Reconfirmation Up Through the 50 SMA

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

August 15, 2024

Market Action

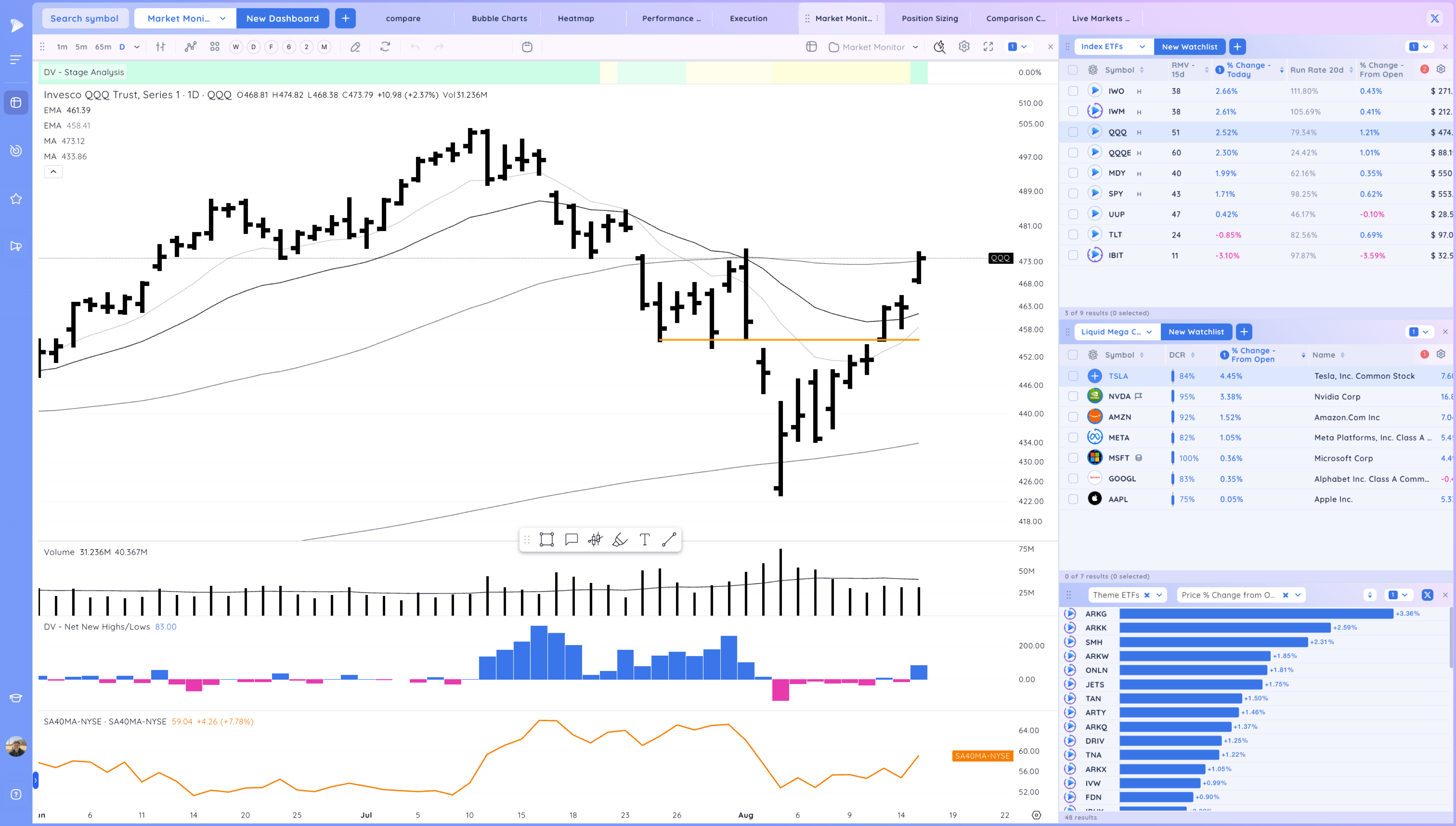

QQQ – Another gap and go and now a push above the 50sma. Strong action

We have pushed very strongly and are a bit “extended” in the very short term. Don’t get caught top heavy.

