Pause in the Trend

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

September 23, 2025

Market Action

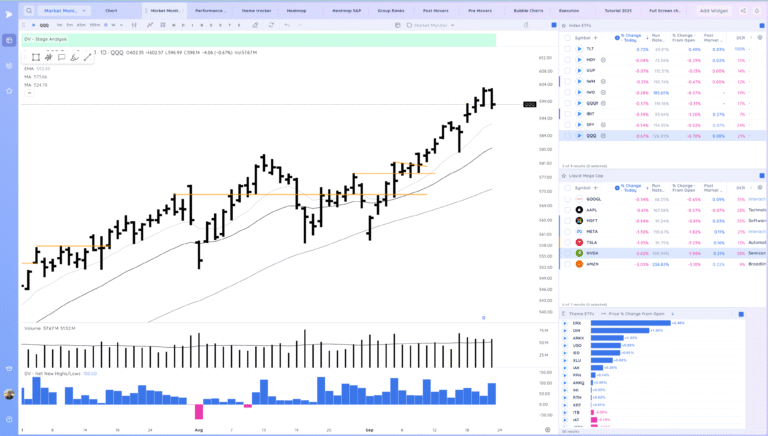

QQQ – Pullback today as we undercut yesterday’s low. We are trending above rising moving averages.

Powell today expressed some hesitancy about future rate cuts.

Bulls want to see continued progress above the MAs or constructive tightening/range building

Bears want to see a sharp break lower closing at lows testing the 10ema

Daily Chart of the QQQ.

