New Market Highs

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

October 25, 2025

Market Action

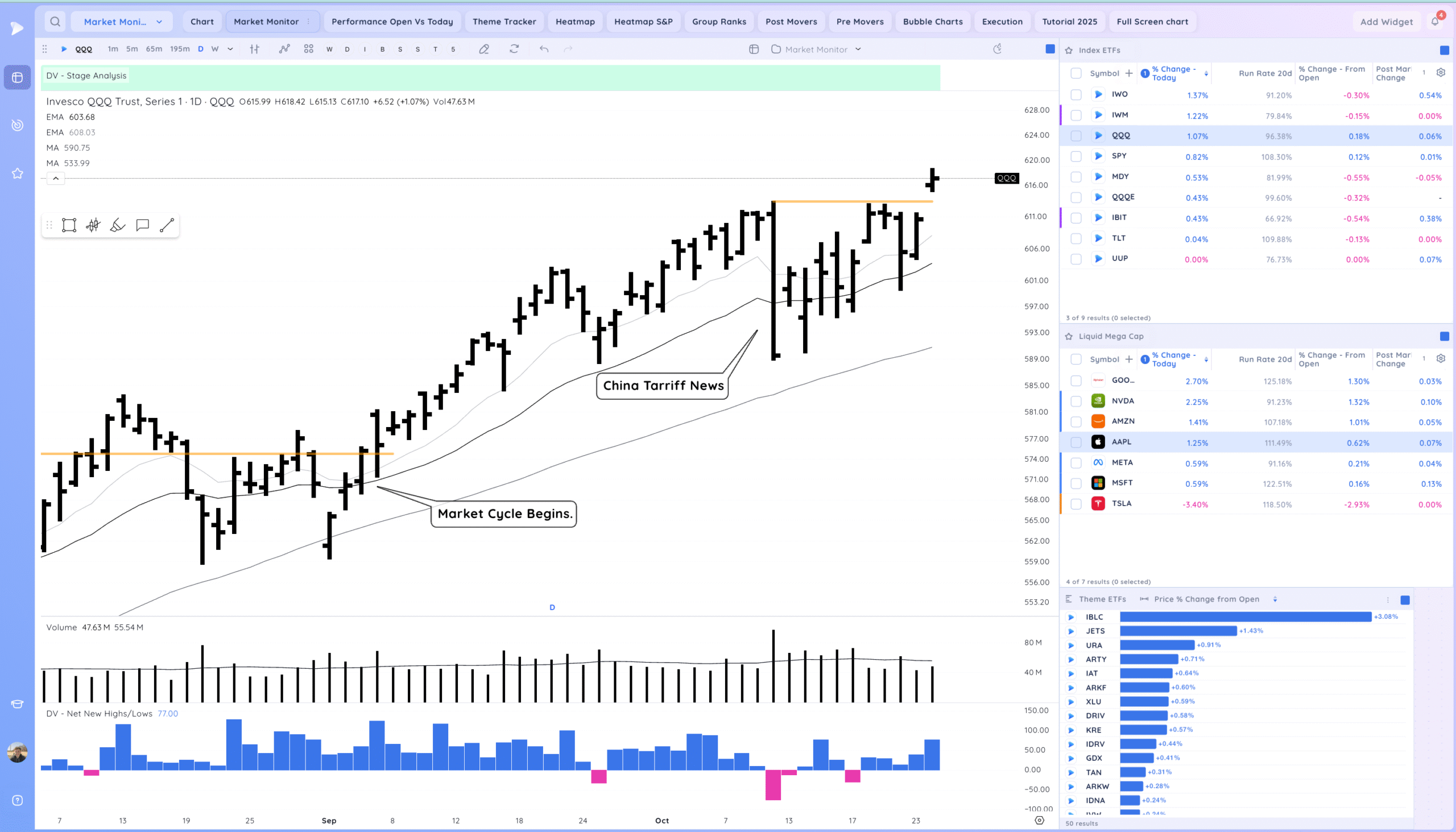

QQQ – Gap and hold above the friday reversal high. We continue the uptrend. A pullback back into the pivot would be normal and natural but I would want to see the recent highs defended on a closing basis.

We have a big week of earnings coming with AAPL AMZN MSFT META etc which could swing things quite a bit.

Bulls want to see us either consolidate calmly or continue trending

Bears want to see a sharp reversal down with big earnings names selling off.

Daily Chart of the QQQ.

