Trending and New Highs

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

October 8, 2025

Market Action

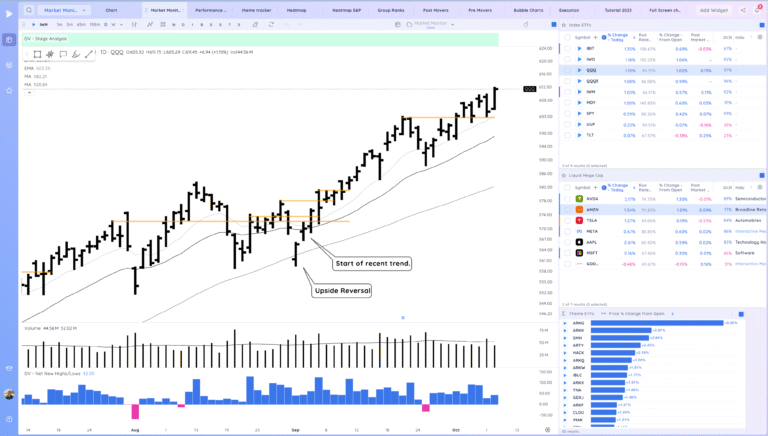

QQQ – Strong recovery with a slight gap up and expansion to the upside. We continue to trend above the moving averages. New Highs

Bulls want to see us continue to trend

Bears want to see a sharp reversal closing below the 10ema

Daily Chart of the QQQ.

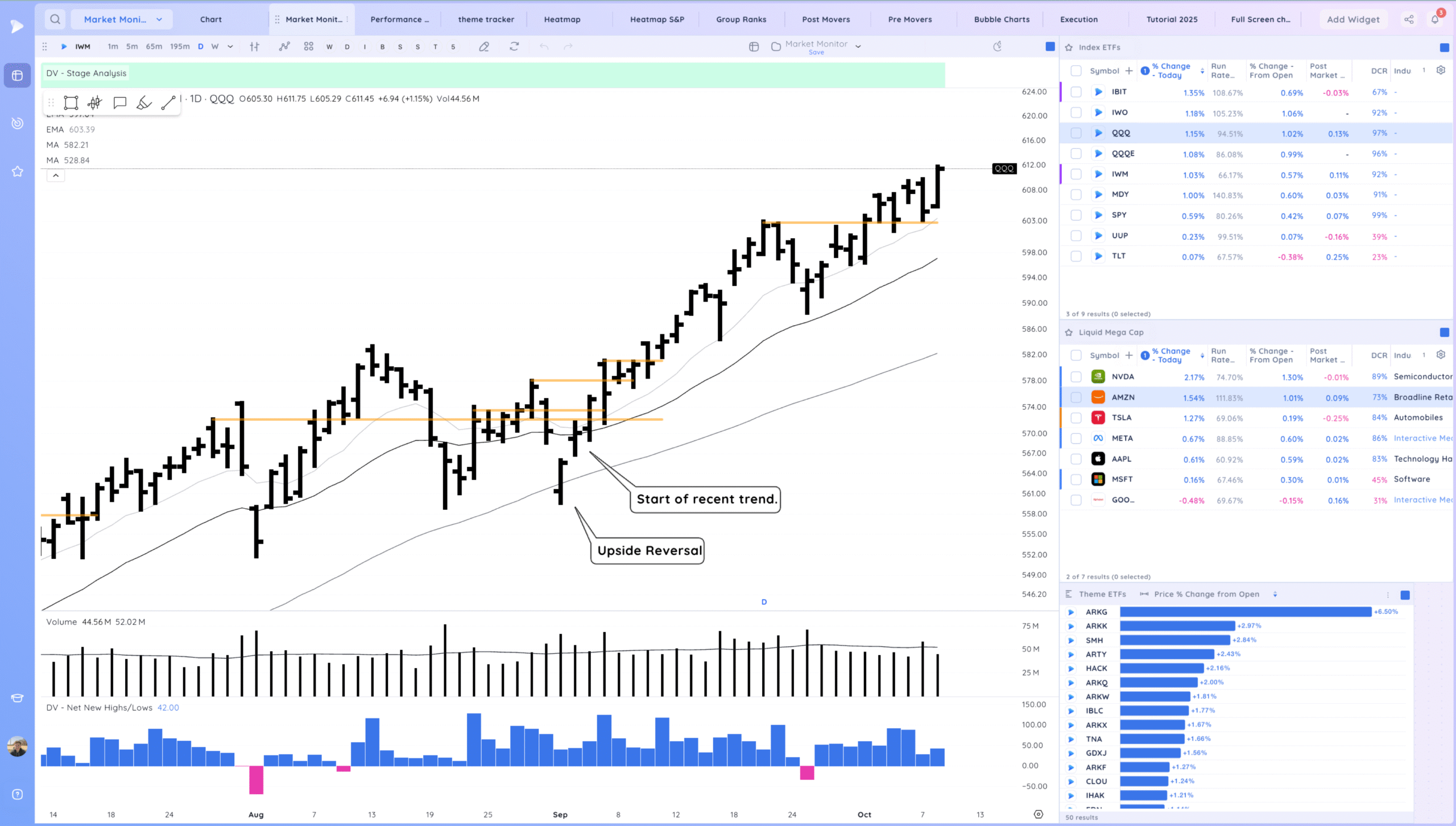

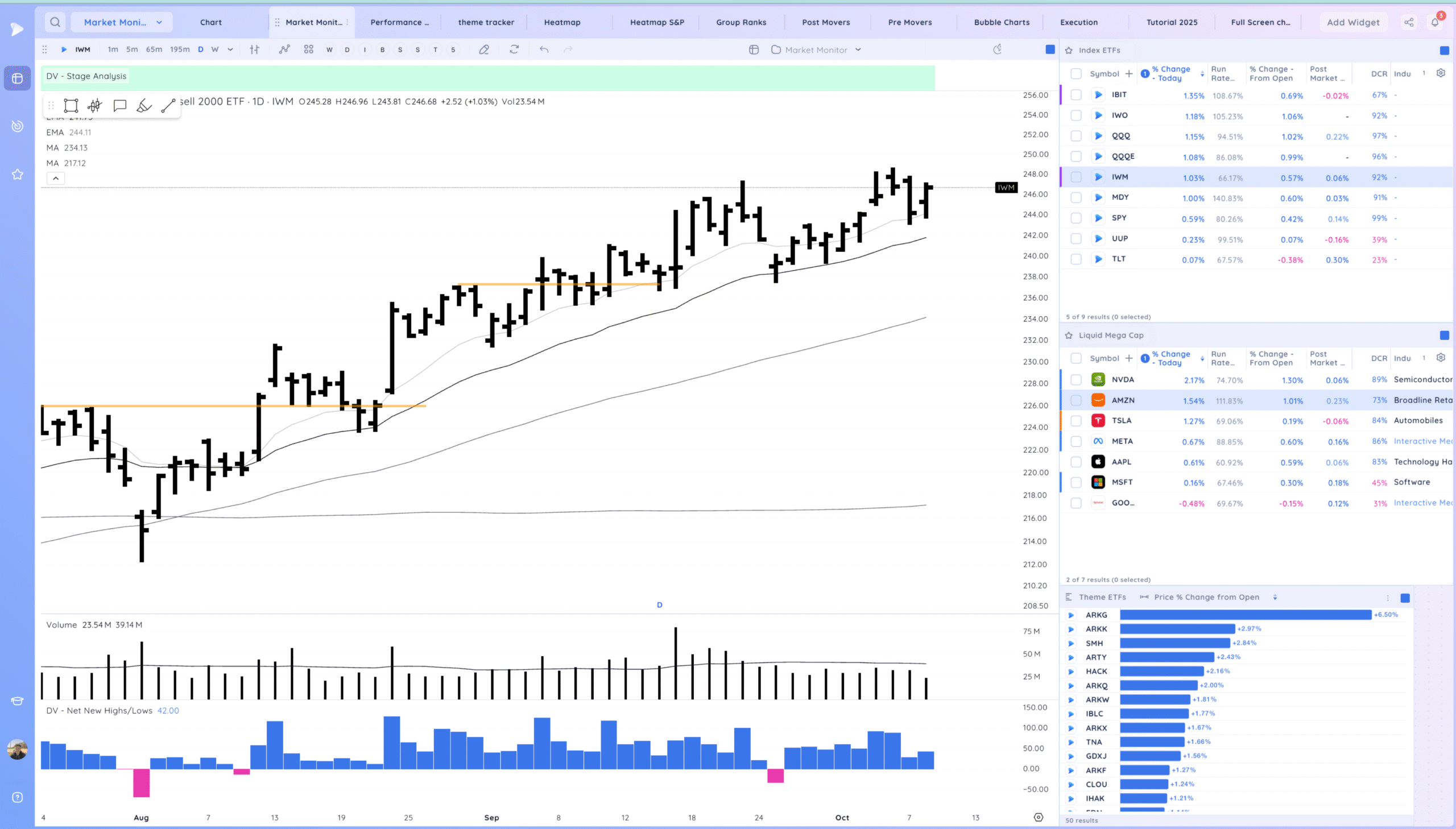

IWM – Strong inside day off the 10ema. Trending above the MAs

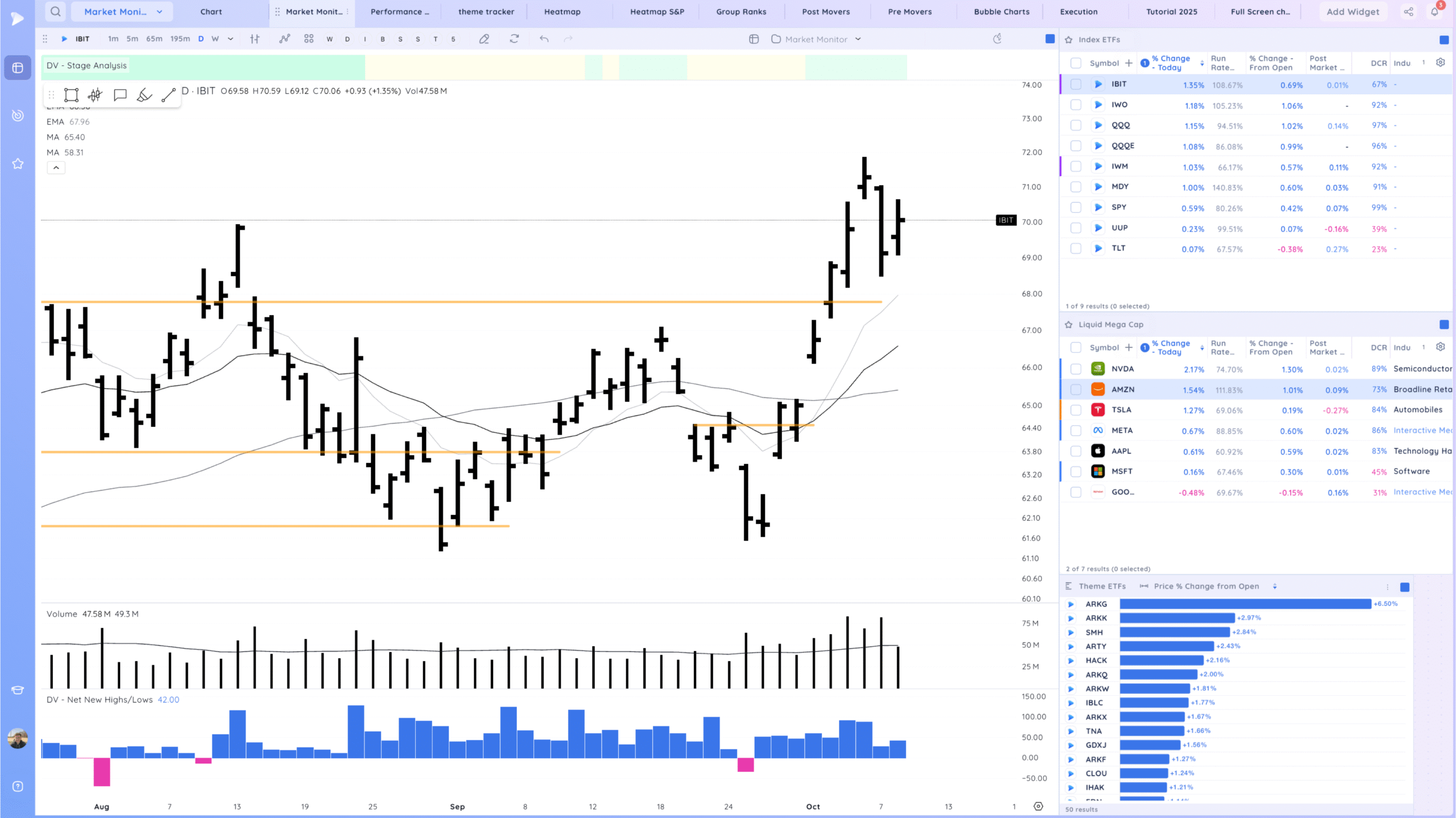

IBIT – Inside day as a range starts to build here above the moving averages.

