Tight Consolidation Day at a Key Level

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

August 25, 2025

Market Action

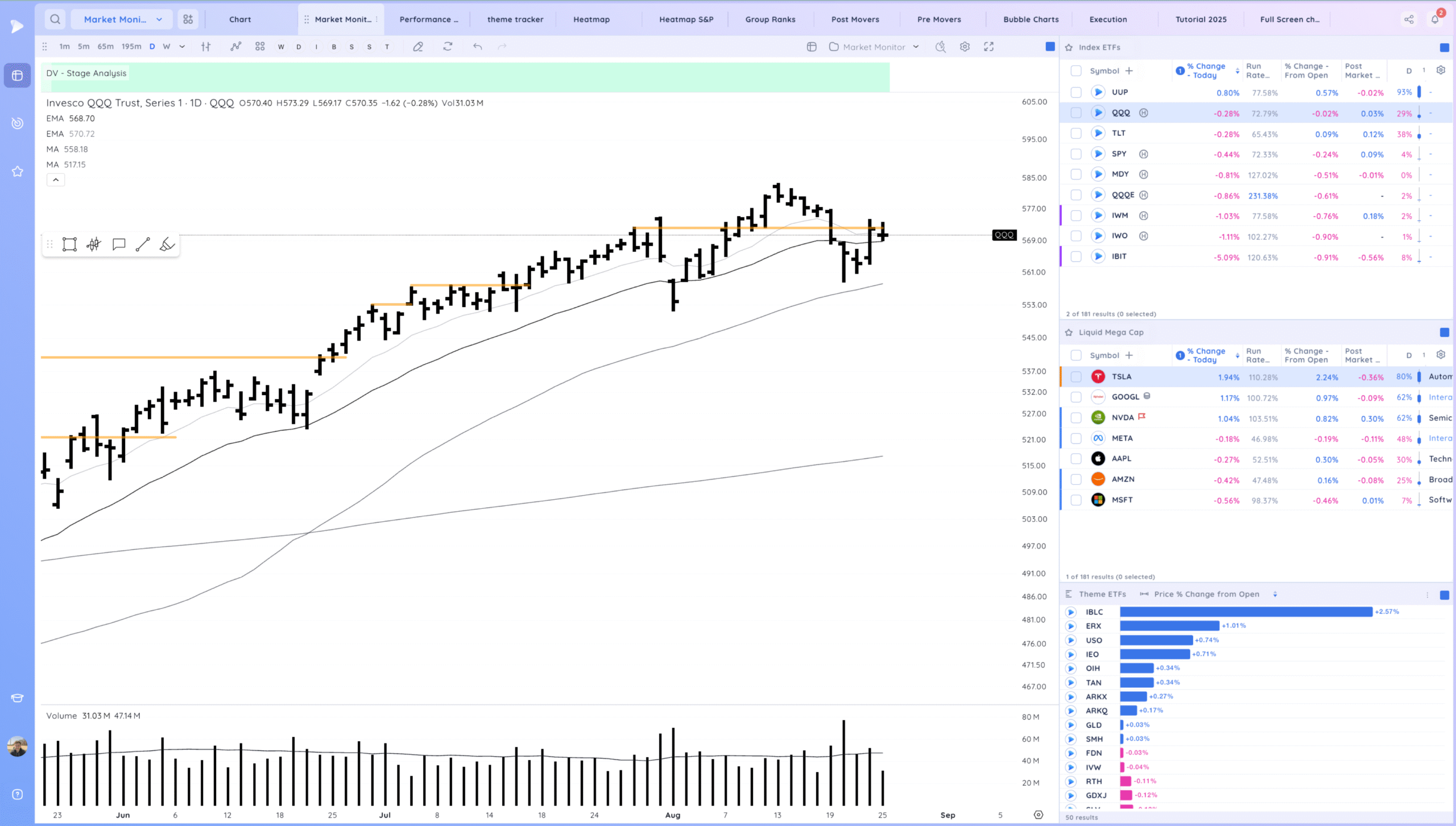

QQQ – tight day at a key level for the consolidation day. Overall looks constructive with names acting well.

Bulls want to see us reconfirm/follow through higher and continue to trend above the 21ema

Bears want to see a reversal back down below the 21ema

Daily Chart of the QQQ.

