Semiconductors Gap Then Sell-Off

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

October 6, 2025

Market Action

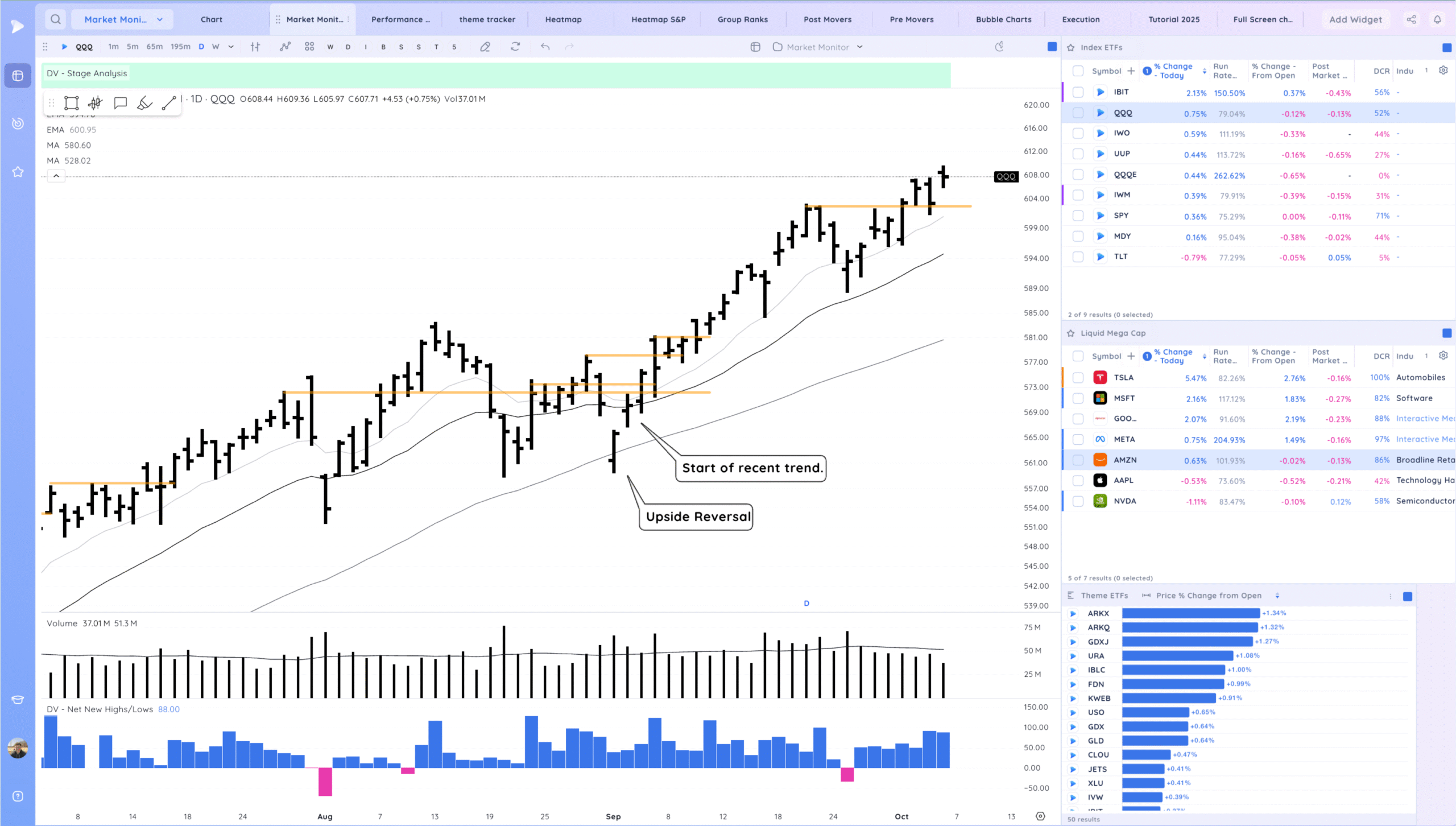

QQQ – Positive expectation breaker as we continue to trend above all the moving averages into new highs. Many semis with gaps today based on Open AI partnership news.

Remember, a strong market is not an excuse to be relaxed about risk management, know your plan for each of your positions how you would handle a large selloff day. Starting to feel like we may get a stress test day soon. Be ready for when it comes.

Bulls want to see a continued trend higher / constructive sideways range building.

Bears want to see a sharp reversal down back towards the 10ema

Daily Chart of the QQQ.

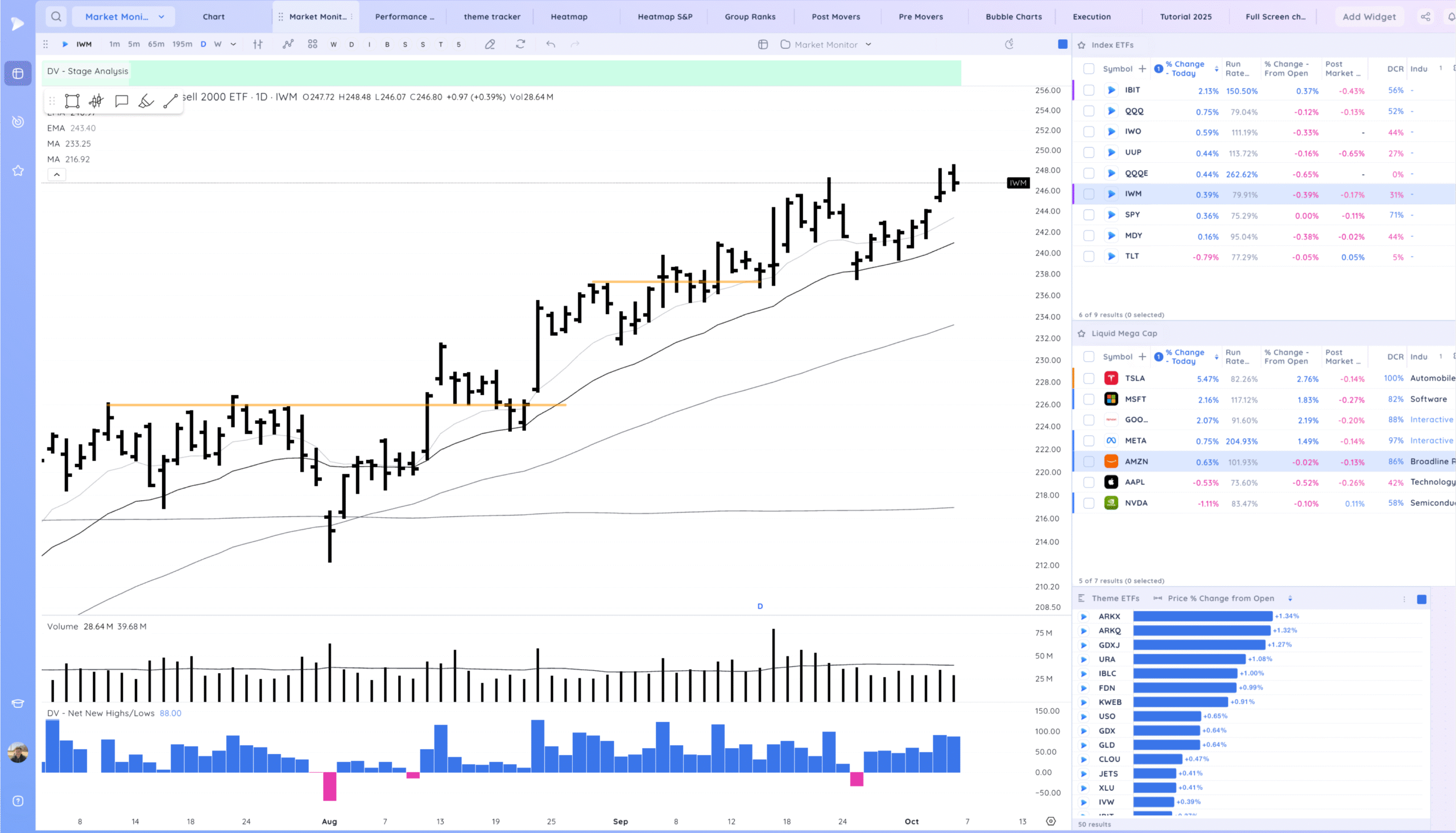

IWM – Trending, slight downside reversal

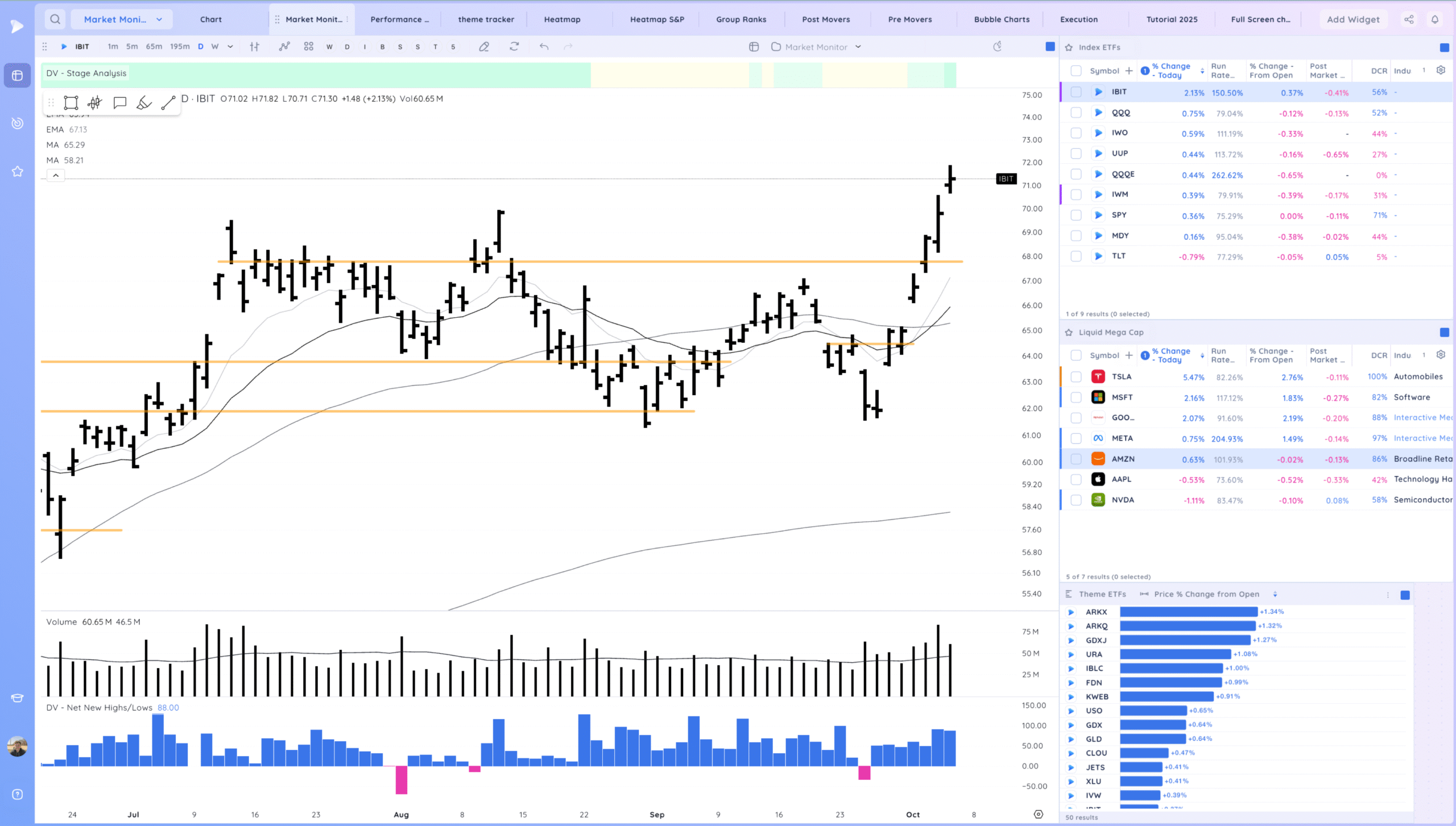

IBIT – Continuing it’s power move higher. keep an eye on names in this theme.

