Trade Opportunity Case Study of the Week: INTC Range, 21ema Pop Breakout – | Nov 2025

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

December 3, 2025

The Trade Opportunity

The purpose of this weekly article is to analyze the top trading opportunity of the week. To improve our identification and execution of high quality trade ideas that meet our setup requirements.

Each article will focus on a stock that meets one of three of the main categories of setups I trade:

- Range Breakout / VCP / tight area breakout

- Pullback to Support/ Key moving average

- Gapper / Post Gap Setup

These articles are like taking a step into the batting cage and loading up a historical at bat from a Ace pitcher in the world series – they will help you prepare and execute in future situations by studying important moments from the past.

The setups we cover will appear again and again in each market cycle

To add market context, the QQQ has rallied strongly from the Friday reversal.

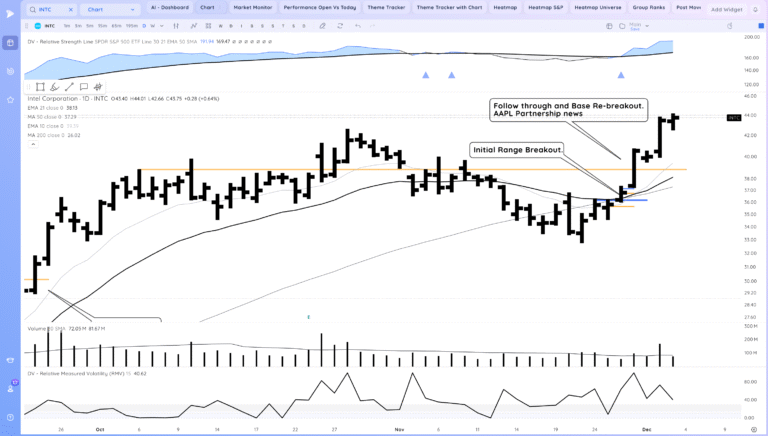

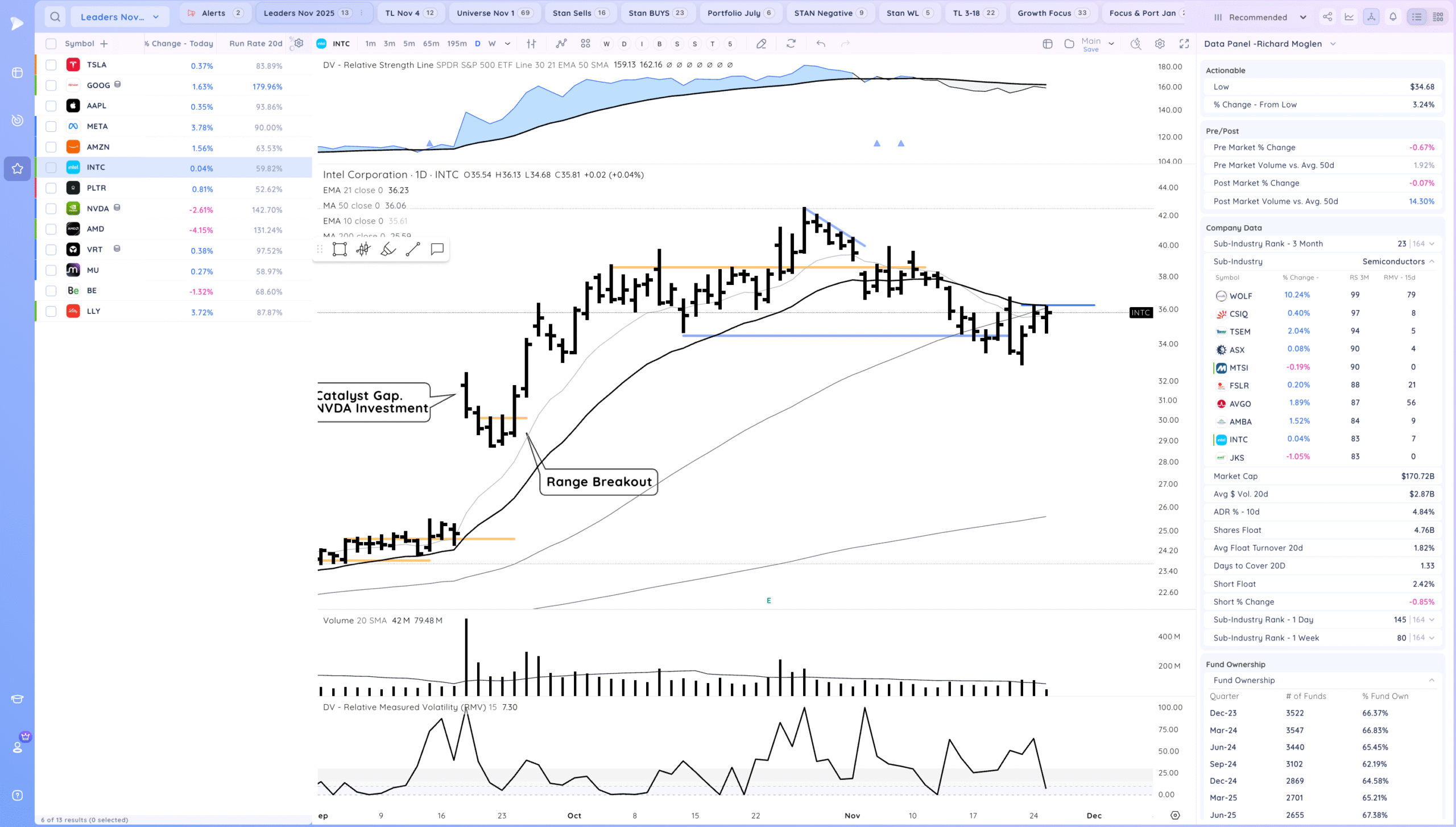

For this week we will be focusing on INTC . Intel has been one of the strongest semi leaders of late and set up multiple opportunities as it followed through and reclaimed the 21ema. Last friday INTC broke out on news that it would be partnering with Apple. We’ll also discuss the most recent action later on.

Discovery – INTC

To catch strong moves you need to have processes in place to get names capable of them on your radar. Think of setting up a funnel system for each of your setups. Distill the characteristics you want it to exhibit and create screens that look for those.

I’m always tracking the top leaders and staying in tune with their status: whether it be basing, trending, getting extended, breaking down, or pulling back. If they are setting up my priority is to build positions in them.

