The Market Sells Off. More China Tensions.

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

October 11, 2025

Market Action

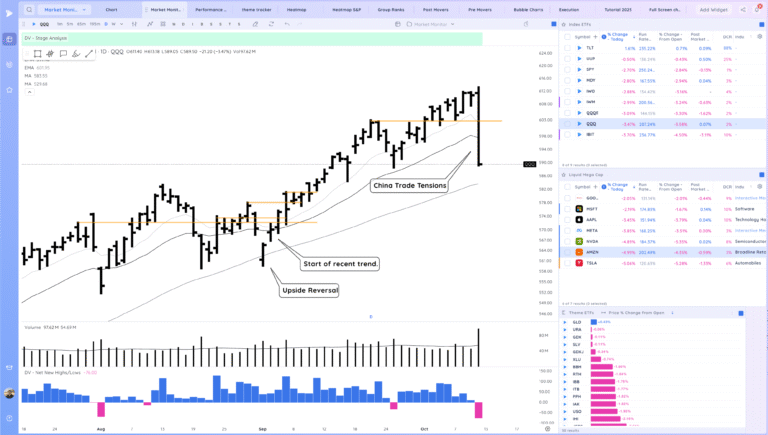

QQQ – Significant sell off with the catalyst of increasing trade tensions with China. The market seemed to be looking for an excuse for a large down day. It may take time but likely this ends up being a buying opportunity. However until there is clarity this is a headwind for the market as it creates uncertainty.

Bulls want to see us snapback quickly above the 21ema with clarity on the trade deal

Bears want to see follow through down with additional negative news catalysts

Daily Chart of the QQQ.

