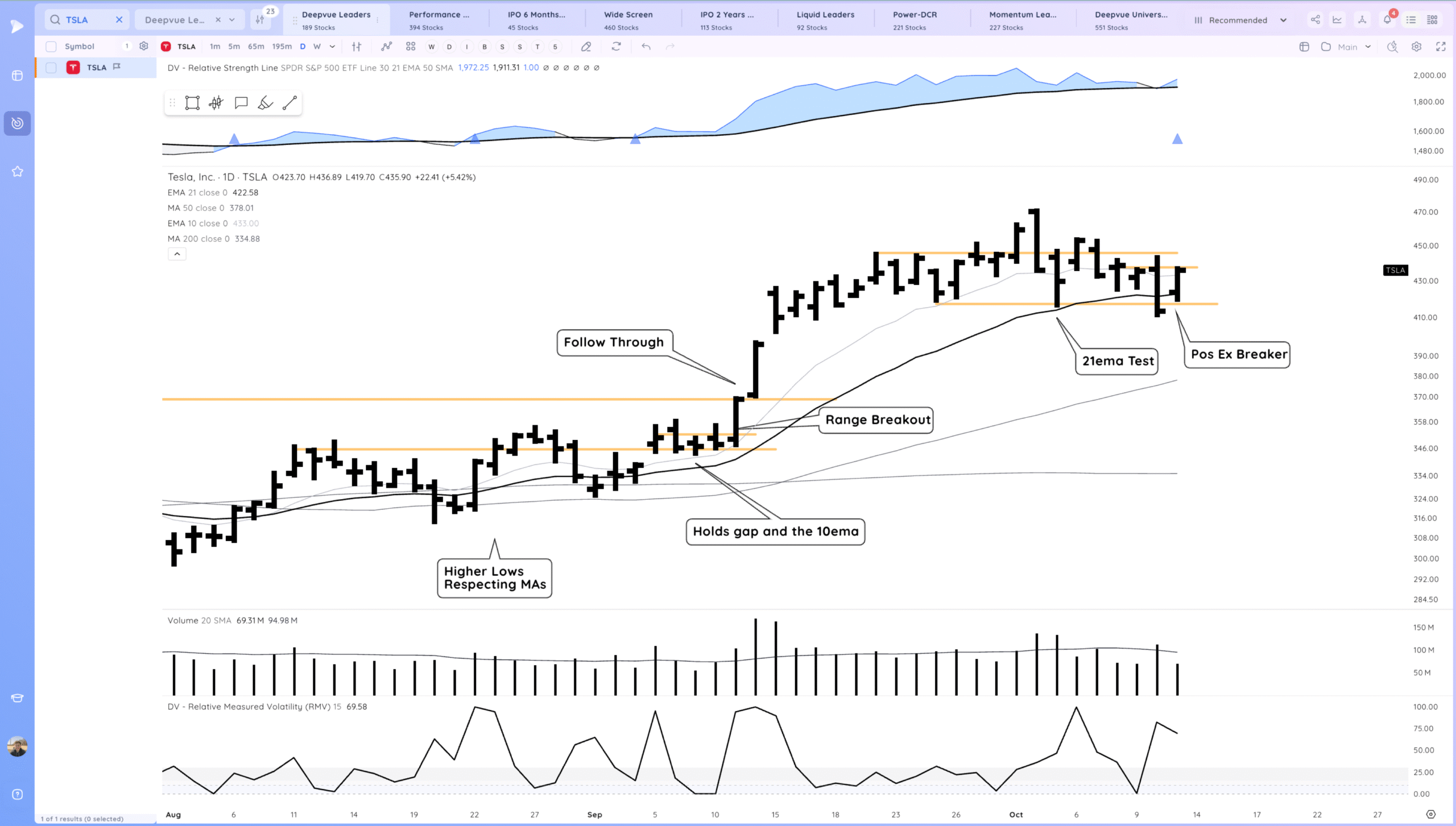

Positive Expectation Breaker.

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

October 13, 2025

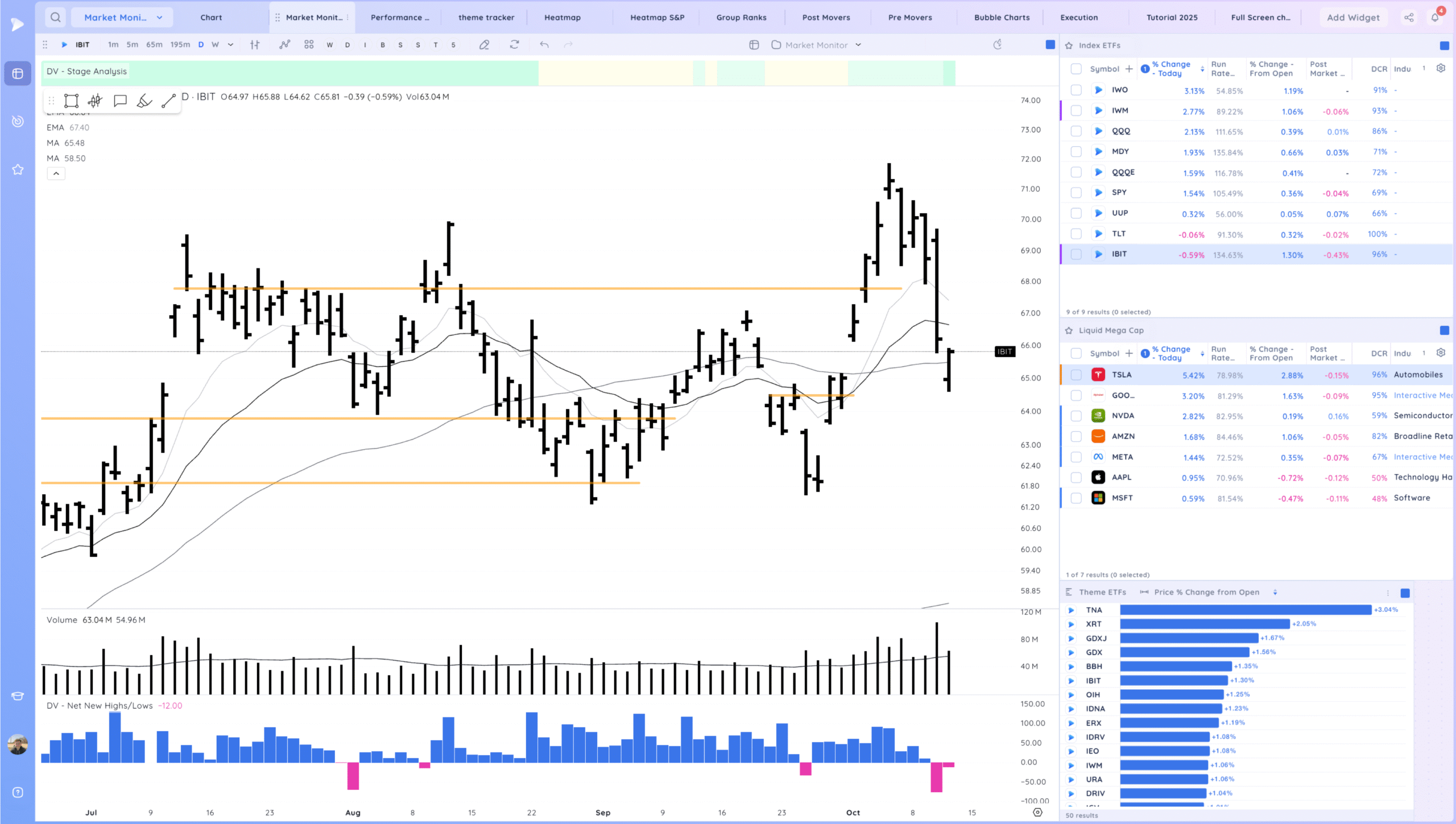

Market Action

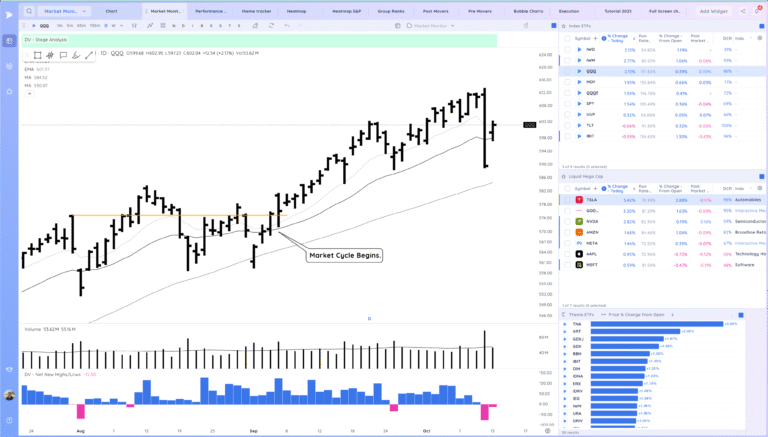

QQQ – The Trade Tensions seemed to be rolled back even on Sunday and today we gapped up and closed well back above the 21ema. I view us as still being in the same market cycle. A negative end to the week with more distribution would change that.

Bulls want to see us hold above the 21ema and continue trending

Bears want to see us reconfirm down, likely with additional negative news catalysts.

Daily Chart of the QQQ.

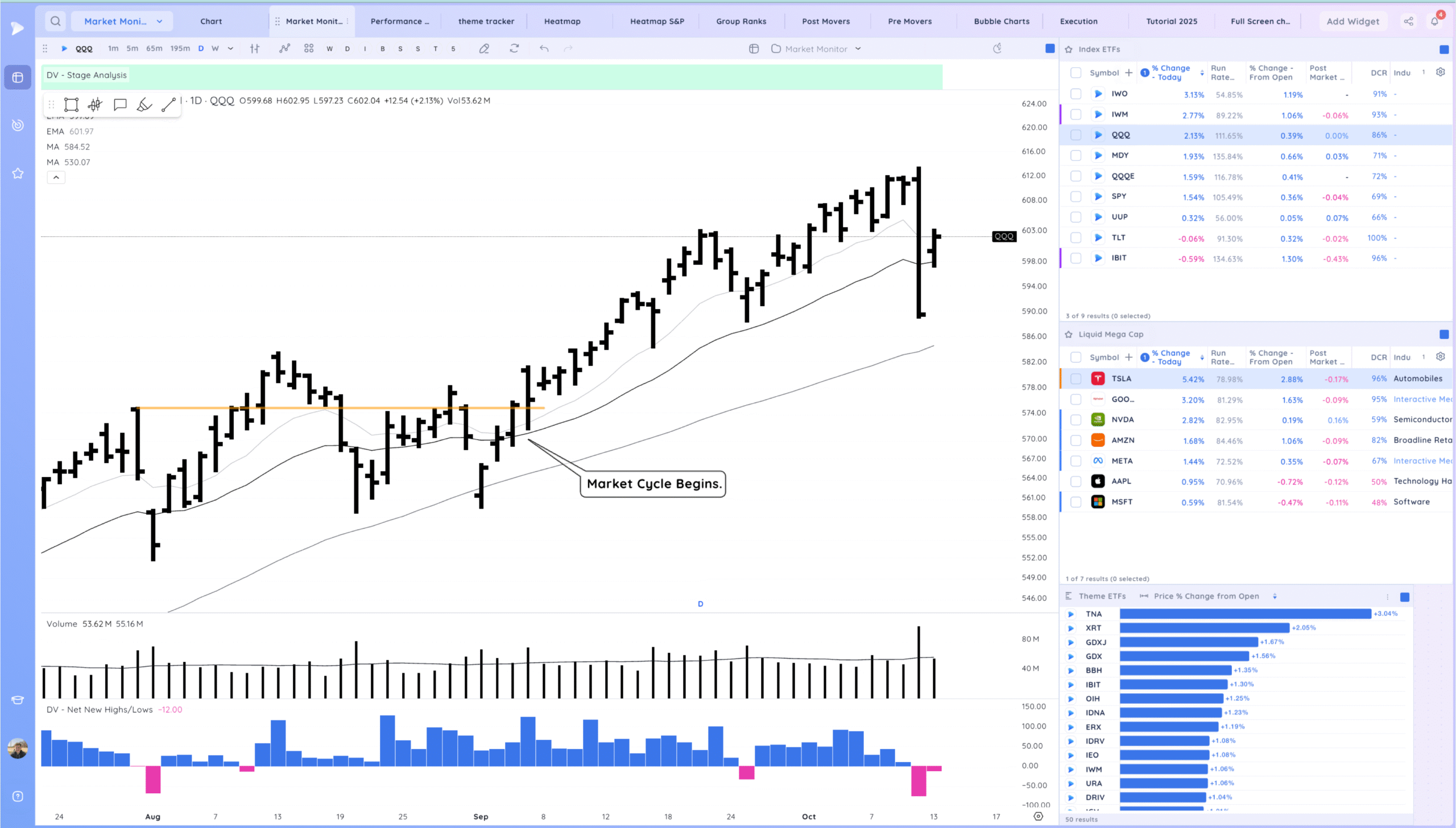

IWM – Reclaim and strong close above the 21ema. Overall still basing since Sep 19