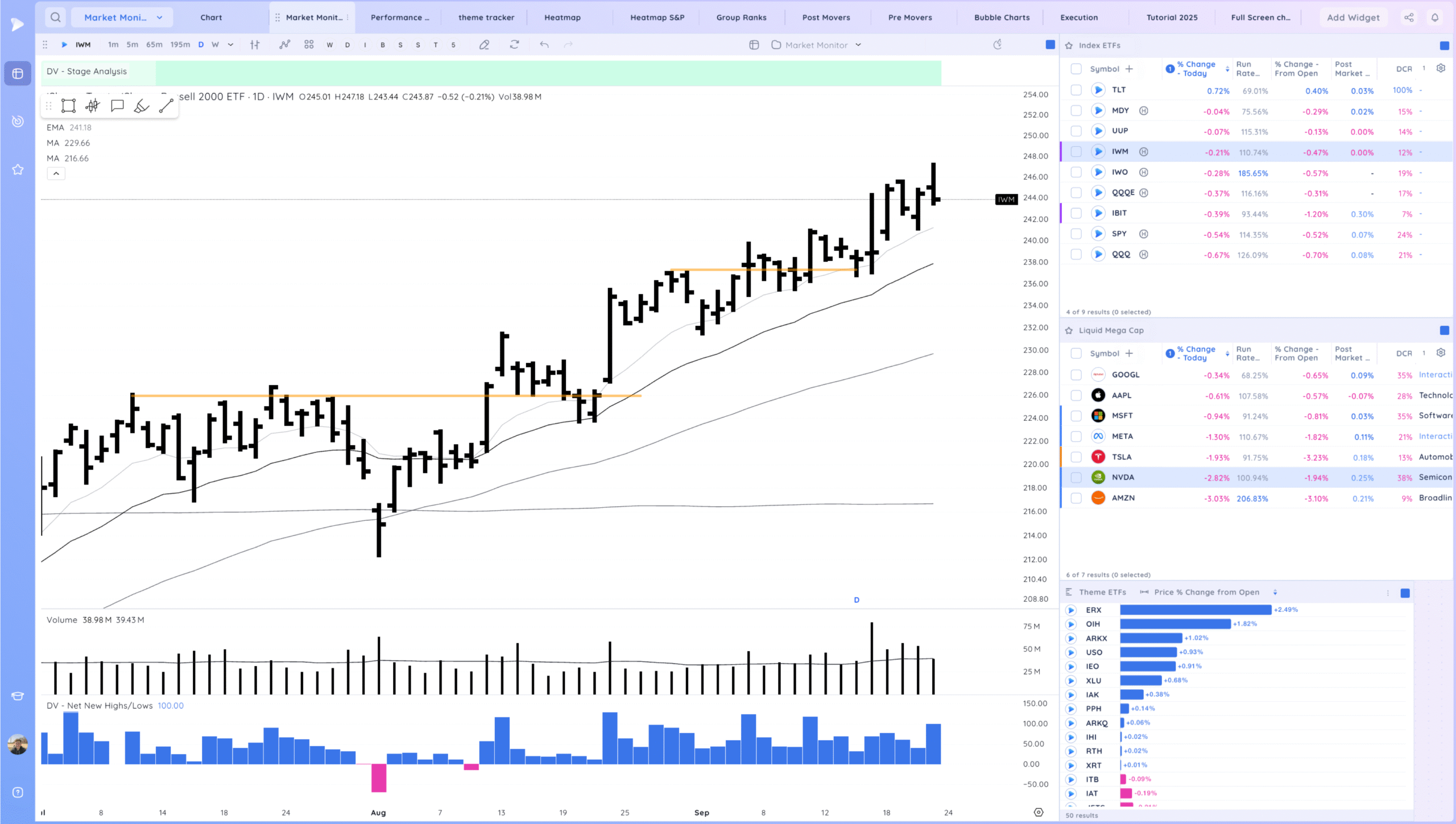

IWM – Downside reversal

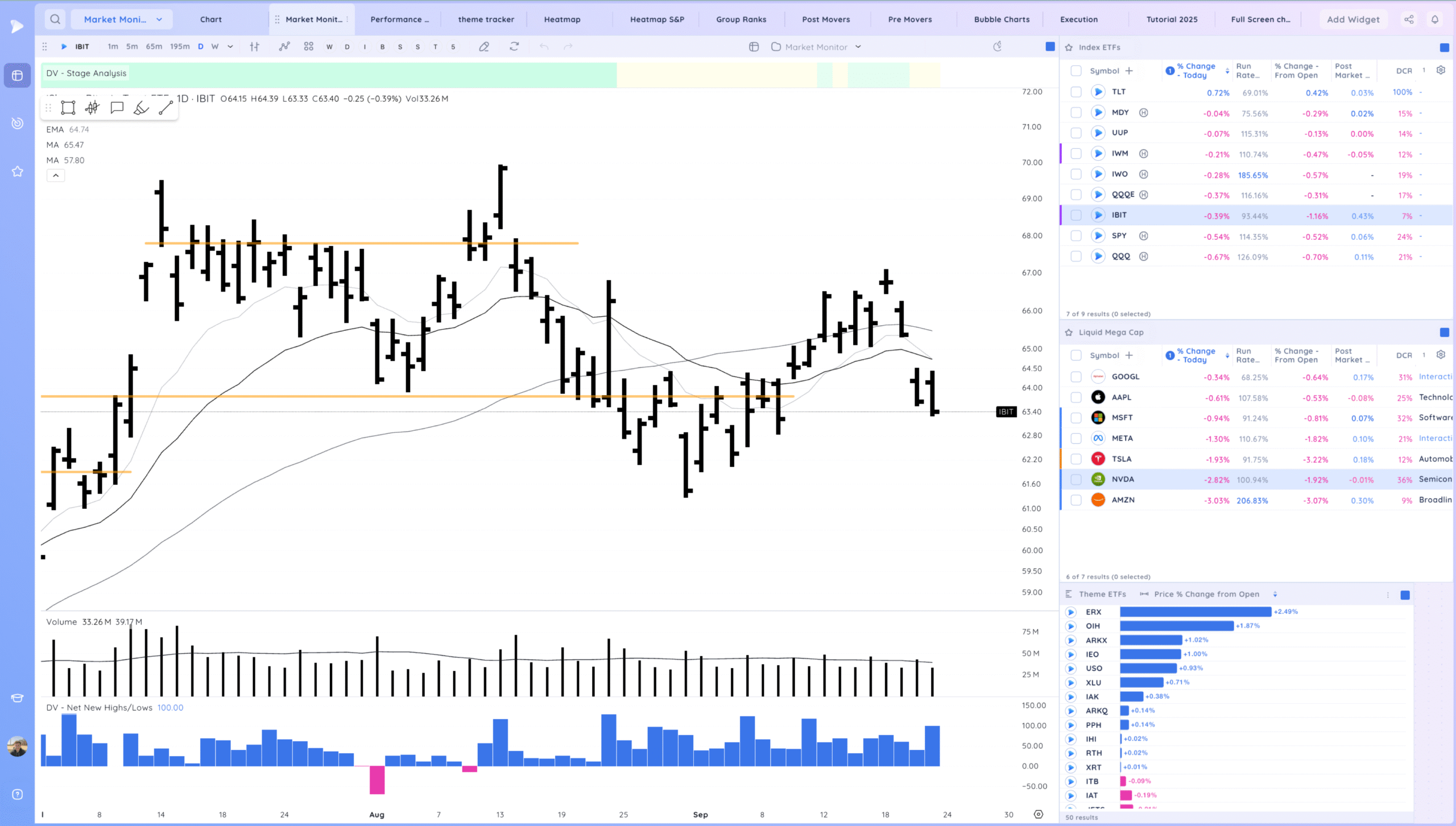

IBIT – Gap up but close at lows

Trends (4/4 Up) – Based on the QQQ

Shortest – 10 Day EMA – Above

Short-term – 21 ema – Above

Intermediate term – 50 sma – Above Rising

Longterm – 200 sma – Up – Above Rising

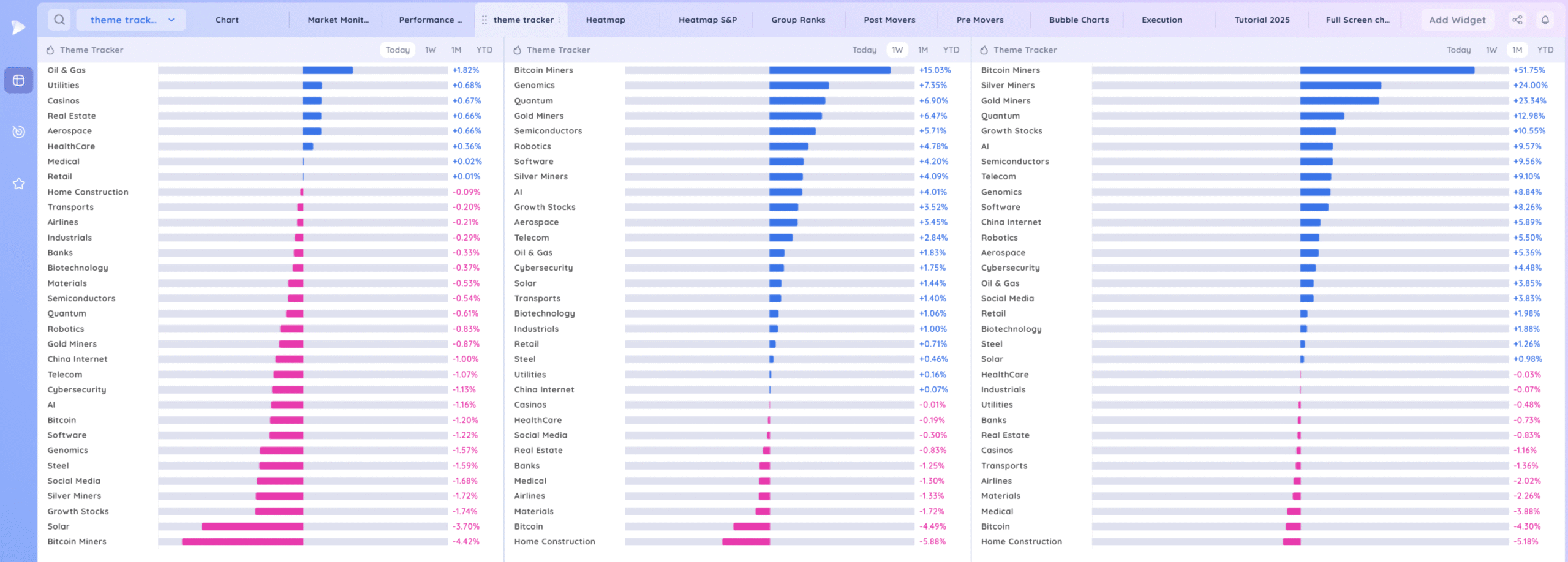

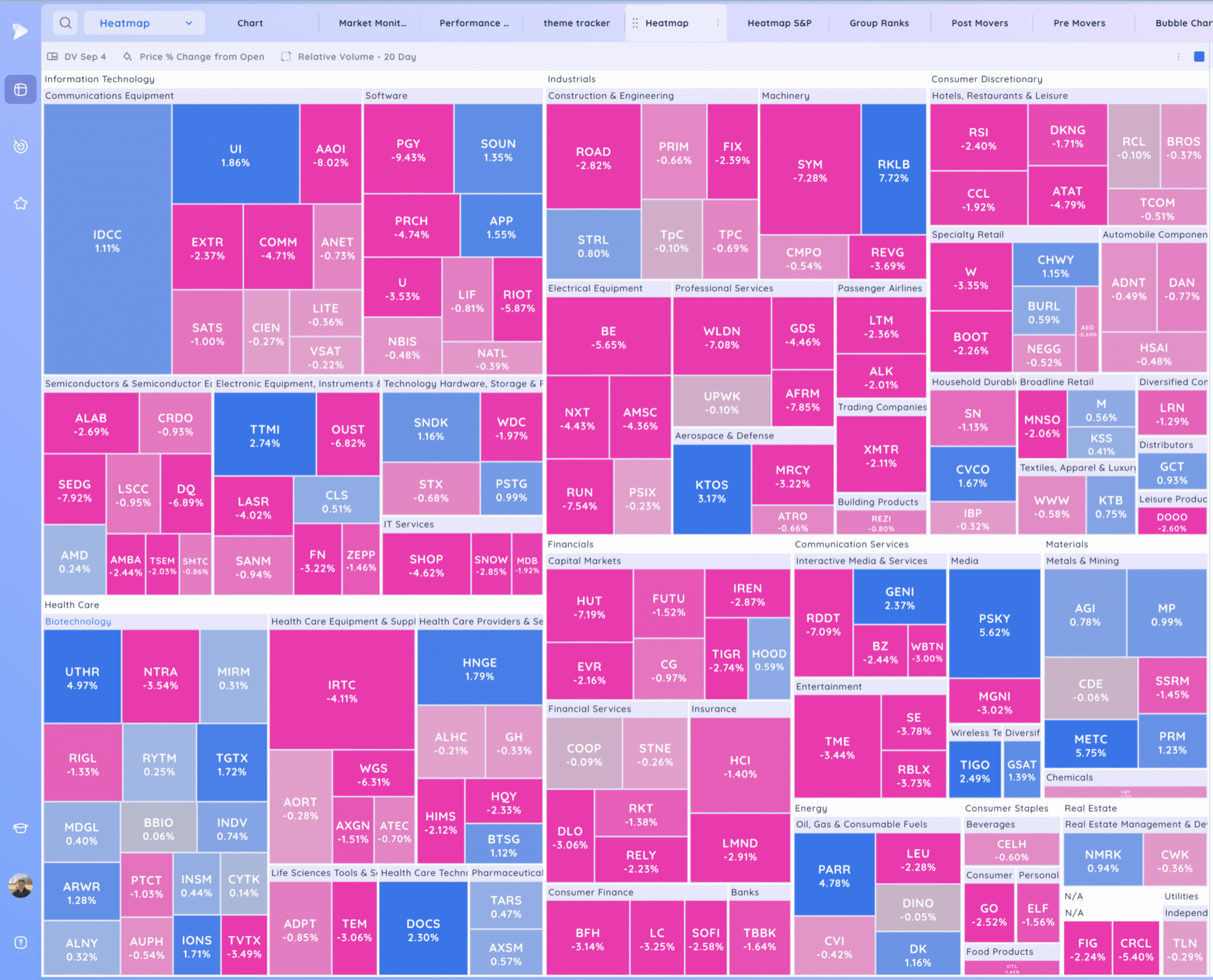

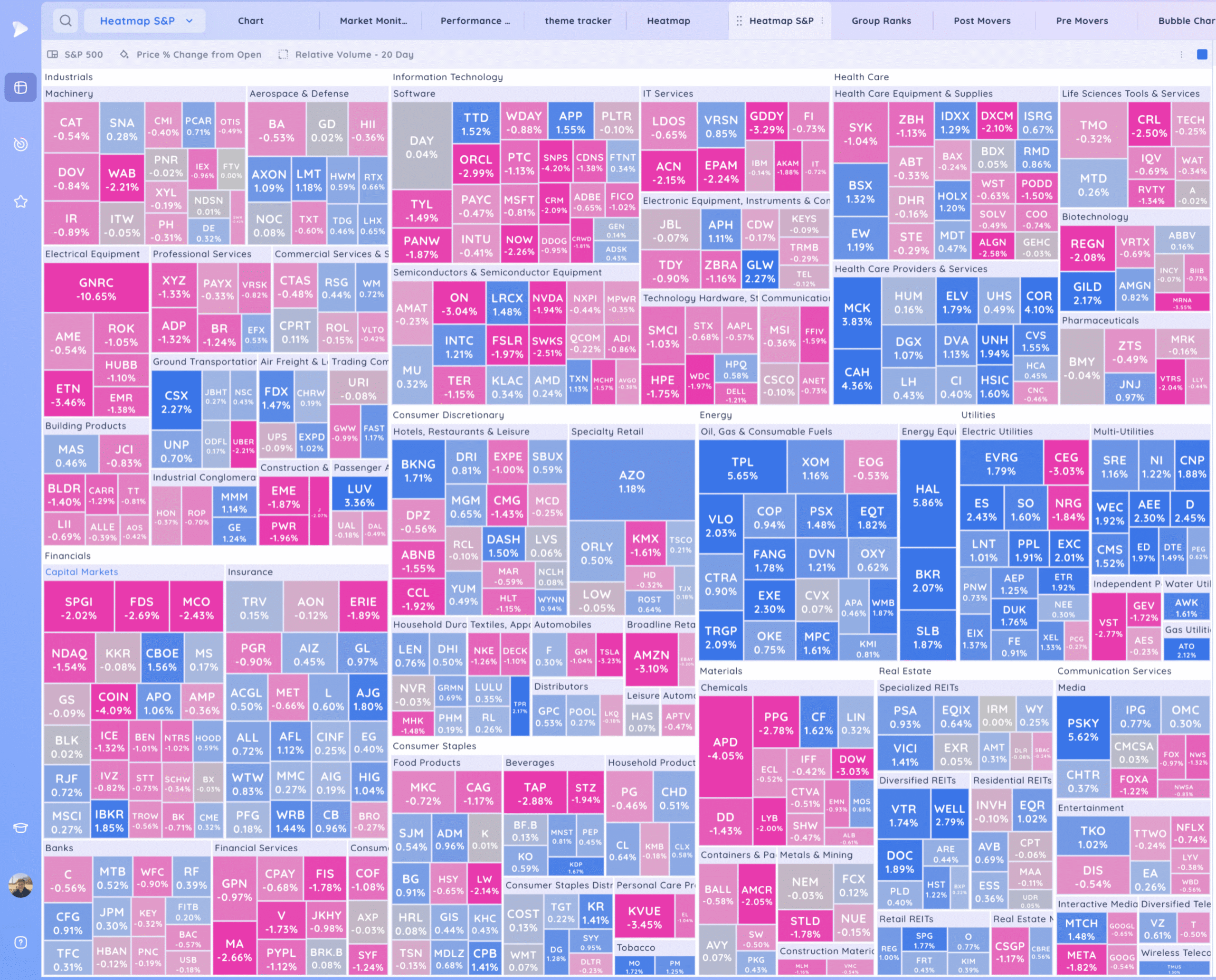

Groups/Sectors

Deepvue Theme Tracker

Deepvue Leaders

S&P 500.

