Trade Opportunity Case Study of the Week: CRS Earnings Gap Day 1 Entries – | October 2025

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

October 26, 2025

The Trade Opportunity

The purpose of this weekly article is to analyze the top trading opportunity of the week. To improve our identification and execution of high quality trade ideas that meet our setup requirements.

Each article will focus on a stock that meets one of three of the main categories of setups I trade:

- Range Breakout / VCP / tight area breakout

- Pullback to Support/ Key moving average

- Gapper / Post Gap Setup

These articles are like taking a step into the batting cage and loading up a historical at bat from a Ace pitcher in the world series – they will help you prepare and execute in future situations by studying important moments from the past.

The setups we cover will appear again and again in each market cycle

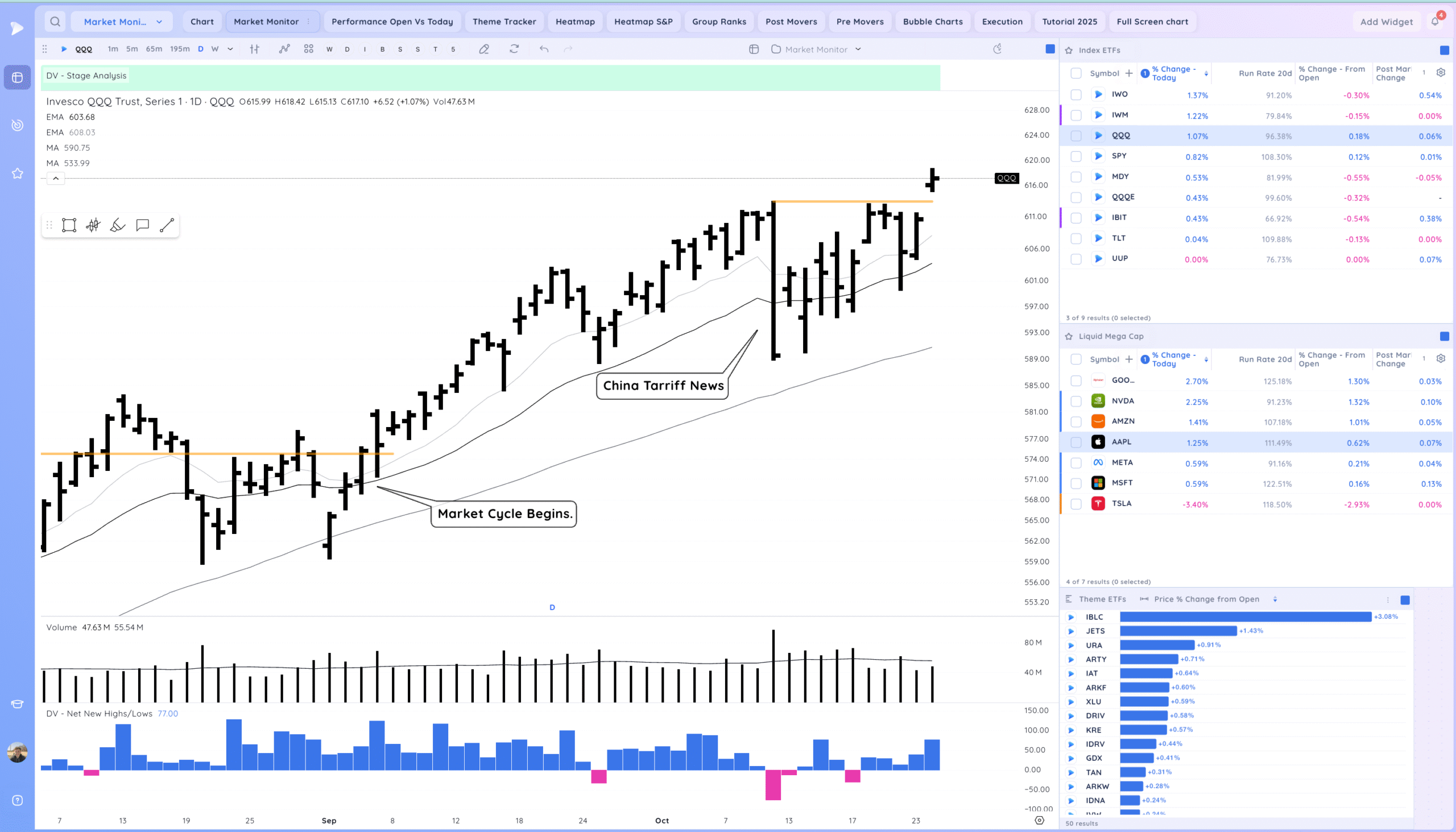

The market this week we pushed from last week’s inside action and made new highs after testing the 21ema. Earnings season is here and we’ve started to see gappers.