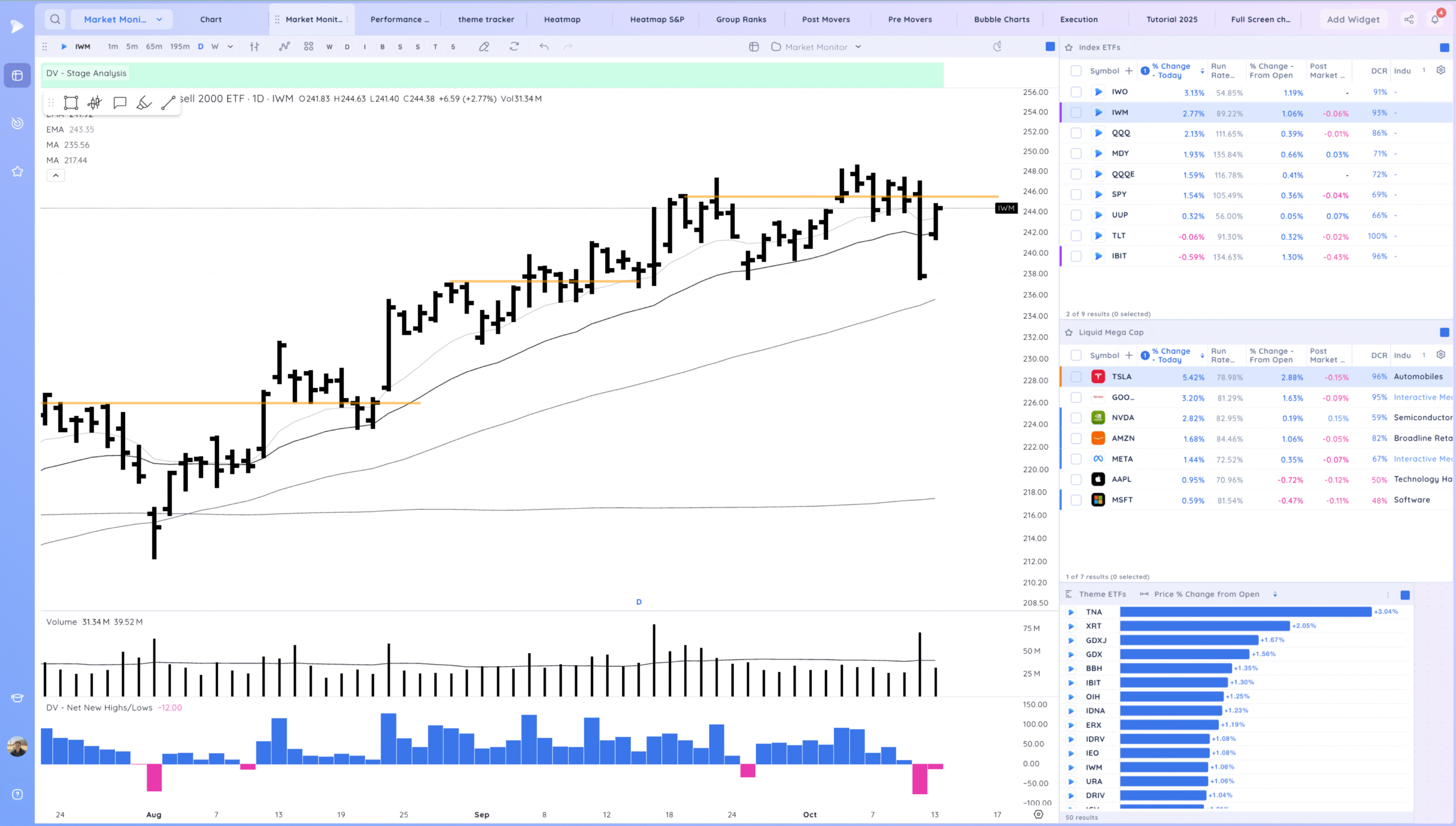

IBIT – The crypto theme took the biggest hits on Friday Upside reversal today. Still has work to do.

Trends (4/4 Up) – Based on the QQQ

Shortest – 10 Day EMA – Above

Short-term – 21 ema – Above

Intermediate term – 50 sma – Above Rising

Longterm – 200 sma – Up – Above Rising

Groups/Sectors

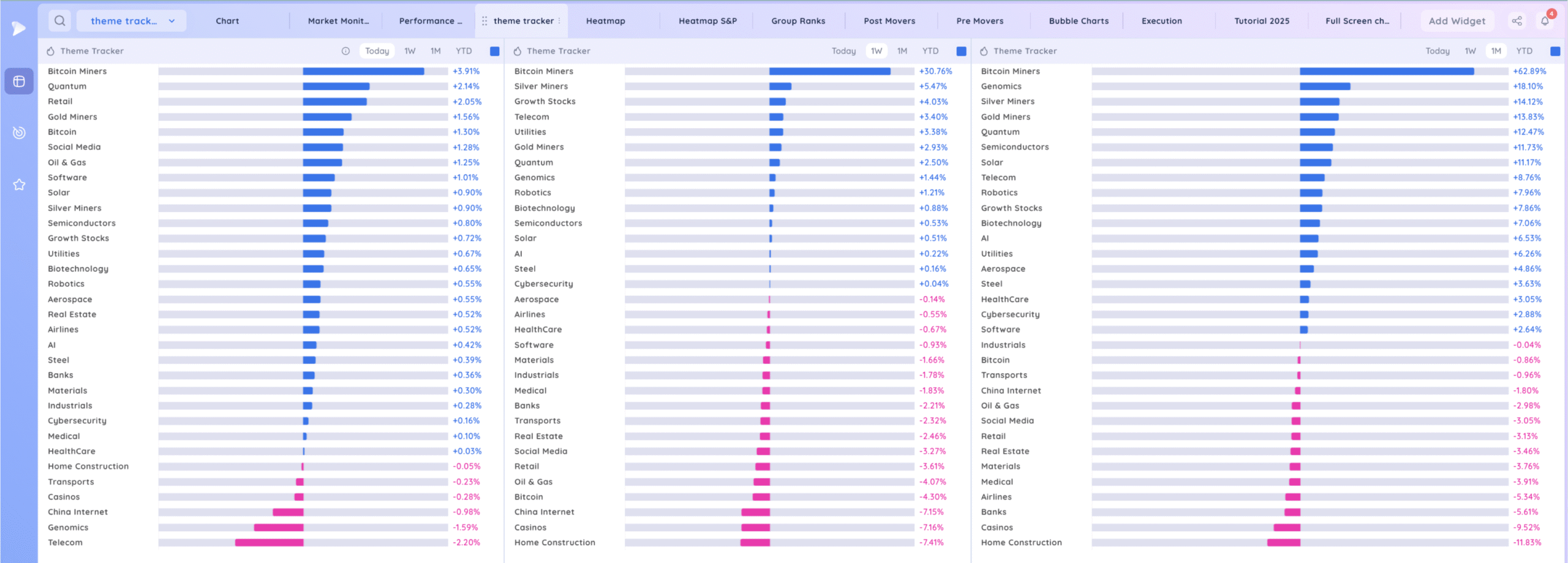

Deepvue Theme Tracker

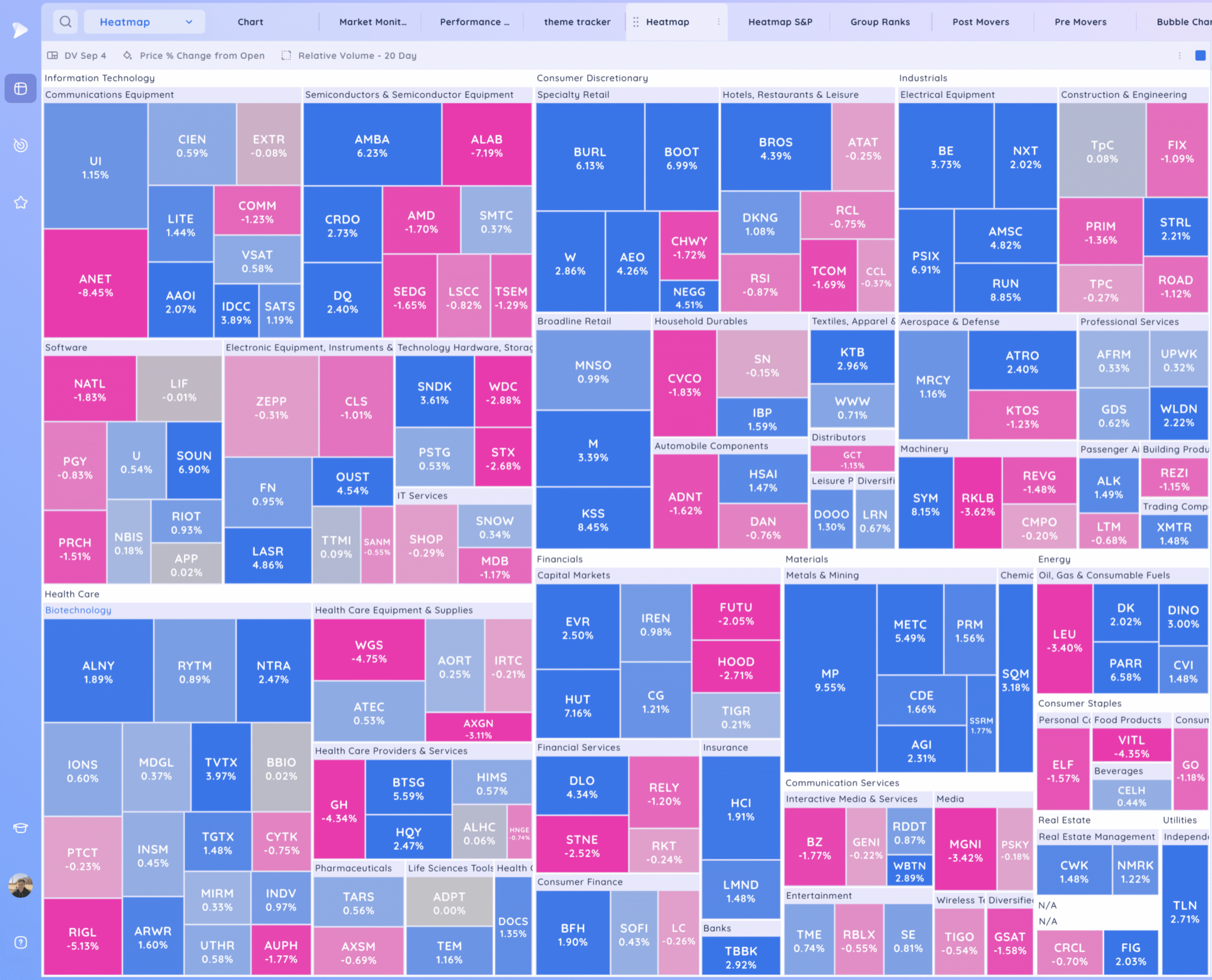

Deepvue Leaders

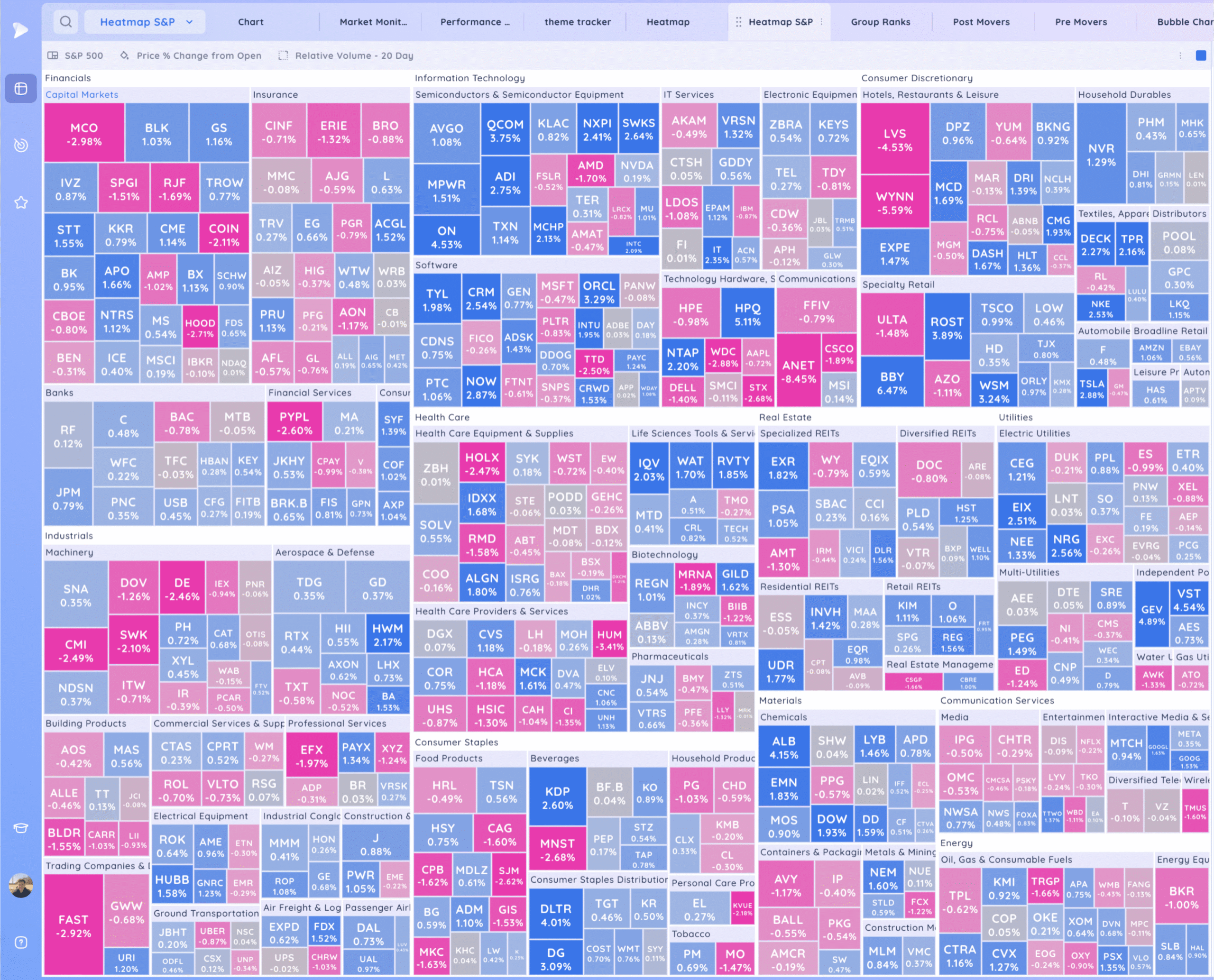

S&P 500.

