Trade Opportunity Case Study of the Week: BE Oops Reversal, 50 SMA Pullback – | Nov 2025

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

November 16, 2025

The Trade Opportunity

The purpose of this weekly article is to analyze the top trading opportunity of the week. To improve our identification and execution of high quality trade ideas that meet our setup requirements.

Each article will focus on a stock that meets one of three of the main categories of setups I trade:

- Range Breakout / VCP / tight area breakout

- Pullback to Support/ Key moving average

- Gapper / Post Gap Setup

These articles are like taking a step into the batting cage and loading up a historical at bat from a Ace pitcher in the world series – they will help you prepare and execute in future situations by studying important moments from the past.

The setups we cover will appear again and again in each market cycle

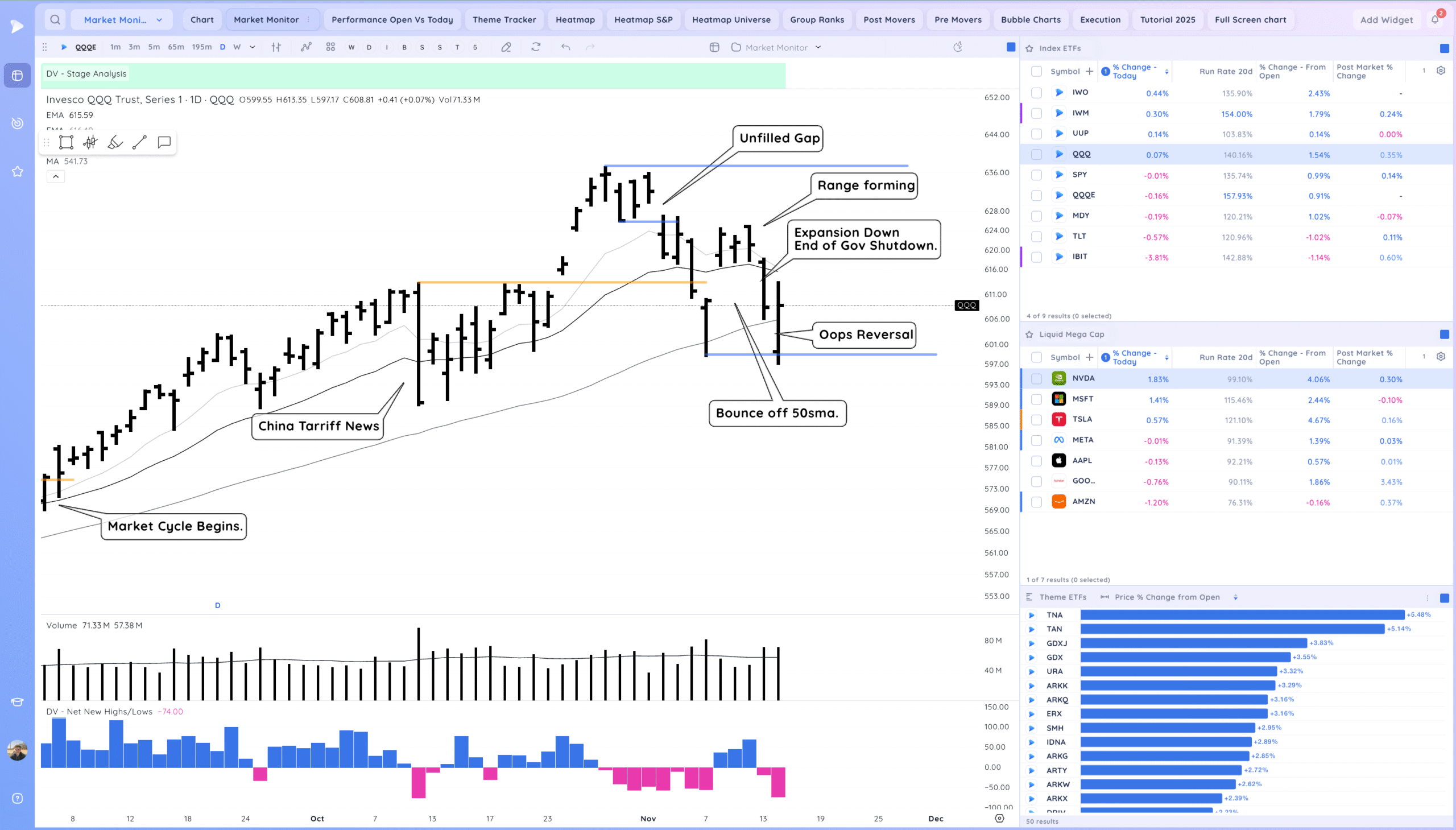

The market this week broke down from a range but put in a sharp reversal higher on friday.

