Trade Opportunity Case Study of the Week: SNOW Earnings Gap Day 1 – | Sep 1 2025

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

September 1, 2025

The Trade Opportunity

The purpose of this weekly article is to analyze the top trading opportunity of the week. To improve our identification and execution of high quality trade ideas that meet our setup requirements.

Each article will focus on a stock that meets one of three of the main categories of setups I trade:

- Range Breakout / VCP / tight area breakout

- Pullback to Support/ Key moving average

- Gapper / Post Gap Setup

These articles are like taking a step into the batting cage and loading up a historical at bat from a Ace pitcher in the world series – they will help you prepare and execute in future situations by studying important moments from the past.

The setups we cover will appear again and again in each market cycle

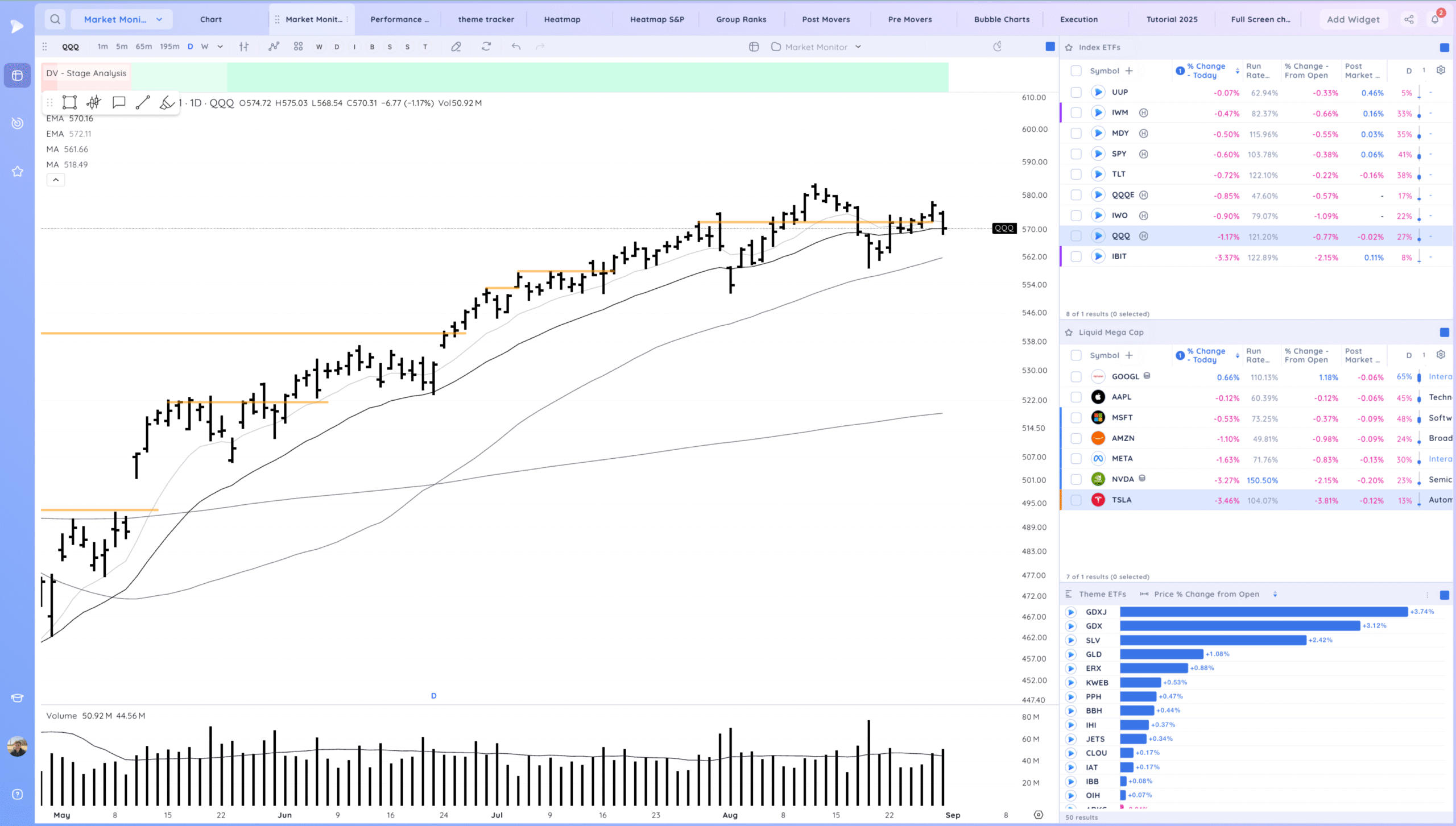

The Market this week was rangebound, moved higher but then put in a negative expectation breaker Friday