Leadership Stocks & Analysis

TSLA – Positive expectation breaker gapping above the range low and closing well. Watching for a range re-breakout

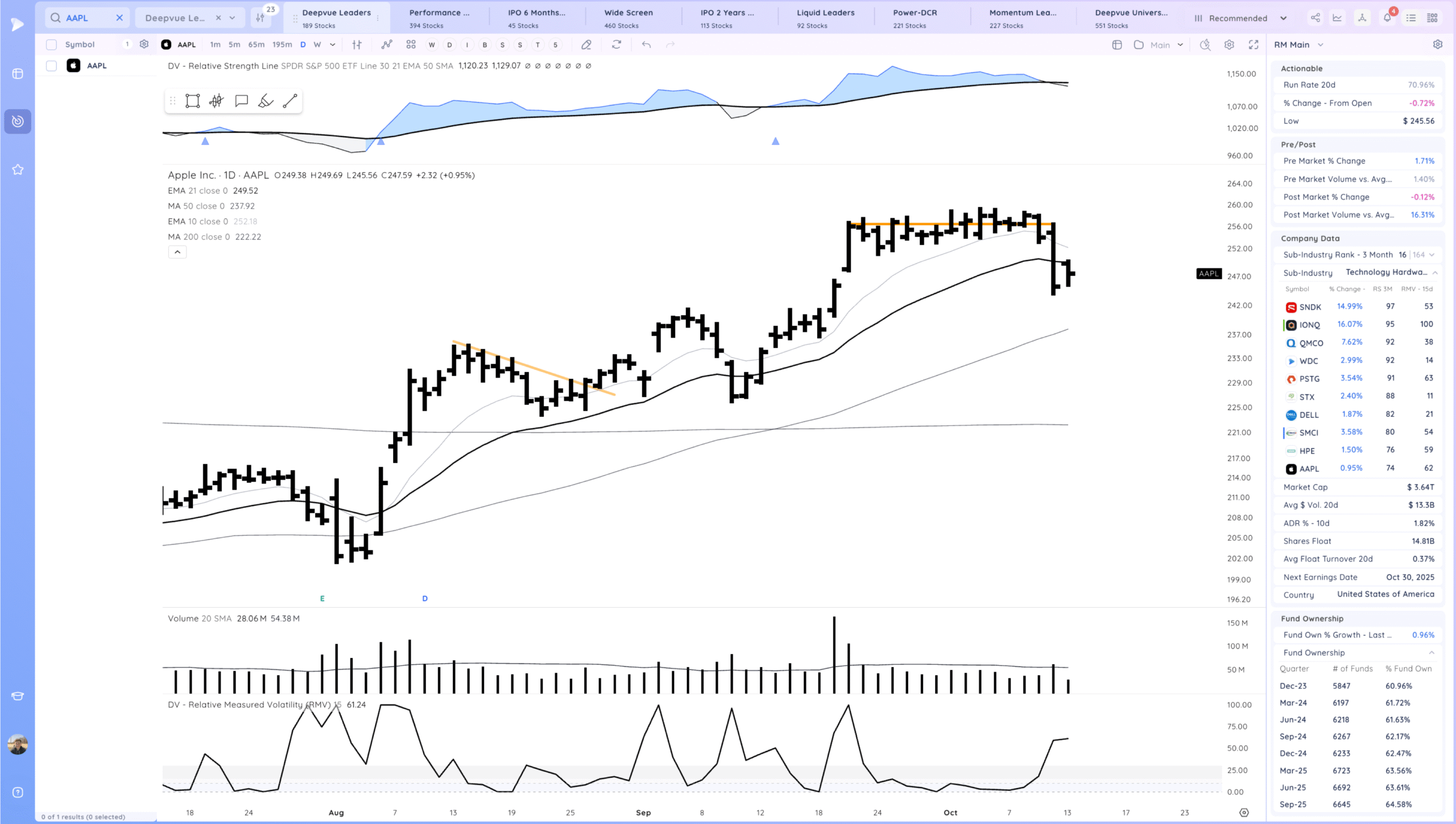

AAPL Inside day but in the lower half of the breakdown bar

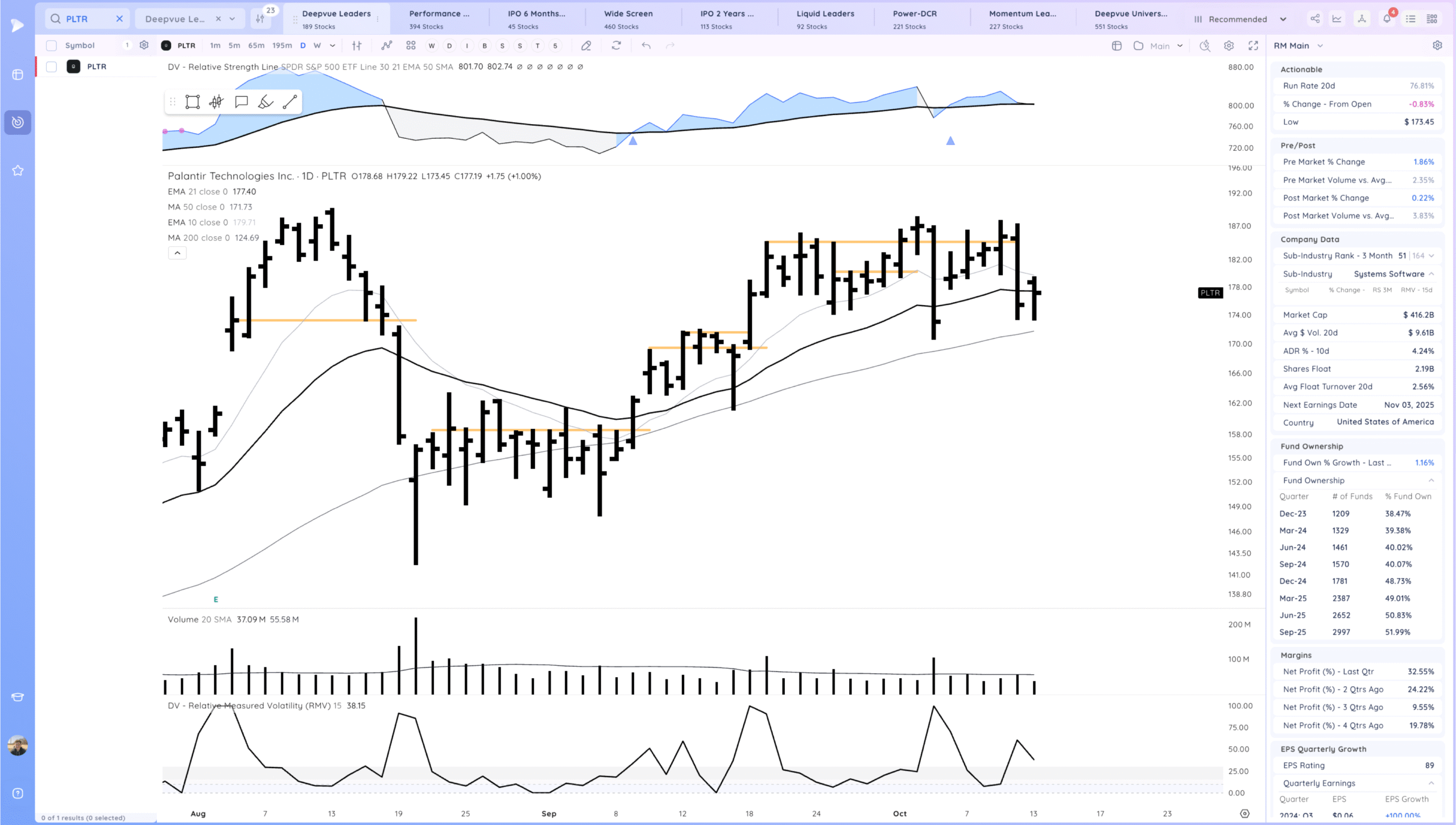

PLTR Upside reversal day. No follow through down

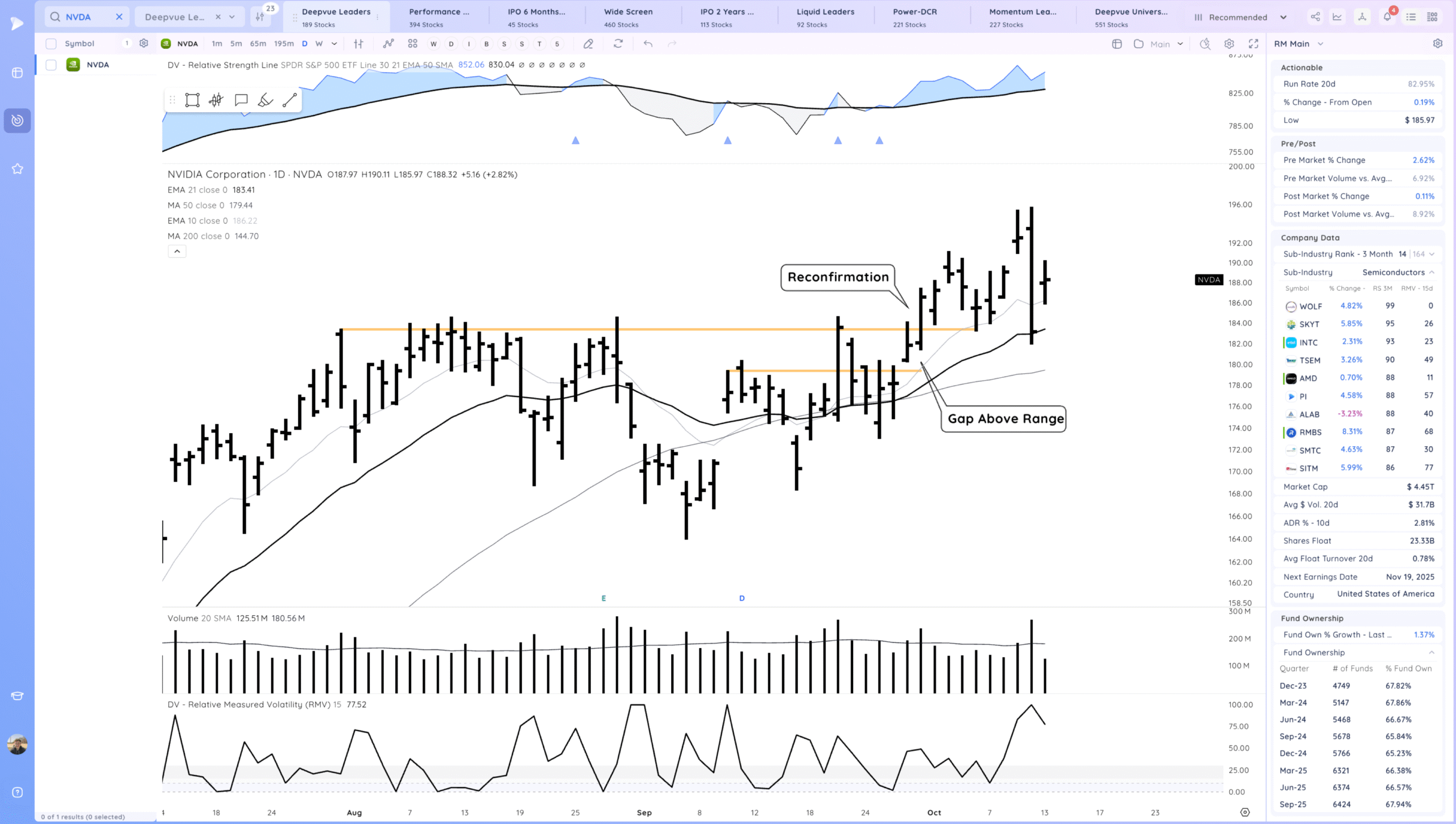

NVDA positive expectation breaker and tight day.