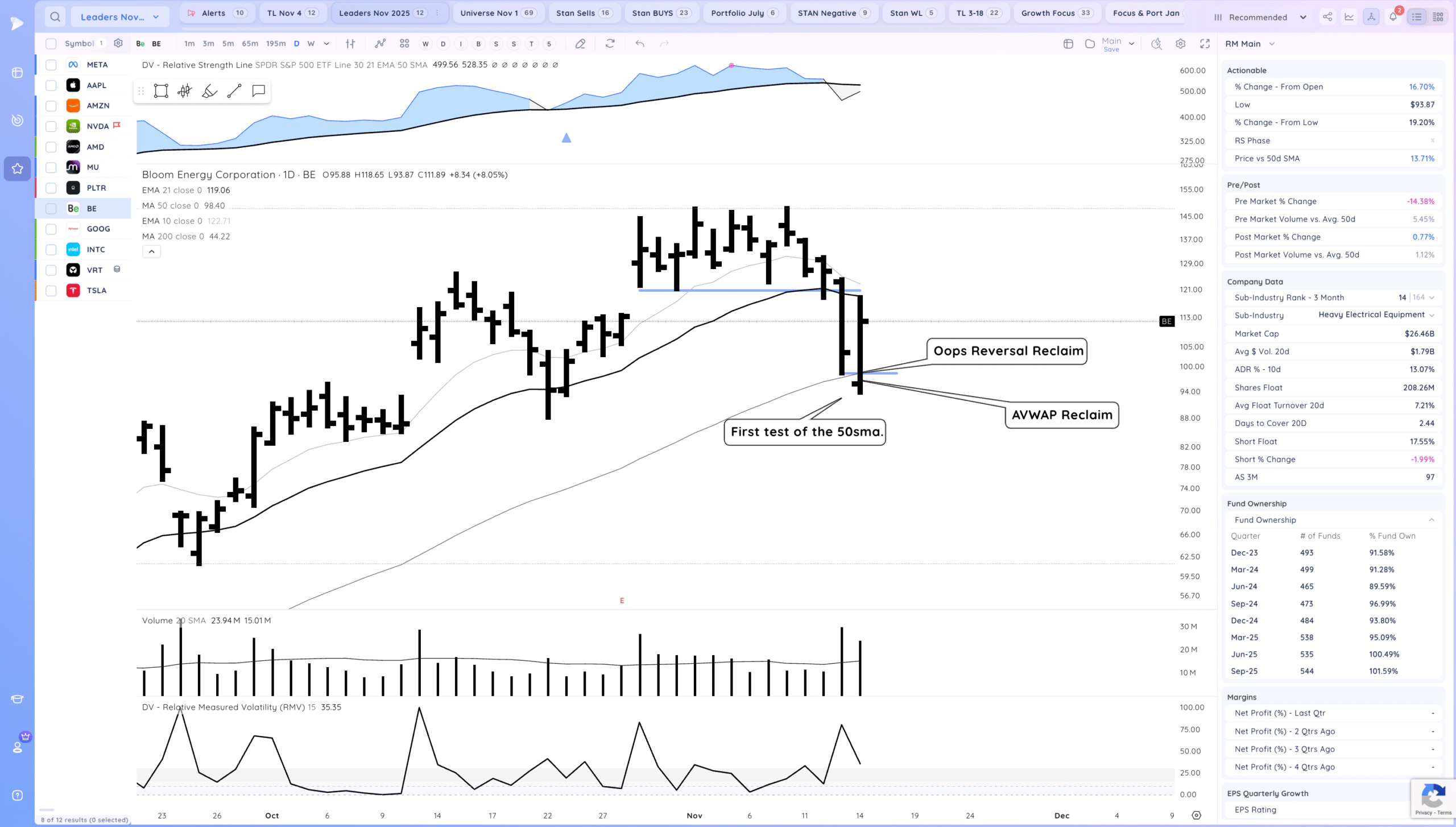

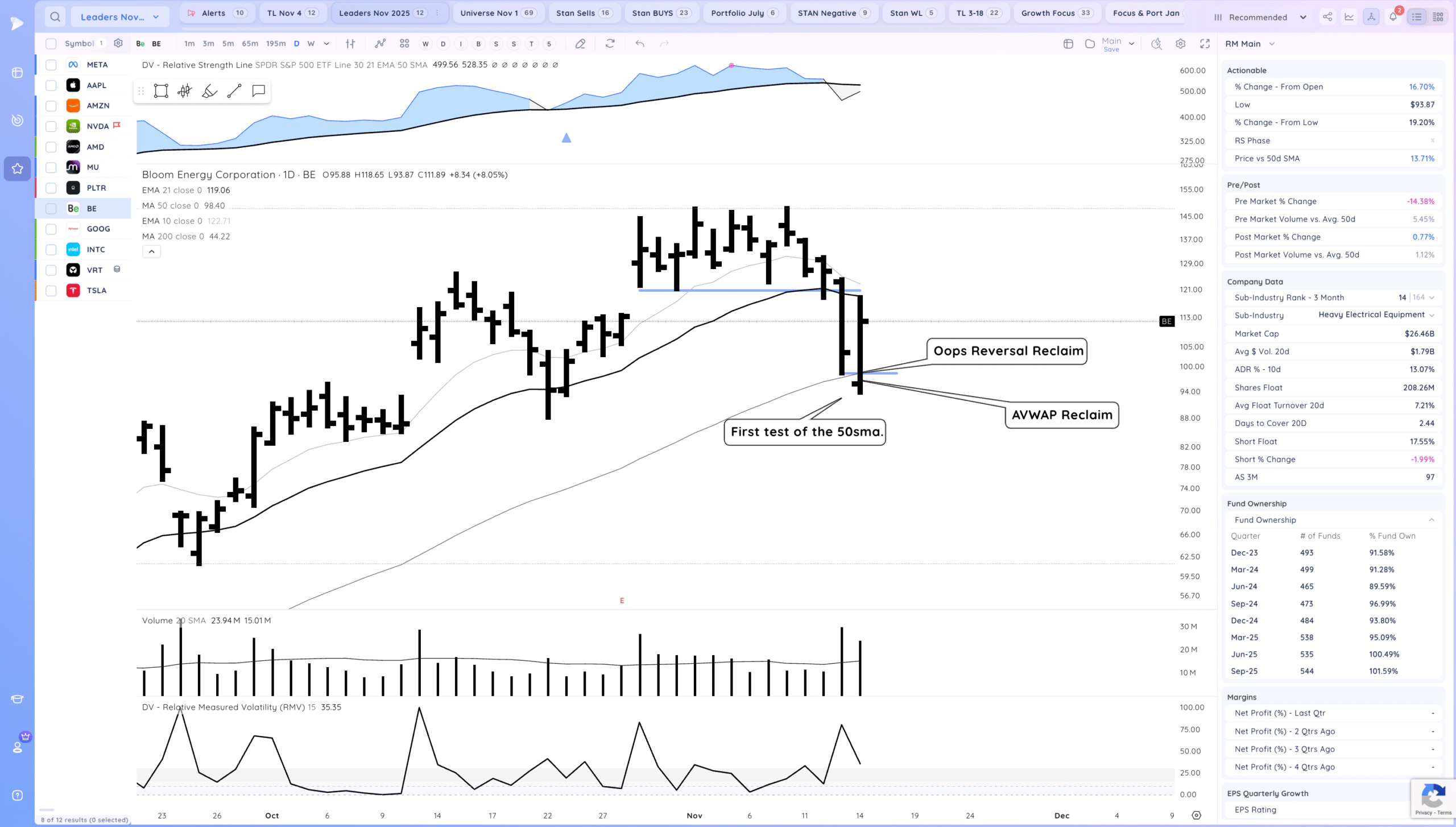

For this week we will be focusing on BE which was a 50sma Pullback and Oops Reversal Friday. BE has been one of the strongest leaders and bounced significantly after the open after reclaiming the prior day’s low and the 50sma.

Discovery – BE

To catch strong moves you need to have processes in place to get names capable of them on your radar. Think of setting up a funnel system for each of your setups. Distill the characteristics you want it to exhibit and create screens that look for those.