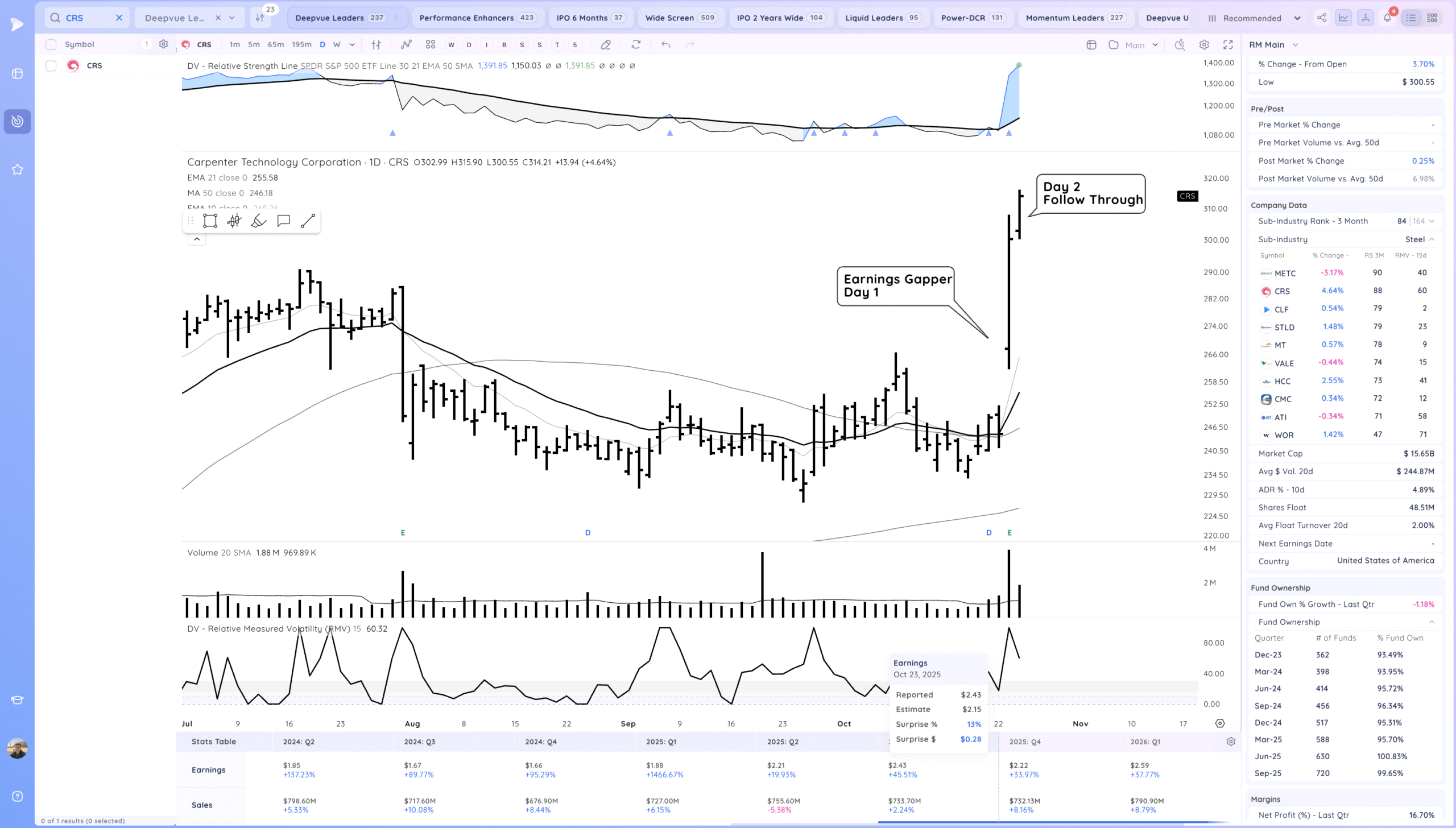

For this week we will be focusing on CRS which gapped up on earnings after reporting Thursday morning.

We will be focusing on Day 1 opportunities (The Day of the gap)

Discovery – CRS

To catch strong moves you need to have processes in place to get names capable of them on your radar. Think of setting up a funnel system for each of your setups. Distill the characteristics you want it to exhibit and create screens that look for those.

