The Market Drops Below the 21ema – Is the TSLA Earnings Pop Enough to Support it?

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

October 23, 2024

Market Action

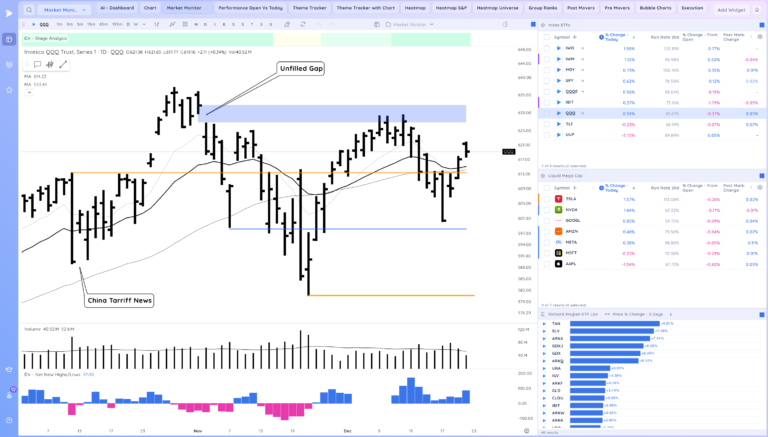

QQQ – From the tight pattern we were forming we saw an expansion to the downside today. This was the bearish scenario mentioned as we undercut the recent lows.

Short Term Expectation based on the close is consolidation or continuation lower. We are at a key level – the 21ema

Bulls want to see us build near the 21ema or have a quick snapback to close the week strongly

Bears want to see us follow through down and close the week below the 21ema

IWM – dropped all the way at one point to the 50 day. Good close

Trends (2/4 Up)

Shortest – 10 Day EMA – Below Declining

Short-term – 21 ema – Below Declining

Intermediate term – 50 sma – Above Rising

Longterm – 200 sma – Up – Above Rising

Never miss a post from Richard Moglen!

Stay in the loop by subscribing.

Coming soon! – Don’t miss the High Tight Flag Masterclass with Leif Soreide!

We are hosting a High Tight Flag Masterclass with Leif on Nov 2 and Nov 9. Leif will be sharing his full process for Identifying, entering, and exiting these high potential setups, which can dramatically improve your performance.

- Learn advanced alternate entries to manage risk while trading high momentum growth stocks

- Learn Leif’s sell rules to maximize returns

- Learn Leif’s personal screening and trading routines

You can join hundreds of traders and register using the button below. Live spots are limited!