I’m always tracking the top leaders and staying in tune with their status: whether it be basing, trending, getting extended, breaking down, or pulling back. If they are setting up my priority is to build positions in them.

BE is one of the leadership stocks I currently review in each report.

In the Thursday report I noted the expansion lower.

This was BE’s first pullback to the 50sma of the move, typically an area we are looking to buy shares. After a sharp down bar like this we are on guard for follow through lower, but since BE and the market at large had pulled back hard, we were setting up for a snap back higher.

If you were not already watching BE each day, you could have found it using the 3 month absolute strength rating in Deepvue. BE’s 3M AS Rating is over 95 signaling a strong leader that is trending.

Or you could also have scanned for 50sma pullbacks using the Price vs 50 sma data point with a threshold of +3% to -3% below that MA.

However you got BE on your radar, you would have seen a strong stock pulling back to a potential area of support. What’s next would be an entry tactic that allows you to position while managing risk: the Oops Reversal

Setup and Execution

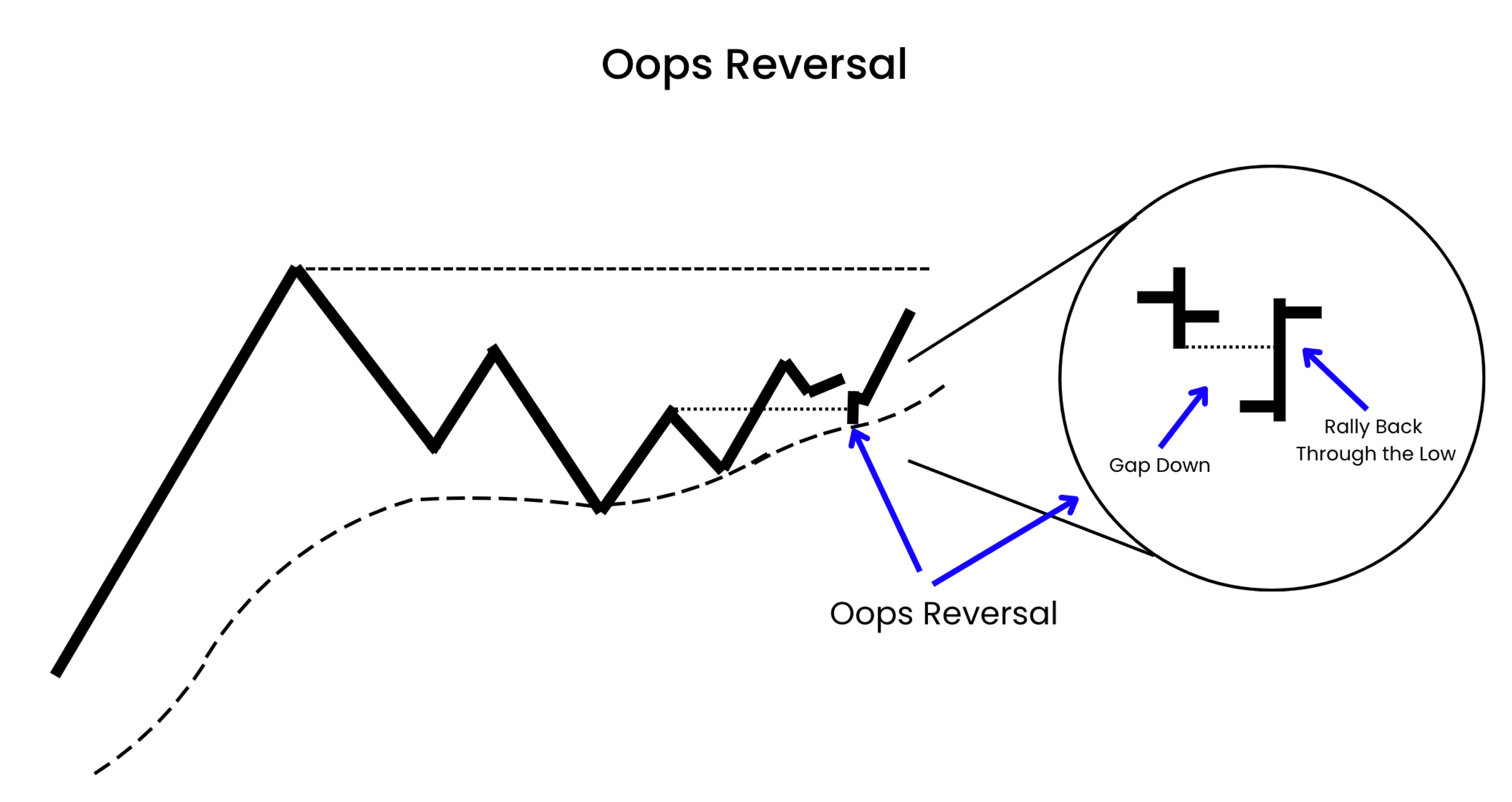

The Oops Reversal is a short term pattern and pullback tactic that occurs when a stock/ market gaps lower than the prior day’s low and then rallies back through that level.

It is a sign of support of the stock and a potential low risk entry point that can give you a cushion right away in a strong stock.

Here is a representation of an oops reversal up the right side of a base:

The Oops Reversal is a sign of short term momentum change and can lead to follow through buying and a resumption of the intermediate term trend.

The psychology around the setup is that the stock is gapping down below the prior day’s low and session, triggering fear and the stops of weak holders. Then institutions or longer term holders use that liquidity to purchase shares, absorbing the supply with new demand. This stabilizes the stock and causes the short term trend change.

Seeing this trend change, traders who were stopped out may buy back in (the Oops) and intraday trend-followers will join in. At the same time any short sellers who entered on the gap down would likely be stopped out and forced to cover, as their stops were likely set at the prior day’s low.

This confluence of market participants and their positioning creates an opportunity for a large directional move back upward, at a point where risk can be managed tightly and logically with a stop at the low of the day

On Friday, the market was set to gap down, even more stretched to the downside and primed for a mean reversion move up. In such cases you would be looking to play an oops reversal entry tactic in stocks that can move and are at key support areas, like BE with the 50 sma.

When trading an Oops reversal and watching for strength off the open I prefer using an intraday timeframe, looking for an opening range to set, and then waiting for a push from that range, an AVWAP reclaim, or a push through the daily pivot for the oops reversal: the prior day’s low.