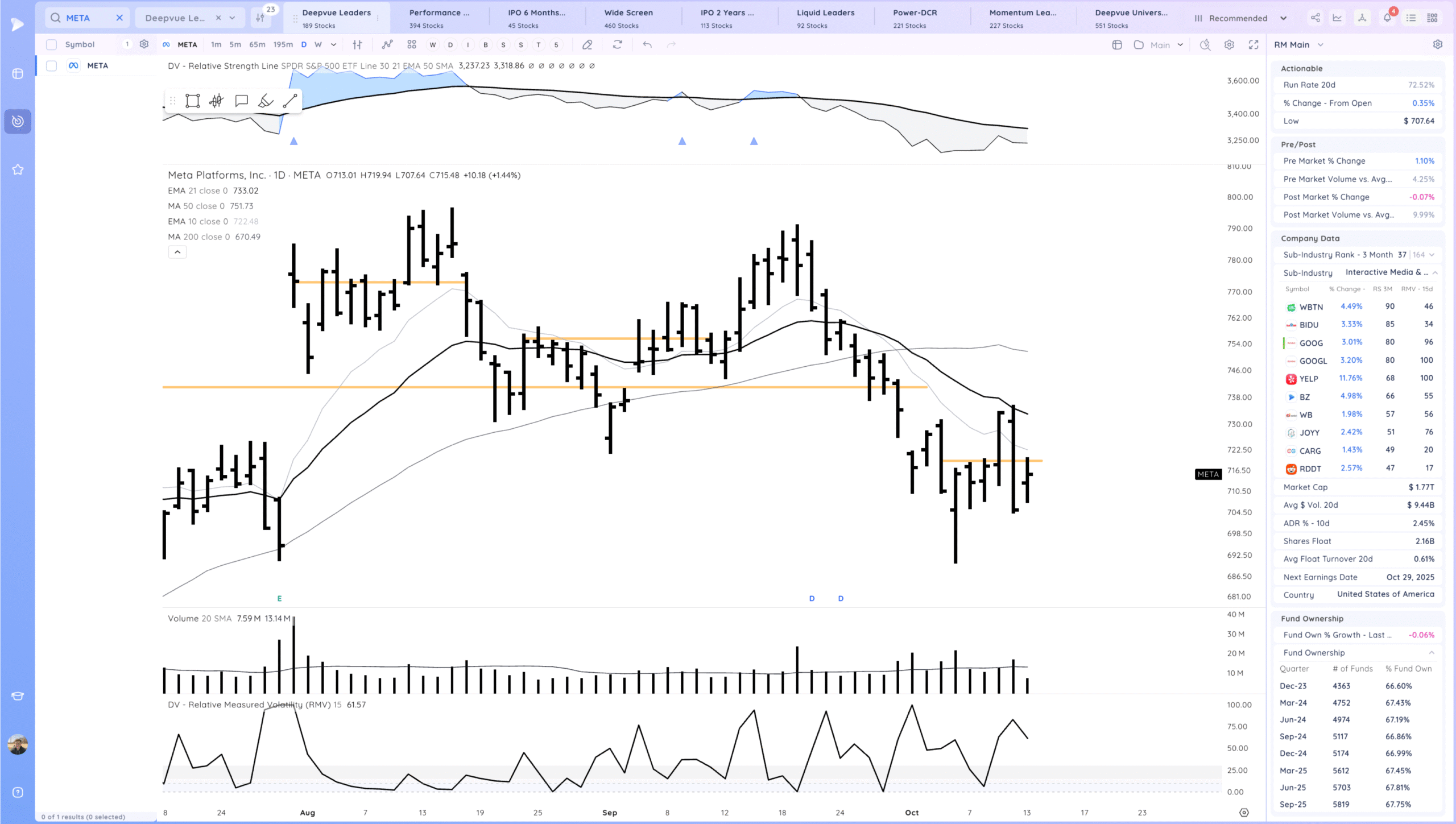

META tight day and back in this range below the MAs

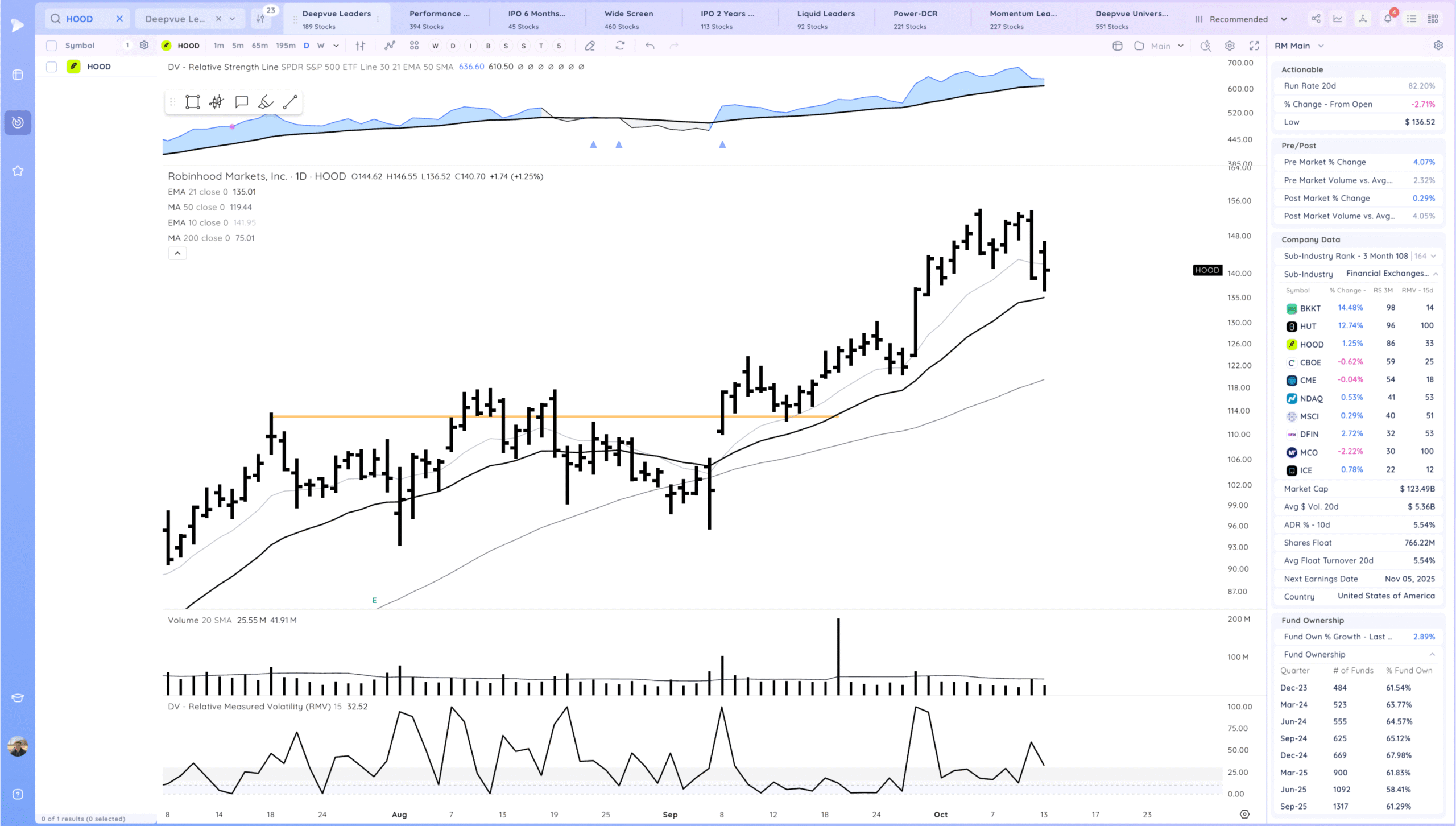

HOOD pullback to the 21ema area

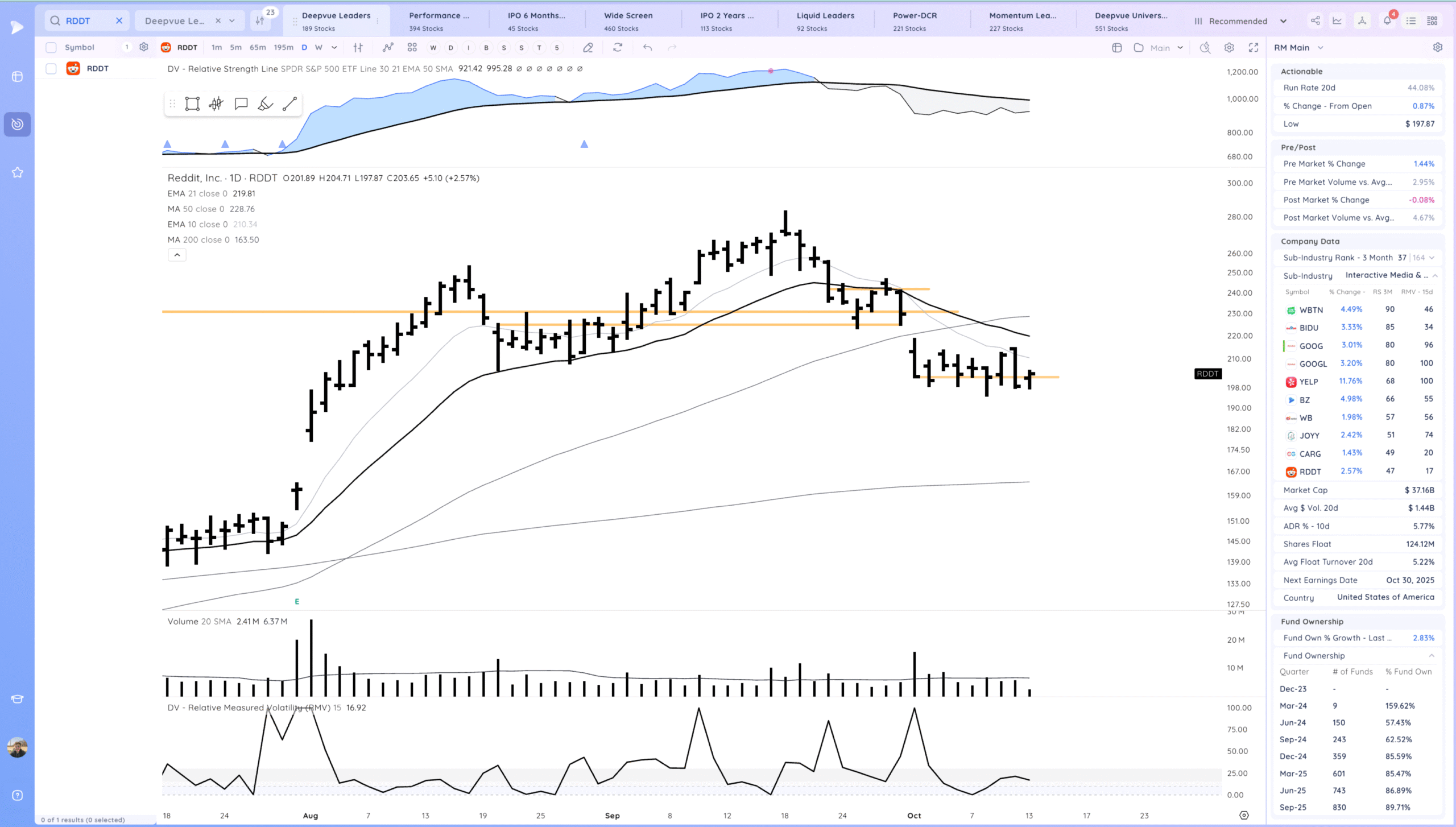

RDDT tight day as it refuses to go lower. Expecting expansion. Below the MAs.