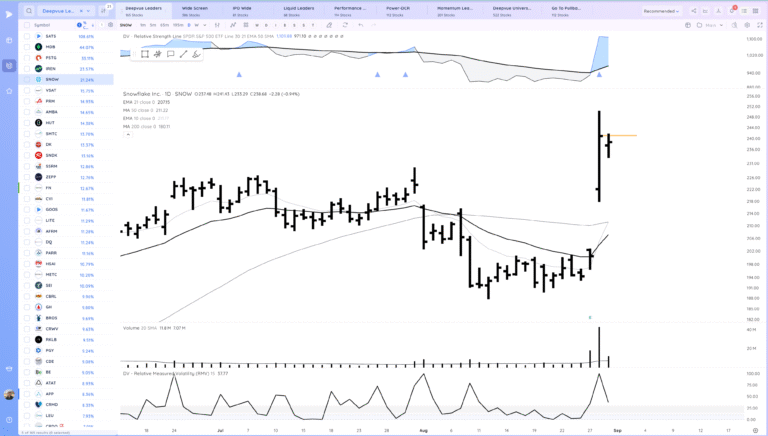

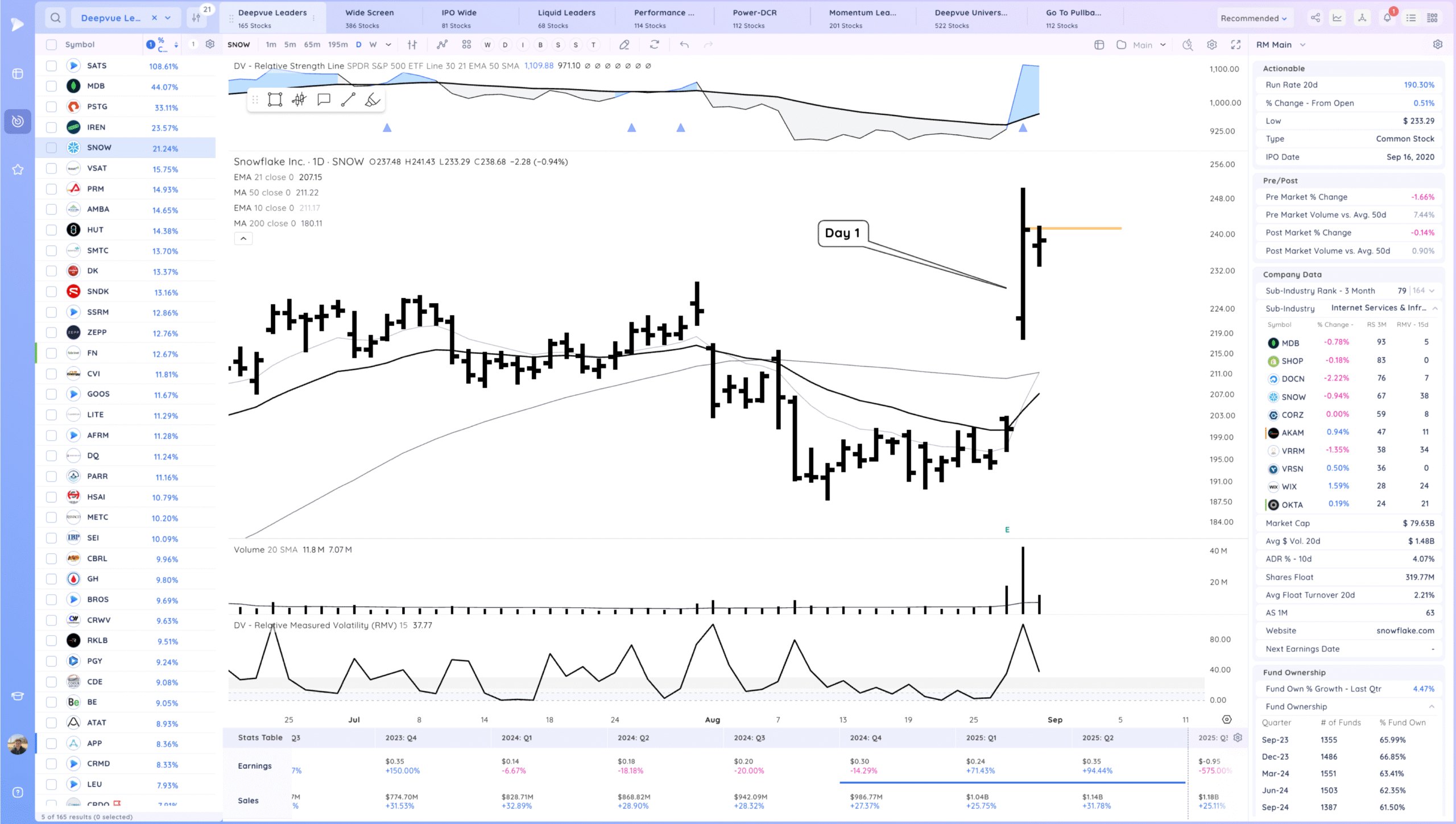

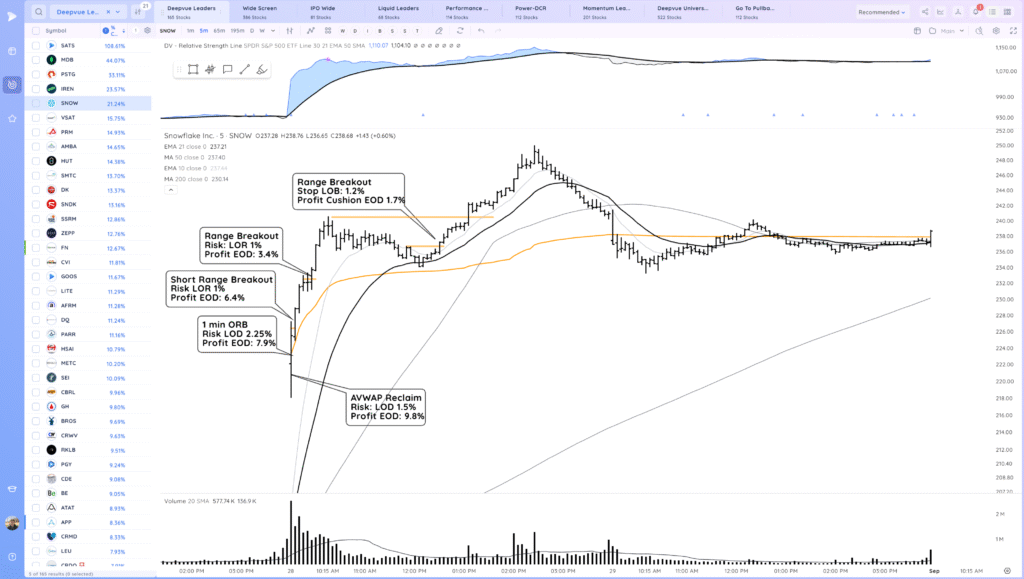

For this week we will be focusing on SNOW’s earnings gap and entry possibilities on day 1.

