Pullback then Upside Reversal

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

December 29, 2024

Market Action

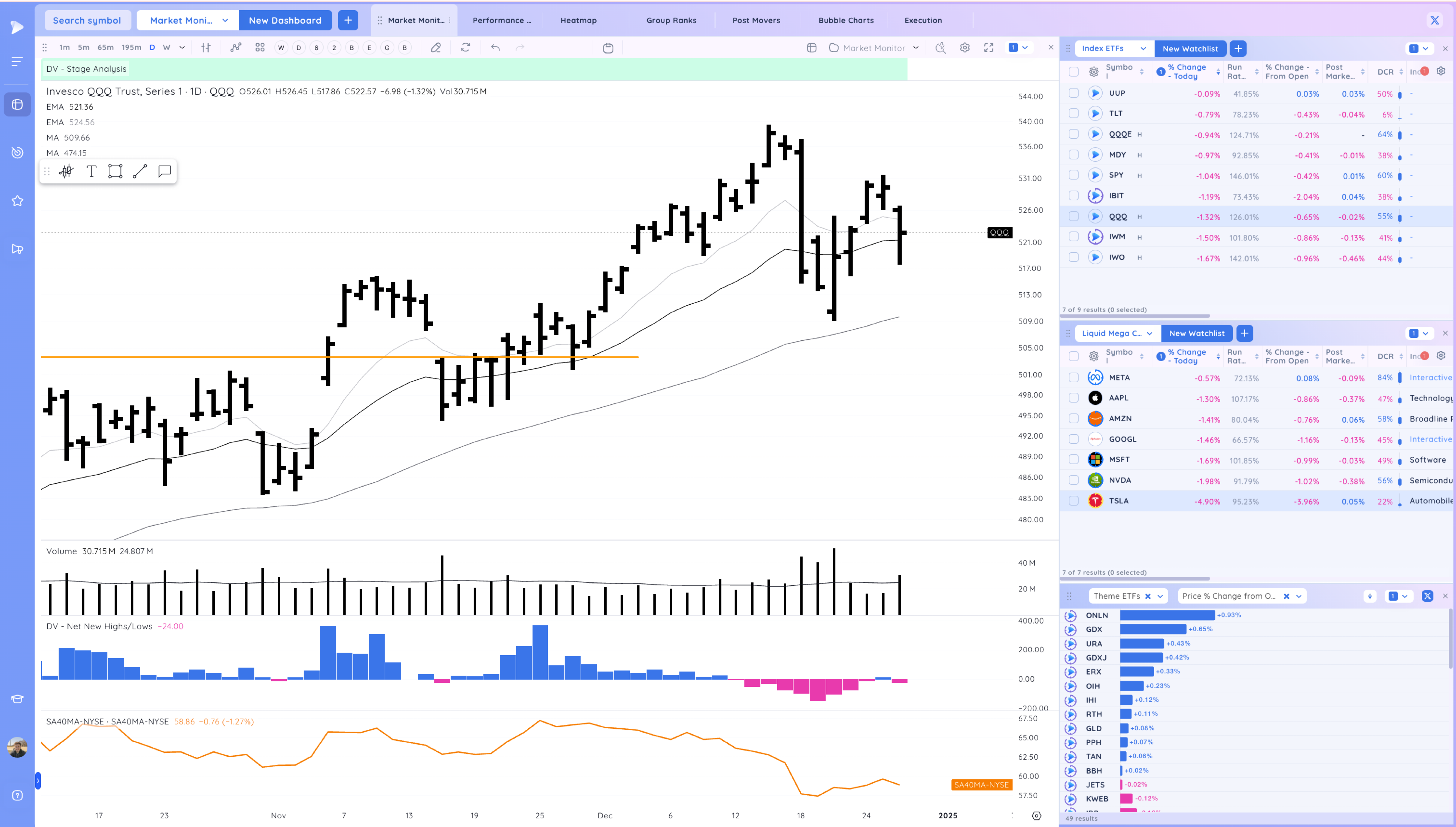

QQQ – choppy action into the last few days of 2025. Break of the 21ema then reclaim. The prior week sell bar still a warning sign. Lower high set thursday and confirmed friday

Short Term Expectation based on the close is consolidation or lower.

