The Market Follows Through Up – Stocks to Watch

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

August 13, 2024

Market Action

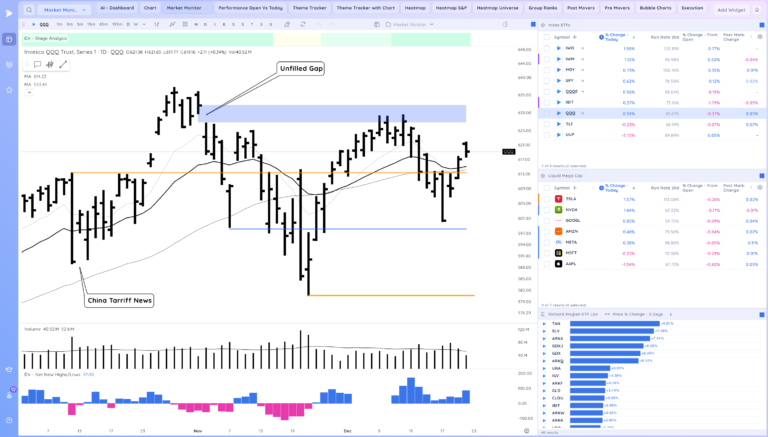

QQQ – We have now pushed above the wedge with today’s gap and go move and reclaimed the 21ema

On any backtest I would like to see today’s low area be defended.

In the 2018 case study below we retook the 21ema before failing shortly so be ready for anything and listen to market feedback on any pilot trades.