Trends (4/4 Up) – Based on the QQQ

Shortest – 10 Day EMA – Above

Short-term – 21 ema – Above

Intermediate term – 50 sma – Above Rising

Longterm – 200 sma – Up – Above Rising

Groups/Sectors

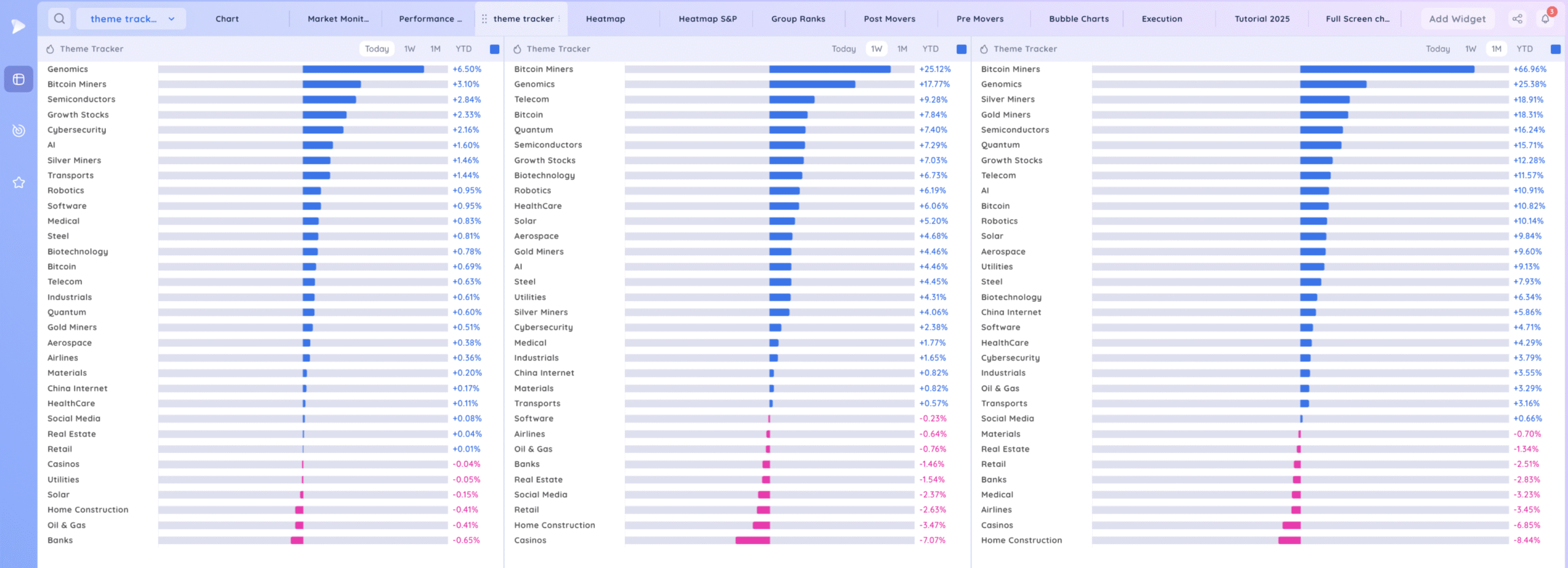

Deepvue Theme Tracker

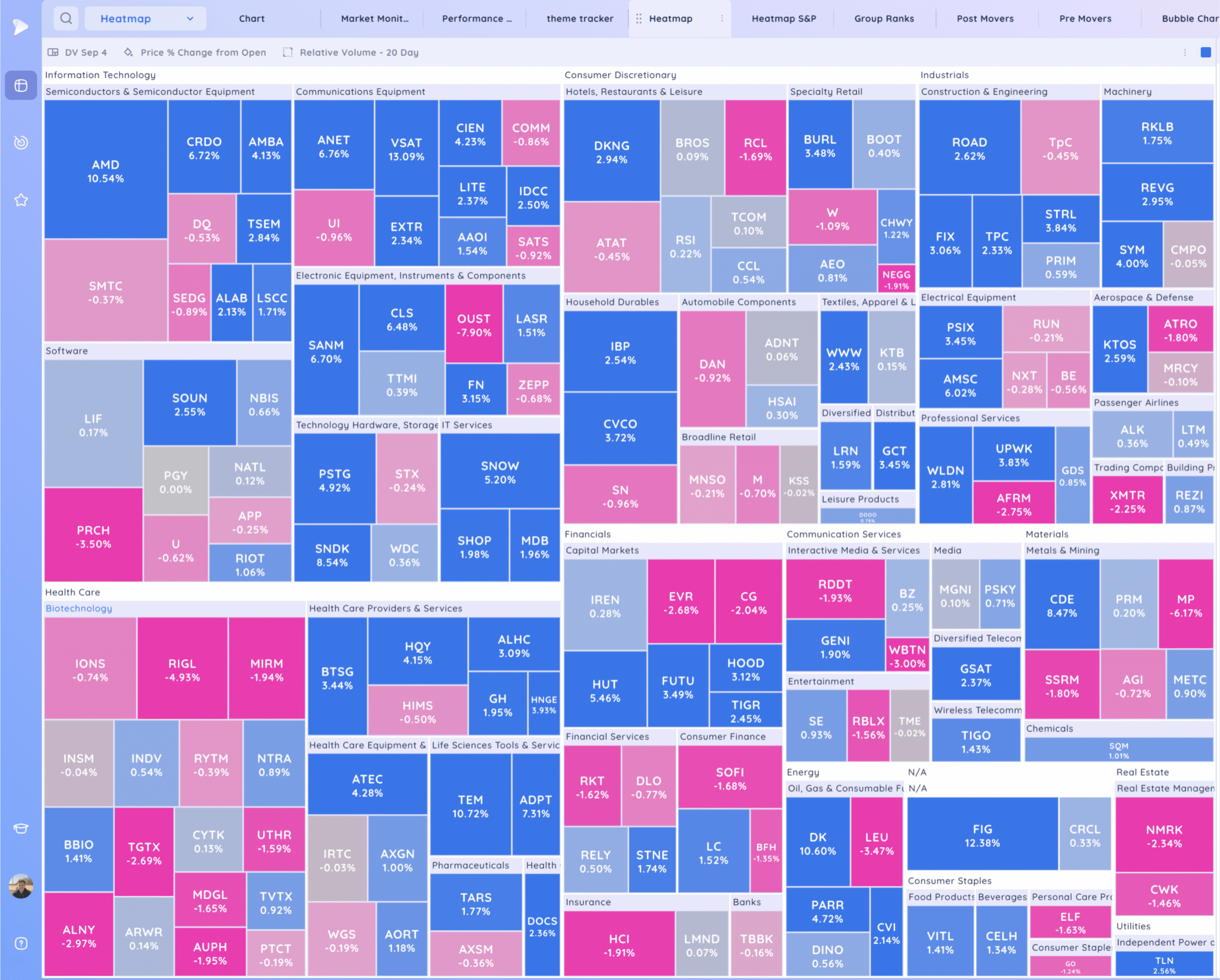

Deepvue Leaders

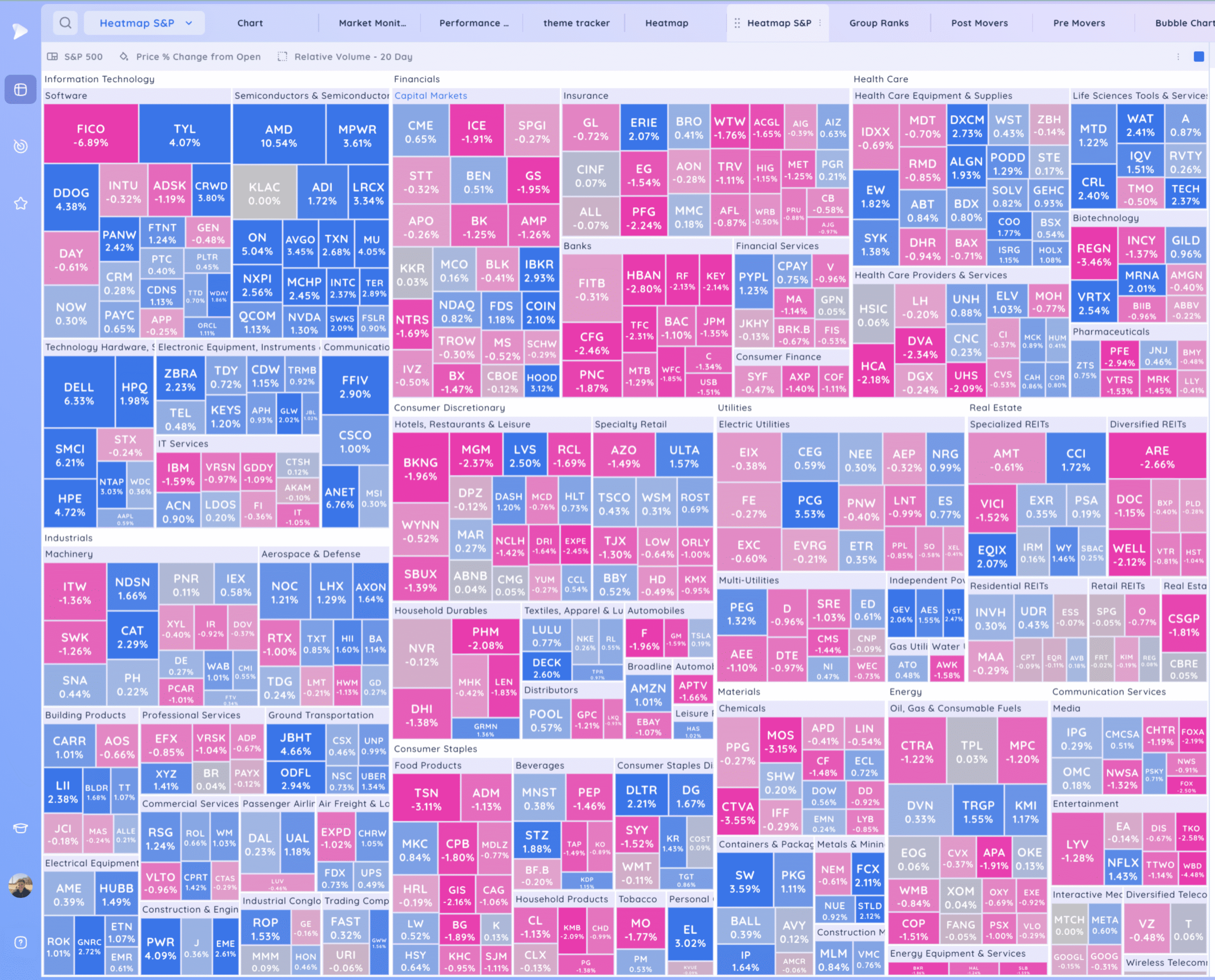

S&P 500.

Leadership Stocks & Analysis

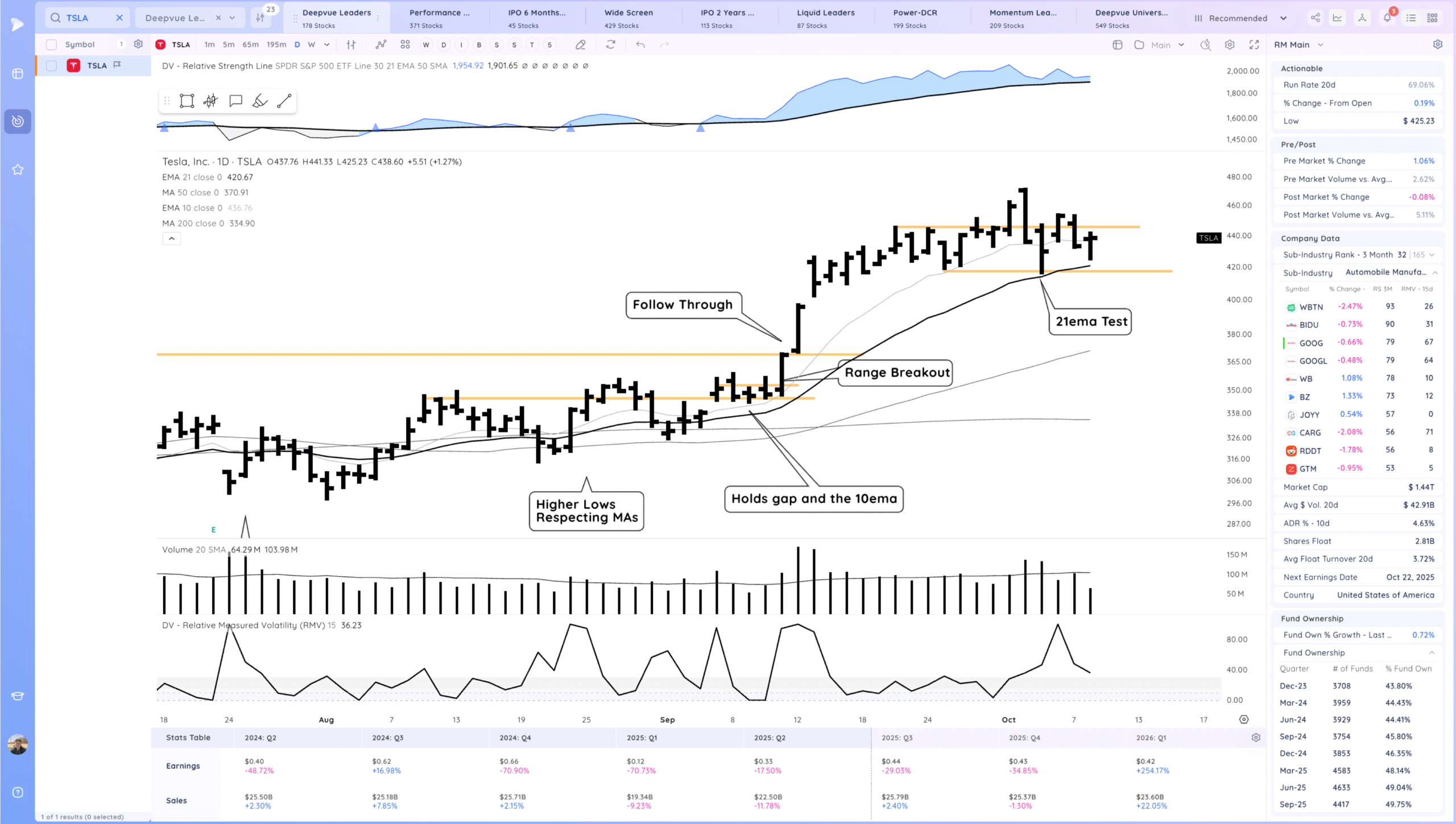

TSLA – Strong upside reversal off the 21ema area as we build out this range more. Watching for follow through higher