Bulls want to see us follow through higher and close the year strong

Bears want to see us selloff below the 21ema

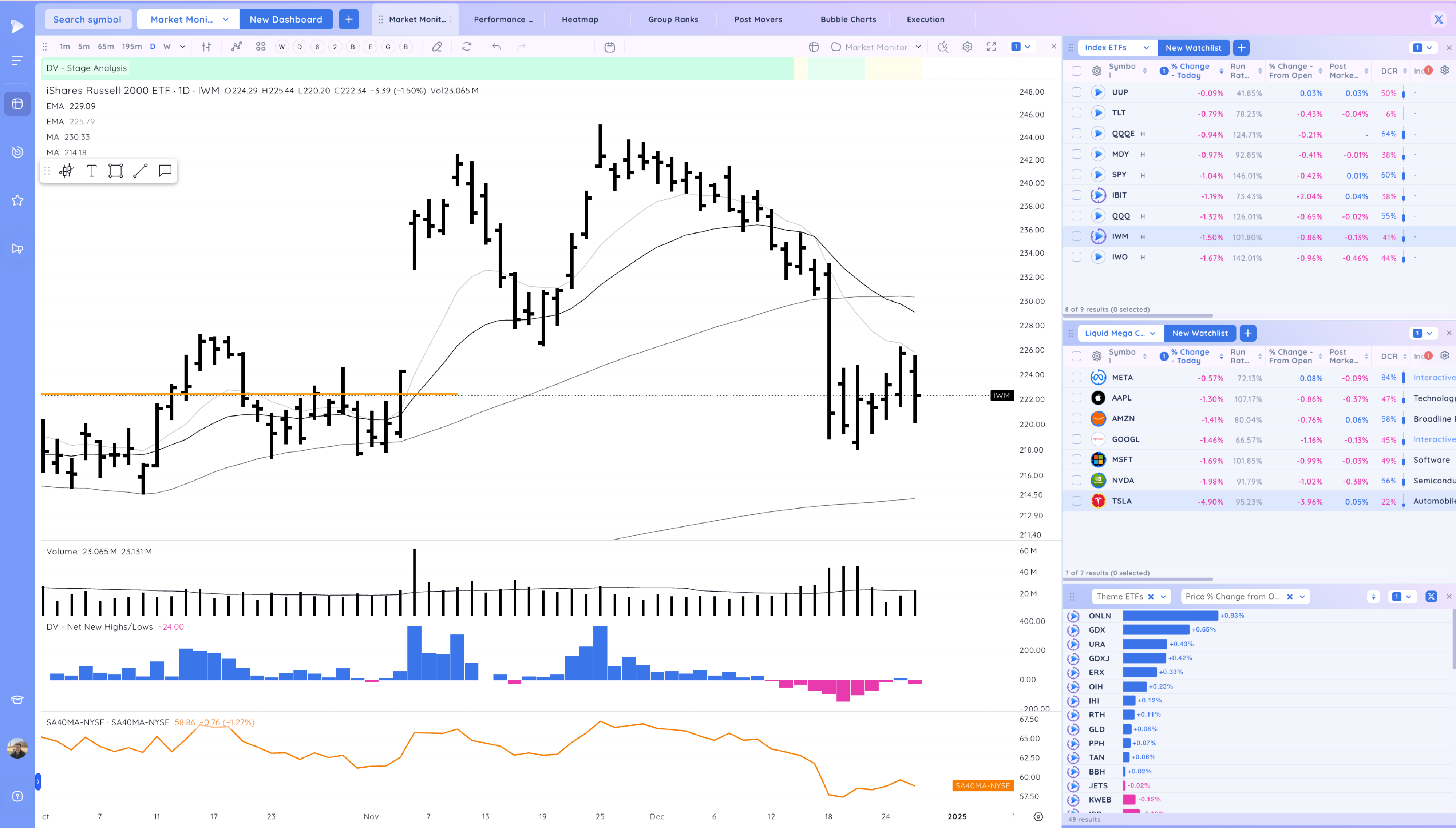

IWM – back in this range now which still looks like a bear flag

Bulls want to break higher

Bears want to see us break lower below the range

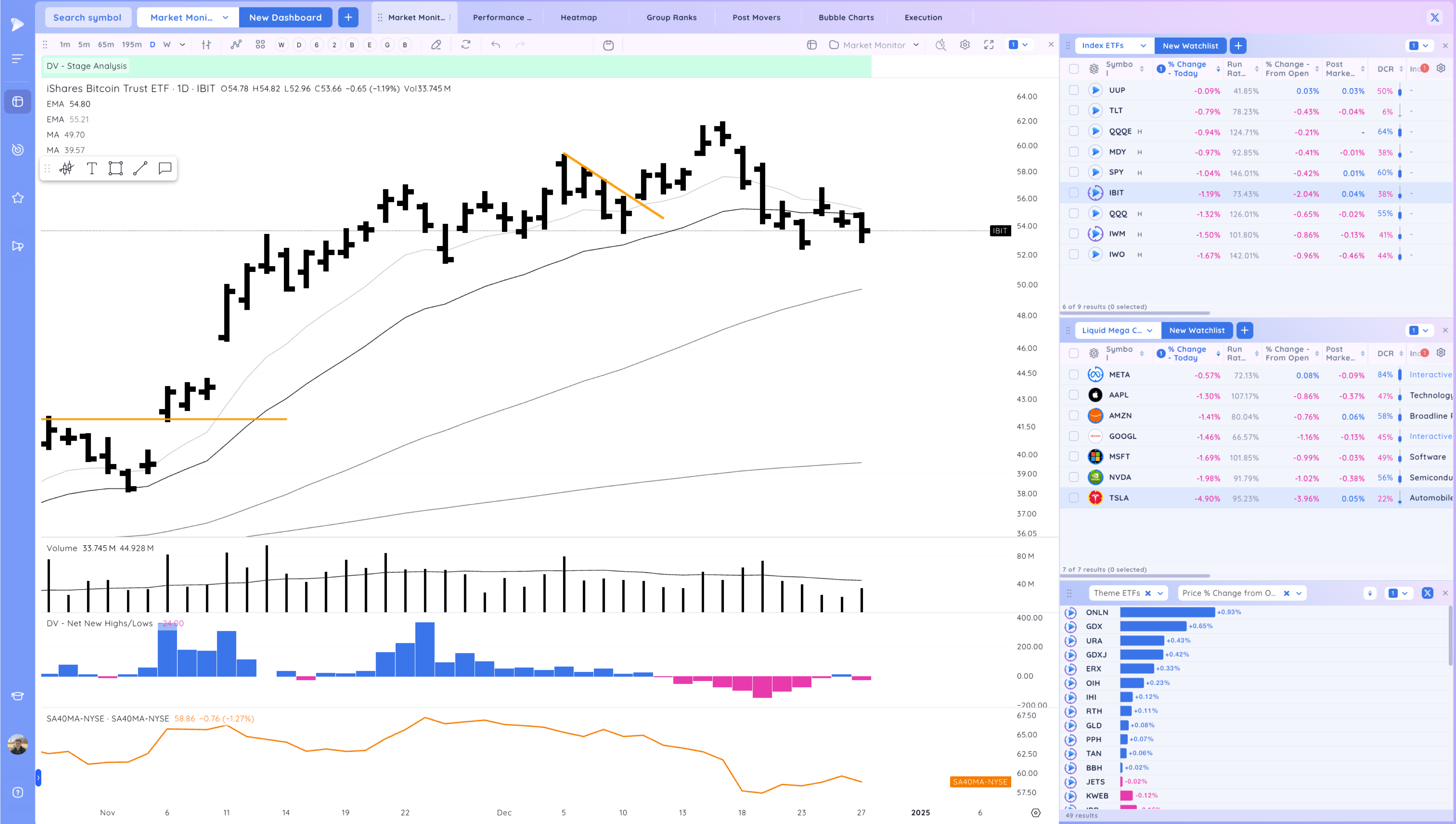

IBIT- multi week pullback now and below the 21ema, on watch or a pop through

Bulls want to see us break out higher

Bears want to see us follow through down

Trends (3/4 Up)

Shortest – 10 Day EMA – Down Below declining

Short-term – 21 ema – Up Above Rising

Intermediate term – 50 sma -Up Above Rising

Longterm – 200 sma – Up – Above Rising

Deepvue Holiday Special Offer – Try 3 Months for only $50

Try out the best platform for CANSLIM Swing and Position Traders – Top Trader Screens, Unique Indicators – Streamlined Routines

Groups/Sectors

Performance Today on the Left, Performance over the past 20 days on the right.

Performance Charts from Deepvue

Deepvue Leaders Heatmap

S&P 500

Group Ranks: 1 Day, 1 Week, 1 Month, 3 Month from left to right. This is now a preset for Deepvue Members

Leaders and Key Moves

NVDA upside reversal at the 21ema,

ALAB beautiful trend

PLTR after tight day testing the 10ema

TSLA looking to test the prior ATH again. watching for a range to form against the 21ema