Trends (4/4 Up) – Based on the QQQ

Shortest – 10 Day EMA – Above

Short-term – 21 ema – Above

Intermediate term – 50 sma – Above Rising

Longterm – 200 sma – Up – Above Rising

Groups/Sectors

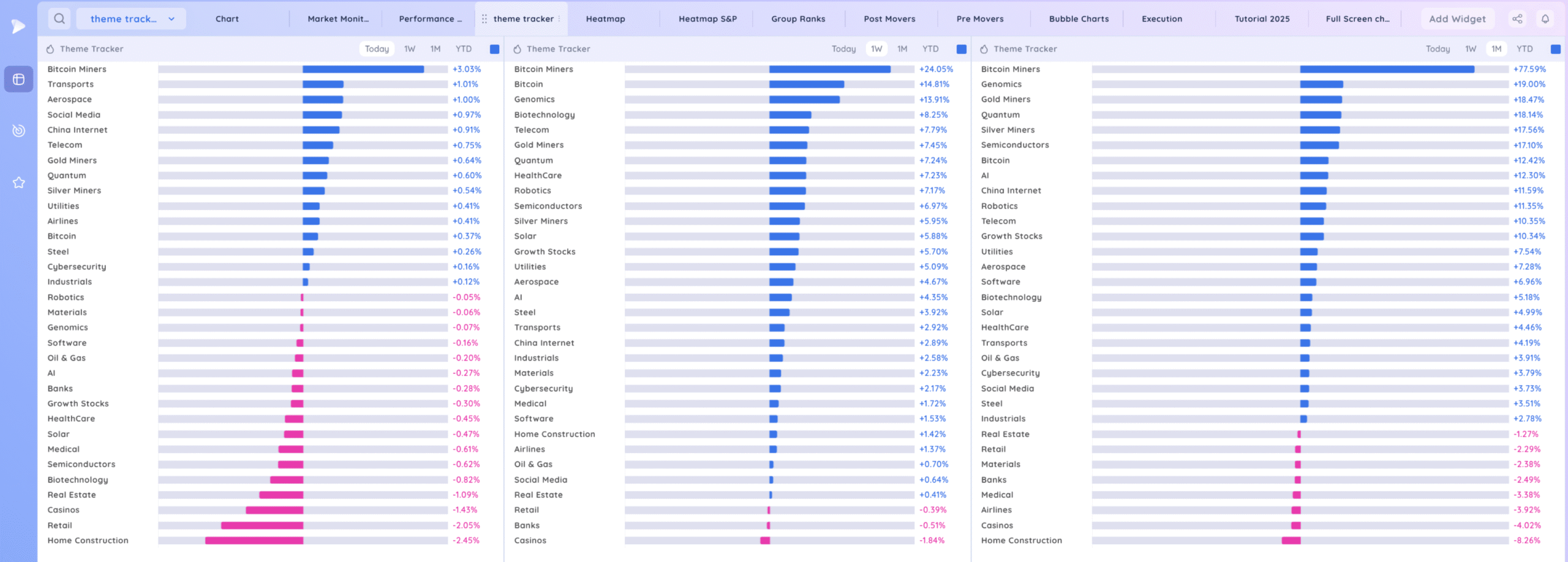

Deepvue Theme Tracker

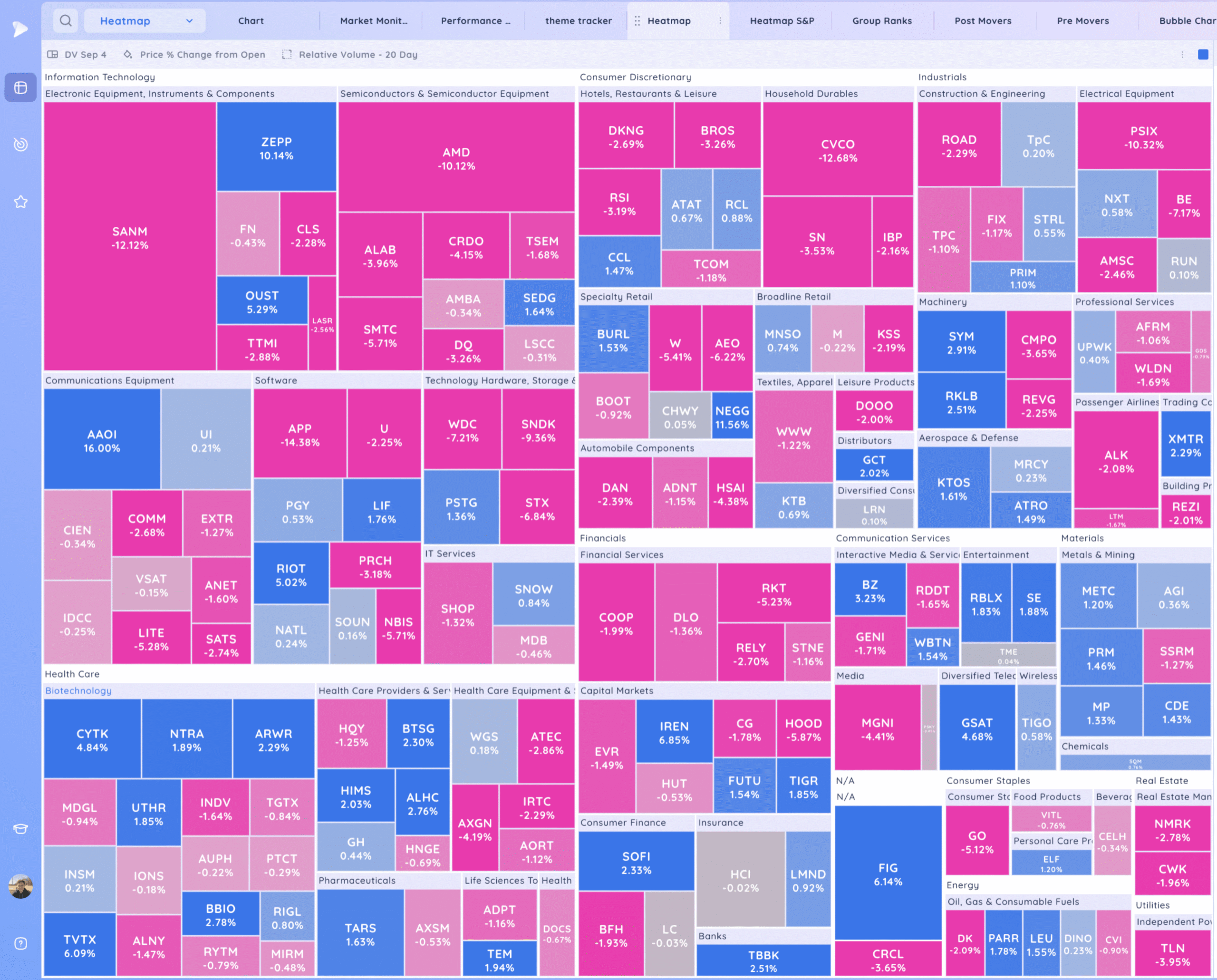

Deepvue Leaders

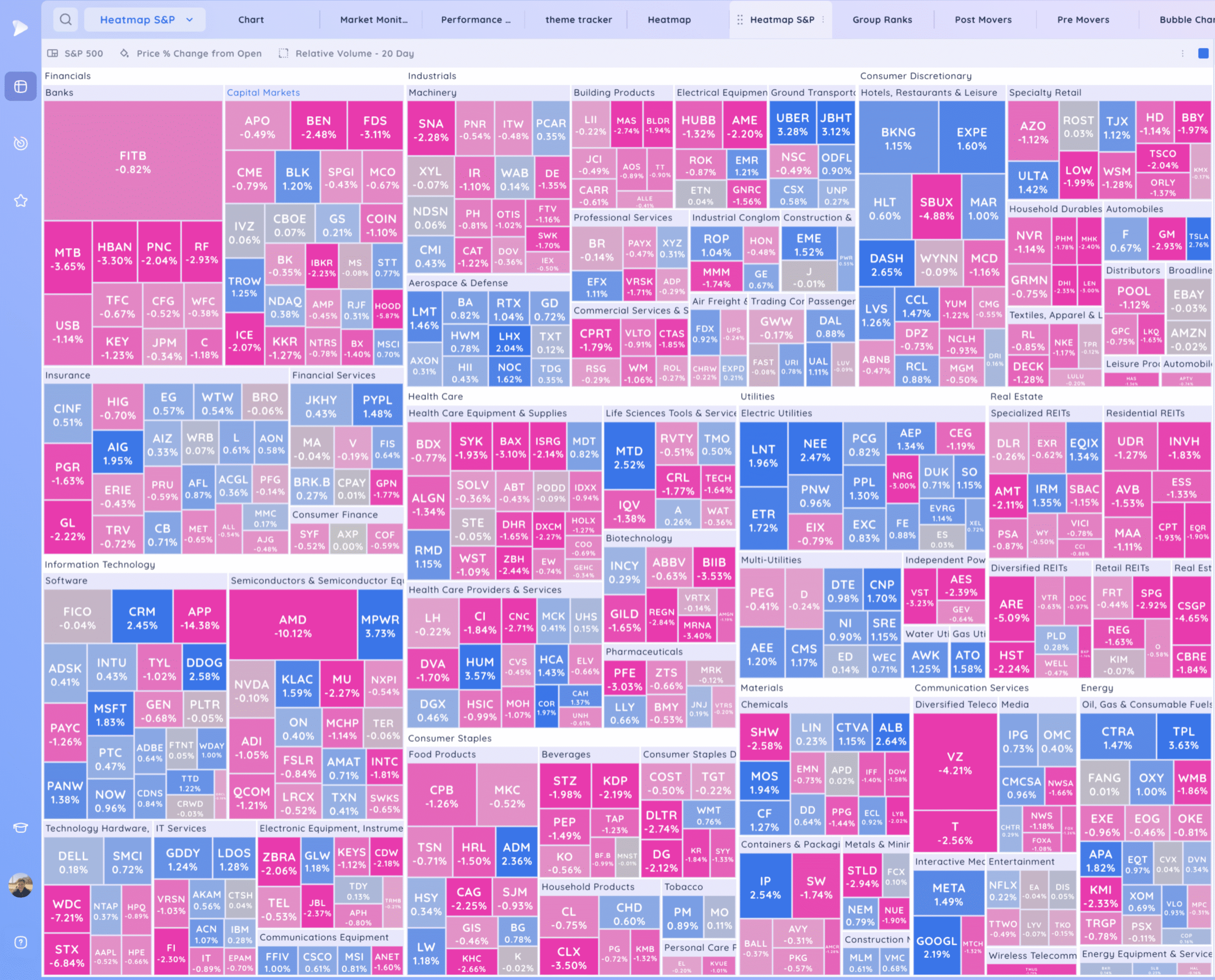

S&P 500.

