Trade Opportunity Case Study of the Week: BE Range Breakout – | Dec 2025

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

December 7, 2025

The Trade Opportunity

The purpose of this weekly article is to analyze the top trading opportunity of the week. To improve our identification and execution of high quality trade ideas that meet our setup requirements.

Each article will focus on a stock that meets one of three of the main categories of setups I trade:

- Range Breakout / VCP / tight area breakout

- Pullback to Support/ Key moving average

- Gapper / Post Gap Setup

These articles are like taking a step into the batting cage and loading up a historical at bat from a Ace pitcher in the world series – they will help you prepare and execute in future situations by studying important moments from the past.

The setups we cover will appear again and again in each market cycle

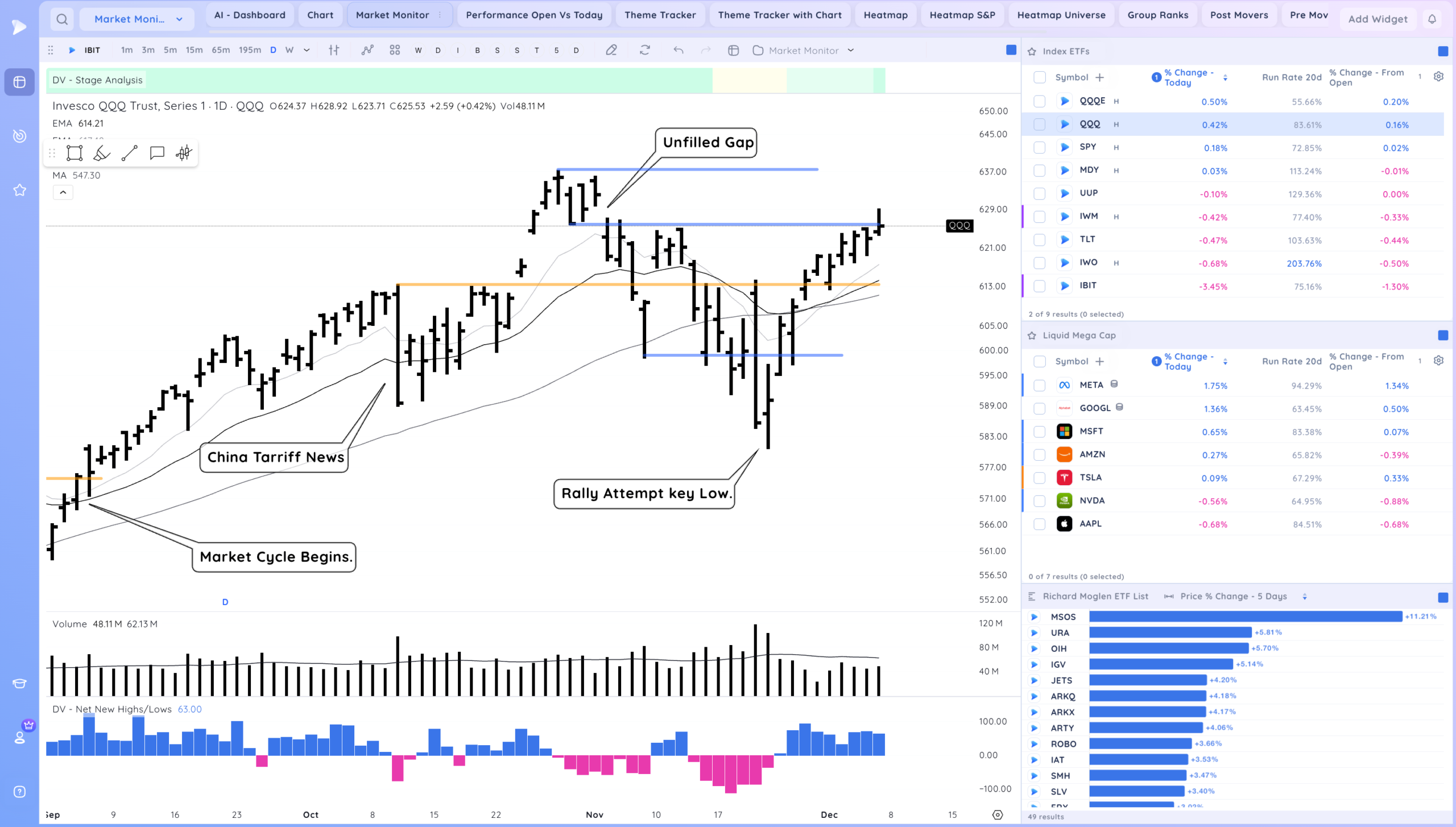

To add market context, the QQQ continued to rally this week into the unfilled gap area.