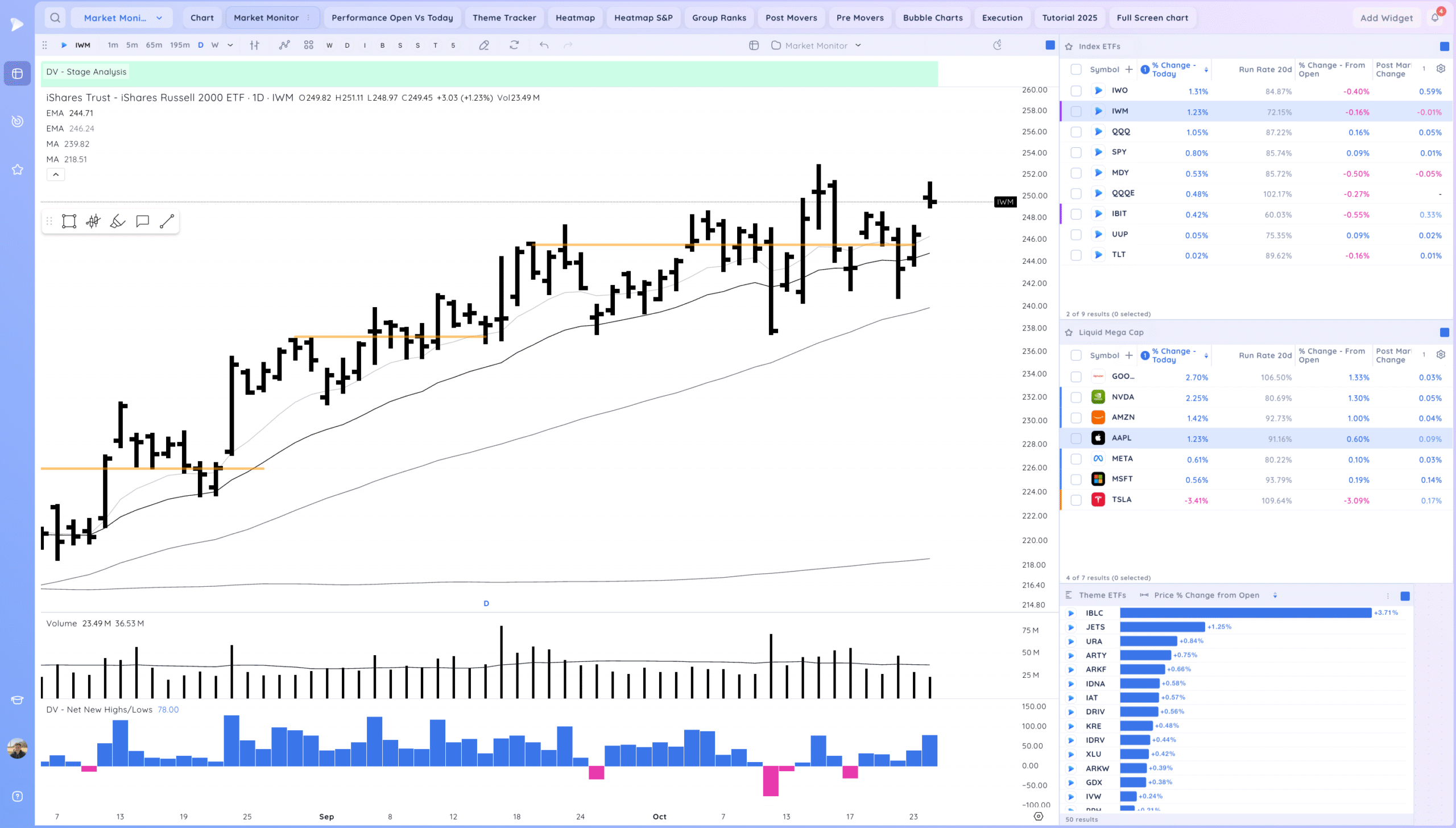

IWM – Gap up and hold, however we did fade from highs

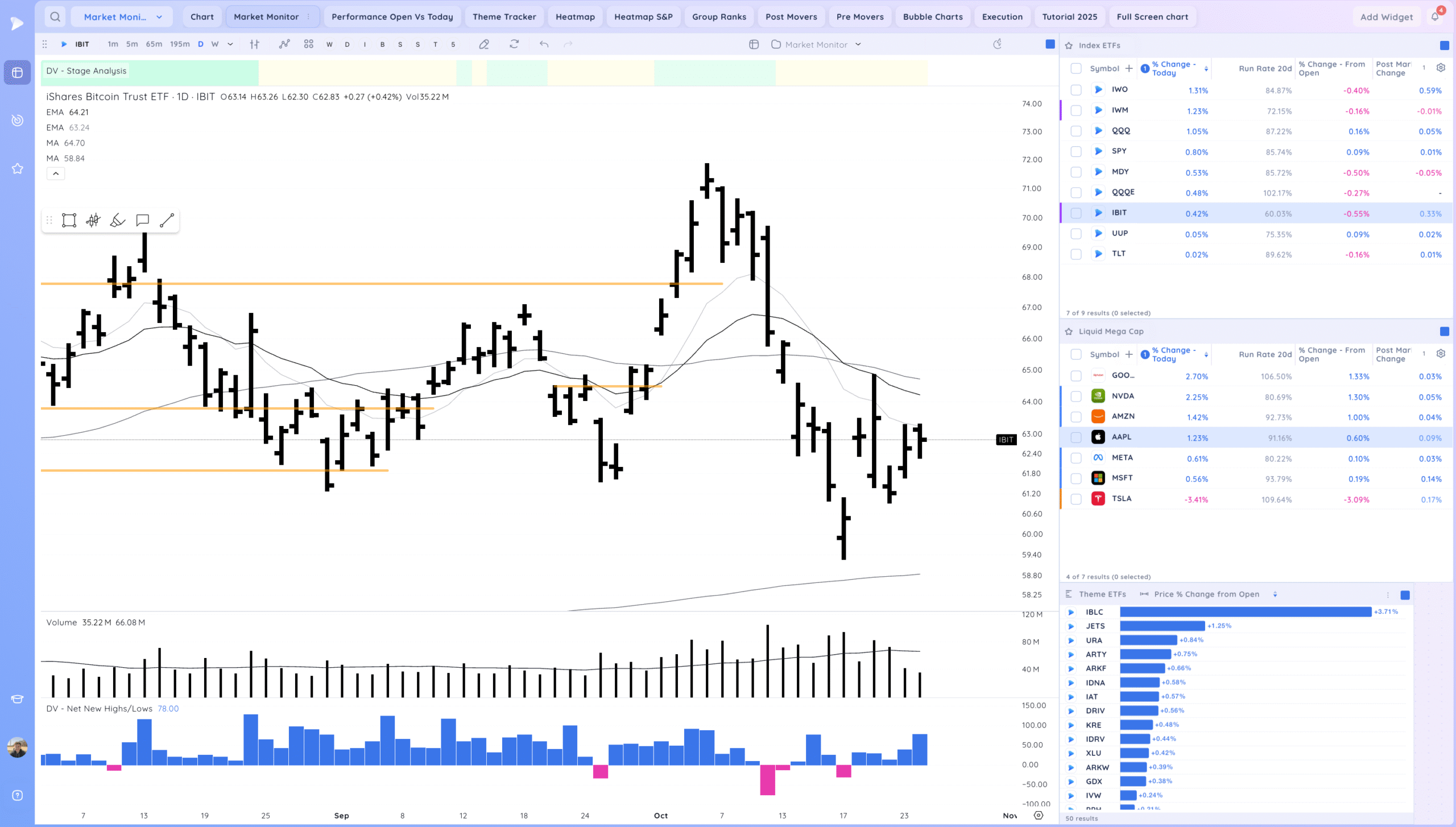

IBIT – Tightening below the moving averages

Trends (4/4 Up) – Based on the QQQ

Shortest – 10 Day EMA – Above

Short-term – 21 ema – Above

Intermediate term – 50 sma – Above Rising

Longterm – 200 sma – Up – Above Rising

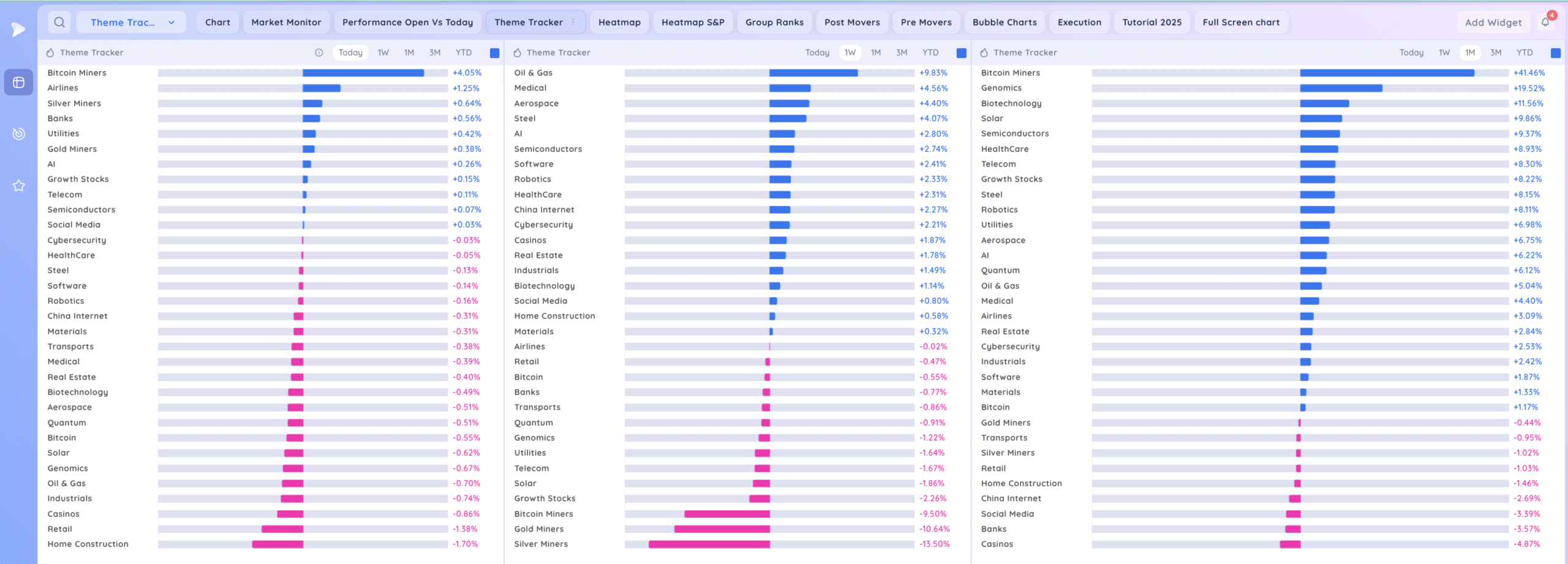

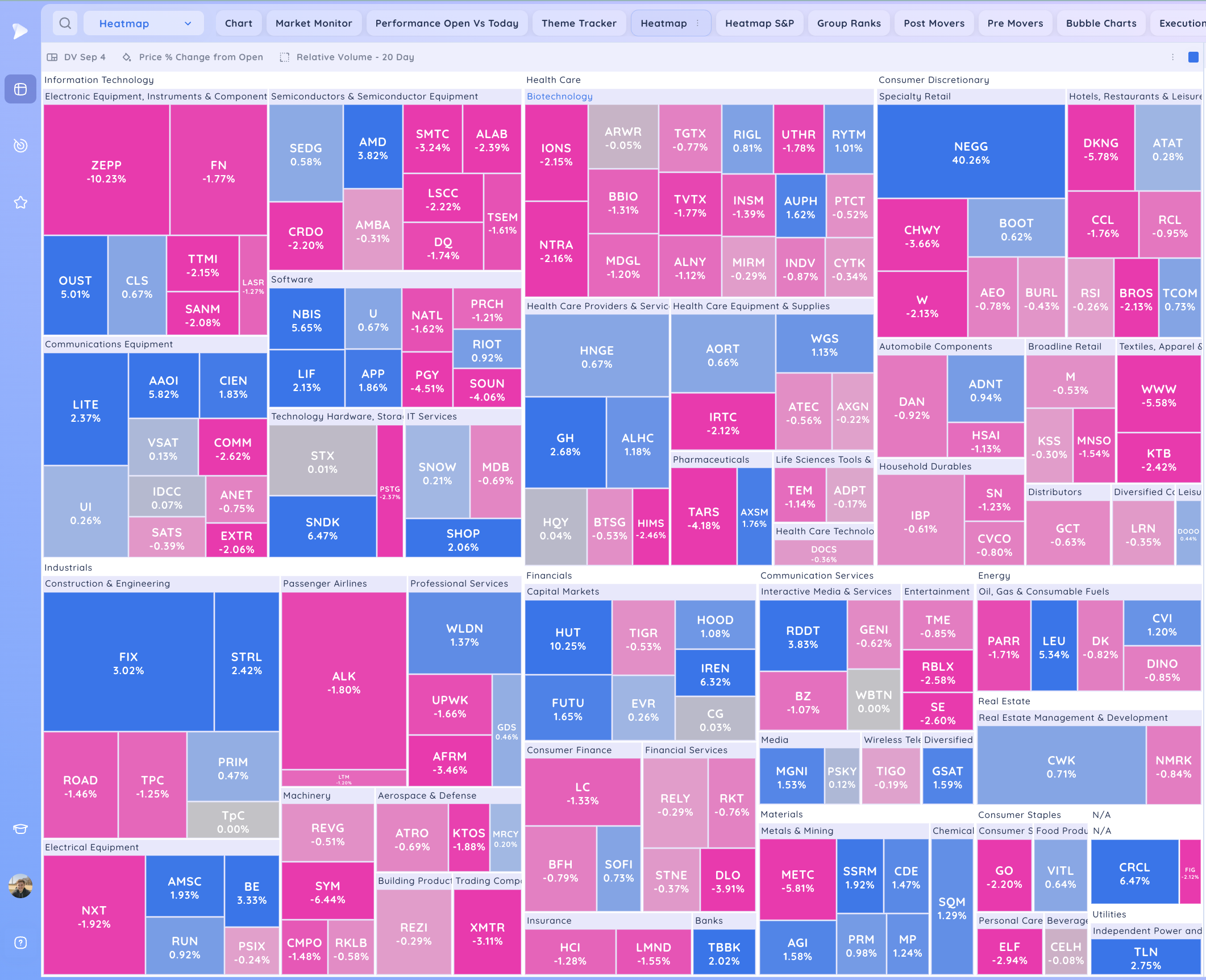

Groups/Sectors

Deepvue Theme Tracker.

Deepvue Leaders.

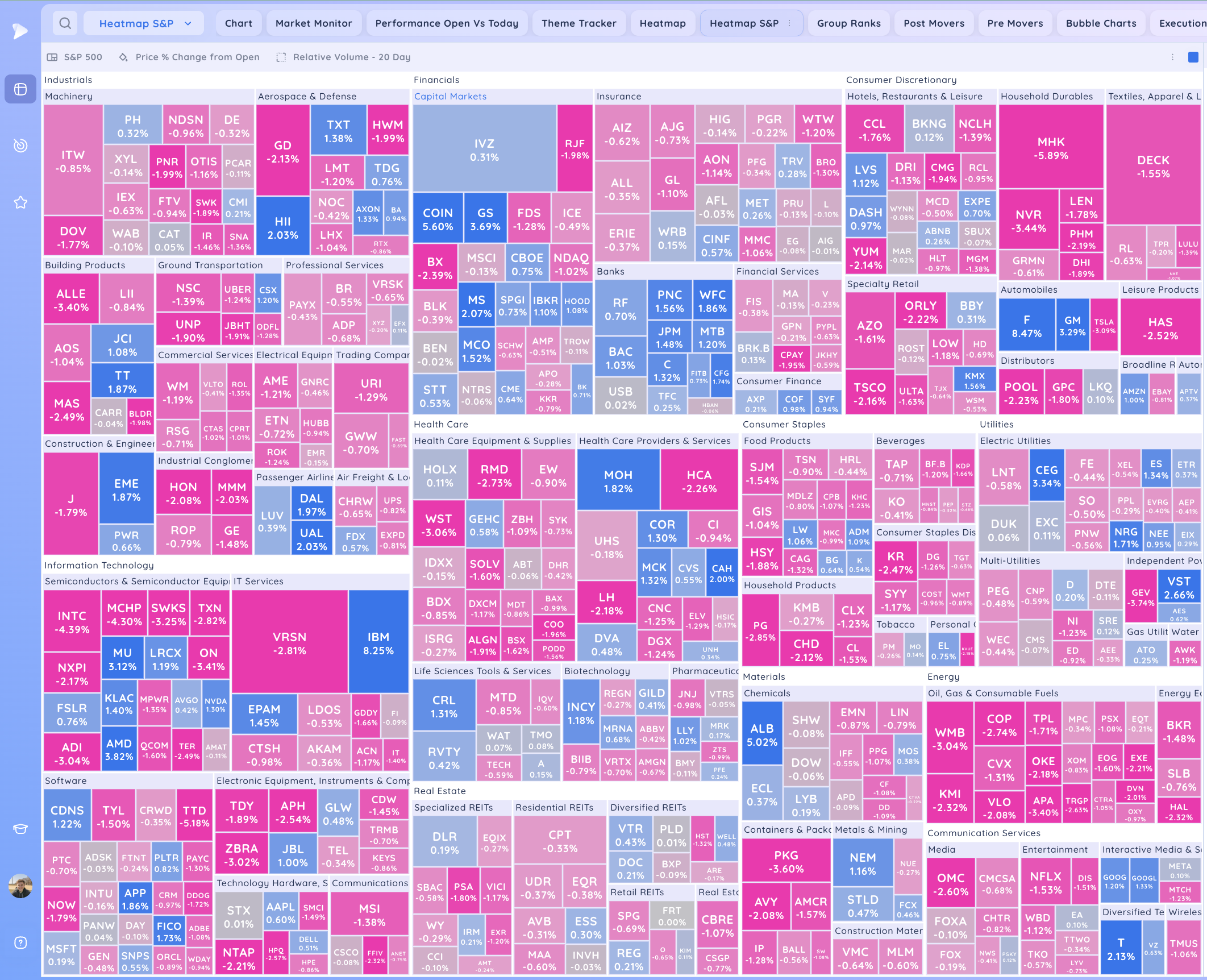

S&P 500.