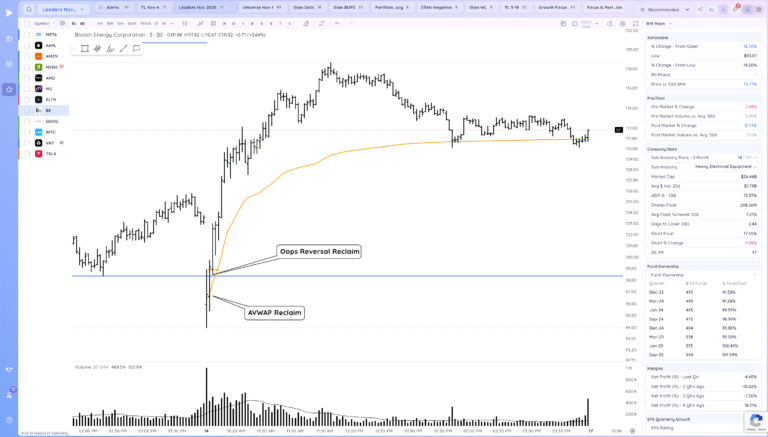

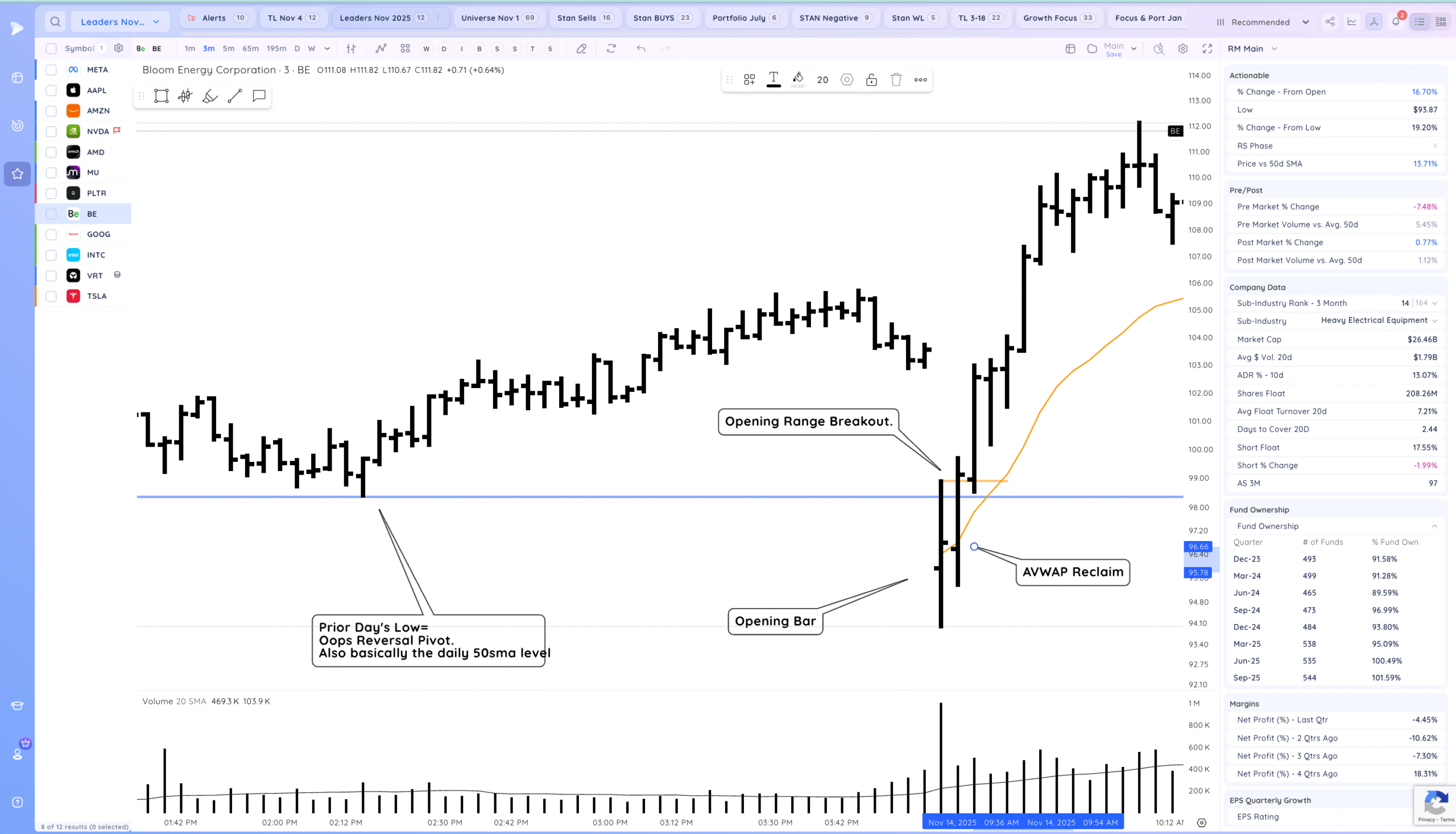

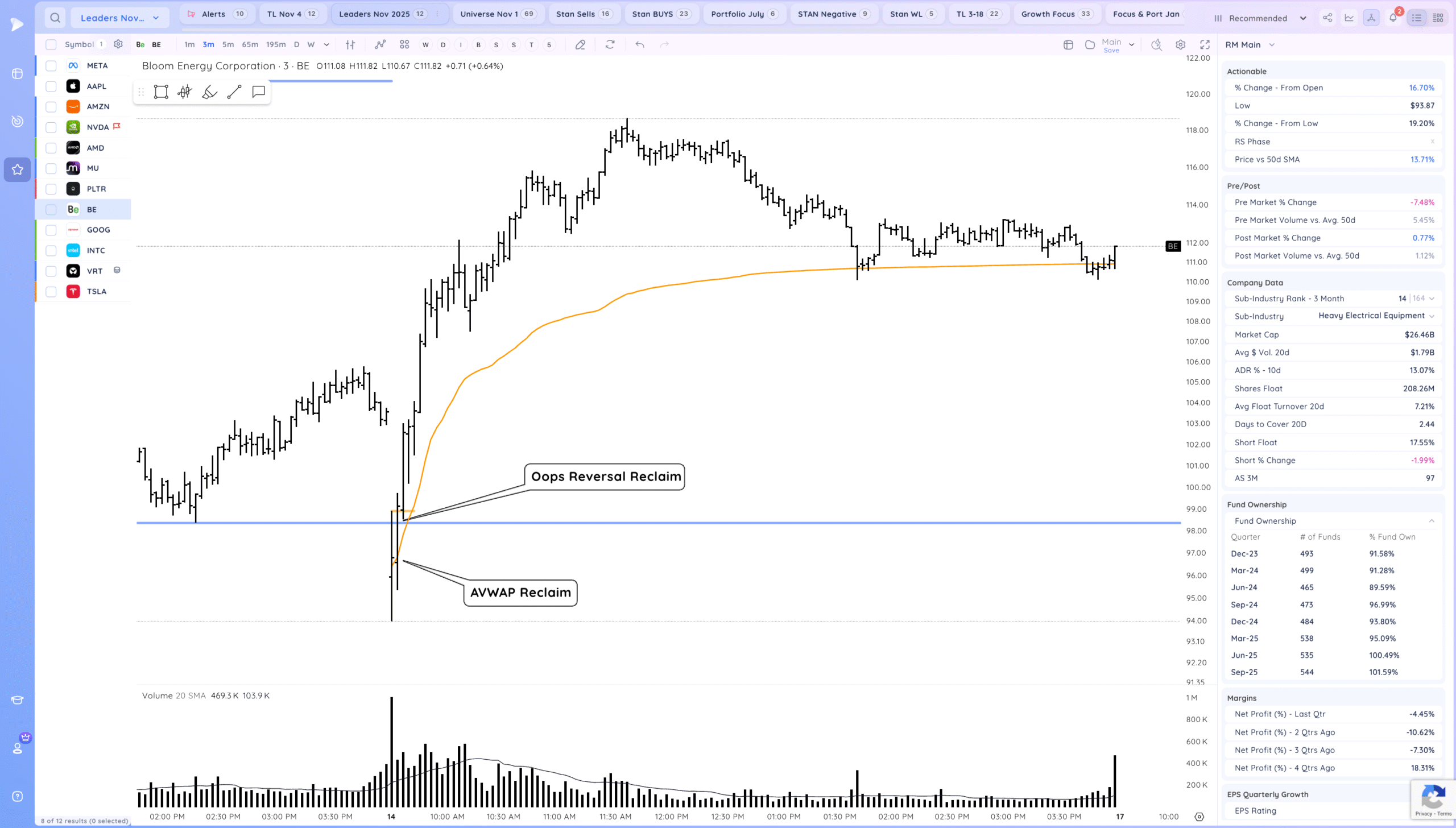

Here is BE on a 3 minute chart

It opened below the prior day low and intraday base, setting up for a reversal with the oops reversal pivot being 98.39 (also lines up with the daily sma).

BE rallied to the point then pulled in before pushing higher retaking the oops reversal pivot, and rallying strongly. This is what the strongest oops reversal look like on intraday timeframes.

Here are potential entries, stops, and results

- Entry 1: Oops Reversal Pivot 98.39 , Stop LOD ~4.3% risk, Cushion EOD 13.81%, Max Gain 20%

- Entry 2: AVWAP Reclaim 96.99, Stop LOD ~3.1% risk – Cushion EOD 15.4%, Max Gain 22%

- Entry 3: Oops Reversal Pivot on reclaim 98.39, Stop LOD ~4.3% risk, Cushion EOD 13.81%, Max Gain 20%

10-15% position sizing is what I would use on the first 50sma pullback.

- A 4.3% Stop means that we could take a 15% position and be risking 0.6% of our portfolio.

- A 3.1% risk means that we could take a 15% position and be risking 0.45% of our portfolio.

Remember, we are only using intraday charts and setups because the stock was setup on a daily timeframe at a level where we can expect a directional move.

This is an important sentence ^

From these entries BE acted in textbook fashion, pushing hard and trending above the daily AVWAP.

On a daily chart we see a strong close after pushing off the 50sma. You have cushion so you have options.

You can play the bounce and potential follow through as a swing trader, or you could take it off into the close as a strong day trade. Or even swing traders could take some off as the market direction is currently a bit choppy and undecided.

Future thoughts

Swing traders would have stops at or a bit above breakeven at the least and likely have taken 25% to 50% of their position off at a 10% gain (and maybe more at 20%).

They would be watching for follow through and be watching for BE to reclaim the prior range and continue trending.

From this point you would want to see BE hold close to the highs of the Friday day and not leak too much lower. It should respect a rising 50sma.