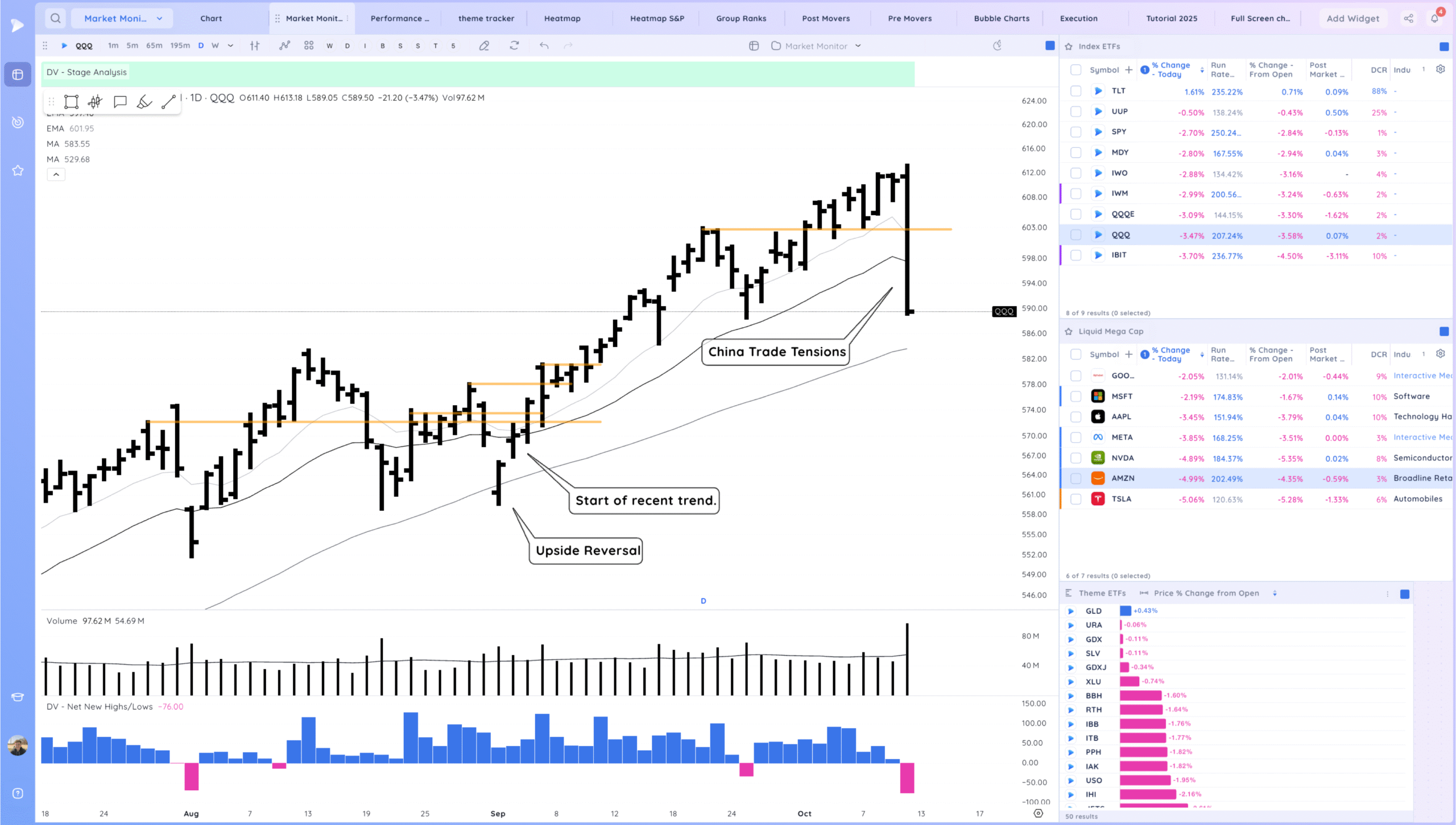

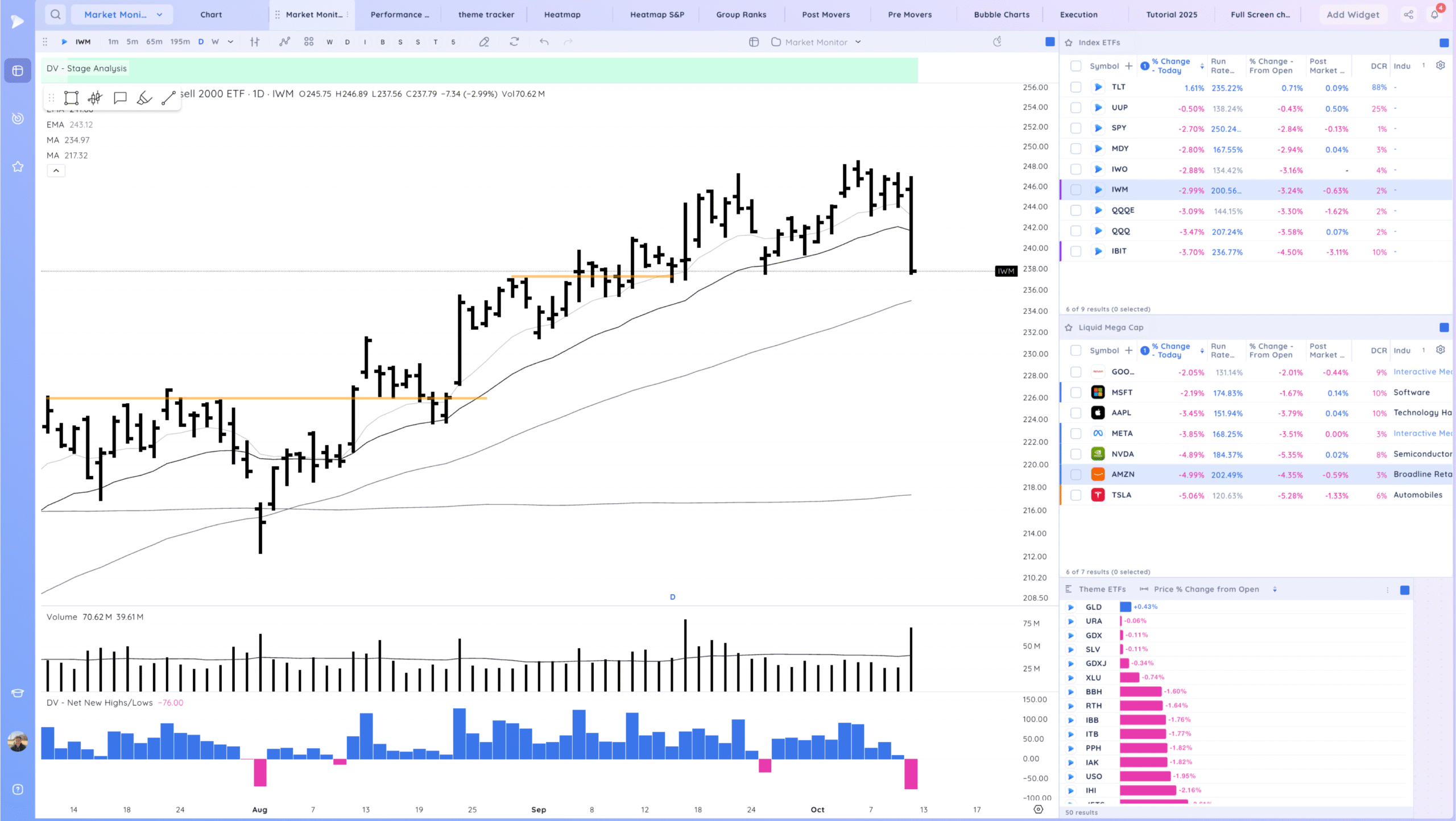

IWM – Sharp break lower below the MAs and recent range

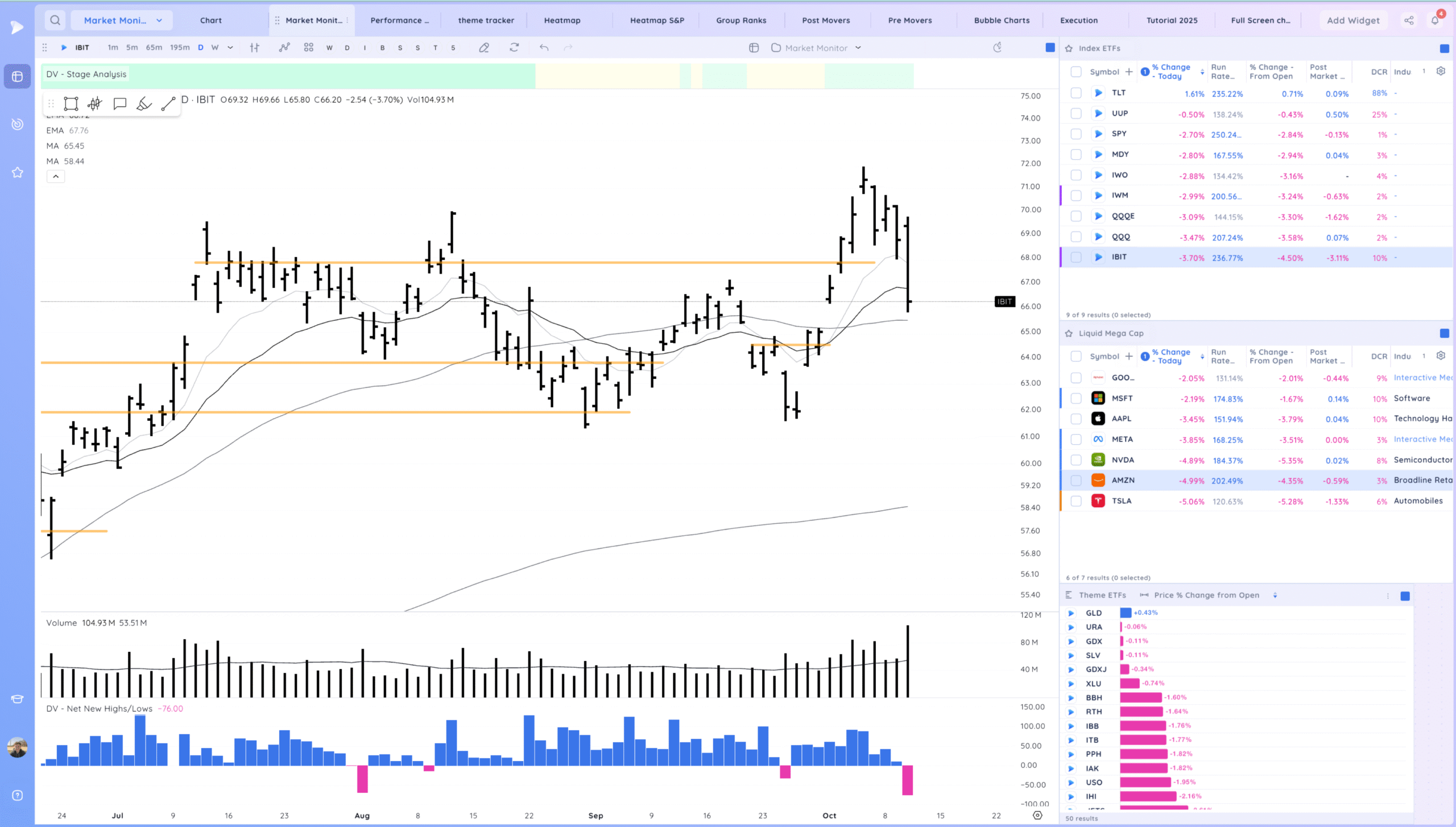

IBIT – Sharp break lower and crypto hit more after hours.