For this week we will be focusing on BE, a current market leader which setup for a range breakout up the right side of it’s developing base.

This is my absolute favorite setup.

Here is what i’m looking for in general:

- Existing Leader in a strong theme which has shown the ability to trend above the moving averages

- Breaks below the 21ema starting a new base

- Extension down that is bought up, starting the move up the right side of a base

- Push higher into the moving averages area where a range forms

- Range breakout – this is where we act

Discovery – BE

To catch strong moves you need to have processes in place to get names capable of them on your radar. Think of setting up a funnel system for each of your setups. Distill the characteristics you want it to exhibit and create screens that look for those.

I’m always tracking the top leaders and staying in tune with their status: whether it be basing, trending, getting extended, breaking down, or pulling back. If they are setting up my priority is to build positions in them.

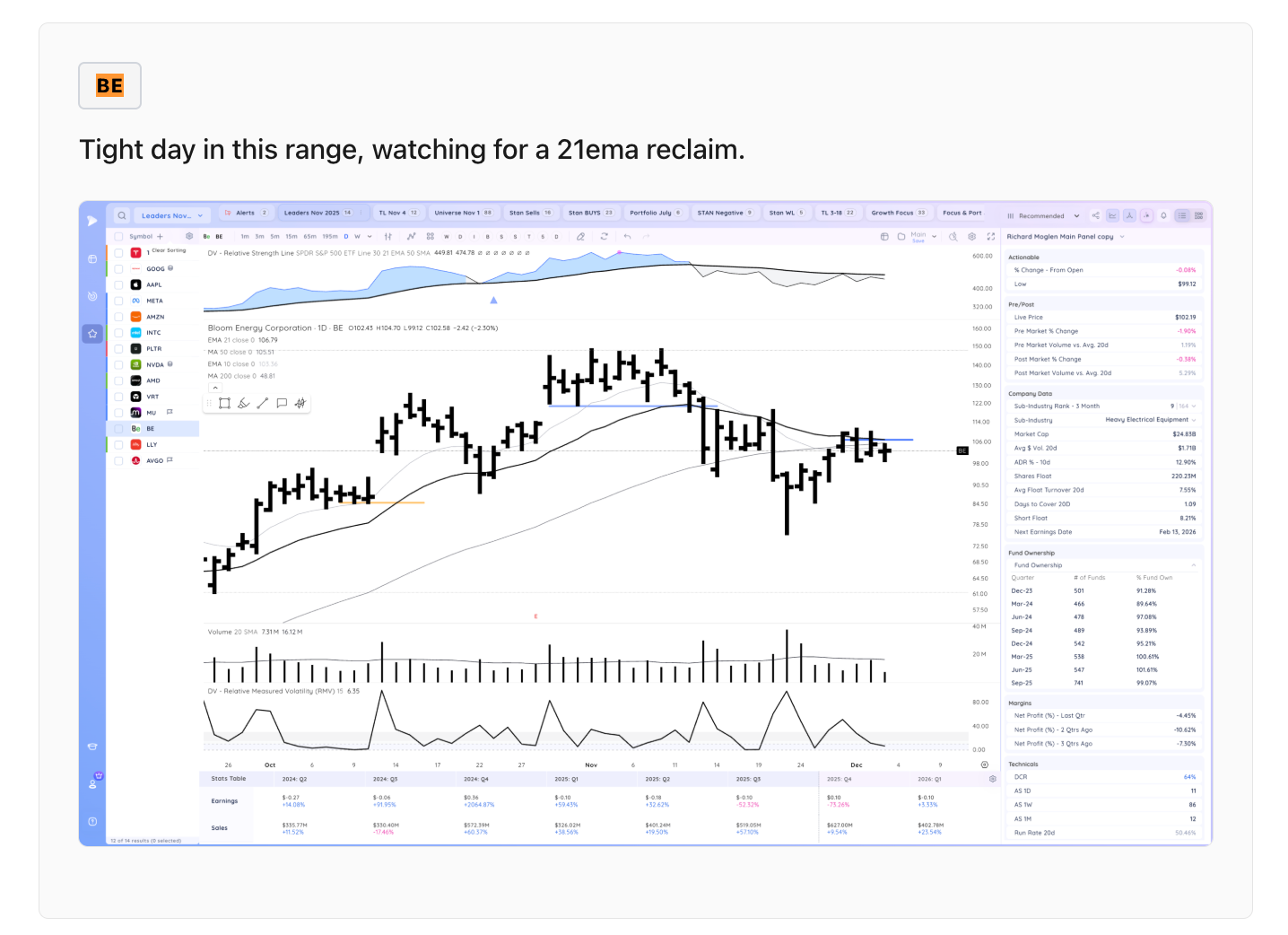

BE is one of the leadership stocks I currently cover in each report. The day before the range breakout I was watching for a push from the range and 21ema reclaim

Crucially, the entire AI energy theme was coiled, setting up for a group move. This adds to my conviction.

If you were not already watching BE each day you could have been screening for tight ranges. In Deepvue you can use Relative Measured Volatility to find stocks setting up in ranges.

A RMV value of under 10 is “coiled” then it’s about seeing if the range is part of a larger setup. I prefer ranges near 21emas up the right sides of bases like BE was showing.