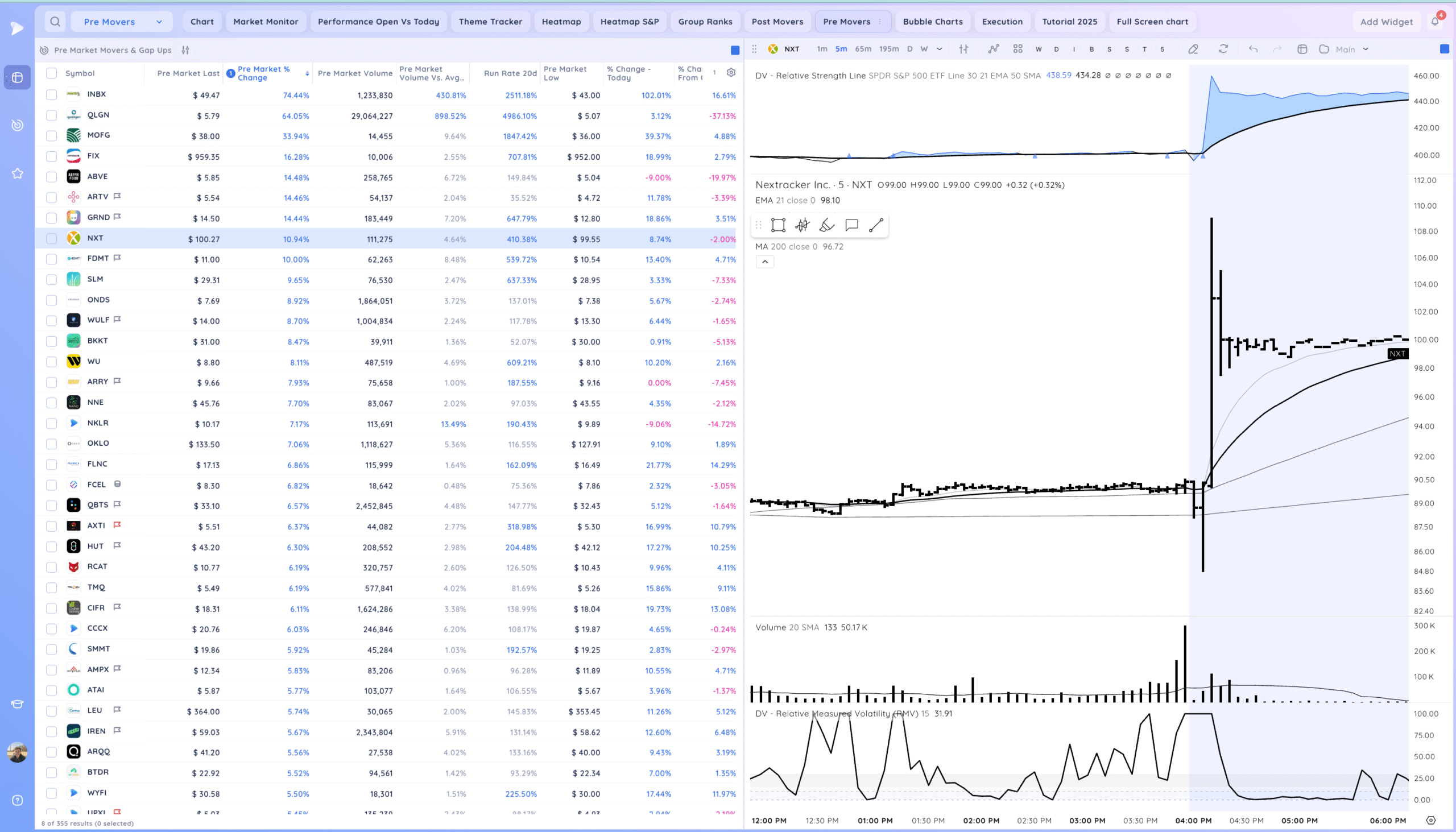

To catch an Earnings Gap you need to monitor for gap ups post and per market and analyze their catalysts.

I have a dashboard setup on Deepvue that helps me with this. I review this nightly & each morning and add any stocks to a watchlist that stand out to review their catalysts

I use a variation of the following prompt to analyze reports for key info.

“Analyze CRS’s most recent earnings report from Thursday morning, what stands out as important and significant, what did they say about revenue, earnings growth, margins, buy backs, new products/developments or future guidance”

- Record profitability + accelerating A&D demand. Operating income hit $153.3M (record; +31% y/y) and EPS $2.43 vs $1.67 last year. Bookings in Aerospace & Defense +23% q/q, and CRS finished negotiations on several long-term aerospace agreements with “significant value realization.”

- Net sales: $733.7M, +2% y/y.

Ex-surcharge sales: $603.1M, +4% y/y (management highlights mix shift to higher-value materials).