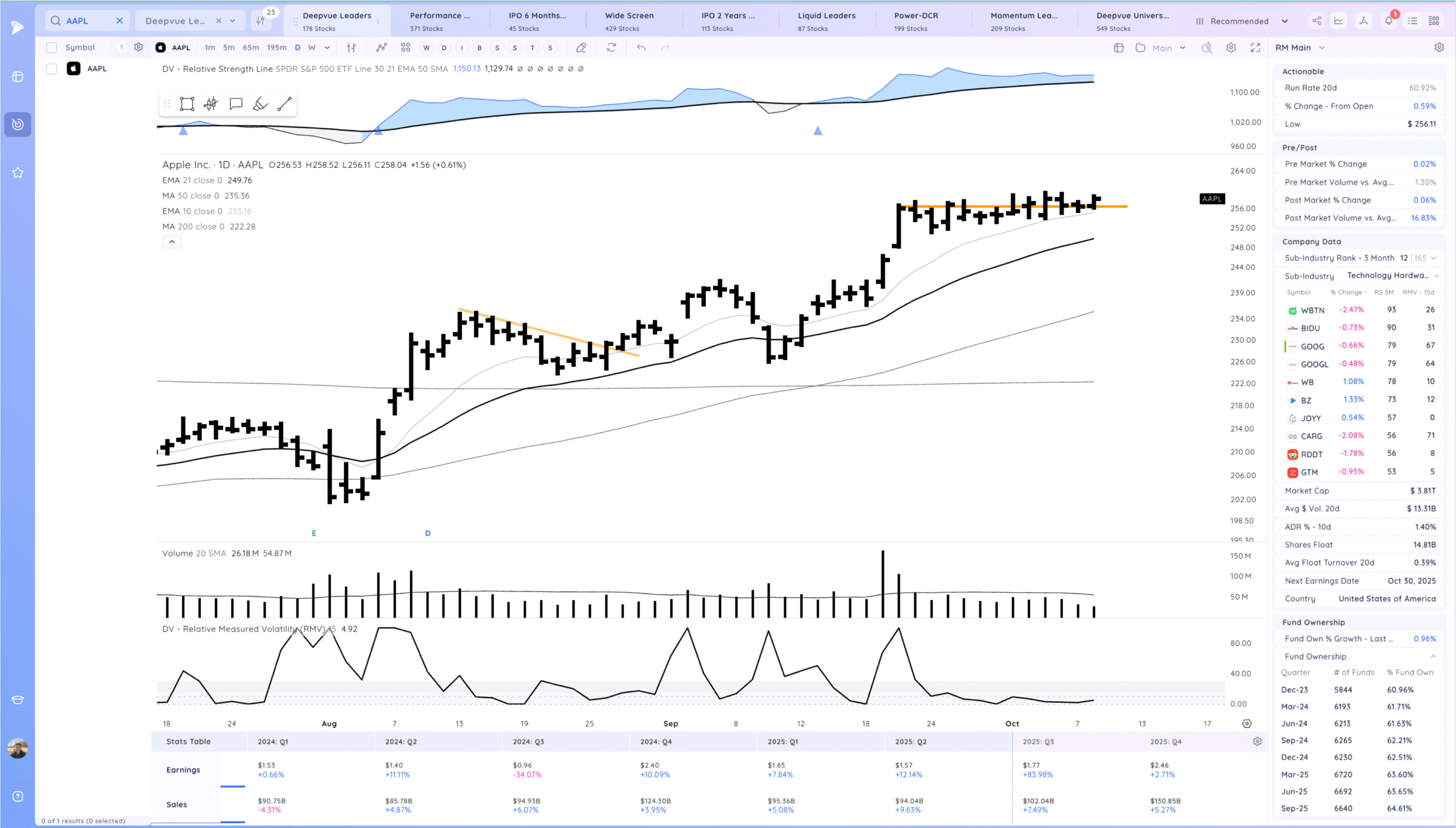

AAPL Slight move higher still in this tight flag

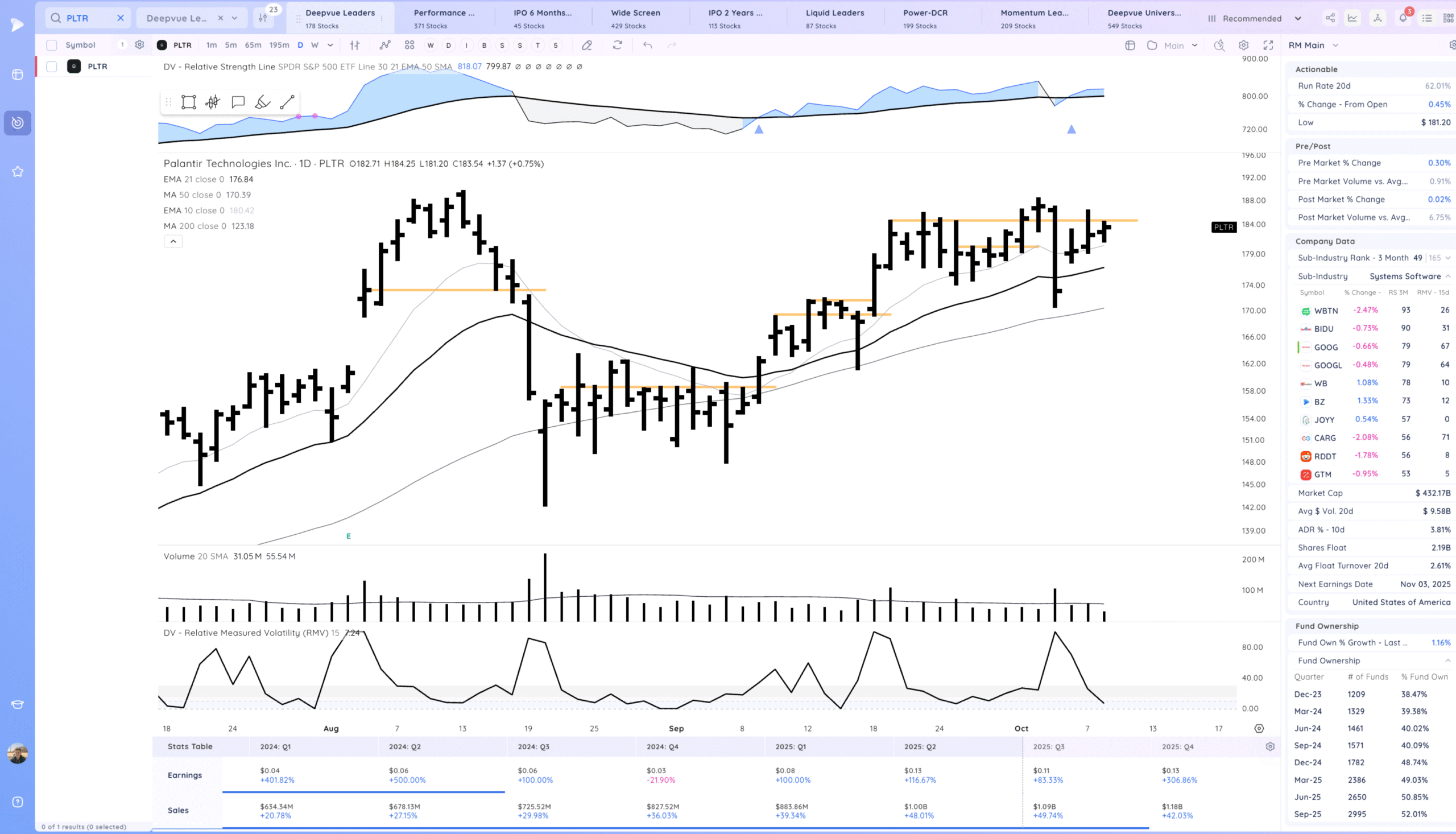

PLTR Tight range forming after the sell off bar. Watching for a handle breakout again

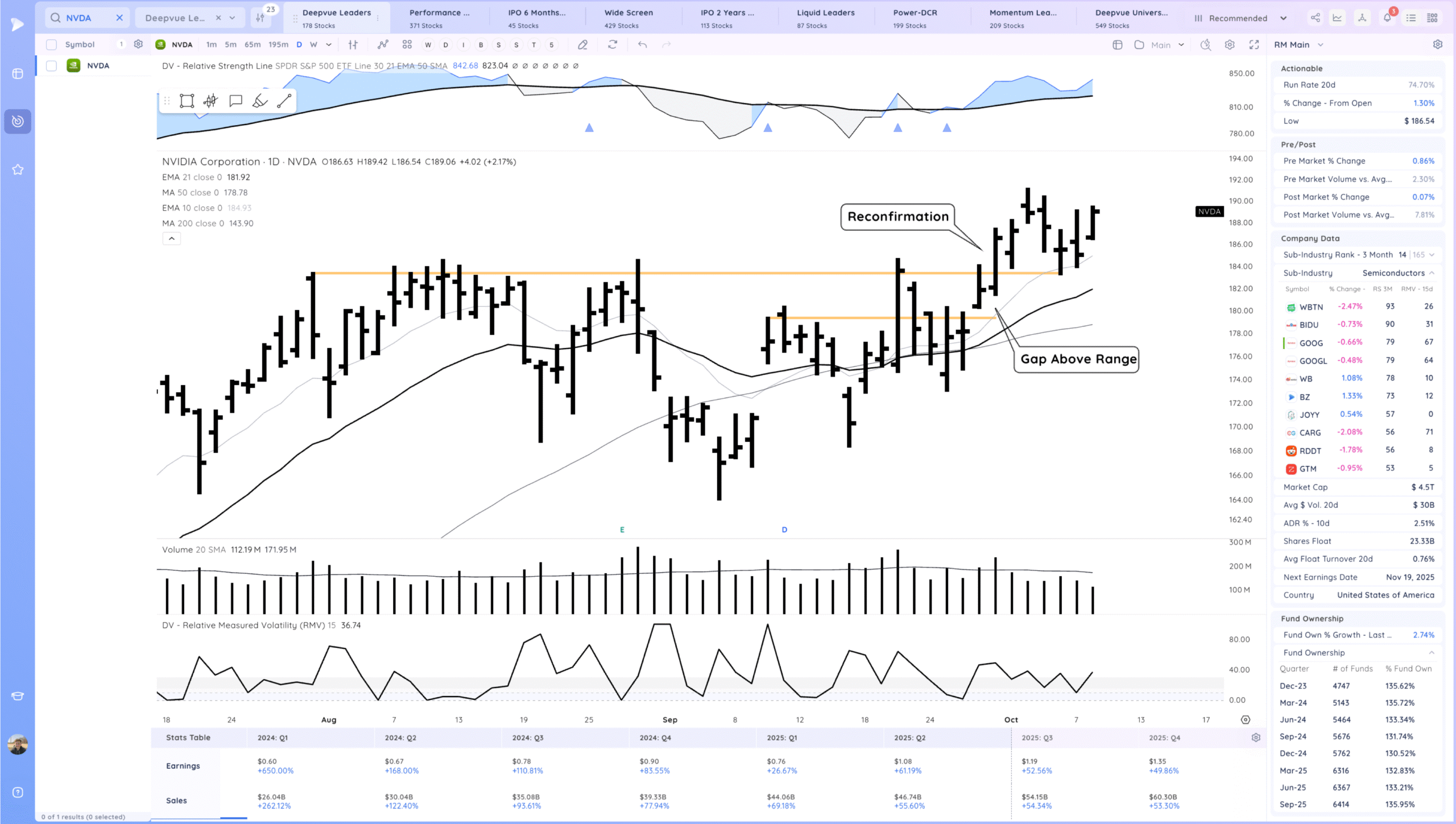

NVDA Good action after yesterday’s downside reversal. Watching for a push higher and trend above the 10ema