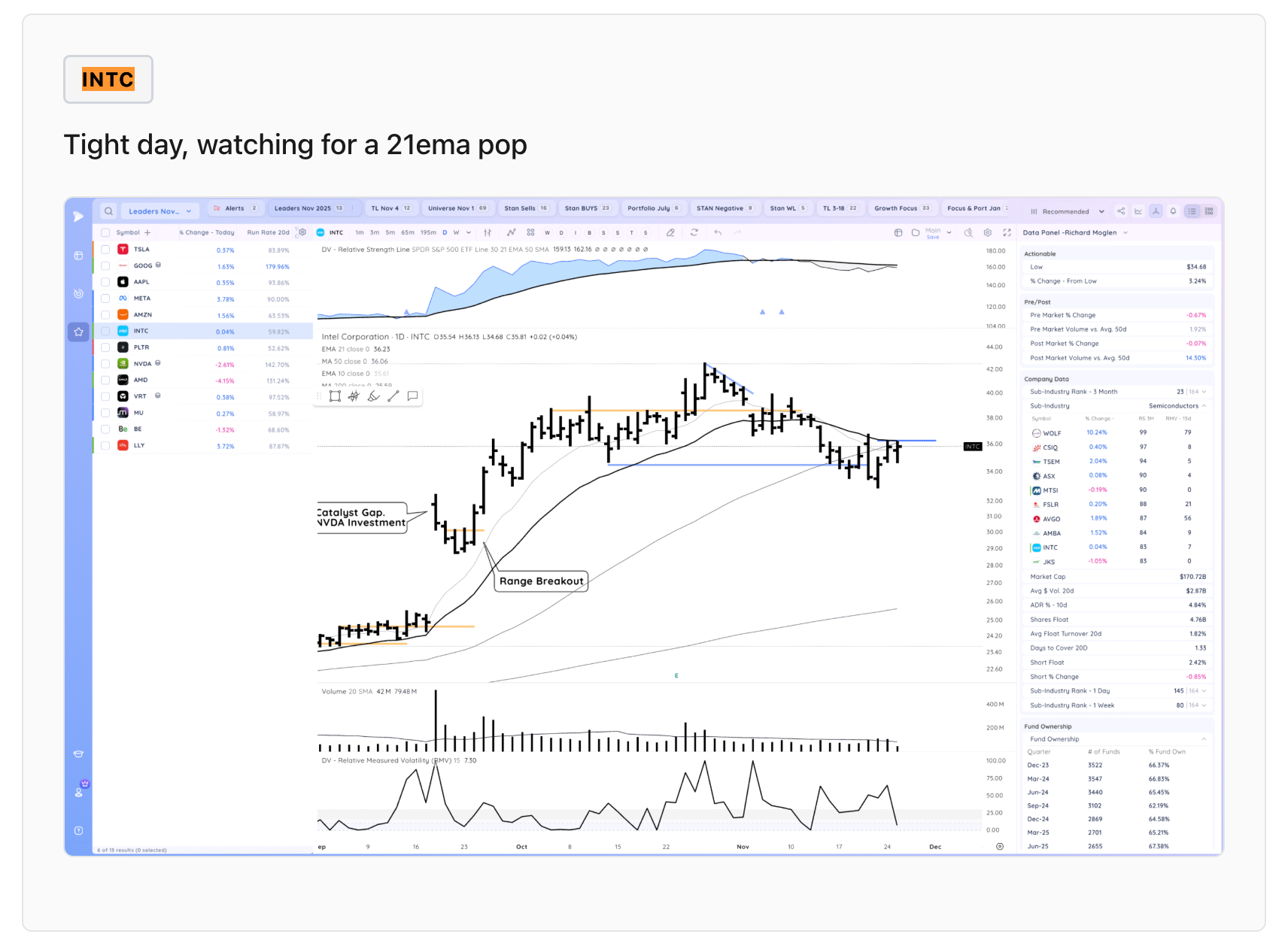

INTC is one of the leadership stocks I currently review in each report. The main setup we’re focusing on today is the 21ema pop which I highlighted last Tuesday.

If you were not already watching INTC each day, you could have found it by tracking recent gaps in a watchlist or by tracking AI related semi names which has been a leading theme

However you got INTC on your radar, you would have seen a current leader setting up for reconfirmation through the key 21ema up the right side after pulling back to a key level.

