NVDA, TSLA Ready for a Move Higher?

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

September 26, 2025

Market Action

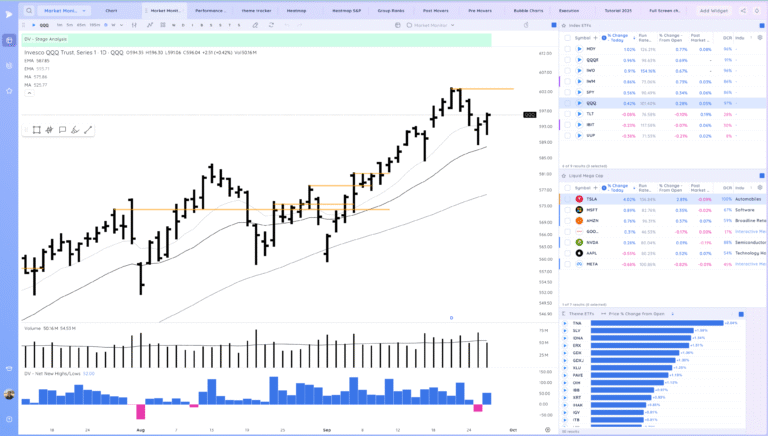

QQQ – This week we got the pullback we were expecting. We remain in an uptrend above the 21ema. Thursday’s low continues to be a key level. Good pushes off lows to end the week. Overall looks like a constructive pullback so far.

Bulls want to see a continued trend higher/constructive range sideways and move from this consolidation

Bears want to see a sharp drop lower testing the 21ema

Daily Chart of the QQQ.

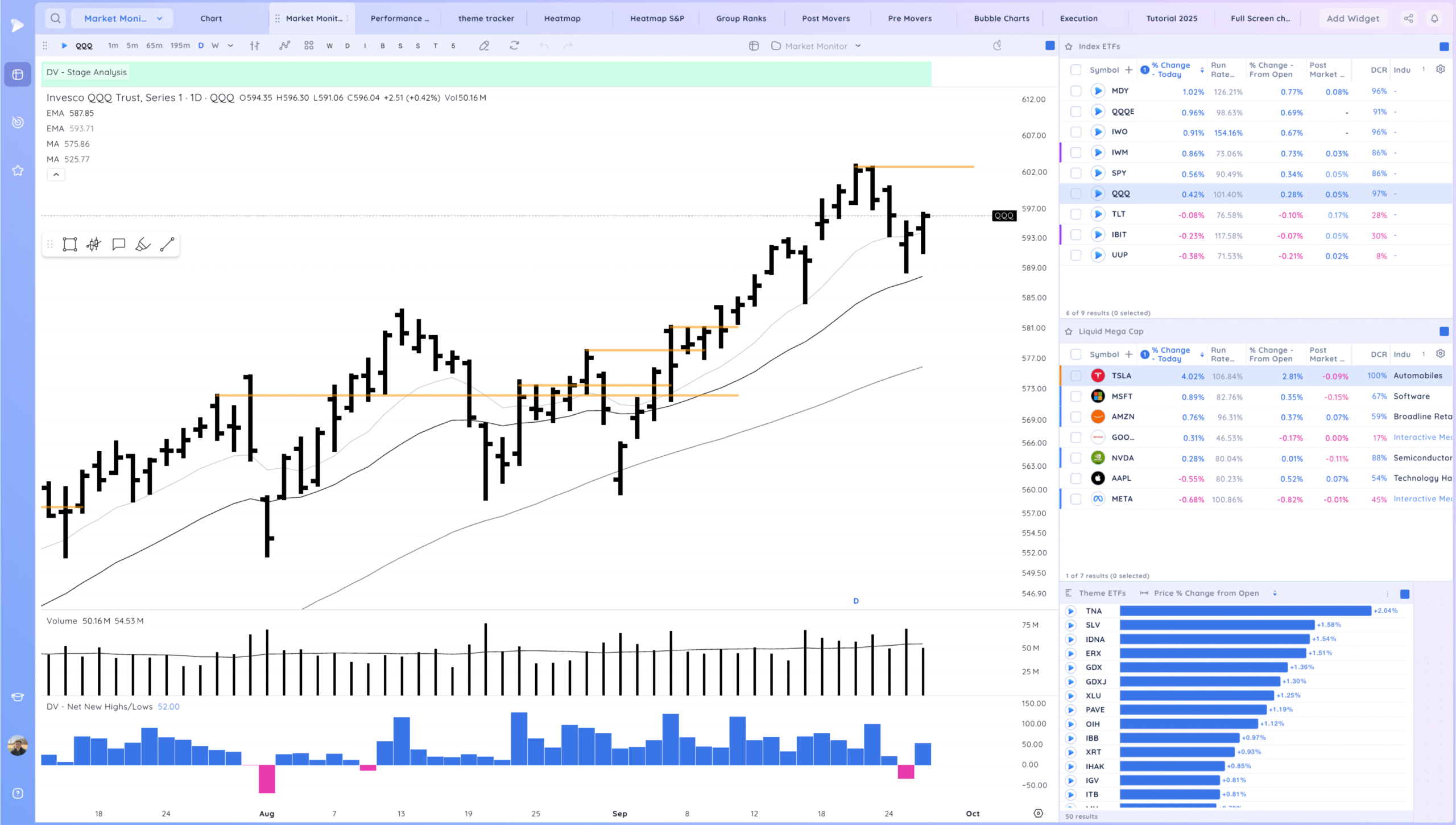

IWM – Follow through higher closing the gap down. Respecting the 21ema.

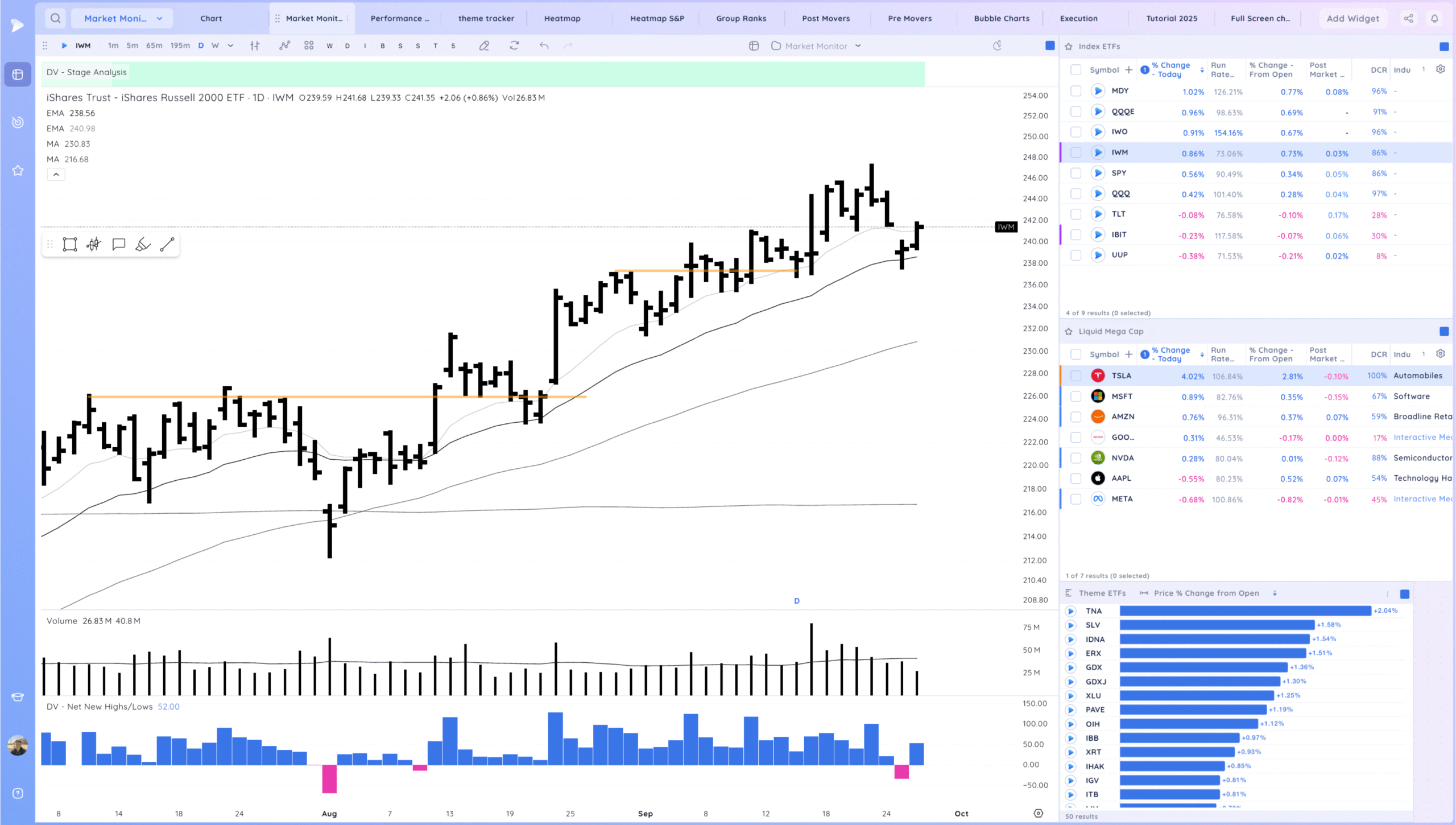

IBIT – Inside day after Thursday’s expansion down. Negative close. We are close to even to the prior key swing low. If we can hold here and not violate thursday’s low much, watch for expansion higher and start of a move up the right side.