Leadership Stocks & Analysis

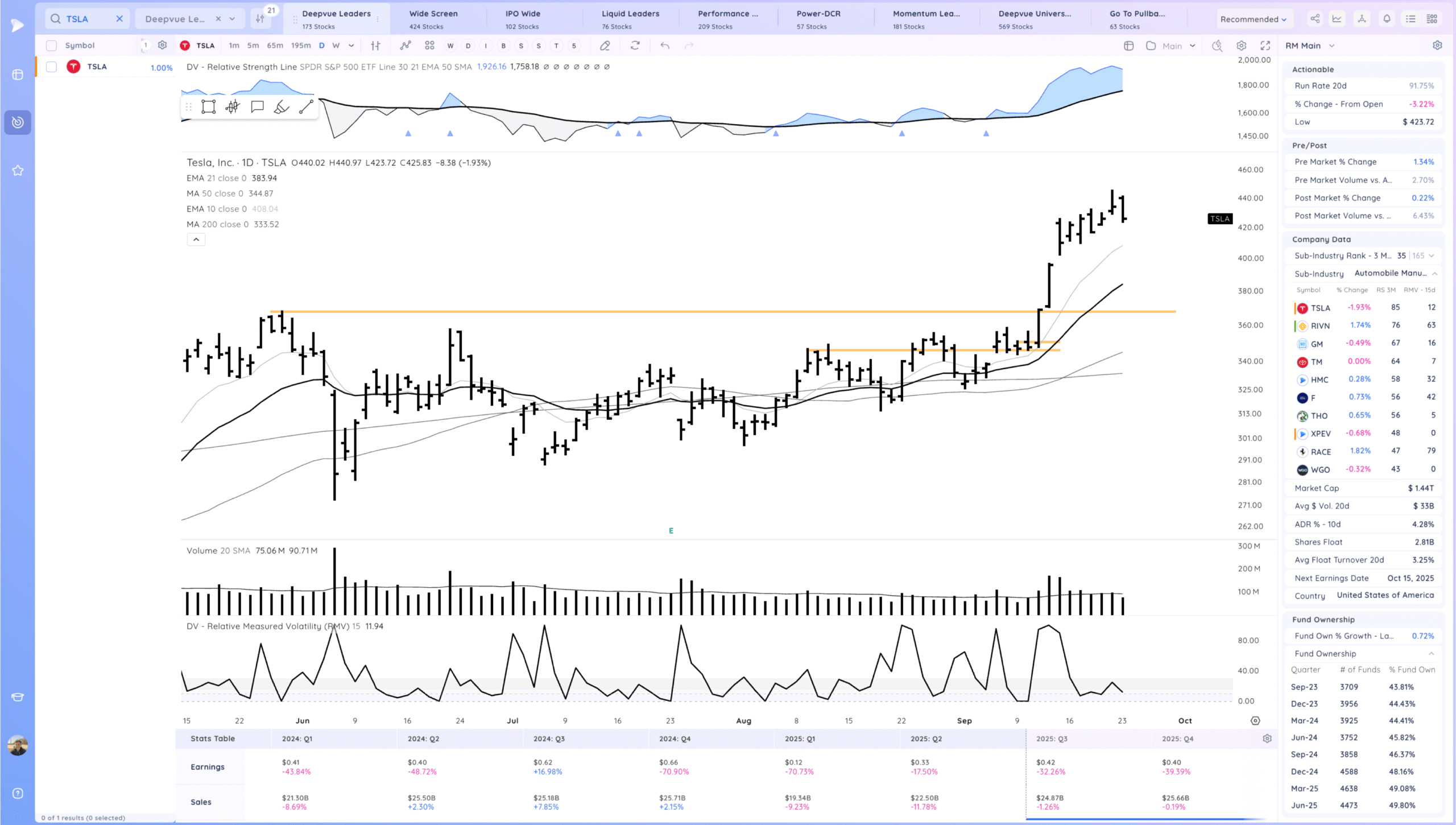

TSLA – Some follow through down after yesterday’s fade.