Setup and Execution

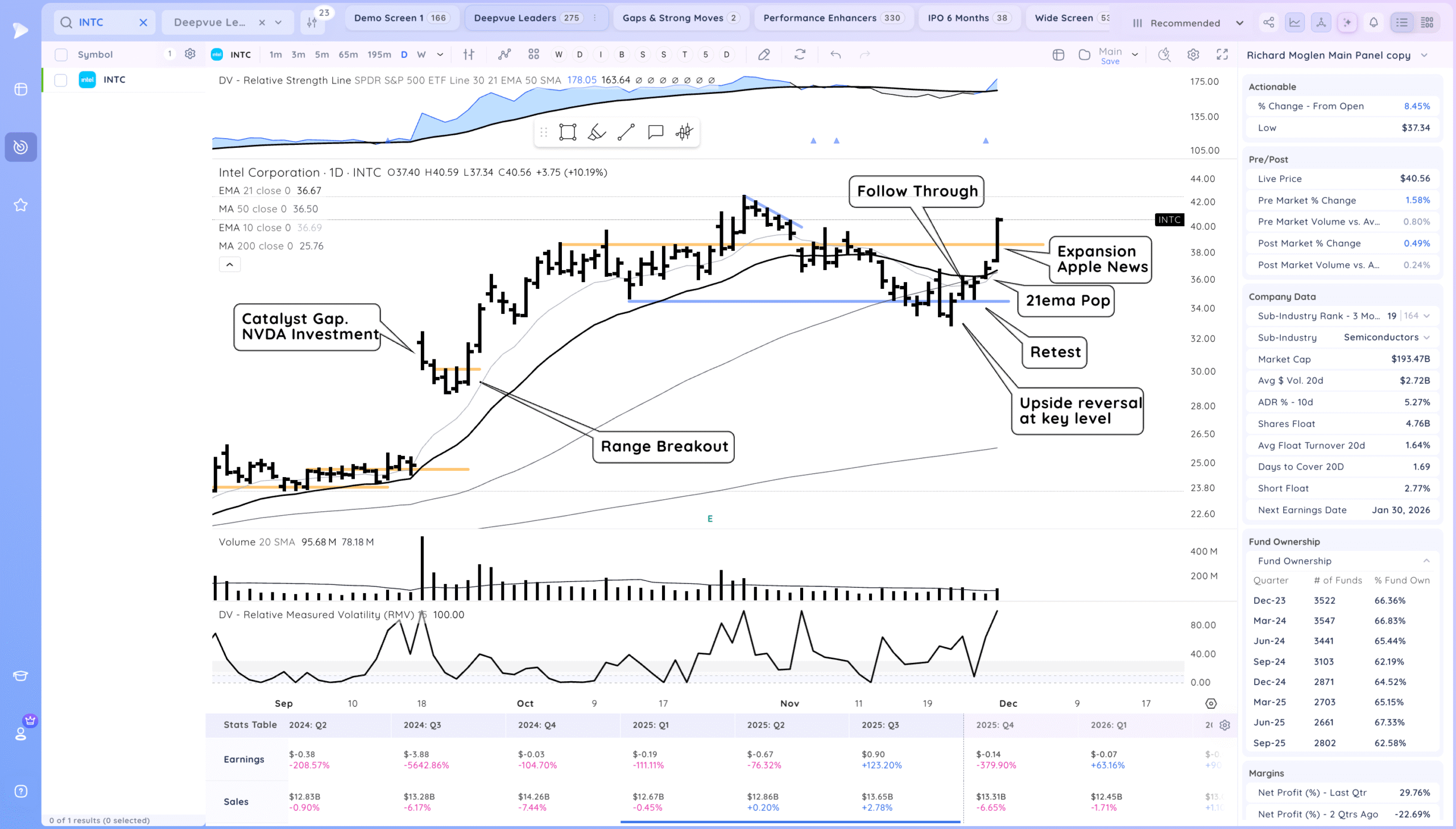

The 21ema Pop occurs after a pullback below the 21ema, a key low is set, and the stock looks to reclaim the MA level/ breakout of a range up the right side and continue trending.