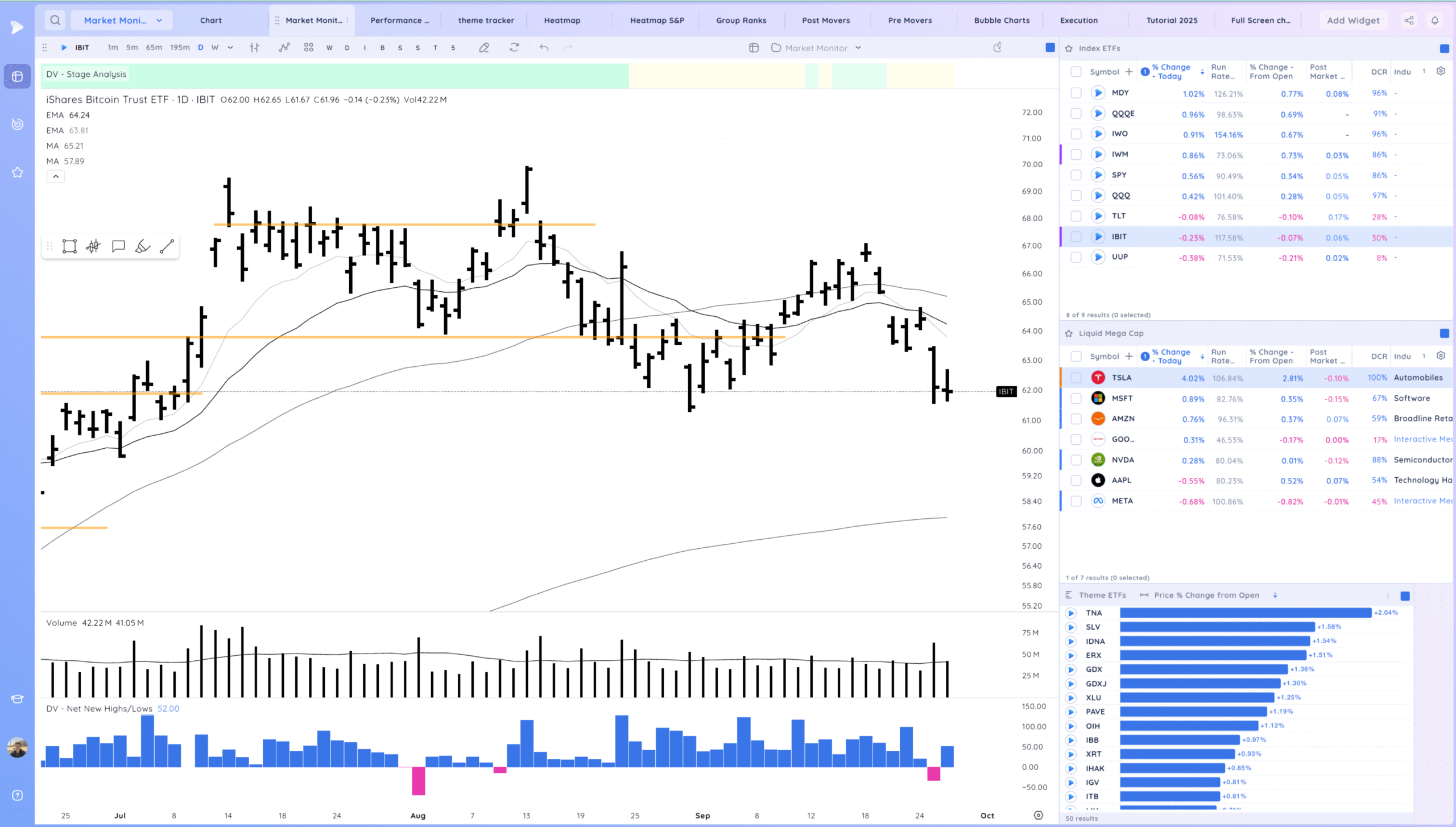

Trends (4/4 Up) – Based on the QQQ

Shortest – 10 Day EMA – Above

Short-term – 21 ema – Above

Intermediate term – 50 sma – Above Rising

Longterm – 200 sma – Up – Above Rising

Groups/Sectors

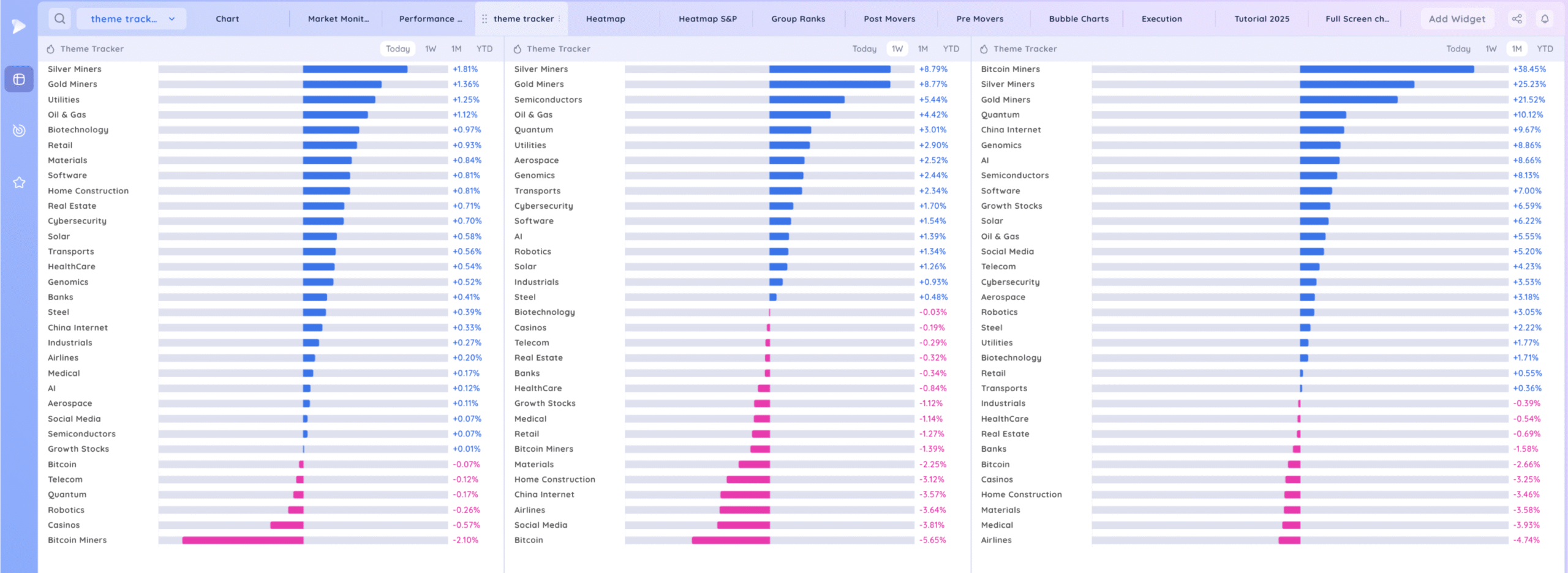

Deepvue Theme Tracker

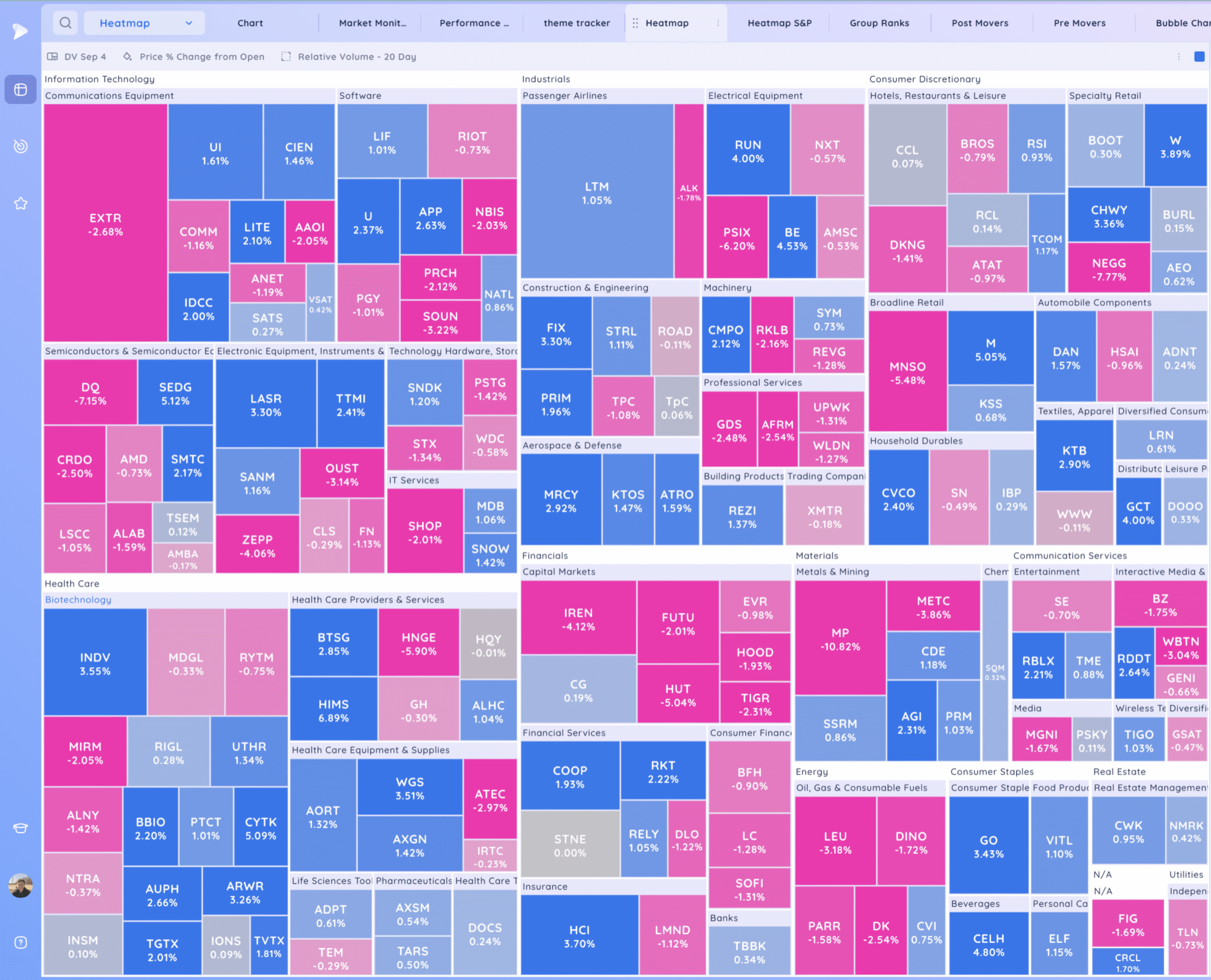

Deepvue Leaders

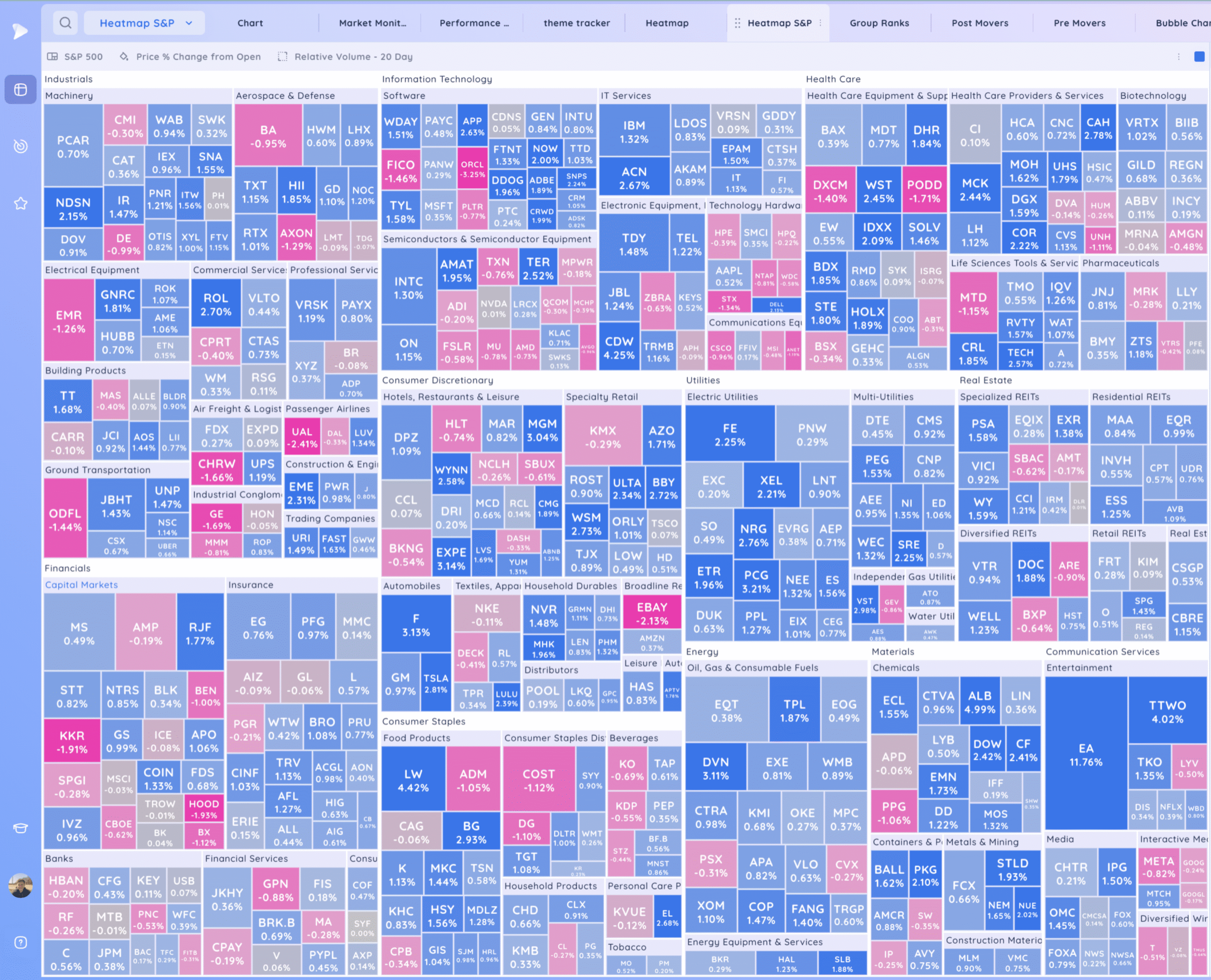

S&P 500.

Leadership

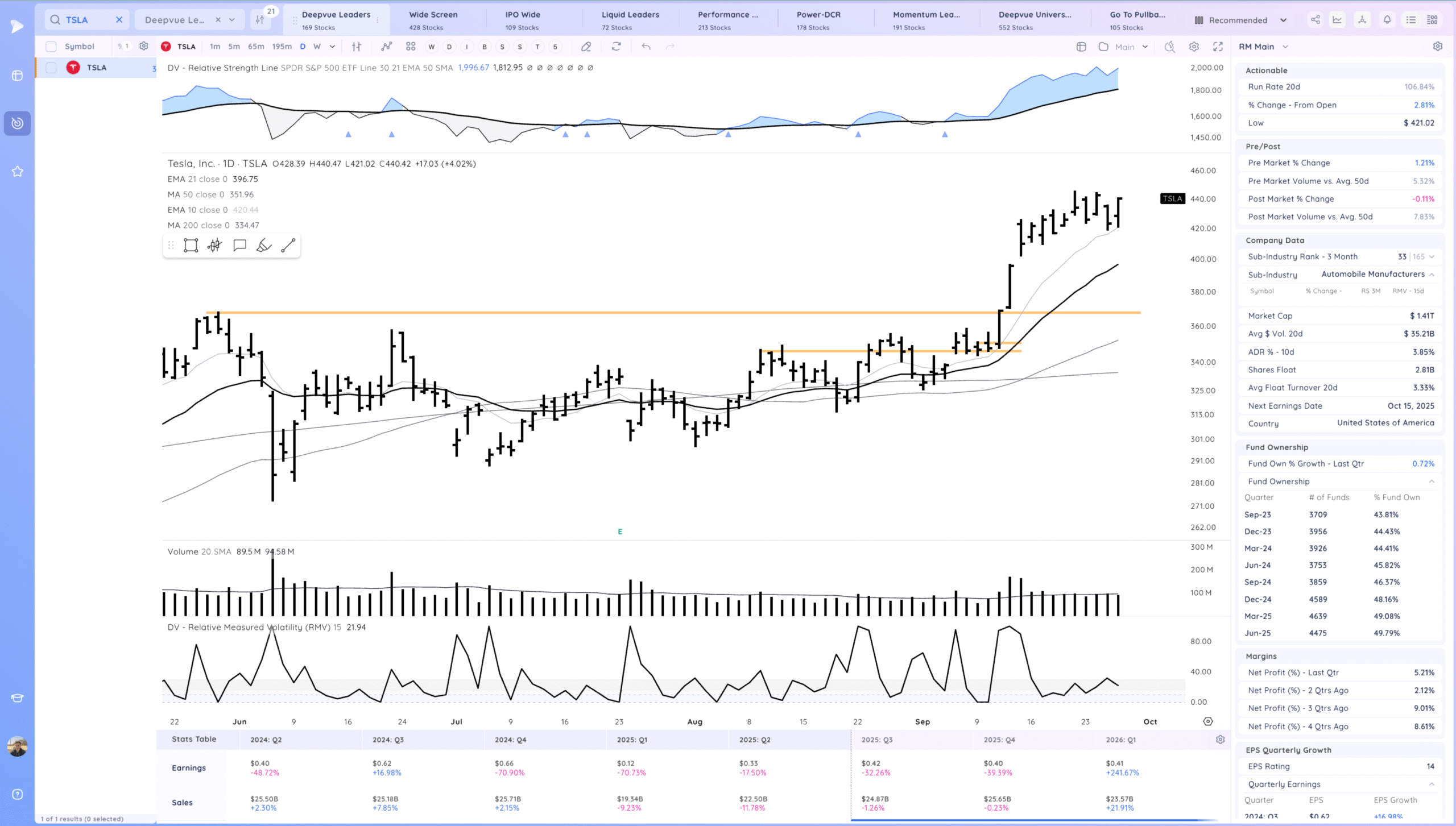

TSLA Great action after the base breakout. Good response after the 10ema pullback to end the week