Operating income: $153.3M vs $113.6M y/y. - EPS: $2.43 (no special items this quarter) vs $1.67 (or $1.73 adj.) a year ago.

- Company operating margin: 20.9% (vs 15.8% y/y).

- Adjusted operating margin ex-surcharge: 25.4% (vs 20.3% y/y).

- SAO (Specialty Alloys Operations): 32.0% adjusted operating margin (15th straight quarterly increase); $170.7M operating income.

- Share Buy Backs: Repurchases: $49.1M (≈ 200k shares) during the quarter; $249M still authorized.

- Capacity expansion: CRS reiterated its brownfield expansion to add primary and secondary melt capacity—positioning for multi-year growth in A&D, Medical, and Power Gen.

- Commercial wins: multiple new LTAs with aerospace customers at attractive value

- FY26 operating income: $660–$700M (+26–33% y/y) with “line of sight to the high end.”

Basically, Strong Growth, Increasing Margins, Share Buy Backs, higher end of guidance.

This all points to the potential for a strong earnings reaction and trend. Given this it would go to the focus list for the day.

Setup and Execution

For earnings gap’s I’m most often looking to enter very shortly off the open using these potential entry tactics

- Opening Range Breakout (1 or 5 Minute)

- Daily AVWAP Undercut and Rally

- Intraday Range/Base Breakout

My preferred entry happens in the first 10 minutes of the trading day, the stock forms a short intraday pullback, undercuts the AVWAP and then reclaims it. In the strong names the stock then breaks out of the opening range and never looks back, trending above the daily AVWAP and intraday moving averages and closing strong.

Gapper Day 1 entries are the only time i’m looking at sub 5 minute charts and I quickly get off them once the stock is trending.