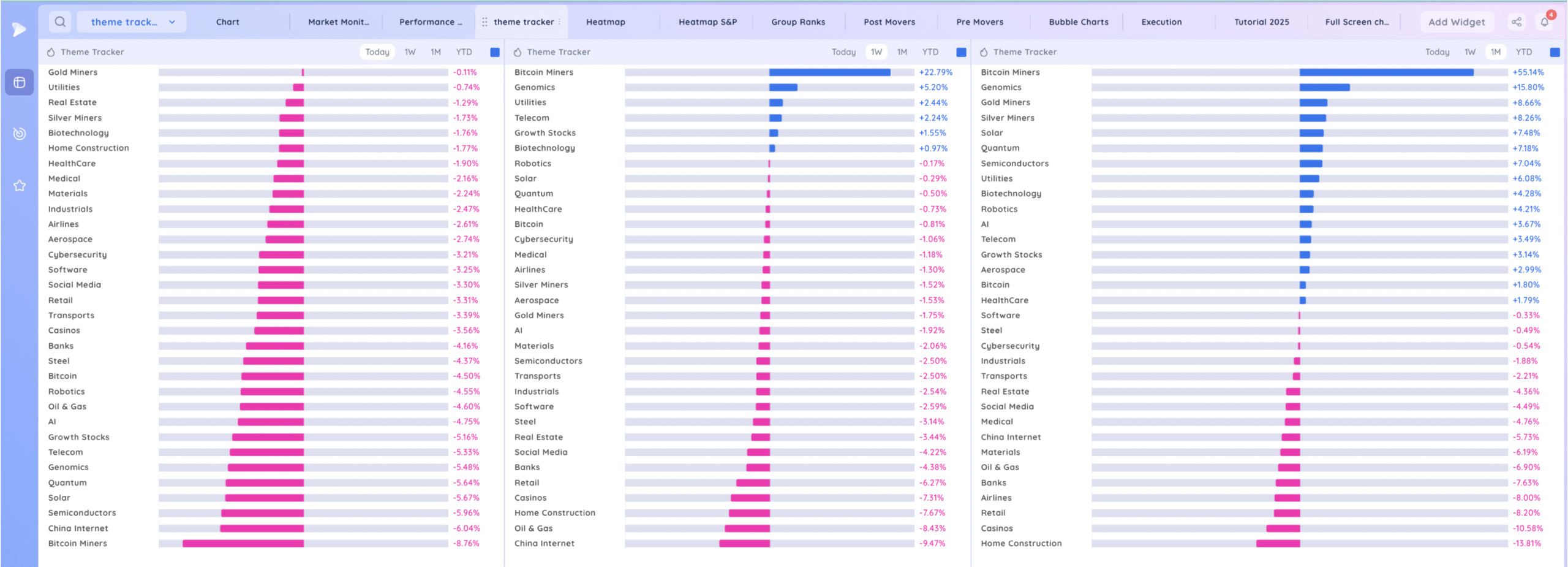

Trends (2/4 Up) – Based on the QQQ

Shortest – 10 Day EMA – Below

Short-term – 21 ema – Below

Intermediate term – 50 sma – Above Rising

Longterm – 200 sma – Up – Above Rising

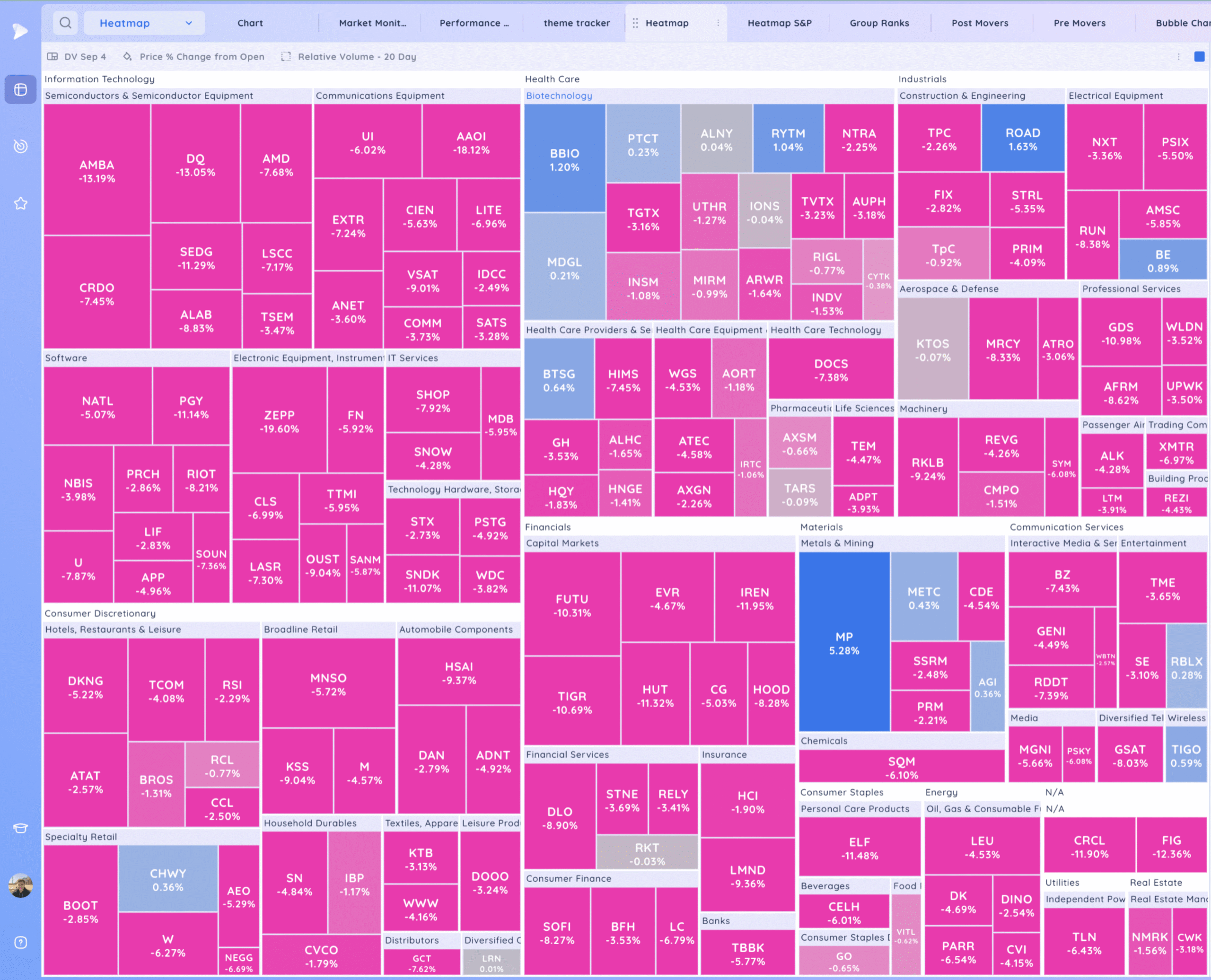

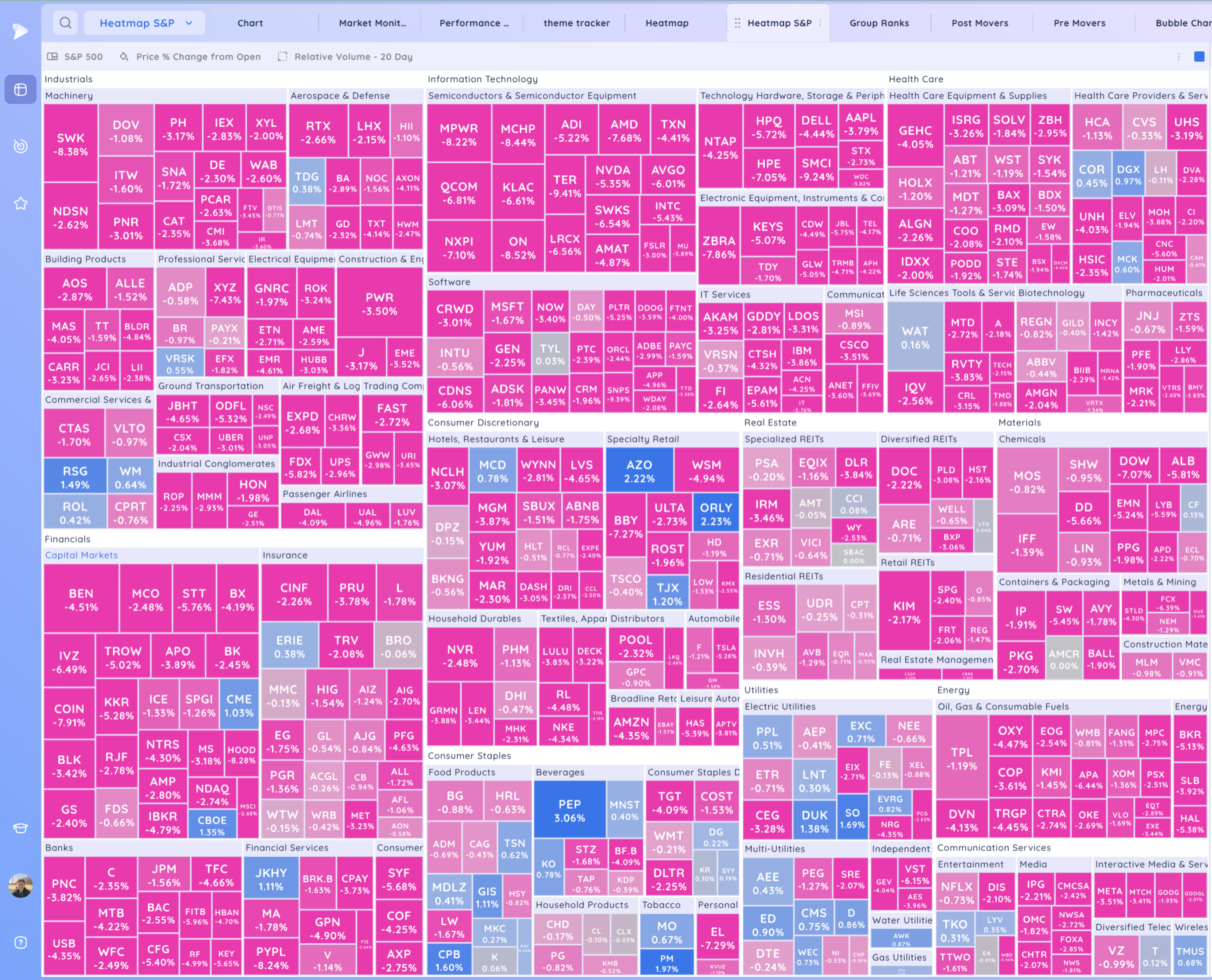

Groups/Sectors

Deepvue Theme Tracker

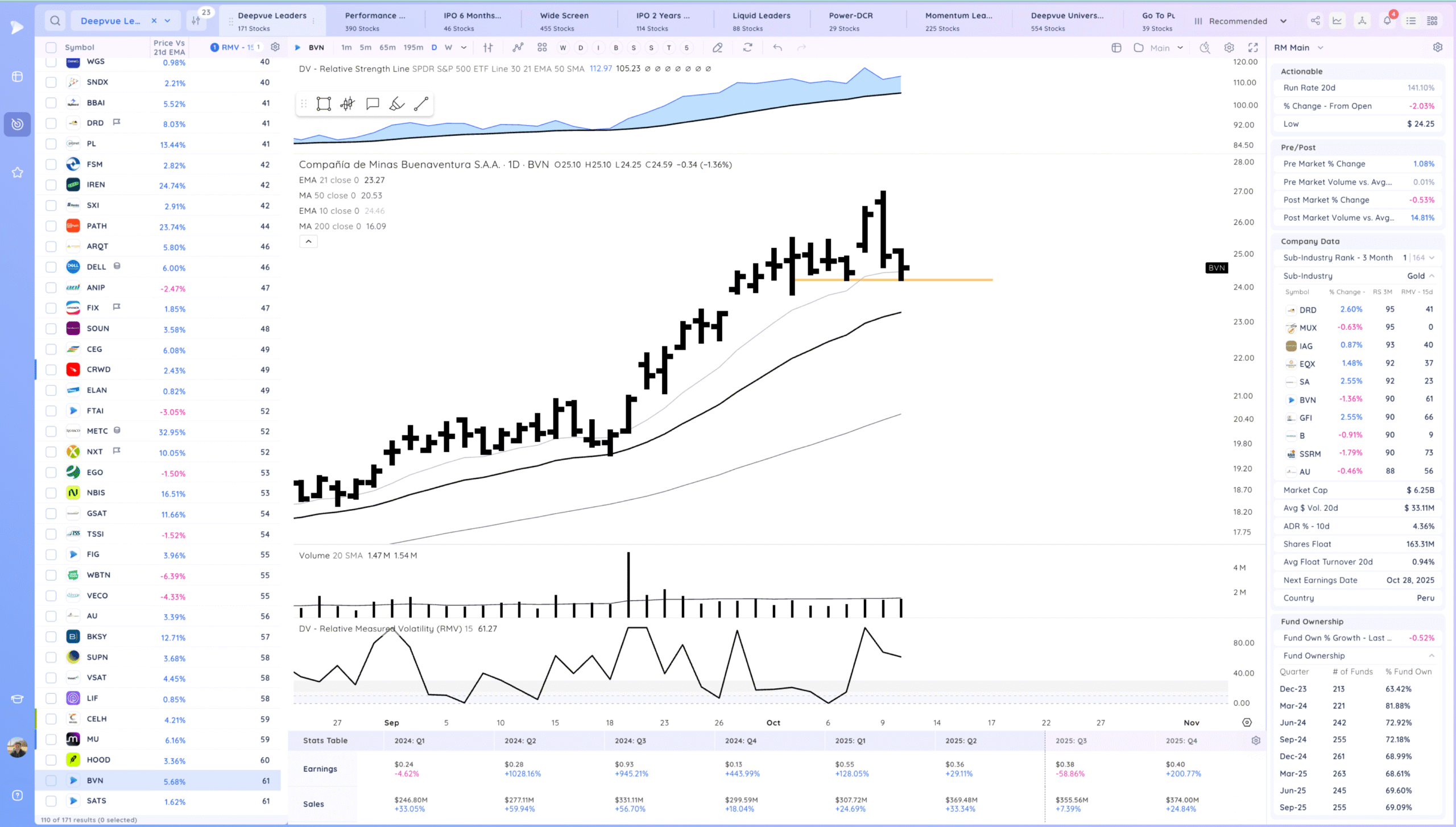

Deepvue Leaders

S&P 500.