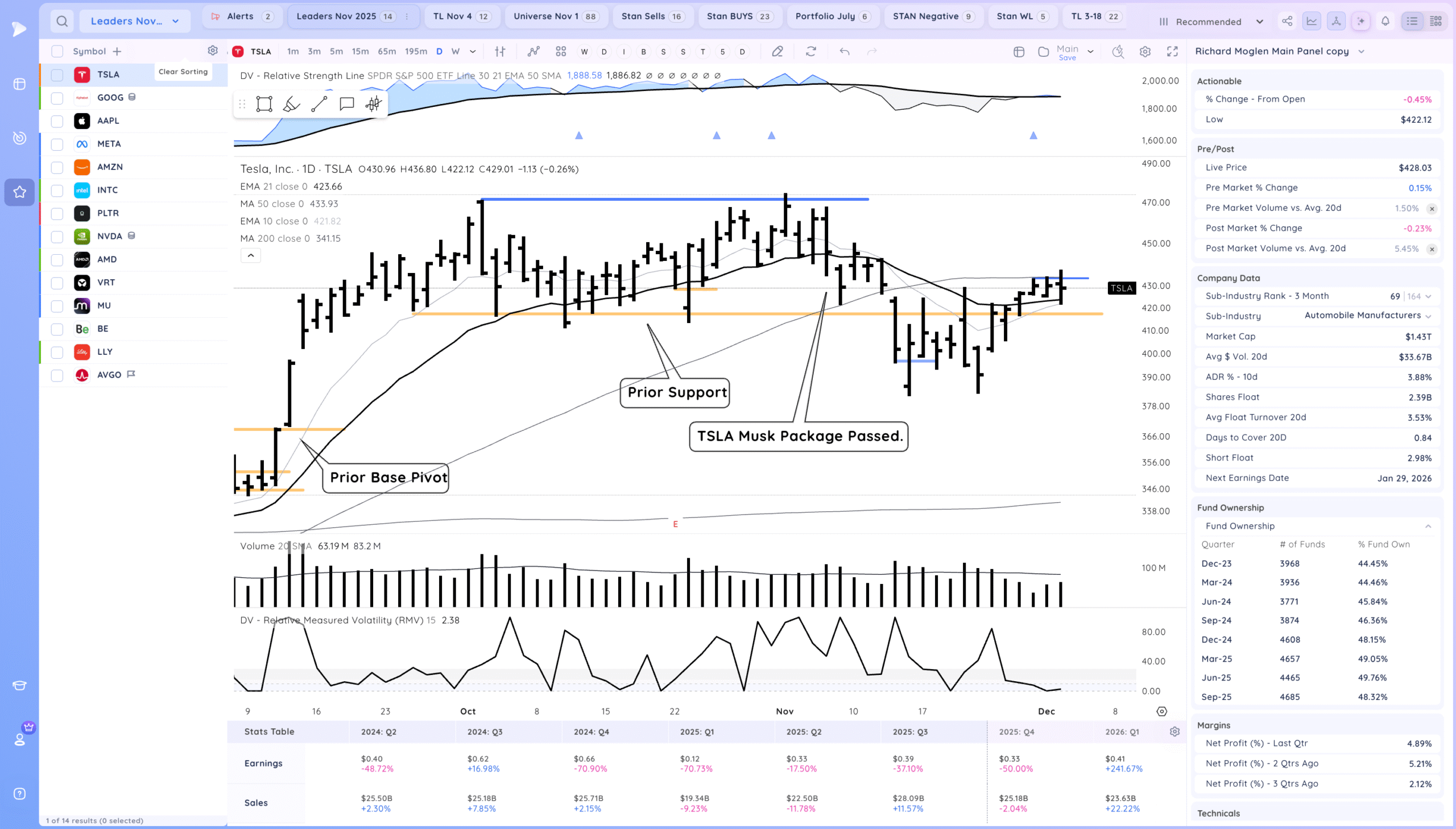

TSLA on Tuesday was a similar setup as it formed a range just above the 21ema and below the 50sma. Notice RMV at sub 5.

The entry point for the 21ema pop is as the stock breaks through the moving average/high