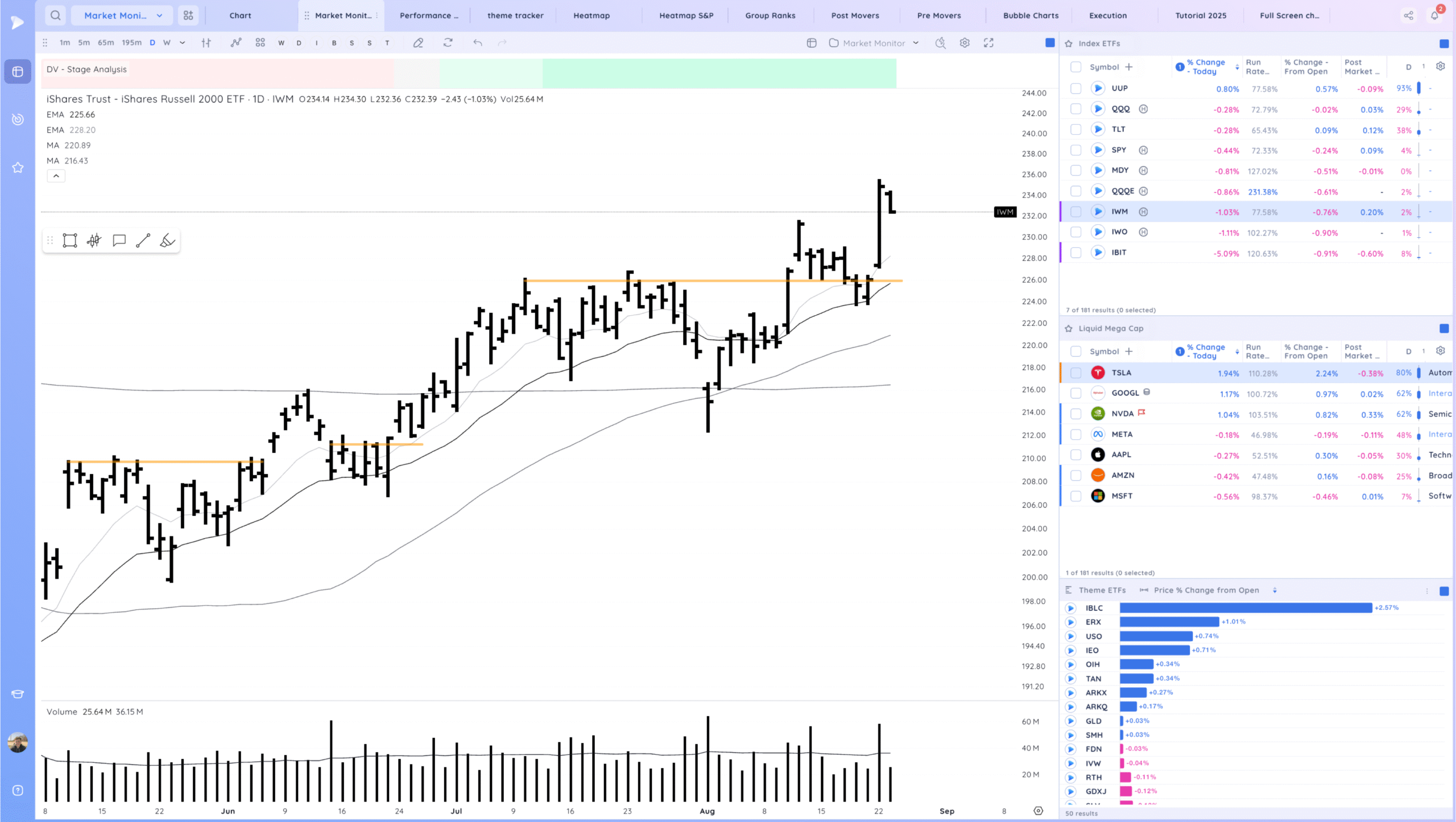

IWM – Inside day. Did close at lows

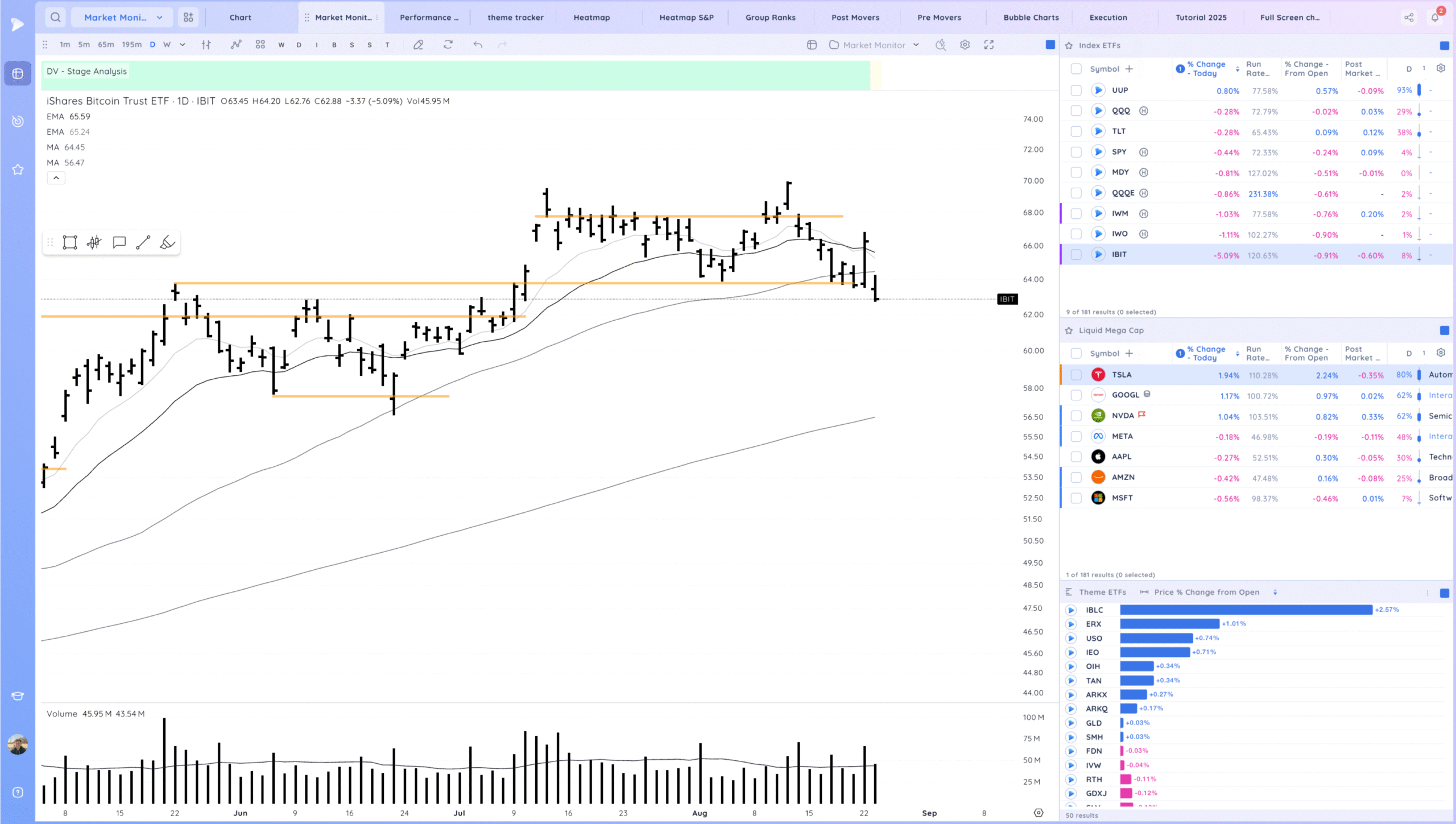

IBIT – negative expectation breaker and closing back below the previous base pivot

