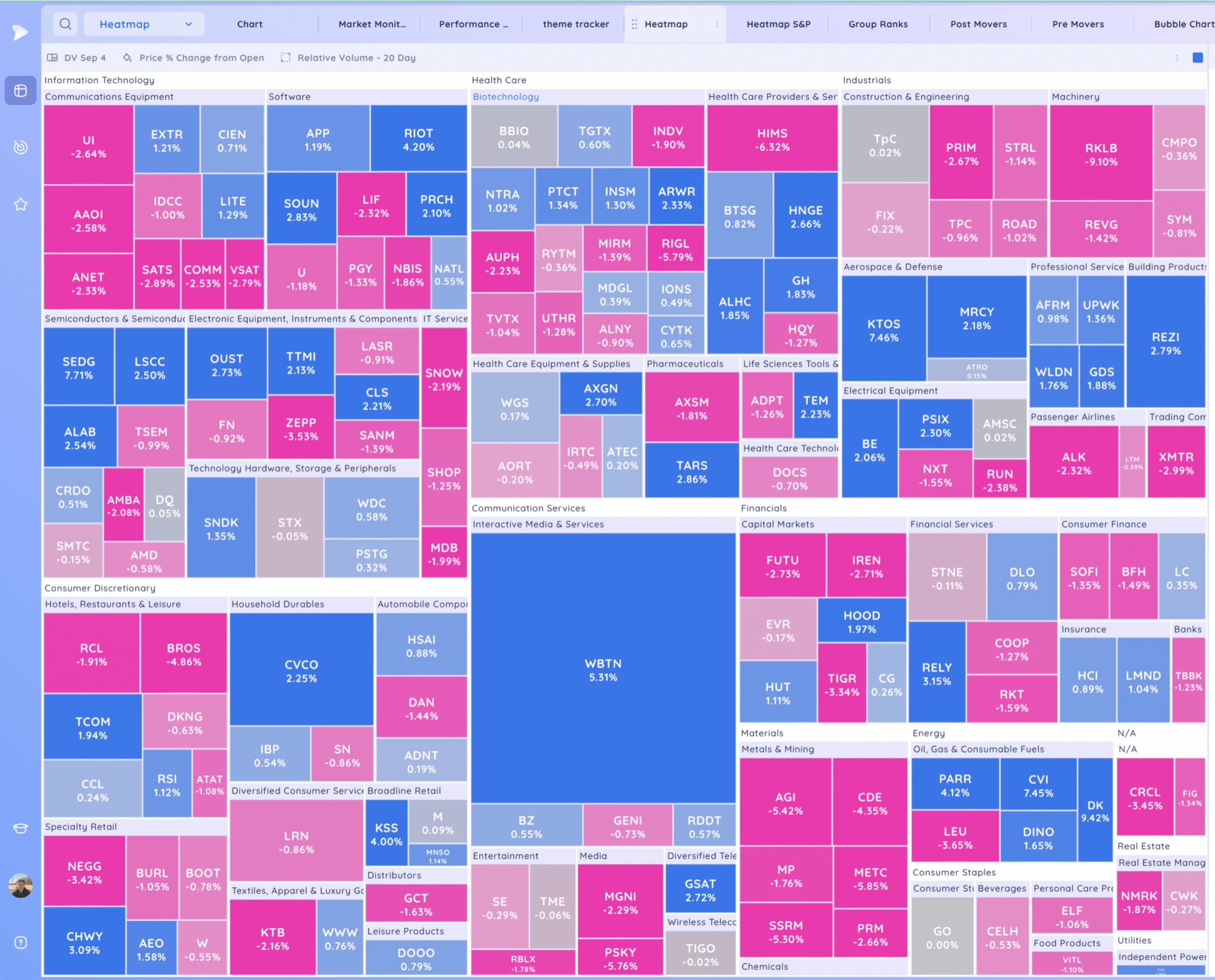

Deepvue Leaders

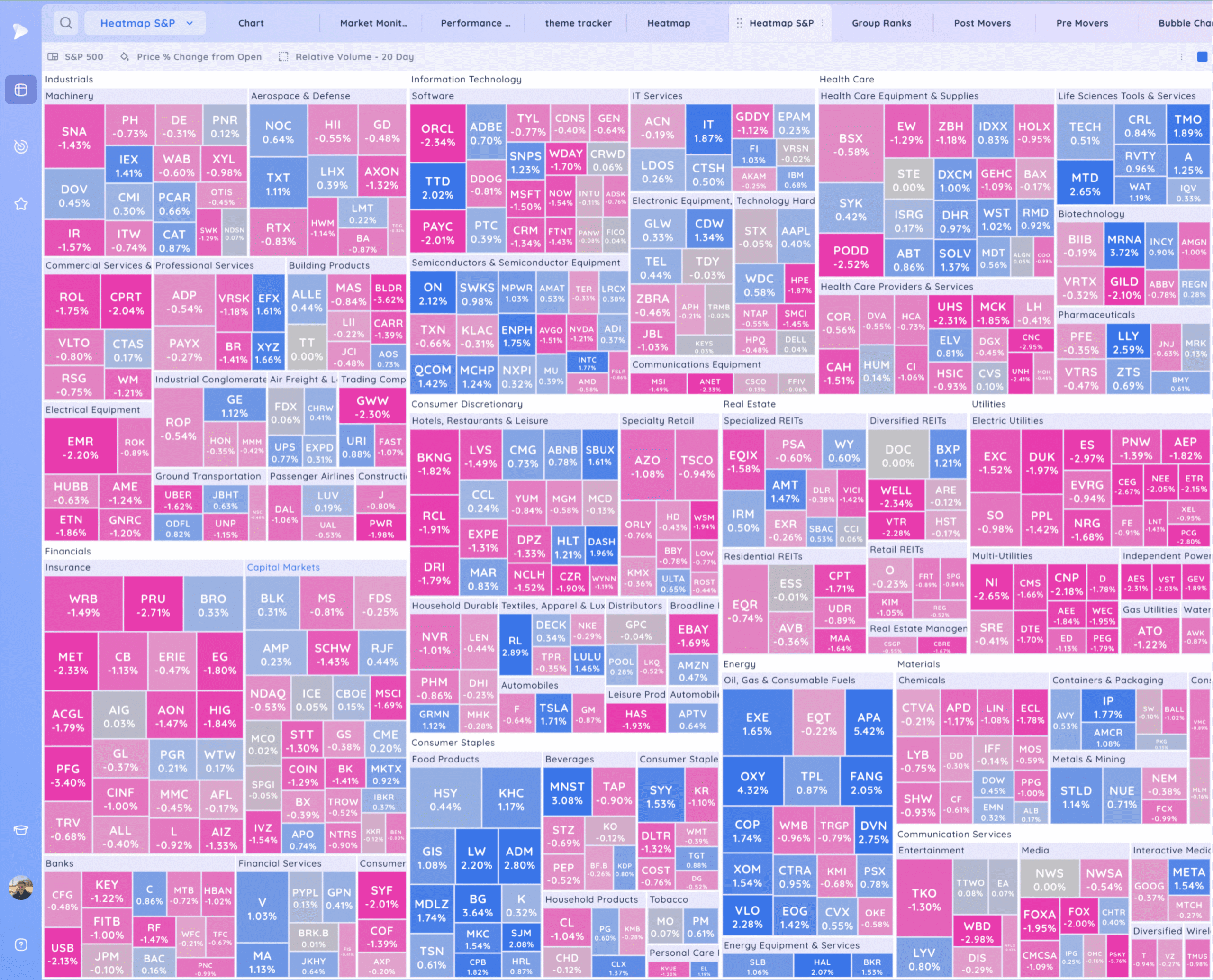

S&P 500.

Leadership Stocks & Analysis

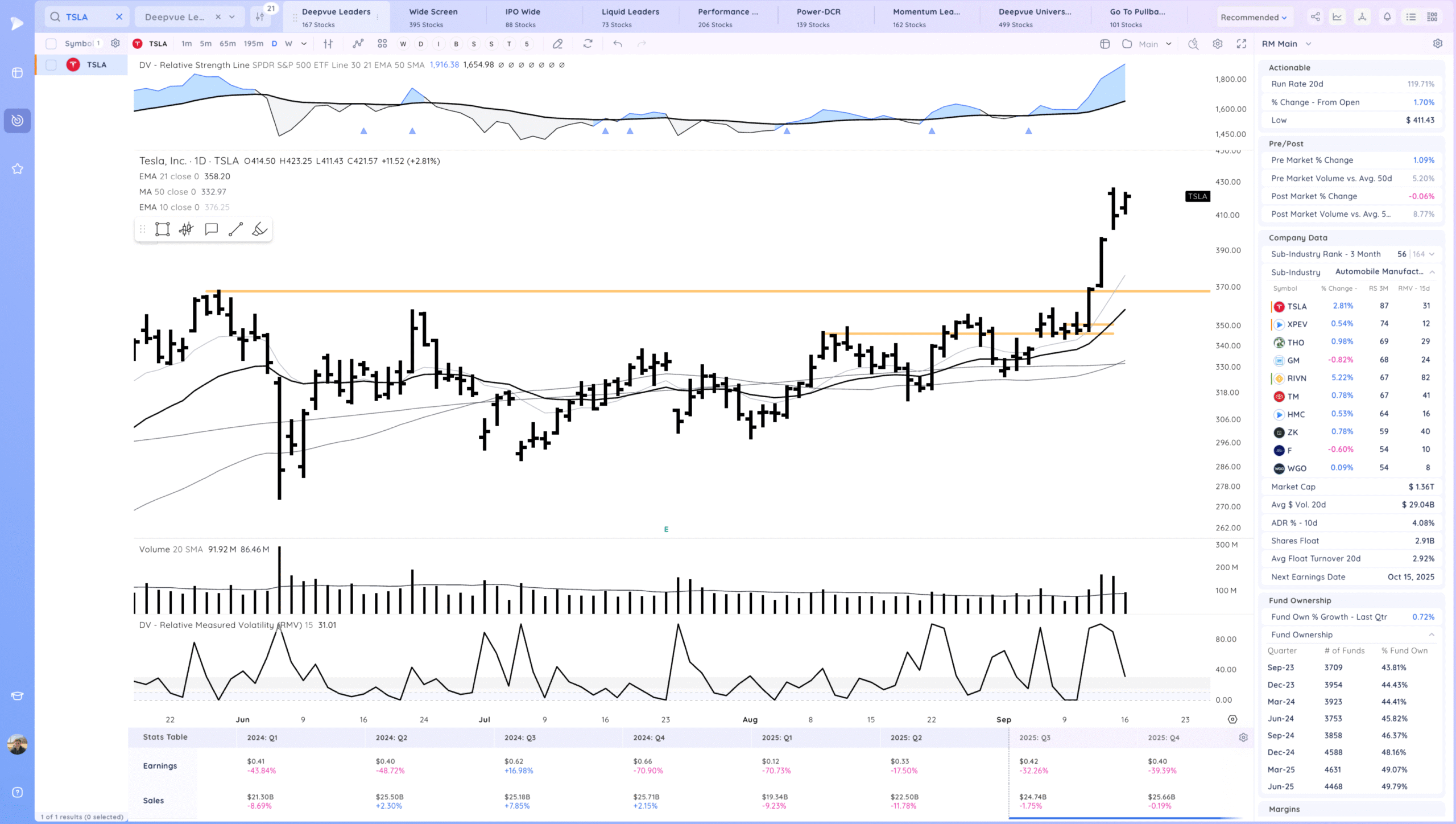

TSLA Inside day, acting well. Ideally forms a tight range letting the 10 ema catch up a bit. Expecting reconfirmation. To the downside that gap remains unfilled. It could pull in hard to fill that and still be in character. Would then be a spot to watch for a push higher from.