of the range. The entry is intraday, not at the close.

For INTC that level was just above 36 going into Nov 26.

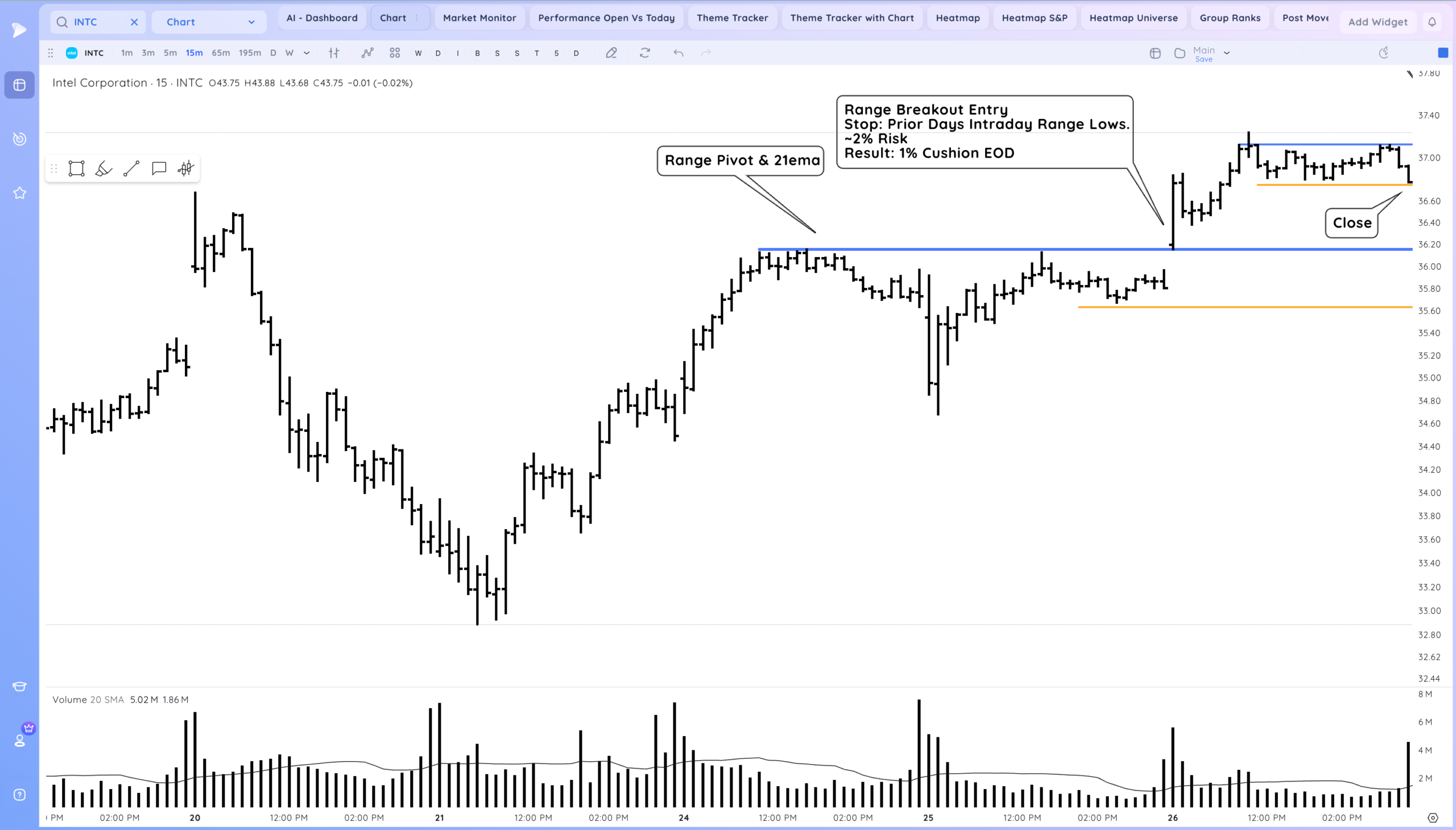

One we have a daily setup and level, we can use intraday charts *wisely* for entry tactics.