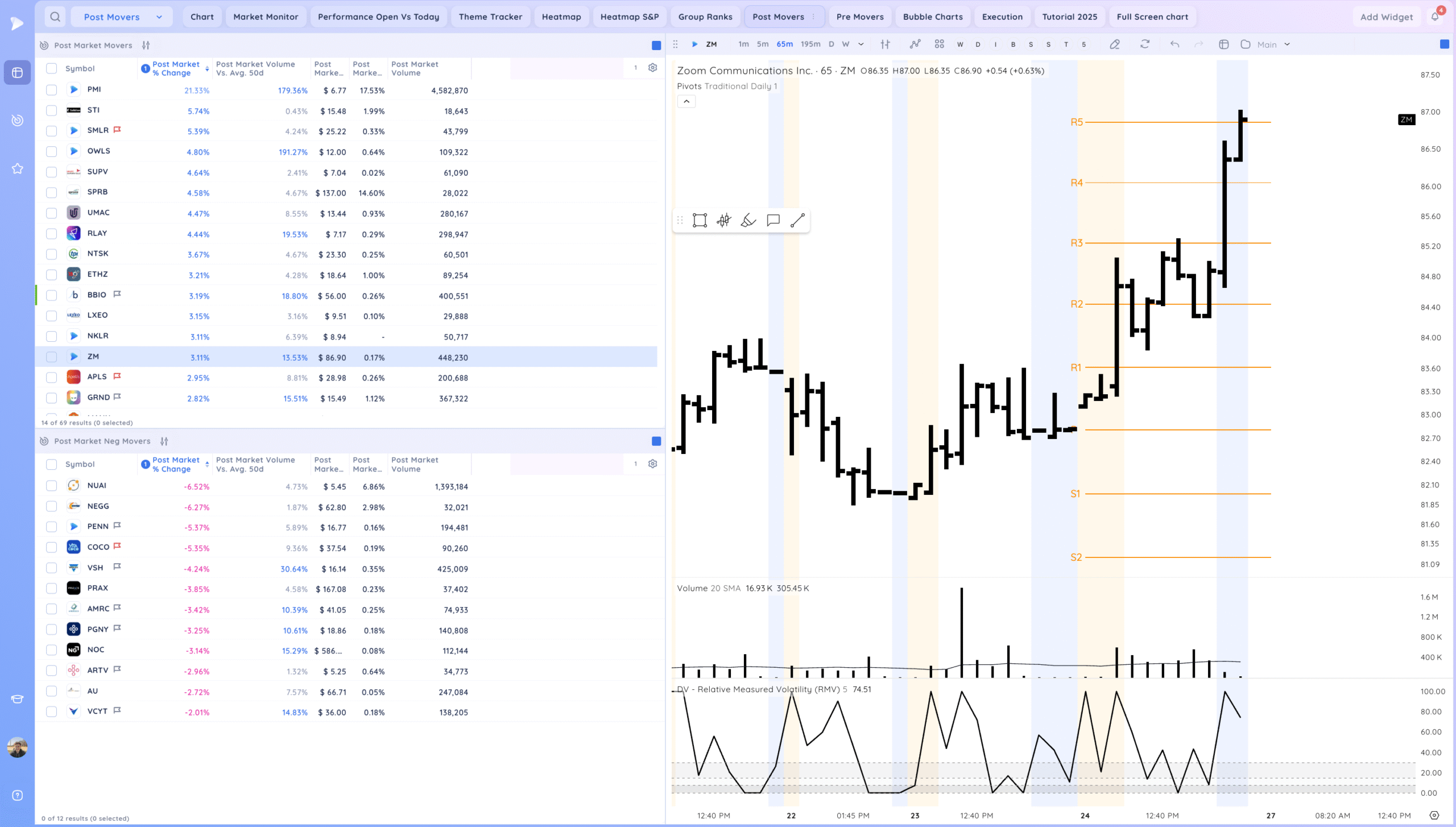

Post Market Movers. Not really any key names of note

Leadership Stocks & Analysis

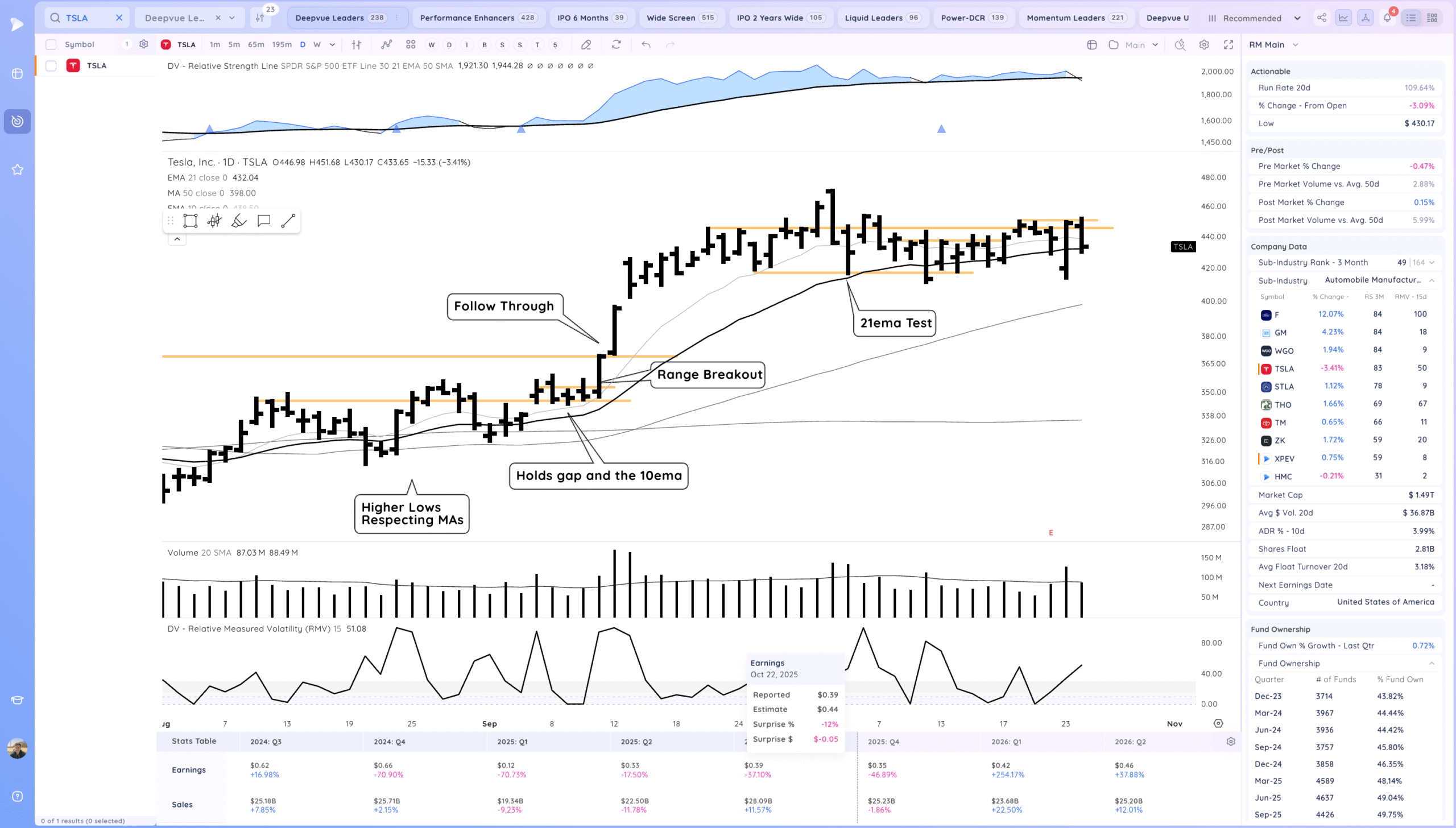

TSLA – Consolidation day as it pulls back into the 21ema. Bulls want to see it hold here and quickly take out the past 2 highs. Overall normal action today after a big range yesterday, A leak lower would be negative.

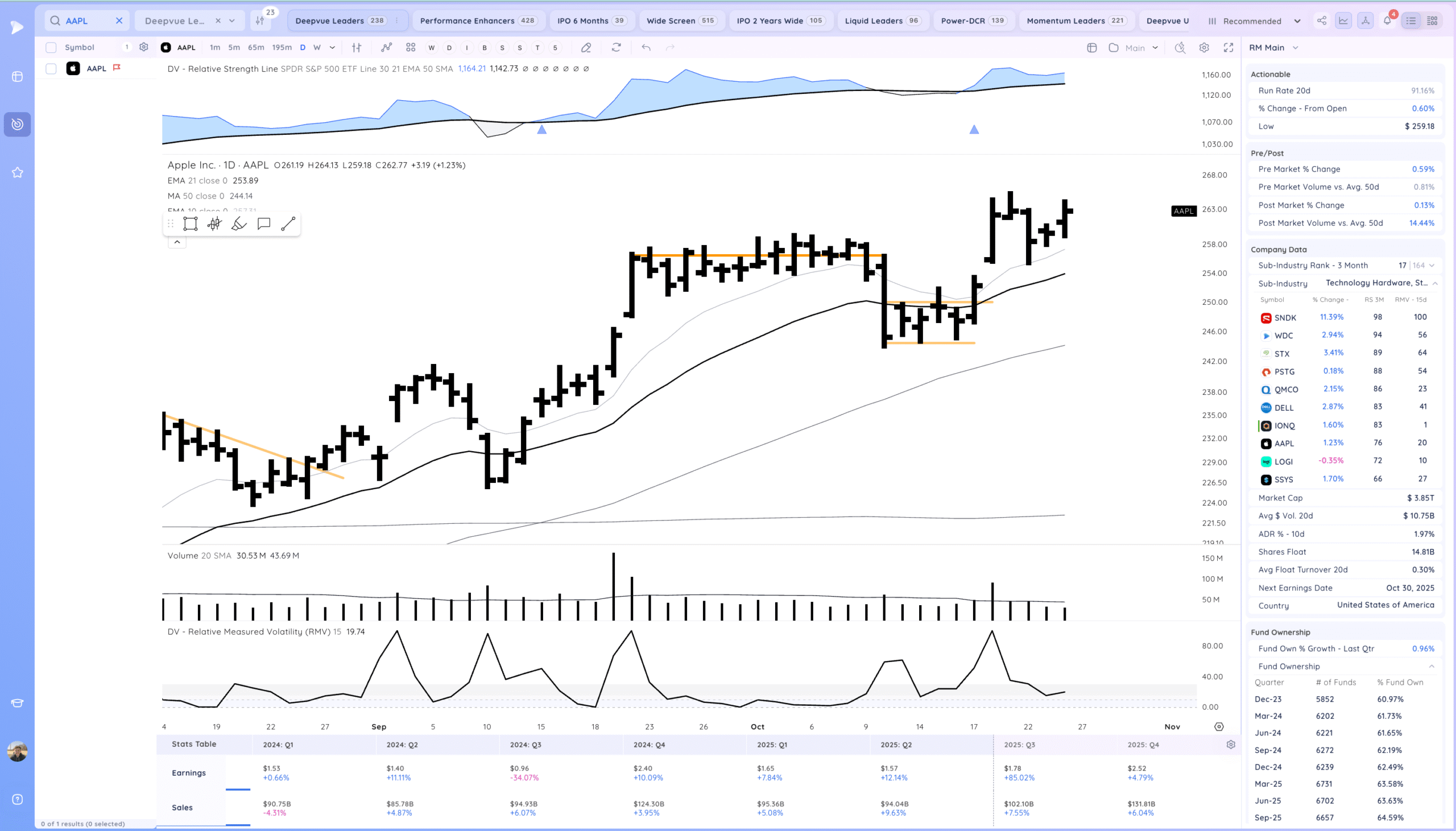

AAPL push from the tight day. Trending

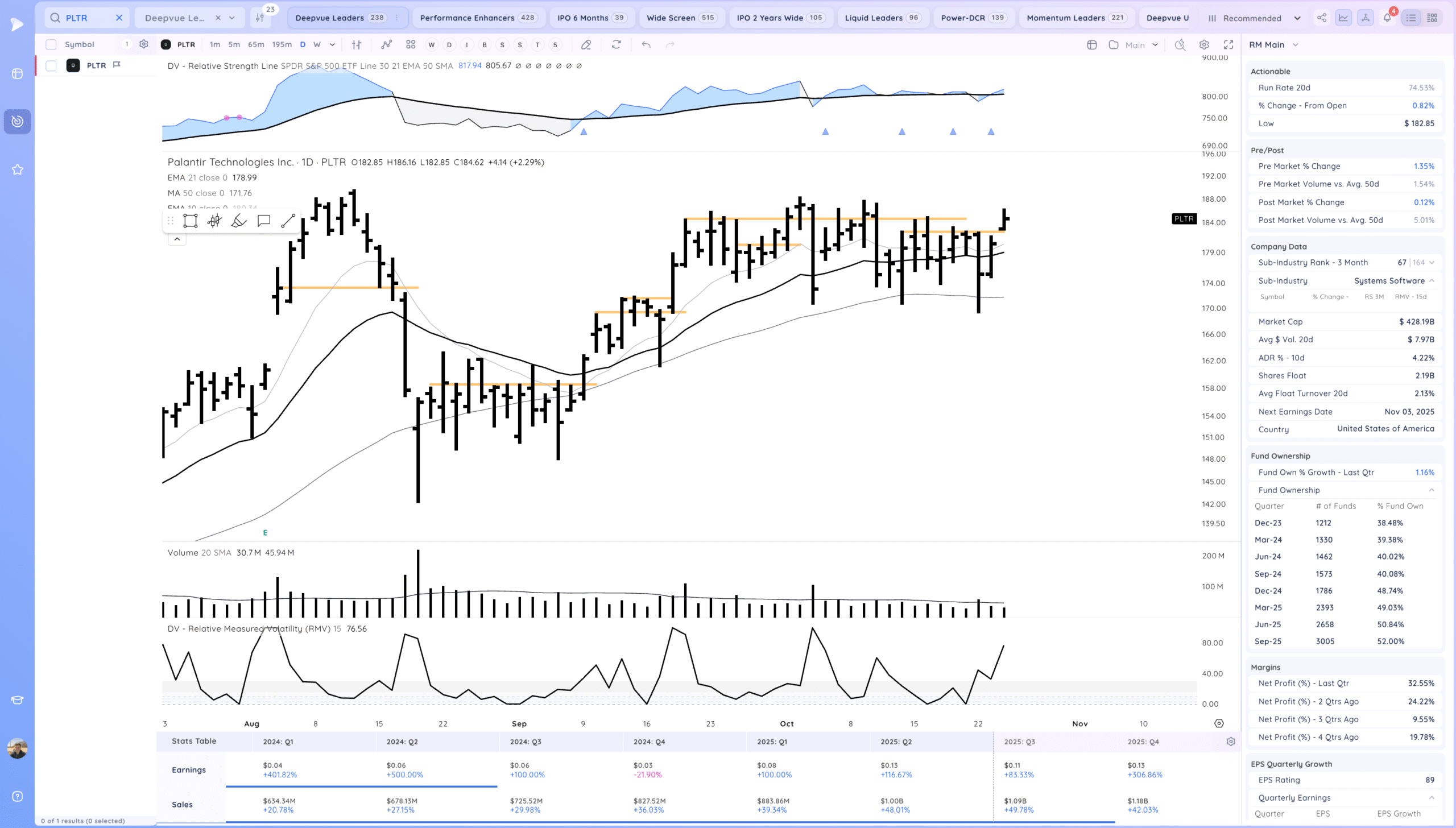

PLTR Gap above the range and hold. Watching for follow through next week. Earnings relatively soon