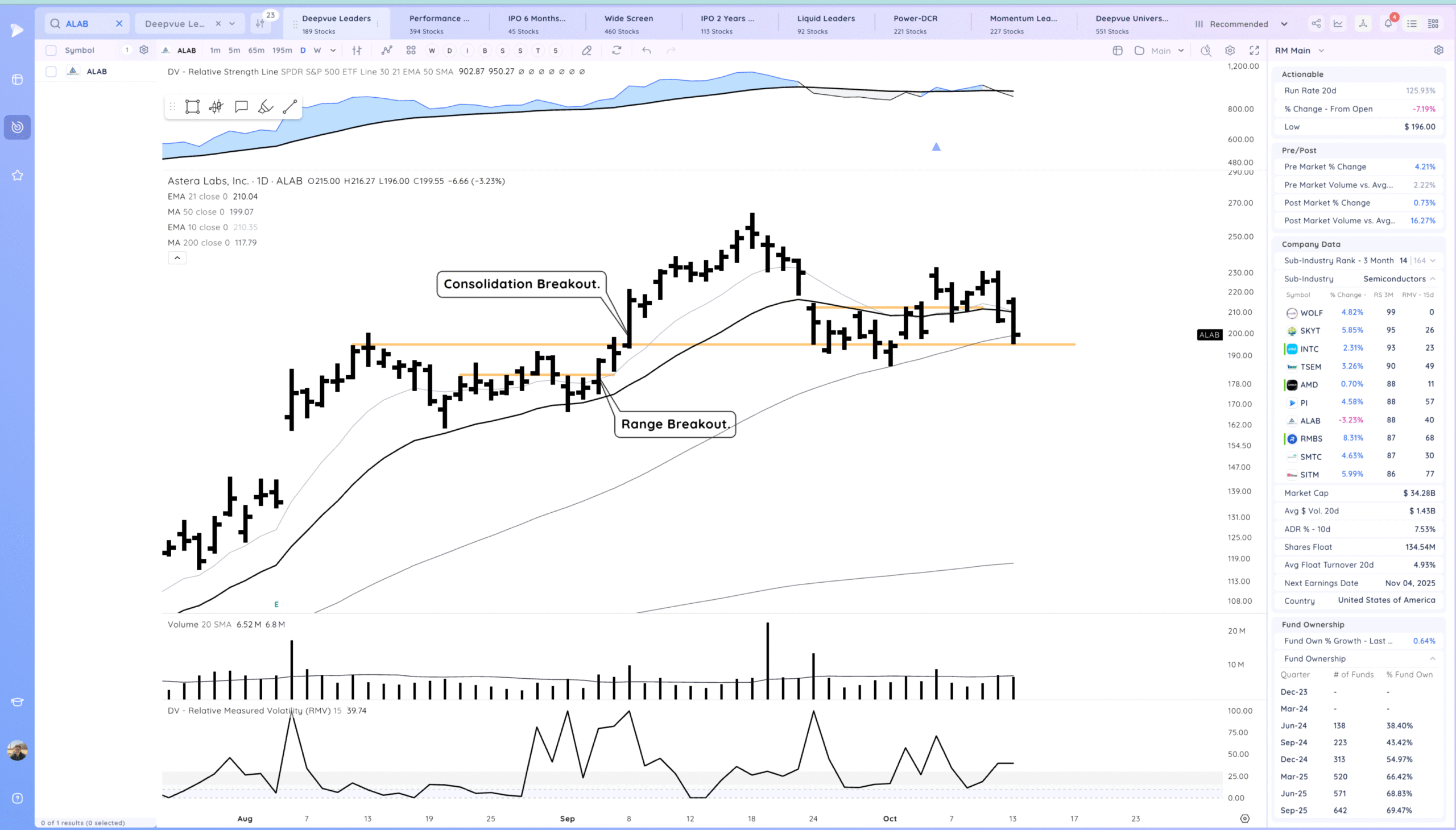

ALAB follow through down testing the base pivot and 50sma area.

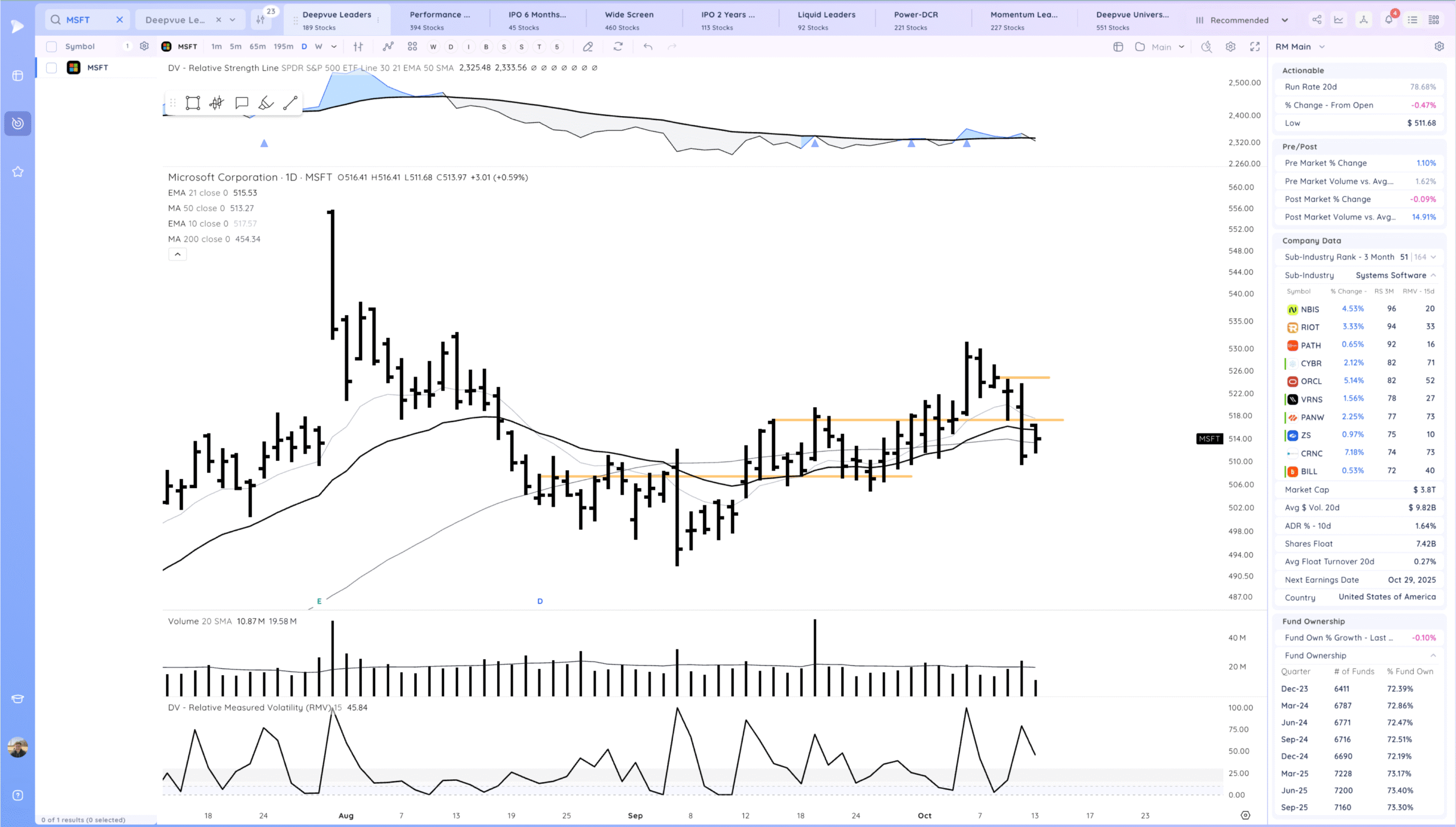

MSFT tight day but below the range pivot

Key Moves

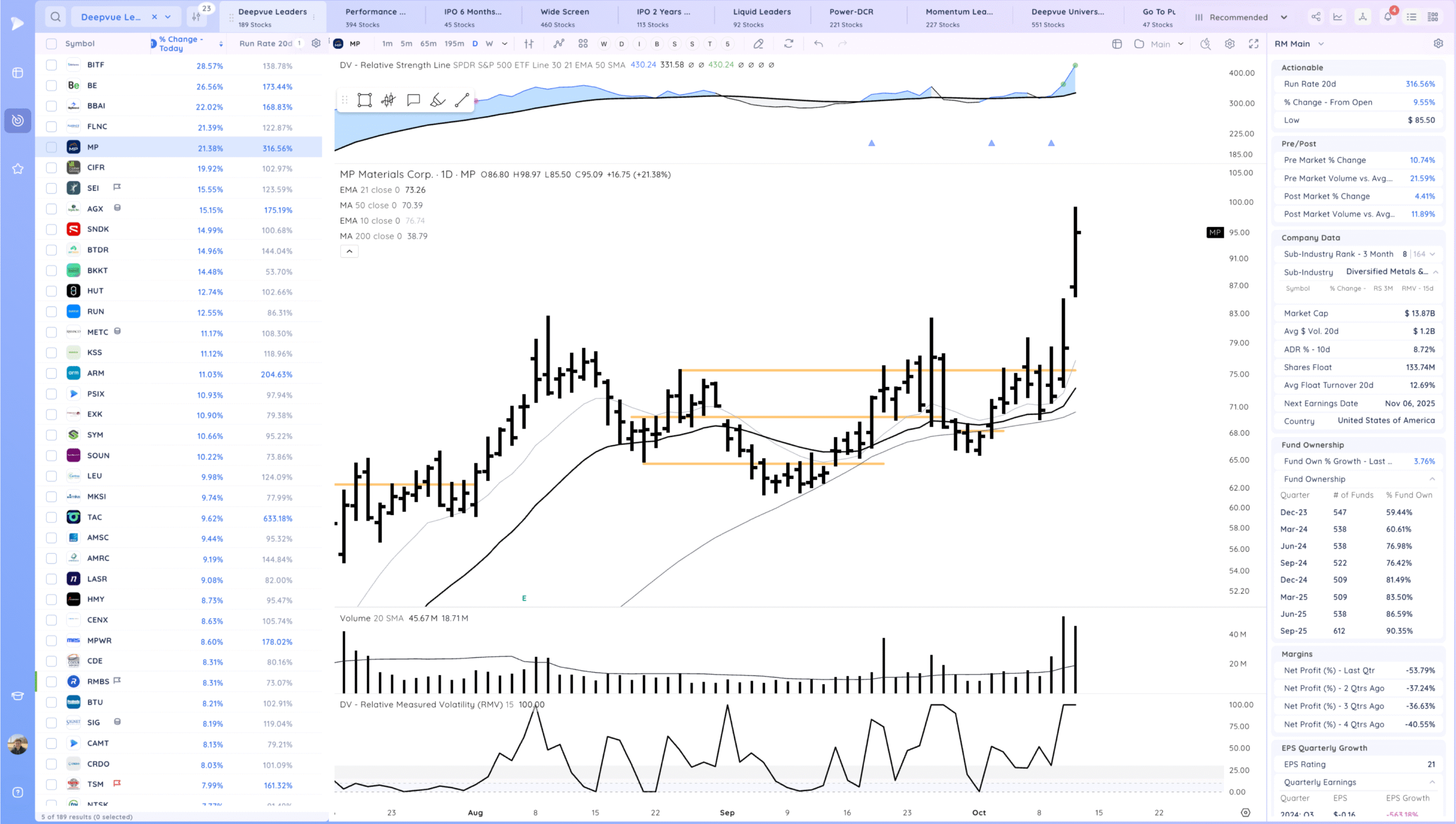

MP Strong follow through up. Risks of more tension with china likely a tailwind for this name