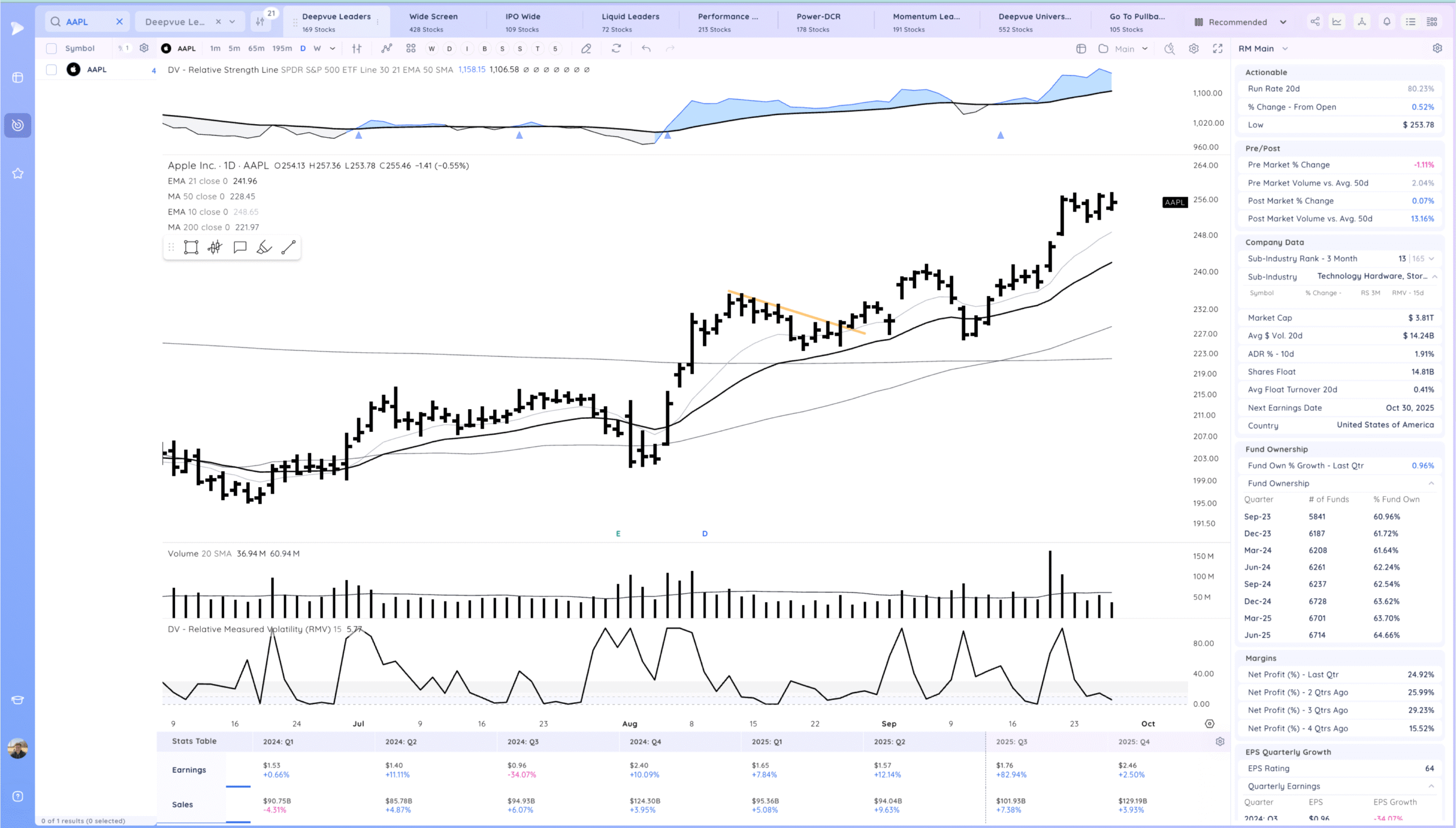

AAPL Tight day to end the week as it builds a short flag

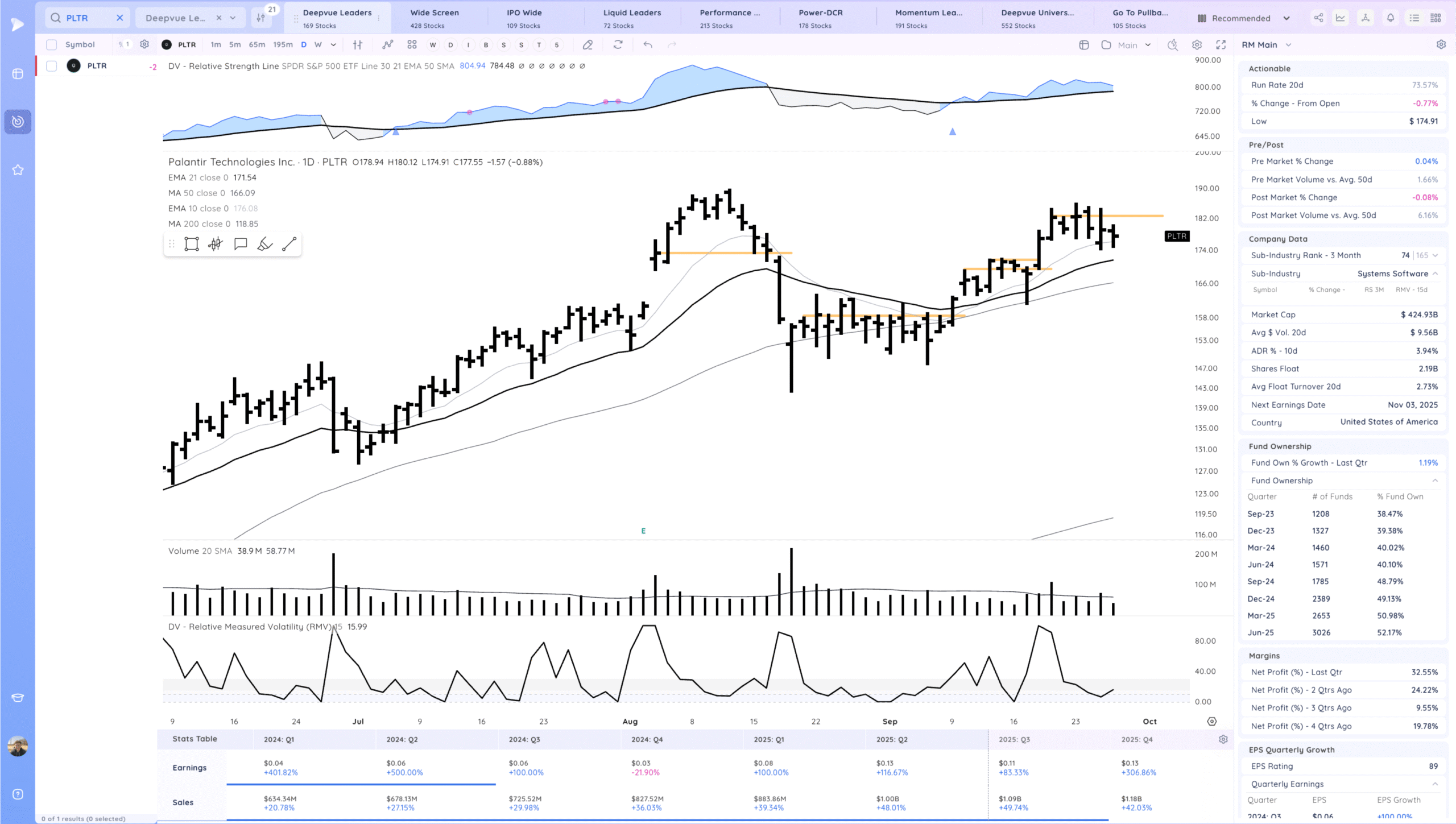

PLTR inside day within this range/handle. Watching for a push off the 10ema next week.

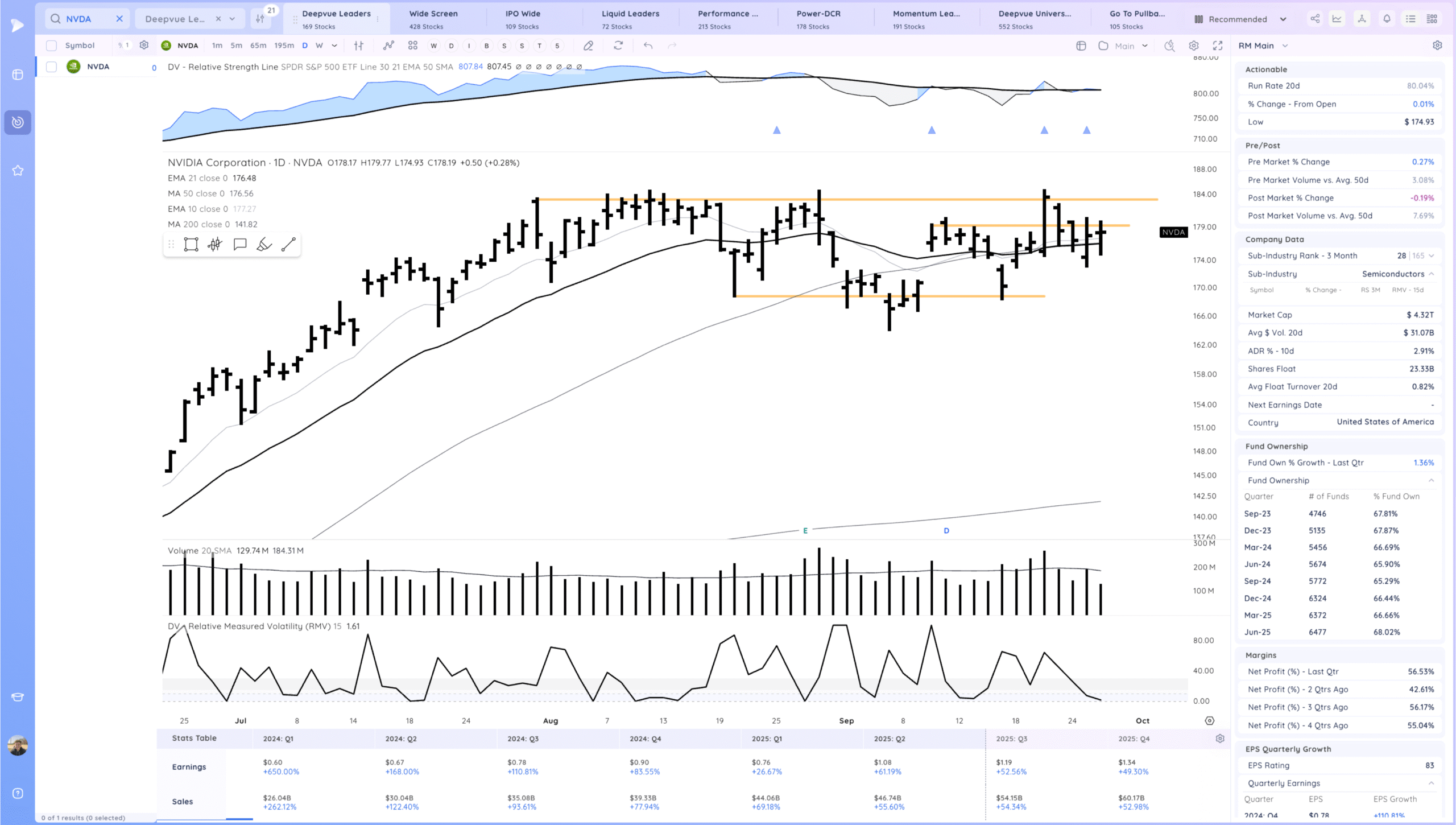

NVDA Tight inside day on the 21ema. Watching for a range breakout next week

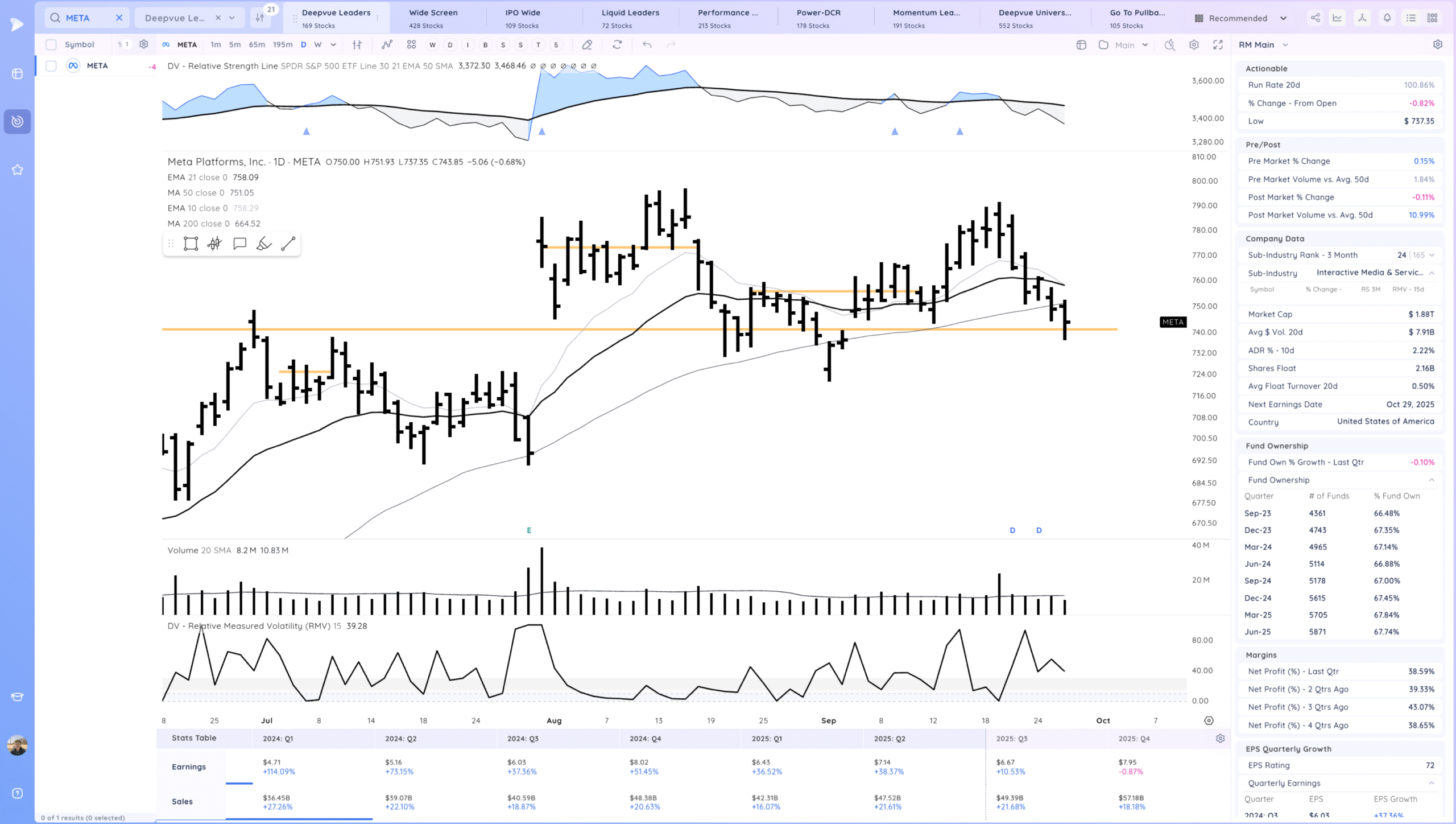

META still pulling in. Right at a prior key high currently.