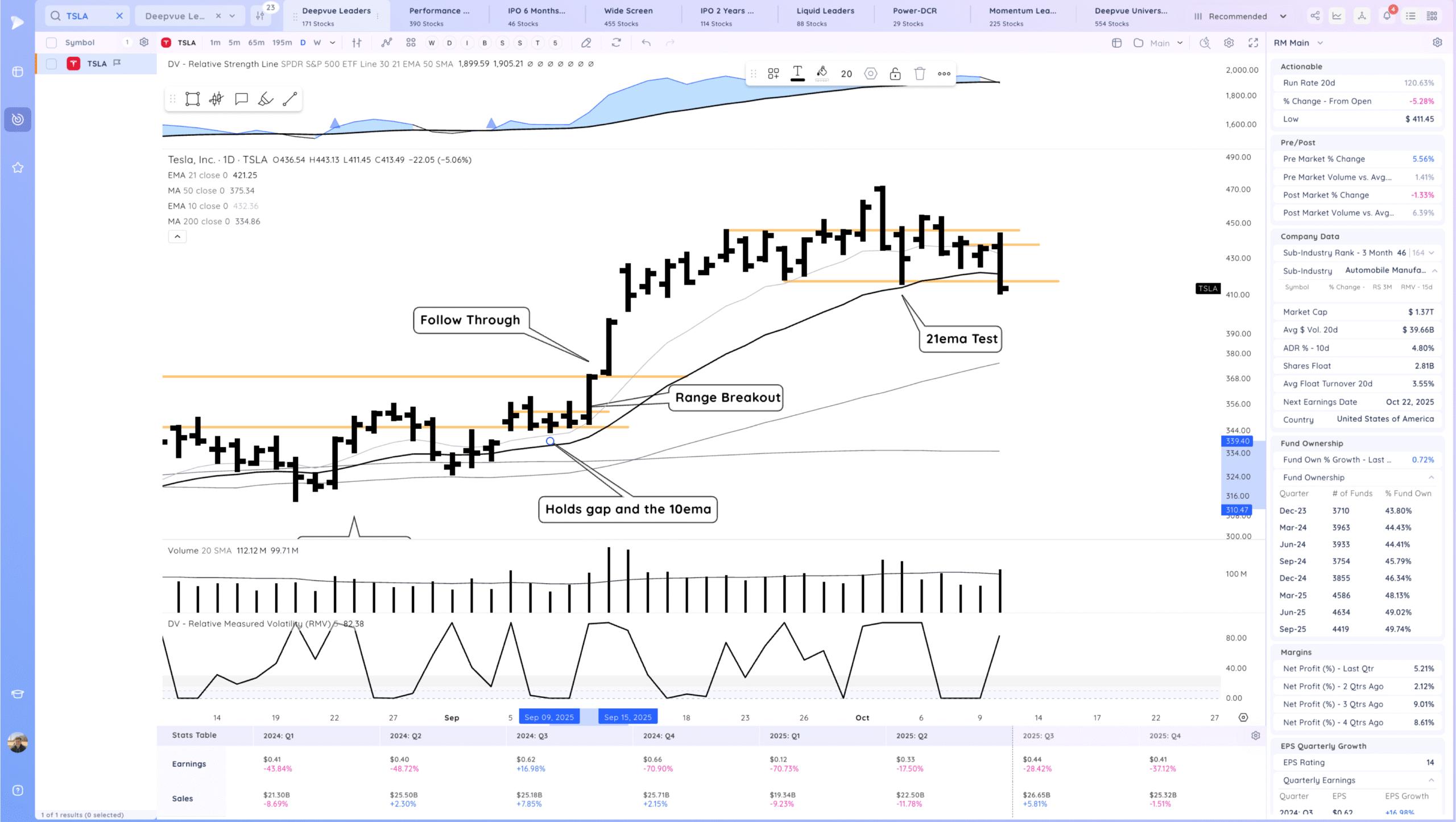

Leadership Stocks & Analysis

TSLA – Failed range breakout and close below the key level and 21ema

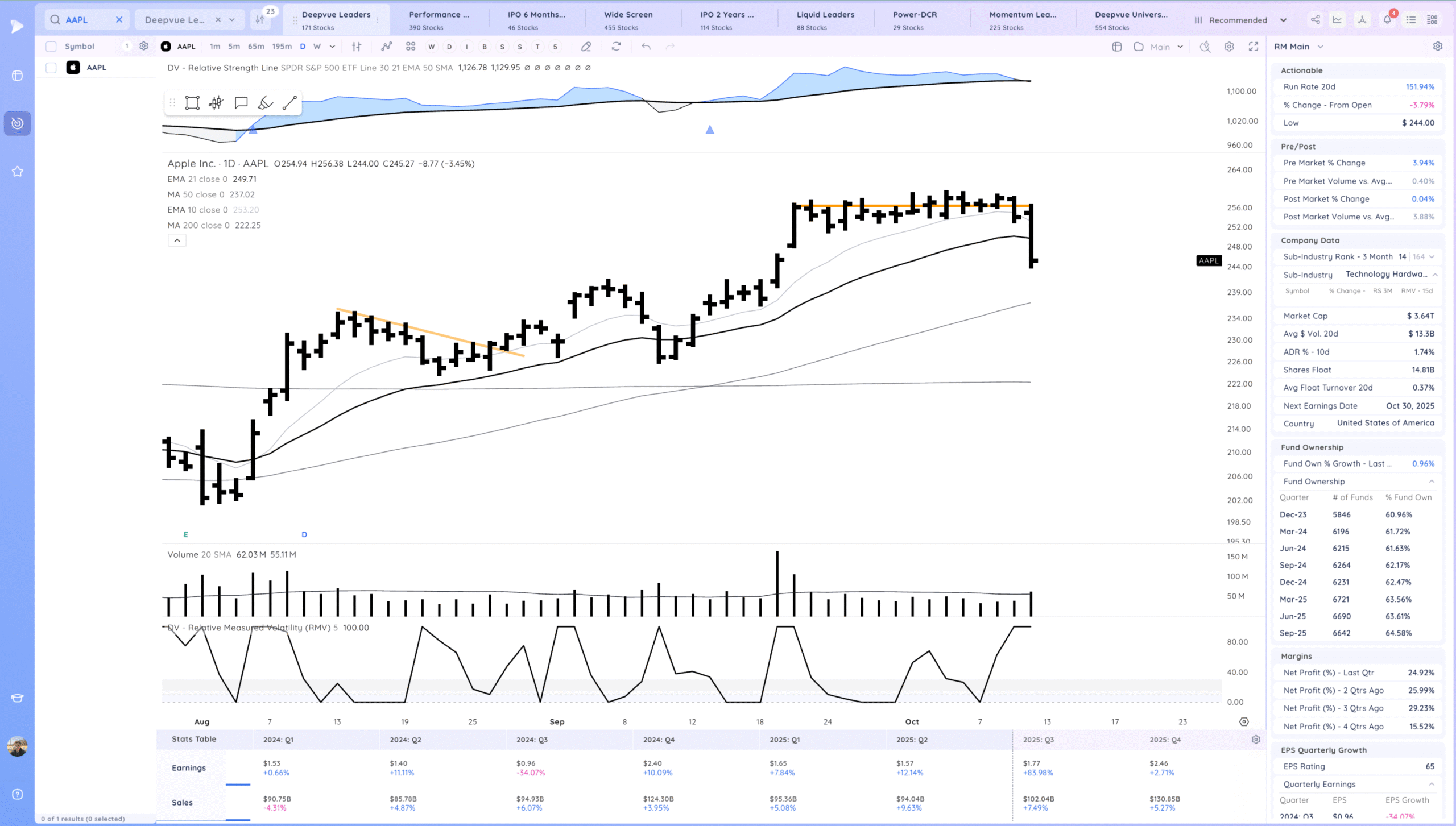

AAPL break below the flag