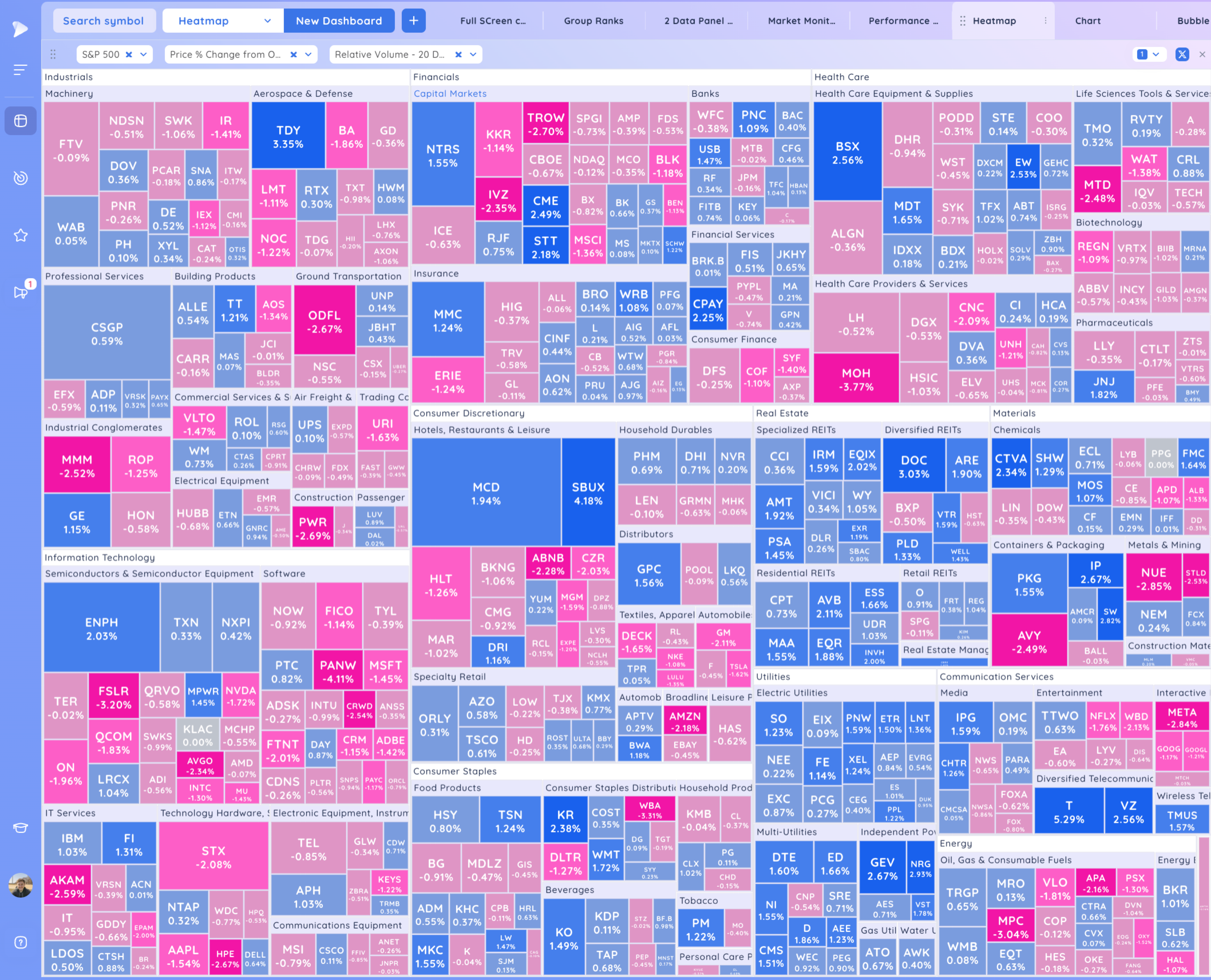

Groups/Sectors – % Change

From yesterday’s close on the left, from today’s open on the right

Most down from the open

Performance Charts from Deepvue

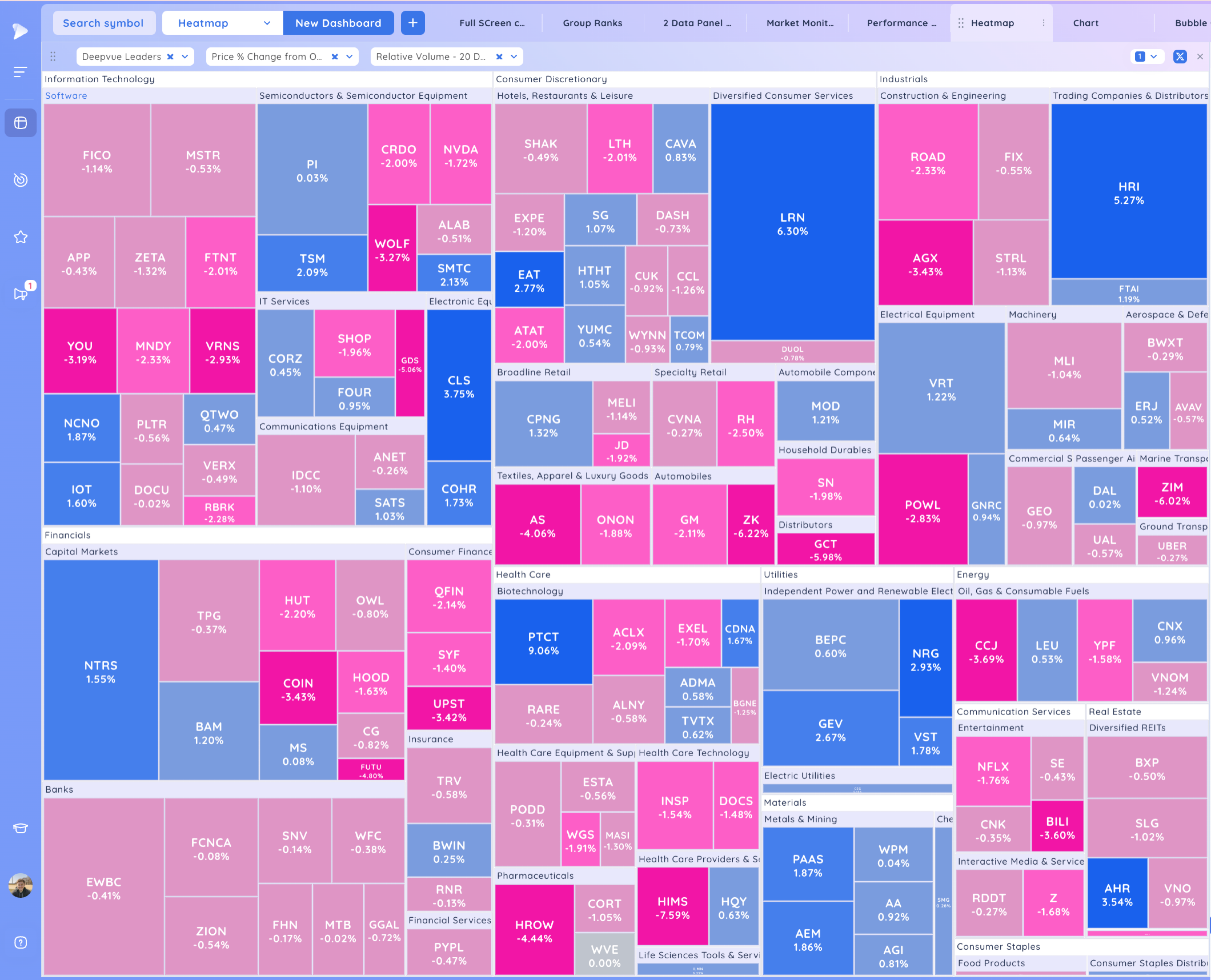

Deepvue Leaders Heatmap

Heatmap from Deepvue