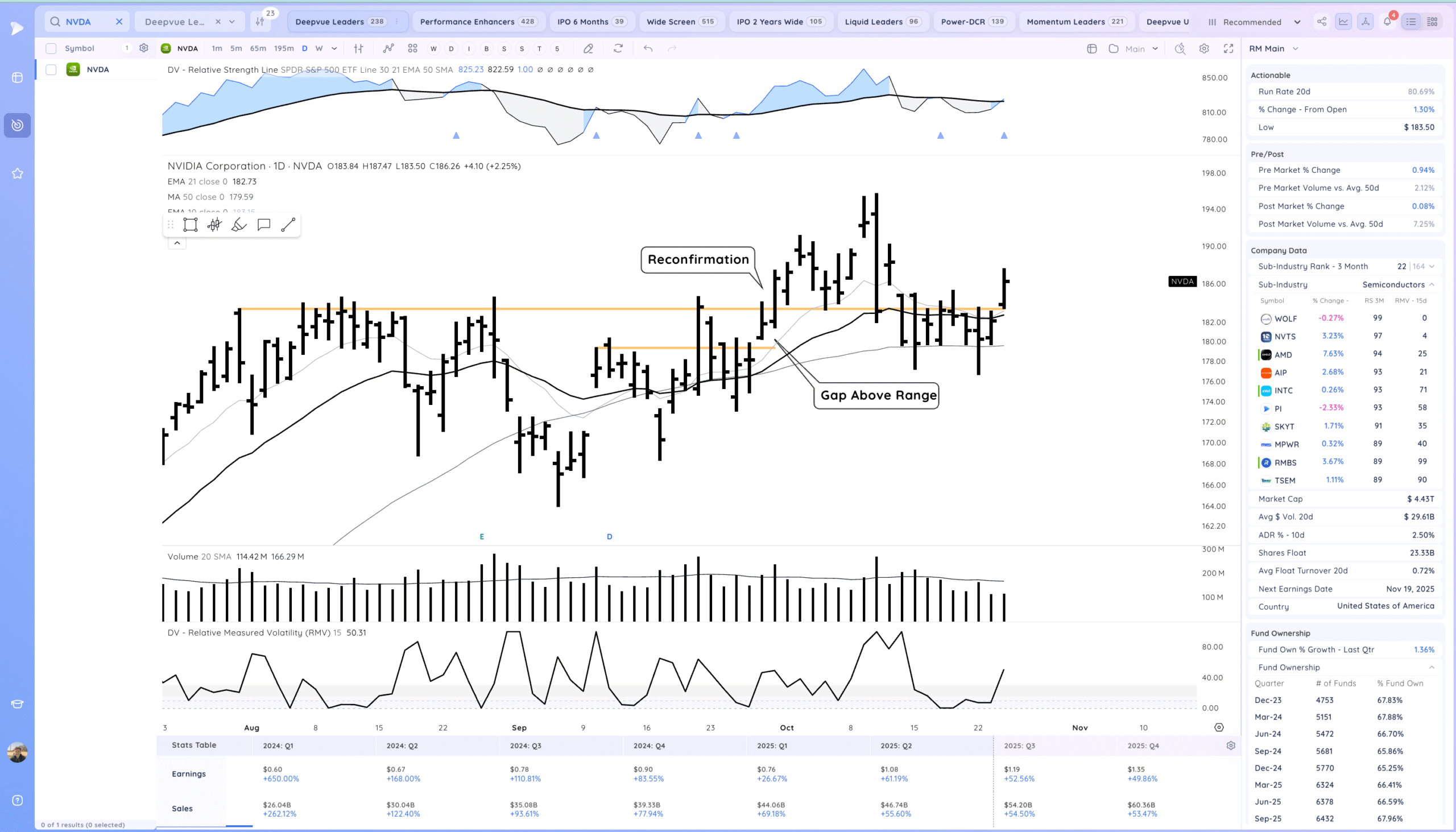

NVDA Range breakout and pop above the 21ema

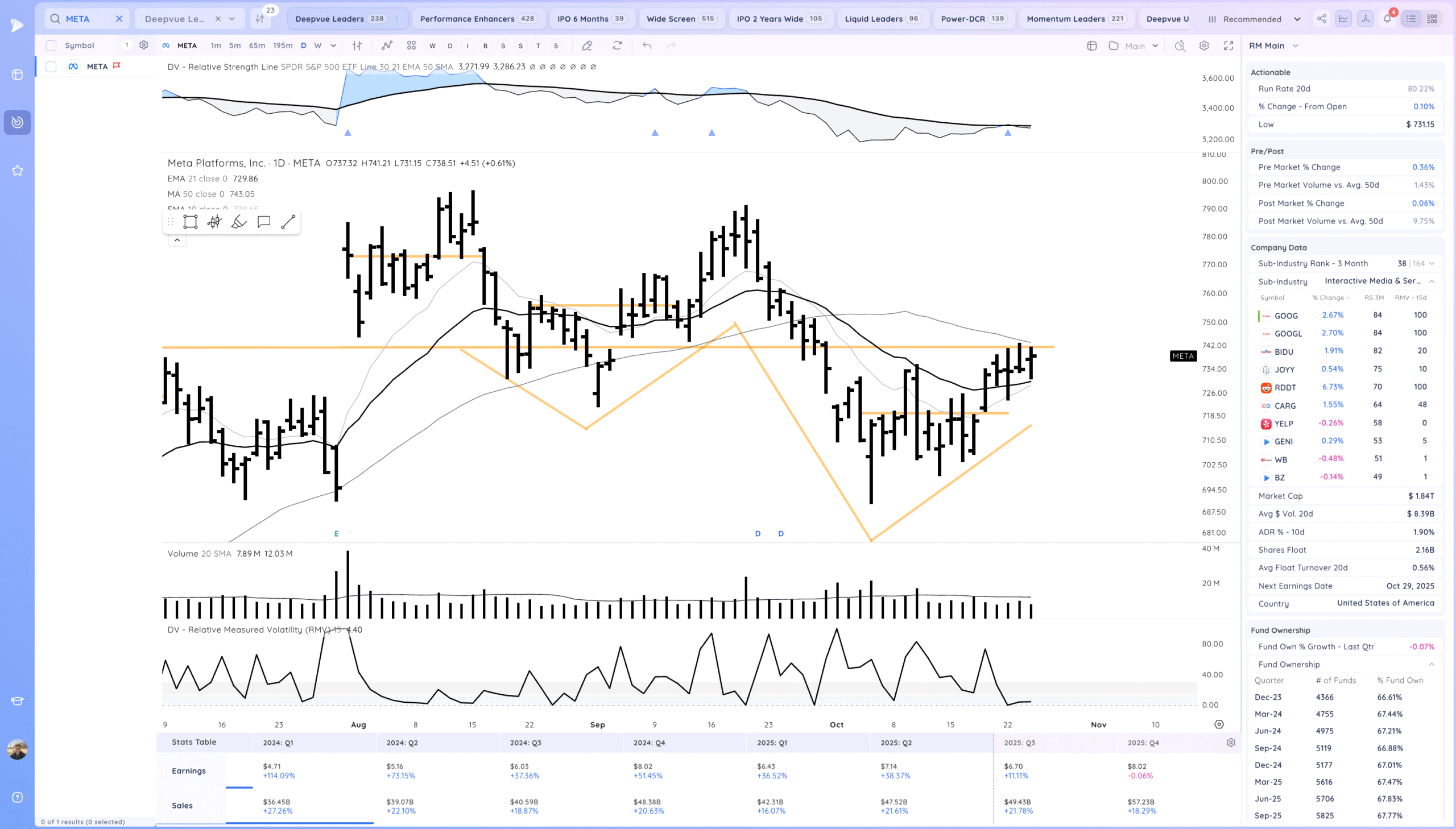

META Tight closes below this level, watching for a pop above. Earnings next week

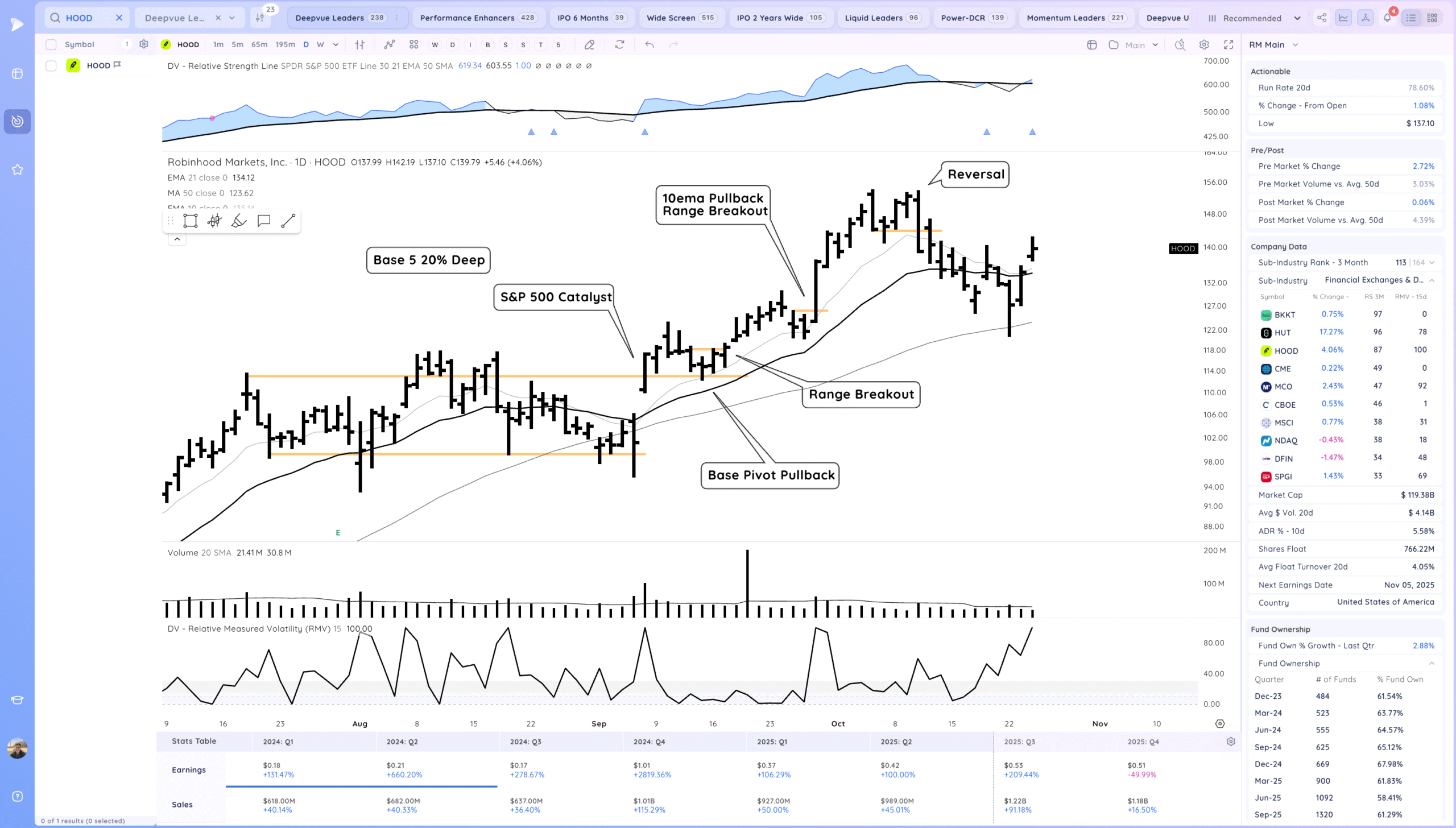

HOOD Follow through higher. Feels a bit like this needs more time to consolidate.