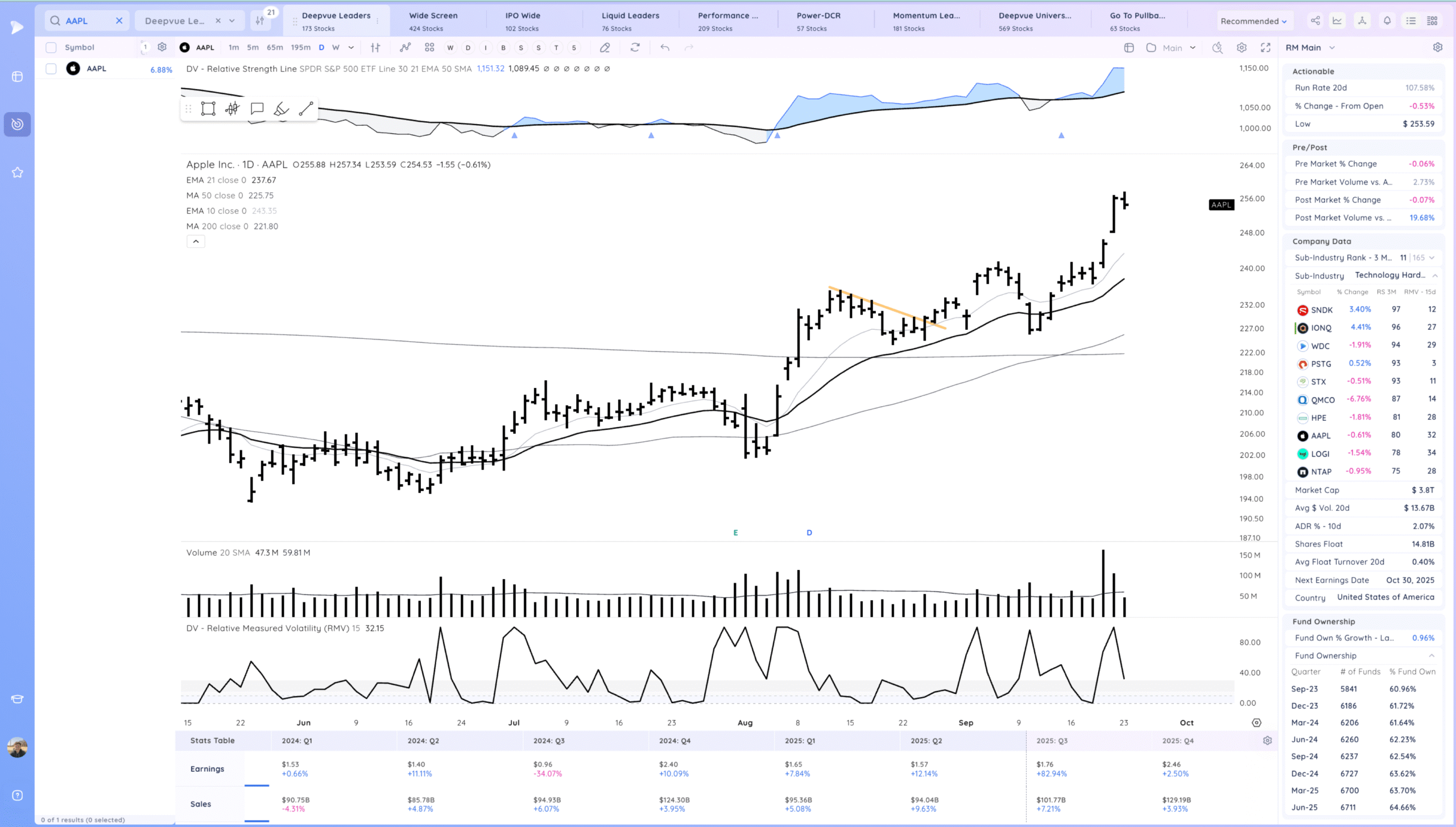

AAPL Slight downside reversal, overall tight day

PLTR Outside day. overall building a short range

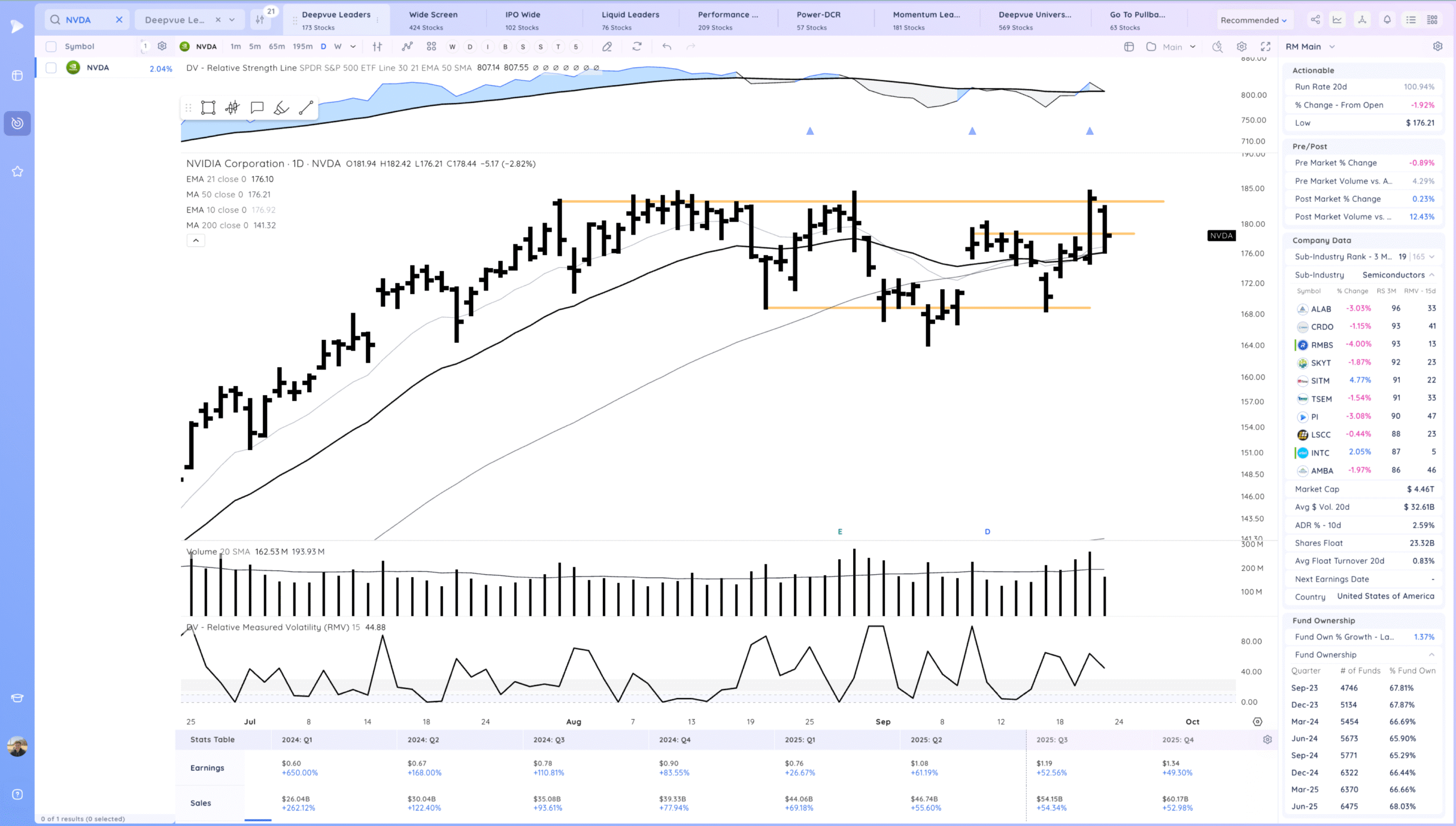

NVDA Reversing yesterday’s move. Constructive if we hold above the 21ema

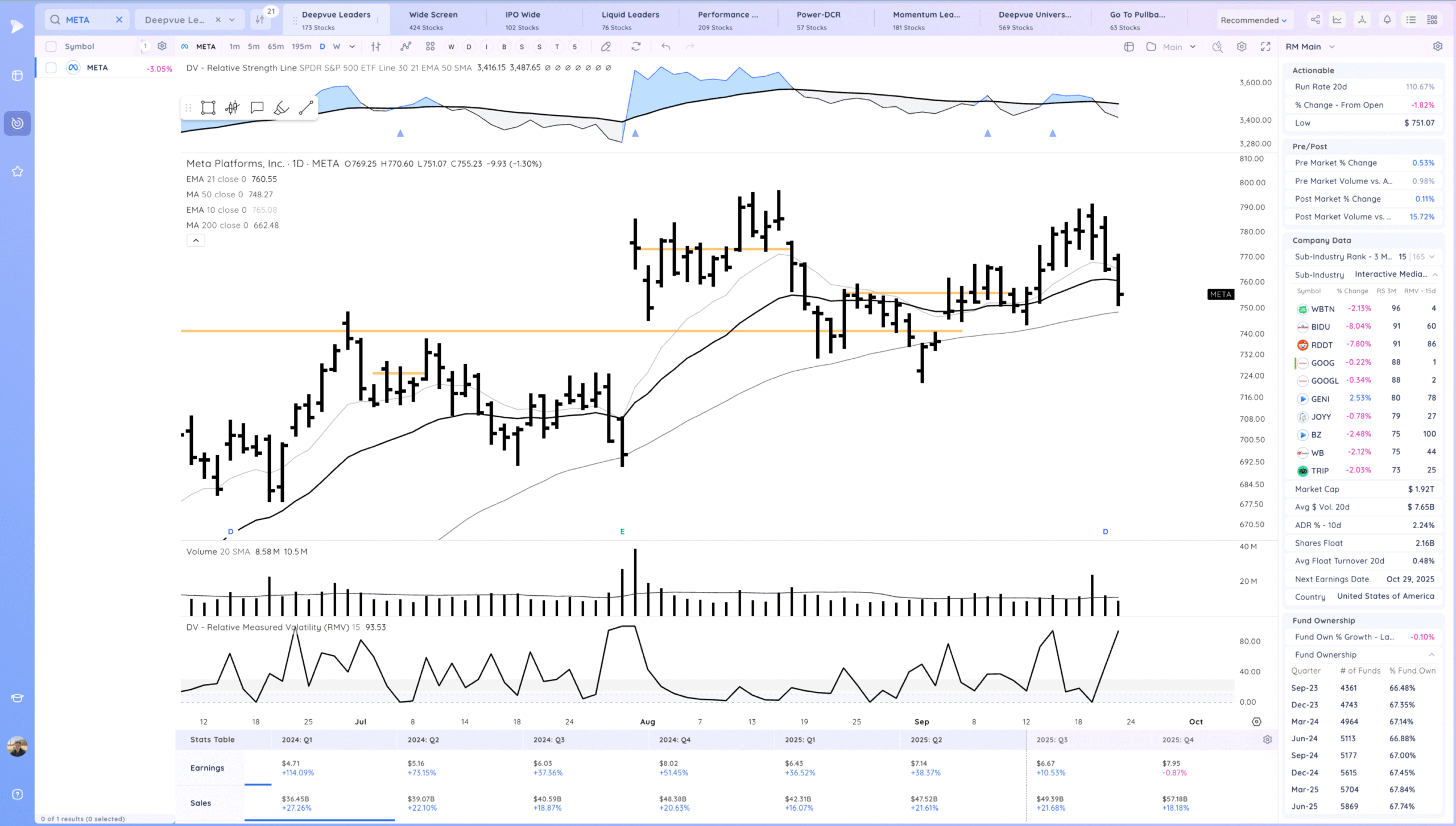

META Closing below the 21ema

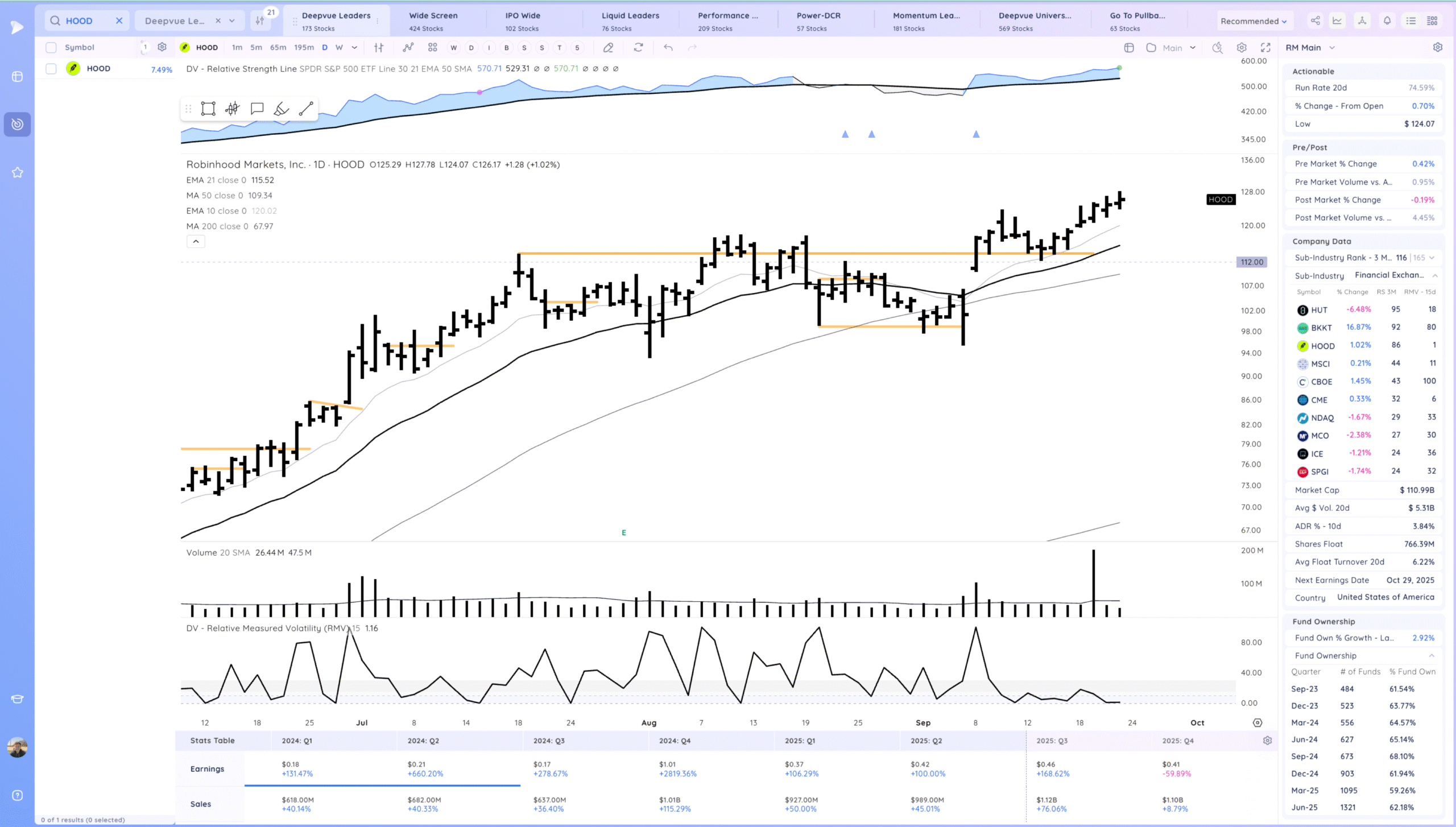