Trends (4/4 Up) – Based on the QQQ

Shortest – 10 Day EMA – Above Rising

Short-term – 21 ema – Above Rising

Intermediate term – 50 sma – Above Rising

Longterm – 200 sma – Up – Above Rising

Groups/Sectors

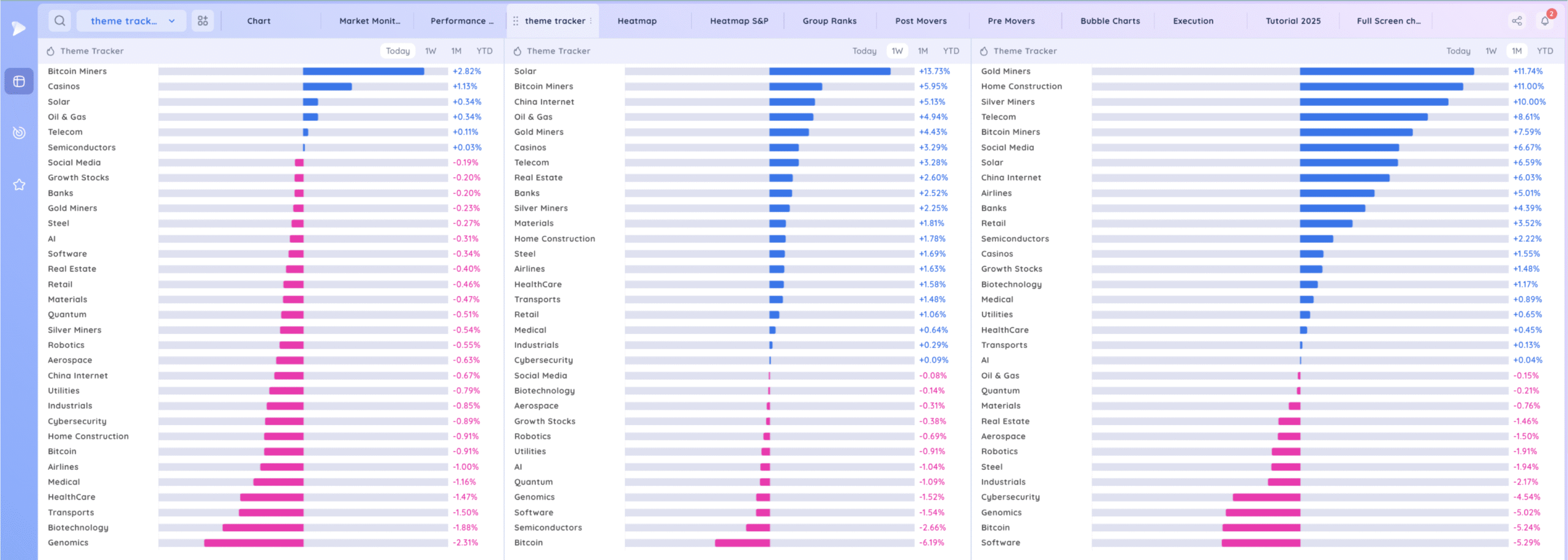

Deepvue Theme Tracker

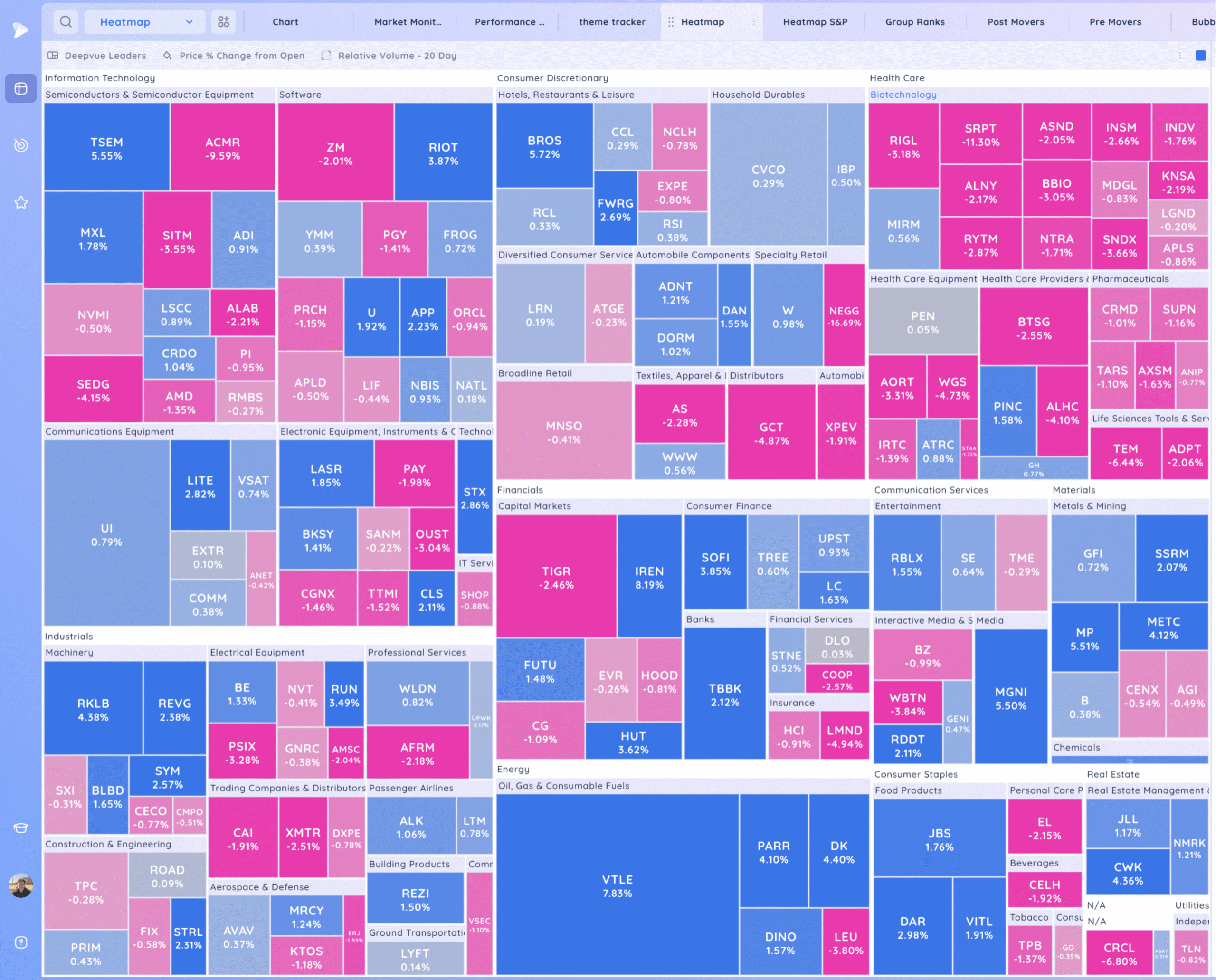

Deepvue Leaders Heatmap

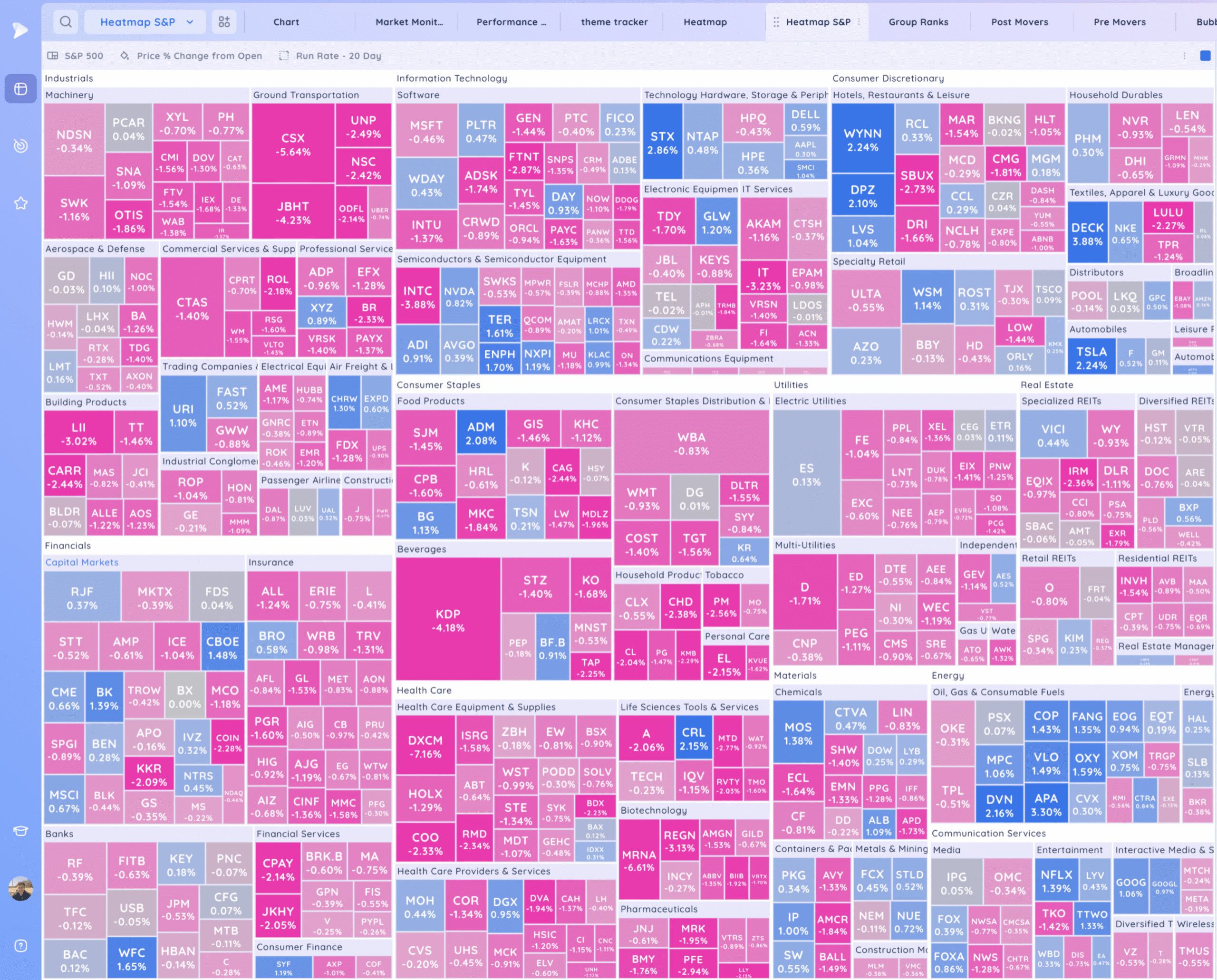

S&P 500.

Leadership

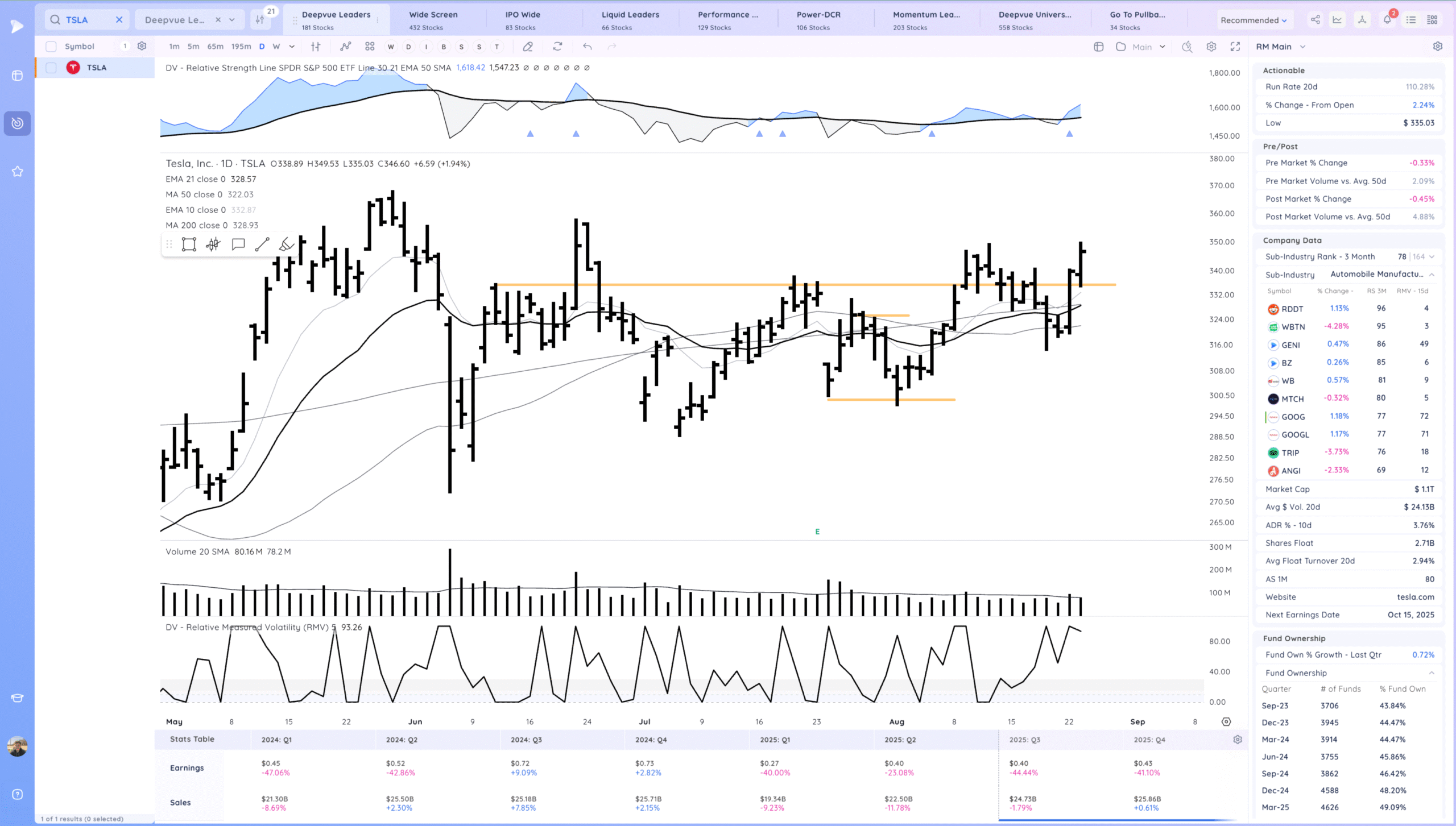

TSLA follow through higher.