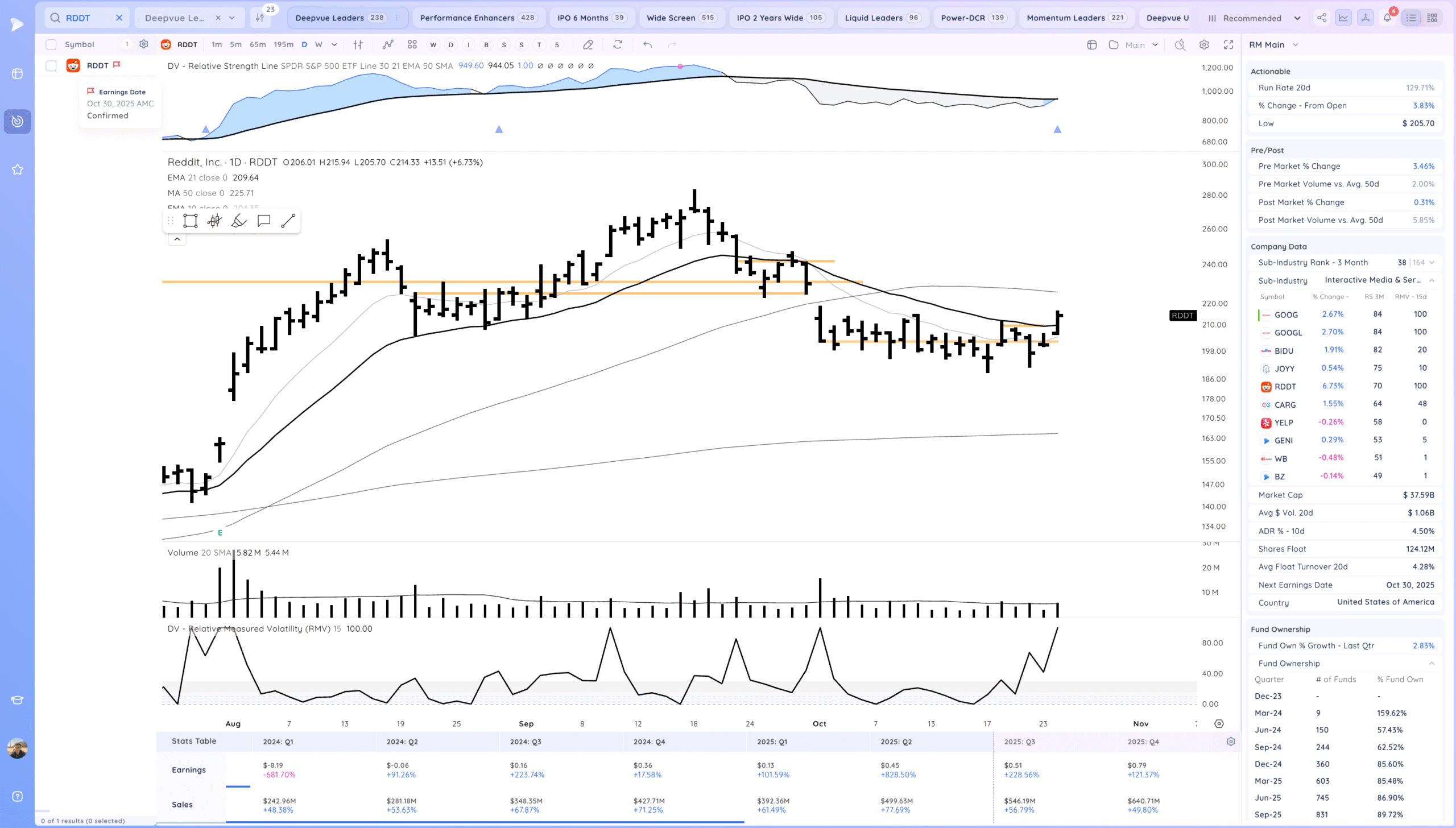

RDDT Range breakout and pop above the 21ema

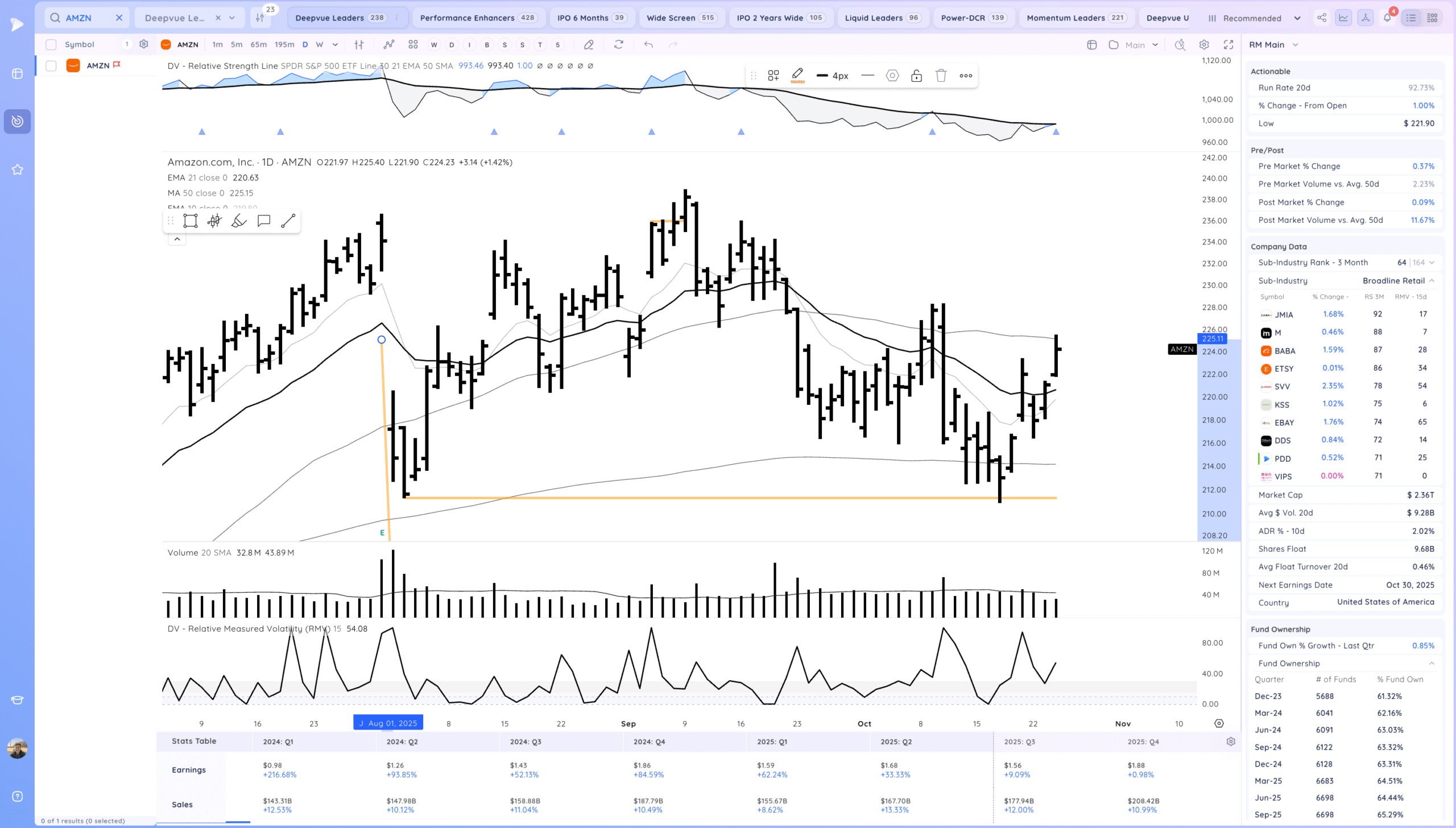

AMZN Follow through higher. Testing the 50sma. Choppy but constructive base

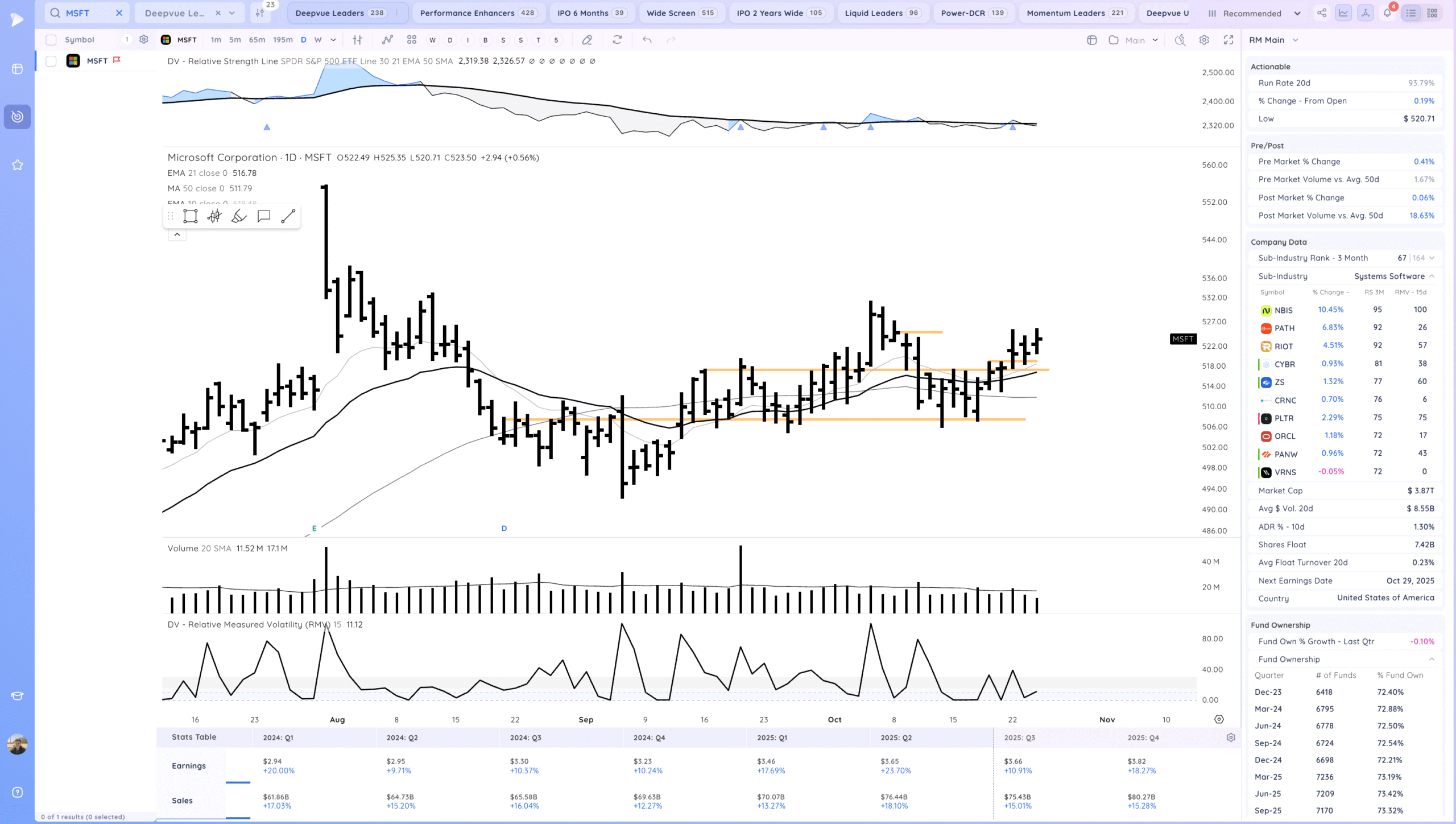

MSFT still tightening up the right side. Earnings next week.