Setup and Execution

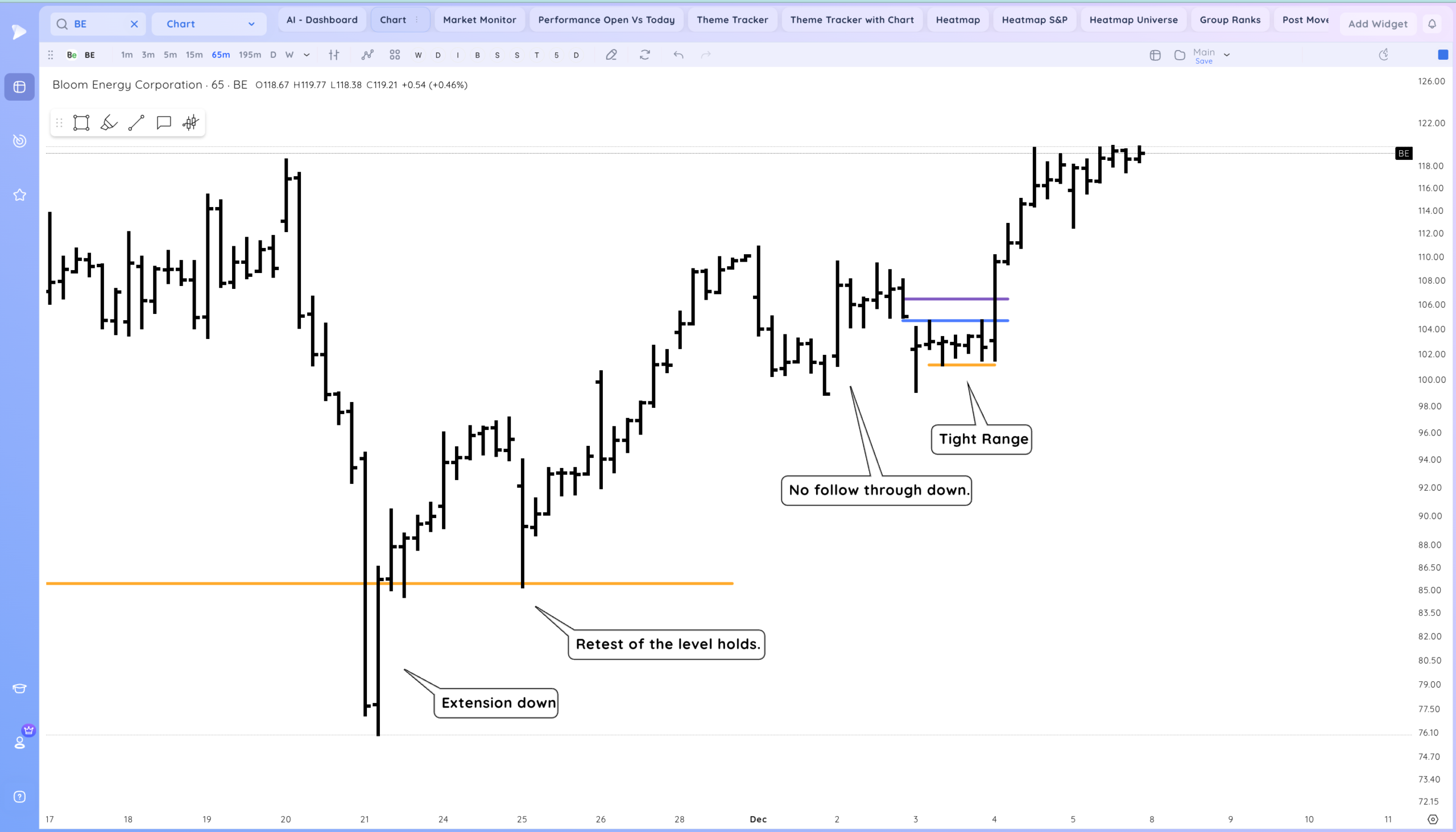

I want to start by breaking down the price action of BE and my mindset after each bar.

At point 0 we have a Sharp Break below the range and 21ema. BE needs a new base to form

- Reconfirmation down, Base in progress, watching for an extension down that is bought up

- Big follow through down undercutting a level but then almost closes even, potential correction low is in. Now we are watching for follow through up

- Retest of the level and another good close. Showing demand, expecting a push higher into the moving averages area

- Gap higher, fade, close up. More demand being shown

- Push into the 21ema area. The first test often is rejected. This is also a 40% move off lows in a few days, expecting a pause

- There we do, rejected and a negative close expecting follow through down based on the close near lows

- Hmm instead of follow through down we gapped up and held and are tightening right below the MAs. Watching for a pop thorugh the 21ema

- Gap down but still holding the range that is forming below the 21ema. And this is a very tight day overall with an upside reversal on the lowest volume in quite a while. BE looks ready, watching for a break above this high and the 21ema

- Boom there is the breakout and strong expansion through the high, 21ema, and range high. Nice close near highs. We are up against a key level

- Constructive consolidation day just below the key levels. watching for follow through up/reconfirmation but aware we could pullback above the 21ema and still be healthy as we build out this base.