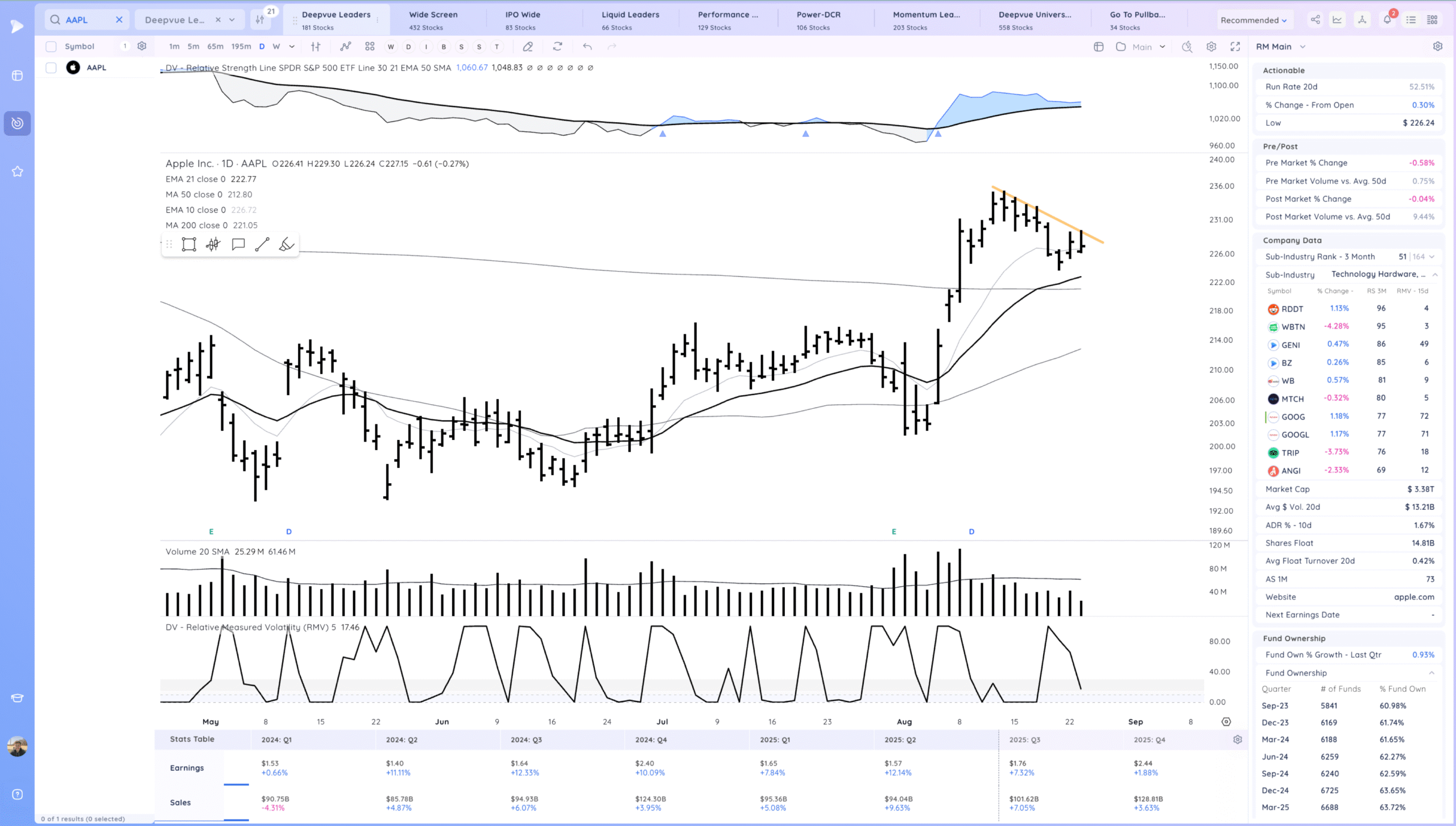

AAPL Still forming this flag around the 10ema

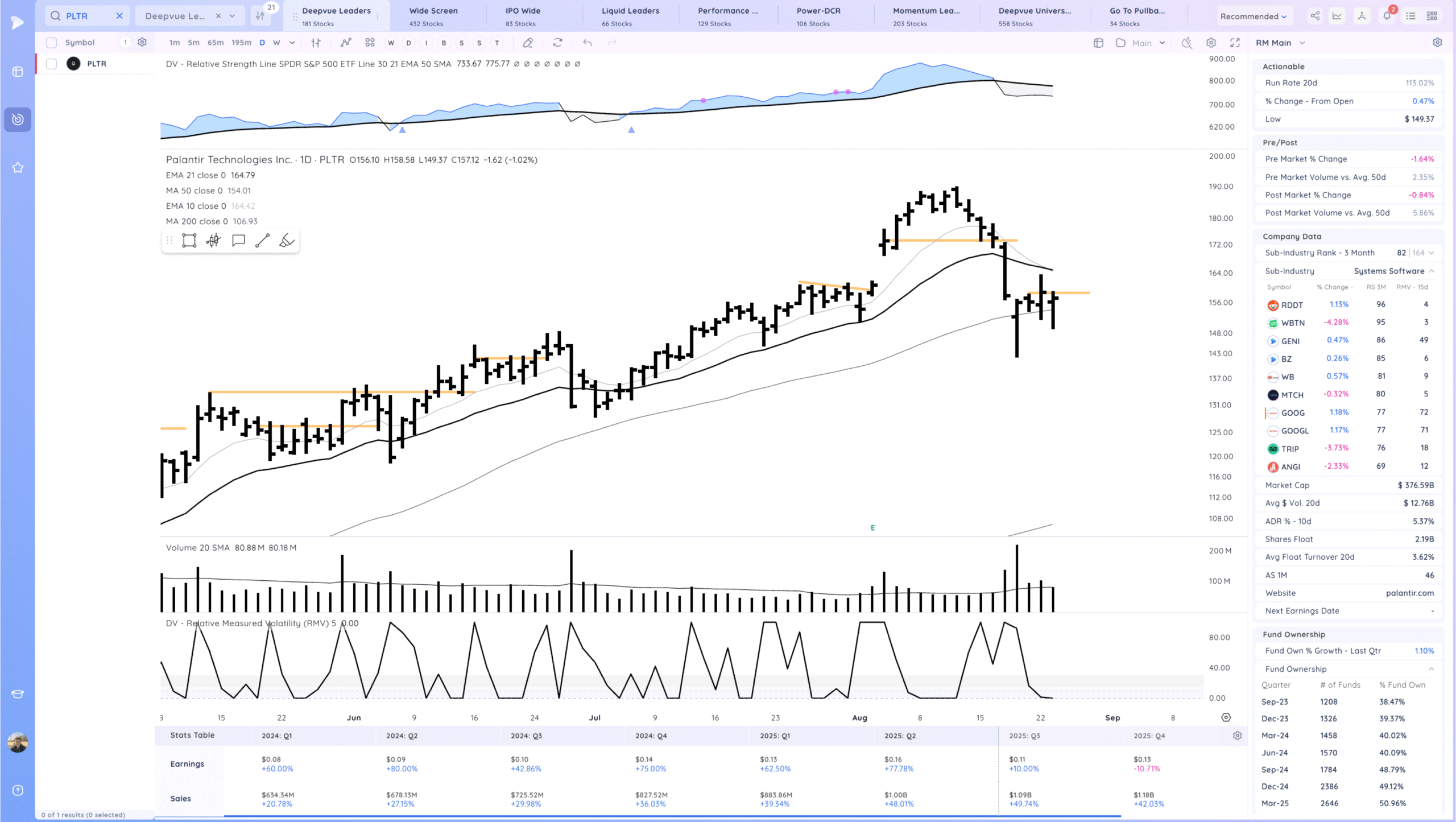

PLTR Holding the 50sma. Forming a range below the 21ema