INTC the next morning pushed right off the open. Entering on the daily range breakout with a stop below the prior day’s intraday range would only be 2% Risk.

With a 2% risk you could size 15% of your portfolio and be risking roughly 0.3% of your total account.

From the range breakout/21ema pop you would have about a 1% cushion into the EOD. Not ideal but enough to hold INTC through to the next day and give it a shot to expand further.

Here is the 21ema pop on a 15min timeframe. You would be entering shortly after the open as it pushed on volume.

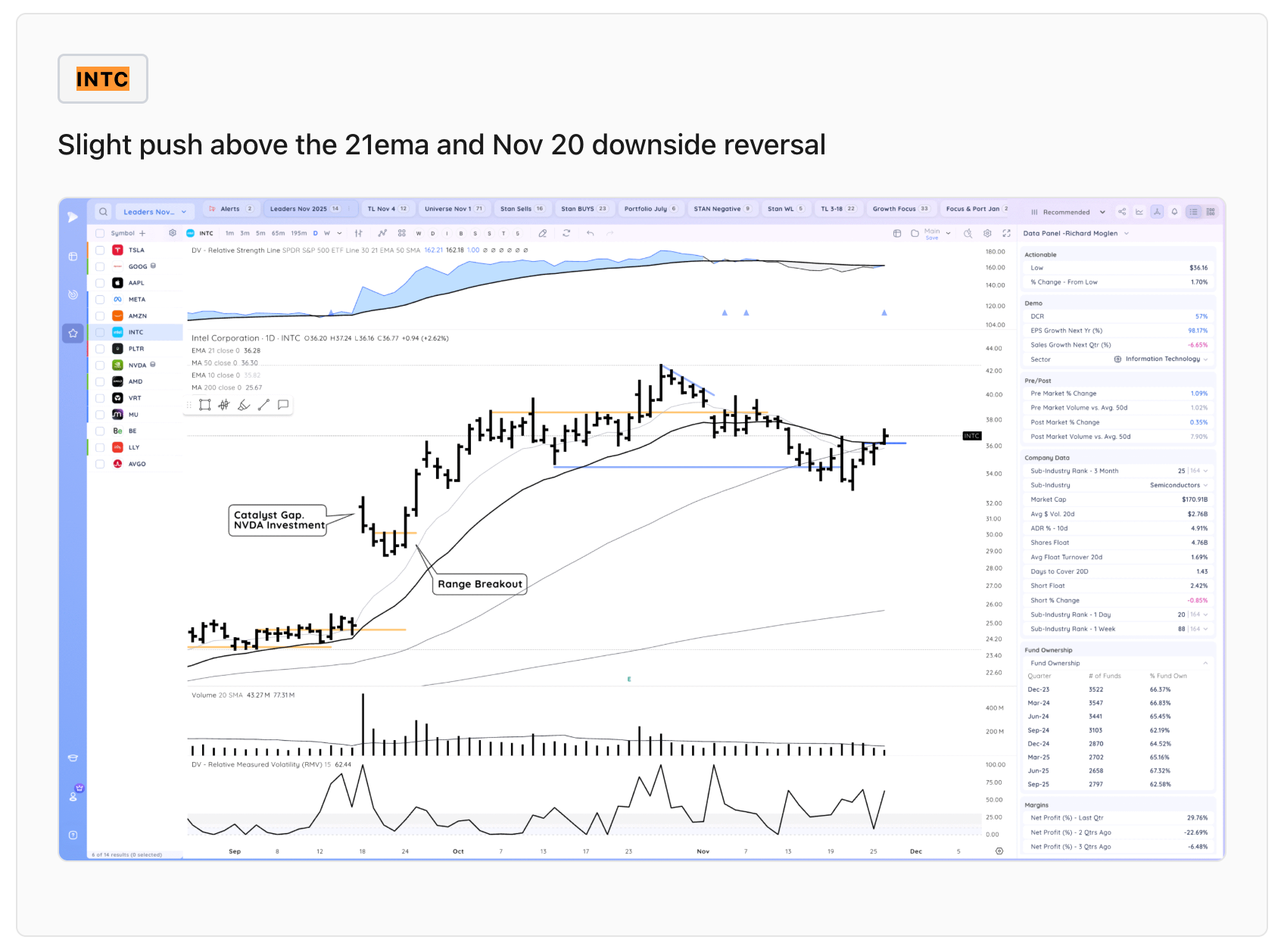

Here were my thoughts after the close of that day

This was a pop above a key level and now we are watching for follow through and a continued push up the right side.