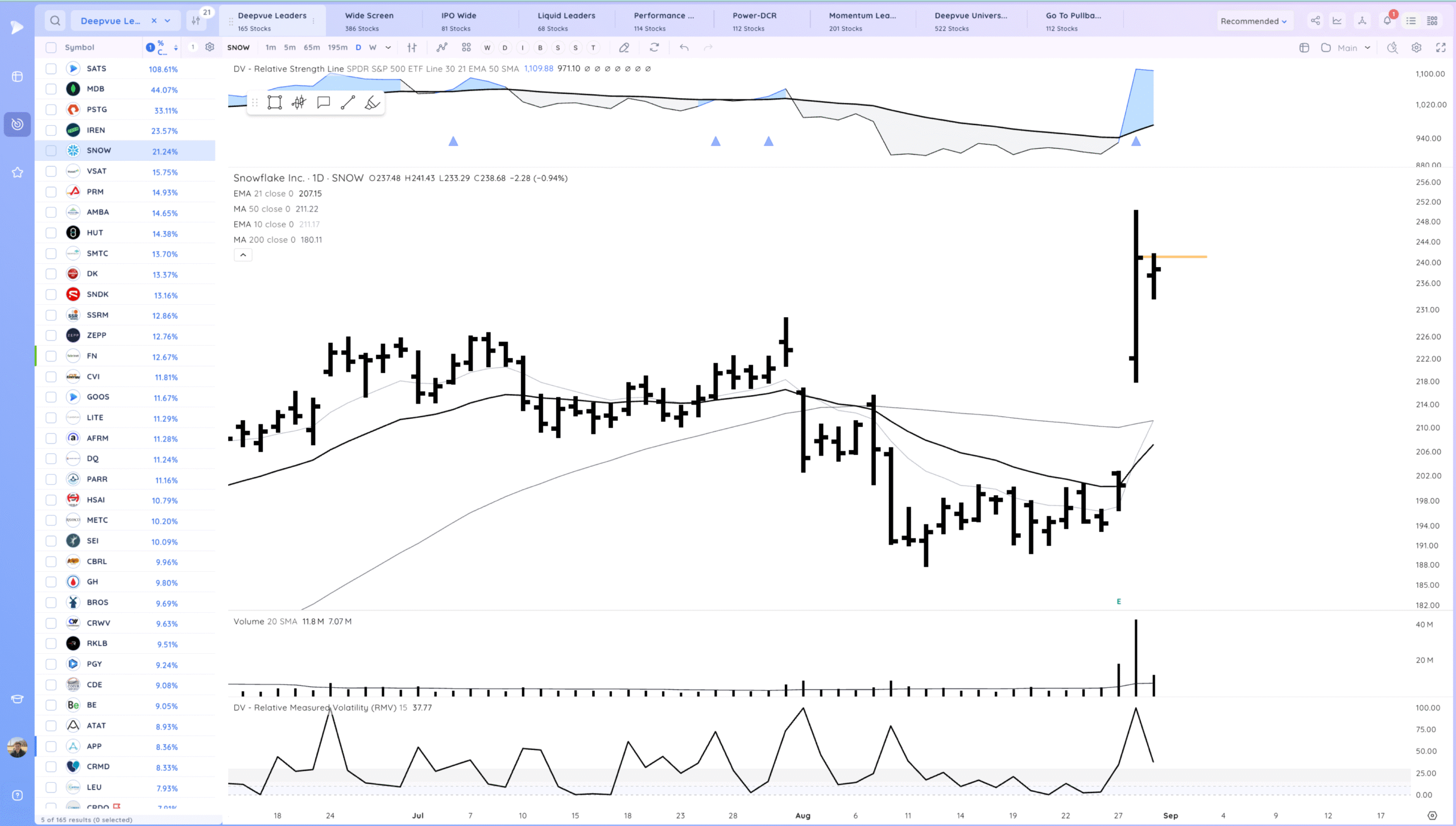

Daily Chart:

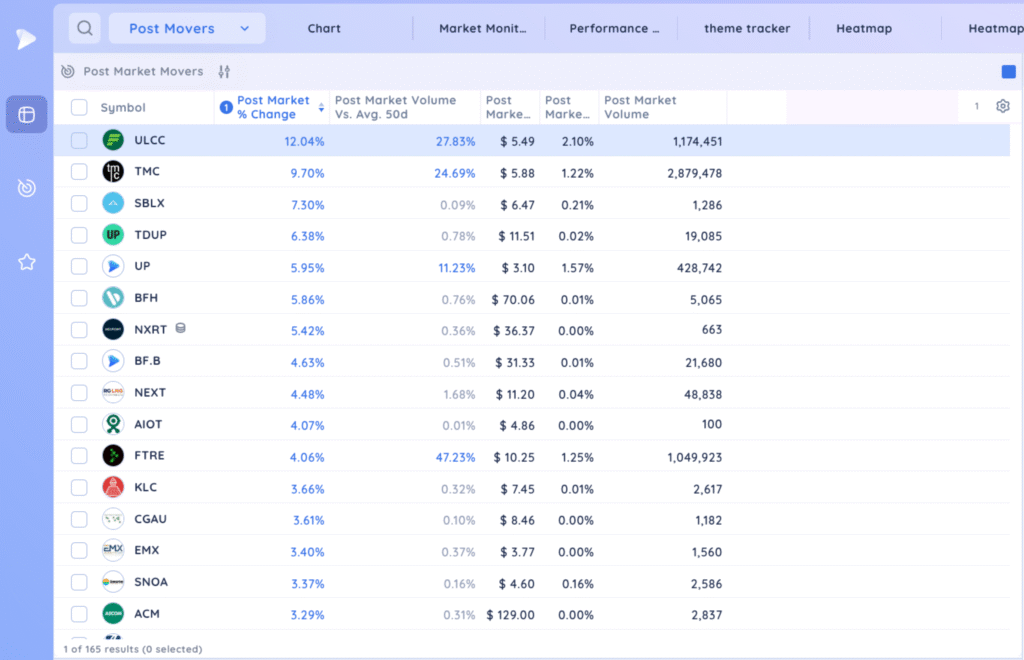

Discovery

To get SNOW on your radar you would need to monitor post market gap ups. You can use a Deepvue Post Market Movers Preset or similar to below to do this.

I look to standouts in terms of Post Market % change > 8% and or post market volume over 30%.

Then for any interesting names my standard practice now is to use ChatGPT to get a quick look at the report and potential impact. I’m most interested in surprises in earnings, revenue, margins and improvements to guidance.

Here is a sample prompt you can use while uploading a stocks slides from the earnings report:

Analyze the most recent earnings report of SNOW and create a concise but in depth report highlighting key changes in the companies financials and significant announcements. Be sure to mention if there were any significant new products/updates as well as any surprises in earnings, sales, margins or other key metrics as well as if there were any updates to guidance

The output should give you a good brief run down and what i’m looking for is positive surprises and raised guidance.

SNOW Bottom Line suggests it would be worth having it on your watchlist, especially as it is in the AI larger theme.

Setup and Execution

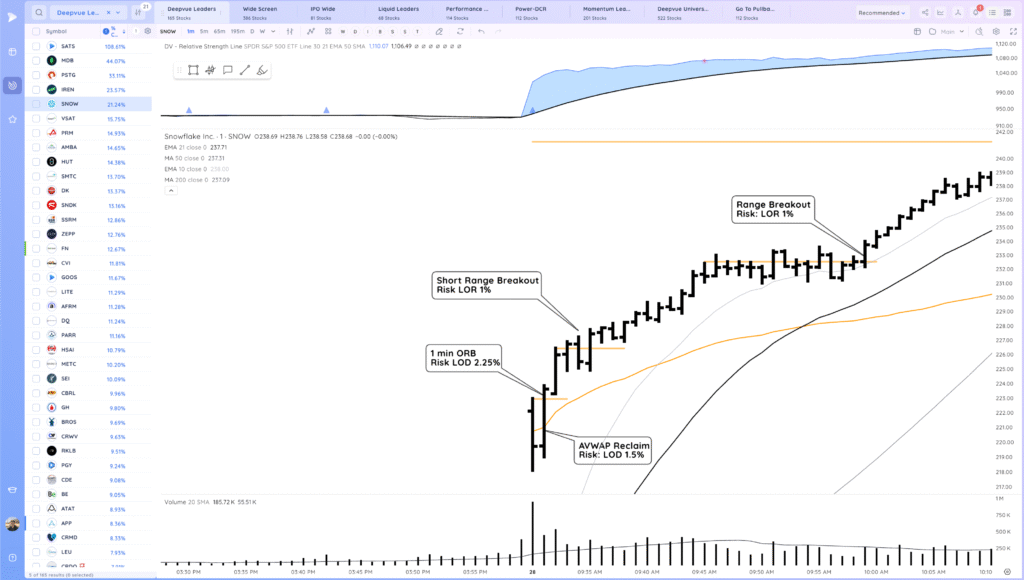

Once SNOW is on your watchlist you would identify the setup and entry tactics you will use to trade it.