HOOD Wedging action higher on lower volume

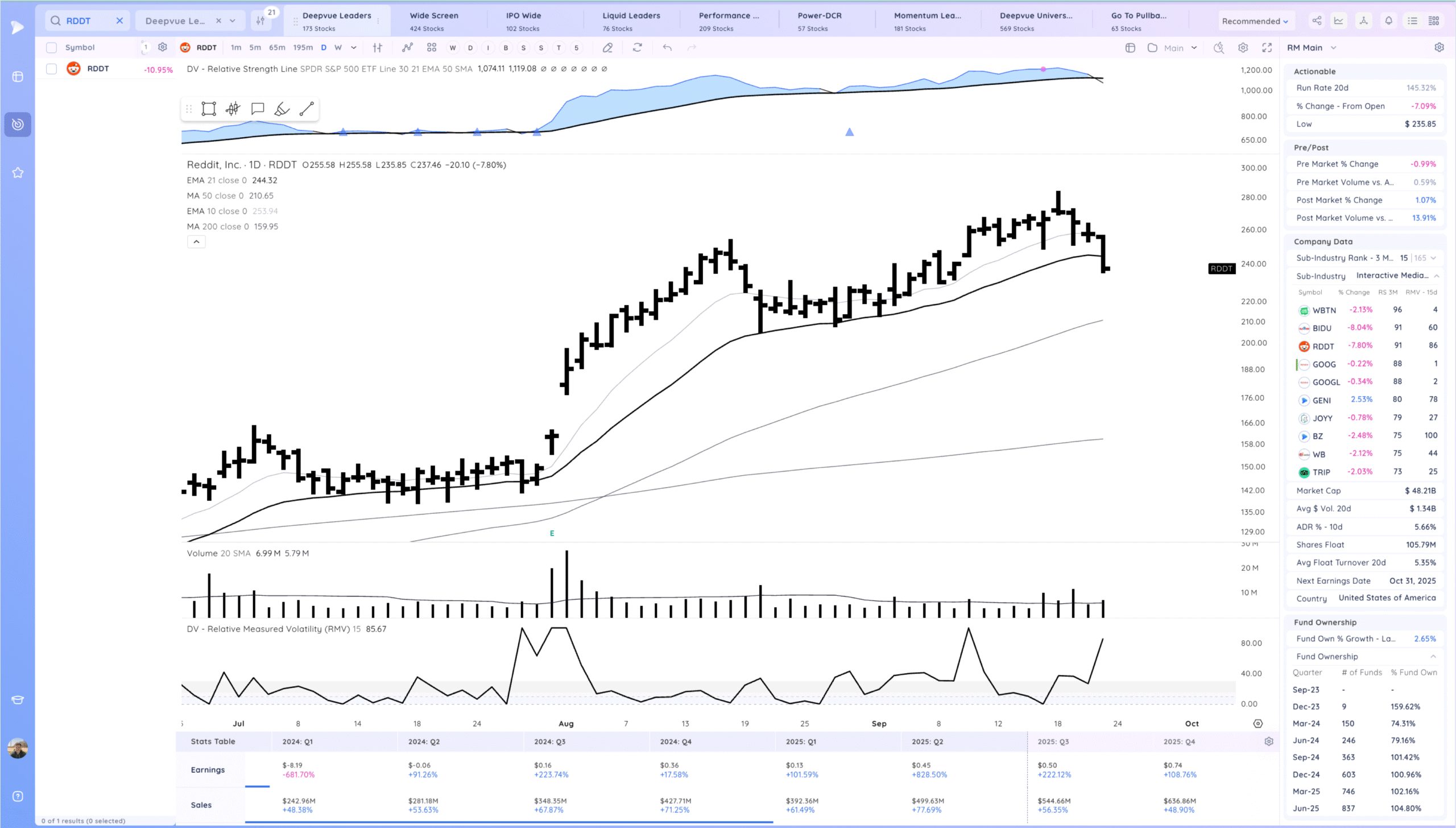

RDDT Expansion downwards after the tight day. Below the 21ema

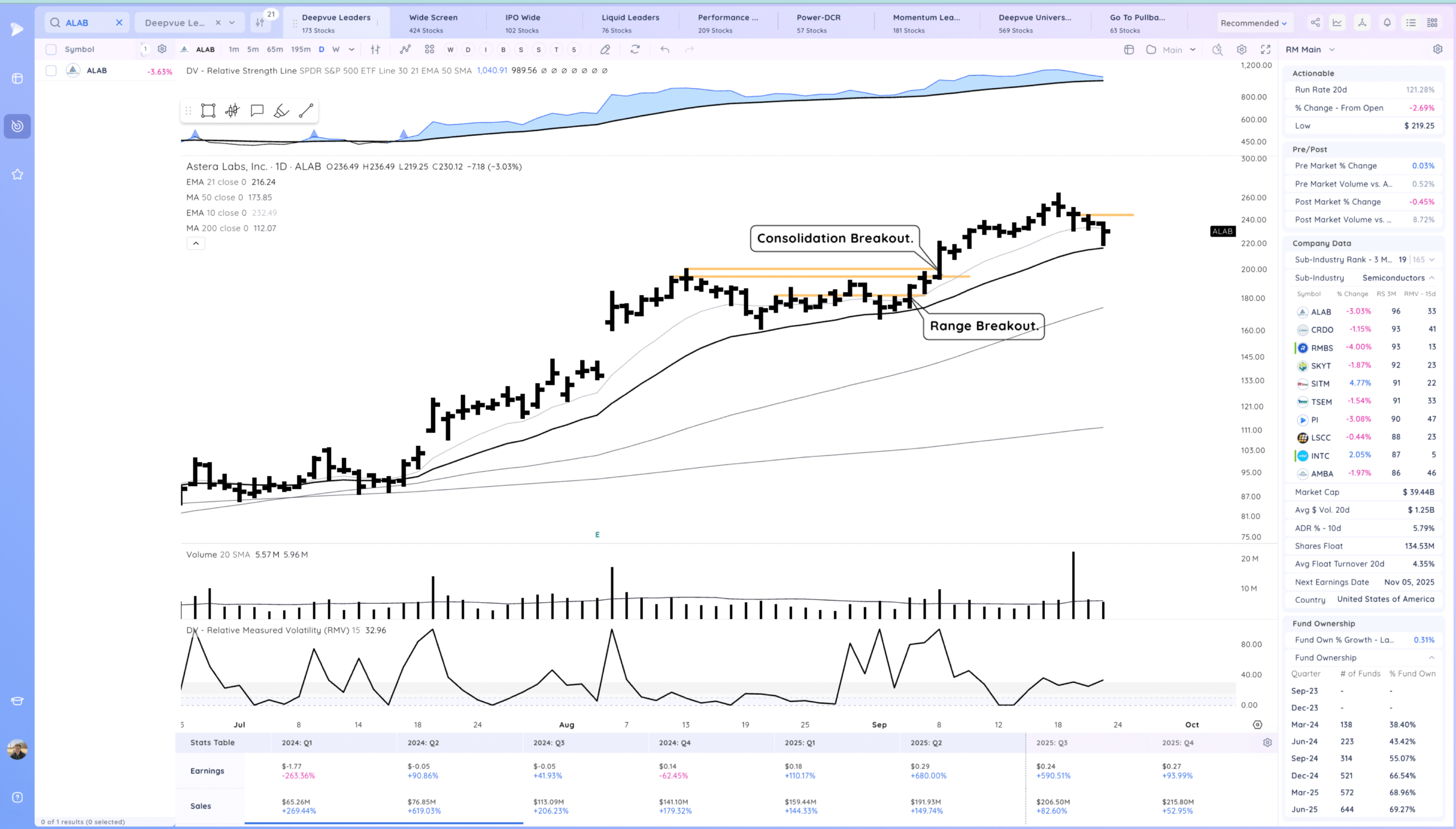

ALAB Break lower initially after the tight day but upside reversal off the 21ema. Watching for follow through up

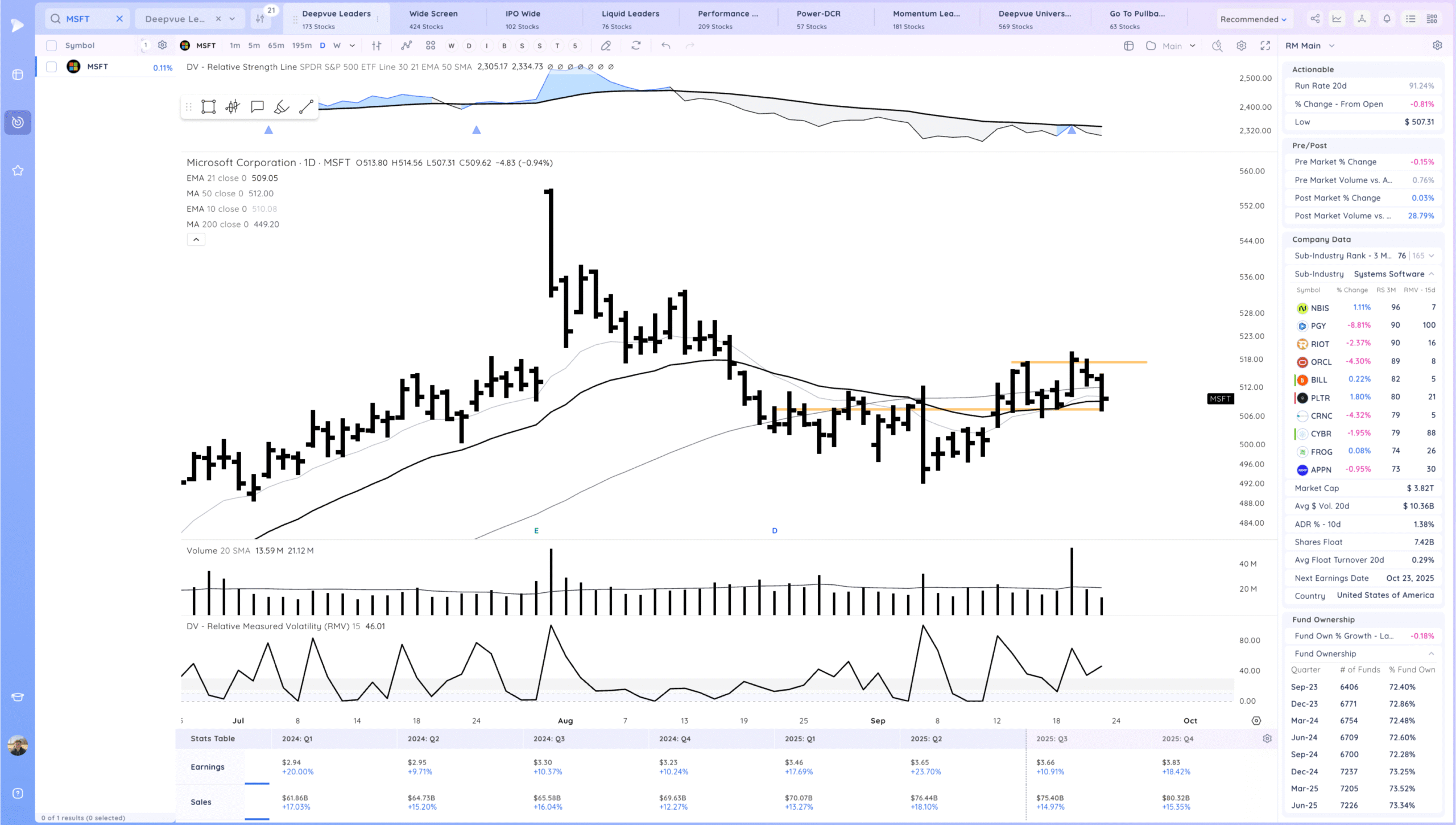

MSFT Back into the MA cluster.