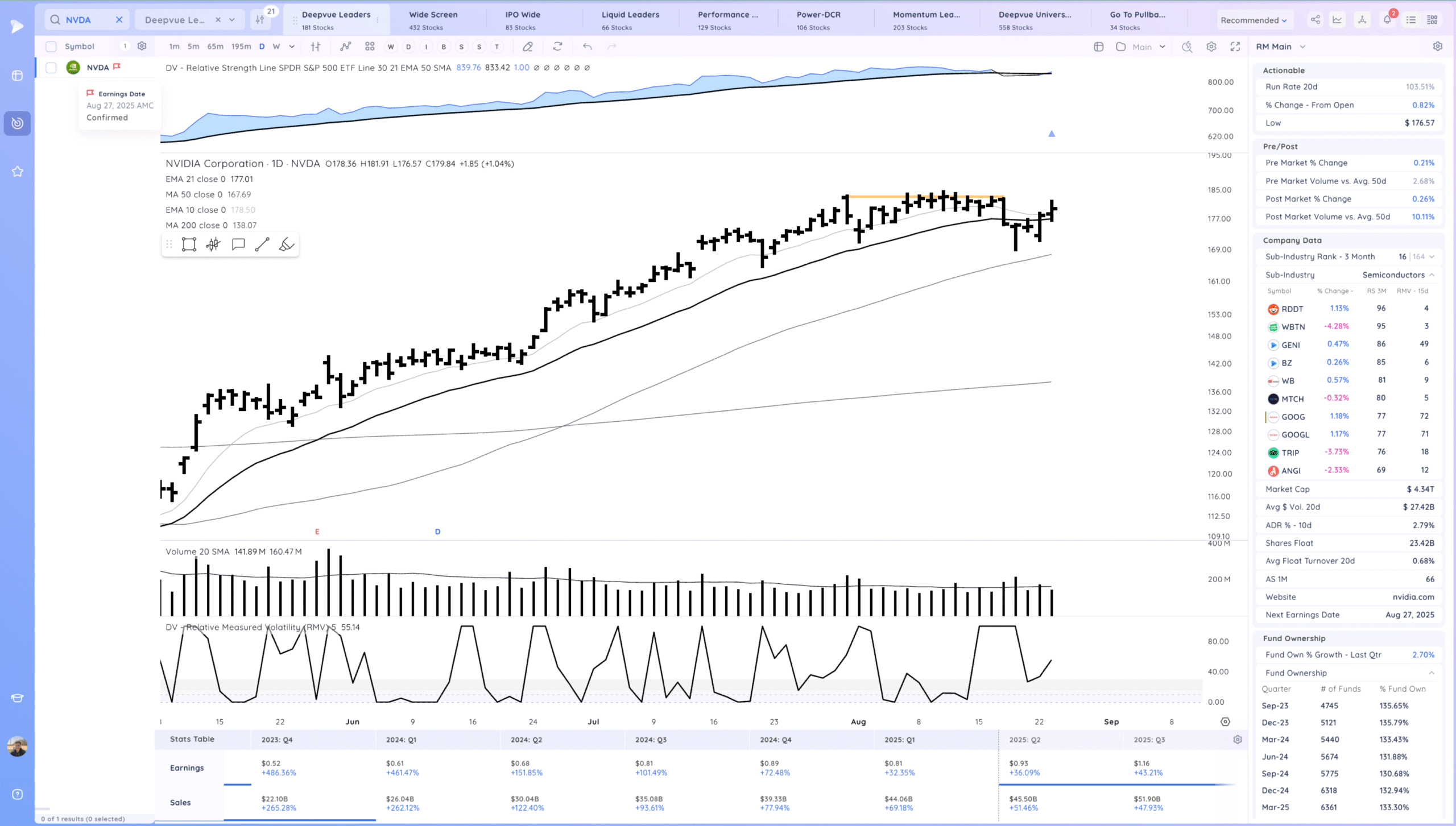

NVDA holding above the 21ema. earnings upcoming. On gap watch

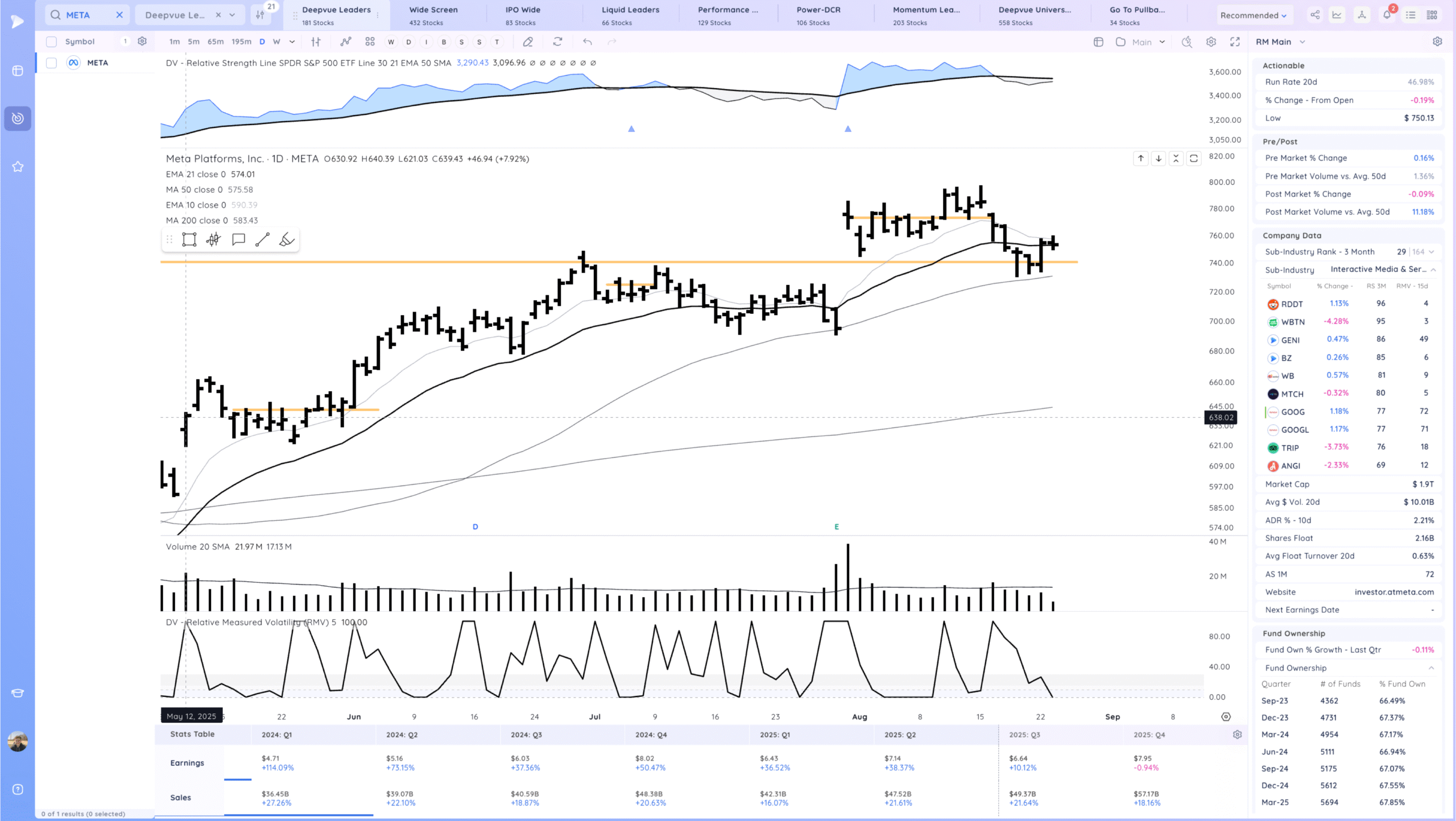

META Tight dat at the 21ema