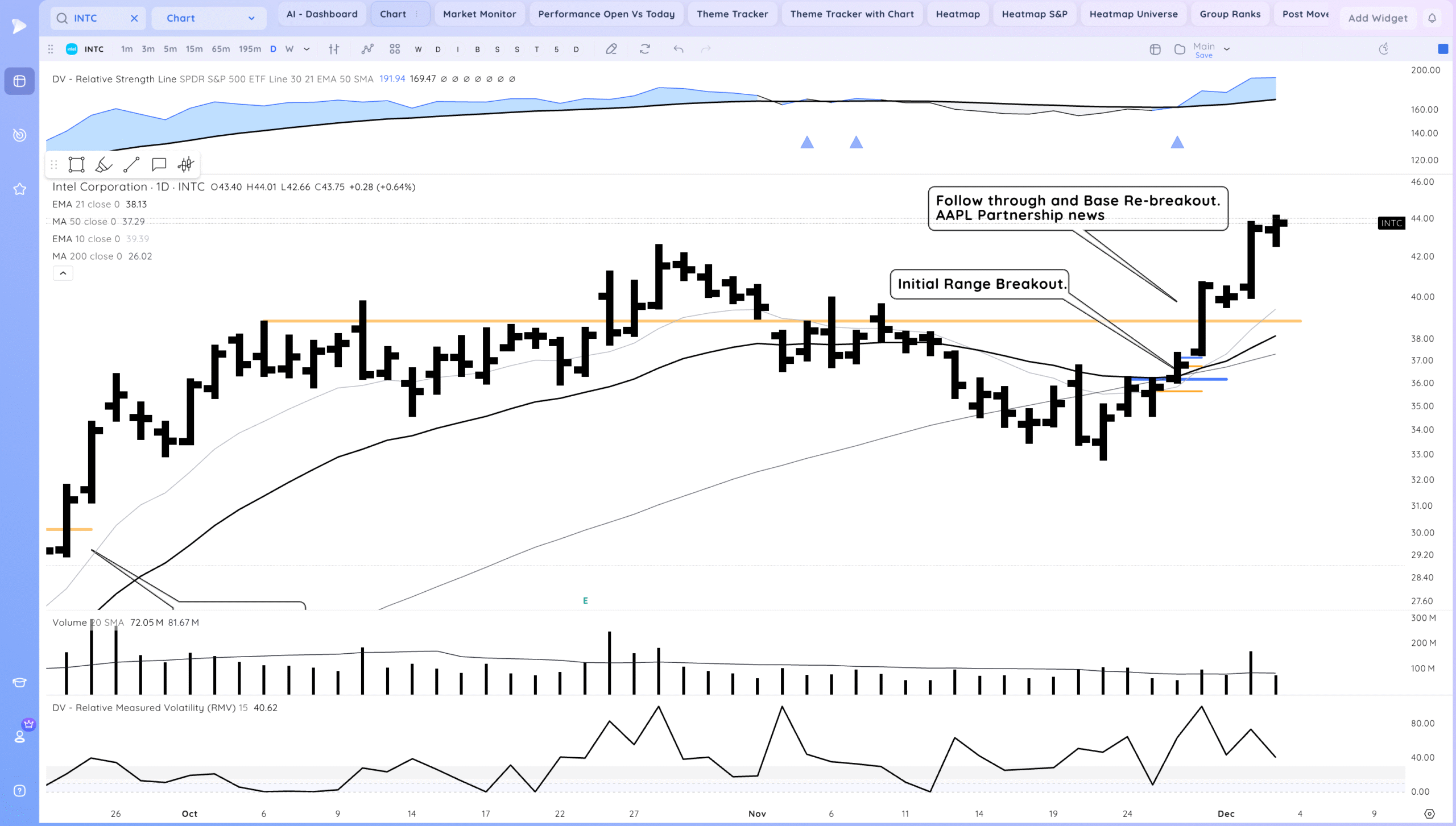

We got the follow through the next day with a gap and go on Apple partnership rumors. During the morning INTC would have also been actionable managing risk at the low of the day or prior day’s close area.

Here is the action on a 5 minute chart. INTC rocketed higher right off the open. You could have managed risk under 2.5% risk versus the prior day close/ intraday range lows.