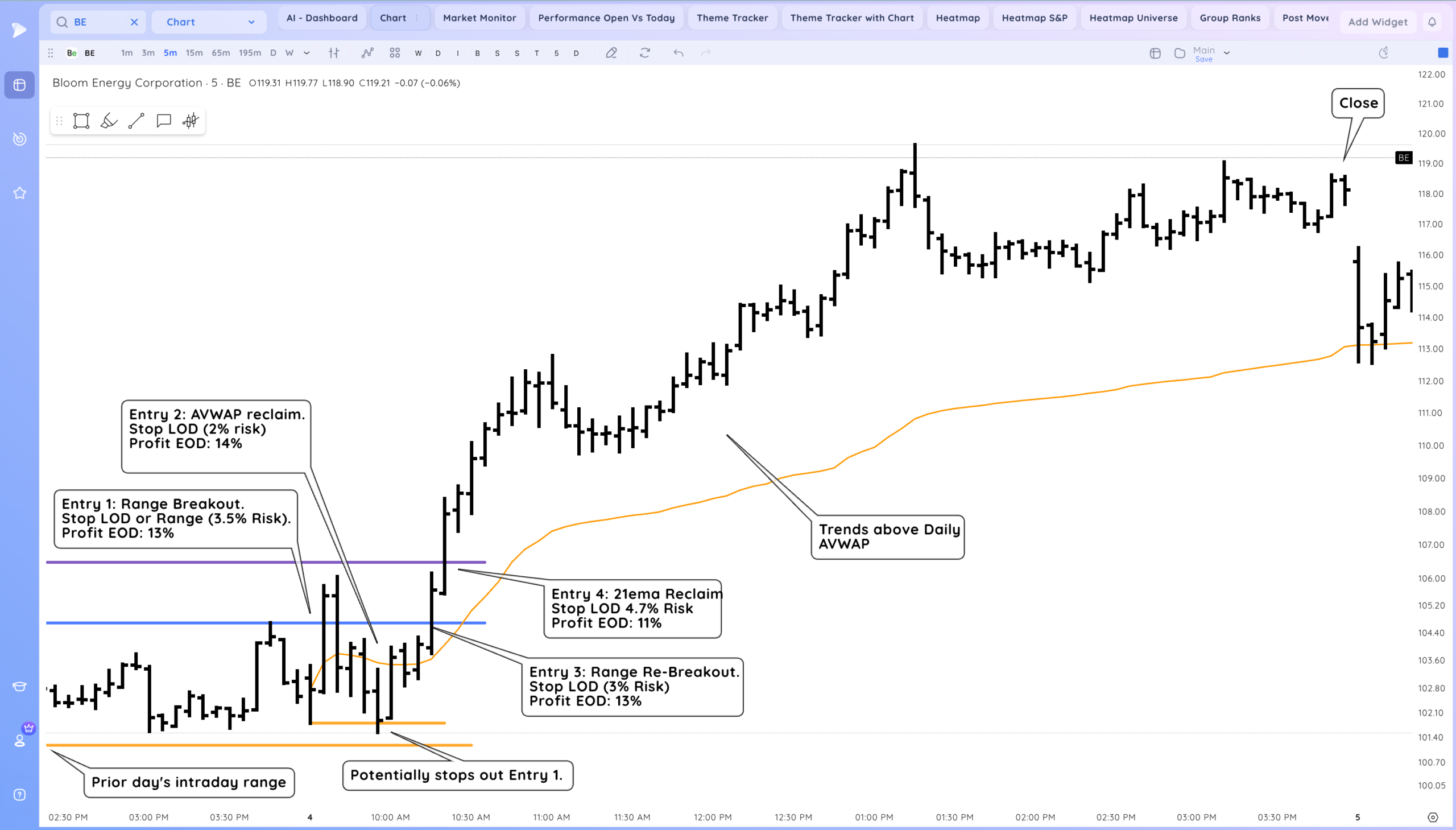

Now let’s get into execution for BE on the range breakout/21ema pop.