50sma level lines up with that prior swing high, a logical spot for a pause. Be ready for anything

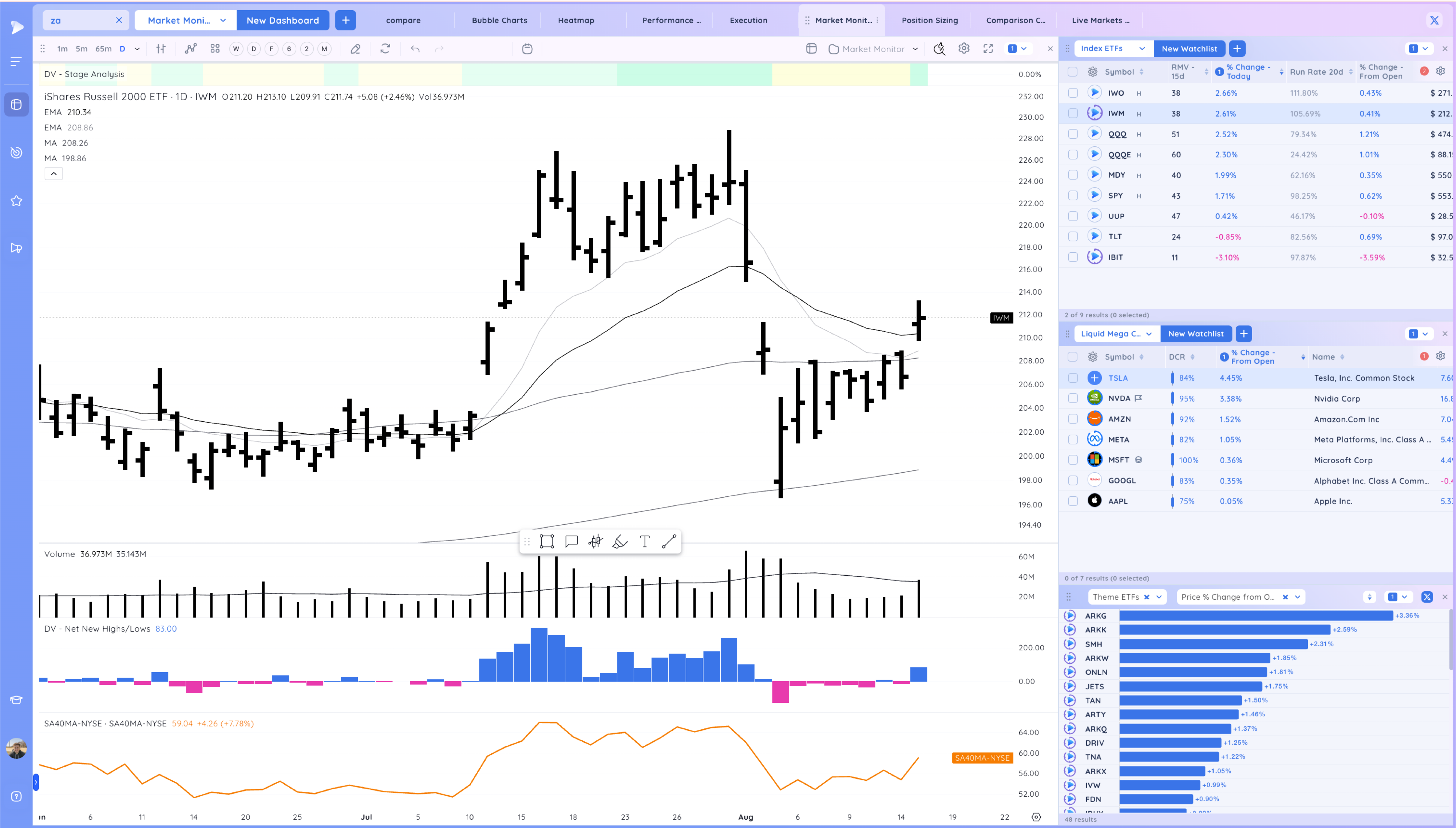

IWM – popping above the 21ema

Market Corrections Case Studies

Most of you have probably already read through these but I will include them daily until we resolve the correction

…

Here are the two case studies of 2018 and 2020 that provide examples of what you can expect form a correction just in case you haven’t seen them yet.