Key Moves

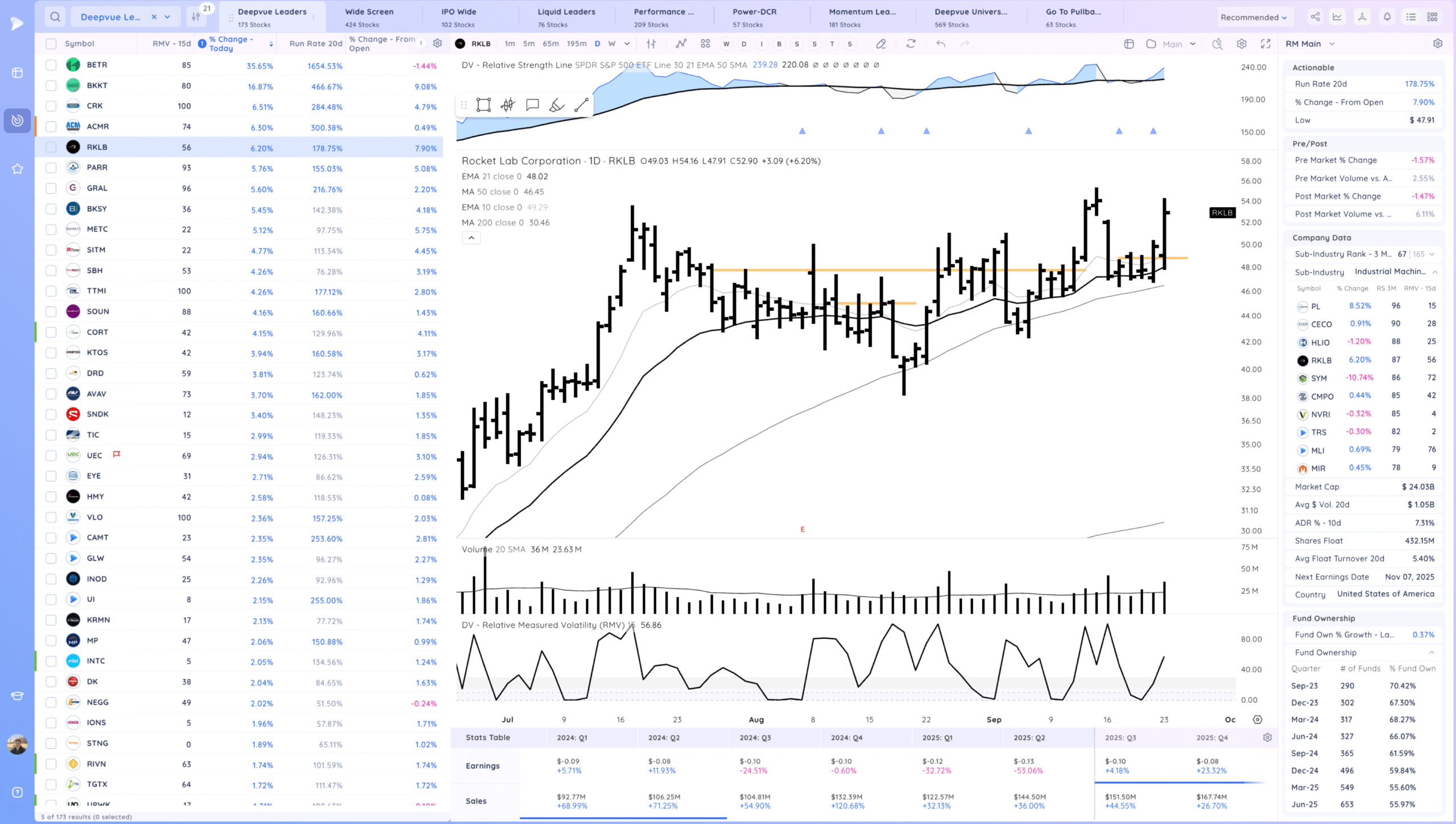

RKLB re-breakout

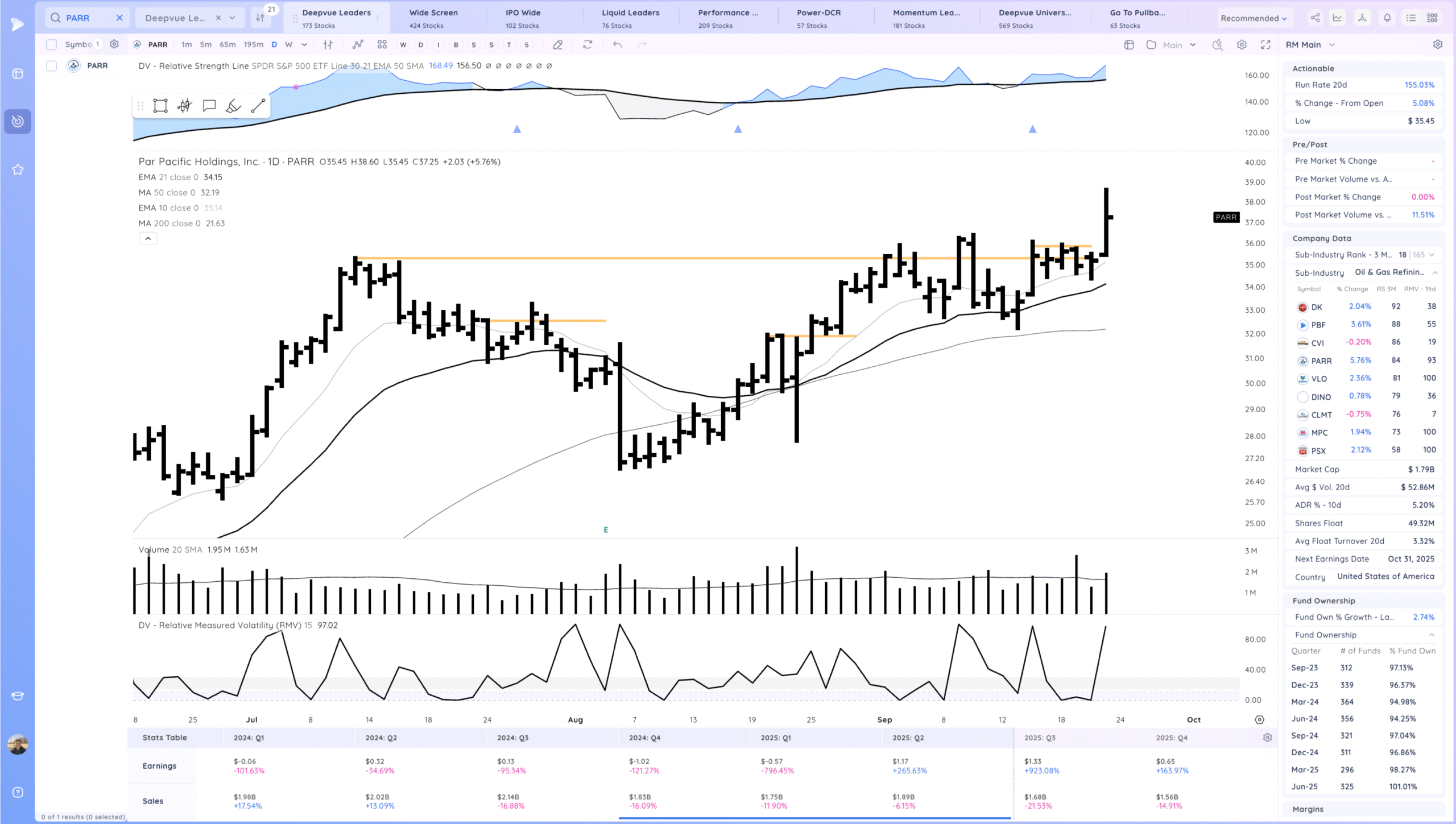

PARR Base Breakout

Setups and Watchlist

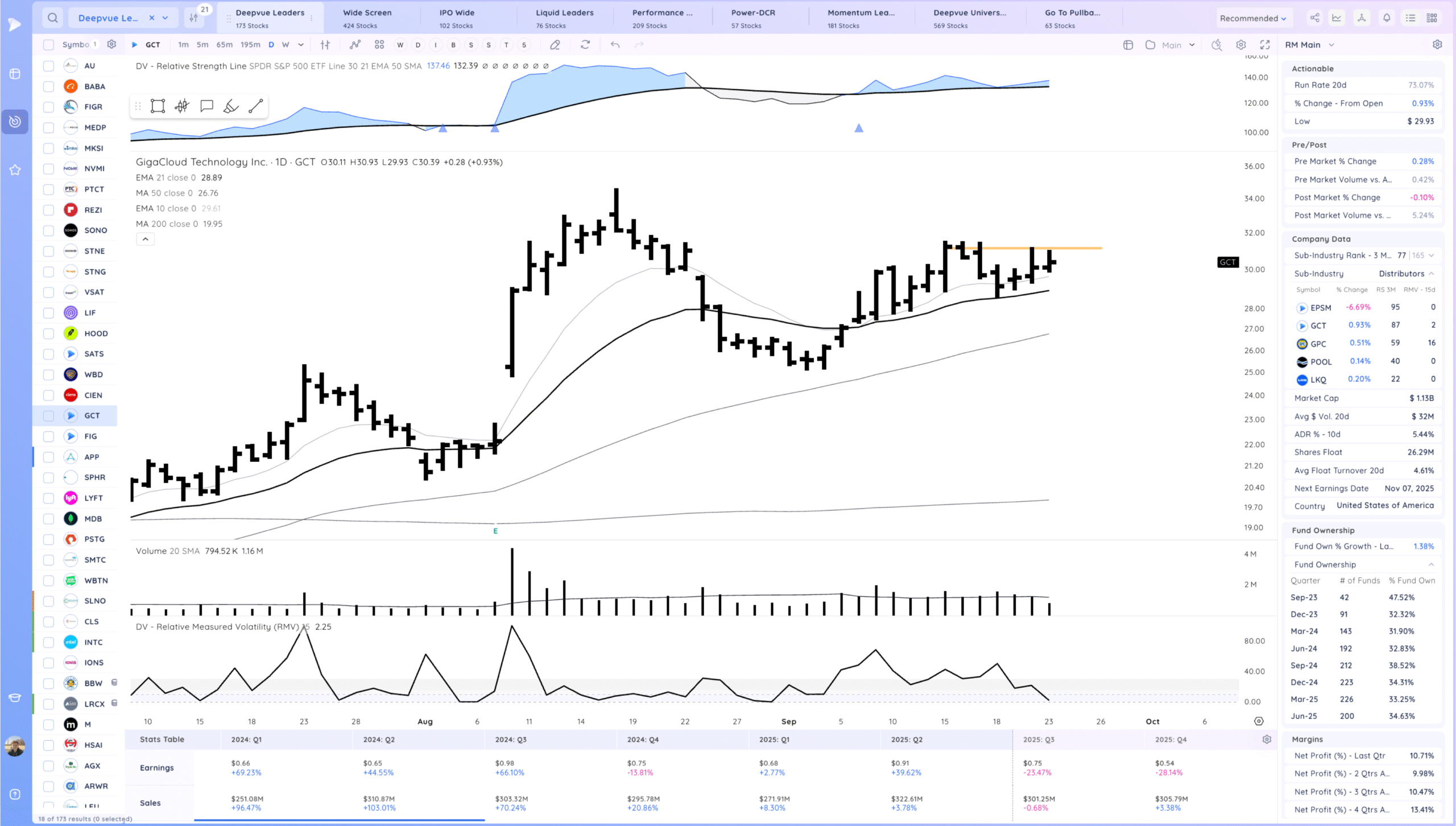

GCT watching for a range breakout. Fast Mover

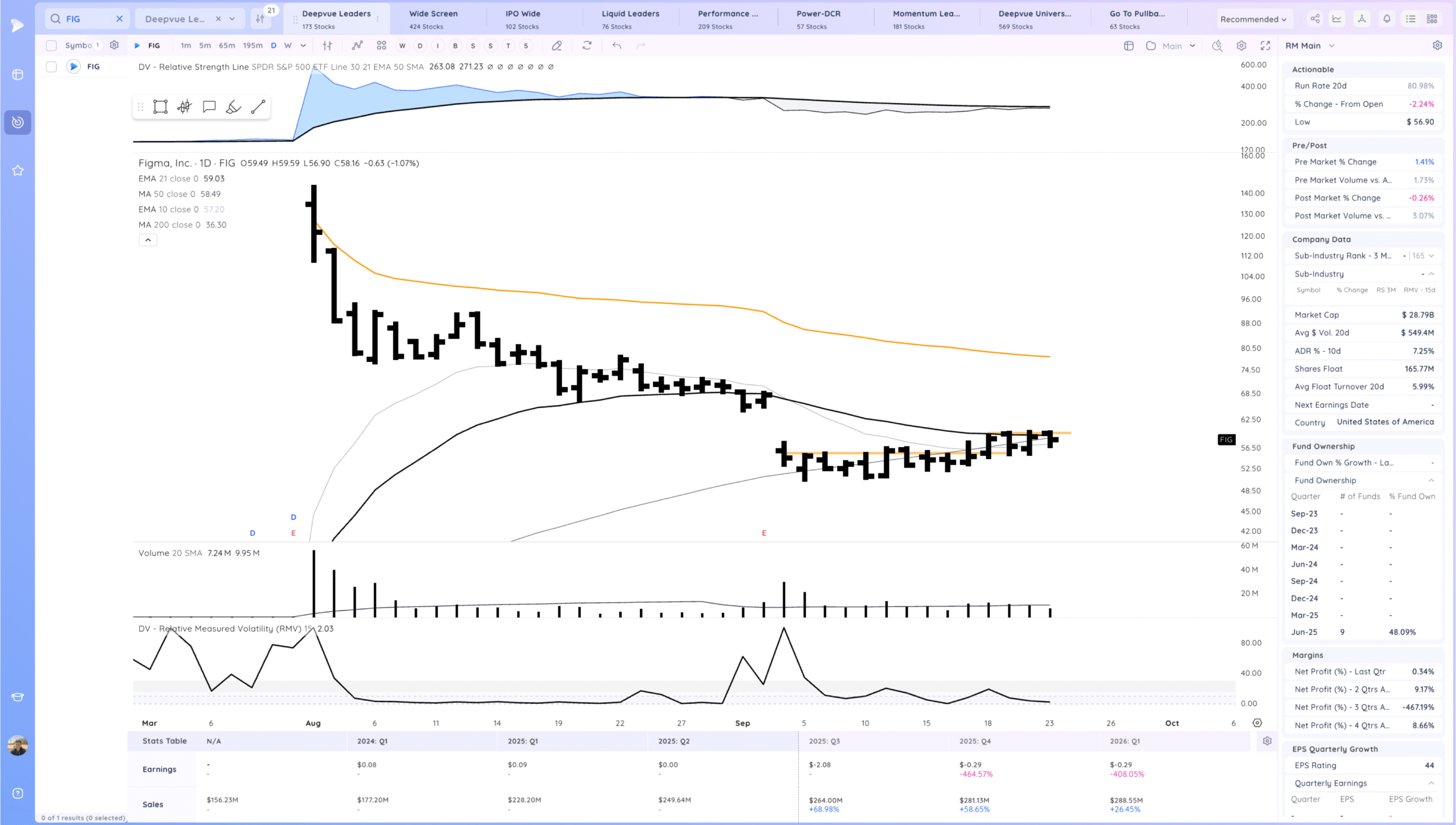

FIG watching for a range breakout

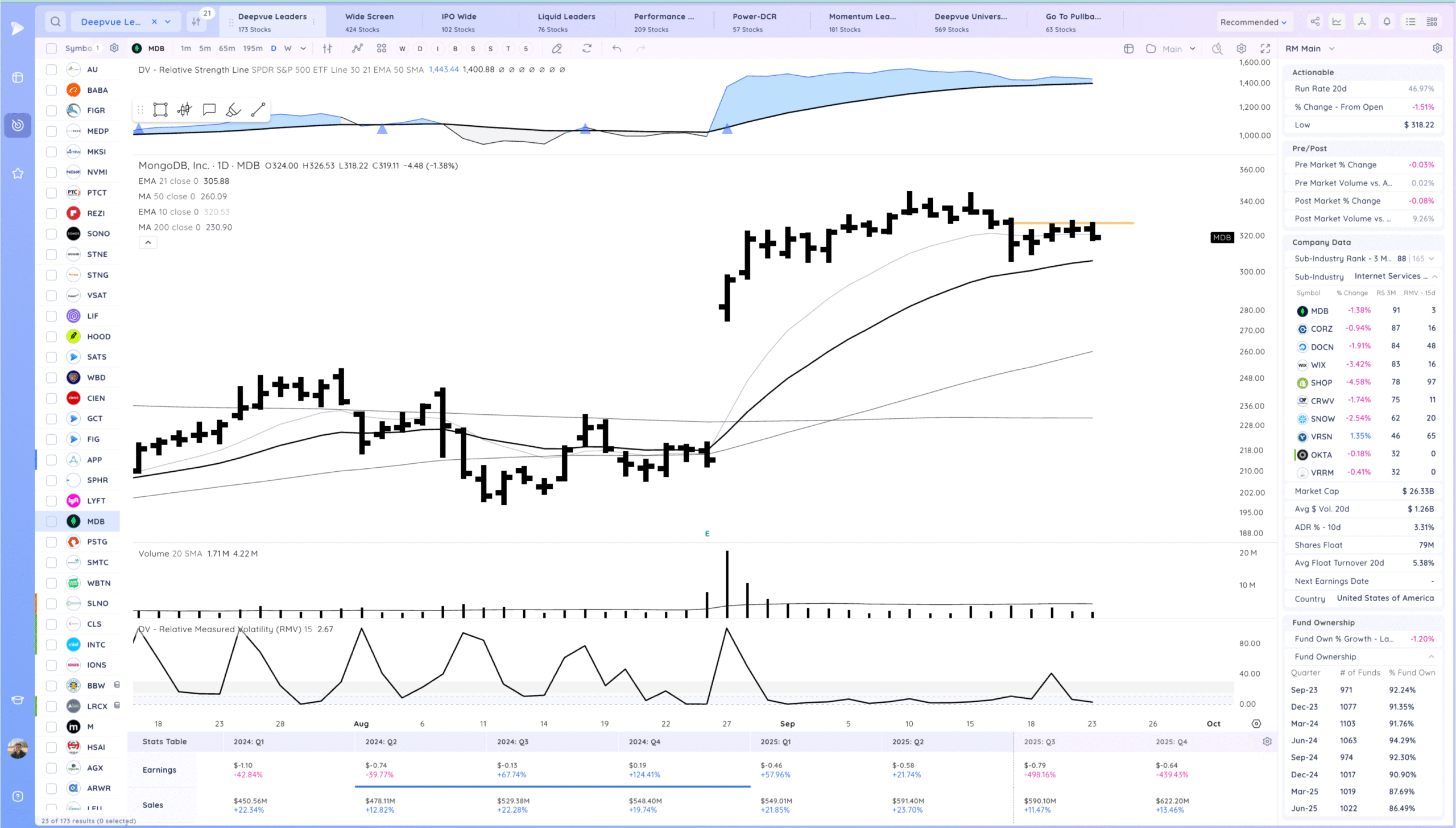