Leadership Stocks & Analysis

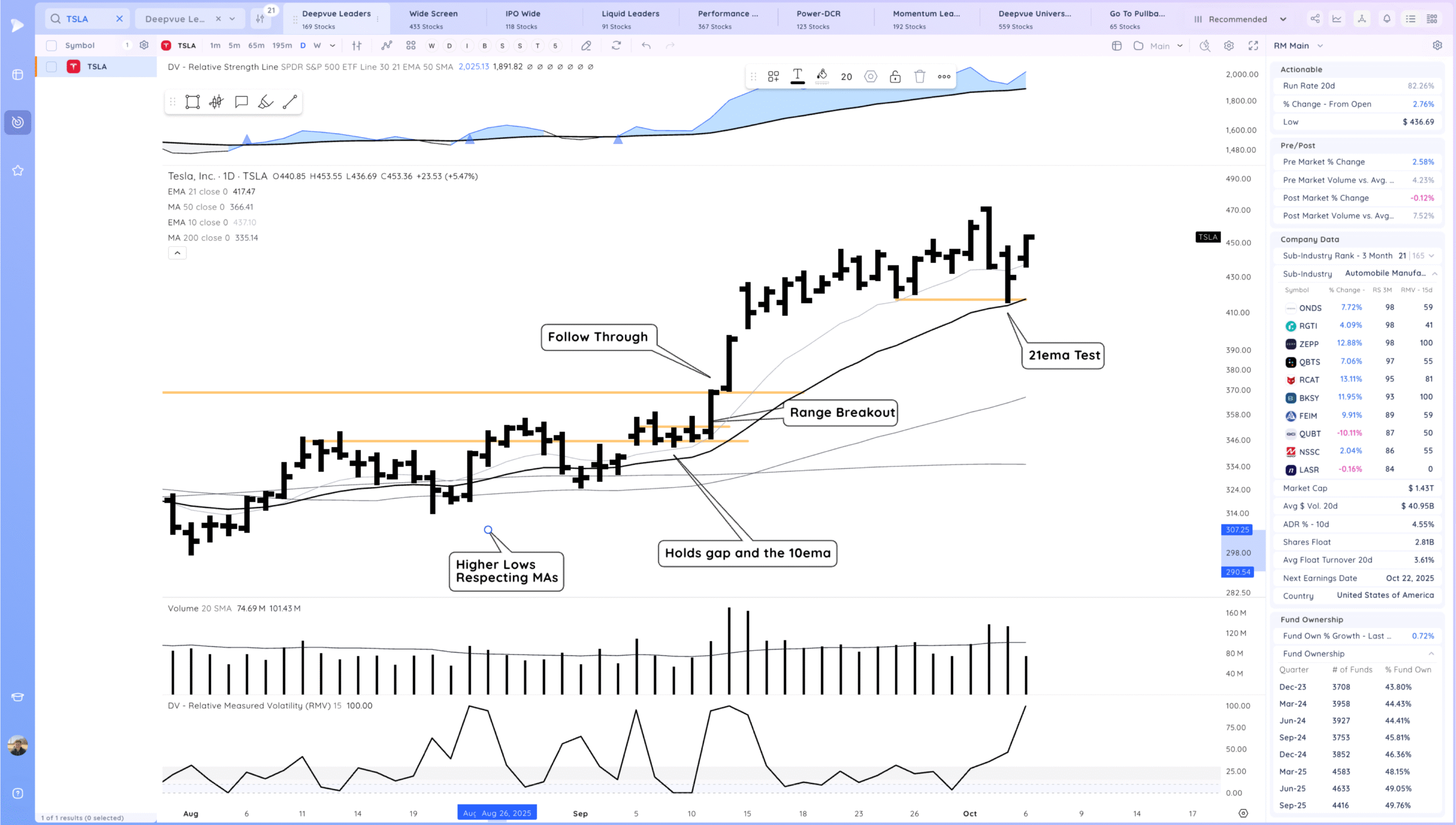

TSLA – Nice follow through up with a strong close. Ideally contracts and forms a price shelf here

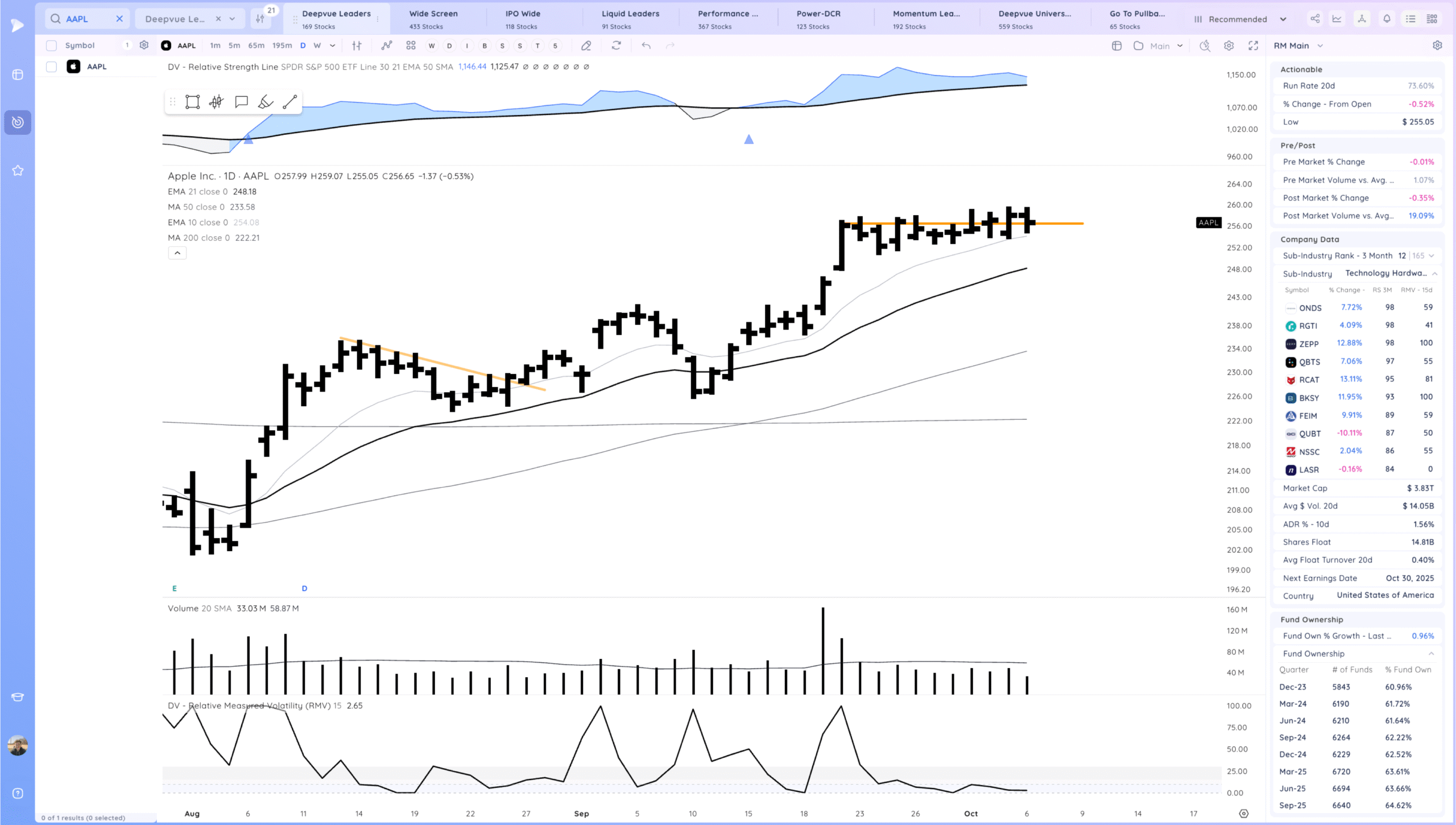

AAPL still forming this flag, watching for a breakout through recent highs

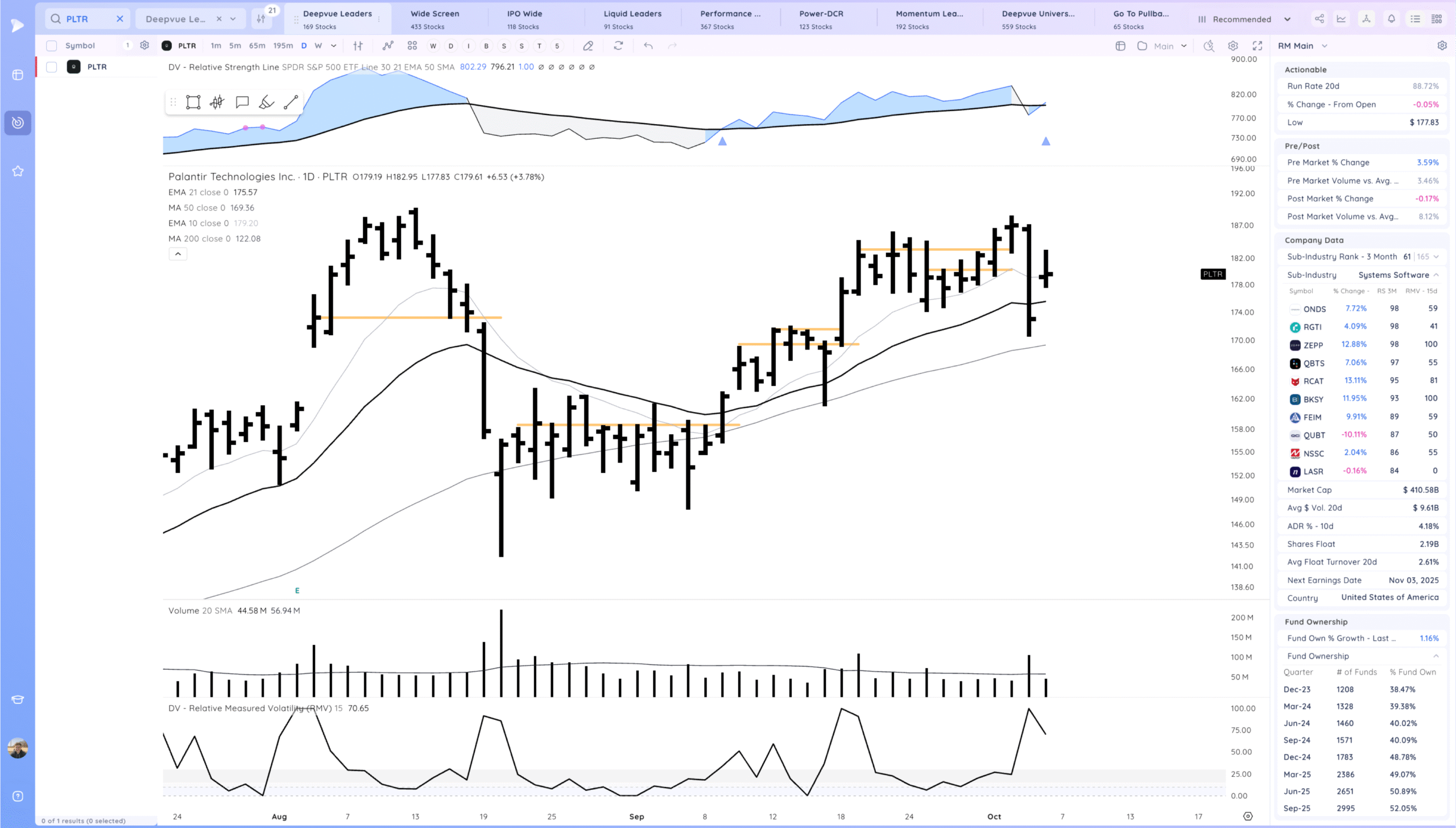

PLTR Positive expectation breaker although it closed off highs. on guard for more weakness.

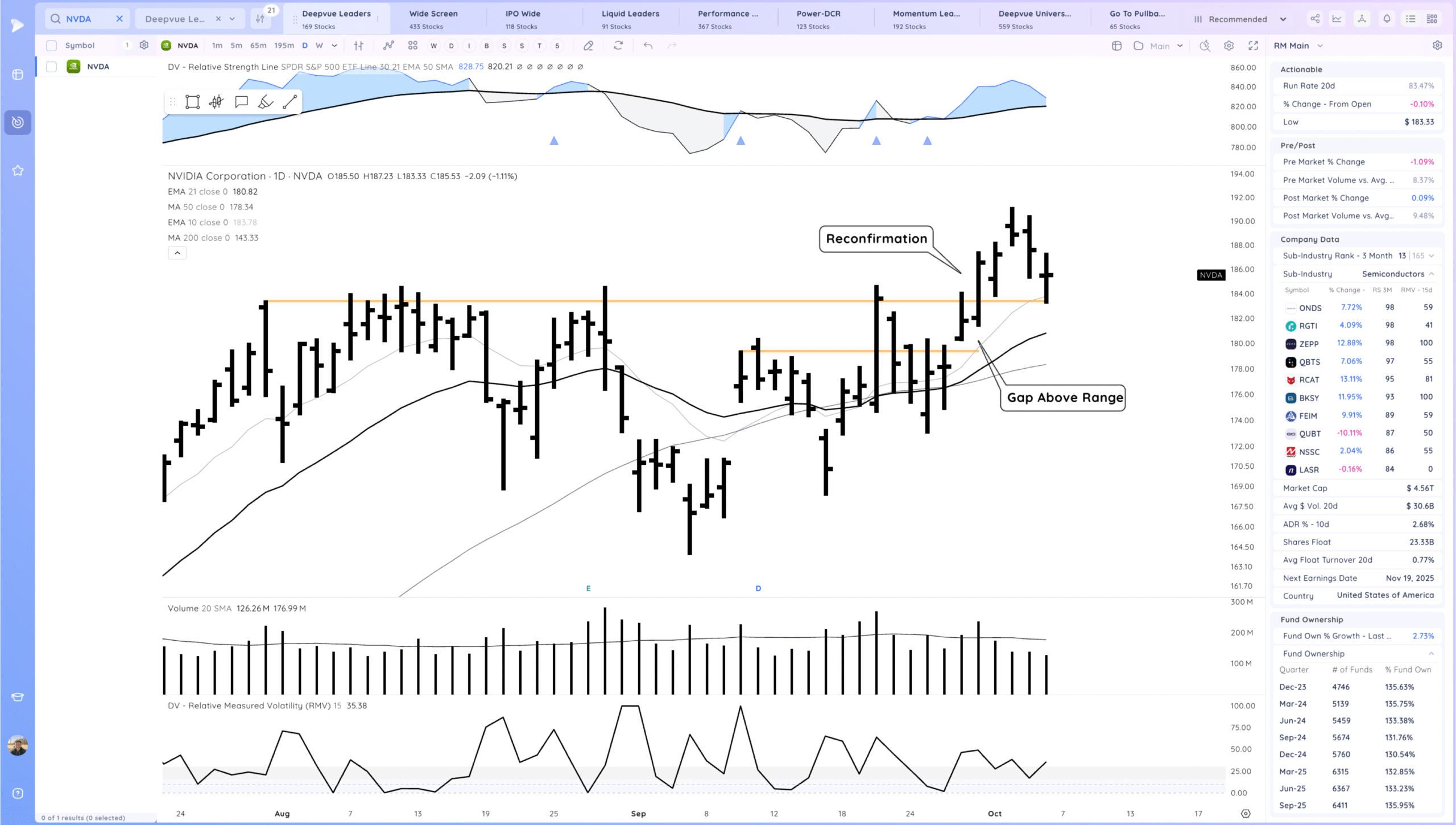

NVDA Pulled into the base pivot in the morning but decent close. Upside reversal. Watching for follow through up