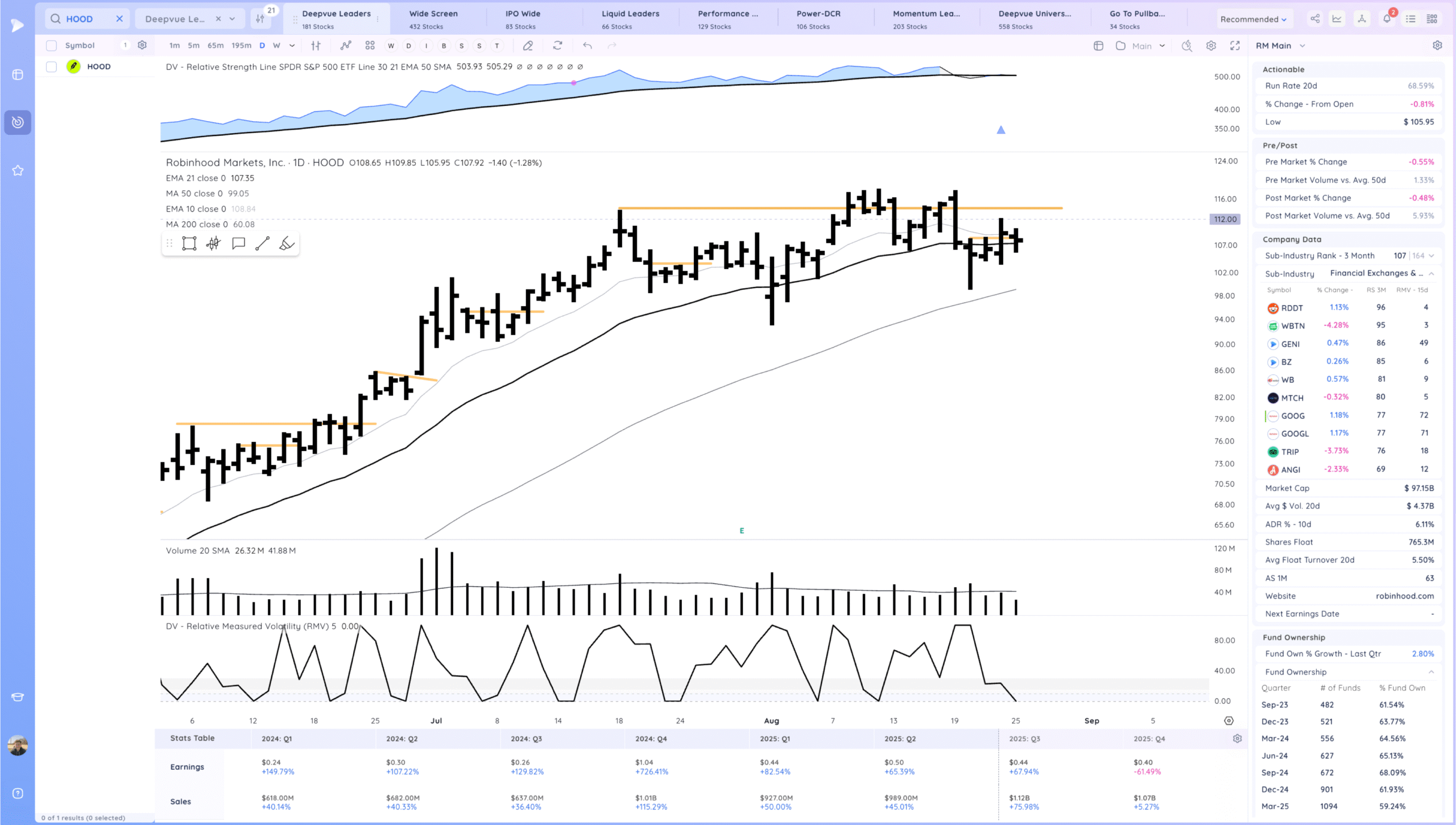

HOOD Tight inside day within this flat base. Watching for expansion

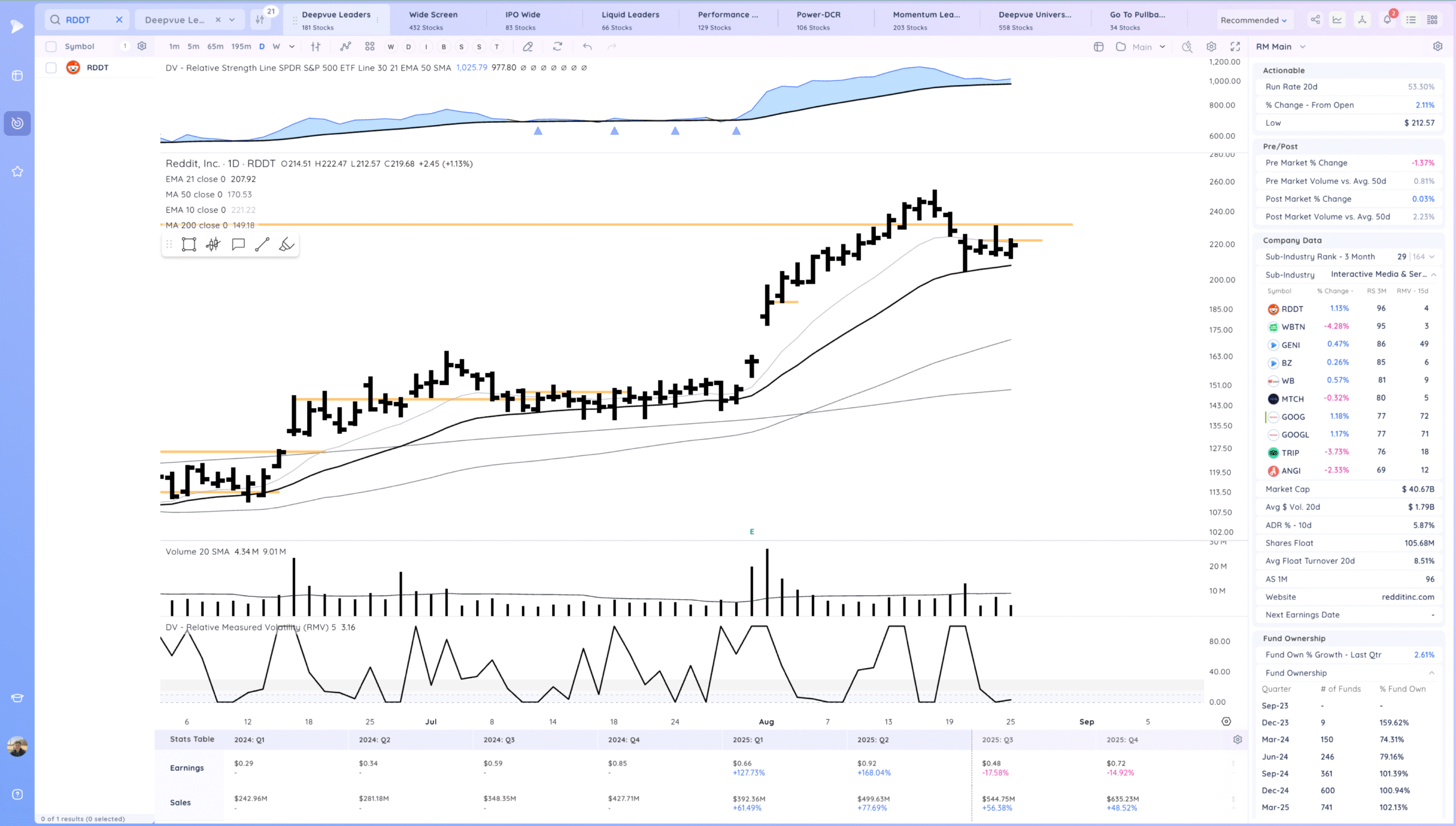

RDDT Forming a range.