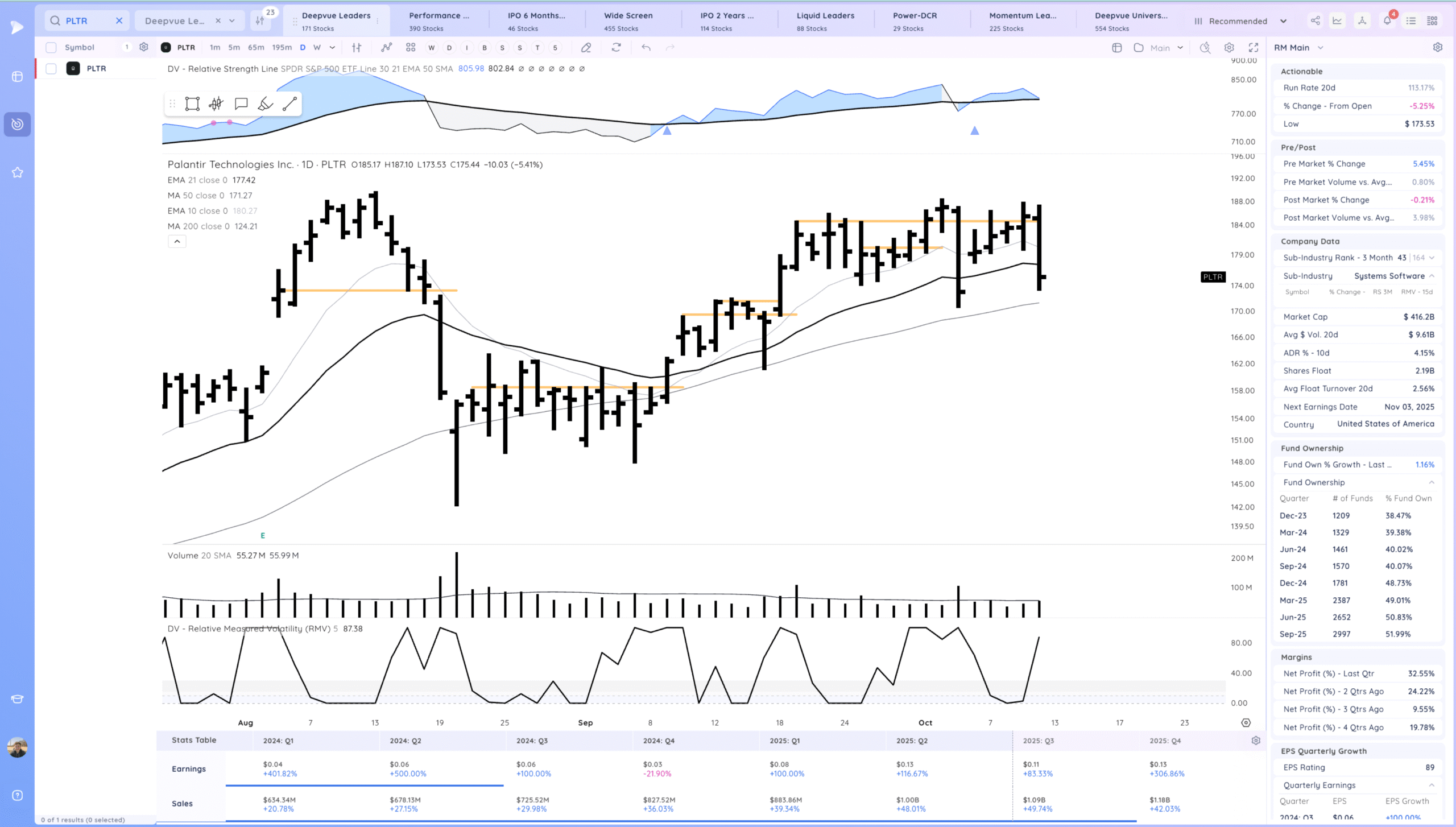

PLTR Break lower, close below the 21ema

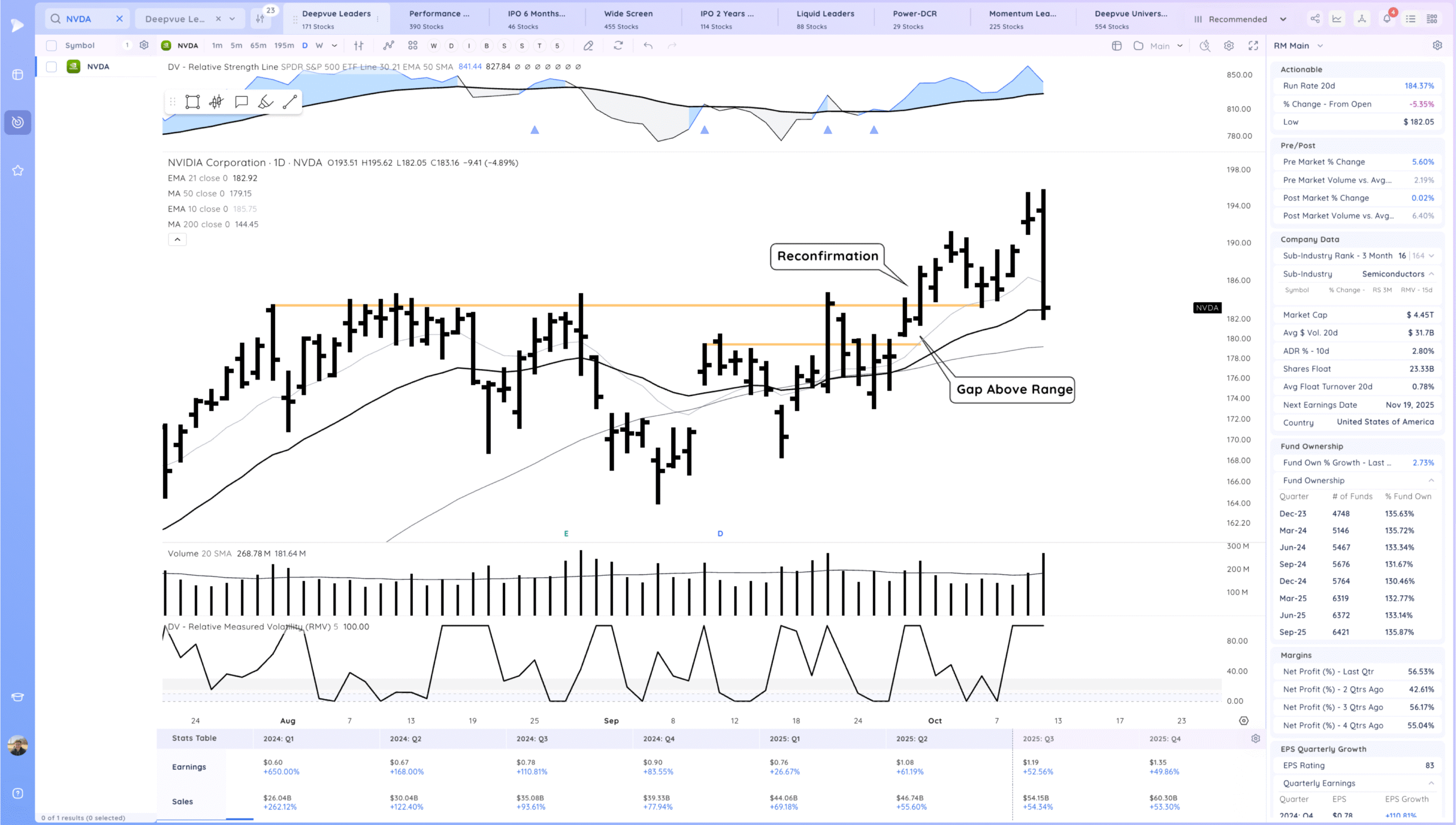

NVDA sharp break lower

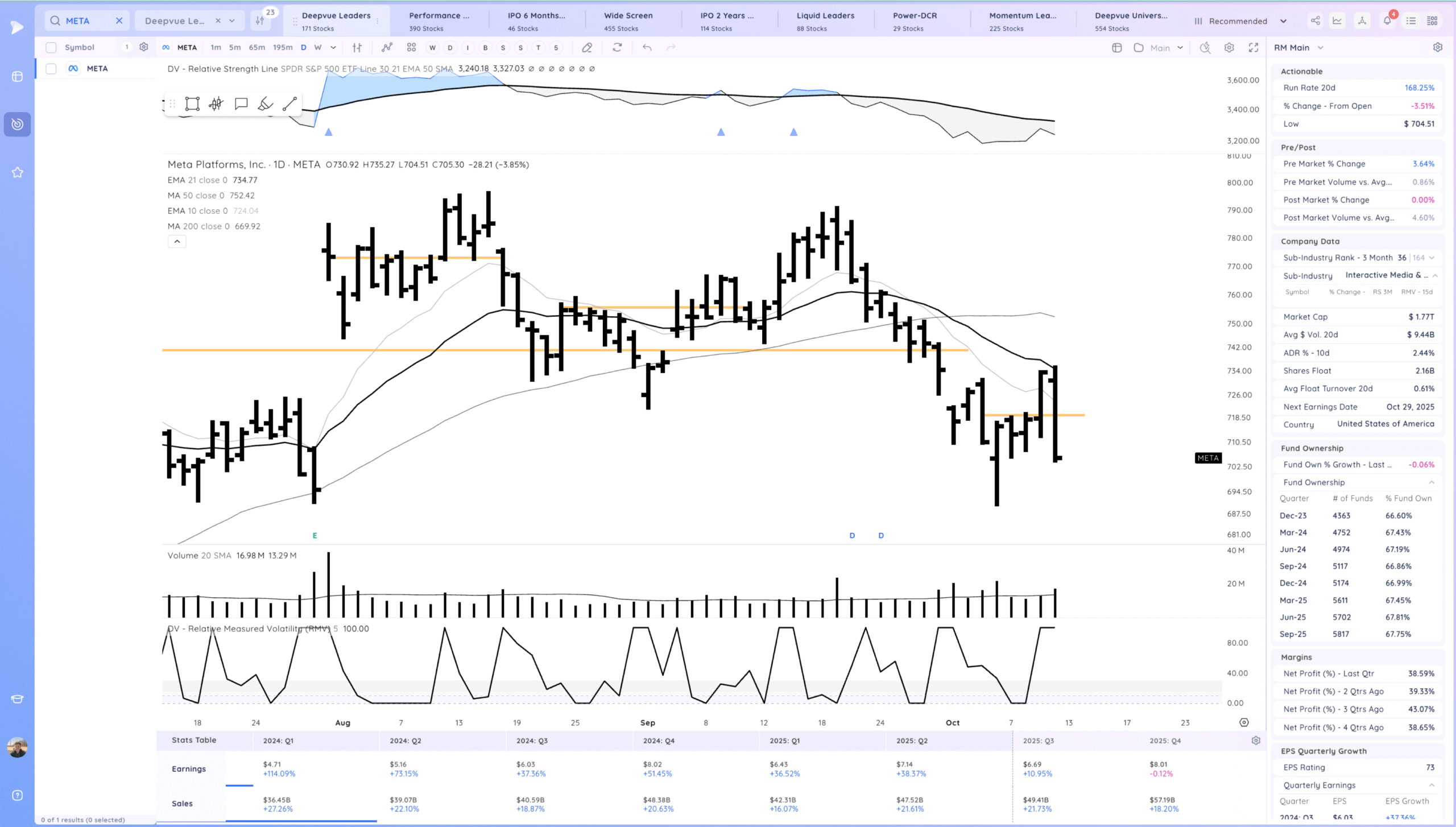

META failure at the 21ema