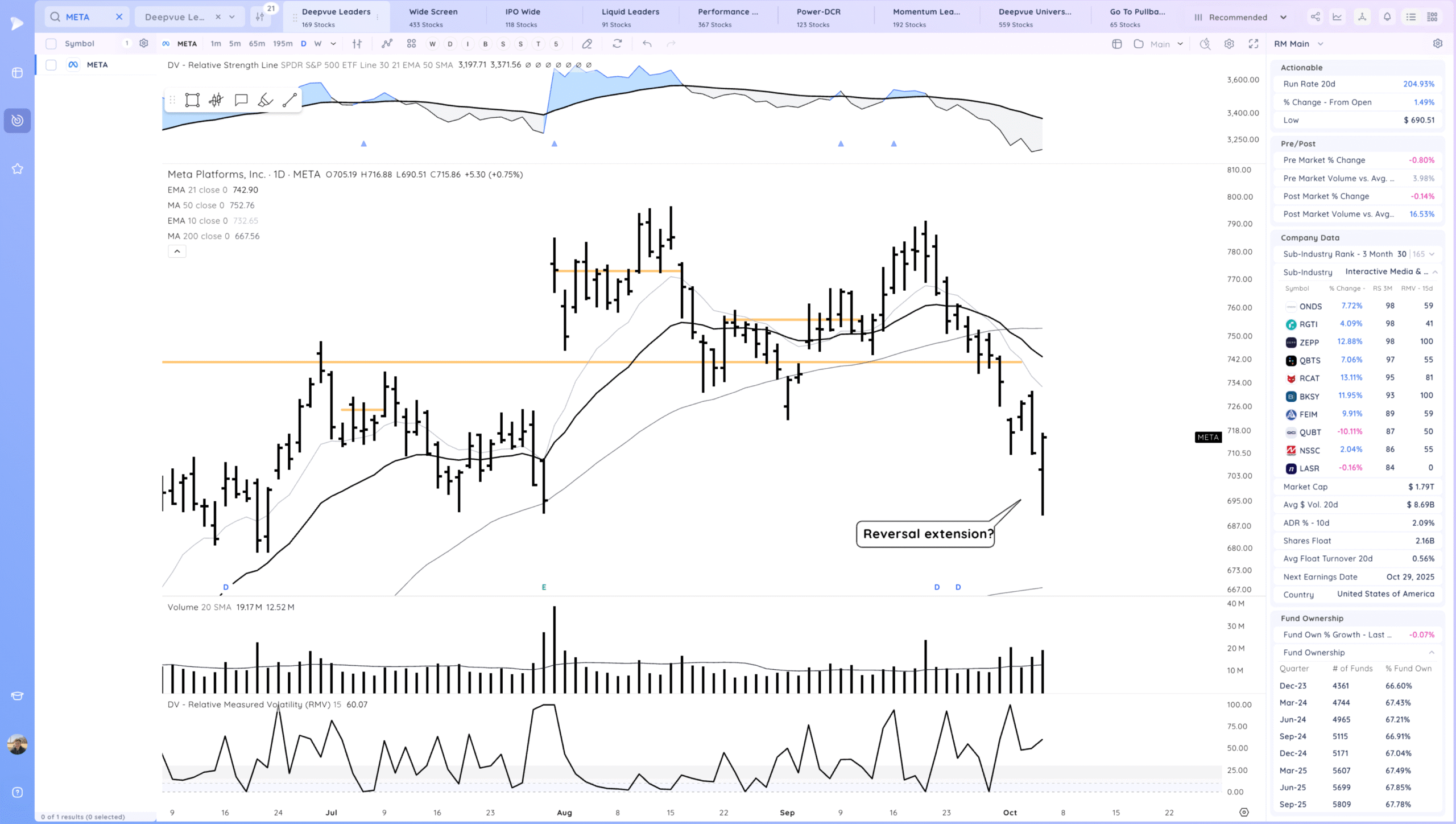

META potential reversal extension. watching for the right side of a base to form

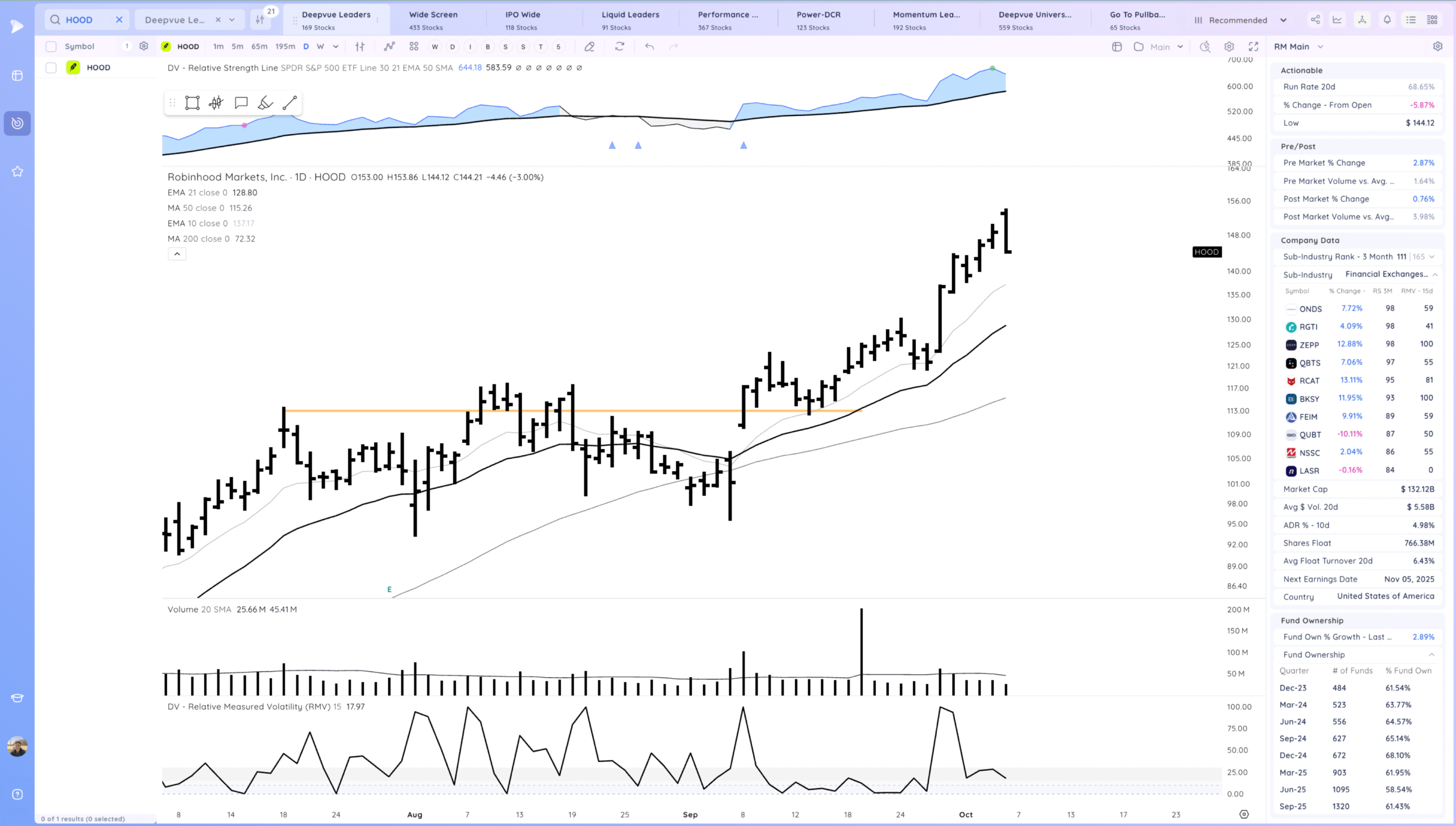

HOOD downside reversal. Trending above MAs. watch for a 10ema pullback

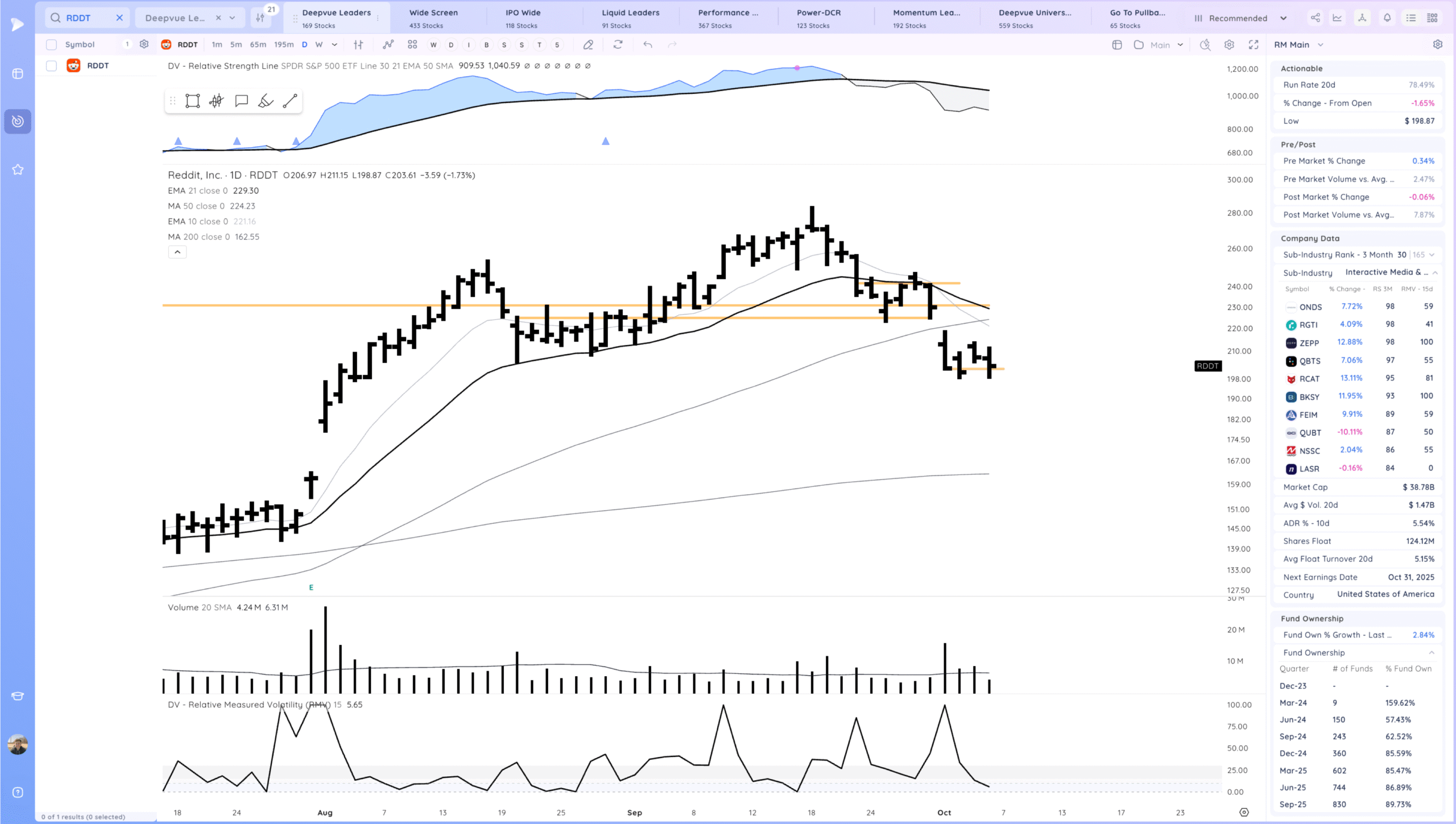

RDDT forming a range down here. Bulls want to see a gap up and good close near the 50sma