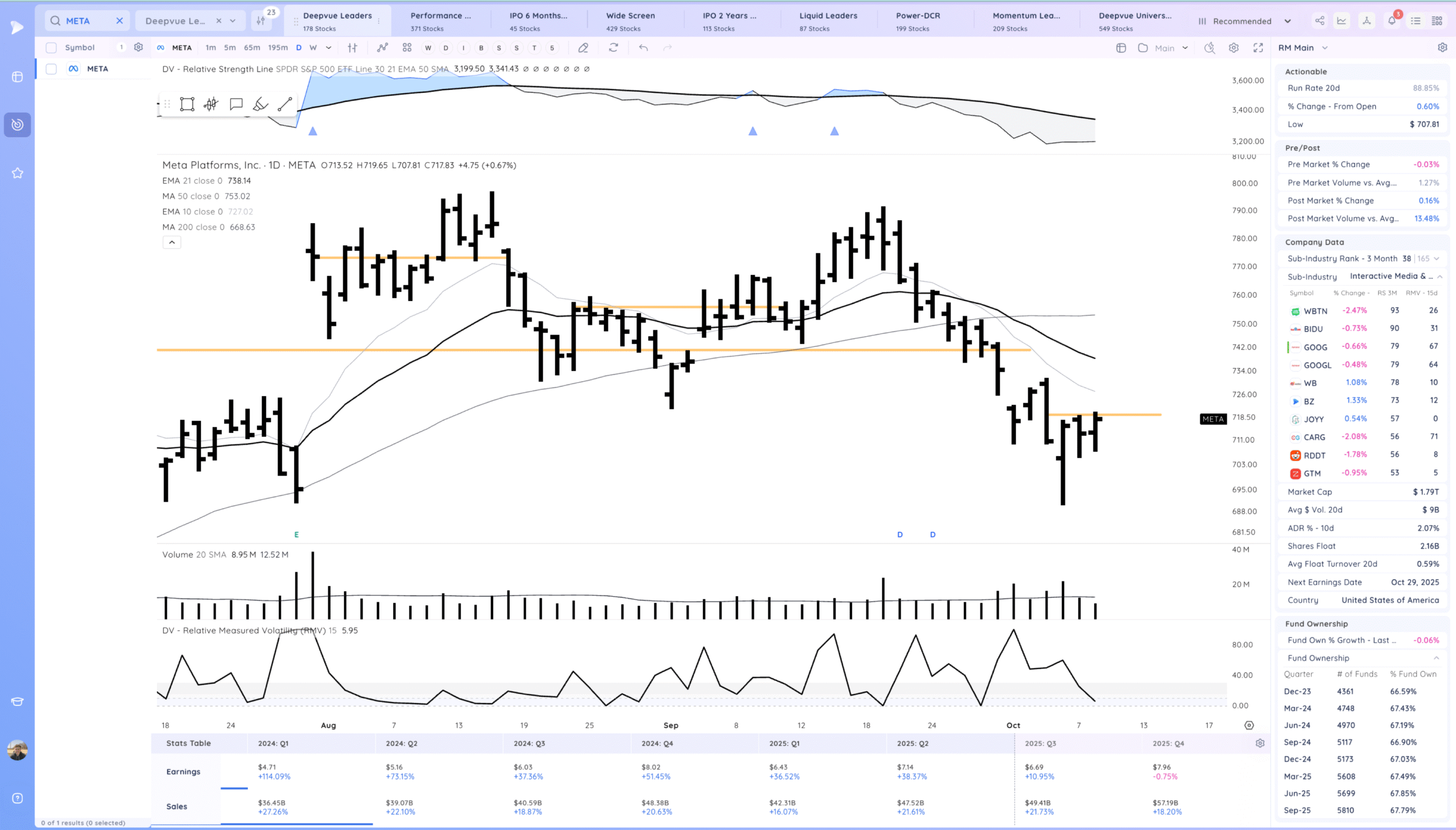

META tight after the potential reversal extension, watching for follow through up

