The Market Reconfirms Down – Stocks Showing RS

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

September 6, 2024

Market Action

QQQ – Our expectation based on the week price action was confirmed and we say another huge bar down. Decidedly below downtrending MAs now. Short term “extended” to the downside so odds of a snap back increased but also things can stay “over-sold” a lot longer than we think

Key levels to watch for potential support are the 200 day, the august lows, and the March highs which is where we currently are.

IWM – similar bar, negative below the MAs

Never miss a post from Richard Moglen!

Stay in the loop by subscribing.

Trends (1/4 Up)

Shortest – 10 Day EMA – Below declining

Short-term – 21 ema – Below declining

Intermediate term – 50 sma – Below declining

Longterm – 200 sma – Up – Above Rising

Groups/Sectors – % Change from Open

Performance Charts from Deepvue

Key Stocks in Deepvue

NVDA reconfirms down

CAVA still showing RS. on a market turn this should be a focus

PLTR also showing rs holding near the 21ema. It just joined the S&P

DUOL still building this handle

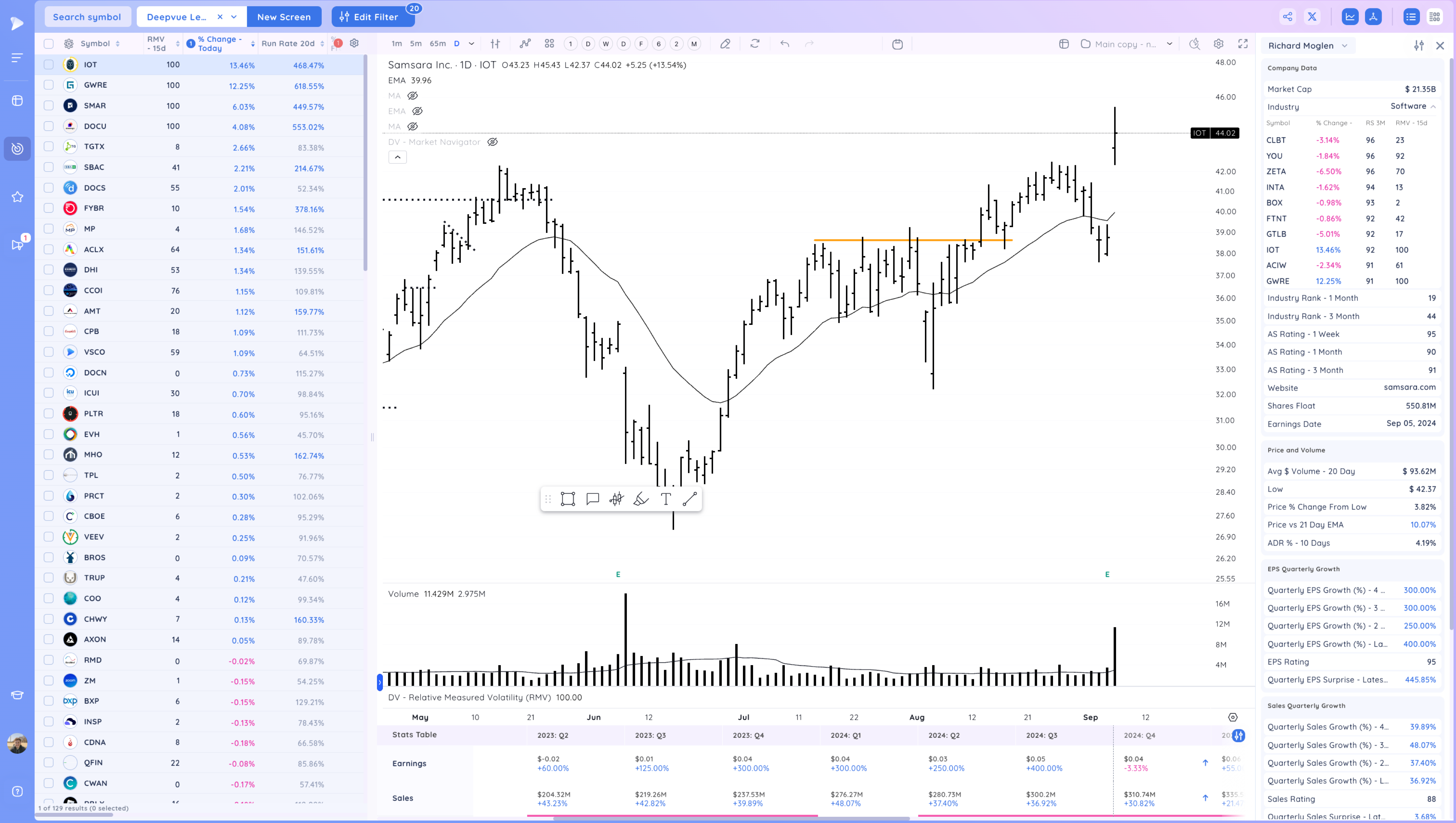

IOT gap to new highs

RDDT still forming this larger range. Would love and undercut of the range and strong close