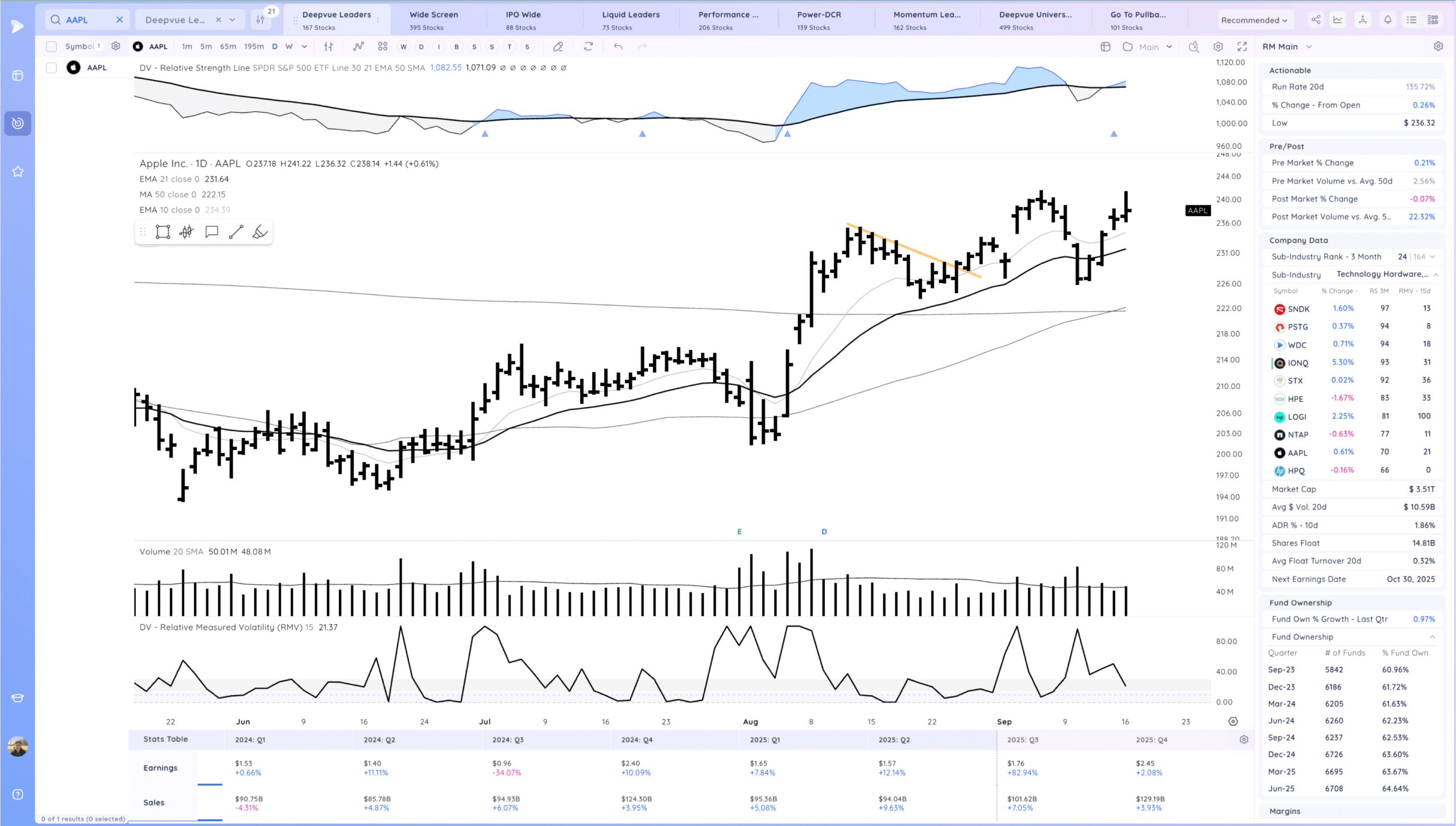

AAPL Fade off highs

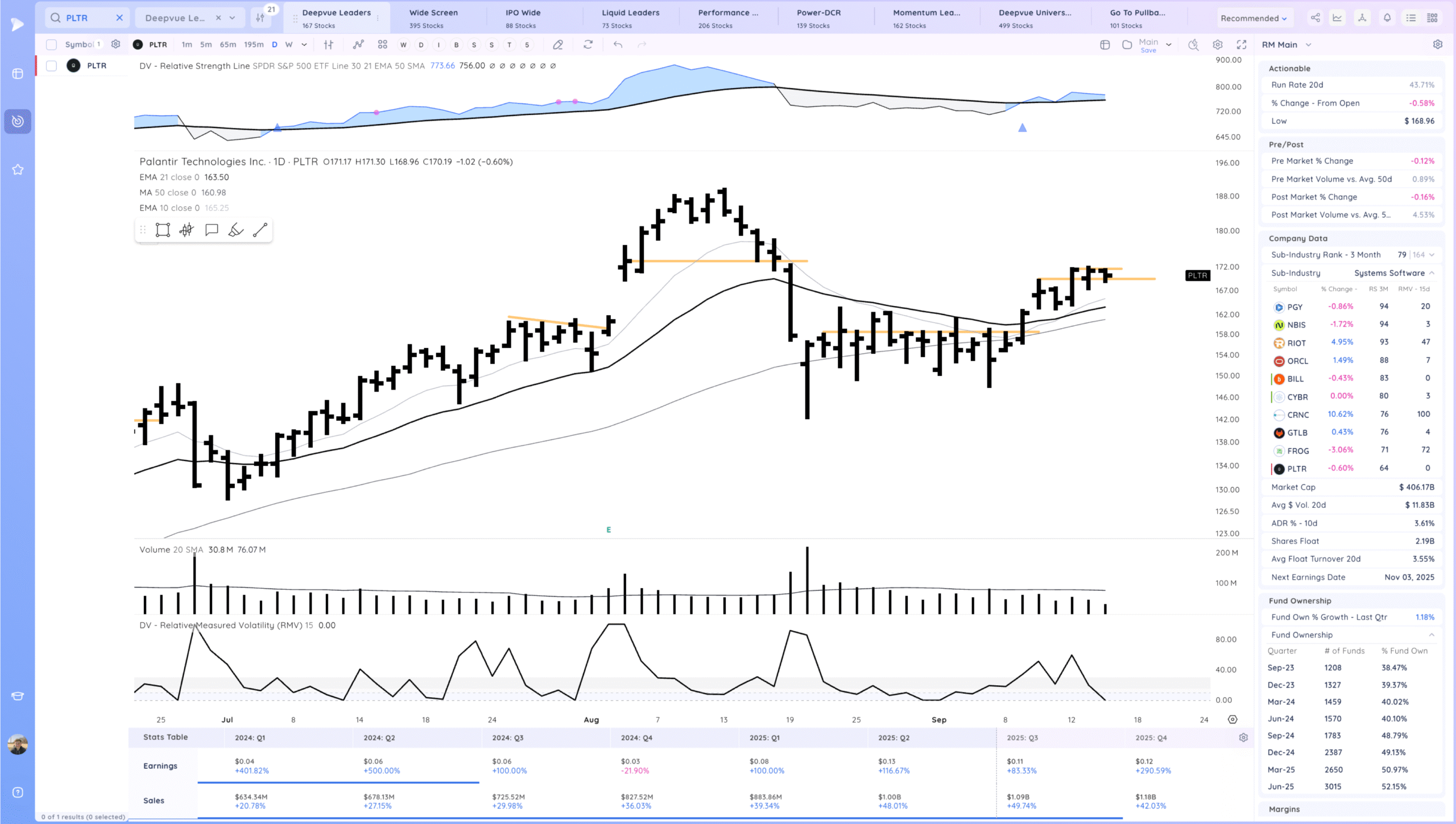

PLTR Tightening more. Watching for continuation. I still feel like this base needs more time to develop

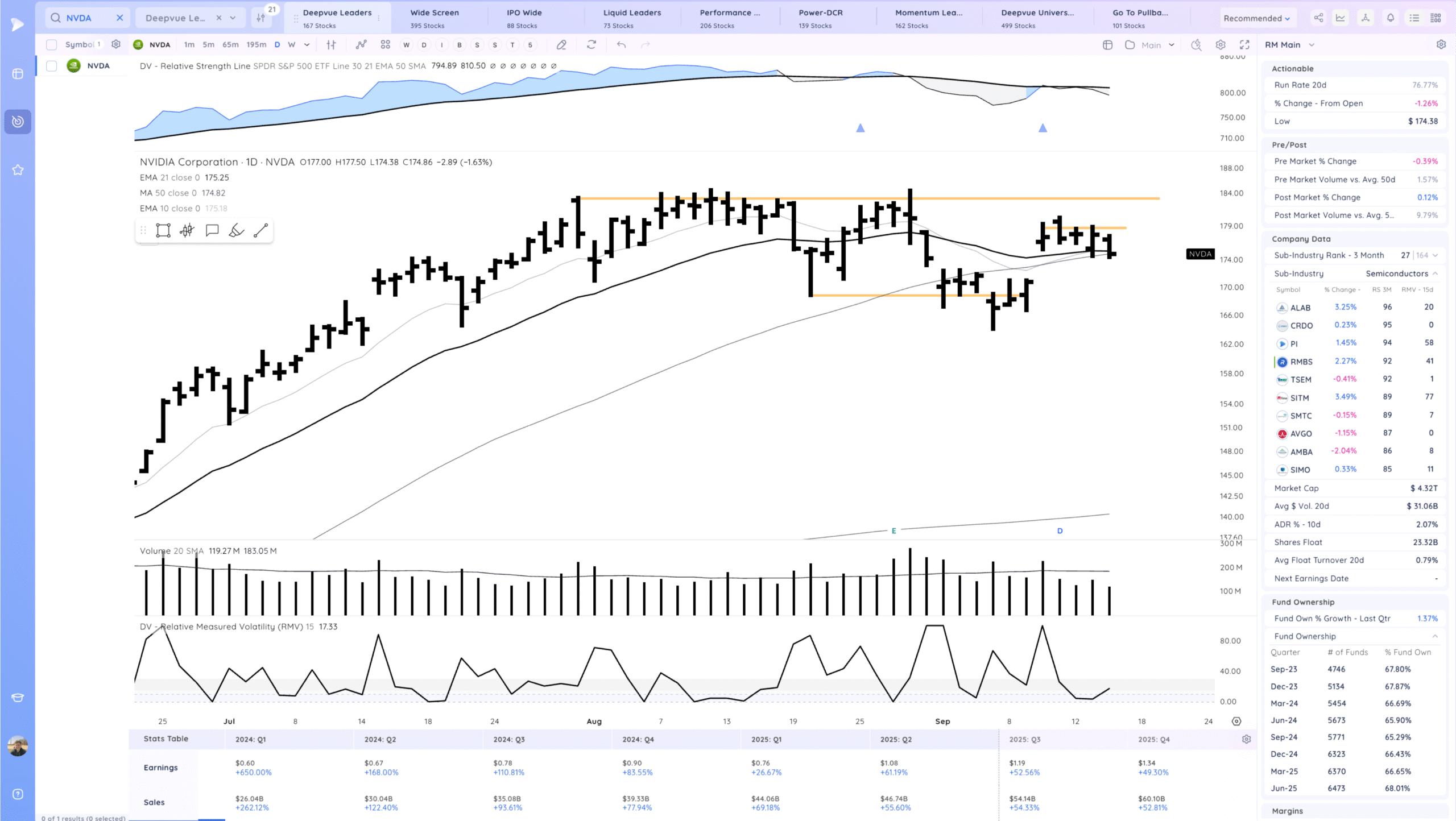

NVDA Leaking lower a bit back into the MA area.