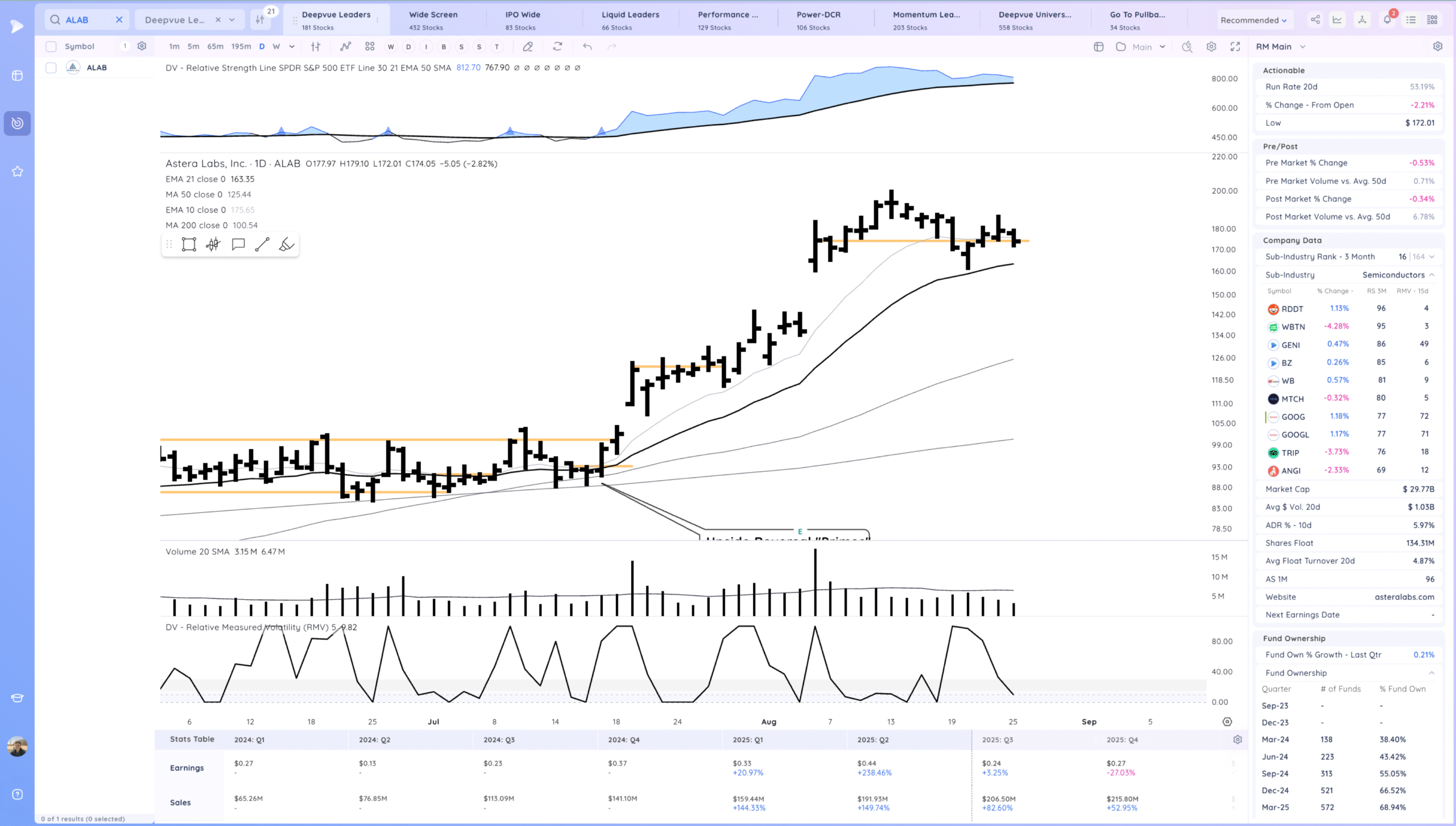

ALAB tightening. Watching for a push higher off the Earnings close level

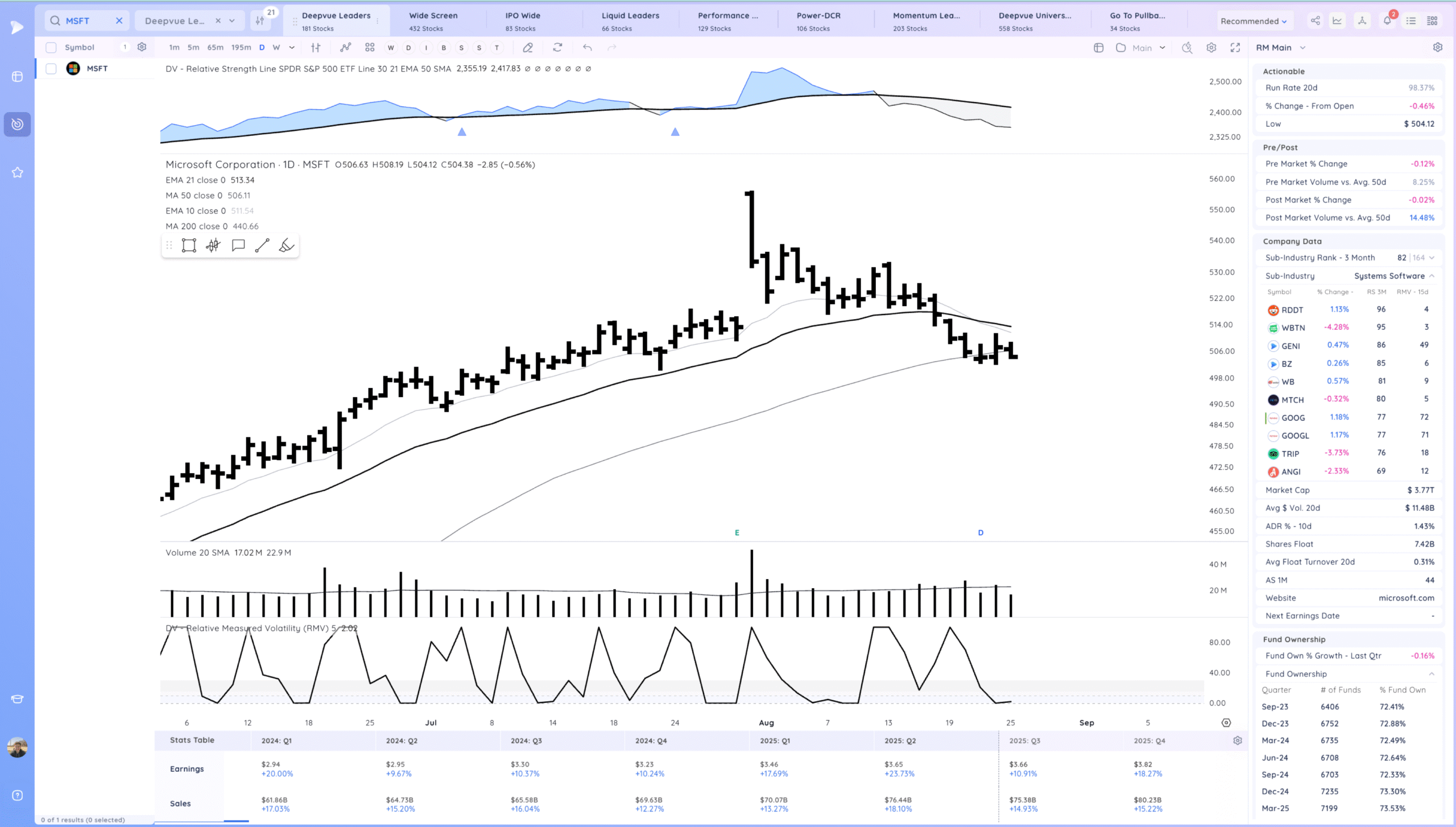

MSFT inside day with a weak close. at the 50 sma. Still showing relative weakness