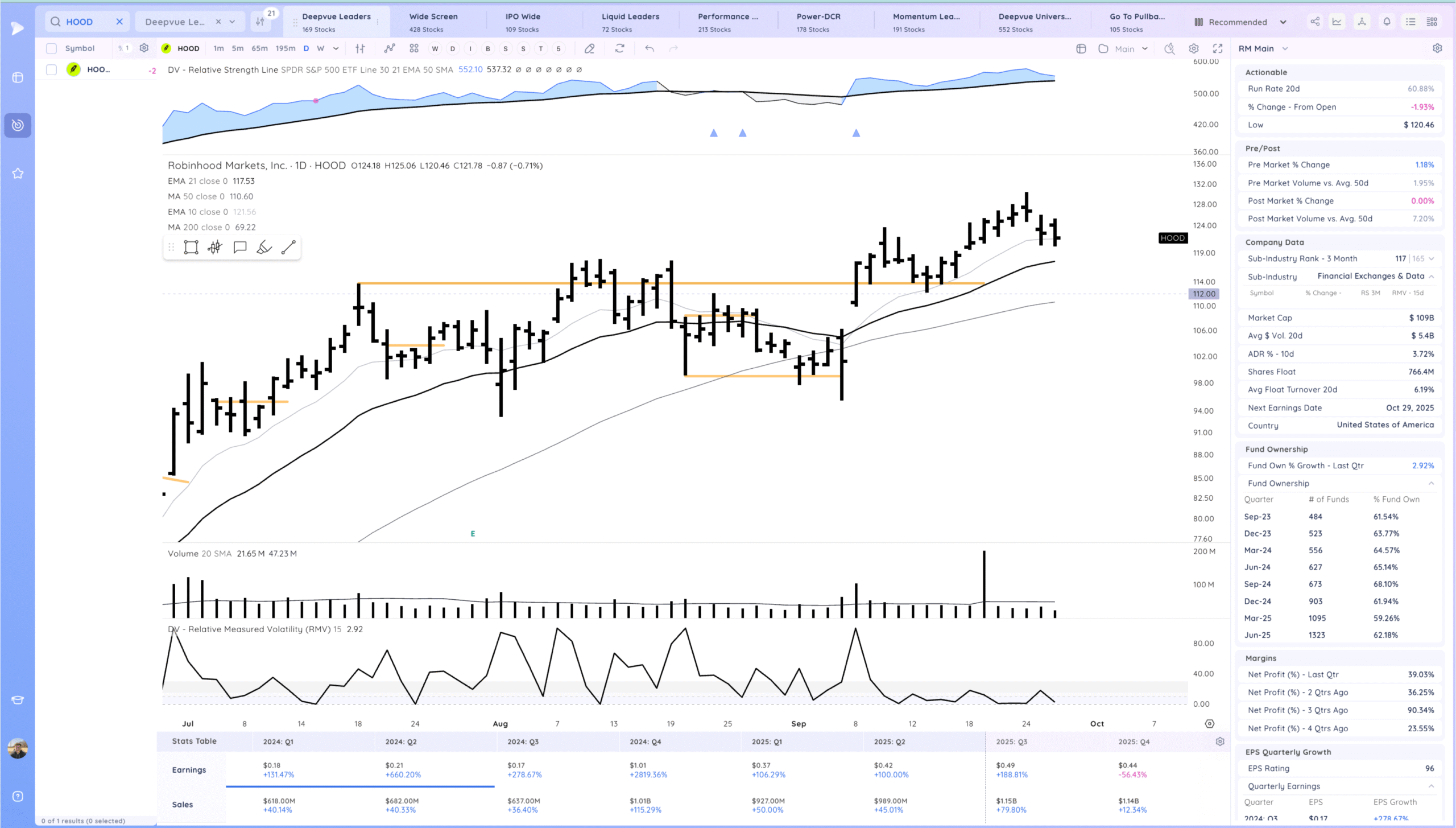

HOOD 10 ema pullback

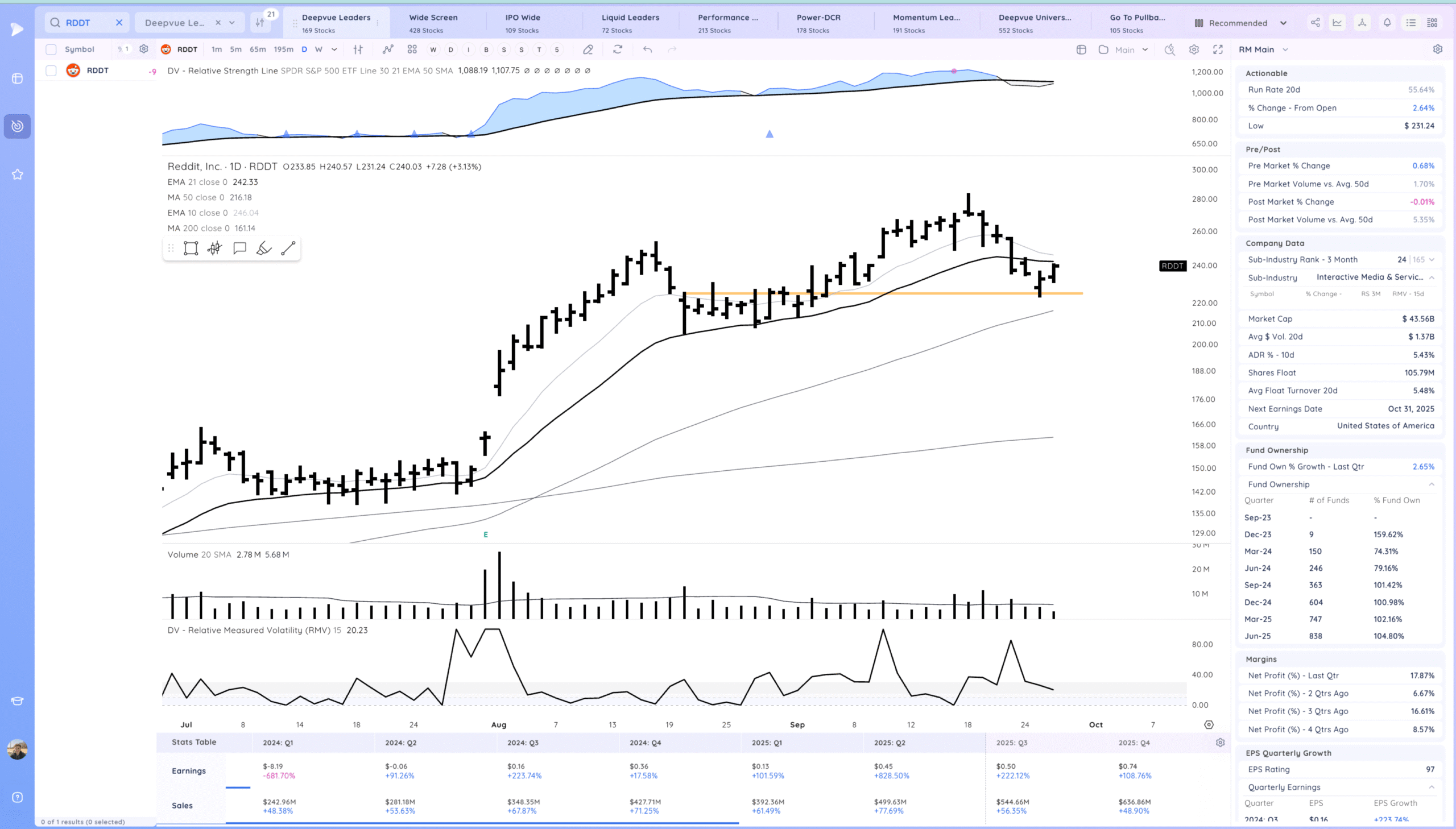

RDDT Bounce off the prior range pivot to end the week. Watching for a pop through the 21ema. A 10week sma bounce on the weekly near highs

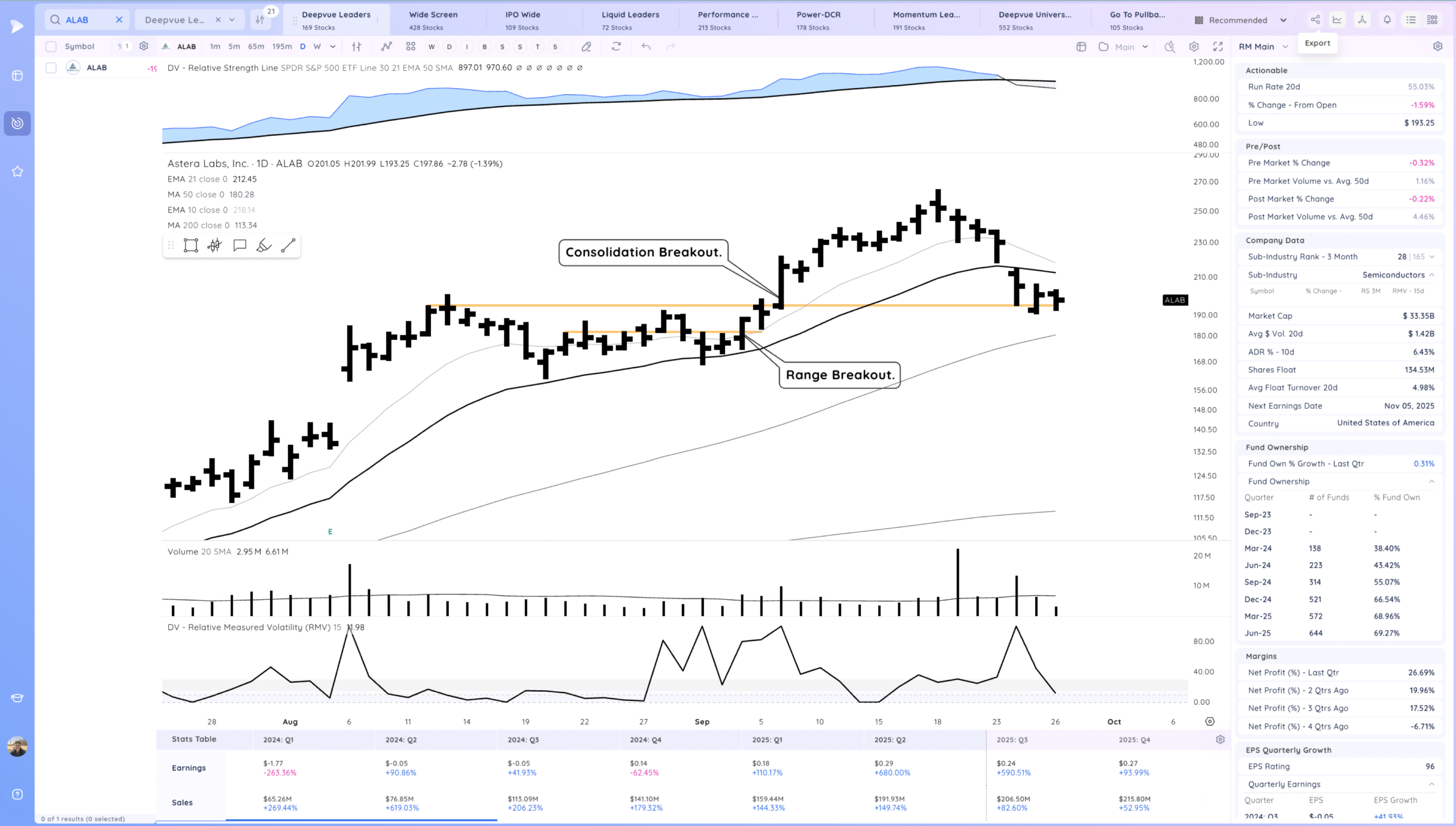

ALAB Forming a range on the prior base pivot. Watching for expansion up next week. Holding Thursday’s low is key

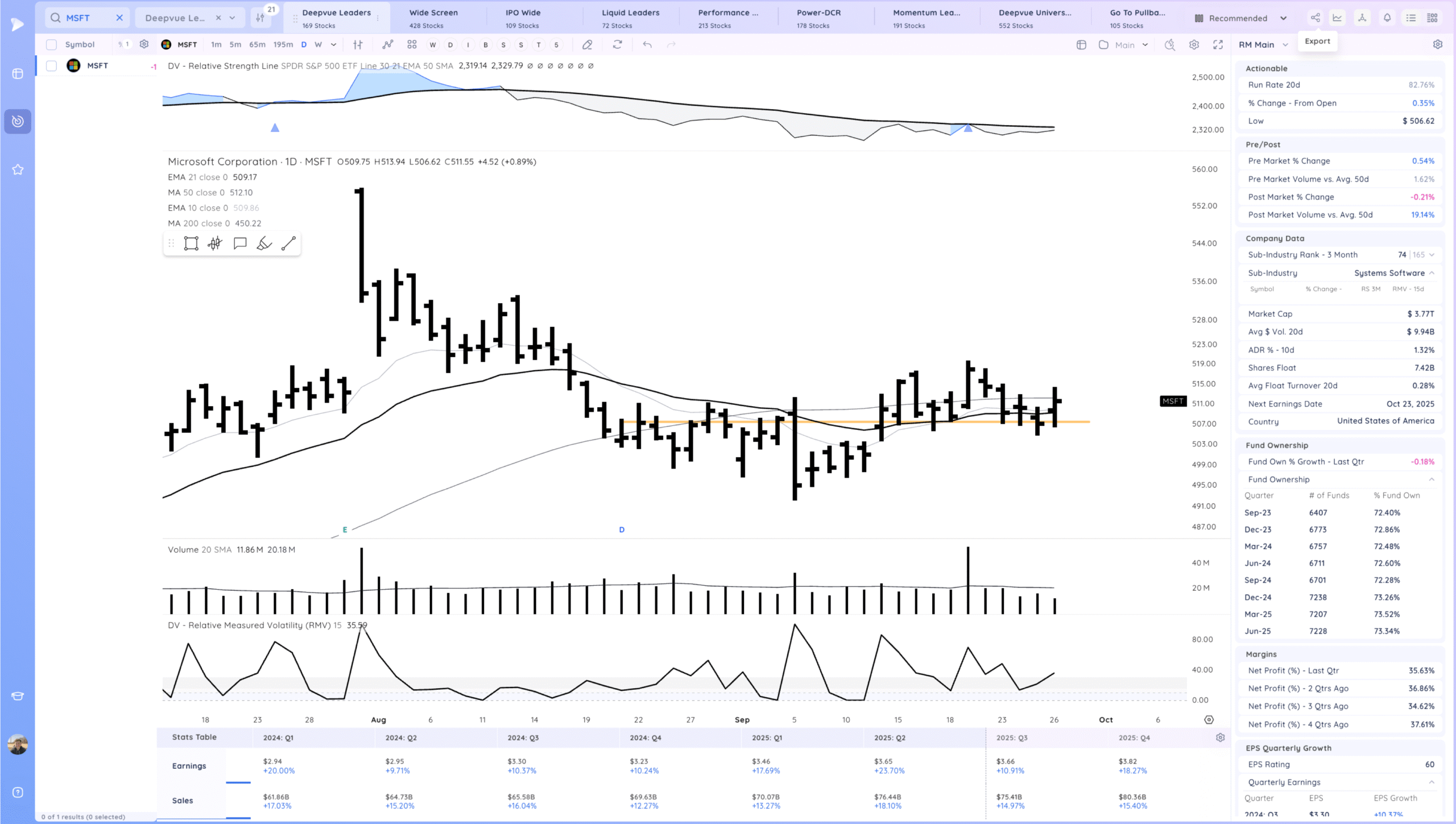

MSFT Still in the MA cluster. Slight push off the range pivot.