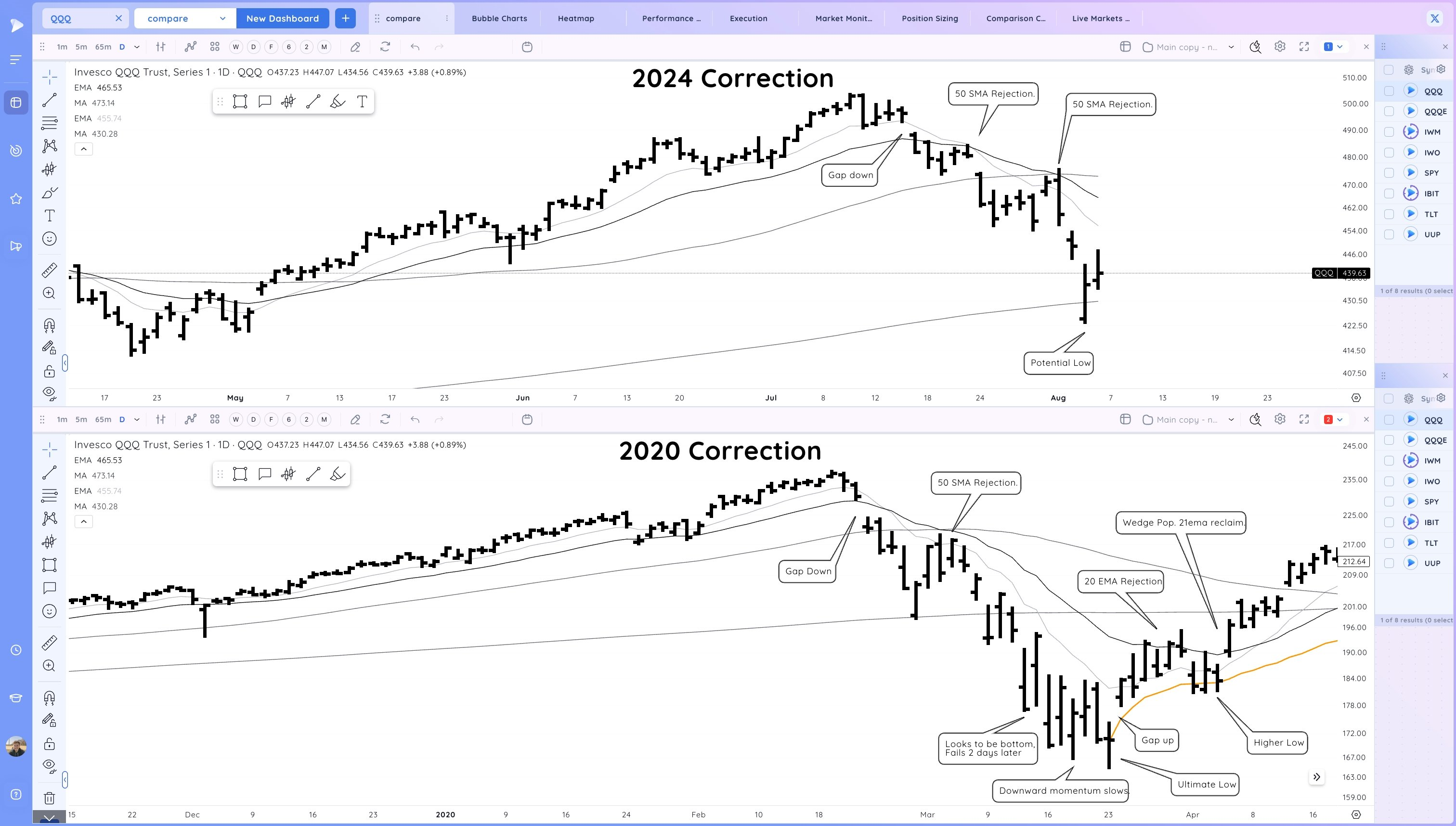

I’ve been taking a look at recent sharp corrections. Here is the 2024 Correction so far compared to the 2020 Correction. Patience (while still prepping for the uptrend) until test/reclaim moving averages from below + form a higher low. If active, tight leashes on trades

QQQ 2024 versus 2020 Case Study – All corrections exhibit similar type action.