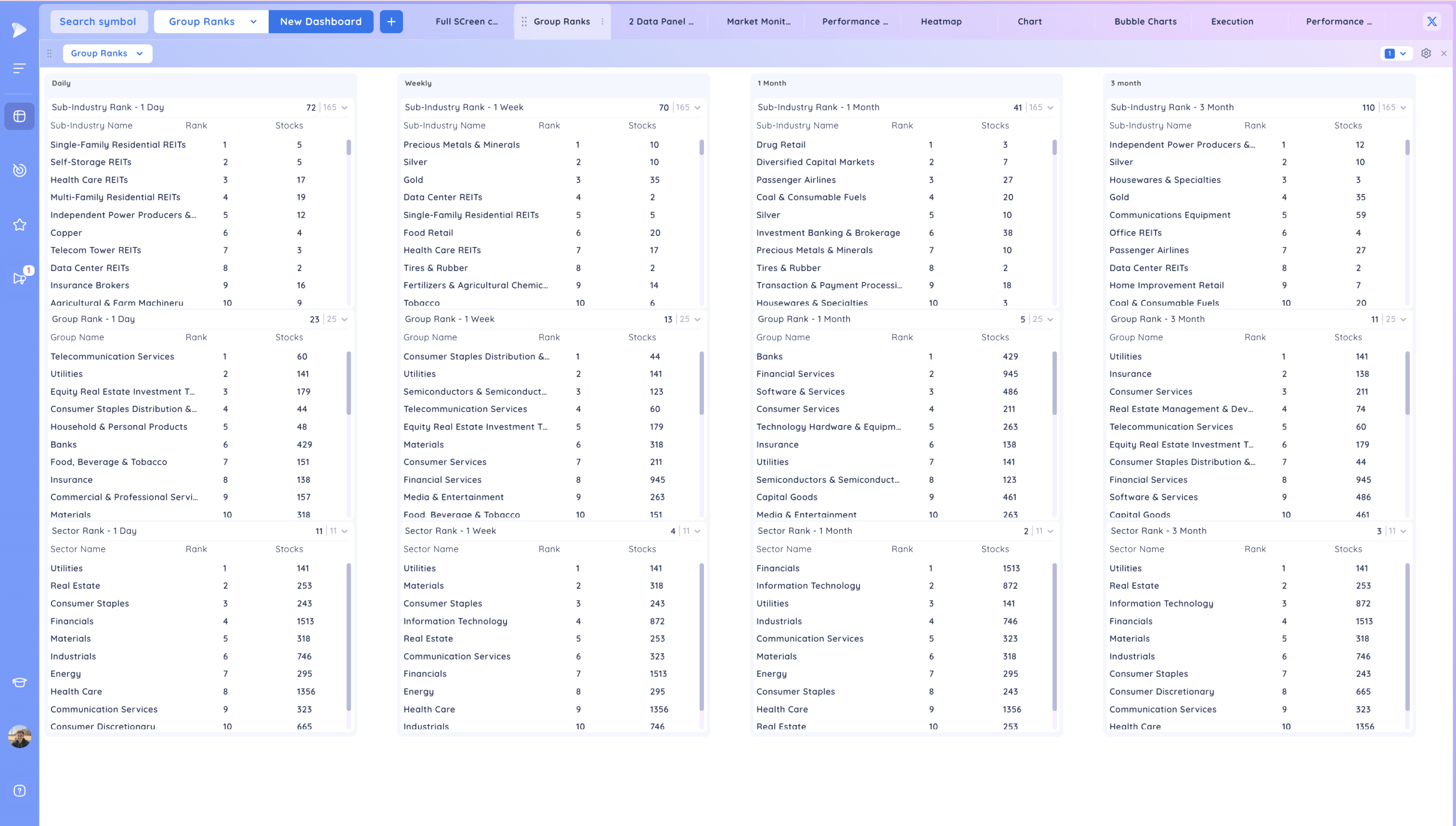

Group Ranks: 1 Day, 1 Week, 1 Month, 3 Month from left to right

Key Stocks in Deepvue

NVDA pullback to the 10ema

META negative downside reversal

AAPL also reversing momentum

TSLA strong action in post post market on earnings. Up near 240. See if that can boost the market a bit

LLY undercutting the oops reversal low, no follow through. Decent close

RDDT fade from highs. Still like the overall pattern

ALAB showing strength. Today note closing ranges and where stocks are compared to their MAs