Key Moves

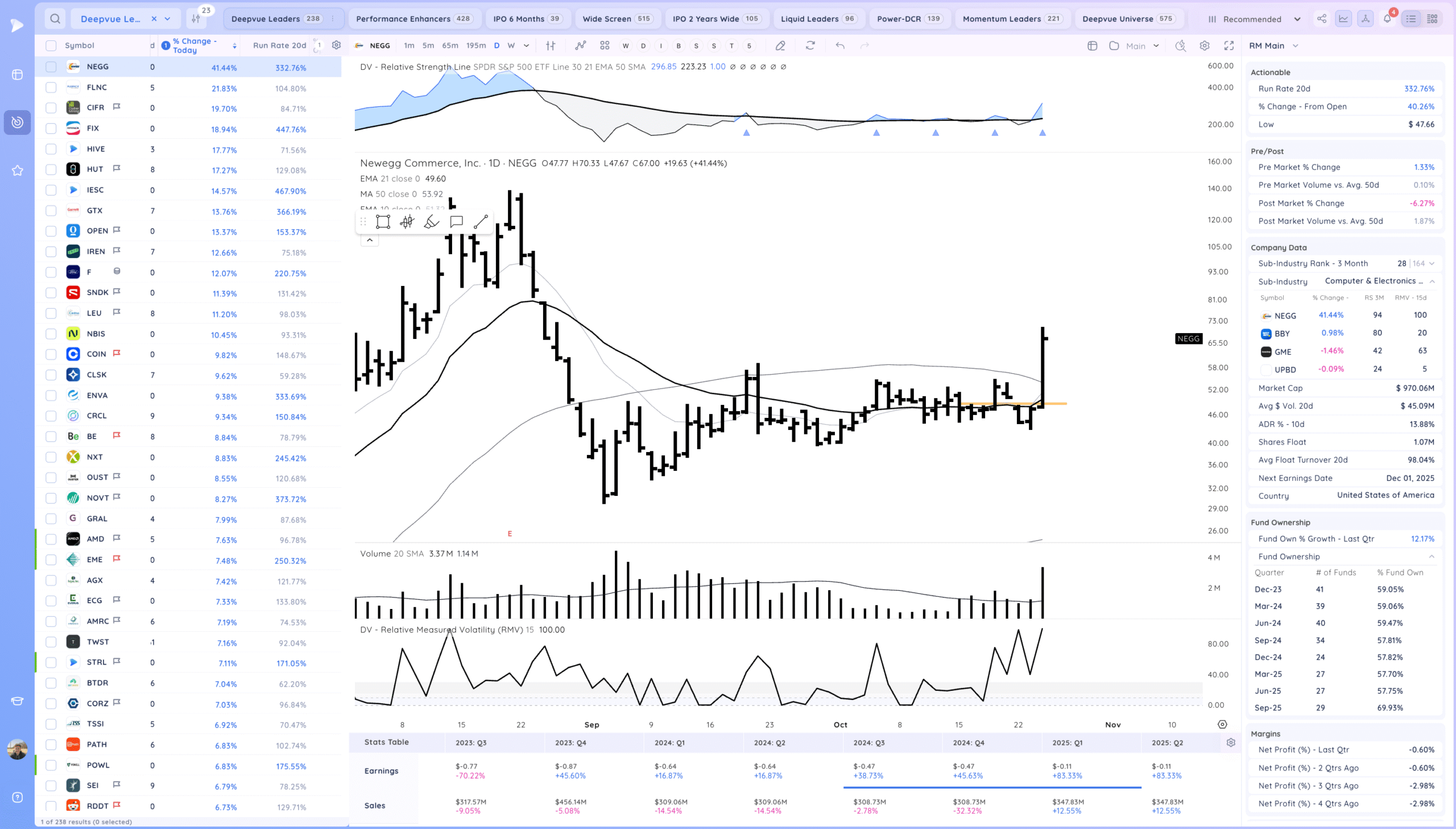

NEGG strong range expansion

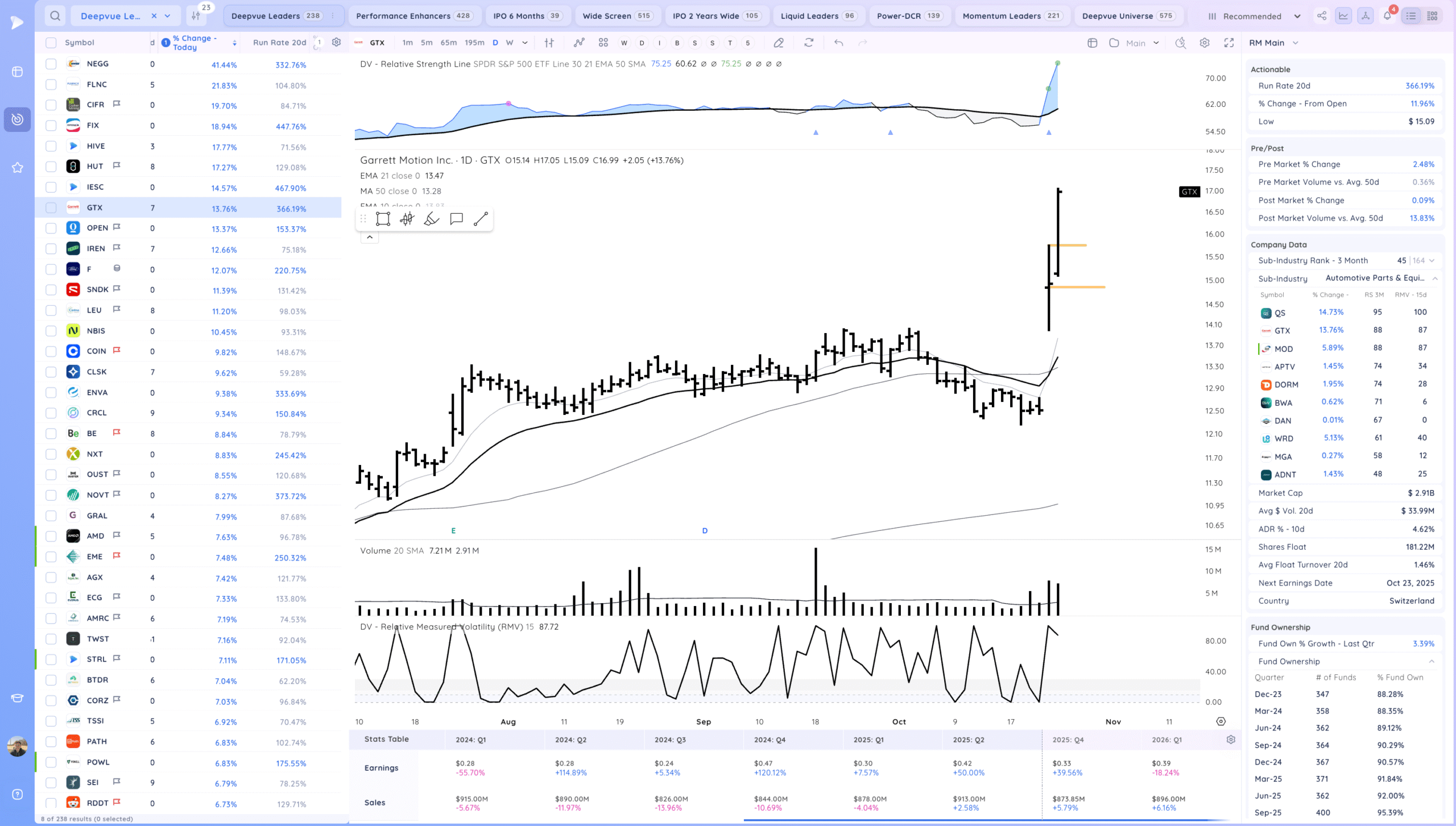

GTX follow through higher

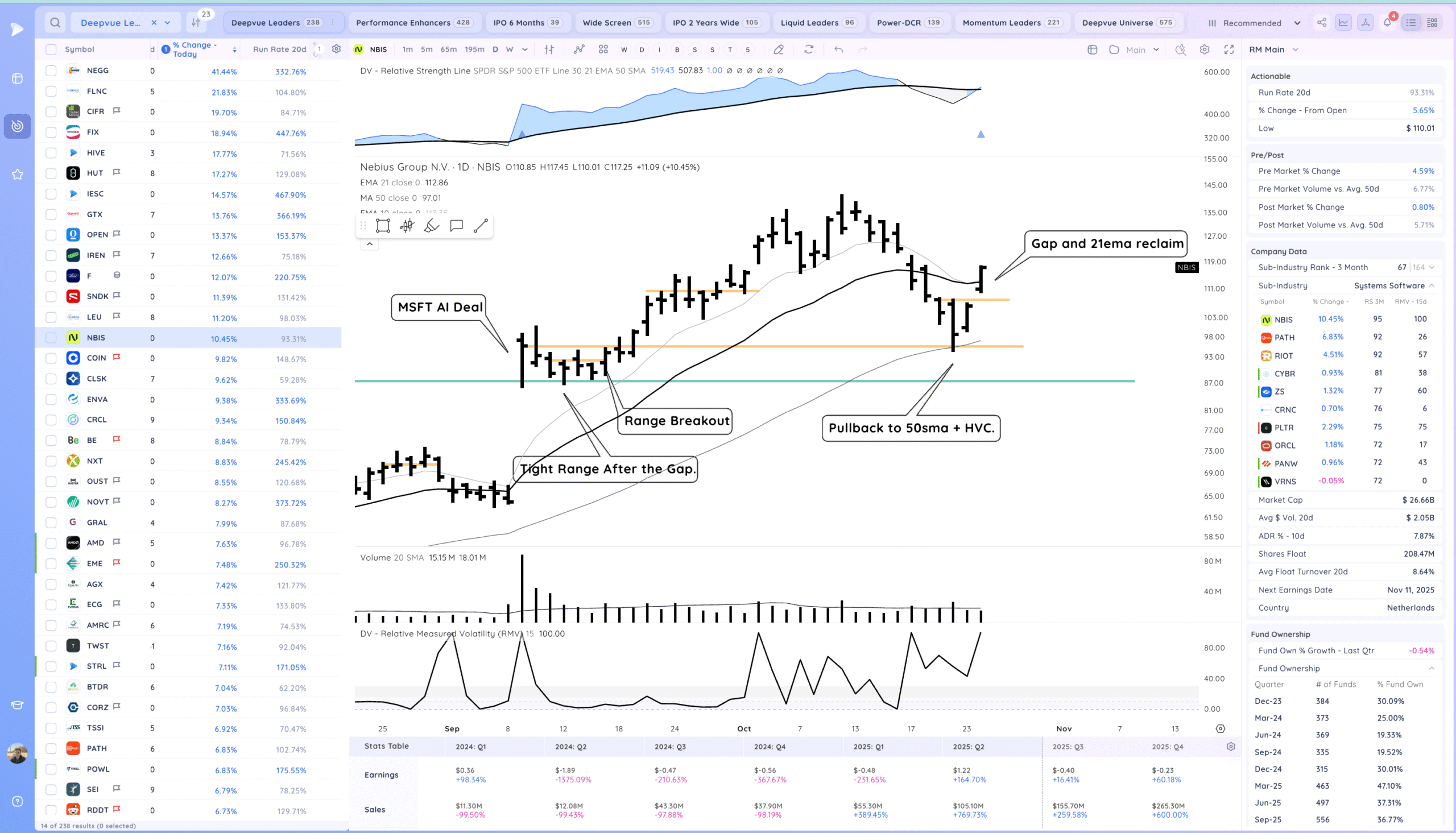

NBIS pop back through the 21ema after the 50sma & HVC retest

Setups and Watchlist

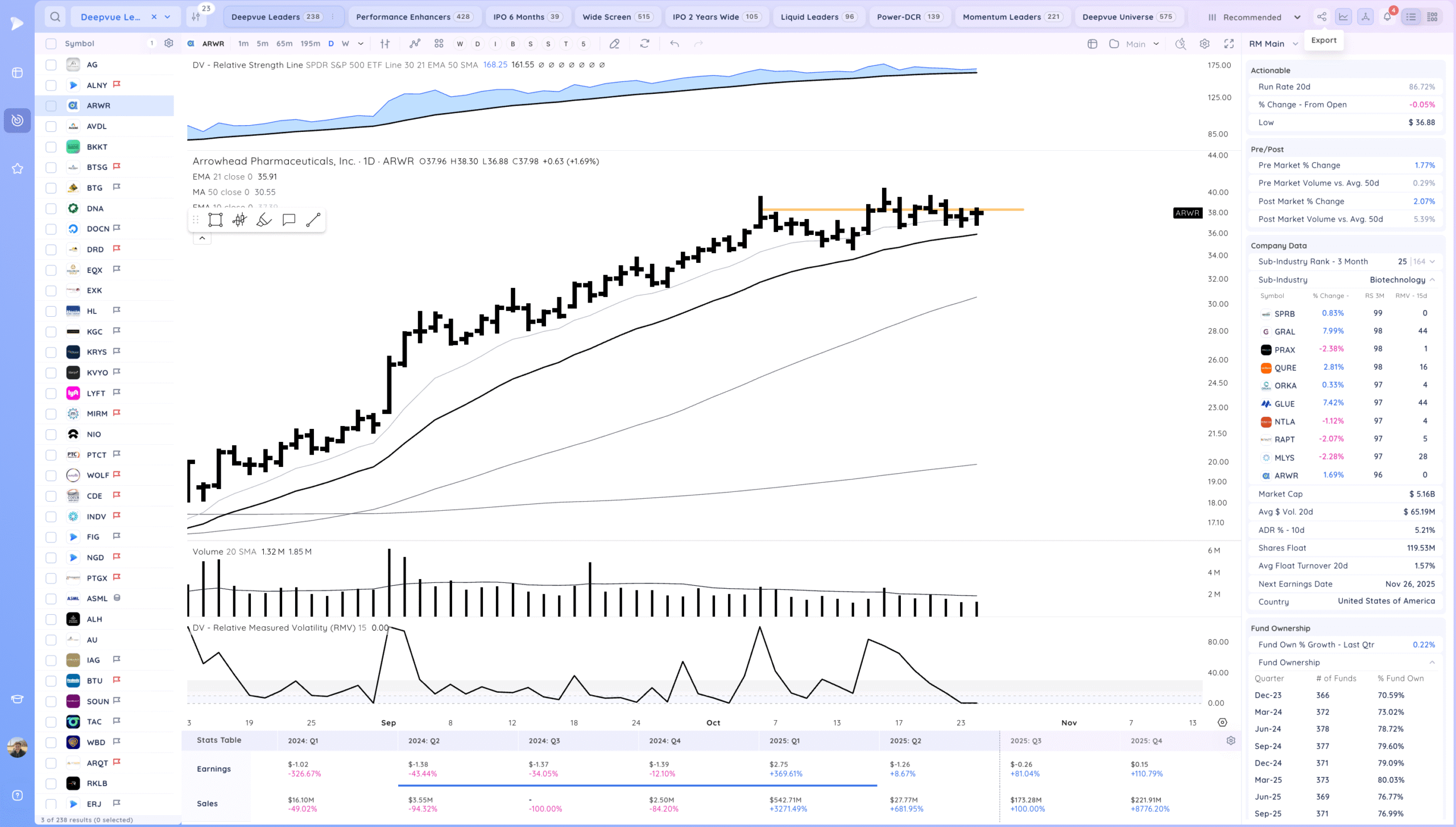

ARWR watching for a range breakout. Biotech but has made model book moves in the past

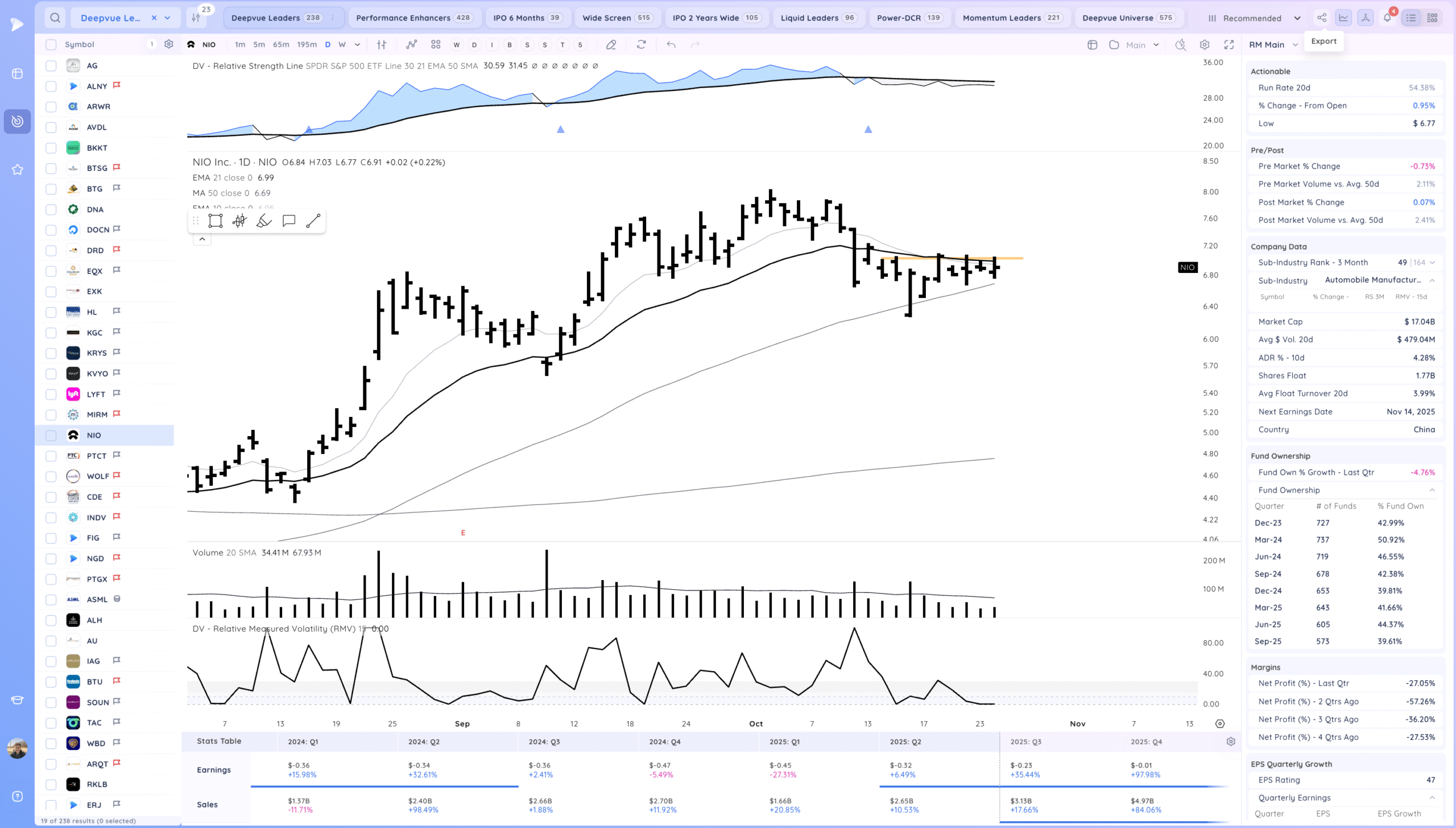

NIO haven’t traded this in a long time but watching for a range breakout through the 21ema. China name so added risk.