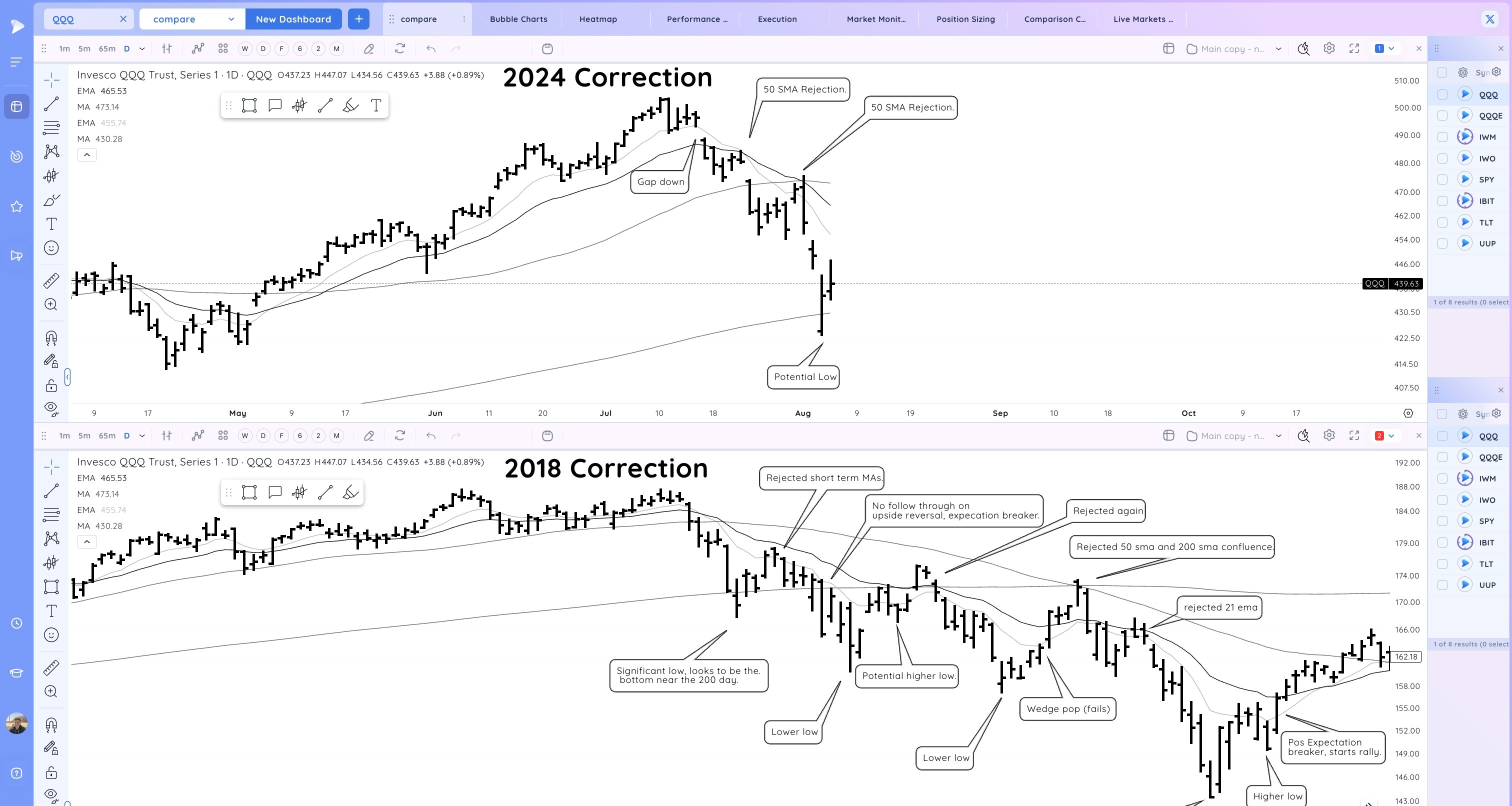

Here is the current 2024 Correction versus the 2018 Correction. Notice in that one there were similar points where it looked to be over, only for the rally to fail at key MAs. We’ll see how this current one ultimately resolves. The low could be in, one day at a time.

QQQ 2024 versus 2018 Case Study – Patience is required during corrections, taking it day by until the market proves itself.

Also key is how potential leaders are acting. As the correction ends they will be all setting up and breaking out through pivots.

Look for group action, big gap ups, volume surges, Higher lows as the market makes lower ones, reclaims of moving averages

Avoiding the chop and frustration is key during corrections. Experienced traders can look to pick spots, daytrade or see if levels holds during the day to hold through the close but less is more until the wind is back at our back.

With all that said you should be getting excited. We’ve had some great opportunities in 2023 and 2024 and this correction is setting up another one. The longer this goes on and the deeper the correction, the greater the potential for another uptrend that could change your year and life. You just have to do your homework and be ready mentally when that happens.