RDDT upside reversal, about 3 week sideways action

Stocks Setting Up

AVGO tightening below highs, Ideally has one more inside day/upside reversal to “prime” the setup

RBRK nice upside reversal, watching for follow through

NAMS biotech swing trade setup. Speculative, no earnings

RBLX setting up again near the 21ema

APP watching for range breakout

INOD upside reversal inside day, watching for reconfirmation. Volatile fast mover

GOOGL watching for push off the base pivot

KYVO stubby but watching for push of 10ema area

RIVN fast mover, watching for follow through up from upside reversal, swing trade name

MSTR make it or break it time, watching for respect of the 50sma

SOFI watching for breakout

KD watching for push higher

BILL watching for 21ema reclaim and push

GEV still in constructive base, can watch for expectation breaker

Themes and Leaders

Key Themes: Software, AI

Liquid Leaders

These names have the top RS, growth stories

TSLA PLTR RDDT ALAB APP DOCS GEV

Performance Enhancers

SOUN QMCO RGTI RUM

Market Thoughts & Focus

Some more weakness to end last week, we’ll see what the new week brings and the new year as well. I’d welcome a sharp correction to reset everything and set up new bases. But also prepared if we rip.

Daily Focus is on RBRK AVGO RDDT

Anything can happen, Day by Day – Managing risk along the way

I hope everyone had a great Christmas!