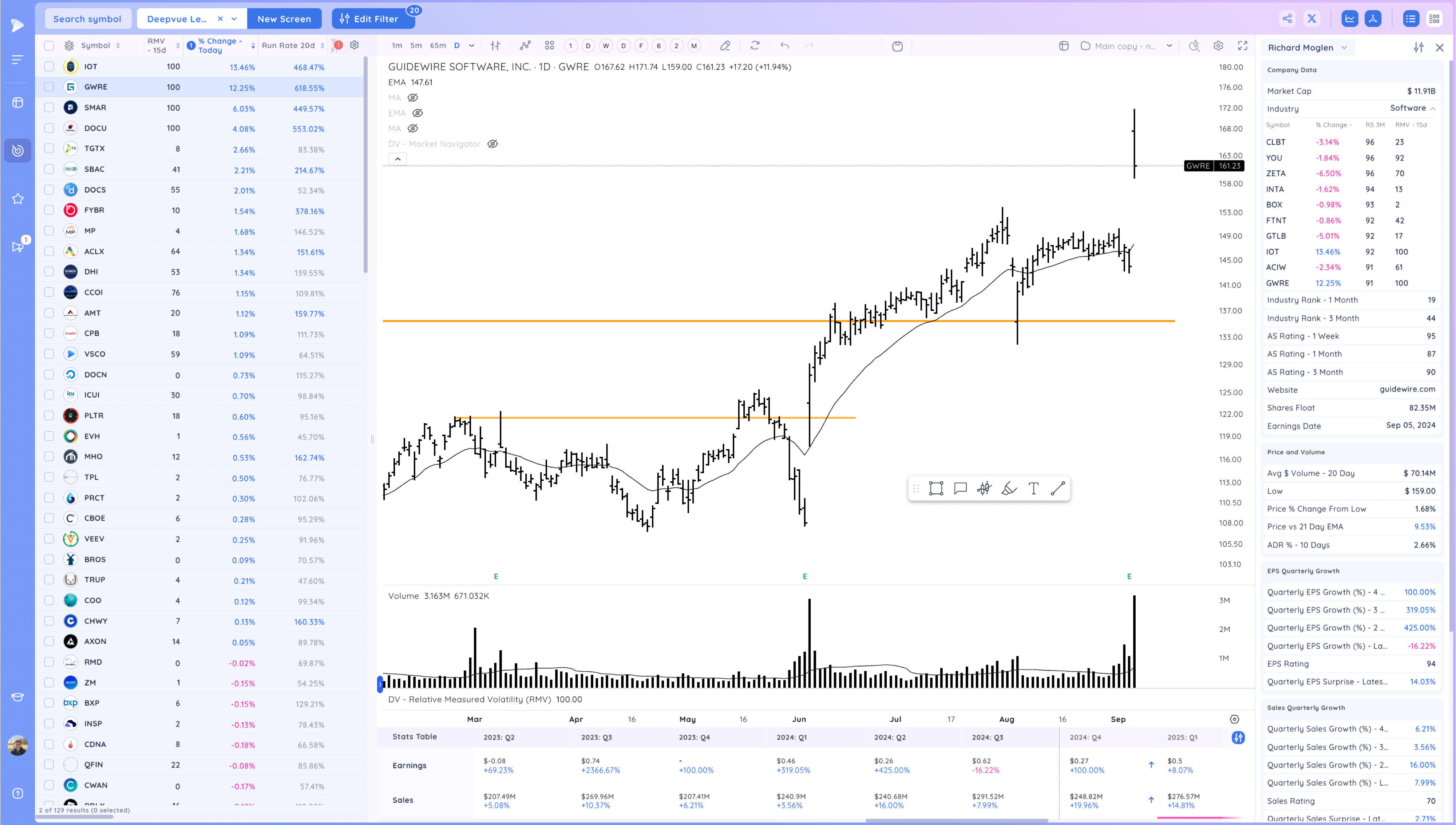

GWRE unknown software name trading at all time highs. It recently broke out of a large base

PODD this is a choppy trader but has had strong moves in the past and is nearing key weekly level

DOCS undercut and rally of short range and AVWAP

Market Thoughts

Semis and the indexes weakened this week. Still seeing some setups in software. Choppy conditions and the market is not really in favor to the log side.

Watching for signs of support and position expectation breakers now at key levels and keeping track of leaders and stocks/groups standing out.

Day by Day – Managing risk along the way