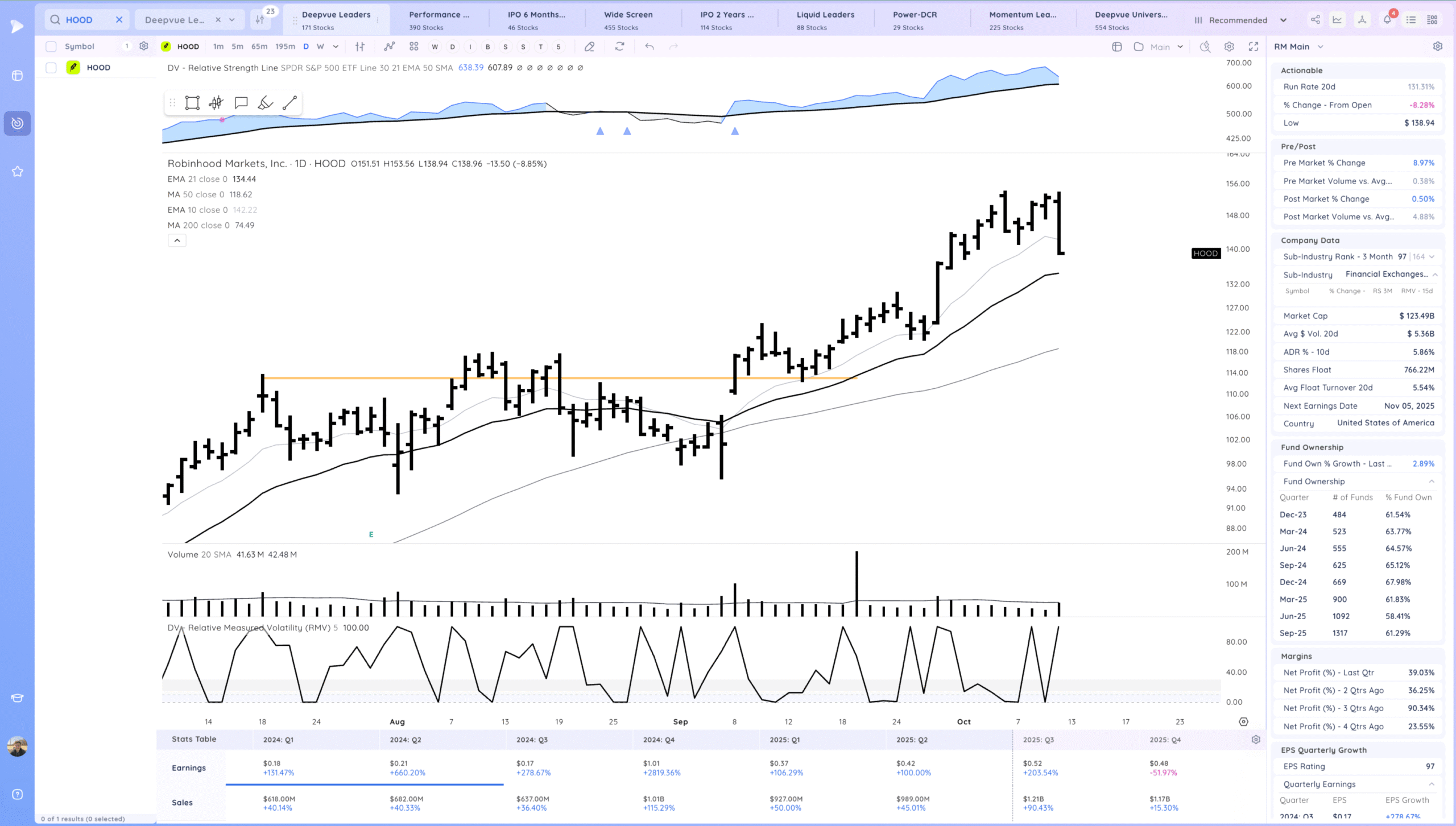

HOOD sharp close below the 10ema

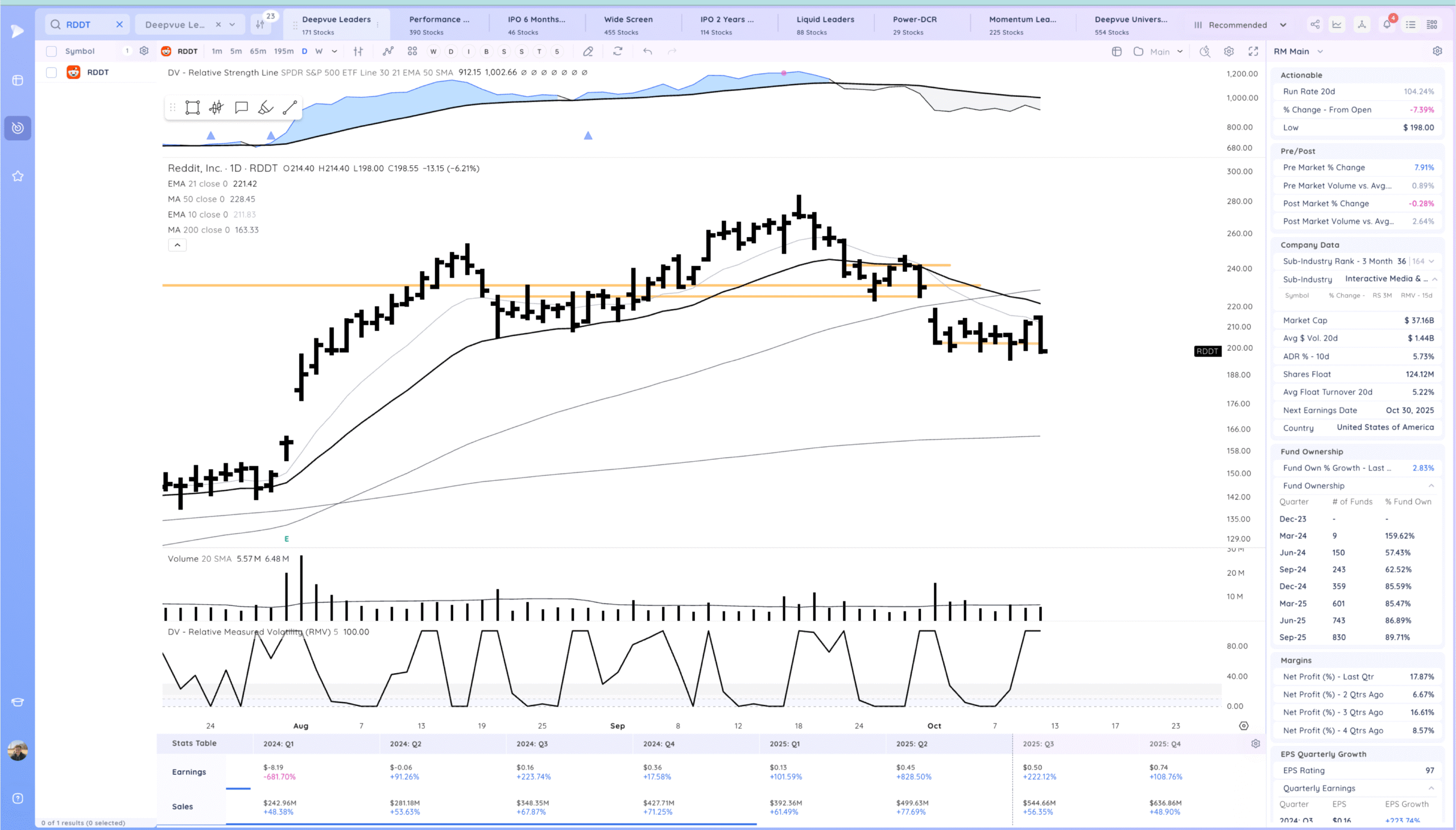

RDDT negative outside day

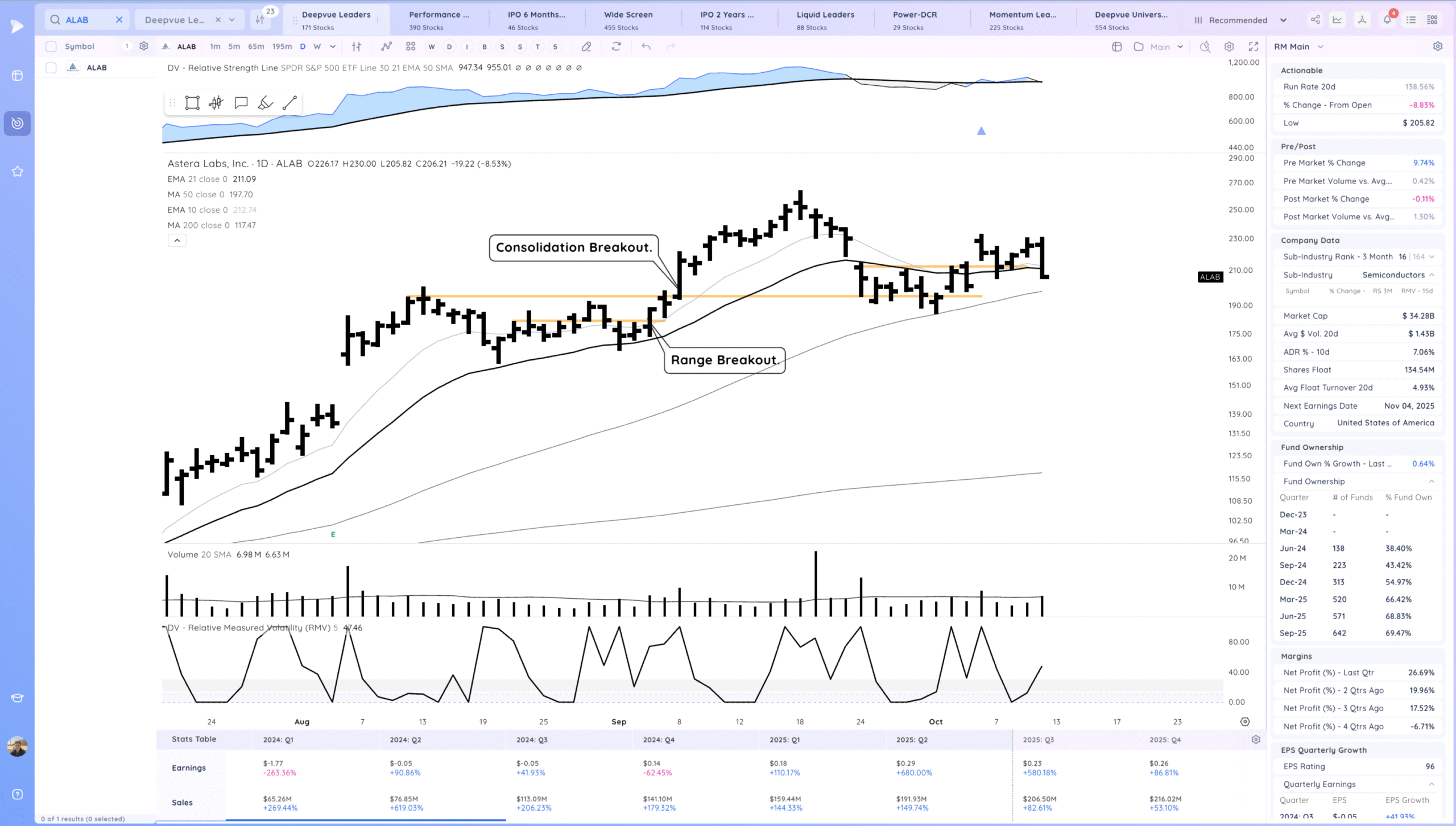

ALAB Close below the 21ema

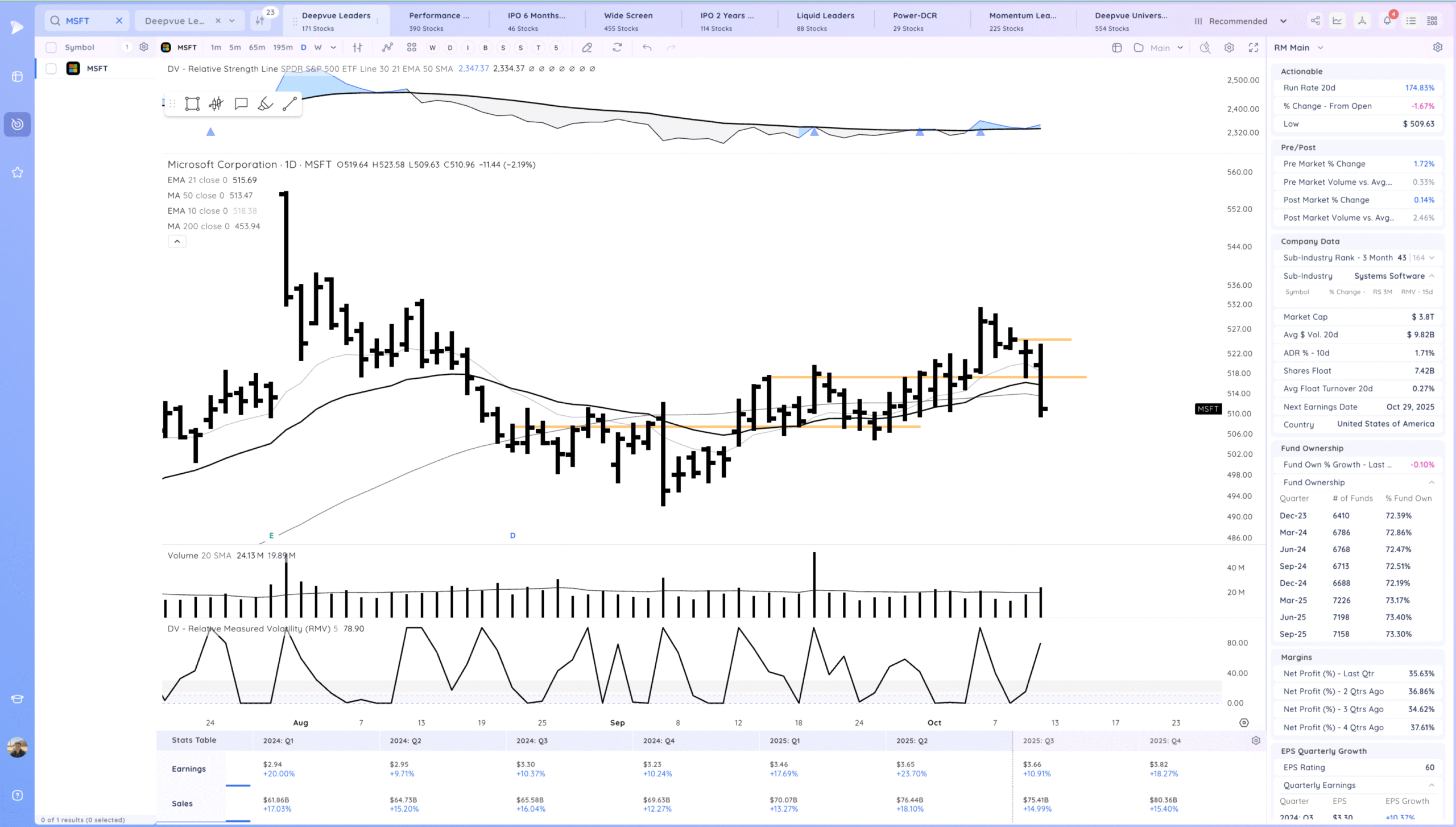