TSM like the action. See if we can continue to U turn if market holds

ASTS breaking below the tight area it had been forming

CEG like how this is acting, 3 day slight pullback into the 21ema area

VST similar – feels like an area where we would want to see support

SMR pullback to the base pivot

WVE tight, upside reversal

COIN negative bar, undercutting the recent 2 days

MSTR – the 10ema remains key

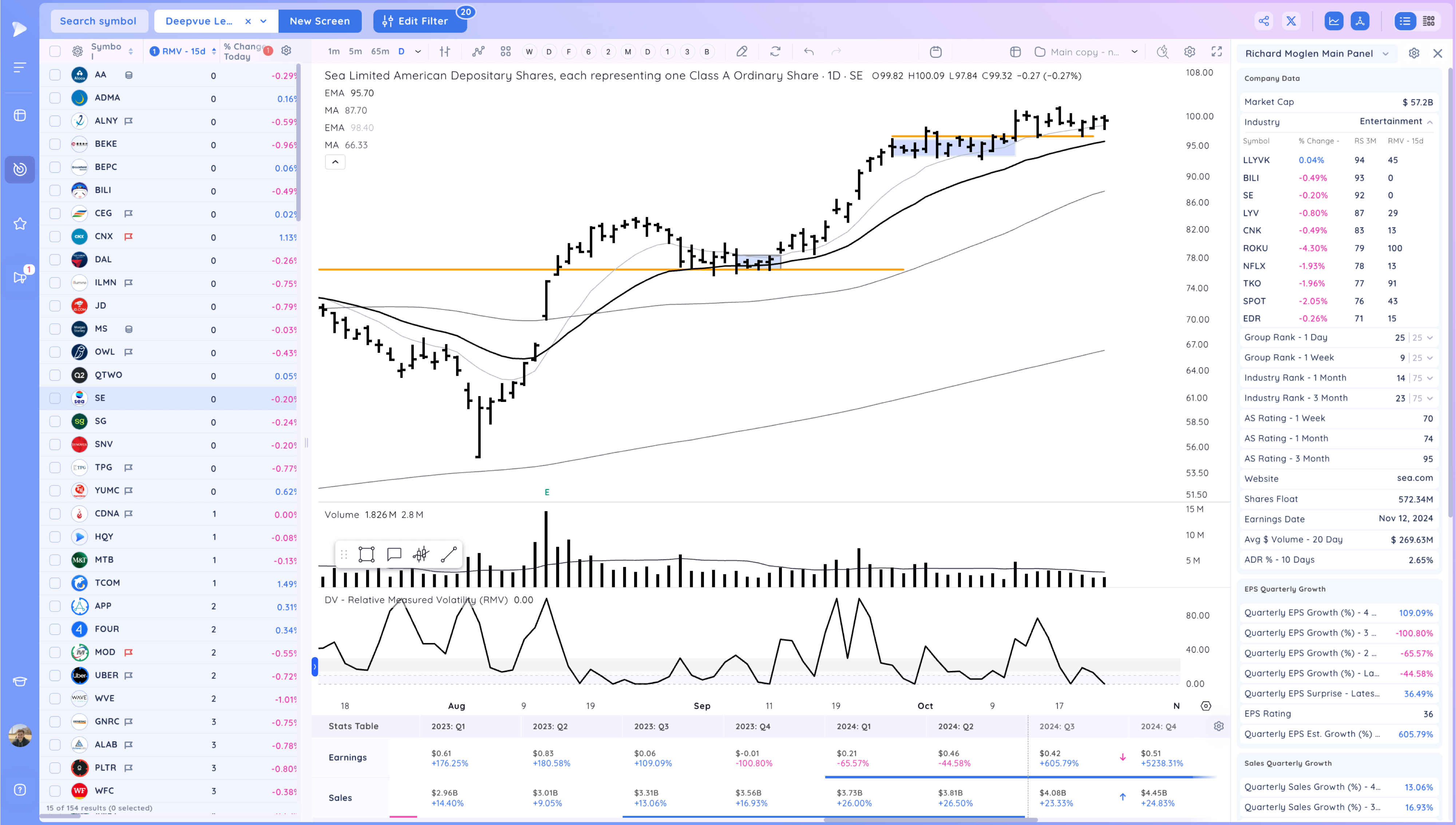

SE holding tight

SG ipo consolidating near new highs

UBER tight action since the gap down

COHR first 21ema pullback

HOOD 10ema pullback

DUOL got the 21ema shakeout yesterday, now see if we can build and push up

Market Thoughts

Well the big caps were coiled and we resolved to the downside. See how things form into the end of the week.

Day by Day – Managing risk along the way