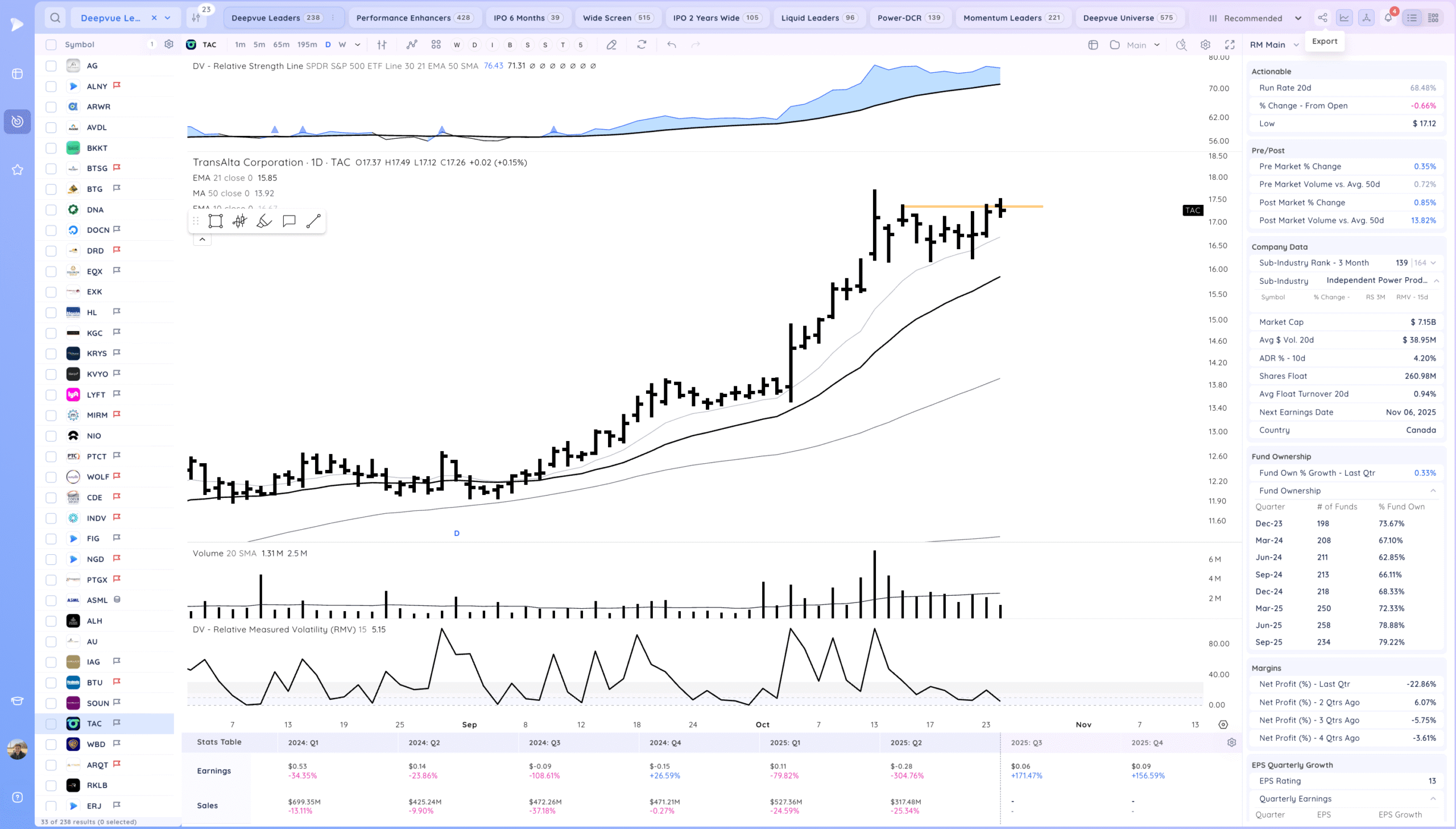

TAC watching for a range breakout. Tight day

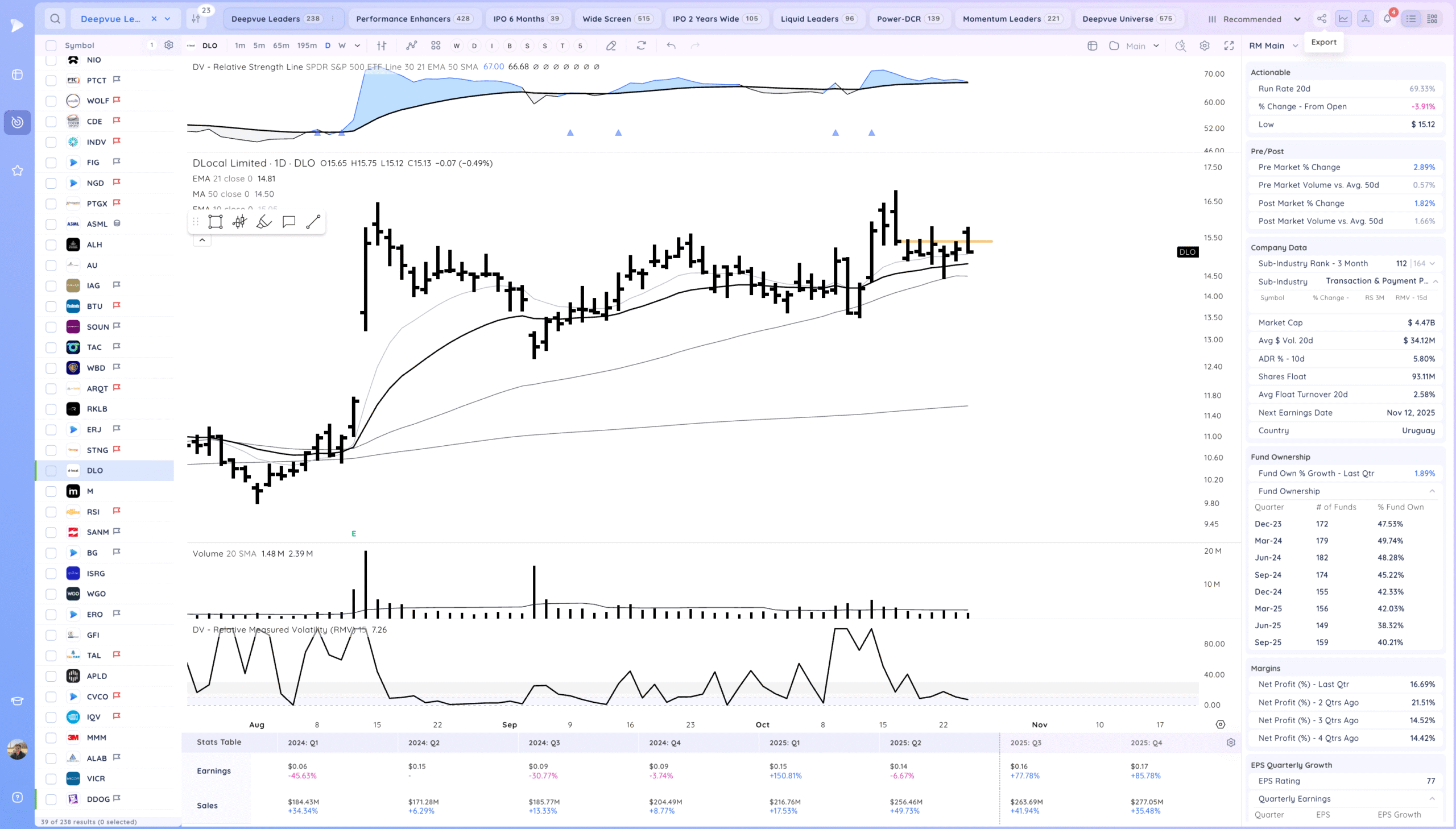

DLO watching for a range re- breakout.