Trends (4/4 Up)

Shortest – 10 Day EMA – Up – Above Rising

Short-term – 21 ema – Up – Above Rising

Intermediate term – 50 sma – Up – Above Rising

Longterm – 200 sma – Up – Above Rising

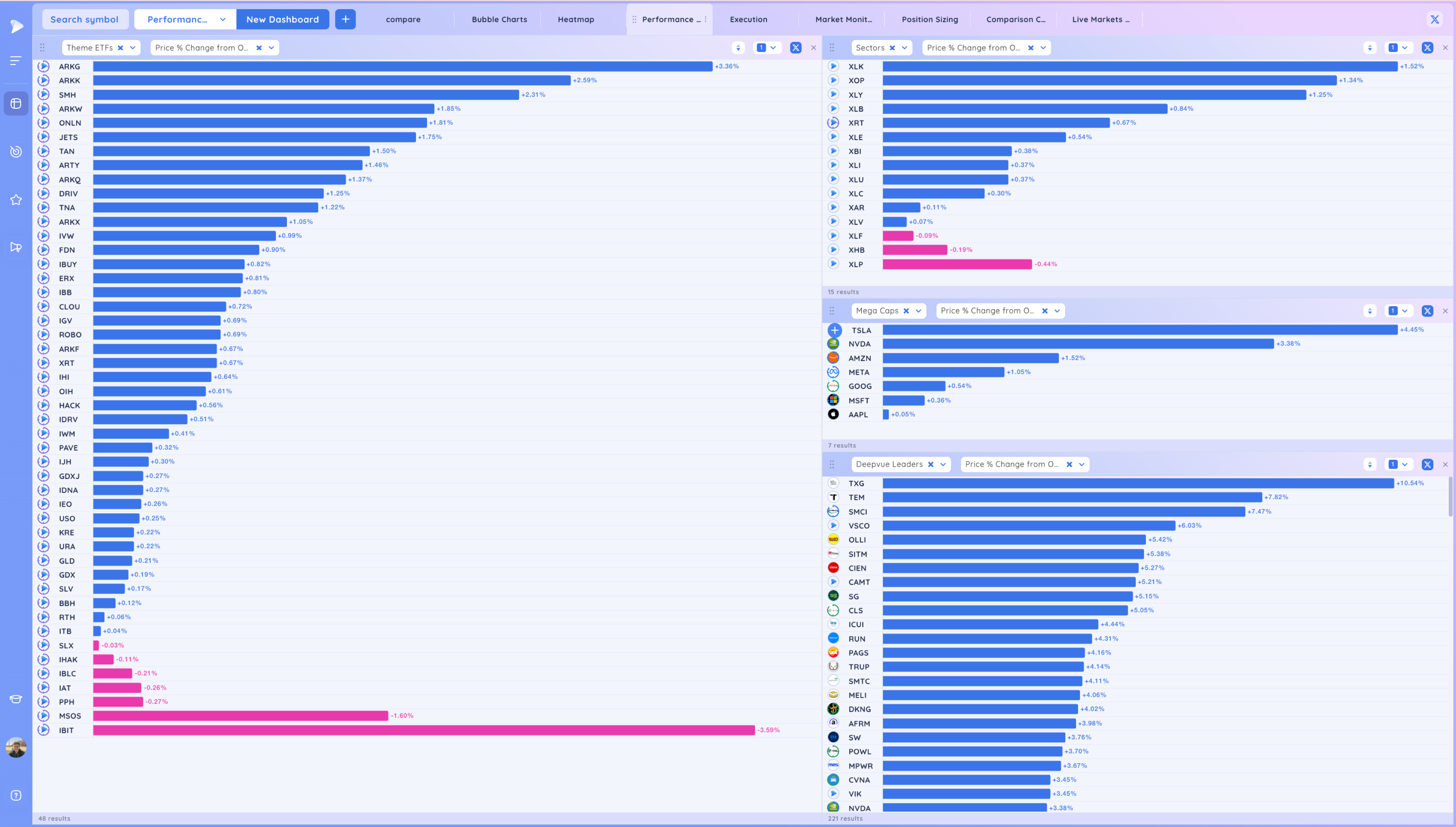

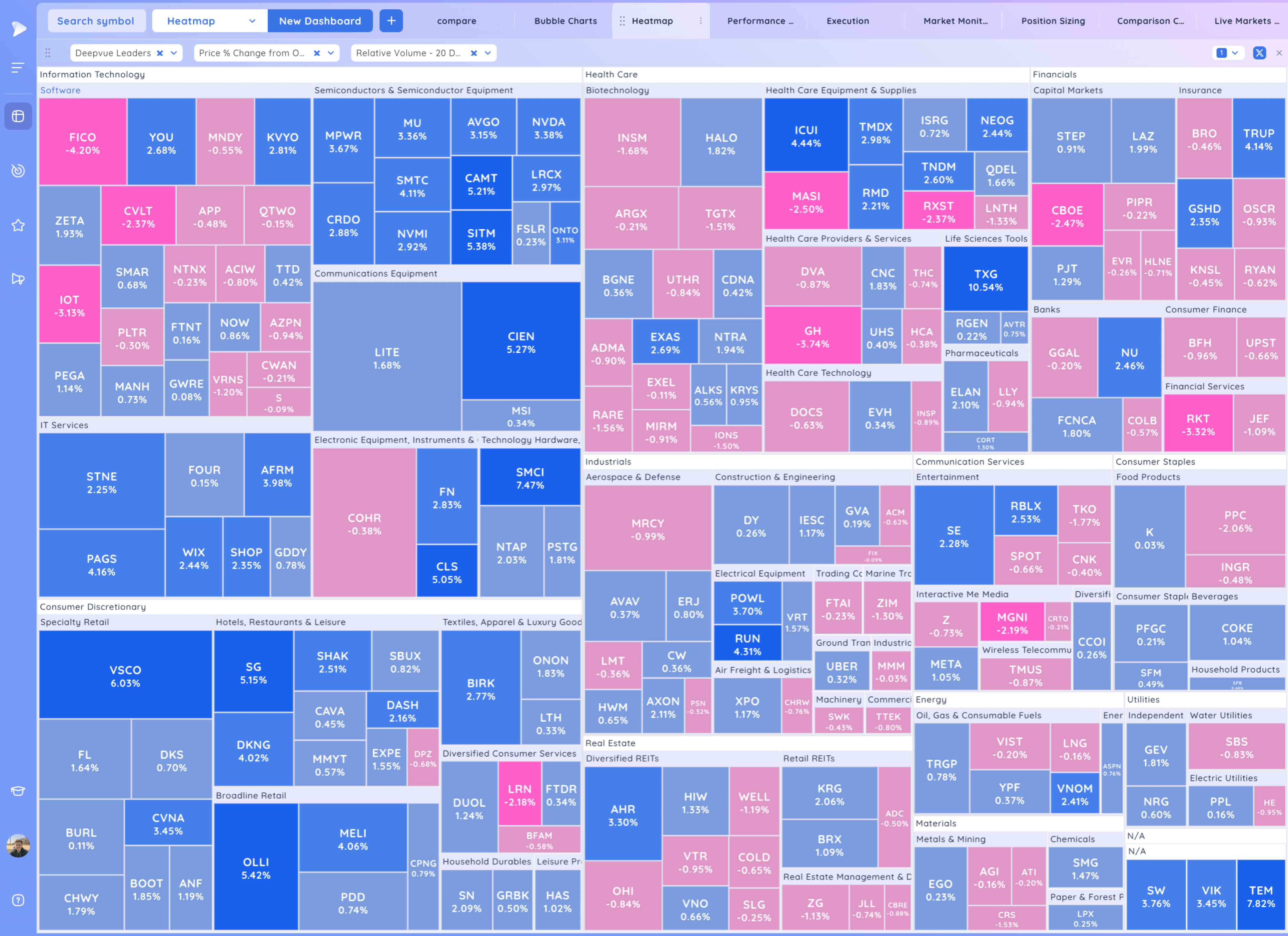

Groups/Sectors – % Change from Open

Performance Charts from Deepvue

Key Stocks in Deepvue

NVDA continuation up through the 50sma

ASTS strong move after earnings.

It’s funny I covered this as an episode pivot example back at $4 https://t.co/VlACO8jzTs

UPST inside day, this can really go if it pushes out

ONON positive expectation breaker

SBUX double inside

KVYO forming a range

EXAS tightening just below the 200 day

TMDX slight push, this likes to grind higher

MELI strong move

SG strong push from double inside

DOCS nice action post gap on declining volume

Market Thoughts

As our traders it’s out job to listen to price action and be flexible. You may have thought this rally was just a bounce, instead it’s gotten stronger. I personally thought we were due for some sideways action, the market kept climbing higher.

We will eventually get sideways action and even this rally may even fail, but the point is to listen to the price action and hold your opinions loosely. Don’t let your biases prevent you for taking a stab at pilots and try trades when the market begins a new market cycle by your definition.

Again, short term “extended” feeling here but early in a cycle that can stay true for a while. Be ready for anything and expect a large down day and know how you will react for each and every position you have. Know which are the cores you want to try to hold, and which are your weaker ones you are willing to toss out

Day by Day – Managing risk along the way