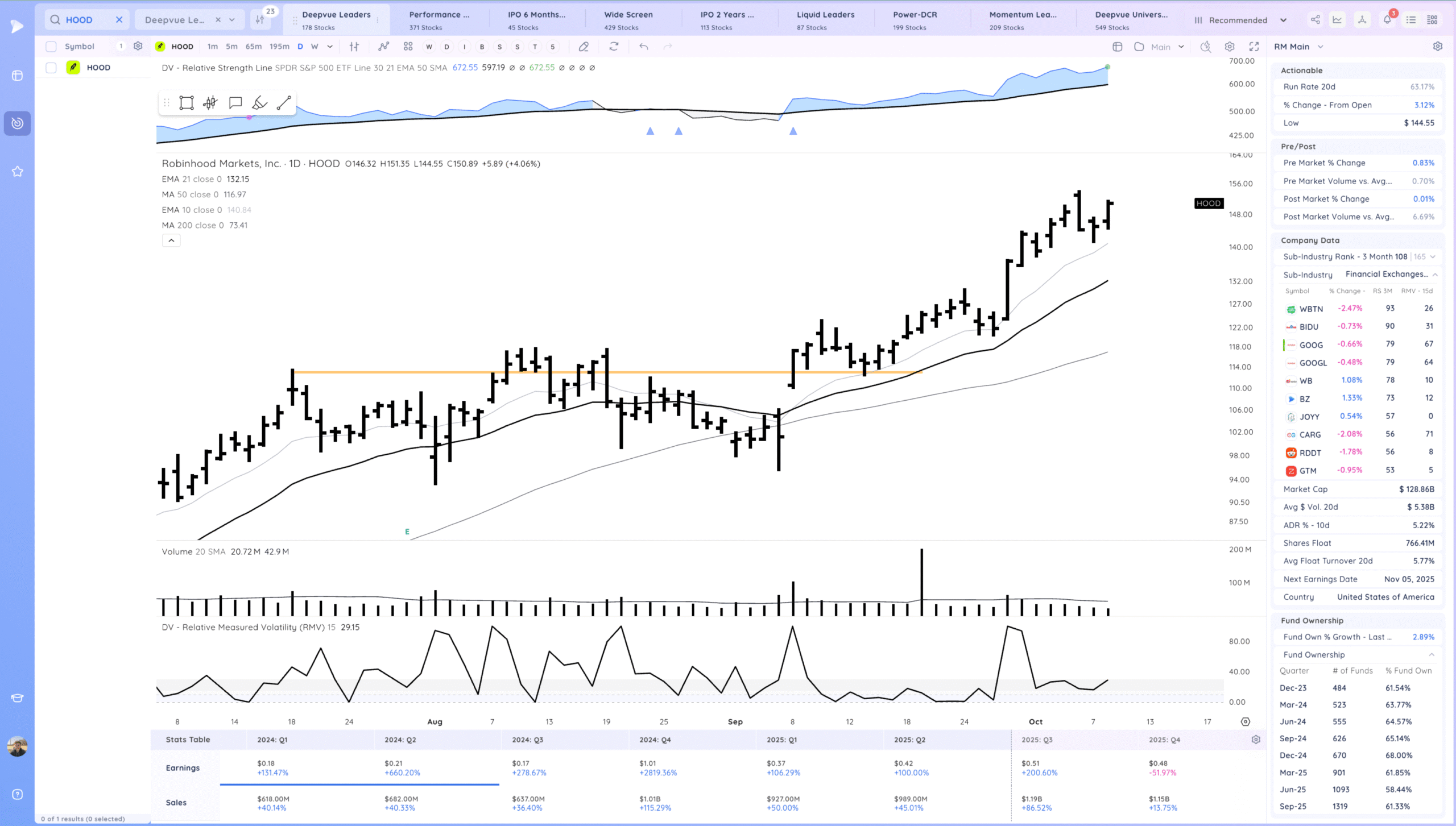

HOOD nice follow through. Trending above the MAs

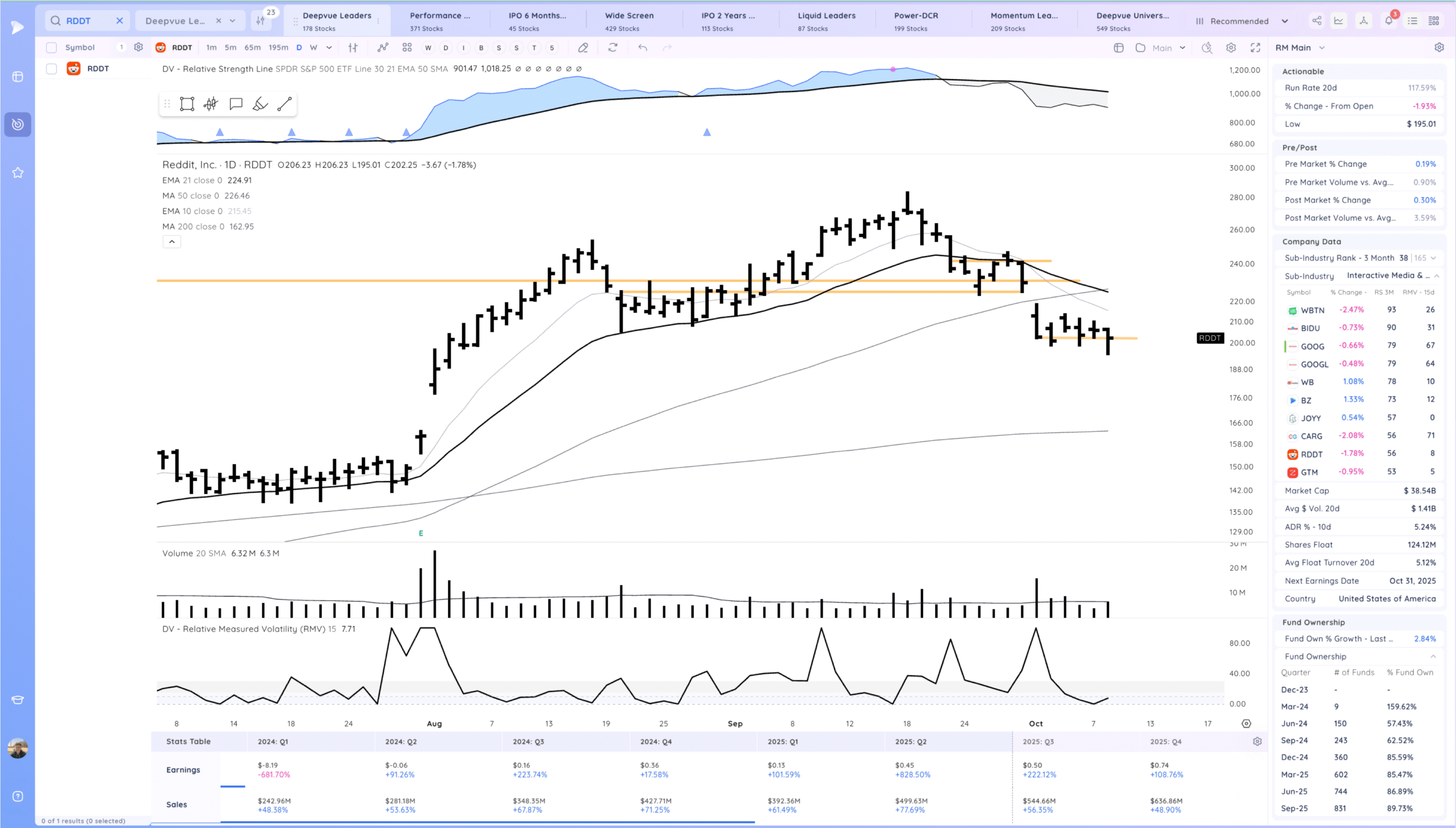

RDDT Upside reversal, watching for follow through up

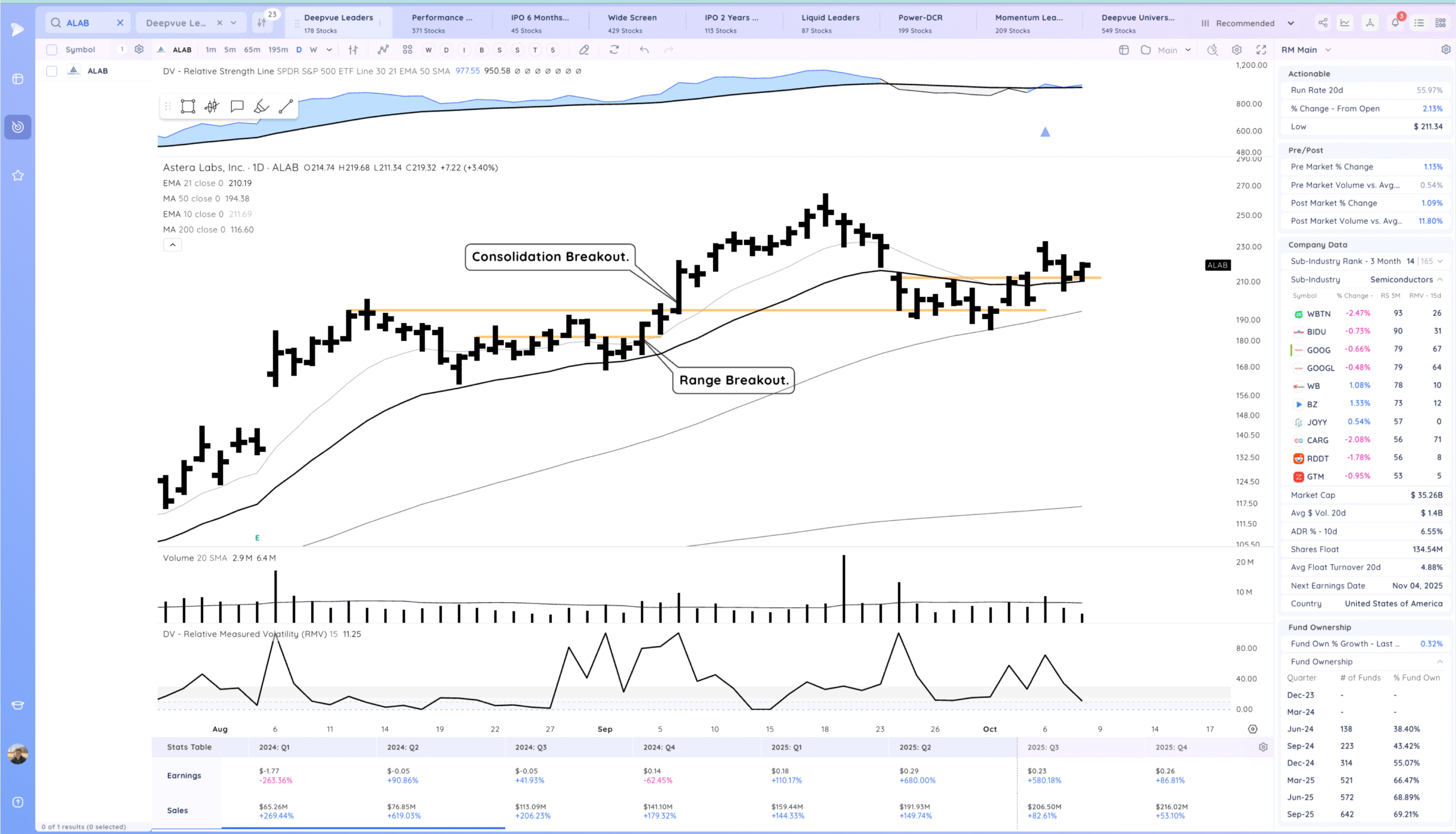

ALAB Inside day on the pivot, watching for a push higher off the pivot and 21ema

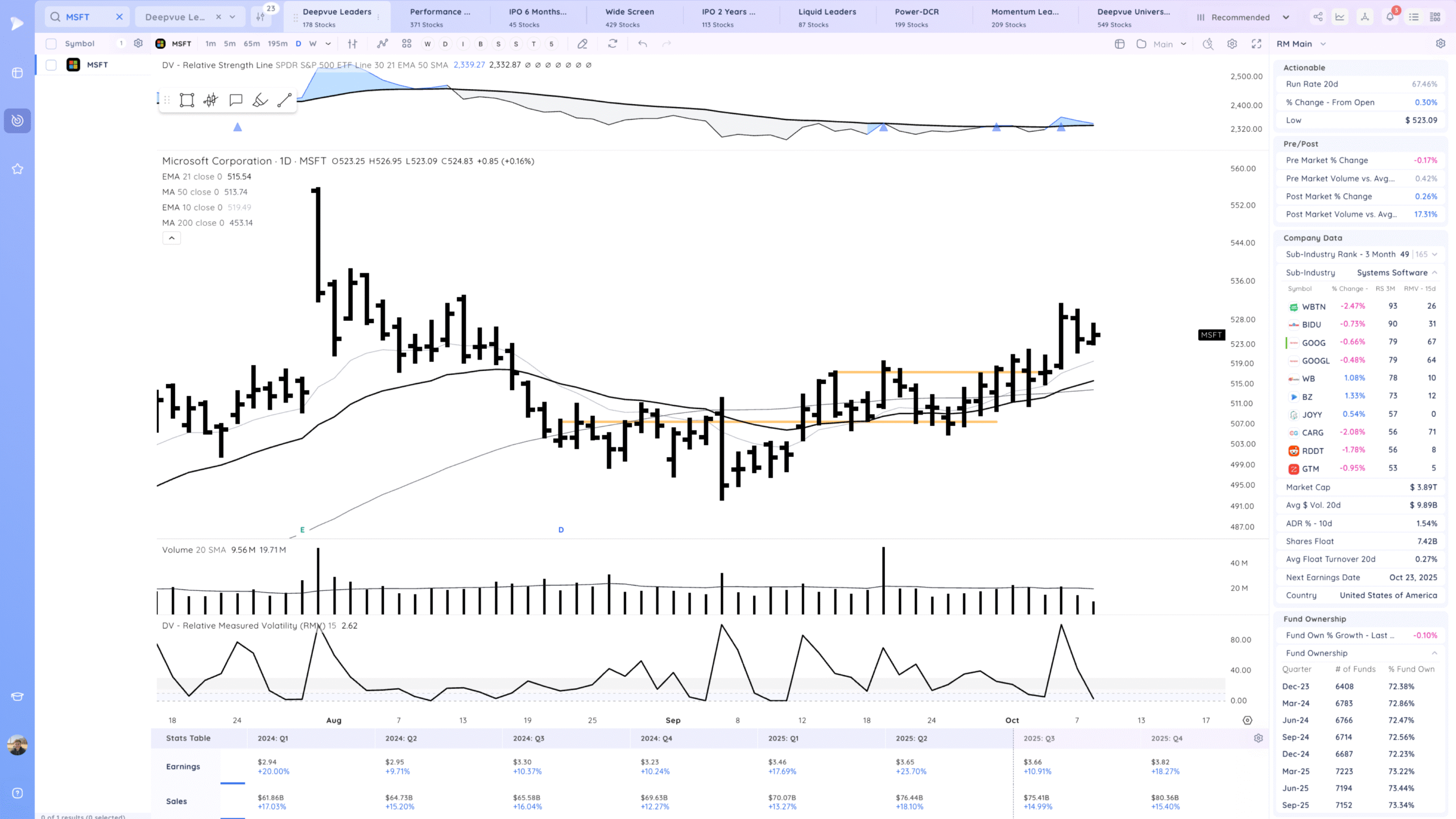

MSFT double inside days after the breakout. watching for re-confirmation

Key Moves

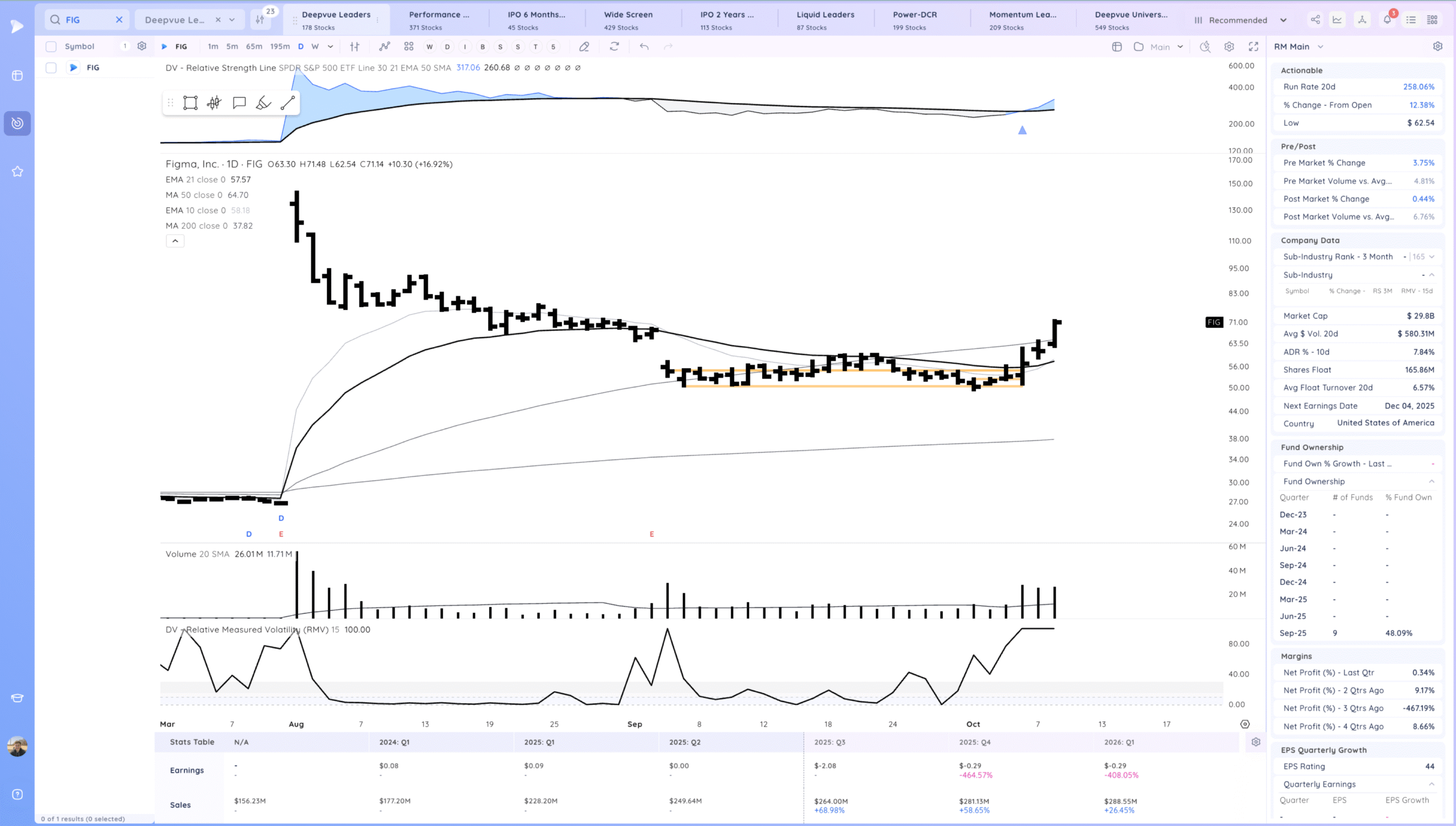

FIG strong reconfirmation after the range breakout 2 days ago. Tight day yesterday