For earnings gap’s I’m most often looking to enter very shortly off the open using:

- Opening Range Breakout (1 or 5 Minute)

- Daily AVWAP Undercut and Rally

- Intraday Range/Base Breakout

The goal is to enter early in the session and benefit from a strong trend day with the stock closing significantly up from the open and near highs.

The Gapper setup and entry tactics do require fast execution and the ability to watch the open.

The first entry opportunity was on the AVWAP reclaim. SNOW initially moved lower but then reclaimed the level with a strong bar that also after took the 1 min ORB.

Risk could be managed on the AVWAP reclaim to the low of the day which would be a 1.5% position stop. On a 15% position size that would be a 0.225% portfolio risk.

The ORB breakout had a larger stop. with 15% size that would be .34%. Still acceptable.

From these entries SNOW stair stepped higher, what you would want to see and set up some potential adds.

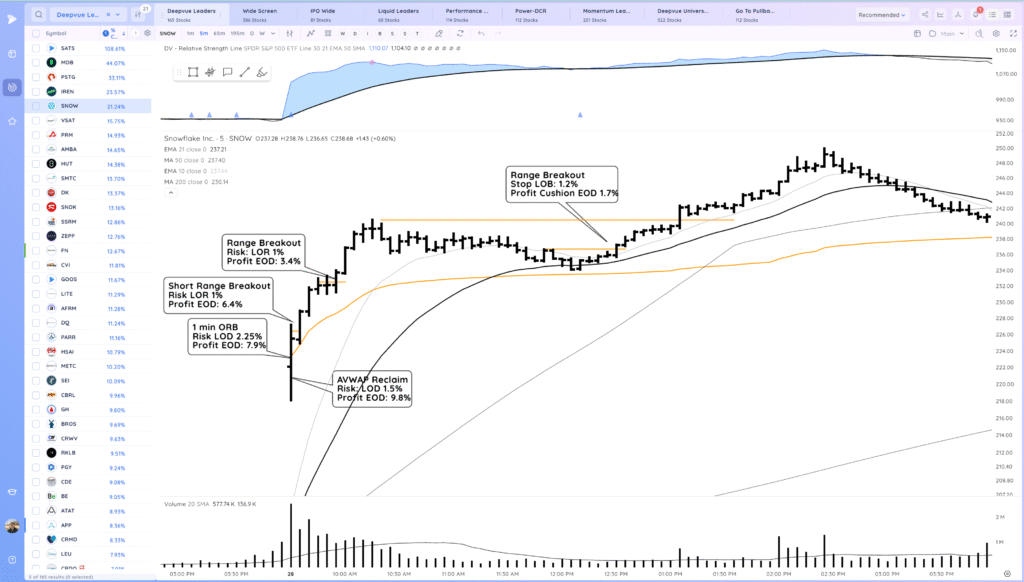

Here is the rest of Day 1 on a 5 minute and the profit cushions EOD on potential entries.

SNOW stayed above the AVWAP the whole day, a promising sign. I would be comfortable holding the position overnight from the first 3 entry points with those cushions.

Stops would be raised to at least breakeven likely 2% above breakeven.

After Day 1 I want enough cushion to be able to handle a larger inside day.

Here is the next day on the 5 minute. SNOW pulled in 3% then based and closed decently. Again from the early entries you should have been able to handle the pull in. However with the market closing negatively some traders may have decided to sell half or a portion of their position to lower open risk overall

Future thoughts

SNOW is acting well after earnings and potential Day 1 entries.

It formed a nice inside day friday as the general market was weak.

If the general market weakens further I would let my position go as it pulls in to the raised stops 2% above breakven.

However if the market recovers I would look to add a second 5-10% portion on a strong range breakout or break through the earnings gap close.

Takeaways

SNOW is a textbook earnings gap that set up nicely early in the session. AI related and with a promising fundamental look. is has potential to start a strong stage 2.

However it is breaking out and gapping later in a market cycle, it’s success will likely be market dependent.

Homework

List out your go to Day 1 entry tactics if you trade them and give a strong example of each and identify stops and risk.

Remember, there are many ways to trade gappers and trading Day 1 is not for everyone.