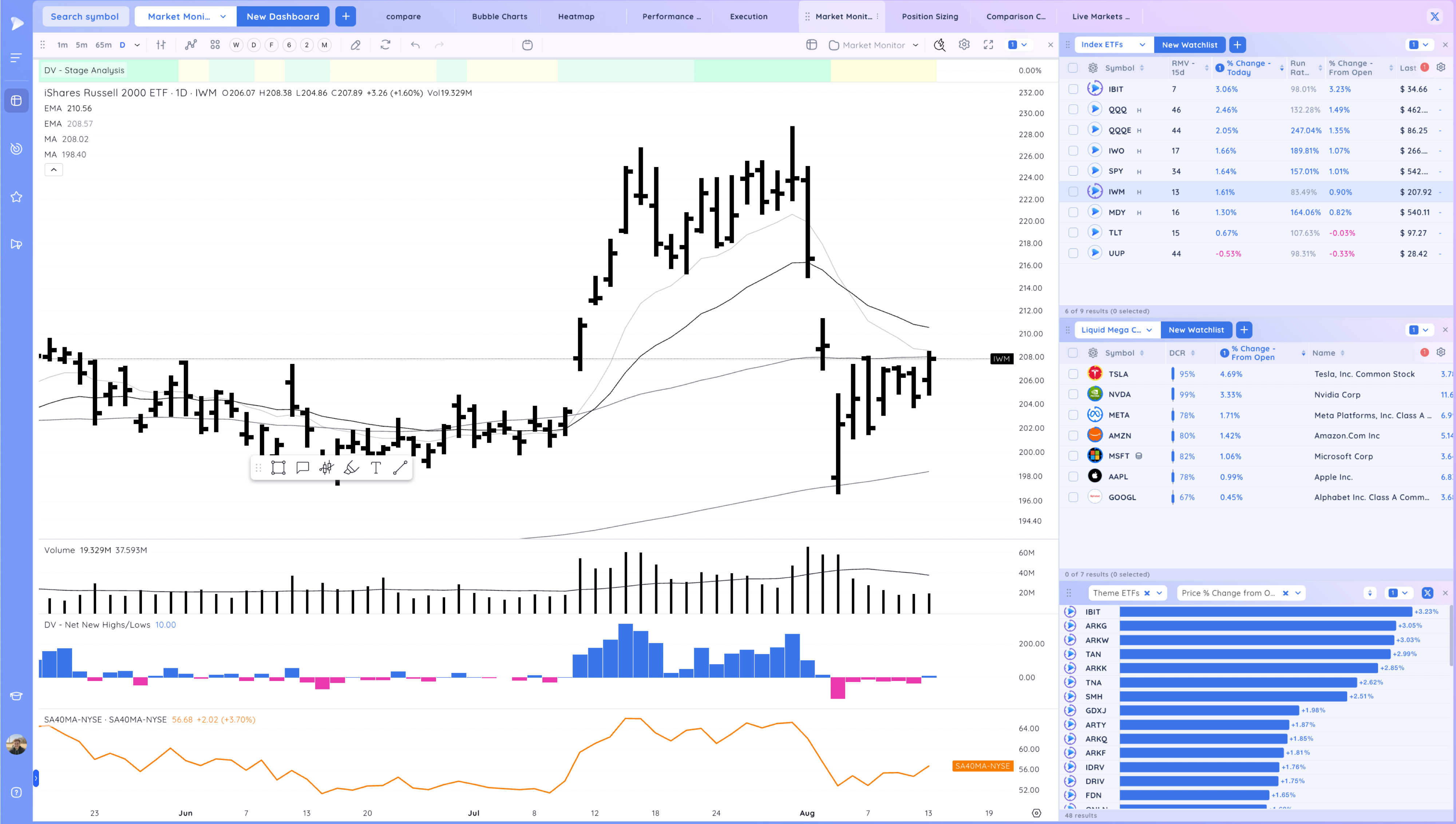

IWM – A bit weaker but near the top of the range

Market Corrections Case Studies

Here are the two case studies of 2018 and 2020 that provide examples of what you can expect form a correction just in case you haven’t seen them yet.