MSFT Break below the pivot and 21ema

Key Moves

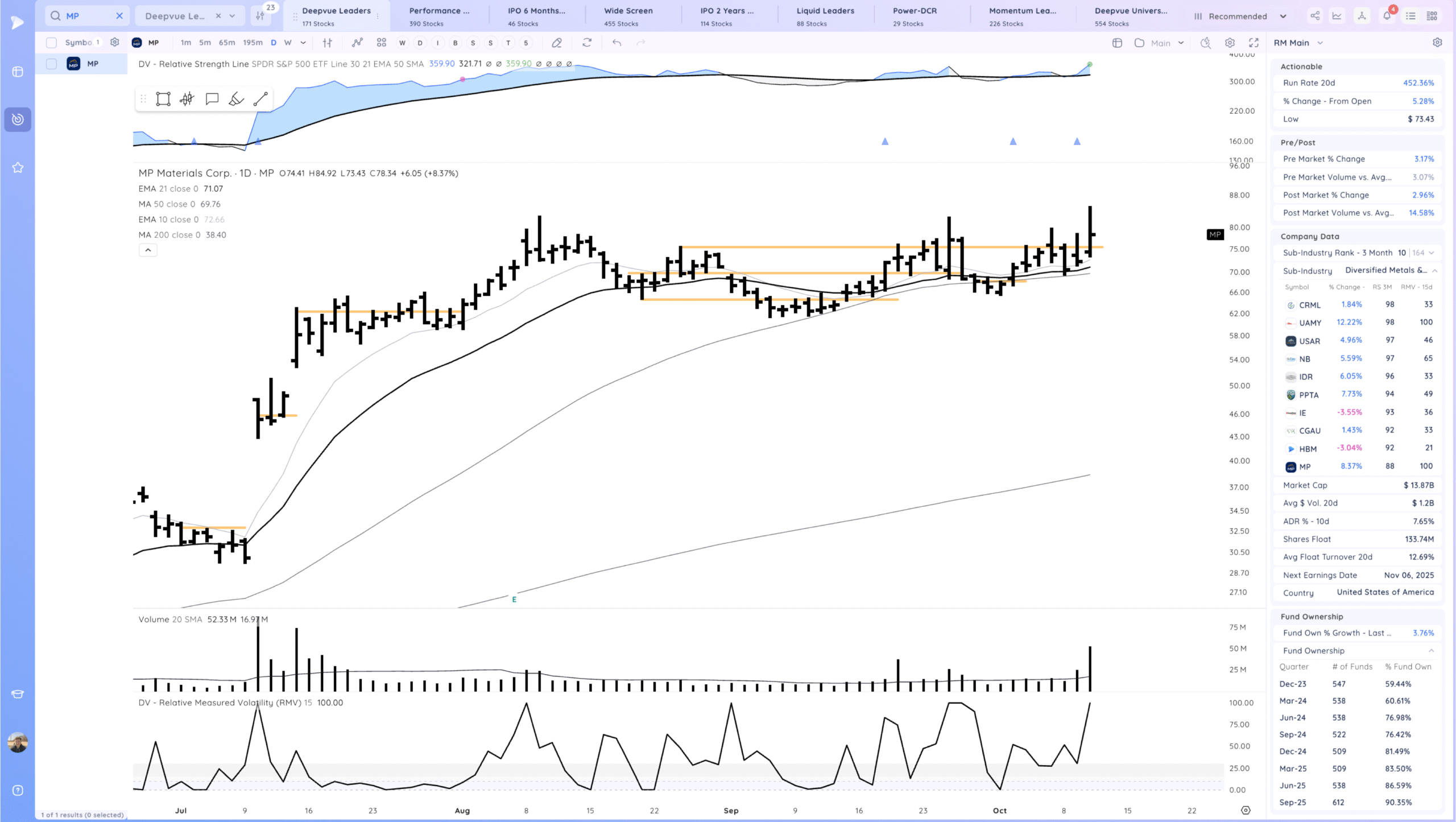

MP has been very choppy but trying to break out. Wicks above 80

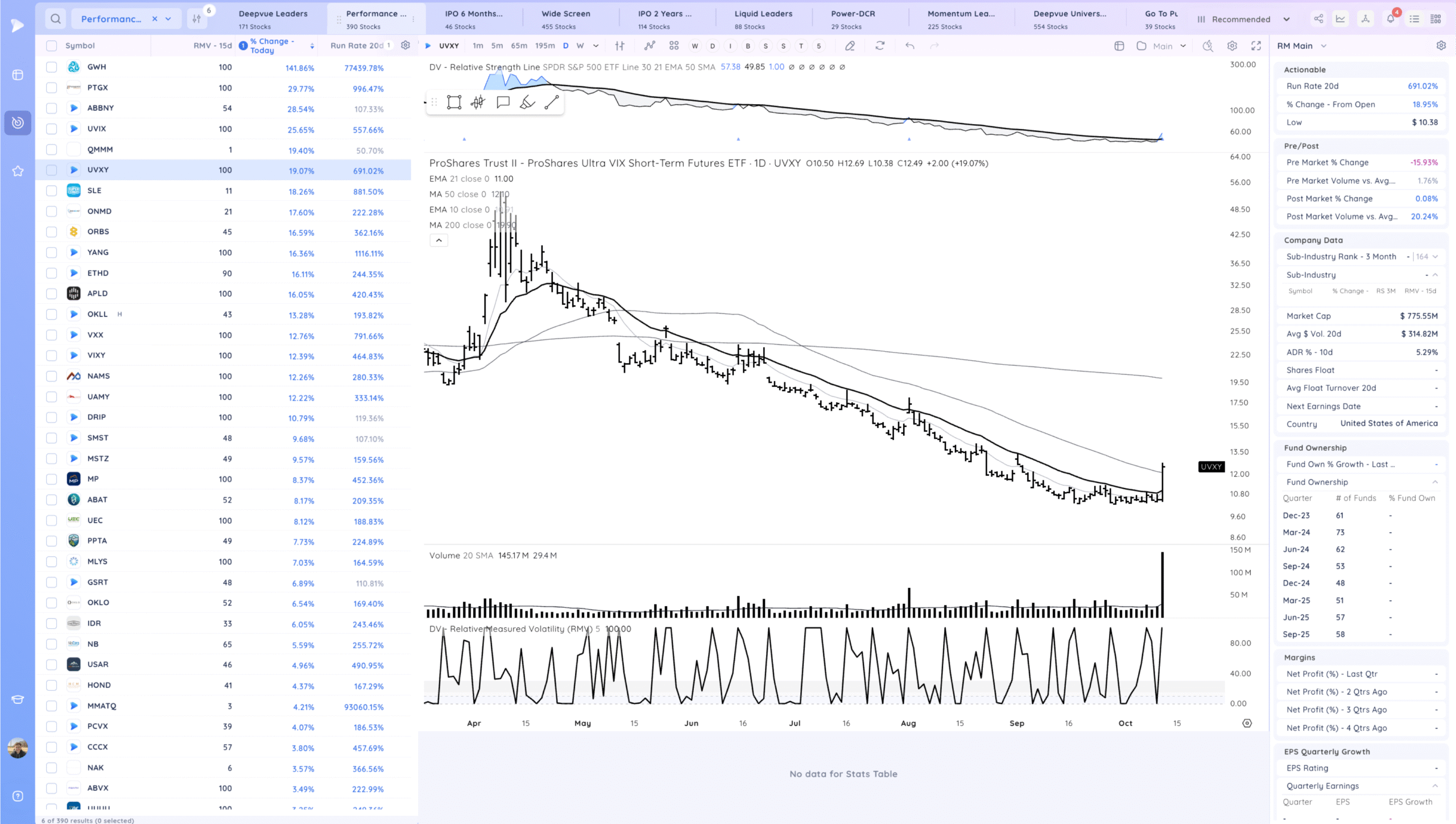

UVXY pop.