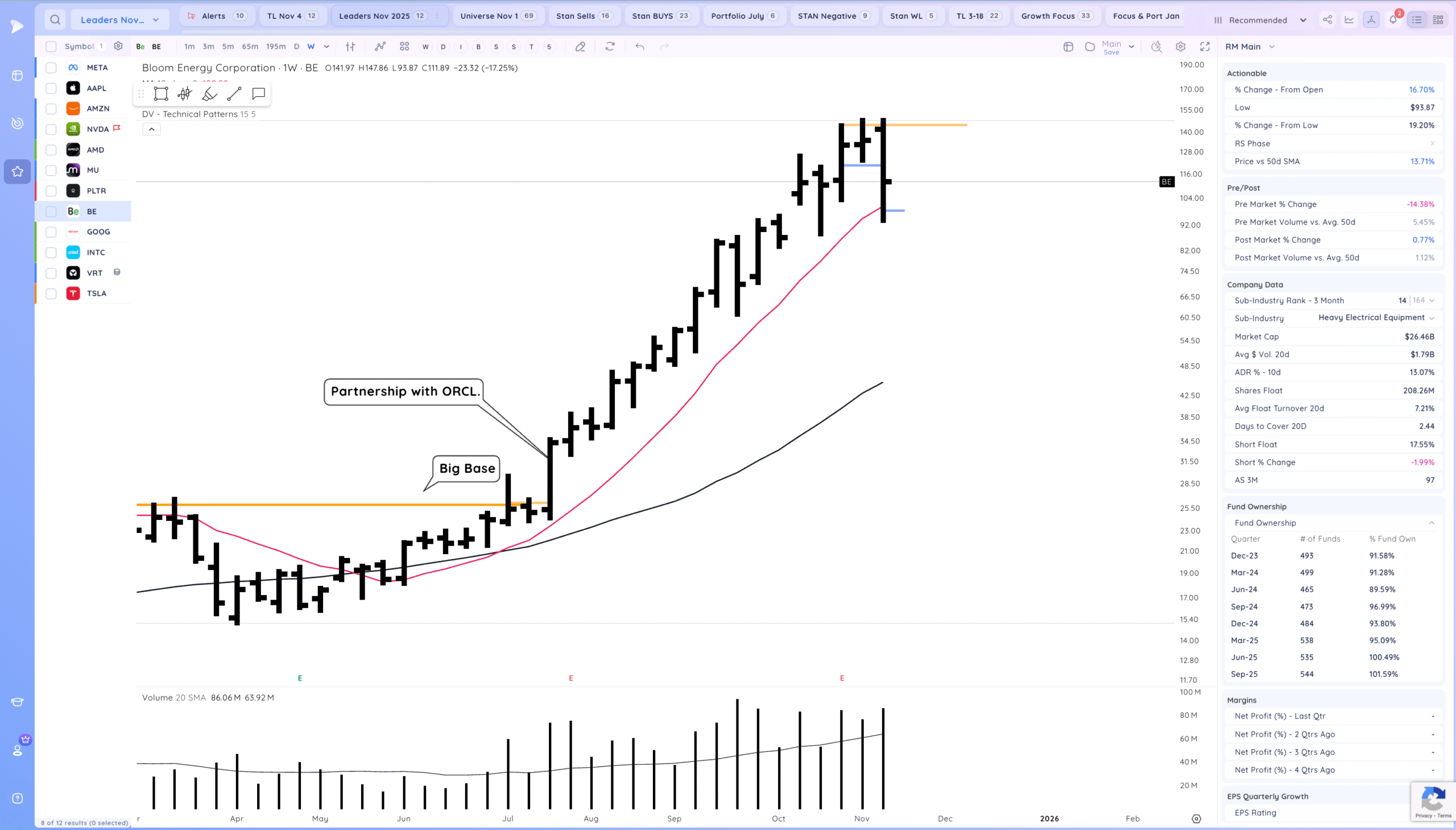

On a weekly chart we can see that BE is starting to consolidate under ~150. After a base we would expect it to continue the strong trend.

A break below the 50sma/10 week would be a sign to take off any shares bought on the bounce.

Weekly chart:

Some more consolidation here can be expected.

Homework

Read my Oops reversal educational article for more examples and details about the entry tactic.

https://traderlion.com/community-post/the-oops-reversal-entry-tactic/