Key Moves

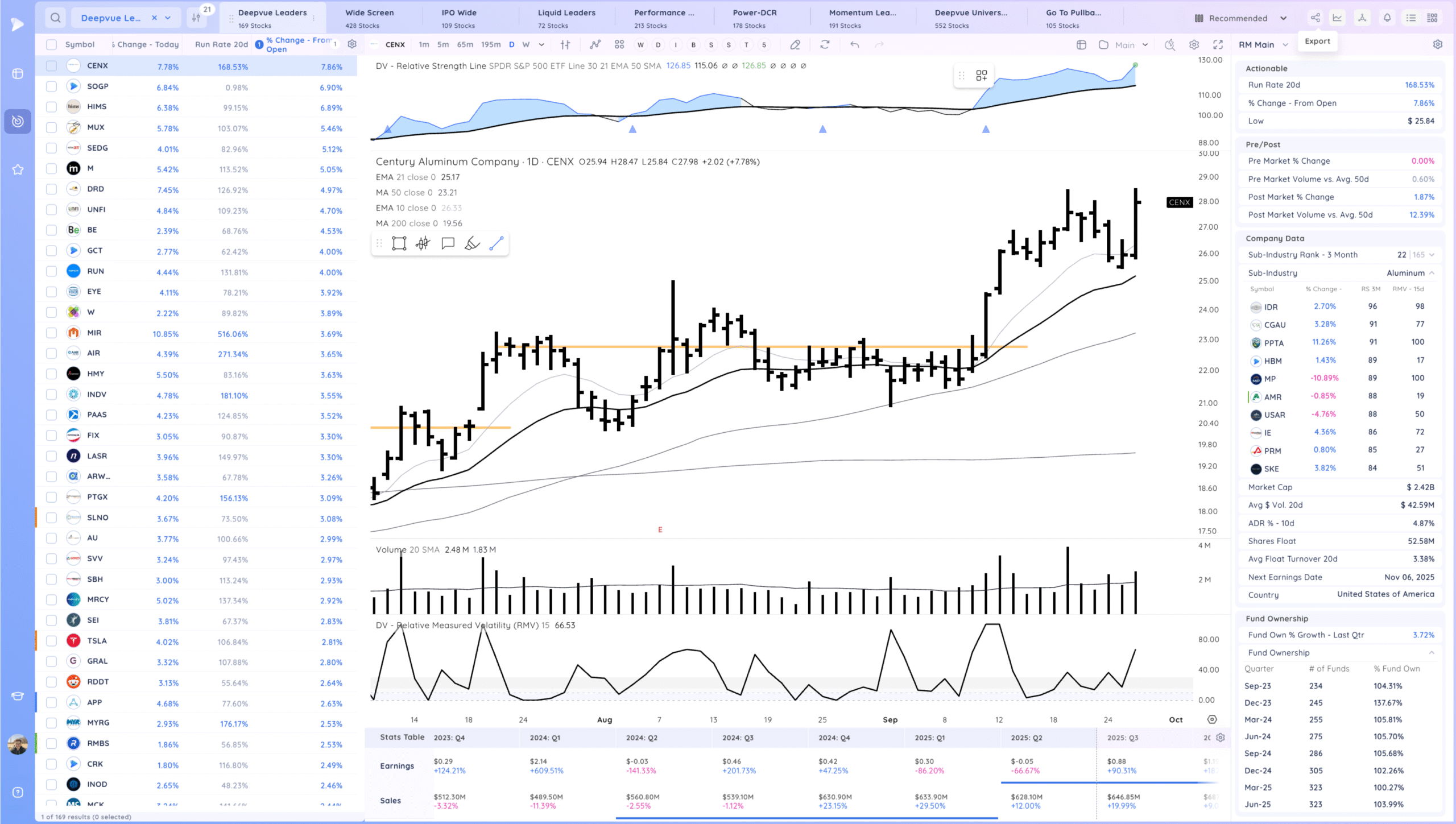

CENX strong 10ema pullback

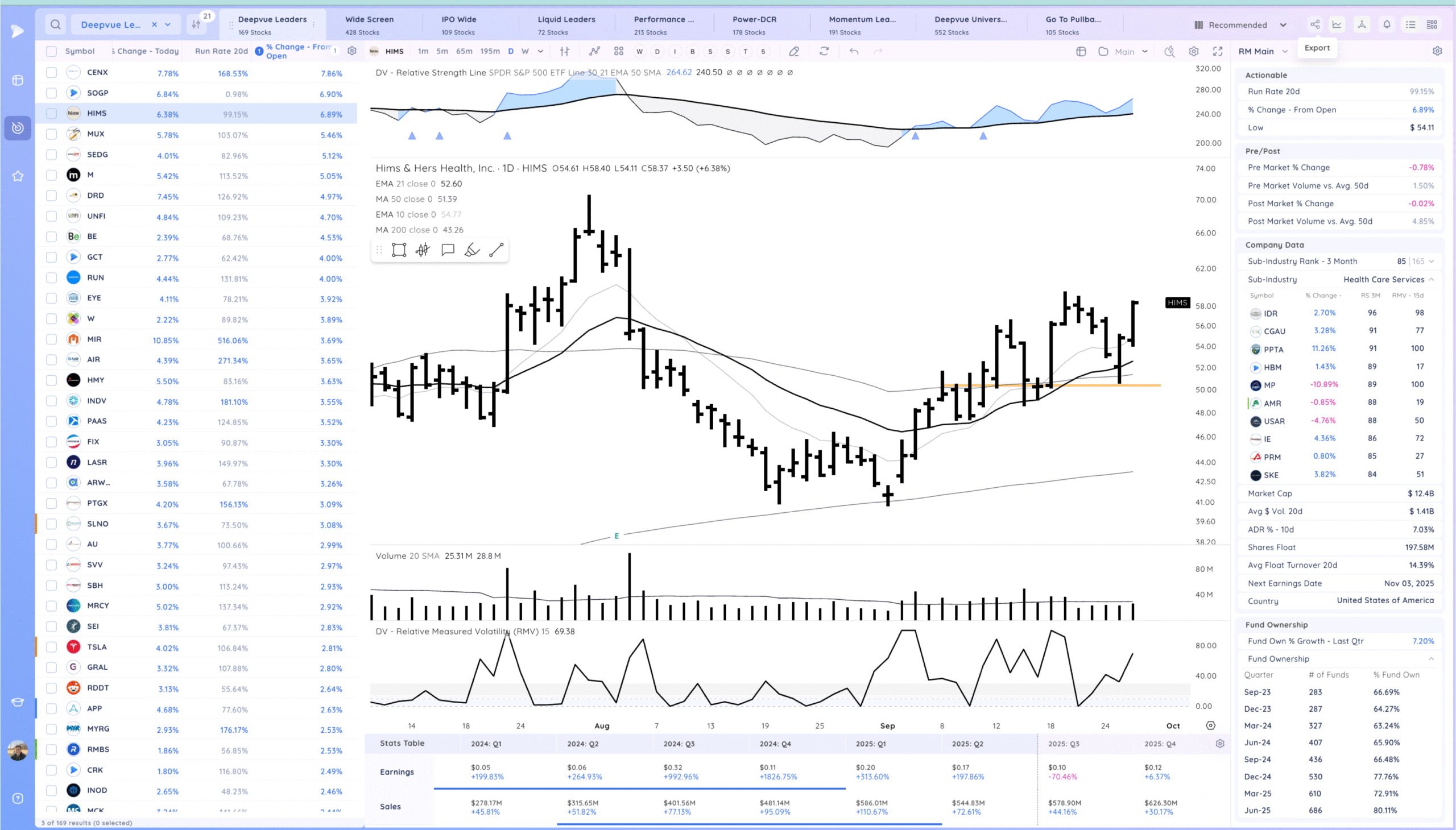

HIMS good follow through after the oops reversal

Setups and Watchlist

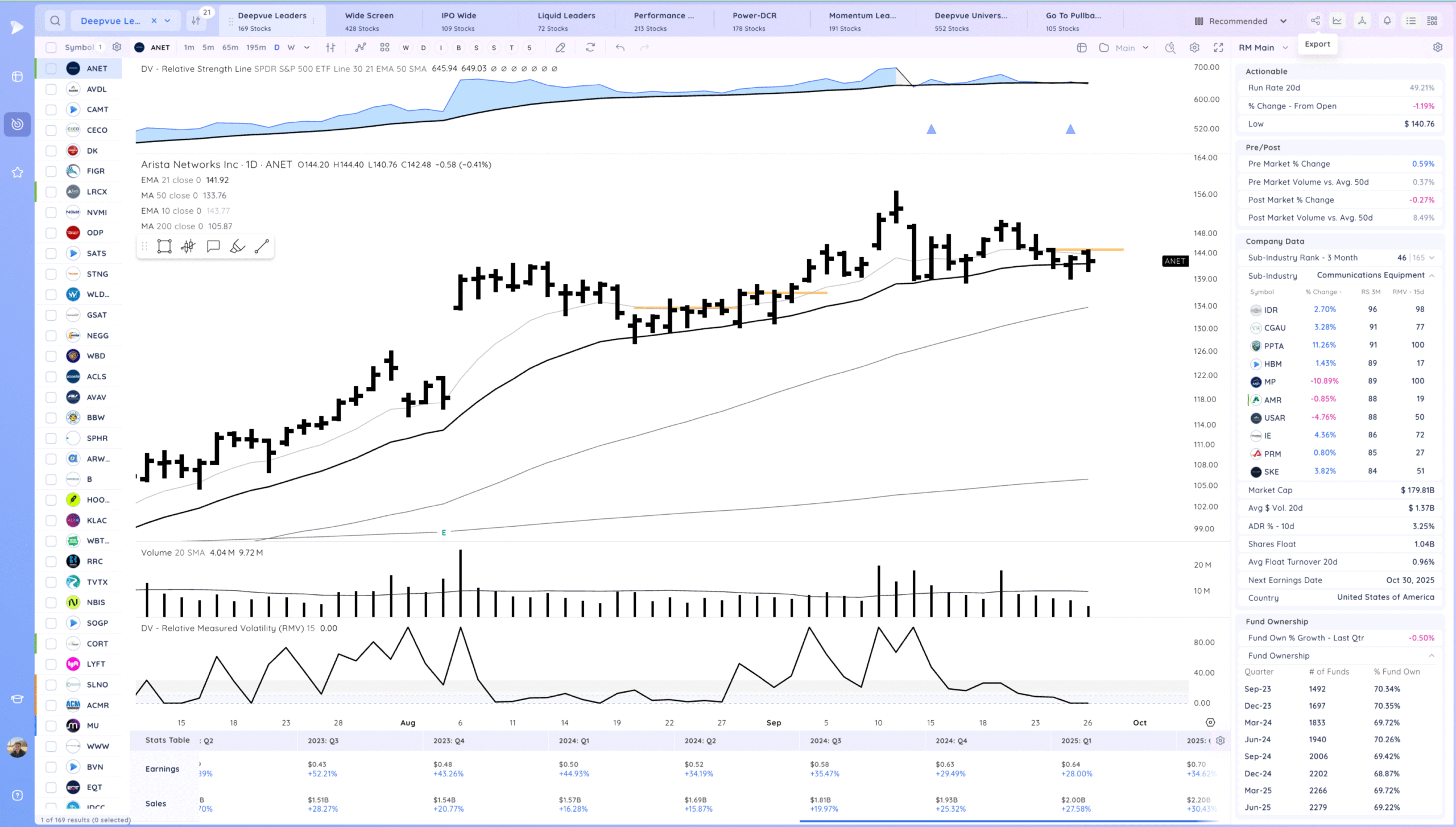

ANET watching for a range breakout

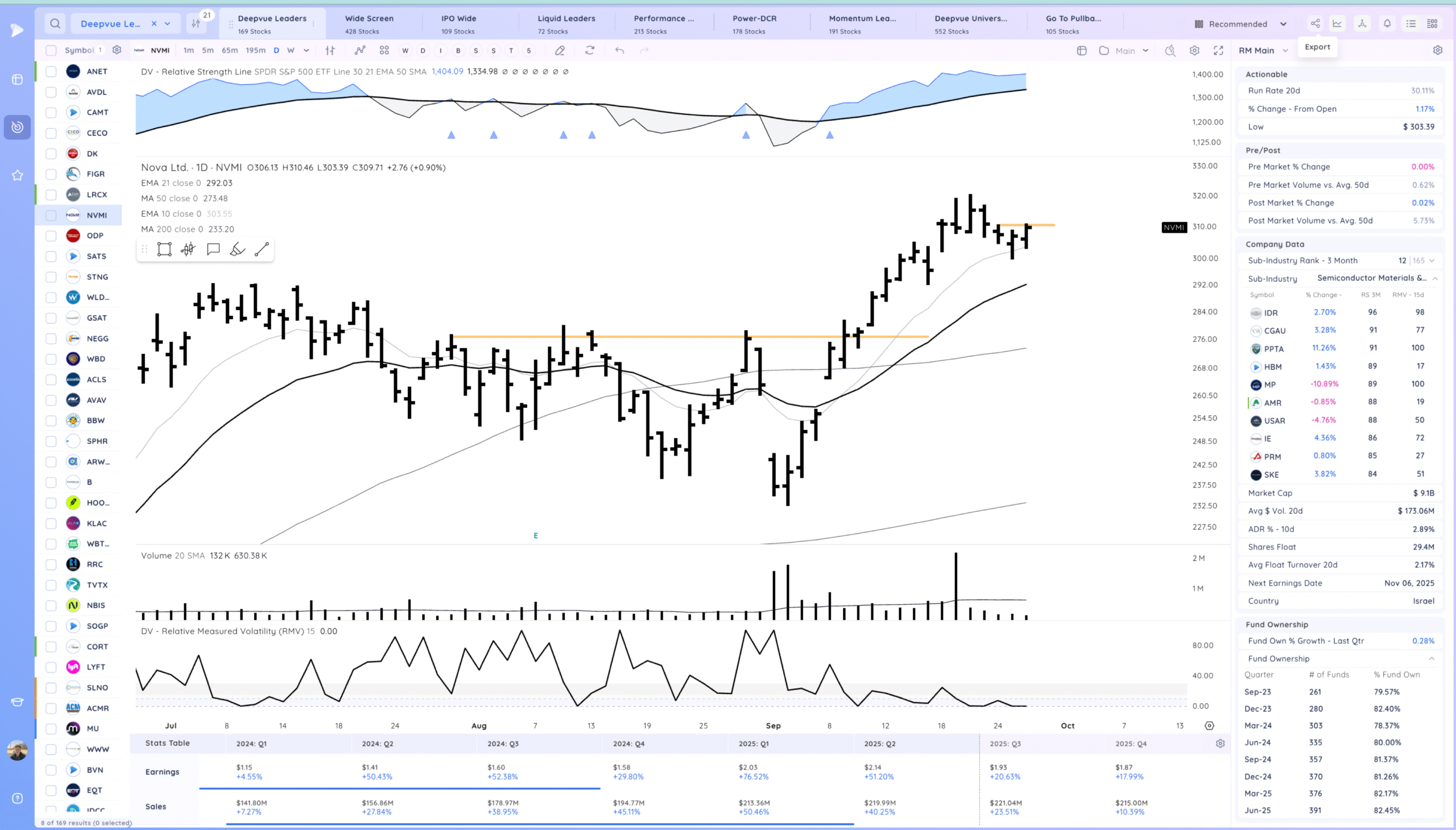

NVMI actionable on the 10ema pullback. Watching for follow through up

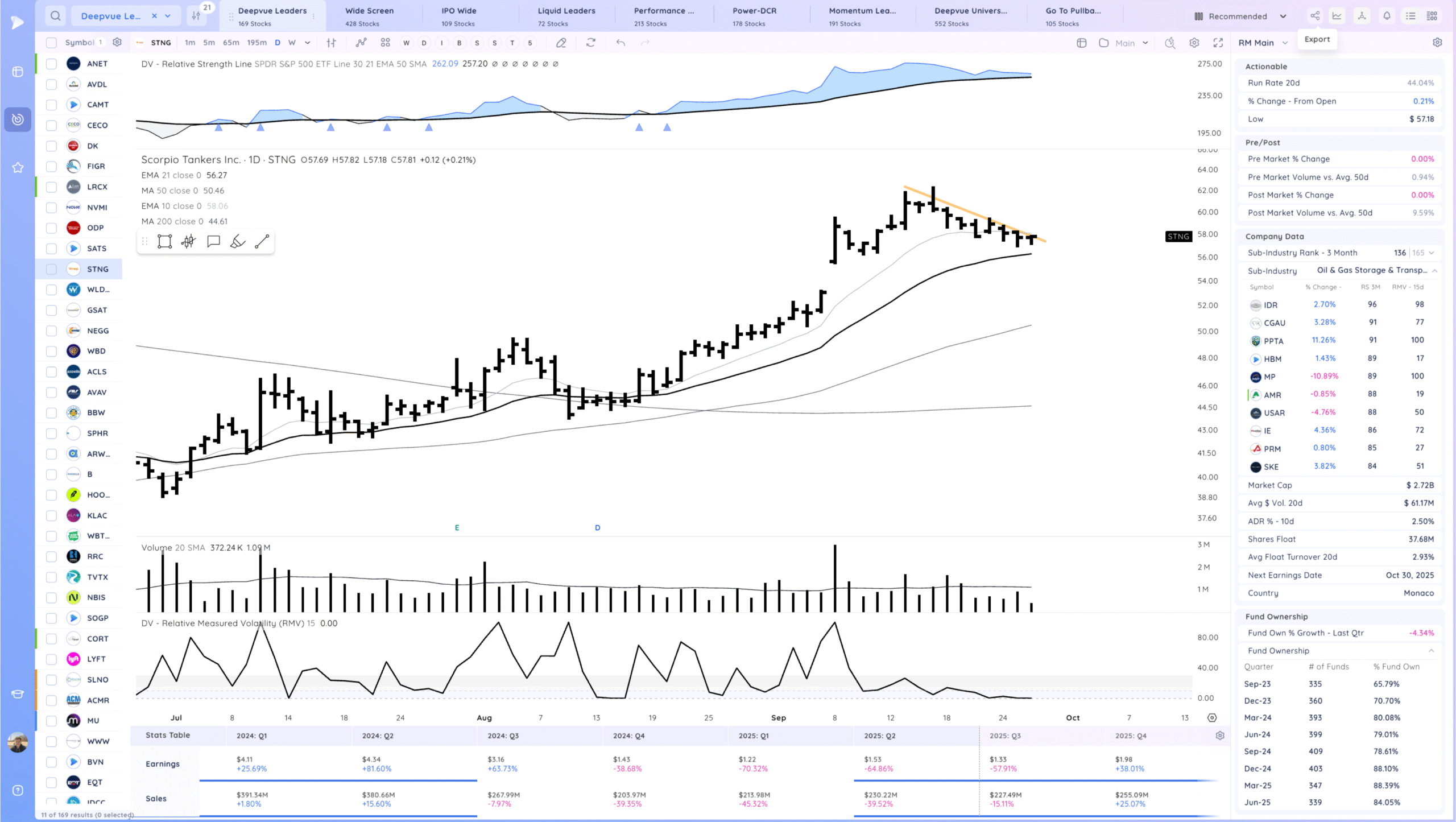

STNG watching for a flag breakout