MDB watching for a range breakout

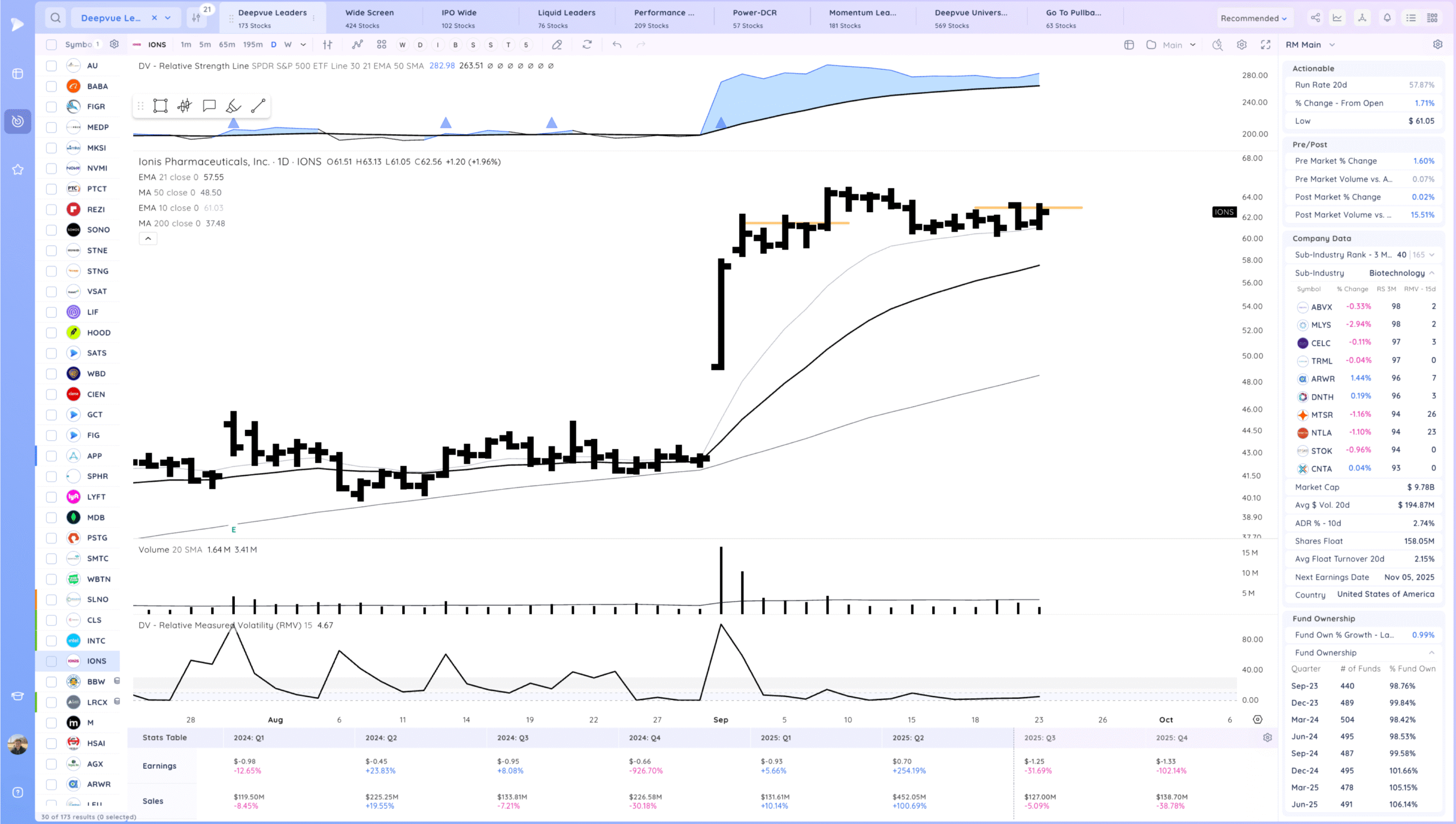

IONS Watching for a range breakout

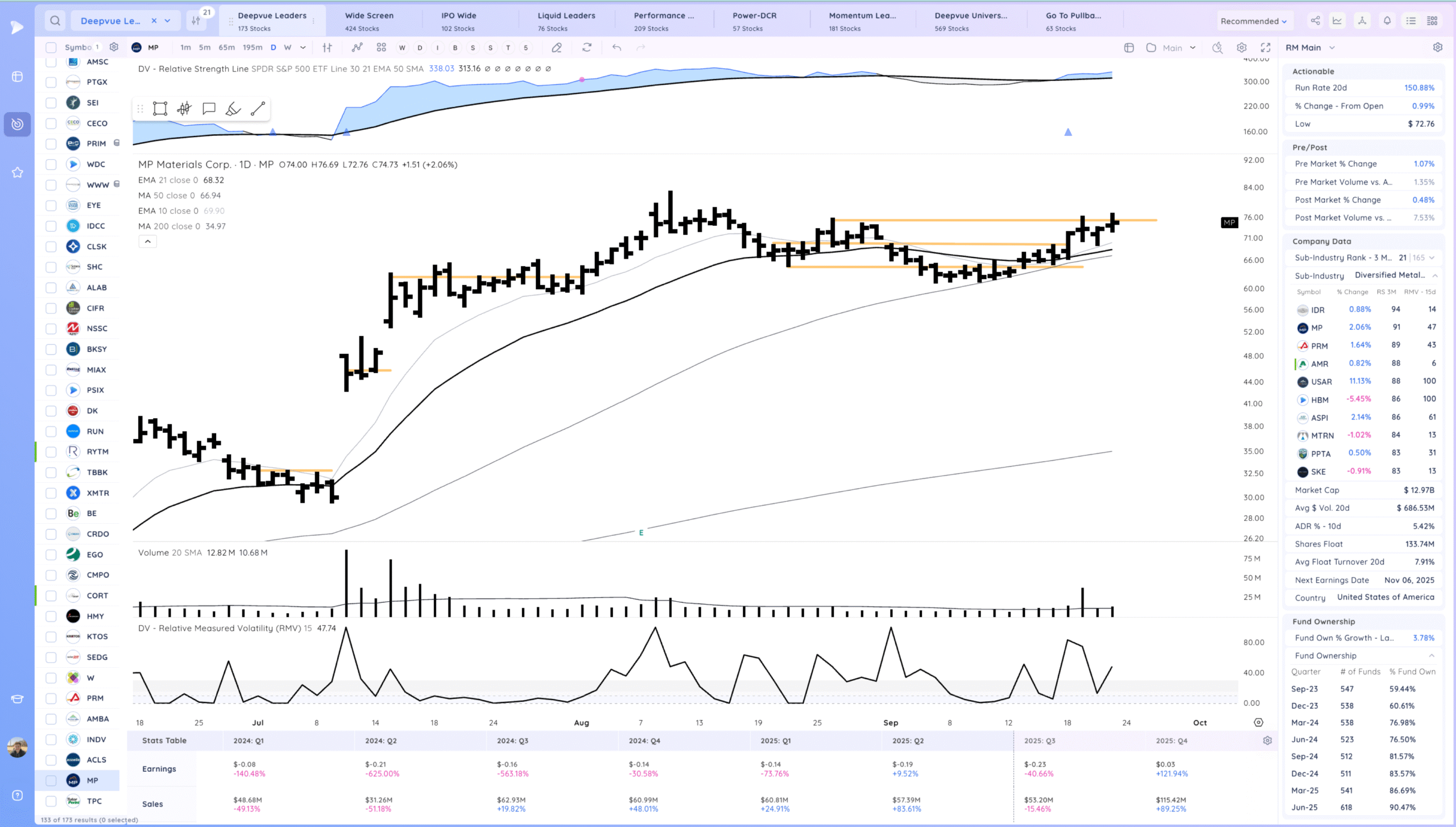

MP watching for a consolidation breakout

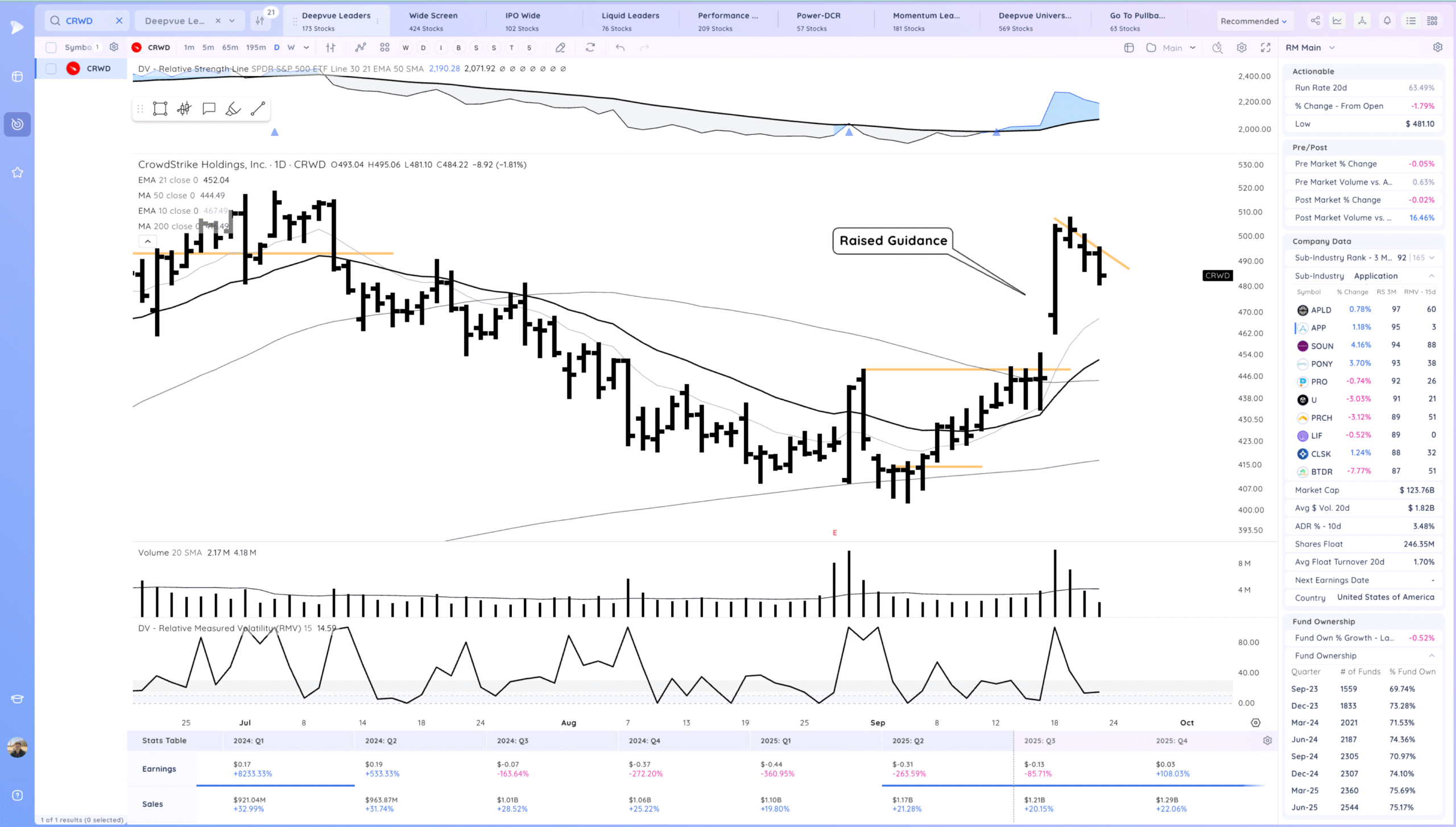

CRWD watching for a flag breakout / positive expectation breaker

Today’s Watchlist in List form

Focus List Names

GCT MDB FIG IONS MP CRWD ALAB

Focus:

MP ALAB FIG

Themes

Strongest Themes: AI, Metals/Miners, Software, Energy, Crypto Miners

Market Thoughts & Focus

Some pullback today and names potentially starting some range building. That would be welcome to set up the next pivots.

Anything can happen, Day by Day – Managing risk along the way