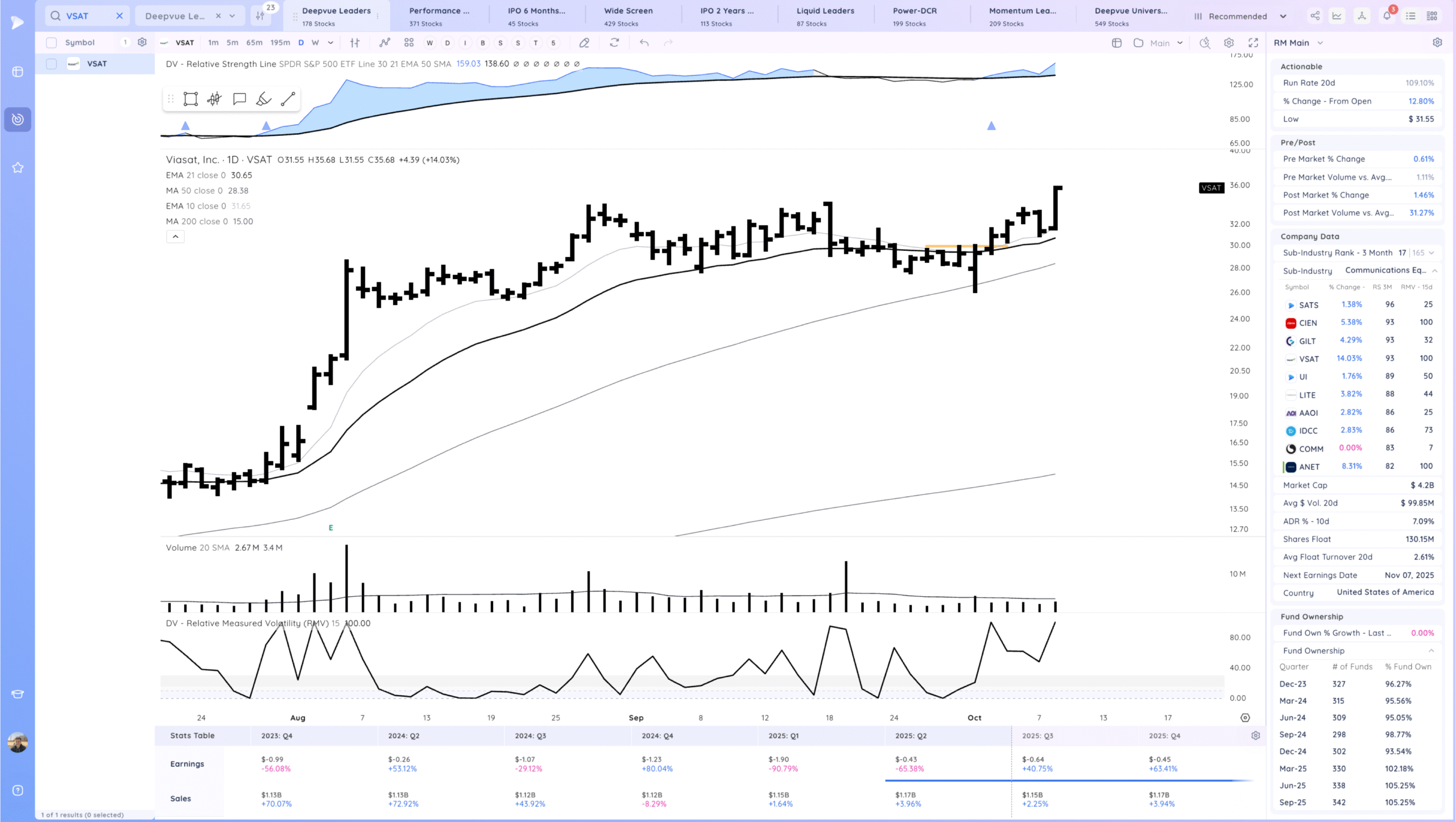

VSAT reconfirmation off 10ema

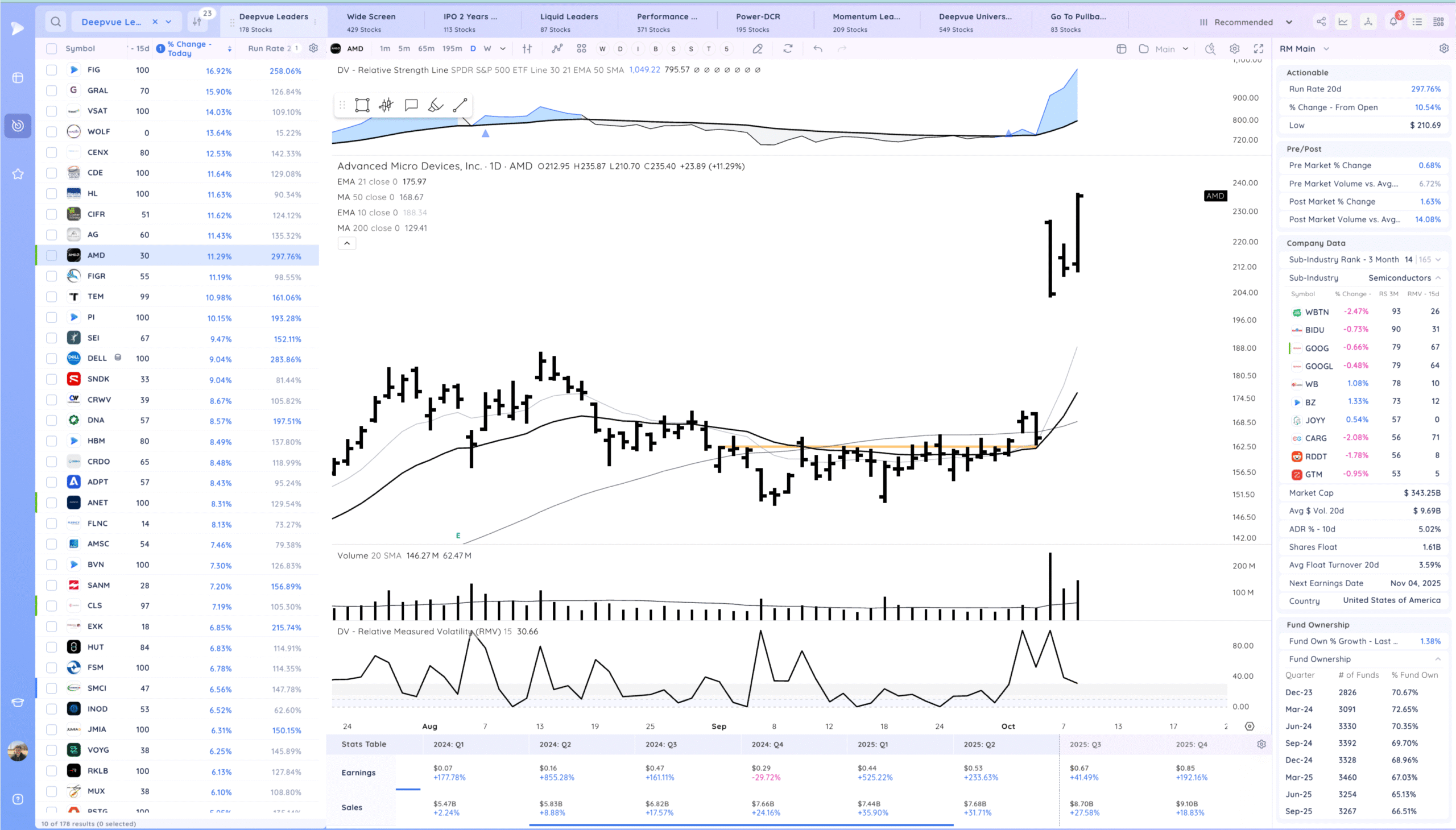

AMD strong move from the inside day! I thought this may need more time after such a big gap but powerful bar here to new highs