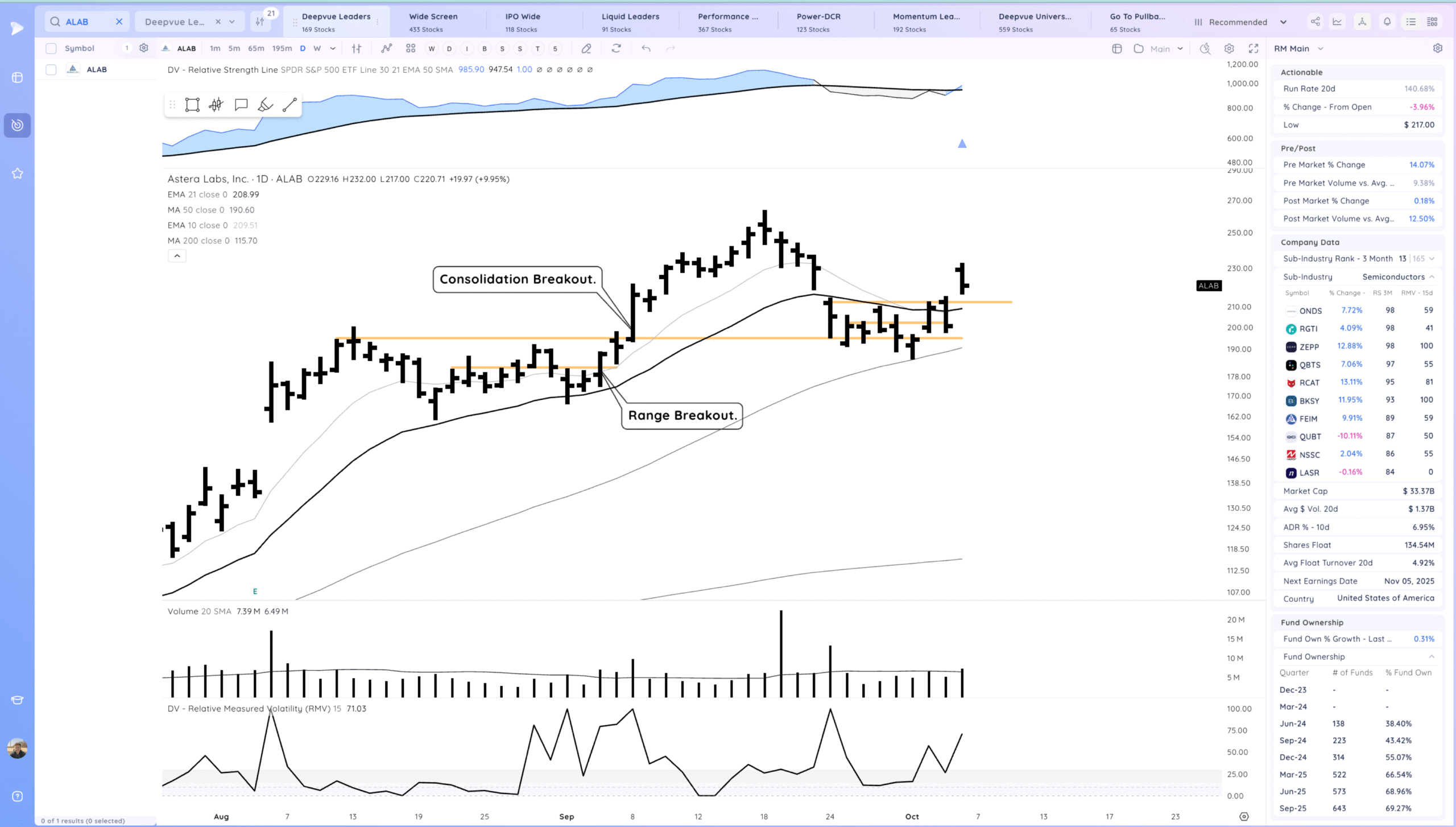

ALAB gap up with semis but meh close. ideally tightens and forms a pivot

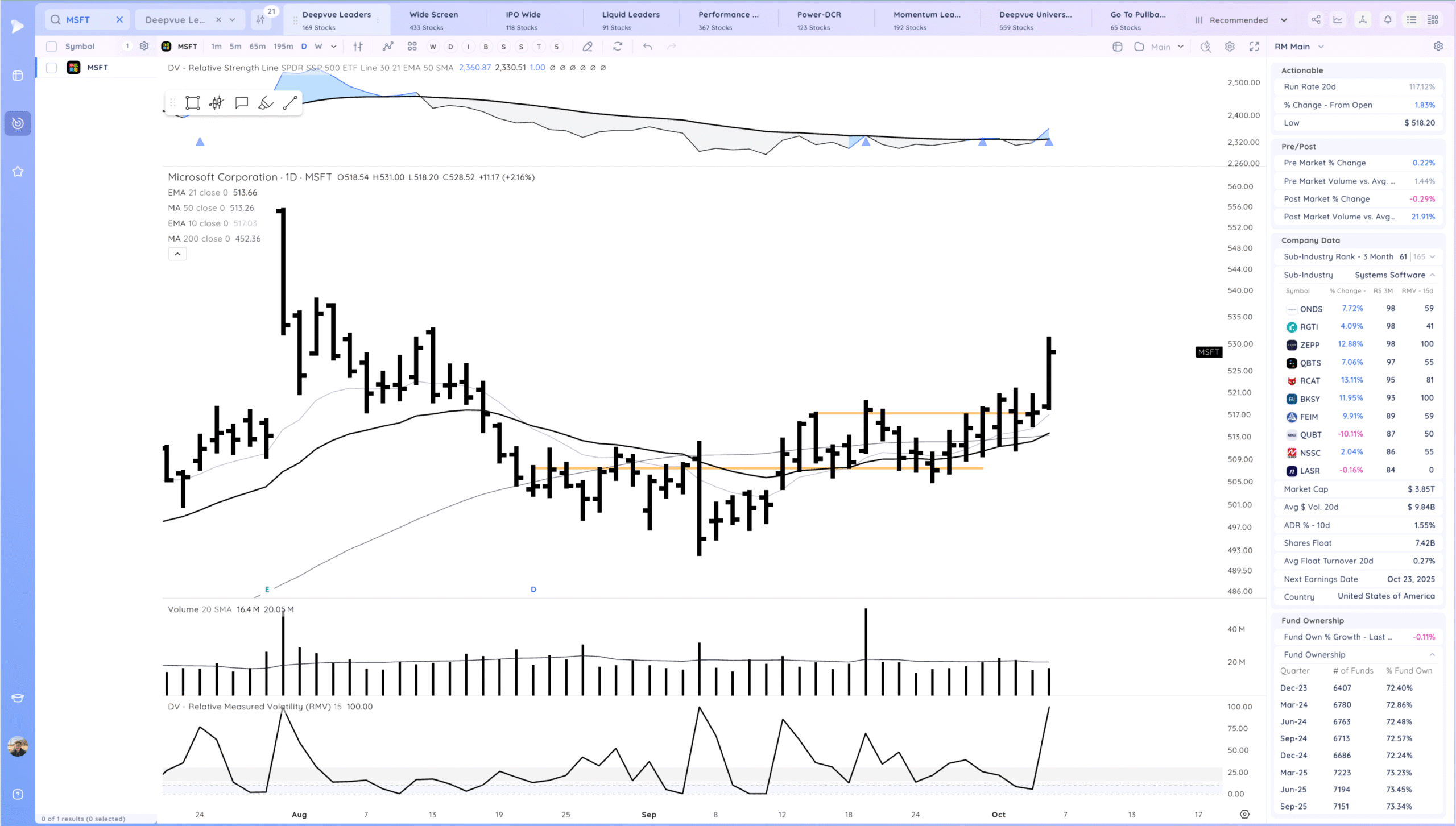

MSFT Range breakout. Inside day primed this

Key Moves