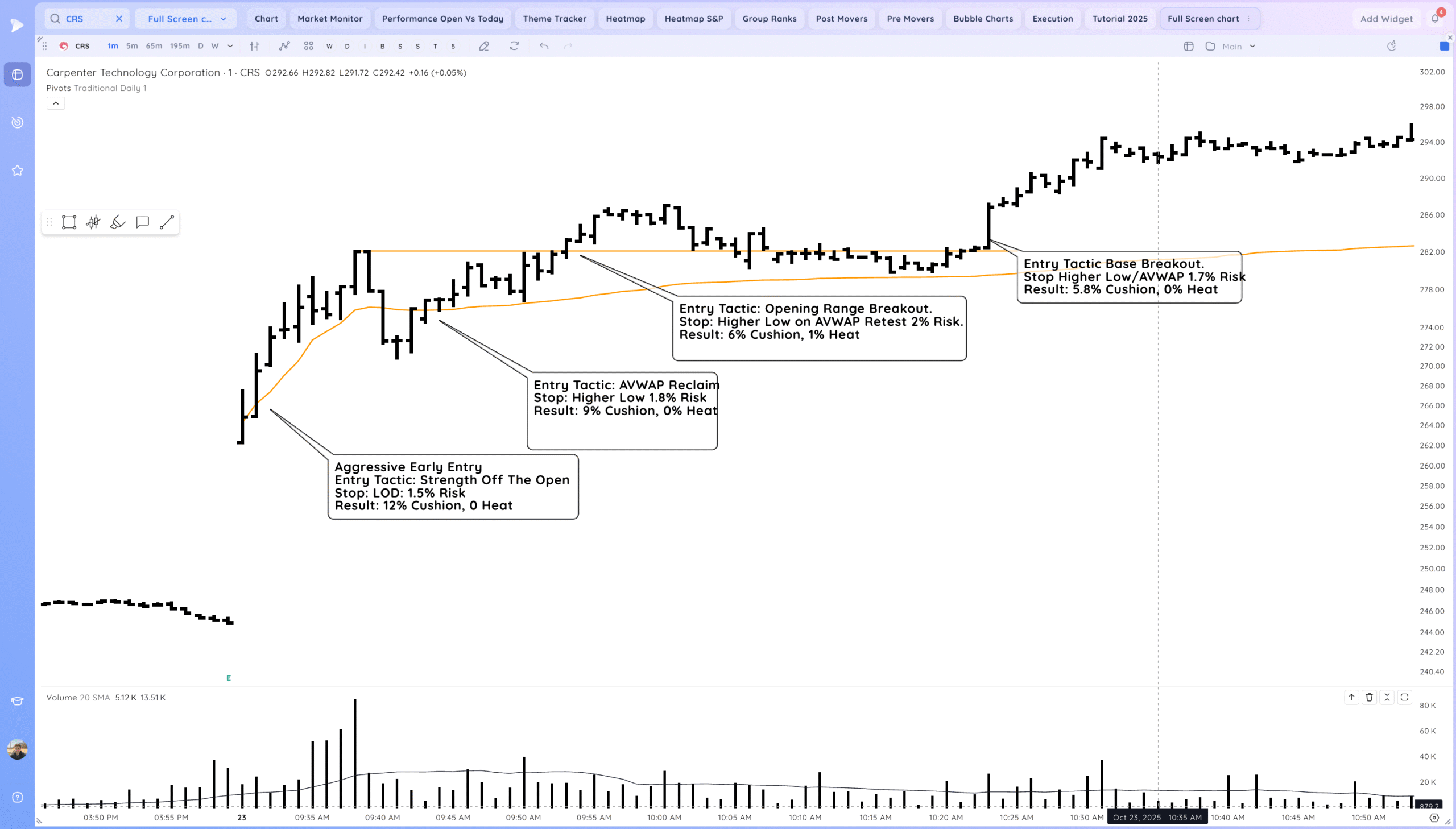

Here is CRS on a 1 min

The AVWAP reclaim (second entry) is my preferred entry tactic.

For each of those note how I track the profit cushion by EOD and also the heat experienced which would be the drawdown from the entry. None of these experienced enough heat for a stop out even with less than 2% stops.

With a 2% stop you could size up to 20% of your portfolio while risking less than 0.4% of your account.