Setups and Watchlist

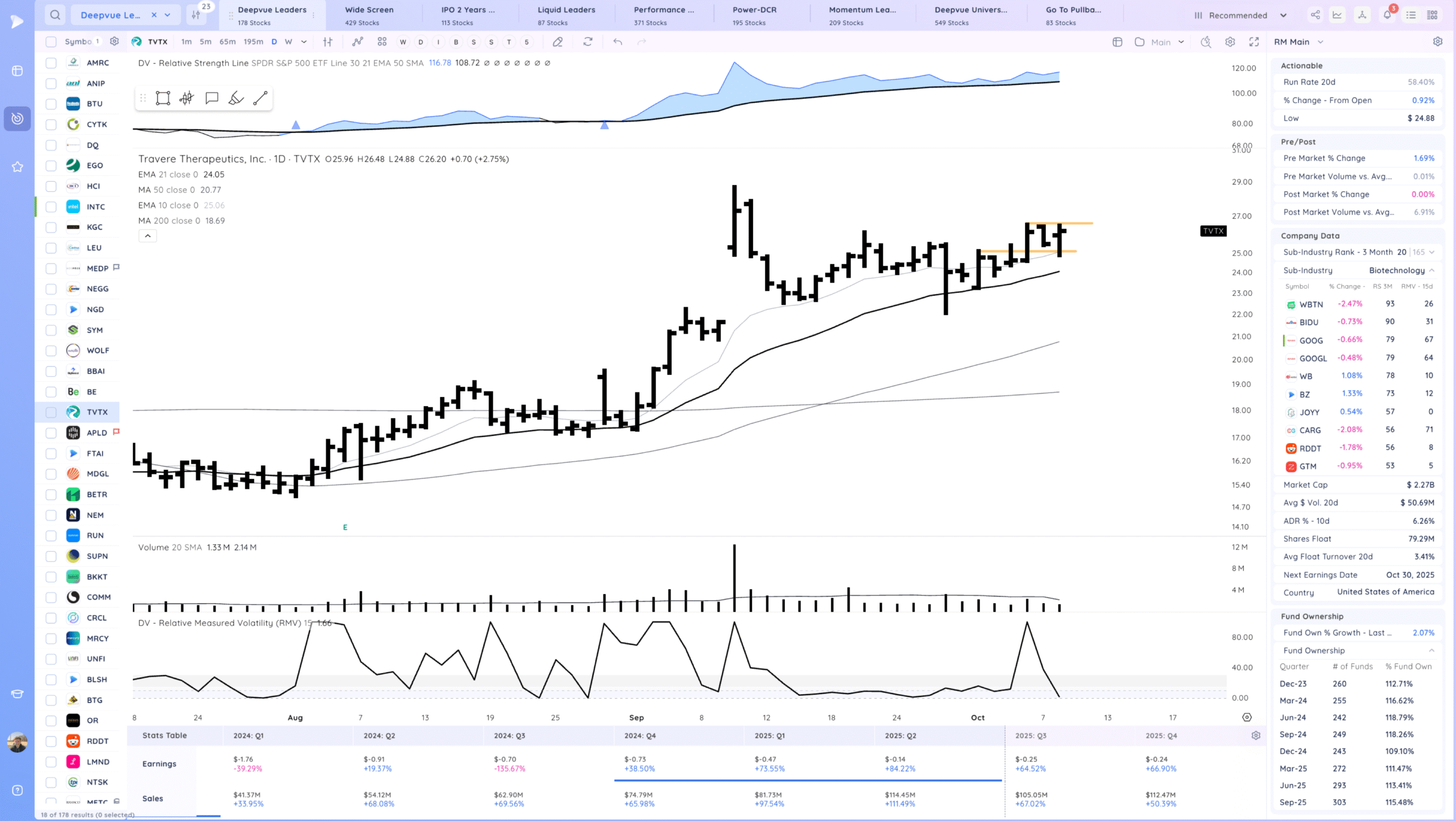

TVTX watching for a range breakout. biotech

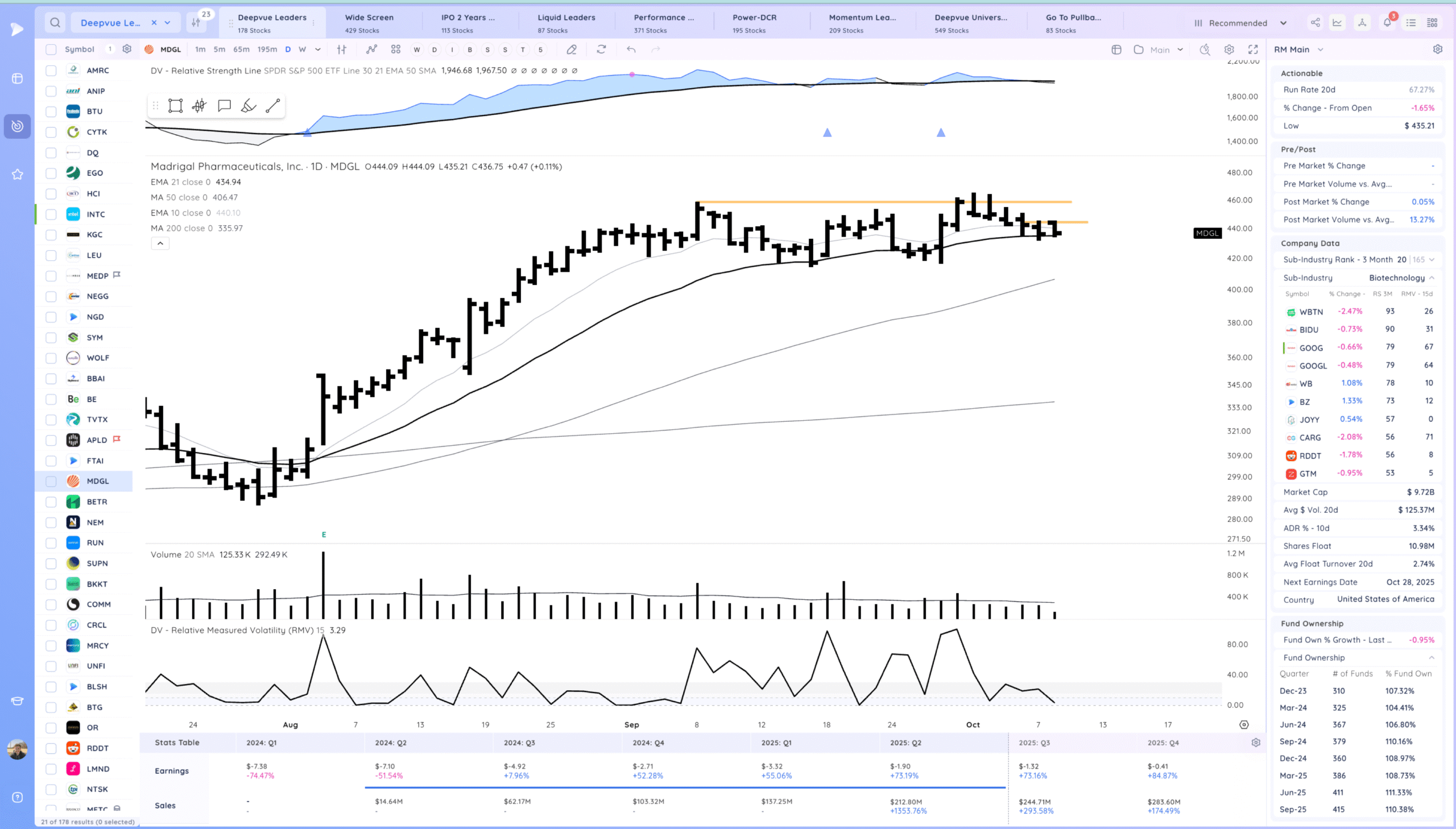

MDGL watching for a range breakout. Biotech

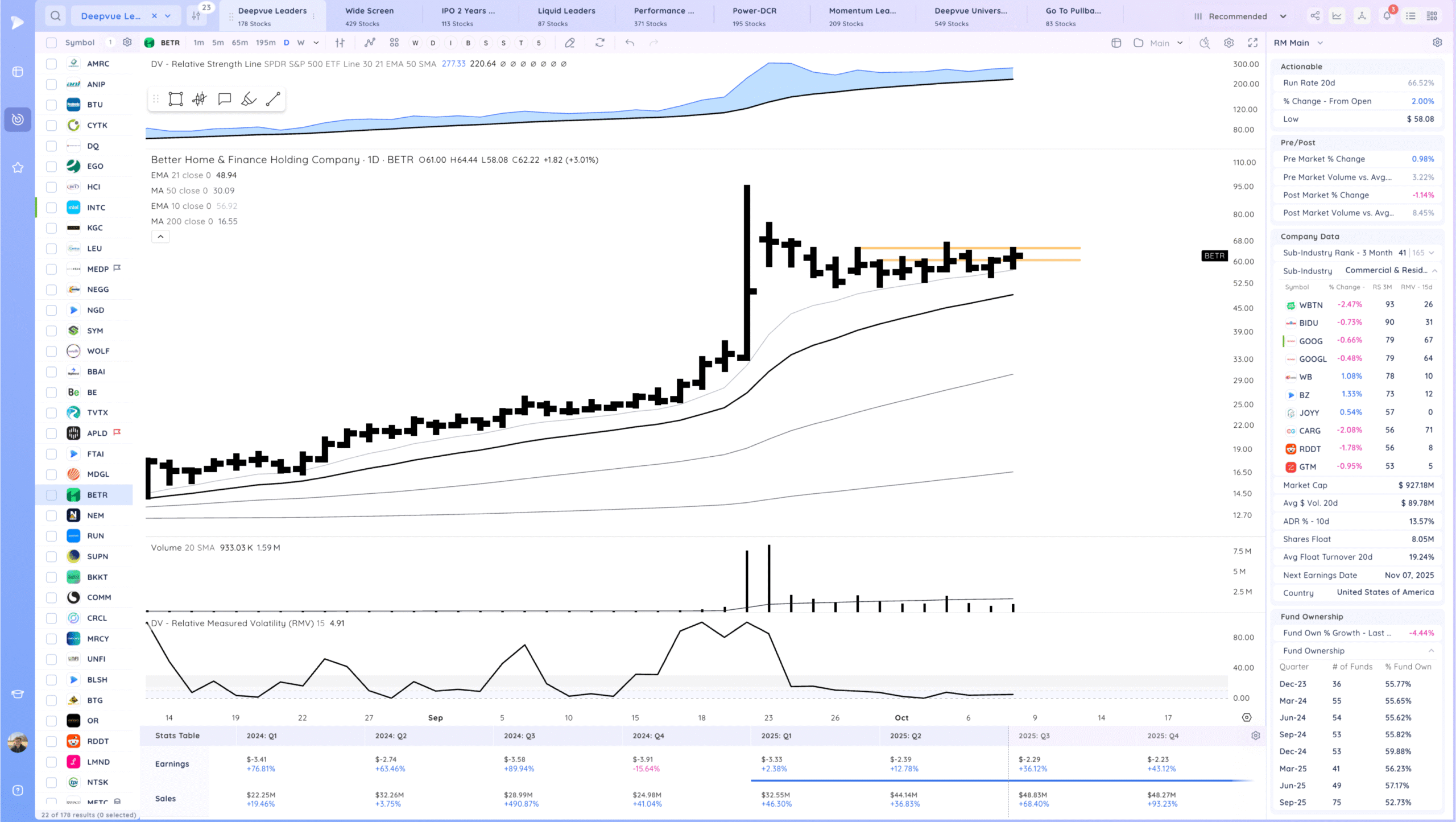

BETR tight setup day, watching for expansion up. Very fast mover. Also watching OPEN

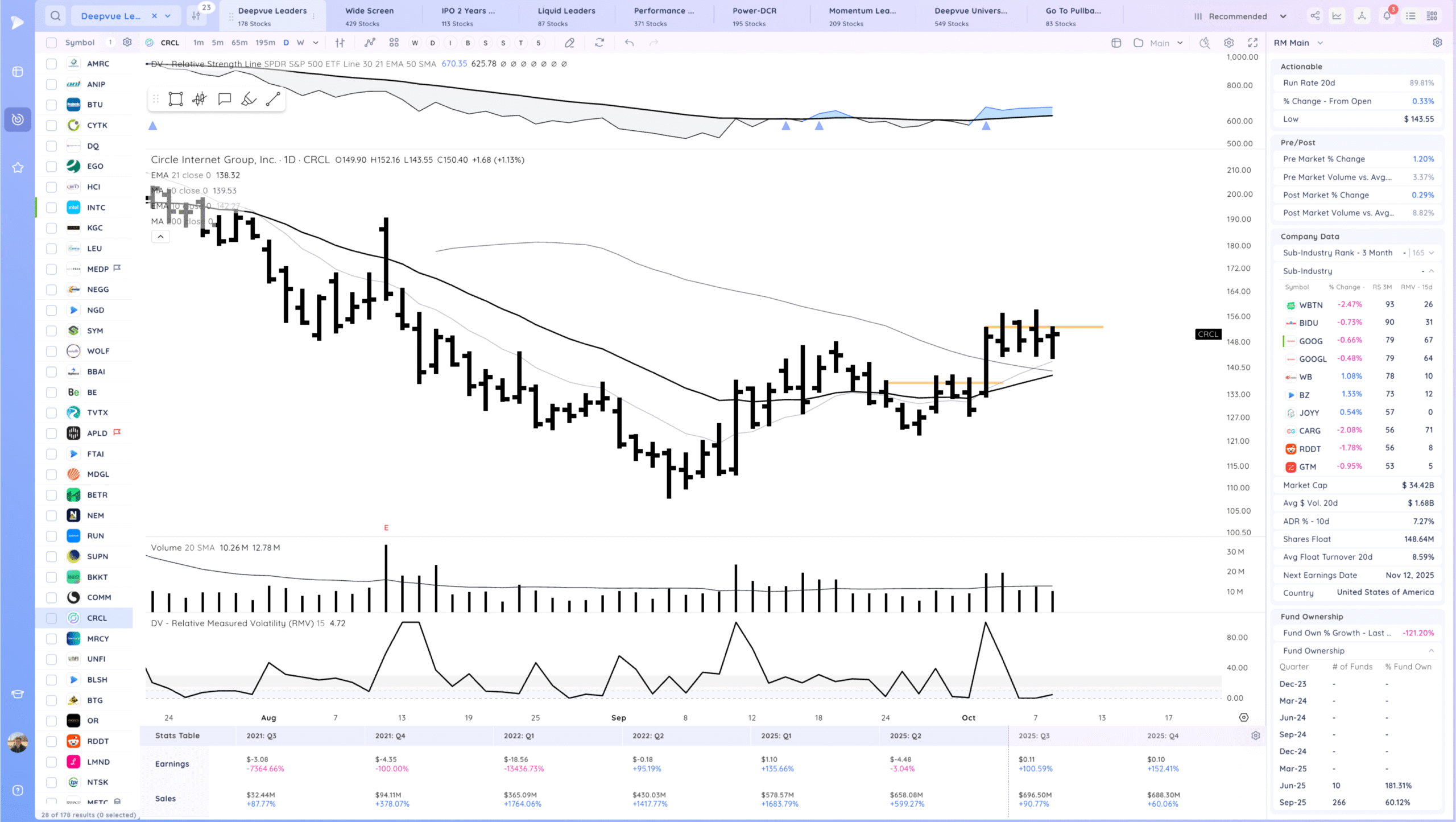

CRCL. watching for a range breakout. Inside day. fast name

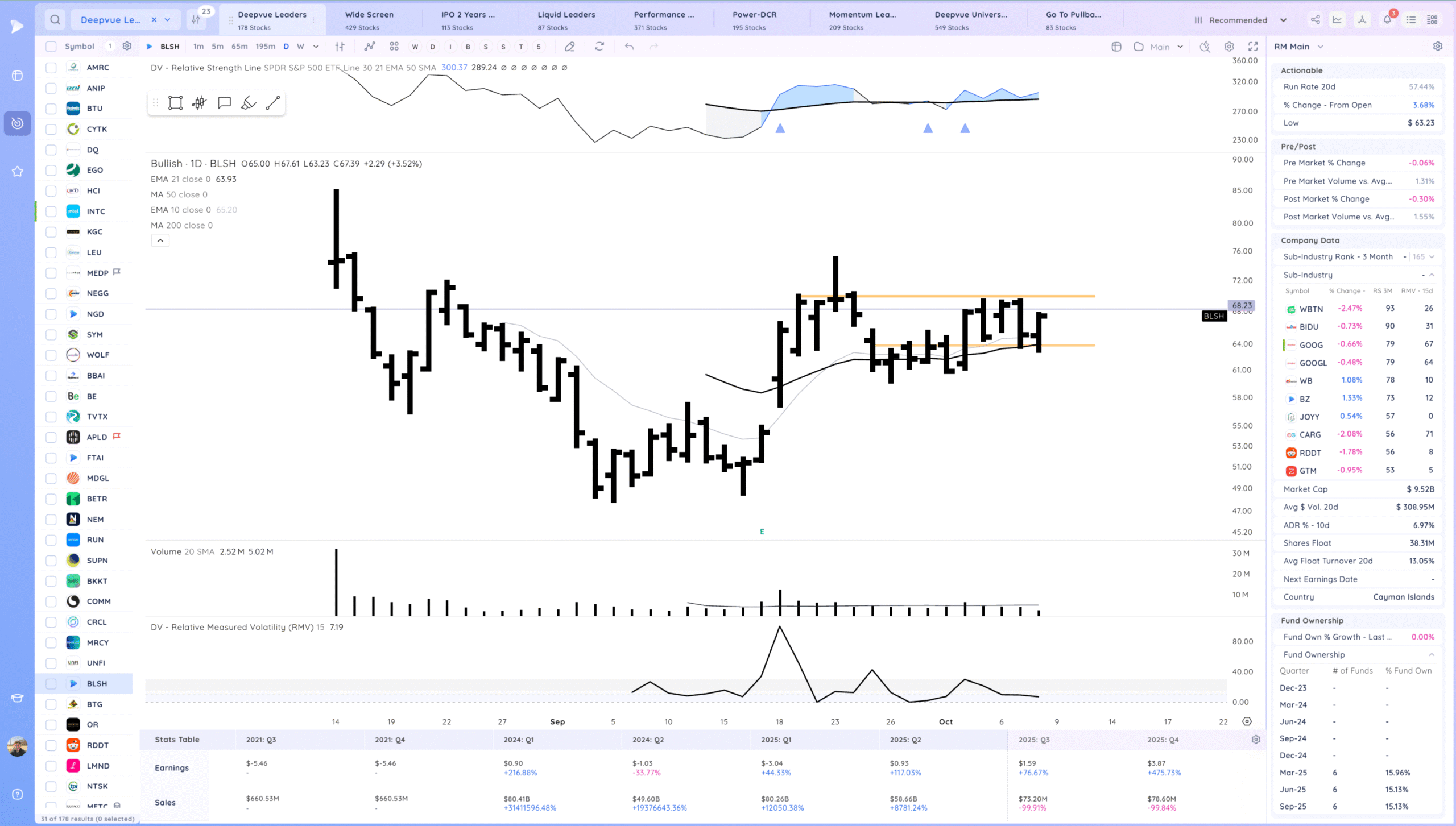

BLSH actionable today off 21ema. Watching for follow through up and a range breakout