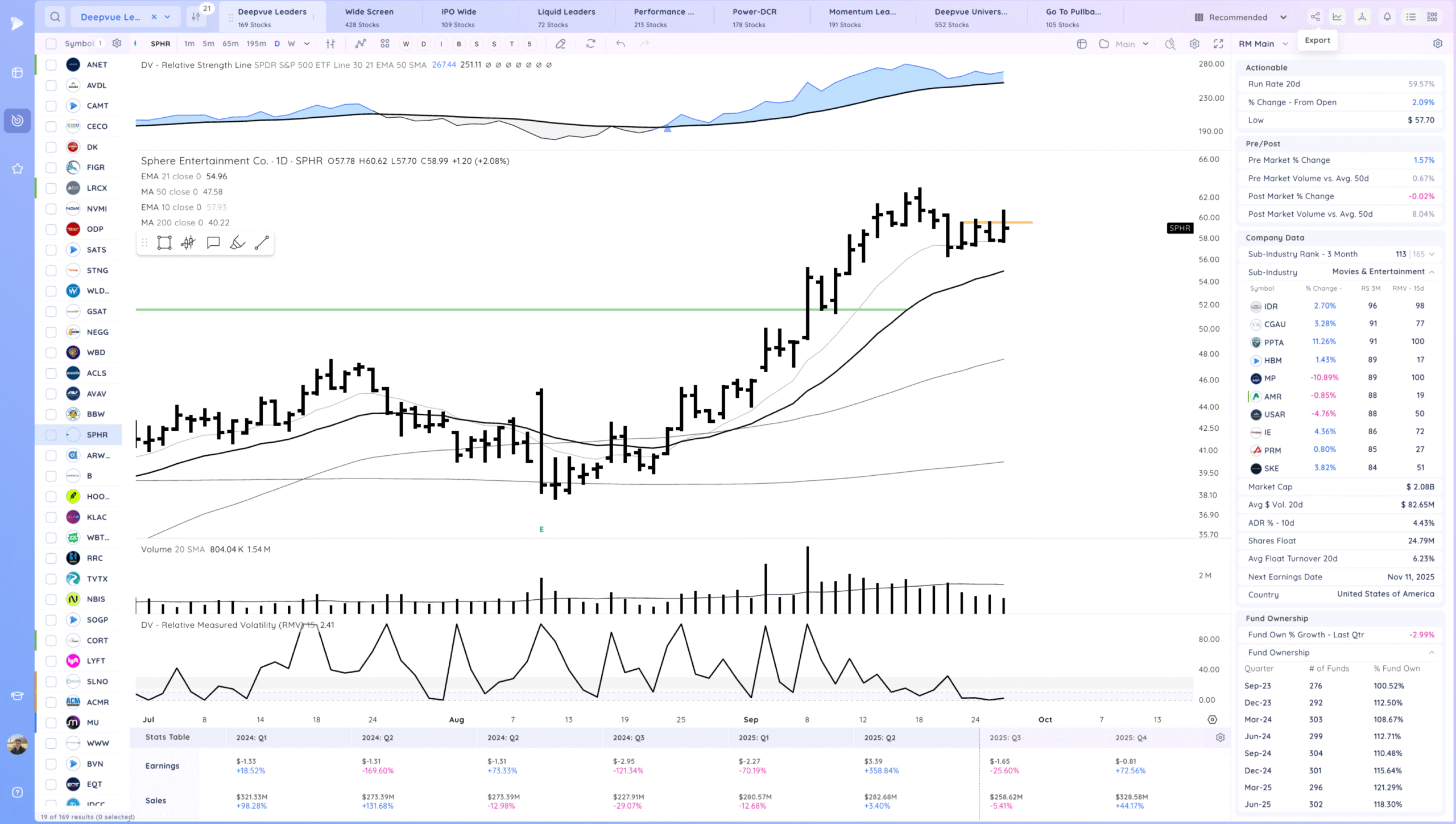

SPHR watching for a range re-breakout

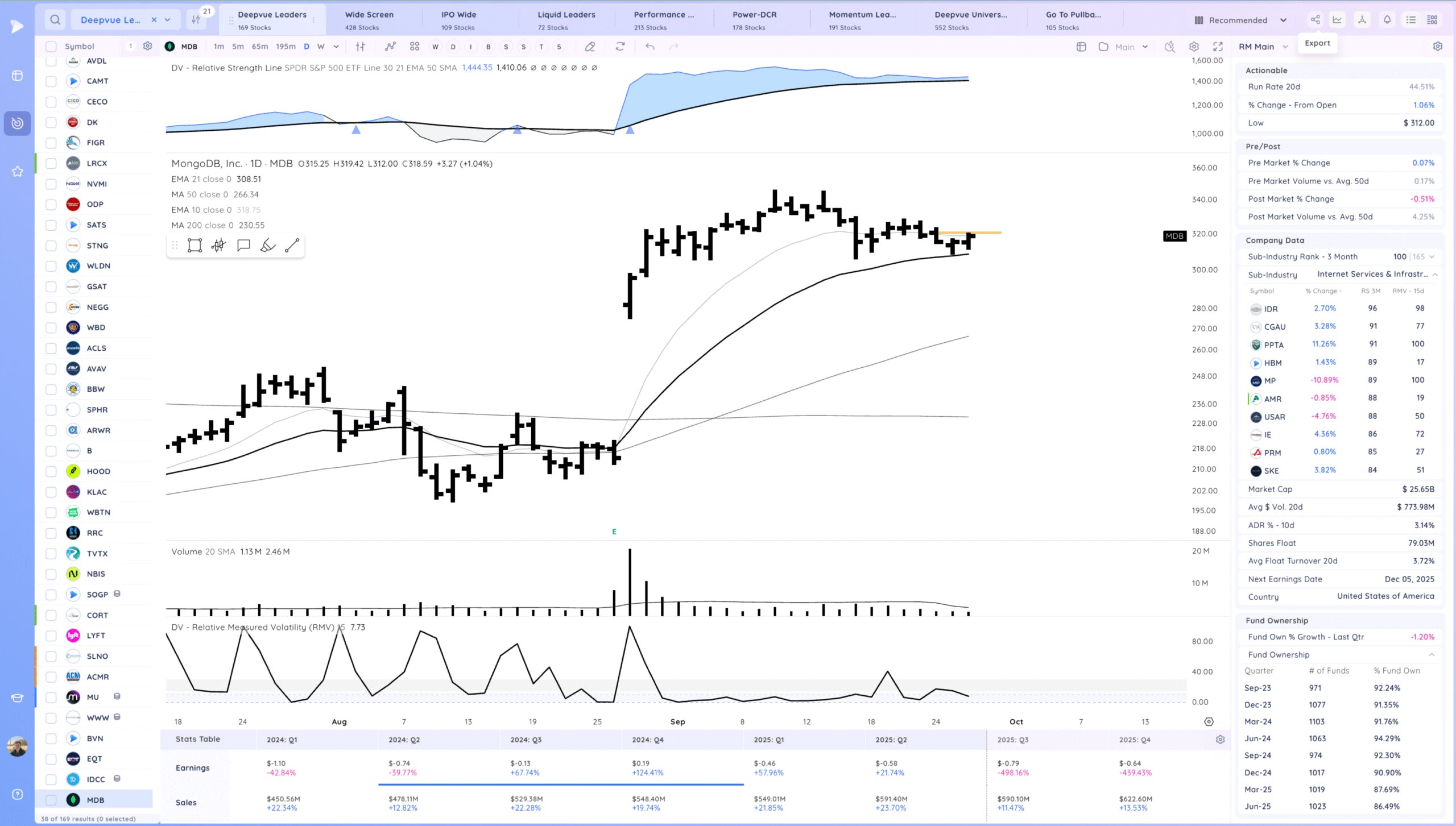

MDB watching for a range breakout

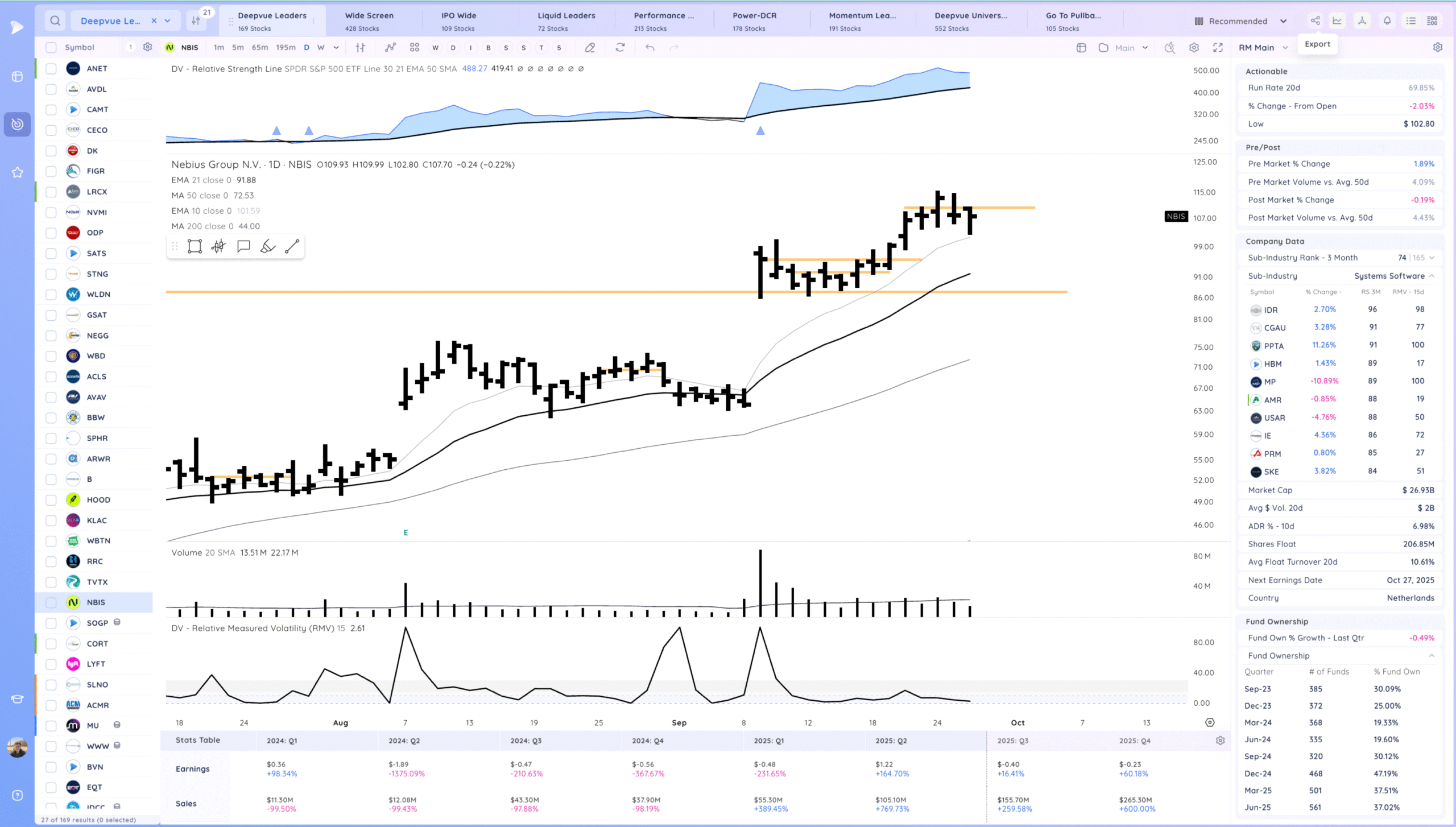

NBIS watching for a range breakout for an add

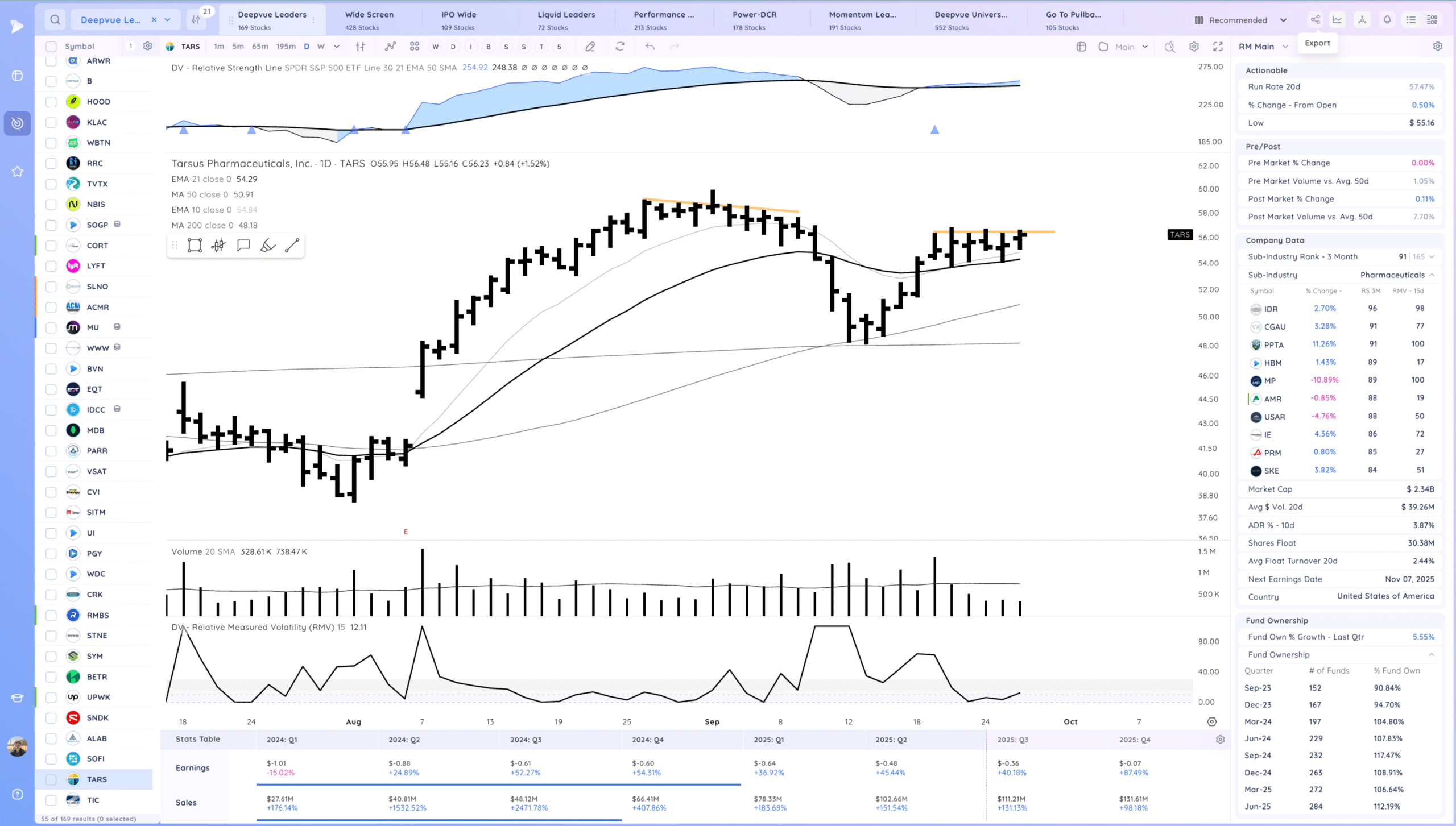

TARS watching for a range breakout. Tight consolidation day, expecting expansion

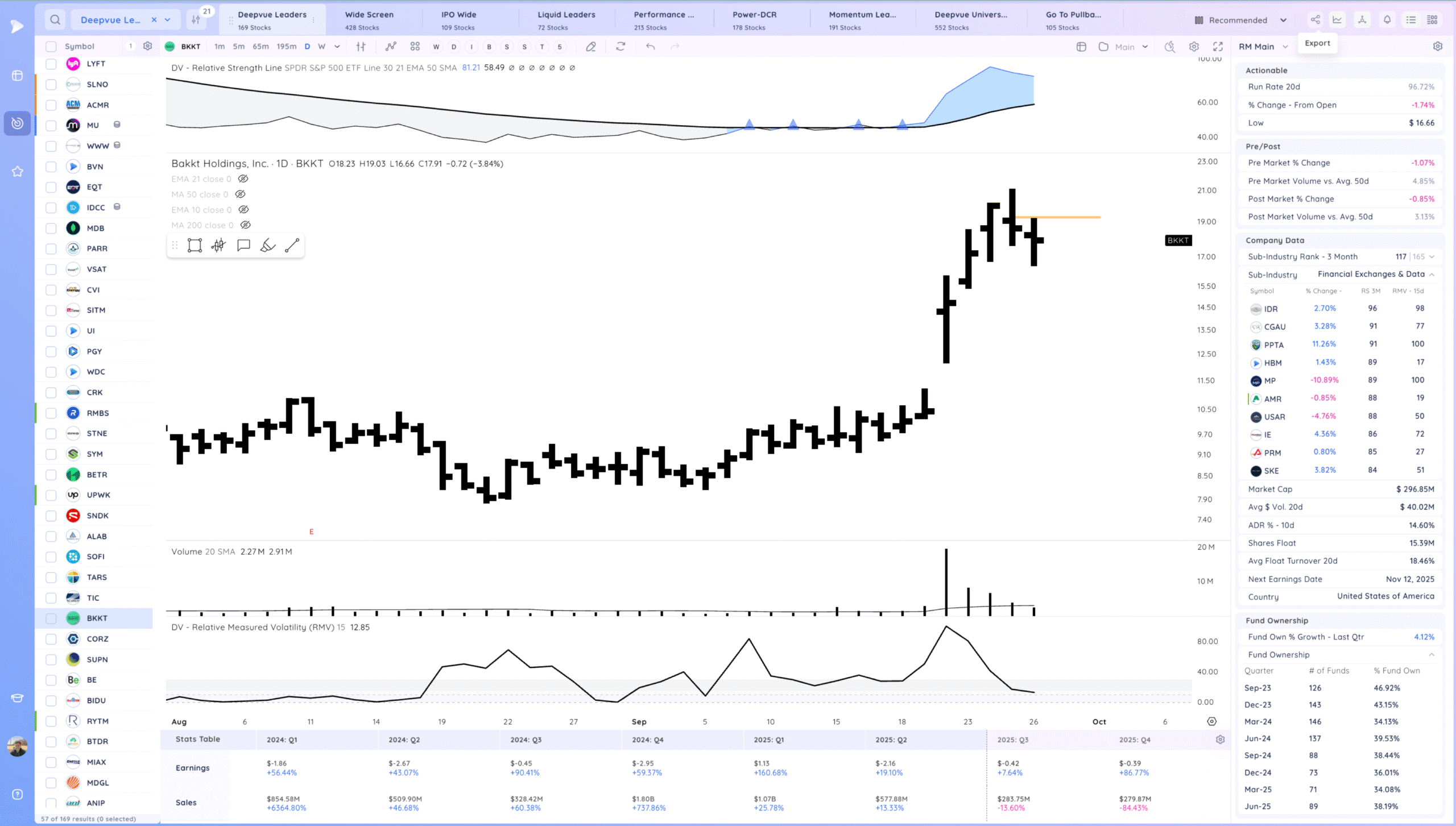

BKKT very spec, fast name, watching for follow through up