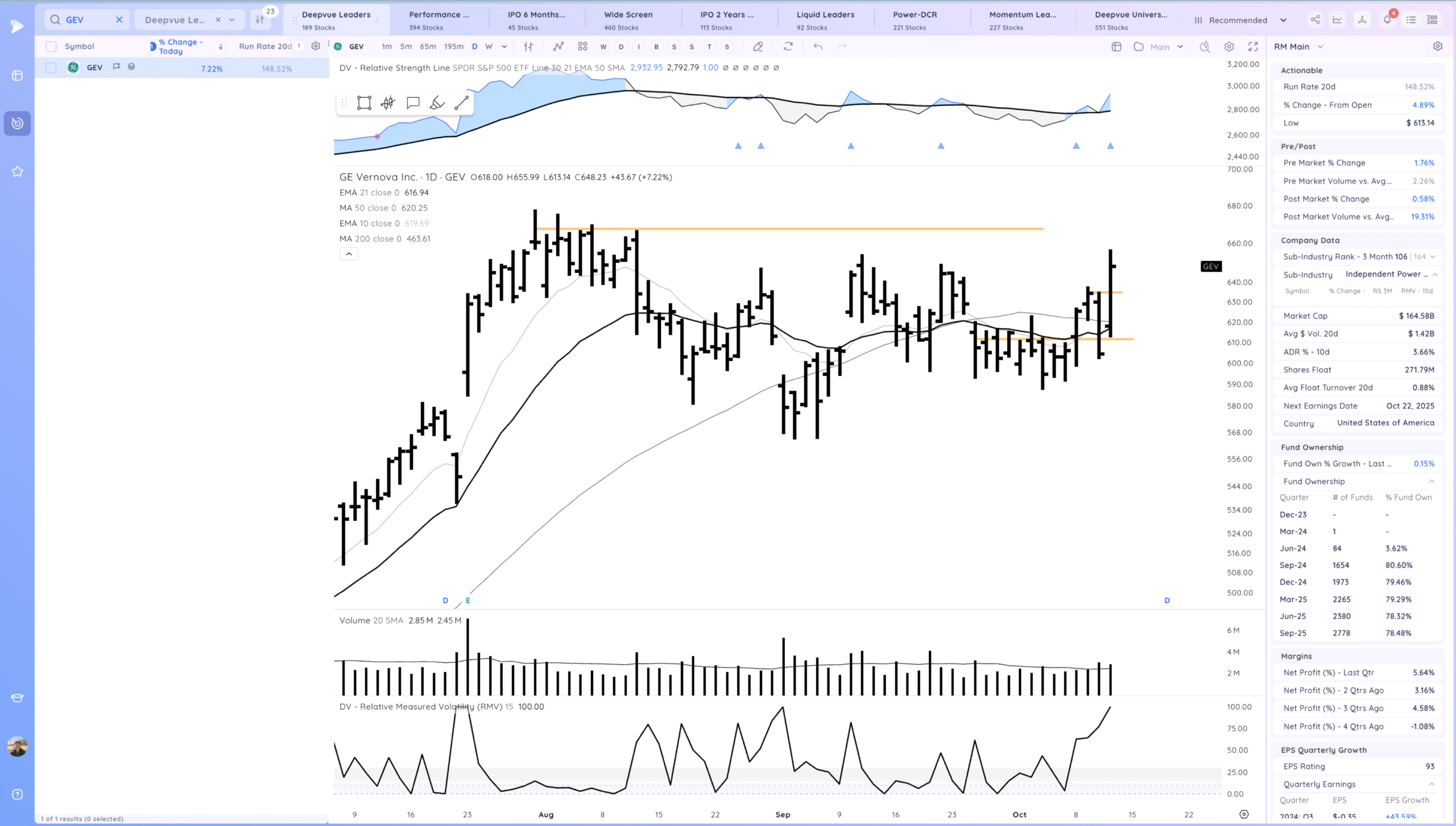

GEV Positive expectation breaker and range breakout. Watching for follow through

Setups and Watchlist

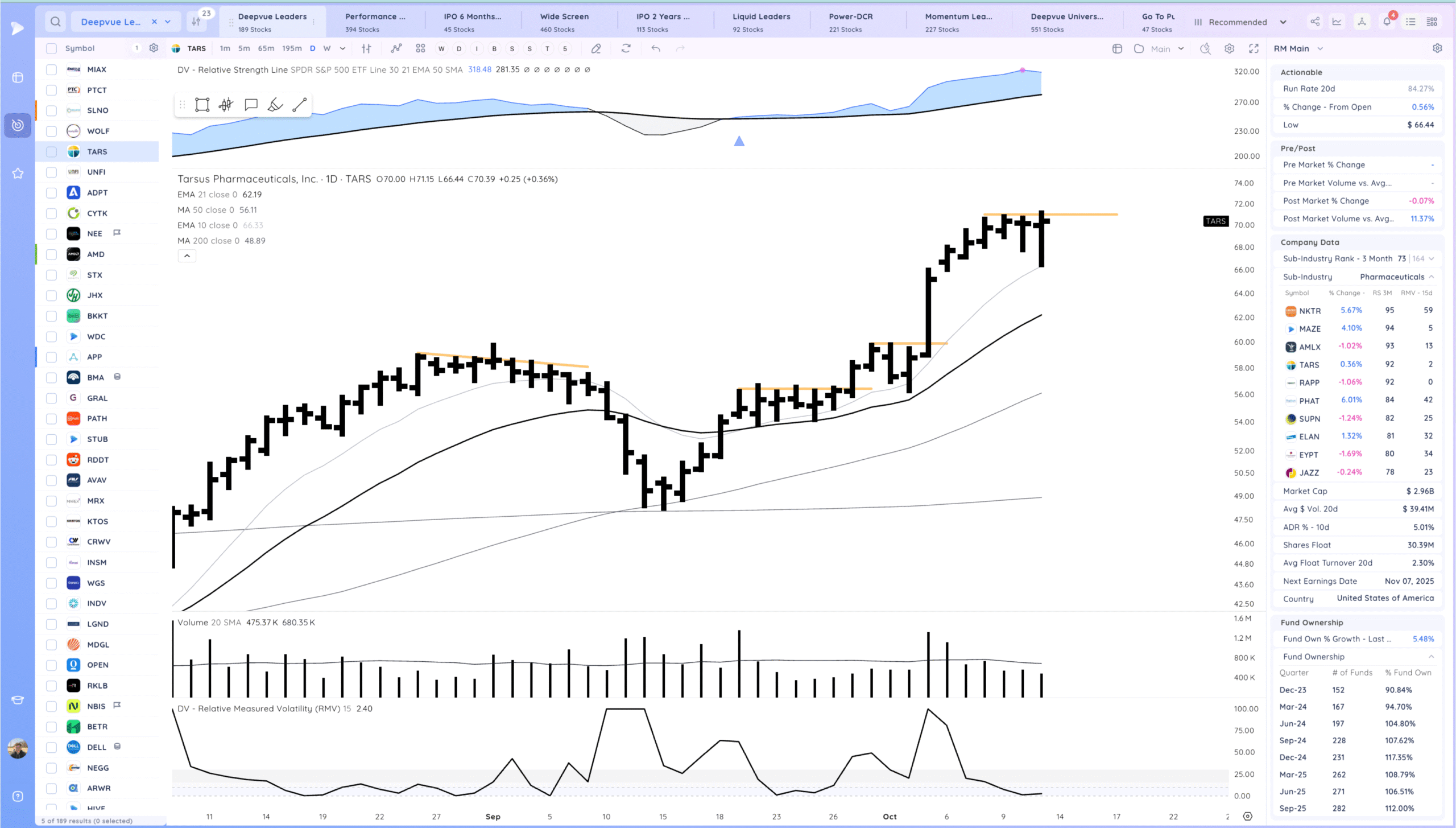

TARS swing trade setup watching for a range breakout

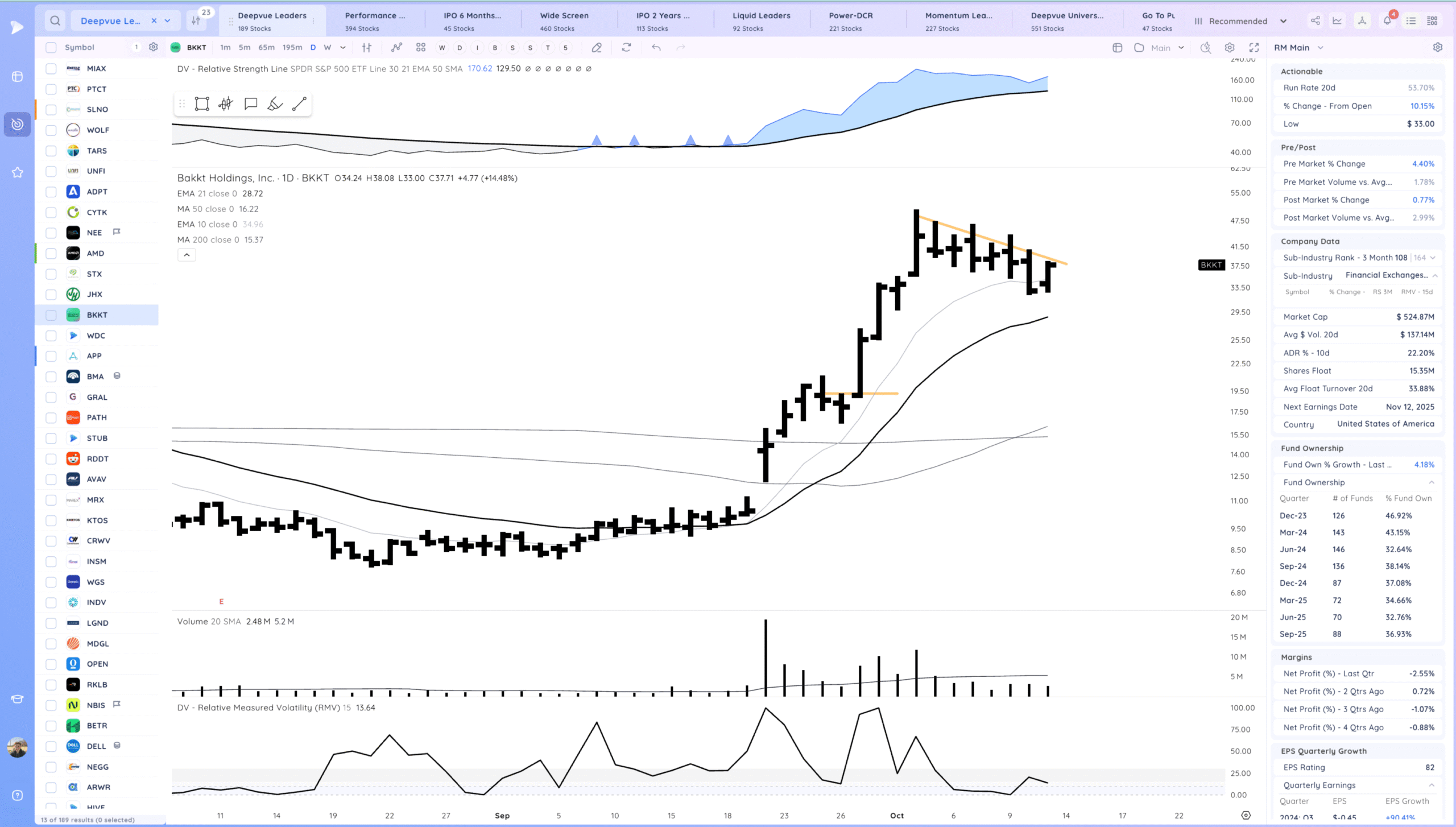

BKKT watching for a flag breakout

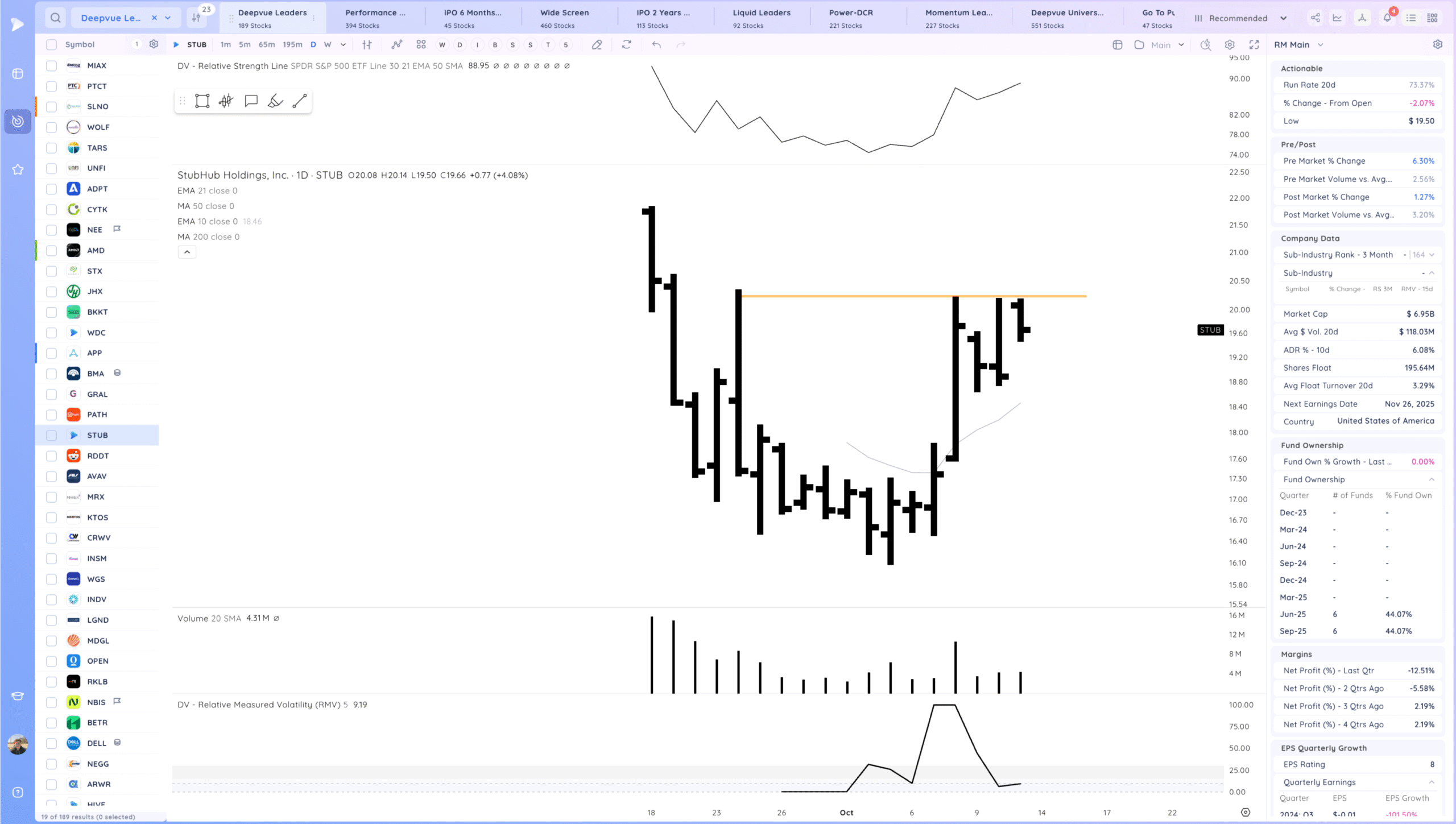

STUB watching for a range breakout

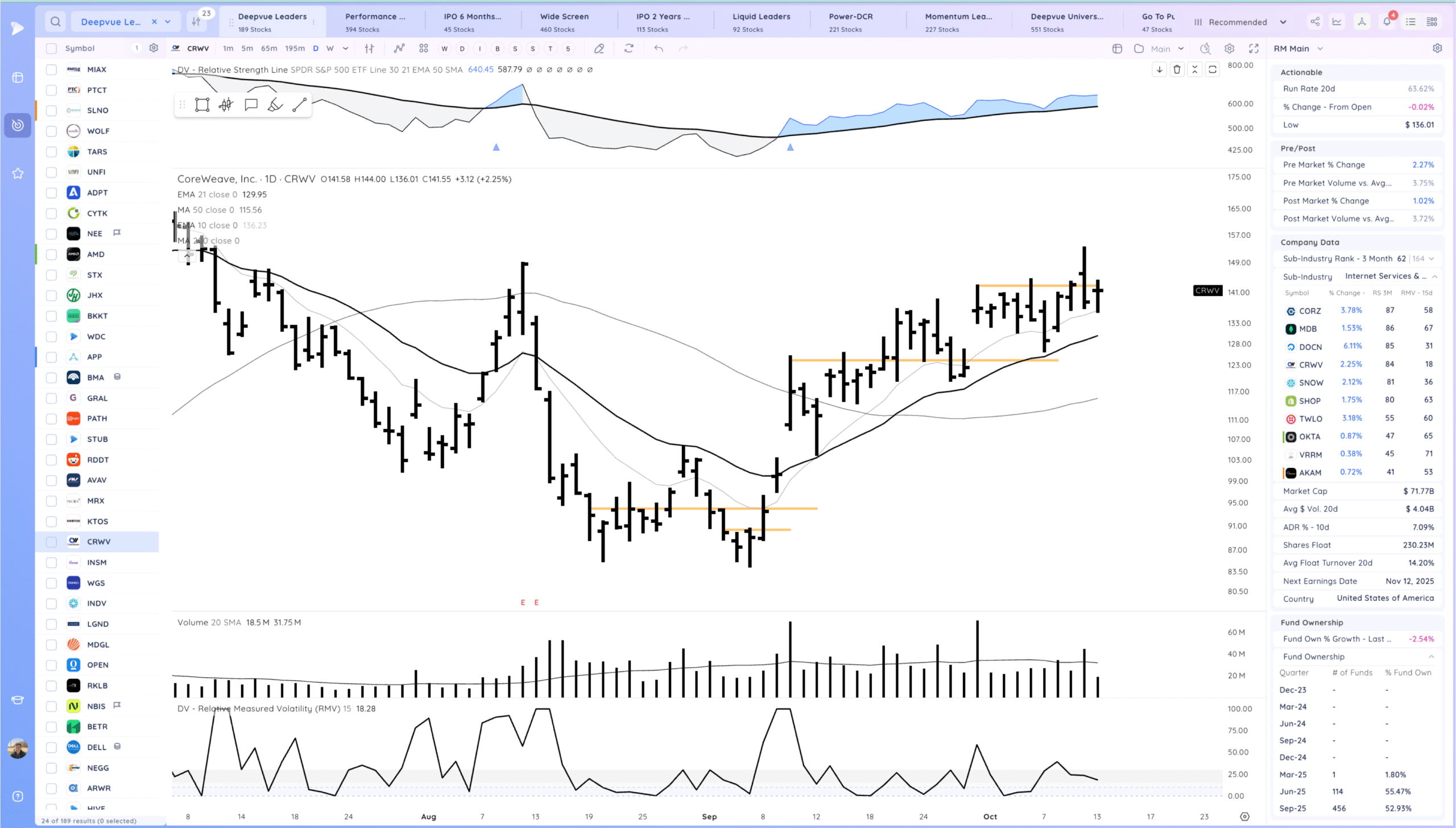

CRWV watching for follow through up and range breakout

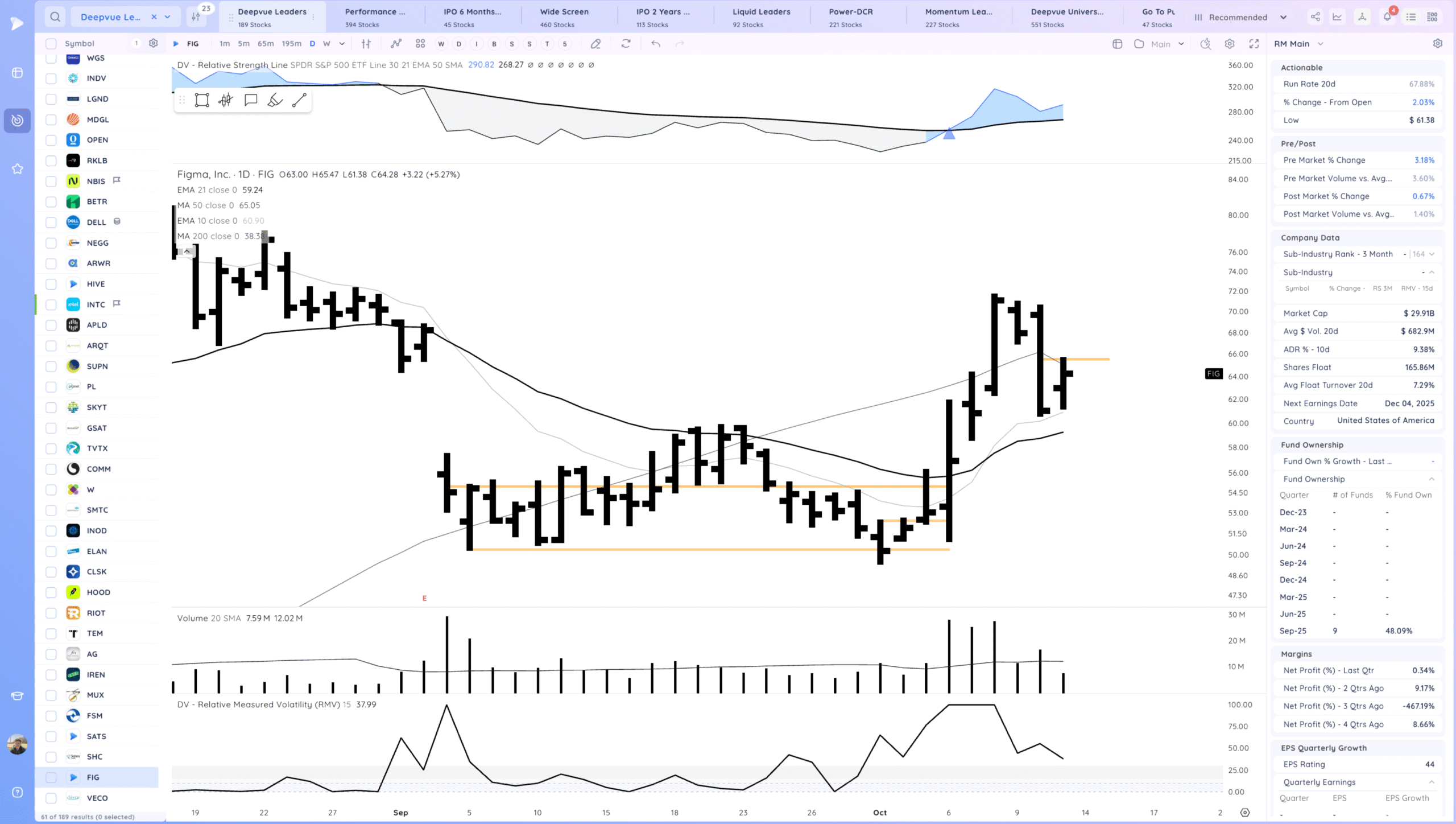

FIG watching for follow through up off the 10ema