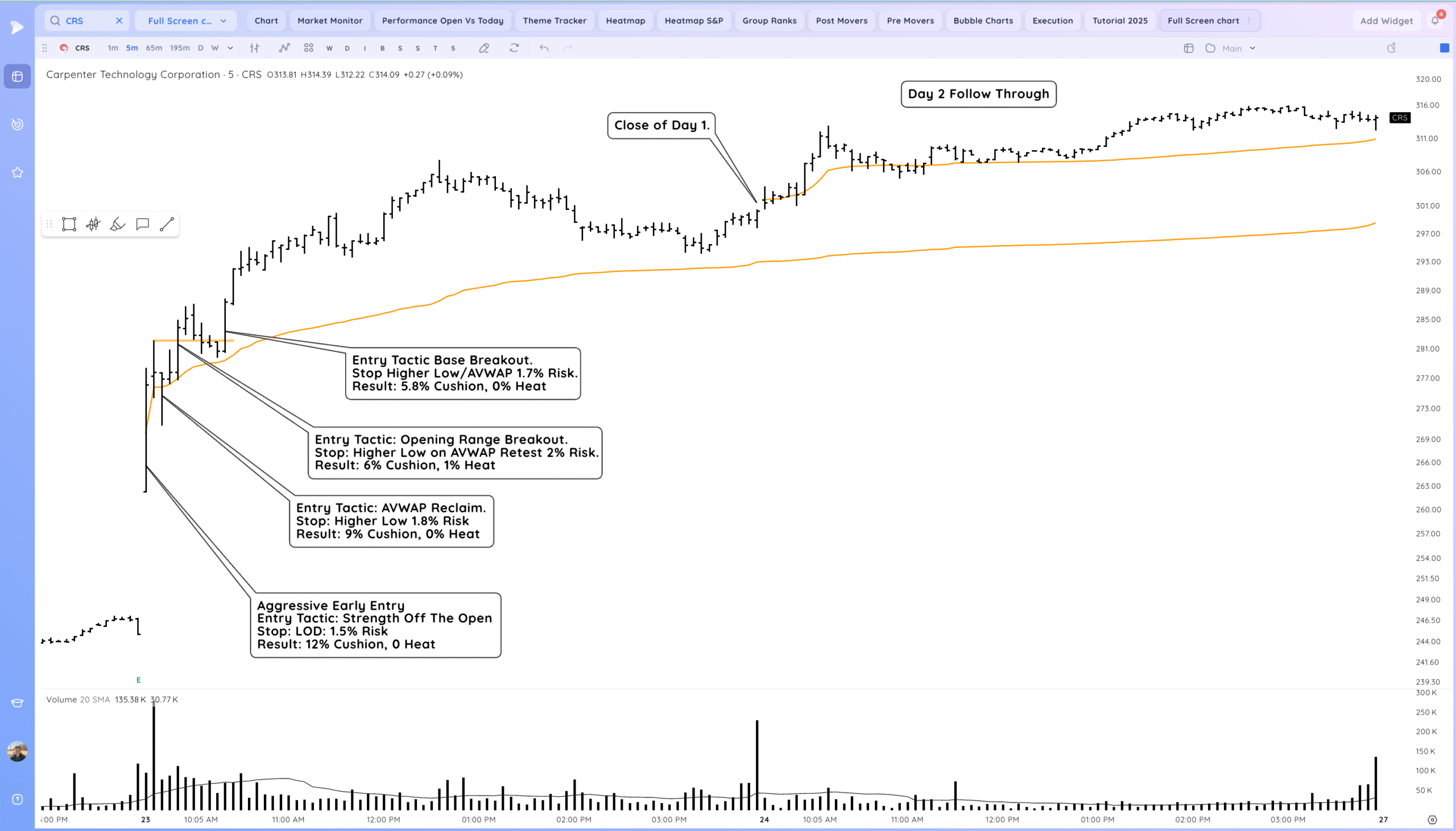

After an entry you want to stock to trend and close strongly. CRS did exactly this. It pushed strongly for the first half of the day before basins constructively above the AVWAP with a short rally into the close. Overall up about 15% from the open.

The next day it follow through. Sometimes these gaps pullback into the day 1 AVWAP before rallying.

The point of a Day 1 is profit from an immediate trend and get a cushion. Often even if a stock pushes day 1 it may need to base for a few days before U turning and trending higher.

With this in mind you either have to be patient with a day 1 entry and we willing to let some cushion be eat up in a pullback/basing period. Or act more as a swing trader and look to be selling into strength Day1,2,3 and reloading back at a range breakout or another entry area.

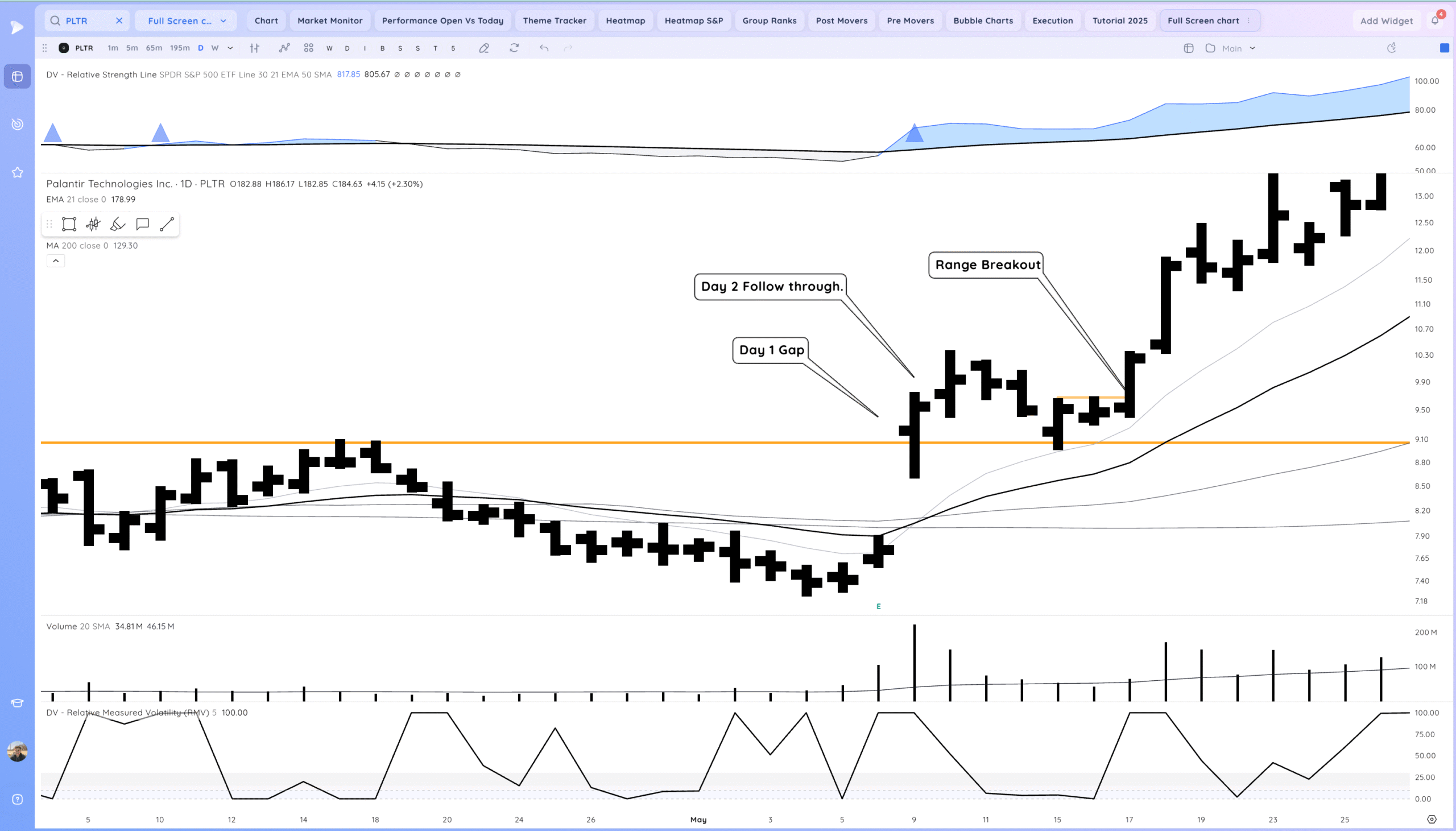

Here is an example with PLTR (Daily Chart)