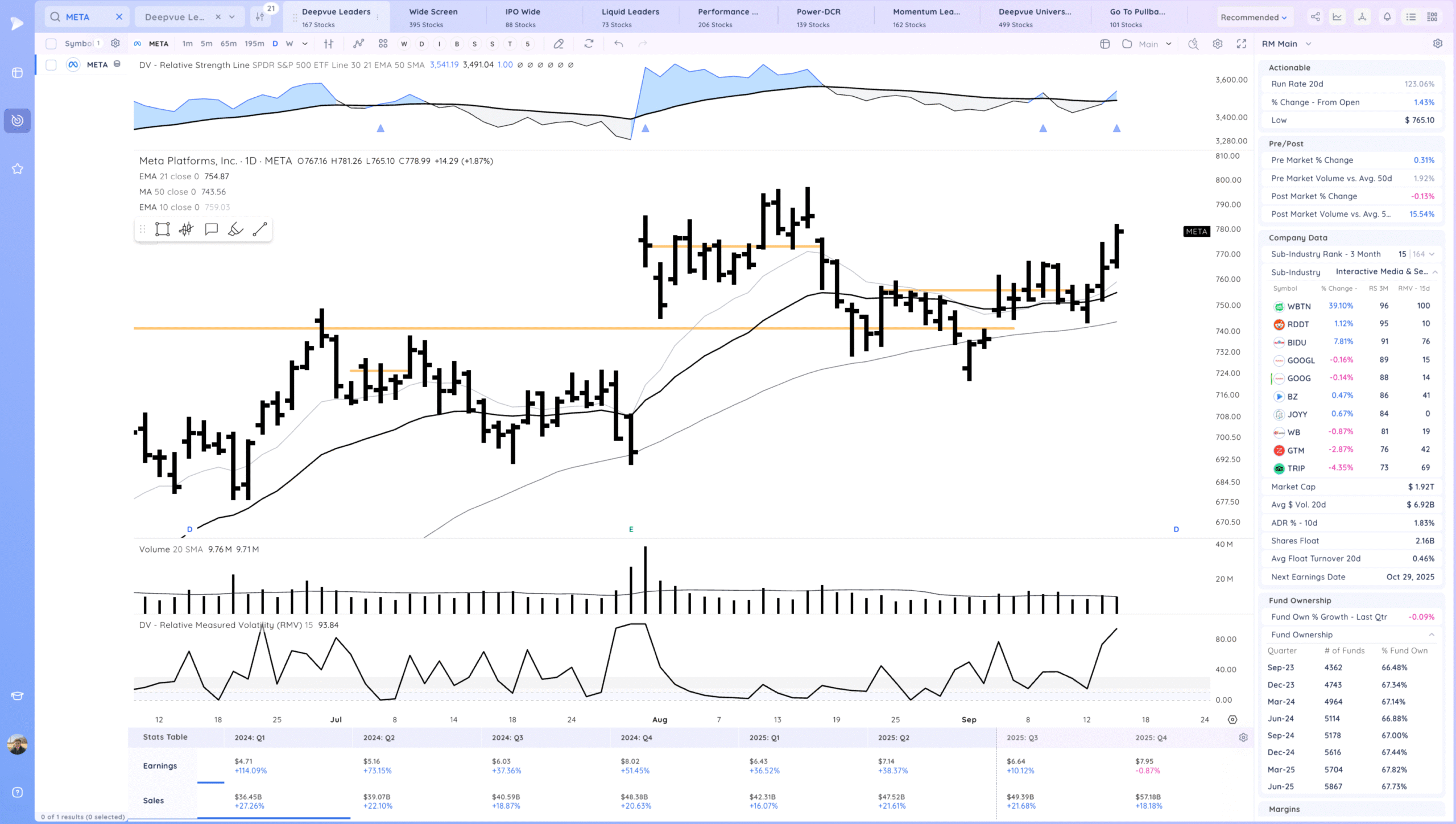

META follow through higher

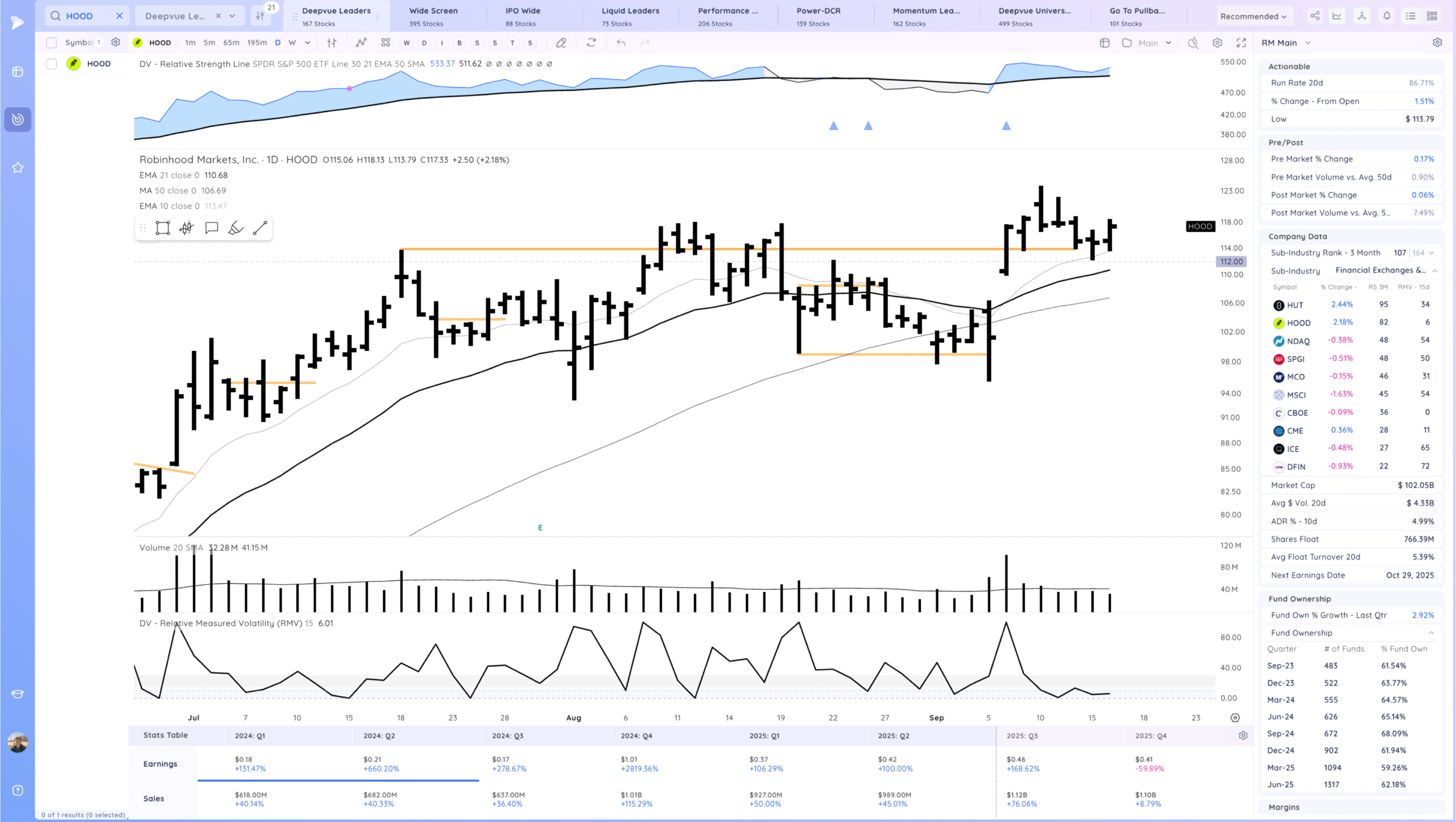

HOOD Slight push higher off the pivot area and the 10ema

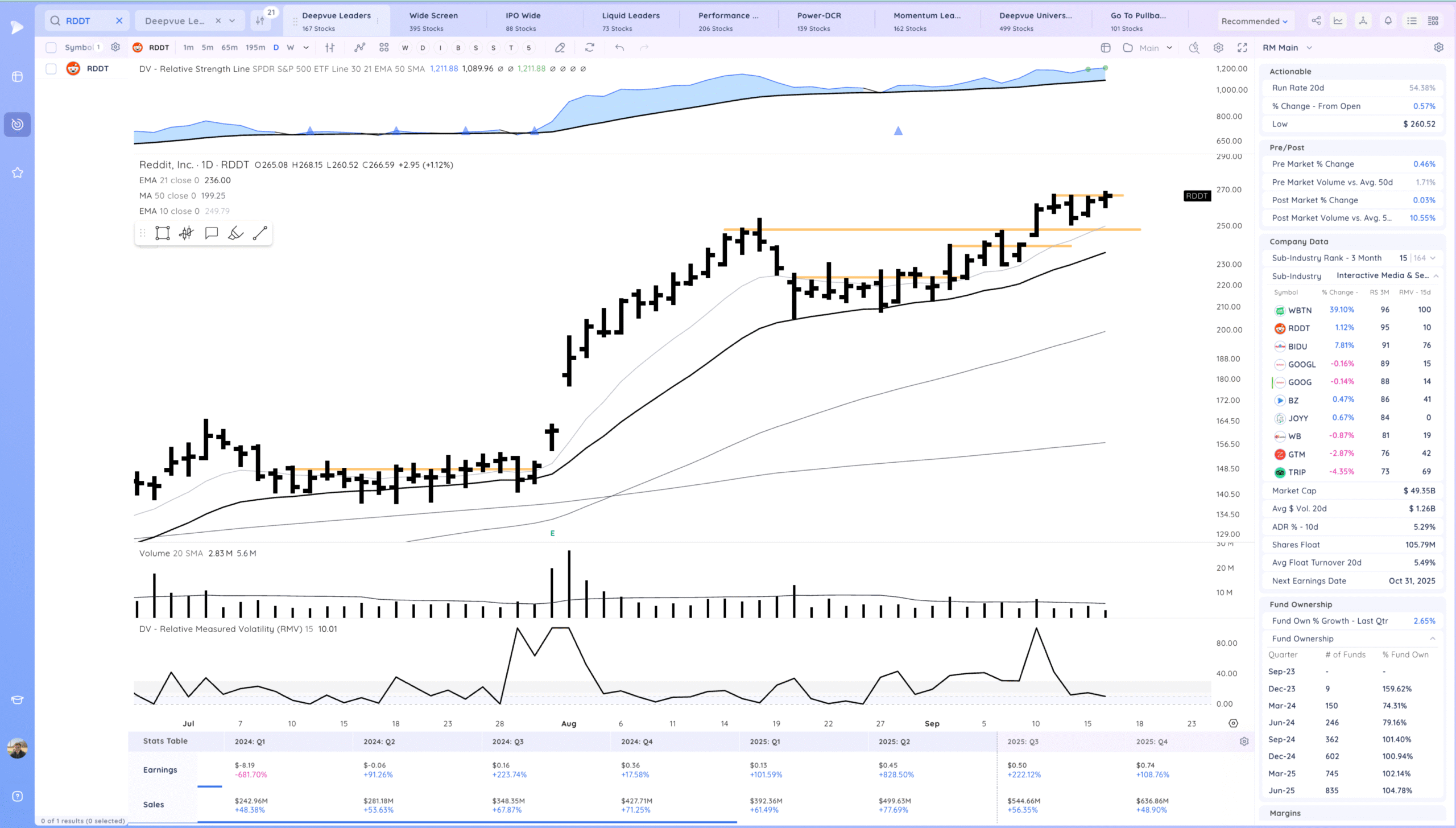

RDDT Overall tight day

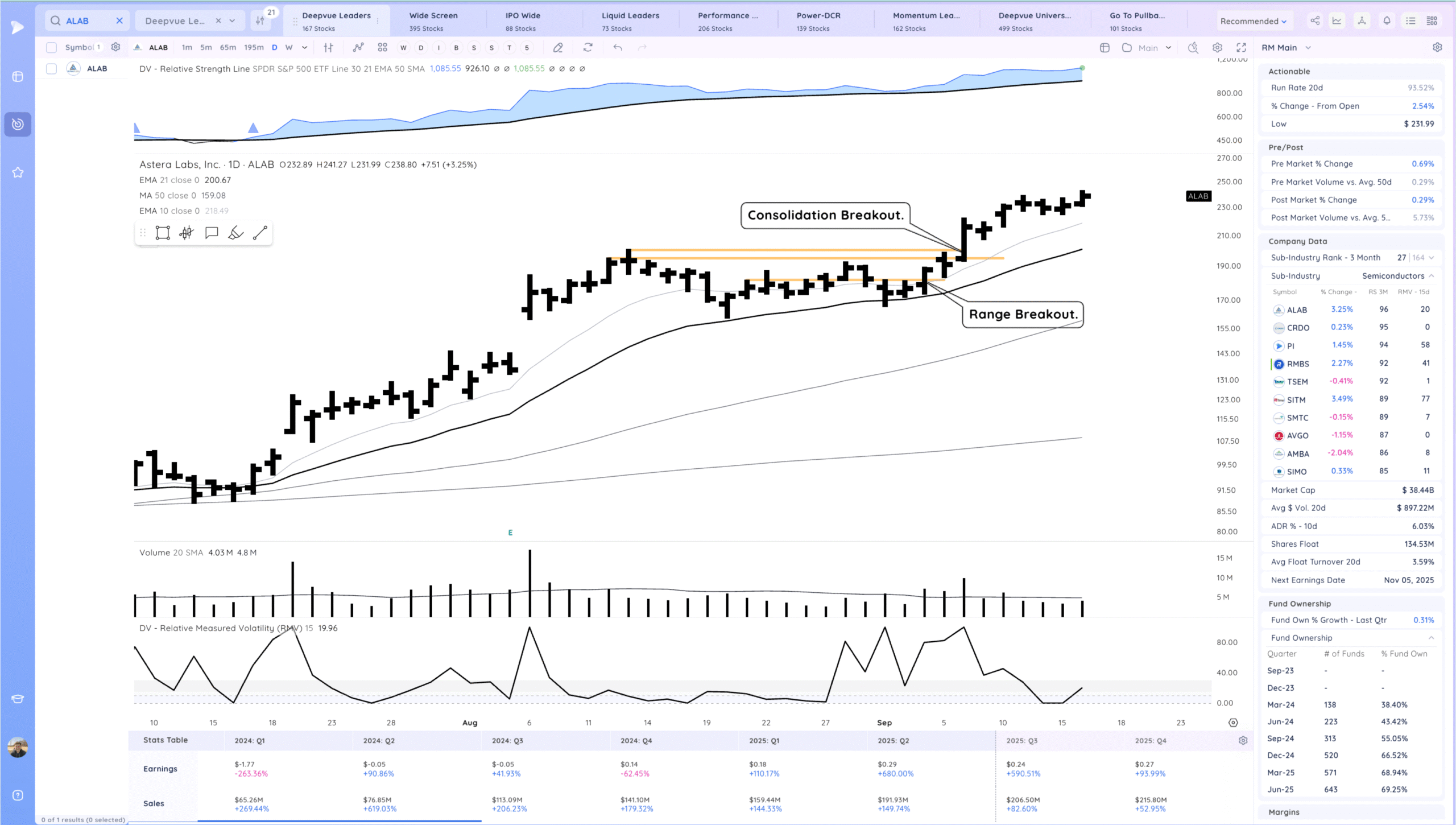

ALAB Trending.