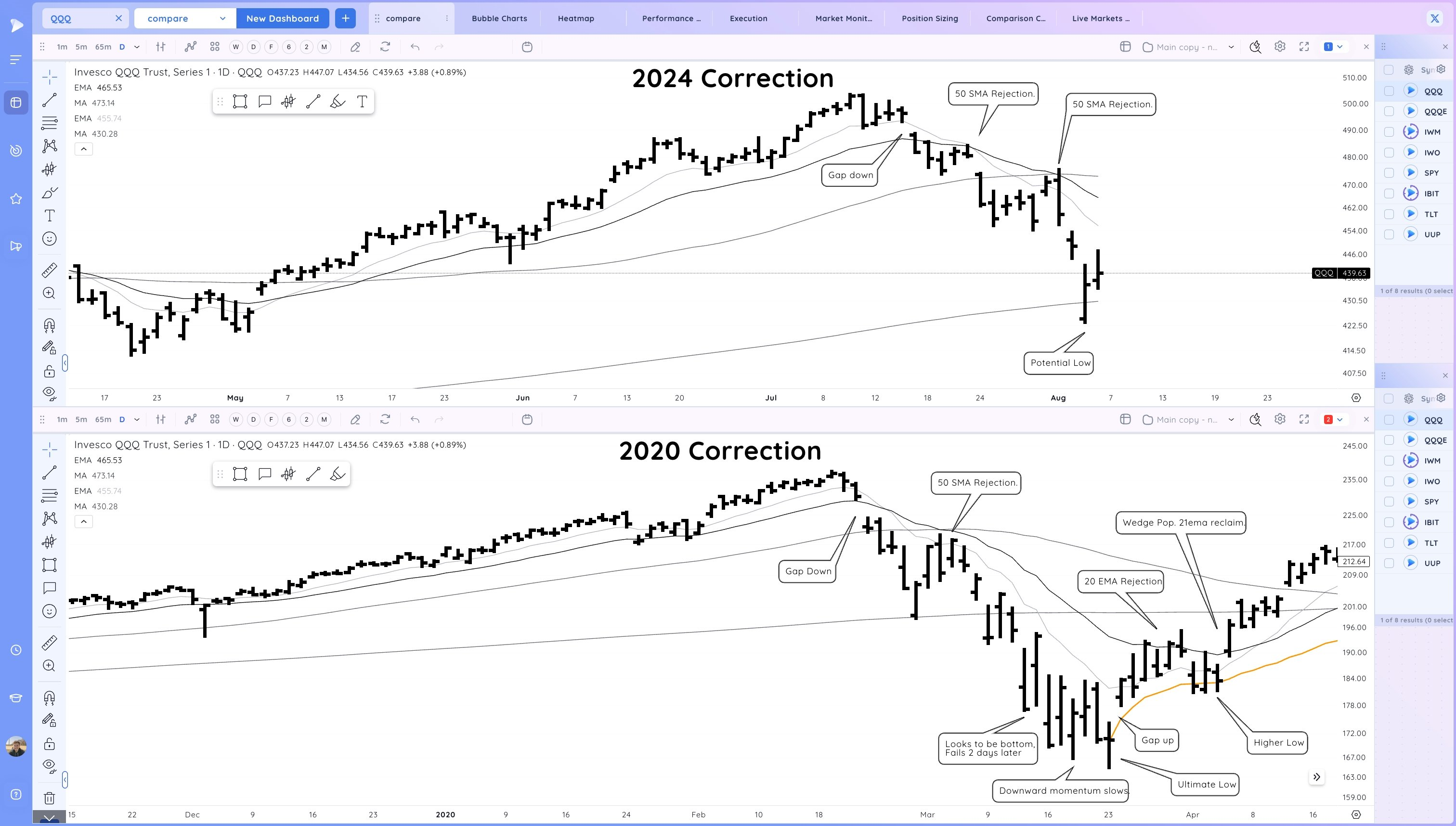

I’ve been taking a look at recent sharp corrections. Here is the 2024 Correction so far compared to the 2020 Correction. Patience (while still prepping for the uptrend) until test/reclaim moving averages from below + form a higher low. If active, tight leashes on trades

Never miss a post from Richard Moglen!

Stay in the loop by subscribing.

QQQ 2024 versus 2020 Case Study – All corrections exhibit similar type action.