If gap ups continue and the market keeps trending, we will likely see more opportunities this cycle that look like PLTR.

Future thoughts

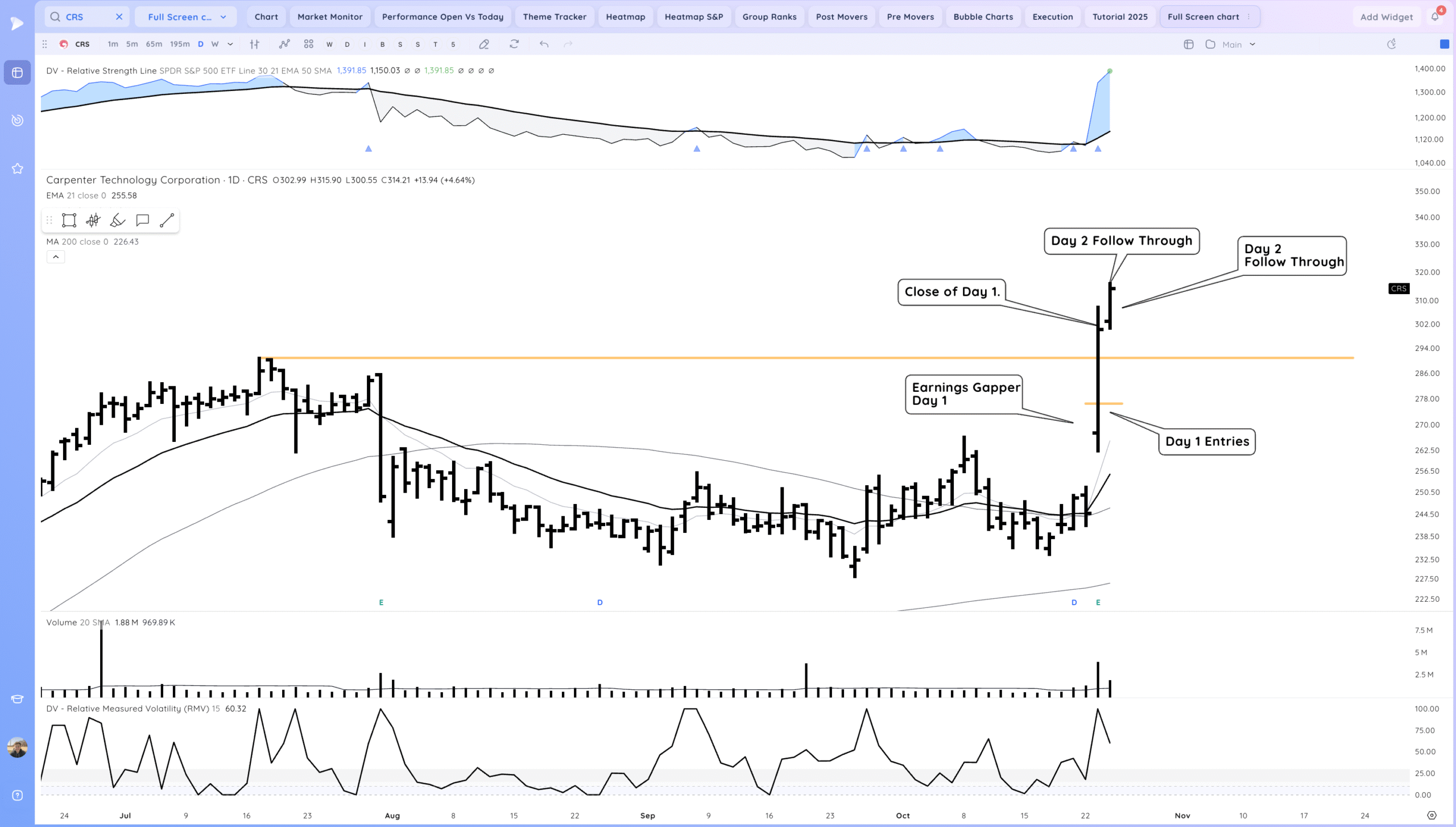

CRS has had a strong day 1 and 2. how the first pullback acts will be telling. does it start breaking down and the gap is sold or does it hold relatively firm and begin trending.