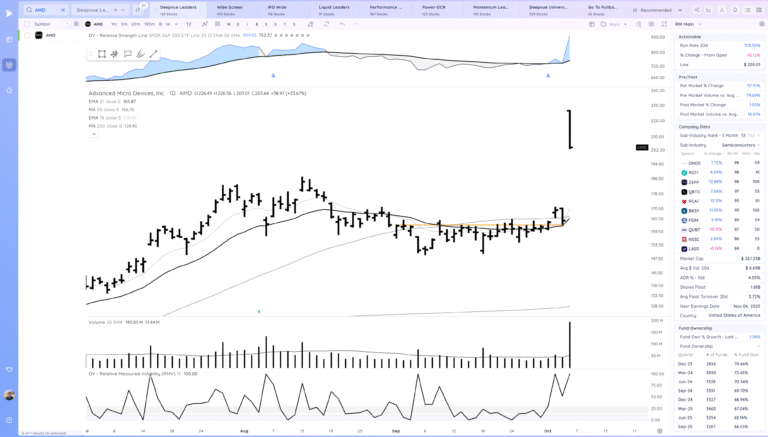

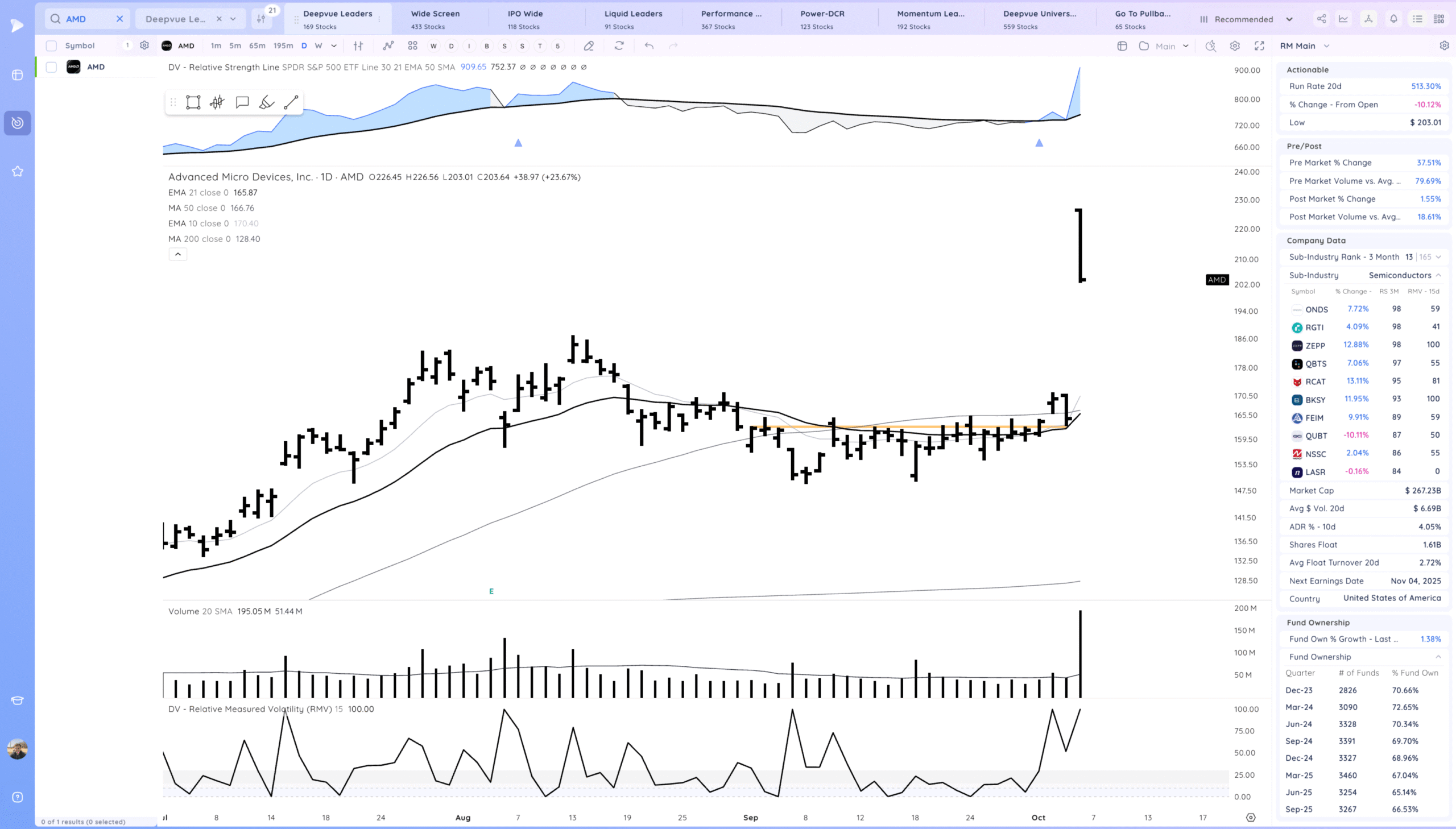

AMD large gap but sold off the open

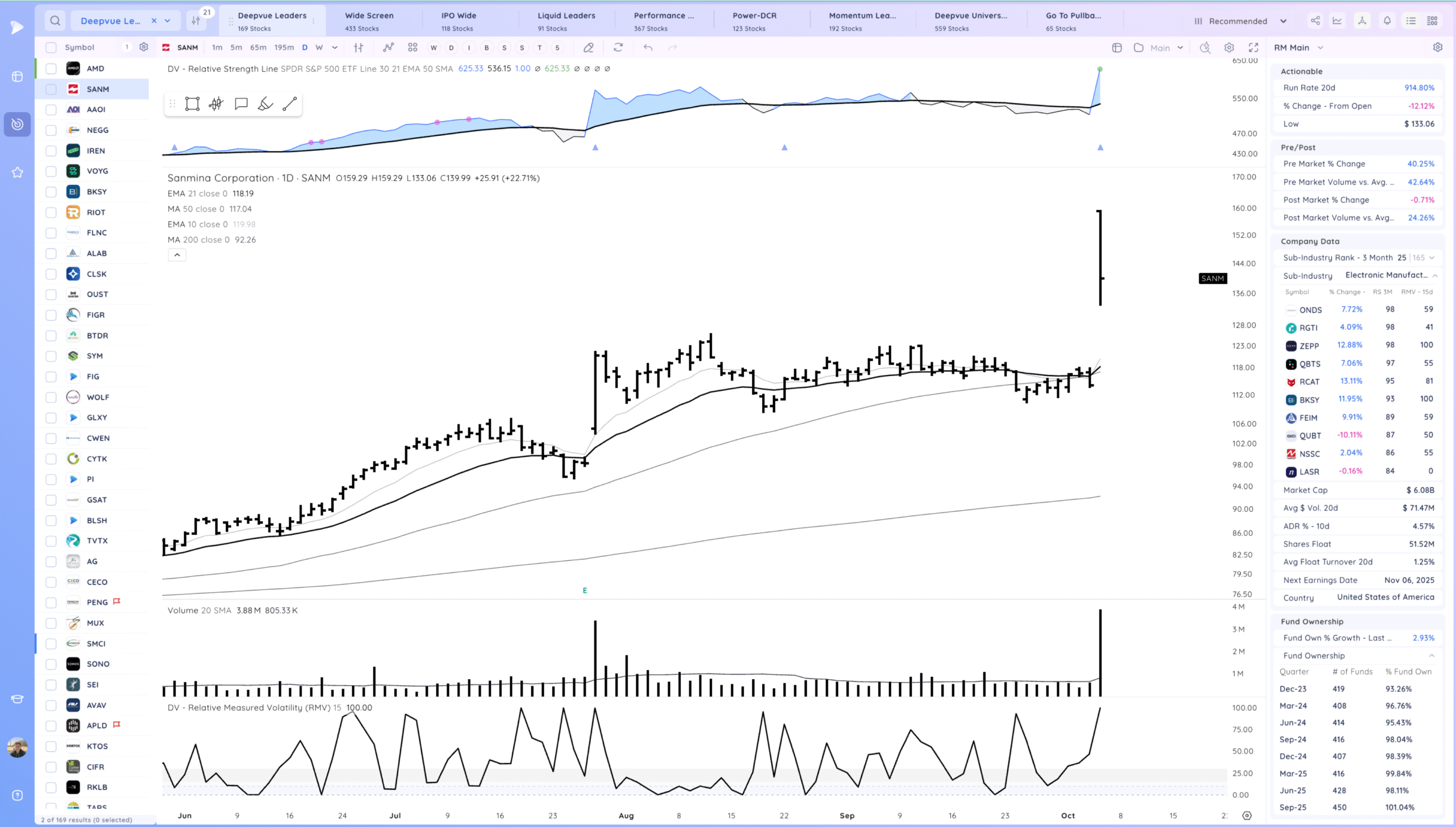

SANM similar

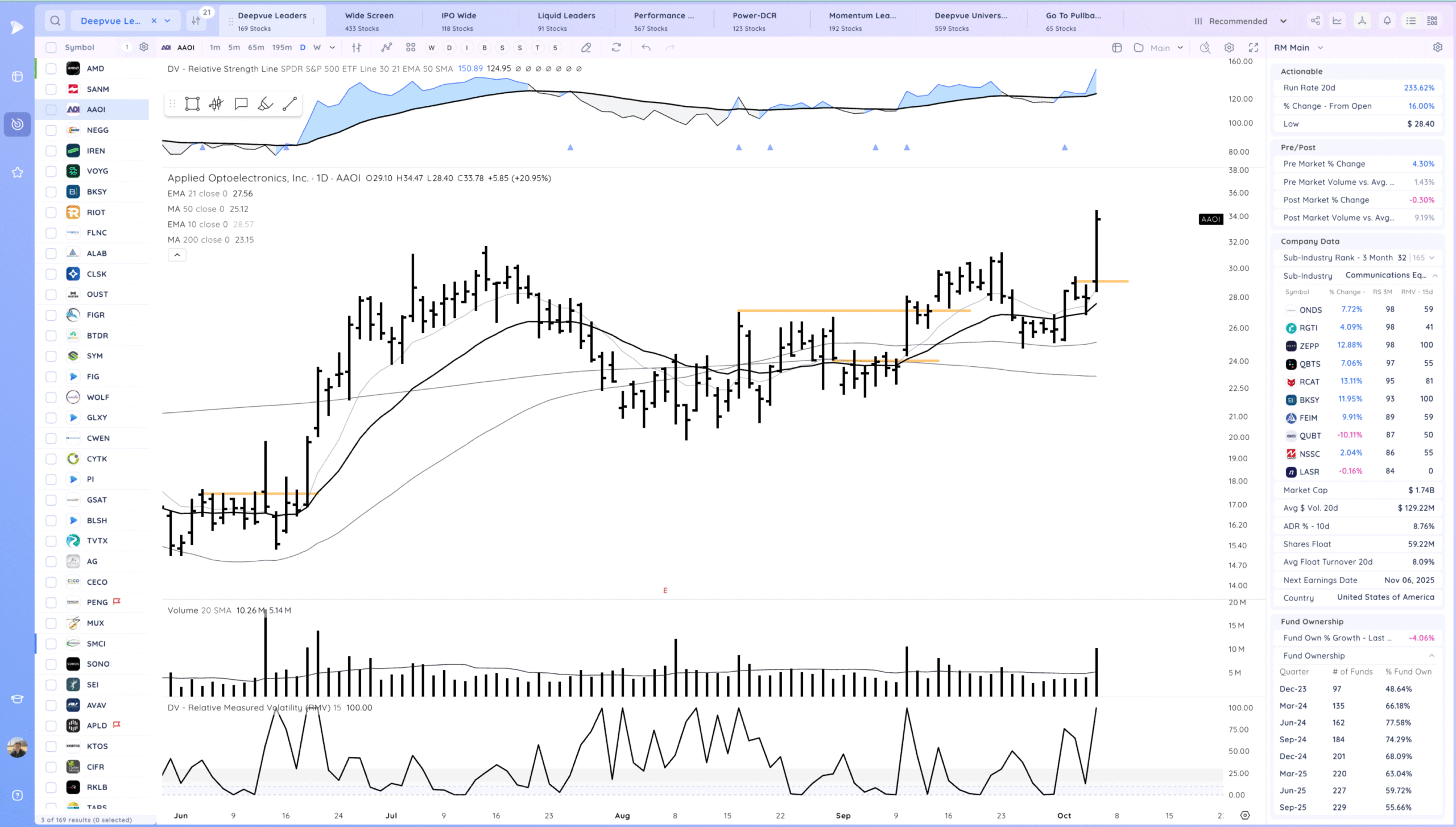

AAOI breakout.