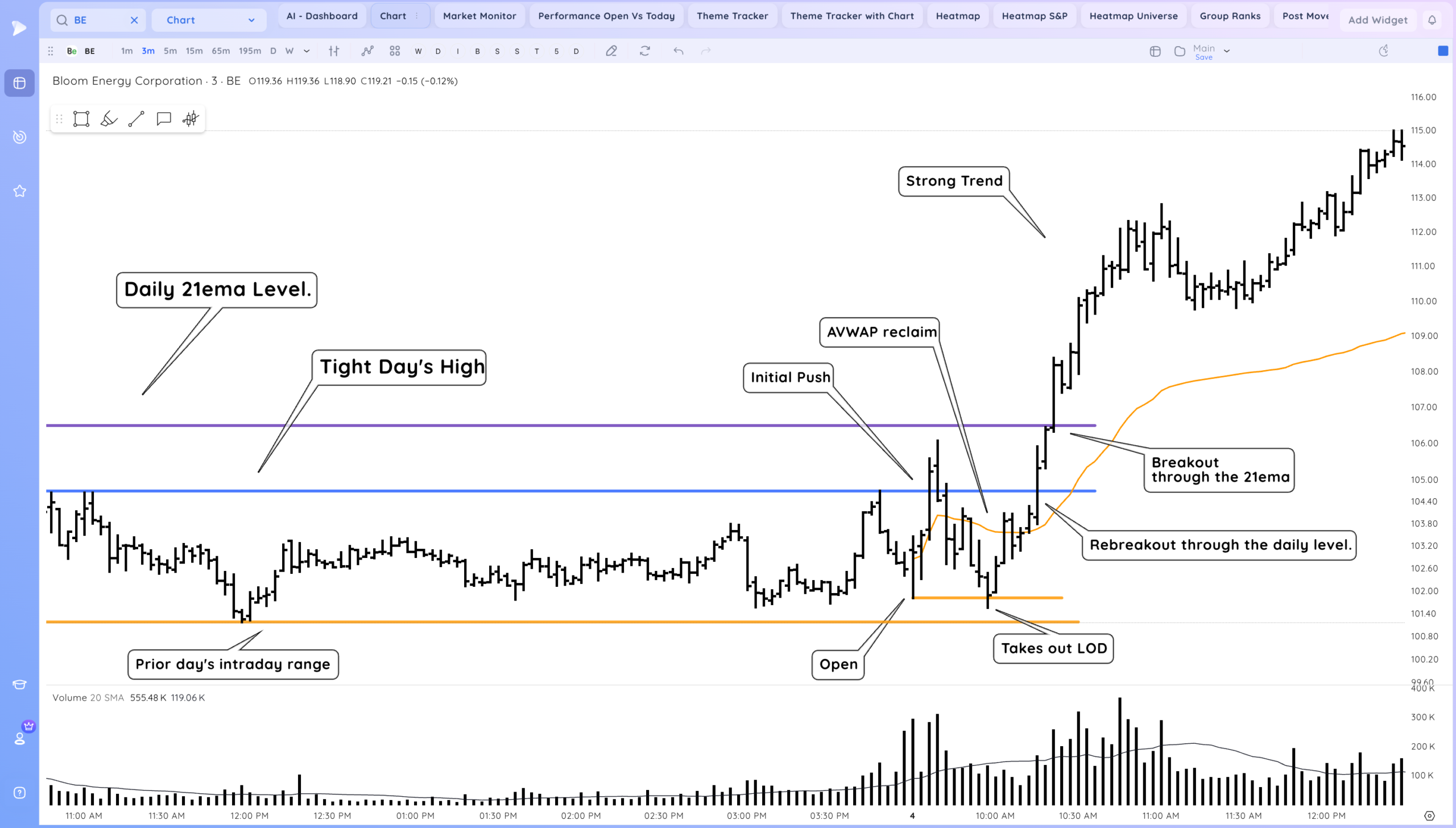

Based on where we were at point 8. We had key daily levels at that days high and the 21ema as pivot points. Once we have daily levels in a strong overall stock in a larger setup we can watch the intraday action for an entry.

Here is how the opening moments played out:

Here are the entries:

For Entry 1 the tightest stop was the LOD. however this stop was very close to the prior day’s intraday range (within 0.7%) so that would be valid as well and be 3.5% Risk. If you did use the LOD, you would have been stopped out and needed to re-buy at another entry.