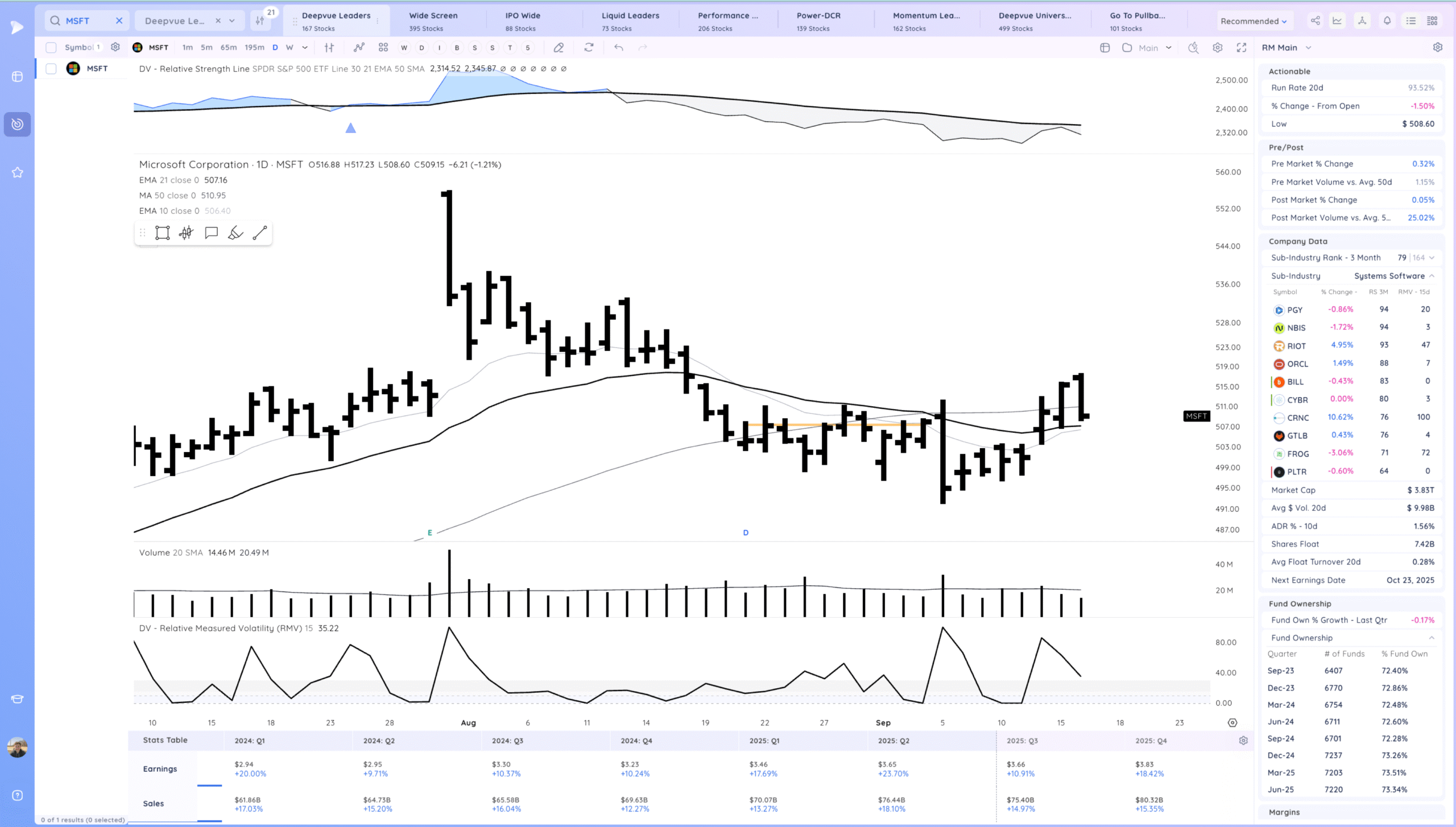

MSFT Downside reversal closing back below the 50sma

Key Moves

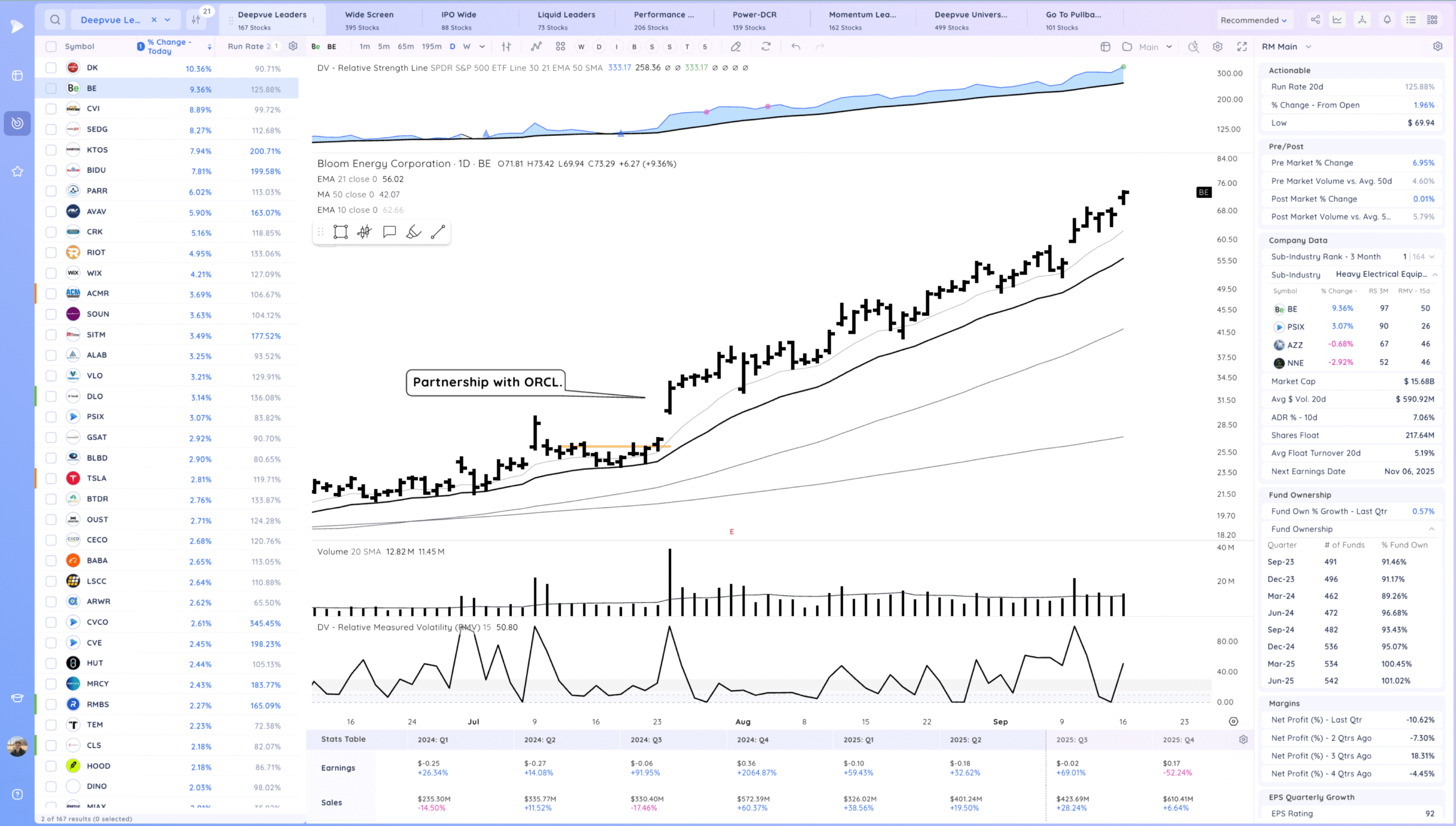

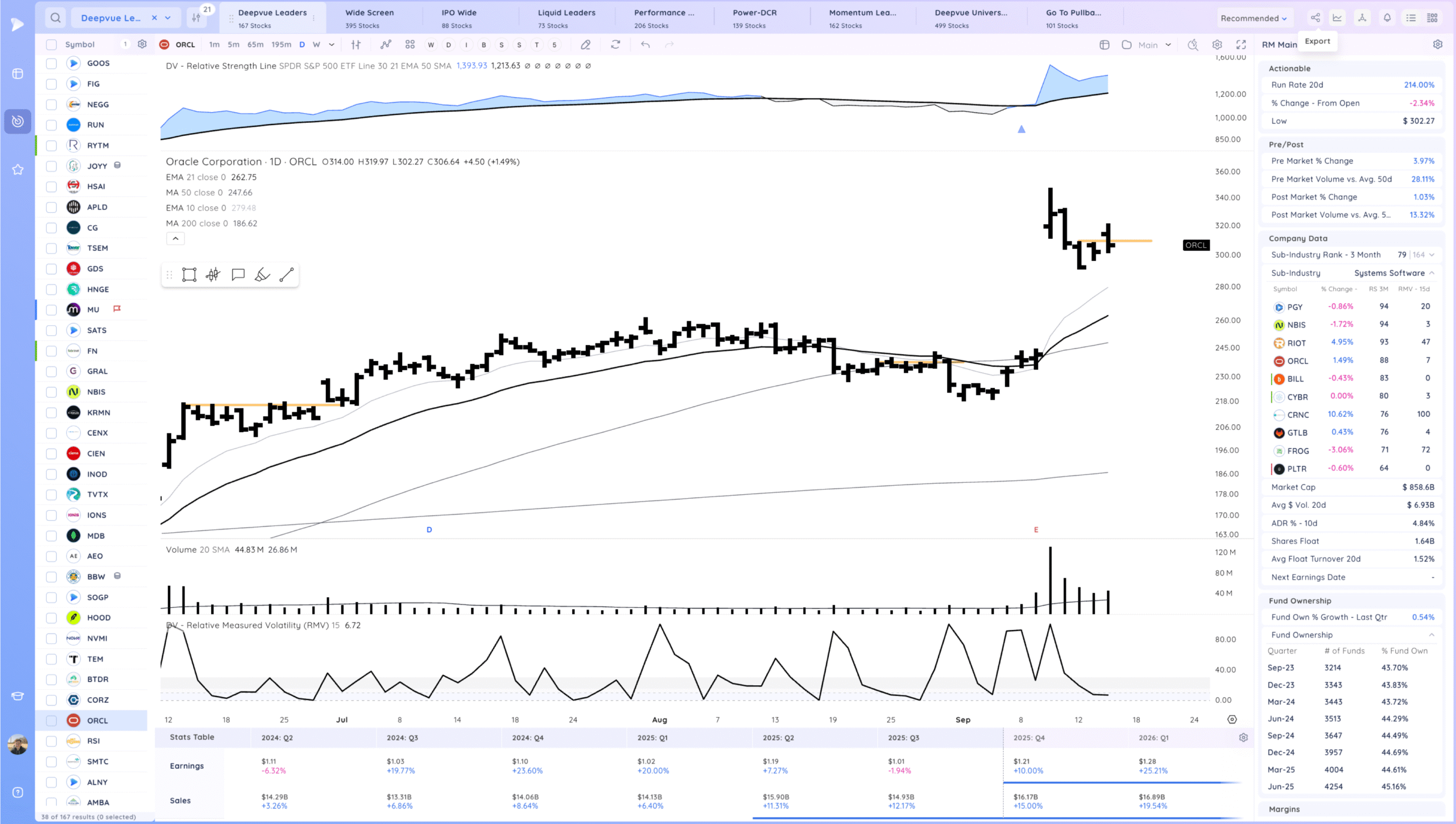

BE gap up as it continues the strong trend since the ORCL partnership catalyst

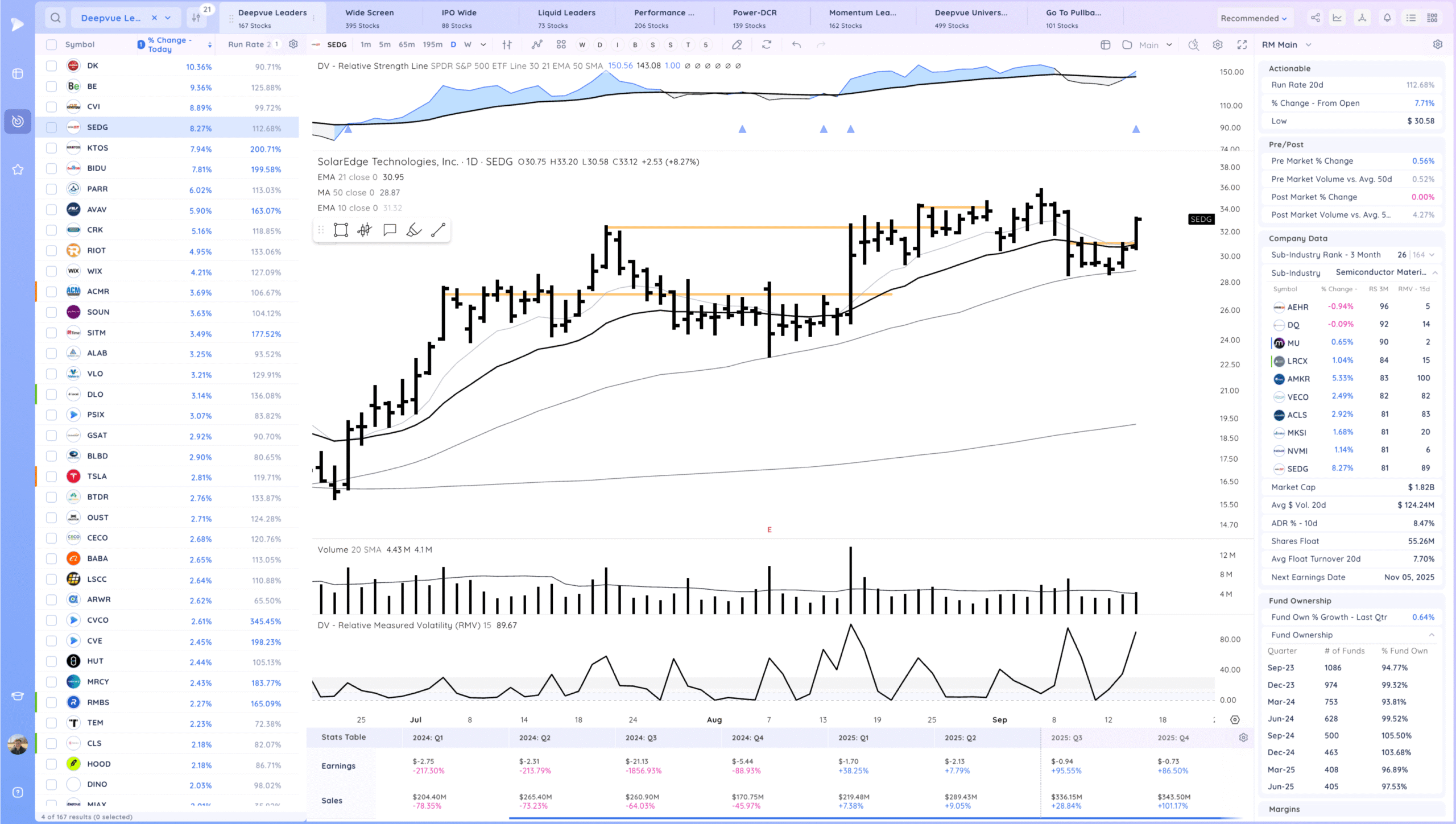

SEDG follow through up above the 21ema

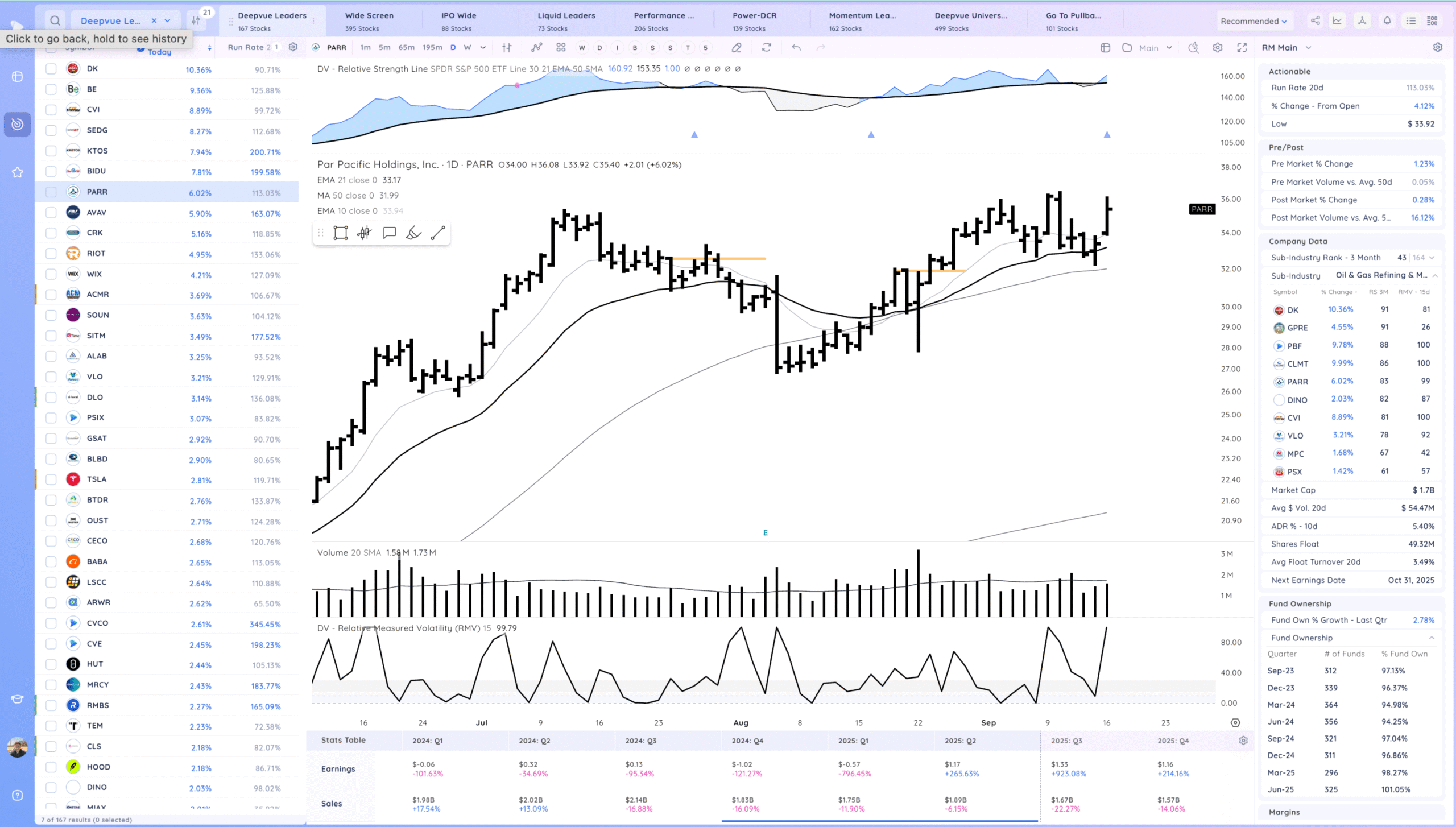

PARR follow through up. oil and gas theme.