Setups and Watchlist

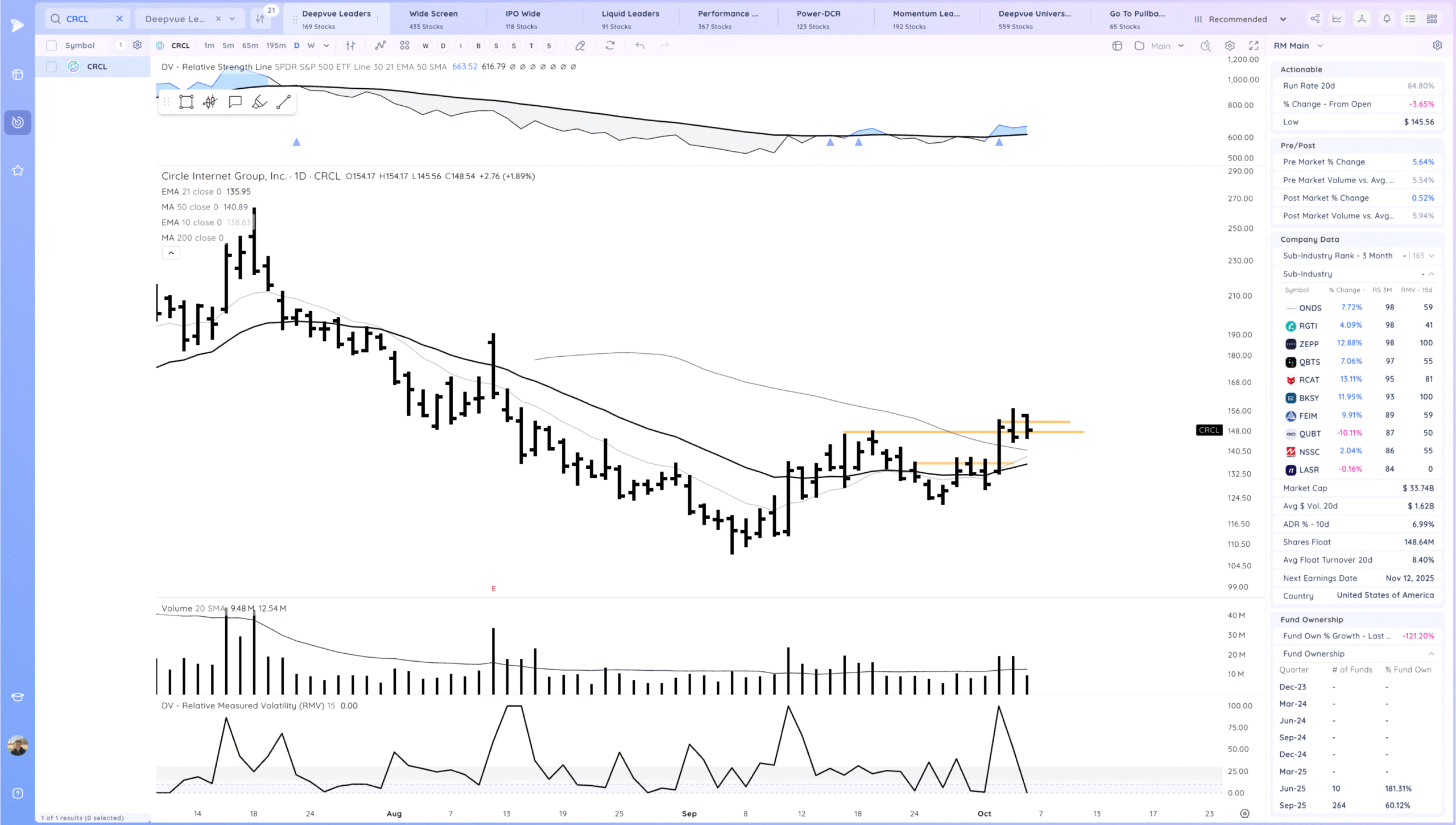

CRCL sitting on the pivot. Watching for a push higher off this level

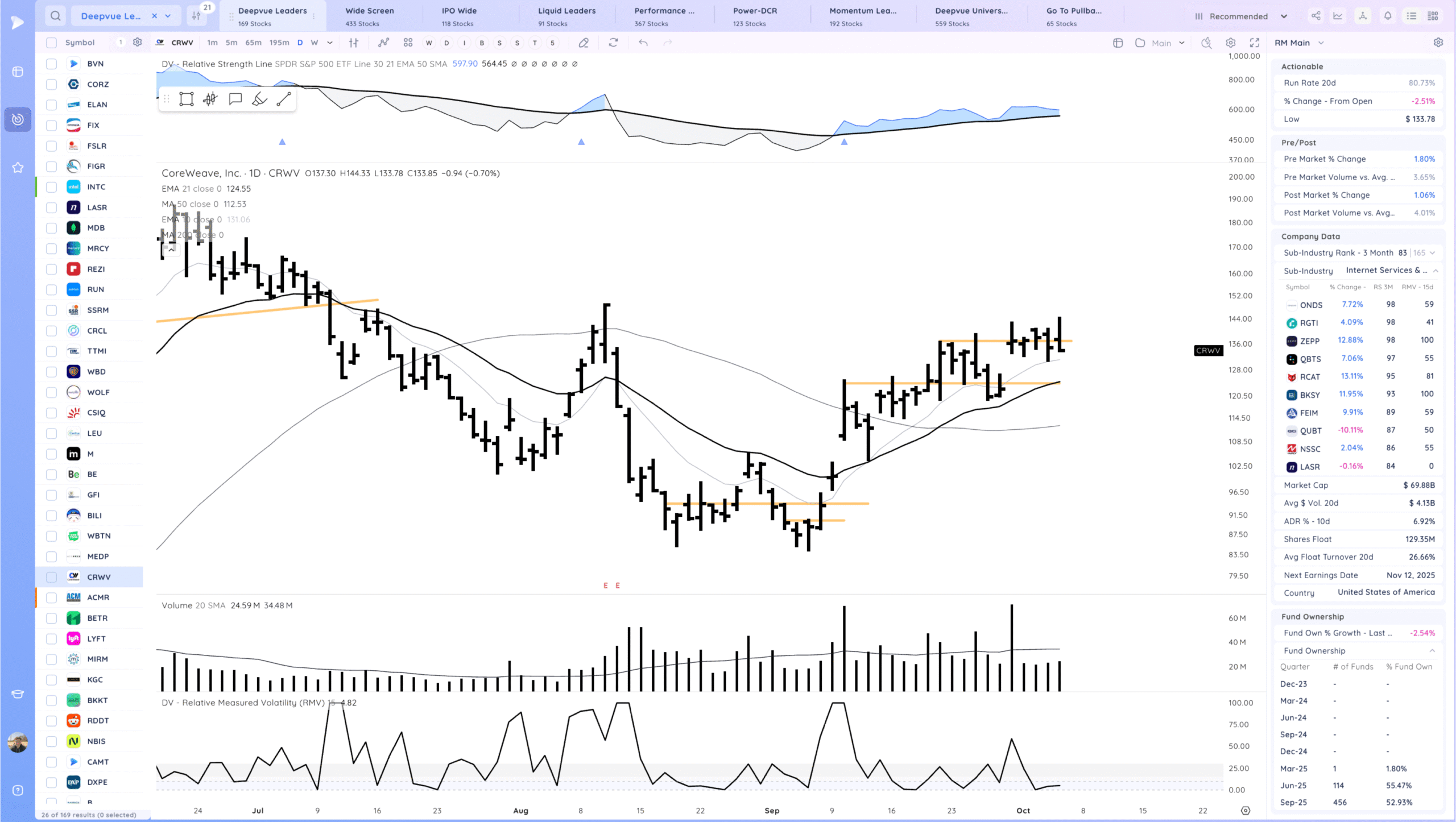

CRWV watching for range re-breakout. Fade today back into the 10ema area

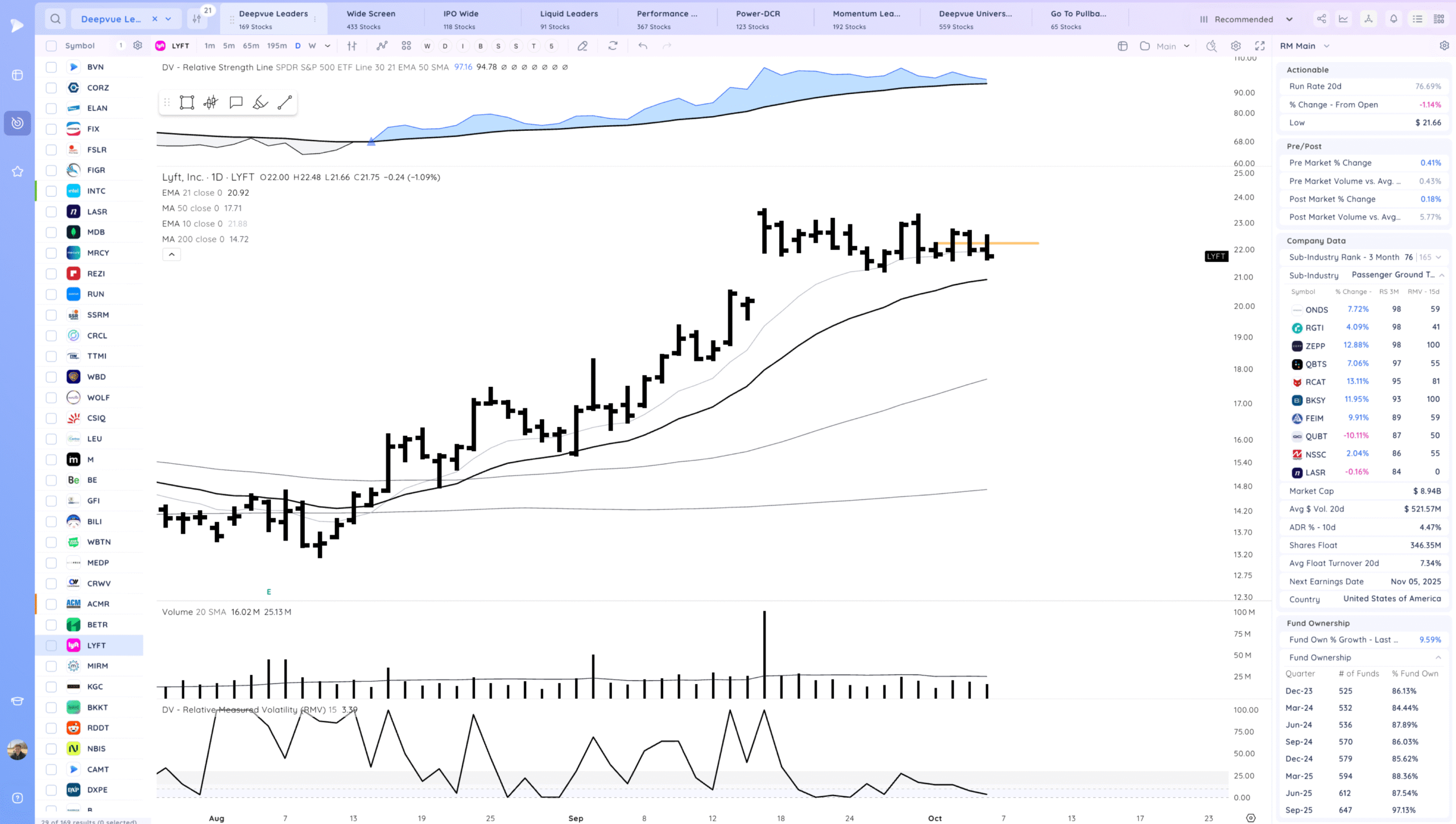

LYFT watching for a range breakout

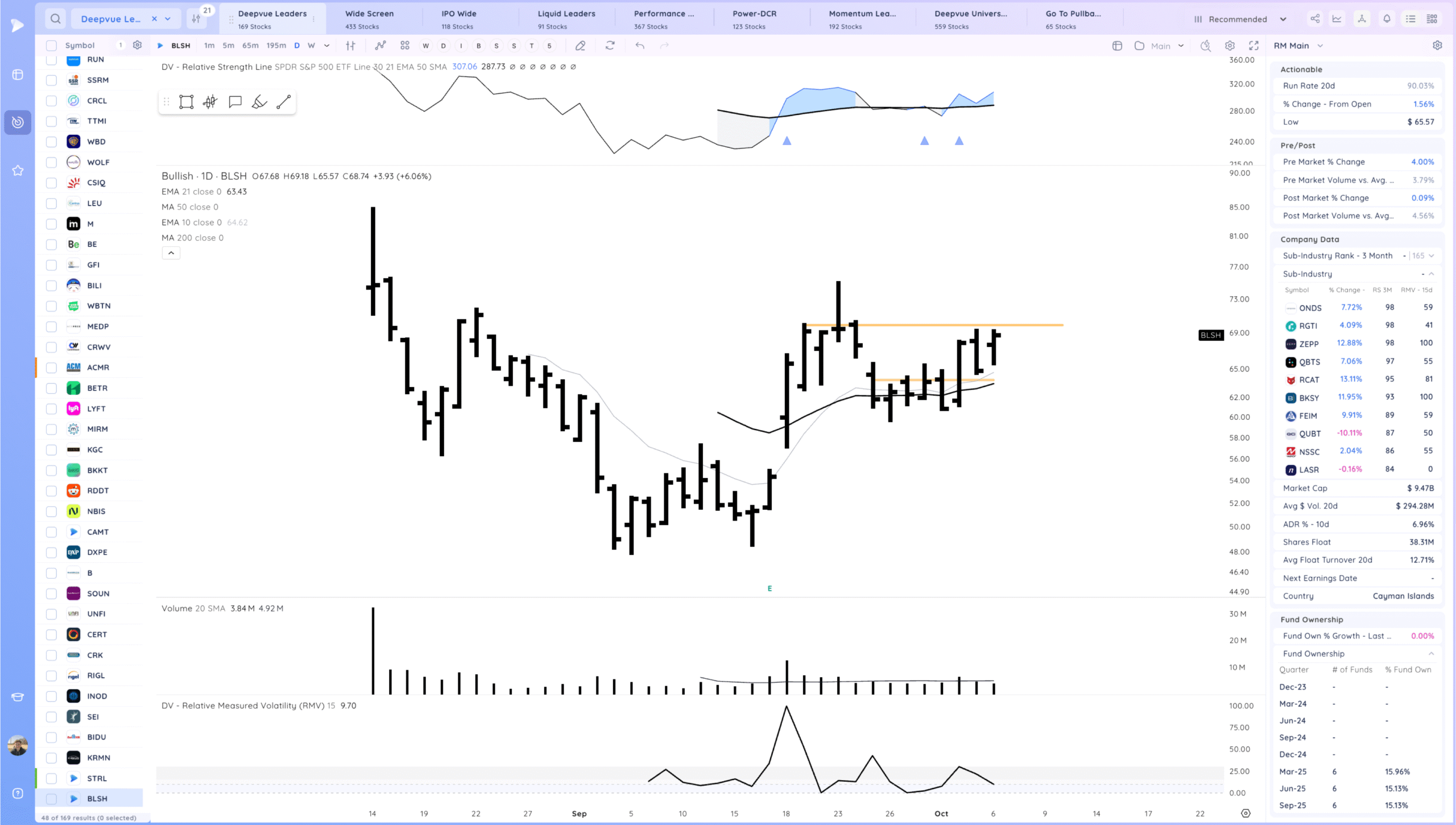

BLSH watching for a range breakout. Inside day. fast name

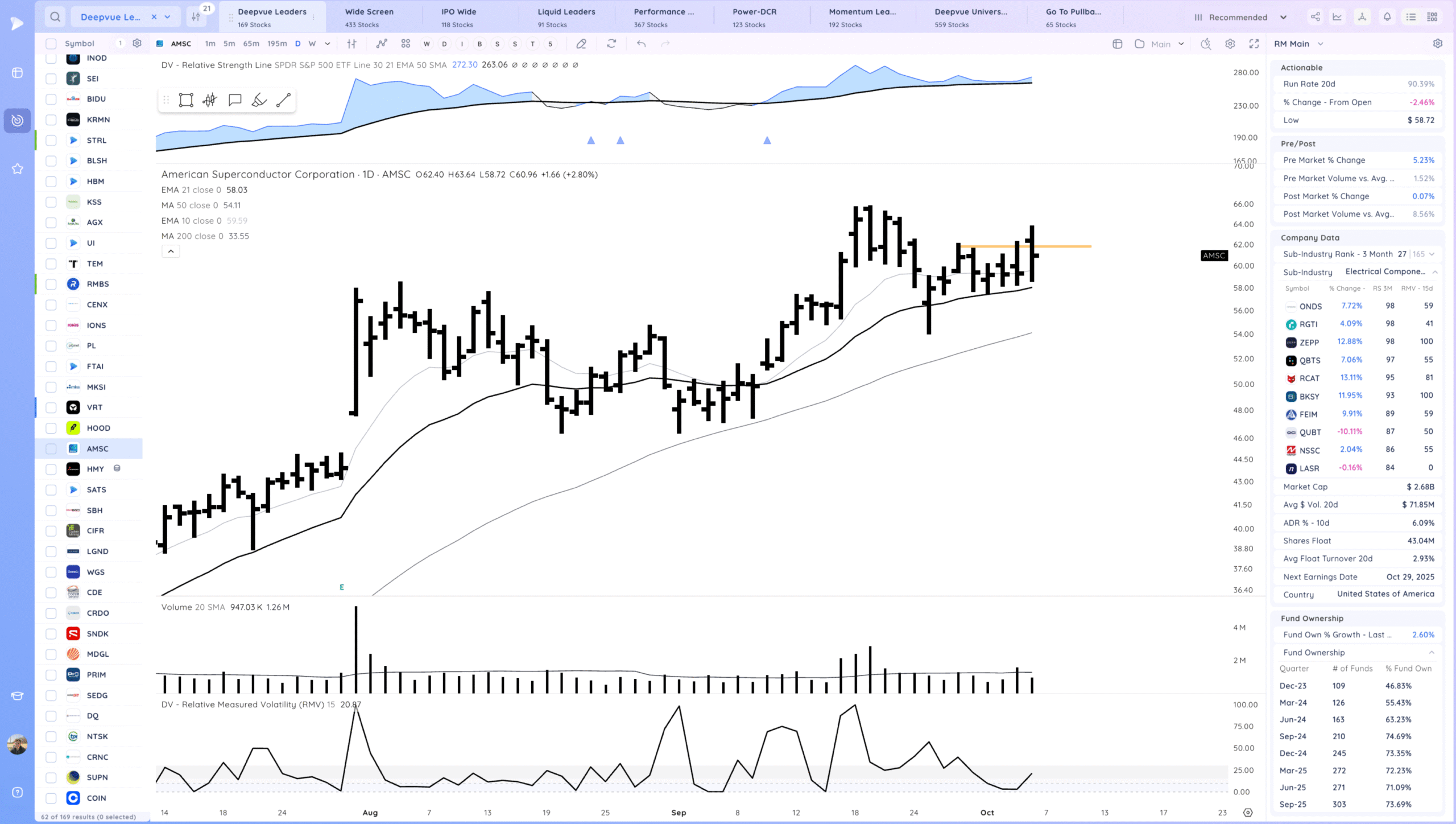

AMSC watching for a range re-breakout

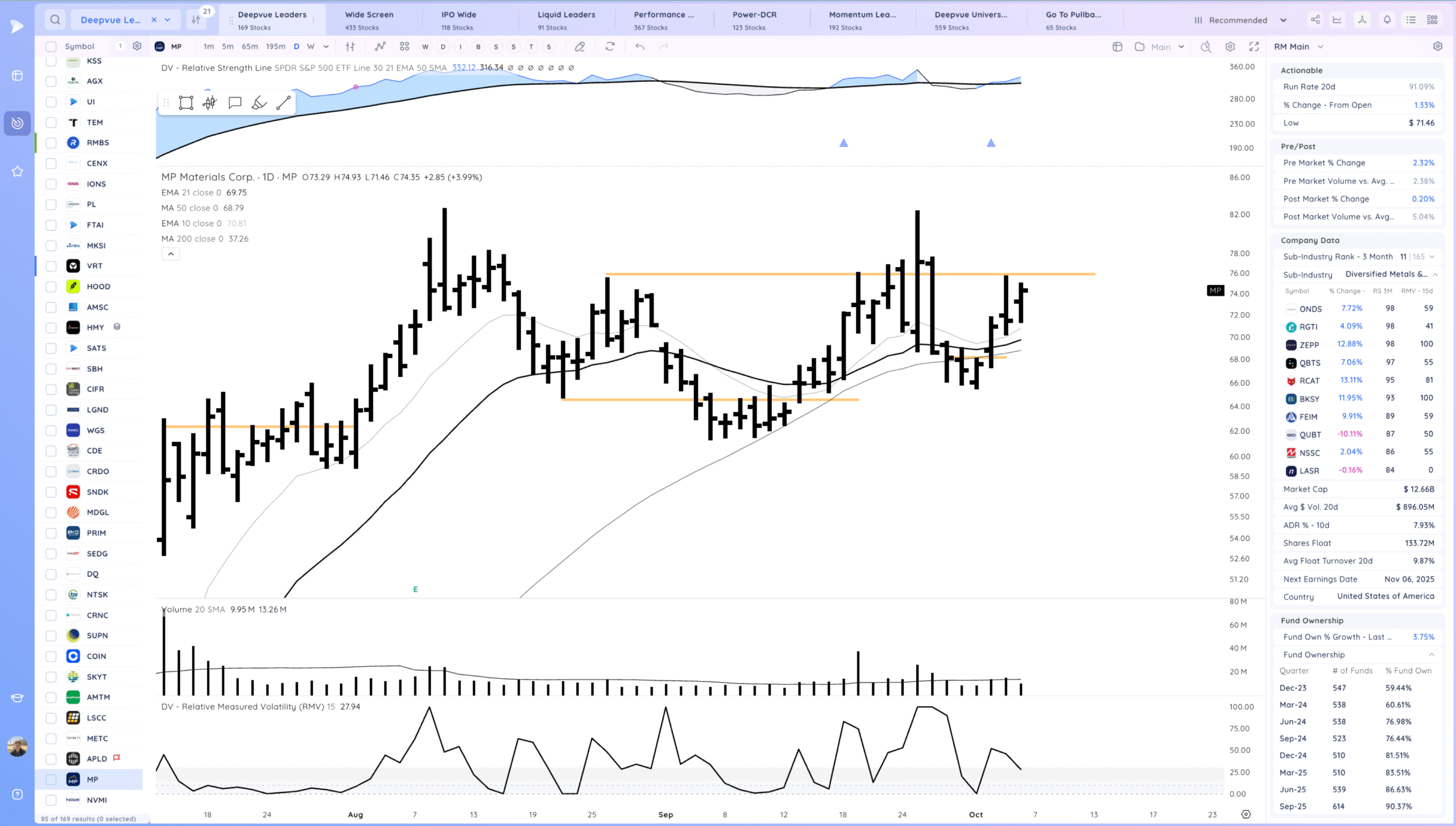

MP ideally tightens further, watching for a breakout