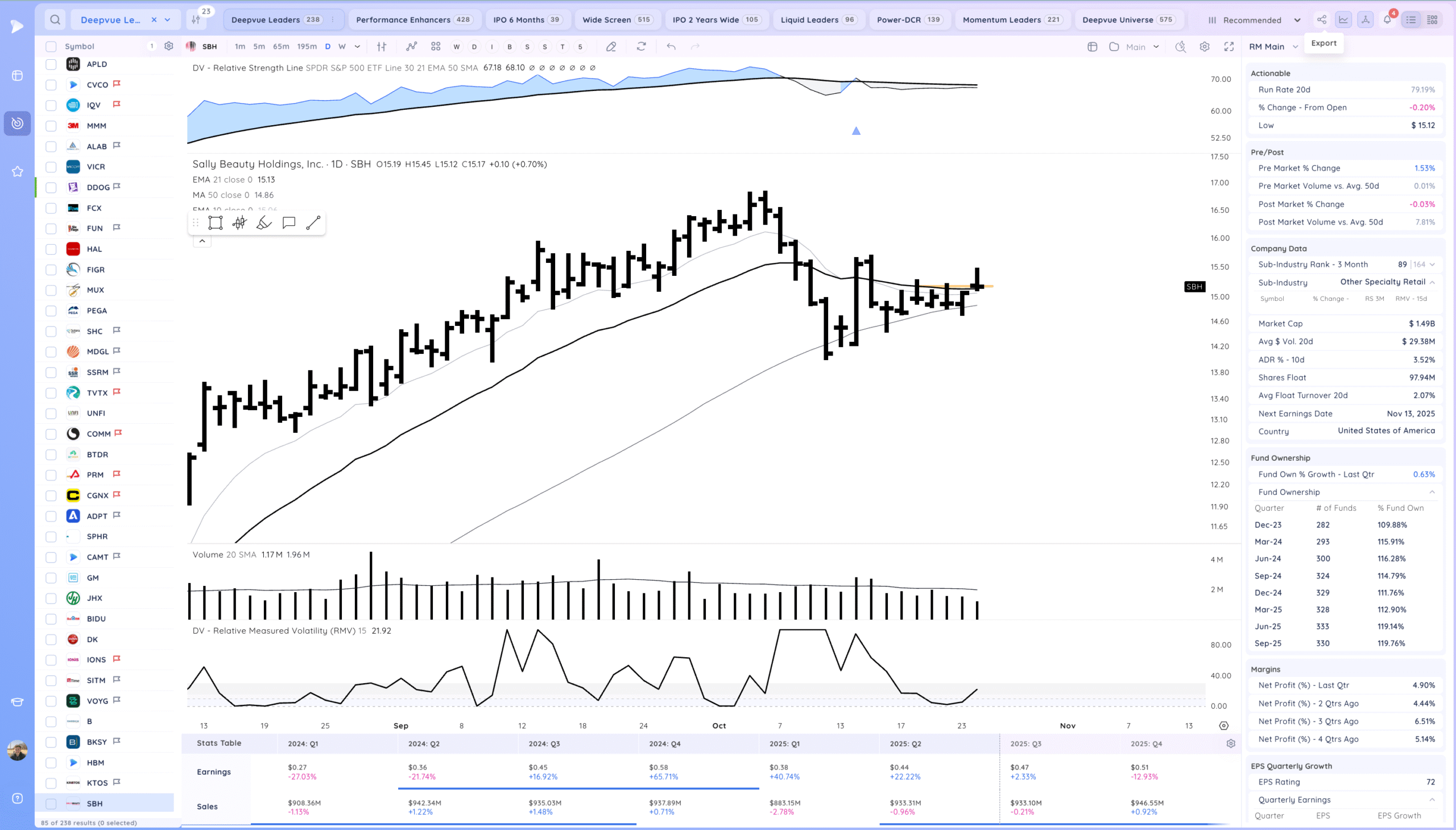

SBH fade today back in the range, watching for a re-breakout

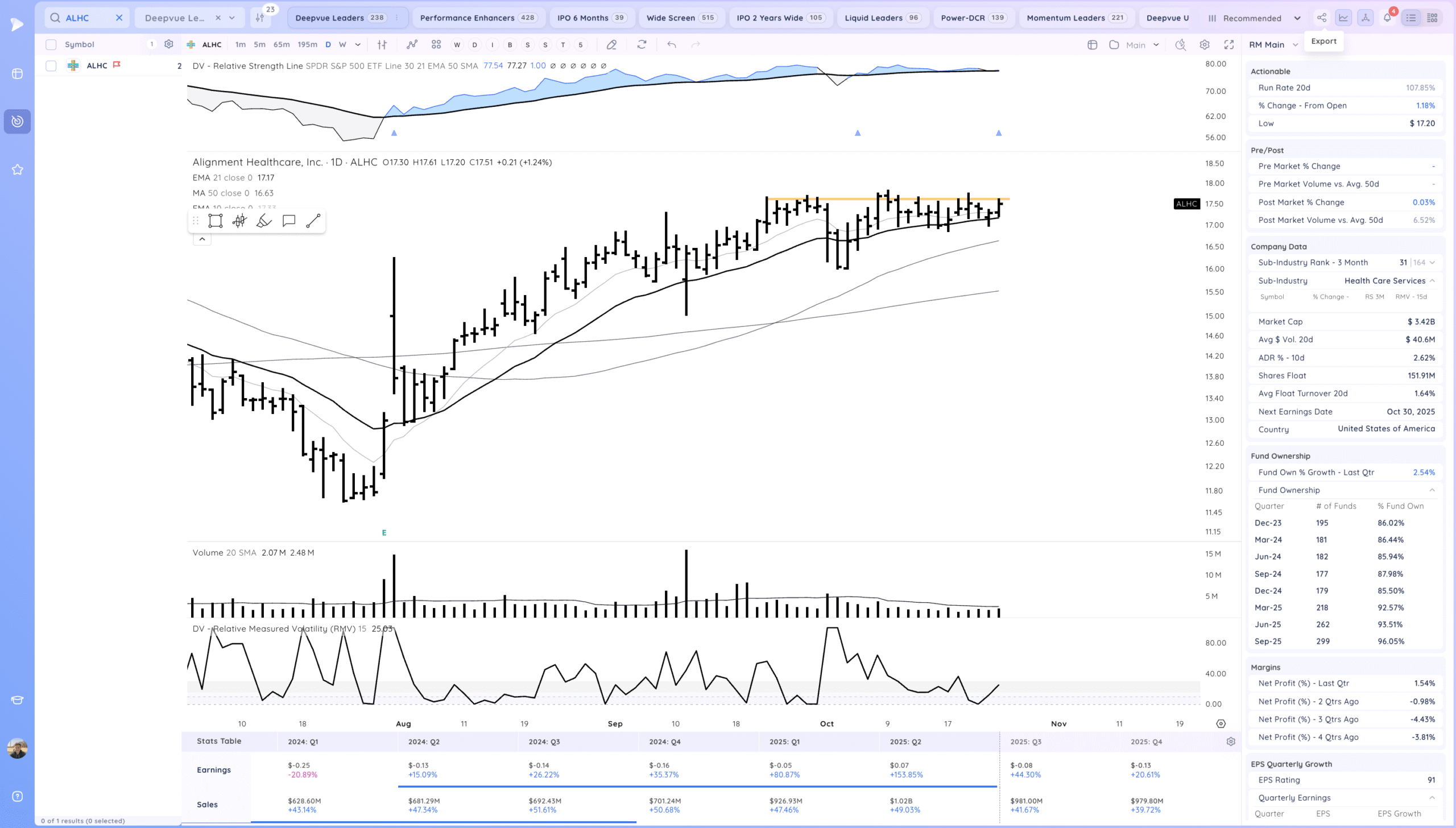

ALHC watching for a range breakout. Earnings upcoming

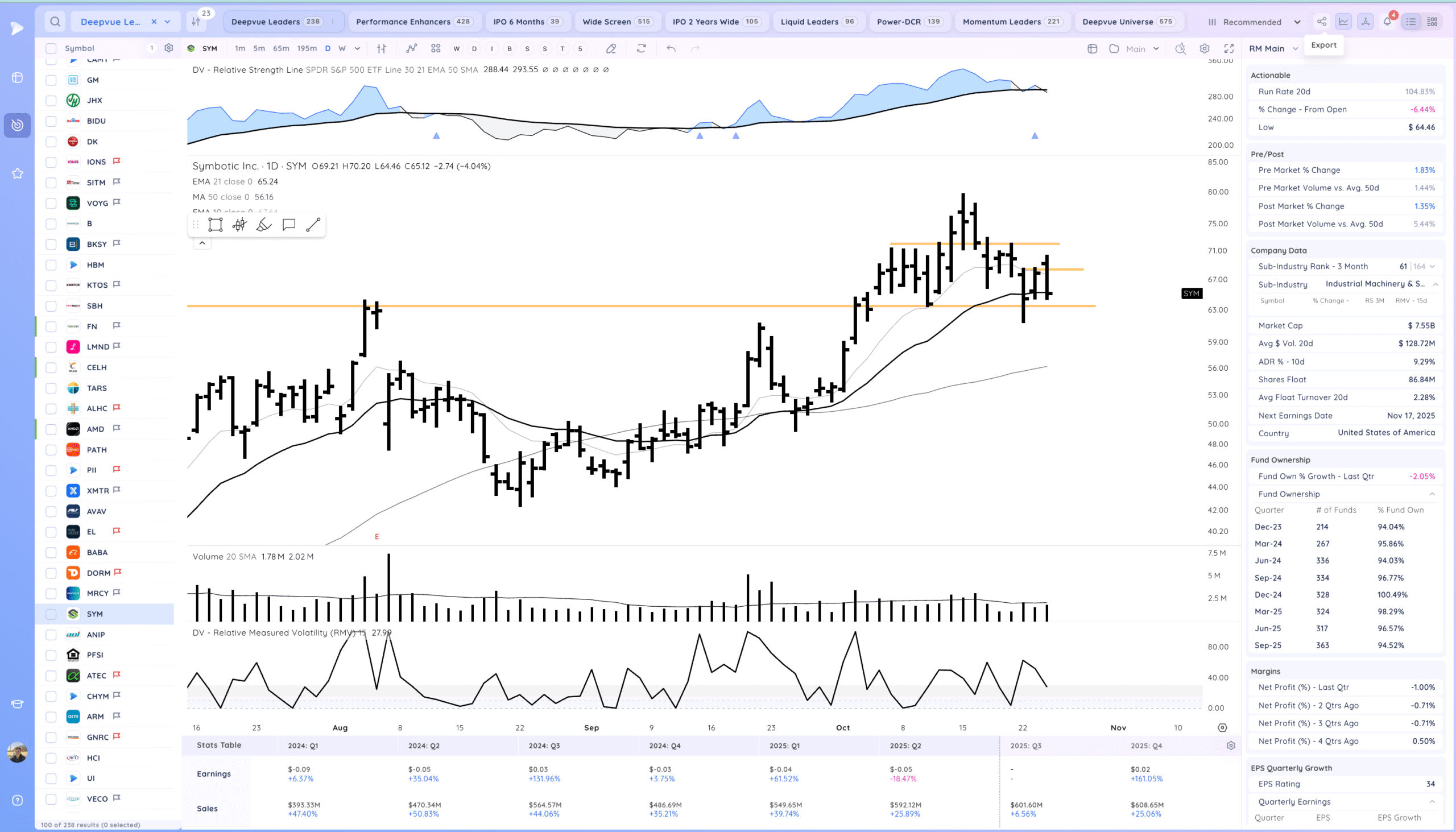

SYM needs to tighten more, watching for a range breakout or pullback versus the big weekly level

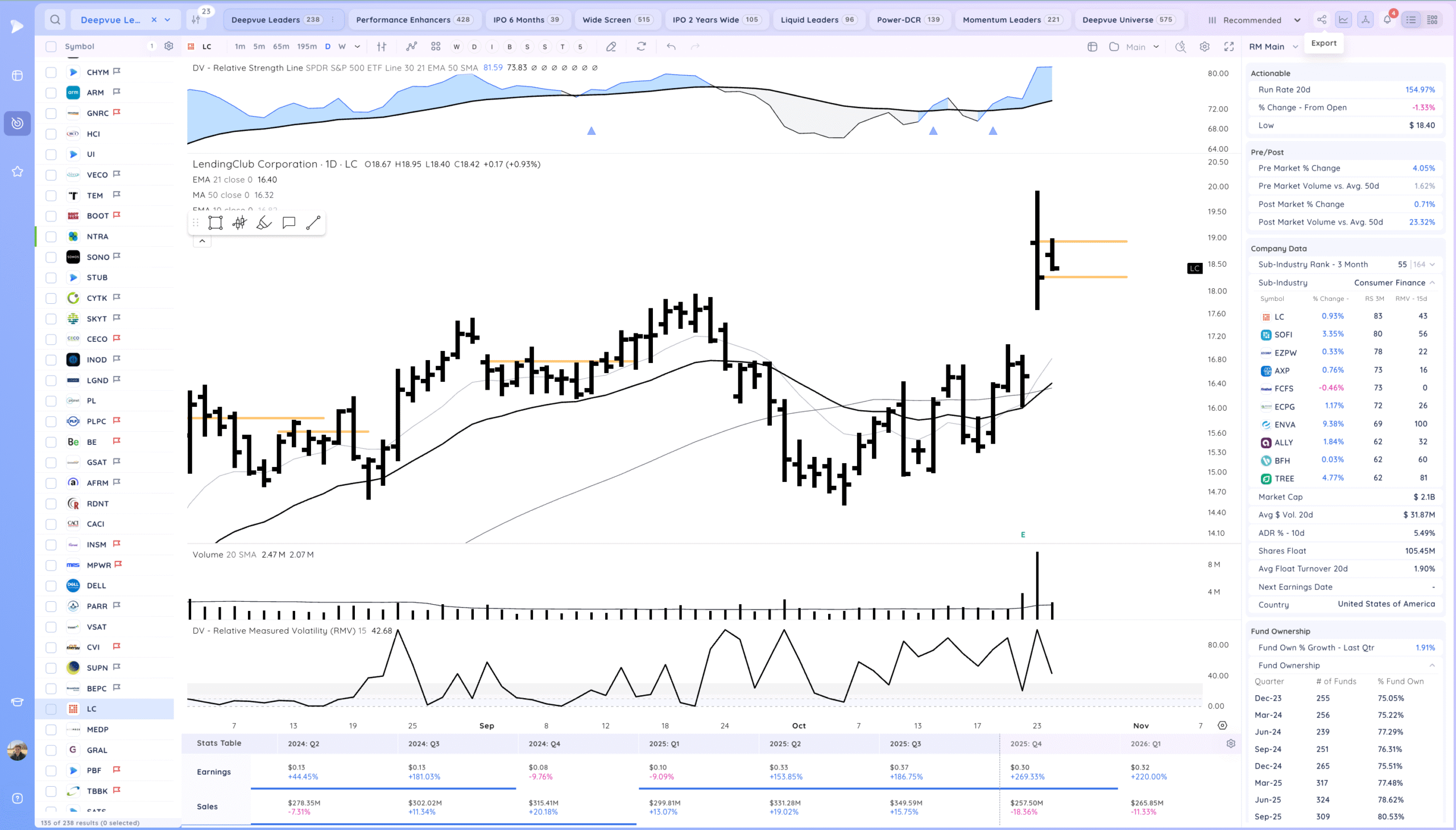

LC watching for a post gap range breakout/undercut and rally of the HVC

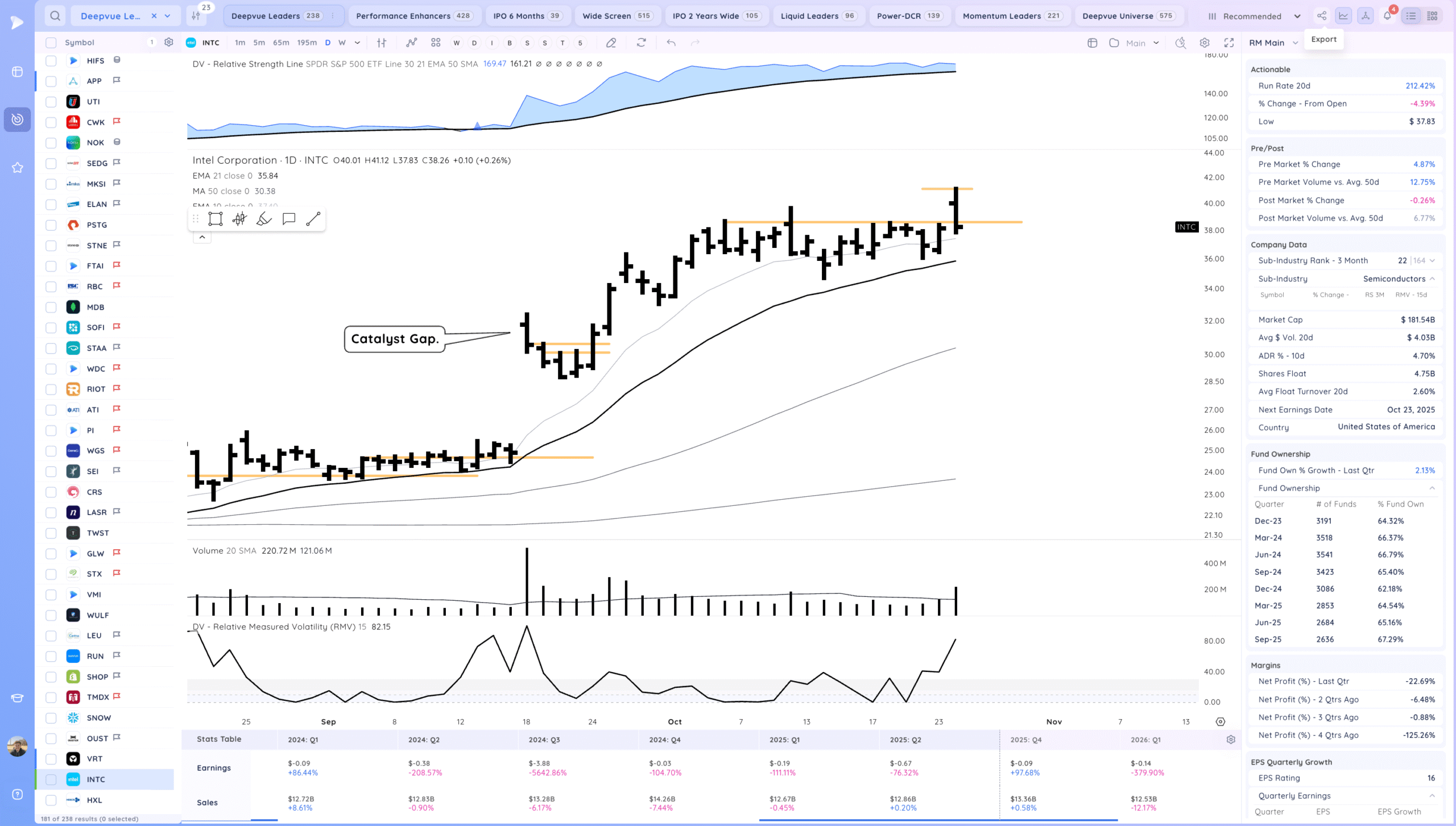

INTC watching for a range re-breakout

Recent Gappers to Track

Day 0

Day 1 +

AMD VICR ISRG PEGA INTC CRS PBF GTX LC MEDP

Today’s Watchlist in List form

Focus List Names

ARWR NIO TAC SBH ALHC SYM LC INTC PLTR NVDA TSLA

Focus:

TSLA (Add) PLTR NVDA AMD

Themes

AI, AI Energy, rare metals, biotech. Oil and Gas, Crypto names recovering

Additional Thoughts

Solid week overall. A lot can happen next week with earnings reports. But constructive.

Anything can happen, Day by Day – Managing risk along the way