Setups and Watchlist

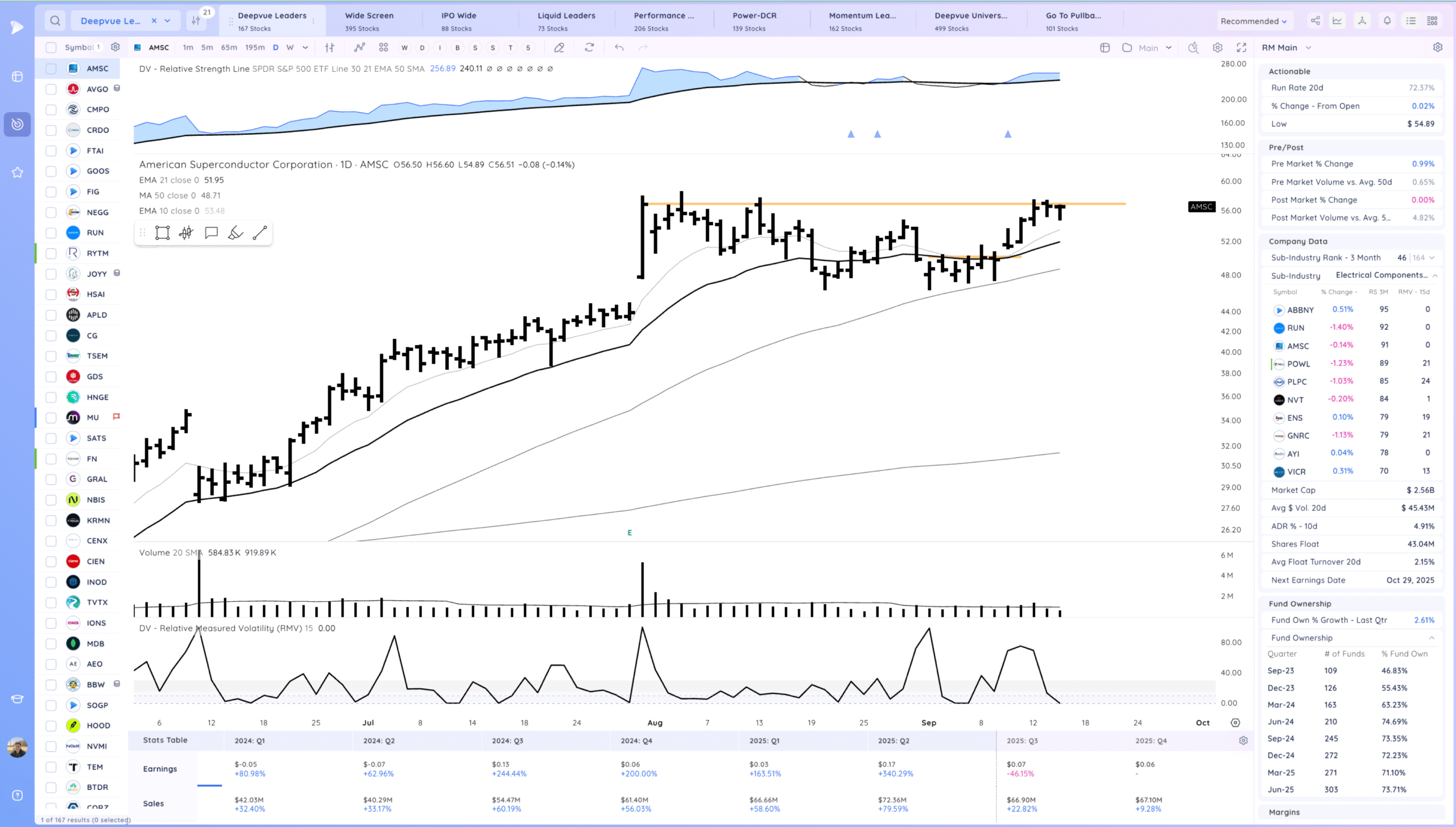

AMSC watching for a consolidation breakout

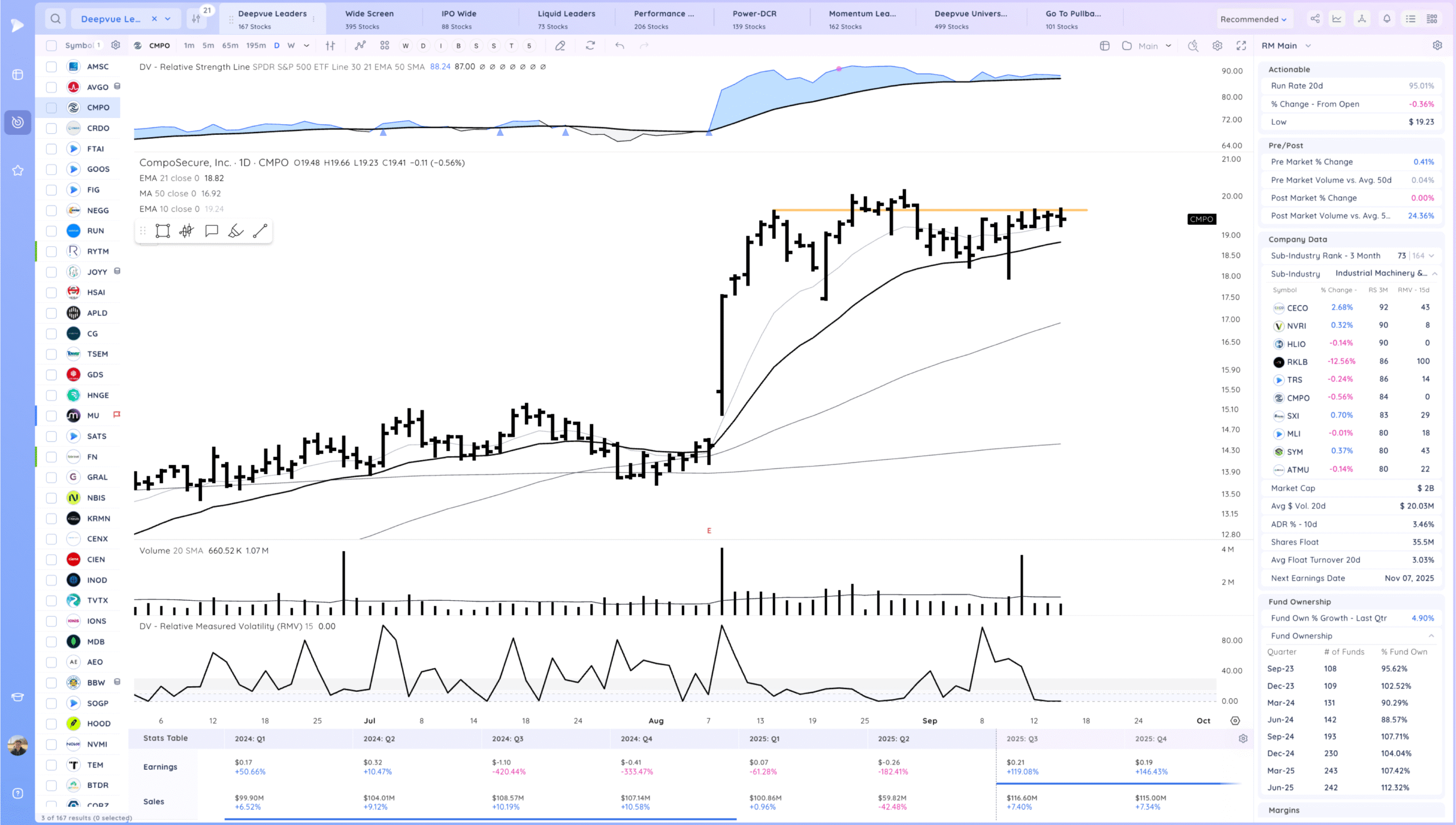

CMPO watching for a range breakout.