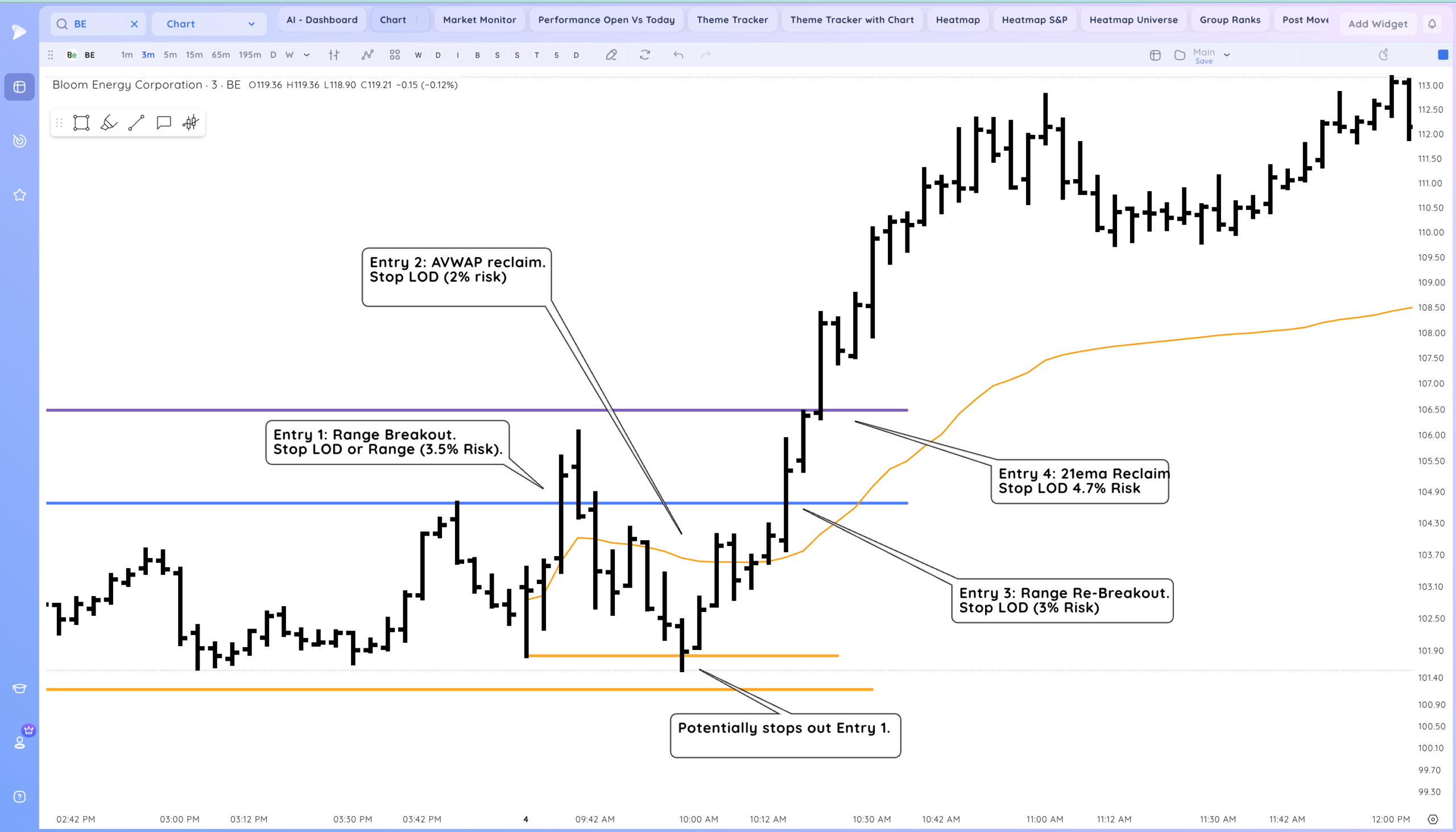

Here is a 5 minute chart showing profit cushions from these entries

With 3.5% Risk you could take a 15% position of your account and be risking ~0.5% of your total account.

With a 2% Risk you could take a 20% position of your account and be risking 0.4% of your total account.

Any of these entries were tight enough to get good size in a key leader.

Here is the look of the setup on a 65 minute chart. Memorize what that tight intraday range looks like with the gap down and then tight action. That is the look of accumulation and a stock ready for expansion

Future thoughts

Since the range breakout BE has acted well, with a consolidation day to end the week.

Aggressive swing traders would have taken 1/4th to 1/2th off on the range breakout day as you got 10% cushion.

Normal action now would be continued ranges, expansions up the right side of the base.

We are running into a key level of a prior range and the downside reversal day high area. A pause here would be normal as long as it holds above the 21ema on a closing basis.

What you would not want to see is a large reversal bar breaking below the 21ema and follow through lower. That would suggest the base needs more time and another reset.

Homework

Learning the progression of a base allows you to anticipate moves and range breakouts like with BE.

I highly recommend watching and taking notes on this video I did with Oliver Kell on his Price cycle

I would also very much reocmmend taking the Price Cycle Mastery course we created, it’s free here