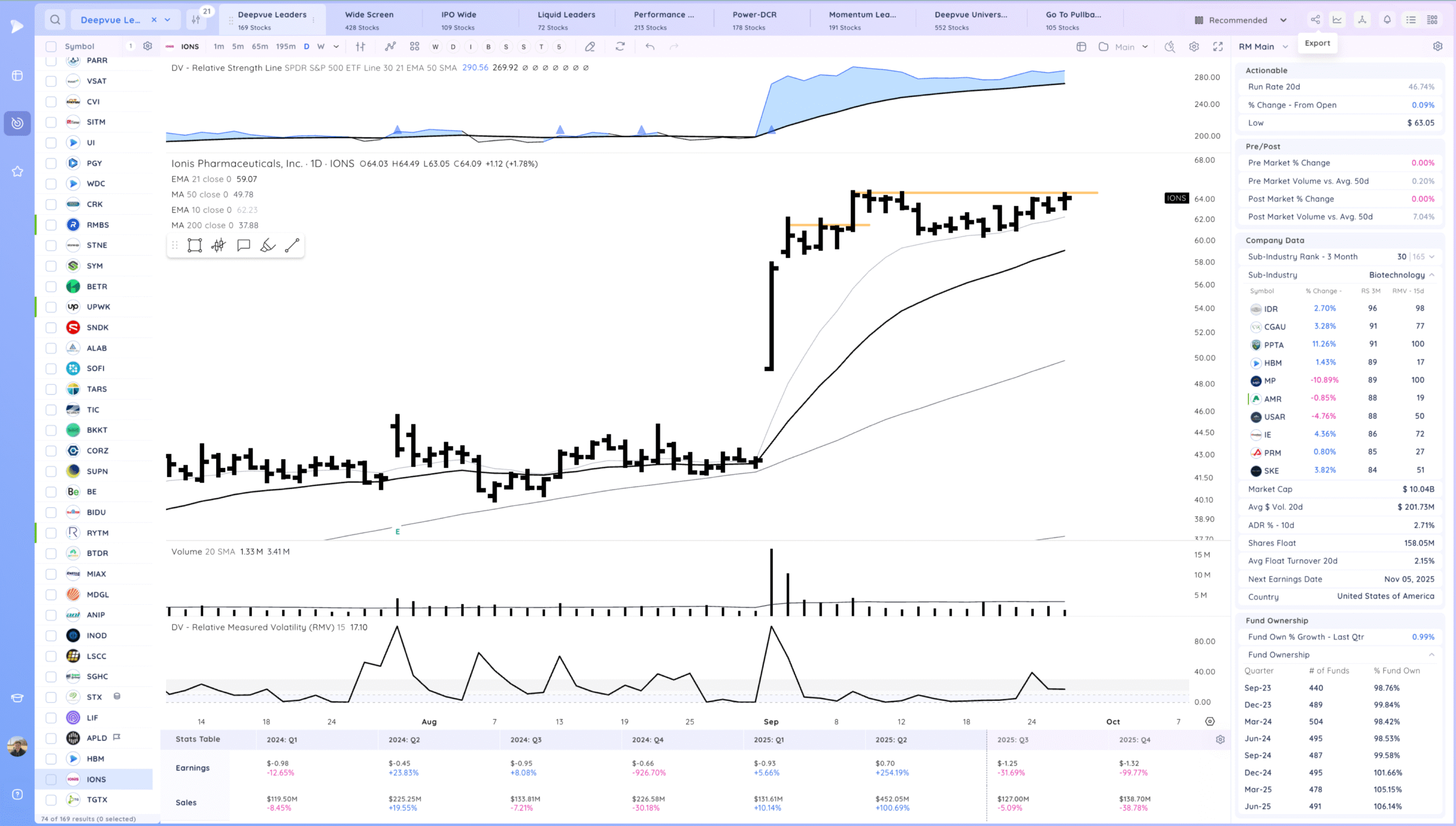

IONS watching for a range breakout

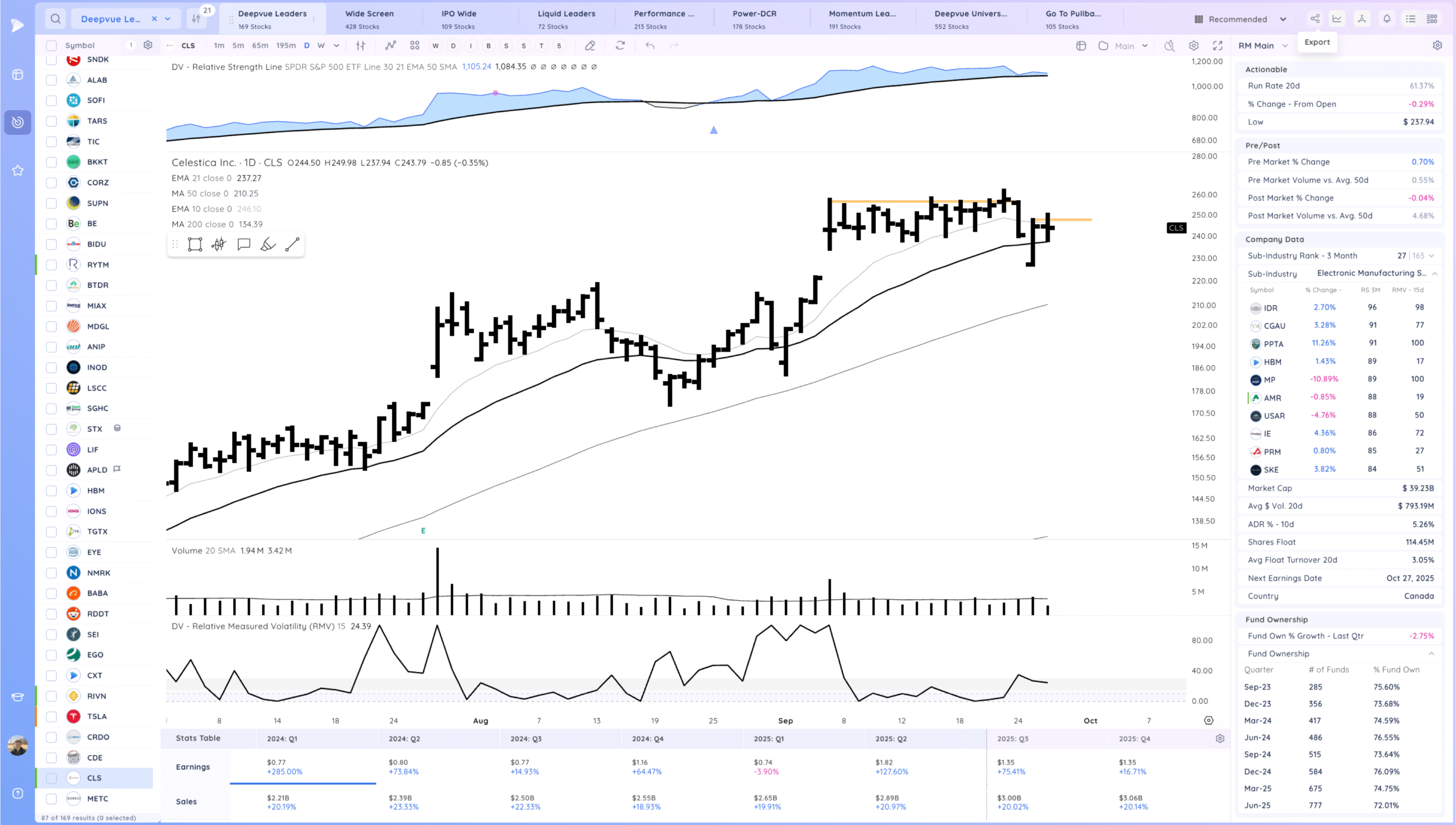

CLS watching for follow through up

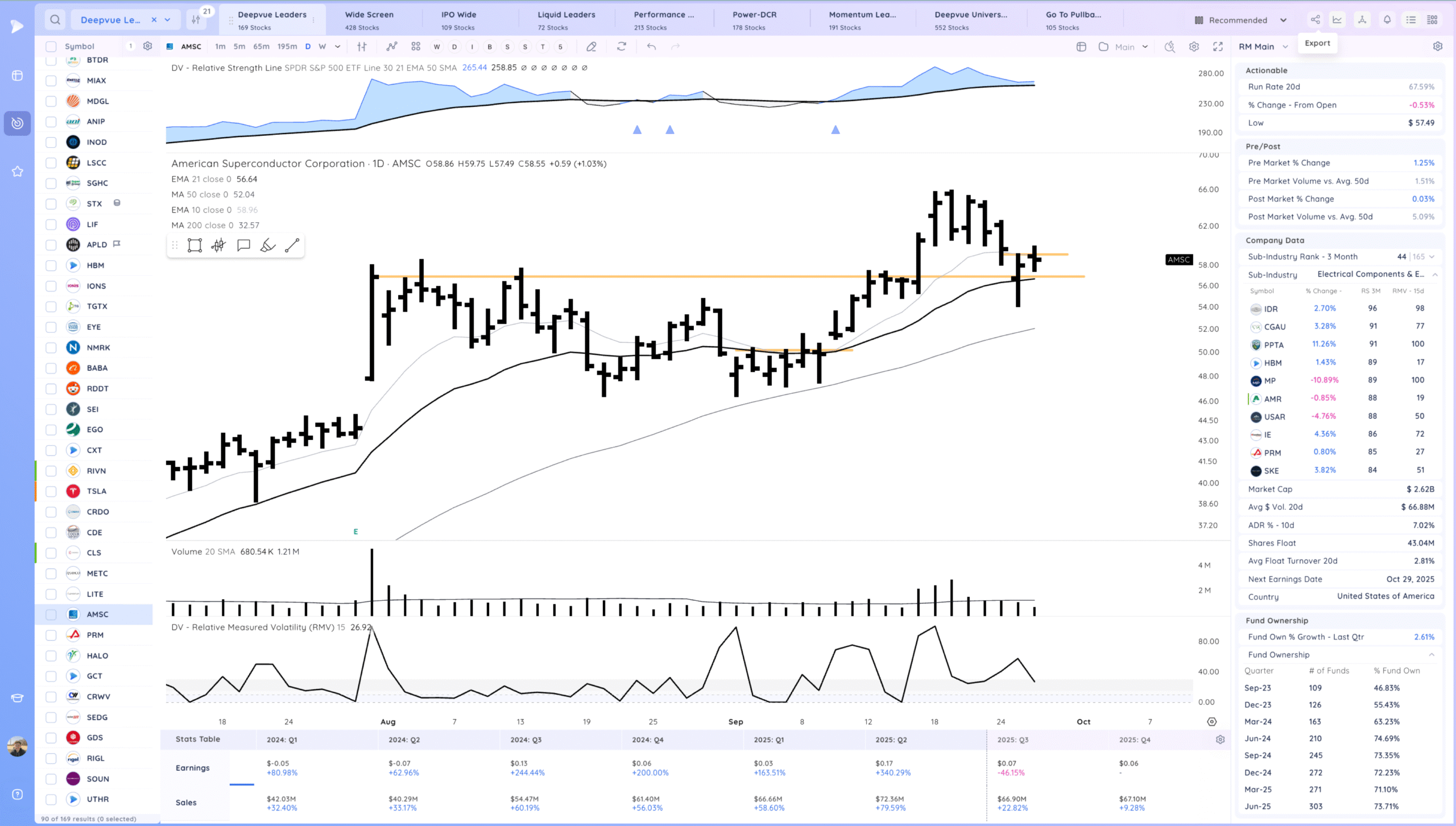

AMSC watching for follow through up. Tight day

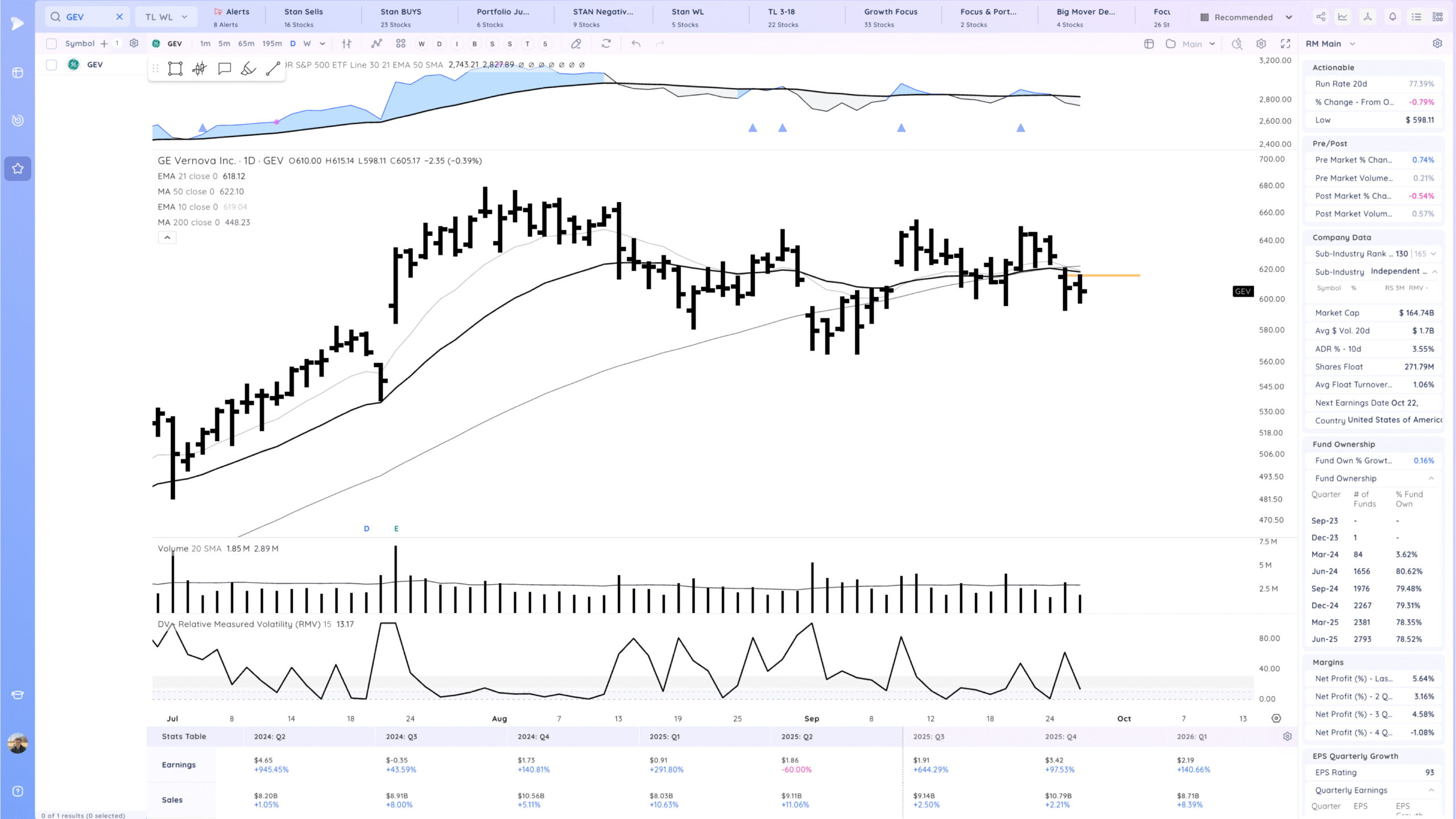

GEV watching for a 21ema pop

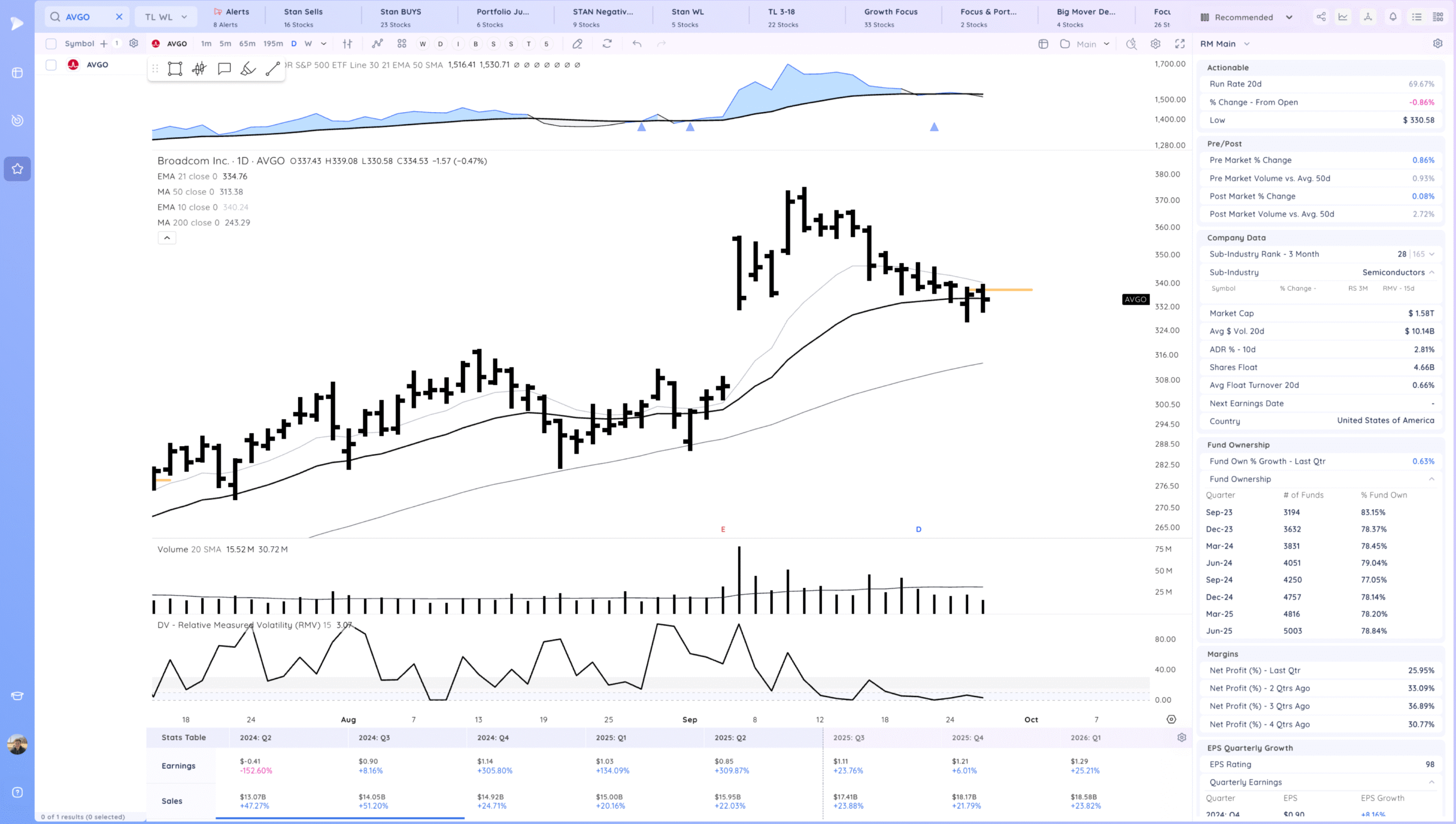

AVGO watching for a range breakout

Today’s Watchlist in List form

Focus List Names

ANET NVMI STNG SPHR NBIS MDB TARS BKKT IONS CLS AMSC GEV AVGO ALAB RDDT PLTR TSLA NVDA

Focus:

GEV ALAB PLTR NVDA

Themes

Strongest Themes: Software, Crypto, Nuclear Power, Semis, Miners, Cruise Liners

Market Thoughts & Focus

Good end to the week as we held the 10ema and overall built ranges and new pivots. Thursday’s lows are key levels to hold. Megacaps & Semis look primed for another move higher.

Anything can happen, Day by Day – Managing risk along the way