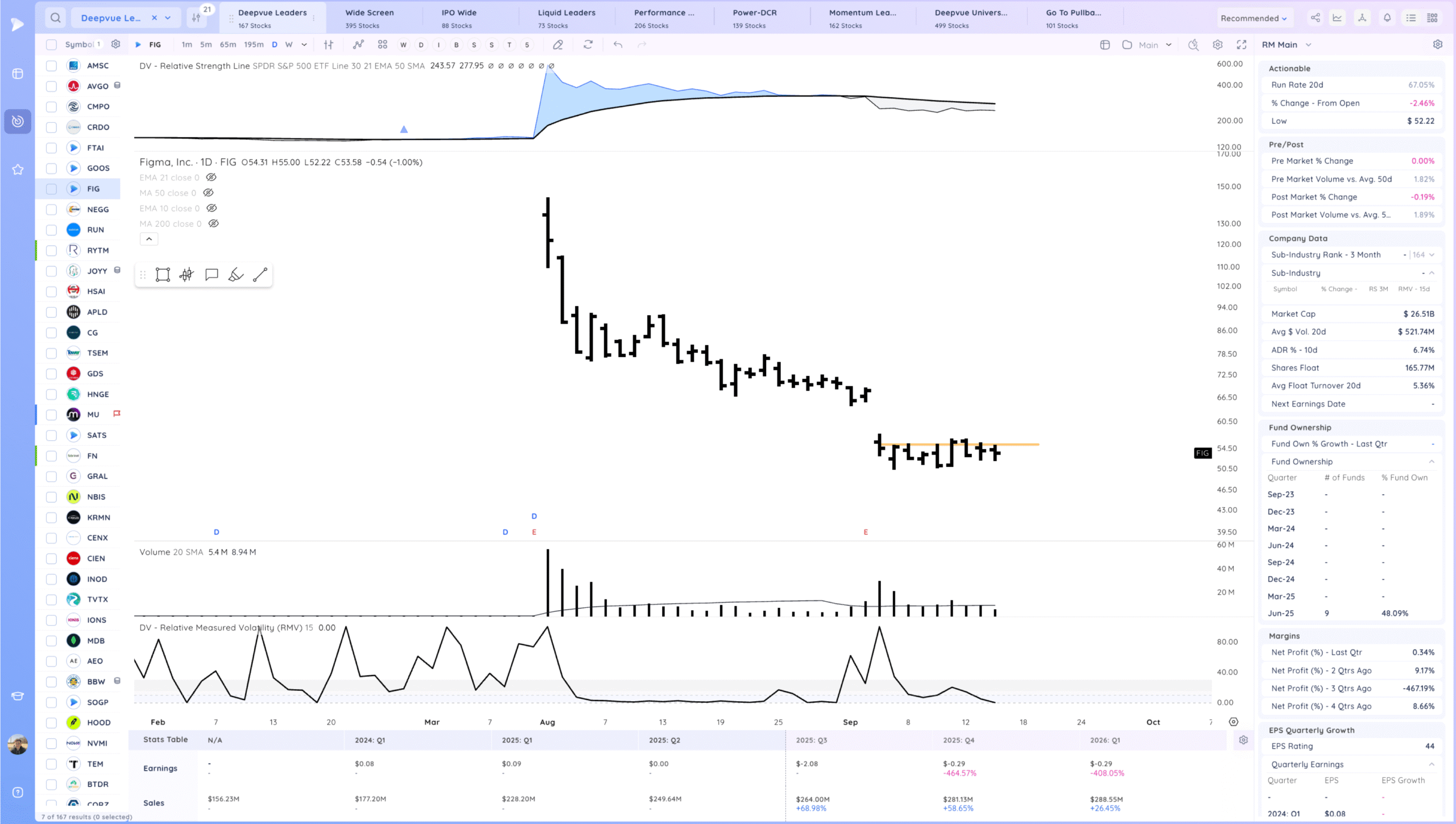

FIG watching for a range breakout. New IPO Swing Idea

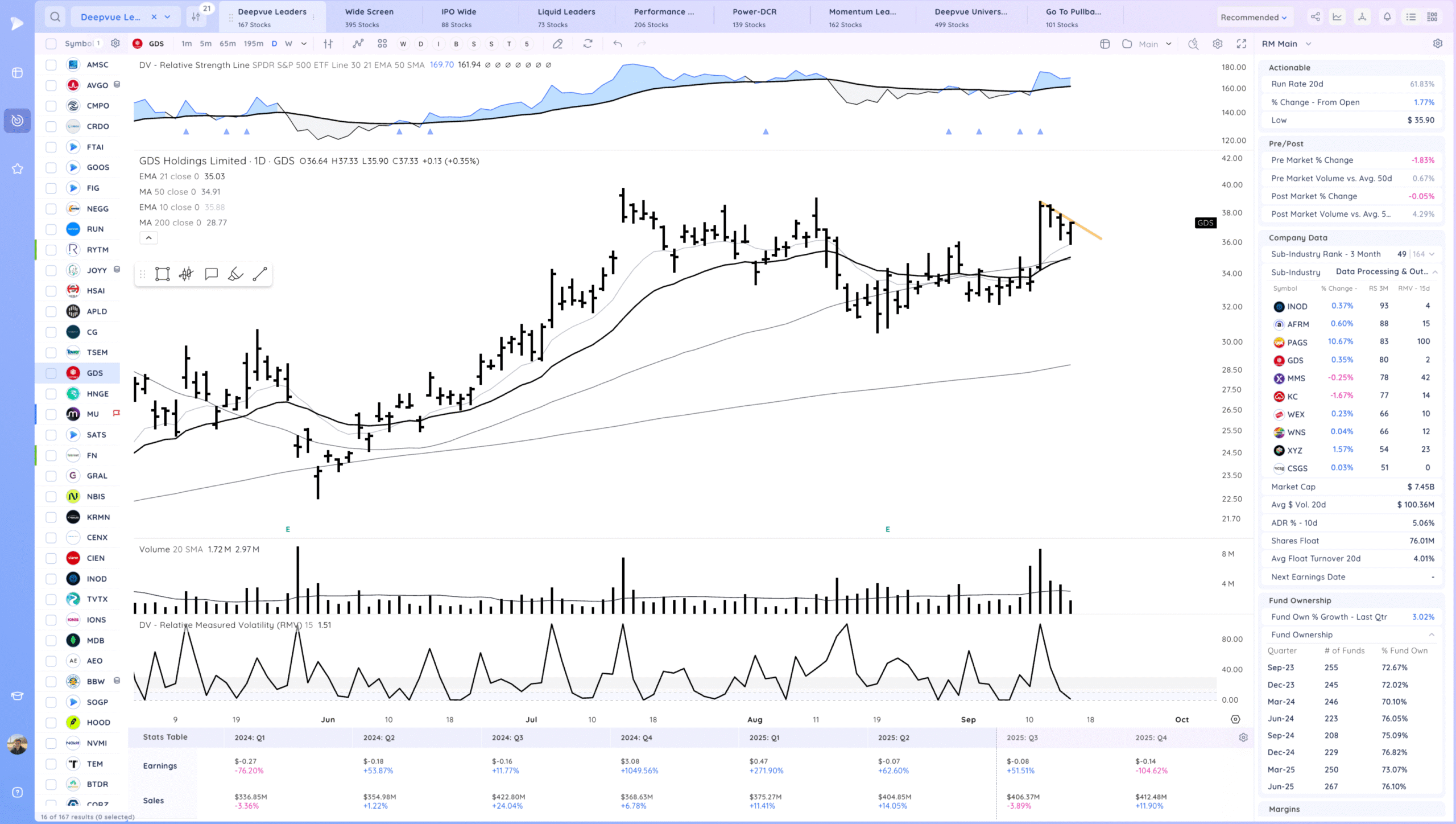

GDS watching for follow through and a flag breakout

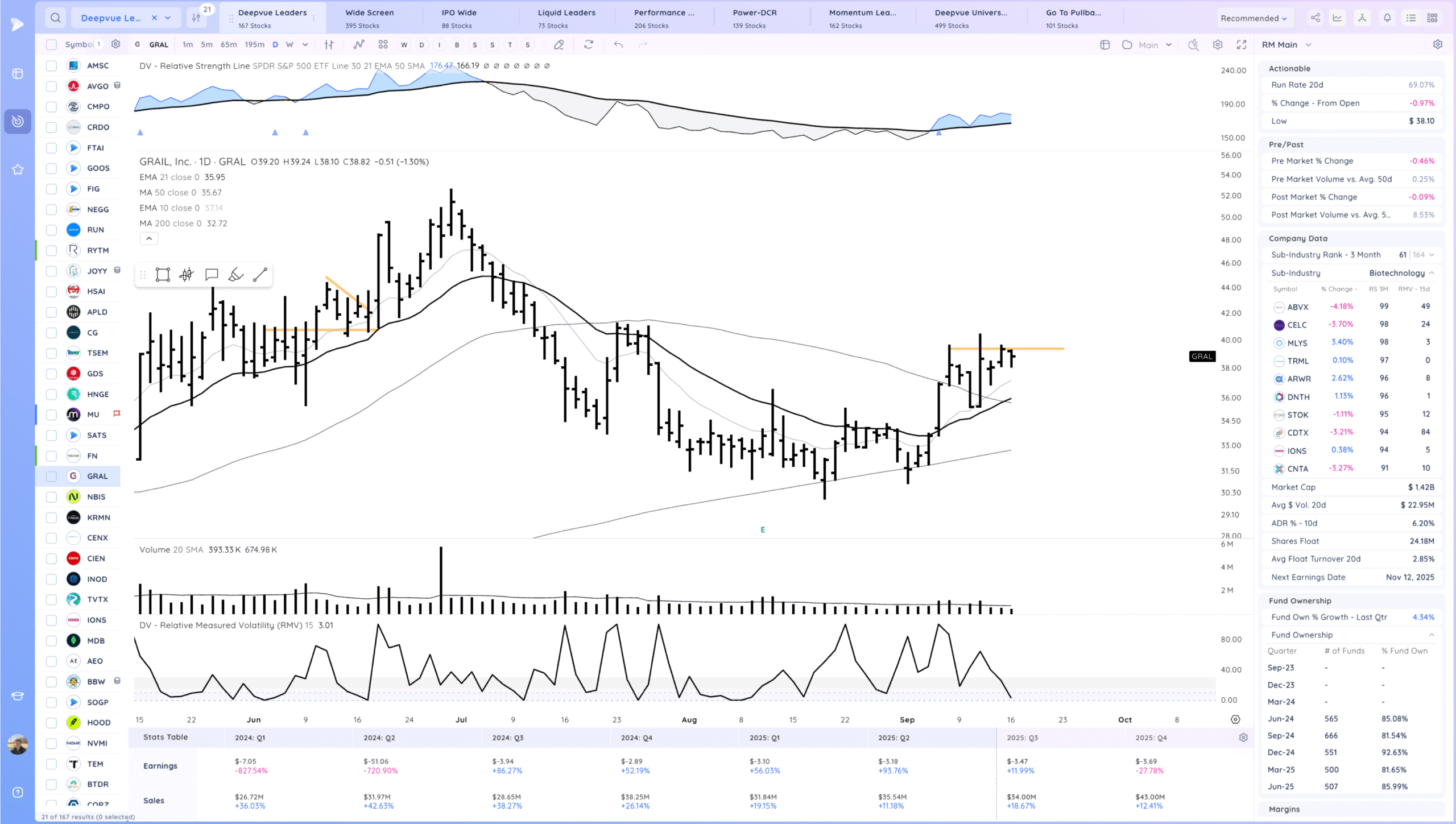

GRAL watching for a range breakout. Very fast mover. Health care AI biotech

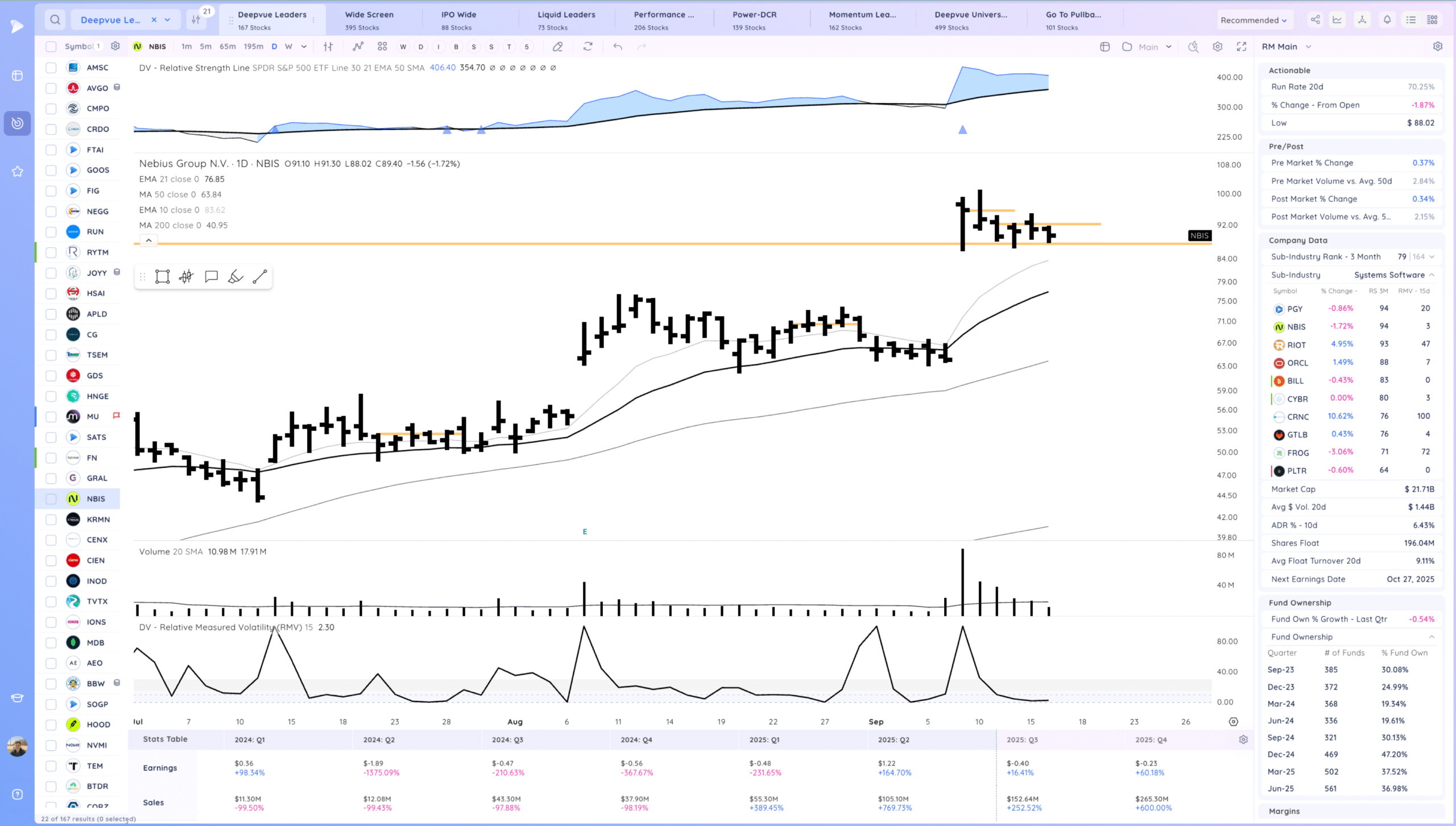

NBIS watching for a range breakout. focus tomorrow

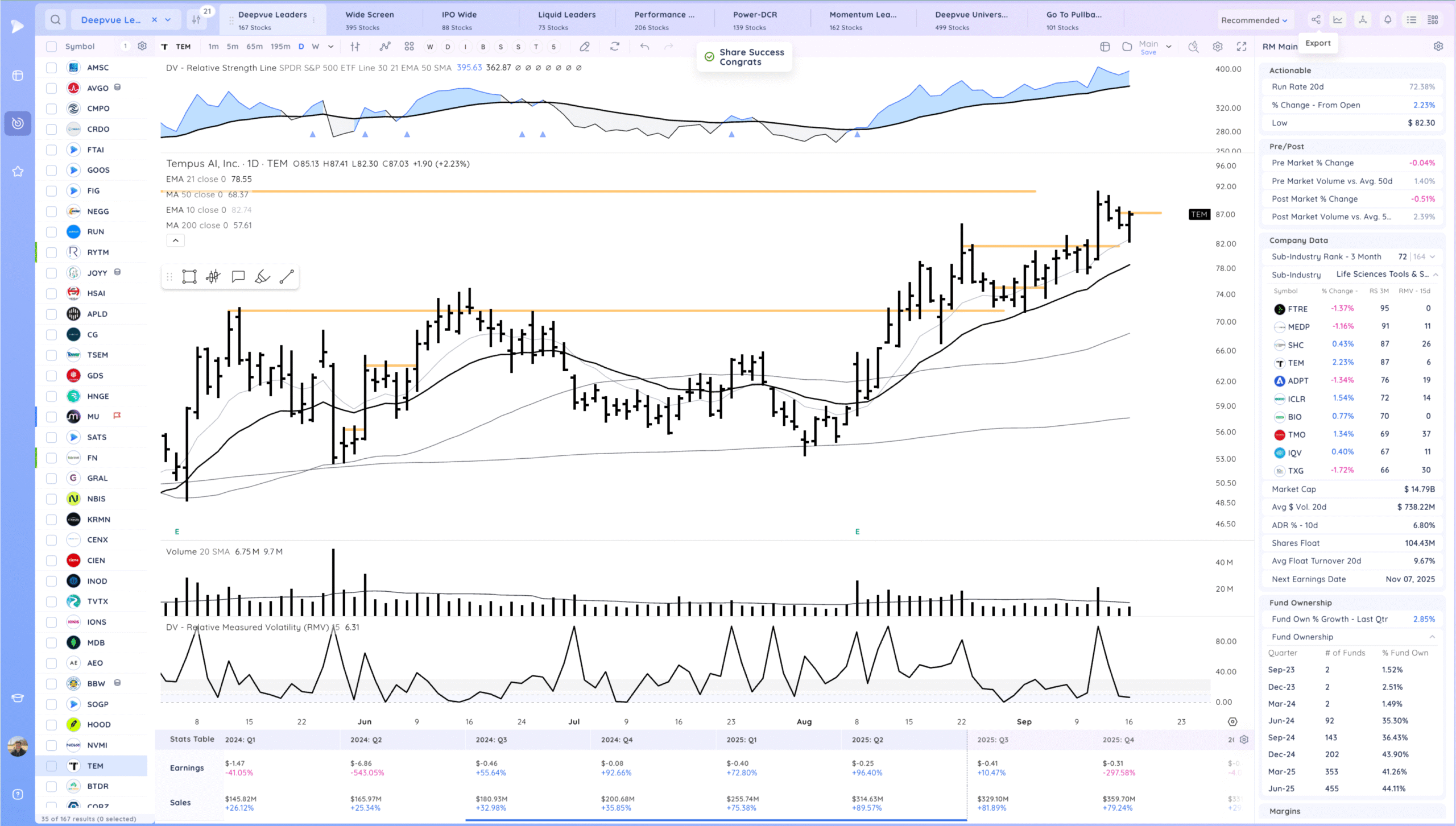

TEM watching for follow through up. Another bounce off the 10ema