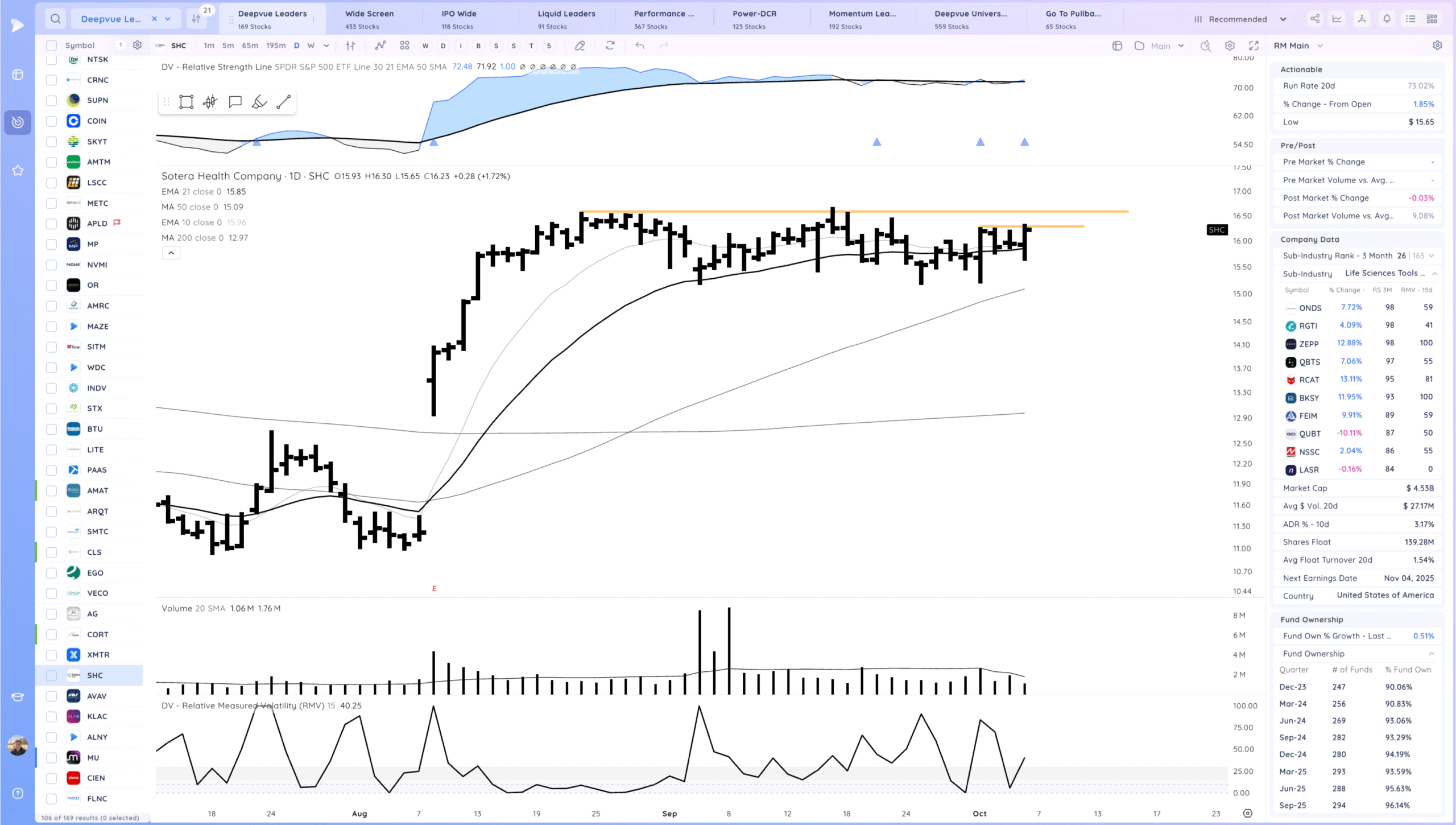

SHC watching for a range breakout.

Today’s Watchlist in List form

Focus List Names

CRCL CRWV LYFT BLSH AMSC MP SHC TSLA NVDA ALAB

Focus:

BLSH CRWV AMSC NVDA

Themes

Strongest Themes: AI, Metals/Miners, Energy, Crypto

Market Thoughts

Good action today although the semiconductor selloffs after the news feels more late cycle to me. I’ll be on guard. At this point are new deals liek that likely to start month long trends or be opportunities for liquidity?

Anything can happen, Day by Day – Managing risk along the way