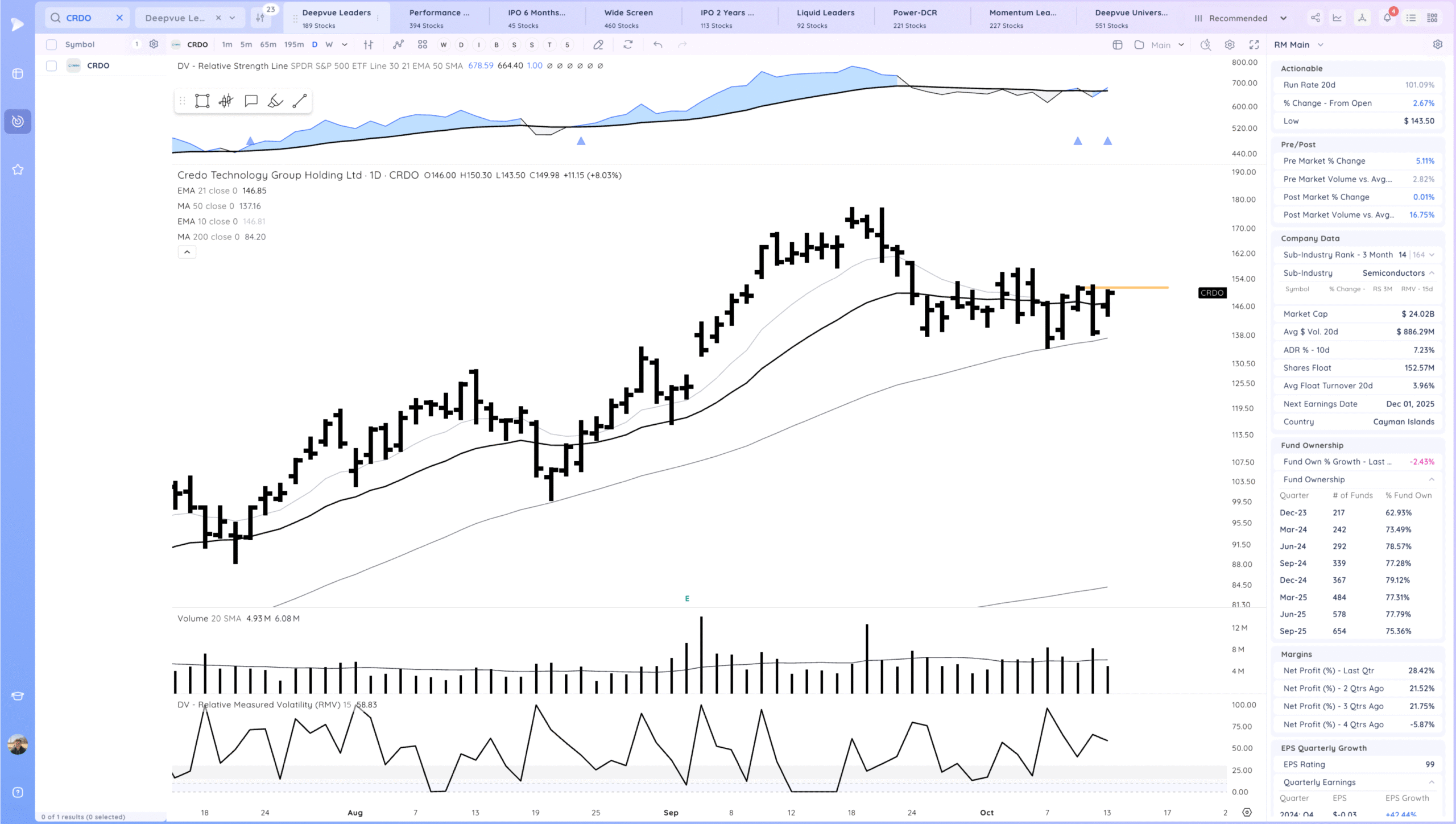

CRDO watching for follow through up and range breakout

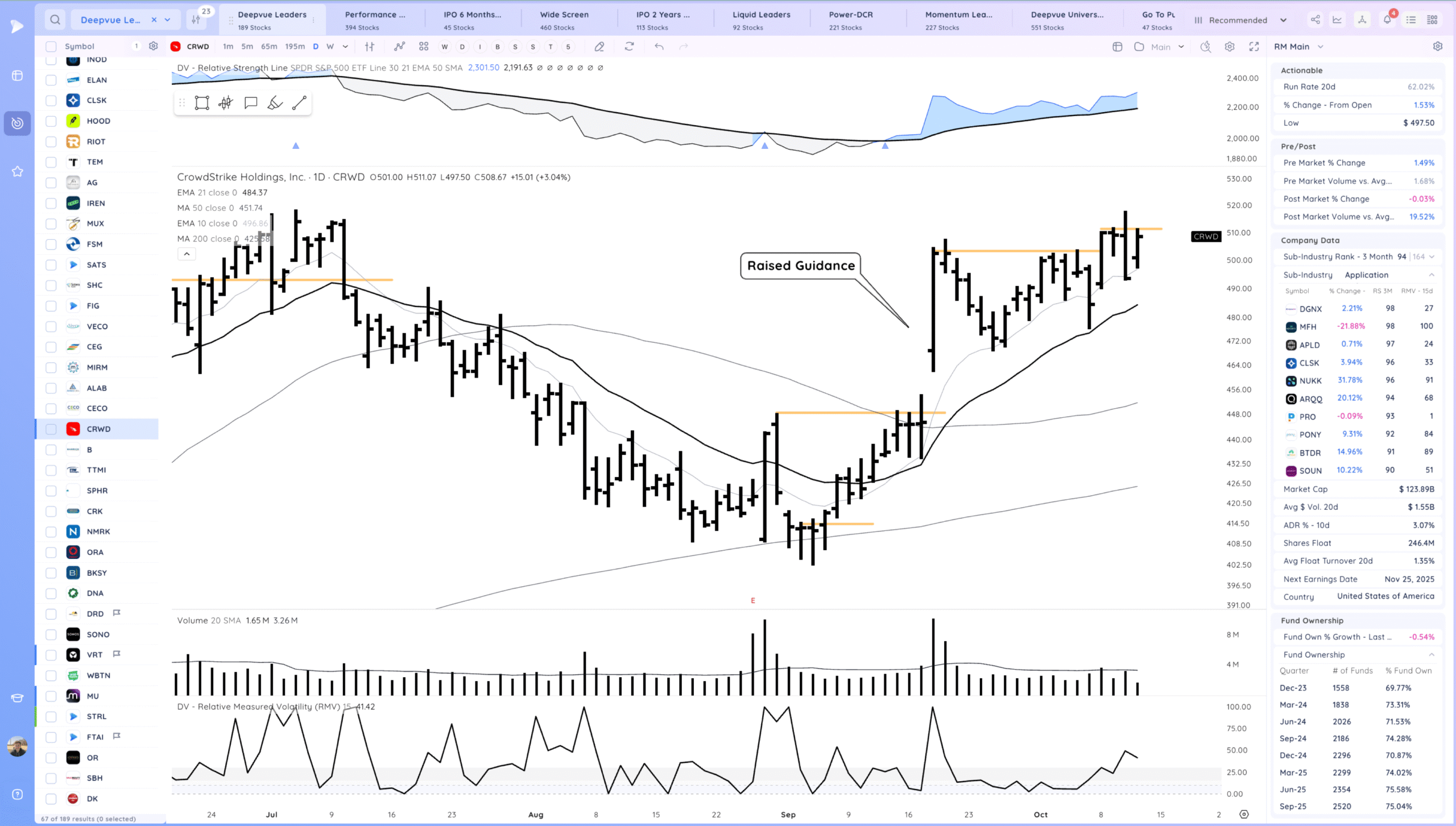

CRWD watching for follow through up and range breakout

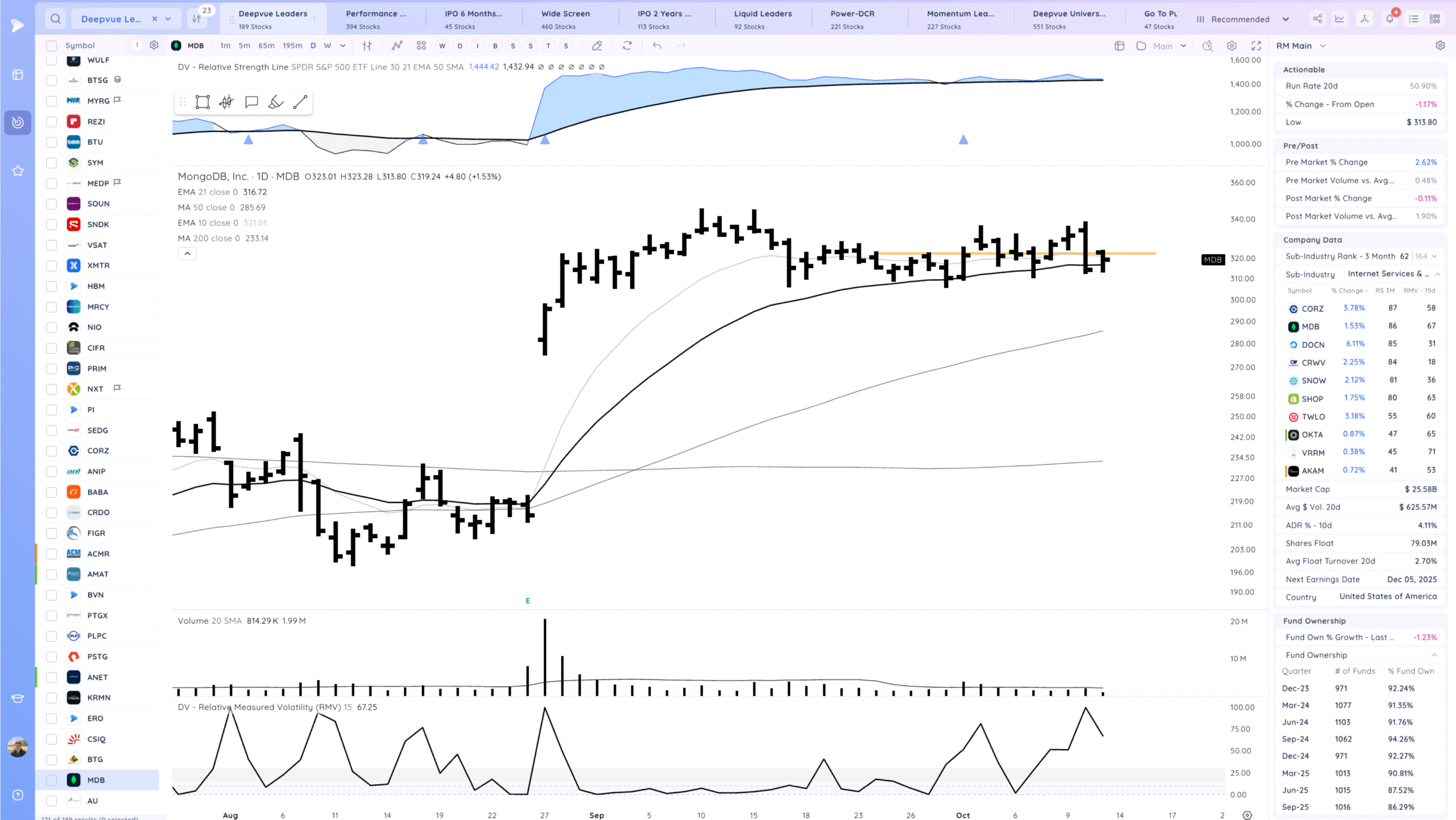

MDB watching for follow through up from the inside day

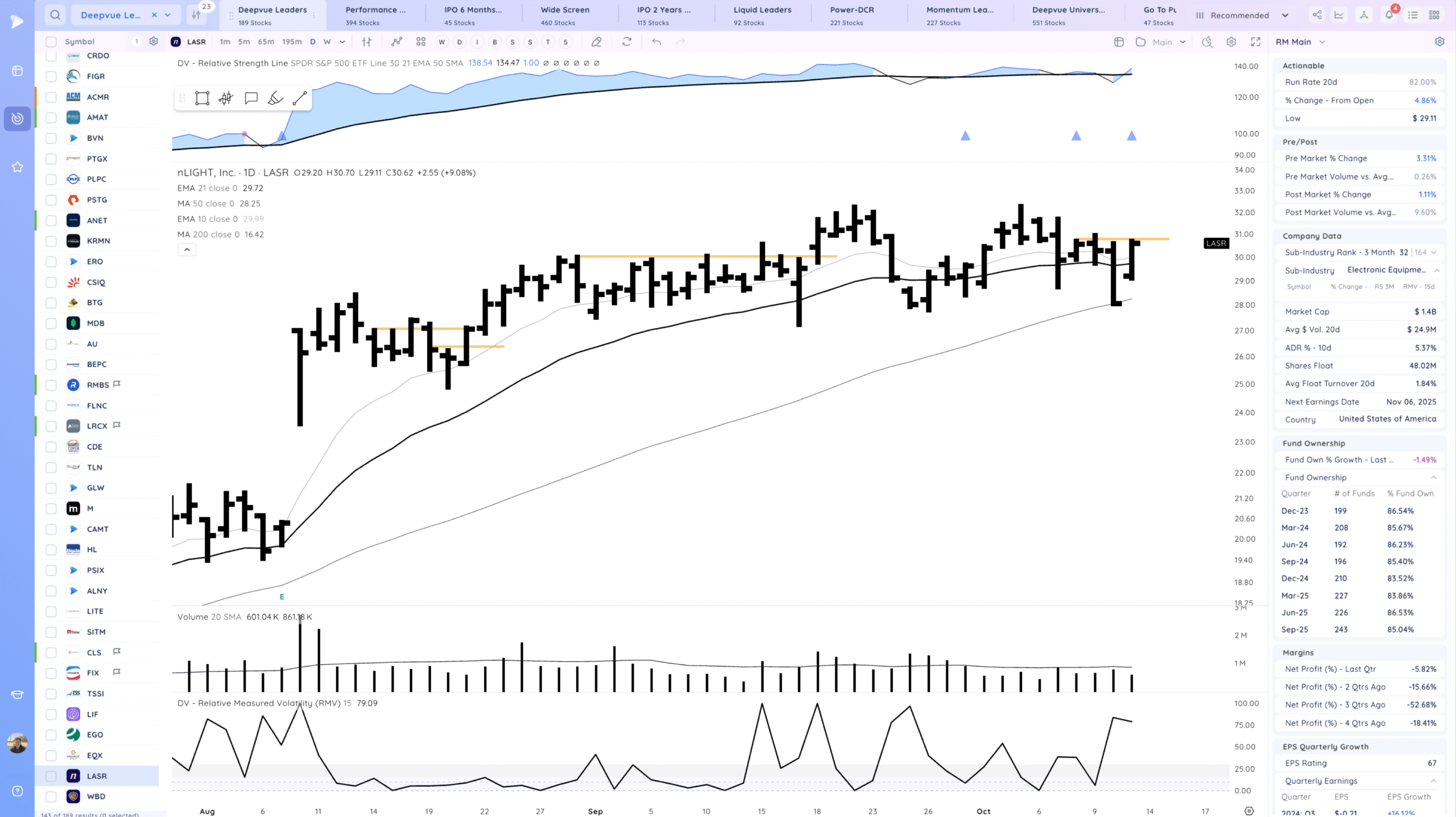

LASR watching for follow through up and range breakout

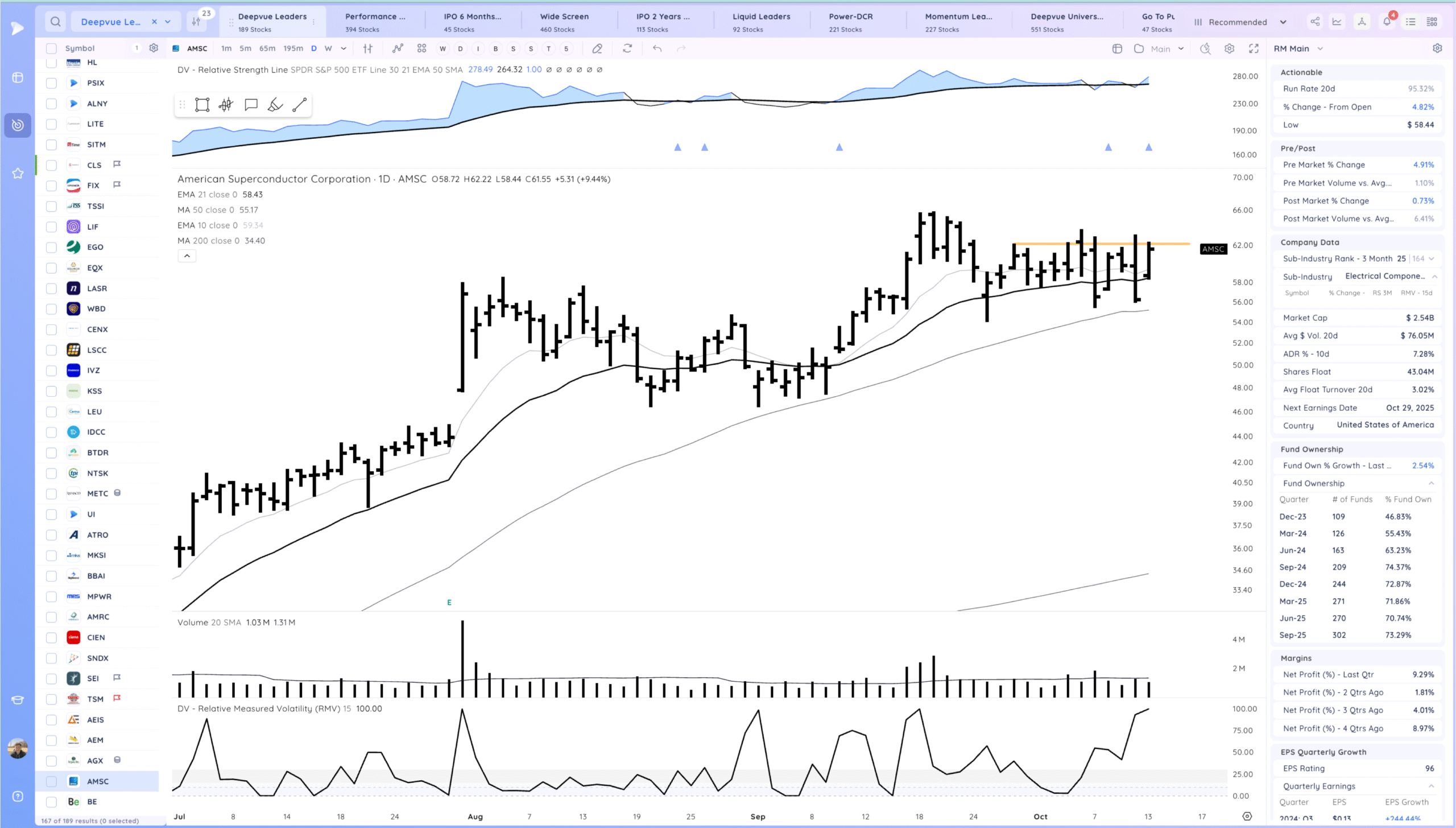

AMSC watching for a consolidation breakout

Today’s Watchlist in List form

Focus List Names

TARS BKKT STUB CRWV FIG CRWD CRDO MDB LASR AMSC TSLA GEV

Focus:

TSLA STUB AMSC CRWV

Themes

Strongest Themes: AI, AI Energy

Vulnerable Themes: Crypto

Additional Thoughts

As mentioned this weekend was an interesting situation as the market could recover quickly if the trade tension catalyst was reversed, as has been the pattern. We got that and today we saw positive expectation breakers across the board. I view us as still being in the same market cycle. I’m focusing on names that bounced strongly today and held their structures.

Anything can happen, Day by Day – Managing risk along the way