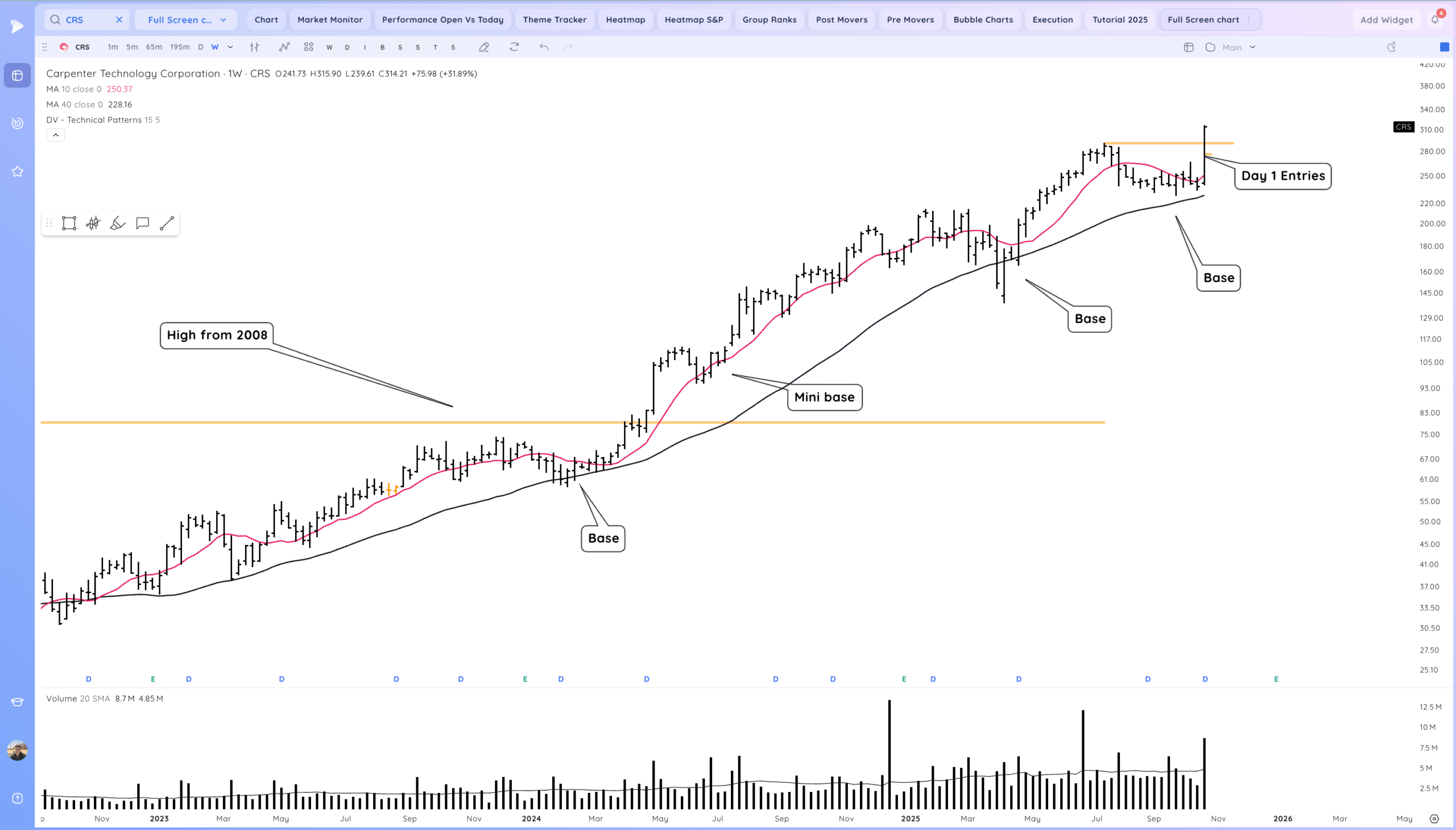

What is constructive is that CRS is breaking out of a base in a longer term uptrend.

A constructive pullback from here would be contained by the base pivot but ideally the HVC (Earnings Gap Close) level.

On a weekly we can see a clean breakout but also that CRS is in a longer term uptrend and emerging from the 2nd major base since breaking into new aths through a level set in 2008.

Homework

Study 5 or more examples from the gappers model book located on your Trade Lab dashboard.

Here is the direct Link: https://traderlion.com/lesson/gappers-model-book/