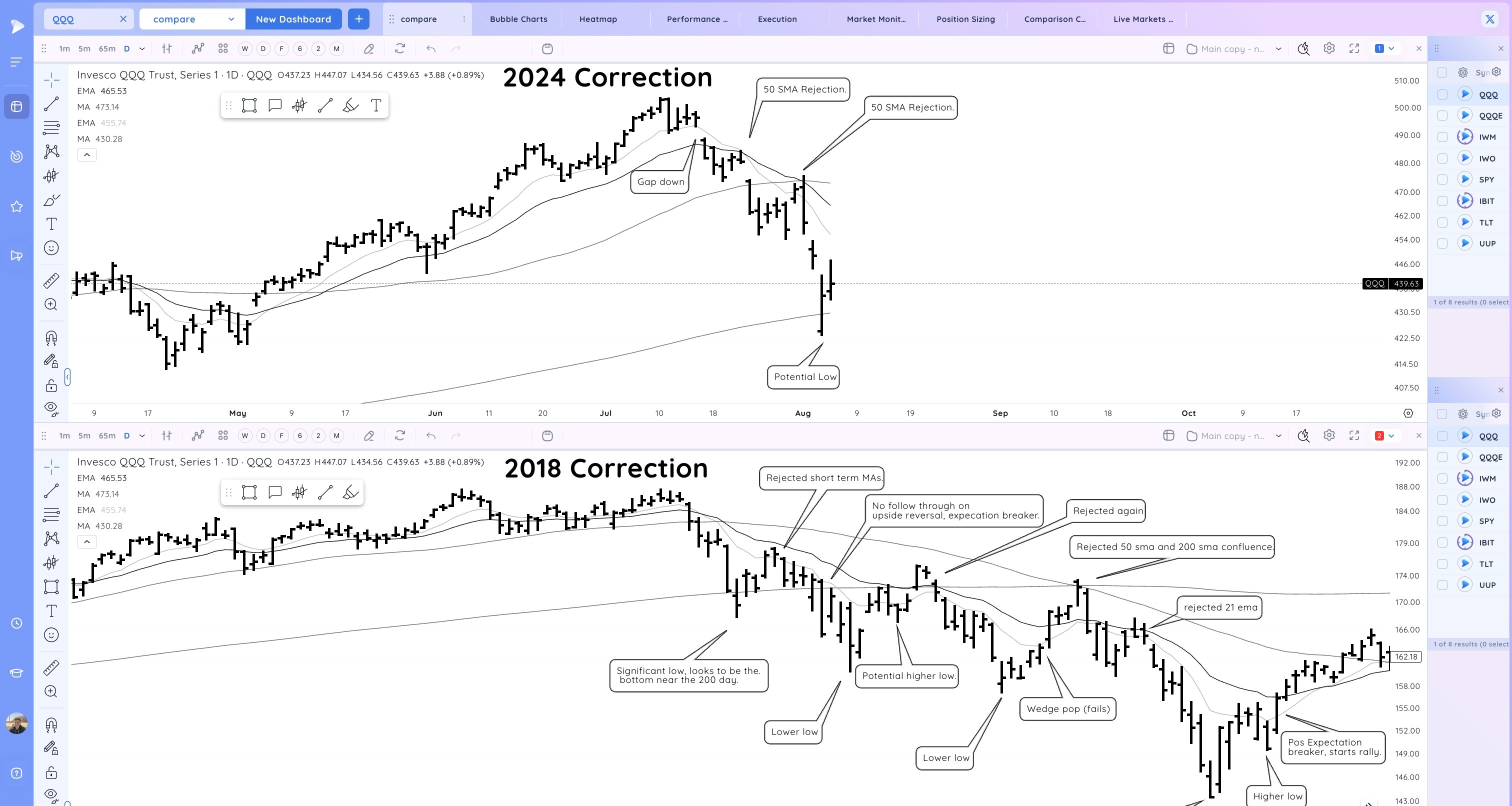

Here is the current 2024 Correction versus the 2018 Correction. Notice in that one there were similar points where it looked to be over, only for the rally to fail at key MAs. We’ll see how this current one ultimately resolves. The low could be in, one day at a time.

QQQ 2024 versus 2018 Case Study – Patience is required during corrections, taking it day by until the market proves itself.

Also key is how potential leaders are acting. As the correction ends they will be all setting up and breaking out through pivots.

Look for group action, big gap ups, volume surges, Higher lows as the market makes lower ones, reclaims of moving averages

Avoiding the chop and frustration is key during corrections. Experienced traders can look to pick spots, daytrade or see if levels holds during the day to hold through the close but less is more until the wind is back at our back.

With all that said you should be getting excited. We’ve had some great opportunities in 2023 and 2024 and this correction is setting up another one. The longer this goes on and the deeper the correction, the greater the potential for another uptrend that could change your year and life. You just have to do your homework and be ready mentally when that happens.

Trends (3/4 Up)

Shortest – 10 Day EMA – Up – Above Rising

Short-term – 21 ema – Up – Above Rising

Intermediate term – 50 sma – Down – Below Declining

Longterm – 200 sma – Up – Above Rising

Groups/Sectors – % Change from Open

Performance Charts from Deepvue

Key Stocks in Deepvue

NVDA strong gap and go move retaking the 21ema

AXON tightening

ONON a bit wild but supported after earnings. One to watch at the pivot

CAVA reconfirmation from tight day

TSLA push from the range and through the 200day

IOT breakout

SBUX huge gap and go on HV with a new ceo catalyst

KVYO tightening post gap

SG tightening post gap

DOCS tightening post gap

EXEL flagging post gap. FTNT ICUI MASI SN SHOP GSHD ACMR as well

HIMS tight range. supportive action today, see if it can follow through up

TEM strong push from tight area

CVNA breakout from tight area. RMV=0 yesterday

MPWR smiliar. RMV 0 yesterday

Market Thoughts

Strong move today popping up through the 21ema. Many names i’ve been watching and trying are reconfirming higher.

A large down day is to be expected at some point. How stocks act then or on a gap down should provide some valuable clues about RS.

Day by Day