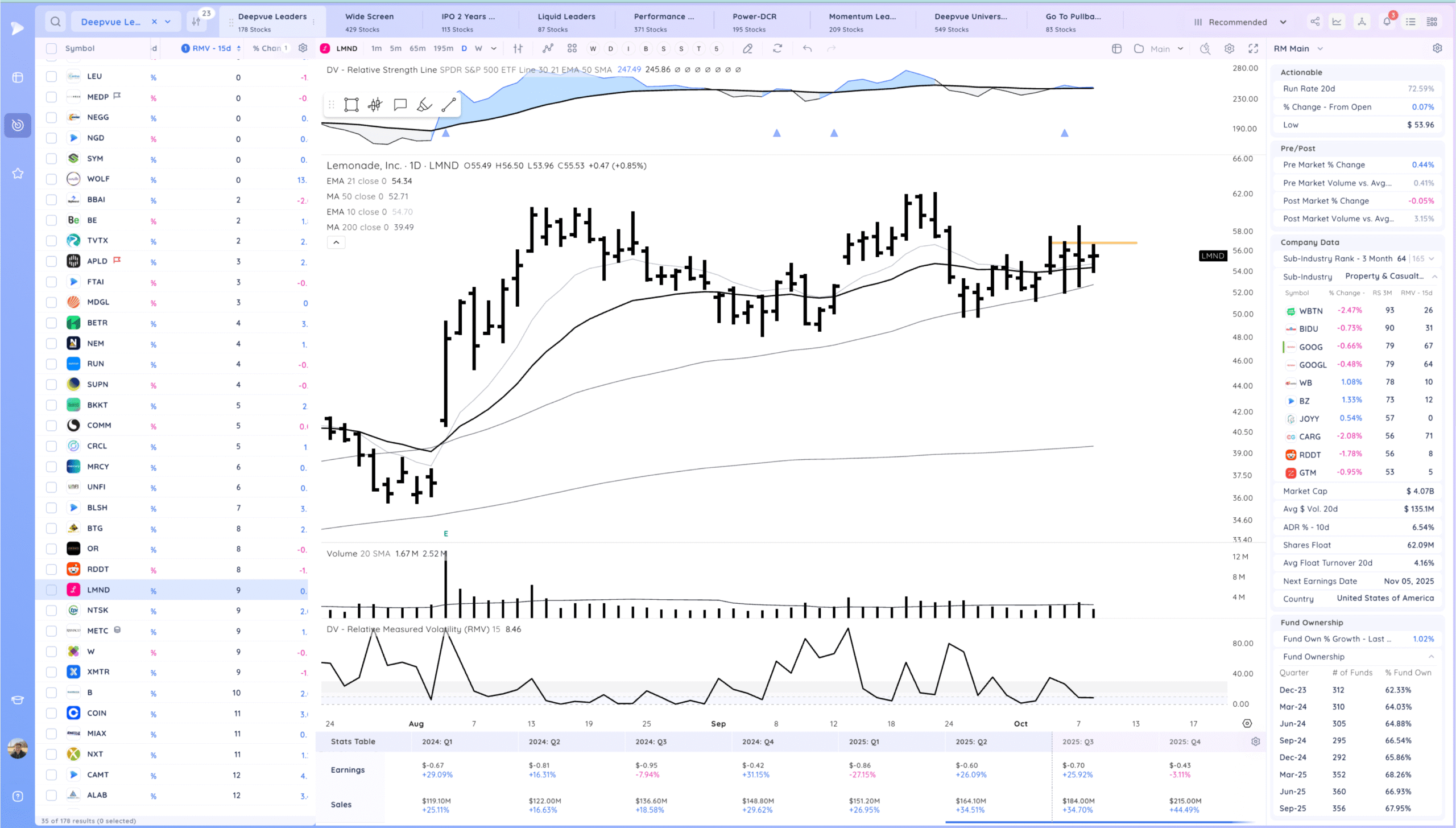

LMND Watching for a range breakout

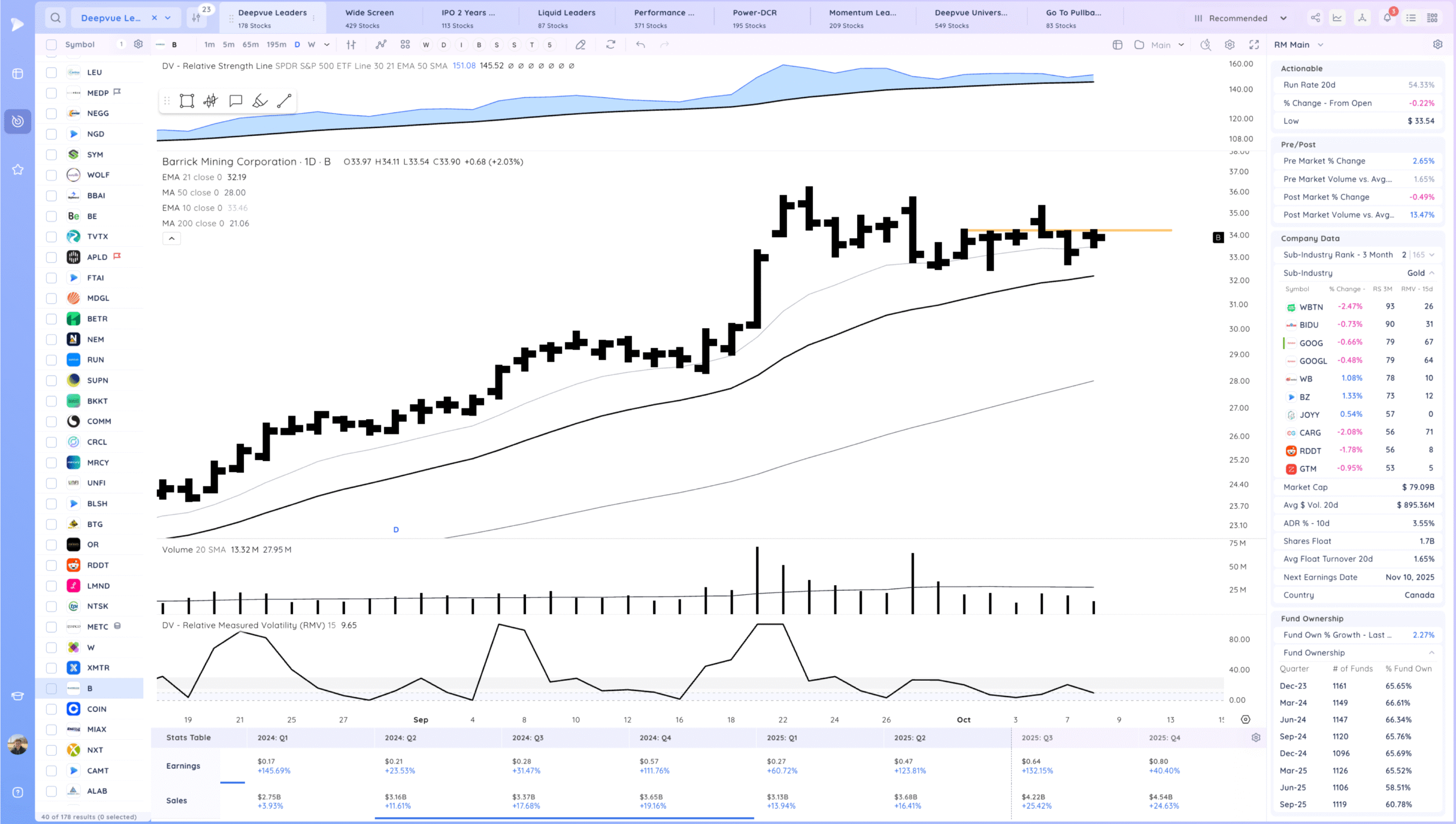

B watching for a range breakout

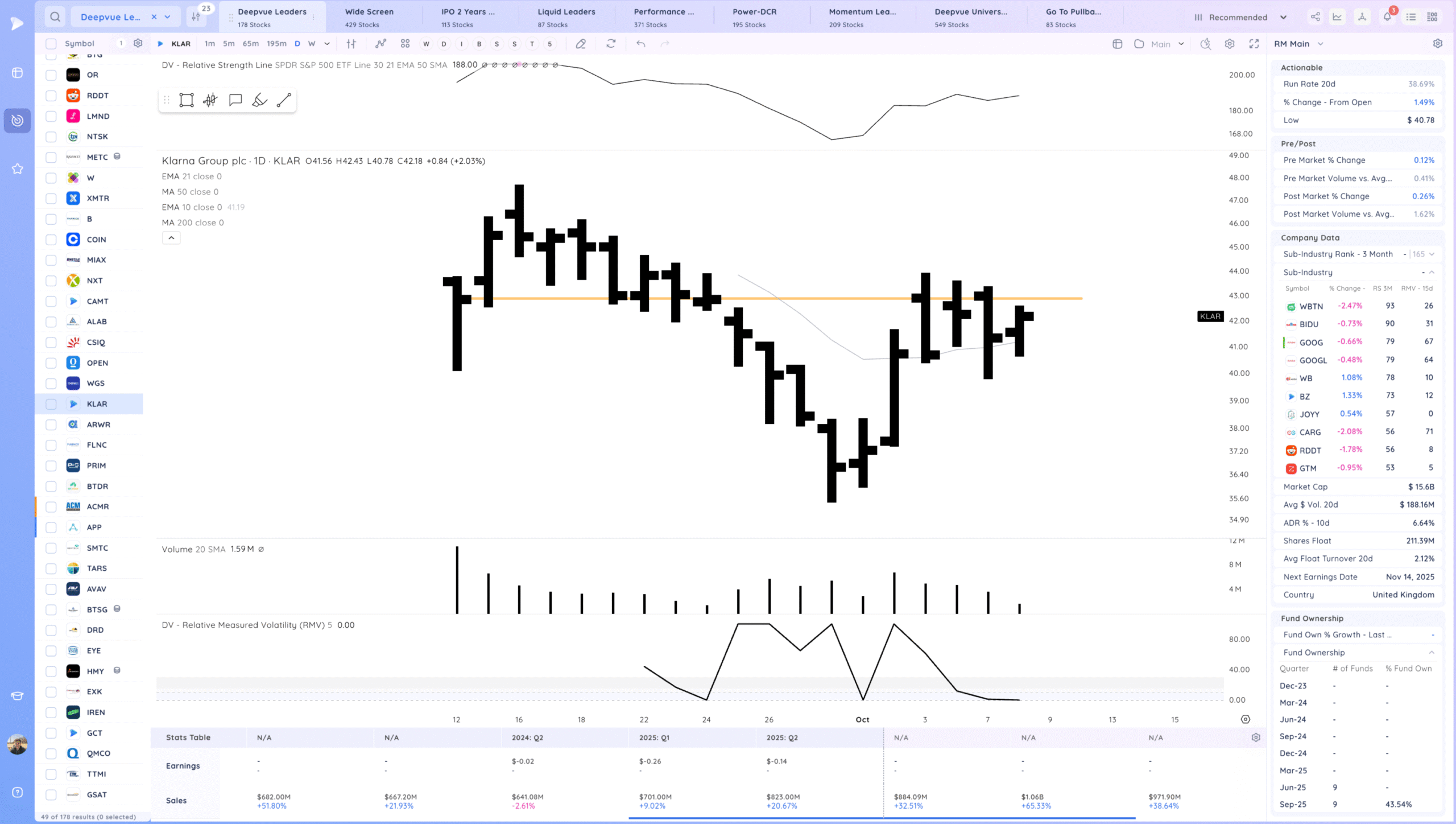

KLAR watching for an push from the inside day and break through the listing day close

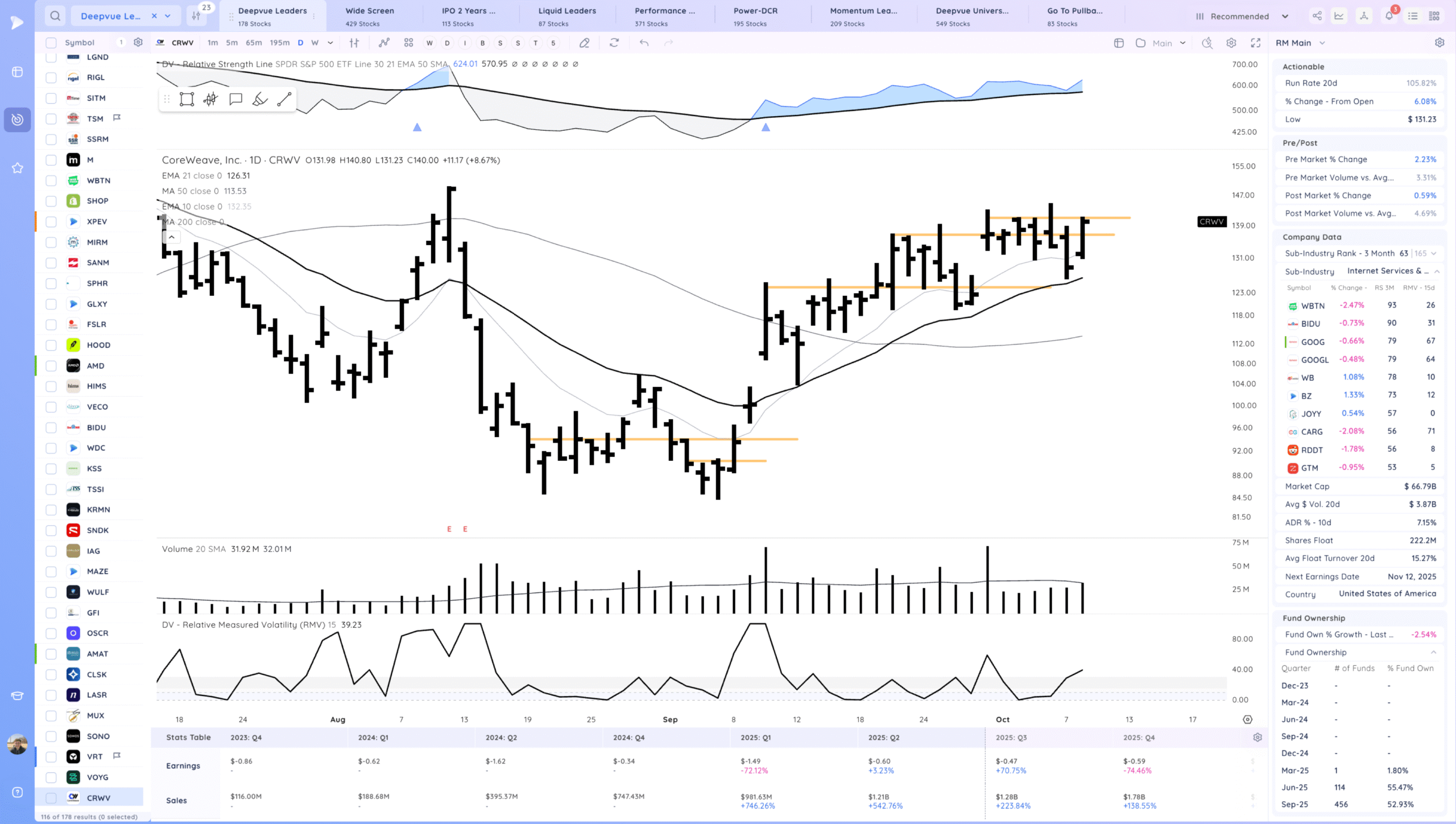

CRWV actionable on positive expectation breaker today. watching for follow through and range breakout

Today’s Watchlist in List form

Focus List Names

TVTX MDGL BETR CRCL BLSH LMND B KLAR CRWV TSLA ALAB PLTR

Focus:

ALAB TSLA KLAR CRCL

Themes

Strongest Themes: AI, Metals/Miners, Energy, Crypto

Market Thoughts

Nice positive expectation breaker today. Trends remain in place.

Anything can happen, Day by Day – Managing risk along the way