ORCL faded people today. watching for range re-breakout

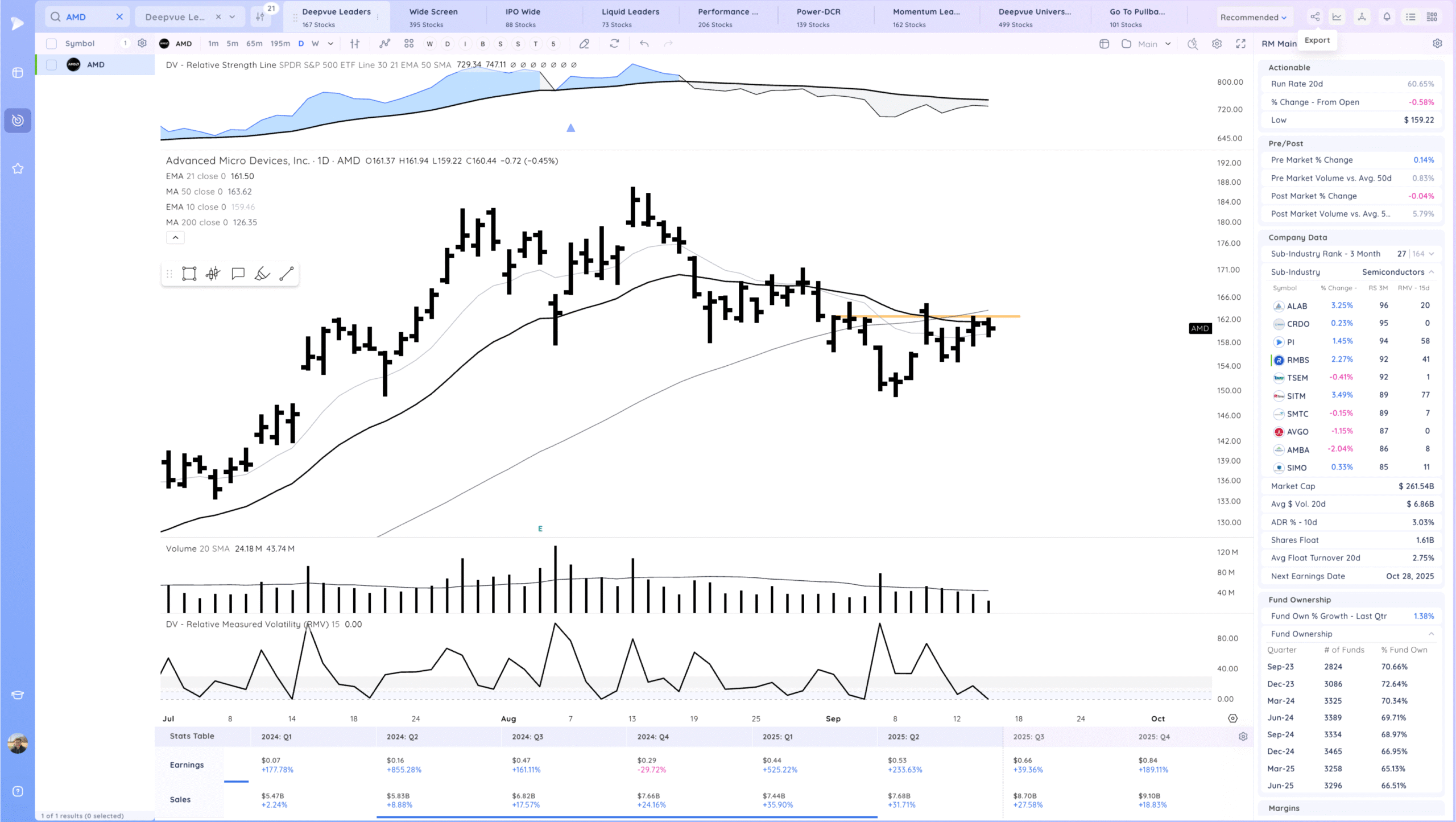

AMD watching for a pop through the 21ema

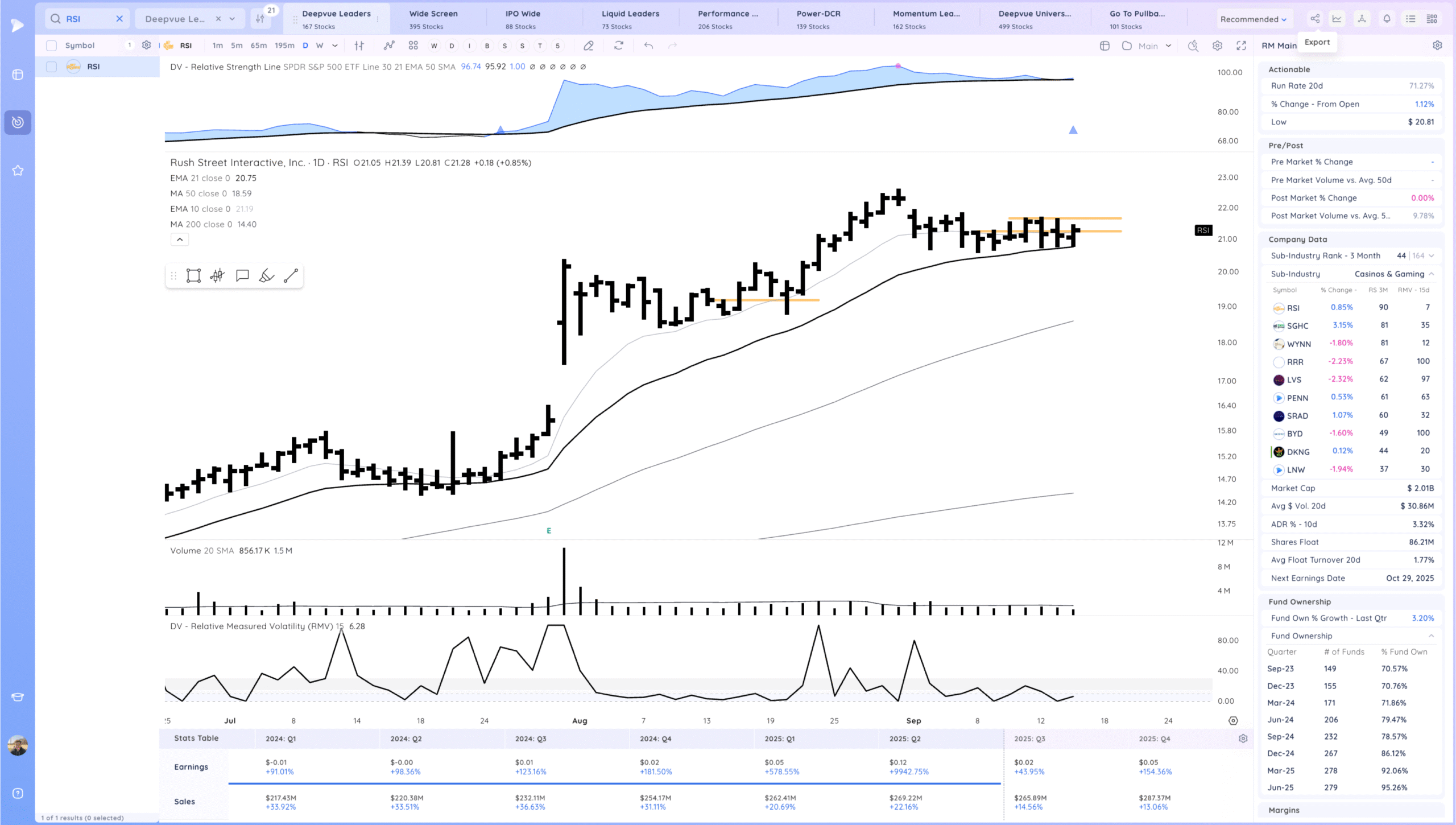

RSI. watching for a range breakout from the inside day on the 21

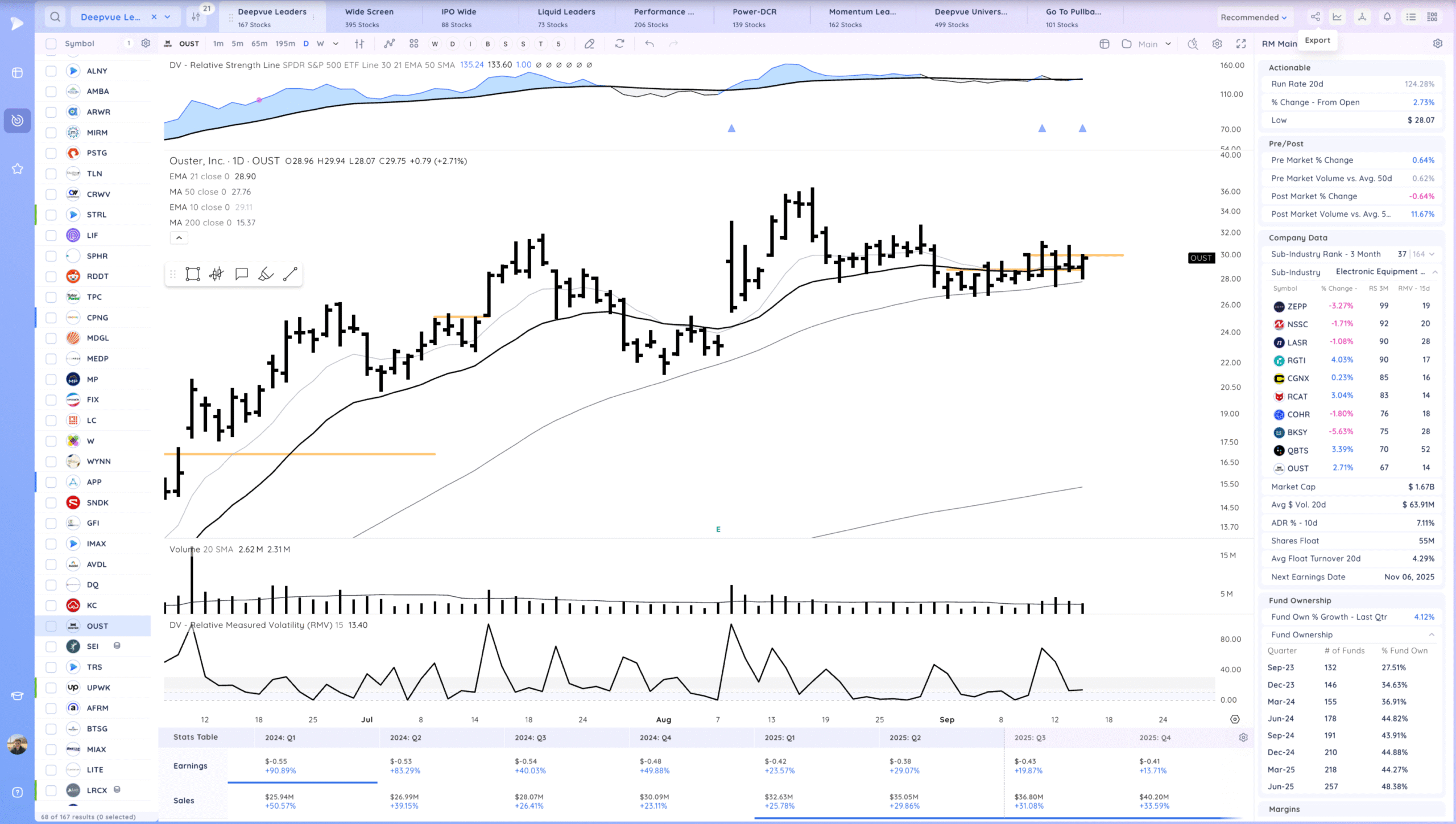

OUST choppy recently but watching for follow through. Fast mover

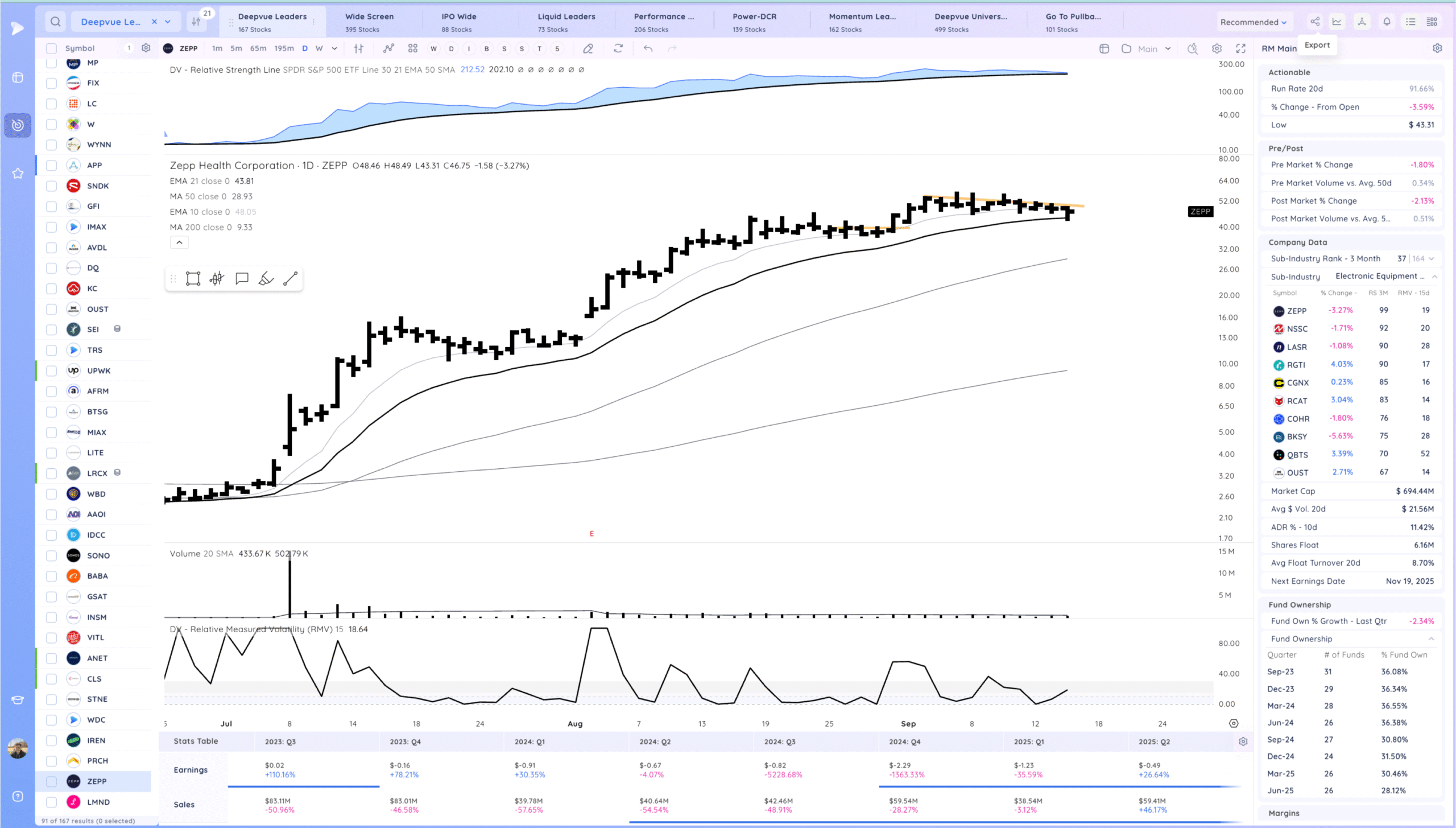

ZEPP still in this flag, watching for a breakout. Very fast mover

Today’s Watchlist in List form

Focus List Names

AMSC CMPO FIG GDS GRAL NBIS TEM ORCL AMD RSI OUST ZEPP RDDT

Focus:

NBIS AMD TEM

Themes

Strongest Themes: AI, Miners, Software, Energy

Market Thoughts & Focus

Continued good action. Stretched a bit in short term. Remember to stay focused and centered. After strong expansion comes expansion and pullback, things don’t go up in a straight line. Expecting some stress tests. Be ready, know your plan for every position you have.

Anything can happen, Day by Day – Managing risk along the way