Future thoughts

Since these entry opportunities INTC has acted in textbook fashion, establishing itself as a semi leader along with AVGO and ASML

Note the tight day and then reconfirmation, textbook strong accumulation.

At this point INTC is up about 20% in a few days from the 21ema pop. Swing traders should have taken 1/3rd to 1/2 off into strength Tuesday and be watching the 10/21emas to trail the rest.

Homework

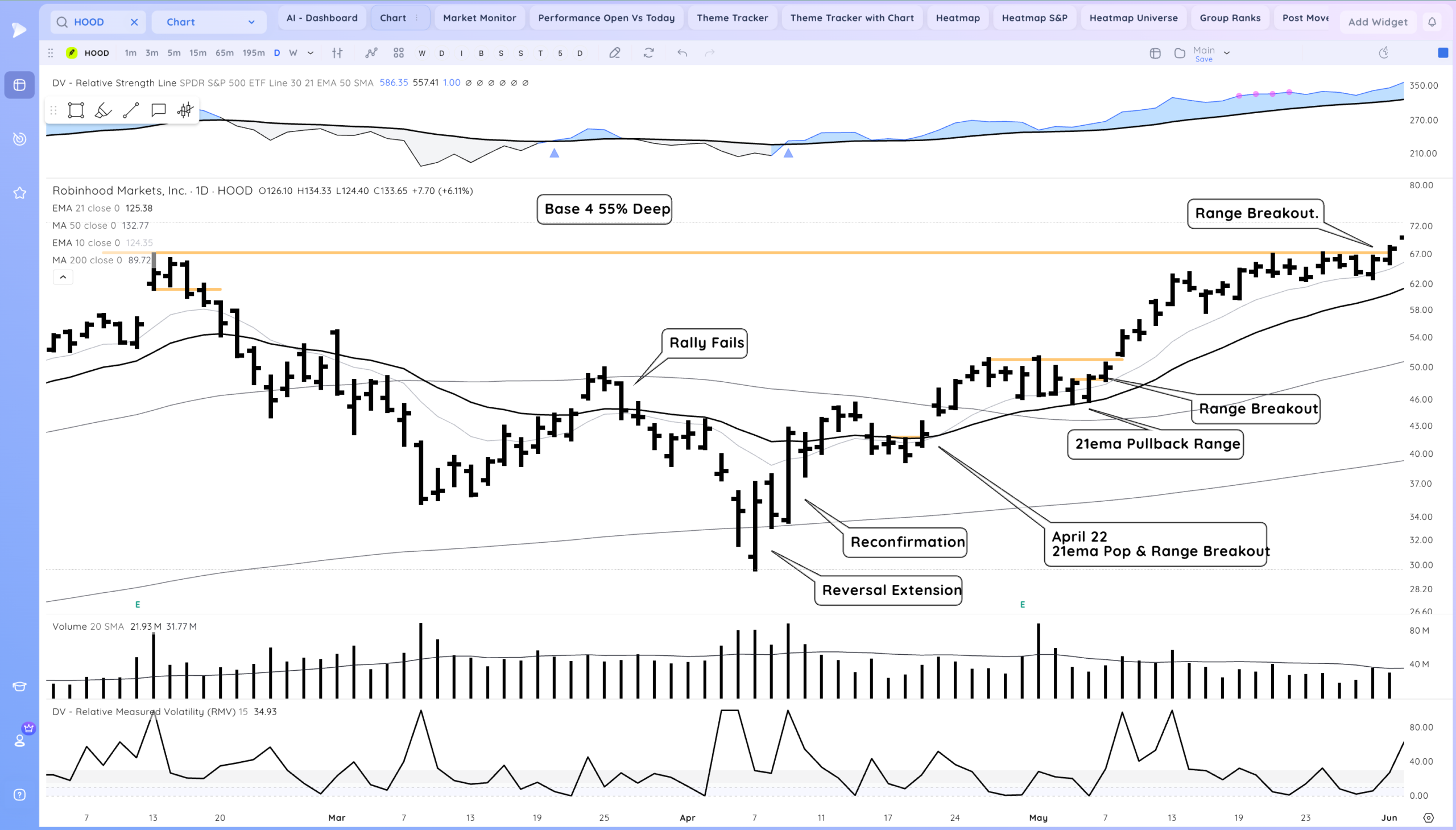

The 21ema Pop is often one of the first tradable spots after a stock puts in a base/key low. Study this HOOD example since it’s a good case study of what they may look like in larger bases.

In larger bases the first test of the 21ema is often a spot where there is some consolidation and a pause.

https://traderlion.com/community-post/the-oops-reversal-entry-tactic/