Setups and Watchlist

There’s not much to the long side. Lots of break downs or downside reversals. Will be watching for relative strength if we get further weakness. If we recover, what retakes the 21ema the strongest.

To the short side you can watch for follow through down after the downside reversals but remember that this market is news driver. An announcement of de-escalation can pop everything higher very quickly.

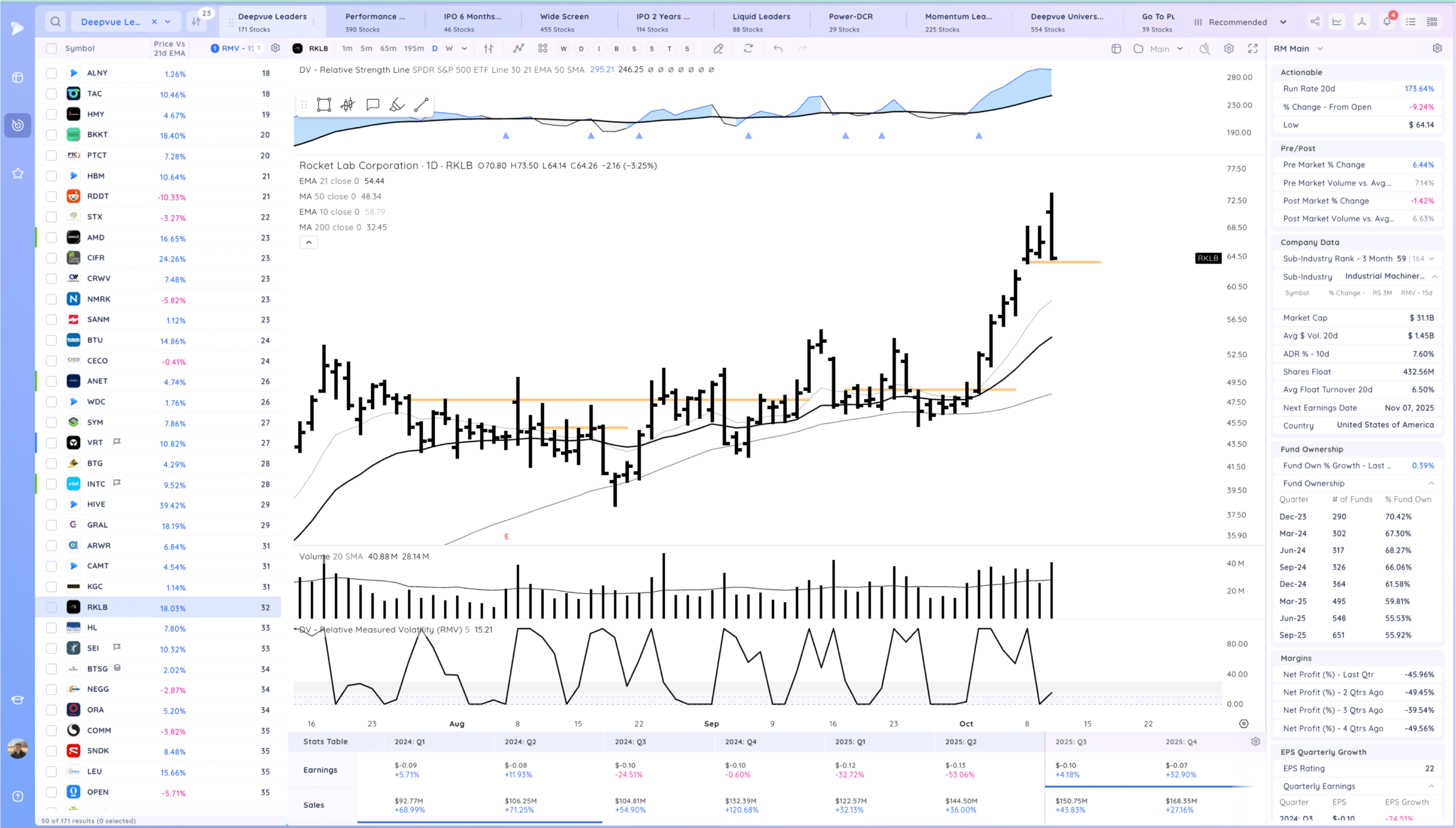

RKLB watching for follow through down

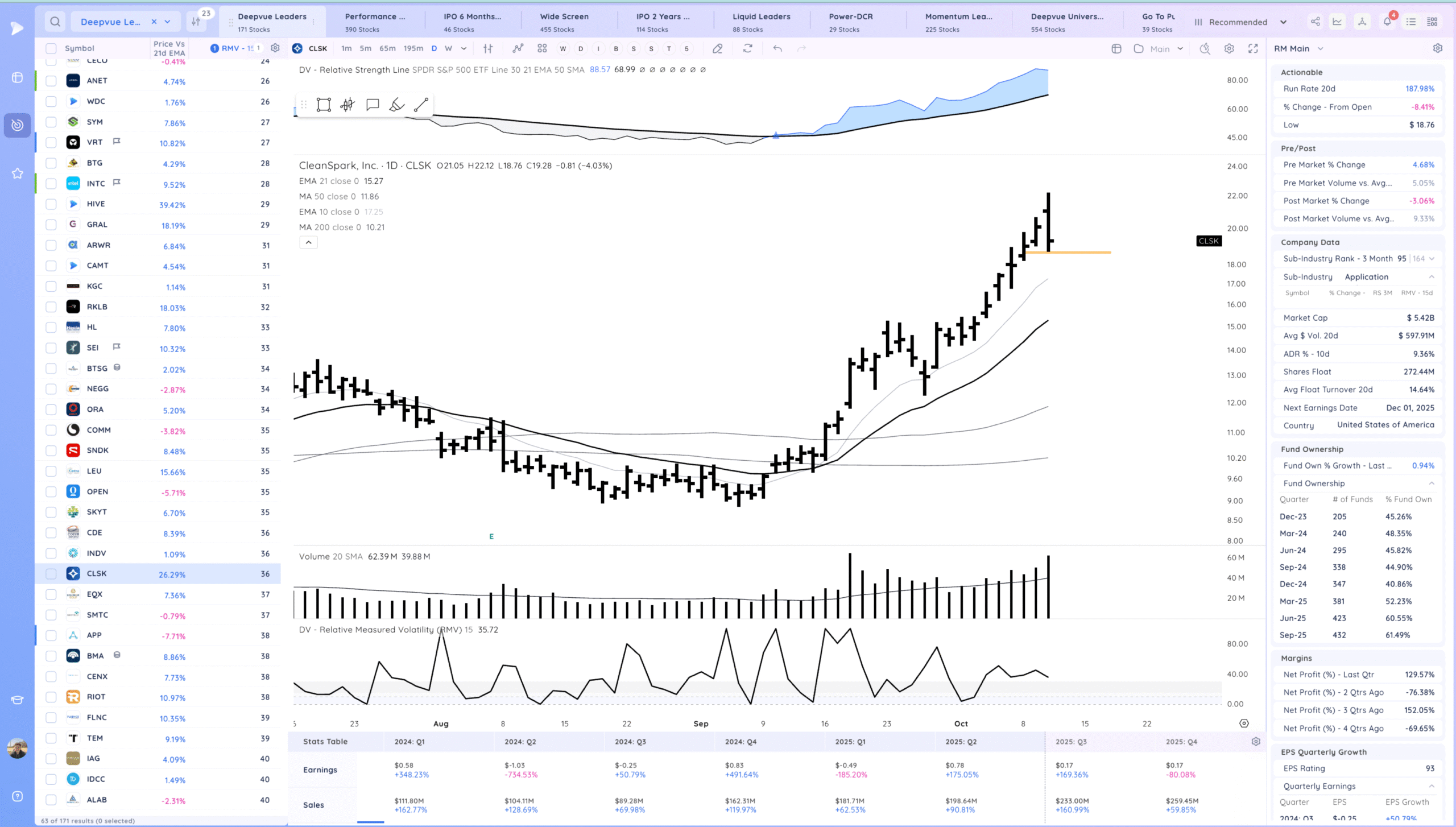

CLSK watching for follow through down.

BVN watching for a range breakdown

Today’s Watchlist in List form

Focus List Names

MP RKLB BVN CLSK NVDA TSLA ALAB

Focus: Mental capital preservation.

Themes

Strongest Themes: AI, AI Energy

Vulnerable Themes: Crypto

Additional Thoughts

It’s a tough situation. Going through my screens not impressed with the action and looks like the start of a pullback. However the catalyst could be reversed and likely we would shoot higher. Vulnerable themes are metals/gold, crypto (unless we recover this weekend)

I’m personally not in a hurry much to do anything early next week. Got defensive Friday as the breakouts reversed. A correction would be a great thing for traders as it would reset the cycle and set up for a strong end of the year.

Anything can happen, Day by Day – Managing risk along the way