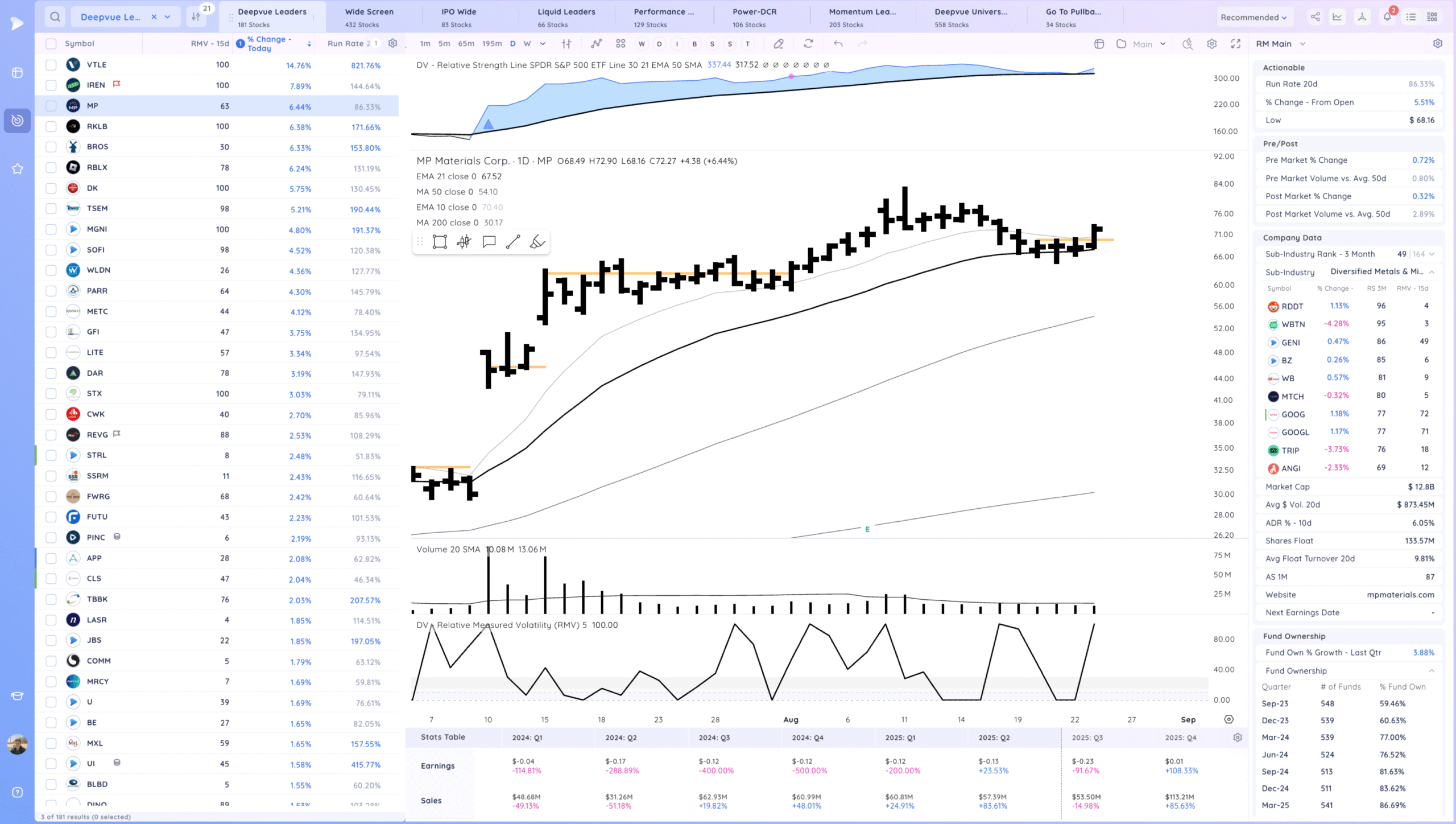

Key Moves

MP range breakout

Setups and Watchlist

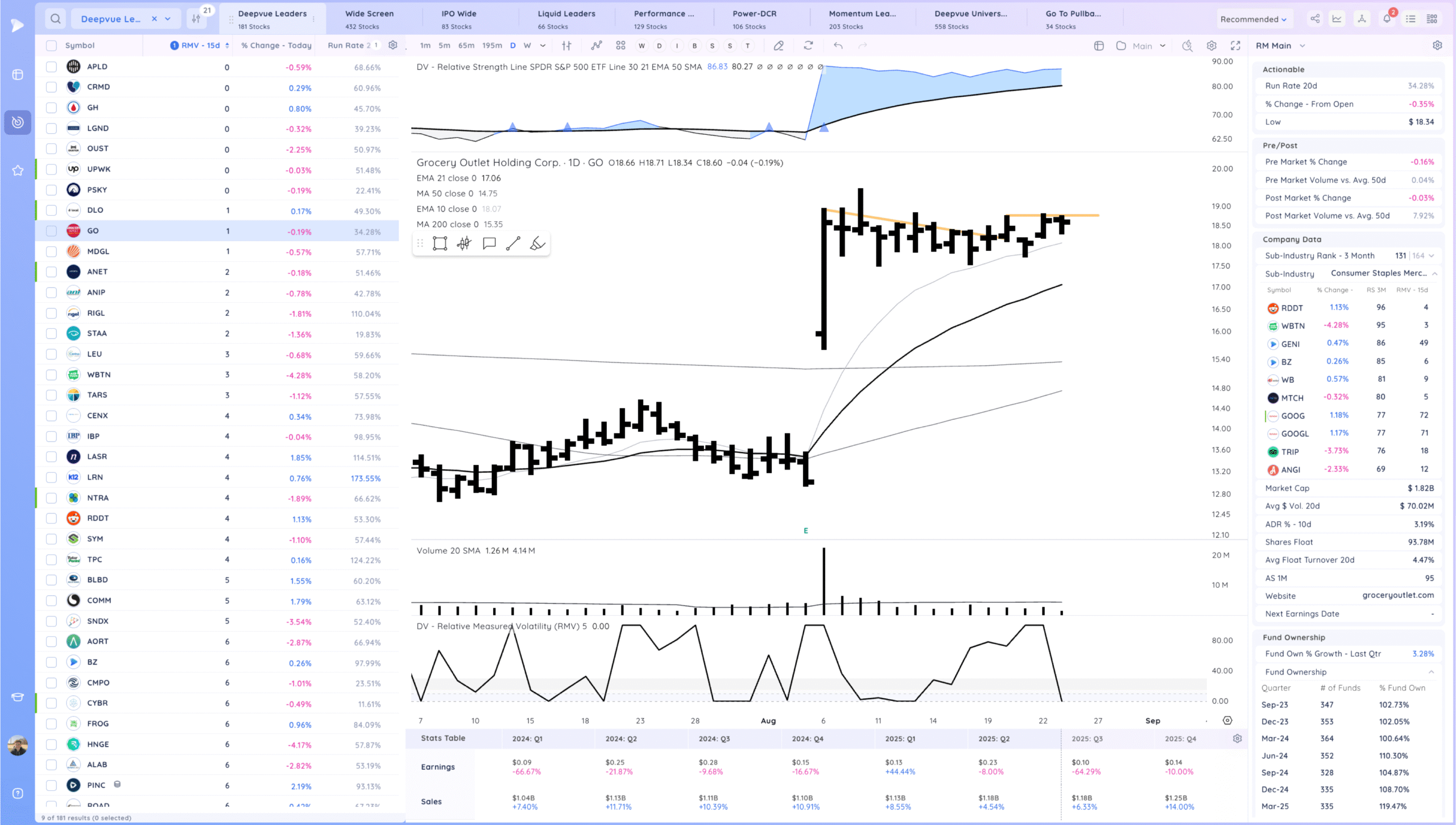

GO watching for a range breakout

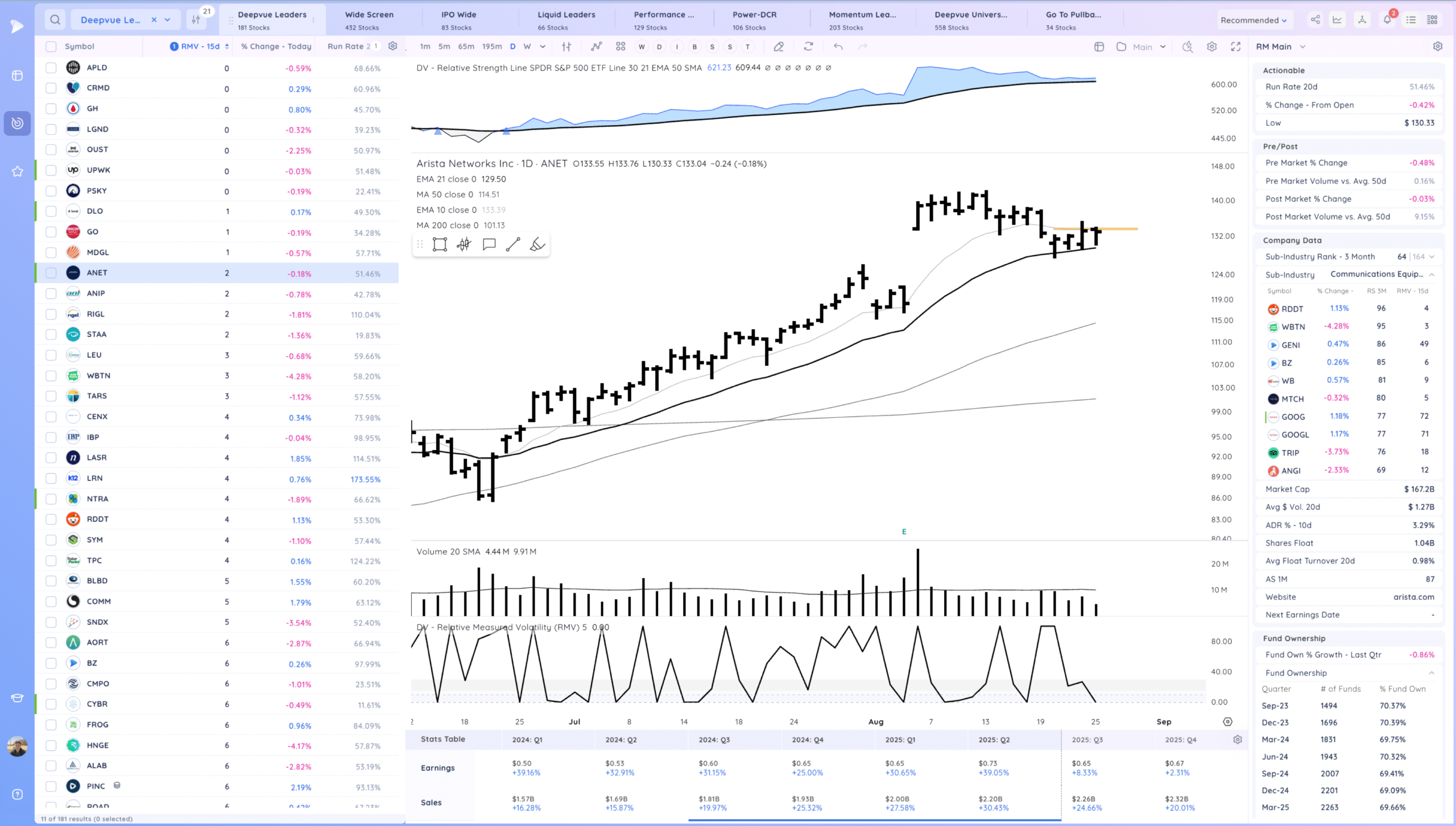

ANET watching for a push from the inside day

Today’s Watchlist in List form

Focus List Names

RDDT ALAB HOOD GO ANE

Focus:

HOOD RDDT ALAB

Themes

Strongest Themes: Software, Crypto, Nuclear Power, Semis, Miners, Cruise Liners

Market Thoughts & Focus

A day of consolidation for the most part. Not seeing many fresh tight areas as most pushed friday. However some current leaders in HOOD RDDT ALAB on focus watch.

Anything can happen, Day by Day – Managing risk along the way